As the gig economy continues to thrive, more people are navigating the path of self-employment. An essential aspect of this journey is effectively tracking income and expenses for tax and business purposes, making the self-employment ledger an invaluable tool. The self-employment ledger is a comprehensive record that details an individual’s earnings and expenditures related to their business activities.

This article aims to provide an in-depth understanding of the self-employment ledger – its importance, how to create and maintain one, and how it factors into financial management for self-employed individuals. Whether you’re a freelancer, a small business owner, or a gig worker, knowing how to manage your self-employment ledger can make the difference between successful financial management and unnecessary financial stress.

Table of Contents

What’s a self-employment ledger?

A self-employment ledger is a detailed record of income and expenses for those who work for themselves, such as freelancers, contractors, and small business owners. It serves as a tool to track and document all self-employment income and related costs, which is crucial for tax filing purposes and financial management.

In a self-employment ledger, you should typically document your income on a per-job or per-client basis, including details like the date, client name, services provided, amount earned, and any associated expenses.

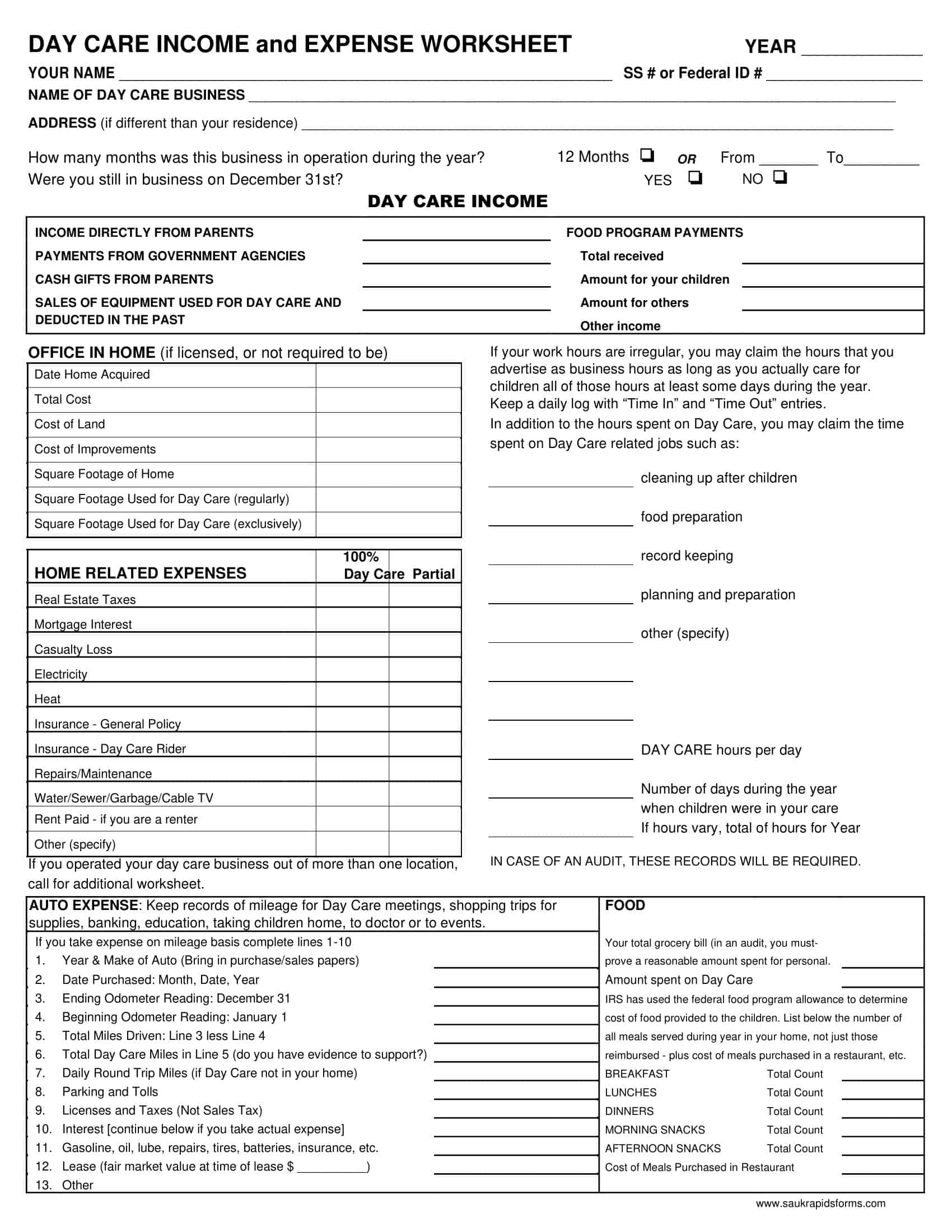

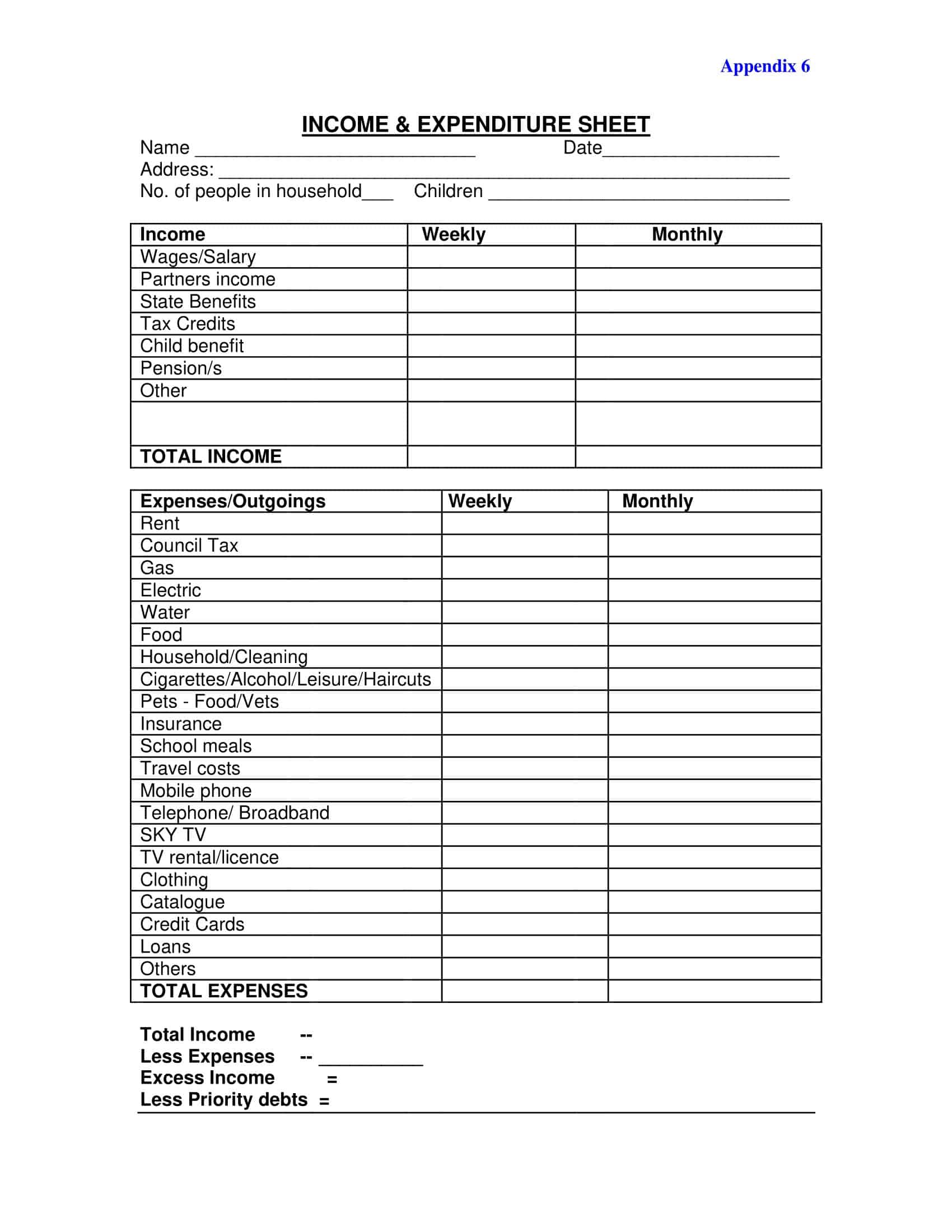

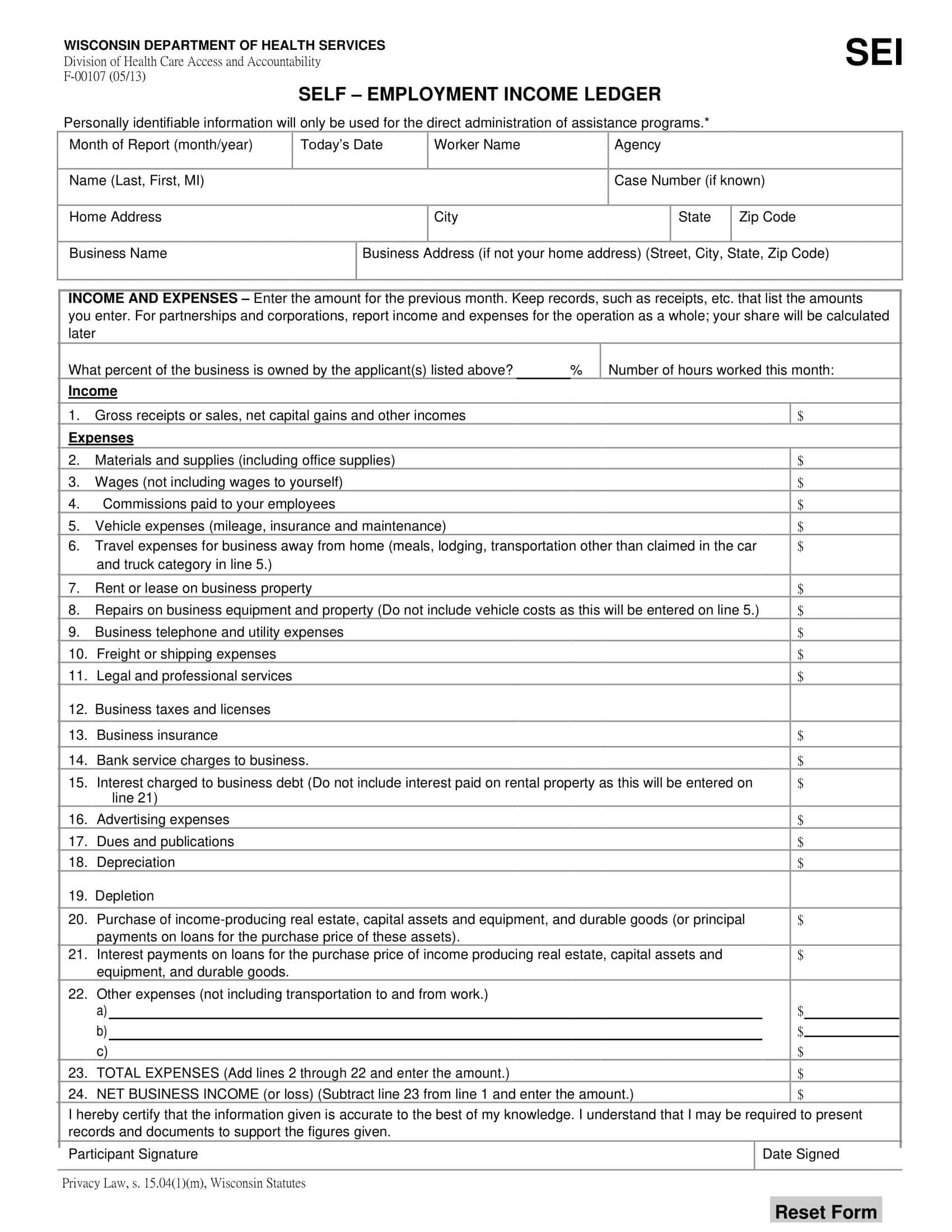

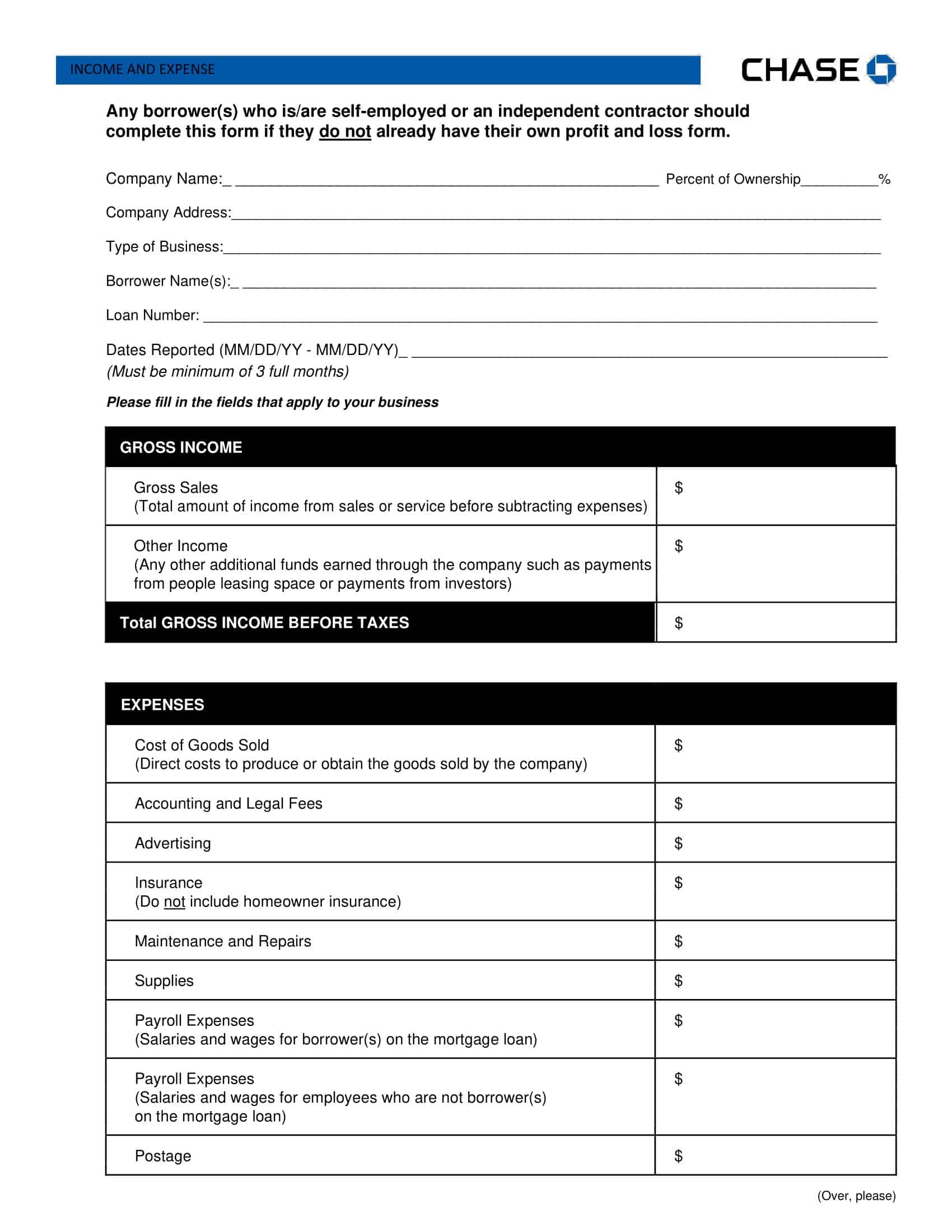

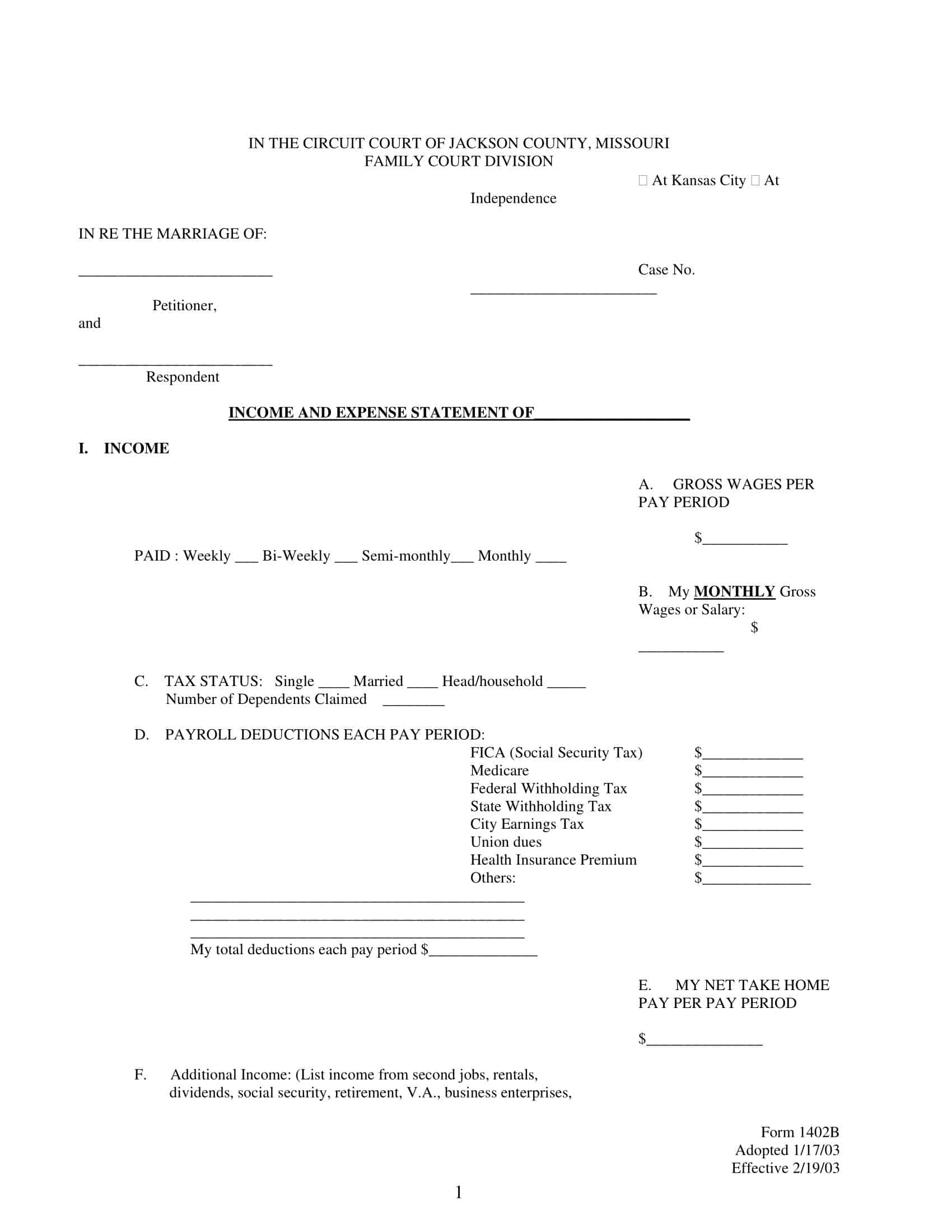

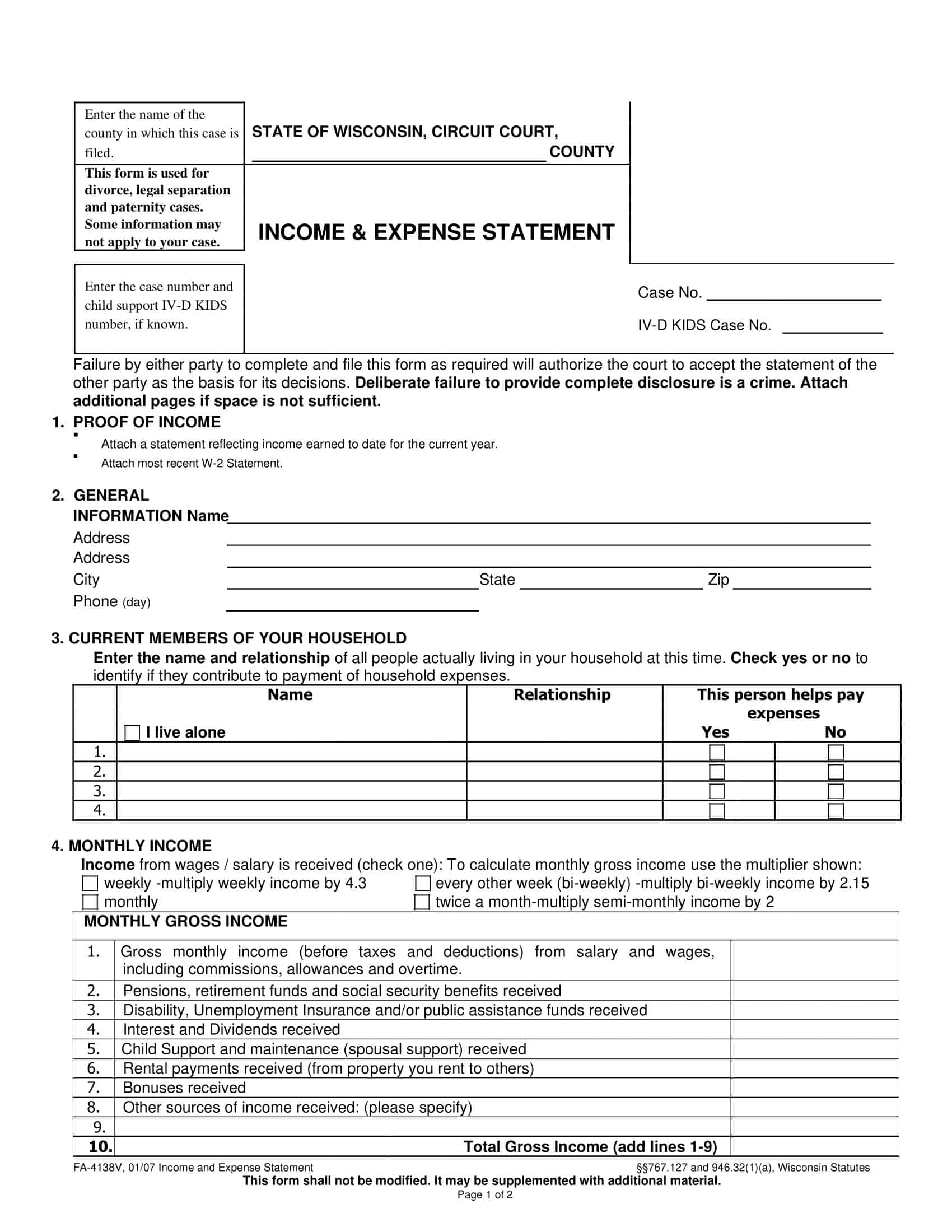

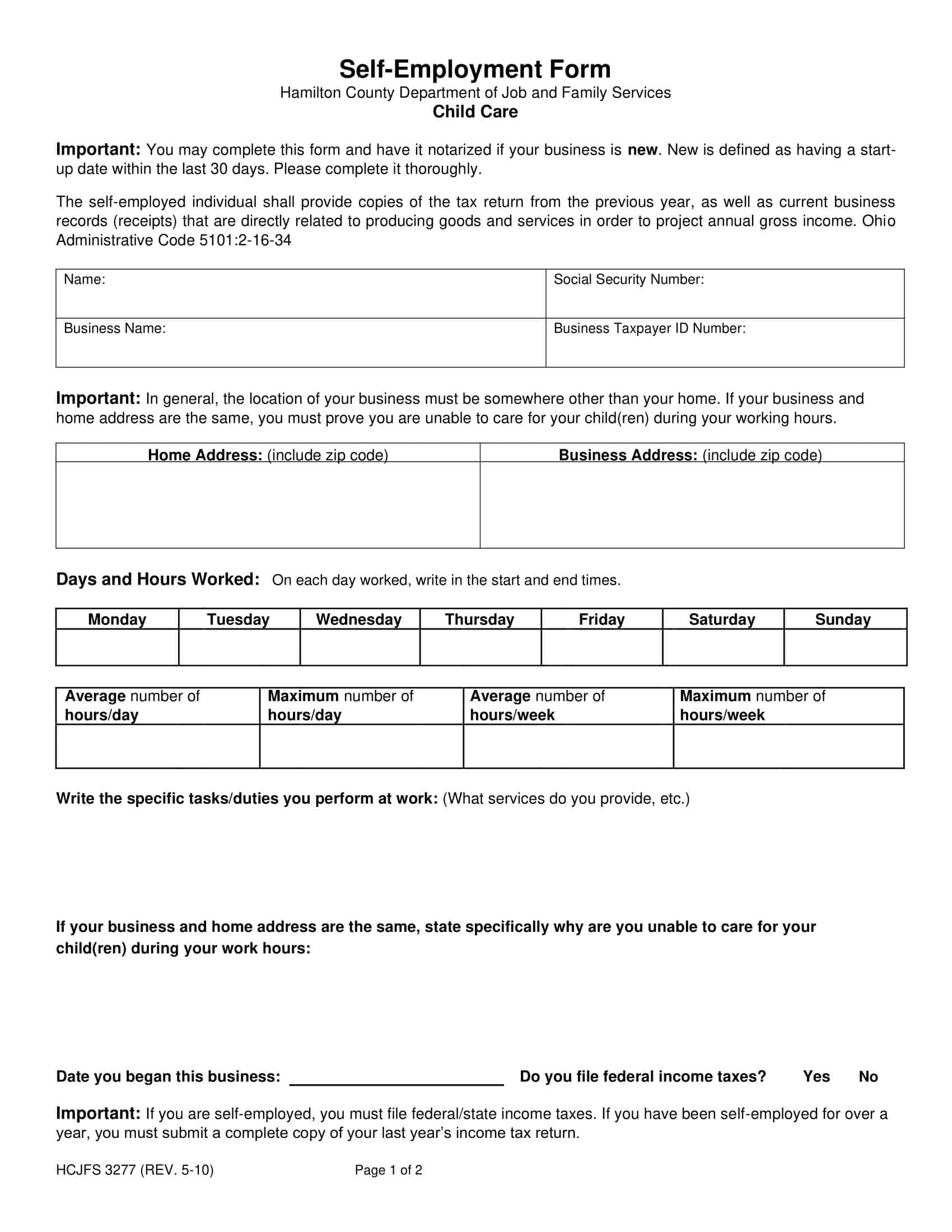

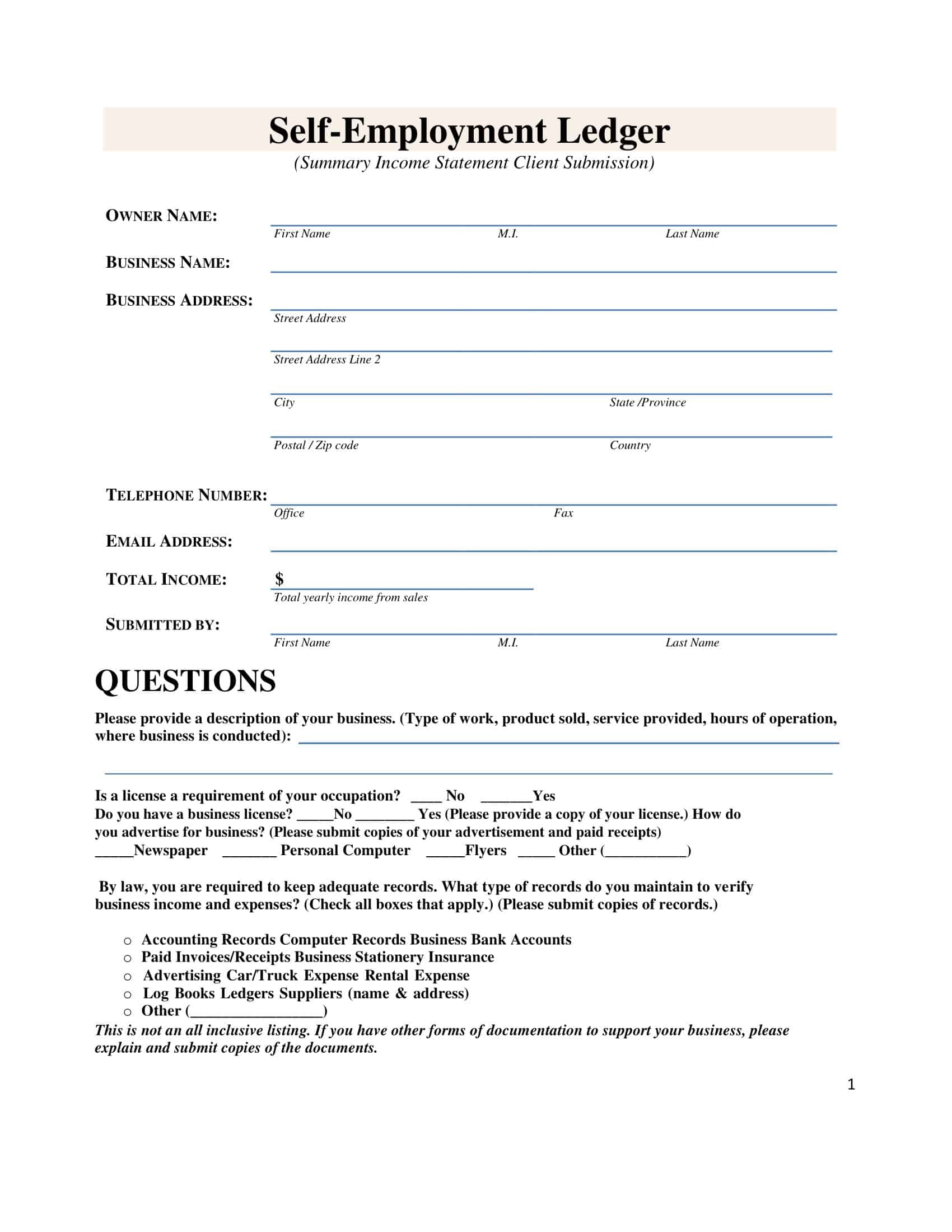

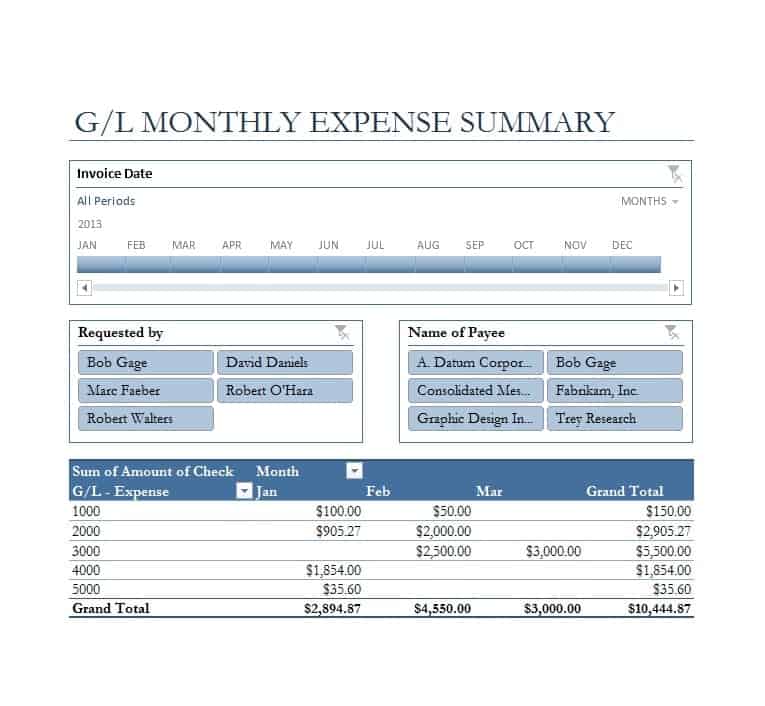

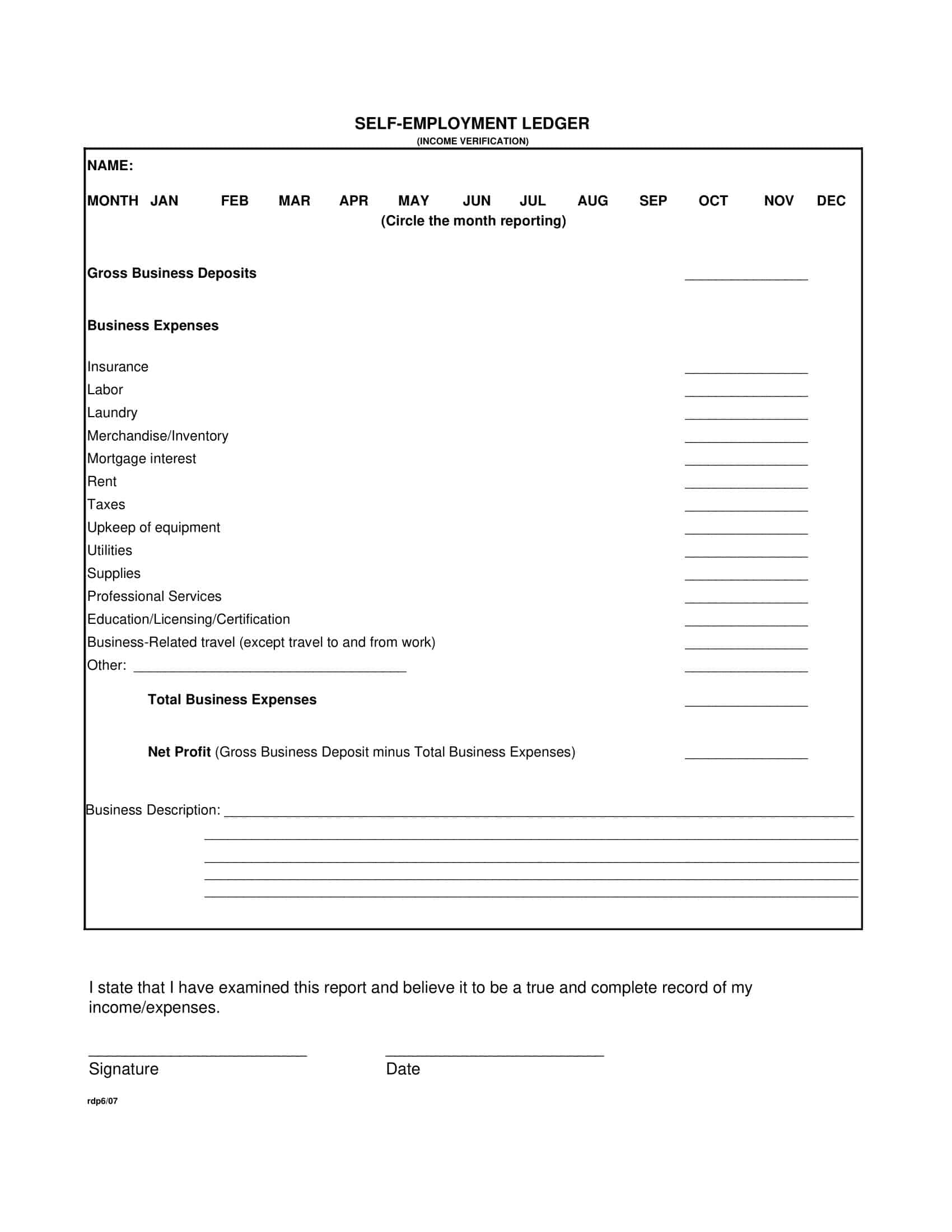

Self-Employment Ledger Templates

Self-Employment Ledger Templates are invaluable tools for individuals who are self-employed and need to keep track of their income and expenses. These templates provide a structured format that allows self-employed individuals to maintain accurate records of their financial transactions, aiding them in managing their business effectively.

A self-employment ledger template typically includes various sections to document essential information. The template often begins with a header that includes the business name, logo, and contact details, providing a professional touch to the ledger. Following the header, there are sections for recording income and expenses separately.

Benefits of Keeping a Self Employment Ledger

Keeping a self-employment ledger offers multiple benefits to freelancers, contractors, and small business owners. It’s more than just a necessary record for tax purposes; it’s also a fundamental tool for managing your business finances and planning for growth. Here are some significant benefits:

Accurate Tax Calculations

As a self-employed individual, you are responsible for paying income tax and self-employment tax, which covers Social Security and Medicare. Having a detailed ledger makes it easier to calculate these taxes accurately. It helps ensure that you’re neither overpaying nor underpaying, both of which can lead to issues with the IRS.

Tax Deduction Identification

Proper record-keeping can help you identify potential tax deductions. Many expenses related to your business, such as equipment costs, travel expenses, office rent, or even a portion of your home’s costs if you work from home, may be tax-deductible. By keeping track of these in your ledger, you can potentially lower your taxable income.

Financial Planning and Budgeting

Your ledger can serve as a valuable tool for financial planning and budgeting. By keeping track of your income and expenses, you can assess your business’s profitability, manage your cash flow, and make informed decisions about scaling your business, pricing your services, or investing in new equipment.

Proof of Income

When applying for a loan, mortgage, or rental agreement, you might be asked to provide proof of income. A well-maintained self-employment ledger can serve this purpose and help you secure the credit or housing you need.

Performance Tracking and Evaluation

Your ledger can provide valuable insights into your business’s performance over time. It can help you identify patterns, such as busy or slow periods, which clients are most profitable, or which services generate the most income. These insights can inform strategic decisions and business planning.

Dispute Resolution

If there’s a disagreement or misunderstanding with a client about payment, your ledger can serve as a record of the work completed and the agreed-upon payment. This could help resolve disputes more smoothly.

Auditing Preparation

In case of an audit by the IRS, having a comprehensive and detailed ledger is invaluable. Auditors will want to see clear documentation of your income and expenses, and your ledger provides this information.

Keeping a self-employment ledger might seem daunting at first, but with a systematic approach and consistency, it becomes a routine part of running your business. It can be as simple as a spreadsheet, or you can use accounting software that suits your business needs. Either way, the benefits of maintaining this record significantly outweigh the time and effort required.

What To Track With A Self-Employment Ledger

Creating and maintaining a self-employment ledger is an essential task for any self-employed individual. But what exactly should you track with your ledger? Let’s break down the key categories:

1. Income:

This is your gross income before any taxes or expenses are deducted. You should record each source of income separately. Here are some specifics you should include:

- Client Details: The name and contact details of the client or source of the income.

- Date: The date you received the payment.

- Service Details: A description of the services you provided, or the product you sold.

- Amount Received: The total amount of income you received from this transaction.

2. Expenses:

Your ledger should also include any expenses related to your self-employment. These can often be deducted from your taxable income. Here are some categories of expenses you might track:

- Business Supplies & Equipment: This could include computers, software, office furniture, or any other tools you need to do your job.

- Advertising & Marketing Costs: Costs related to promoting your business, such as online advertising, printing business cards, or website maintenance costs.

- Travel Expenses: If you travel for work, you can include costs like airfare, hotel stays, meals during travel, and mileage expenses.

- Home Office Expenses: If you use part of your home exclusively for your work, you may be able to deduct a portion of your rent or mortgage, as well as utilities.

- Insurance & Professional Fees: This could include business insurance premiums, or fees paid to lawyers, accountants, or other professionals.

- Education & Training: Costs related to maintaining or improving your professional skills may also be deductible.

For each expense, you should record:

- Vendor/Provider Details: The name and contact details of the vendor or provider.

- Date: The date the expense was incurred.

- Expense Details: A description of the expense, including why it was necessary for your business.

- Amount Paid: The total amount of the expense.

3. Taxes:

As a self-employed person, you’ll likely need to make quarterly estimated tax payments. Record the date and amount of each payment in your ledger.

Remember, it’s important to keep receipts or other proof of all your income and expenses. If you’re audited by the IRS, you’ll need to provide this documentation.

Using software can help automate much of this process, and there are many apps and programs designed specifically for self-employed individuals. However, a simple spreadsheet can also work if you’re just starting out or if you prefer a more hands-on approach.

Maintaining a self-employment ledger requires consistency and attention to detail, but it’s worth it. The more accurate and detailed your records, the better you’ll understand your business finances, and the easier it will be to file your taxes.

How to Make a Self-Employment Ledger

Creating a self-employment ledger doesn’t have to be an overly complex process. While there are software options available, let’s start with the basics and set up a ledger using a spreadsheet program like Microsoft Excel or Google Sheets. Here are step-by-step instructions:

Step 1: Open a New Spreadsheet

Start by opening your preferred spreadsheet program and creating a new document. This will be your self-employment ledger.

Step 2: Create Income and Expense Tabs

To keep your ledger organized, it’s a good idea to create separate tabs or sheets for your income and expenses. At the bottom of the spreadsheet, click on the ‘+’ button (or equivalent in your program) to add a new sheet.

Step 3: Set Up Your Income Sheet

On the ‘Income’ sheet, create the following columns:

- Date: This will record the date you received income.

- Client: This will record the name of the client or source of income.

- Service/Product: This column should describe what product or service you provided to earn the income.

- Amount: This is the amount of income received.

Step 4: Set Up Your Expenses Sheet

On the ‘Expenses’ sheet, create the following columns:

- Date: This records the date you incurred the expense.

- Vendor/Provider: This will be the name of the entity where the expense was paid.

- Expense Category: This could be utilities, rent, equipment, advertising, etc.

- Purpose: Describe the purpose of the expense, particularly how it’s related to your business.

- Amount: This is the amount of the expense.

Step 5: Record Your Income

Every time you earn money from your self-employment, add a new row in the ‘Income’ sheet. Fill out each column with the appropriate details.

Step 6: Record Your Expenses

Similarly, every time you incur a business-related expense, add a new row in the ‘Expenses’ sheet. Fill out each column with the relevant details.

Step 7: Keep Track of Your Taxes

Create another tab or sheet for ‘Taxes’. Keep a record of your quarterly estimated tax payments here, noting down the date and amount each time you make a payment.

Step 8: Regular Updates and Reviews

Ensure you regularly update your ledger – ideally, right when you receive income or incur an expense. Regularly review your records, ensuring they’re accurate and up-to-date.

Step 9: Safe Storage

Make sure to store your ledger in a secure location. If you’re using a digital spreadsheet, make sure it’s backed up in a secure cloud storage system or an external drive.

Step 10: Keep Physical and Digital Receipts

Along with your ledger, remember to save receipts for your expenses and proof of income. For physical receipts, consider scanning them and keeping a digital copy. This backup will be important in case of audits and when you’re preparing your tax returns.

This is a basic setup and can be adjusted to suit your specific needs. For example, if you have regular travel or mileage expenses, you might want to add a separate tab for that. If you need more advanced features like automatic calculations, invoice generation, or integration with your bank account, you may want to consider using accounting software designed for small businesses or self-employed individuals. Remember, the most important thing is to keep accurate, up-to-date records.

Tips for Effective Self-Employment Ledger Management

Maintaining a self-employment ledger requires a regular, disciplined approach. Here are some tips to help you manage your ledger effectively:

1. Update Regularly:

The key to effective ledger management is regular updates. Instead of waiting to input all your data at once, make it a habit to update your ledger as soon as you earn income or incur a business expense. This prevents the task from becoming overwhelming and minimizes the risk of forgetting or overlooking transactions.

2. Keep Receipts:

Always ask for receipts and keep them safe. For physical receipts, consider digitizing them for easier storage and organization. Receipts are crucial for verifying the expenses listed in your ledger, especially if you’re audited by the IRS.

3. Stay Organized:

Your ledger should be easy to understand and navigate. Use clear, consistent categories for income and expenses. If you’re using a digital spreadsheet, use features like color-coding or filters to make it easier to locate specific transactions.

4. Understand Tax Deductibles:

Familiarize yourself with what expenses are tax-deductible. This can include costs for office supplies, business use of your home, professional services, travel, and more. Including these in your ledger can reduce your taxable income.

5. Use Technology:

Leverage technology to make ledger management easier. There are numerous apps and software that can connect to your bank account, track expenses, log mileage, generate invoices, calculate taxes, and more. They can automate much of the process and save you significant time.

6. Regular Reviews:

Schedule regular reviews of your ledger—monthly, quarterly, or biannually. This allows you to spot patterns, assess your business’s financial health, and make informed decisions about your business operations.

7. Separate Business and Personal Finances:

If possible, use separate bank accounts for your business and personal finances. This makes it easier to track your business income and expenses without them getting mixed up with personal transactions.

8. Record Detailed Descriptions:

When recording income or expenses, provide detailed descriptions. Instead of writing “supplies,” for instance, write “printer ink for office.” This makes it easier to understand each entry at a glance and provides clearer documentation in case of an audit.

9. Consult with a Professional:

Consider consulting with an accountant or tax professional, especially when you’re just starting. They can help you set up your ledger, understand tax obligations, identify deductibles, and ensure you’re complying with all regulations.

10. Secure Your Records:

Make sure your ledger and other financial records are stored securely. If you’re using digital records, back them up in a secure cloud service or an external hard drive. For physical records, use a secure, fire-safe box or a locked filing cabinet.

FAQs

Are there any tools to automate the Self-Employment Ledger process?

Yes, there are many apps and software programs designed specifically for self-employed individuals or small businesses. These tools can connect to your bank account to automatically track income and expenses, generate invoices, calculate taxes, and more.

How long should I keep my Self-Employment Ledger records?

It’s recommended to keep your self-employment ledger and other tax records for at least three years from the date you filed your original return, as this is the period within which the IRS can audit your return. However, in some situations (such as if you claimed a loss from worthless securities or bad debt deduction), the IRS recommends keeping records for seven years.

Do I need to use a specific format or software for my self-employment ledger?

There’s no mandatory format or software for a self-employment ledger. What’s most important is that it accurately records all your self-employment income and expenses. You could use a simple spreadsheet or a specialized accounting software, depending on your preference and the complexity of your business finances.

How do I determine what counts as a business expense in my self-employment ledger?

A business expense is generally something you need to pay for in the course of carrying out your work. This could include the cost of goods sold, rent or mortgage for business premises, advertising expenses, and equipment or supplies needed for your work. It’s a good idea to consult with a tax professional to ensure you’re correctly identifying deductible business expenses.

I have a mix of employment and self-employment income. Do I still need a self-employment ledger?

Yes, if you have any self-employment income, you should maintain a self-employment ledger for that portion of your income and related expenses. Your employment income and any associated costs (like employment taxes) should be tracked separately, as the tax implications can be different.

Can I deduct the cost of software or other tools I use for maintaining my self-employment ledger?

Generally, if you purchase software or other tools specifically for the purpose of tracking your business income and expenses, you can deduct these costs as a business expense. However, it’s best to consult with a tax professional to understand the specific rules in your situation.

What happens if I make a mistake in my self-employment ledger?

It’s important to try and keep your ledger as accurate as possible, but everyone makes mistakes. If you discover an error in your ledger, correct it as soon as possible. If the mistake affects your tax return, you may need to amend your return. It’s best to consult with a tax professional if you’re unsure how to handle a mistake.

Can I hire someone else to maintain my self-employment ledger for me?

Yes, many self-employed individuals hire bookkeepers or accountants to manage their financial records. However, even if you hire someone else, it’s important to understand the basics of your income and expenses so you can manage your business effectively.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Financial Projections Templates [Excel, PDF] 3 Financial Projection](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Projection-1-150x150.jpg)