Securing transactions with tangible proof has become a cornerstone in modern business environments, fostering trust and transparency between parties. The indispensable tool making this possible, the payment receipt, plays a vital role in this process.

This article illuminates the intricate world of payment receipts, their diverse applications, and their growing importance in business ecosystems. Get ready to explore the realms of these vital financial instruments, their evolution, and the pivotal role they play in shaping both individual and organizational financial narratives.

Table of Contents

What is a payment receipt?

A payment receipt is a document provided by a seller or service provider to a buyer as proof that a payment has been made for goods or services. It typically includes information such as the date of the transaction, the items purchased or services rendered, the amount paid, and the seller’s and buyer’s details.

Payment receipts serve several crucial functions, including assisting in financial record-keeping, acting as evidence for tax purposes or audits, and confirming that the buyer has indeed paid for the transaction. In essence, a payment receipt is a critical financial tool that validates transactions and maintains a transparent exchange of goods and services.

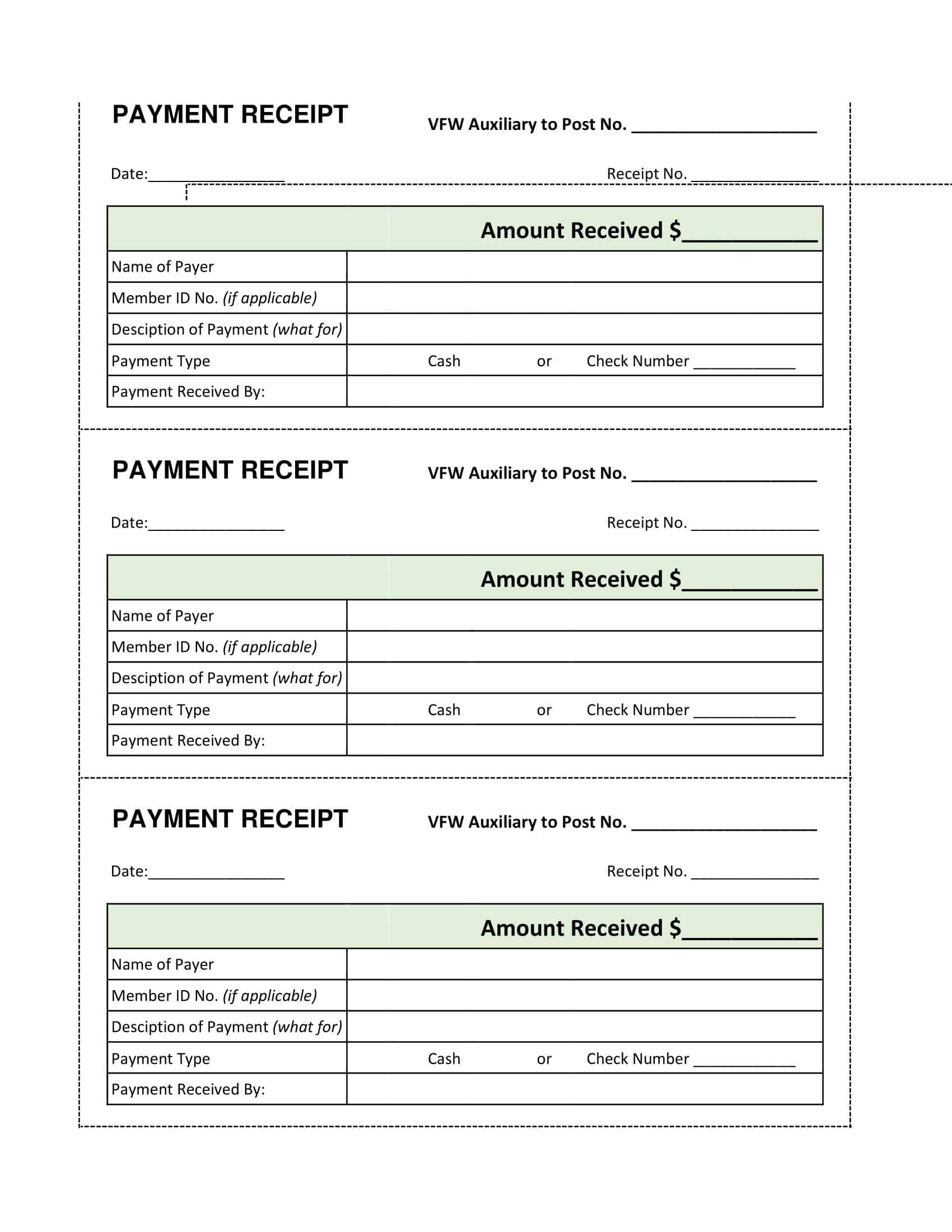

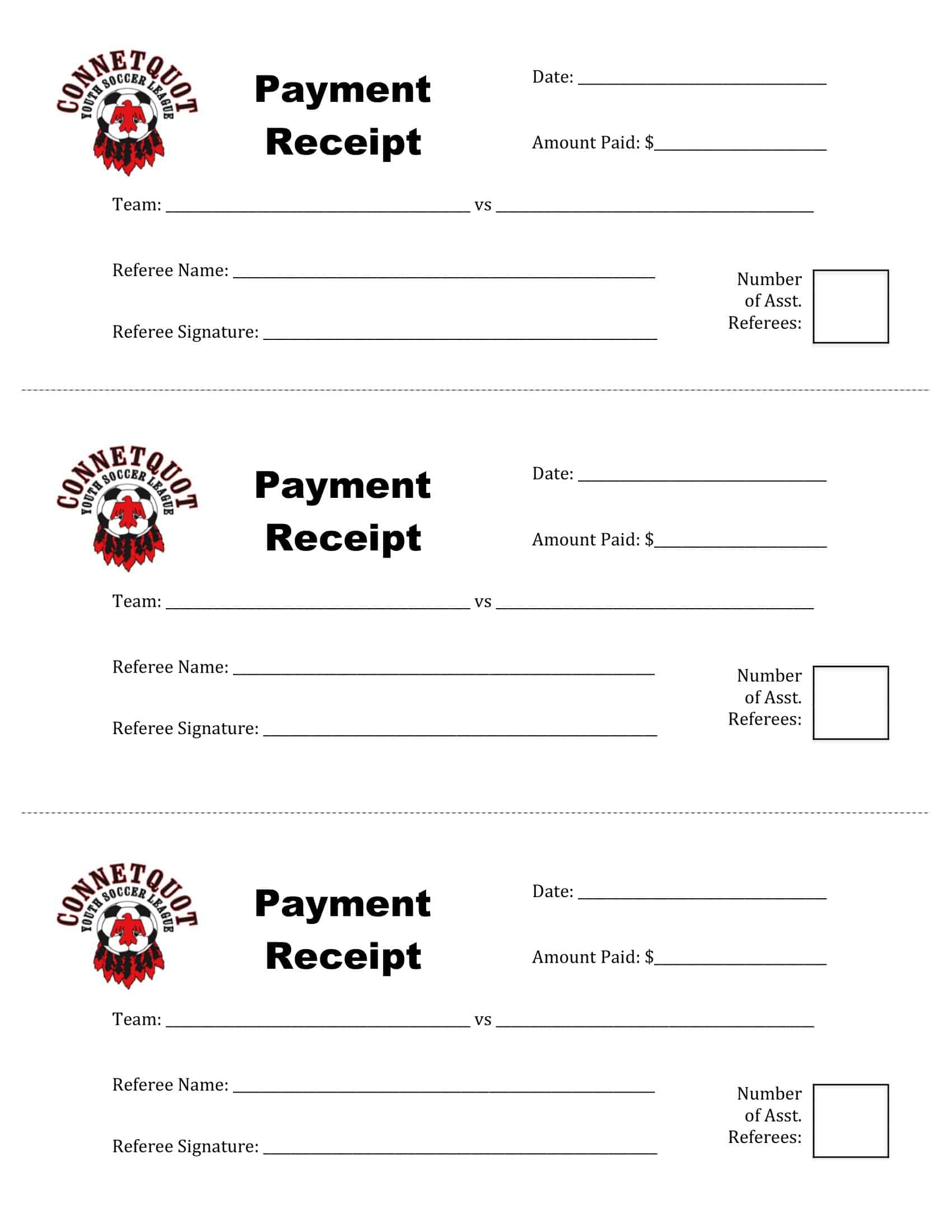

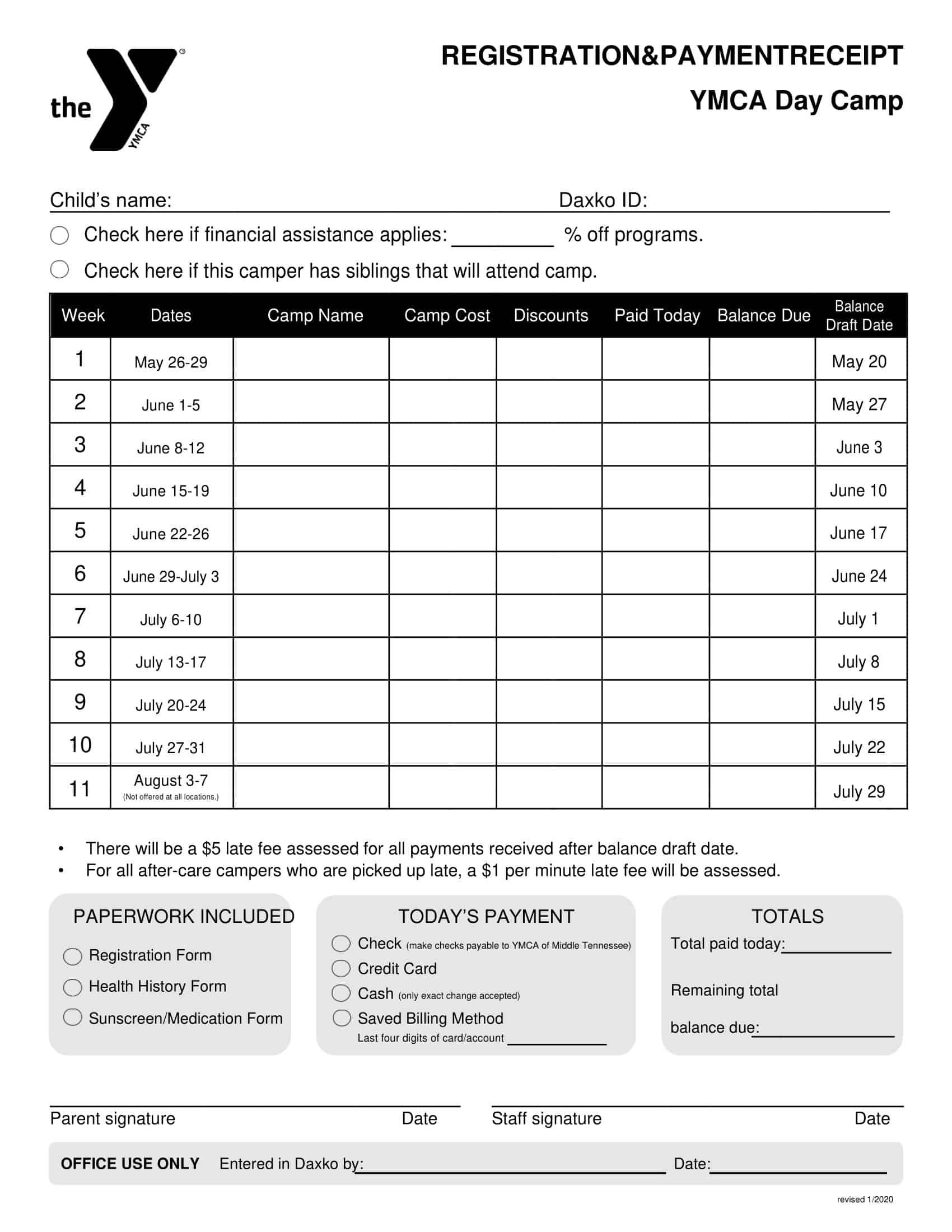

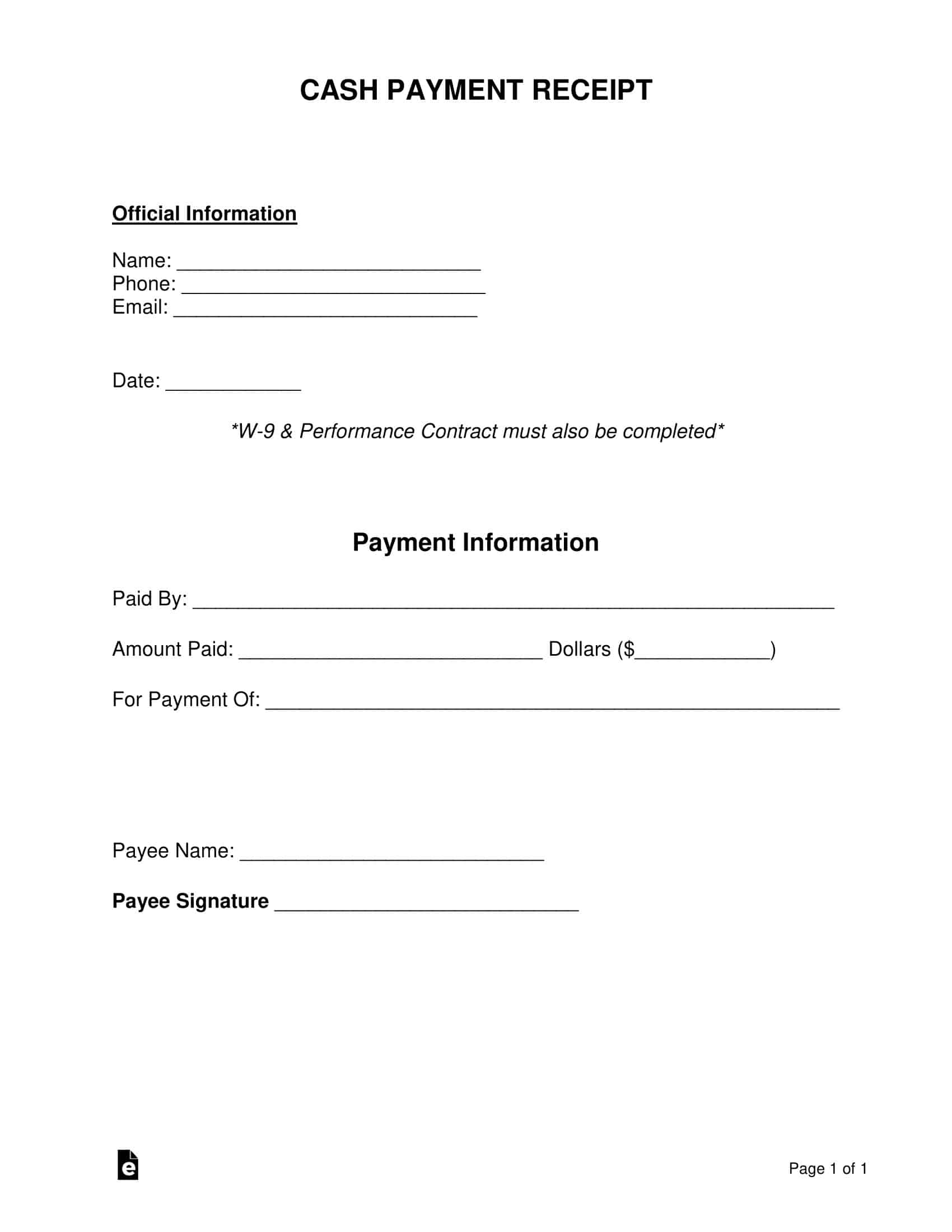

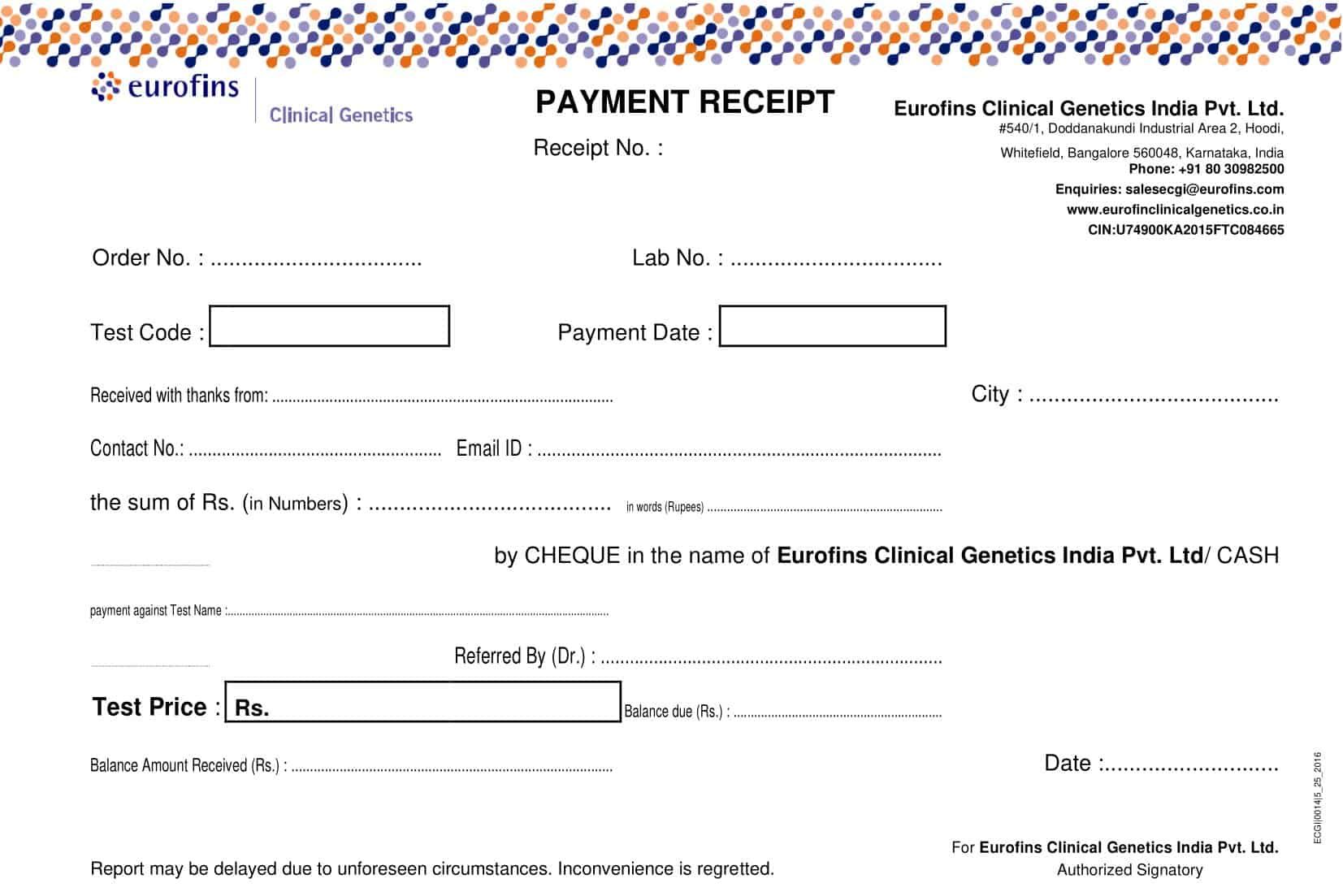

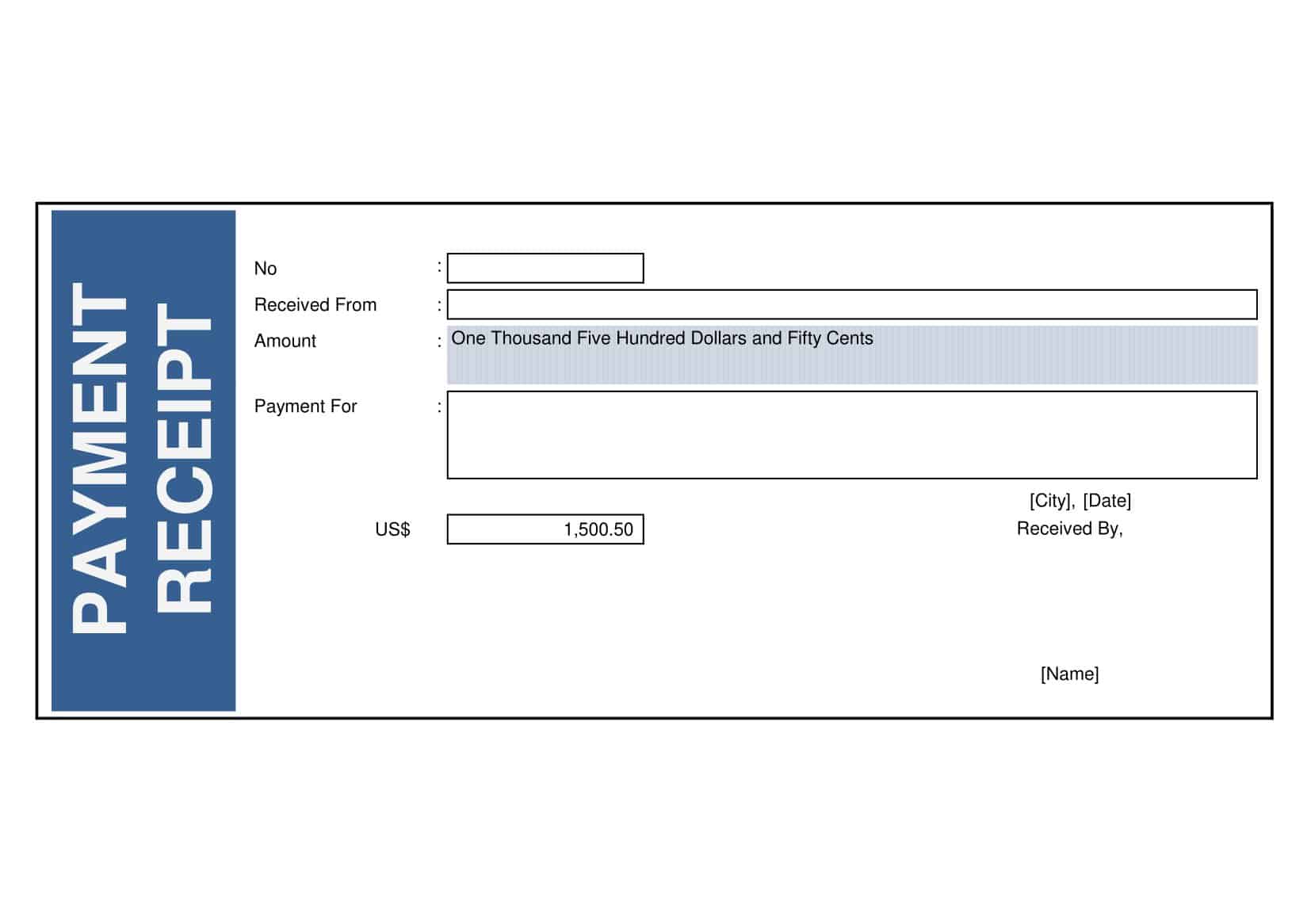

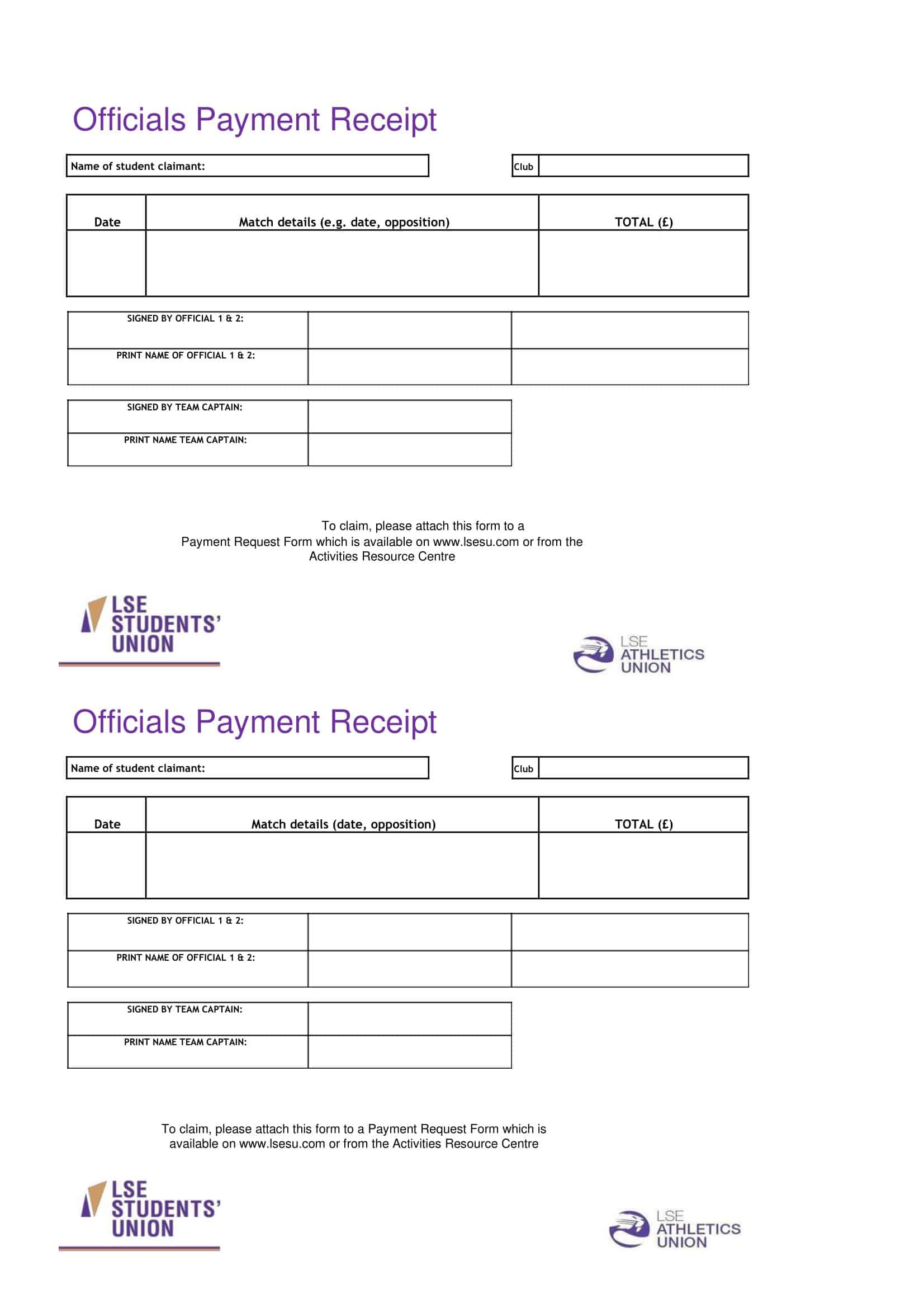

Payment Receipt Templates

The “Payment Receipt” templates provide comprehensive and organized documentation of financial transactions. These templates serve as invaluable tools for businesses and individuals alike, offering a clear and concise breakdown of the payment details without the need for transition words.

Each payment receipt template is thoughtfully designed to ensure consistency in format and presentation, allowing users to convey information effectively. These templates typically contain essential elements, such as the date of the transaction, the payee’s and payer’s names, the payment amount, and a description of the goods or services rendered.

Furthermore, the templates often incorporate spaces for signatures, providing an extra layer of authenticity and validation. This feature ensures that both parties involved in the transaction acknowledge their participation, thus minimizing potential disputes.

Importance of Generating Payment Receipt

The generation of payment receipts is a critical component of any financial transaction, whether it involves an individual making a personal purchase or a large corporation conducting multi-million dollar deals. The importance of generating these documents can be viewed from a variety of perspectives, emphasizing their integral role in finance, accounting, tax compliance, and dispute resolution.

- Record Keeping: A payment receipt is a document that marks the completion of a transaction. It allows both the payer and payee to keep track of their money flow. For businesses, receipts act as a reference point, enabling them to monitor their income and expenses. This systematic tracking aids in maintaining a healthy financial status and aids in making strategic decisions based on revenue trends and spending patterns.

- Tax Compliance: For tax purposes, payment receipts are essential. They serve as proof of revenue and expenditures, allowing businesses and individuals to accurately calculate their taxable income. Without receipts, it could become challenging to justify claimed expenses or income during an audit, potentially leading to penalties or legal issues.

- Financial Management and Budgeting: Receipts are vital tools for personal and corporate financial management. They provide an accurate reflection of expenses, helping individuals and companies budget effectively and manage cash flow. Analyzing receipt patterns can highlight areas where costs could be cut or where more investment might be beneficial.

- Legal Protection: In the case of disagreements or legal disputes over payments, a receipt is a legally recognized document that serves as evidence. It can prove that a service was rendered or that goods were provided and paid for, protecting both buyer and seller from potential legal complications.

- Customer Service: Providing a receipt is a standard business practice that gives customers assurance about their purchases. If they need to return or exchange a product, or if they have queries about their purchase at a later date, the receipt serves as a detailed record of the transaction.

- Professionalism: Issuing a receipt reflects positively on the business or service provider. It instills trust in customers and clients, demonstrating that the enterprise operates professionally and takes its obligations seriously.

- Reconciliation: In business accounting, receipts are used during the reconciliation process, where the company’s financial records are compared with bank statements to ensure consistency and accuracy. Without payment receipts, detecting discrepancies or errors becomes substantially more difficult.

What is included on a payment receipt?

A payment receipt is a detailed document that acknowledges that a payment has been made for a product or service. While the exact format can vary depending on the organization, jurisdiction, or the nature of the transaction, certain key pieces of information are typically included on a payment receipt.

Business Information

This includes the name, address, and contact details of the seller or service provider. For businesses, this often includes their logo as well. In some jurisdictions, businesses might also be required to include their tax or business identification number.

Customer Information

Depending on the nature of the transaction, the buyer’s name, address, and sometimes their contact information might be included. This is more common in business-to-business transactions, or when the purchase involves a warranty or support agreement.

Date and Time

The exact date and time when the transaction took place are always mentioned. This information is critical for record keeping, tax filing, and can be especially useful if a dispute arises later.

Receipt Number

Each receipt is assigned a unique identification number. This number is crucial for referencing and tracking the transaction in future.

Description of Goods or Services

The receipt should provide detailed information about the product or service that was purchased, including quantities if applicable. This may also include additional details such as the model number or color of a product.

Unit Price and Total Amount

Each item or service listed on the receipt will have an associated unit price. The total amount paid is also clearly indicated, often both before and after any taxes that might apply.

Payment Method

The receipt should also indicate how the customer paid. Whether the payment was made via cash, credit or debit card, bank transfer, or online payment service, the relevant details are usually included.

Tax Information

If applicable, the receipt will list the amount of tax charged on the transaction. Depending on local tax laws, this could be broken down into different types of taxes (for example, sales tax, VAT, or GST).

Signature

In some cases, particularly for larger transactions or those involving certain types of services, the receipt might also include a space for the buyer or the seller to sign.

Refund or Return Policy

Some receipts also include information about the seller’s return, refund, or exchange policies.

Payment receipt vs. Sales receipt

While the terms “payment receipt” and “sales receipt” are often used interchangeably, there are subtle differences between them based on the nature of the transactions they document. Understanding these differences is crucial for accurate record-keeping, accounting, and financial management. Here’s a detailed comparison:

1. Payment Receipt

A payment receipt is a document provided by a seller or service provider to a buyer as evidence that a payment has been received. It is typically issued after the completion of a transaction. This receipt includes information such as the date of payment, the amount paid, and the seller’s and buyer’s details.

The primary purpose of a payment receipt is to serve as proof that the seller or service provider has received payment for a good or service already delivered. It acknowledges that an obligation arising from a past transaction has been fulfilled.

Key Elements of a Payment Receipt:

- Date of payment

- Amount paid

- Method of payment (cash, check, card, bank transfer, etc.)

- Information about the payer and payee

- Signature of the receiver

2. Sales Receipt

On the other hand, a sales receipt is a document that confirms a sale has occurred. It’s provided by the seller to the buyer at the time of the sale and details what was purchased, how much it cost, and how the buyer paid.

The sales receipt serves as a record of what was sold and is an acknowledgment from the business that they received payment in exchange for the goods or services provided.

Key Elements of a Sales Receipt:

- Date of sale

- Detailed list of goods or services sold, including quantities and prices

- Total amount paid, including any taxes or discounts

- Method of payment

- Information about the buyer and seller

Comparison and Differences

While both documents serve to authenticate a transaction, the primary difference lies in the timing and the details they provide.

A payment receipt primarily confirms payment, typically for a past transaction. It might not include detailed information about what was purchased, making it more focused on the financial aspect rather than the goods or services provided.

On the other hand, a sales receipt is a comprehensive document given at the point of sale. It provides a detailed list of the goods or services sold, their individual prices, the total amount paid, taxes, discounts, and the payment method. It ties the payment to the exact goods or services purchased.

In practice, many businesses use a comprehensive sales receipt that serves both purposes. It details the items purchased and serves as proof of payment, essentially combining the functions of a payment receipt and a sales receipt into one document.

To conclude, while both types of receipts are crucial in documenting financial transactions, the choice between a payment receipt and a sales receipt largely depends on the nature and timing of the transaction.

How do I make a payment receipt?

Creating a payment receipt can be a straightforward process, but it’s essential to ensure that you include all the necessary information. Here’s a step-by-step guide on how to create a payment receipt:

Step 1: Choose the Right Template or Software

Depending on the nature of your business, you may choose to use a manual receipt book, a template in a word processing or spreadsheet program, or a specialized accounting or point of sale (POS) software. Make sure the chosen method suits your business needs.

Step 2: Include Your Business Details

Start by including your business name, address, and contact information. If your business has a logo, include that as well. These details authenticate the receipt.

Step 3: Add Customer Information

In some cases, you may need to include the name and contact details of the customer, especially in transactions involving larger amounts or where a warranty or after-sale service might apply.

Step 4: Assign a Unique Receipt Number

Each receipt should have a unique identification number for easy tracking and referencing. This could be a simple sequential number, or it might include codes to identify the date, location, or type of sale.

Step 5: Input Date and Time

Record the date and time of the transaction. This is important for both you and the customer’s records, and it might be required for tax purposes.

Step 6: Detail the Goods or Services

List all the goods or services that were purchased. For each item, include a description, the quantity, and the price.

Step 7: Indicate the Total Amount

Calculate and clearly state the total amount paid. If any taxes, fees, or discounts apply, list these separately and include them in the total.

Step 8: State the Payment Method

Include information on how the payment was made (e.g., cash, credit/debit card, check, online payment).

Step 9: Signature

While not always necessary, especially for small retail transactions, you might choose to include a line for a signature from the seller or the buyer.

Step 10: Add Return Policy

If applicable, include details about your return, refund, or exchange policy on the receipt.

Step 11: Provide the Receipt to the Customer

Finally, give the receipt to the customer. This could be a printed paper receipt, or in the case of online transactions, you might email a digital receipt.

How can you provide proof of payment receipt?

Providing proof of payment is often necessary in scenarios where there’s a need to confirm that a transaction has been completed successfully. The most common form of proof is the payment receipt itself. Here’s a step-by-step guide on how you can provide proof of payment:

Step 1: Keep All Receipts

Whether you’re conducting business transactions or making personal purchases, always ensure to keep all receipts. These documents serve as the primary proof of payment. In the digital age, receipts may not be physical pieces of paper but can be emails or digital notes from online transactions. It’s a good idea to organize your receipts, whether in physical files or digital folders.

Step 2: Make Copies

To safeguard your proof of payments, make copies of your receipts. For physical receipts, you can scan or photograph them and store the digital copies safely. For digital receipts, consider backing them up in more than one location, like a cloud storage service and on your local storage.

Step 3: Use Bank Statements

In addition to receipts, bank statements can serve as proof of payment, especially for transactions made via debit or credit cards, or bank transfers. They reflect the transaction details, including the date, payee information, and amount paid. If necessary, you can request official statements from your bank.

Step 4: Provide Payment Receipt

If you need to show proof of payment, you can provide the original receipt, or a copy if necessary. Make sure all the details on the receipt are clearly visible. In the case of digital transactions, you can forward the digital receipt via email or print it out.

Step 5: Additional Confirmation

In some cases, you might need to provide additional confirmation, especially if there’s a dispute about whether payment was received. In such instances, you can provide a bank statement showing the transaction. For checks, you can get a copy of the cleared check from your bank.

Step 6: Obtain a Payment Receipt Letter

In circumstances where the payment receipt is lost or wasn’t issued, you can request a payment receipt letter from the recipient as proof of payment. This letter should include details of the transaction, including the amount paid, the date, and acknowledgment of receipt of payment.

Step 7: Use a Notarized Document

In more formal or significant transactions (like property sale), a notarized document can serve as proof of payment. A notary public will confirm the identities of the parties involved and the transaction details.

Best Payment Receipts And Billing Software

Selecting the best invoicing and billing software often depends on the specific needs of your business. Here are a few top-notch options renowned for their features, reliability, and user experience:

1. QuickBooks: QuickBooks is a robust accounting software solution that offers comprehensive invoicing features. With QuickBooks, you can customize and send invoices, track invoice status, receive payments, and send payment reminders.

2. FreshBooks: Known for its user-friendly interface, FreshBooks offers excellent invoicing features, time tracking, expense tracking, and project management tools. It’s particularly well-suited to freelancers and small businesses.

3. Xero: Xero offers a range of features including invoicing, inventory tracking, bank reconciliation, and expense management. Xero’s interface is simple and clean, making it easy for users to navigate.

4. Zoho Invoice: Zoho Invoice is part of a larger suite of business applications from Zoho. It’s a straightforward invoicing tool, particularly well-suited to small businesses, allowing users to create personalized invoices, automate payment reminders, and accept online payments.

5. Wave: Ideal for freelancers and small businesses, Wave provides a free invoicing and receipt tracking solution. It also offers integrated payroll, automatic bookkeeping, and reporting.

6. Sage 50Cloud: Sage 50Cloud combines the convenience of cloud with the power of desktop accounting software. It offers comprehensive invoicing, cash flow, budgeting, inventory tracking, and tax functions.

7. Invoicely: Invoicely is a solid choice for small businesses, offering scalable invoicing solutions with features like time and expense tracking, customizable invoices, and multi-currency support.

FAQs

Can a payment receipt be issued for both cash and electronic payments?

Yes, payment receipts can be issued for both cash and electronic payments. The receipt should specify the payment method used, whether it is cash, credit card, debit card, check, online transfer, or any other form of payment.

Can a payment receipt be issued electronically?

Yes, payment receipts can be issued electronically. With the advancement of technology, electronic receipts have become more common. They can be sent via email, generated through online payment platforms, or provided as downloadable documents from a website.

Is a payment receipt the same as an invoice?

No, a payment receipt and an invoice are different documents. An invoice is issued by a seller to request payment from a buyer for goods or services provided. It includes the details of the transaction, such as the itemized list of products or services, quantities, prices, and the total amount due. On the other hand, a payment receipt is issued by the recipient of the payment to acknowledge that the payment has been received.

Can a payment receipt be used for tax purposes?

Yes, payment receipts are often used for tax purposes. They serve as evidence of business expenses or income received and can be used to support tax deductions, reimbursements, or audits. It’s important to keep accurate and organized payment receipts to ensure compliance with tax regulations.

Is it necessary to provide a copy of the payment receipt to the customer?

Providing a copy of the payment receipt to the customer is considered good practice. It helps in maintaining transparency, building trust, and allows customers to have a record of their payment for their own reference or accounting purposes.

How long should payment receipts be kept?

The duration for which payment receipts should be kept may vary depending on legal and accounting requirements. In general, it is advisable to keep payment receipts for a minimum of three to seven years. However, it’s always recommended to consult with an accountant or legal professional to determine the specific retention period based on your location and business needs.

Can payment receipts be used to request a refund?

Yes, payment receipts are often required when requesting a refund. They serve as proof of payment and are necessary to validate the original purchase. When seeking a refund, it’s important to provide the payment receipt along with any other relevant documents or information required by the refund policy of the seller or service provider.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)