The income statement is a critical component of a company’s financial statements, providing insight into its revenue, expenses, and overall profitability. It’s a fundamental tool for any business, from small startups to large corporations, to evaluate their financial performance and make informed decisions.

By combining the income statement with the balance sheet and statement of cash flows, businesses can gain a comprehensive understanding of their financial health and use the information to plan and make smart financial decisions.

Table of Contents

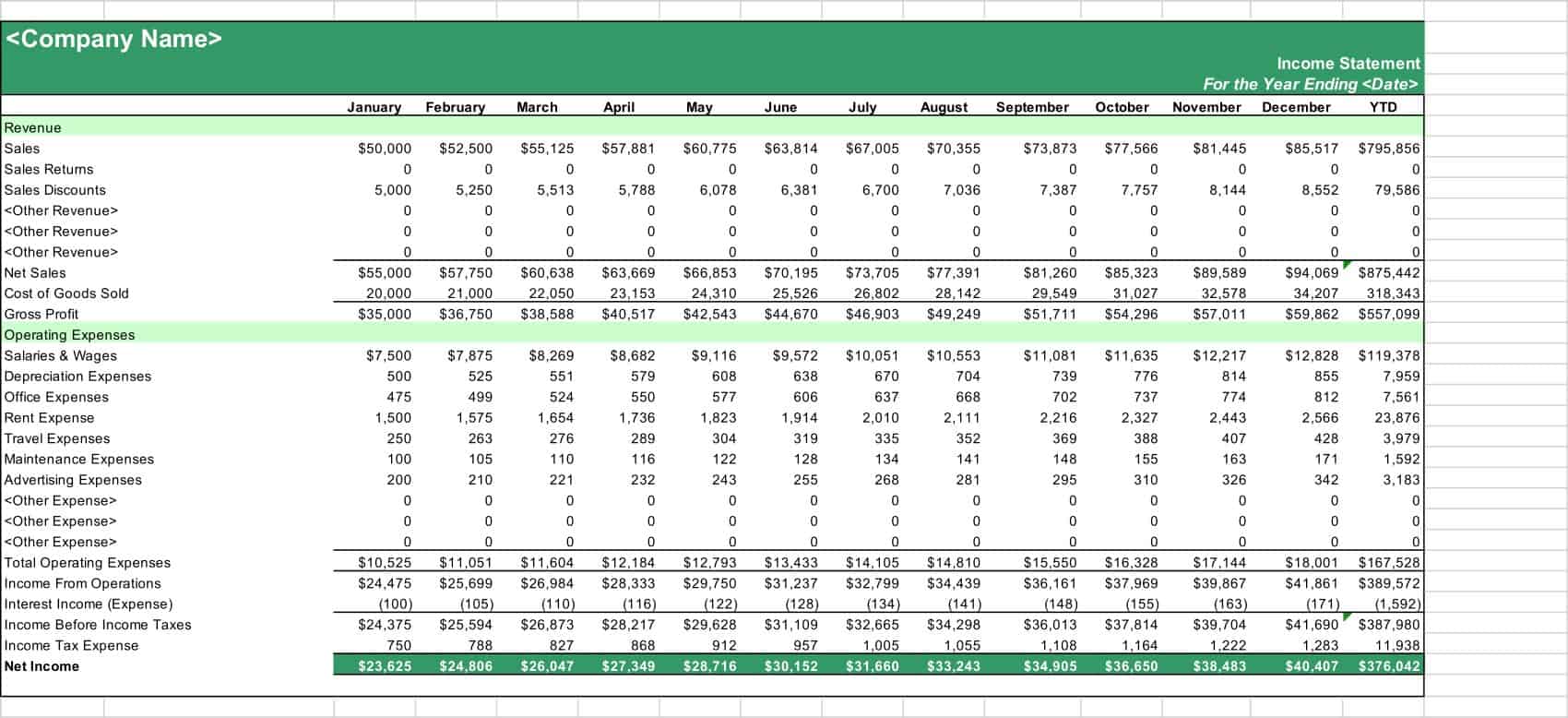

Income Statement Templates

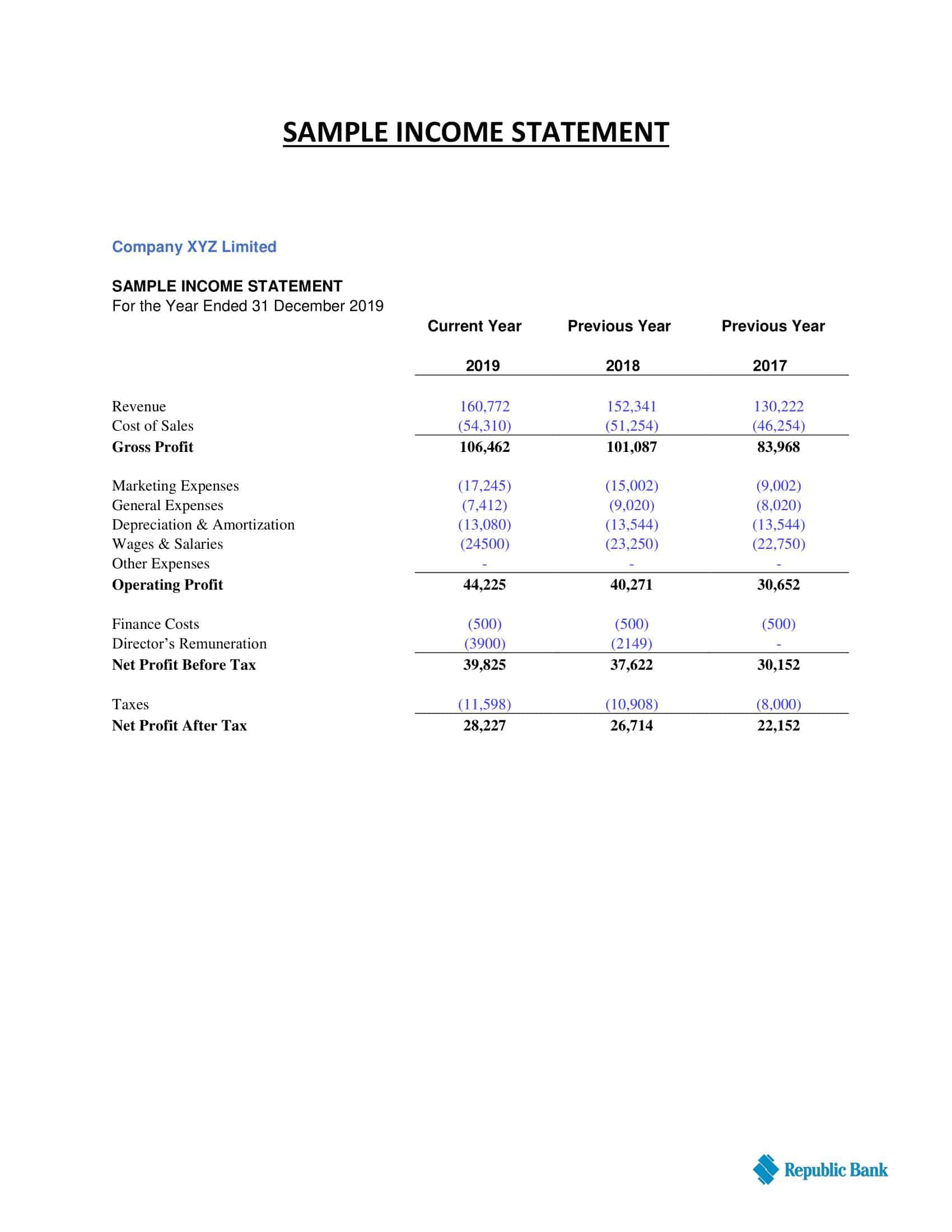

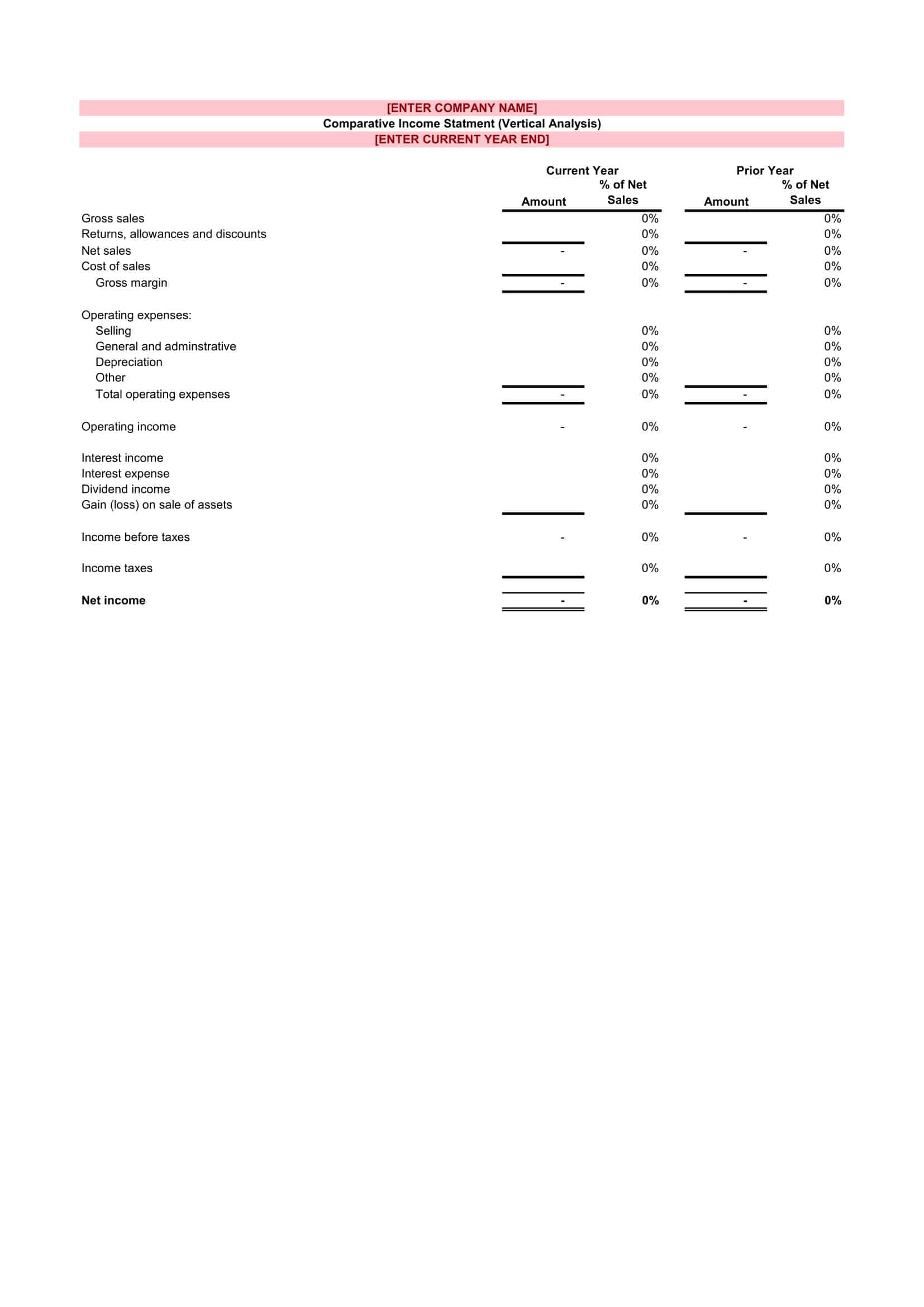

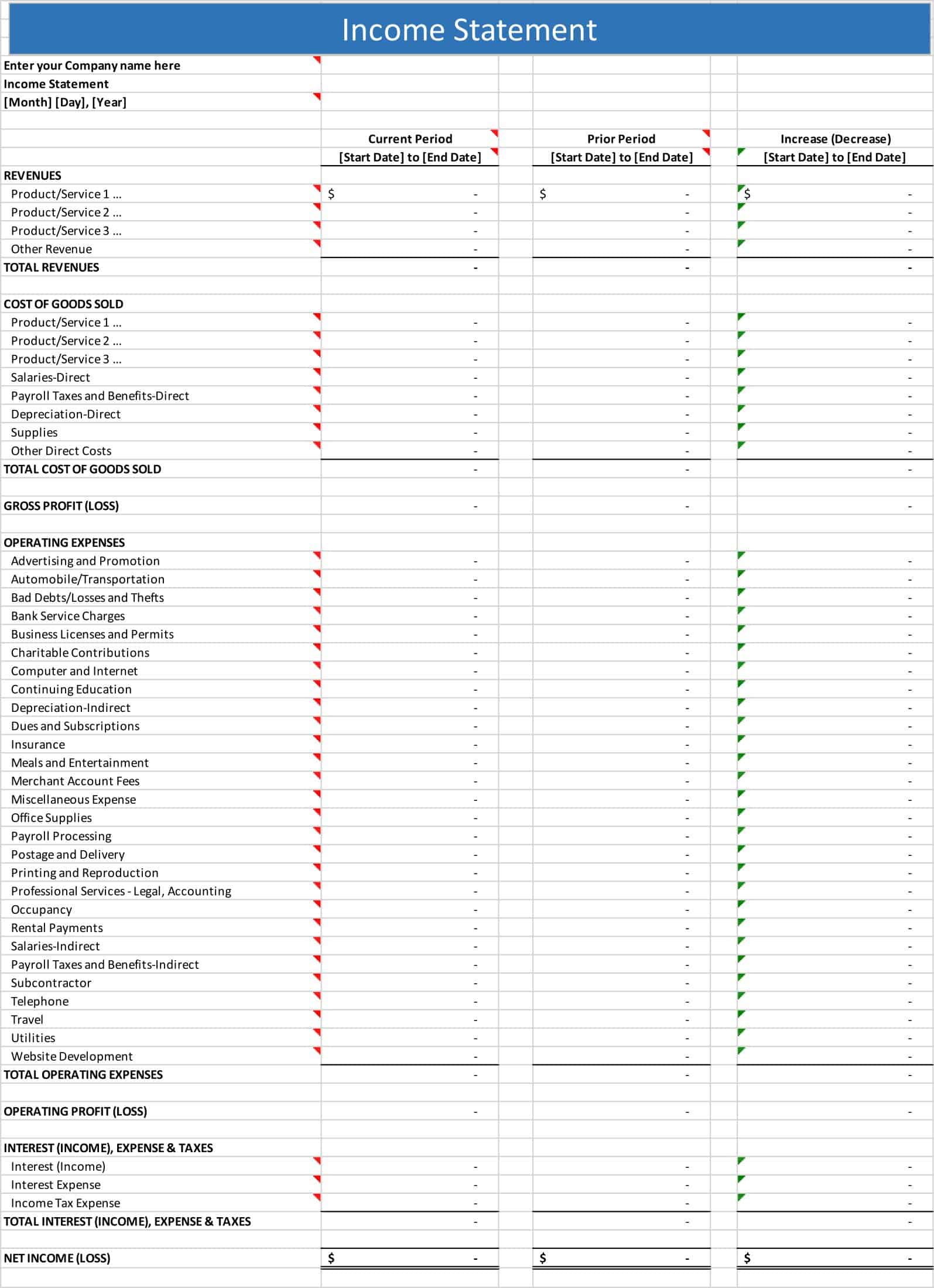

Income Statement Templates, also known as Profit and Loss Statement Templates, are financial documents that provide a summary of an organization’s revenues, expenses, gains, and losses over a specific period. These templates serve as a standardized format for presenting the financial performance of a business, allowing stakeholders to assess its profitability and make informed decisions.

Income Statement Templates can be customized to suit the specific needs and reporting requirements of different businesses or industries. They can be designed as digital spreadsheets, financial software reports, or integrated into accounting systems. By utilizing Income Statement Templates, businesses can analyze their revenue, expenses, and profitability, identify areas of strength and weakness, and make informed financial decisions. These templates serve as a valuable tool for financial reporting, budgeting, and performance evaluation.

What is an income statement?

![Free Printable Income Statement Templates [Excel, Word, PDF] 1 Income Statement](https://www.typecalendar.com/wp-content/uploads/2023/06/Income-Statement-1.jpg 1920w, https://www.typecalendar.com/wp-content/uploads/2023/06/Income-Statement-1-300x169.jpg 300w, https://www.typecalendar.com/wp-content/uploads/2023/06/Income-Statement-1-1024x576.jpg 1024w, https://www.typecalendar.com/wp-content/uploads/2023/06/Income-Statement-1-768x432.jpg 768w, https://www.typecalendar.com/wp-content/uploads/2023/06/Income-Statement-1-1536x864.jpg 1536w, https://www.typecalendar.com/wp-content/uploads/2023/06/Income-Statement-1-1200x675.jpg 1200w)

An income statement, also known as a profit and loss statement or P&L, is a financial document that reports a company’s revenue and expenses over a specific period of time (usually quarterly or annually) to determine its net income or loss. It shows how much money a company brought in, how much it spent, and what its final profit or loss was. The information on the income statement is used to assess the financial performance of a business and inform decisions about future operations.

Types of Income Statements

There are two main types of income statements: single-step and multi-step.

Single-Step Income Statement: This type of income statement presents all revenues and expenses in one single subtraction to arrive at the bottom line of net income. This format is straightforward and simple, making it easy to understand for those who are less familiar with financial statements.

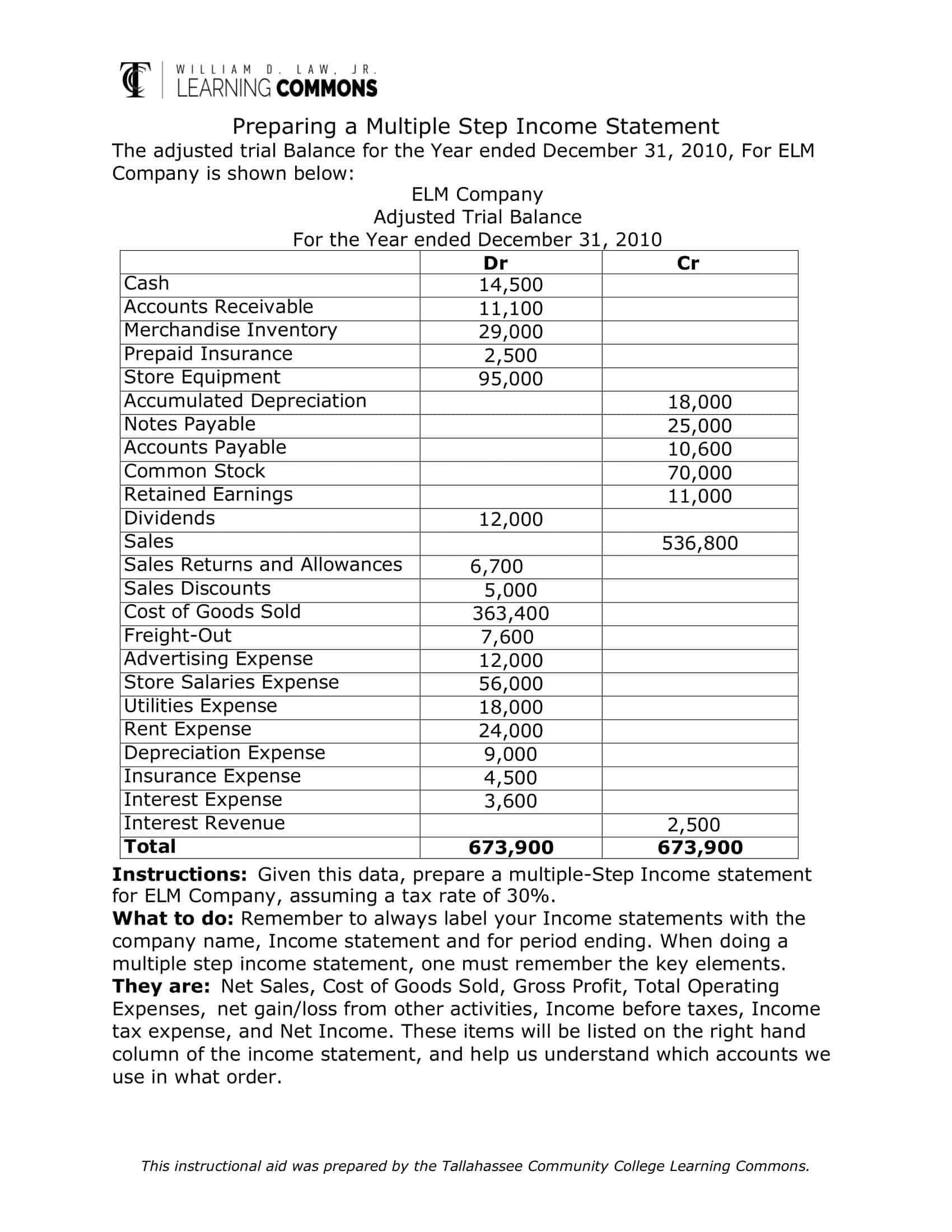

Multi-Step Income Statement: The multi-step income statement provides a more detailed look into a company’s financial performance by breaking down the operating and non-operating items. It begins with the calculation of gross profit (revenue minus the cost of goods sold), then calculates operating expenses, and subtracts all expenses to arrive at the bottom line of net income. This format is useful for businesses that have multiple revenue streams or a significant amount of operating expenses.

Here’s a brief overview of the additional types of income statements:

Simple/Basic Income Statement: A simple or basic income statement typically only includes the most basic elements of revenue and expenses, providing a quick overview of the company’s financial performance.

Pro forma Income Statement: A pro forma income statement is a projection of future financial performance, usually for a proposed project or business venture. It includes estimated revenues and expenses, and helps provide a prediction of what the company’s financial performance could look like in the future.

Common Size Income Statement: A common size income statement presents all items as a percentage of total revenue. This allows for easy comparison of a company’s financial performance over time, or between different companies.

Contribution Margin Income Statement: A contribution margin income statement focuses on the relationship between a company’s revenue and variable costs. It helps to identify which products or services are the most profitable and can inform decision-making about pricing and production.

Absorption Costing Income Statement: An absorption costing income statement includes all costs of production, including both direct and indirect costs, in the calculation of cost of goods sold. This method is used by companies that want to allocate all production costs to the products they produce.

Variable Costing Income Statement: A variable costing income statement only includes direct costs, such as raw materials and direct labor, in the calculation of cost of goods sold. This method is used by companies that want to focus on the costs that vary directly with production levels.

Partial Income Statement: A partial income statement only includes a subset of revenue and expenses, such as those related to a specific product or department. It’s used by businesses to get a more detailed understanding of a specific aspect of their financial performance.

CVP Income Statement: A CVP (cost-volume-profit) income statement focuses on the relationship between a company’s costs, revenue, and volume. It’s used to make decisions about pricing, production, and cost control.

Segmented Income Statement: A segmented income statement provides information about a company’s performance by product line, geographic location, or other business segments. This allows for more detailed analysis of a company’s financial performance.

Comparative Income Statement: A comparative income statement compares a company’s financial performance over two or more time periods. It provides a snapshot of how a company’s financial performance has changed over time.

Projected Income Statement: A projected income statement is a forecast of a company’s future financial performance, based on historical data and estimated future trends. It’s used by companies to plan for future operations and make informed decisions.

Consolidated Income Statement: A consolidated income statement combines the financial information of multiple subsidiary companies into a single statement. It provides a comprehensive picture of the financial performance of a parent company and its subsidiaries.

Each type of income statement serves a specific purpose and can provide valuable information for financial analysis and decision-making. By understanding the different types of income statements, businesses can choose the right one to fit their needs and gain valuable insights into their financial performance.

What is included in the income statement?

An income statement typically includes the following components:

Revenue: This is the total amount of money a company earns from the sale of its goods or services.

Cost of goods sold (COGS): This is the direct cost of producing the goods or services sold, including the cost of raw materials, labor, and manufacturing overhead.

Gross profit: This is the amount of money left over after the COGS are subtracted from the revenue.

Operating expenses: These are the indirect costs of running a business, such as marketing, salaries, and rent.

Operating income: This is the amount of money left after the operating expenses are subtracted from the gross profit.

Other income/expenses: This can include items such as interest income, gains or losses from investments, and any other income or expenses that don’t fit into the other categories.

Pretax income: This is the amount of money left after the other income/expenses are subtracted from the operating income.

Income tax expense: This is the amount of money a company owes in taxes on its pretax income.

Net income: This is the final profit or loss figure, which is the amount of money a company has left after all revenues, costs, and taxes are taken into account.

Income statements may also include other information, such as sales by product line or geographic region, depending on the company’s needs and the purpose of the statement.

Who uses an income statement?

An income statement is used by a variety of stakeholders including:

Investors: To evaluate the financial performance of a company and make informed investment decisions.

Management: To track the company’s performance over time and make informed business decisions.

Lenders: To assess a company’s ability to repay loans and determine the level of risk involved in lending to the company.

Regulators: To ensure that a company is in compliance with financial reporting requirements and regulations.

Suppliers: To determine a company’s ability to pay for goods and services.

Competitors: To benchmark the performance of a company against its competitors.

Employees: To understand the financial performance of the company they work for and its ability to offer competitive compensation and benefits.

How to Create Your Own Income Statement

Creating an income statement requires gathering information about your company’s revenues, expenses, and other financial transactions. Here is a step-by-step guide on how to create your own income statement:

Gather financial data: Collect all financial information for the period you want to cover, including sales revenue, cost of goods sold, operating expenses, and any other income or expenses.

Determine the format: Choose the format that best suits your needs, such as a single-step or multi-step income statement.

Calculate gross profit: Subtract the cost of goods sold from the revenue to find the gross profit.

Calculate operating expenses: Add up all the operating expenses, such as marketing, salaries, and rent.

Calculate operating income: Subtract the operating expenses from the gross profit to find the operating income.

Calculate other income/expenses: Add up any other income or expenses, such as interest income or gains from investments.

Calculate pretax income: Subtract the other income/expenses from the operating income to find the pretax income.

Calculate tax expense: Calculate the income tax owed based on the pretax income and current tax laws.

Calculate net income: Subtract the tax expense from the pretax income to find the net income, which represents the company’s final profit or loss for the period.

Present the information: Organize and present the information in a clear, concise, and easy-to-understand format, such as a table or chart.

Accounting Terms You Need to Know

There are several common accounting terms that are frequently used in financial statements and it’s important to understand the differences between them. Here are some common accounting terms and their definitions:

Revenue: The amount of money received by a company from its sales or services.

Gross Profit: The difference between the cost of goods sold and the revenue.

Operating Expenses: The expenses incurred by a company in the normal course of business, excluding the cost of goods sold.

Operating Income: The profit earned by a company from its main operations, calculated as the difference between revenue and operating expenses.

Net Income: The profit earned by a company after taking into account all revenue, expenses, taxes, and other deductions.

Assets: The resources owned by a company that have value and can be used to generate future income.

Liabilities: The obligations of a company to repay debts or pay for goods and services.

Equity: The residual interest in the assets of a company after deducting liabilities.

Cash Flow: The movement of cash into and out of a company, representing the inflow from operating, investing, and financing activities and the outflow for expenses, investments, and financing.

Accruals: Expenses or revenues that are recognized in the income statement before the cash is received or paid.

Depreciation: The allocation of the cost of an asset over its useful life.

Amortization: The process of gradually reducing the value of an intangible asset over time, such as patents or copyrights.

Bad Debt: An uncollectible debt that was previously recorded as revenue.

Capital Expenditures: Expenditures made by a company to acquire or upgrade long-term assets, such as property, plant, and equipment.

Cost of Goods Sold (COGS): The cost of producing the goods or services sold by a company.

Reserve: An amount set aside to cover future liabilities or expenses.

Write-off: The removal of an asset or liability from the balance sheet because it is no longer expected to provide future benefits.

Allowance for Doubtful Accounts: An estimate of the amount of accounts receivable that may not be collected.

Inventory: Raw materials, work-in-progress, and finished goods that a company holds for sale.

Accrued Expenses: Expenses incurred but not yet paid or recorded.

Capitalization: The process of recording an expenditure as an asset instead of an expense.

Deferred Revenue: Revenue received but not yet earned, recorded as a liability.

Dividends: Distributions of earnings to shareholders of a company.

Goodwill: An intangible asset that represents the value of a company’s reputation and customer relationships.

Impairment: A permanent reduction in the value of an asset.

Lease: A contract between a lessor and a lessee, giving the lessee the right to use an asset for a specified period of time in exchange for payment.

Notes Payable: A written promise to pay a debt at a specified future date.

Preferred Stock: A type of stock that pays a fixed dividend and has priority over common stock in the payment of dividends and the distribution of assets in the event of liquidation.

Stock Options: The right to purchase stock at a specified price, granted to employees or other individuals as a form of compensation.

FAQs

What is the difference between an income statement and a balance sheet?

An income statement shows a company’s financial performance over a specific period of time, while a balance sheet shows a company’s financial position at a specific point in time. An income statement focuses on revenue and expenses, while a balance sheet focuses on assets, liabilities, and equity.

Why is an income statement important?

An income statement is important because it shows a company’s financial performance over a specific period of time. It provides valuable information about a company’s revenue, expenses, and profit, which helps stakeholders make informed decisions about the company.

What is the purpose of an income statement?

The purpose of an income statement is to show a company’s financial performance over a specific period of time. It provides information about a company’s revenue, expenses, and profit, which helps stakeholders make informed decisions about the company.

How is an income statement different from a cash flow statement?

An income statement focuses on a company’s revenue, expenses, and profit, while a cash flow statement focuses on a company’s inflows and outflows of cash. An income statement is concerned with profit and loss, while a cash flow statement is concerned with cash balances.

How often should a company produce an income statement?

A company should produce an income statement at least once a year, typically at the end of its fiscal year. Some companies may also produce income statements on a quarterly or monthly basis.

What is the difference between a single-step and multi-step income statement?

A single-step income statement simply lists all revenues and all expenses and calculates the net income. A multi-step income statement breaks down the calculation of net income into several steps, including gross profit and operating income.

Can an income statement be used to predict a company’s future performance?

While an income statement can provide valuable information about a company’s past performance, it should not be used as a sole predictor of future performance. Other factors, such as market conditions, competition, and changes in a company’s operations, can also impact future performance.

![Free Printable Food Diary Templates [Word, Excel, PDF] 2 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 3 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 4 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

The income statement guide on this website is a fantastic resource for understanding financial statements! Thanks to the author for breaking down the complexities. Your insights are incredibly helpful for anyone navigating the world of finance.