As a business owner, I know how important it is to protect my business from chargebacks and payment disputes. After dealing with a few headaches from unauthorized credit card charges, I decided it was time to start using credit card authorization forms. These forms have become an essential part of my client payment process.

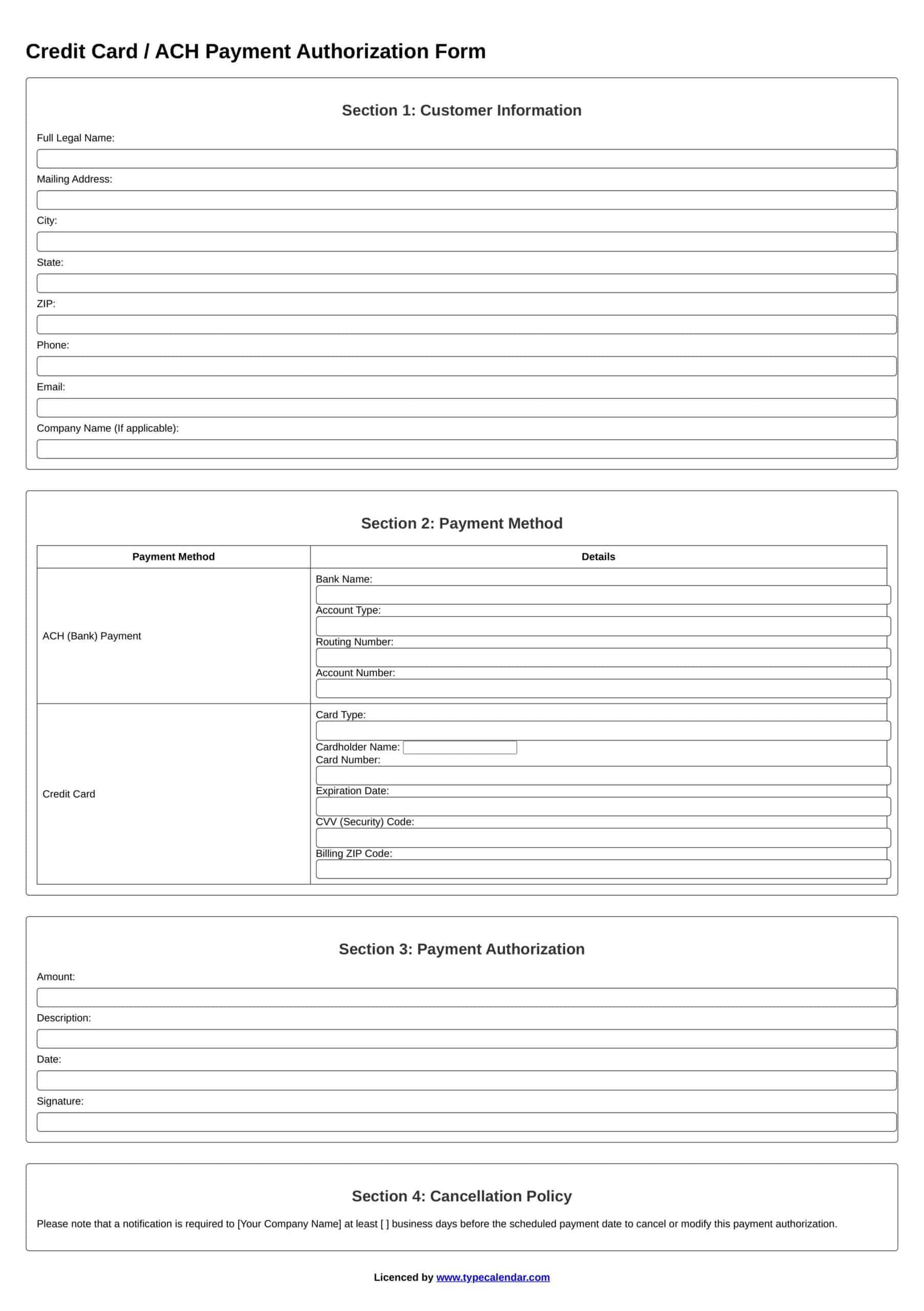

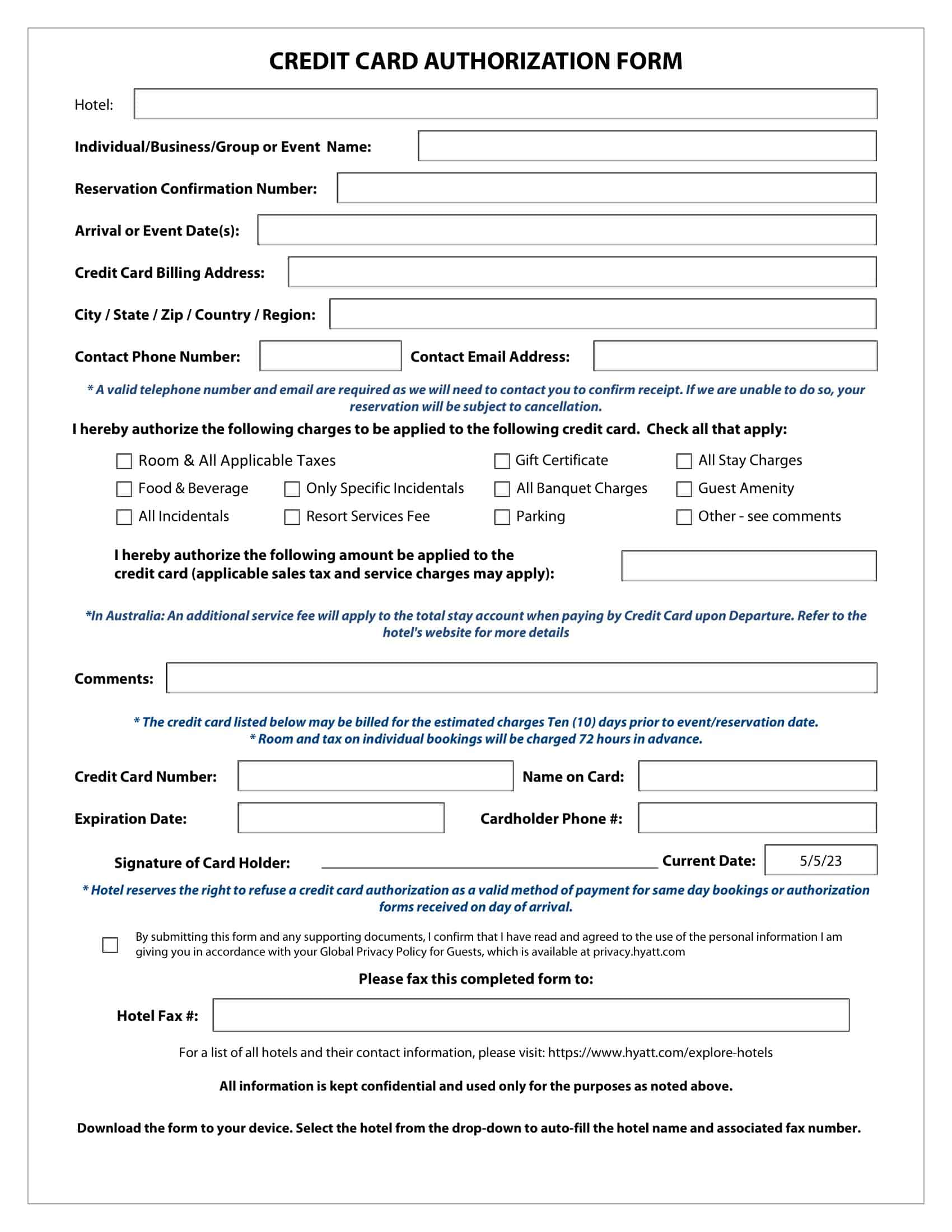

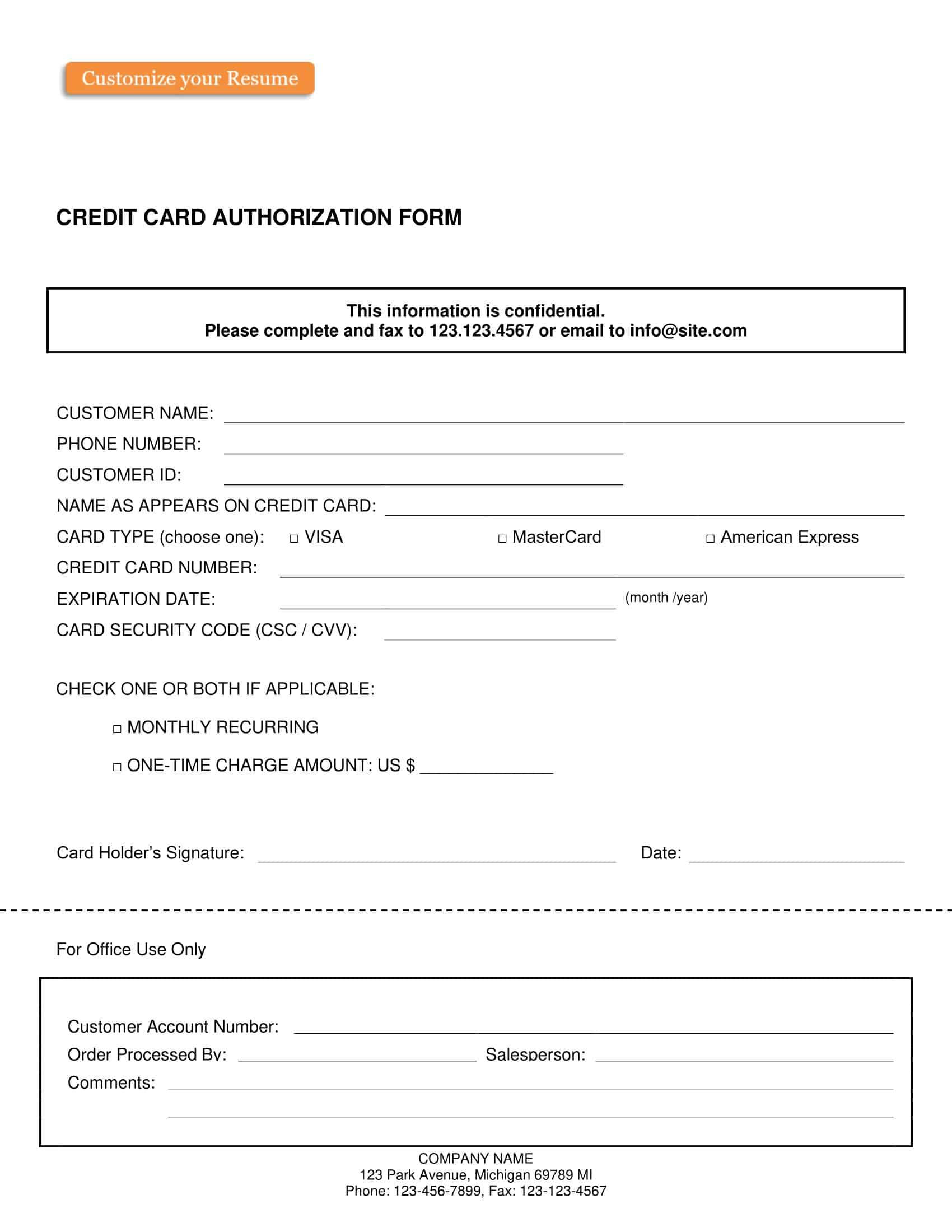

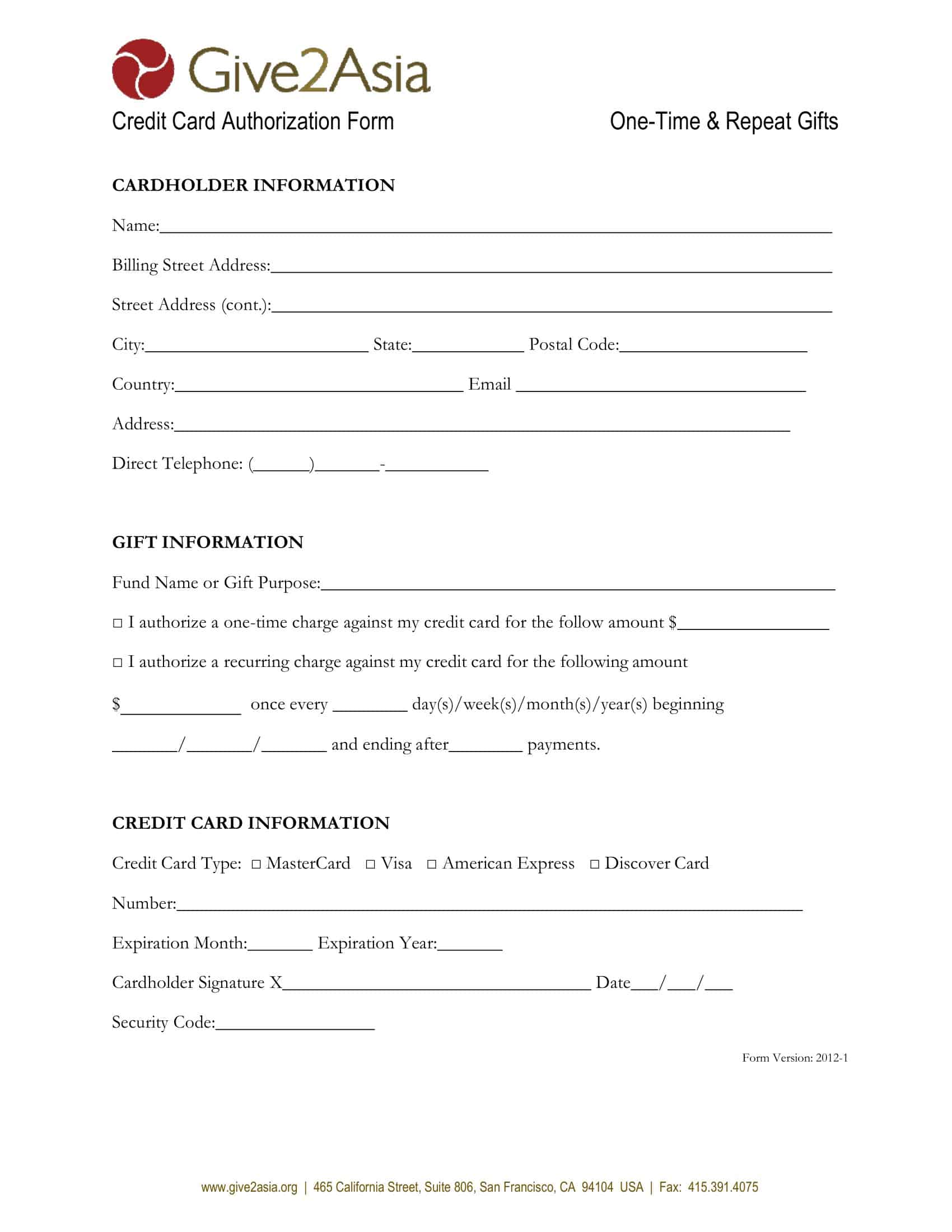

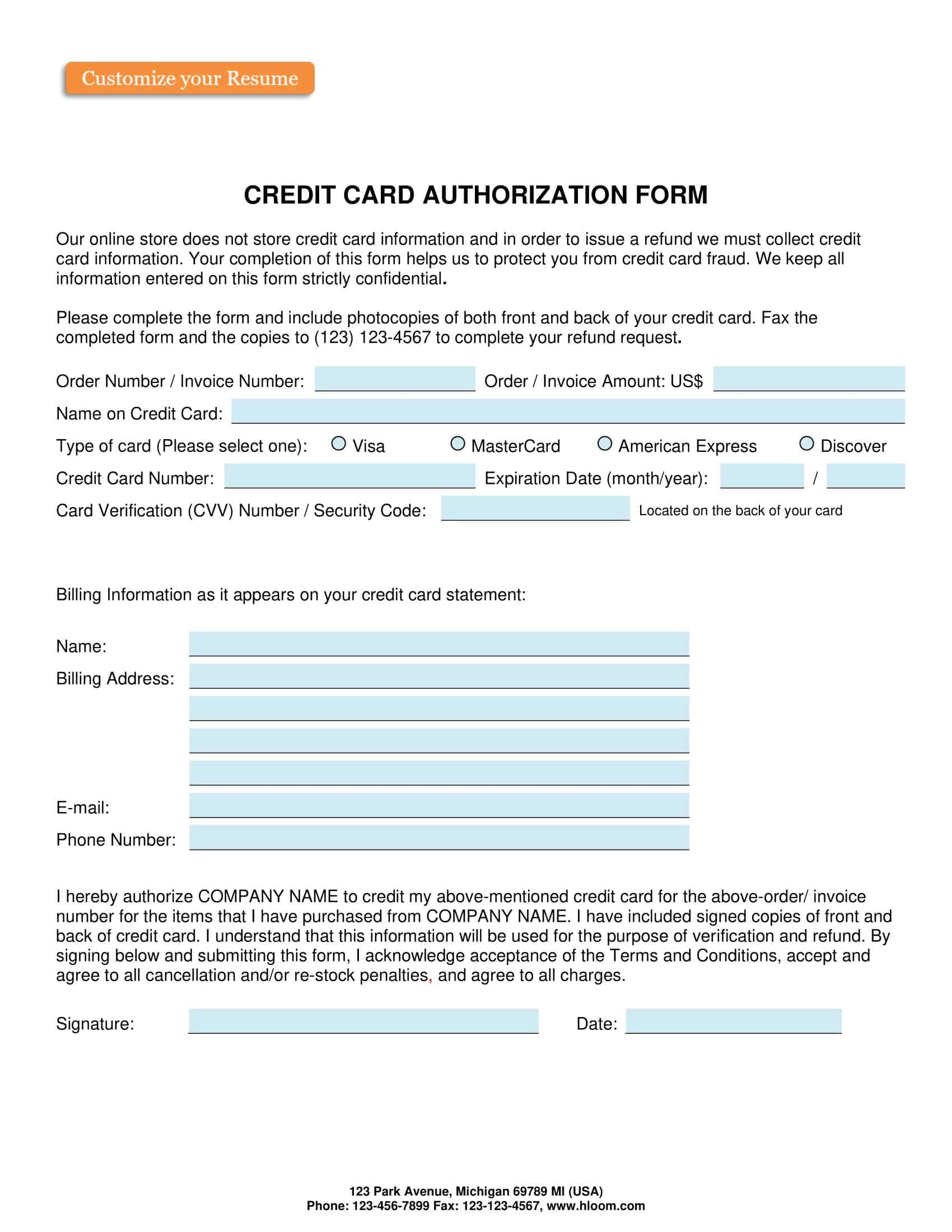

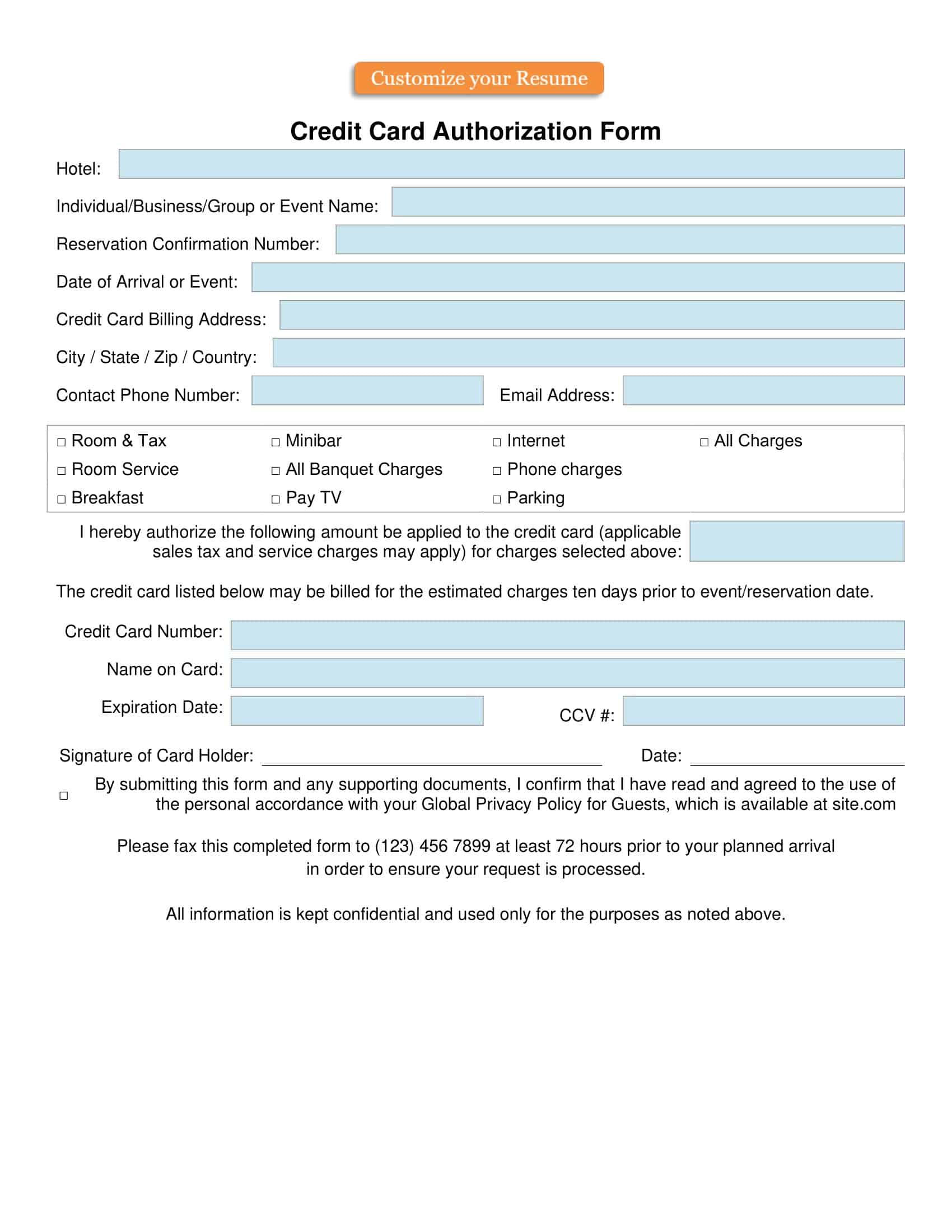

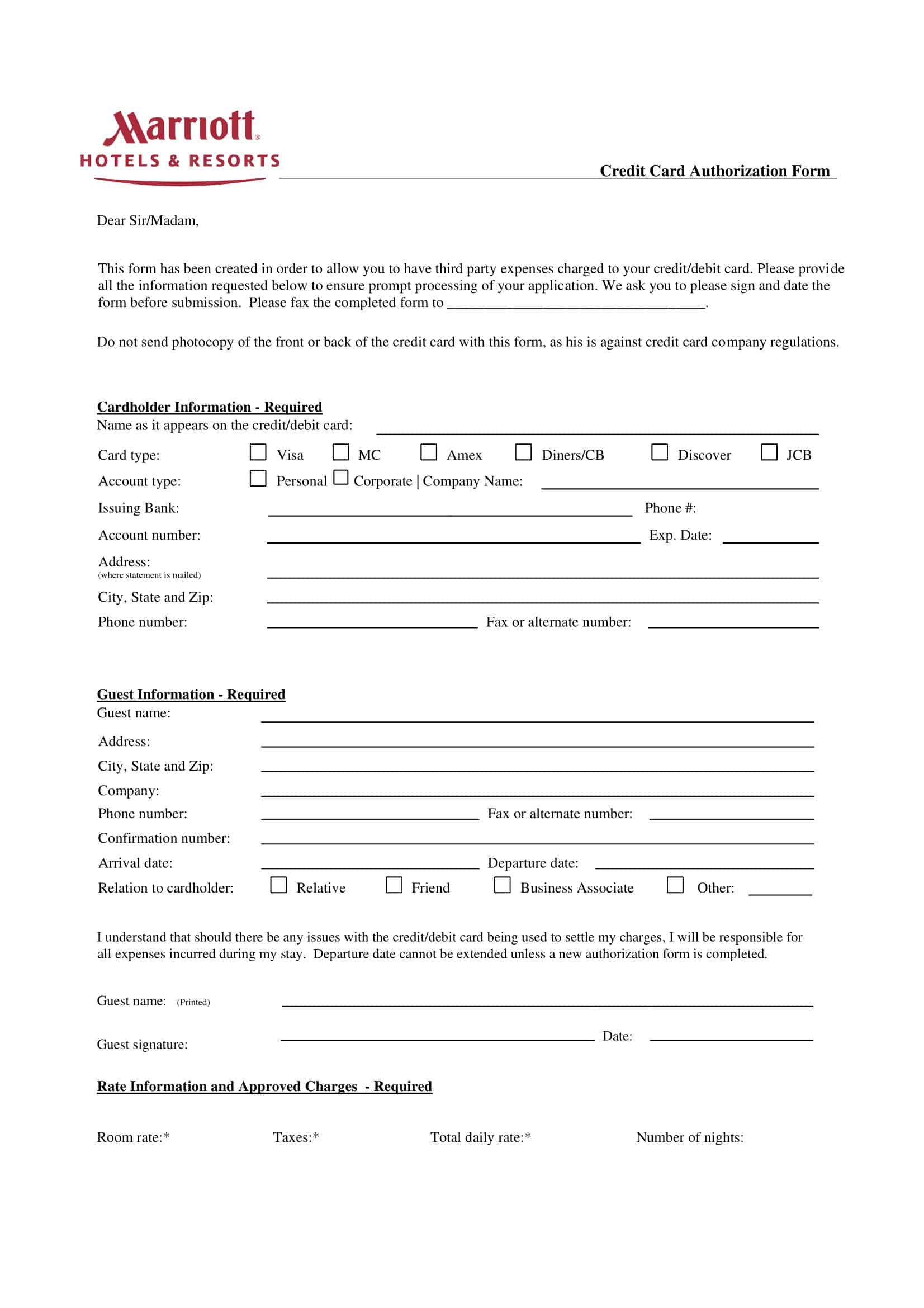

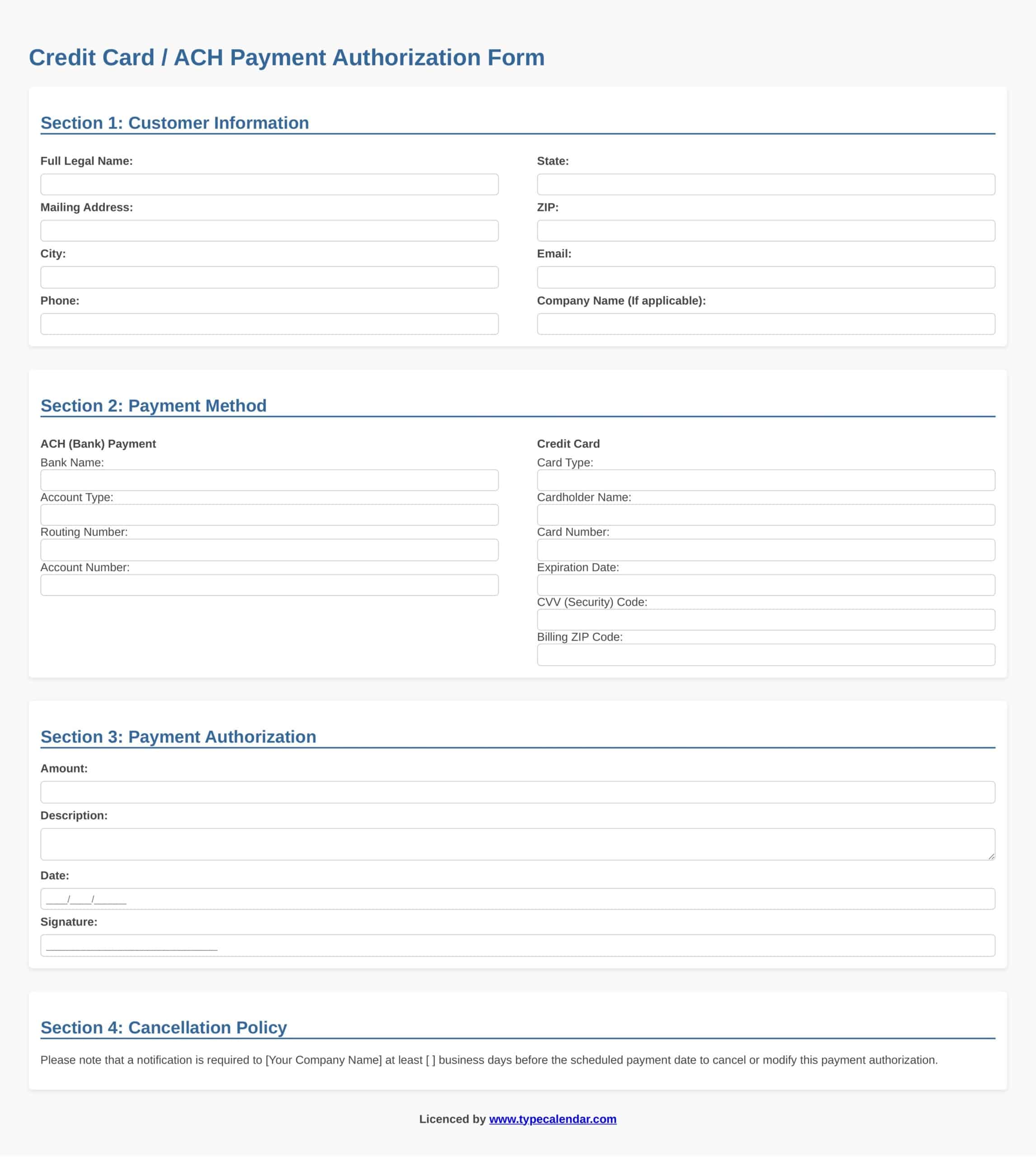

A credit card authorization form is a document signed by the cardholder giving me permission to charge their card for services. This protects me from situations where a client later disputes a charge as fraudulent or unauthorized.

The authorization form includes important details like the cardholder’s name, card number, expiration date, and billing address. It also includes the total amount I’m authorized to charge the card and the frequency, such as monthly or annually. The customer then signs and dates the form.

A clear form minimizes confusion and ensures that my clients fully understand what they are signing. It also protects me in case a dispute does arise – I have a signed document authorizing the charges.

Including an authorization form as part of my payment process has given me great peace of mind. I know that as long as customers complete the form, I am protected from unfair chargebacks and disputes. I’d recommend any business that accepts credit card payments to start using authorization form templates. Protecting your business is worth the minimal effort

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 1 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Financial Projections Templates [Excel, PDF] 2 Financial Projection](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Projection-1-150x150.jpg)

![Free Printable Goal Chart Templates [PDF, Word, Excel] 3 Goal Chart](https://www.typecalendar.com/wp-content/uploads/2023/06/Goal-Chart-150x150.jpg)