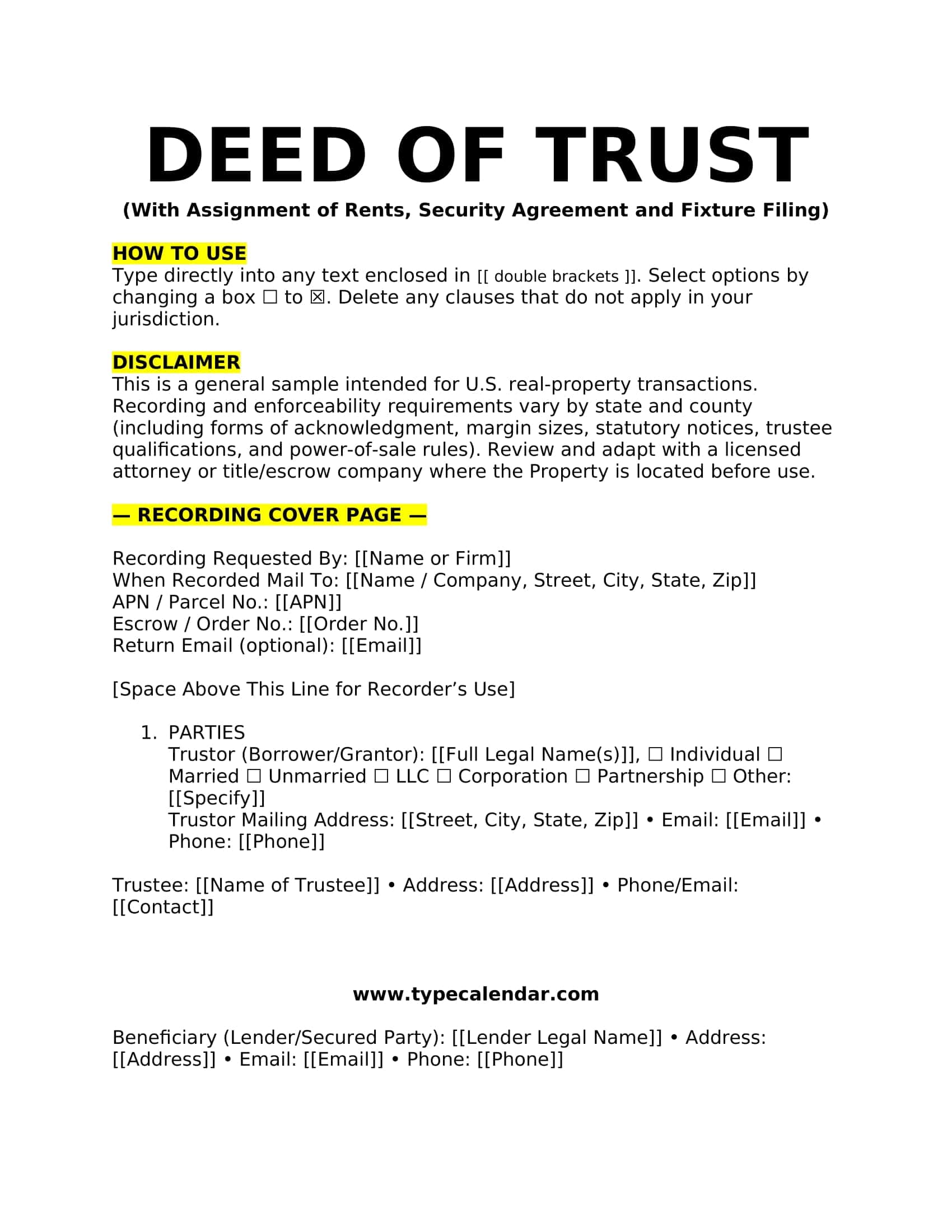

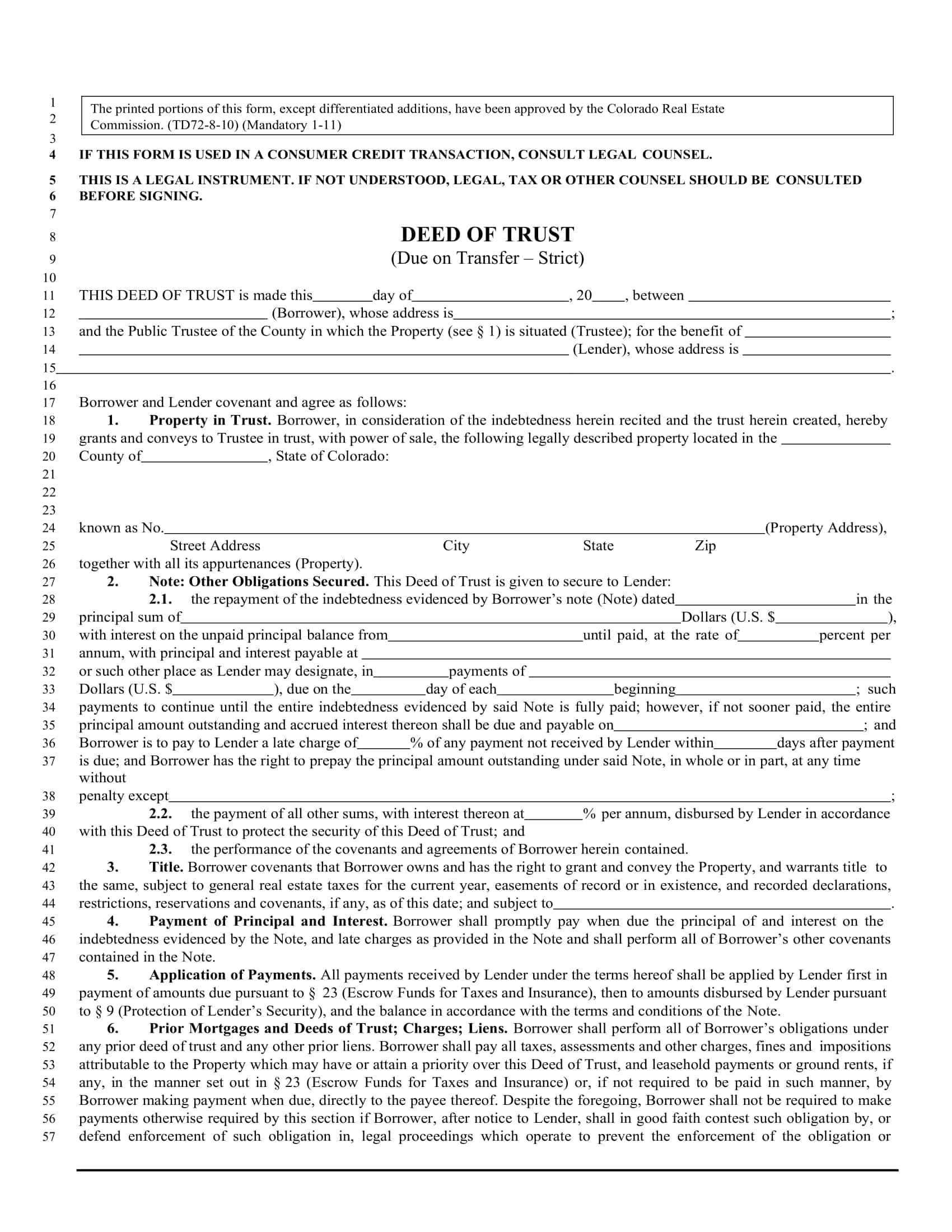

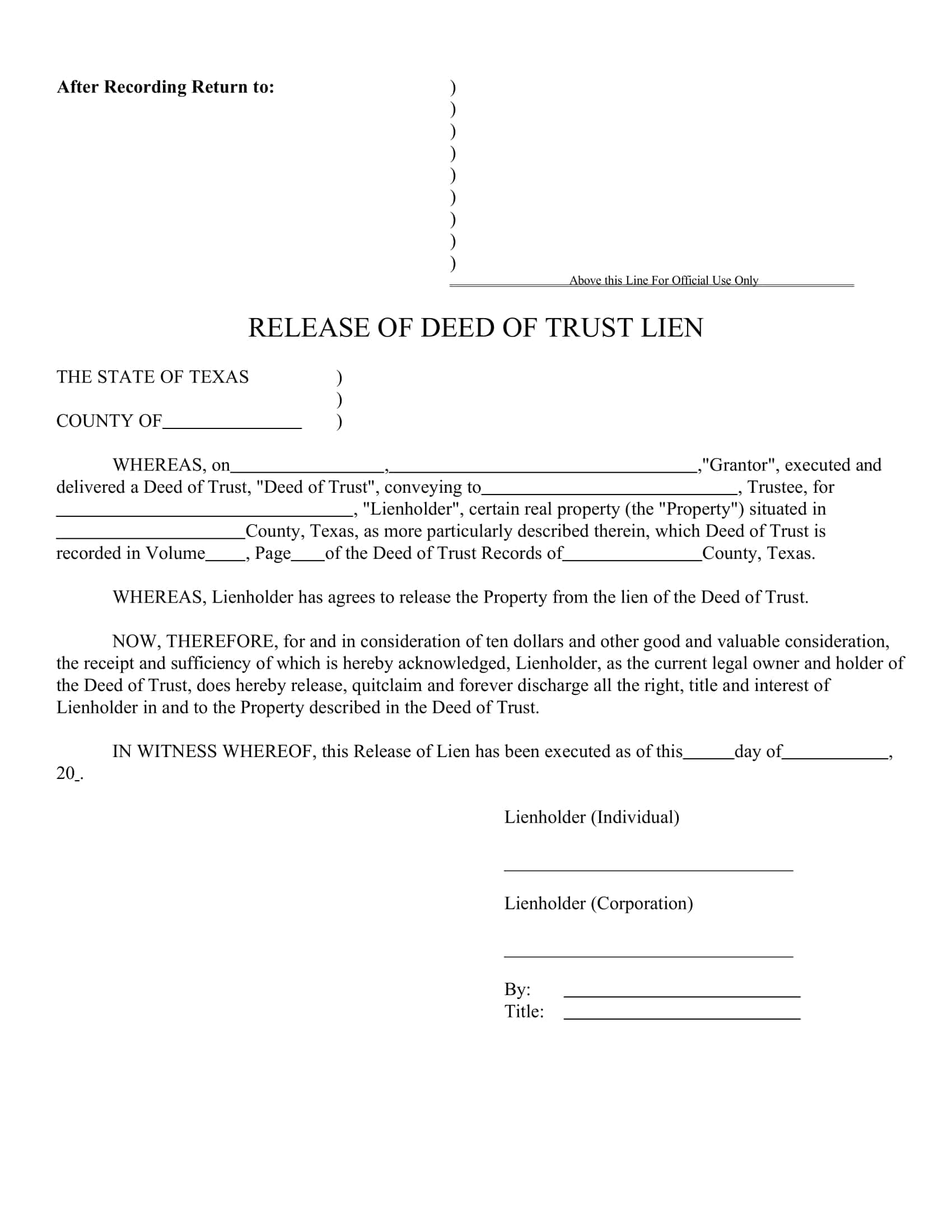

If you’re borrowing money secured by real estate, one of the most critical documents you’ll sign is a Deed of Trust. This instrument defines the roles of the borrower (trustor), the neutral third party (trustee), and the lender (beneficiary) and, in many states, allows nonjudicial foreclosure under a power of sale clause if the borrower defaults. That’s why TypeCalendar has brought together more than 45 original Deed of Trust resources/templates focused on practical use and legal clarity: Comprehensive Deed of Trust Form, ready-made example texts and easily customizable template options can be downloaded individually.

Table of Contents

What Is a Deed of Trust?

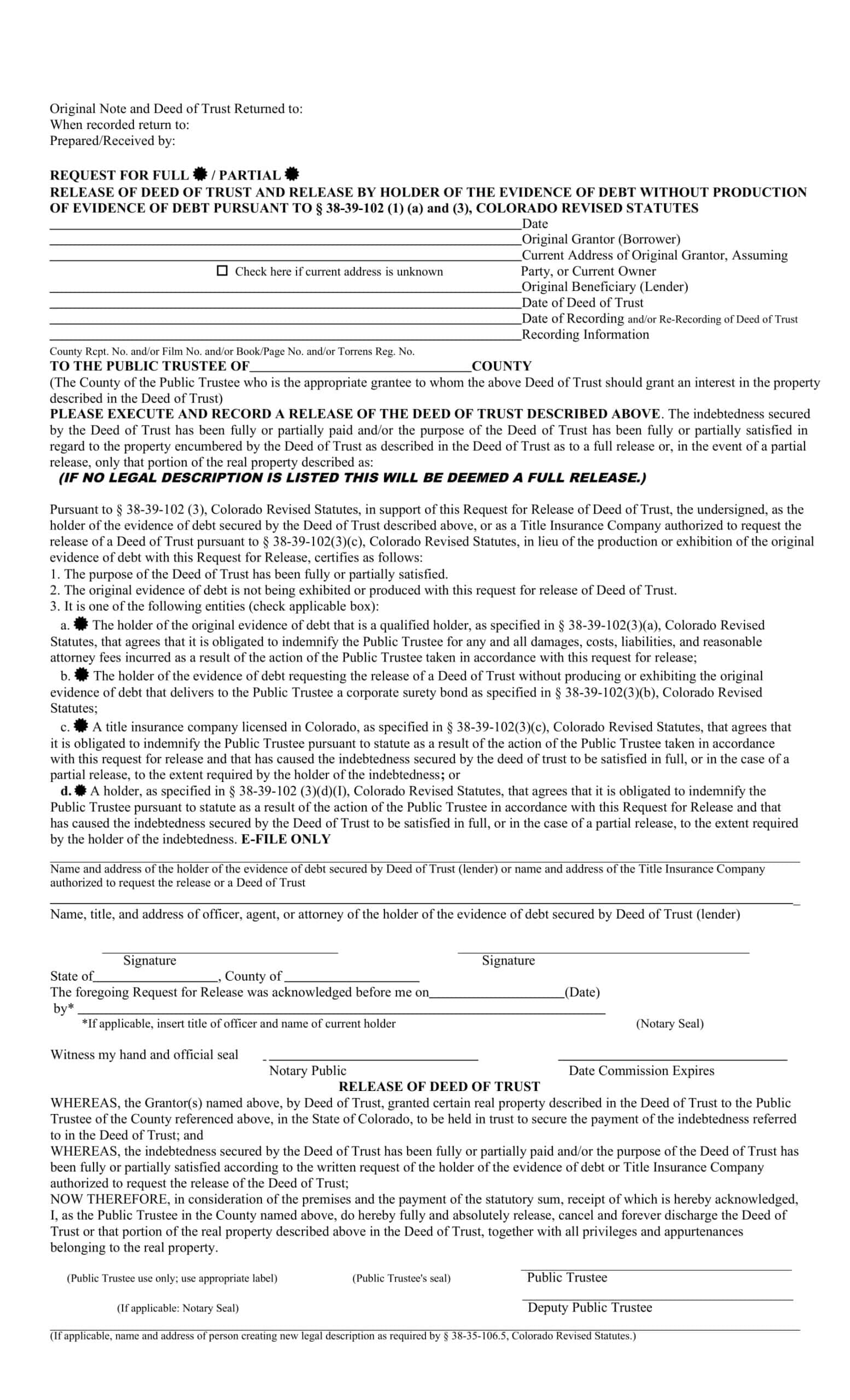

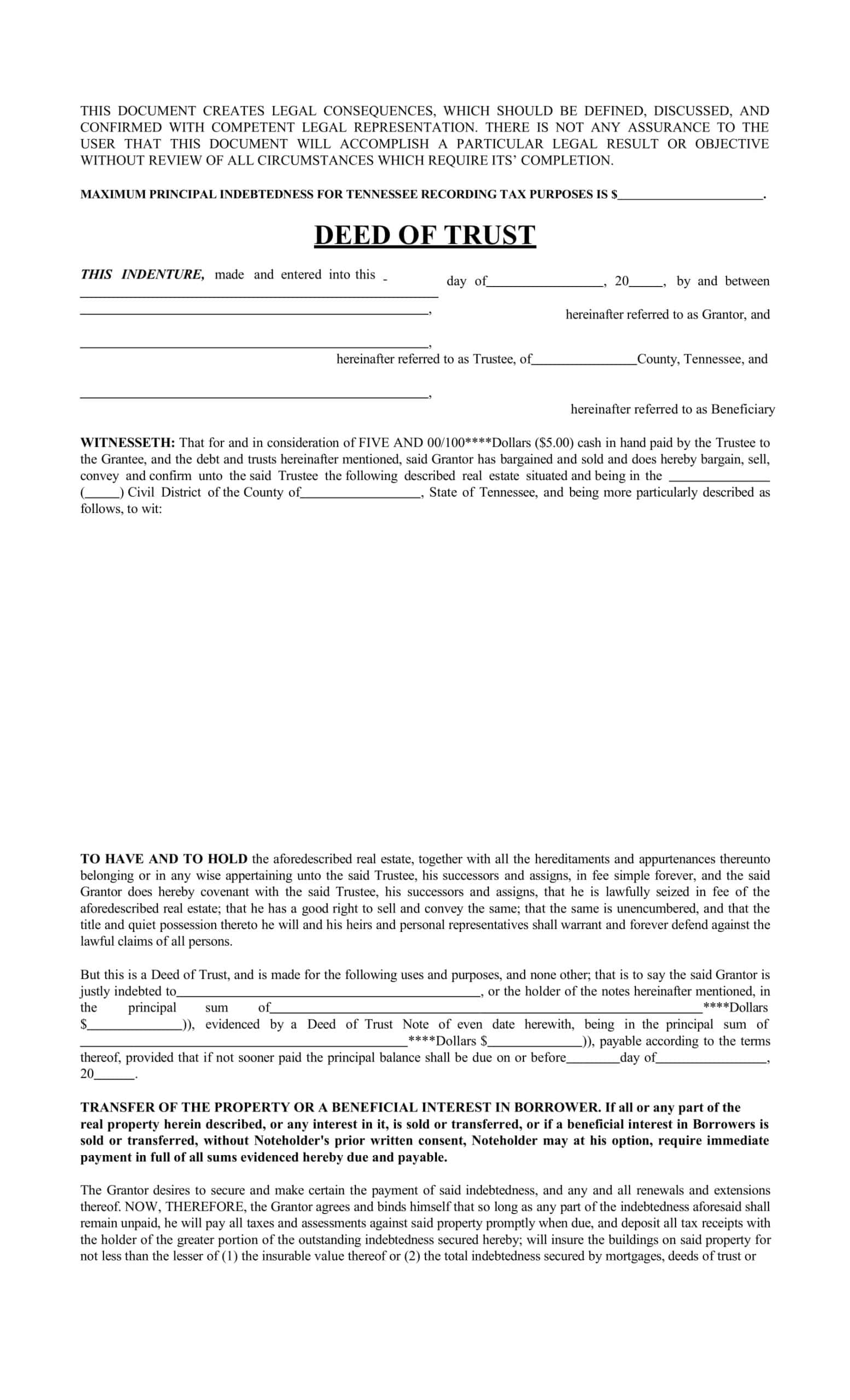

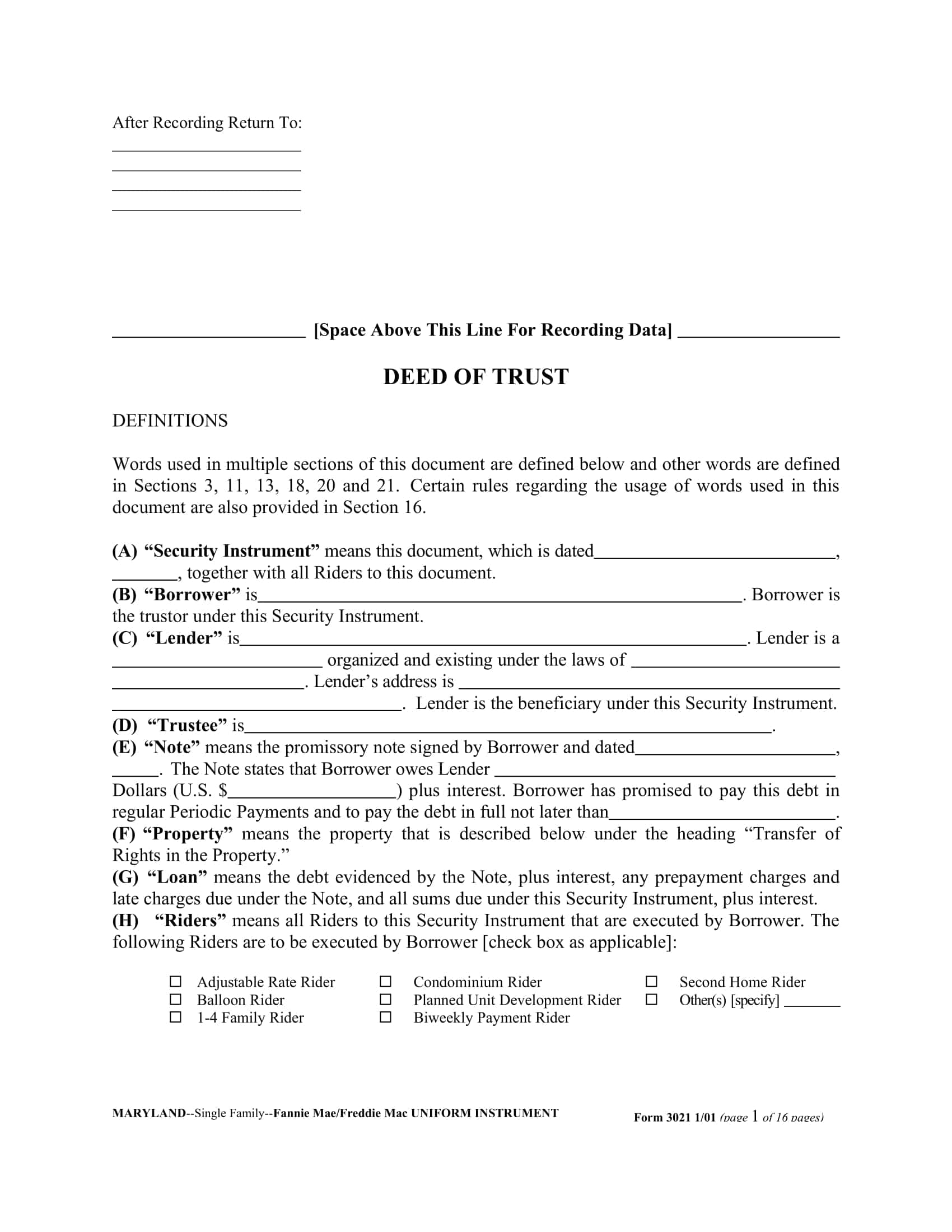

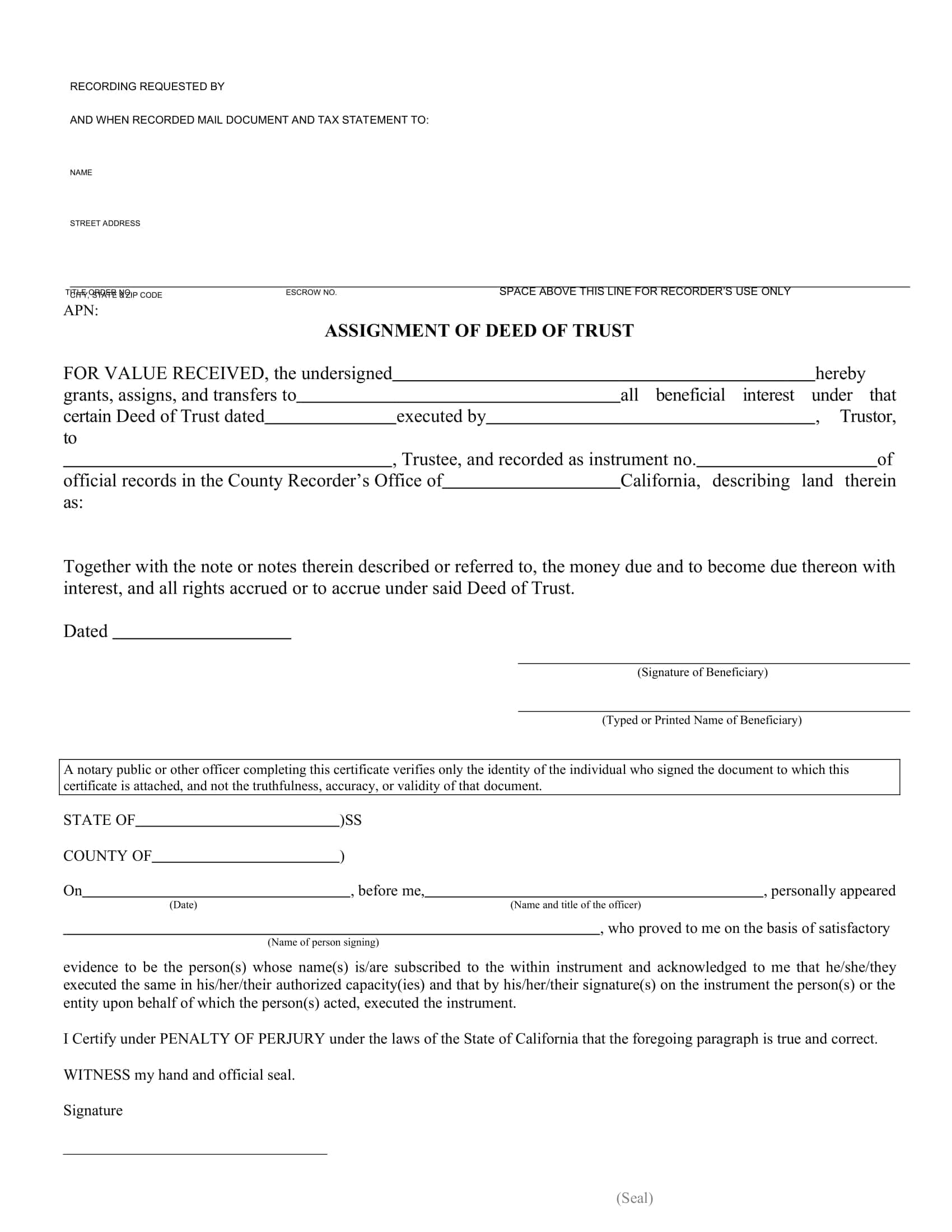

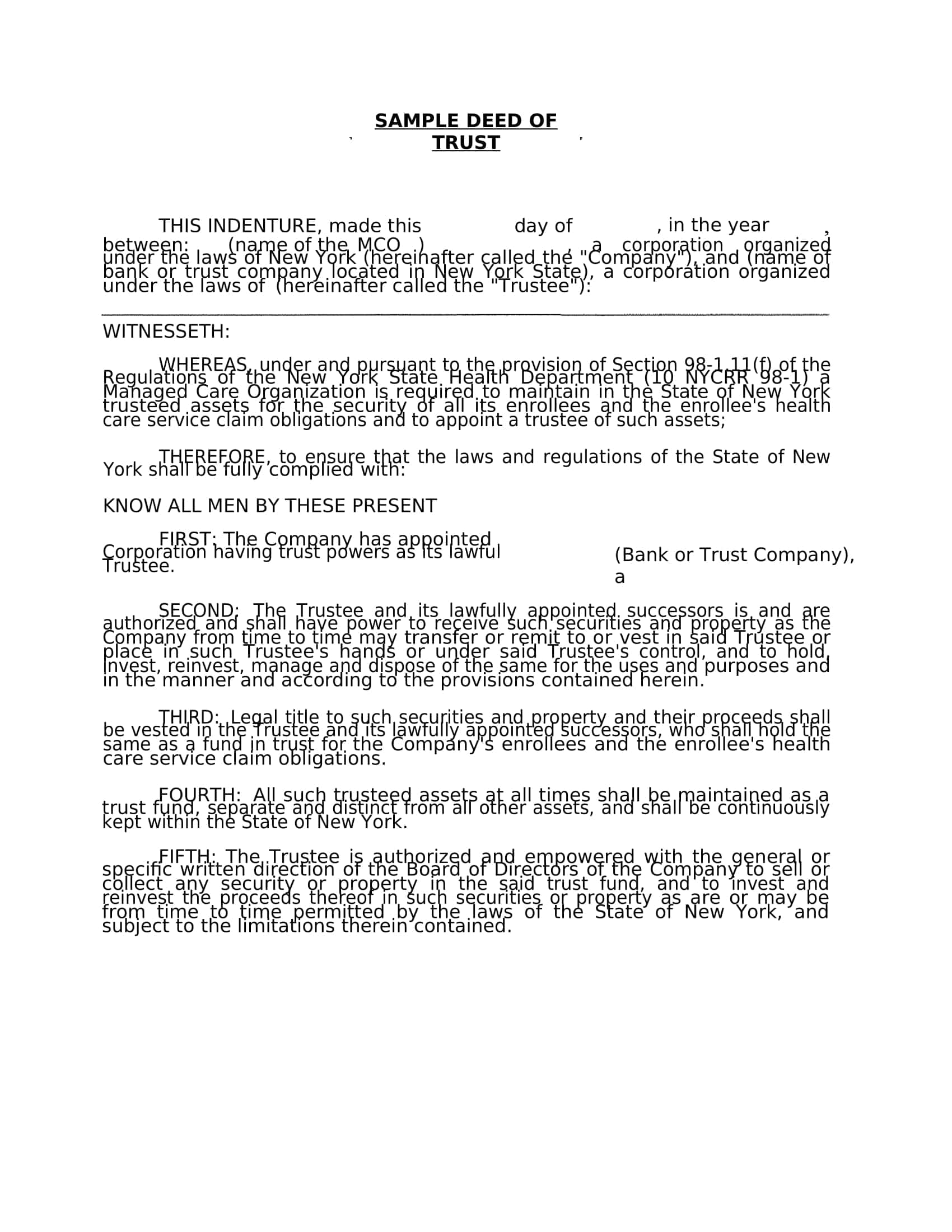

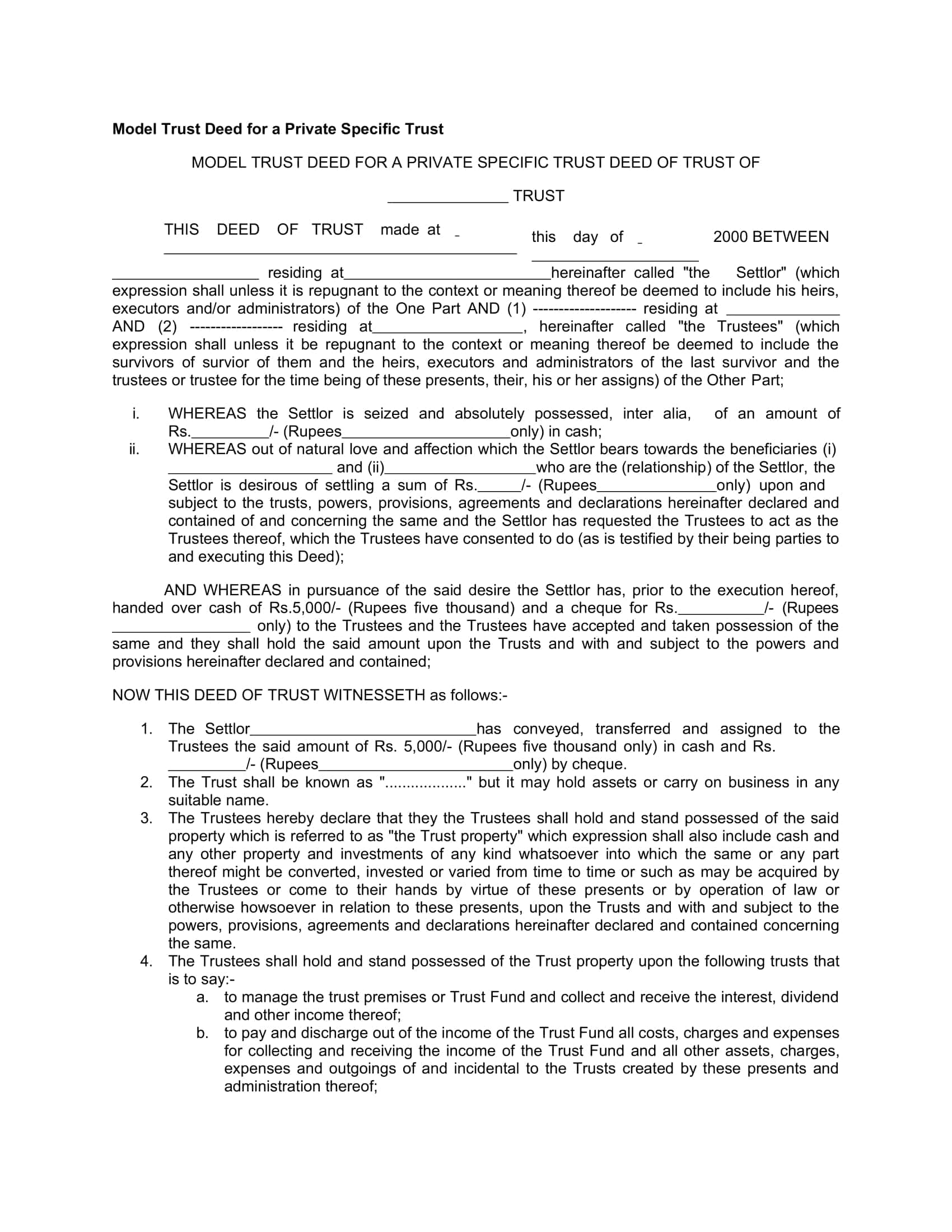

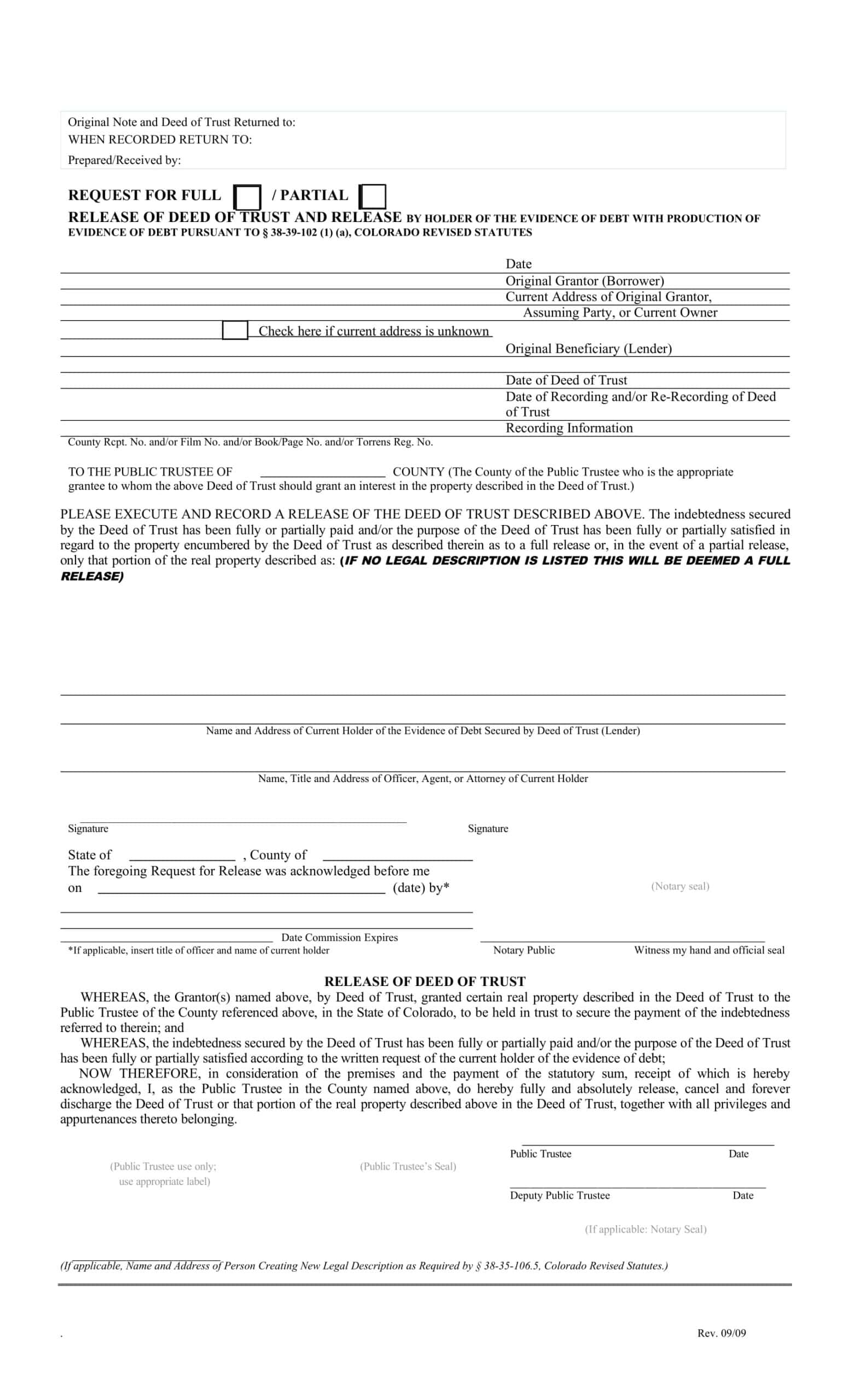

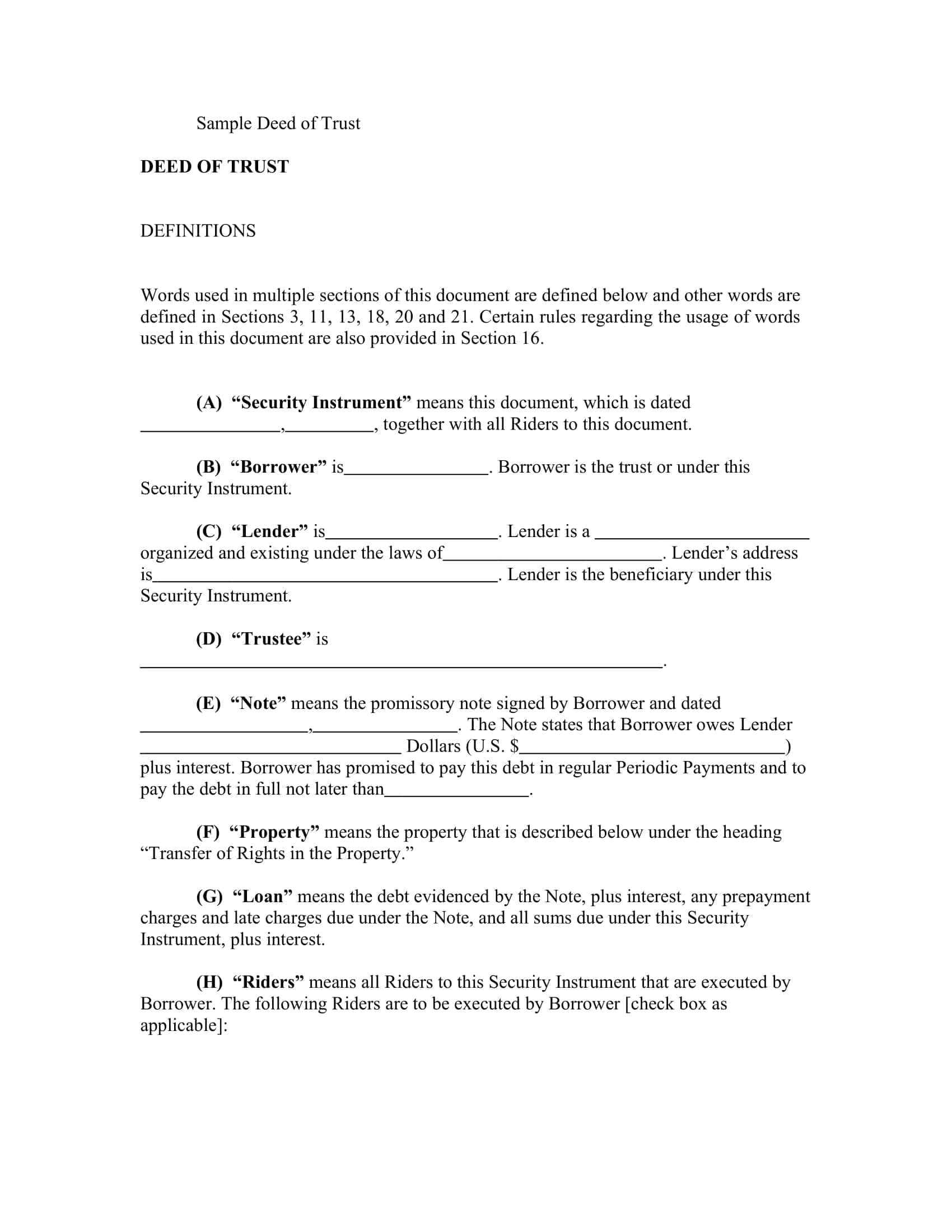

Although it seems to be from the same family as a mortgage, a Deed of Trust is three-party instrument administered through a trustee. The borrower leaves the property as collateral “in trust”; provisions protecting the creditor’s right on the title deed come into effect until the loan is repaid. The reason it is preferred in many “power-of-sale” states is that the process progresses relatively quickly and predictably thanks to non-judicial foreclosure in case of default.

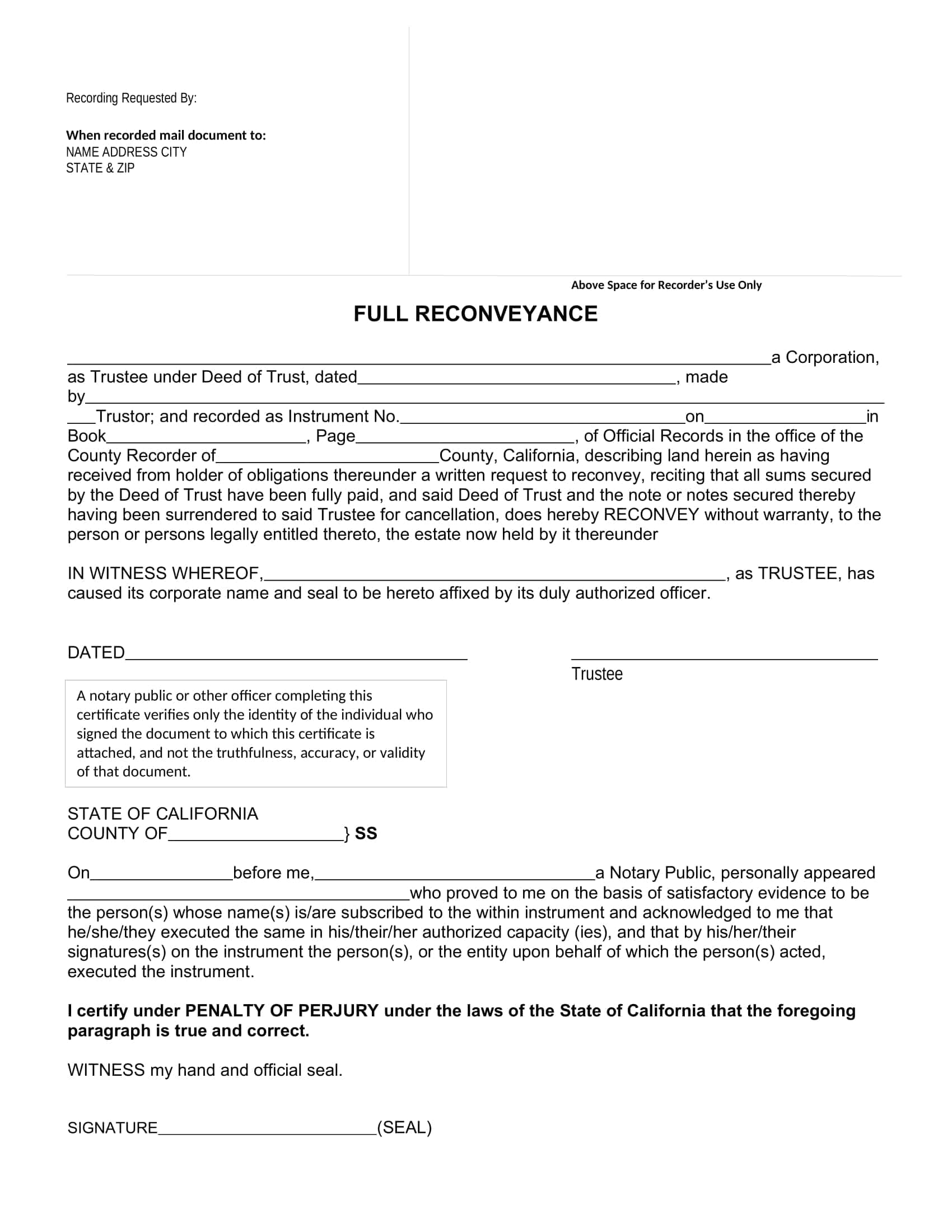

The Comprehensive Deed of Trust Form in our package provides all the critical details of this architecture definition of default, acceleration, impound account for taxes/premiums, insurance obligations, due-on-sale, assignment of rents, repair/protection provisions with open placeholders.

45+ Deed of Trust Form Templates

Common Use Cases

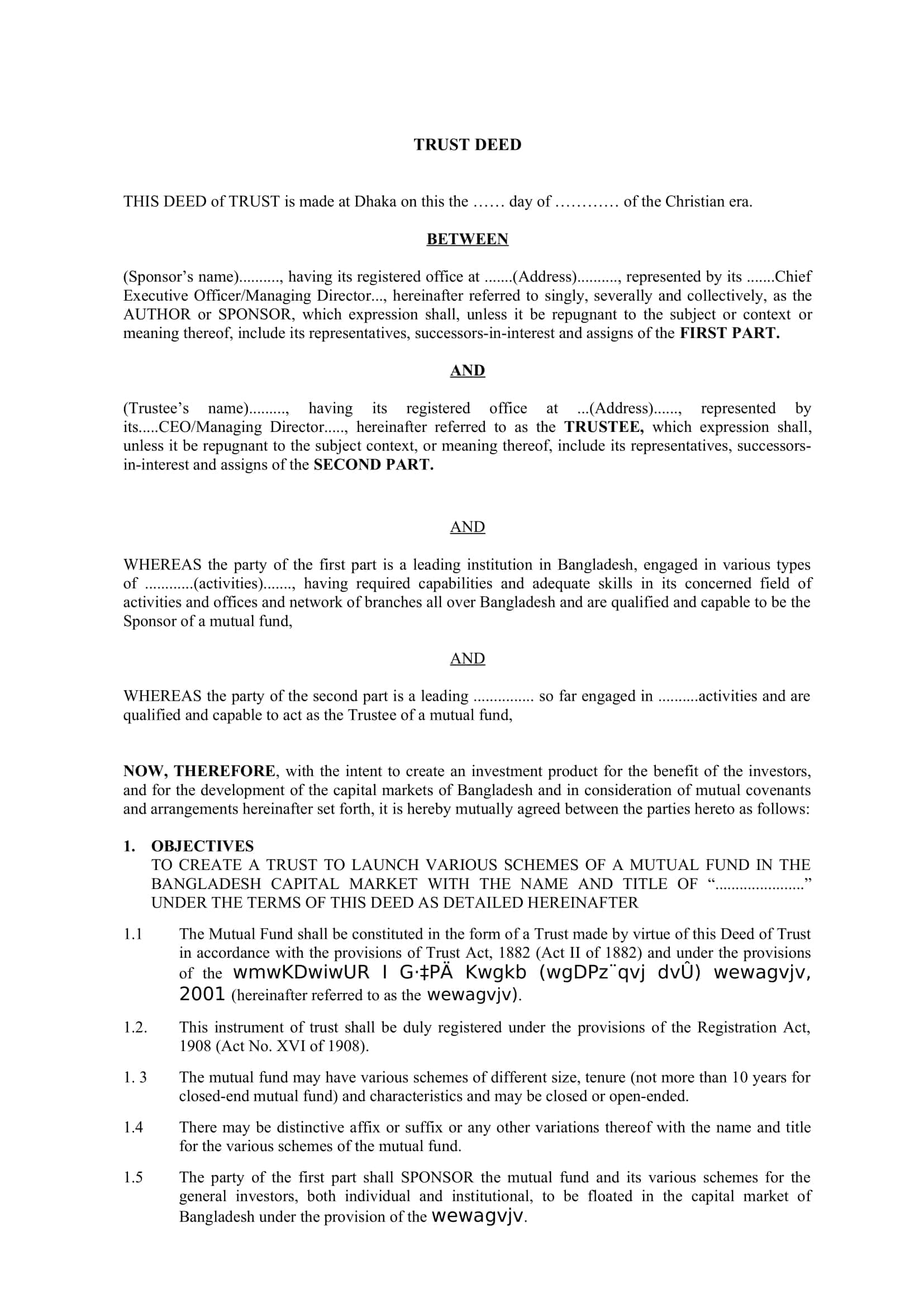

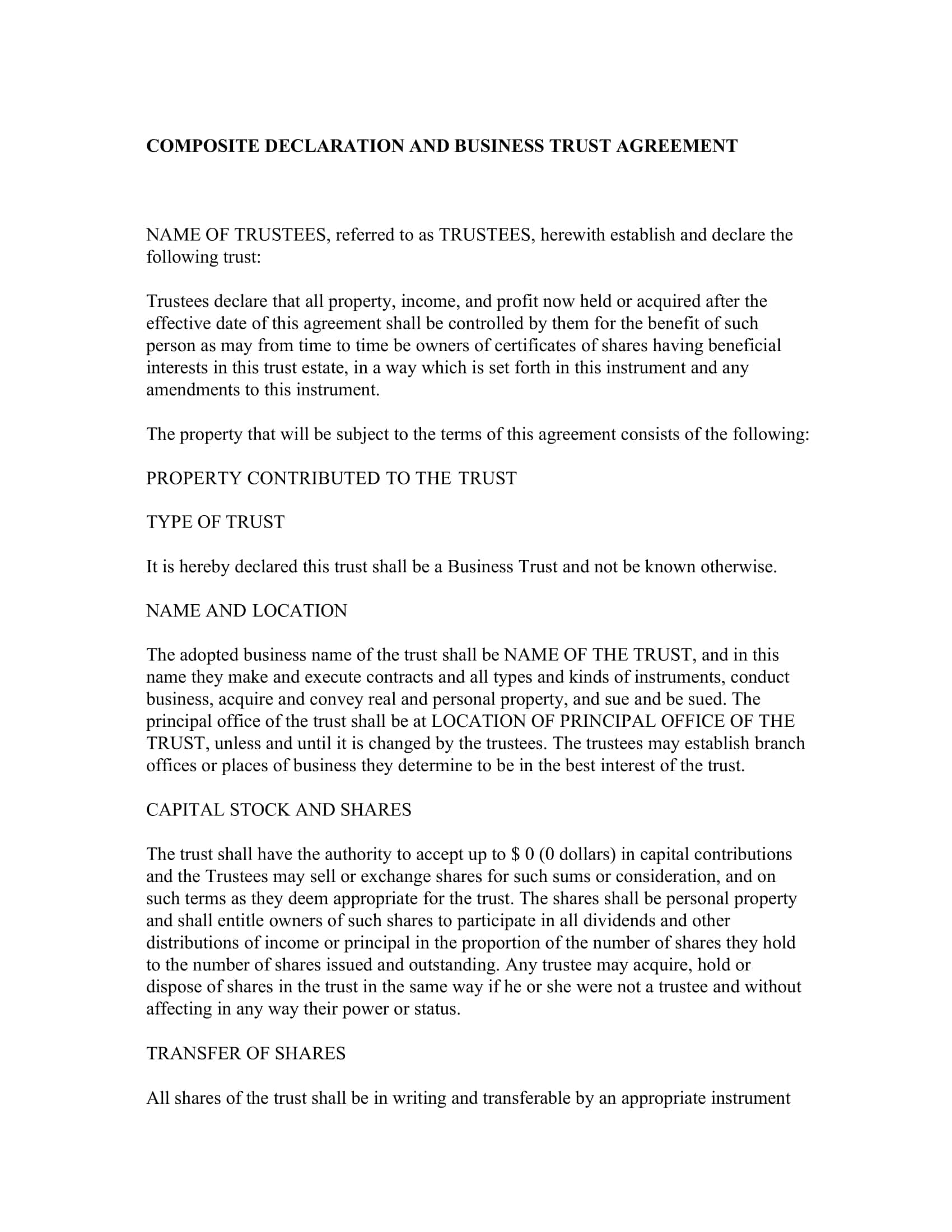

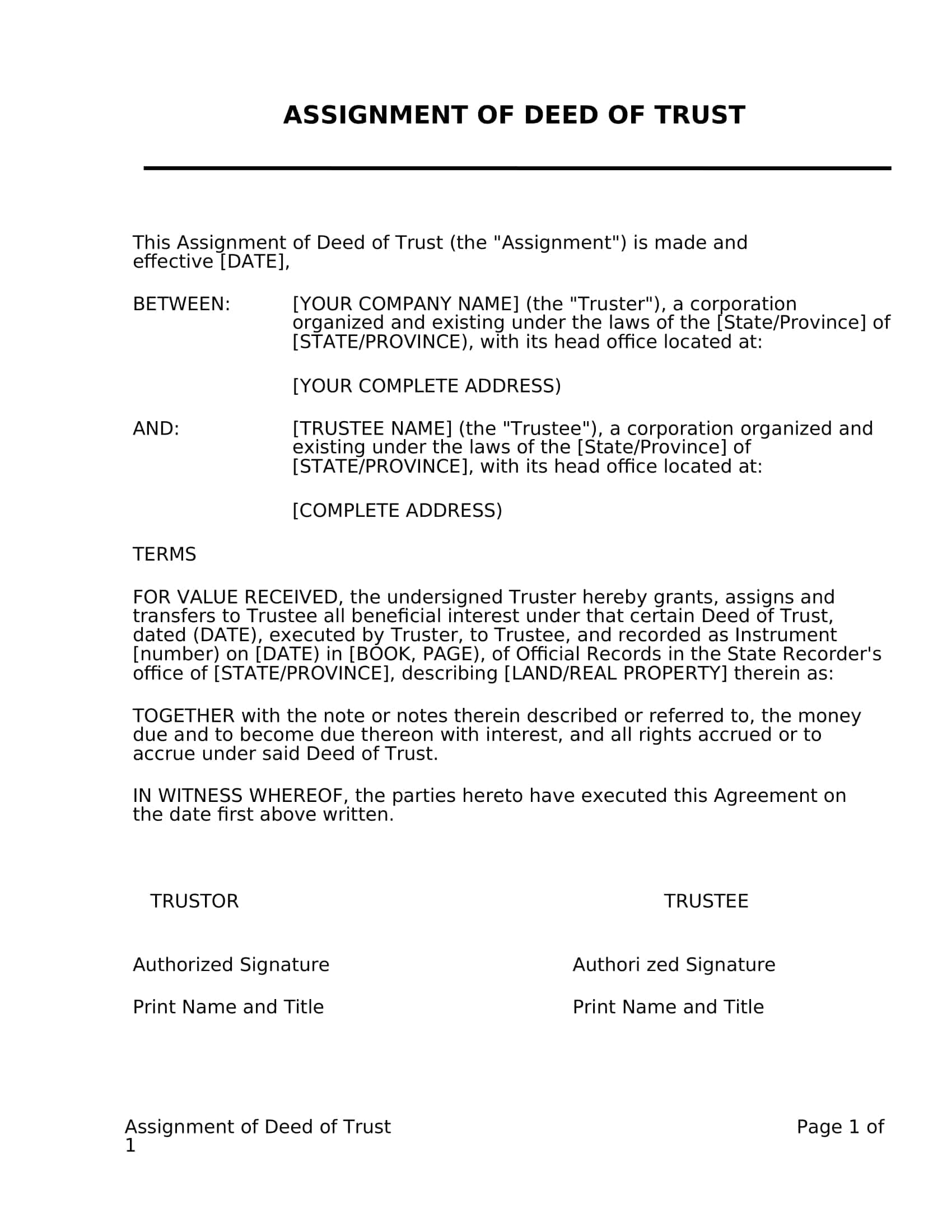

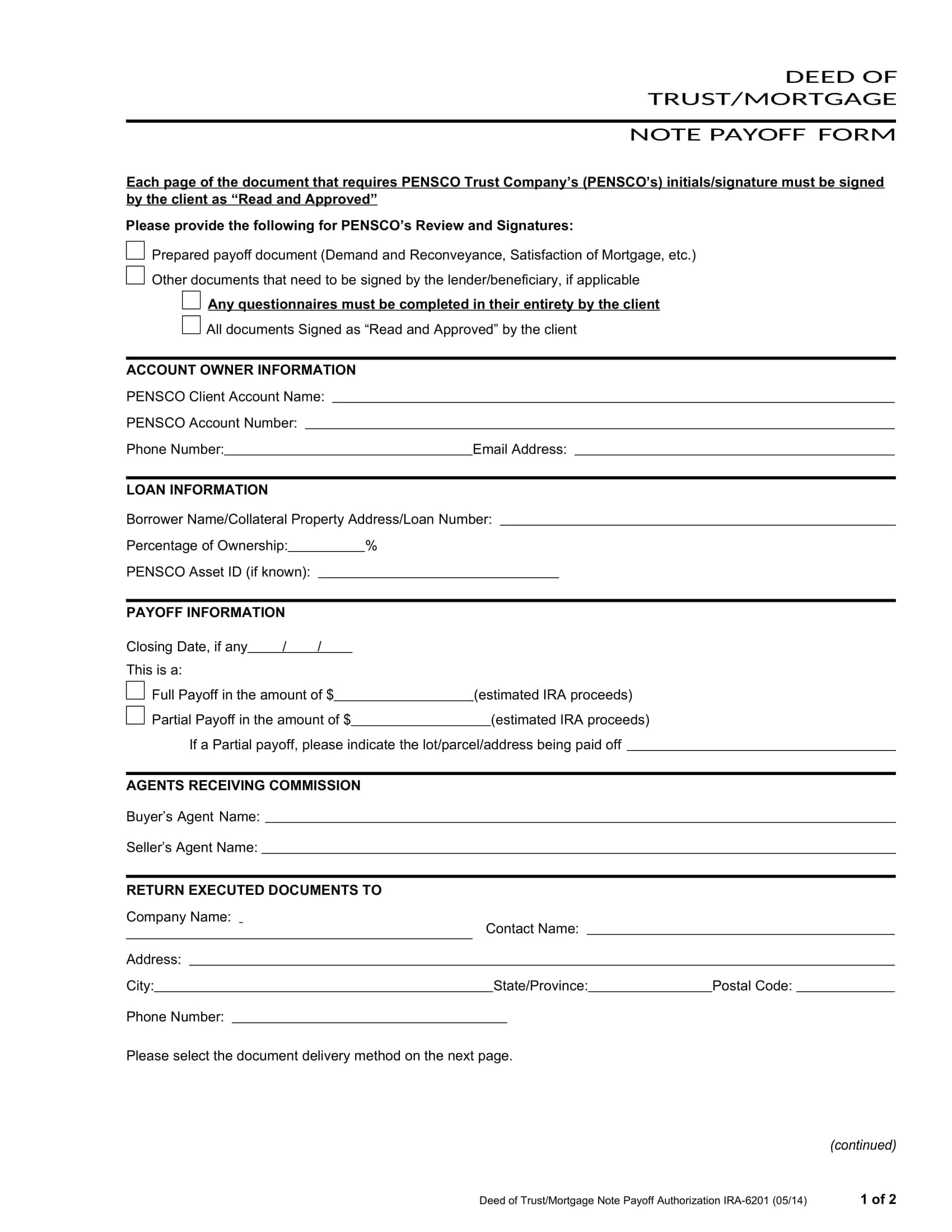

Flexible flows such as housing loans, investment housing and small commercial real estate financing, construction progress payment scenarios for rehabilitation/renovation projects, private lenders or seller financing are typical areas of use of Deed of Trust. While standardized provisions prevail in bank loans, collateral lists, “draw schedules” and additional security provisions are more detailed in private lending and developer-focused transactions. The templates in the collection contain separate language blocks suitable for these different contexts.

Document Anatomy: What a Strong “Comprehensive Form” Includes

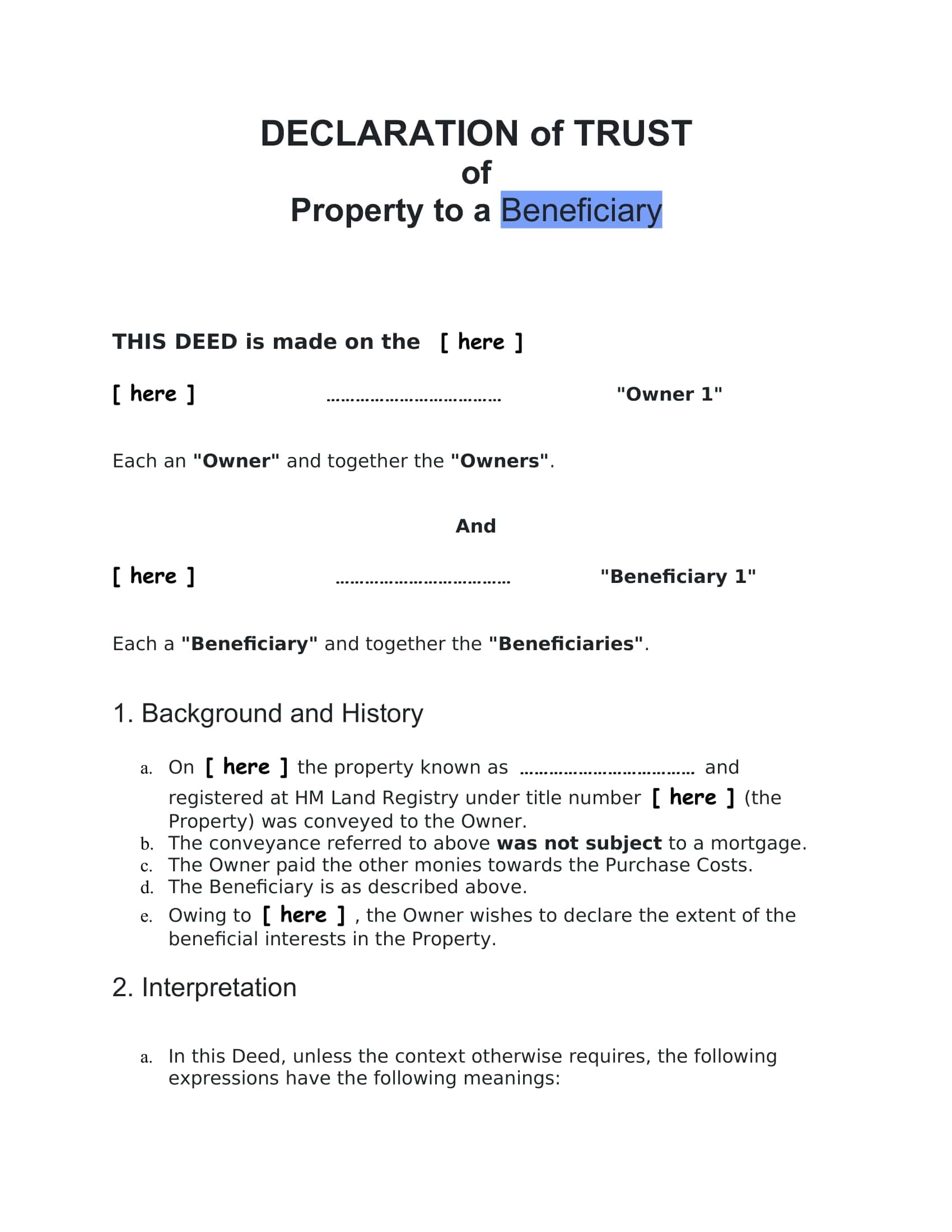

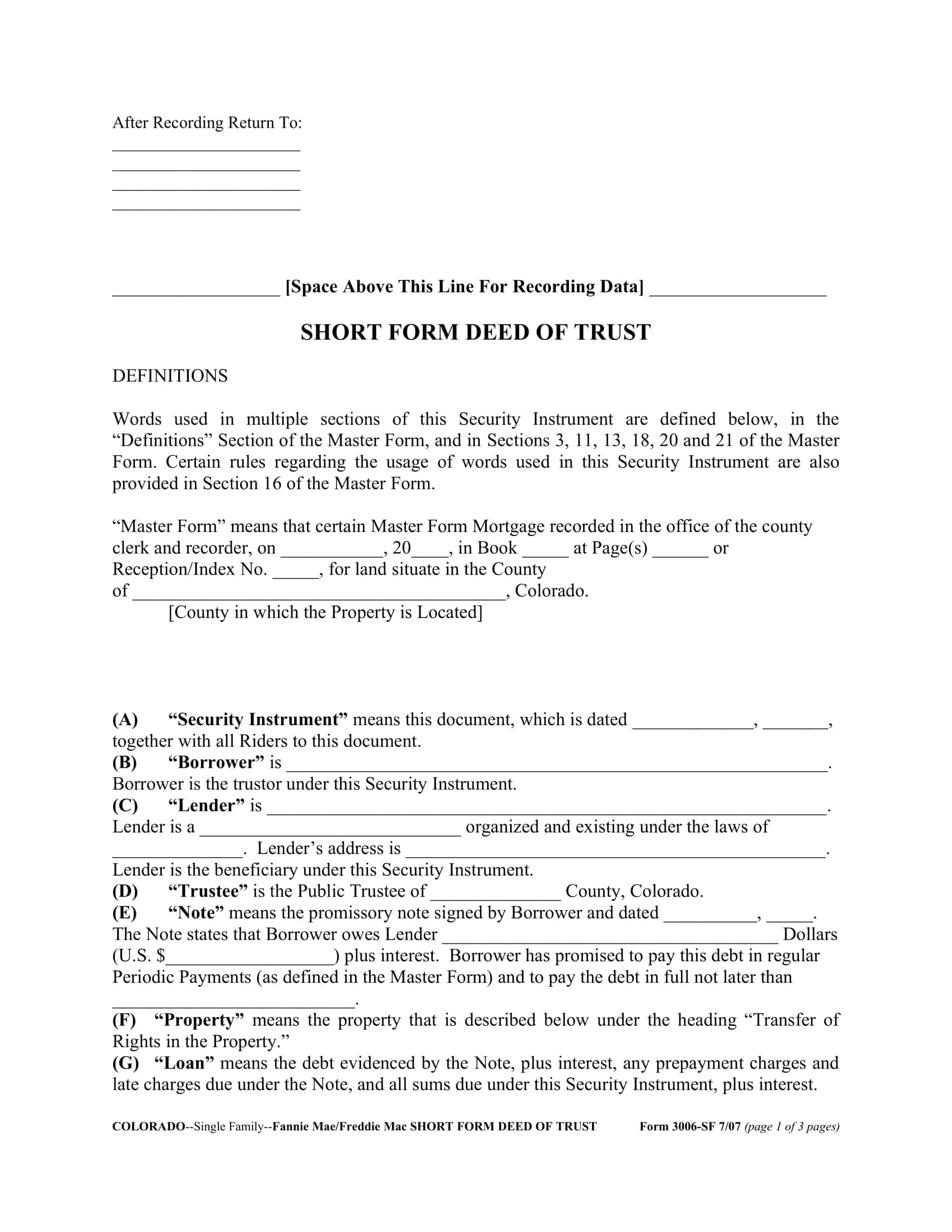

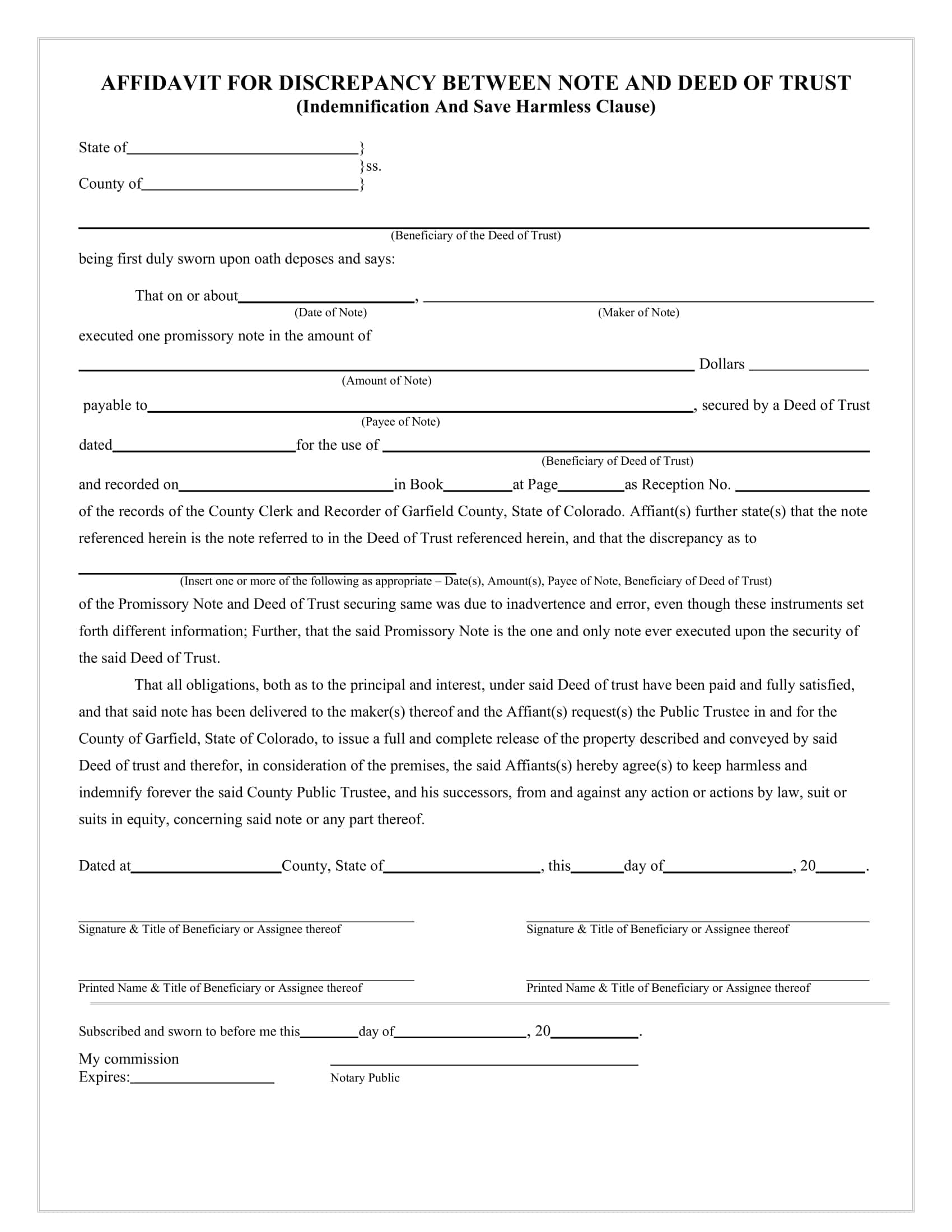

A solid draft; considers the trio of basic agreement + promissory note + annexes together. Detail the legal description of the property (metes-and-bounds or lot-and-block), escrow/impound setup for taxes and insurance, occupancy declarations, repair and maintenance obligations, transfer restrictions (due-on-sale/transfer), and events of default with their remedies.

Then the riders come into play: Adjustable Rate Rider for adjustable rate, PUD/Condo Rider for site/housing association, Assignment of Rents Rider if there is a rental plan, Construction Rider if there is construction.hen the riders come into play: Adjustable Rate Rider for adjustable rate, PUD/Condo Rider for site/housing association, Assignment of Ren.

Editing and Customization Flow

All templates are editable and in line with field reality. In DOCX/Google Docs versions, headings, definitions and cross-references are automatically numbered; promissory note and rider references are updated as you add content. PPTX/Slides guide sets are included to visualize the flow and party roles in closing meetings; for teams that require a locked view, simply convert to a final PDF. Since each template can be downloaded individually, you can choose only the structure you need and avoid unnecessary file clutter.

Download, Customize, and Close Safely

Whether you’re on the lender or borrower side, a clear, complete and ready-to-record Deed of Trust template speeds up the process and reduces surprises. Select the Comprehensive Deed of Trust Form, example and editable template file suitable for your scenario from TypeCalendar’s 45+ original Deed of Trust collection; add the legal definition, connect the necessary riders, make it ready for signature and registration. Download today and entrust your transaction to a solid security instrument, not uncertainty, tomorrow.

![Free Printable Location Release Form Templates [PDF, Word] Property / Example 1 Location Release Form](https://www.typecalendar.com/wp-content/uploads/2023/05/Location-Release-Form-1-150x150.jpg)

![%100 Free Hoodie Templates [Printable] +PDF 3 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)