Whether you’re a small business owner or running a larger company, stock tracking is a complex process. To manage this process professionally and avoid mistakes, it is essential to keep records with a stock ledger. Otherwise, it is impossible to avoid crises such as incorrect stock tracking, overstock cost, consumer dissatisfaction, or an emergency supply chain.

TypeCalendar’s Stock Ledger Template is designed to solve these problems once and for all. Available completely free of charge, our stock ledger templates are fully compatible with Excel and Google Sheets, and we also offer a PDF version for those who prefer a more print-friendly, streamlined option. You can download any of the templates we offer to take control of your business stock and avoid unexpected crises.

Table of Contents

What is a stock ledger?

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 1 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger.jpg 1920w, https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-300x169.jpg 300w, https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-1024x576.jpg 1024w, https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-768x432.jpg 768w, https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-1536x864.jpg 1536w, https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-640x360.jpg 640w, https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-1200x675.jpg 1200w)

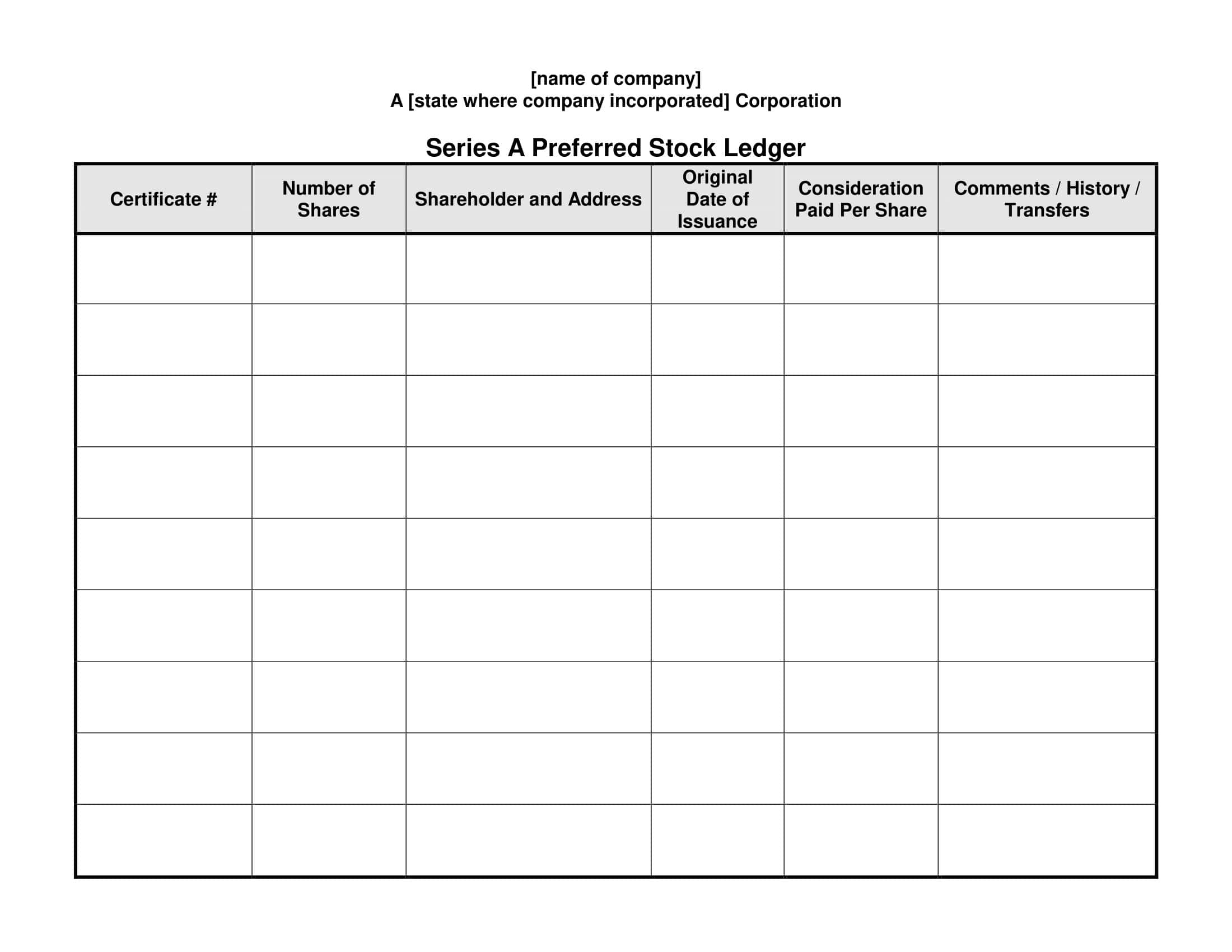

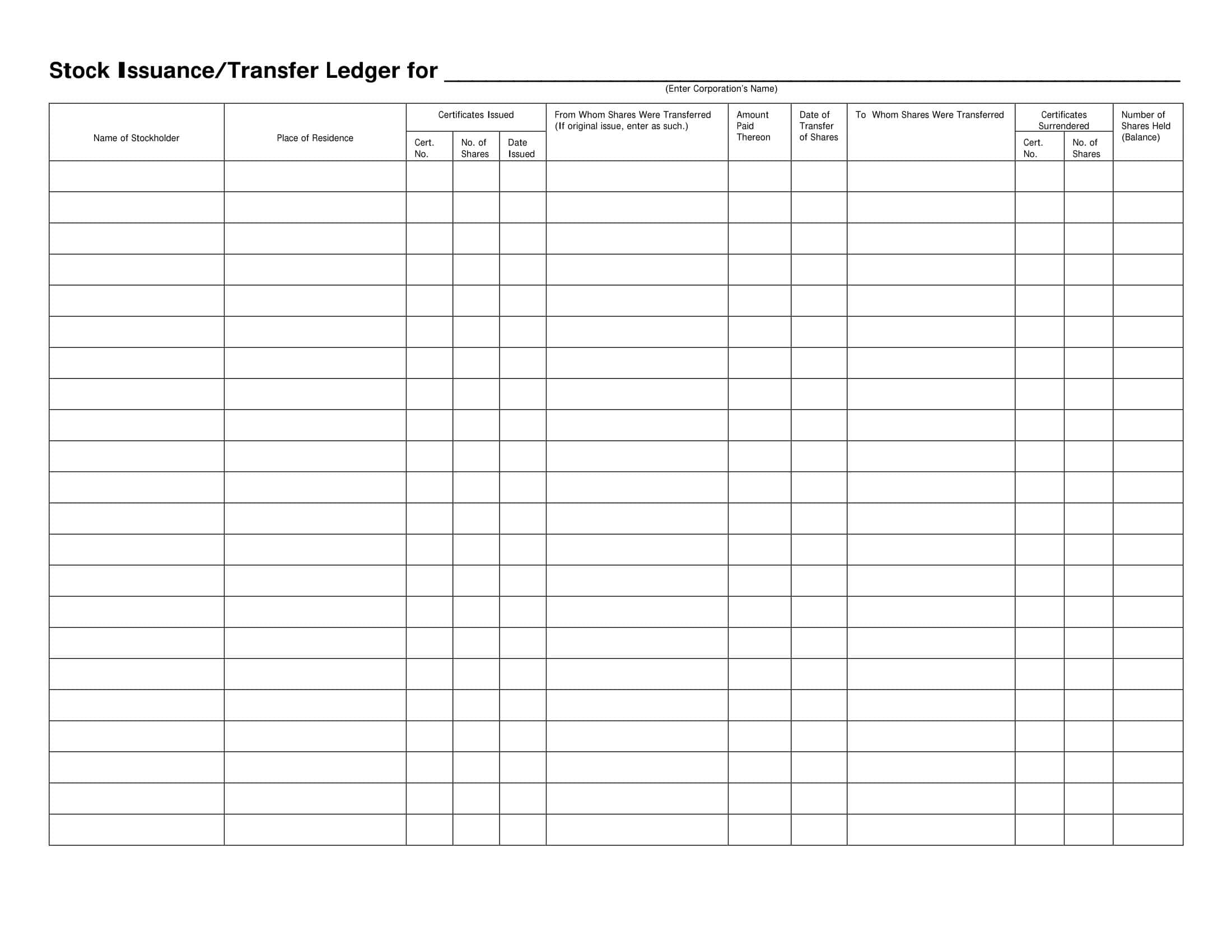

It is a document that shows any inventory movement of your business in detail, both chronologically and financially. Stock Ledger contains information such as transaction type (input/output/transfer), date, description, quantity, and unit price for each transaction made. It can also automatically calculate your running balance after each transaction.

For example, you have a toy retail store. You want to keep track of which products are sold faster or which products are waiting in the warehouse, at this point you solve this problem by using the stock ledger template. Additionally, if you need accurate data for tax filings, keeping detailed inventory records with a stock ledger can simplify the process and reduce last-minute stress.

Stock Ledger Templates

Why Use a Stock Ledger Template?

Using a ready-made stock ledger template is always a step ahead in terms of tracking your business. Why? Because manual data entry often leads to calculation errors in financial transactions. However, built-in formulas in a stock ledger template dramatically reduce the risk of such mistakes—almost to zero. Supply or sales departments are busy departments, extra stock tracking increases the workload here, but records kept using the stock ledger template save time for these departments. The most important benefit of a stock ledger is the financial transparency it offers—you can update stock levels, sales data, and cost figures in real time, all within a single file.

Who Can Benefit from a Stock Ledger Template?

As we mentioned earlier, anyone involved in inventory management—whether operating a small startup or a large-scale business—can use a stock ledger template. Even individual entrepreneurs can streamline their operations and stay organized with the help of a stock ledger template. For example, if you sell handmade goods, a stock ledger template can help you monitor both raw materials and finished products with ease.

Download the Free Stock Ledger Template Now

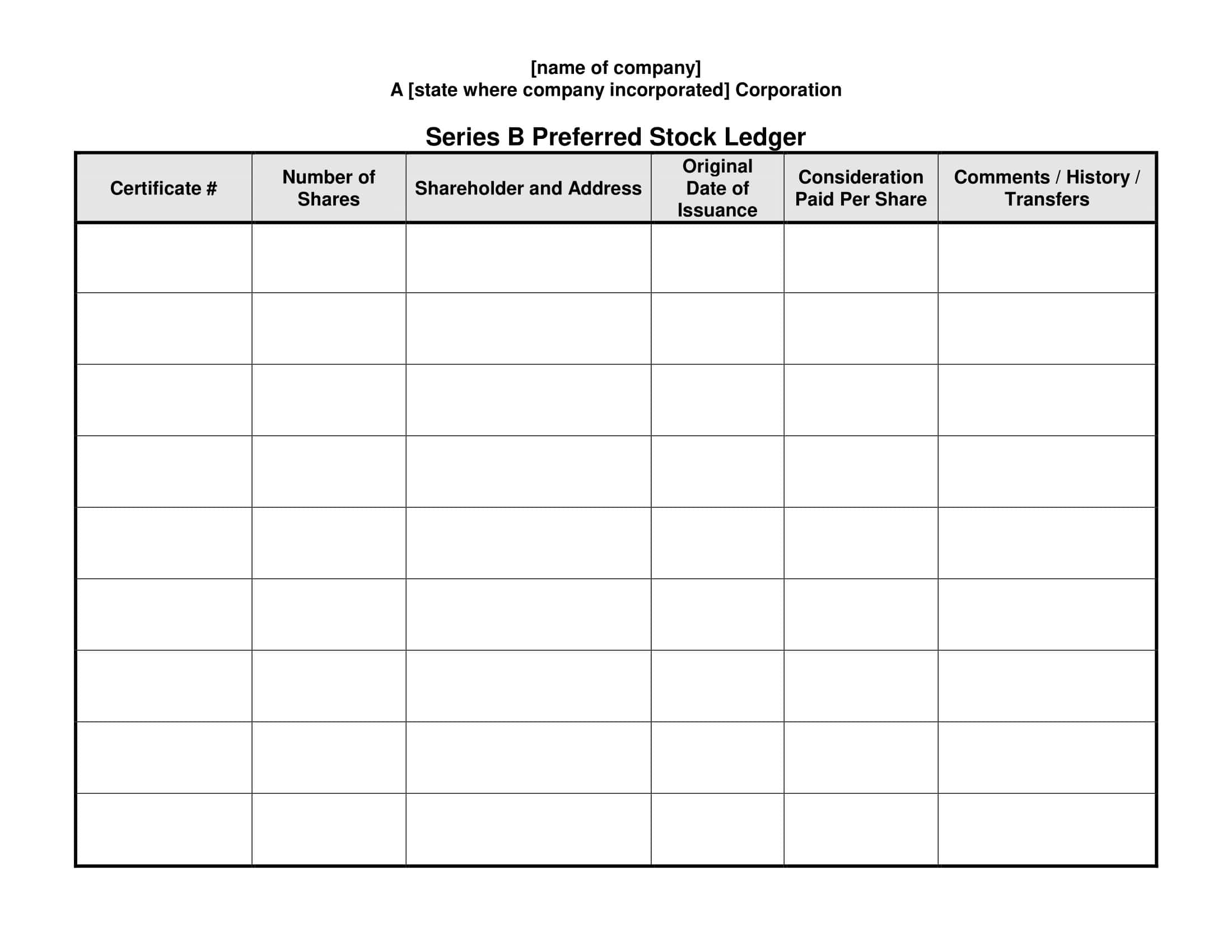

Don’t wait—take control of your stock records today. We’re giving you 19 professionally designed, fully fillable templates you can export to Excel® or Google Sheets™ with a single click. Prefer paper. You can also export the downloaded template directly to Excel or Google Sheets after filling it out. There are also separate PDF versions for those who want to print and do manual data entry. Download and start using this easy-to-use, free stock ledger template that fits your business needs.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Financial Projections Templates [Excel, PDF] 3 Financial Projection](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Projection-1-150x150.jpg)

![Free Printable Goal Chart Templates [PDF, Word, Excel] 4 Goal Chart](https://www.typecalendar.com/wp-content/uploads/2023/06/Goal-Chart-150x150.jpg)