A mileage log is an important tool for individuals and businesses that rely on their vehicles for transportation. Whether you are a self-employed individual who uses your car for work-related activities or a business owner who needs to track the miles driven by your employees, keeping accurate records of your mileage is essential.

A mileage log is a simple and effective way to track and document the miles driven for business, medical, or charitable purposes. By keeping track of your mileage, you can claim tax deductions and other benefits, in addition to having a record of your vehicle’s maintenance and fuel consumption. In this article, we will explore the importance of keeping a mileage log and provide tips on how to create and maintain an accurate mileage log.

Table of Contents

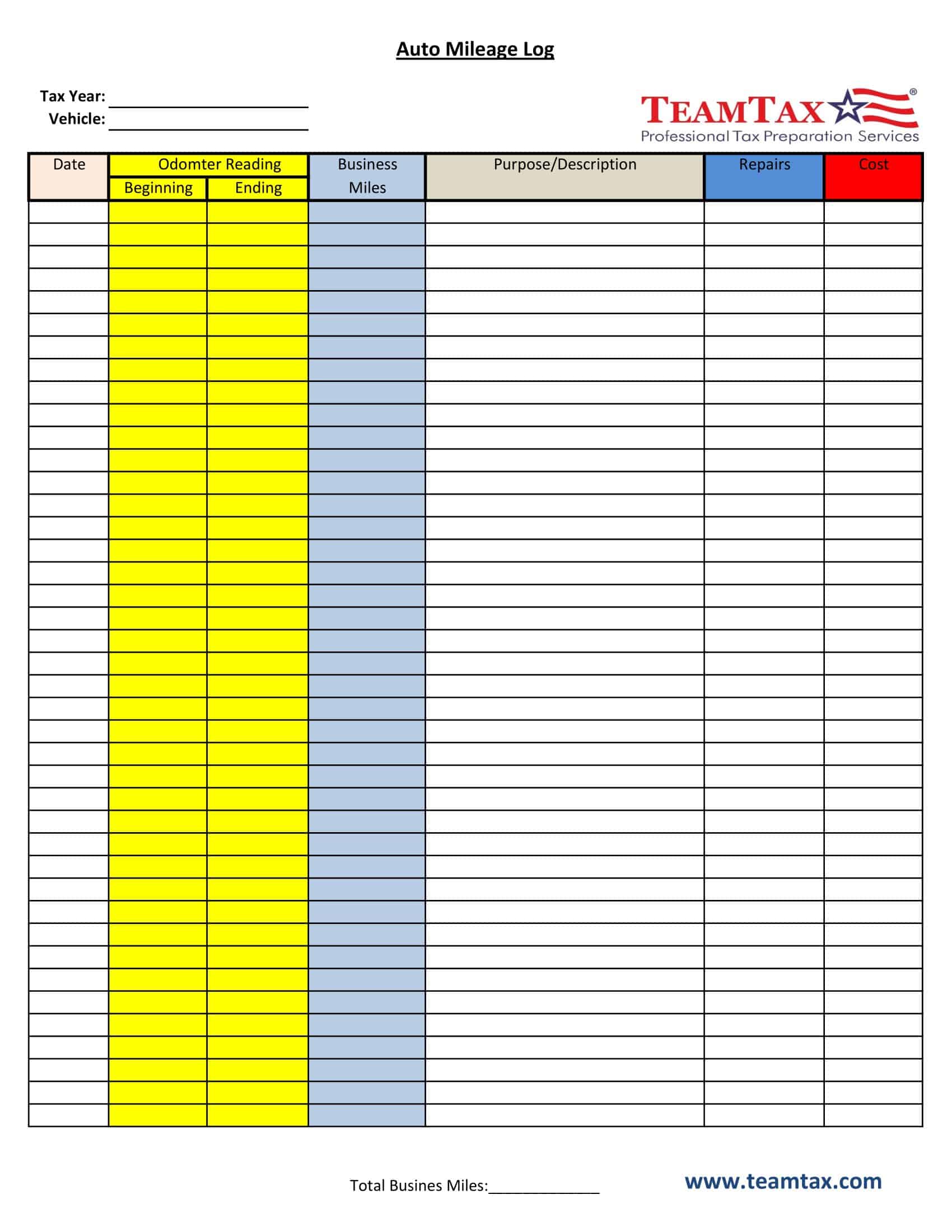

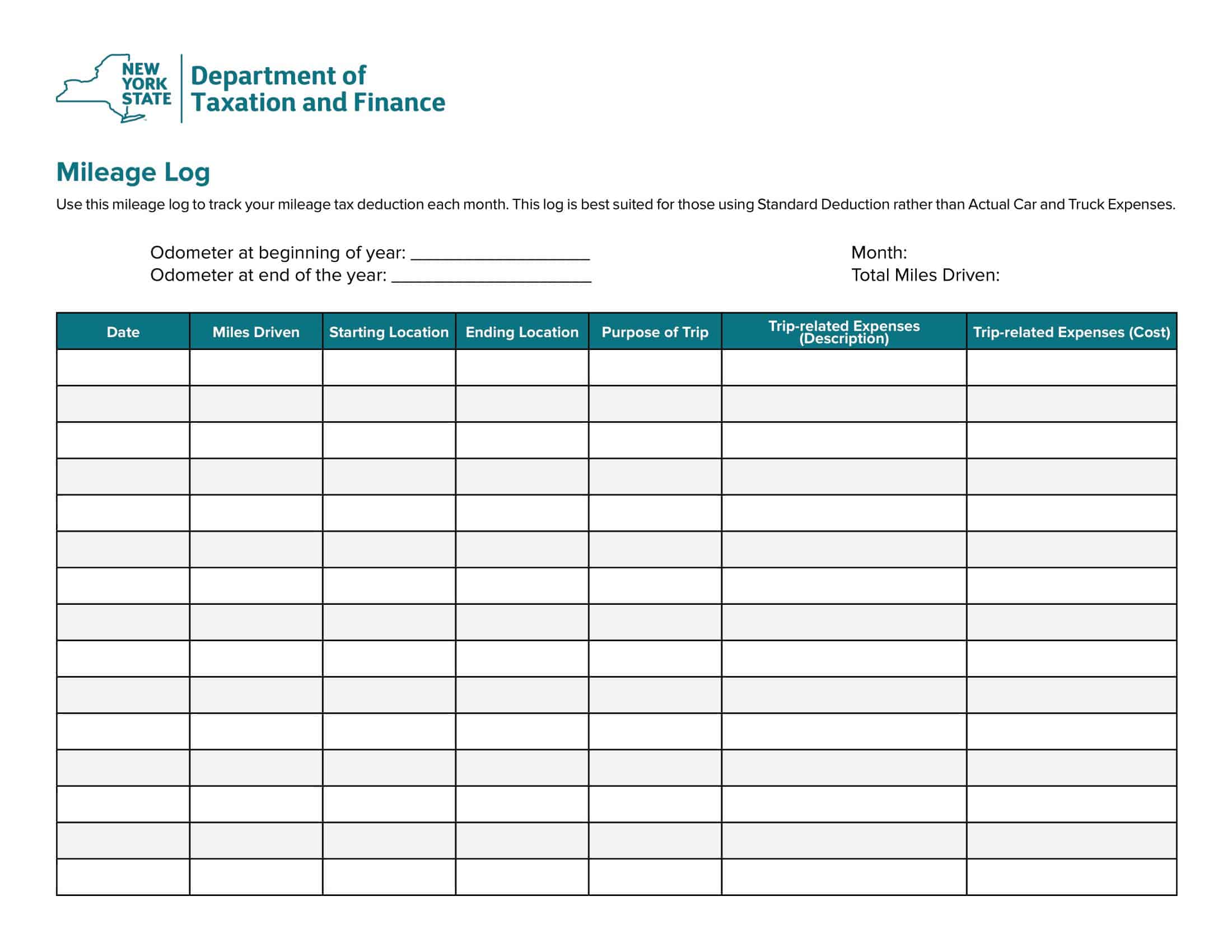

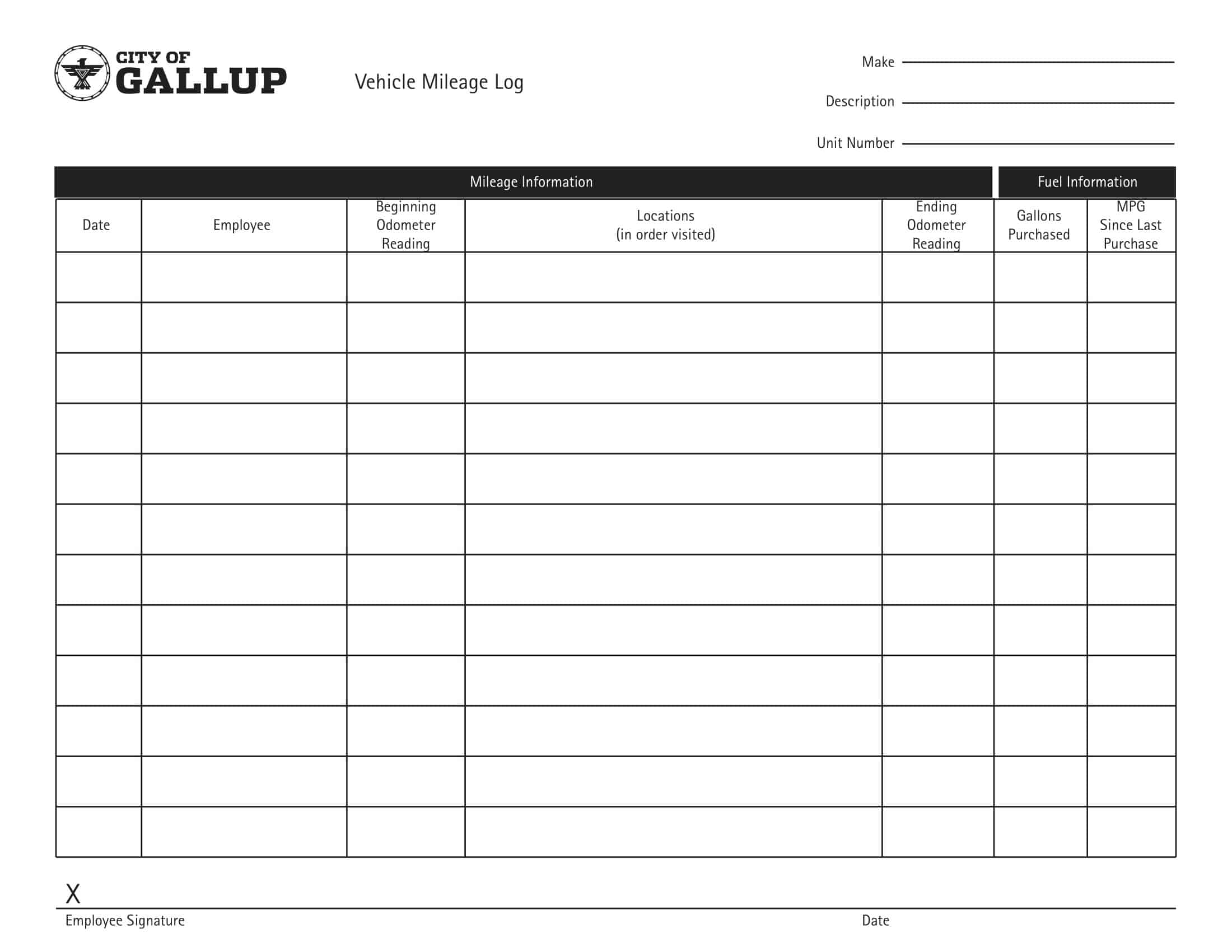

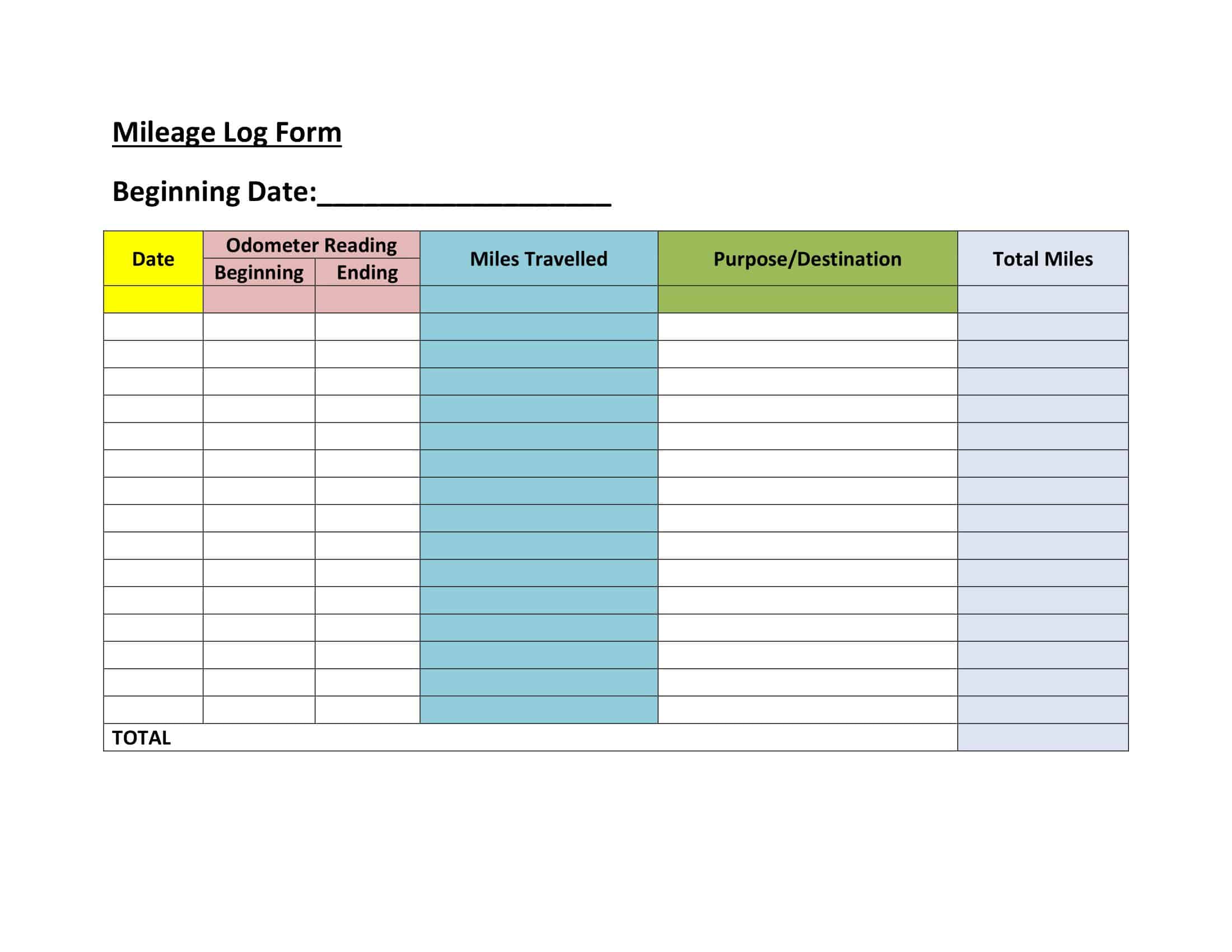

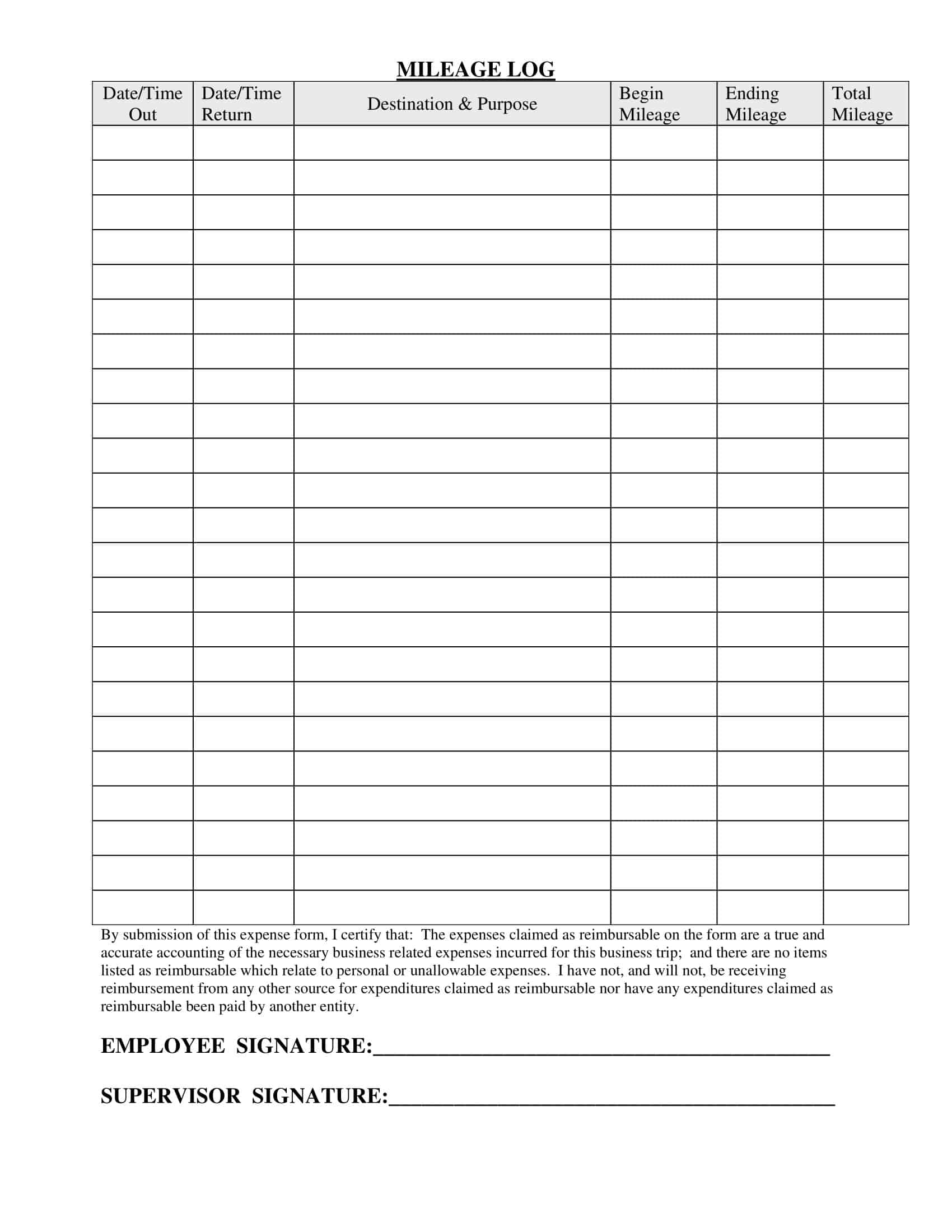

Mileage Log Templates

Mileage Log Templates are practical tools used to track and record mileage for business or personal purposes. These templates provide a structured format for documenting essential details related to each trip, such as the date, starting and ending locations, mileage, and purpose of the journey. They serve as a convenient way to keep accurate records of mileage for various purposes, including tax deductions, reimbursement claims, or general expense tracking.

Mileage Log Templates can be customized based on individual preferences, specific reporting requirements, or the type of vehicle used. They can be designed as digital spreadsheets, printable forms, or integrated into mileage tracking apps or software. By utilizing Mileage Log Templates, individuals or businesses can maintain accurate records of their travel distances, track deductible mileage for tax purposes, or submit mileage reimbursement claims. These templates serve as a valuable tool for efficient mileage tracking, expense management, and compliance with record-keeping requirements.

What information a mileage log include ?

A mileage log typically contains the following information:

Date of Trip: This is the date on which the trip was taken.

Starting Point: This is the location where the trip began.

Ending Point: This is the location where the trip ended.

Purpose of Trip: This is the reason for the trip, such as business, medical, or charitable.

Distance Traveled: This is the total distance traveled for the trip in miles or kilometers.

Mode of Transportation: This is the type of vehicle used for the trip, such as a car, truck, or bicycle.

Fuel Cost: This is the cost of fuel used for the trip.

Maintenance Cost: This is the cost of any maintenance or repairs made to the vehicle during the trip.

Other Expenses: This is any additional expenses incurred during the trip, such as tolls or parking fees.

Signature: This is the signature of the person who took the trip.

It’s important to keep in mind that the format of a mileage log may vary depending on the individual or business using it. Some mileage logs may also include additional information such as the vehicle’s make and model, VIN, and license plate number.

Why Do You Need to Track Mileage?

Tracking mileage is important for a number of reasons:

Tax Deductions: By keeping track of your mileage, you can claim tax deductions for business, medical, or charitable purposes. The IRS allows individuals and businesses to deduct a certain amount for each mile driven for these purposes.

Reimbursement: If you are self-employed or if you work for a company that does not provide a company vehicle, keeping track of your mileage can help you get reimbursement for your transportation expenses.

Record Keeping: Keeping a mileage log can help you keep track of the maintenance and repair needs of your vehicle. It can also give you an idea of your fuel consumption and costs, which can be helpful when budgeting.

Compliance: For businesses, keeping track of mileage can help with compliance with laws and regulations, such as IRS regulations.

Cost Savings: By tracking your mileage, you can make adjustments to your driving habits and routing to reduce your fuel consumption and maintenance costs.

Business Analysis: For businesses, tracking mileage can also help with analyzing the efficiency of their operations and identifying areas for cost savings.

IRS Mileage Tracking Requirements

The Internal Revenue Service (IRS) has specific requirements for tracking mileage for tax purposes. According to the IRS, individuals and businesses must keep accurate records of their mileage in order to claim deductions for business, medical, or charitable purposes.

The IRS requires that you keep a record of the date of the trip, the number of miles driven, and the business purpose of the trip.

The IRS also requires that you keep a record of the starting and ending odometer readings for each trip.

You must maintain records such as receipts, bills, or similar documents that support the amount of your expenses.

The IRS also requires that you maintain a log or diary of your business use of the vehicle, in which you record the date, the number of miles driven, and the business purpose of the trip.

The IRS also allows for the use of a standard mileage rate, which is a set amount of reimbursement for each mile driven for business purposes. The rate changes each year and you can check the current rate on the IRS website.

You must keep all records of your business mileage for at least three years from the date you file your tax return.

It’s important to note that the IRS has strict rules for tracking mileage and keeping records. It’s a good idea to consult with a tax professional or accountant to ensure that your mileage log is in compliance with IRS regulations.

Types of Business Driving That Qualifies

There are several types of business driving that qualify for tax deductions. These include:

Driving to and from client or customer meetings: If you use your personal vehicle to travel to meetings with clients or customers, you can claim a deduction for the miles driven. This includes initial meetings to discuss potential business, as well as follow-up meetings to discuss ongoing business.

Driving to and from job sites or worksites: If you use your personal vehicle to travel to different job sites or worksites, you can claim a deduction for the miles driven. This includes both short-term and long-term job sites or worksites.

Driving to and from business-related conferences or events: If you use your personal vehicle to travel to conferences, trade shows, or other events related to your business, you can claim a deduction for the miles driven. This includes both the travel to and from the event, as well as any side trips taken while at the event.

Driving to and from business-related training or education: If you use your personal vehicle to travel to training or education sessions that are related to your business, you can claim a deduction for the miles driven. This includes both the travel to and from the session, as well as any side trips taken while at the session.

Driving for delivery or transportation of goods: If you use your personal vehicle to deliver or transport goods for your business, you can claim a deduction for the miles driven. This includes both short-distance and long-distance deliveries or transportation.

Driving for business-related travel: If you use your personal vehicle to travel overnight for business-related reasons, you can claim a deduction for the miles driven. This includes both the travel to and from the overnight destination, as well as any side trips taken while at the destination.

Types of Business Driving That Doesn’t Qualify

There are certain types of mileage that do not qualify for tax deductions. These include:

Commuting

Driving from your home to your regular place of business does not qualify for a deduction. This is considered commuting and is not considered a business expense.

Personal errands

Driving for personal reasons, such as running errands or going to appointments, does not qualify for a deduction. These miles must be separated from the business miles.

Travel between multiple business locations

If an employee is traveling between different locations that are not his regular work location, they should be able to claim a deduction. But if an employee is traveling between multiple business locations that are considered his regular work location, these miles do not qualify for a deduction.

Travel for purely personal reasons

If an employee uses their vehicle for personal reasons and not for business, those miles will not qualify for a deduction.

Travel for entertainment or recreation

If an employee uses their vehicle for entertainment or recreation, such as going to a concert or sporting event, these miles do not qualify for a deduction.

What Happens if You Don’t Keep a Mileage Log?

If you don’t keep a mileage log, it can be difficult to prove to the IRS that the miles you are claiming as a business expense are in fact business-related. Without accurate records, the IRS may disallow your deductions, which can result in additional taxes, penalties, and interest.

Additionally, without a mileage log, you may not be able to accurately determine the amount of your deduction. You may end up claiming a higher or lower amount than you are entitled to, which can also result in additional taxes or penalties.

It is important to note that, The IRS requires you to maintain accurate records of your mileage, so it’s a best practice to keep a mileage log that documents the date, purpose of the trip, and the starting and ending odometer readings for each business trip.

By keeping a accurate mileage log, you will be able to prove to the IRS that the miles you are claiming as a business expense are in fact business-related and you are entitled to the deductions.

How to Log Mileage for Taxes

Keeping a mileage log for taxes is an important step in claiming deductions for business-related travel. Here is a step-by-step guide on how to log mileage for taxes:

Step 1: Choose a method for tracking your mileage: There are several ways to track your mileage, including using a paper log, a spreadsheet, or a mileage tracking app. Whatever method you choose, make sure it is easy for you to use and allows you to accurately record the date, purpose of the trip, and starting and ending odometer readings for each business trip.

Step 2: Start logging your mileage: From the first day of your tax year, begin logging all of your business-related mileage. This includes driving to and from client or customer meetings, job sites or worksites, business-related conferences or events, business-related training or education, deliveries or transportation of goods, and business-related travel. Make sure to also log any personal miles you take during the year, as these miles must be separated from the business miles.

Step 3: Be consistent: Try to log your mileage in the same way every day and make sure to record all business-related miles driven.

Step 4: Keep detailed records: In addition to recording the date, purpose of the trip, and starting and ending odometer readings, make sure to keep detailed records of the business purpose of each trip. This can include the names of clients or customers visited, the address of the job site or worksite, and the name and location of the conference or event.

Step 5: Keep all receipts: Keep all receipts for any business-related expenses, such as tolls, parking fees, and car repairs. These expenses can also be claimed as deductions.

Step 6: Calculate your deductions: At the end of the tax year, calculate your total business-related mileage and multiply it by the IRS standard mileage rate for the year. This will give you the total amount of your mileage deduction.

Step 7: File your taxes: When filing your taxes, be sure to include your mileage log and any other documentation of business-related expenses. This will help to ensure that your deductions are accepted by the IRS.

By following these steps and keeping accurate records, you will be able to claim the maximum deduction for business-related mileage on your taxes. Remember, it is important to keep accurate records of business miles driven, including the date, purpose of the trip, and the starting and ending odometer readings. This will help to ensure that only qualified mileage is claimed as a deduction on taxes.

FAQs

How do I create a mileage log?

To create a mileage log, use a template or table capturing essential trip details like: date, departure/arrival destinations, purpose categories (business, medical etc.), odometer readings, tolls or parking if applicable, and automatic mileage calculations summing trip distance deductions available.

What does the IRS require for a mileage log?

IRS requirements for acceptable mileage logs record at minimum the trip date, destination, and business purpose declaration. Including departure points and odometer data provides clearer validation if audited. Electronic logs using apps also qualify with auto-validation like time/location stamping.

Can you track mileage in Excel?

Yes, Excel provides ideal customizable mileage log templates to track tax deductible, reimbursement or vehicle expense details. Tables auto-calculate odometer differences as mileage rates entered for each trip line. Charts visually compare mileage across timeframes.

How do I make a mileage tracker?

To make a manual mileage tracker, create a small notepad table with columns for date, travel purpose category, start and end odometer readings. Quickly jot details during the trip. For digital trackers, use templates or mileage log apps GPS mapping each trip.

Is it better to claim mileage or gas on taxes?

Claiming the standard business mileage rate is typically better than actual vehicle expenses and gas receipts if your annual business miles driven exceeds around 10,000. The fixed per mile amount simplifies deductions. Check annually as gas prices fluctuate on which method favors you most.

How do I prove mileage for taxes?

Save odometer readings and dates from maintenance garage invoices to show ownership timeframe. Retain detailed mileage logs by trip and simplify verification with apps logging location data. Take photos of odometer displays before/after trips. Avoid rounding as exact totals prove essential if claiming high mileage.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 3 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)