A collection letter is a formal document used by businesses and organizations to request payment from a customer or client who has failed to make a timely payment. These letters are typically sent after an invoice or bill has gone unpaid for a certain period of time and serve as a reminder to the customer of their outstanding debt.

They also inform the customer of any late fees or additional charges that may have accumulated as a result of the unpaid bill. Collection letters are an important tool for businesses to use in order to ensure timely payment and maintain a positive cash flow.

Table of Contents

What is the purpose of a debt collection letter?

The purpose of a debt collection letter is to remind a customer or client of an outstanding debt and request payment in full. These letters are typically sent after an invoice or bill has gone unpaid for a certain period of time and serve as a reminder to the customer of their outstanding debt. They also inform the customer of any late fees or additional charges that may have accumulated as a result of the unpaid bill.

The collection letter serves as an official notice of the outstanding debt and the consequences of non-payment. The purpose of a debt collection letter is to encourage the customer to take action and pay the debt, in order to maintain a positive cash flow for the business. Additionally, it also serves as a document for the business that can be used in case of any legal action taken against the customer.

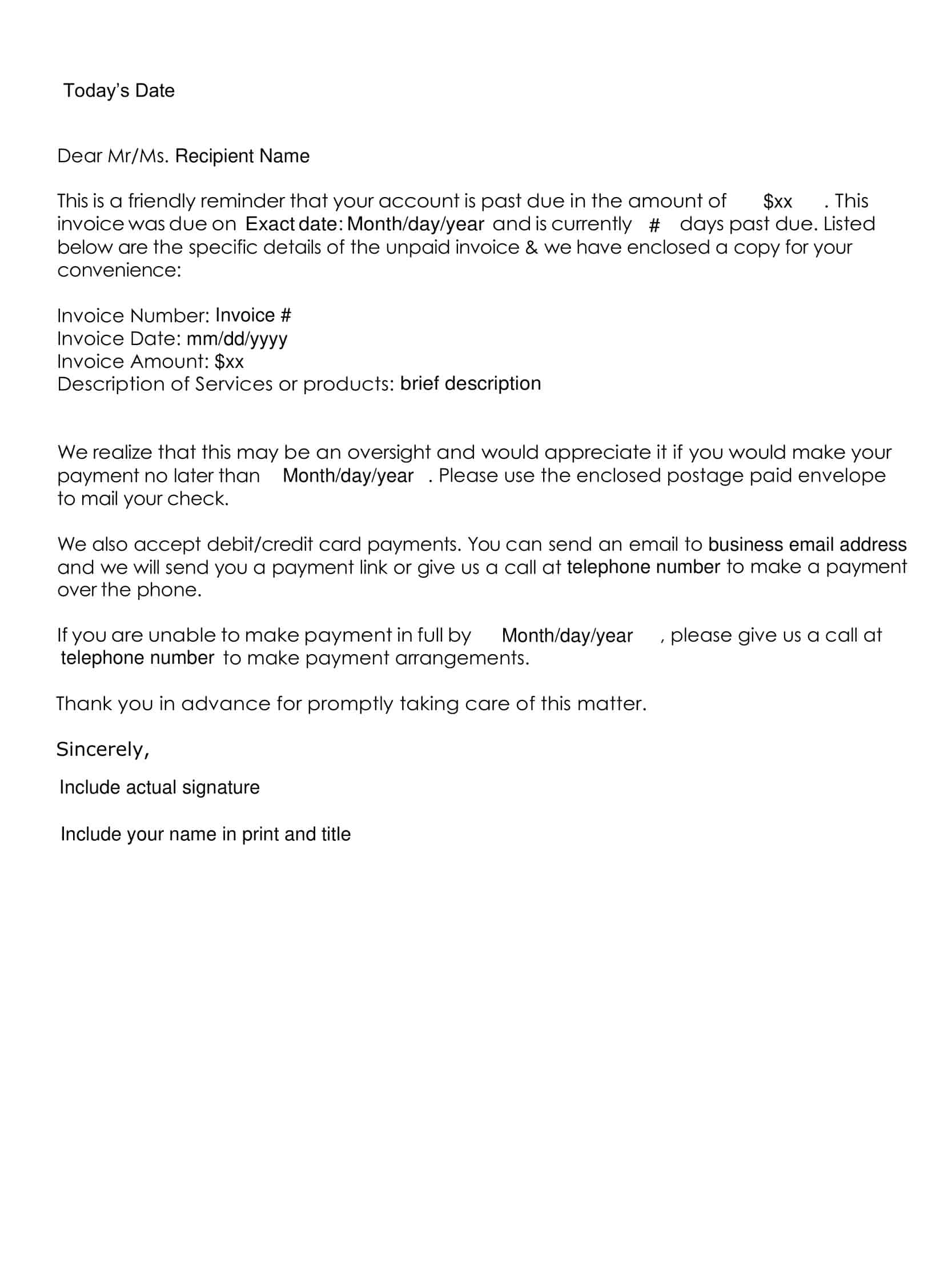

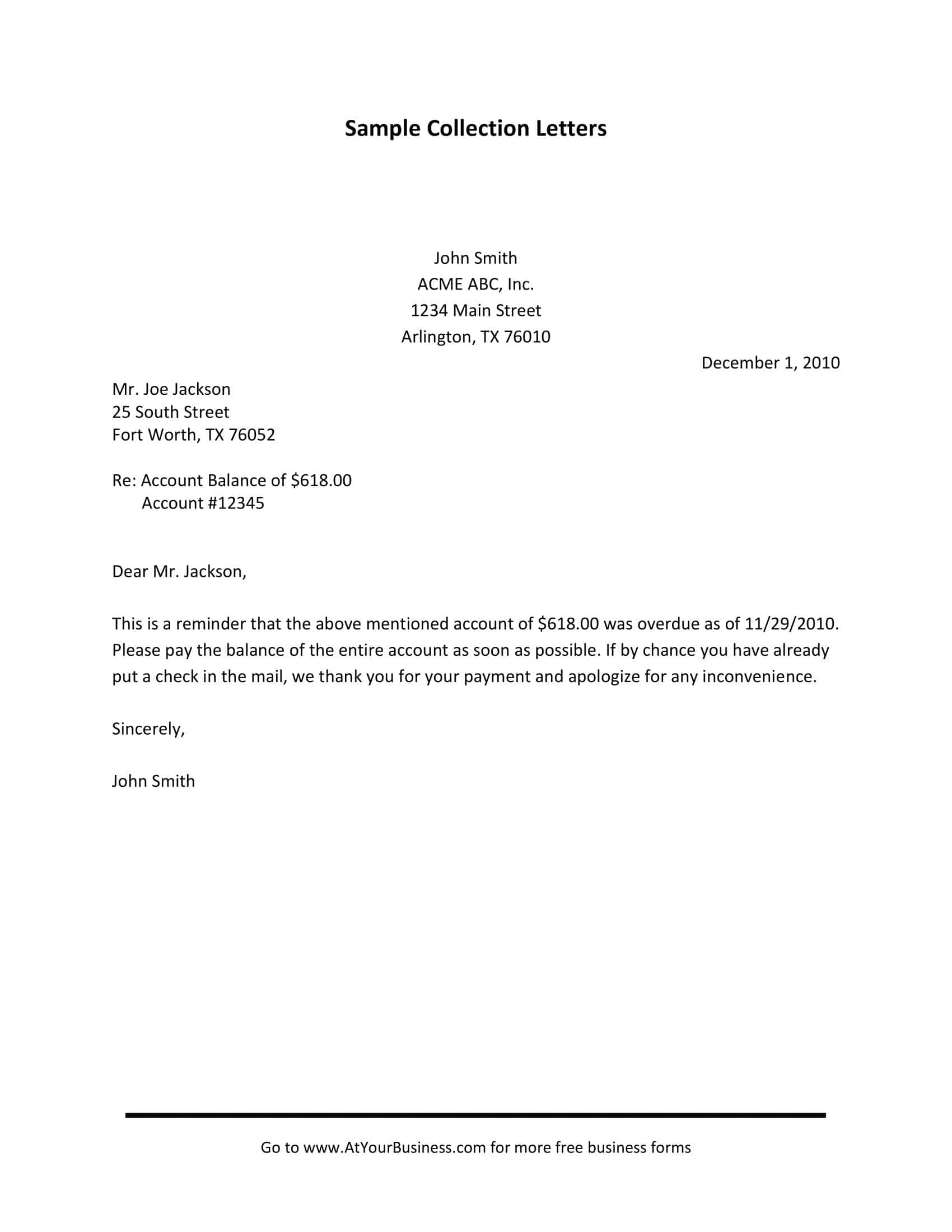

Collection Letter Templates

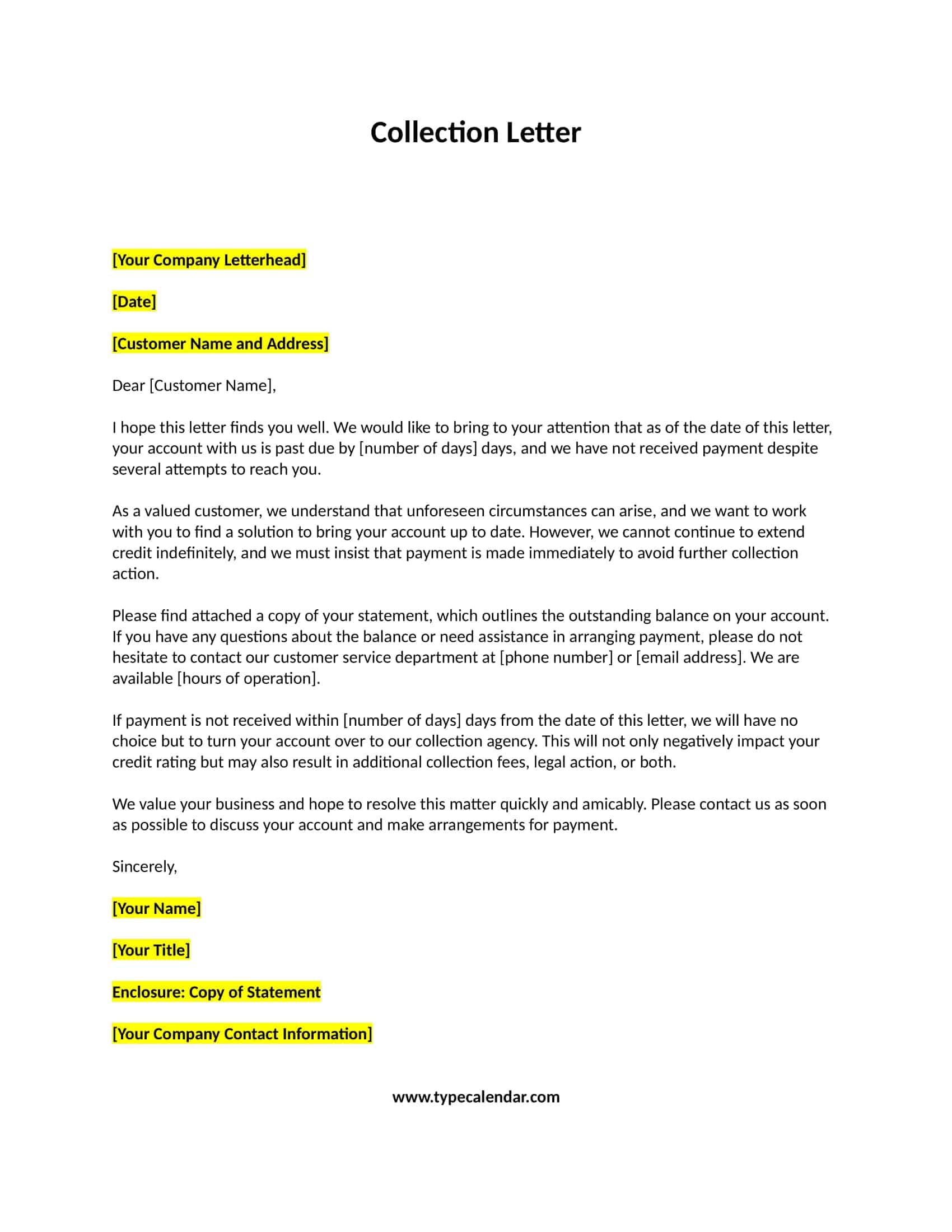

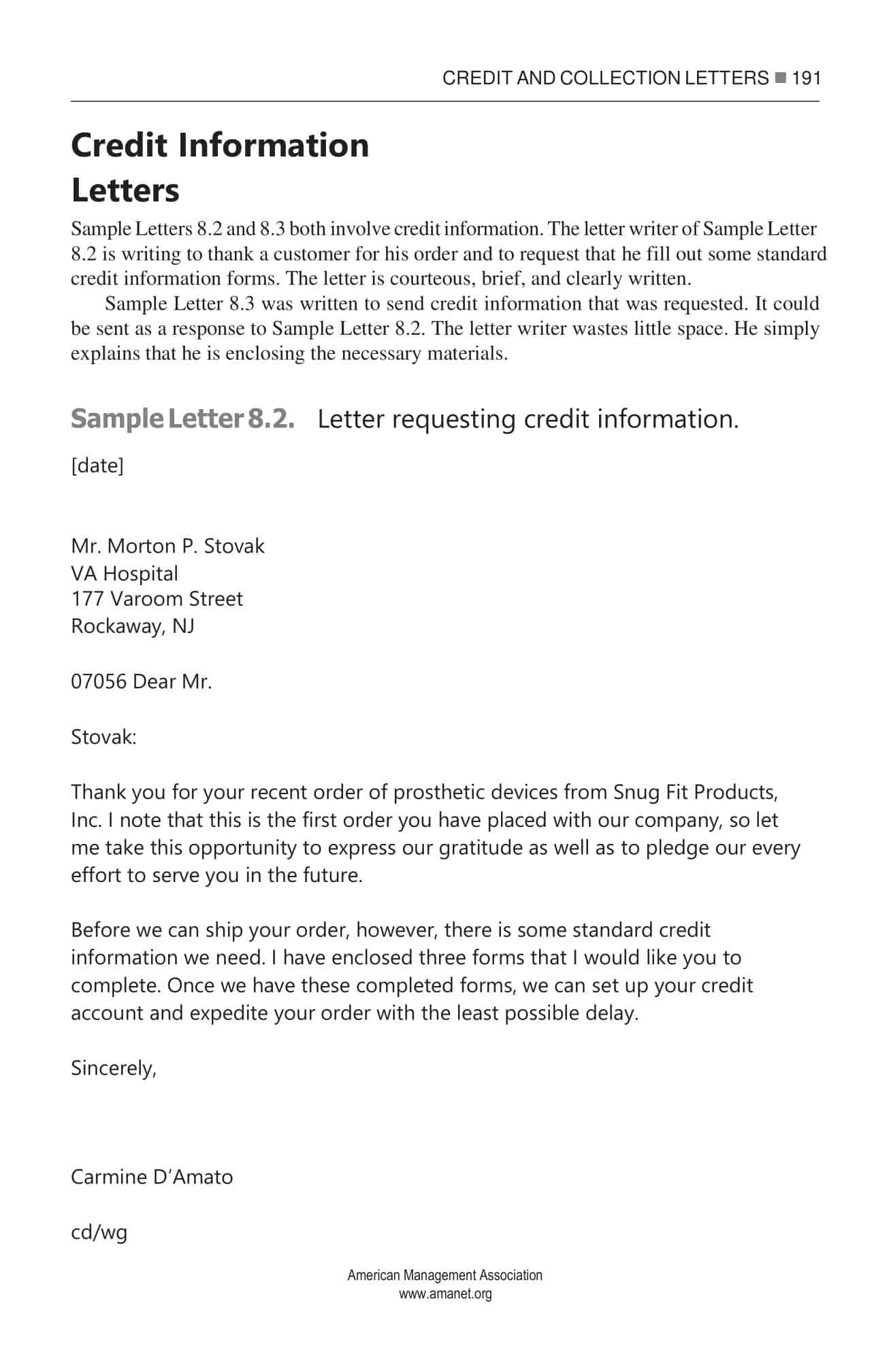

Collection letters are formal correspondences sent by creditors and debt collectors to individuals or businesses with outstanding payments. The purpose is to demand payment of the overdue amount. Templates provide the structure and wording for effective collection letters.

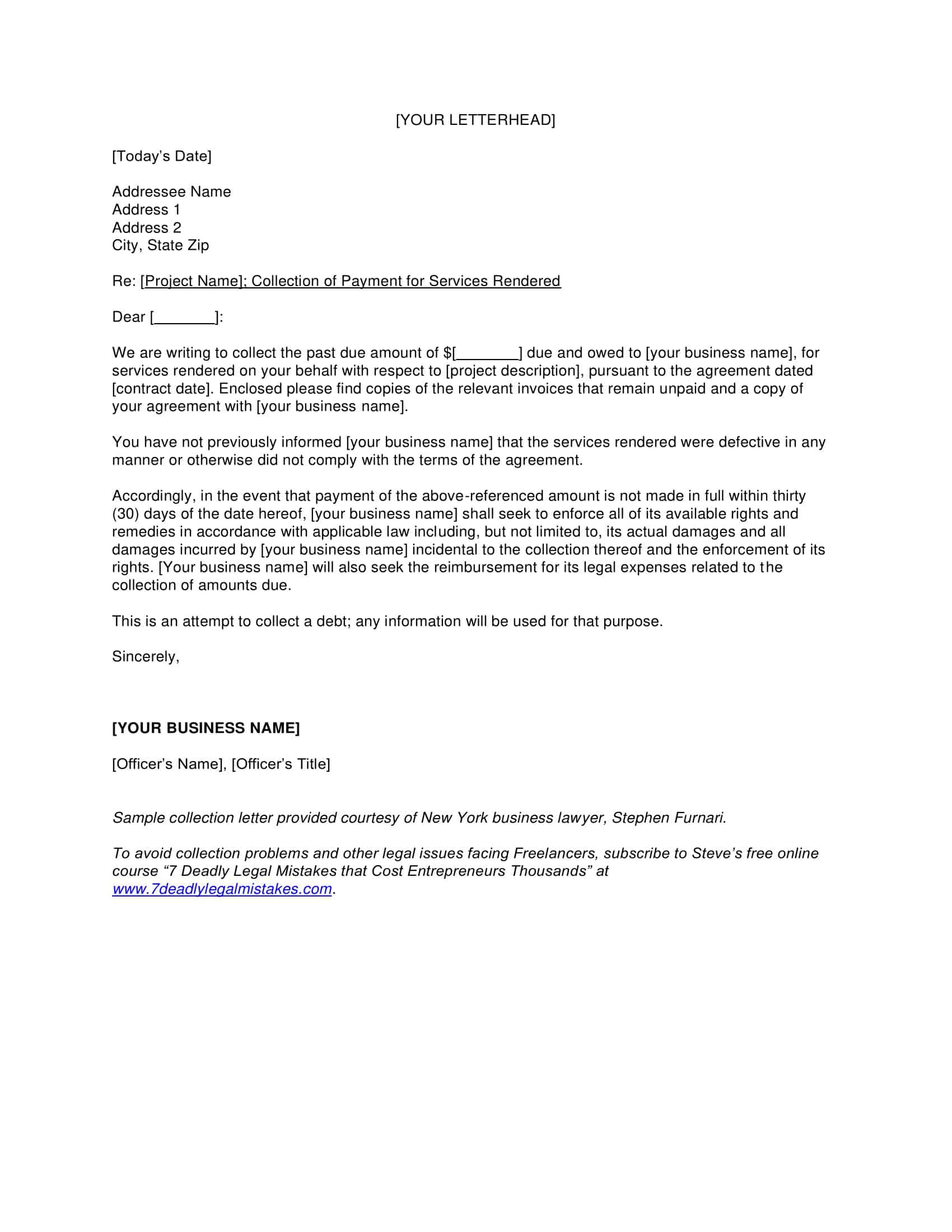

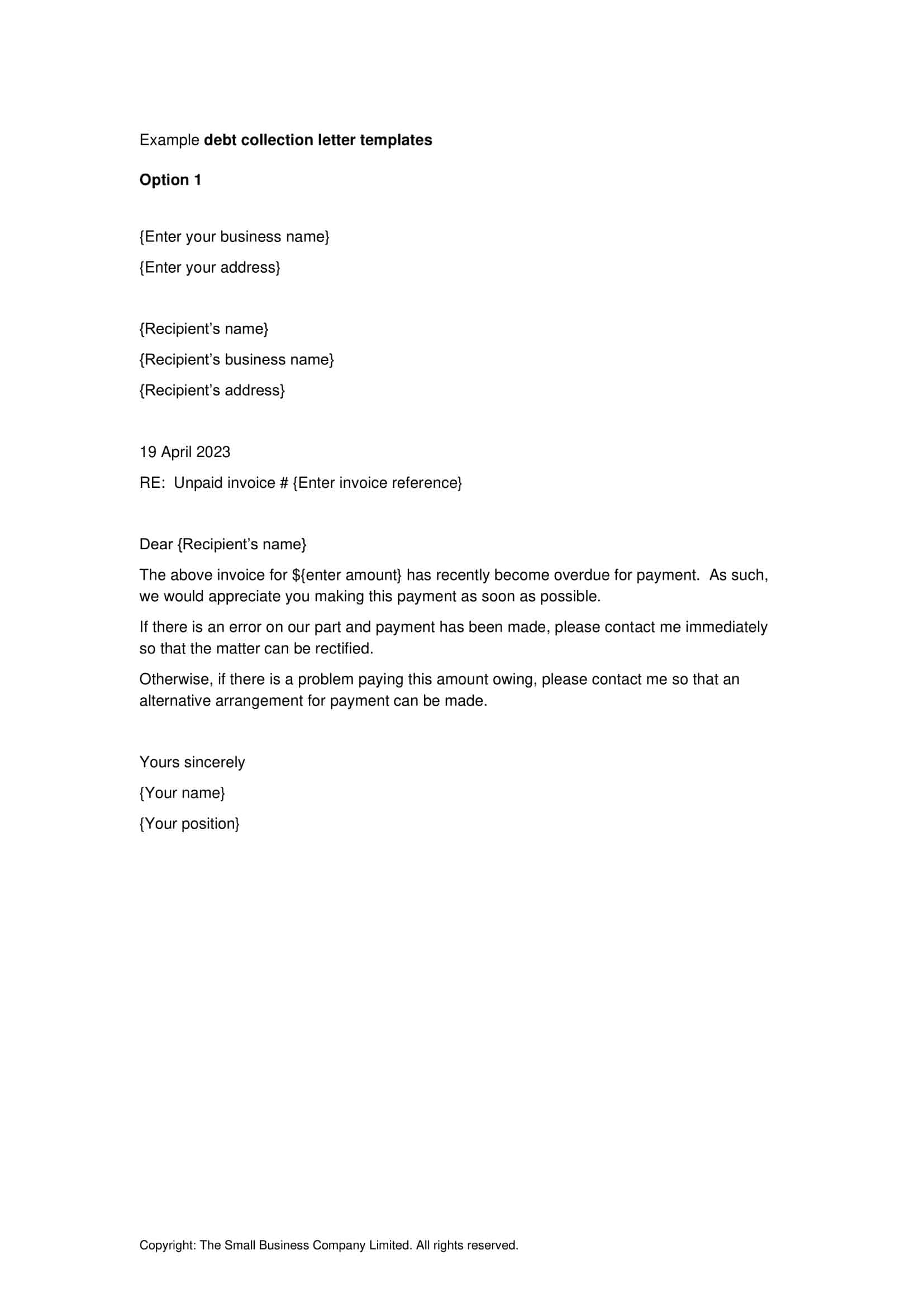

The first paragraph of a collection letter template states the reason for the letter – the amount owed, account number, and invoice details. It makes a clear request for payment by a specific date. Details on ways to pay like online, by phone, or mail are provided.

The middle section reiterates the request for payment. It opens discussion of payment plan options if needed. Contact information for the accounts receivable department is provided. Setting a firm payment deadline and offering flexible options give urgency while maintaining a professional tone.

The conclusion paragraph stresses the importance of a prompt response. It firmly states the next collections actions if no payment is received by the deadline, such as involving collection agencies or legal action. It aims to motivate payment through urgency rather than aggression. Effective templates balance formality with flexibility to achieve results.

Types of collection letter templates

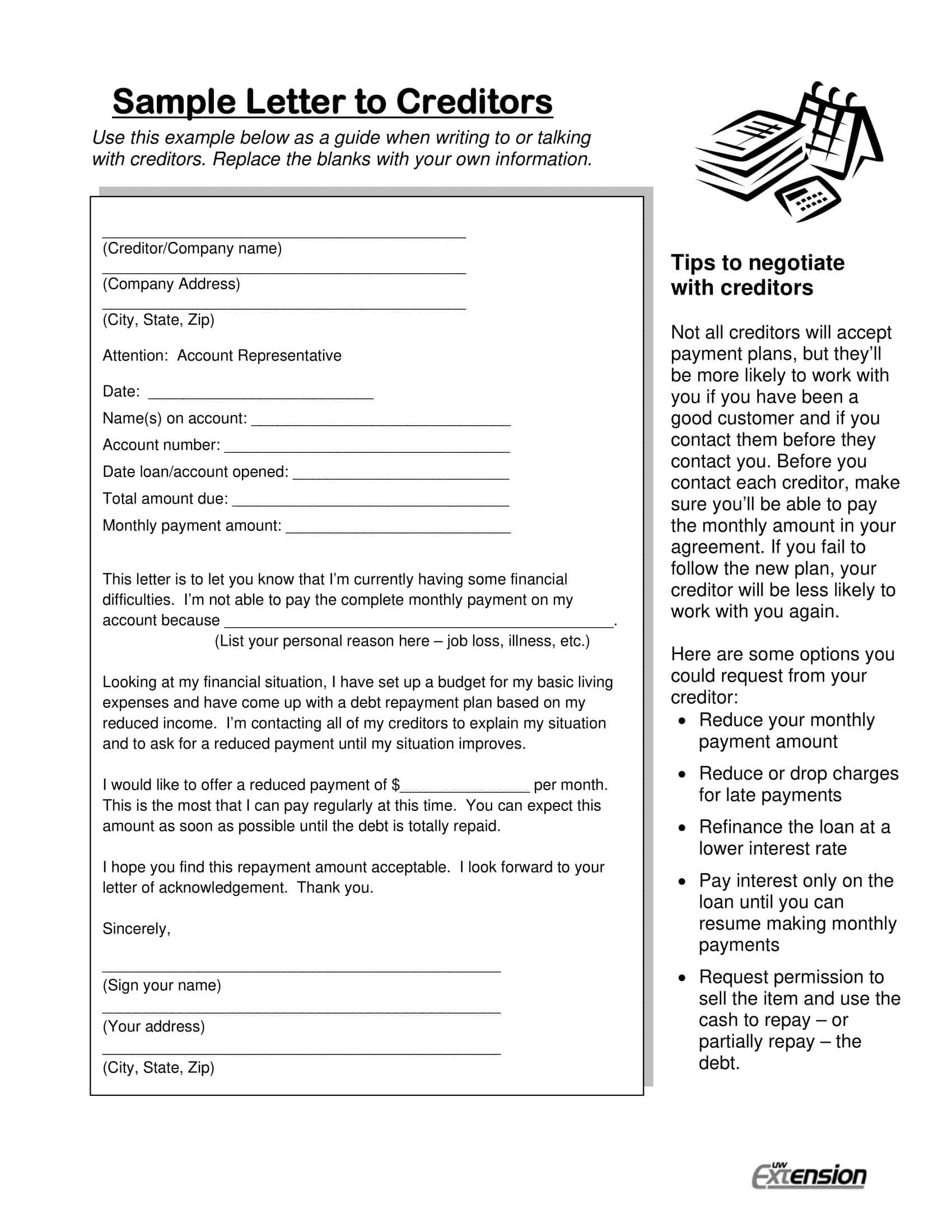

There are several different types of collection letter templates that can be used depending on the specific circumstances of the outstanding debt. Some common types include:

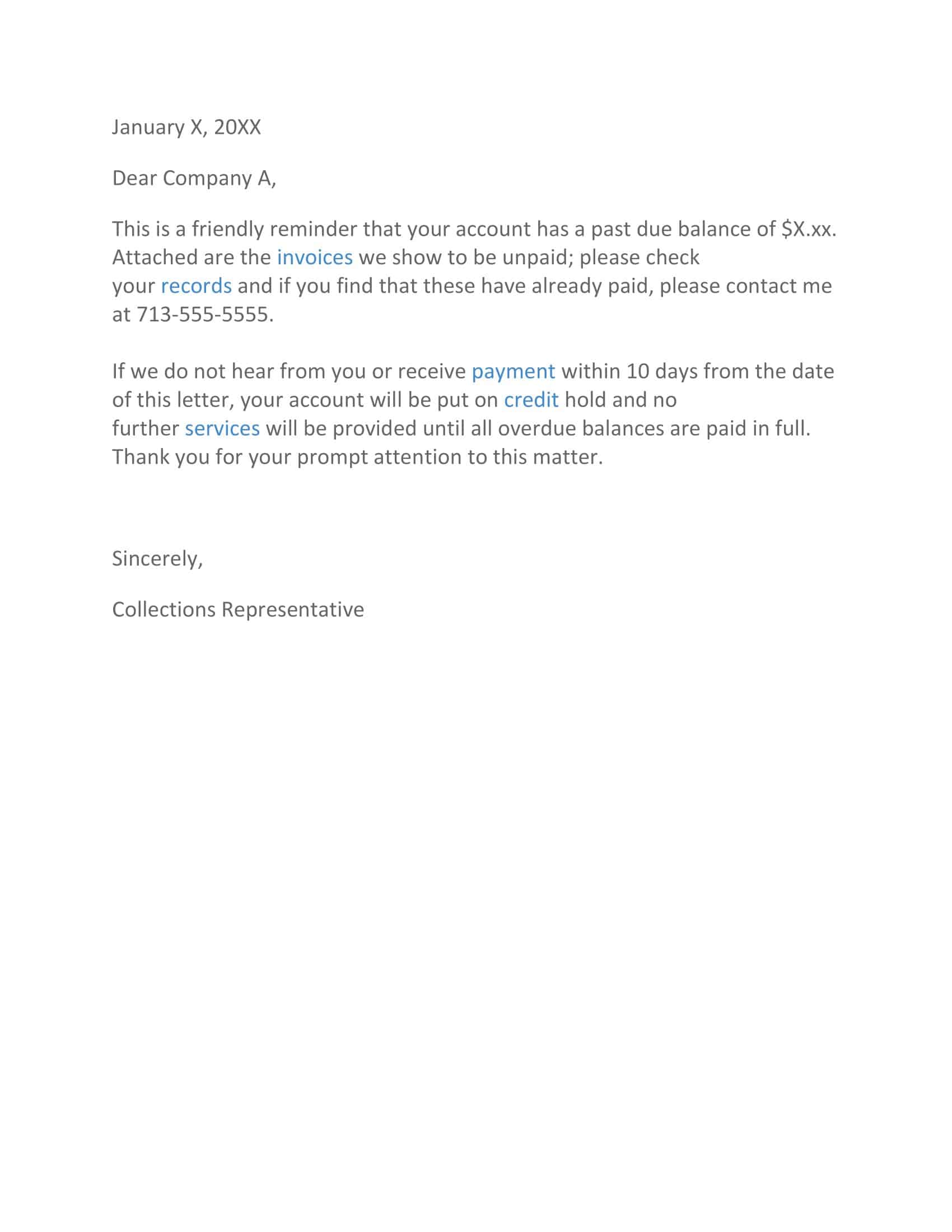

Initial collection letter: This is the first letter sent to a customer who has failed to make a payment. It serves as a reminder of the unpaid bill and requests payment in full.

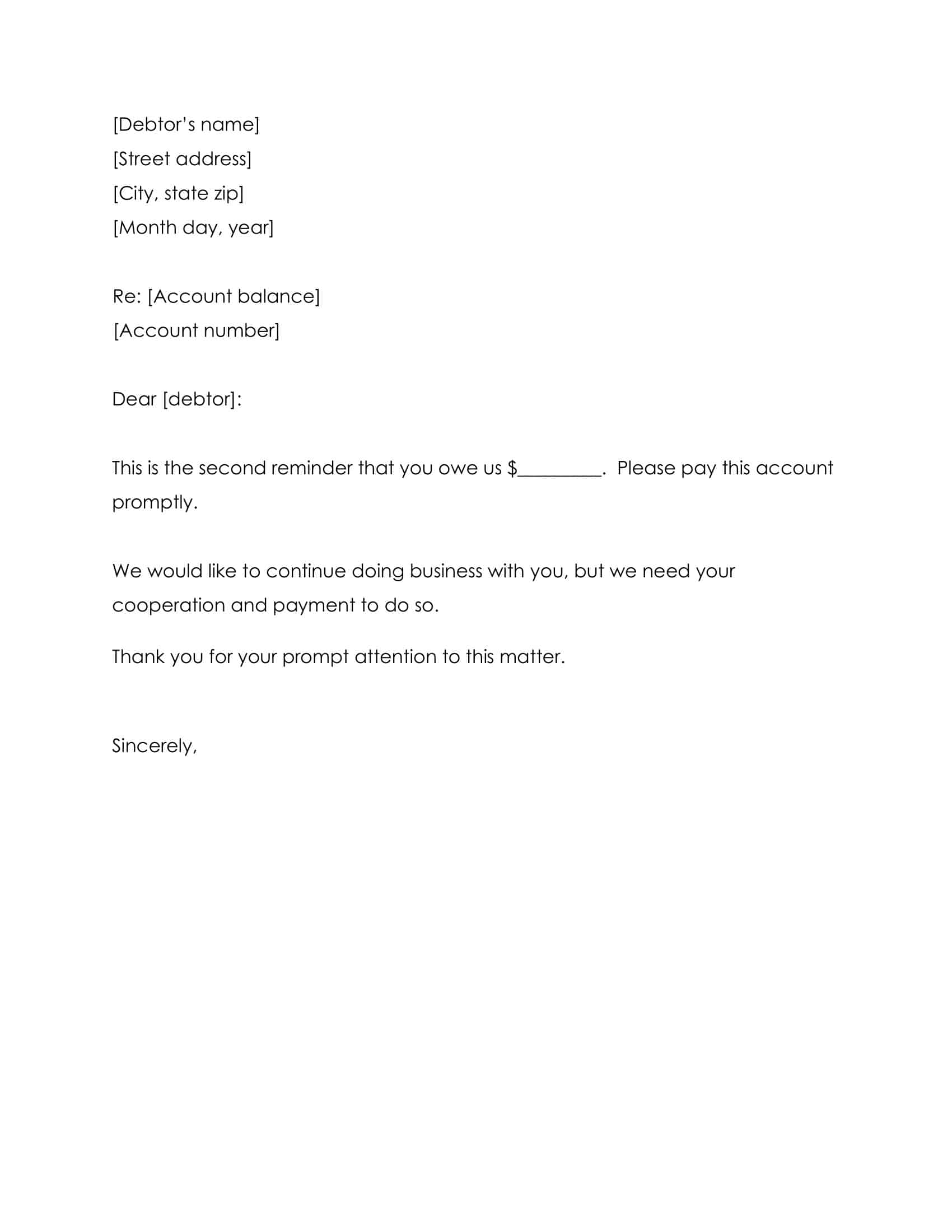

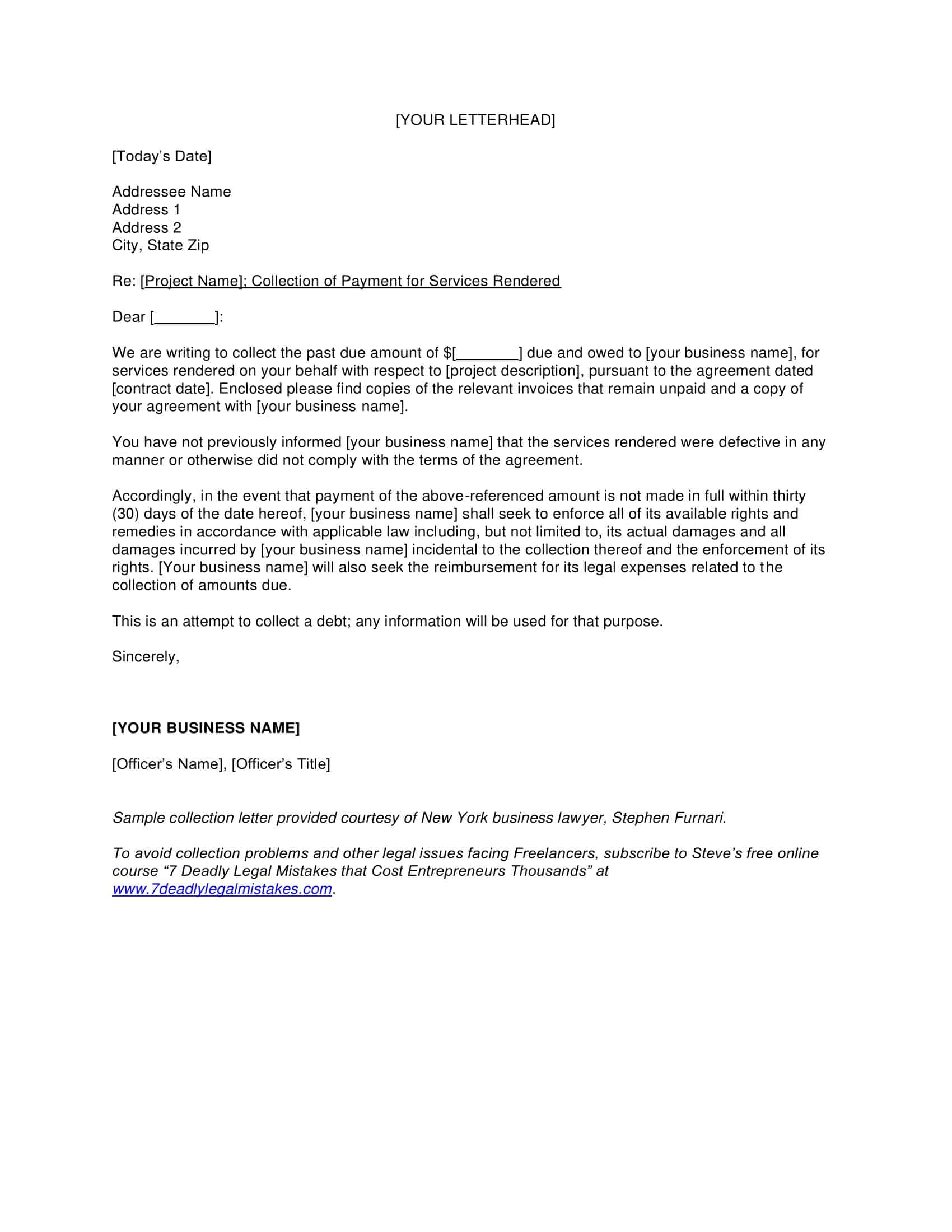

Second notice collection letter: This letter is typically sent after the initial collection letter has gone unanswered. It may include additional information about the consequences of non-payment, such as late fees or interest charges.

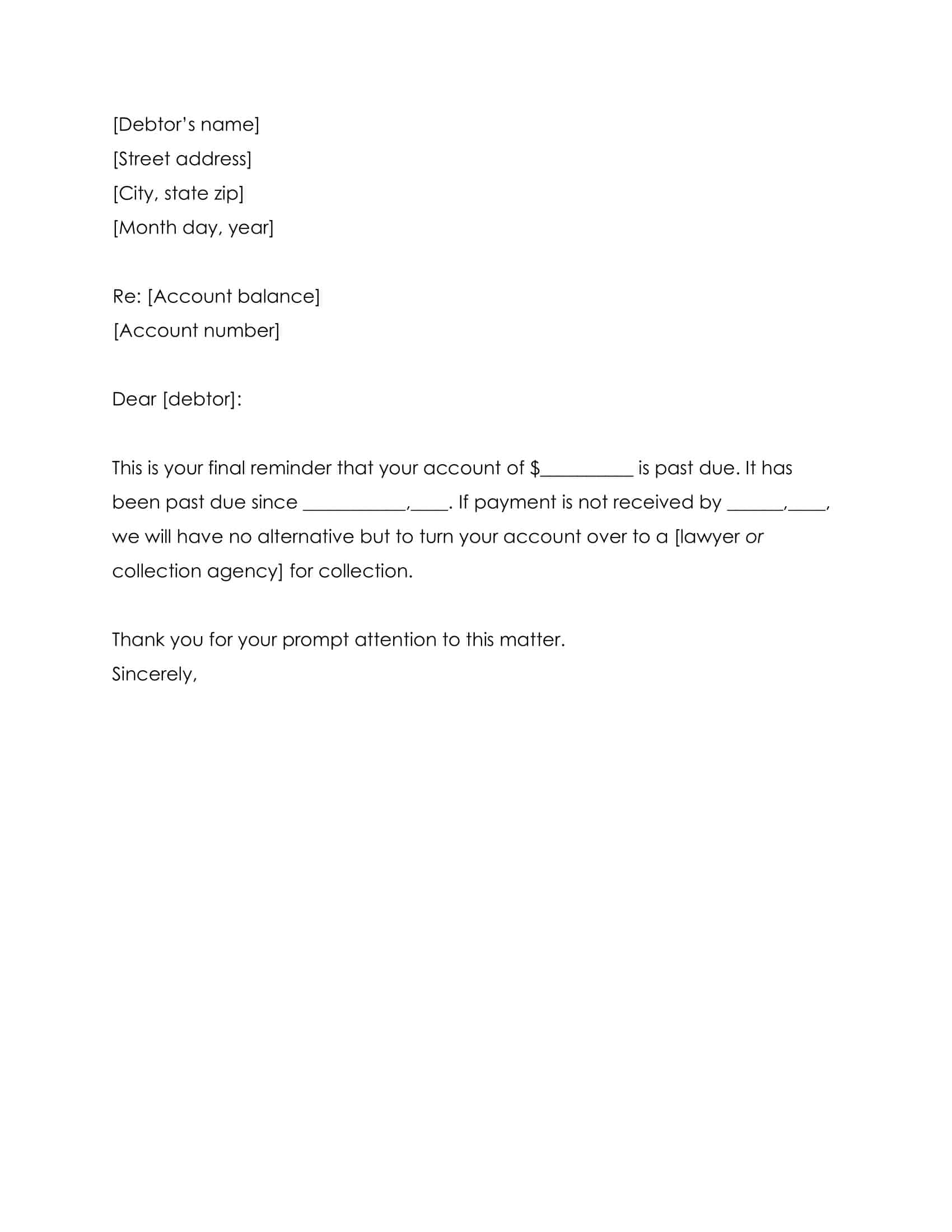

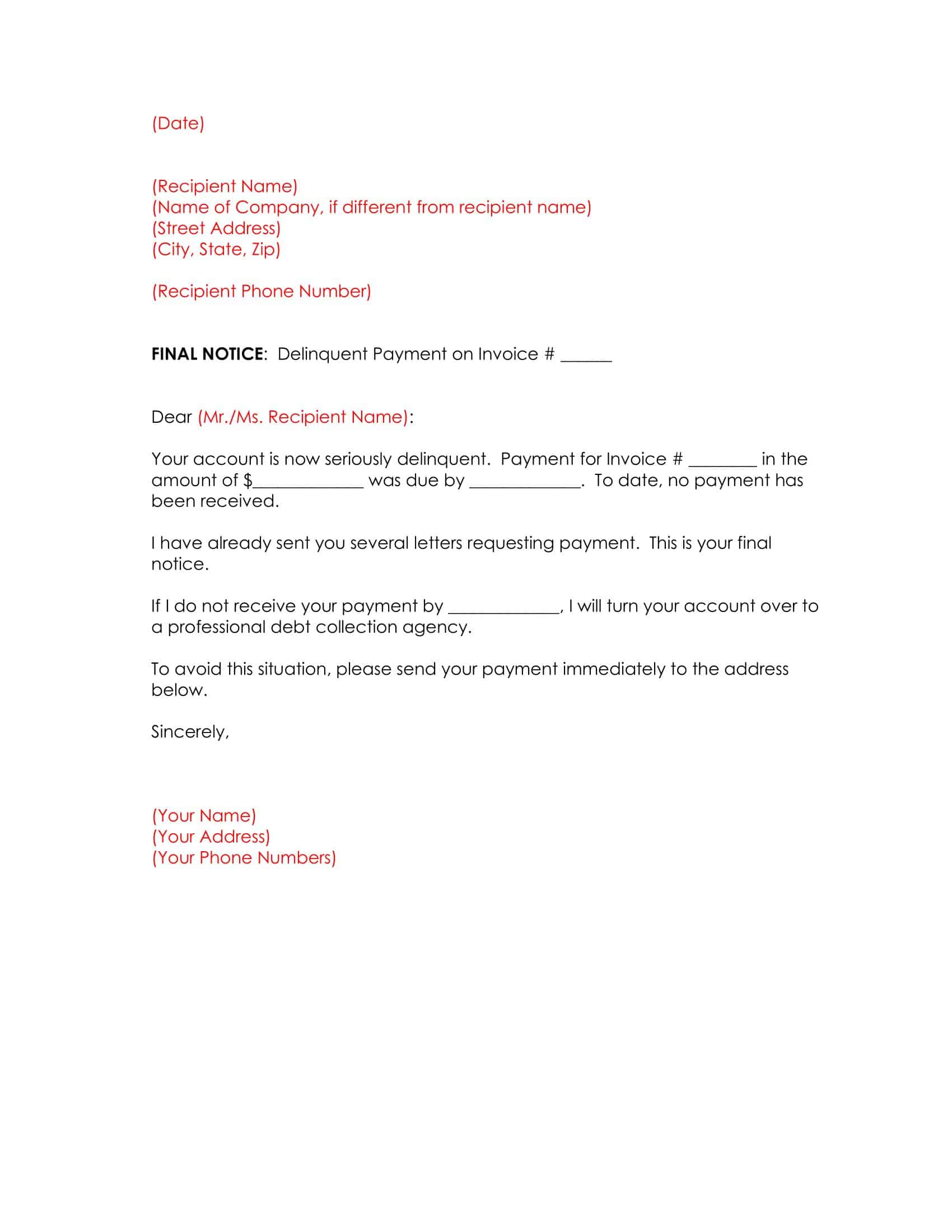

Final notice collection letter: This letter is the last warning before legal action may be taken. It advises the customer that if payment is not received within a specific period of time, the account will be turned over to a collection agency or attorney.

Past due collection letter: This letter is sent to a customer who has failed to make a payment on a past due account. It reminds the customer of the outstanding debt and requests payment as soon as possible.

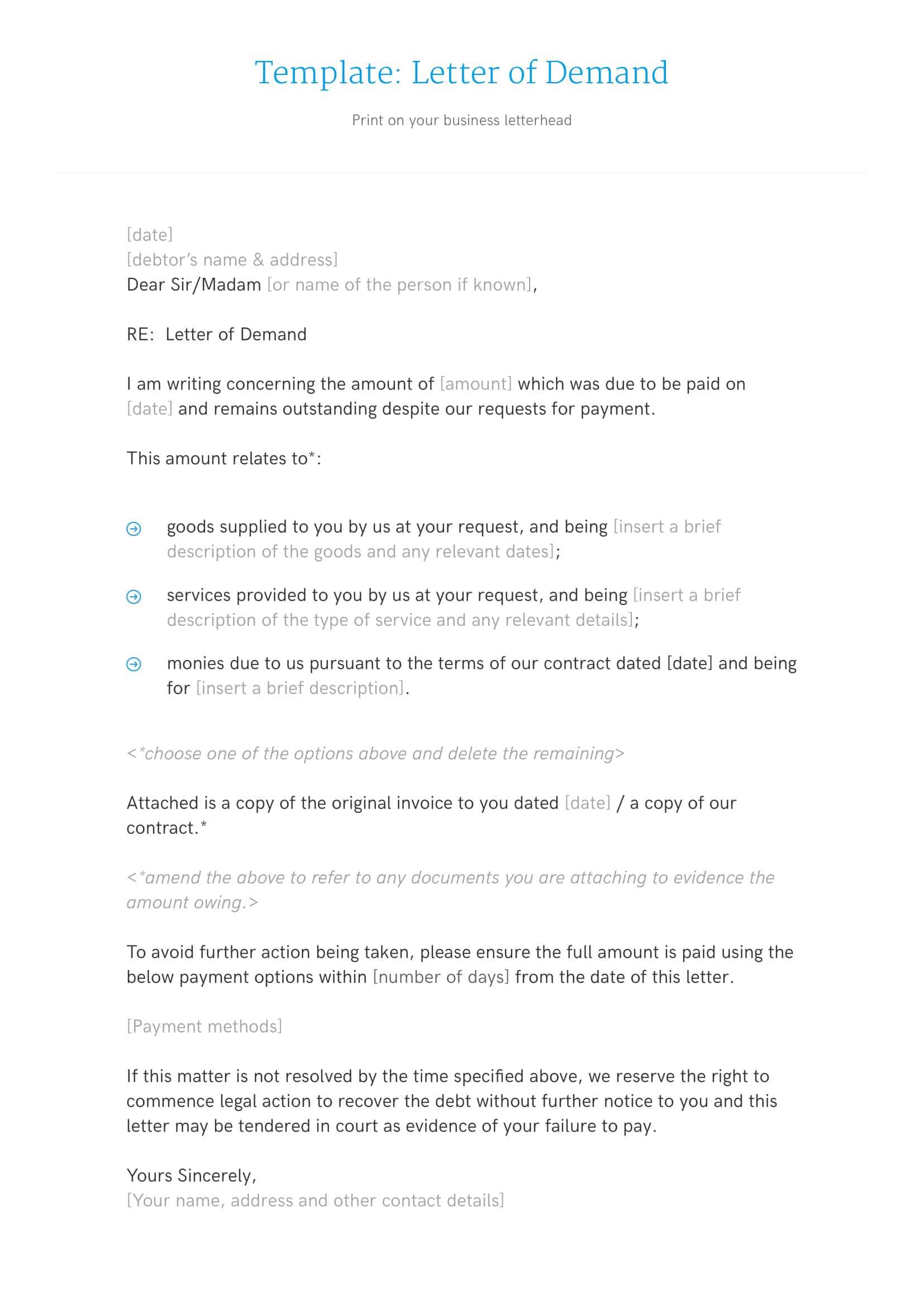

Demand letter: This letter is a formal demand for payment and serves as a warning that legal action may be taken if the debt is not paid.

Dispute resolution letter: This letter is used when a customer disputes a debt or bill. It provides a clear and concise explanation of the dispute resolution process and how the customer can dispute the debt.

What should be included in a debt collection letter?

A debt collection letter should include the following information:

The amount of the debt: The letter should clearly state the amount of the debt that is owed, including any late fees or additional charges that may have accumulated.

The invoice or account number: The letter should include the invoice or account number associated with the debt, so the customer can easily reference it.

The date the debt was incurred: The letter should include the date the debt was incurred, so the customer knows how long the debt has been outstanding.

The payment due date: The letter should include the date by which payment is due.

Contact information: The letter should include the business’s contact information, including phone number and email address, so the customer knows how to reach out for further information.

Consequences of non-payment: The letter should state the consequences of non-payment, such as late fees, interest charges, or legal action.

Reminder of the payment options available: The letter should remind the customer of the payment options available, such as online payment portals, automatic debit, or mailing in a check.

The signature of the sender: The letter should be signed by the sender, for example an employee or an agent of the business.

A polite and professional tone: It is important to keep a polite and professional tone throughout the letter, as it can help to maintain a positive relationship with the customer.

How to Write a Debt Collection Letter

Writing a debt collection letter can be a delicate task, as it involves requesting payment from a customer who may be experiencing financial difficulties. However, it is an important step in maintaining a positive cash flow for your business and ensuring timely payment of invoices and bills. Here is a step-by-step guide on how to write a debt collection letter, along with some tips for making the process more effective.

Step 1: Gather the necessary information

Before you begin writing the letter, gather all the necessary information about the debt. This includes the amount of the debt, the invoice or account number, the date the debt was incurred, and any late fees or additional charges that may have accumulated. This information will be crucial in providing specific details about the debt in the letter.

Step 2: Choose the appropriate tone

When writing a debt collection letter, it is important to maintain a polite and professional tone. The letter should be written in a neutral and factual manner, without any threats or intimidation. Avoid using aggressive or confrontational language, as this can cause the customer to become defensive and less likely to pay the debt.

Step 3: Identify yourself and the purpose of the letter

Begin the letter by identifying yourself and your business, and clearly stating the purpose of the letter. For example, you could say something like “I am writing to remind you of an outstanding debt of $X, invoice number Y, that you owe to our company.” This immediately sets the tone and purpose of the letter.

Step 4: Provide specific details about the debt

In the next paragraph, provide specific details about the debt, including the amount, invoice or account number, and the date the debt was incurred. It’s also important to mention the payment due date if there is any. This information helps the customer understand the exact debt they owe, and also enables them to quickly find the relevant records if they need to.

Step 5: Outline the payment options

In the next paragraph, outline the various payment options available to the customer. For example, you could say something like “We accept payment by check, money order, credit card, or online through our website.” This makes it easy for the customer to understand how they can pay the debt and also choose the most convenient option for them.

Step 6: Mention the consequences of non-payment

It’s important to mention the consequences of non-payment in the letter. For example, you could say something like “Please note that if payment is not received within 30 days, a late fee of X% will be added to the balance.” It’s also important to mention that if the customer does not pay, the company will take legal action if necessary.

Step 7: Provide contact information

Include your contact information in the letter, such as your phone number and email address, so the customer knows how to reach out for further information.

Step 8: Close the letter professionally

End the letter with a professional closing, such as “Thank you for your prompt attention to this matter.” Also, make sure to include your signature, and the company’s stamp if any.

Tips for writing a collection letter

Use a professional tone

The tone of the letter should be polite and professional. Avoid using threatening or aggressive language.

Include all relevant information

Be sure to include the borrower’s name, contact information, the amount of the debt, and any relevant dates (e.g. the date the debt was incurred, the date payment was due).

Give a specific deadline for payment

Include a specific date by which the borrower must pay the debt. This can help to motivate the borrower to take action.

Outline the consequences of non-payment

Let the borrower know the potential consequences if they do not make payment, such as legal action or additional fees.

Include contact information

Provide the borrower with a way to contact you or your company, such as an email address or phone number, to discuss the debt or make payment arrangements.

Keep a copy of the letter for your records

Keep a copy of the letter for your records in case you need to refer to it later or use it as evidence in court.

Follow up

If the borrower does not respond or make payment within the specified timeframe, follow up with another letter or phone call to remind them of their debt and the consequences of non-payment.

Consider sending the letter by certified mail

This will give you a proof of delivery and a record of when the borrower received the letter.

Be aware of the laws

Be familiar with the laws related to debt collection in your state and make sure you are following them when writing and sending the letter.

Be consistent and persistent

Be consistent in your follow-up efforts, and be persistent in your efforts to collect the debt. This will help to ensure that you receive payment as quickly as possible.

FAQs

How do I write a collection letter?

Start a collection letter with the date, customer name/address, and account details. Politely state the amount owed and request payment by a specific date. Mention ways to pay and offer to discuss payment options if needed. Add a warning about next steps if not paid but maintain a courteous tone. Include contact details and sign off politely.

How do I write a letter to collect money owed?

State the amount owed and due date directly. Politely request payment and provide instructions. Express willingness to handle questions or discuss payment options. Say next steps involve third-party collections if not paid by the deadline. Maintain a professional tone and avoid threats.

What is an example of a first collection letter?

A first collection letter should focus on polite reminders and flexible options. For example, “This initial notice is to inform you that your payment of $500 for invoice 123 is now 30 days past due. Please remit by 1/15/2023 or call to arrange installments. We wish to resolve this amicably and prevent further actions.”

How do you professionally ask for payment in a letter?

Professionally request payment in a letter with a courteous tone using phrases like “Kindly remit payment at your earliest convenience” or “Please submit the past due amount by XX/XX/XXXX.” Avoid aggressive demands.

Should collection letters be sent by mail or email?

Collection letters can be sent by formal mail or email. Mail adds an extra level of formality but email is faster and more cost-effective. Send an initial email notice first, then follow up with a mailed letter if needed before pursuing legal action.

What details should be included in collection letters?

Key details in collection letters include the customer’s name, account number, invoice numbers, exact overdue amounts, applicable dates, payment options, company contact information, and next steps if not paid promptly. Keep it concise yet comprehensive.

What is an example of a collection letter?

Here’s an example first collection letter:

Dear John,

Our records indicate there is an outstanding balance of $500 on your account #1234 for the invoice dated 1/1/2023. Please remit this payment at your earliest convenience. Payment can be made via check, online, or phone. Please contact us if you would like to arrange a payment plan. If the full payment is not received by 2/1/2023, we will be forced to take next steps, such as referring the account to a collection agency. Please get in touch with any questions.

Regards, Sarah Accounts Receivable

![Free Printable Friendly Letter Templates [PDF, Word, Excel] 1st, 2nd, 4th Grade 1 Friendly Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-1200x1200.jpg 1200w)

![43+ Printable Leave of Absence Letter (LOA) Templates [PDF, Word] / Free 2 Leave of Absence Letter](https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-1200x1200.jpg 1200w)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)