A rental property must be approached like any other entrepreneurial venture, maintaining thorough documentation of rental transactions. Relying solely on receipts may leave property owners at a disadvantage when they need to assess past financial records.

To optimize the management of a rental property business, it’s essential to adopt advanced record-keeping techniques that offer valuable insights into rental revenue performance. The rent ledger serves as an indispensable tool in this process. By reviewing the ledger, landlords can access detailed information on past and pending payments, allowing them to identify and distinguish between punctual and delinquent tenants with ease.

Table of Contents

What is a rental ledger?

A rental ledger is a comprehensive record-keeping tool used by landlords and property managers to track and document rent payments made by tenants. This organized record typically includes essential details such as tenant names, rental property addresses, payment dates, amounts paid, outstanding balances, and any late fees or additional charges.

Rental ledgers serve as a valuable resource for landlords to monitor the financial performance of their rental properties, assess tenants’ payment history, and make informed decisions regarding property management. Additionally, the rental ledger can provide valuable evidence in case of disputes or legal proceedings related to rent payments or tenant behavior.

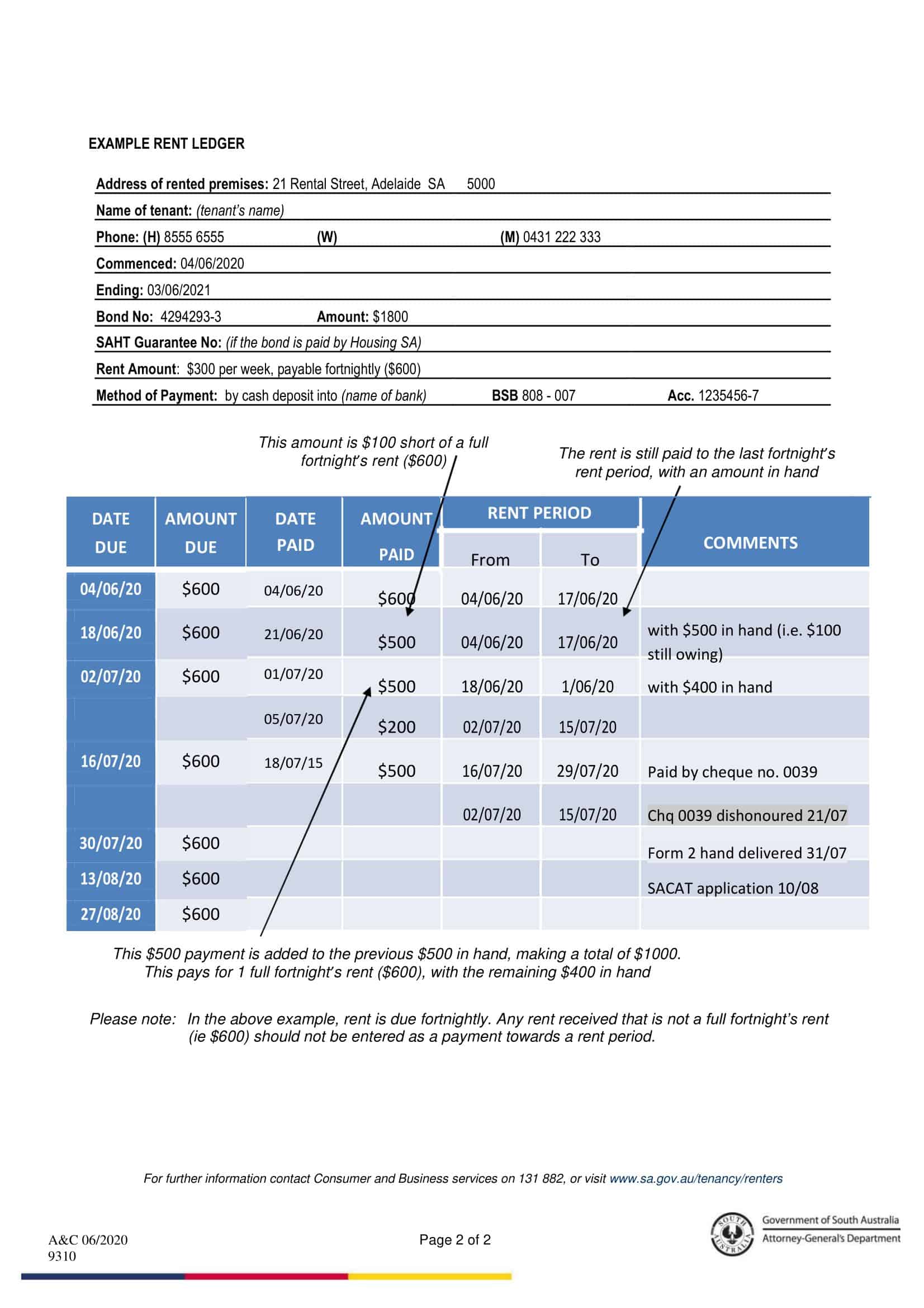

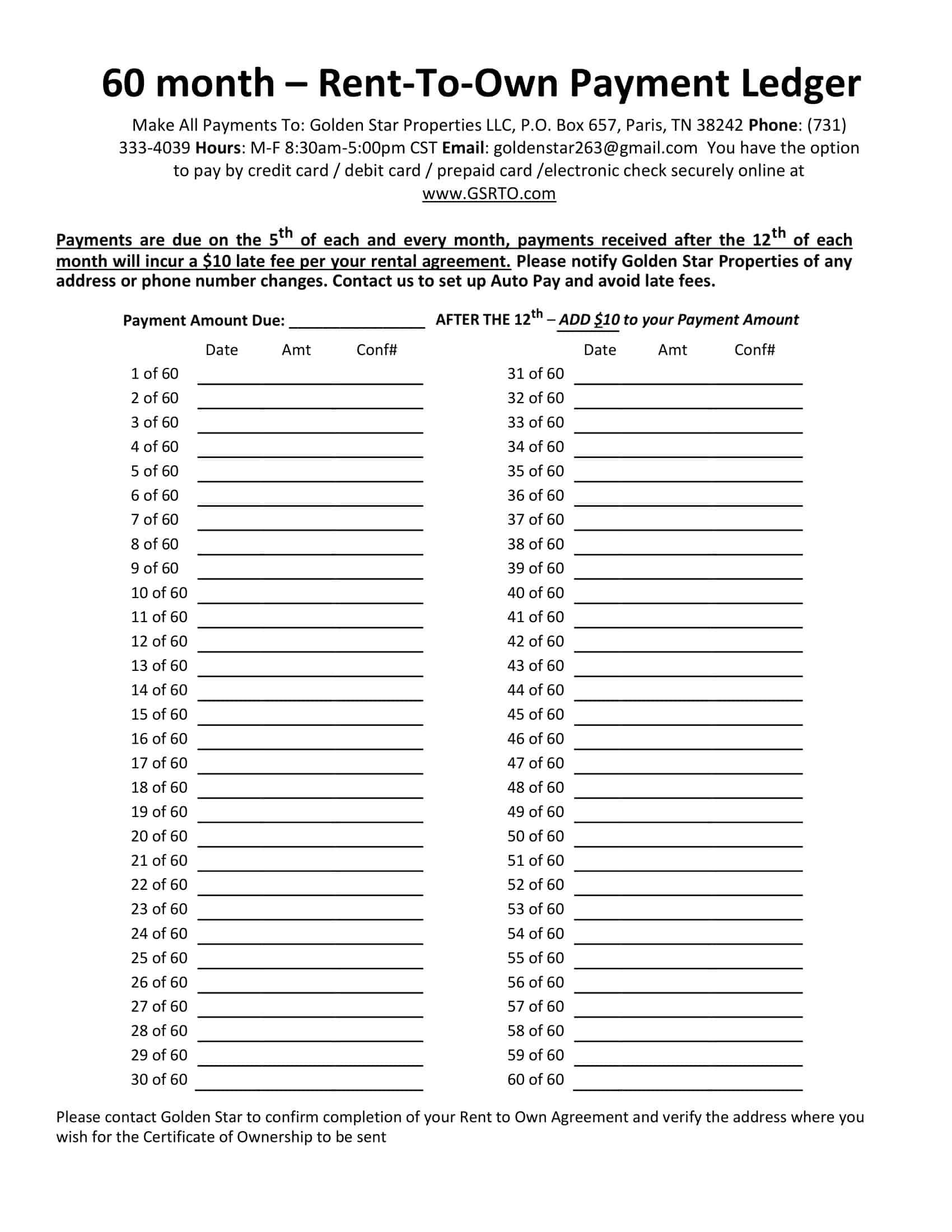

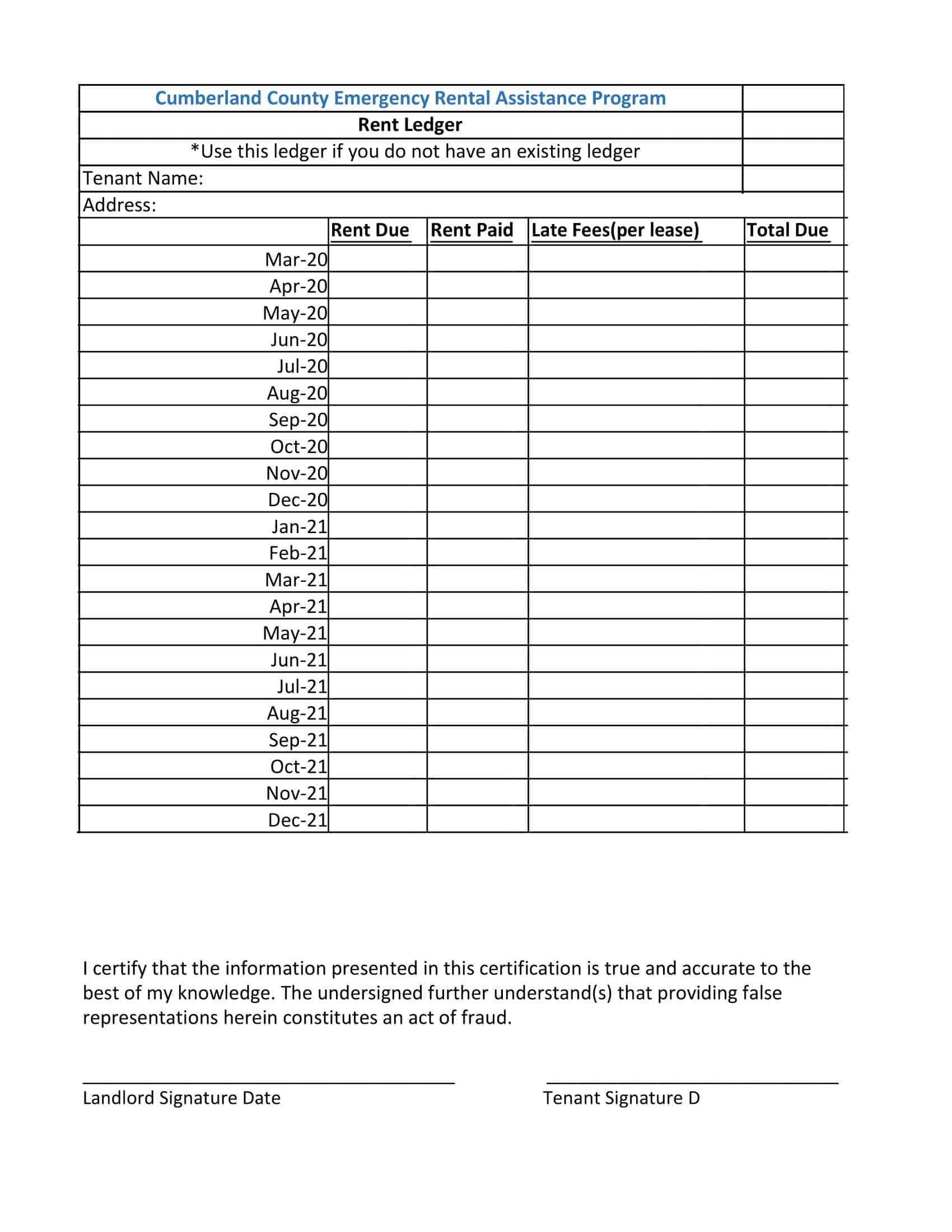

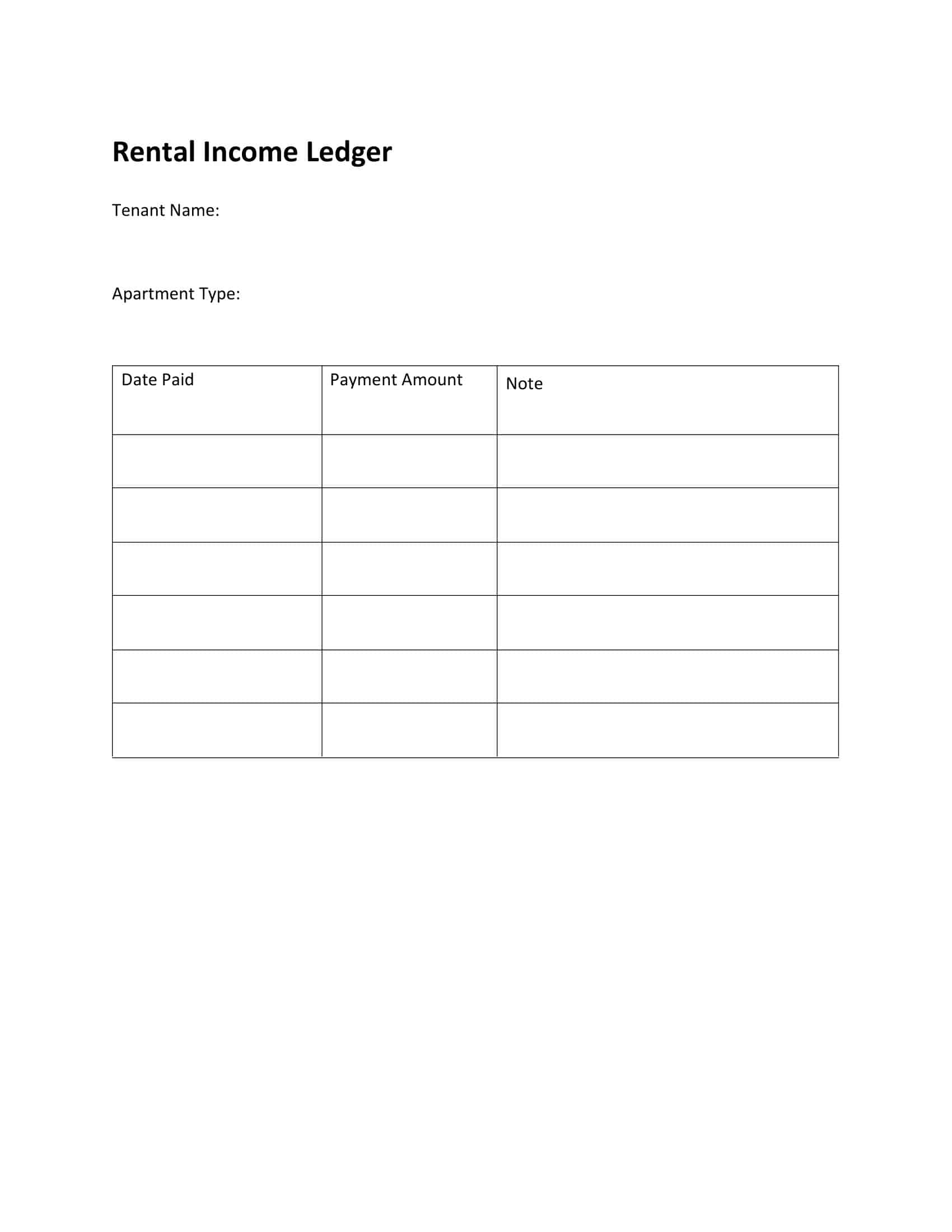

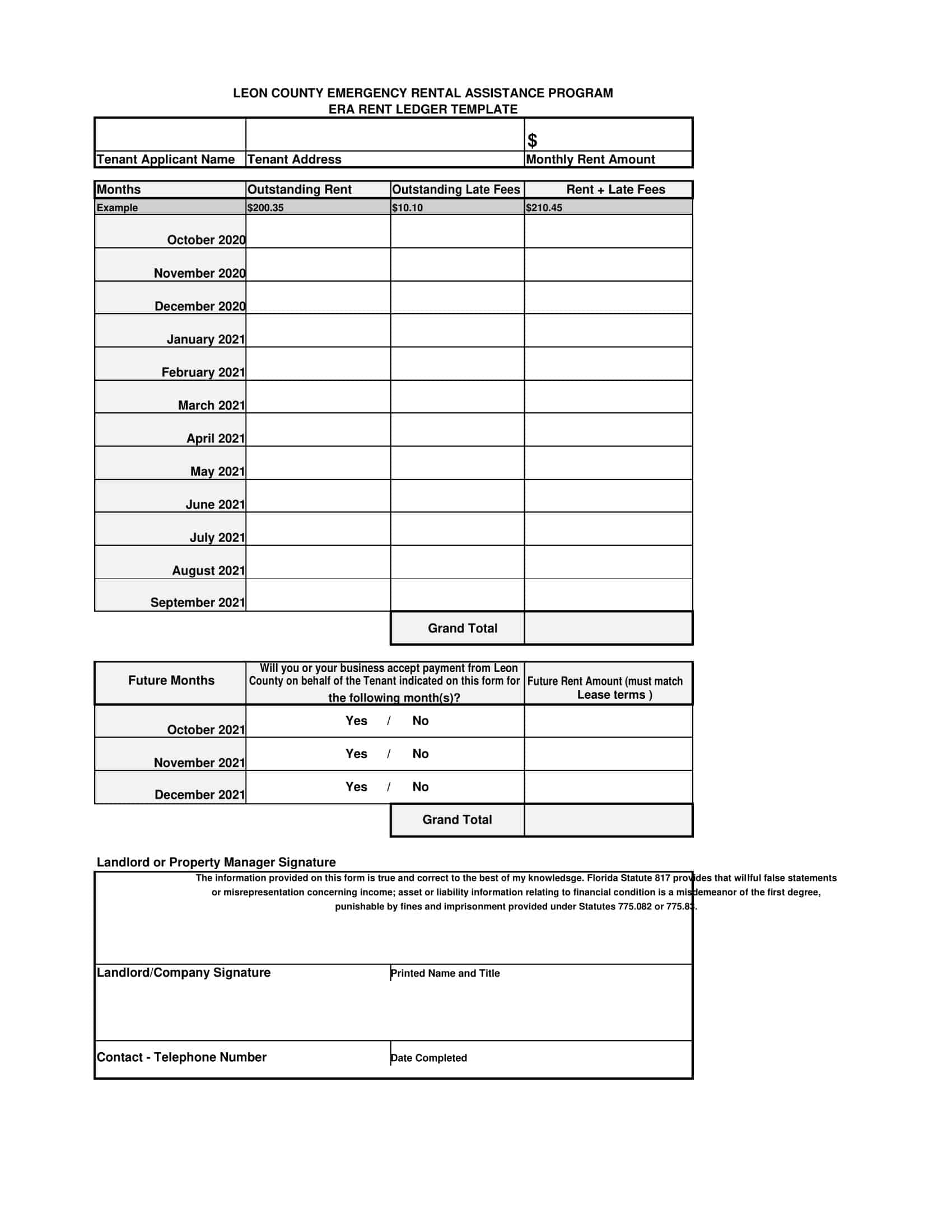

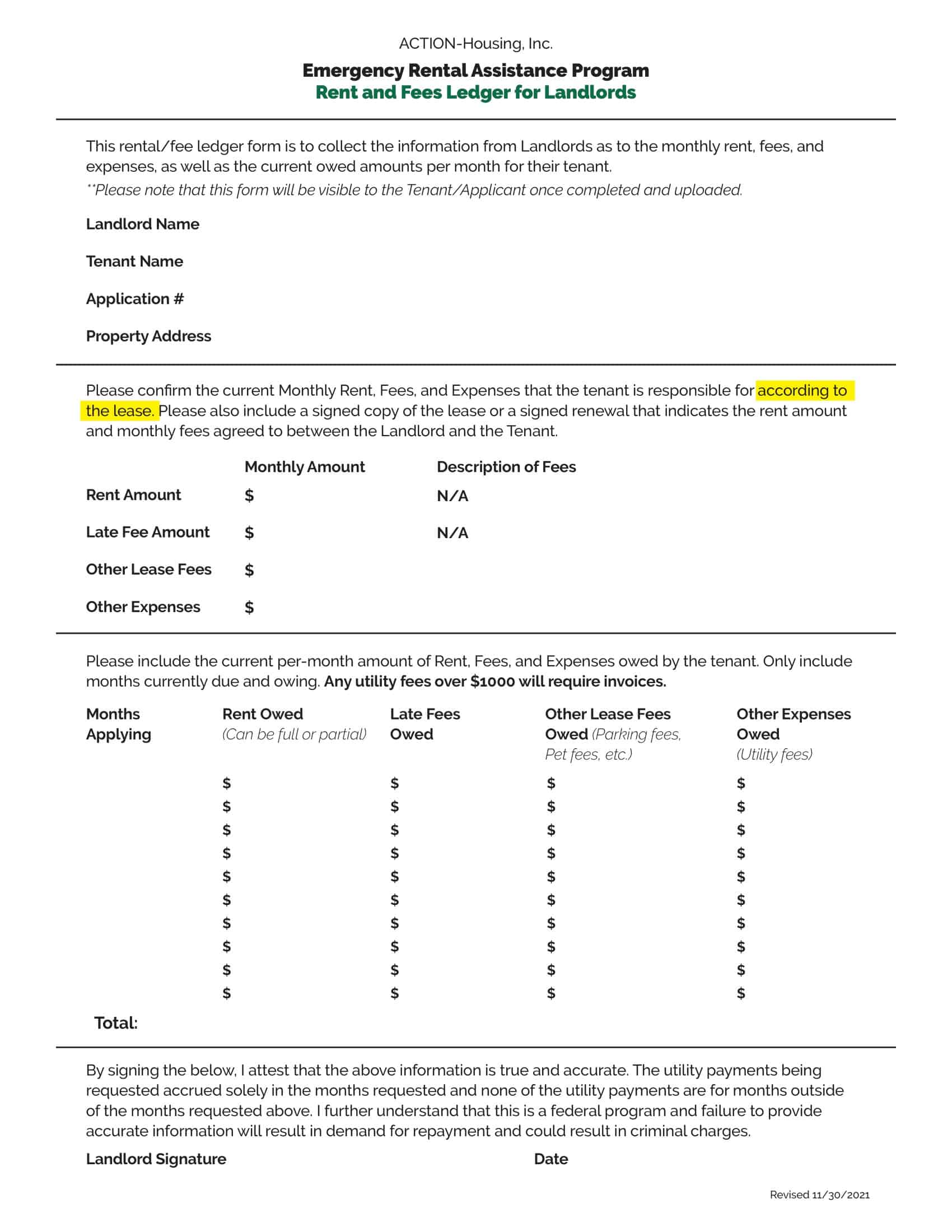

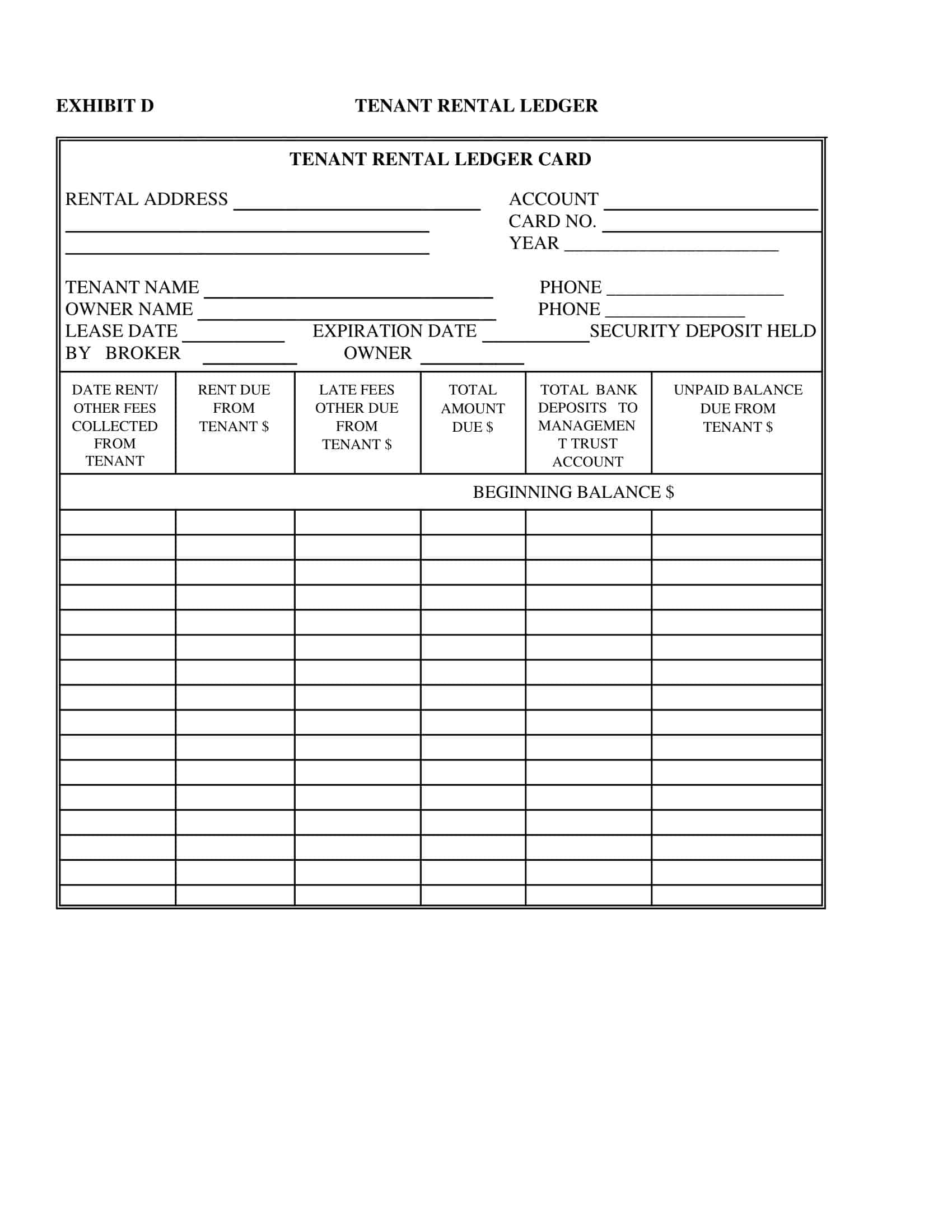

Rental Ledger Templates

Rental Ledger Templates are pre-designed formats used by landlords or property managers to maintain accurate records of rental payments and transactions for their properties. These templates provide a structured framework for organizing financial information related to tenant rent payments, security deposits, late fees, and any other financial transactions associated with the rental property. Rental Ledger Templates ensure consistency, accuracy, and organization in tracking and managing rental income and expenses.

Rental Ledger Templates provide a structured and systematic approach to tracking and managing rental income and expenses. By using these templates, landlords and property managers can ensure accurate record-keeping, financial transparency, and effective communication with tenants regarding rental payments.

These templates facilitate efficiency, organization, and compliance with accounting standards, enabling landlords to maintain detailed and consistent financial records for their rental properties. Rental Ledger Templates serve as valuable tools in managing rental properties, maintaining accurate financial documentation, and promoting transparent and professional landlord-tenant relationships.

Why is a Rent Ledger Important?

A rent ledger holds significant importance for landlords and property managers for several reasons:

Financial tracking and organization: A rent ledger helps maintain an organized record of rental income, enabling landlords to track individual tenant payments, outstanding balances, and late fees. This organization simplifies financial management and ensures that all transactions are accurately documented.

Tenant payment history: By providing a clear overview of each tenant’s payment history, rent ledgers allow landlords to identify punctual tenants and those with a pattern of late or missed payments. This information is valuable when making decisions about lease renewals or addressing rent-related issues.

Legal protection: In the event of a dispute or legal proceeding involving rent payments, security deposits, or eviction, a well-maintained rent ledger serves as evidence to support the landlord’s claims. Accurate and detailed records can help resolve conflicts and protect the landlord’s interests.

Tax and accounting purposes: Rent ledgers are essential for accurately reporting rental income and expenses on tax returns. They also provide a solid foundation for financial planning, budgeting, and decision-making related to property investments.

Monitoring property performance: A rent ledger offers insights into the financial performance of rental properties, helping landlords identify areas for improvement, potential rent adjustments, or the need for additional investment in property maintenance.

In summary, a rent ledger is a vital tool for successful rental property management, ensuring accurate financial tracking, legal protection, and informed decision-making.

Information on a Rent Ledger

A rent ledger is a financial document used by landlords or property managers to track rental payments made by tenants. It records the payment history, outstanding balances, and other relevant information pertaining to the tenant’s account. Key elements found on a rent ledger include:

Tenant’s Name and Contact Information: The full name of the tenant, their phone number, email address, and any other relevant contact information for easy identification and communication.

Property Address: The complete address of the rented property, including the unit or apartment number, street, city, state, and ZIP code.

Lease Start and End Dates: The start and end dates of the tenant’s lease agreement. This information is crucial for tracking when the lease is set to expire and for calculating the pro-rated rent for partial months.

Rent Amount: The agreed-upon monthly rent amount specified in the lease agreement.

Payment Due Date: The date by which the tenant is expected to pay the rent each month.

Payment Method: The method of payment accepted by the landlord or property manager, such as cash, check, or electronic transfer.

Payment History: A record of each rent payment made by the tenant, including the date, amount, and any associated transaction details.

Late Fees: Any late fees charged to the tenant for overdue rent payments, according to the terms specified in the lease agreement.

Security Deposit: The initial deposit paid by the tenant, which may be used to cover unpaid rent, damages, or other expenses at the end of the lease term.

Balance: The tenant’s current outstanding balance, calculated by summing the rent due, late fees, and any other charges, and then subtracting the payments made.

Notes: Any additional notes or comments related to the tenant’s account, such as maintenance requests, payment arrangements, or lease violations.

Who Can Use a Rent Payment Ledger?

A rent payment ledger can be used by various parties involved in the rental process to track and manage rental payments. These include:

Landlords

Individual property owners who rent out their properties can use a rent payment ledger to keep track of their tenants’ rent payments, outstanding balances, and other financial information related to the rental.

Property Managers

Property management companies or professionals who manage properties on behalf of landlords can use rent payment ledgers to maintain accurate records of rent collection and tenant account balances.

Tenants

Tenants can also maintain their own rent payment ledgers to keep track of their payment history, due dates, and outstanding balances. This can be helpful for budgeting purposes and as a personal record in case of disputes with the landlord or property manager.

Accountants

Accountants or bookkeepers working with landlords or property managers can use rent payment ledgers to track rental income, prepare financial statements, and ensure accurate tax reporting.

Real Estate Investors

Investors who own multiple rental properties can use rent payment ledgers to monitor the financial performance of their investments and assess the effectiveness of their property management strategies.

Legal Professionals

Lawyers and other legal professionals representing either landlords or tenants in rental disputes may use rent payment ledgers as evidence to support their case and demonstrate the payment history and outstanding balances of the parties involved.

How to Create a Rent Ledger

Creating a rent ledger involves organizing and recording relevant rental information in a clear and accessible format. Here is a comprehensive step-by-step guide to creating a rent ledger:

Step 1: Choose a Format

Decide whether you want to create a physical rent ledger (using a notebook or binder) or a digital rent ledger (using a spreadsheet or property management software). Digital ledgers are recommended for easier updating, calculations, and data storage.

Step 2: Set Up the Ledger Layout

For a digital ledger, open a spreadsheet application (like Microsoft Excel or Google Sheets). Create columns with the following headers: Tenant’s Name, Property Address, Lease Start Date, Lease End Date, Rent Amount, Payment Due Date, Payment Method, Payment History, Late Fees, Security Deposit, Balance, and Notes.

Step 3: Input Tenant Information

Enter the tenant’s name, contact information, and property address in the respective columns. This information can be found in the lease agreement or tenant application form.

Step 4: Record Lease Dates and Rent Amount

Input the lease start and end dates, as well as the agreed-upon monthly rent amount in the corresponding columns.

Step 5: Specify Payment Due Date and Method

Enter the monthly payment due date and the accepted payment methods (cash, check, electronic transfer, etc.).

Step 6: Record Security Deposit

Input the security deposit paid by the tenant at the beginning of the lease term, if applicable.

Step 7: Initialize the Balance

Set the initial balance for each tenant, which should be zero if there are no outstanding charges or payments at the beginning of the lease.

Step 8: Update Payment History

As the tenant makes rent payments, record the date and amount of each payment in the Payment History column. Include any transaction details, such as check numbers or confirmation codes for electronic transfers.

Step 9: Apply Late Fees

If a tenant’s rent payment is overdue, apply any late fees specified in the lease agreement to their account and update the Balance column accordingly.

Step 10: Calculate Current Balance

Regularly update the tenant’s outstanding balance by summing the rent due, late fees, and any other charges, then subtracting the payments made.

Step 11: Add Notes

Use the Notes column to record any additional information related to the tenant’s account, such as maintenance requests, payment arrangements, or lease violations.

Step 12: Review and Update Regularly

Regularly review and update the rent ledger to ensure accurate records of all transactions, balances, and tenant information.

Questions a Rent Ledger Answers

Here are some questions a rent ledger can answer:

- Who are the tenants and what is their contact information?

A rent ledger includes the names and contact details of all tenants, making it easy to identify and communicate with them.

- What is the address of the rented property?

The ledger records the complete address of the property, which is essential for organizing and managing multiple rental units.

- When do the lease agreements start and end?

The rent ledger provides the lease start and end dates, helping to determine when lease renewals or new tenant searches are needed.

- How much is the monthly rent and when is it due?

The ledger includes the monthly rent amount and due date, allowing for easier rent collection and budgeting.

- What payment methods are accepted?

The rent ledger indicates the acceptable payment methods, such as cash, checks, or electronic transfers.

- What is the payment history for each tenant?

The ledger provides a record of all rent payments made by the tenant, which is useful for tracking payment habits and resolving disputes.

- Are there any late fees or other charges applied to the tenant’s account?

Late fees and other charges are documented in the rent ledger, ensuring accurate tracking of additional fees and penalties.

- What is the current outstanding balance for each tenant?

The rent ledger calculates the tenant’s outstanding balance, making it easy to identify overdue payments or credits.

- How much was the security deposit and has it been refunded or applied?

The ledger records the security deposit amount, which is essential for tracking and managing deposit refunds or deductions at the end of the lease.

- Are there any additional notes or issues related to a tenant’s account?

The rent ledger may include a notes section, which can be used to document any special arrangements, maintenance requests, or lease violations.

Conclusion

In conclusion, a rental ledger is a vital tool for landlords, property managers, and tenants, offering a systematic and organized way to track rental payments, outstanding balances, and other essential financial information. By maintaining an up-to-date and accurate rent ledger, parties involved in the rental process can ensure smooth communication, prevent misunderstandings, and efficiently manage their financial responsibilities. As a result, rental ledgers contribute to the overall success and stability of the landlord-tenant relationship, promoting a positive rental experience for all parties involved.

FAQs

How often should I update my rental ledger?

You should update your rental ledger regularly, ideally after each rental payment is received or any additional charges or fees are applied. Regular updates ensure accurate records and enable you to identify overdue payments promptly.

What should I do if there is a discrepancy in the rental ledger?

If you find a discrepancy in the rental ledger, verify the information with your records, receipts, or bank statements. If the discrepancy persists, contact the landlord, property manager, or tenant to discuss and resolve the issue.

Can I use software or apps to create and manage my rental ledger?

Yes, you can use spreadsheet applications like Microsoft Excel or Google Sheets to create a digital rental ledger. Additionally, there are dedicated property management software and apps available that include rental ledger features, making it easier to manage and track rental payments.

Should I provide my tenants with a copy of their rental ledger?

Providing tenants with a copy of their rental ledger can be a good practice, as it helps them track their payment history, due dates, and outstanding balances. This can promote transparency and prevent misunderstandings related to rental payments.

How do I handle partial rent payments in a rental ledger?

Record partial rent payments in the Payment History column, and update the Balance column accordingly. Be sure to note any agreed-upon payment arrangements in the Notes section to prevent confusion.

How can I use the rental ledger for tax purposes?

A rental ledger helps you track rental income and expenses, making it easier to complete your tax return accurately. You can use the ledger to calculate total rental income, late fees, and any deductible expenses related to property management.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free, Printable Car Rental Agreement Templates [PDF, Word] 3 Car Rental Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Car-Rental-Agreement-1-150x150.jpg)