A checkbook register is a simple and effective tool that allows individuals to track and manage their personal or business finances. It is a record-keeping system that tracks the account balances and transactions in a checking account. By regularly updating the register, individuals can keep track of their spending, monitor their account balances, and identify any errors or suspicious activity in a timely manner.

Whether you prefer to use a paper register or a digital one, a checkbook register is a valuable resource for managing your finances and ensuring that you stay on top of your finances. In this article, we will explore the basics of a checkbook register, including how to use it, what information to include, and the benefits of keeping a well-maintained register.

Table of Contents

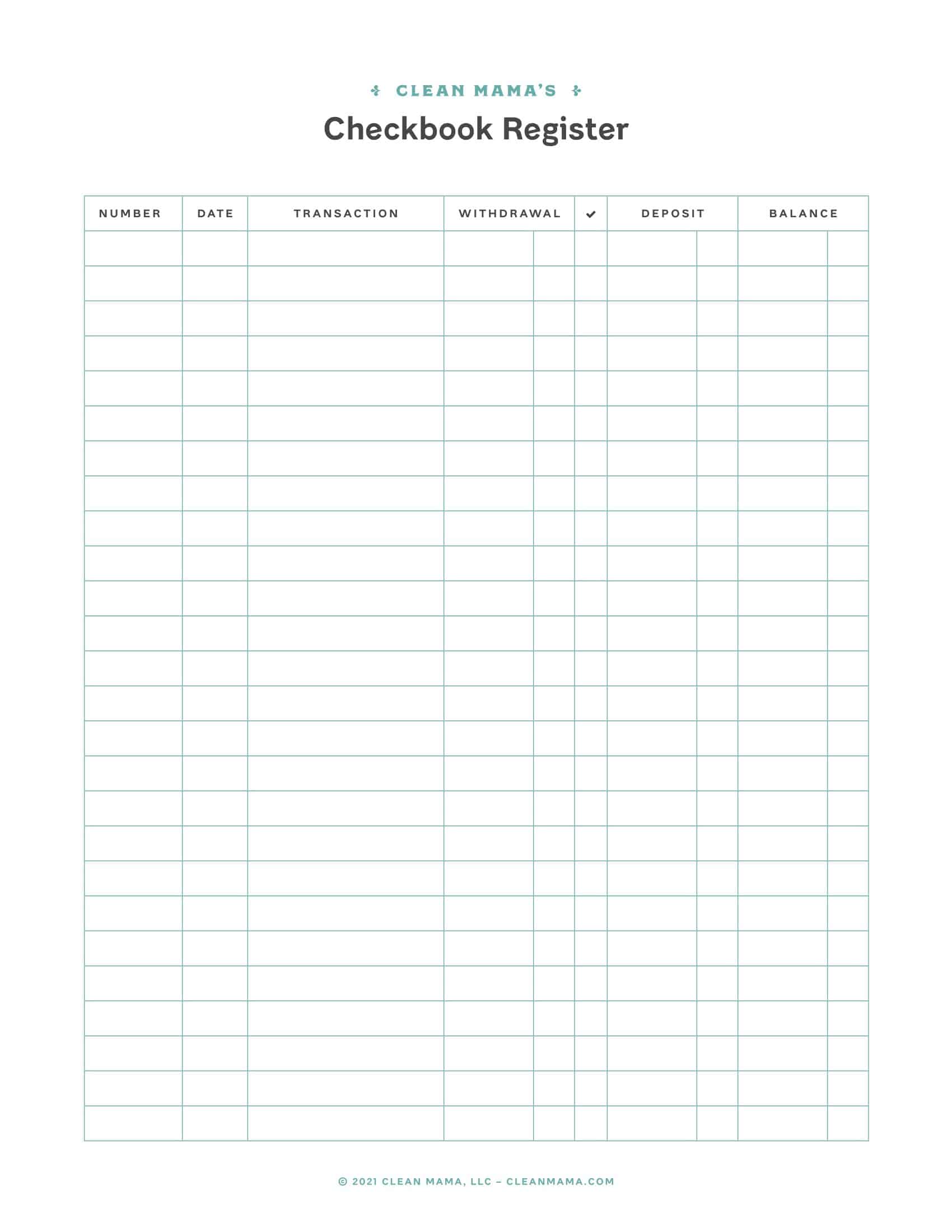

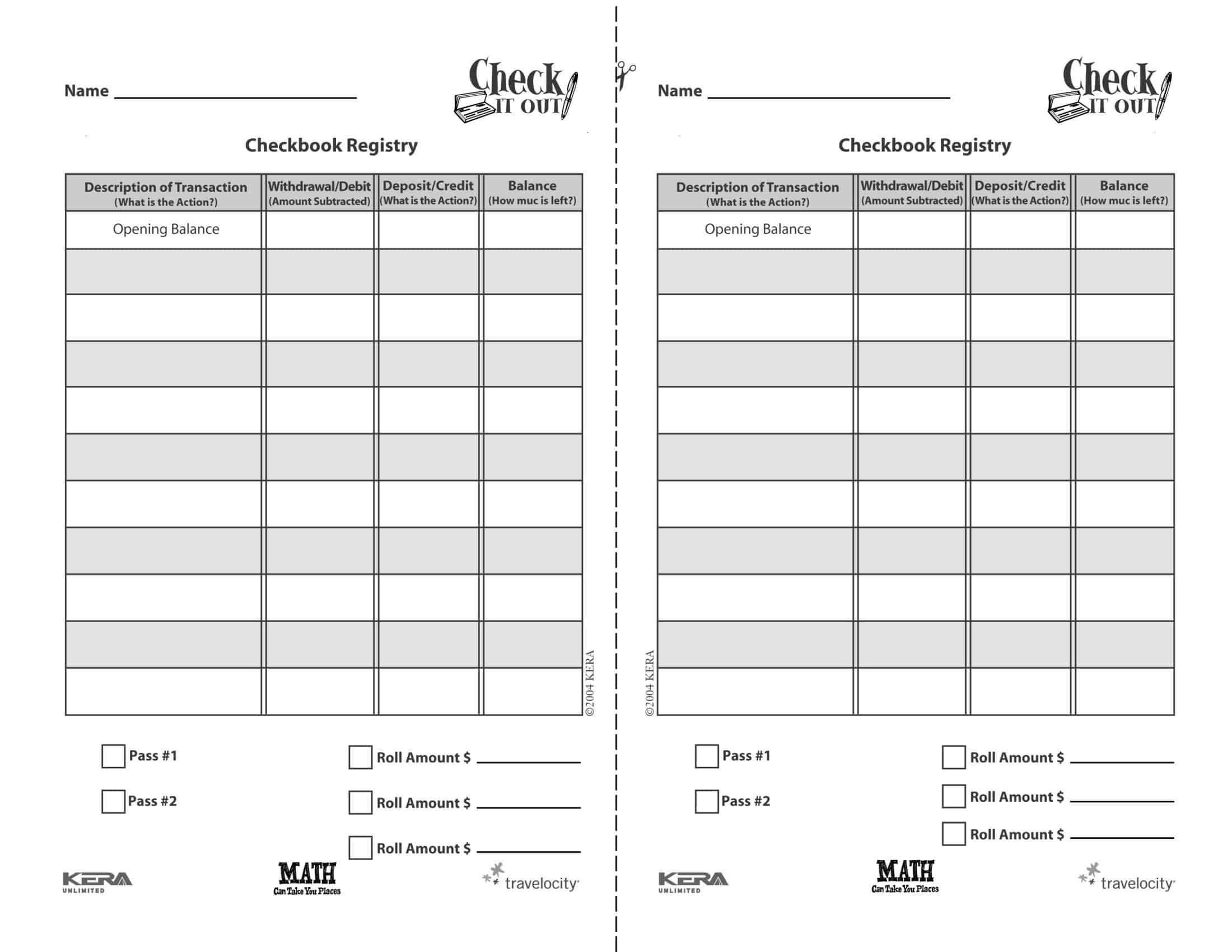

Checkbook Register Templates

Checkbook Register Templates are essential tools used to track and manage personal or business financial transactions. These templates provide a structured format for recording details of each check, deposit, withdrawal, or other financial activities in a checkbook or bank account. Checkbook Register Templates help individuals or businesses maintain accurate and up-to-date records of their financial transactions, monitor their account balance, and reconcile bank statements.

Checkbook Register Templates can be designed for manual record-keeping or created in spreadsheet or digital formats for electronic tracking. These templates are invaluable for individuals or businesses to maintain accurate financial records, monitor spending and income, and manage their account balances effectively. By utilizing Checkbook Register Templates, individuals can keep a close eye on their finances, avoid overdrawing accounts, and make informed financial decisions. Whether used for personal budgeting or business accounting purposes, Checkbook Register Templates provide a consistent and organized approach to managing financial transactions.

Benefits of using a check register

There are several benefits to using a checkbook register:

Financial Awareness: By keeping a record of all your transactions, a checkbook register helps you understand your spending patterns and track your account balances. This can help you better manage your finances, set and maintain a budget, and avoid overdrafts and other fees.

Error Detection: A checkbook register can help you detect and resolve errors or fraudulent activities in your account. This is particularly important in protecting your finances and avoiding losses.

Record Keeping: A checkbook register is a useful tool for keeping records of your financial transactions. This can be useful for tax purposes, reconciling your account, or as a reference when making future financial decisions.

Convenient: Whether you prefer a paper or digital register, they are both easy to use and accessible. Digital checkbook registers can be updated in real-time and are easily accessible from any device with an internet connection, while paper registers are compact and portable.

Budgeting: A checkbook register can help you keep track of your spending and monitor your progress towards your financial goals. By categorizing your expenses, you can see where your money is going and adjust your spending habits as needed.

In short, using a checkbook register provides a quick and easy way to stay on top of your finances, make informed financial decisions, and avoid costly errors and oversights.

When To Use Your Check Register

A check register should be used every time you write a check, make a debit card purchase, withdraw cash, or make any other transaction that affects your account balance. By recording each transaction as it occurs, you can keep a clear and accurate record of your spending, deposits, and account balances.

Additionally, it is recommended to regularly review and reconcile your checkbook register with your monthly bank statement. This will ensure that you catch any errors or fraudulent activities in a timely manner and prevent potential financial losses.

Using your check register consistently and regularly can also help you identify patterns in your spending and make informed financial decisions, such as setting and maintaining a budget, reducing unnecessary expenses, and saving for future goals.

What Transactions are Included in a Check Register?

A check register typically covers all transactions related to your checking account, including:

Check payments: Whenever you write a check to pay for something, record the date, payee, amount, and any relevant notes in your check register.

Debit card transactions: These transactions include purchases made using your debit card and any automatic bill payments or direct debits set up through your checking account.

Cash withdrawals: Whether you withdraw cash from an ATM or over-the-counter at a bank, make sure to record the date, amount, and location of each withdrawal in your check register.

Deposits: Whether it’s your paycheck or a deposit from another source, make sure to record the date, amount, and any relevant notes in your check register.

Bank charges: If you incur any fees from your bank, such as overdraft fees or monthly maintenance fees, make sure to record these in your check register.

Running balance: By keeping track of your account balance after each transaction, you can ensure that you are always aware of how much money is available in your checking account.

Reconciliation: Using your check register, you can reconcile your account by comparing the transactions recorded in your register with your monthly bank statement. This helps to ensure that there are no errors or discrepancies between your records and those of your bank.

Budgeting: By recording all transactions in your check register, you can see exactly how much money is being spent on various expenses, such as groceries, entertainment, and bills. This information can be useful for creating and sticking to a budget.

Tax documentation: Your check register can also serve as an important source of documentation for tax purposes, as it provides a record of all your income and expenses throughout the year.

How to Manage your Check Register

Managing your check register is an important part of keeping track of your finances and ensuring that you have an accurate record of your transactions. Here’s a step-by-step guide to help you effectively manage your check register:

Keep track of all transactions

This includes all checks, deposits, debit card purchases, and any other financial transactions.

Record transactions promptly

It is important to record transactions as soon as they occur so that you have an up-to-date record of your finances.

Use a check register

You can use a check register to keep track of your transactions, or you can use a software program or an online banking system that allows you to manage your finances electronically.

Verify transactions

Make sure to verify each transaction with your bank statement to ensure that you have recorded everything accurately. If there are any discrepancies, make the necessary corrections in your check register.

Balance your checkbook regularly

Balancing your checkbook means making sure that your check register accurately reflects the current balance in your account. You can do this by comparing the balance in your check register to your bank statement.

Make note of important information

Make sure to include important information in your check register, such as the date, the payee, and the purpose of each transaction.

Use your check register as a budgeting tool

You can use your check register to help you keep track of your spending and make informed decisions about your finances.

Review your check register regularly

Regularly reviewing your check register will help you stay on top of your finances and identify any areas where you may need to make changes or improvements.

FAQs

Do I need to keep a physical checkbook register or can I use digital tools?

You can use either a physical checkbook register or digital tools to keep track of your check transactions. There are many digital options available, including spreadsheet software and mobile applications.

How often should I update my checkbook register?

You should update your checkbook register after each check transaction to ensure that your records are accurate and up-to-date.

How does a checkbook register help reconcile my bank statement?

By recording each check transaction in your checkbook register, you can compare the entries in your register to your bank statement to ensure that all transactions are accounted for. This helps you identify any discrepancies or errors and helps you keep track of your spending.

How do I use a checkbook register?

To use a checkbook register, simply record each check transaction, including the date, payee, check number, and the amount of the check. You should also update your balance after each transaction.

Does Excel have a checkbook register template?

Yes, Excel has free checkbook register templates you can download. These contain columns to log essential details like date, description, check number, payment/debit amount, deposit amount, and running balance. You can add rows to track transactions.

Does Google have a checkbook register template?

Google Sheets includes pre-made checkbook register templates you can open, edit and customize to fit your needs. Enter data, colors and formatting while auto-calculating running balances. Easily accessible on any device.

Do banks give free check registers?

Many banks do provide free physical check registers to account holders. These take the form of a small ledger book with columns and spaces to record transactions as you write checks or make deposits, withdrawals, transfers, payments from your account.

What data should be in a checkbook register?

Essential checkbook register data includes: Date of transaction, Type like payment/deposit, Check number (if applicable), Description/Payee, Debit/Payment amount, Credit/Deposit amount, and Balance amount after each entry.

Does Microsoft have a checkbook register?

Microsoft Excel offers downloadable checkbook register templates for free. These contain an editable spreadsheet with columns for date, description, check number, payment amount, deposit amount and running balance to log transactions.

How do I make a checkbook in Google Sheets?

Open a new Google Sheet and create columns for Date, Description, Check no., Payment amt, Deposit amt, Balance. The Balance column can auto-calculate with a formula like “=B6+C7” adding and subtracting transactions. Then add rows to log each checkbook activity.

![Free Printable Food Diary Templates [Word, Excel, PDF] 1 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)