Financial projections are an important aspect of any business plan, as they provide a clear picture of a company’s expected financial performance in the future. These projections, which can include income statements, balance sheets, and cash flow statements, are used by investors, lenders, and management to evaluate a company’s ability to generate profits and cash flow, as well as its overall financial health.

In this article, we will discuss the key elements of financial projections and how they are used in the financial planning and analysis process. We will also cover some best practices for creating accurate and reliable financial projections.

Table of Contents

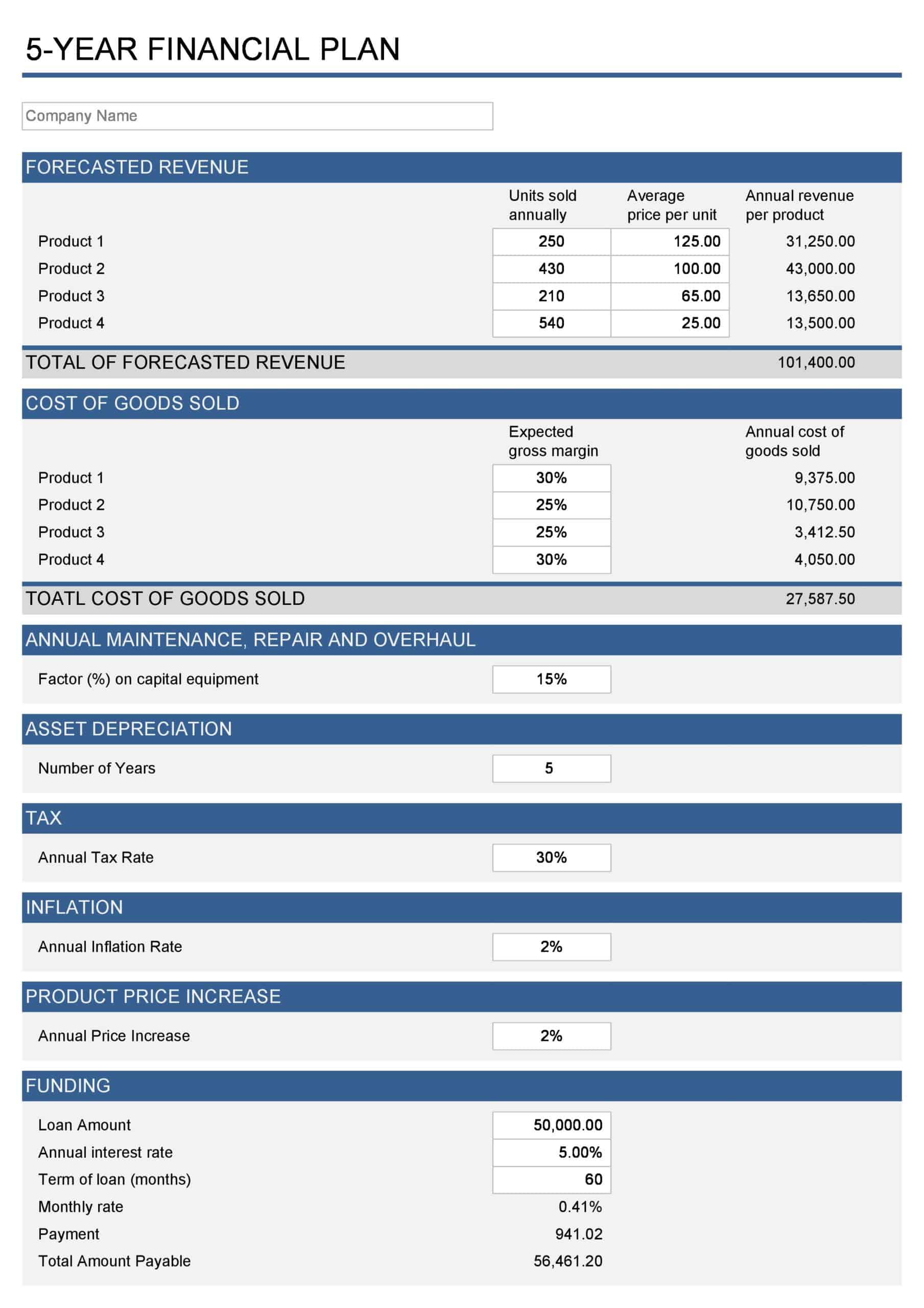

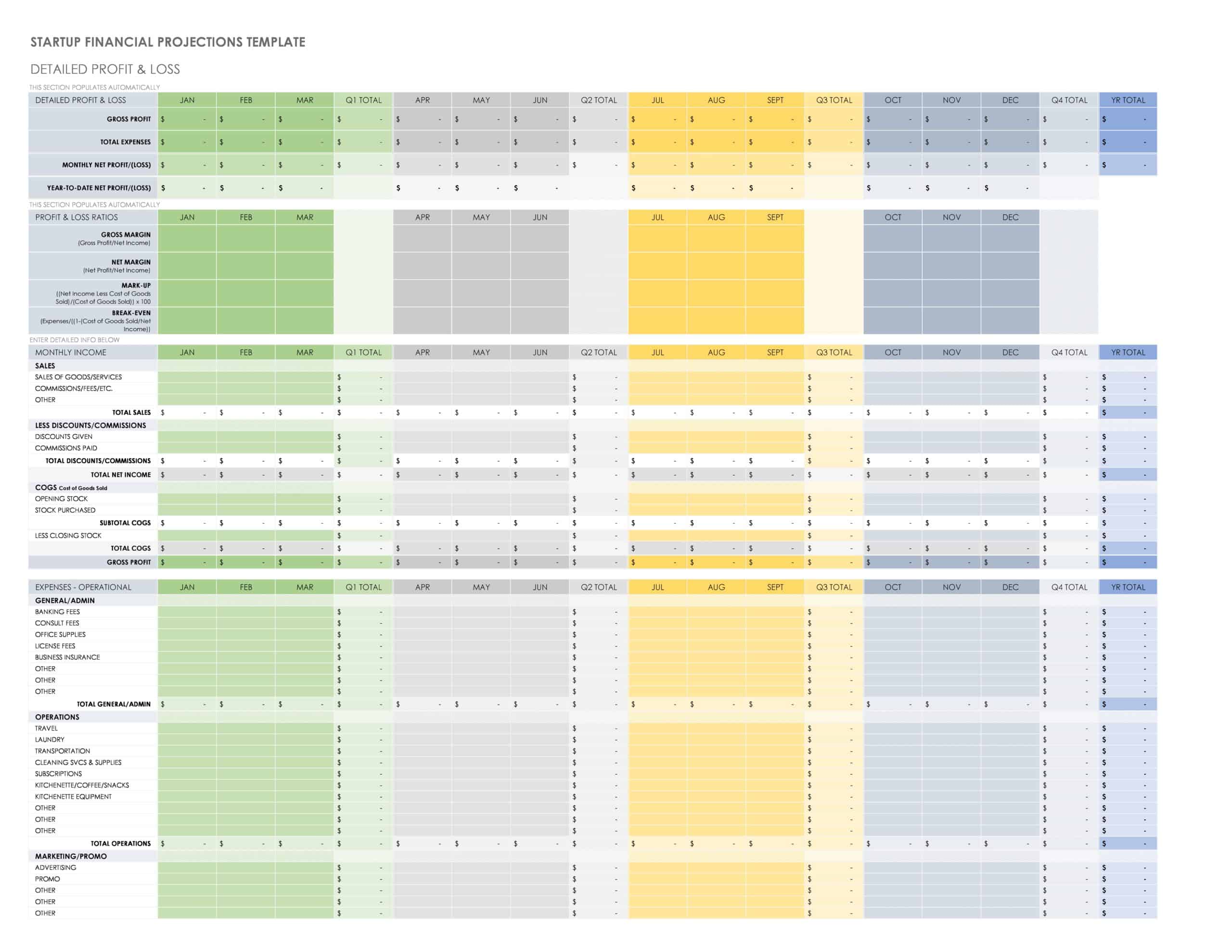

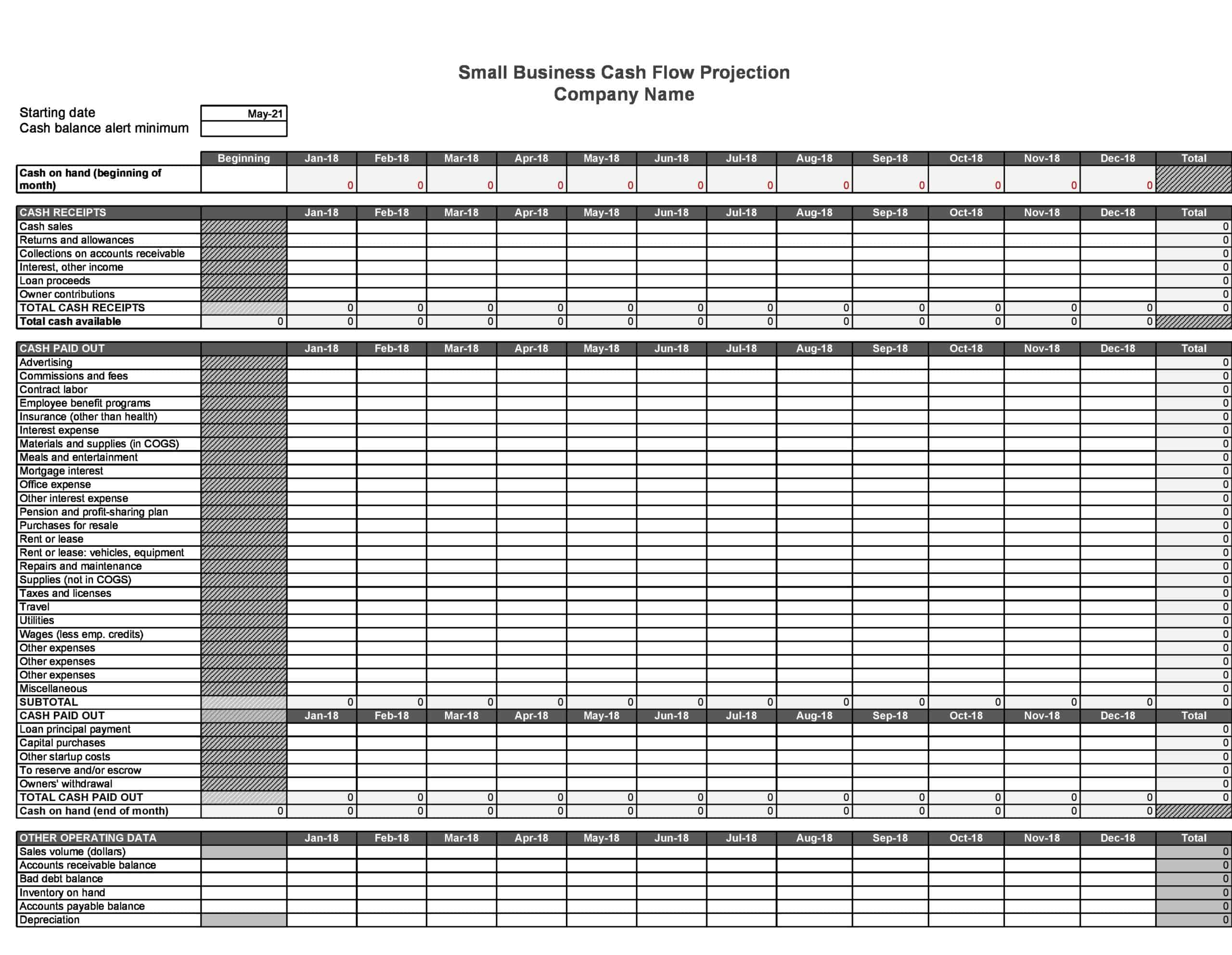

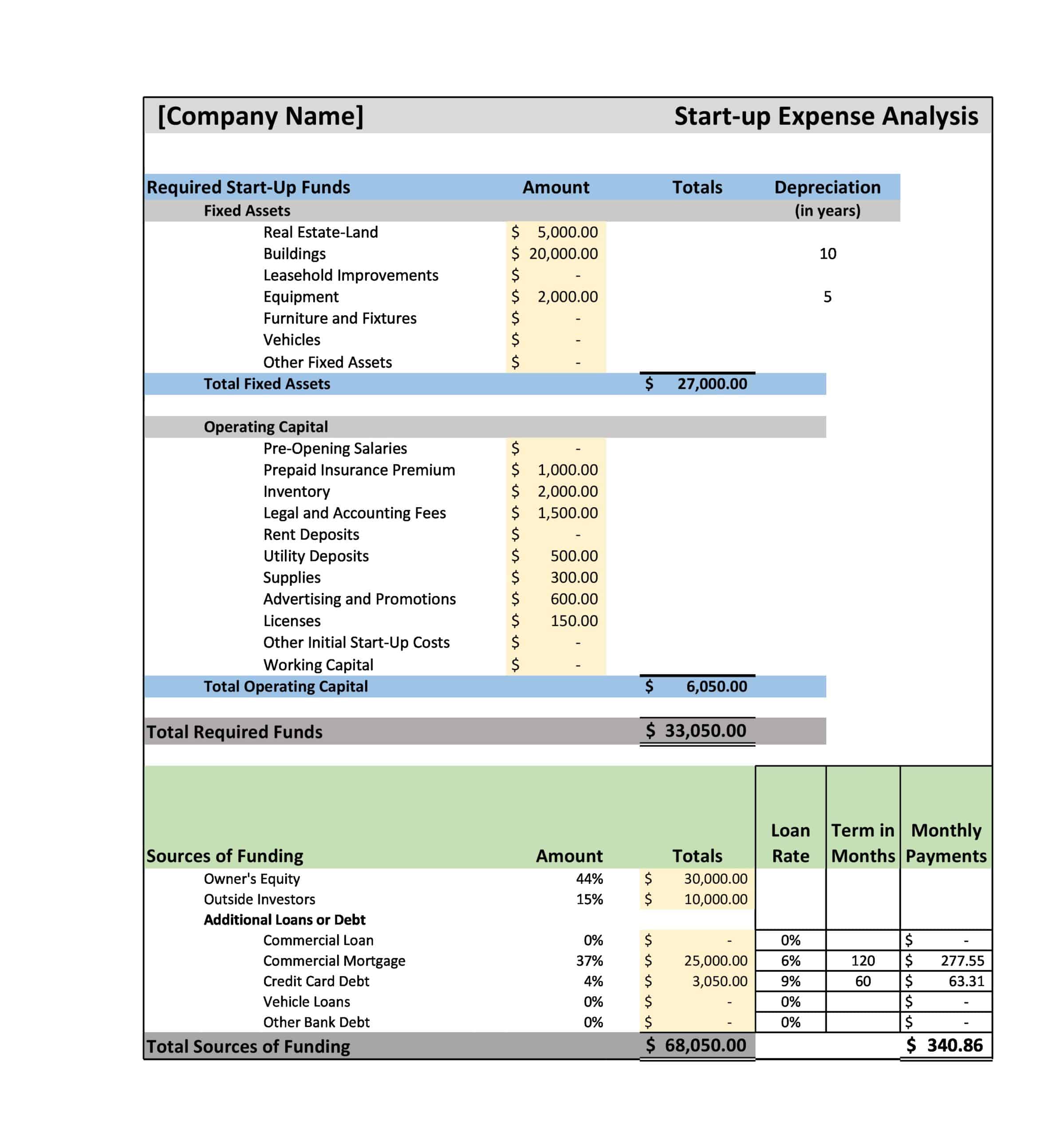

Financial Projections Templates

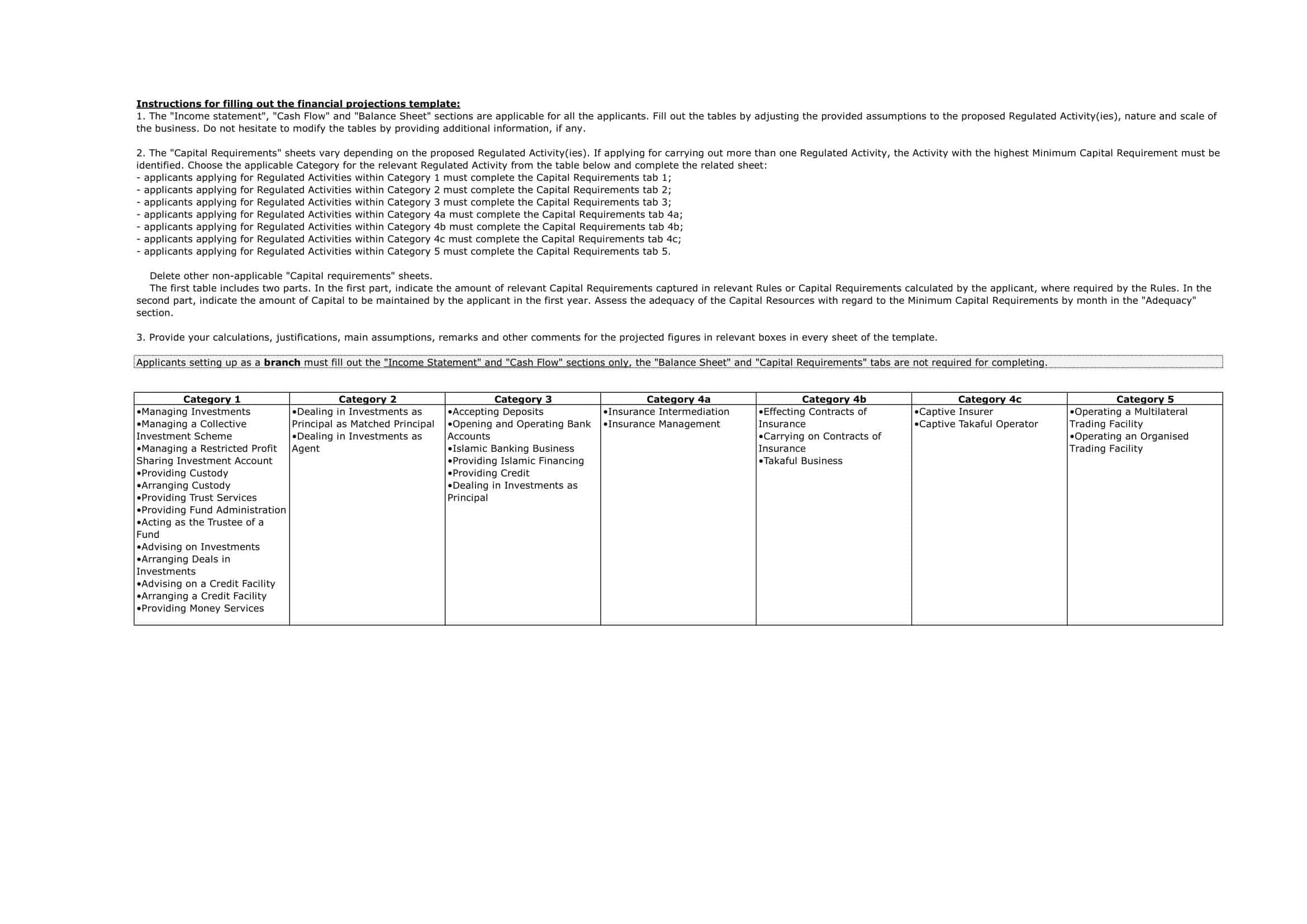

Financial Projections Templates are pre-designed formats used by businesses and individuals to forecast and project their financial performance over a specific period. These templates provide a structured framework for estimating future revenues, expenses, cash flows, and other financial metrics based on historical data, market trends, and anticipated business activities. Financial Projections Templates enable organizations to assess their financial viability, plan for growth, make informed decisions, and communicate their financial outlook to stakeholders.

Financial Projections Templates assist organizations in planning, decision-making, and communicating their financial outlook. By using these templates, businesses and individuals can forecast and project their financial performance, assess their financial feasibility, and identify opportunities for growth and improvement.

Financial Projections Templates facilitate strategic planning, budgeting, fundraising, and financial analysis, enabling organizations to make informed and data-driven decisions. These templates are valuable tools for startups, small businesses, investors, lenders, and other stakeholders interested in understanding the financial future of an organization or venture.

Understanding the Importance of Financial Projections Templates and When to Use Them

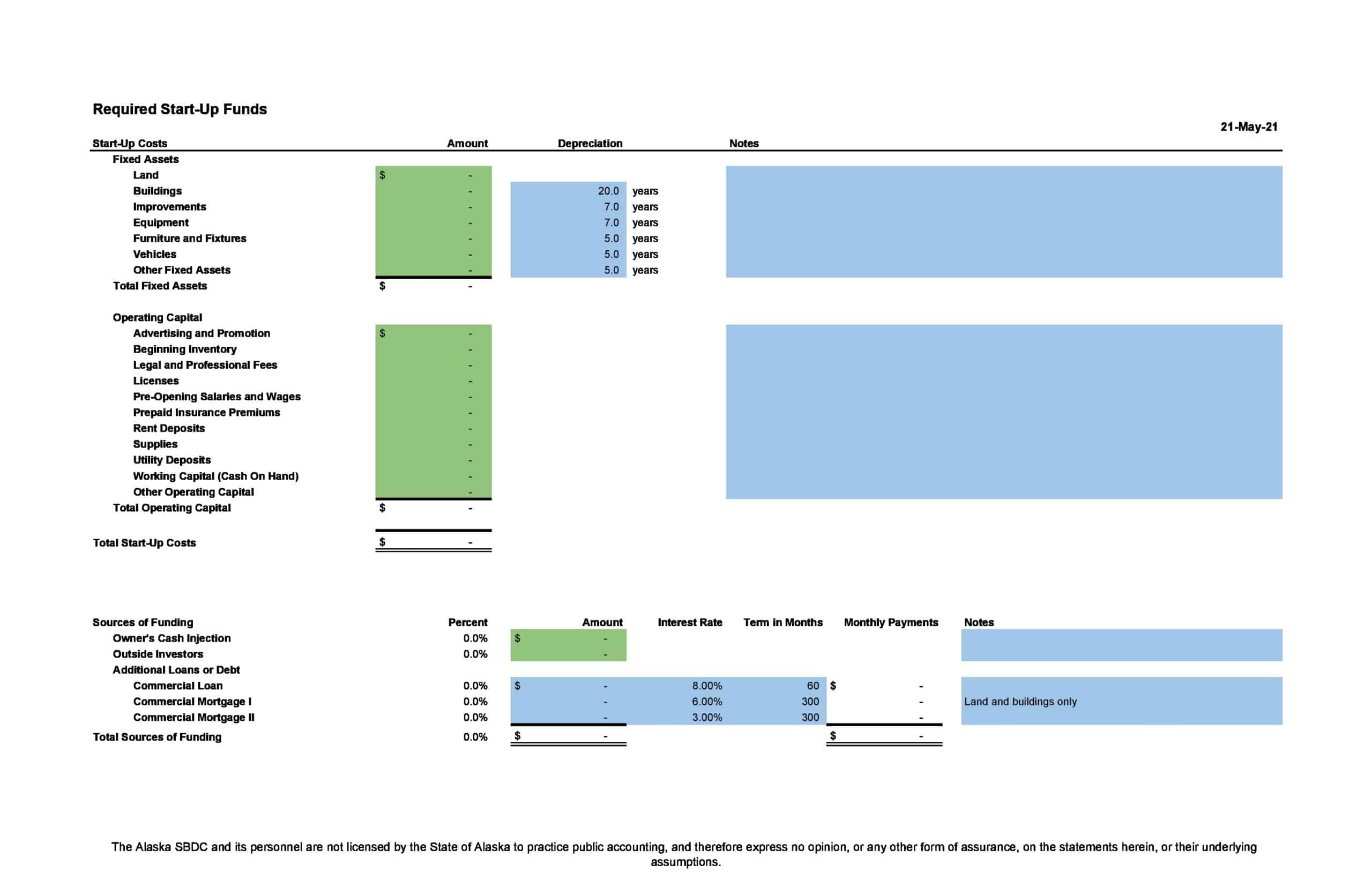

A financial projections template is typically used when a company is preparing to raise capital, such as through a loan or an investment. The template can be used to create financial projections that will be included in a business plan or pitch deck.

Some other situations where a financial projections template may be useful include:

Starting a new business: If you’re starting a new business, creating financial projections can help you understand the potential costs and revenue of the venture, and determine whether it is viable.

Growing an existing business: Financial projections can be used to plan for and track the growth of an existing business.

Forming a budget: Financial projections can also be used as a basis for creating a budget, which can help a business manage its expenses and ensure that it has sufficient funding to meet its goals.

Strategic Planning: it could be use as tool for strategic planning and scenario analysis to test different scenarios and understand the impact on the financial health of the company

Applying for funding or credit: Many lending institutions and investors will require financial projections as part of the application process.

It’s worth noting that a Financial Projection Template is just a guide and a starting point, it will not take into account all the unique aspects of a business, actual figures may be different and should be tailored accordingly.

Essential Elements of Financial Projections Template

When creating financial projections, there are several key elements that should be included in order to provide a comprehensive picture of a company’s expected financial performance. Here is a guide on what to include in financial projections:

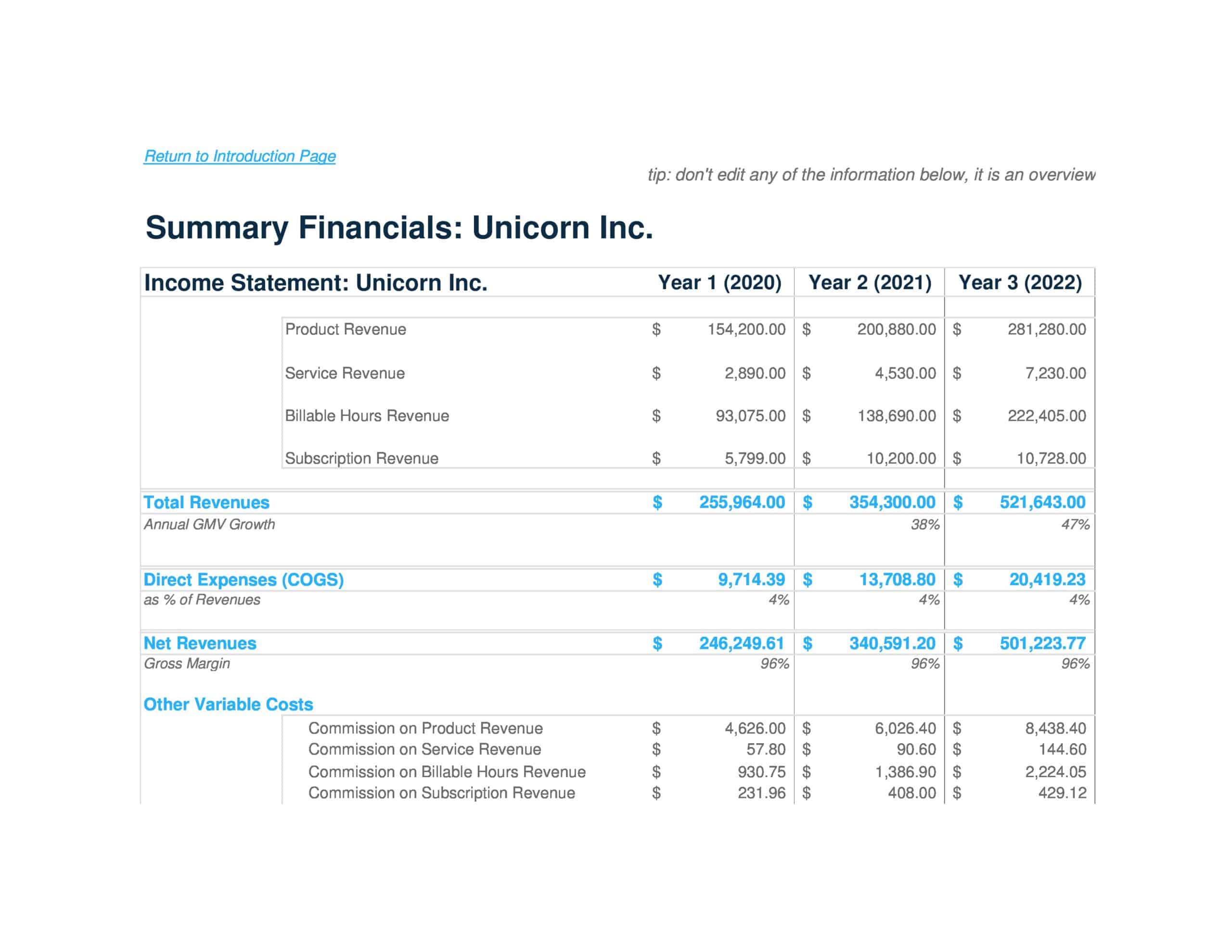

Income statement: This is a key financial statement that shows a company’s revenues, costs, and expenses over a specific period of time, typically a year. It is used to calculate a company’s net income, which is the difference between its revenues and expenses.

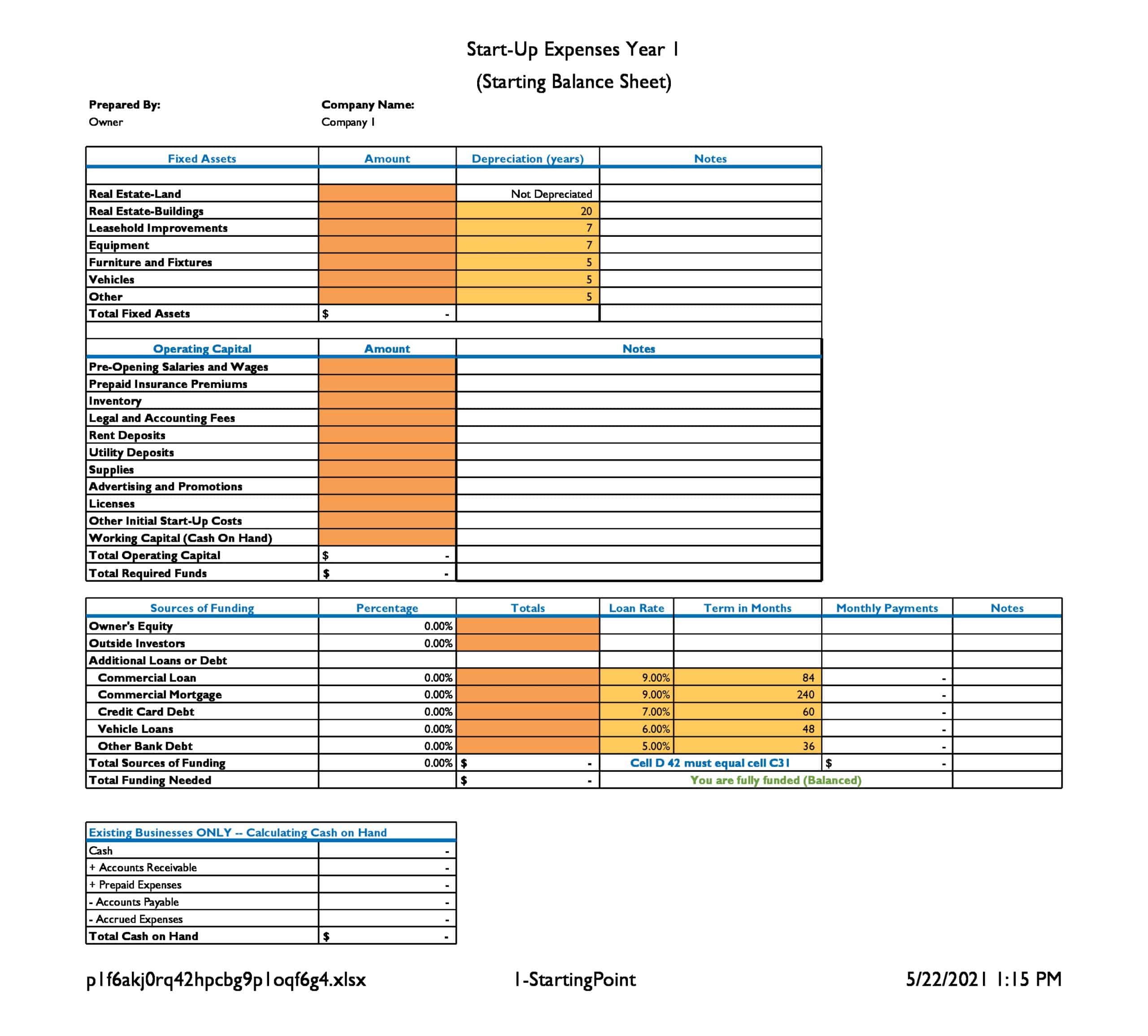

Balance sheet: A balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a specific point in time. It is used to evaluate a company’s overall financial health and its ability to meet its financial obligations.

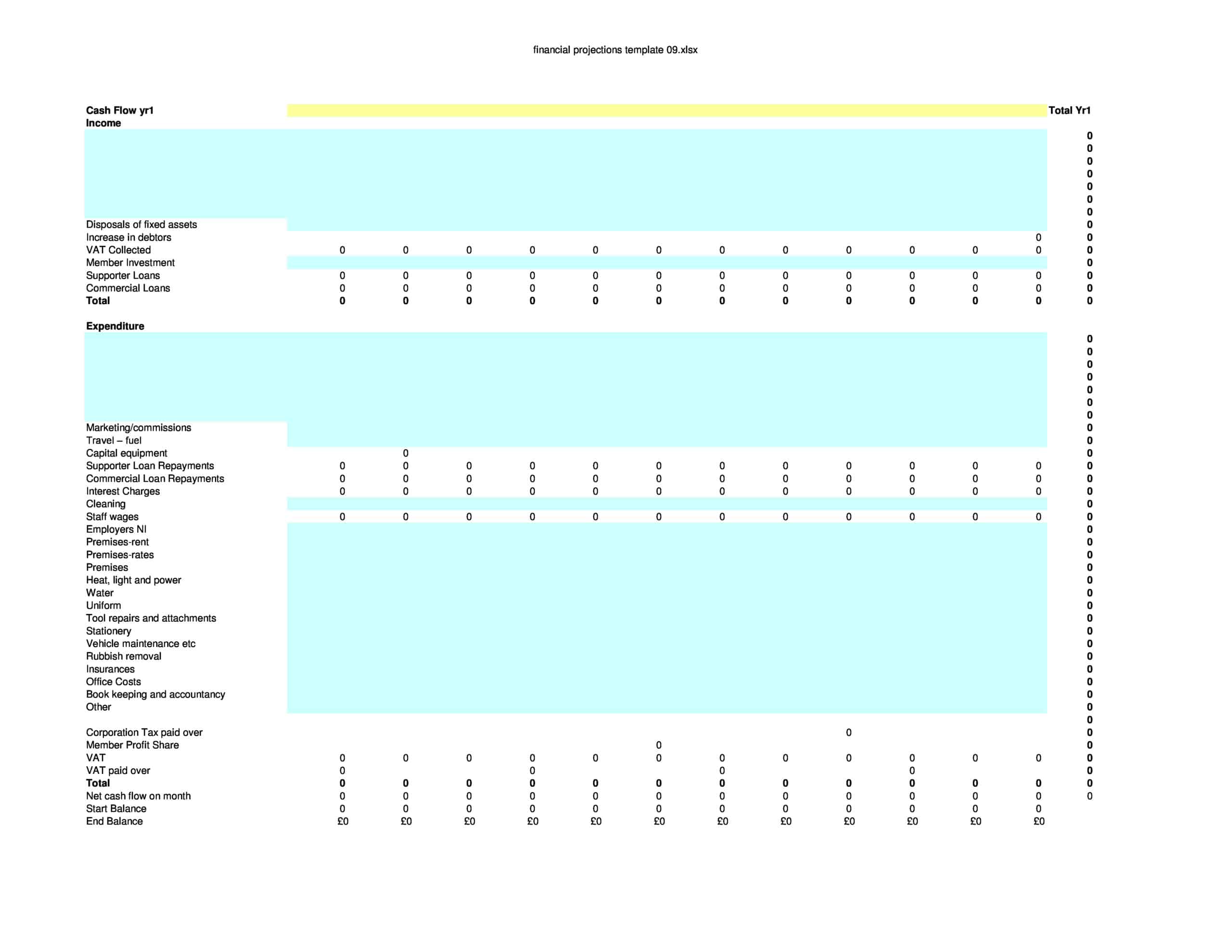

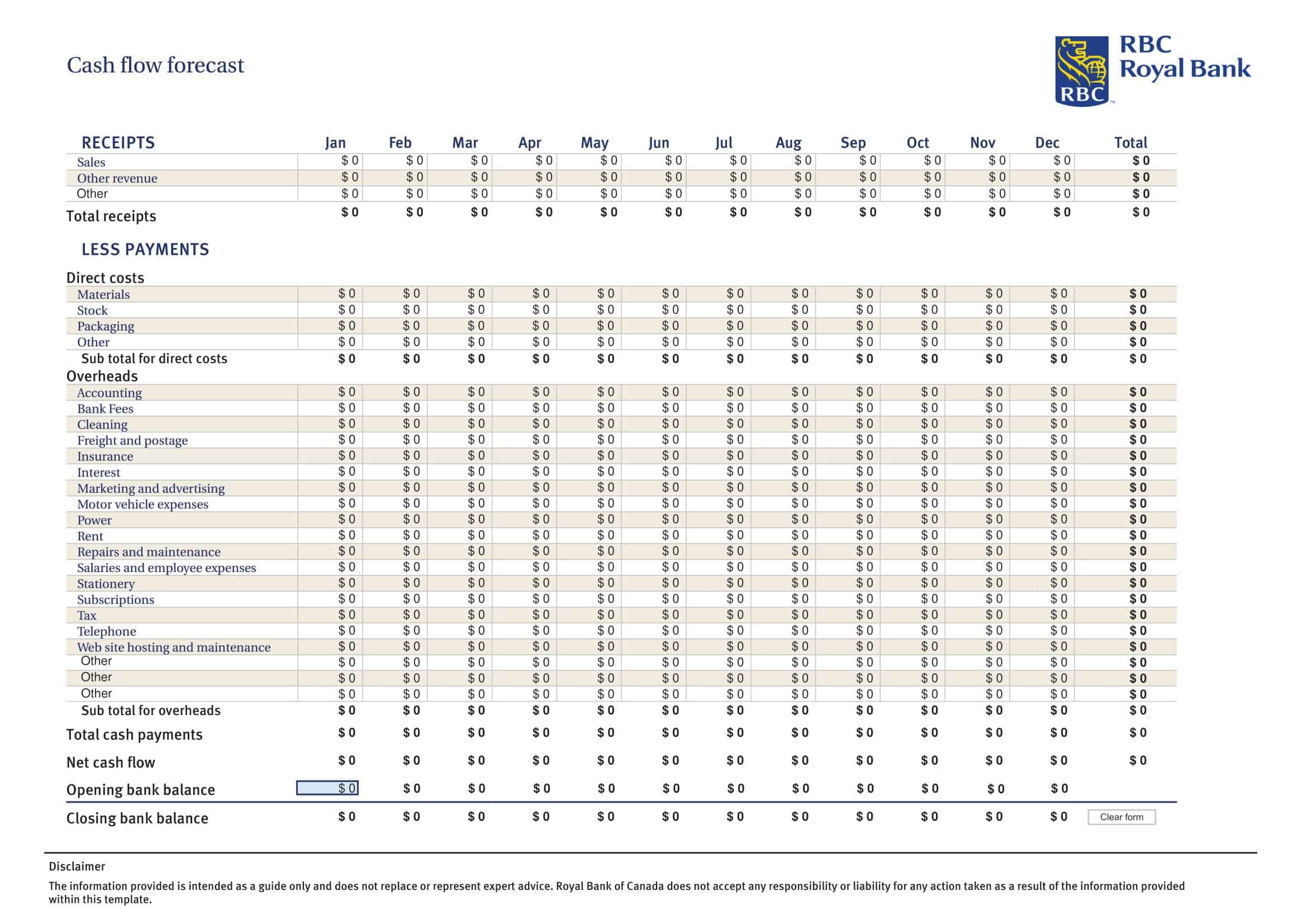

Cash flow statement: This statement shows the cash inflows and outflows of a company over a specific period of time, typically a year. It is used to evaluate a company’s liquidity and its ability to generate cash flow.

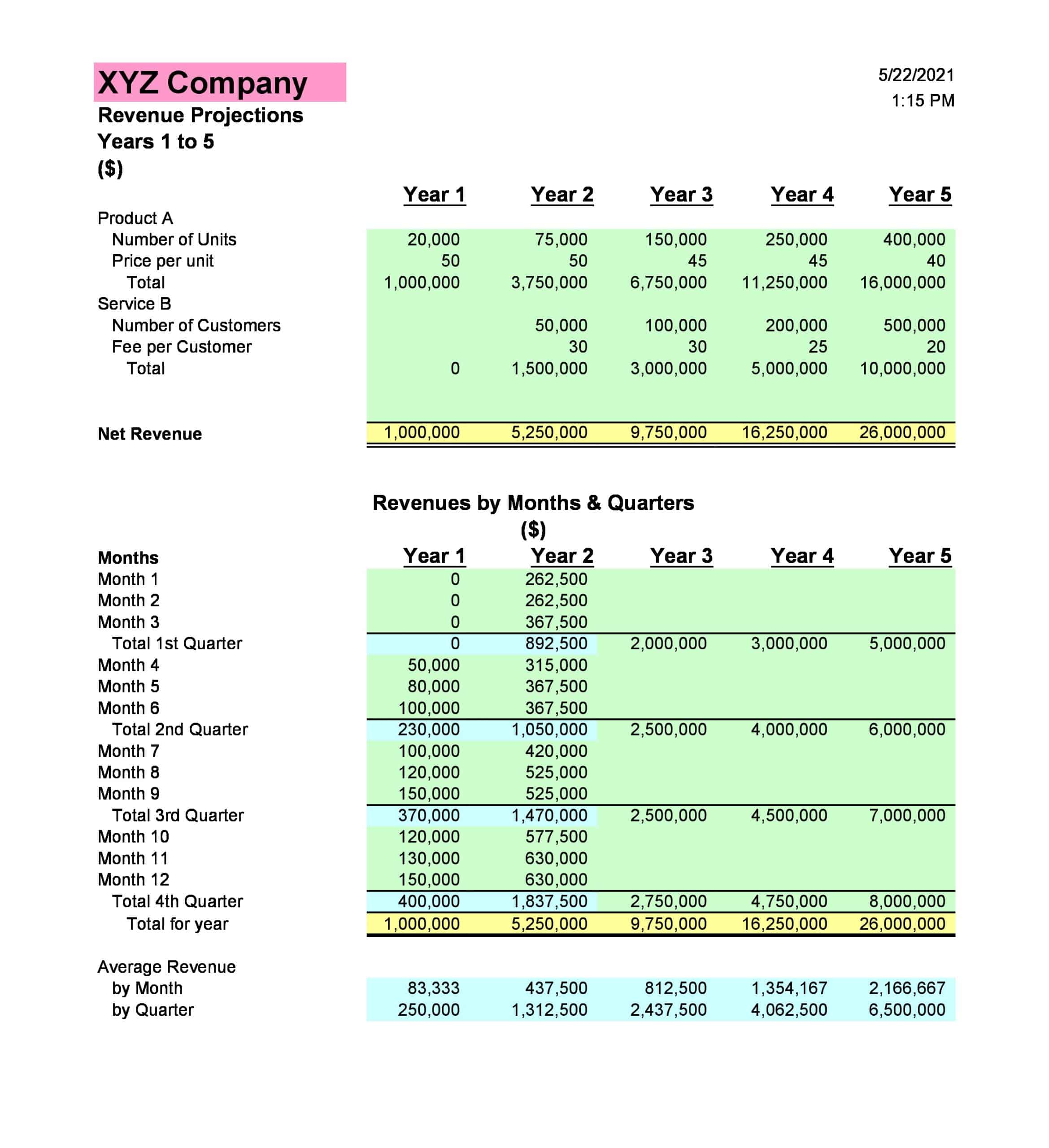

Sales forecast: Sales forecast is a prediction of future revenue by a product, region, channel or any other criteria, is a key element for any business as it indicates the expected revenue generation.

Pro-forma financial statements: These are projections of a company’s financial statements, including the income statement, balance sheet, and cash flow statement. The pro-forma statements typically include projected figures for the next several years, and are used to estimate a company’s future financial performance.

Break-even analysis: This analysis determines the level of sales or revenue at which a company will start to make a profit. The information from this analysis can be used to set sales targets, pricing strategies, and other key business decisions.

Assumptions: Include the assumptions you make about the economic environment, competition, customer behavior, and other factors that may impact the financial projections. It is important to be transparent about assumptions made, so that readers can understand the basis of projections.

Sensitivity Analysis: this is the process of testing different scenarios and understand the impact on the financial projections. It will allow to understand the uncertainties and risks associated to the assumptions made.

By including these elements in financial projections, a company can create a comprehensive picture of its expected financial performance, which can be used for strategic planning, budgeting, and decision-making. It also helps investors and lenders to understand the financial health and potential of the company, and to make informed decisions about whether to invest or lend.

How to make financial projections

Creating accurate and reliable financial projections is an important step in the financial planning and analysis process for any business. Financial projections are used to estimate a company’s future financial performance and are typically included in a business plan or pitch deck. Here is a guide on how to make financial projections:

Understand your business

Before you can create financial projections, you need to have a good understanding of your business, including its industry, target market, and competitive landscape. This will help you make more realistic projections and identify key drivers of revenue and expenses.

Gather historical financial data

Review your company’s past financial performance and gather financial data, such as income statements, balance sheets, and cash flow statements. Look for trends, such as changes in revenue, costs, and expenses, that may impact future performance.

Identify key drivers of revenue and expenses

Identify the key drivers of revenue and expenses for your business, such as sales volume, pricing, and costs. This will help you create more accurate projections and identify potential risks and opportunities.

Create a sales forecast

A sales forecast is a prediction of future revenue by a product, region, channel or any other criteria. Based on the historical data and understanding of the business, the sales forecast can be generated by using different methods such as time series analysis, trend analysis or a combination of both.

Project pro-forma financial statements

Using the sales forecast, create projections of the income statement, balance sheet, and cash flow statement. The pro-forma statements typically include projected figures for the next several years and will help you estimate the company’s future financial performance.

Include assumptions and calculations

Make sure to include assumptions and calculations used to create the financial projections. This will help the reader to understand the basis of the projections, any possible risks and opportunities.

Perform sensitivity analysis

Sensitivity analysis is the process of testing different scenarios to understand the impact on the financial projections. For example, if your company’s revenue depends heavily on a single product, it is important to understand the impact of a decline in sales of that product on the overall revenue. By performing sensitivity analysis, you can understand the uncertainties and risks associated with the assumptions made, and plan accordingly.

Keep it updated

Financial projections are not set in stone, and it is important to keep them updated as the business evolves and new information becomes available. Review the financial projections regularly and update them as necessary.

Seek professional help

If you’re not comfortable creating financial projections on your own, consider seeking the help of a financial professional. A financial analyst or accountant can help you create accurate and reliable projections and provide valuable insights into the financial health of your business.

It’s worth noting that creating financial projections is an iterative process and will require some judgement calls and assumptions. The figures may not match the actual numbers, as they are a prediction, however, they should be as accurate as possible, taking into account the available information. It’s crucial to explain the assumptions and the methods used to make the projections, so the readers understand the basis of the projections and the possible risks and opportunities.

FAQs

How often should financial projections be updated?

Financial projections should be reviewed and updated regularly, as the business evolves and new information becomes available. It’s a good practice to update them at least annually, or when there are major changes to the business.

Is it necessary to seek professional help for making financial projections?

It is not necessary to seek professional help for making financial projections, but it can be helpful. A financial analyst or accountant can provide valuable insights into the financial health of the business and can help create accurate and reliable projections.

Can financial projections be 100% accurate?

Financial projections are based on estimates and assumptions, and can never be 100% accurate. However, it’s important to use accurate historical data, realistic assumptions and perform sensitivity analysis to make the projections as accurate as possible.

How long should the financial projections cover?

Financial projections can cover different periods of time, but typically they should cover at least the next three to five years.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Goal Chart Templates [PDF, Word, Excel] 3 Goal Chart](https://www.typecalendar.com/wp-content/uploads/2023/06/Goal-Chart-150x150.jpg)