A last will and testament is a legal document that outlines how a person’s assets and property should be distributed after their passing. It is also known as a “final will” or “testament” as it overwrites any previous wills written by the individual. It is an important document to have, not just for those with significant assets or wealth, but for anyone who wants to ensure that their loved ones are taken care of and that their wishes are carried out.

Having a last will and testament in place can also make the probate process much easier for your family and loved ones during a difficult time. In this article, we will discuss the importance of having a last will and testament, the process of creating one, and what to include in it.

Table of Contents

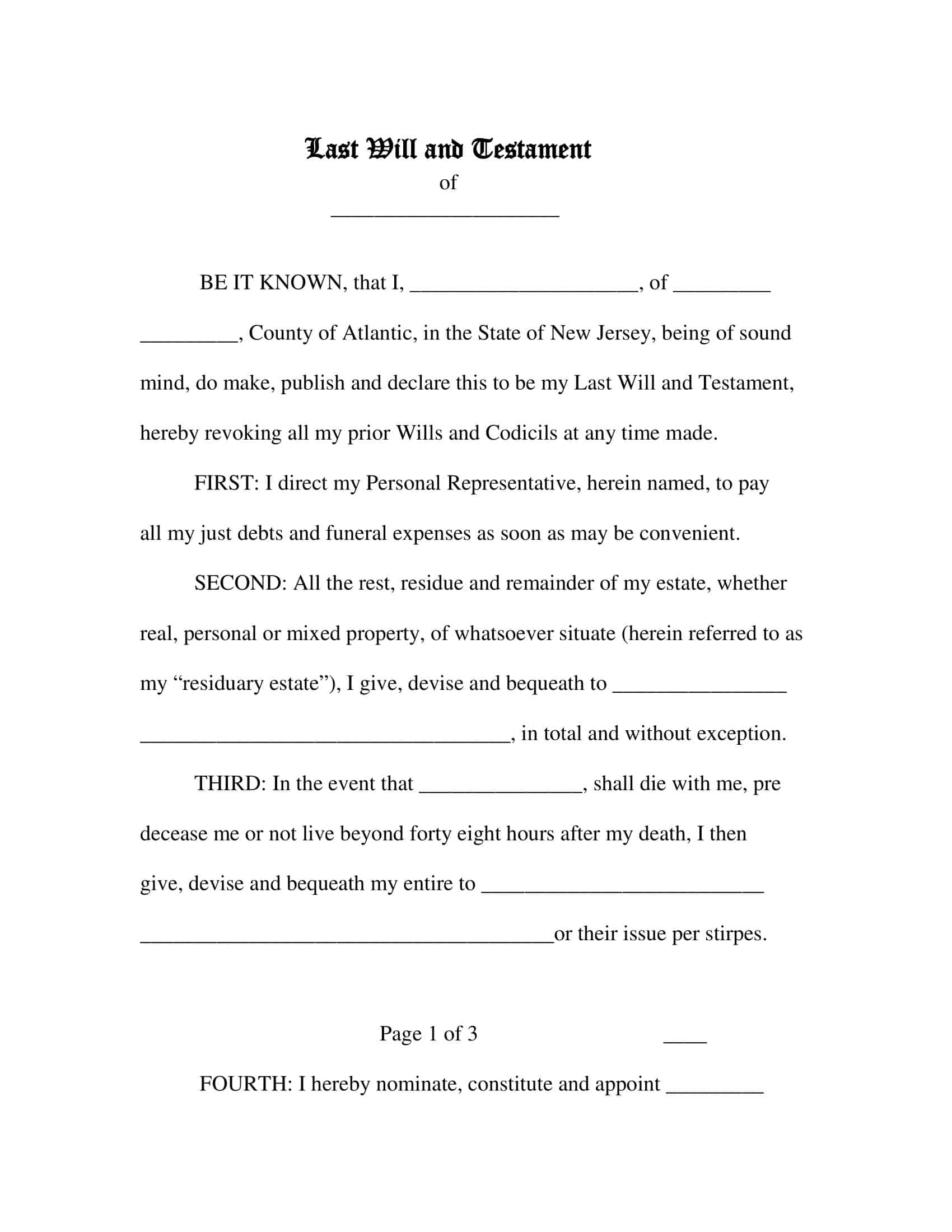

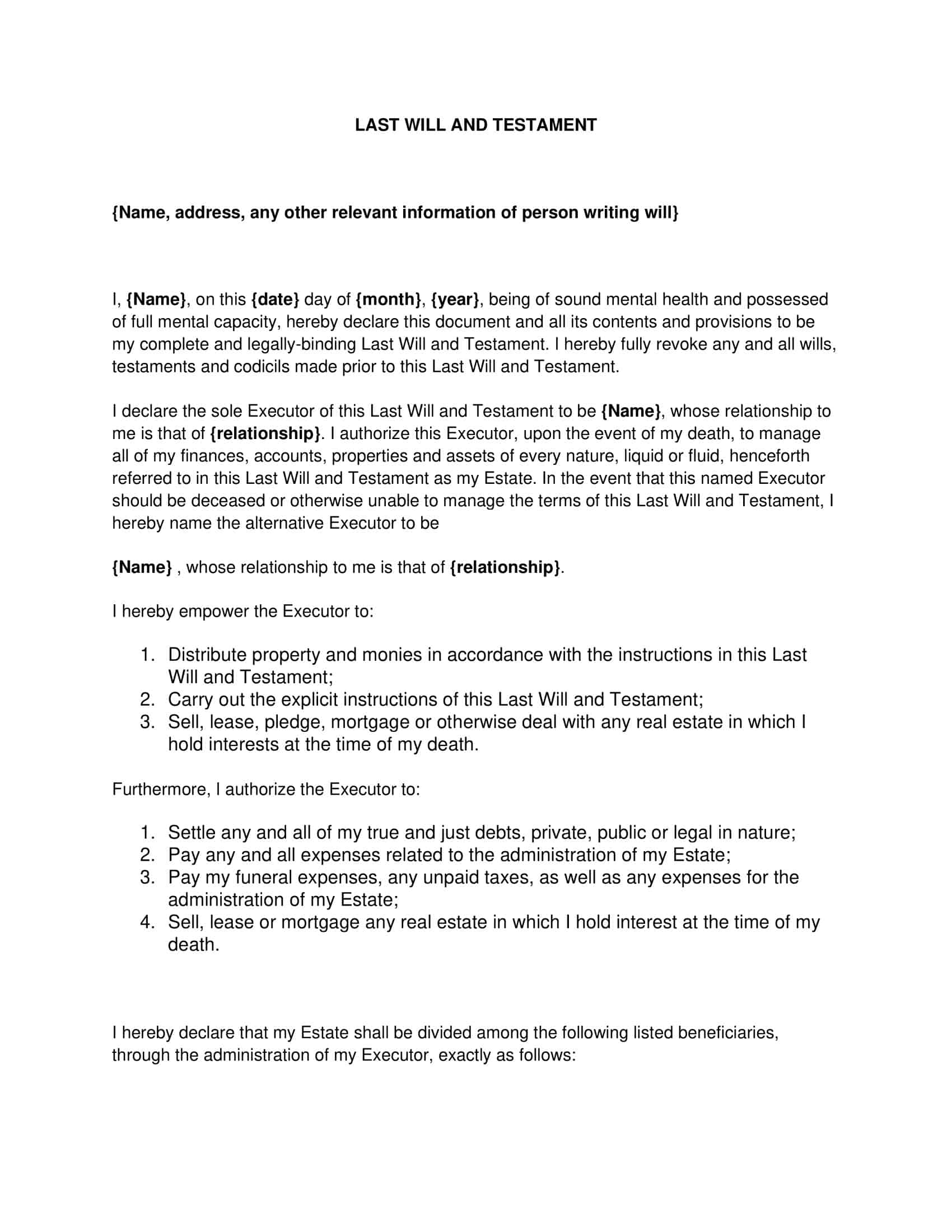

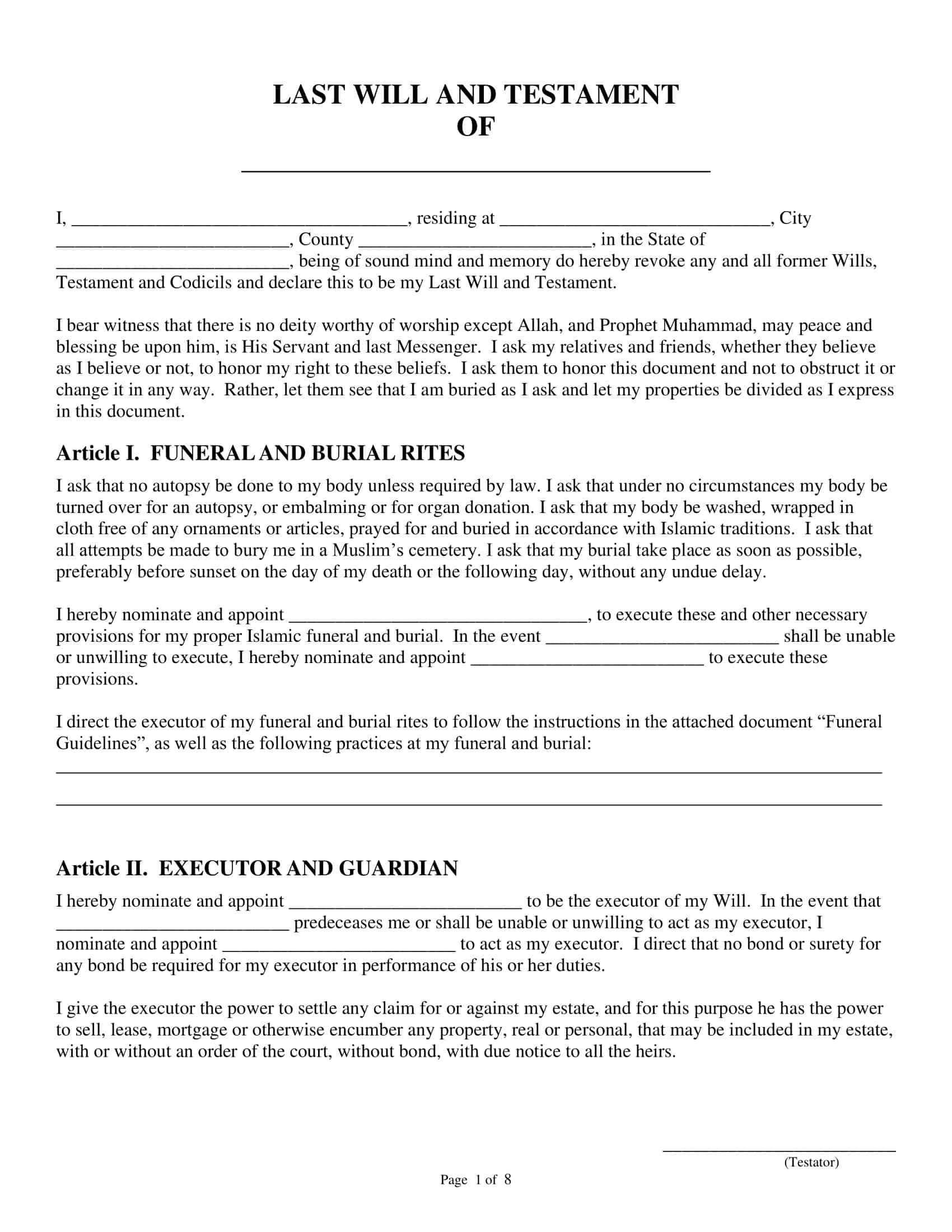

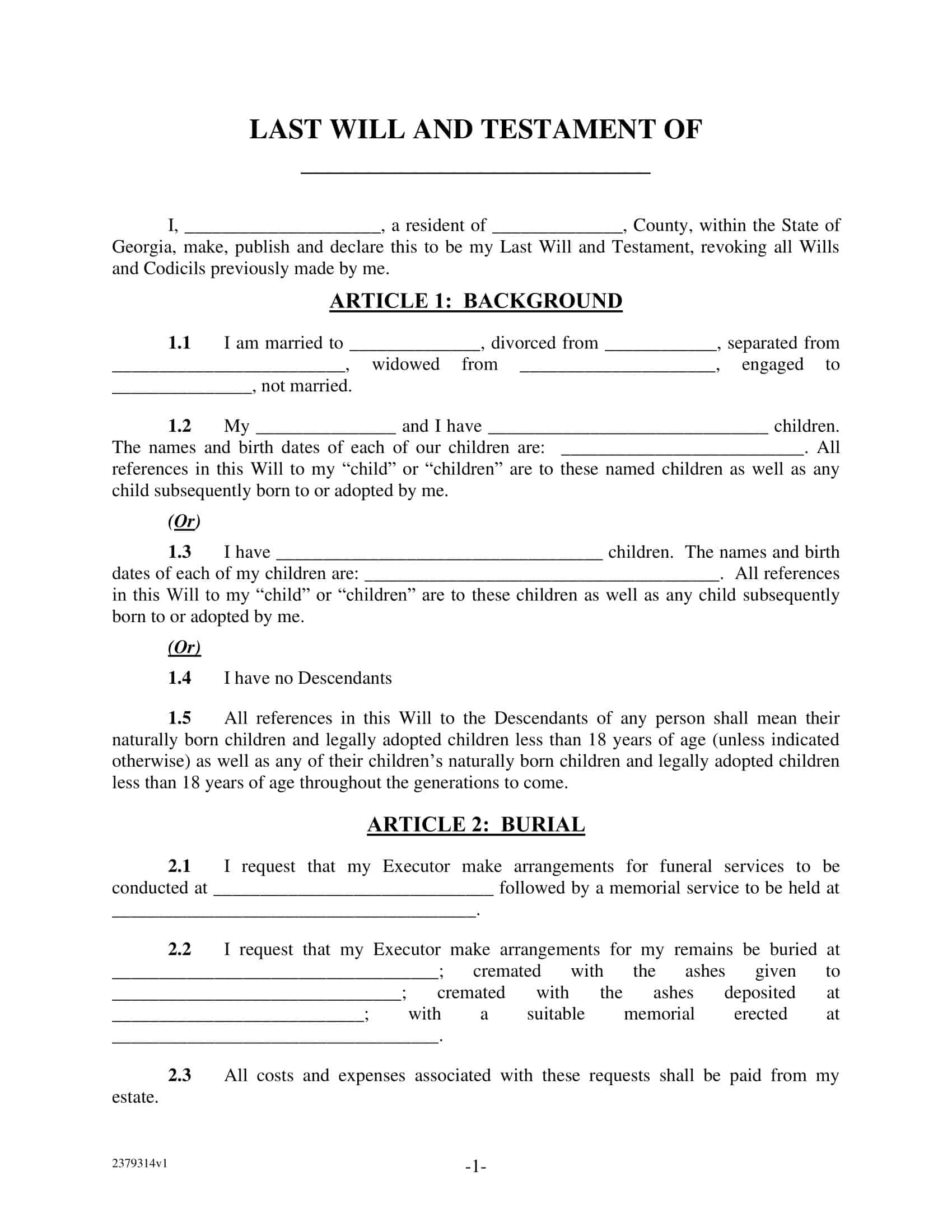

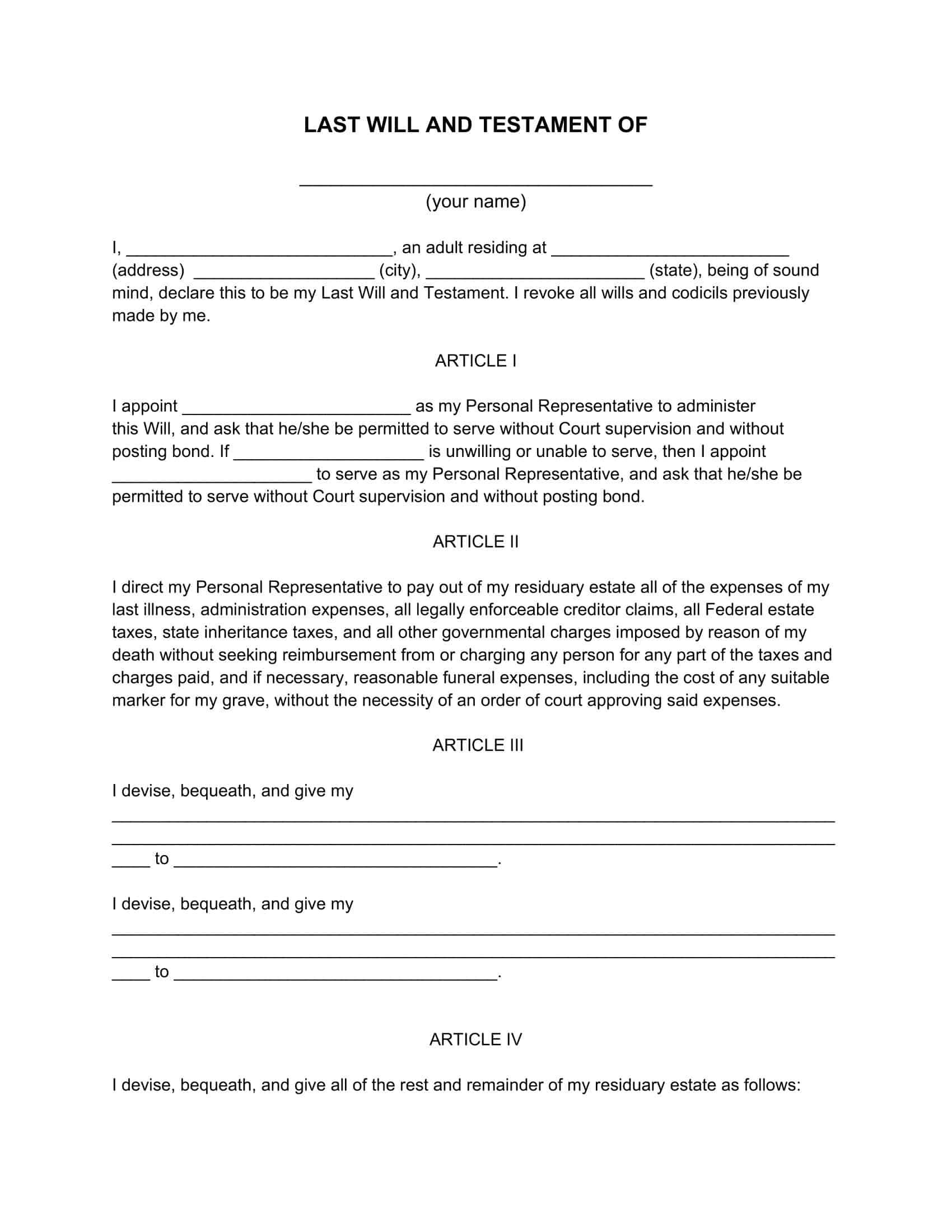

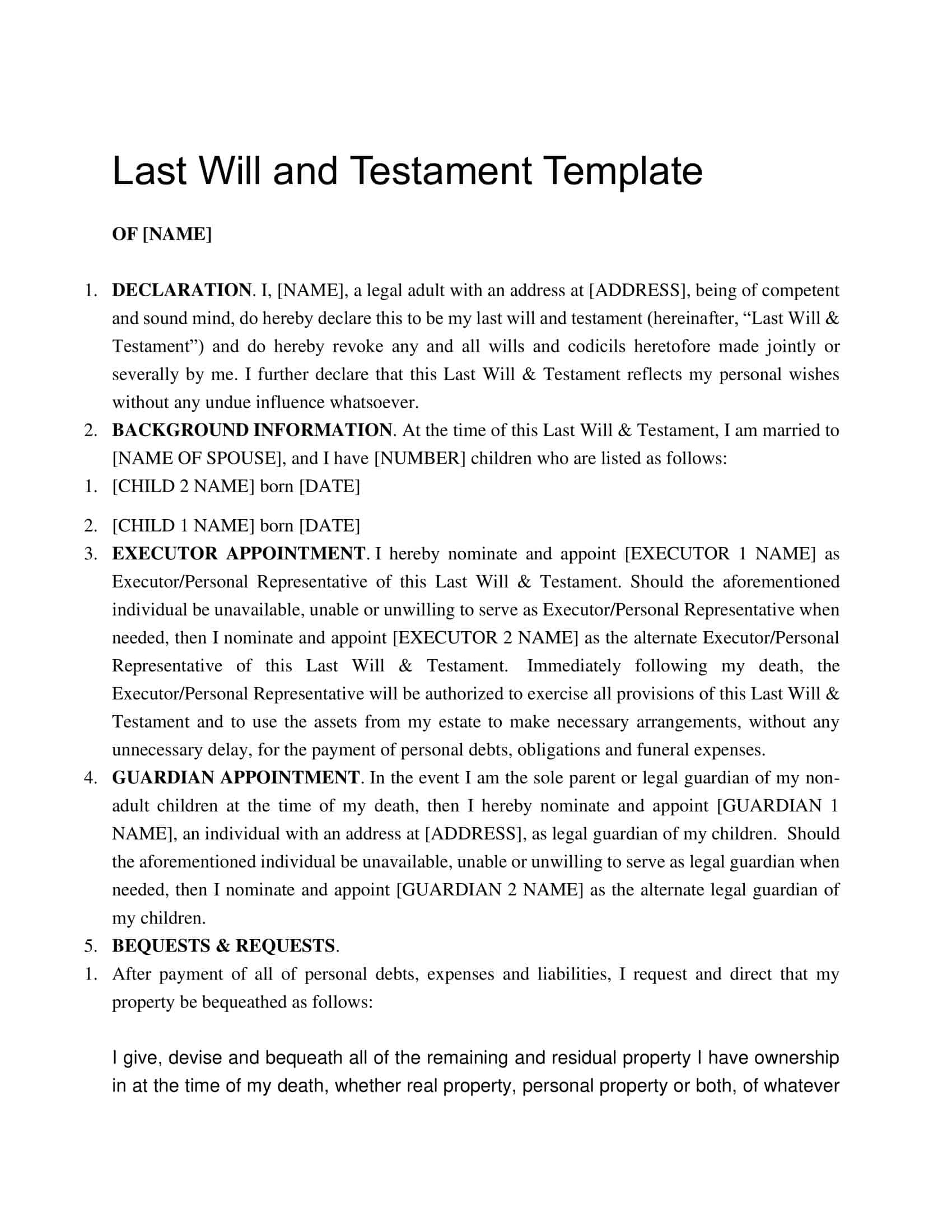

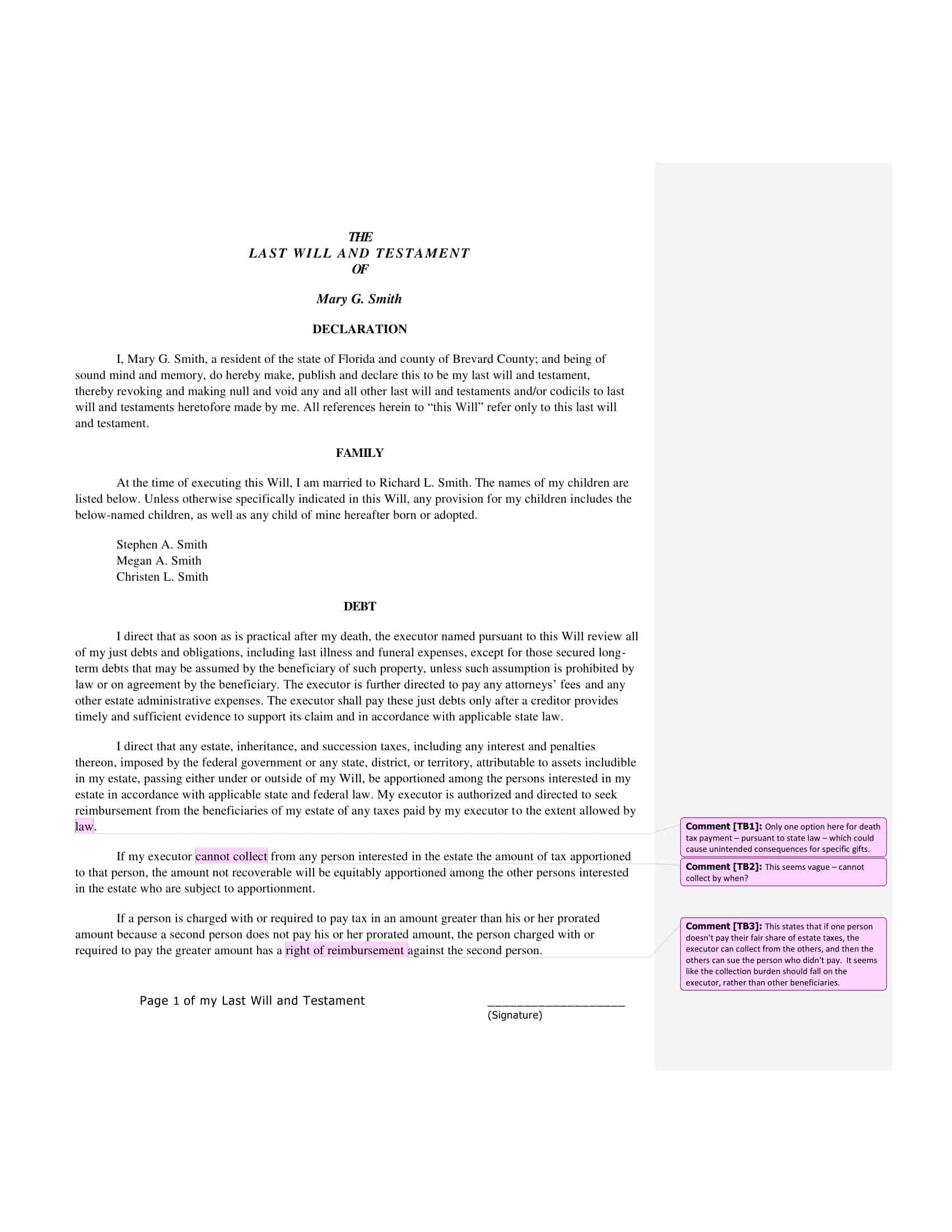

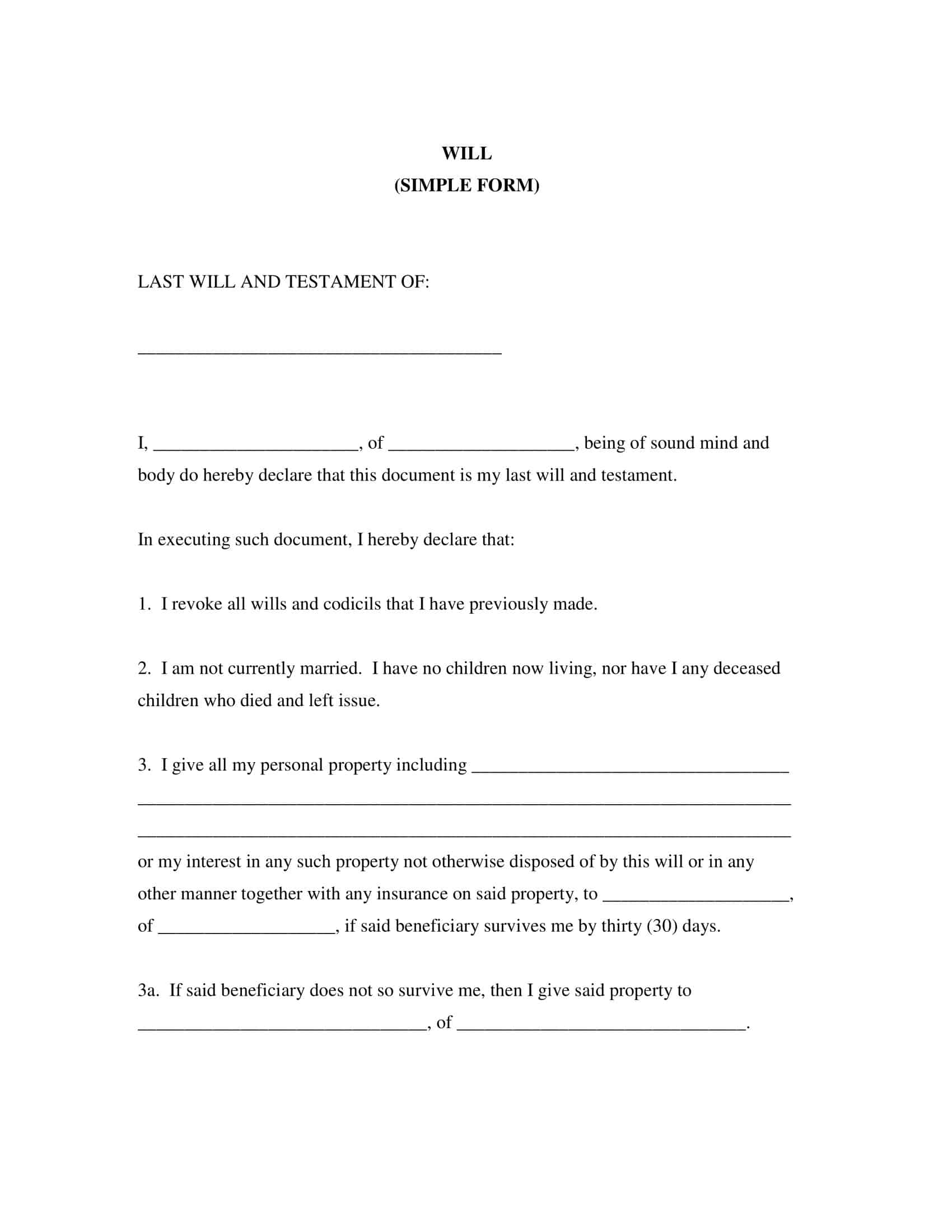

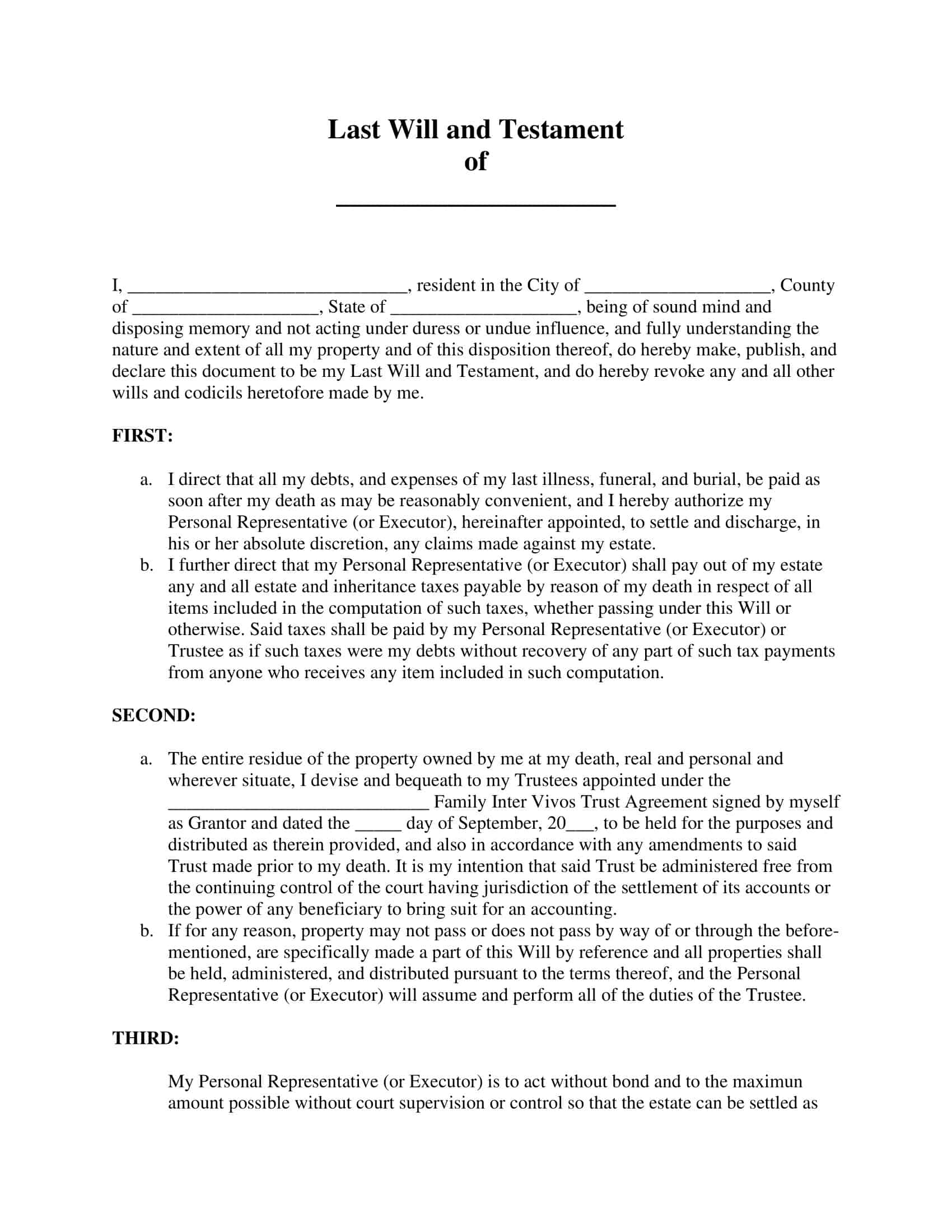

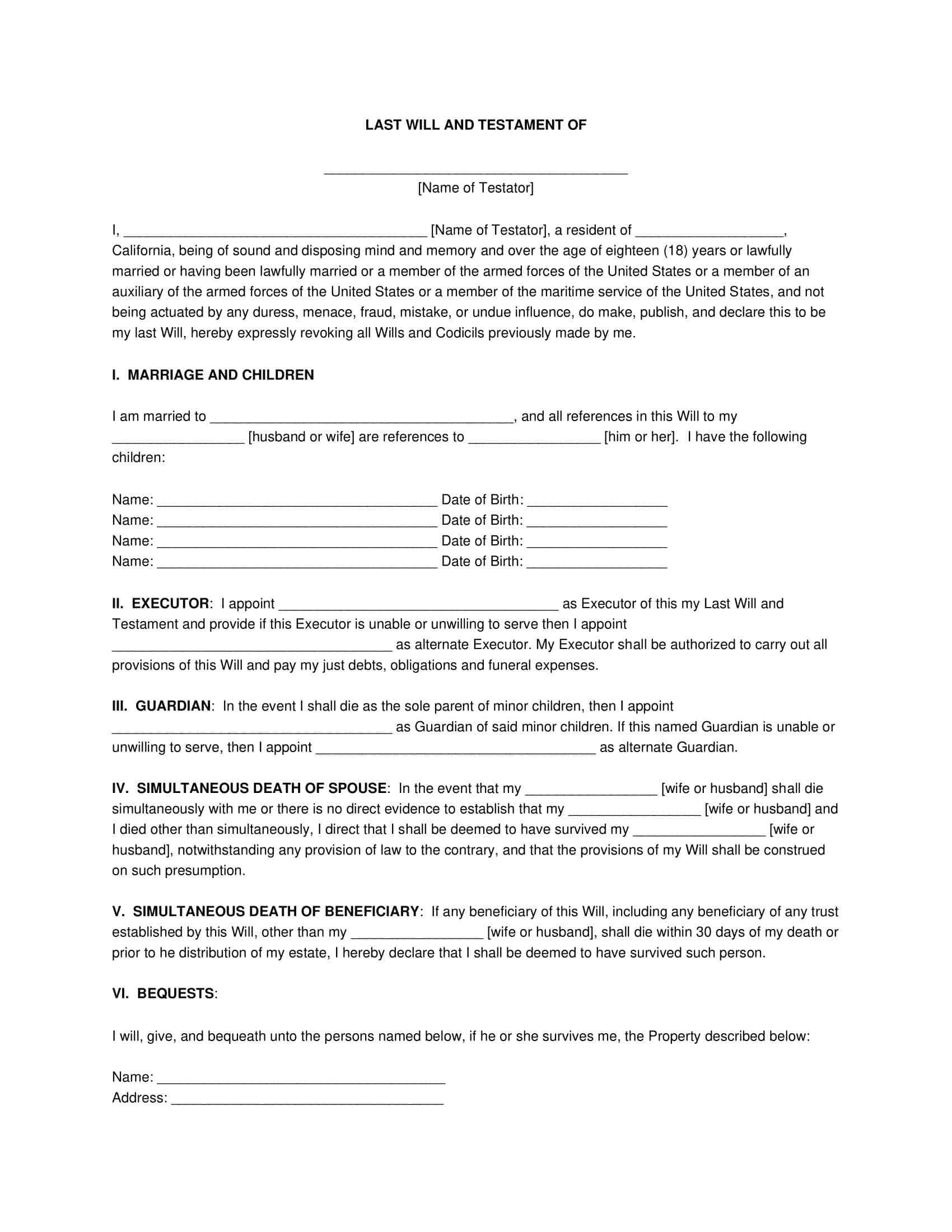

Last Will And Testament Templates

Plan your estate and secure your legacy with ease using our comprehensive Last Will and Testament Templates. These templates provide a structured and legally sound framework for creating your final wishes and distributing your assets according to your preferences. Whether you’re looking to create a simple will or a more complex estate plan, our templates offer customizable sections for naming beneficiaries, appointing guardians for minors, designating an executor, and specifying specific bequests or instructions.

With our printable and editable templates, you can ensure that your final wishes are clearly stated and legally binding. Protect your loved ones and leave a lasting legacy by creating a personalized Last Will and Testament that reflects your unique circumstances and wishes. Our templates provide peace of mind and help you navigate the estate planning process with confidence. Start planning your legacy today with our Last Will and Testament Templates.

Key Players in the Last Will and Testament Process: Understanding the Roles and Responsibilities

A Last Will and Testament is a legal document that outlines how a person’s assets will be distributed after they pass away. There are several key individuals involved in the creation and execution of a will:

The Testator: This is the person who is creating the will and making the decisions about how their assets will be distributed.

The Executor: This person is responsible for carrying out the instructions in the will after the testator passes away. They will be responsible for managing the testator’s assets, paying debts and taxes, and distributing the remaining assets according to the will.

Beneficiaries: These are the individuals or organizations that will receive assets from the testator’s estate. They may include family members, friends, or charitable organizations.

Witnesses: In most cases, a will must be signed in the presence of at least two witnesses, who must also sign the will. These witnesses must be of legal age and of sound mind and must not be beneficiaries under the will.

Notary Public: A notary public is an official who can witness the signing of legal documents, including a will, and can certify that the signature is valid.

Probate Court: After the testator passes away, the will must be filed with the probate court, which will oversee the distribution of the assets according to the will. The court may appoint an administrator if the will does not name an executor or if the named executor is unable or unwilling to serve.

It is always advisable to consult with an attorney to ensure that the will is valid and legally binding and that it meets the specific requirements of the jurisdiction in which it will be filed.

When can you use a Last Will and Testament?

A Last Will and Testament can be used to distribute a person’s assets after they pass away. It is typically used to:

Distribute property and assets: A will allows a person to specify who will receive their property and assets after they die. This can include real estate, personal property, bank accounts, stocks, and other investments.

Appoint a guardian for minor children: A will can be used to appoint a guardian for any minor children the testator may have. This is particularly important if both parents pass away and there is no one else to take care of the children.

Provide for pets: A will can include provisions for the care of a testator’s pets after they die.

Appoint an executor: A will allows a person to appoint someone to handle the distribution of their assets and the administration of their estate after they die.

Provide for special needs or disabled individuals: A will can include provisions for the care and support of special needs or disabled individuals.

Make charitable donations: A will can be used to make charitable donations and bequests to charitable organizations.

Why is a Last Will important?

A Last Will and Testament is an important legal document because it allows a person to control what happens to their assets and property after they pass away. Without a will, a person’s assets will be distributed according to the laws of intestacy in the state where they reside, which may not align with their wishes or the needs of their loved ones.

Here are a few specific reasons why a will is important:

It allows you to control the distribution of your assets: A will allows you to specify exactly who will receive your assets and property after you die. This can ensure that your assets are distributed in a way that aligns with your wishes and the needs of your loved ones.

It allows you to appoint a guardian for your minor children: A will can be used to appoint a guardian for any minor children you may have. This is particularly important if both parents pass away and there is no one else to take care of the children.

It allows you to provide for pets: A will can include provisions for the care of your pets after you die.

It allows you to appoint an executor: A will allows you to appoint someone to handle the distribution of your assets and the administration of your estate after you die.

It allows you to make charitable donations: A will can be used to make charitable donations and bequests to charitable organizations.

It can save your loved ones time and money: When a person dies without a will, their estate must go through the process of intestate succession, which can be time-consuming, costly, and may not align with the deceased’s wishes.

Living Trust vs. Will: What’s the Difference?

A Last Will and Testament, a Living Will, and a Living Trust are all legal documents that can play a role in estate planning, but they serve different purposes and have different implications.

A Last Will and Testament (also known as simply a will) is a legal document that outlines how a person’s assets will be distributed after they pass away. It allows the testator to specify who will receive their property and assets, who will be the guardian of their minor children, and who will serve as the executor of their estate.

A Living Will, also known as an Advance Directive, is a legal document that specifies what medical treatment a person wants to receive or not receive if they become incapacitated and unable to communicate their wishes. This can include things like life support, artificial nutrition, and other medical treatments.

A Living Trust is a legal arrangement in which a trustee holds legal title to a person’s assets for the benefit of the trust’s beneficiaries. Living trusts are often used to avoid probate, keep assets private and to manage assets for beneficiaries who are unable to do so themselves. The trustmaker (the person who sets up the trust) can choose to act as the trustee during their lifetime and name a successor trustee to take over after their death.

A Last Will is used to distribute assets after a person’s death, a Living Will to dictate medical treatments in case of incapacity and a Living Trust is used to avoid probate and manage assets during life and after death. It is possible for a person to have all three documents in place to cover different aspects of their estate planning.

How To Write A Last Will And Testament

Writing a Last Will and Testament can be a complex process, and it is always recommended to consult with an attorney to ensure that your will is legally binding and meets the requirements of your jurisdiction. However, here are some general steps you can take when writing a will:

Step 1: Gather Information

Make a list of all your assets and liabilities, including real estate, bank accounts, investments, personal property, and debts.

Make a list of all the people you want to include in your will, including family members, friends, and charitable organizations.

Decide who you want to appoint as the executor of your will and as the guardian for any minor children.

Step 2: Decide on the type of Will

There are different types of will, such as simple will, testamentary trust, etc. Decide which type of will is best for you and your assets.

Step 3: Write the Will

Start by writing a statement that declares that this is your last will and testament.

Specify how your assets will be distributed. Be as specific as possible when describing your assets and who will receive them.

Appoint an executor and alternate executor. The executor is responsible for carrying out the instructions in the will and managing the assets.

Appoint a guardian for any minor children.

Include any special instructions or provisions, such as pet care or charitable donations.

Sign and date the will, and have it witnessed by at least two people who are not beneficiaries under the will.

Step 4: Review and Update

Review the will periodically to ensure that it still reflects your wishes and that it is still valid and legally binding.

Review the will if you have significant life events such as marriage, divorce, birth of a child, or the death of a beneficiary or executor.

Step 5: Store the Will

Keep the original will in a safe place, such as a fireproof safe or a safety deposit box.

Provide a copy of the will to the executor, and inform them where the original will is stored.

Inform your family and loved ones of the existence of the will and where it can be found.

FAQs

Who can make a will?

Anyone who is of legal age (18 or older in most states) and of sound mind can make a will.

What happens if you die without a will?

If a person dies without a will, their assets will be distributed according to the laws of intestacy in the state where they reside. This may not align with their wishes or the needs of their loved ones.

Do I need a lawyer to make a will?

While it is not legally required to have a lawyer to make a will, it is recommended to consult with an attorney to ensure that your will is legally binding and meets the requirements of your jurisdiction.

How often should I update my will?

It is recommended to review and update your will periodically as your assets, family, and personal circumstances change.

Can a will be changed after it is signed?

Yes, a will can be changed after it is signed through the process of amendment or codicil. However, it is important to ensure that the changes are made in accordance with the laws of your jurisdiction and that the will remains legally binding.

What happens to a will after the testator dies?

After the testator dies, the will must be filed with the probate court, which will oversee the distribution of the assets according to the will. The court may appoint an administrator if the will does not name an executor or if the named executor is unable or unwilling to serve.

Can a will be contested?

Yes, a will can be contested by interested parties, such as beneficiaries or family members, if they believe that the will is not valid or that the testator was not of sound mind when the will was made.

How is a will probated?

A will is probated by filing it with the probate court in the county where the testator resided at the time of their death. The court will appoint an executor and oversee the distribution of the assets according to the will.

Can I leave my assets to anyone I want in my will?

In general, you can leave your assets to anyone you want in your will. However, there may be certain legal limitations, such as laws that protect the rights of certain family members, such as a spouse or minor children, to inherit a portion of your estate.

Can I disinherit someone in my will?

Yes, you can disinherit someone in your will, but it’s important to keep in mind that there may be legal limitations, such as laws that protect the rights of certain family members, such as a spouse or minor children, to inherit a portion of your estate.

Can a will be used to set up a trust?

Yes, a will can be used to set up a trust, known as a testamentary trust, which can be used for various purposes such as providing for a beneficiary who is unable to manage their own assets or to minimize taxes on the estate.

Can a will be used to leave assets to a charity?

Yes, a will can be used to leave assets to a charity, either through a specific bequest or by leaving a percentage of the estate to the charity.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)