A business credit application is a document used by financial institutions, suppliers, and other companies to assess a business’s creditworthiness. It serves as a request for credit and includes important information about a business, such as its ownership, financial history, and projected future performance.

The credit application process is an important step in securing funding for a business, as well as establishing and maintaining a good credit history. Whether you are starting a new business or expanding an existing one, a well-prepared business credit application can make all the difference in obtaining the financing you need to grow and succeed.

Table of Contents

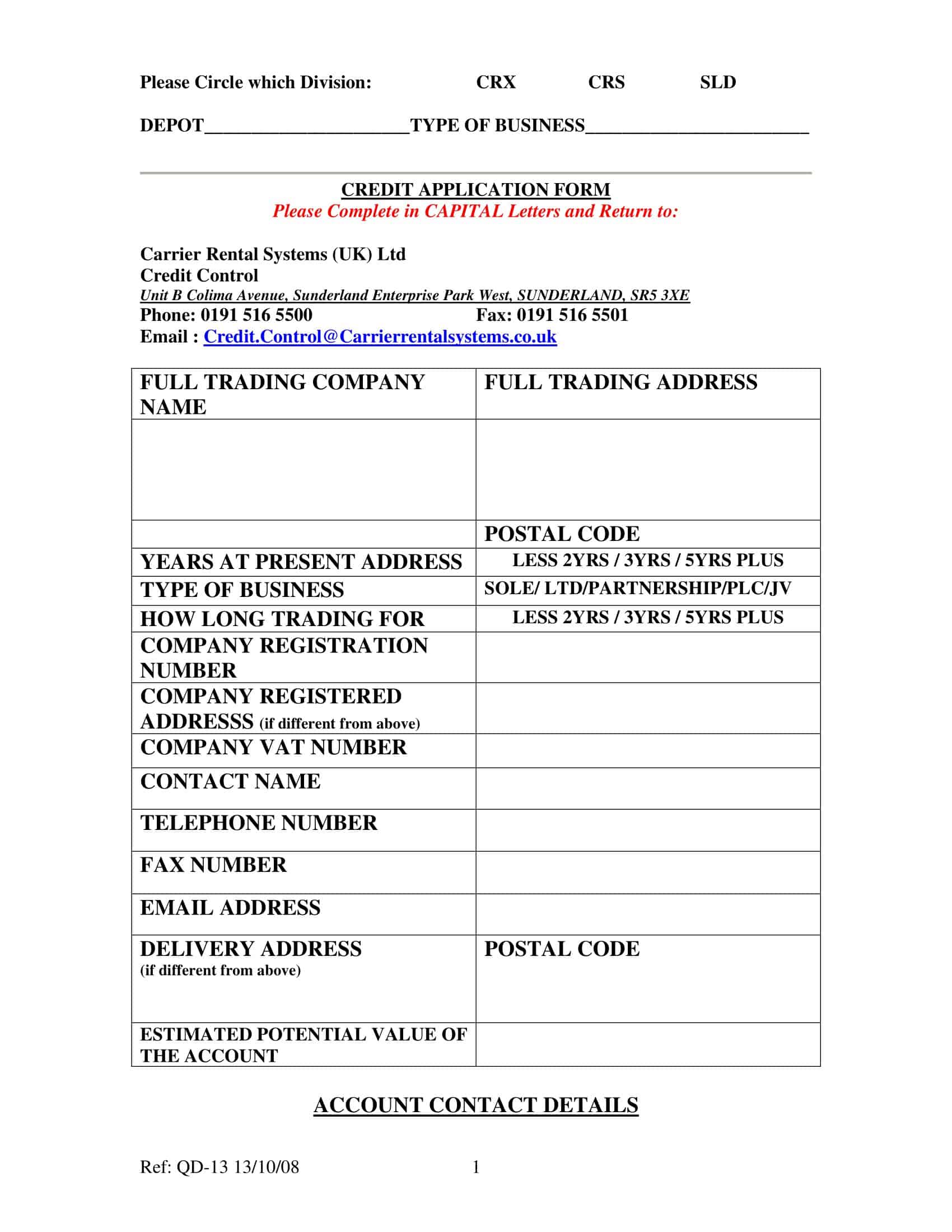

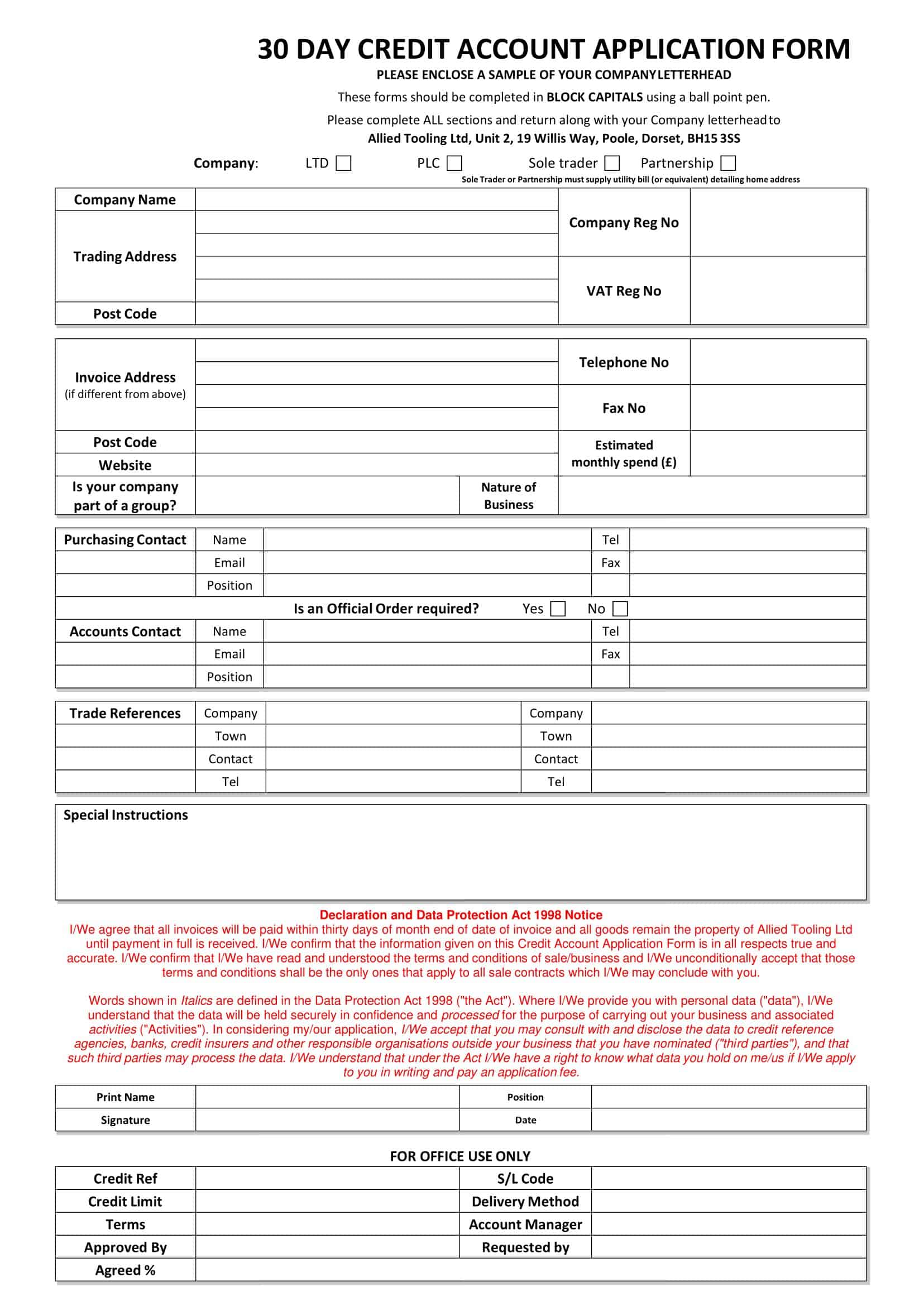

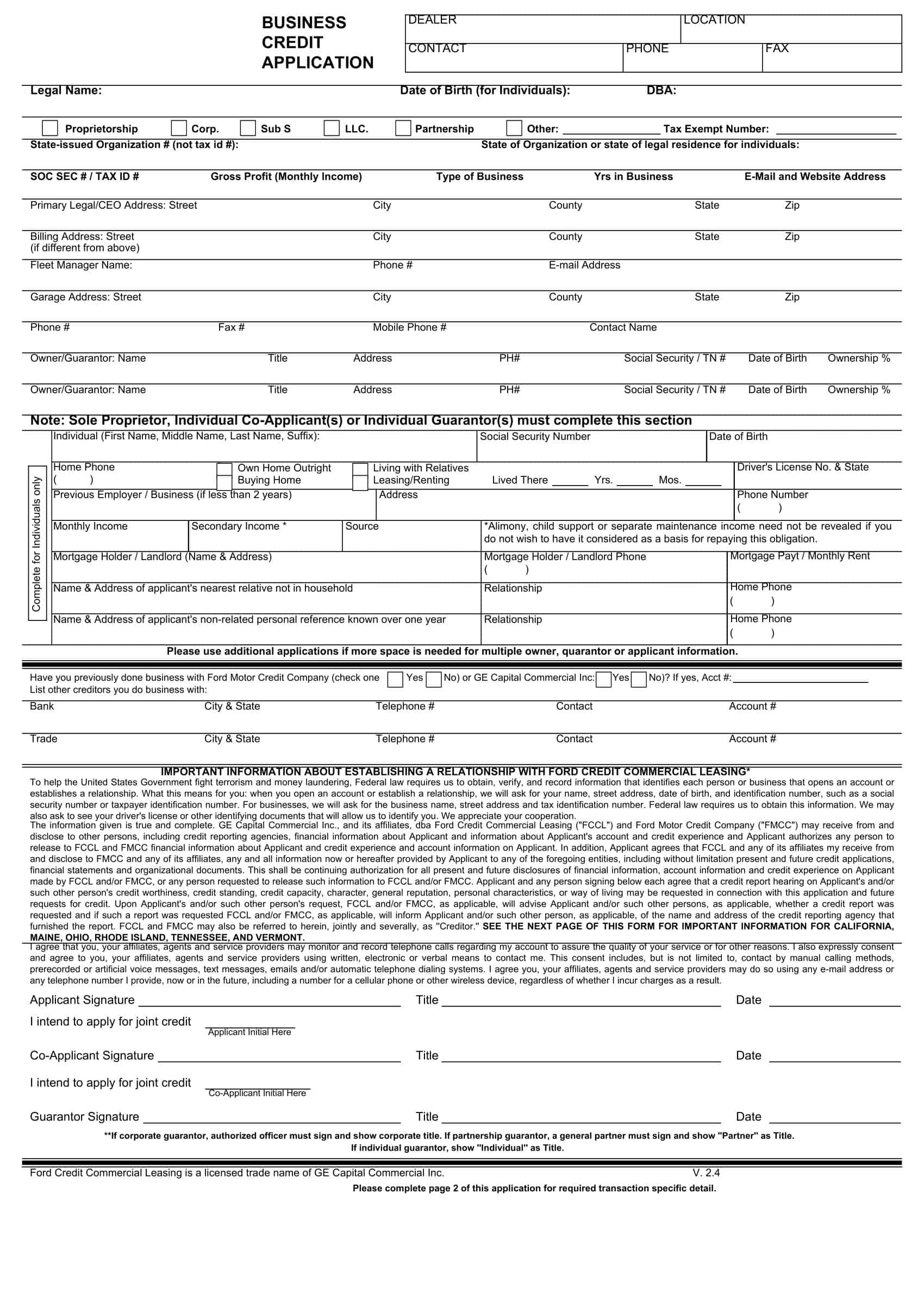

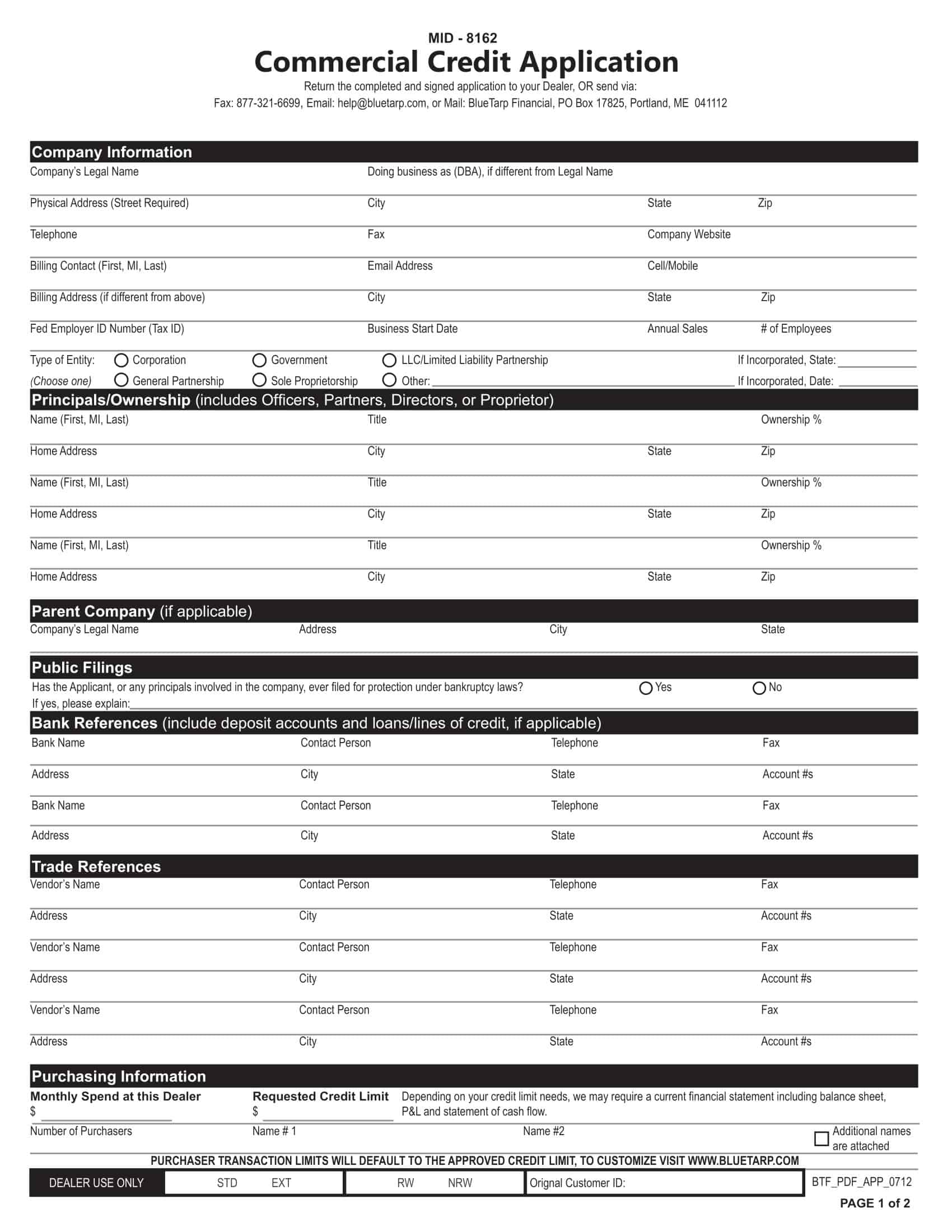

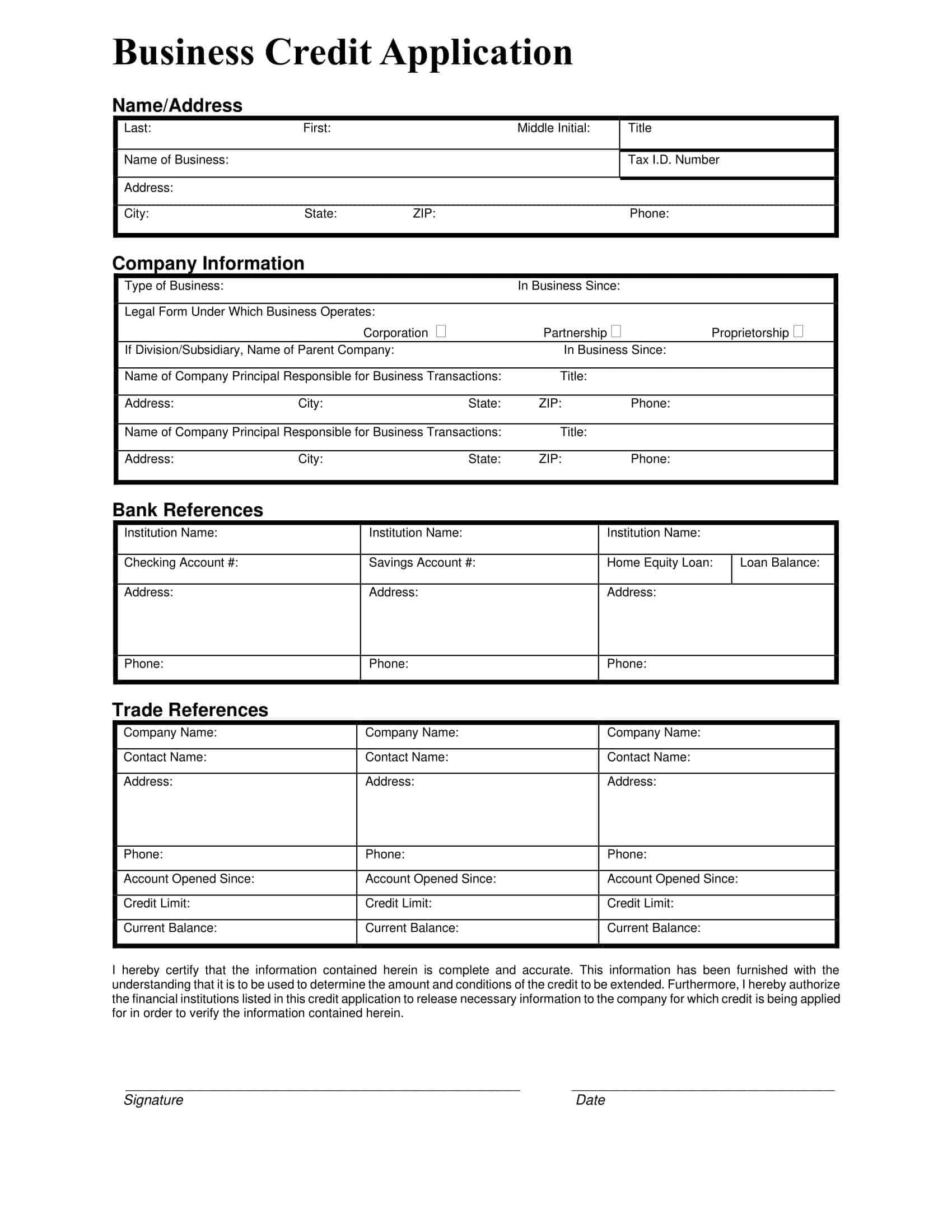

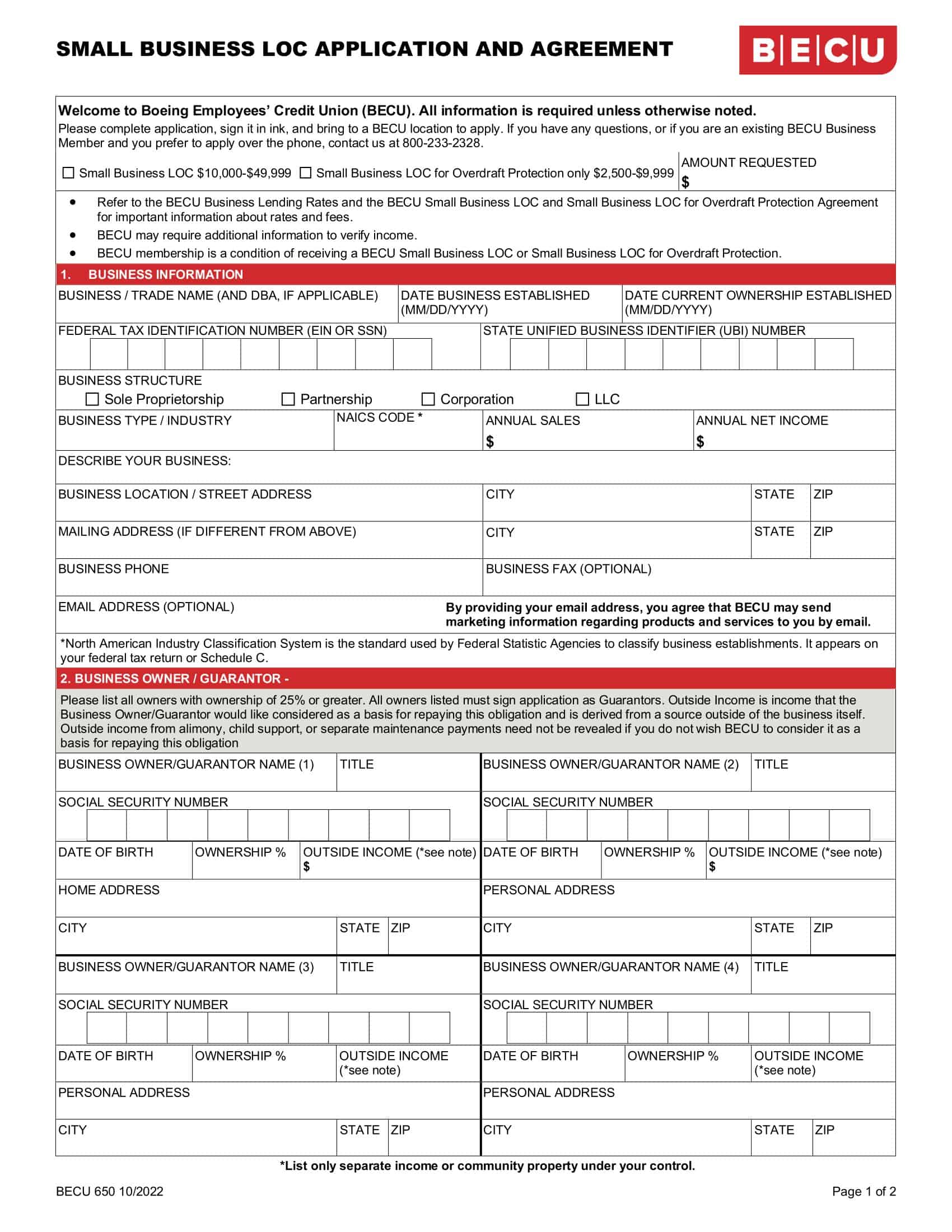

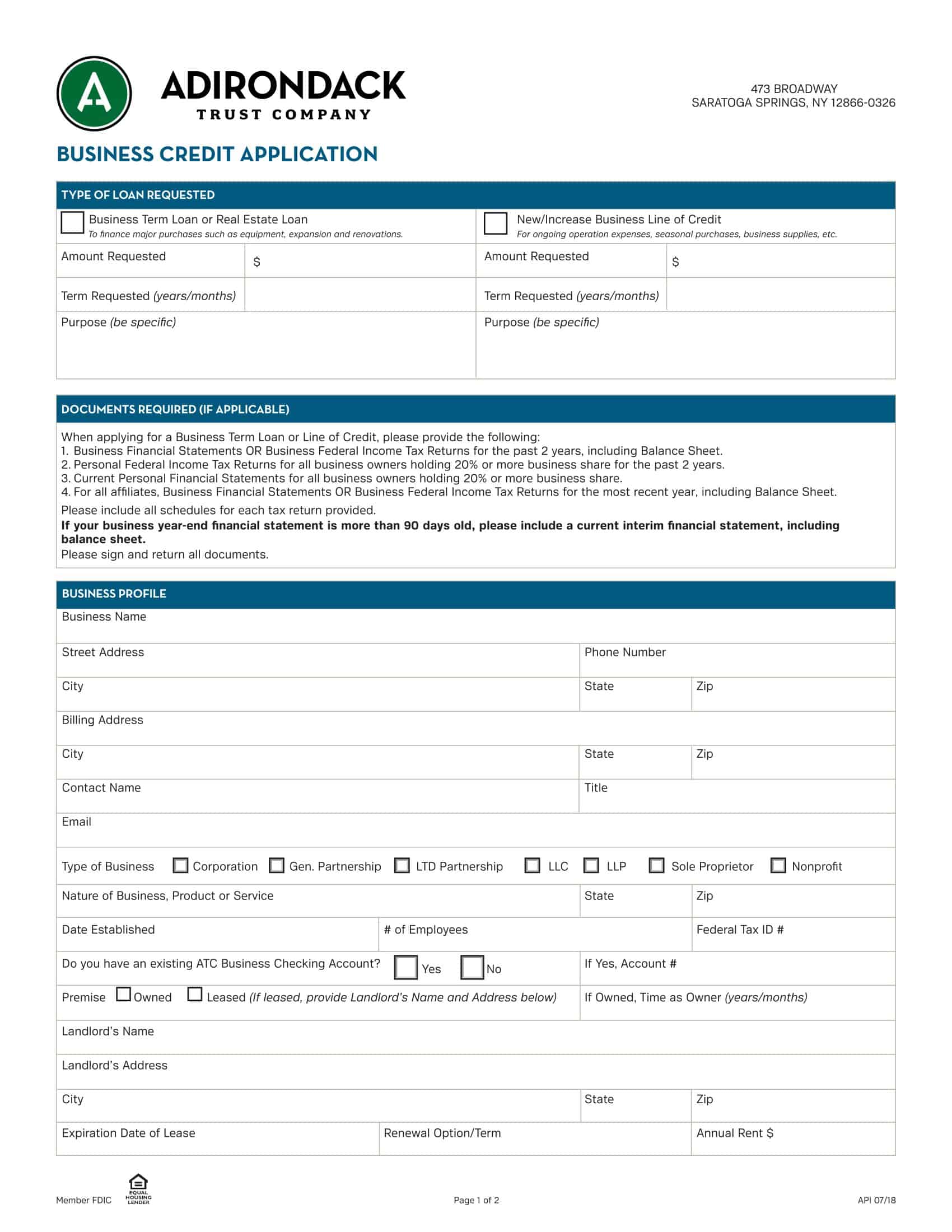

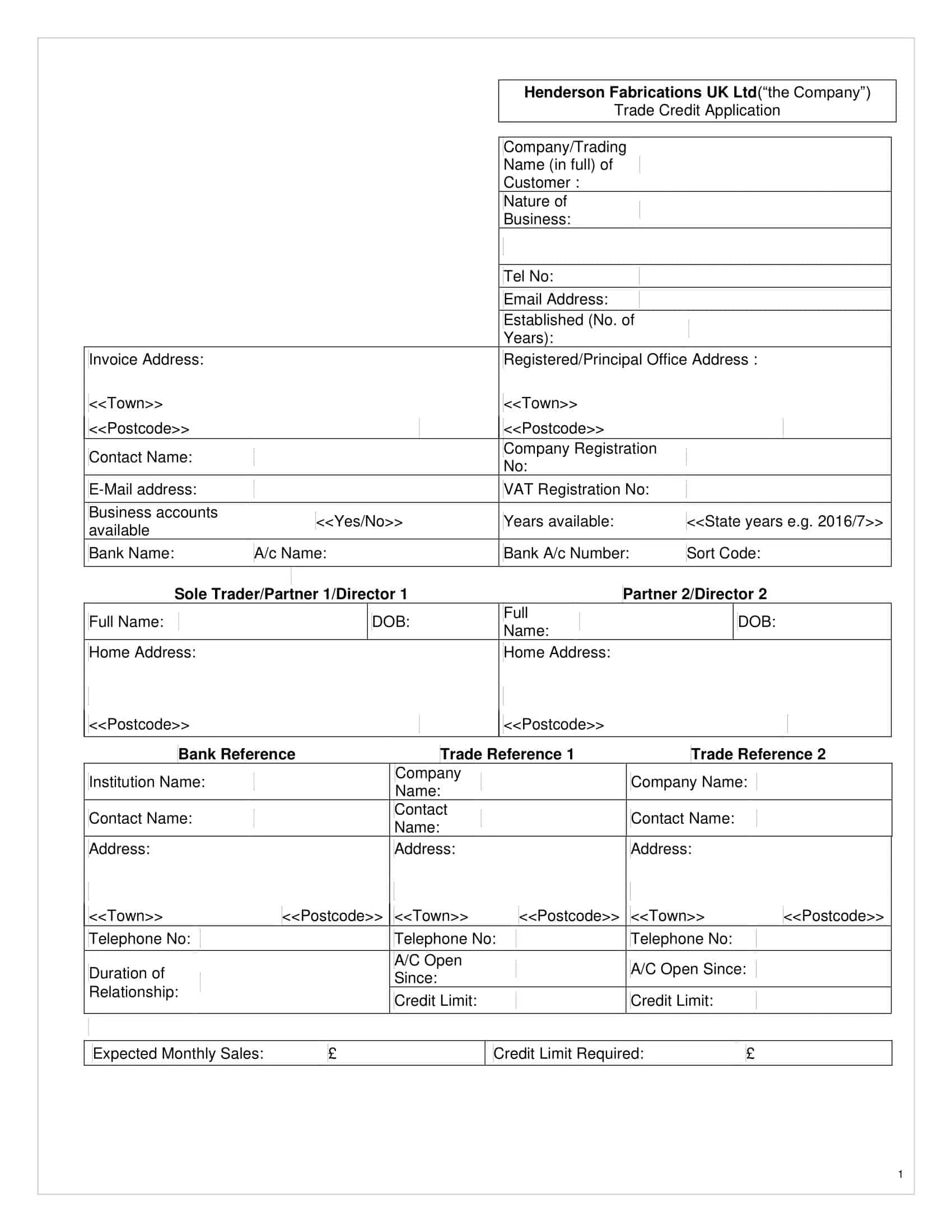

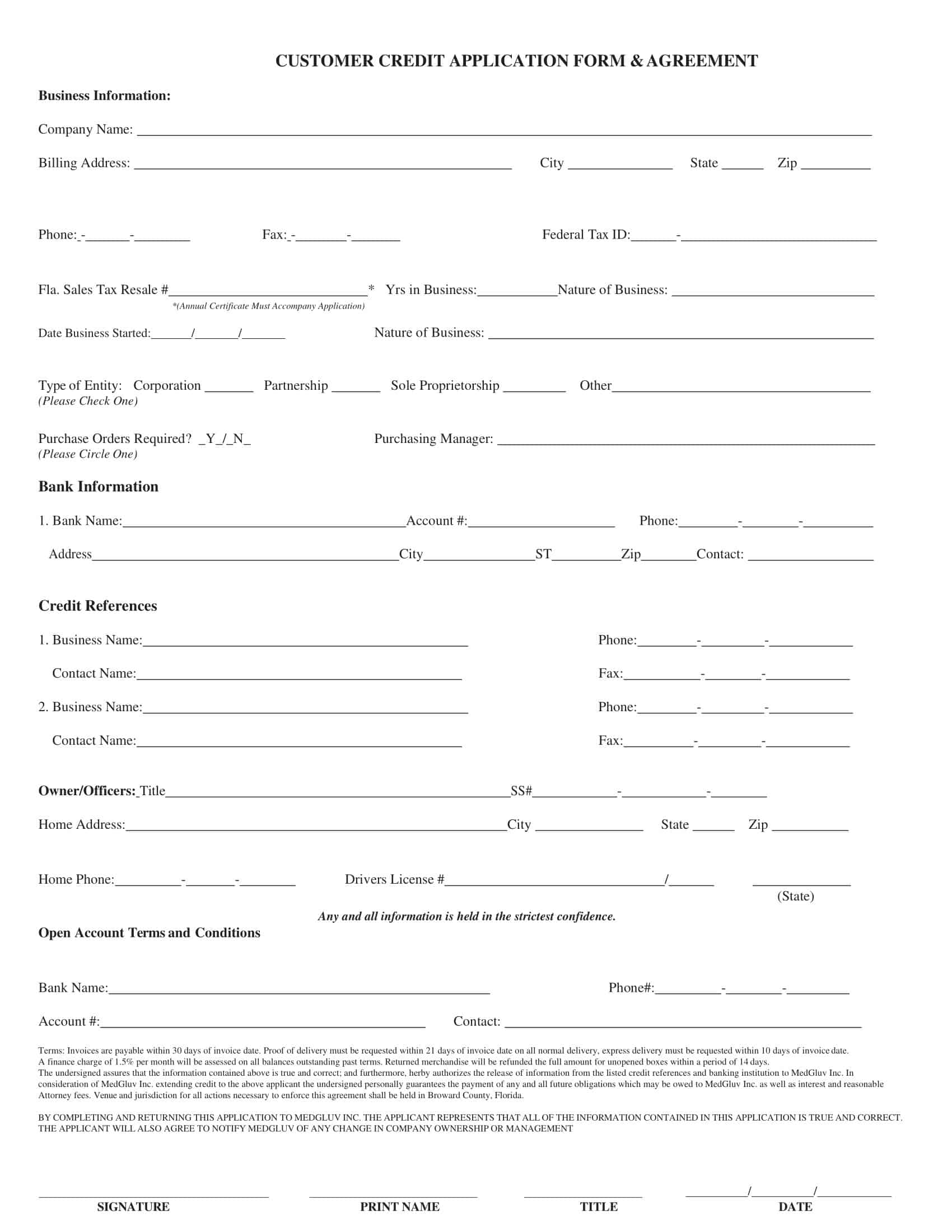

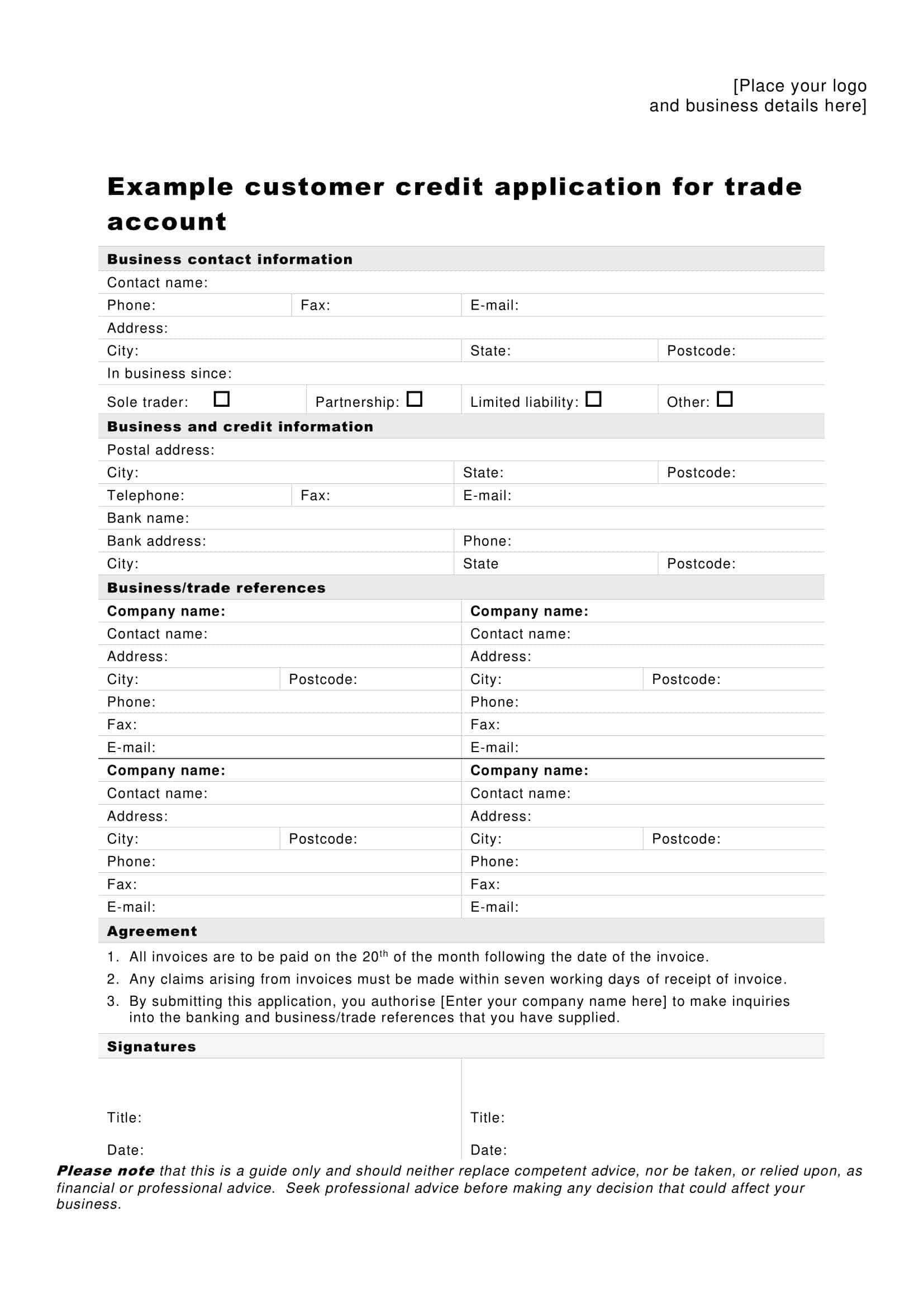

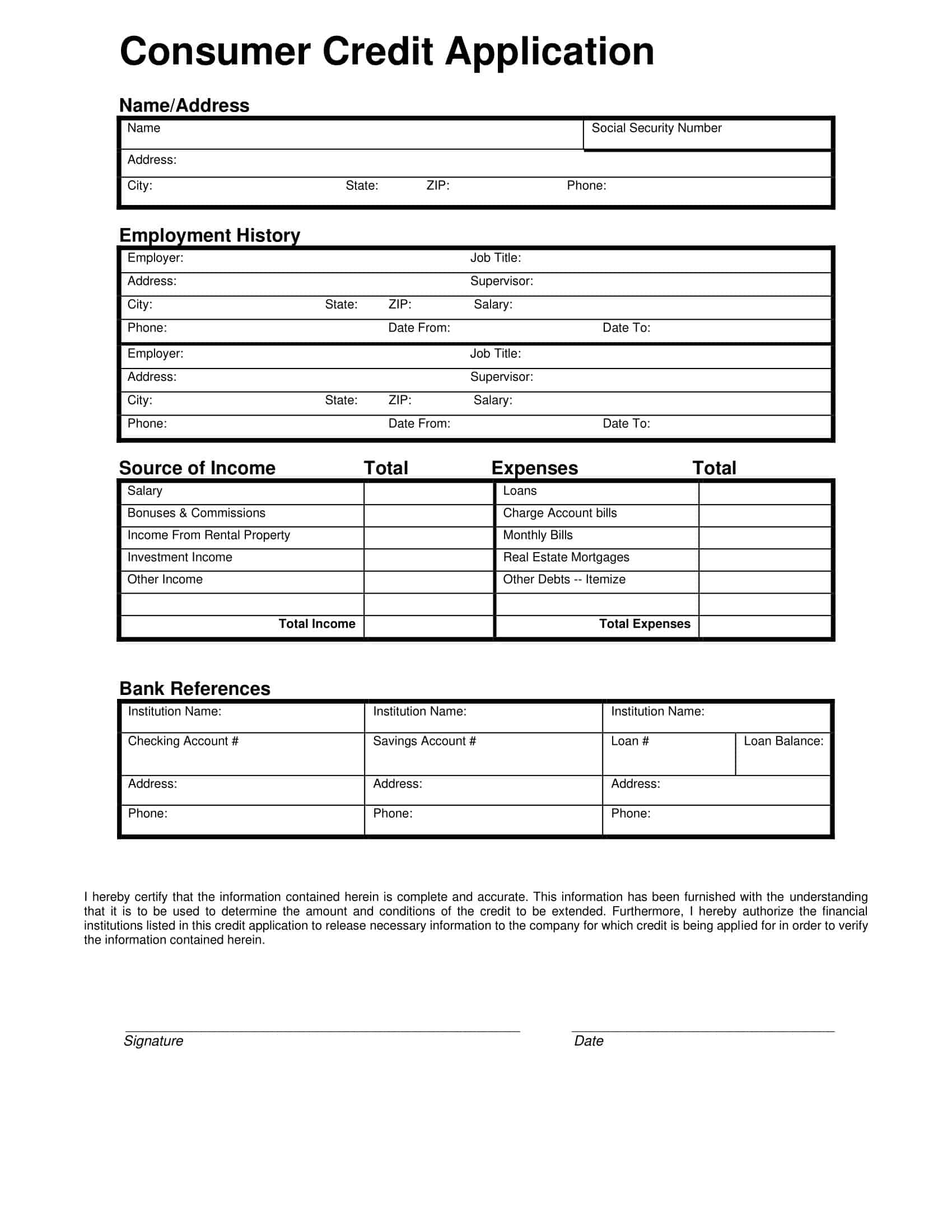

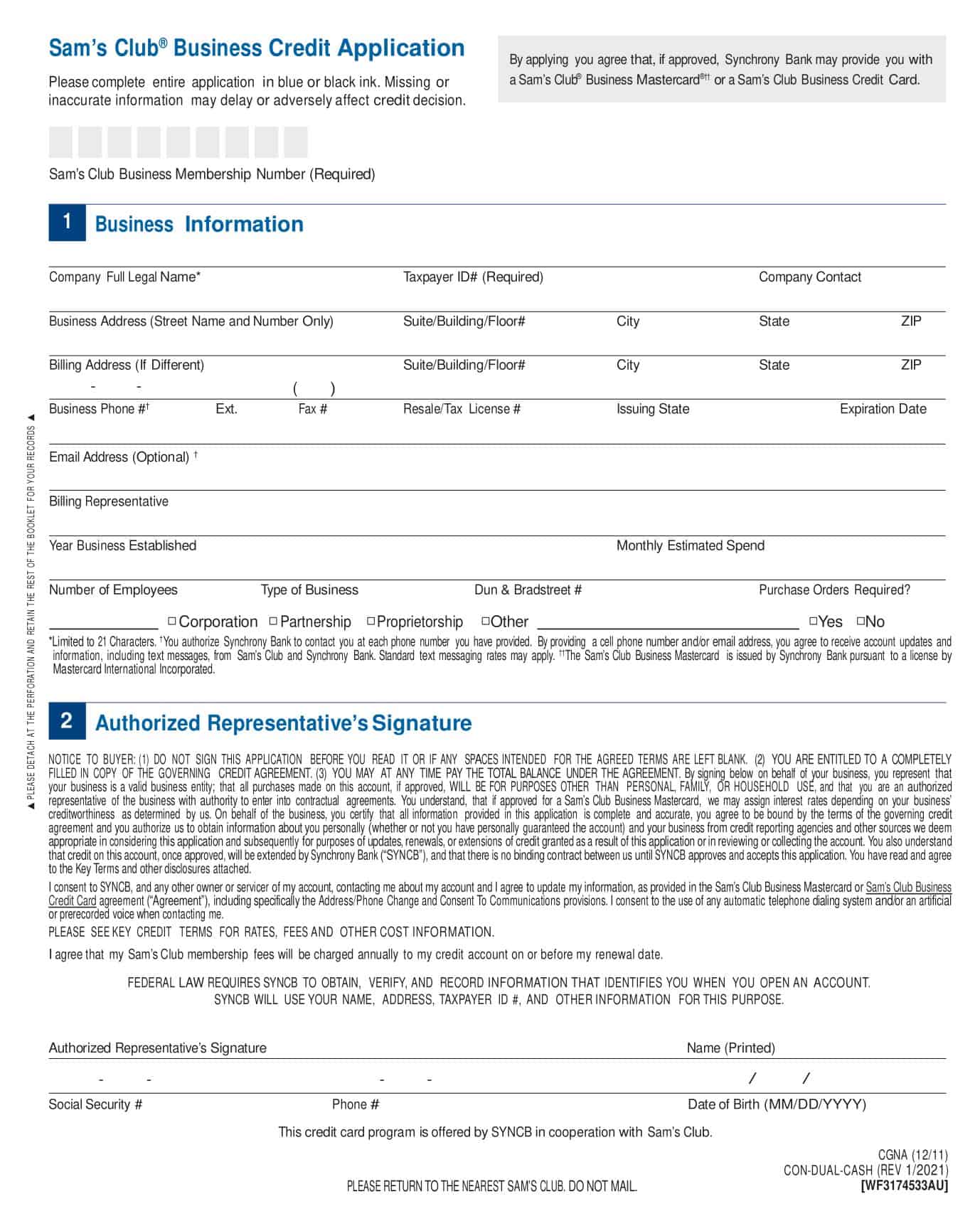

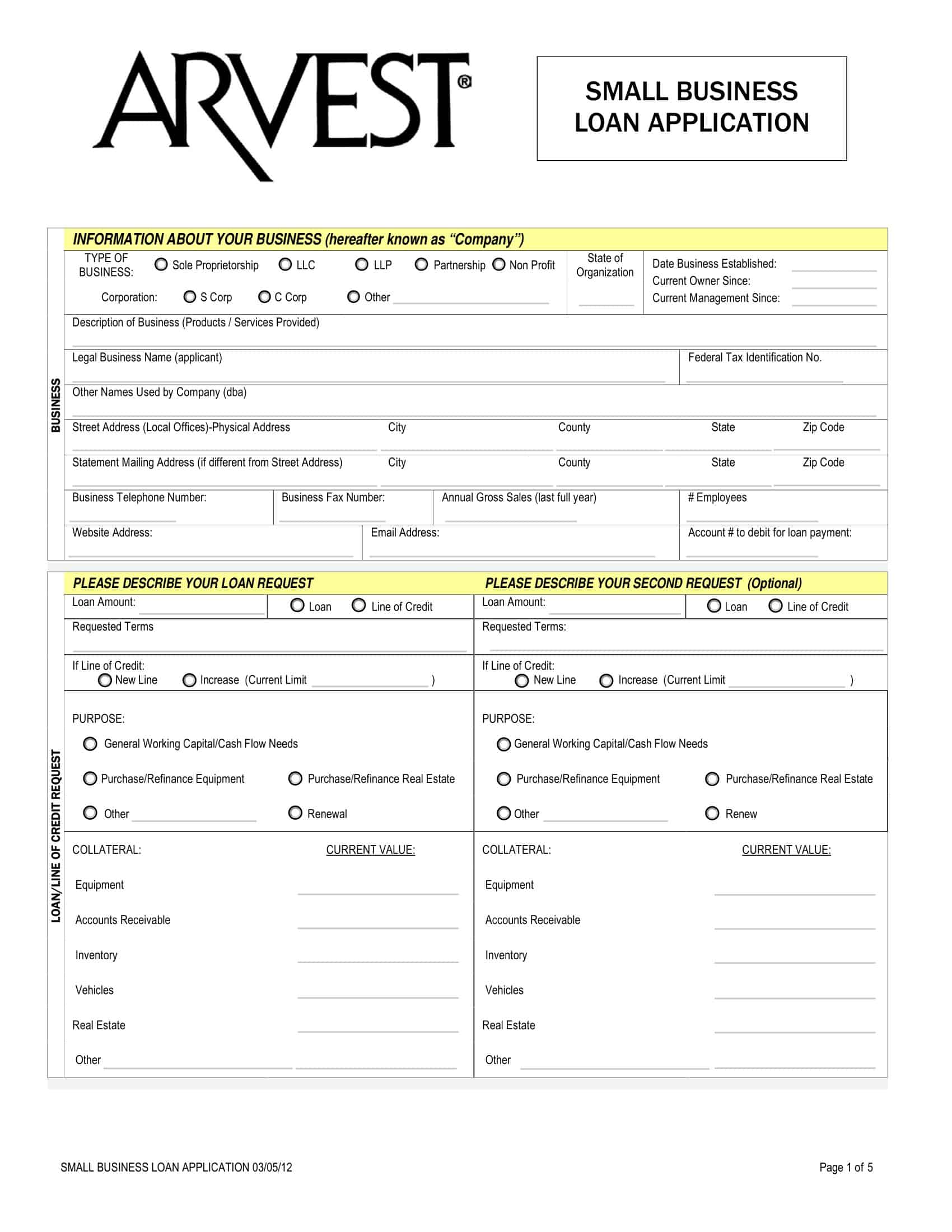

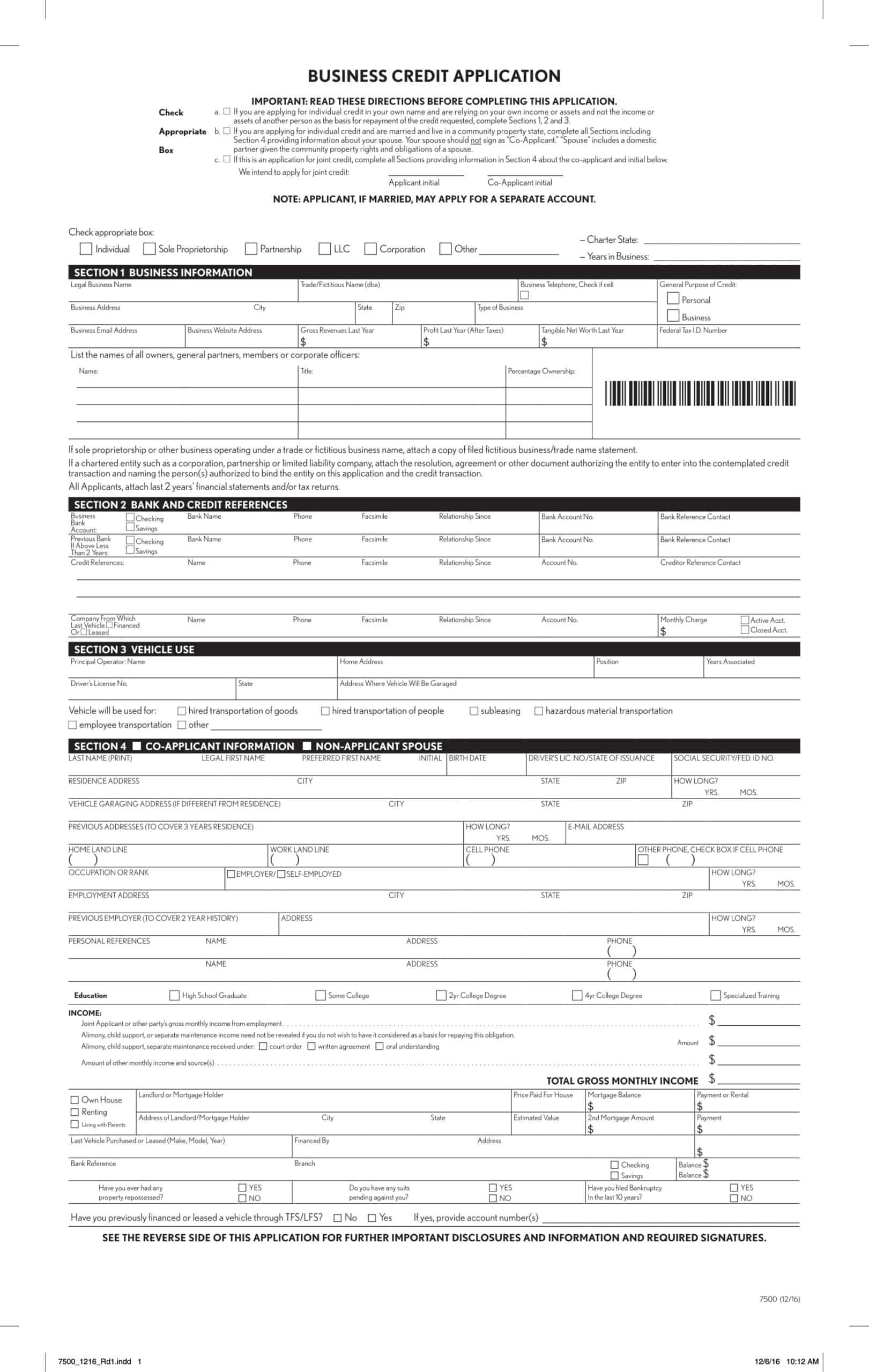

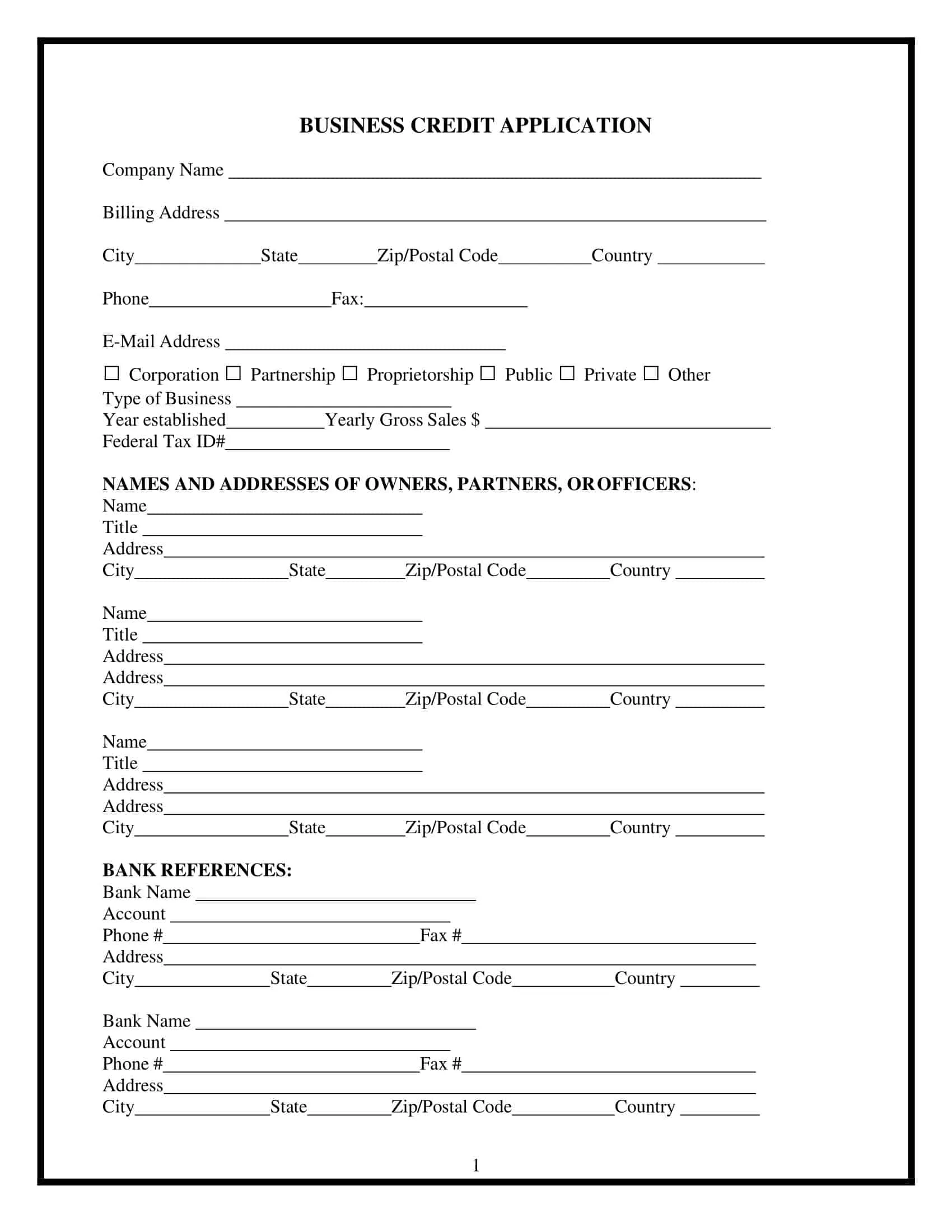

Business Credit Application Templates

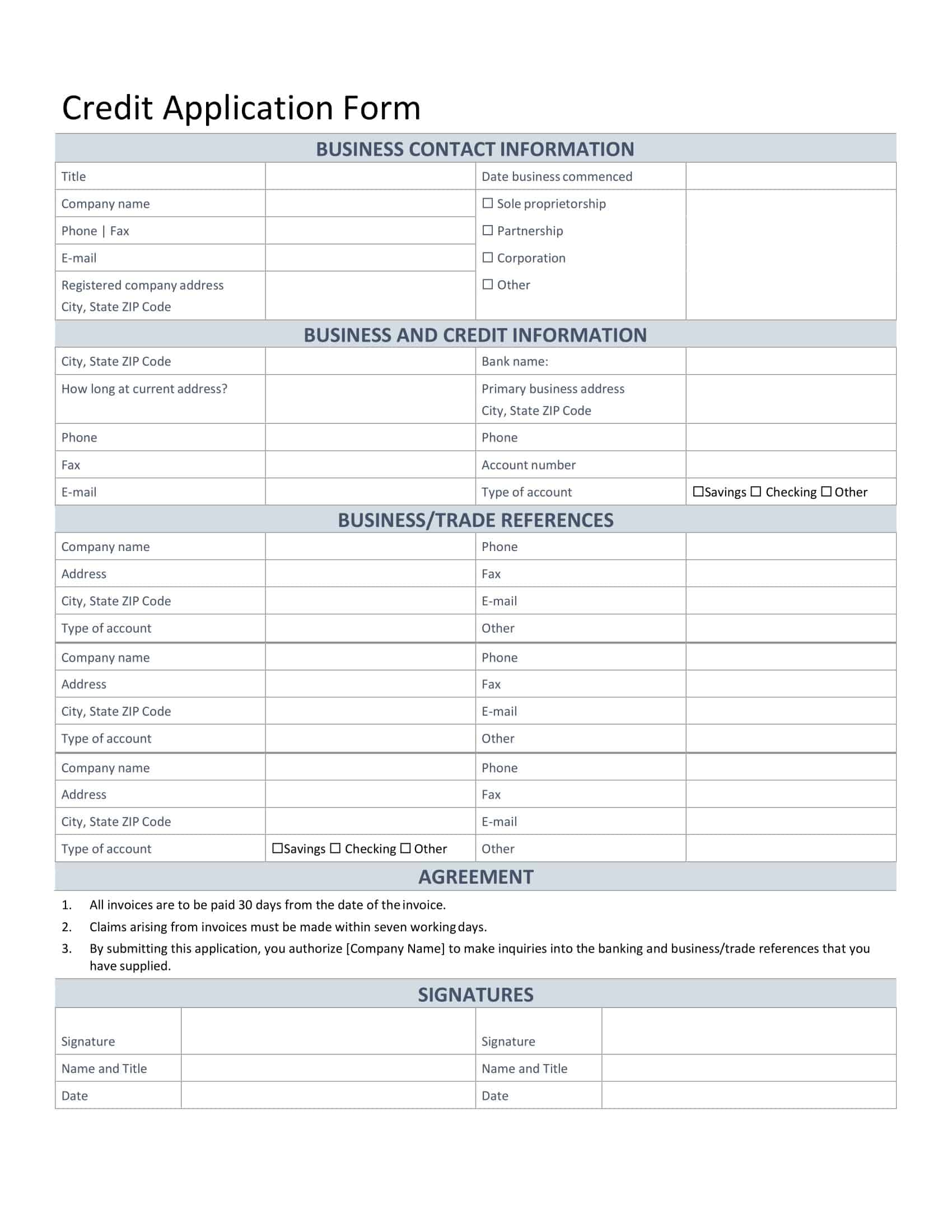

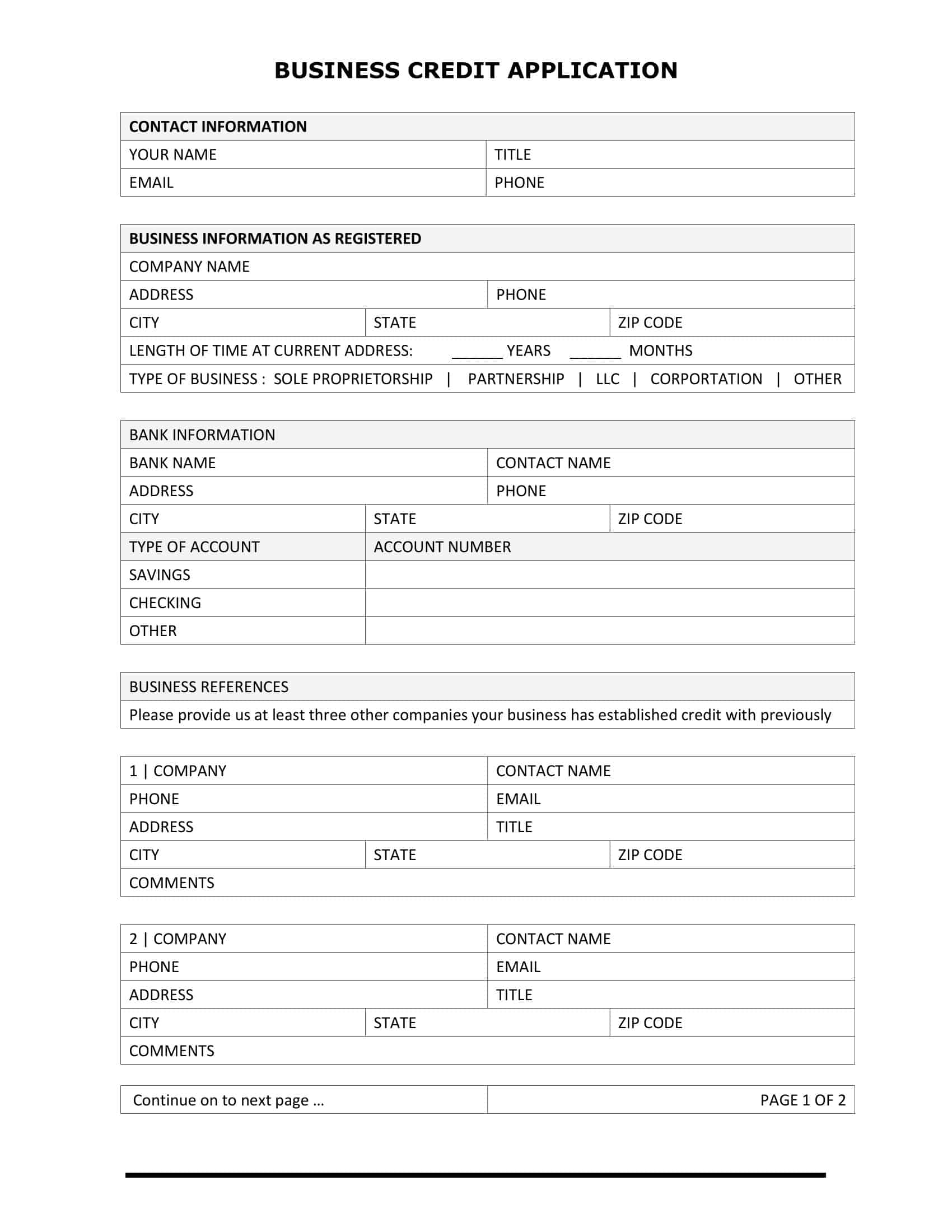

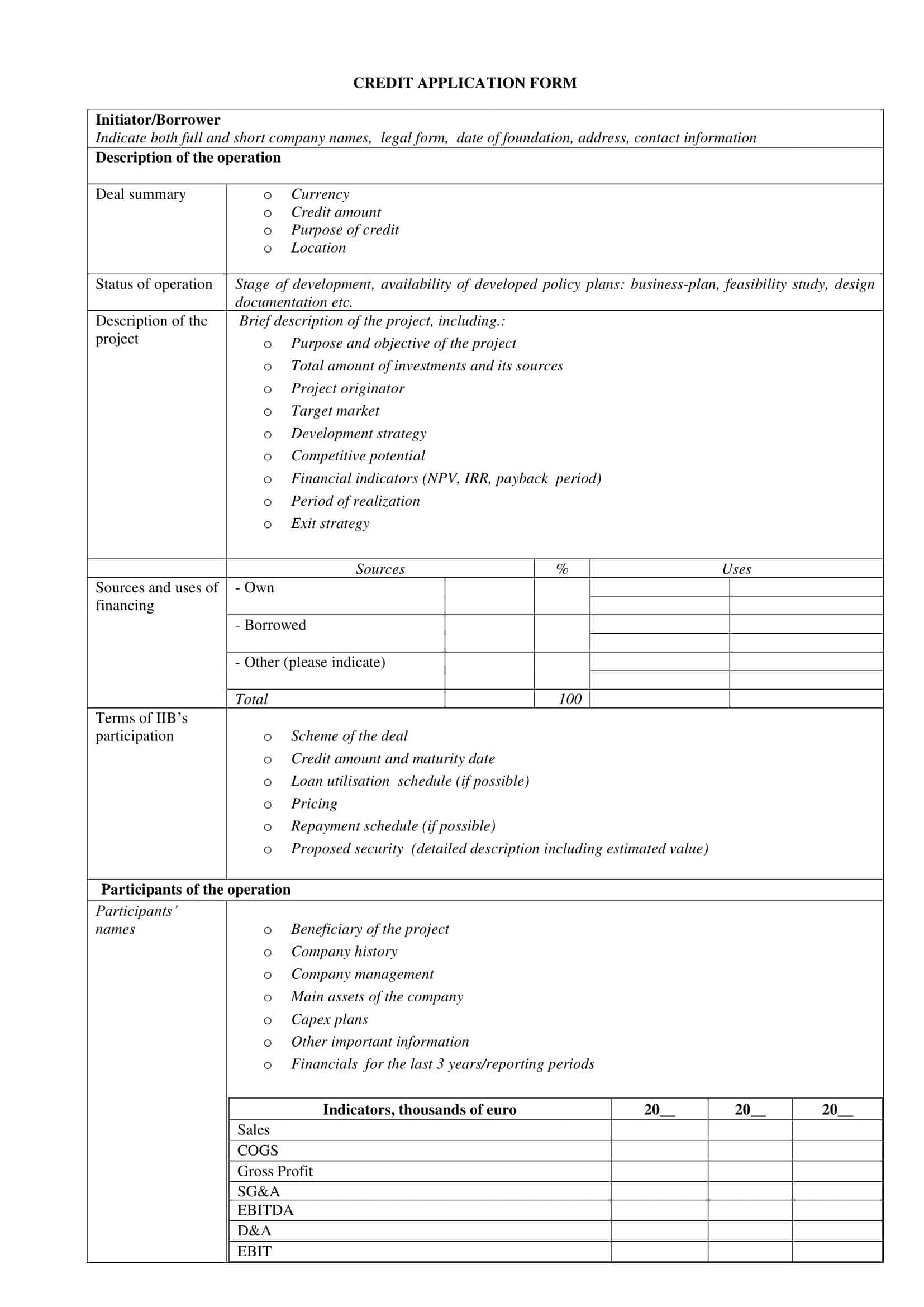

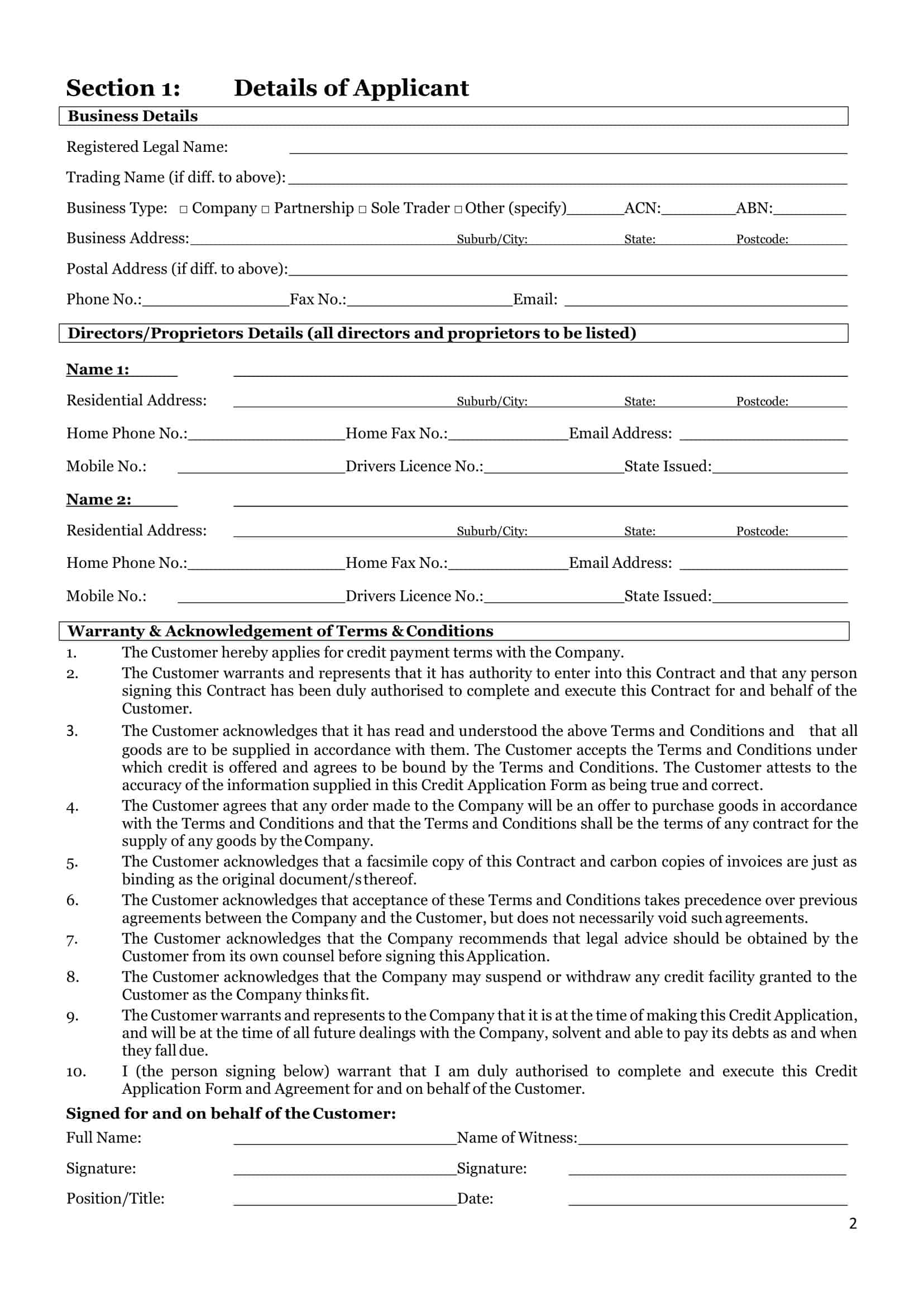

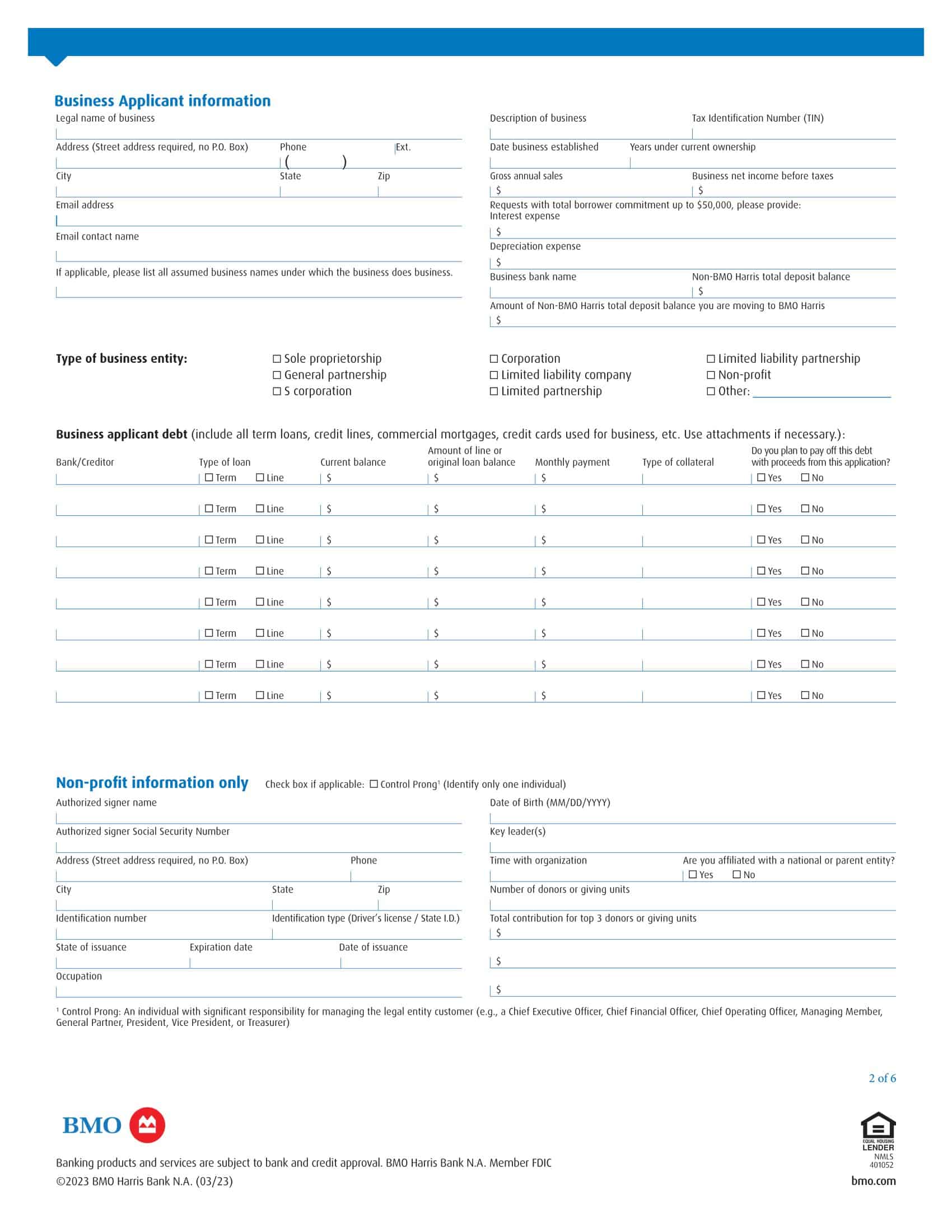

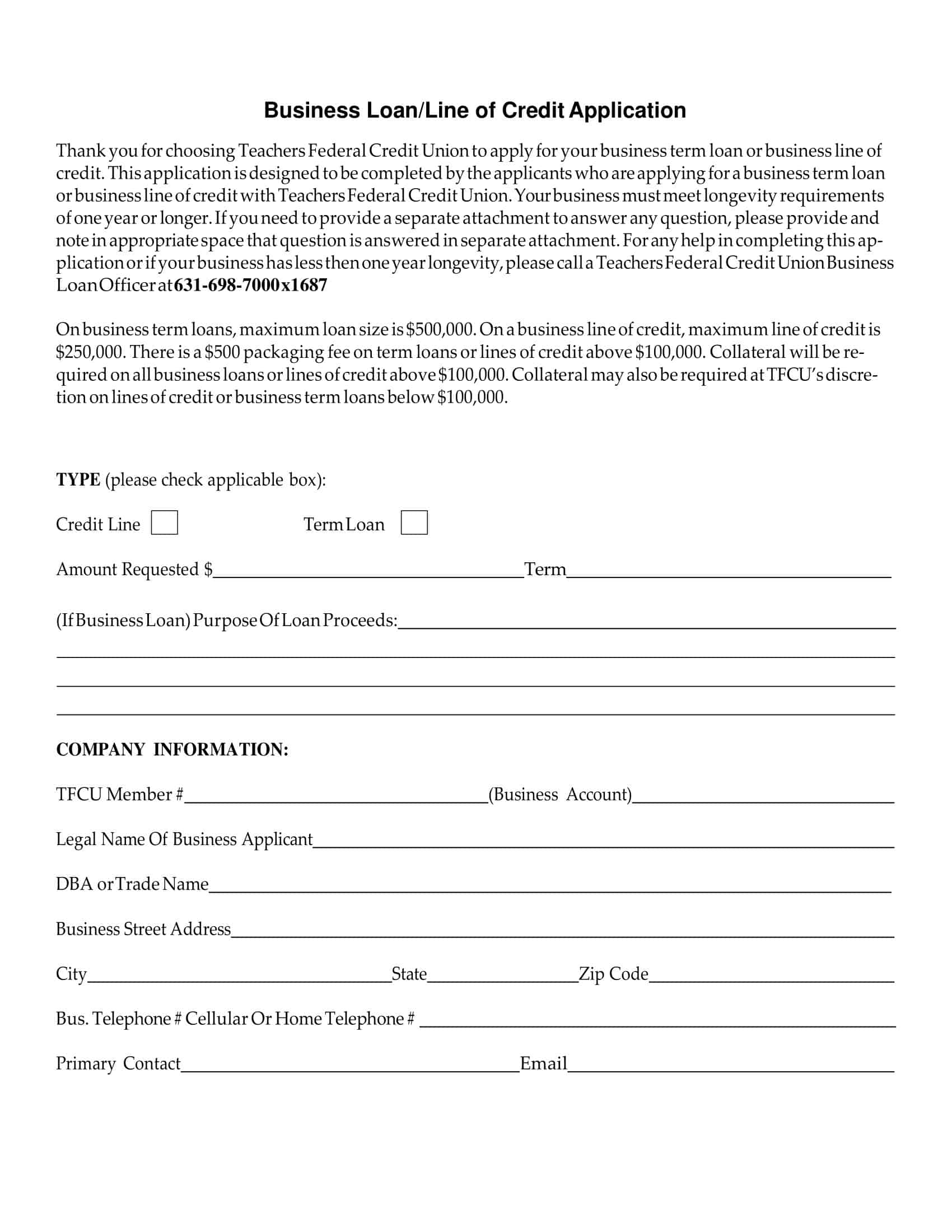

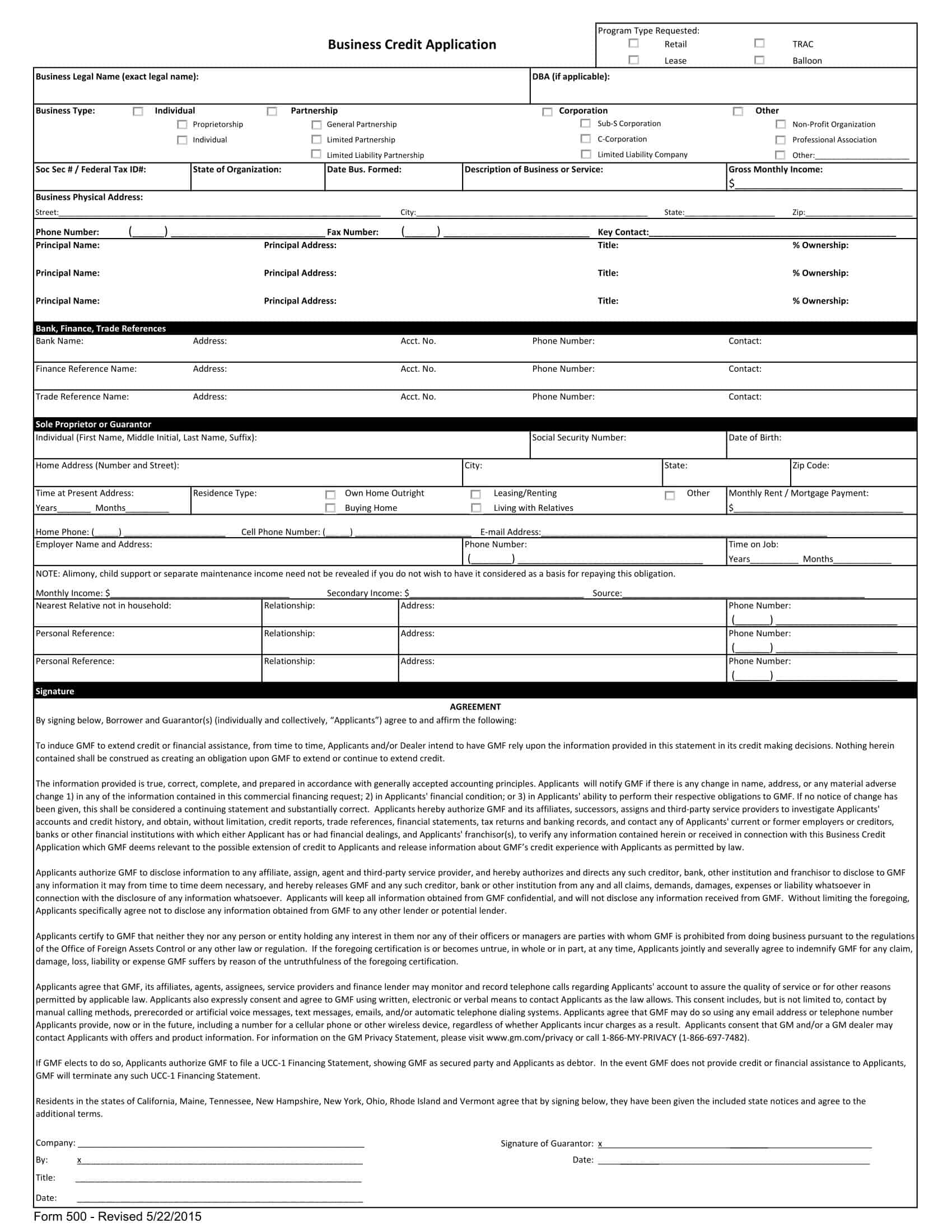

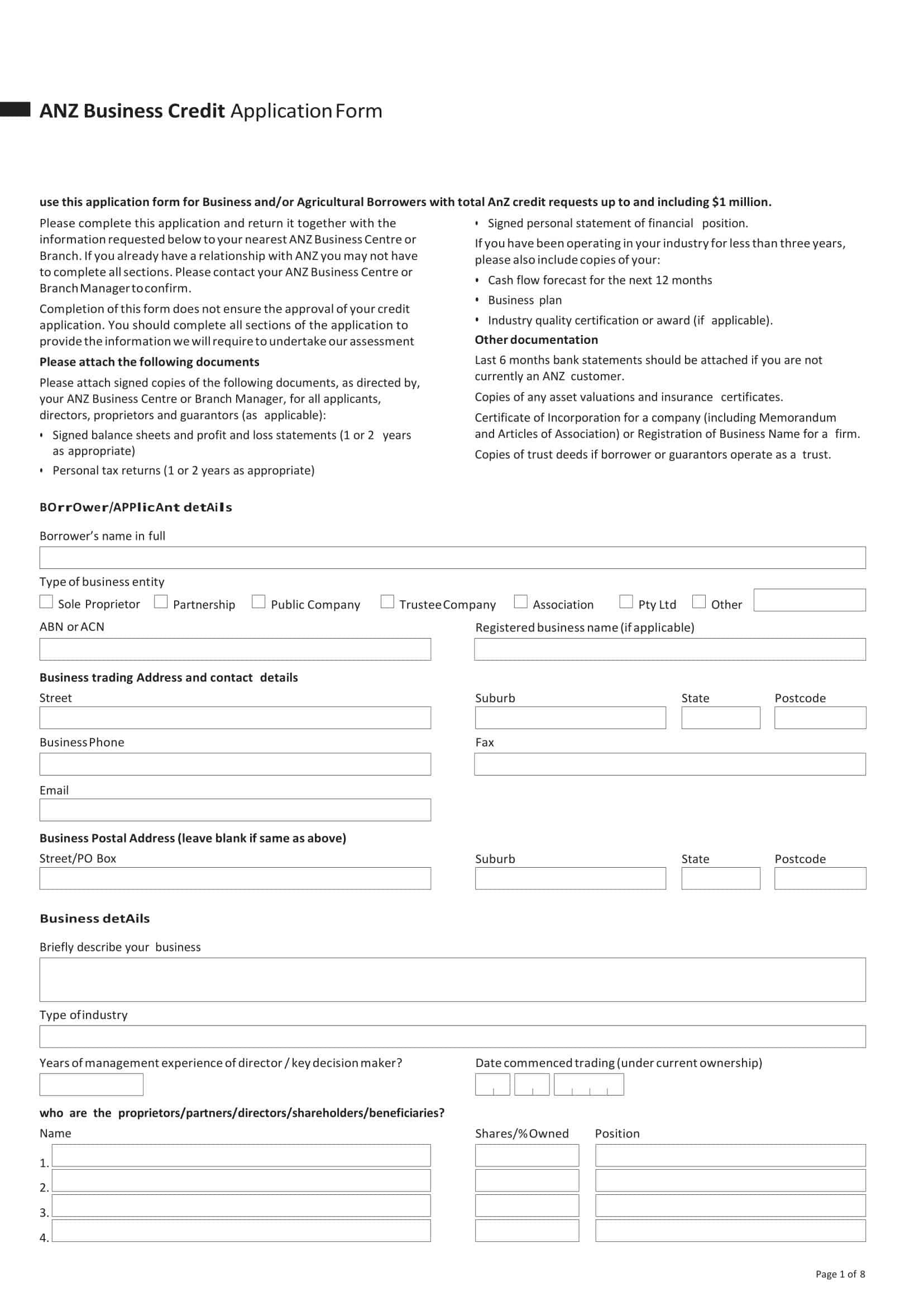

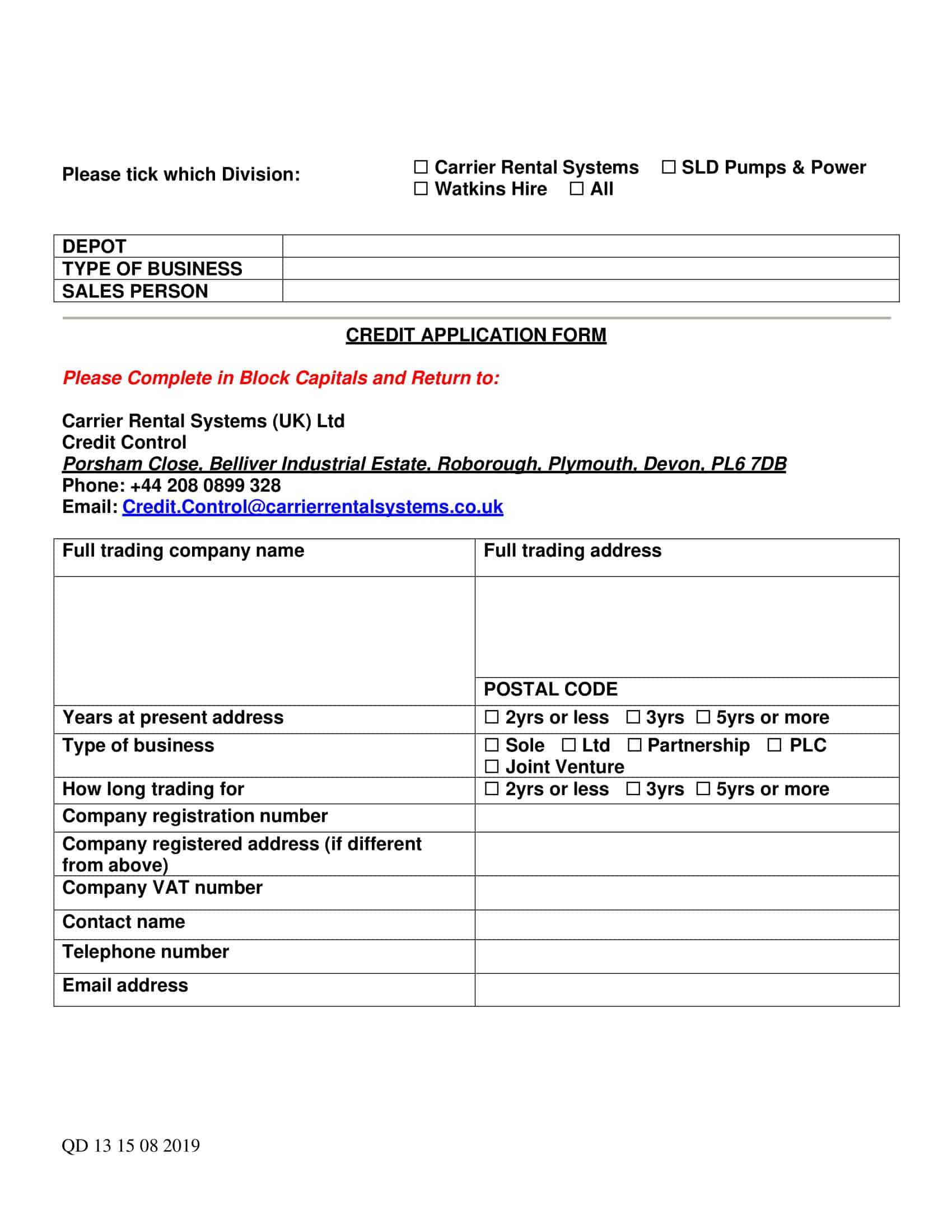

Business Credit Application Templates are pre-designed forms or documents used by businesses to request credit from suppliers, financial institutions, or other entities. These templates provide a standardized format for collecting essential information about the business, its financial history, and its creditworthiness. Business Credit Application Templates ensure consistency, accuracy, and professionalism in the credit application process, facilitating efficient and effective credit evaluation and decision-making.

Business Credit Application Templates provide a structured and standardized approach to applying for credit. By using these templates, businesses can ensure that the necessary information is collected accurately and consistently, expediting the credit evaluation process. These templates facilitate effective communication between the applicant and the creditor, enabling the creditor to assess the creditworthiness of the business and make informed decisions regarding credit approval and terms.

What should be included in a business credit application?

A business credit application typically includes the following information:

Business information: Name, address, phone number, tax ID, business structure (e.g. sole proprietorship, partnership, corporation), and years in business.

Ownership information: Names and addresses of all owners, as well as their ownership percentages.

Financial information: Current and projected revenue, expenses, and profits. This may also include a balance sheet, income statement, and cash flow statement.

Bank information: Information about the business’s current bank and banking relationship, including the bank’s name, account number, and length of relationship.

Trade references: Names and contact information of suppliers or other businesses that have extended credit to the business.

Personal information: Names and addresses of all owners, as well as their social security numbers.

Collateral: A description of any assets that the business can use as collateral, such as real estate, vehicles, or inventory.

Signature: A signature from an authorized representative of the business, certifying that the information provided is accurate and complete.

Types of Business Credit

Trade Credit: Credit extended by suppliers to a business for purchasing goods or services.

Bank Loans: Loans provided by banks, including lines of credit, term loans, and small business loans.

Equipment Financing: Financing options for purchasing equipment, such as leases or loans.

Invoice Financing: A form of financing where a business sells its accounts receivable at a discount to a third-party lender.

Business Credit Cards: Credit cards specifically designed for business use, often offering rewards, cash back, and other benefits.

Merchant Cash Advance: A short-term loan based on a business’ future credit card sales.

Crowdfunding: A method of financing a business through the contributions of a large number of people, often via the internet.

Microloans: Small, short-term loans designed for small businesses or startups.

SBA Loans: Loans backed by the Small Business Administration, offering favorable terms and low interest rates to qualifying businesses.

Supplier Credit: Credit extended by a business to its customers for purchases, often with the option to pay later.

How Business Credit Works

Business credit works by establishing a separate credit history for a business, separate from the personal credit history of its owners or officers. Just as with personal credit, a business’s credit history is built through its credit and financial activities, such as borrowing and repaying loans, paying bills on time, and maintaining good financial records.

The process of building business credit typically begins by obtaining a tax ID number and registering with business credit reporting agencies, such as Dun & Bradstreet or Experian. Next, a business can establish credit by applying for a business credit card, obtaining a loan, or applying for a line of credit.

Once a business has established credit, it can use that credit to obtain loans, lines of credit, and other financial products, such as leases or supplier credit. Lenders and other providers of credit use a business’s credit history to assess its creditworthiness and determine the terms and conditions of any credit it is extended.

Overall, having a good business credit history can be beneficial for a business by making it easier to obtain financing, helping to establish better relationships with suppliers and lenders, and improving a business’s overall financial stability and reputation.

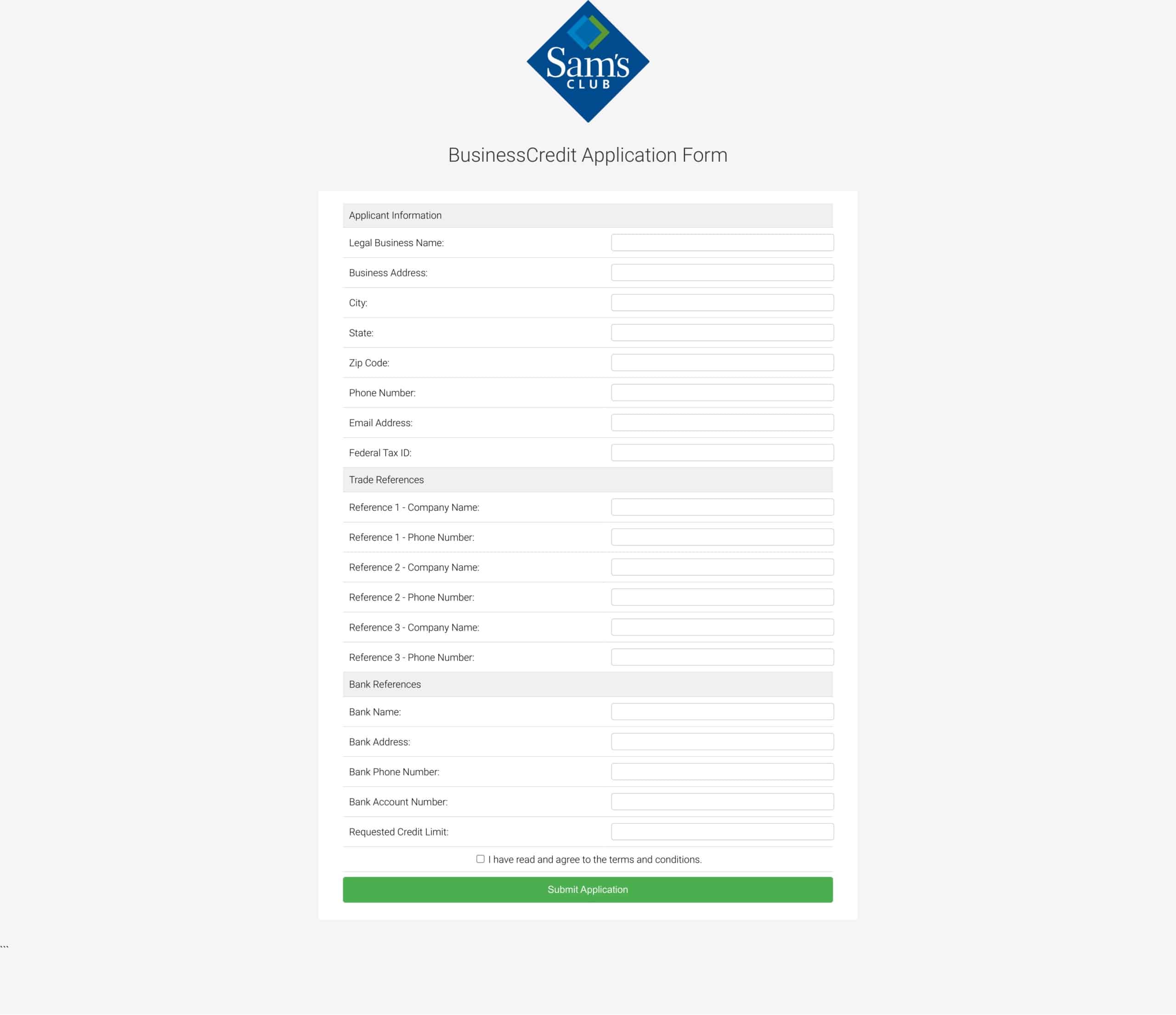

Making online business credit applications

Making an online business credit application is a convenient and efficient way for a business to apply for credit. The process typically involves the following steps:

Gather necessary information: Before making an online business credit application, a business should have all the necessary information, including its tax ID number, business structure, financial information, bank information, trade references, and personal information of owners and authorized representatives.

Find online lenders: Search online for lenders that offer business credit and compare terms, interest rates, and requirements.

Complete online application: Fill out the online business credit application, providing all the necessary information. Some online applications may require additional documentation, such as financial statements or tax returns, which can be uploaded or provided electronically.

Receive credit decision: After submitting the online business credit application, the lender will review the information and make a credit decision. This decision may be provided online, and the business will typically be notified of the outcome within a few days.

Accept or decline credit offer: If the business is approved for credit, it can accept or decline the credit offer online. If the business accepts the credit offer, the lender will typically provide instructions for how to complete the credit process, including any additional requirements or documentation that may be needed.

Things to Consider including the following for creating an online business credit application form:

Business Information: Name, Address, Phone, Email, Website, Legal Structure, Industry

Contact Information: Owner’s name, title, phone and email.

Financial Information: Annual revenue, number of employees, years in business

Trade References: List of suppliers or customers the business has worked with

Bank Information: Name and Contact Information for the business’ bank

Authorized Signers: Names and titles of individuals authorized to submit the application

Government-Issued ID: A government-issued photo ID for the business owner or authorized signer

Agreement to Terms and Conditions: A checkbox or signature field indicating agreement to terms and conditions of the credit application.

Advantages and Disadvantages of Business Credit

Advantages of Business Credit:

Access to Capital: Credit provides businesses with access to capital they may not have otherwise.

Improved Cash Flow: Credit can help businesses manage cash flow, allowing them to make purchases and investments without depleting their cash reserves.

Increased Purchasing Power: Business credit can increase a company’s purchasing power, allowing them to buy in bulk or take advantage of volume discounts.

Credit History: Building a positive credit history can improve a business’s reputation and make it easier to obtain future credit.

Separation of Personal and Business Finances: Business credit allows business owners to keep their personal and business finances separate, potentially reducing personal financial liability.

Disadvantages of Business Credit:

Cost: Business credit often comes with fees, interest, and other costs that can add up over time.

Risk of Over-Indebtedness: Overusing credit can lead to over-indebtedness and make it difficult for a business to meet its financial obligations.

Personal Guarantee: Many forms of business credit require a personal guarantee, putting the personal assets of business owners at risk if the business defaults on its loans.

Negative Impact on Credit Score: Late payments or defaults on business credit can negatively impact the business’s credit score and make it more difficult to obtain future credit.

Repayment Obligations: Using credit creates ongoing repayment obligations, requiring businesses to make regular payments and potentially impacting cash flow.

How do you fill out a business credit application?

To fill out a business credit application, you will need to provide the following information:

- Accurate and up-to-date business information, including business name, address, contact information, legal structure, and industry.

- Financial information, such as annual revenue, number of employees, and years in business. You may also need to provide tax identification numbers, such as an Employer Identification Number (EIN).

- Trade references, including the names and contact information for suppliers or customers the business has worked with.

- Bank information, including the name and contact information for the business bank.

- Authorized signers, including the names and titles of individuals authorized to submit the application.

- Government-issued identification, such as a driver’s license or passport, for the business owner or authorized signer.

- Signature or agreement to the terms and conditions of the credit application, indicating that you have read and agreed to the terms and conditions outlined in the application.

FAQs

How long does it take to get approved for business credit?

The length of time it takes to get approved for business credit can vary depending on the lender and the type of credit being applied for. Some applications may be approved in a matter of minutes, while others may take several days or weeks to process.

What factors determine a business’s creditworthiness?

A business’s creditworthiness is determined by a variety of factors, including credit history, financial stability, and repayment history. Other factors may include the size and industry of the business, the length of time it has been in operation, and the personal credit history of the business owner or authorized signers.

Can a business have a credit score?

Yes, businesses can have a credit score, just like individuals. A business credit score is a numerical representation of a business’s creditworthiness and is used by lenders to determine the risk of providing credit.

What are the consequences of defaulting on business credit?

The consequences of defaulting on business credit can include damage to the business’s credit score, difficulty obtaining future credit, and potentially legal action by the lender to recover the debt. In some cases, a personal guarantee may also put the personal assets of business owners at risk.

How often do I have to make payments on my business credit?

The frequency of payments on business credit will vary depending on the type of credit and the terms agreed upon with the lender. Some forms of credit may require monthly payments, while others may require quarterly or annual payments.

Can a business apply for multiple forms of credit at once?

Yes, a business can apply for multiple forms of credit at once, but this can impact the business’s credit score and make it more difficult to obtain future credit. It is recommended to only apply for the credit a business needs and to carefully consider the terms and conditions of each loan or line of credit.

How do I improve my business’s credit score?

To improve a business’s credit score, it is important to make timely payments on all forms of credit, maintain a low credit utilization rate, and avoid applying for too much credit at once. Regularly monitoring the business’s credit report and correcting any errors can also help improve the credit score.

Is a personal guarantee required for business credit?

A personal guarantee may be required for some forms of business credit, such as small business loans or lines of credit. A personal guarantee means that the business owner is personally responsible for repaying the debt if the business is unable to do so. The requirement for a personal guarantee will vary depending on the lender and the type of credit being applied for.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Credit Dispute Letter Templates Form 609 [PDF, Word] 3 Credit Dispute Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Credit-Dispute-Letter-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Credit-Dispute-Letter-1-1200x1200.jpg 1200w)