If you are unfamiliar with a small estate affidavit form, it is likely because you have not previously encountered the probate process. This particular form serves to safeguard individuals who have inherited assets or property, allowing them to gain control of these assets without waiting for the estate to go through probate. This can be especially significant for family members who relied on the deceased person for financial support.

Although it is common for individuals to have a lawyer prepare this form on their behalf, it is possible to explore an example of a small estate affidavit if you wish to attempt drafting the document yourself. It is important to note that there are typically legal limitations regarding the size of the estate that this form can protect, and state-specific guidelines must also be followed for these estate processes. To write a small estate affidavit independently, it is essential to have a comprehensive understanding of the specific limitations applicable in your state.

Table of Contents

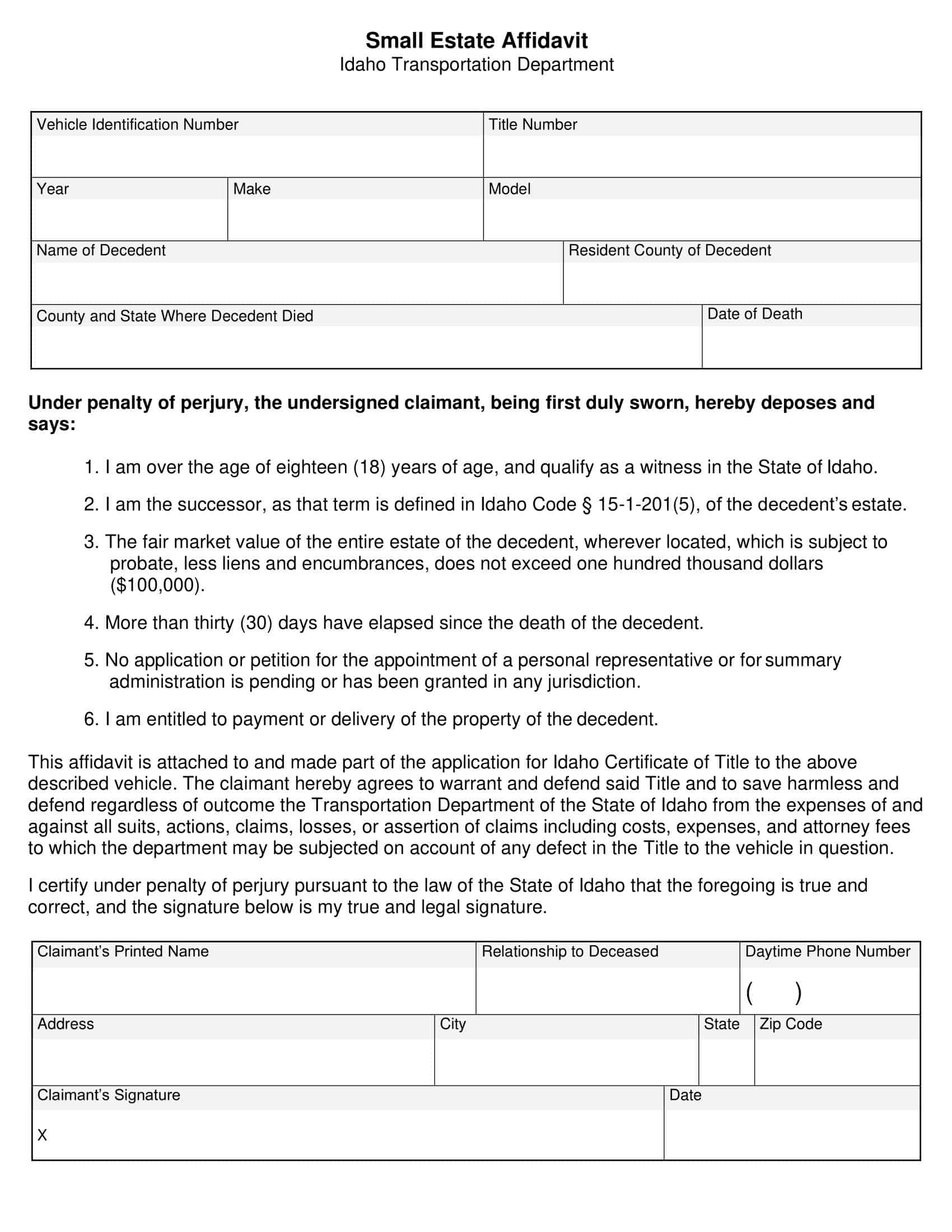

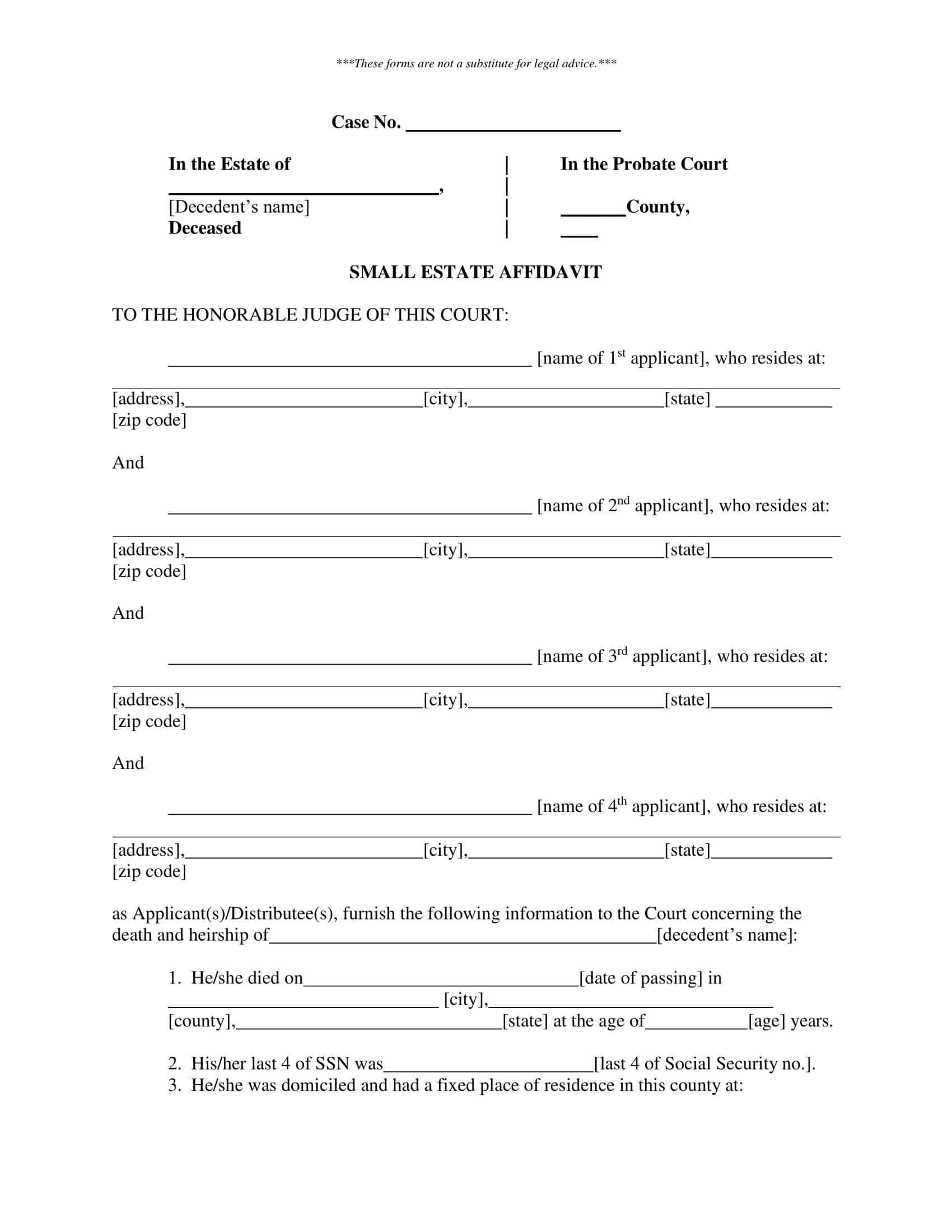

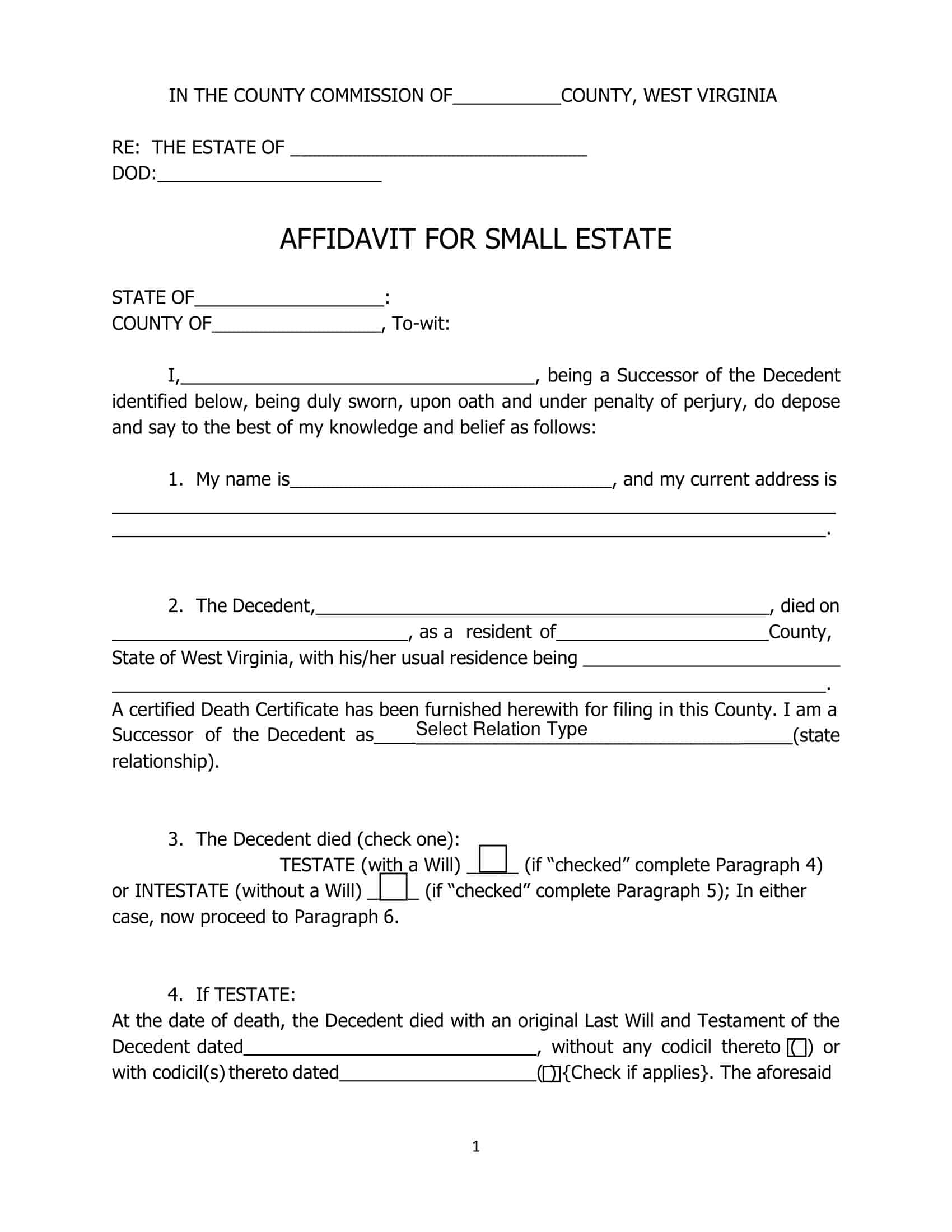

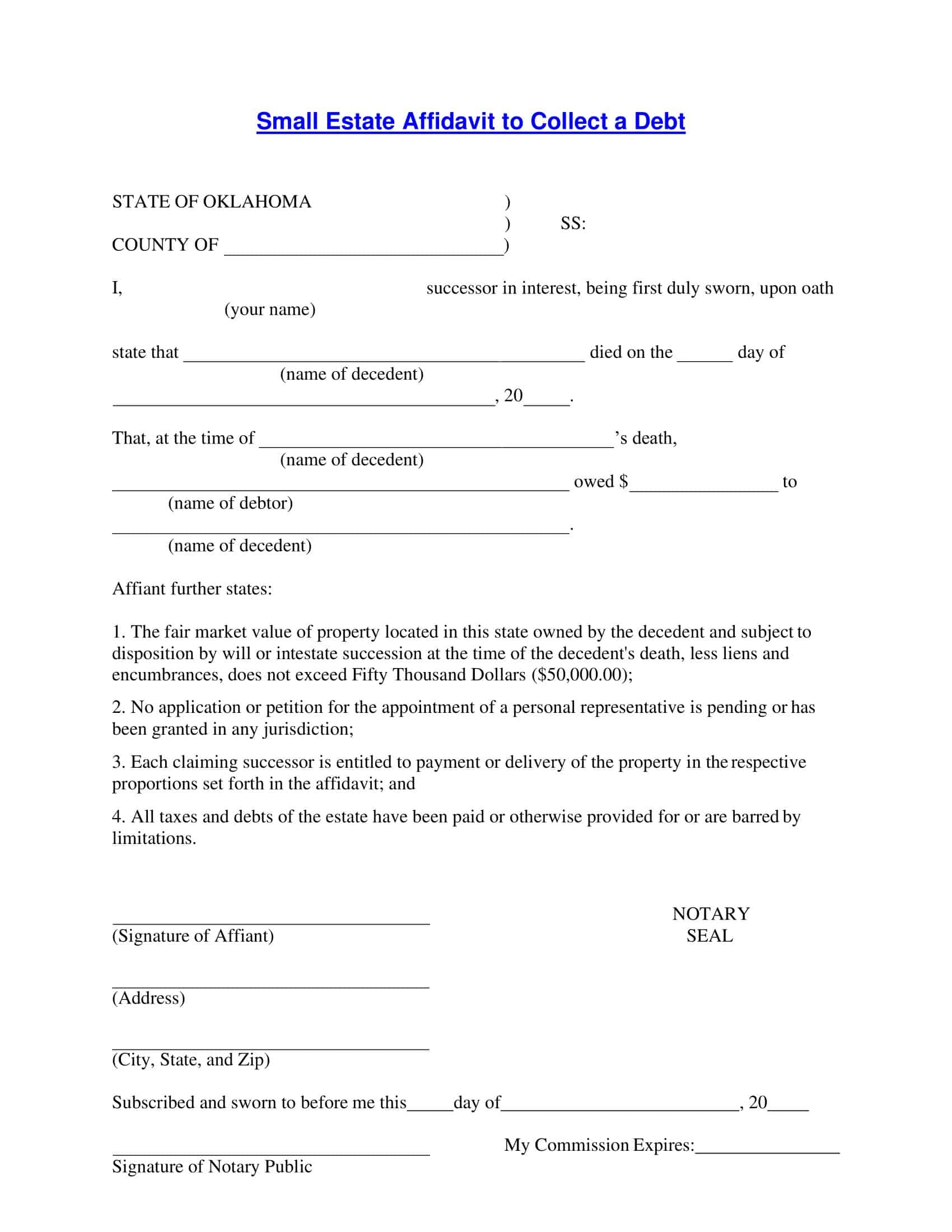

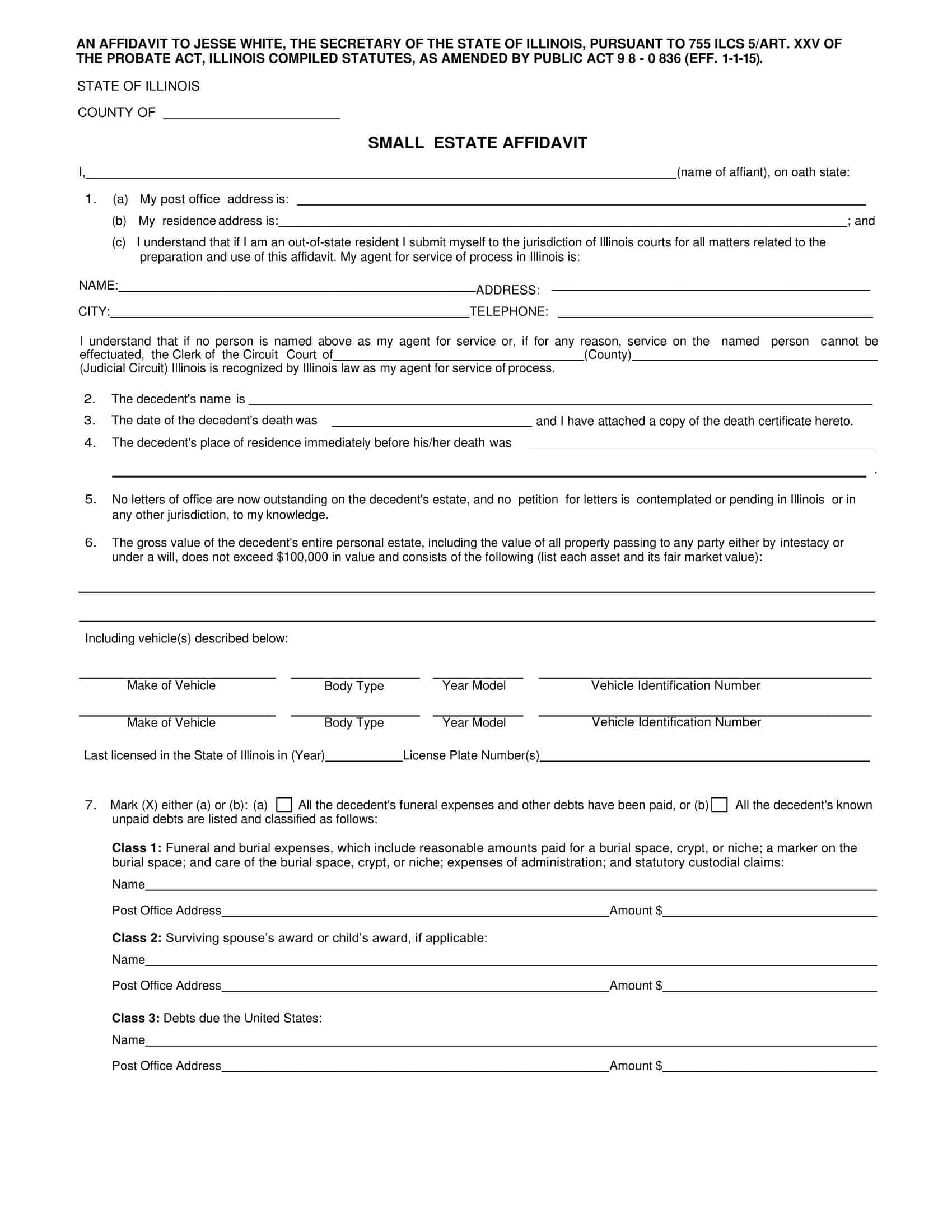

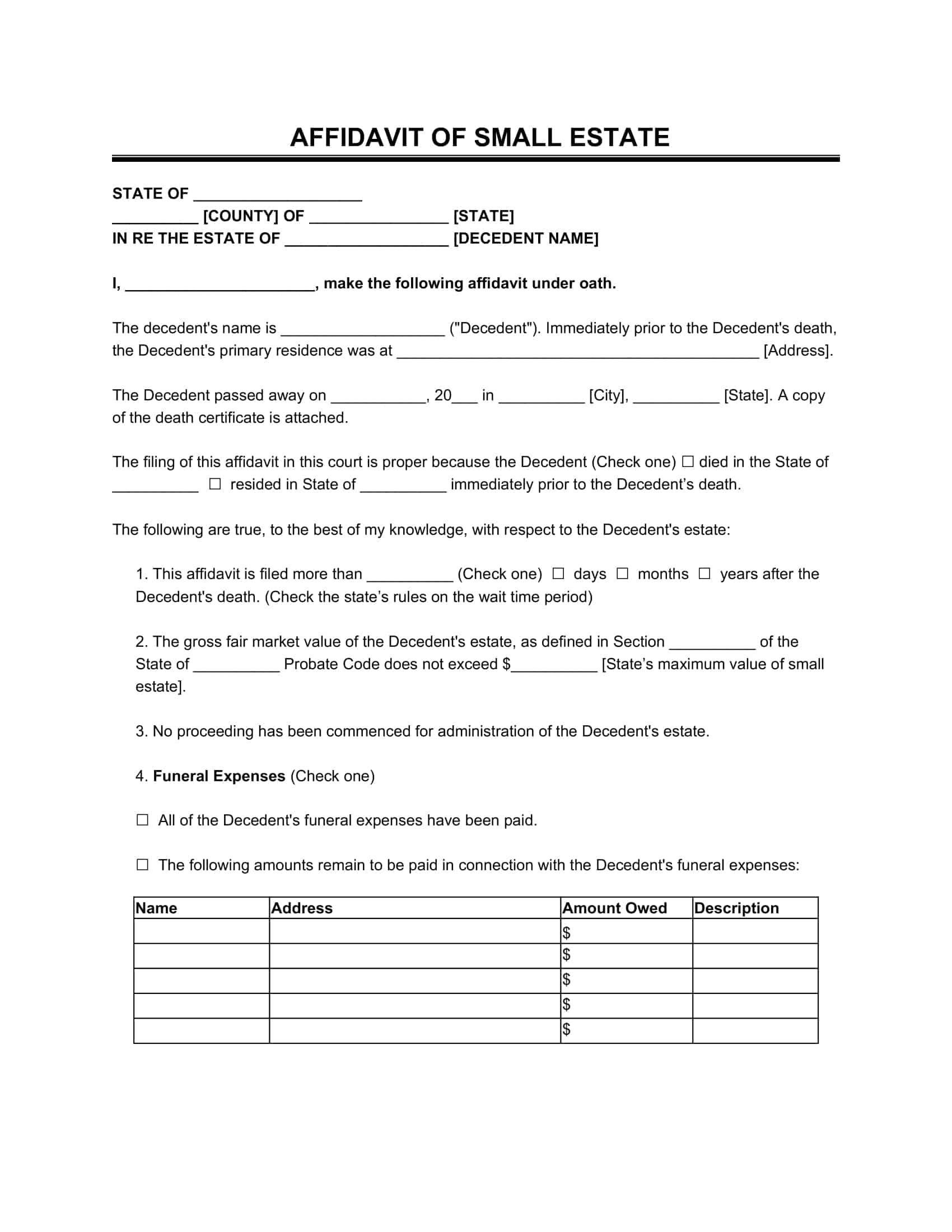

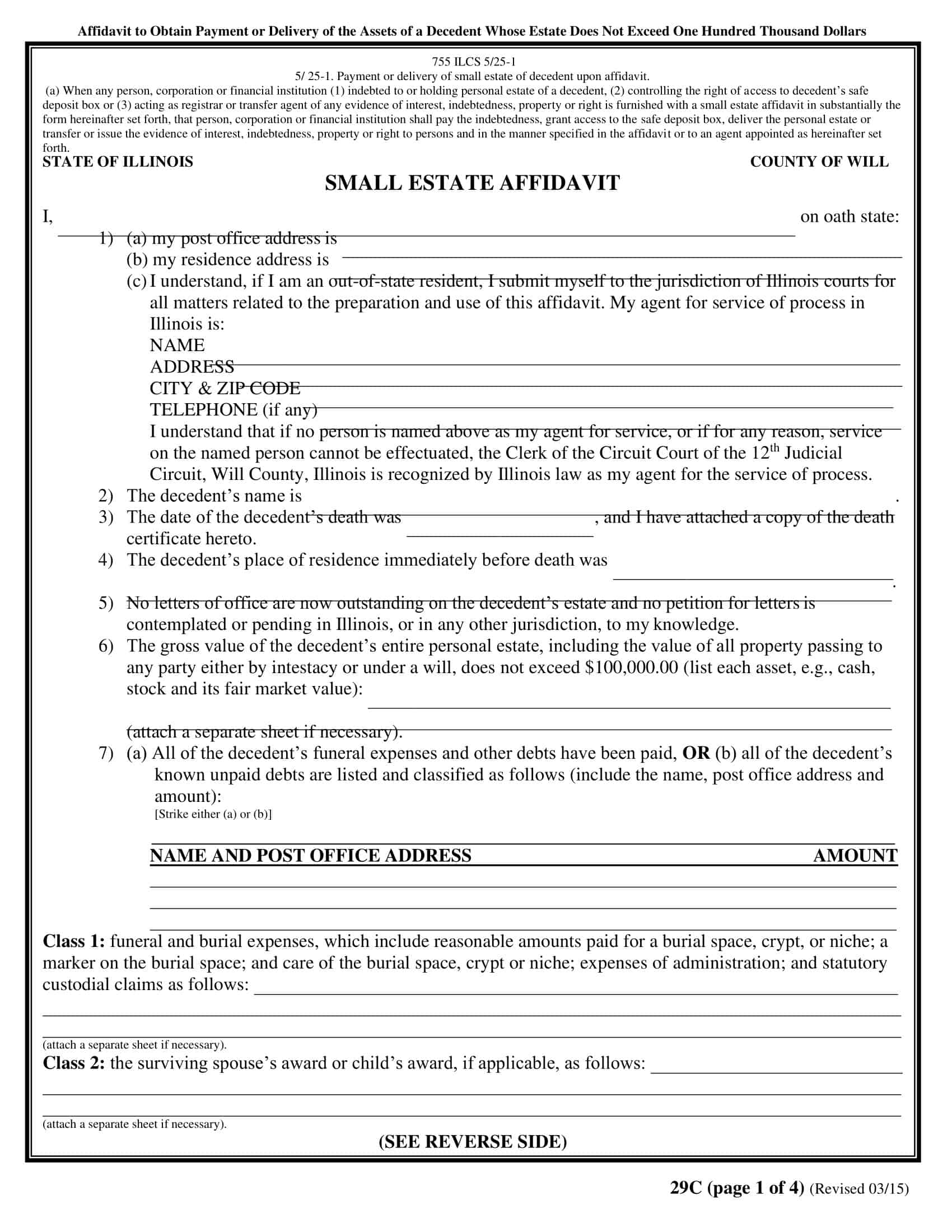

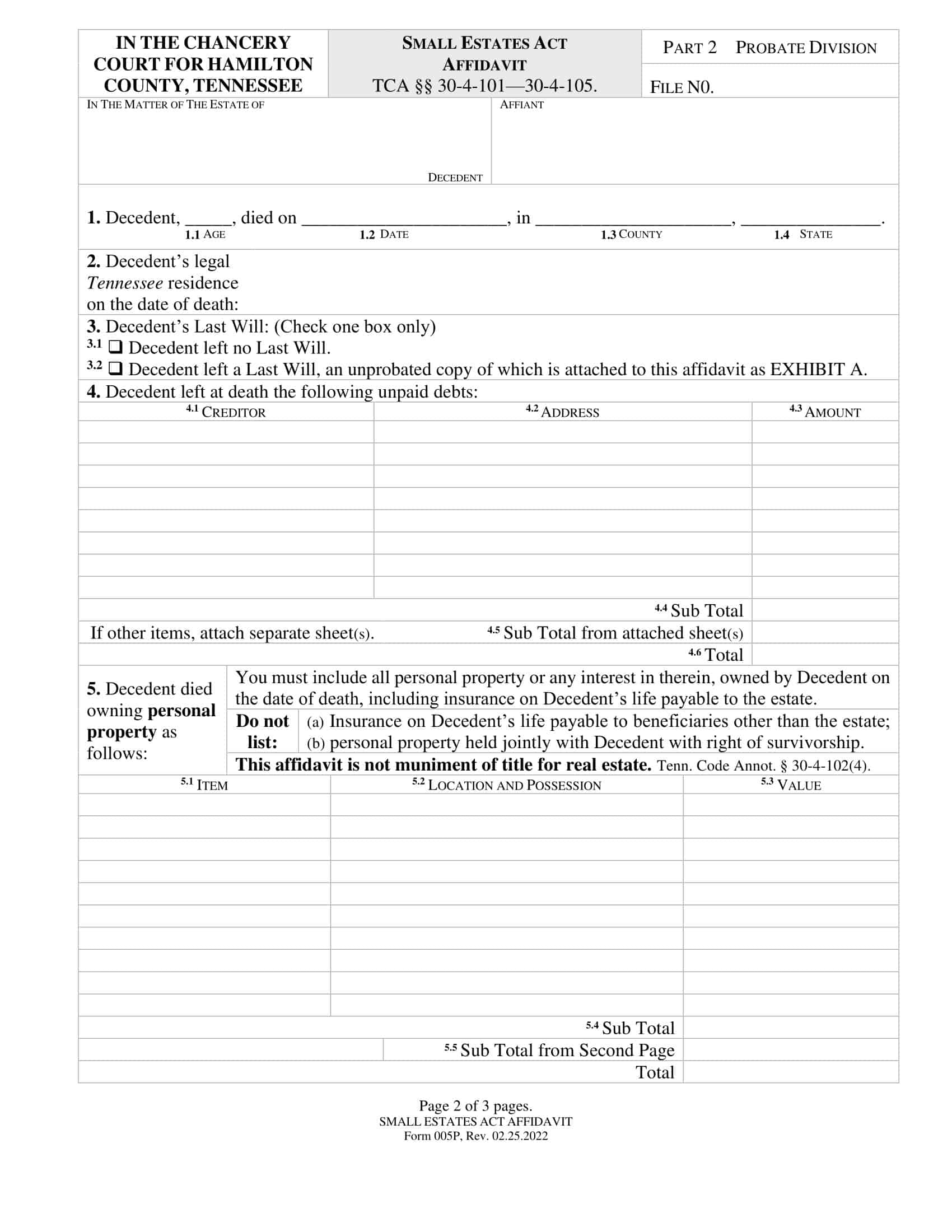

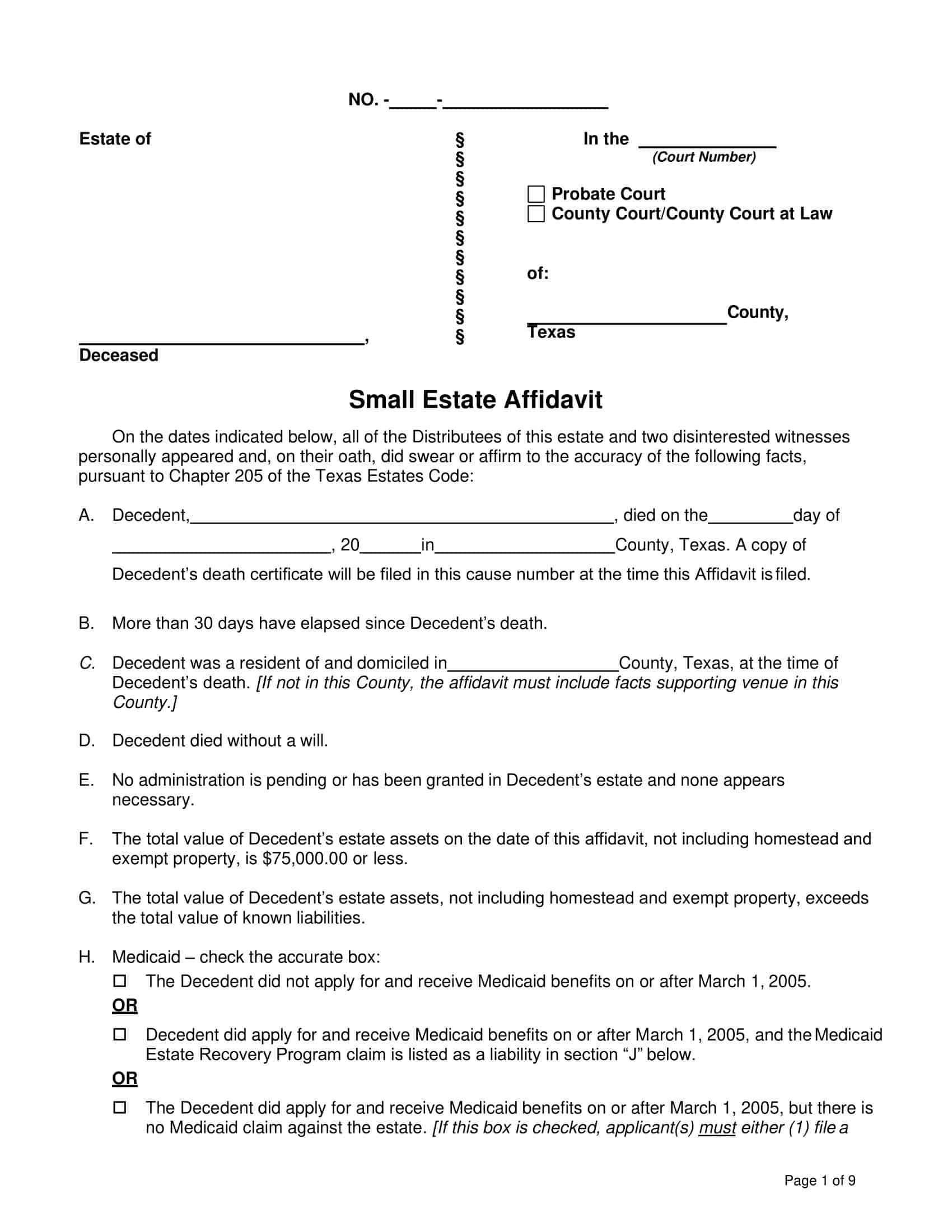

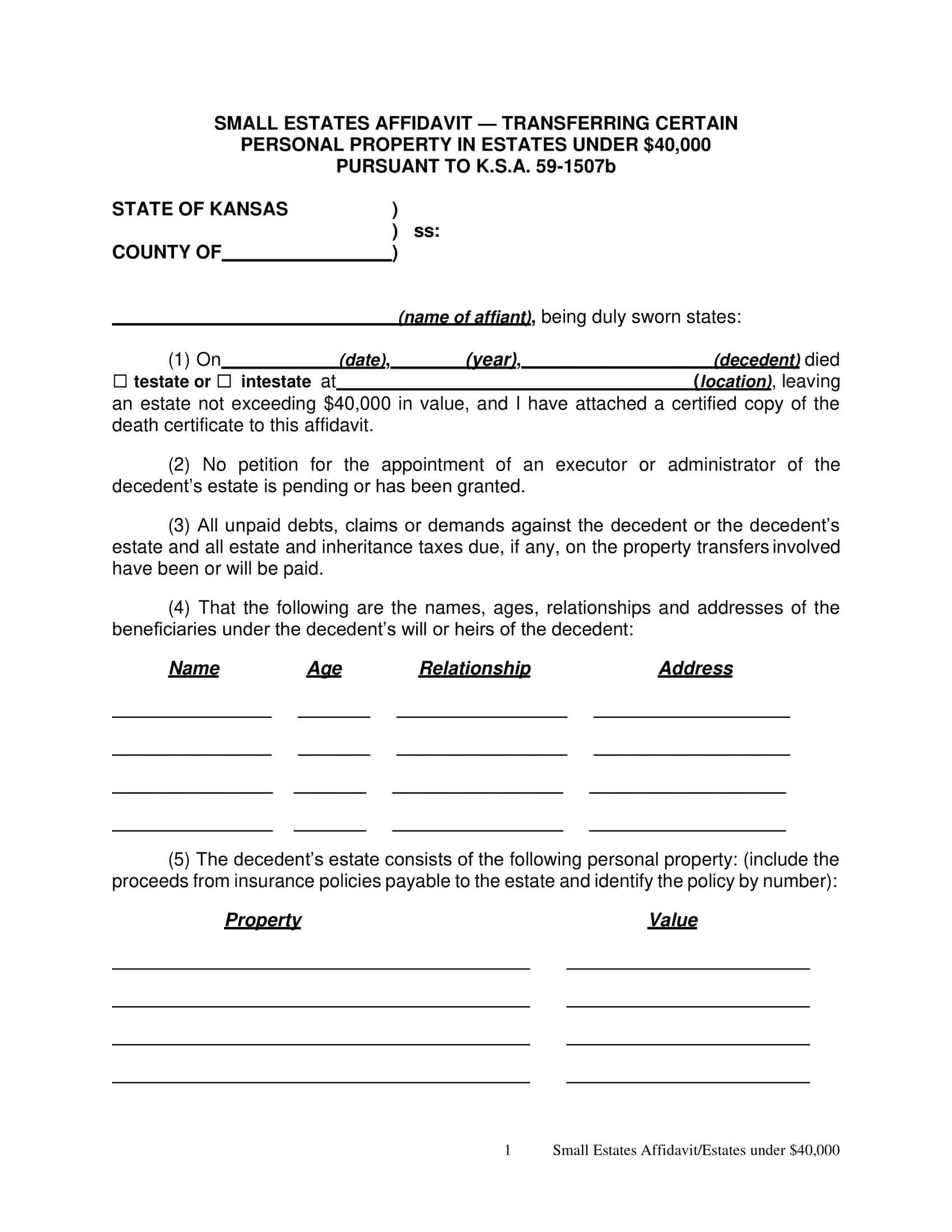

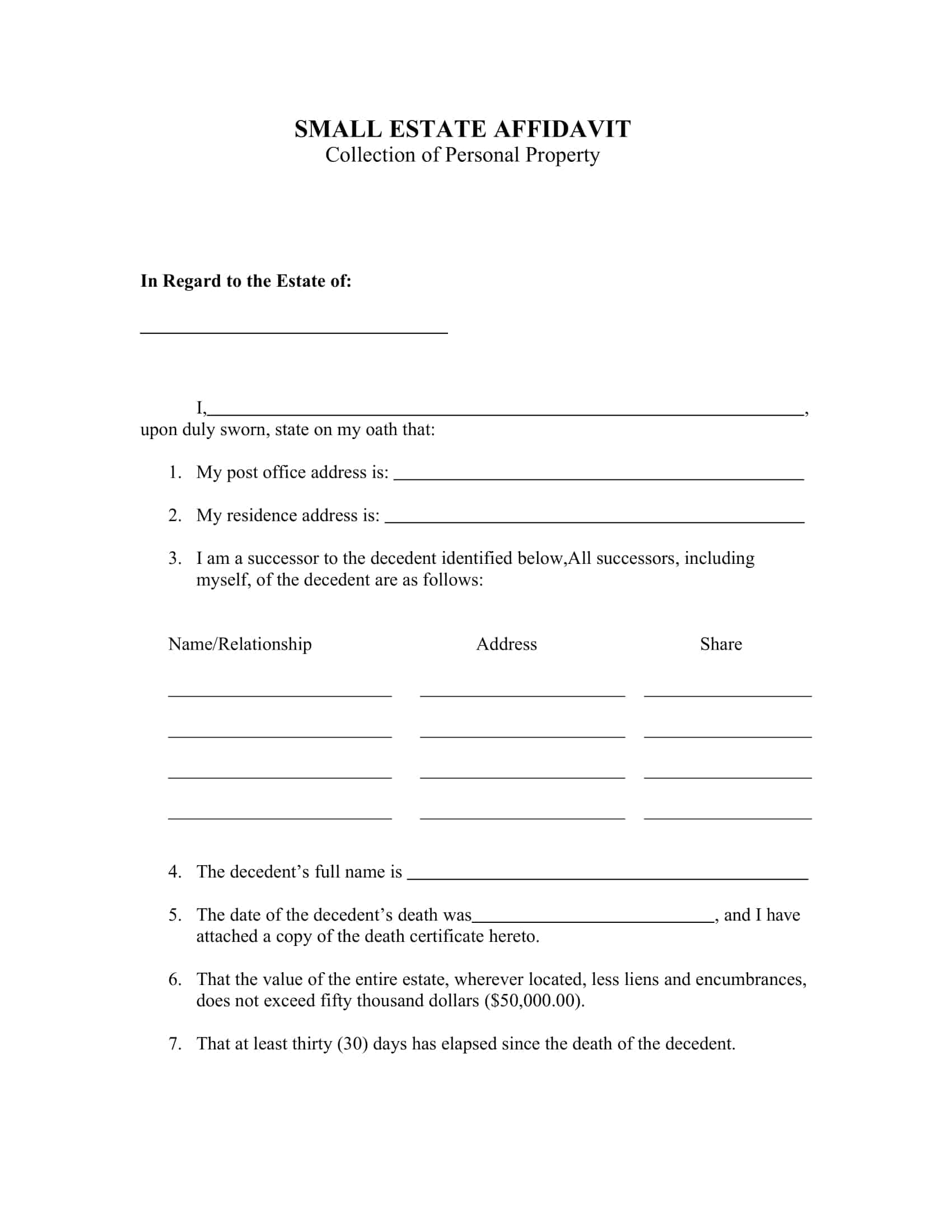

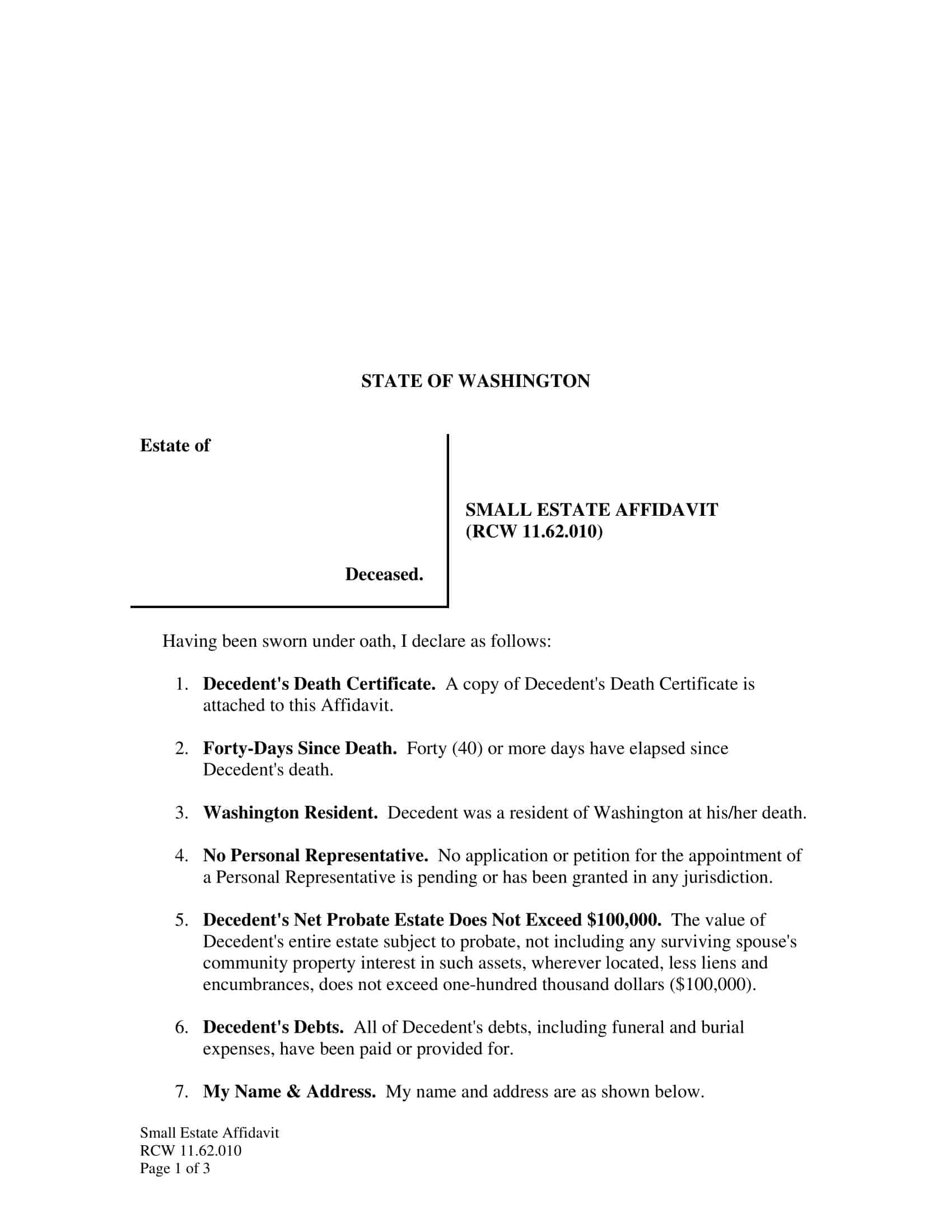

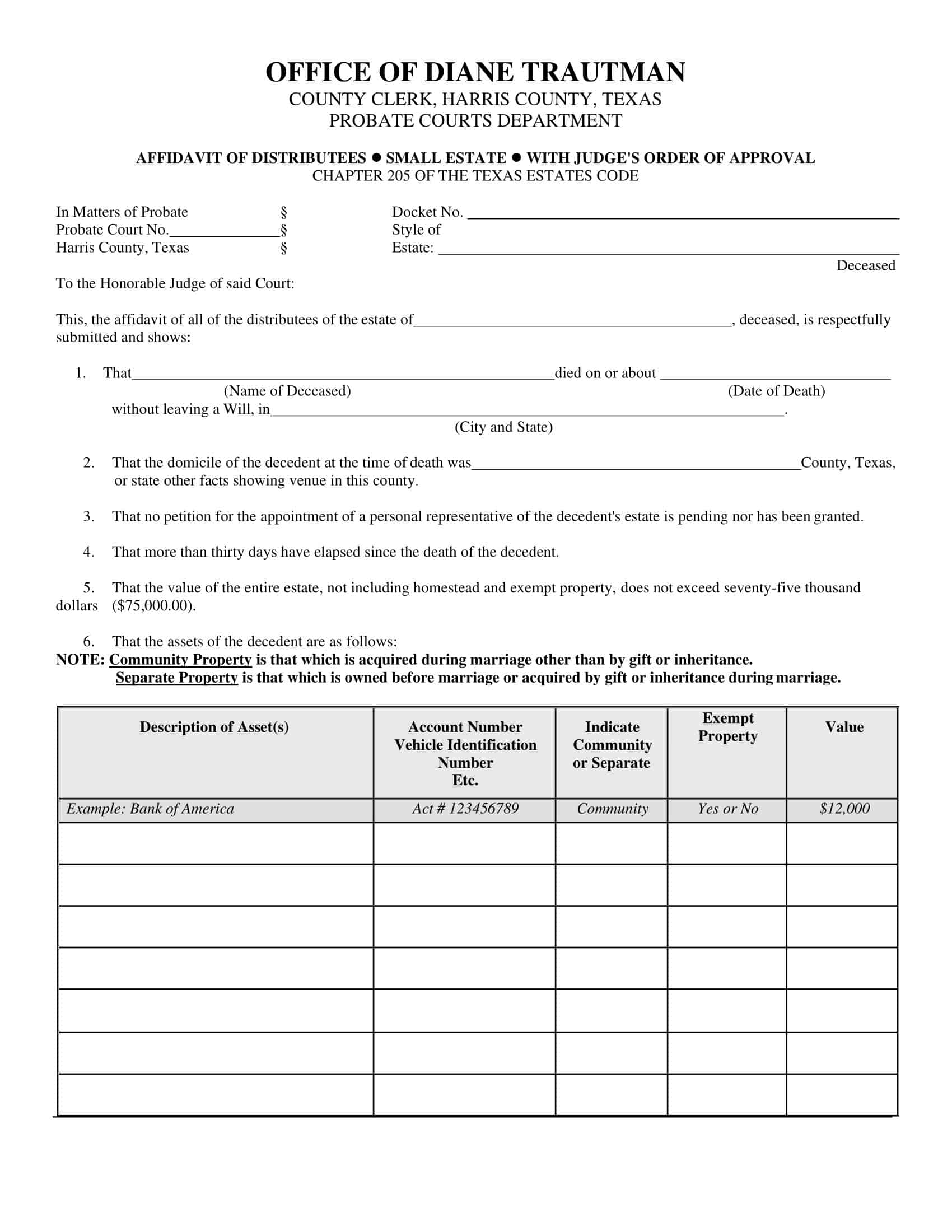

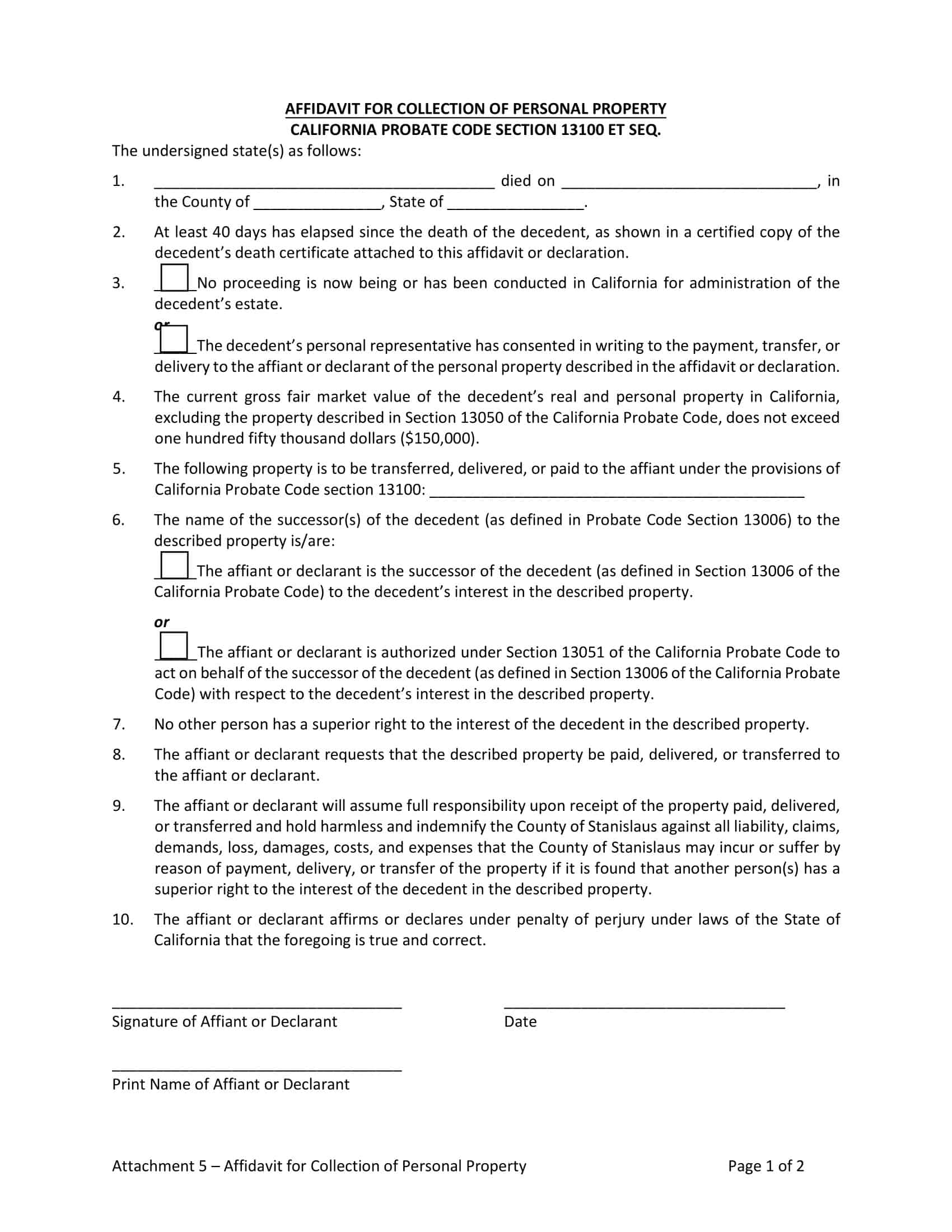

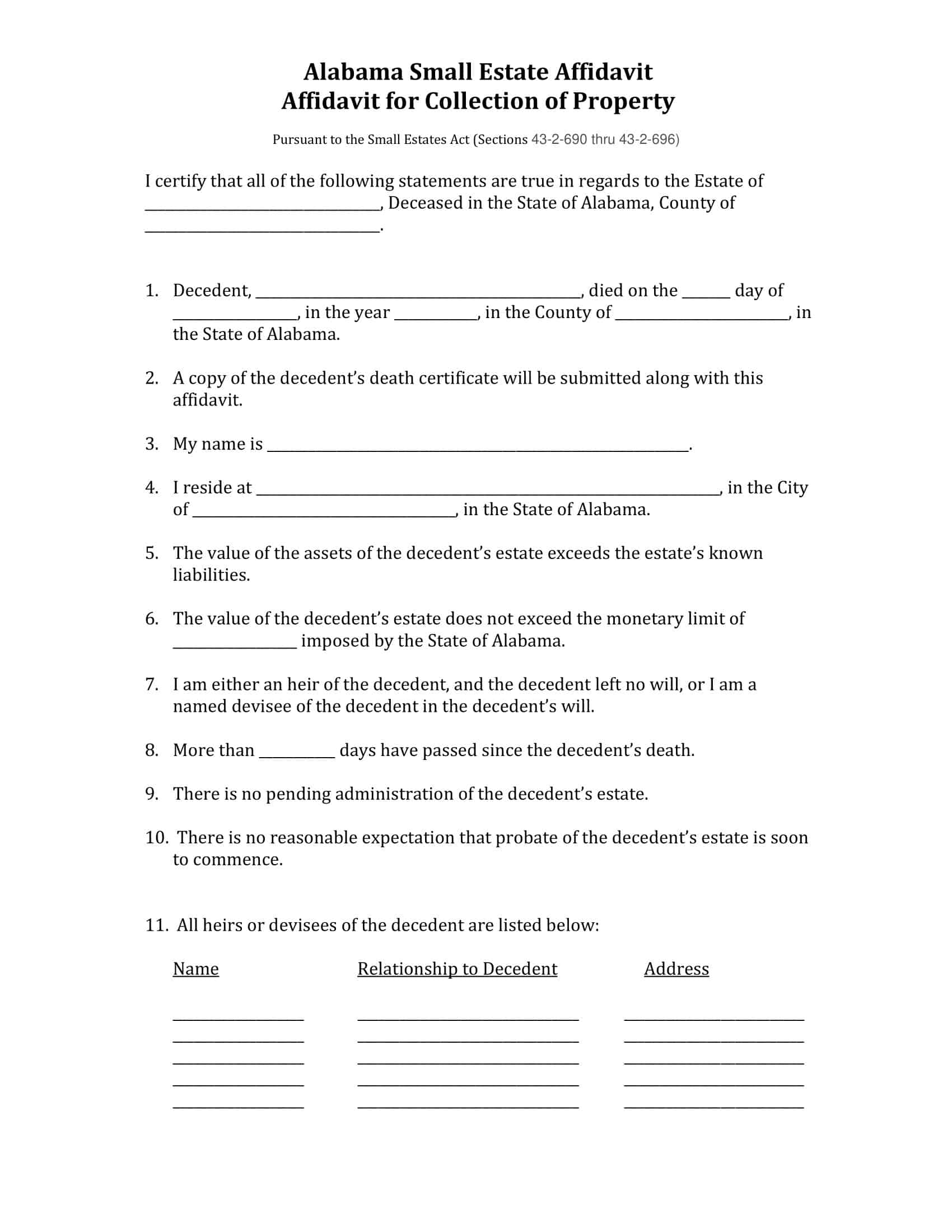

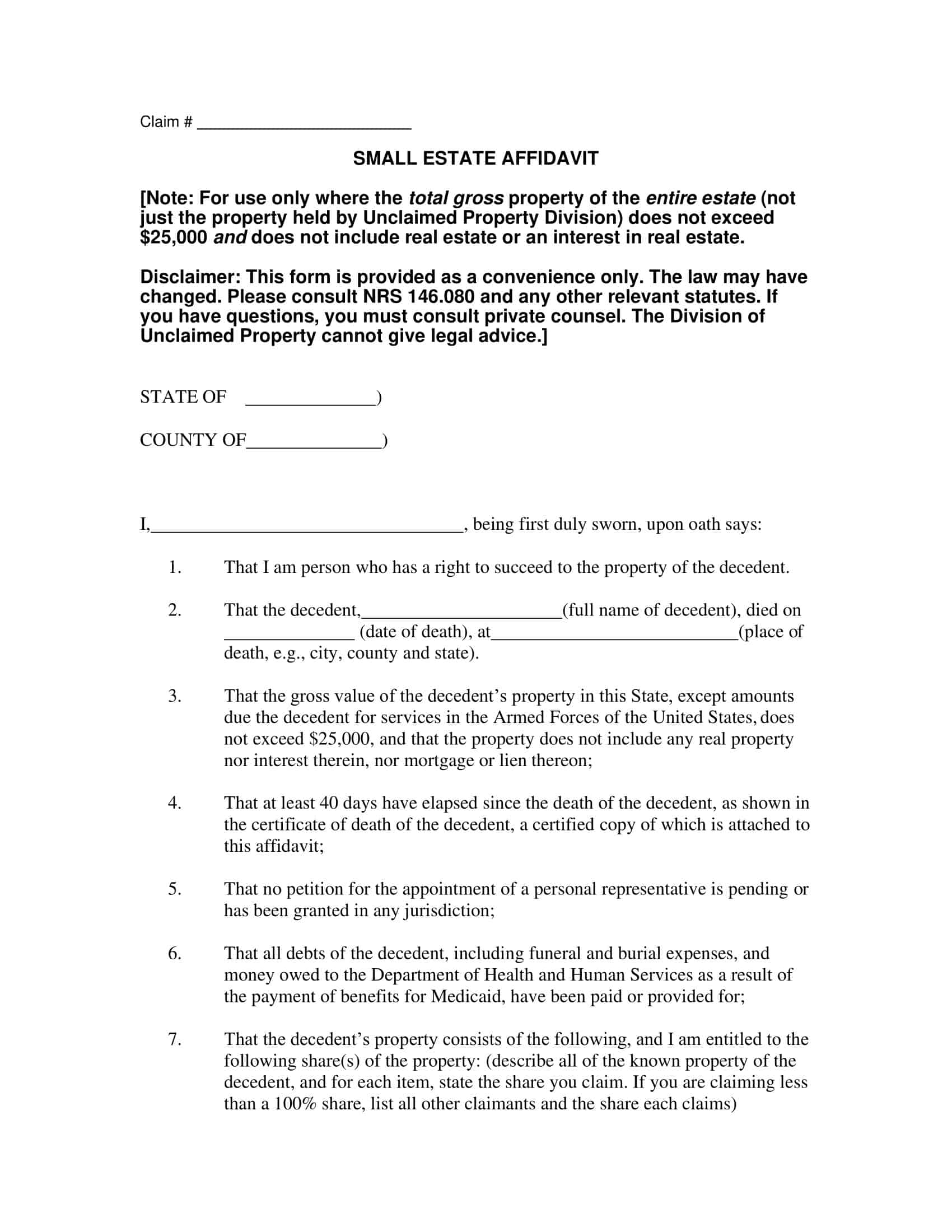

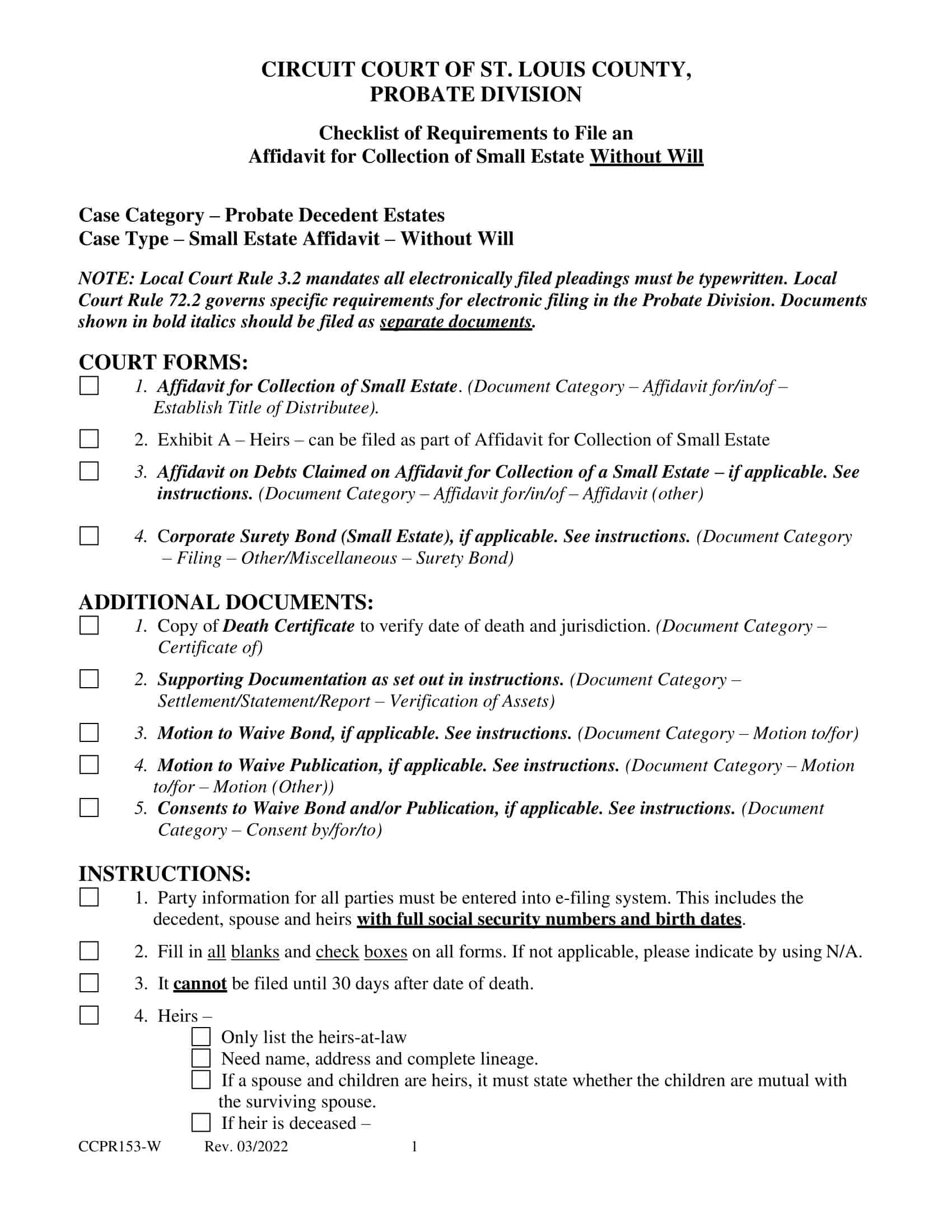

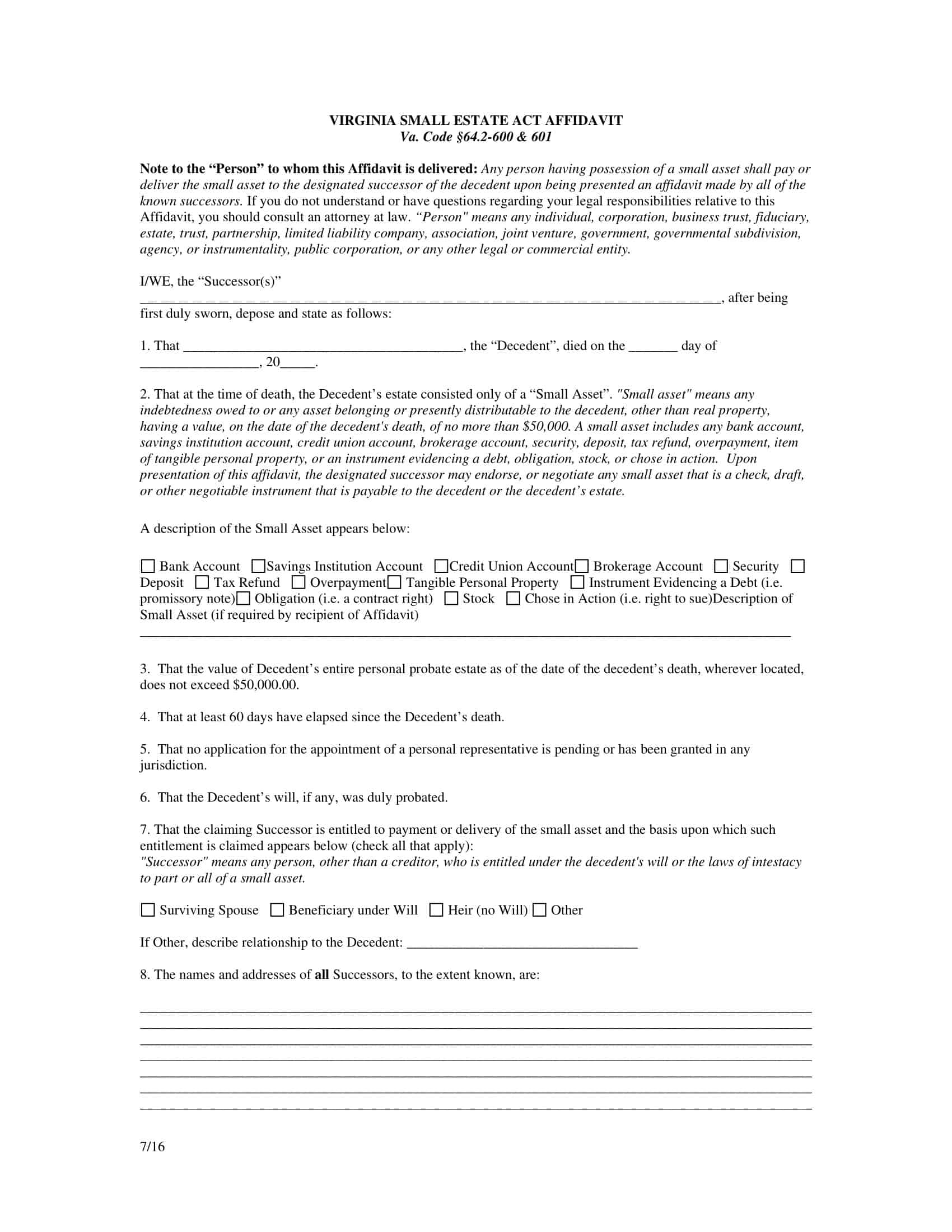

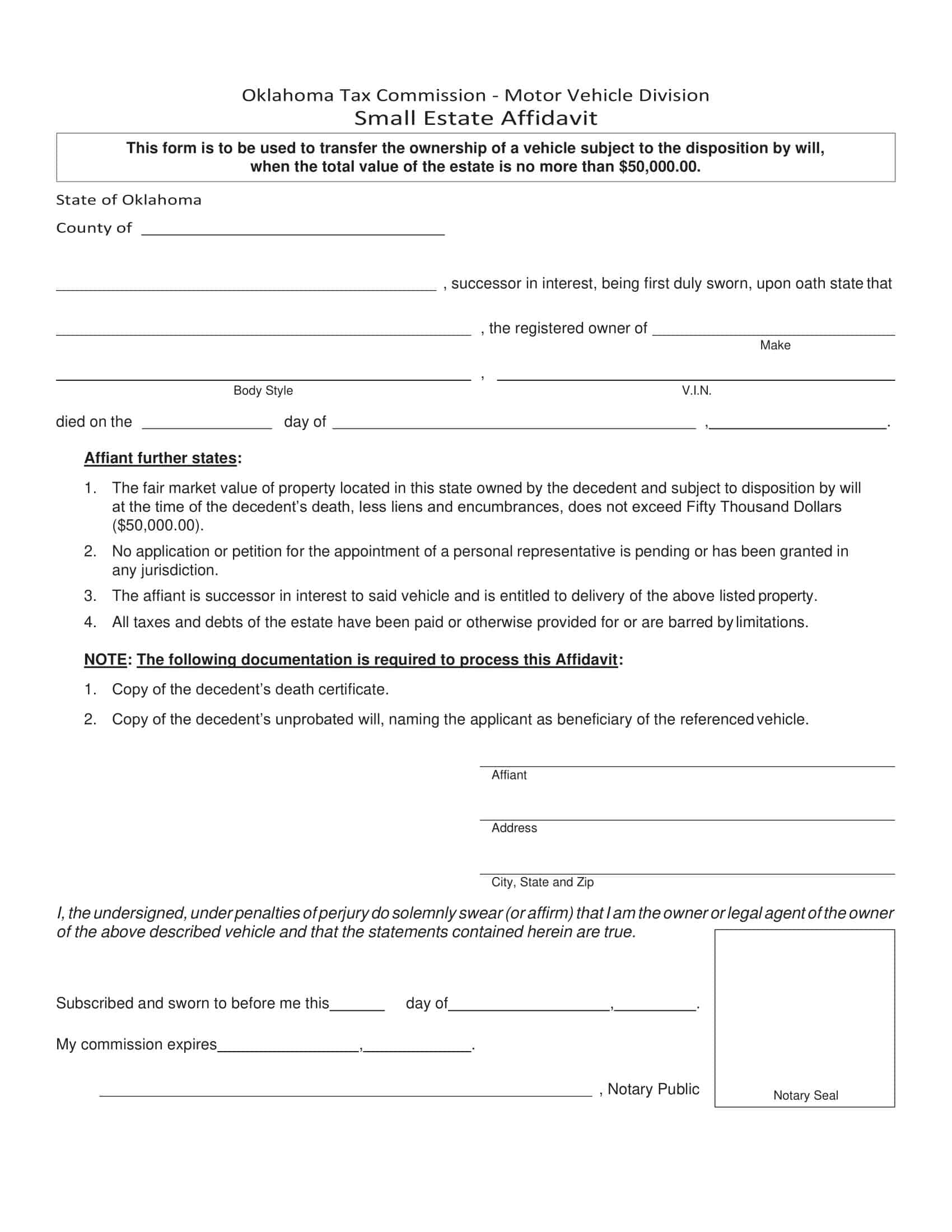

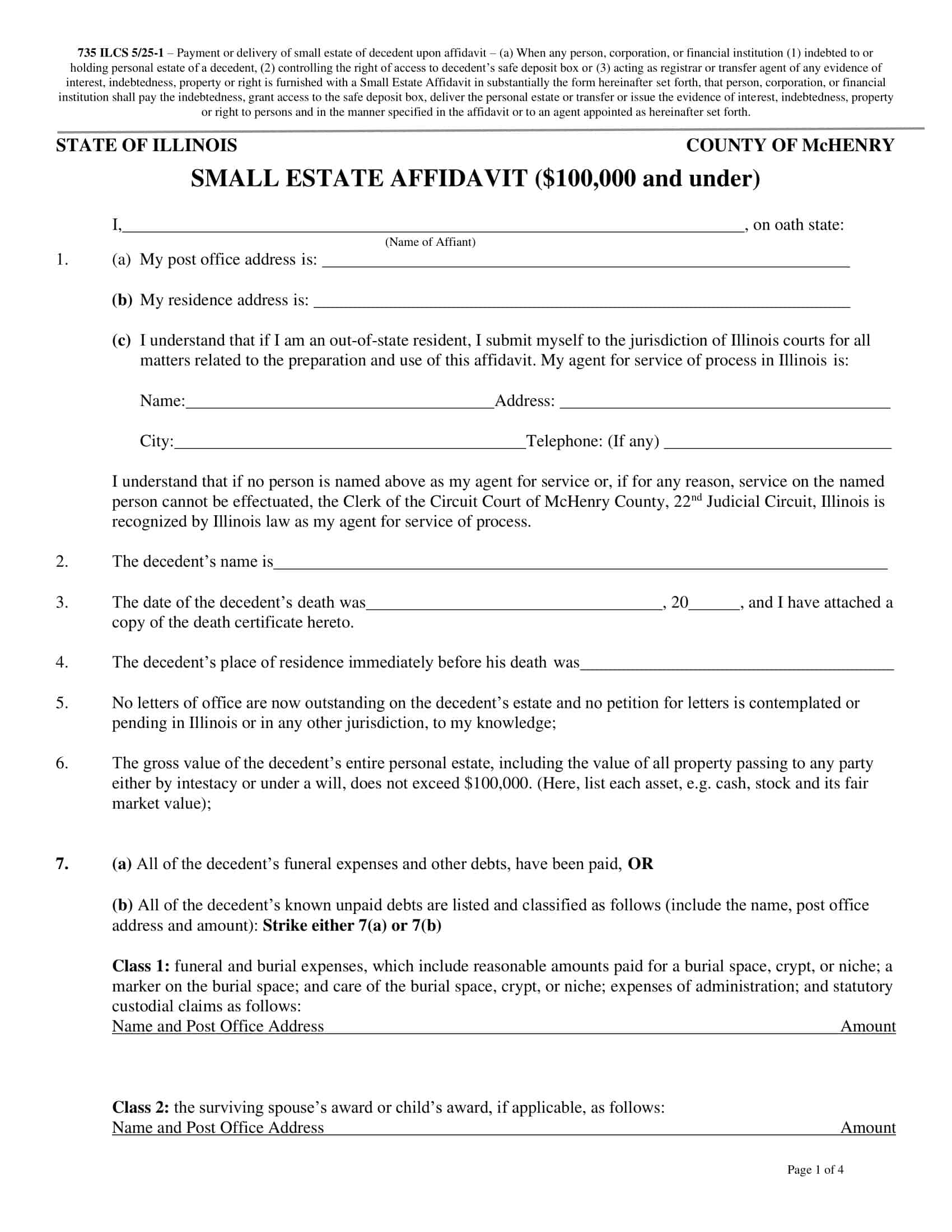

Small Estate Affidavit Templates

A small estate affidavit is a crucial legal document that aids in the efficient and streamlined settlement of smaller estates. When a person passes away, their assets and belongings are typically distributed through a complex legal process called probate. However, in cases where the estate’s value is below a certain threshold, the use of a small estate affidavit can bypass the lengthy probate process and provide a simpler alternative for transferring assets to the rightful heirs.

Small estate affidavit templates are pre-designed forms that guide individuals through the process of creating a legally valid small estate affidavit. These templates serve as a valuable resource, ensuring consistency and accuracy in documenting the essential details of the estate settlement.

It is important to note that small estate affidavit requirements may vary from jurisdiction to jurisdiction. Therefore, it is advisable to consult with a legal professional or review the specific laws and regulations in your jurisdiction before using a small estate affidavit template to ensure compliance with local requirements.

In summary, small estate affidavit templates are invaluable tools that simplify the settlement of smaller estates. By providing a structured format for capturing essential information, these templates streamline the process, save time, and minimize expenses. When used correctly and in accordance with local laws, small estate affidavit templates can facilitate a smoother estate settlement process, allowing heirs and beneficiaries to receive their rightful inheritance efficiently.

What is a small estate affidavit?

A small estate affidavit, also known as an affidavit of heirship or affidavit of small estate, is a legal document used in the probate process to transfer assets or property to the rightful heirs without going through the traditional, more complex probate proceedings. It is typically used when the deceased person’s estate falls below a certain value threshold determined by state laws.

The small estate affidavit is typically completed by an individual who is entitled to inherit assets or property from the deceased person’s estate. The affidavit provides a sworn statement that confirms the person’s relationship to the deceased and their right to inherit. It also includes a detailed inventory of the assets and their estimated values.

By filing a small estate affidavit, the person can avoid the time-consuming and expensive probate process. Instead, they can present the affidavit to the appropriate parties, such as financial institutions or government agencies, to transfer the assets directly to the heirs.

What are the essential terms to familiarize yourself with when dealing with small estate affidavits and the probate process?

When dealing with small estate affidavits and the probate process, there are several key terms that are important to understand. Here is a comprehensive list of terms:

Small Estate: A small estate refers to an estate with a total value that falls below a certain threshold determined by state law. The specific value limit varies by state and is a crucial factor in determining if a small estate affidavit can be used.

Affidavit: An affidavit is a written statement made under oath, typically witnessed or notarized, that presents facts or information relevant to a legal matter. In the context of small estate affidavits, it is a document that outlines the heir’s relationship to the deceased and their entitlement to inherit assets.

Probate: Probate is the legal process through which a deceased person’s estate is administered and distributed to the rightful beneficiaries. It involves validating the will (if one exists), settling debts, and transferring assets to heirs. Small estate affidavits are an alternative to the formal probate process for qualifying estates.

Heir: An heir is an individual who is entitled to inherit the assets or property of a deceased person according to the laws of intestacy (when there is no will) or the provisions stated in the will.

Executor/Personal Representative: An executor, also known as a personal representative, is the person designated in a will or appointed by the court to administer the estate, carry out the terms of the will, and handle the probate process. Small estate affidavits allow heirs to bypass the need for an executor in certain situations.

Estate Inventory: The estate inventory is a comprehensive list of the deceased person’s assets, including real estate, bank accounts, investments, personal belongings, and other valuable items. It provides an overview of the estate’s value and is often required when preparing a small estate affidavit.

Value Threshold: The value threshold refers to the maximum total value of an estate that qualifies for the simplified small estate affidavit process. This threshold is determined by state law and may vary depending on the jurisdiction.

Intestate: Intestate refers to a situation in which a person dies without leaving a valid will. In such cases, state laws dictate how the deceased person’s assets will be distributed among heirs.

Notarization: Notarization is the process of having a document officially certified by a notary public, who confirms the authenticity of signatures and witnesses the signing of the affidavit. Notarization is often required for small estate affidavits to add legal validity to the document.

Transfer of Title: The transfer of title refers to the legal process of transferring ownership of property or assets from the deceased person to their rightful heirs. This transfer typically occurs after the completion of the small estate affidavit process.

How to file a small estate affidavit ?

The filing process for a small estate affidavit can vary depending on the jurisdiction and local rules. Typically, small estate affidavits are filed with the probate court or the clerk’s office in the county where the deceased person resided at the time of their death. This is often the same court where probate matters are handled.

To determine the specific location for filing a small estate affidavit, it is recommended to contact the probate court or the clerk’s office directly. They can provide you with the necessary information, including any specific forms or documentation required, filing fees, and their preferred method of submission (in-person, mail, or online).

It is important to note that each state and county may have different procedures, so it is crucial to follow the guidelines provided by the local authorities to ensure that your small estate affidavit is filed correctly.

How much does a small estate affidavit cost?

The costs associated with a small estate affidavit can vary widely depending on the jurisdiction, specific requirements, and local regulations. Filing fees can range from nominal amounts, such as $20 to $100, to higher fees of several hundred dollars or more in some cases. Publication fees, if required, can range from $50 to $200 or more. Notary fees typically range from $5 to $50, depending on the location and notary’s rates.

It is essential to note that these figures are approximate and may not accurately reflect the costs in your specific jurisdiction. To obtain the most accurate and up-to-date information on the costs associated with a small estate affidavit in your area, it is best to directly contact the probate court or clerk’s office in the county where the filing will take place. They can provide you with precise details regarding any applicable fees and costs.

When is a small estate affidavit needed?

A small estate affidavit is typically needed in situations where the value of a deceased person’s estate falls below a certain threshold determined by state law. The specific threshold can vary by jurisdiction. Generally, a small estate affidavit is used as an alternative to the formal probate process for estates that meet the criteria.

Here are some common situations where a small estate affidavit may be needed:

Small Estate Value: When the total value of the deceased person’s estate, including assets and property, is below the threshold set by state law, a small estate affidavit may be utilized. The purpose is to simplify and expedite the transfer of assets to the rightful heirs.

No Probate Proceedings: If the deceased person’s estate does not require formal probate proceedings due to its small size, a small estate affidavit can be used to bypass the lengthy and complex probate process.

Immediate Access to Assets: A small estate affidavit can be used to grant heirs immediate access to assets, such as bank accounts, vehicles, or personal belongings, without the need for court intervention.

Simplified Transfer of Property: When transferring real estate or other titled property to heirs, a small estate affidavit can facilitate the transfer process without the need for a formal deed or probate court involvement.

It is important to note that the availability and specific requirements for a small estate affidavit can vary by jurisdiction. It is advisable to consult with the probate court or seek legal advice to determine if a small estate affidavit is appropriate and applicable in your specific situation.

How to write a small estate affidavit

Here is a step-by-step guide on how to write a small estate affidavit:

Step 1: Understand the requirements

Familiarize yourself with the specific requirements and guidelines for small estate affidavits in your jurisdiction. These can vary, so it’s important to know the rules and limitations that apply.

Step 2: Gather necessary information

Collect all the essential information about the deceased person, their assets, and their heirs. This includes their full legal name, date of death, and a comprehensive inventory of their assets and property.

Step 3: Begin with a heading

Create a heading at the top of the document that clearly states it is a “Small Estate Affidavit” and includes the deceased person’s name and the jurisdiction where the affidavit is being filed.

Step 4: Introduce the affiant

Identify yourself as the affiant, the person making the statement, and provide your full legal name and contact information.

Step 5: Establish relationship to the deceased

State your relationship to the deceased person and how you are legally entitled to act on behalf of their estate. Include relevant details, such as being an heir, spouse, or personal representative.

Step 6: Describe the deceased and their assets

Provide essential information about the deceased person, such as their full name, date of birth, and date of death. Outline the assets and property included in the estate, listing them in detail.

Step 7: Confirm the value of the estate

Indicate the estimated total value of the estate. Ensure that it falls below the threshold required for a small estate affidavit according to your jurisdiction’s laws.

Step 8: Sworn statement

Include a sworn statement affirming that the information provided in the affidavit is true and accurate to the best of your knowledge. This statement should be made under penalty of perjury, so it is essential to be truthful and honest.

Step 9: Notarization

Leave space for the affidavit to be notarized. Once you have completed the document, sign it in the presence of a notary public who will then notarize your signature.

Step 10: Attach supporting documents

Include any necessary supporting documents required by your jurisdiction, such as a death certificate, asset documentation, or other legal proof related to the estate.

Step 11: Submit the affidavit

File the completed small estate affidavit with the appropriate probate court or clerk’s office in the county where the deceased person resided. Follow the specific filing instructions and pay any required filing fees.

Unlocking the Benefits of Small Estate Affidavits: Avoiding Probate Issues Made Easier

Small estate affidavits can indeed be a valuable tool in avoiding probate issues. When the value of an estate falls below a certain threshold, as determined by state laws, using a small estate affidavit can provide a simplified and expedited process for transferring assets to the rightful heirs. By utilizing this legal document, individuals can bypass the often lengthy and costly probate proceedings.

One of the main advantages of small estate affidavits is their ability to grant immediate access to assets to the rightful beneficiaries without the need for court intervention. This can be particularly beneficial for family members who were financially dependent on the deceased person and need prompt access to funds or property.

Moreover, small estate affidavits offer a streamlined approach to transferring property, including real estate, by eliminating the need for a formal deed or involving the probate court. This can save significant time and expense for the involved parties.

It’s important to note that the availability and requirements of small estate affidavits may vary by jurisdiction. Therefore, it is essential to consult with the probate court or seek legal advice specific to your state’s laws to ensure compliance and determine if a small estate affidavit is the appropriate solution to avoid probate issues.

Overall, small estate affidavits can provide a convenient and cost-effective alternative to probate for smaller estates, allowing for a smoother transfer of assets and mitigating potential complications associated with the probate process.

FAQs

Do I need an attorney to prepare a small estate affidavit?

In many cases, hiring an attorney is not required to prepare a small estate affidavit. The document can be created by the affiant, following the specific guidelines and requirements of their jurisdiction. However, consulting with an attorney can provide guidance and ensure compliance with the applicable laws.

How is a small estate affidavit filed?

To file a small estate affidavit, the completed document, along with any supporting documentation, must be submitted to the probate court or the clerk’s office in the county where the deceased person resided. The affiant will typically need to pay any required filing fees and follow the specific filing instructions provided by the court.

What happens after a small estate affidavit is filed?

Once a small estate affidavit is filed and approved by the court, the assets and property listed in the affidavit can be transferred to the rightful heirs without undergoing the formal probate process. The affiant may need to provide a certified copy of the affidavit to relevant parties, such as financial institutions, to facilitate the transfer of assets.

How does a small estate affidavit differ from probate?

A small estate affidavit is an alternative to the formal probate process. While probate involves court supervision and can be time-consuming and costly, a small estate affidavit provides a streamlined approach, allowing for the transfer of assets without the involvement of the probate court.

What assets can be transferred using a small estate affidavit?

Generally, a wide range of assets can be transferred using a small estate affidavit, including bank accounts, personal property, vehicles, and certain types of real estate. However, it is important to note that some assets may have specific requirements or restrictions, and certain assets may not be eligible for transfer using a small estate affidavit. Consulting with an attorney or reviewing state laws can provide clarification on asset eligibility.

Can a small estate affidavit be used if there is a will?

Yes, a small estate affidavit can be used even if there is a valid will. If the estate’s value falls below the specified threshold, the small estate affidavit can serve as an efficient means to transfer assets to the rightful beneficiaries without the need for formal probate proceedings.

How long does it take to process a small estate affidavit?

The processing time for a small estate affidavit can vary depending on factors such as the jurisdiction, court workload, and completeness of the submitted documents. Generally, it can take several weeks to a few months for the court to review and approve the affidavit. It is advisable to inquire with the probate court or clerk’s office for an estimate of the processing time in your specific jurisdiction.

Are small estate affidavits recognized in all states?

Small estate affidavits are recognized in many states, but specific laws and requirements may vary. Each state has its own statutes and regulations regarding small estate affidavits, including the value threshold and specific procedures to be followed. It is important to consult the laws of the relevant state to ensure compliance.

Can a small estate affidavit be contested?

In certain circumstances, a small estate affidavit can be contested if there are valid reasons to dispute the transfer of assets. However, the grounds for contesting may vary by jurisdiction, and it is generally more challenging to contest a small estate affidavit compared to a formal probate process. Consulting with an attorney can provide guidance on contesting procedures and requirements.

![Free Printable Offer to Purchase Real Estate Form Templates [PDF, Word] 1 Offer To Purchase Real Estate](https://www.typecalendar.com/wp-content/uploads/2023/05/Offer-To-Purchase-Real-Estate-1-150x150.jpg)

![Free Printable Roommate Agreement Templates [Word, PDF] 2 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 3 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)