An income verification letter is a document used by individuals, lenders, or other organizations to confirm an individual’s employment and income status. This letter is typically requested for a variety of purposes, such as loan applications, rental applications, or verification of employment for insurance purposes.

It is a formal, written statement from an employer that includes the individual’s job title, salary, and length of employment. An effective income verification letter should be clear, concise, and include all relevant information to meet the requestor’s needs.

Table of Contents

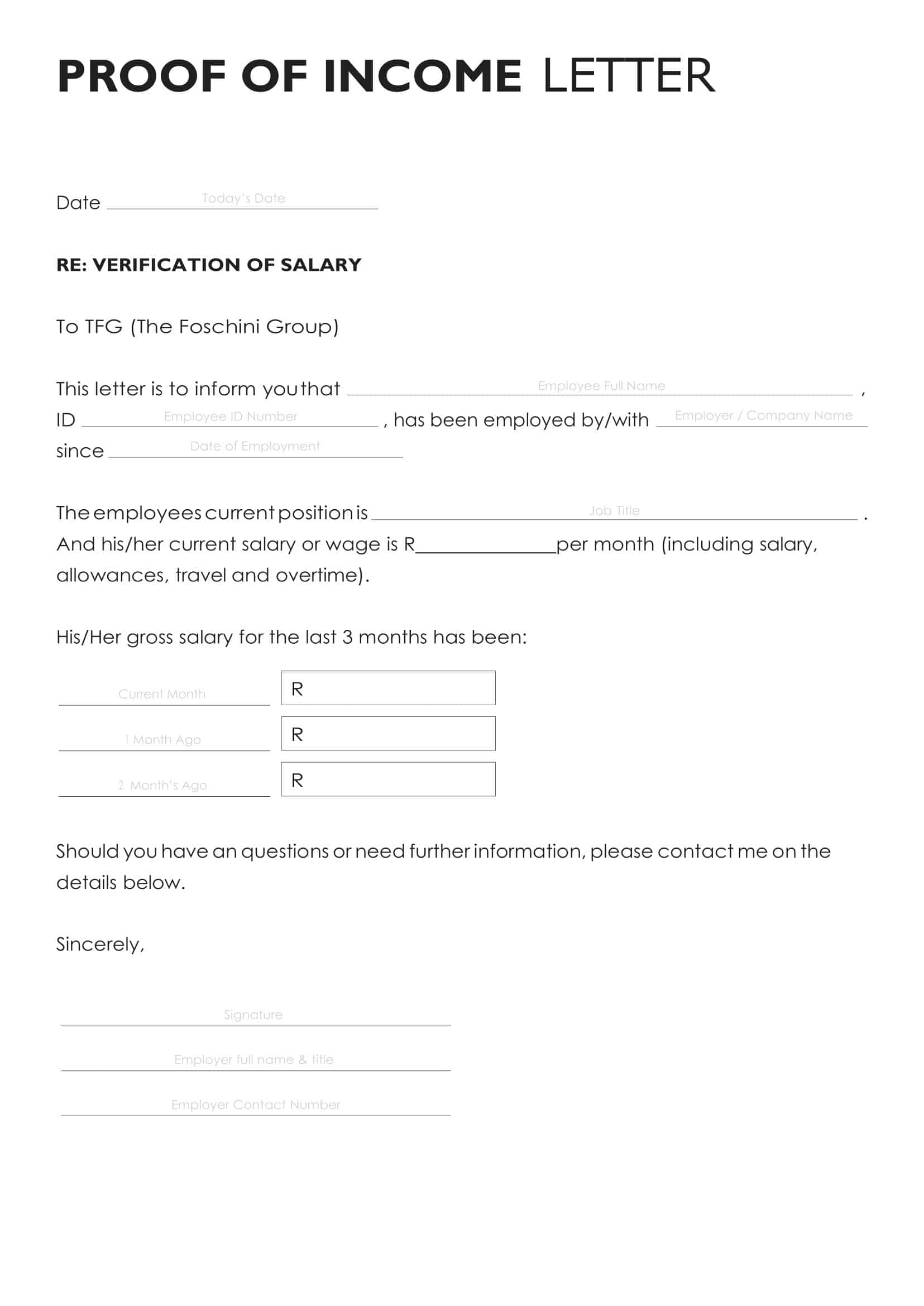

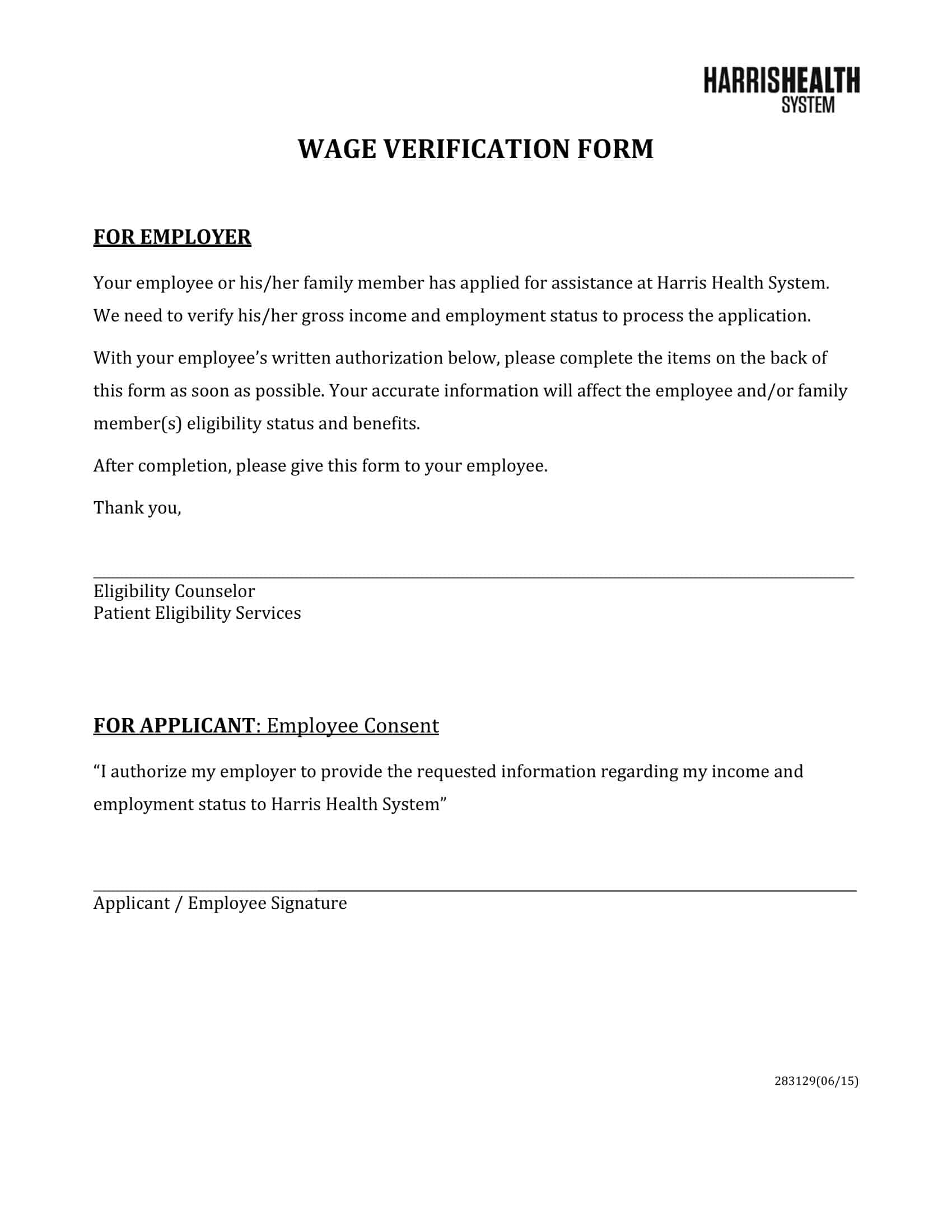

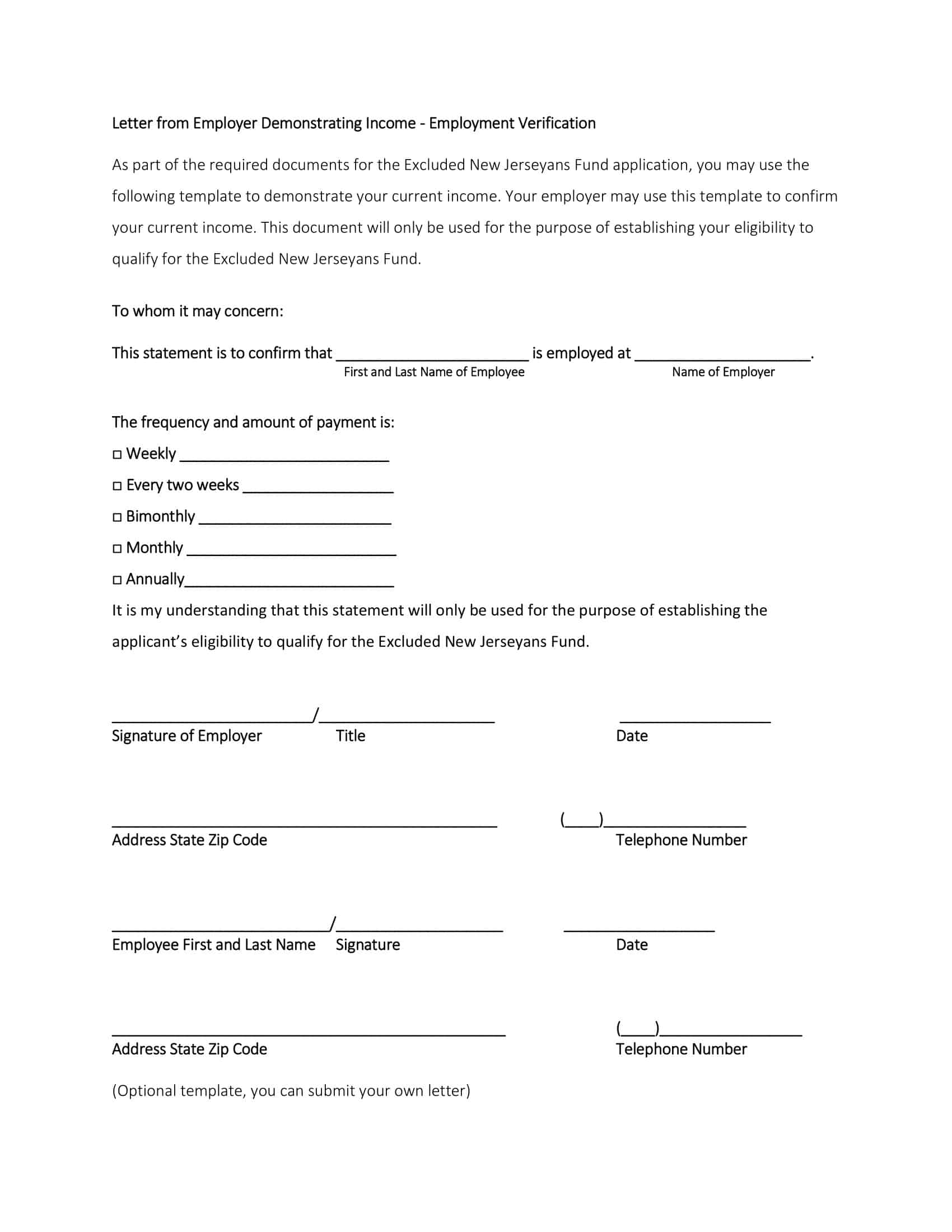

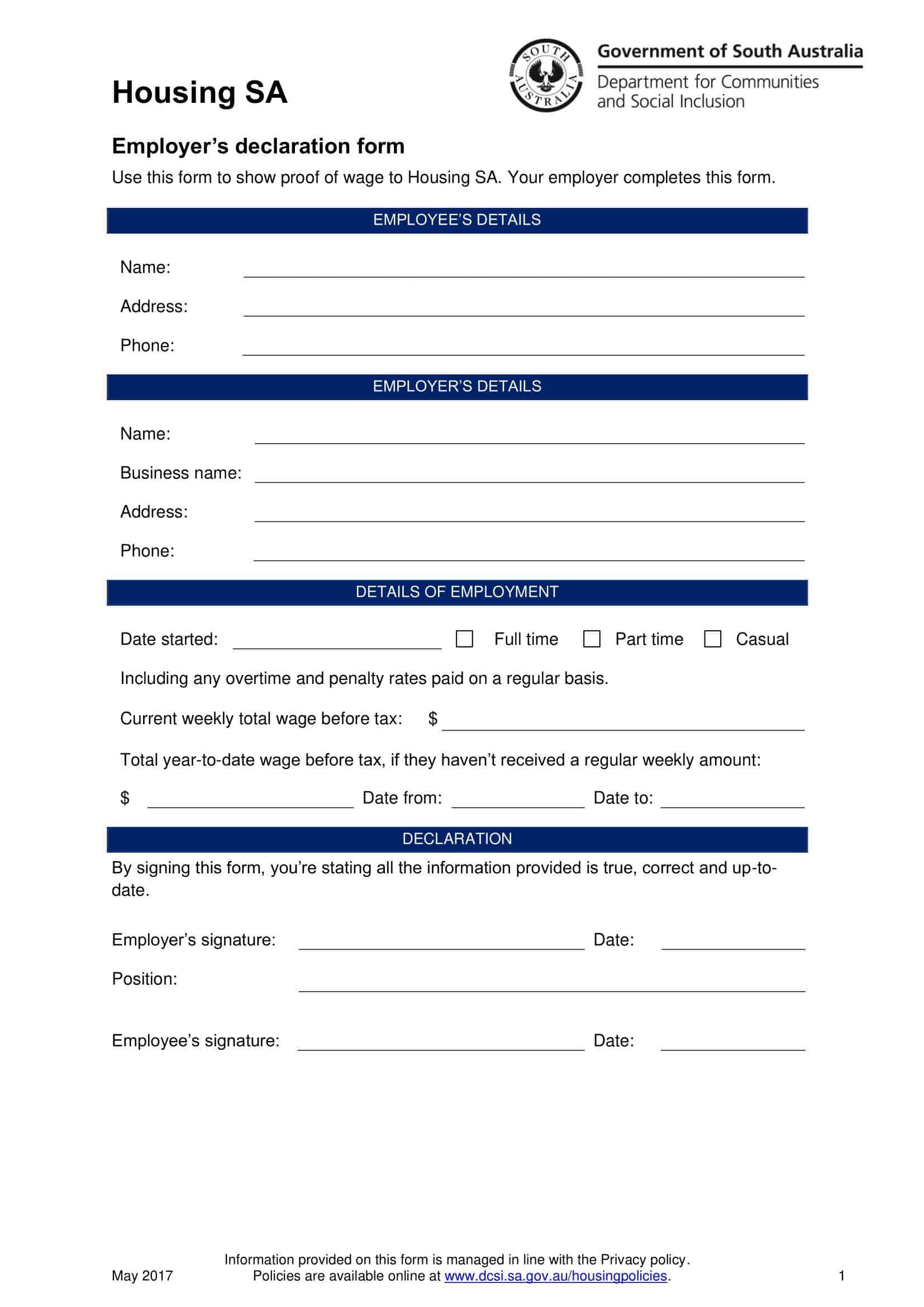

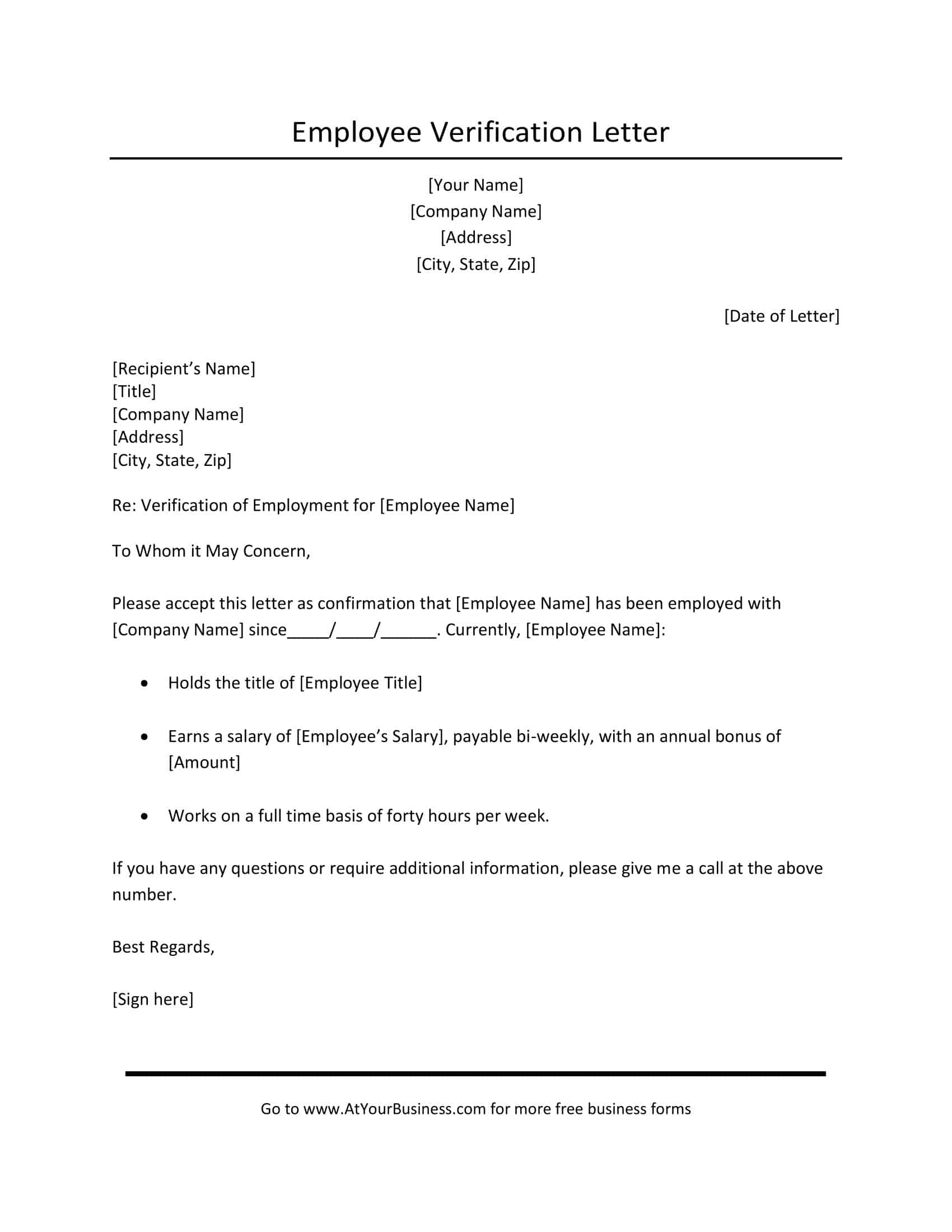

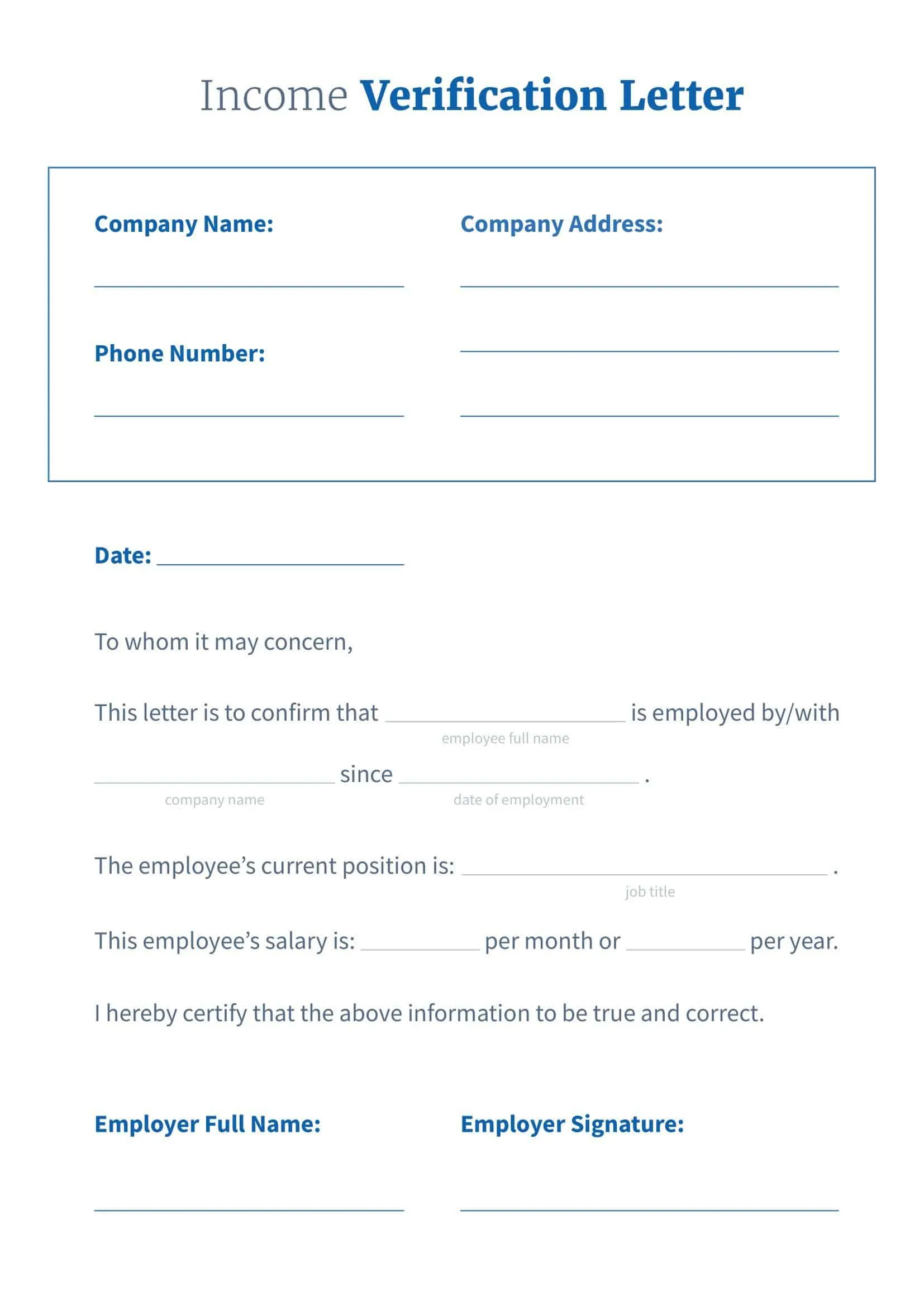

Income Verification Letter Templates

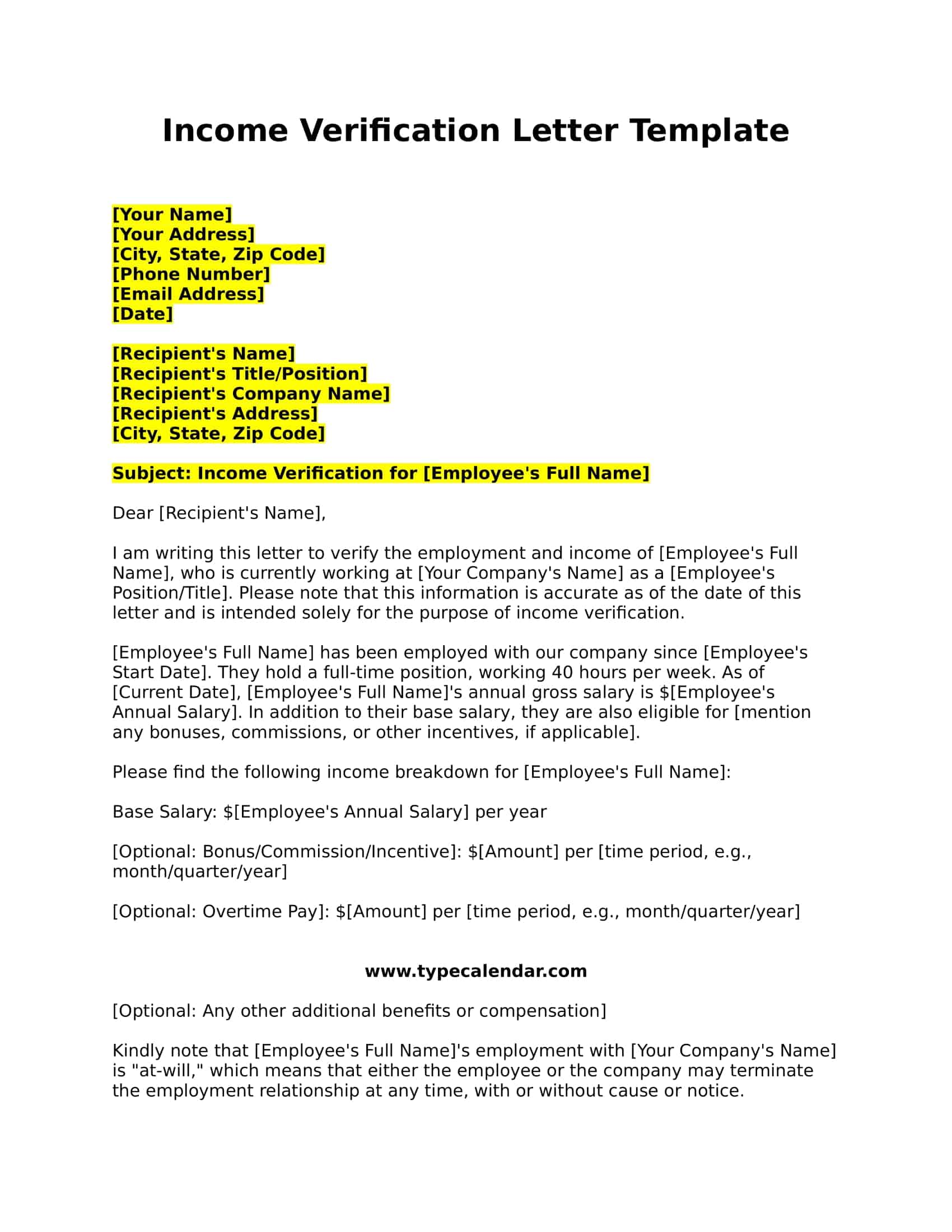

Income Verification Letter Templates are pre-designed formats used by employers, financial institutions, or other entities to provide official confirmation of an individual’s income. These templates provide a structured framework for documenting and verifying the individual’s income details, employment status, and other relevant information required for various purposes, such as loan applications, rental agreements, or government assistance programs. Income Verification Letter Templates ensure consistency, accuracy, and professionalism in providing a credible and reliable source of income information.

Income Verification Letter Templates provide a structured and standardized approach to confirming an individual’s income. By using these templates, employers and other entities can ensure that the income verification letters are consistent, accurate, and reliable. These templates facilitate efficient communication, support documentation submission, and assist in meeting the requirements of various applications or programs that require income verification. Income Verification Letter Templates serve as valuable tools in validating income information, establishing credibility, and promoting transparency in financial transactions and agreements.

Types of income verification letters

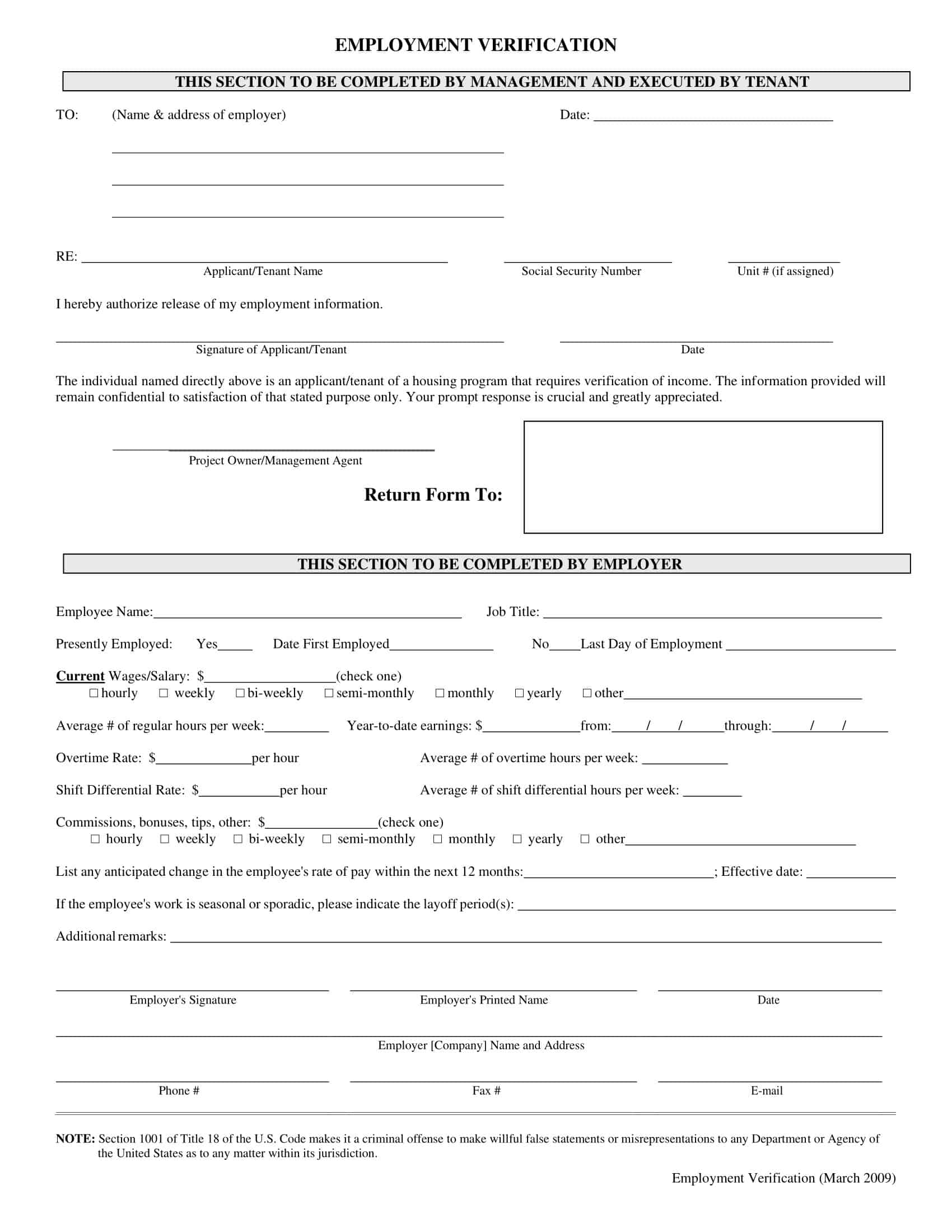

Employment Verification Letter: This letter confirms an individual’s current employment status and job title, as well as the length of time they have been employed.

Salary Verification Letter: This letter provides information on an individual’s current salary and any bonuses or commission they receive.

Self-Employment Verification Letter: This letter confirms an individual’s self-employed status, including the type of business they run and the length of time they have been self-employed.

Benefits Verification Letter: This letter verifies an individual’s eligibility for benefits such as health insurance, sick leave, and paid time off.

Income Verification Letter for Loan Application: This letter is used by lenders to confirm an individual’s income and employment status as part of the loan application process.

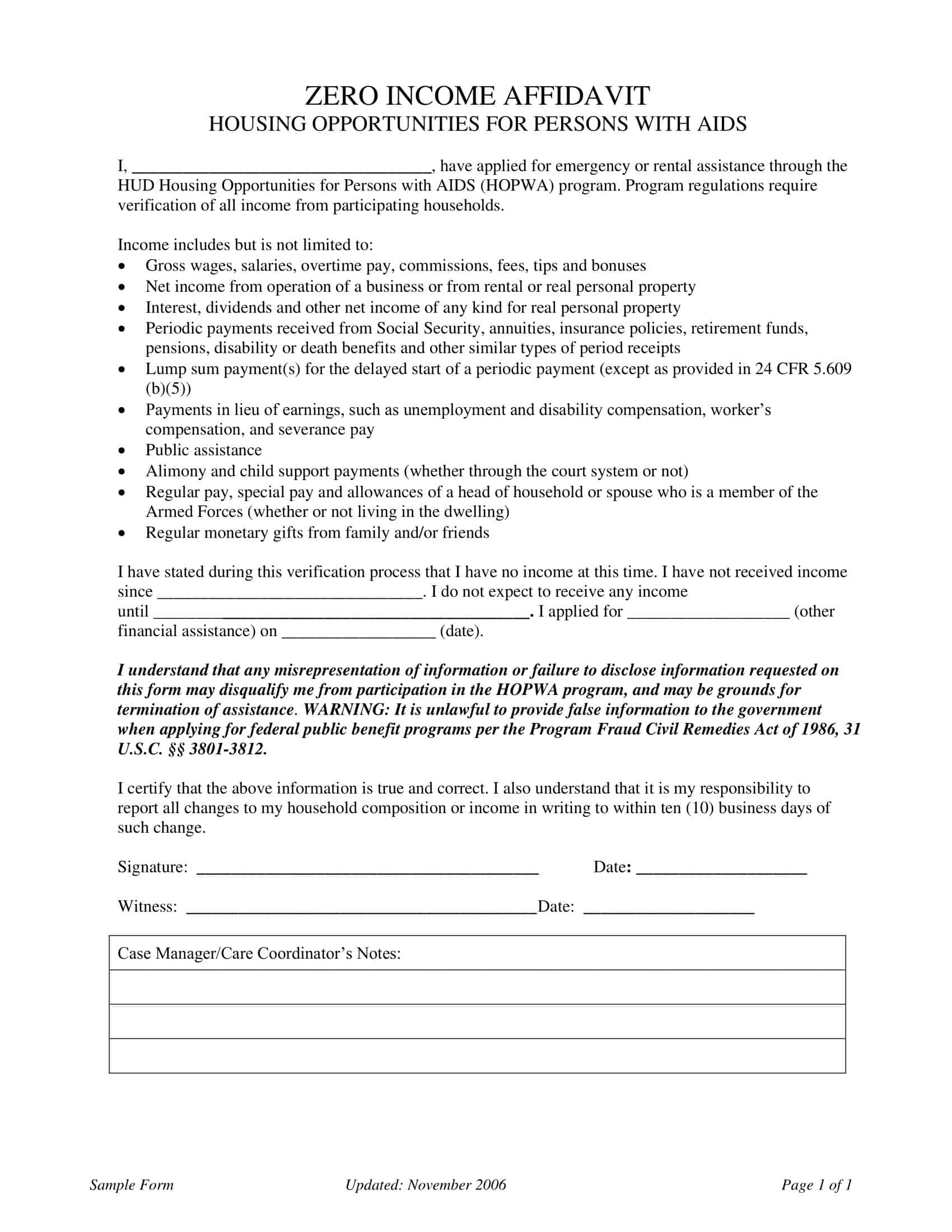

Income Verification Letter for Government Benefits: This letter is used by government agencies to verify an individual’s income for the purpose of determining eligibility for government benefits.

Rent Verification Letter: This letter is used by landlords or property management companies to verify an individual’s income and employment status as part of the rental application process.

Why do you need an income verification letter?

Income verification letters are needed for a variety of reasons, including:

Loan applications: Lenders may request an income verification letter as part of the loan application process to assess an individual’s ability to repay the loan.

Rental applications: Landlords or property management companies may request an income verification letter to confirm an individual’s income and employment status as part of the rental application process.

Government benefits: Government agencies may request an income verification letter to determine an individual’s eligibility for government benefits based on their income.

Insurance verification: Insurance companies may request an income verification letter to verify an individual’s employment and income status for the purpose of determining insurance coverage or premium costs.

Employment verification: Employers may request an income verification letter from current or former employees for various purposes, such as reference checks or background screenings.

Financial planning: Individuals may request an income verification letter for their own personal financial planning purposes, such as creating a budget or applying for a loan.

Having an accurate and up-to-date income verification letter is important for individuals and organizations alike, as it provides a reliable source of information about an individual’s employment and income status.

How do I write a proof of income letter?

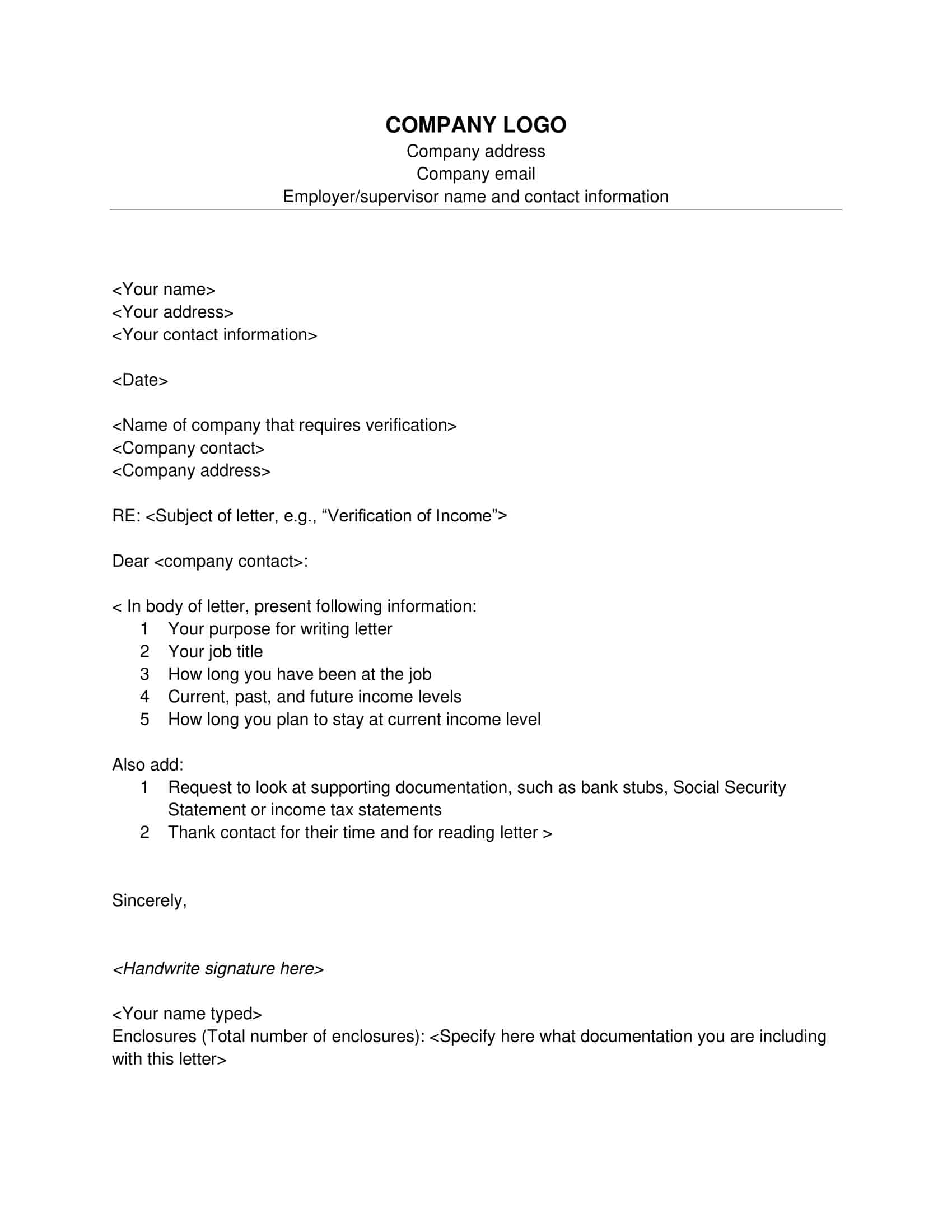

To write an effective proof of income letter, follow these steps:

Identify the purpose of the letter: Determine the reason for the request for proof of income, as this will help you tailor the letter to meet the specific needs of the requestor.

Gather relevant information: Collect all relevant information, such as the individual’s job title, salary, length of employment, and any bonuses or commission they receive.

Start with a professional header: The header should include the name and address of the individual or organization writing the letter, as well as the date.

Use a clear and concise introduction: Start the letter with a brief introduction, stating the purpose of the letter and the individual’s name and job title.

Provide a clear and detailed description of income: Include the individual’s current salary, any bonuses or commission they receive, and the length of time they have been employed.

Use a professional and formal tone: The tone of the letter should be professional and formal, as this is a formal document.

Include a signature and contact information: Include the signature of the individual or authorized representative writing the letter, as well as their contact information for follow-up questions or clarifications.

Proofread and edit the letter: Carefully proofread and edit the letter for accuracy and clarity.

It is important to make sure that the information in the letter is accurate and up-to-date, as well as clearly and concisely stated. Providing a detailed and well-written proof of income letter can help ensure that the requestor’s needs are met and that the individual’s employment and income status are confirmed.

Tips for writing your salary verification letter

Here are some tips for writing an effective salary verification letter:

Be specific: Provide specific and accurate information about the individual’s salary, including their job title, annual salary, and any bonuses or commissions they receive.

Use a professional tone: Use a formal and professional tone when writing the letter, as it is a formal document.

Keep it short and to the point: The letter should be concise and to the point, including only the necessary information to meet the requestor’s needs.

Use clear and concise language: Use clear and concise language, avoiding technical terms or jargon that may not be understood by the reader.

Include relevant details: Include relevant details, such as the length of employment, start date, and any other relevant information that may be required by the requestor.

Proofread the letter: Carefully proofread the letter for accuracy and clarity, and make any necessary corrections before submitting it.

Include your signature and contact information: The letter should be signed by an authorized representative, and include their contact information for follow-up questions or clarifications.

By following these tips, you can help ensure that the salary verification letter is effective and meets the needs of the requestor. A well-written salary verification letter can provide important information about an individual’s employment and income status and help confirm their ability to meet their financial obligations.

FAQs

Who needs an Income Verification Letter?

Income Verification Letters are often requested by landlords, lenders, and other organizations to verify an individual’s ability to pay rent or repay a loan.

What information should be included in an Income Verification Letter?

The letter should include the individual’s job title, salary, length of employment, and any bonuses or commission they receive. It should also include the date, a professional header, a clear and concise introduction, a signature and contact information of the authorized representative.

How often do I need to update my Income Verification Letter?

It depends on the requirements of the requestor, but it is recommended to update the letter every six months or whenever there is a change in the individual’s employment or income status.

Who can write an Income Verification Letter?

An Income Verification Letter can be written by an authorized representative from the individual’s employer, such as a manager or HR representative.

What if the information in my Income Verification Letter is incorrect?

It is important to ensure that the information in the letter is accurate and up-to-date. If there are any errors or inaccuracies, the letter should be corrected and re-submitted to the requestor.

Is an Income Verification Letter legally binding?

An Income Verification Letter is not legally binding, but it can serve as an official document confirming an individual’s employment and income status.

![Free Printable Friendly Letter Templates [PDF, Word, Excel] 1st, 2nd, 4th Grade 1 Friendly Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-1200x1200.jpg 1200w)

![43+ Printable Leave of Absence Letter (LOA) Templates [PDF, Word] / Free 2 Leave of Absence Letter](https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-1200x1200.jpg 1200w)

![Free Printable Congratulation Letter Templates [PDF, Word] Examples 3 Congratulation Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-1200x1200.jpg 1200w)