Rebuilding a company’s budget from scratch is a daunting task that requires a great deal of effort and resources. It involves starting afresh and wiping the slate clean of any pre-existing financial commitments or assumptions.

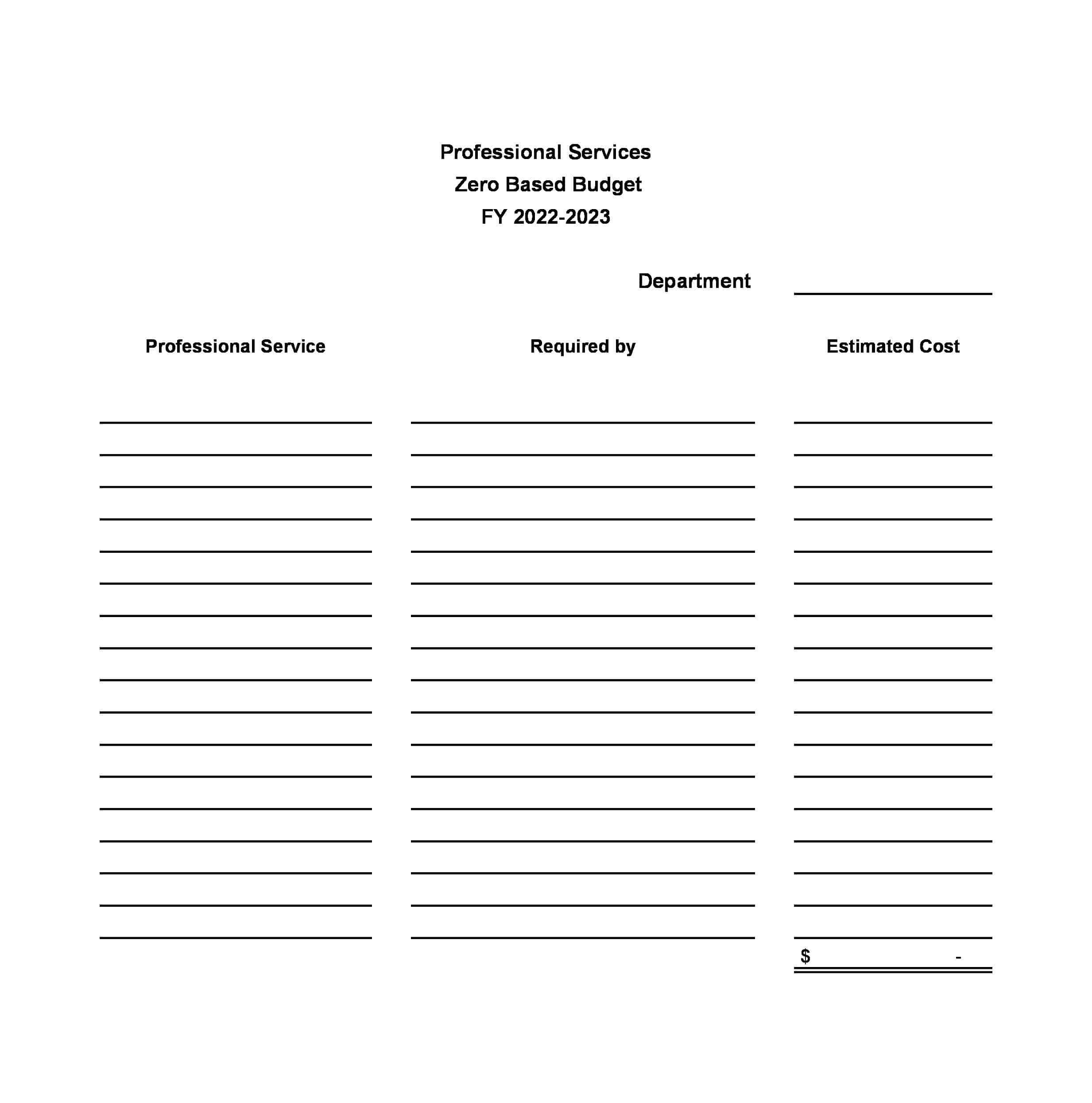

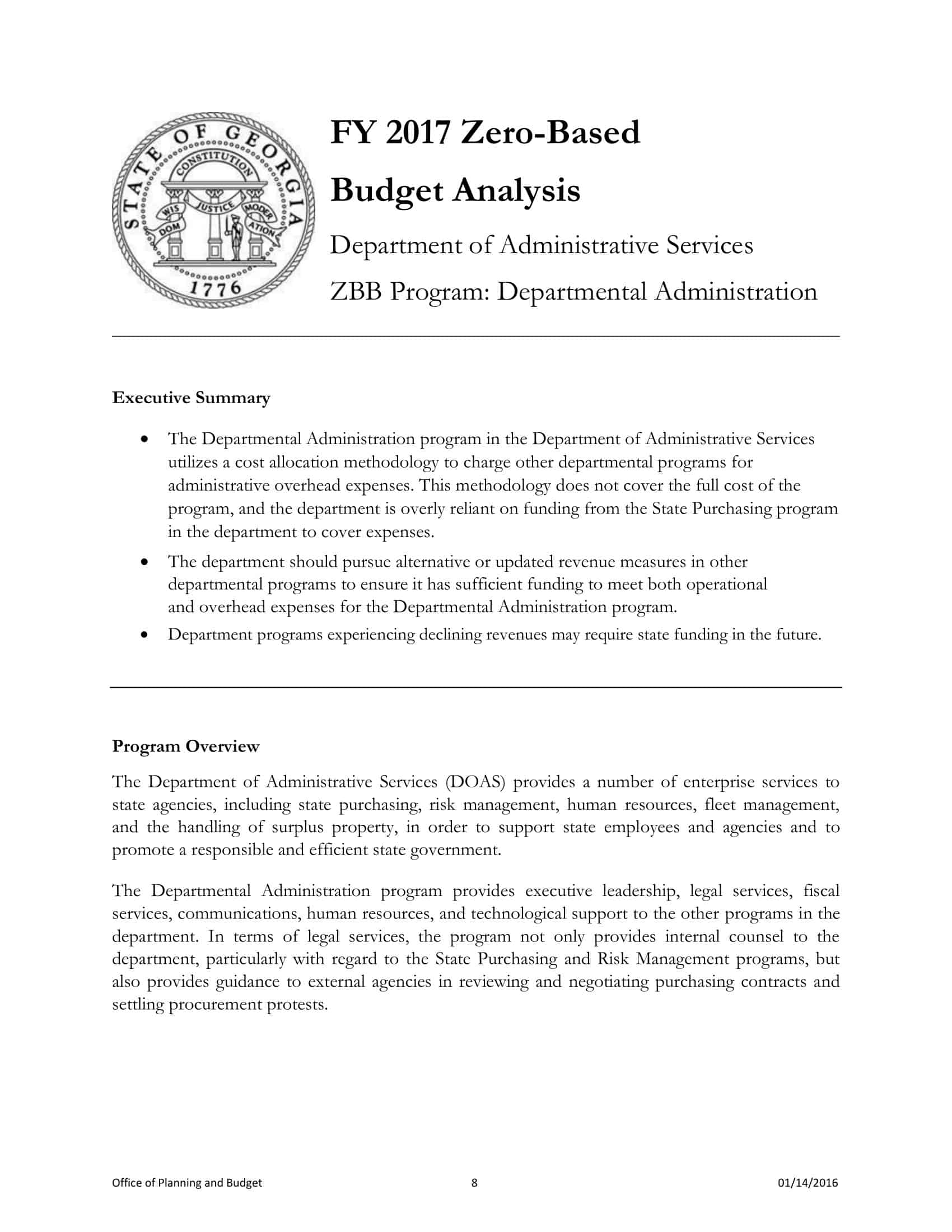

This approach, known as zero-based budgeting, is typically reserved as a last resort for companies facing dire financial situations. However, in recent times, more and more businesses are turning to this extreme budgeting method as a means of improving financial management and driving long-term success. Zero-based budgeting involves the use of specialized forms that require each item to be justified and analyzed before it is included in the budget.

Table of Contents

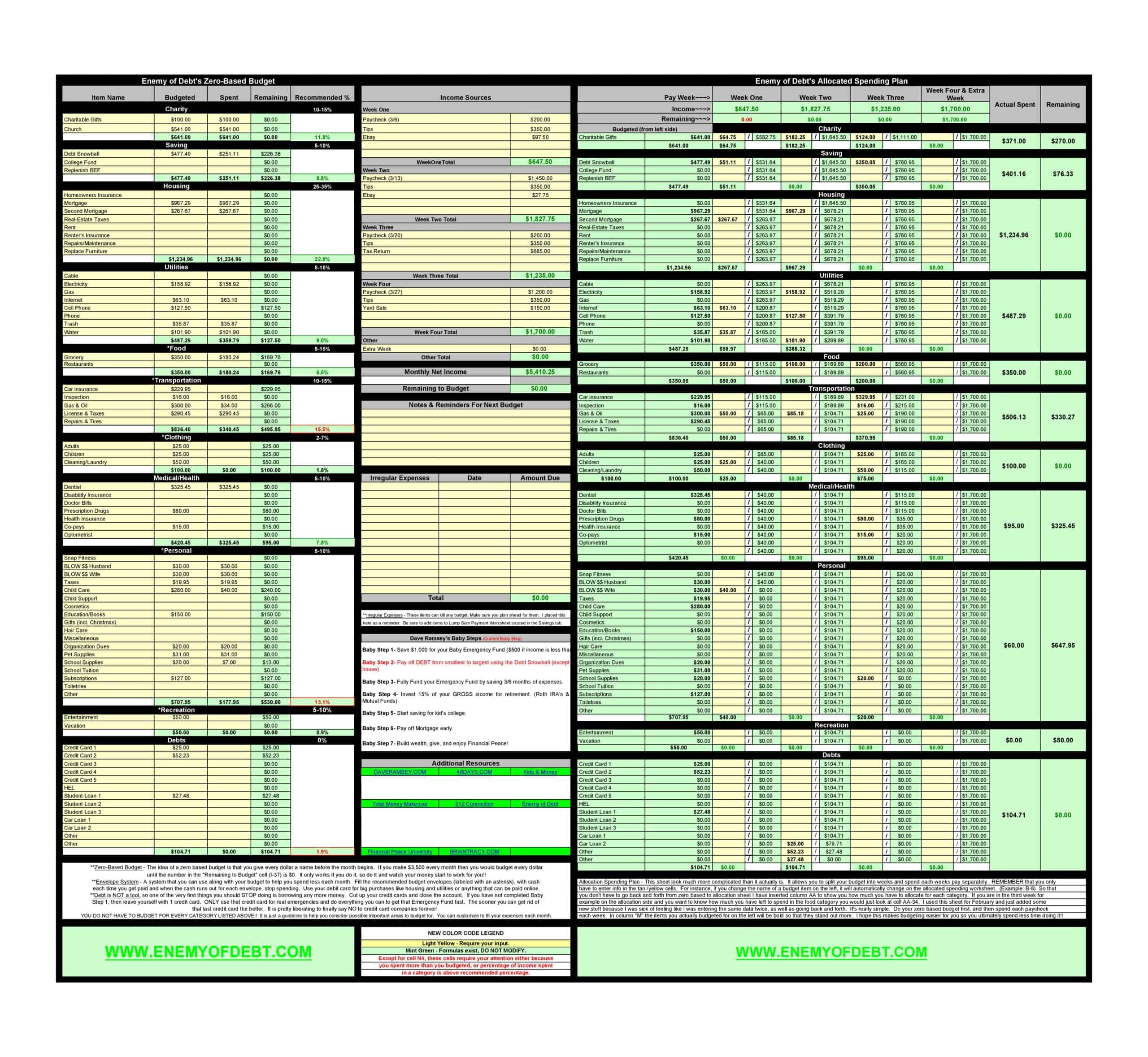

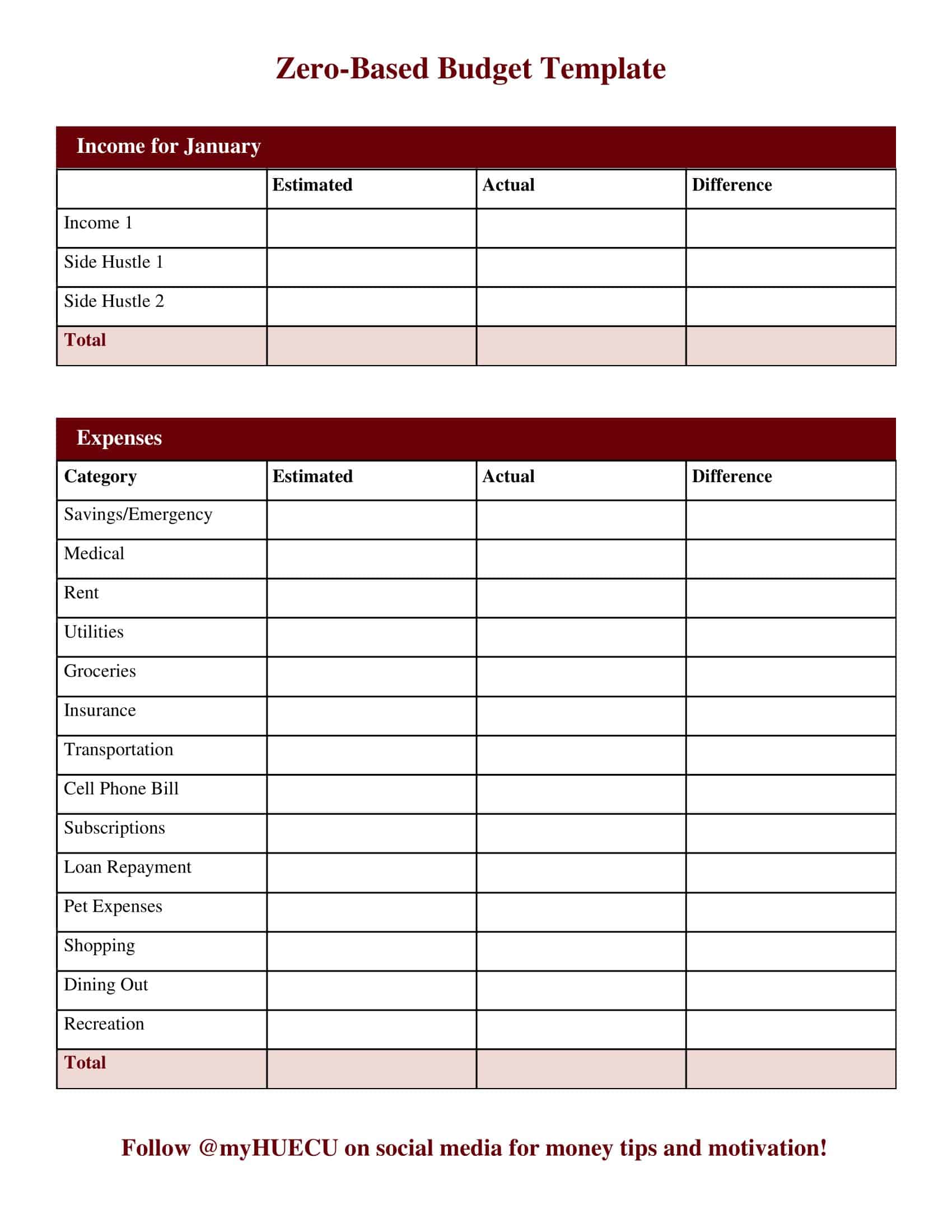

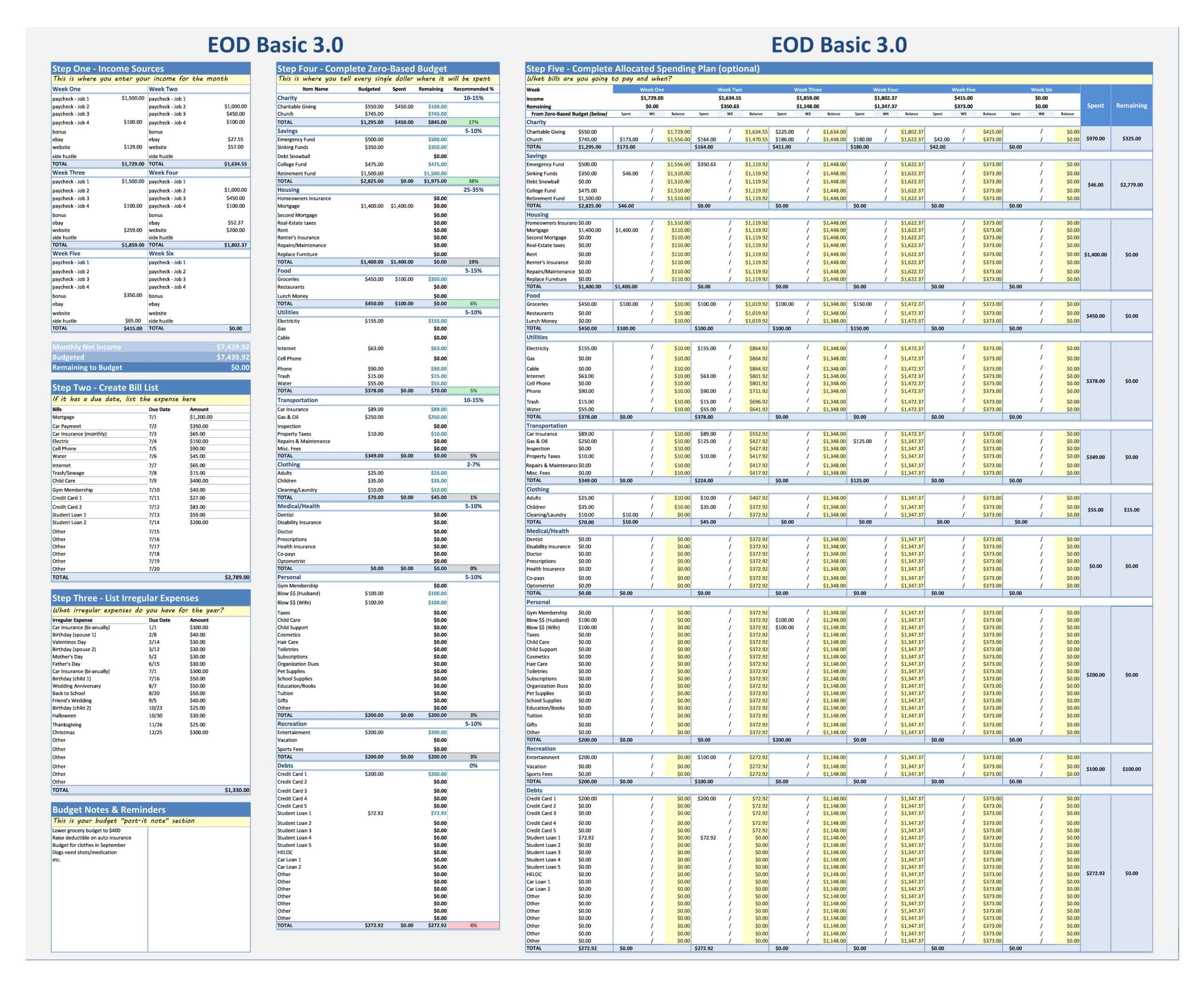

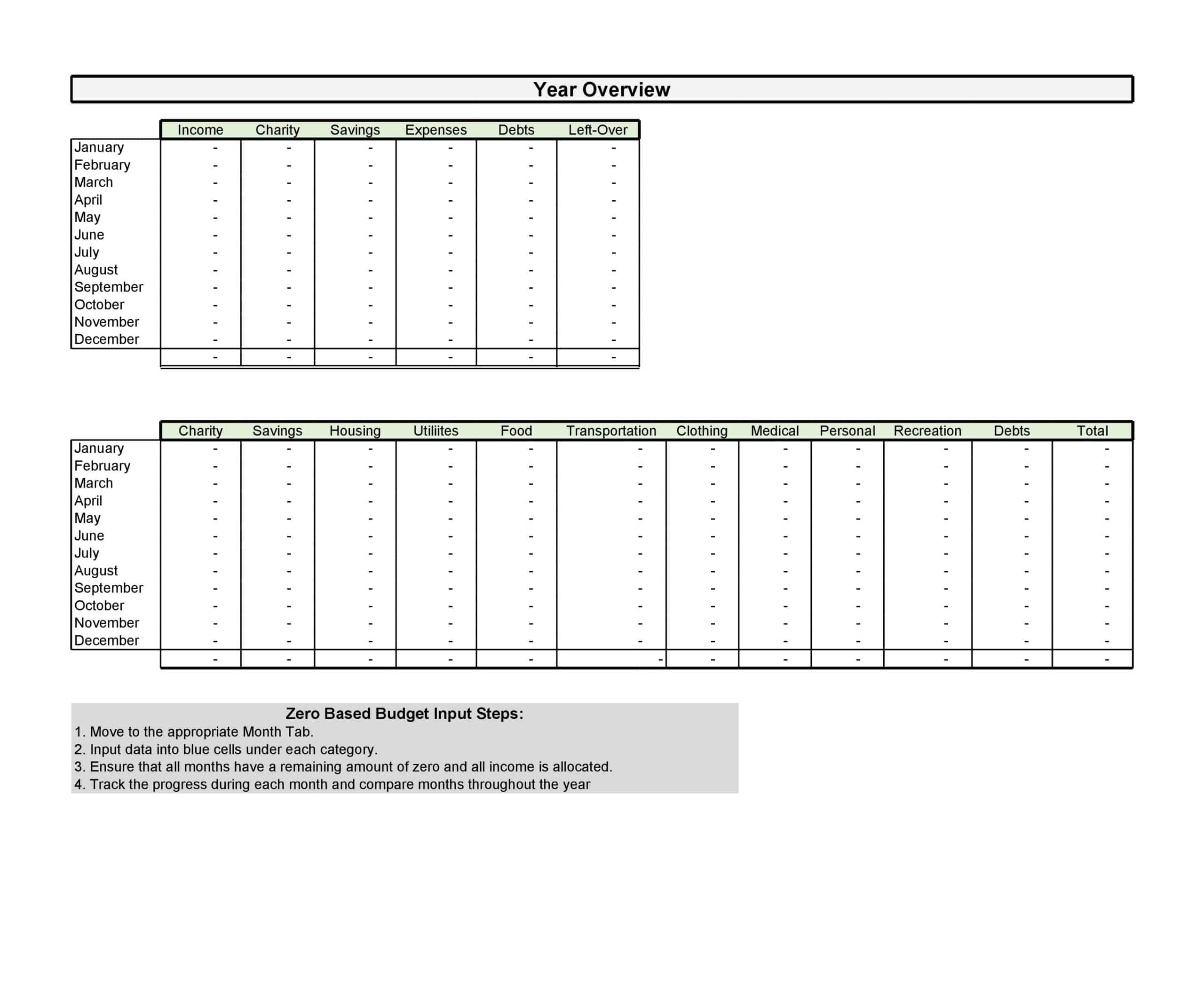

Zero-Based Budget Templates

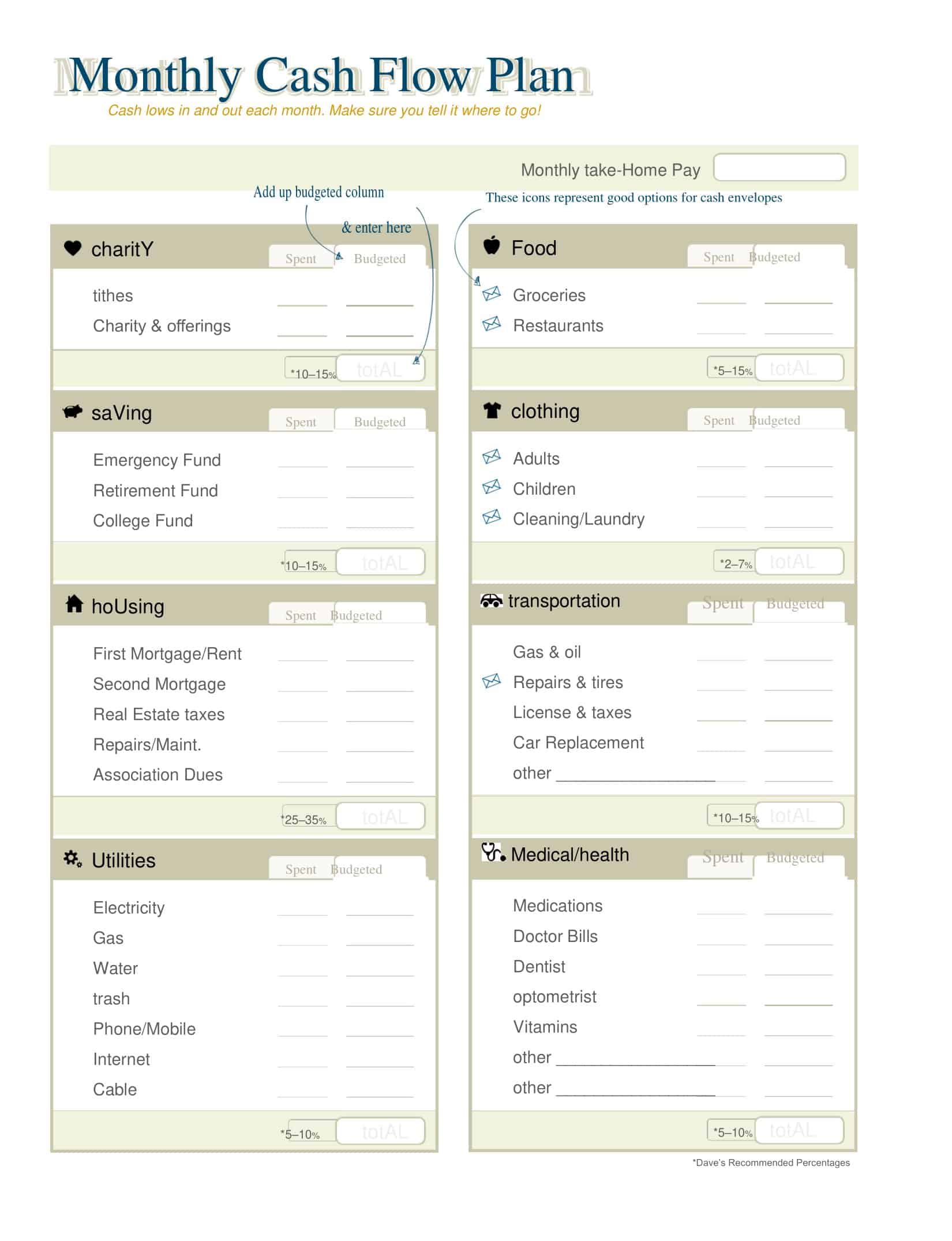

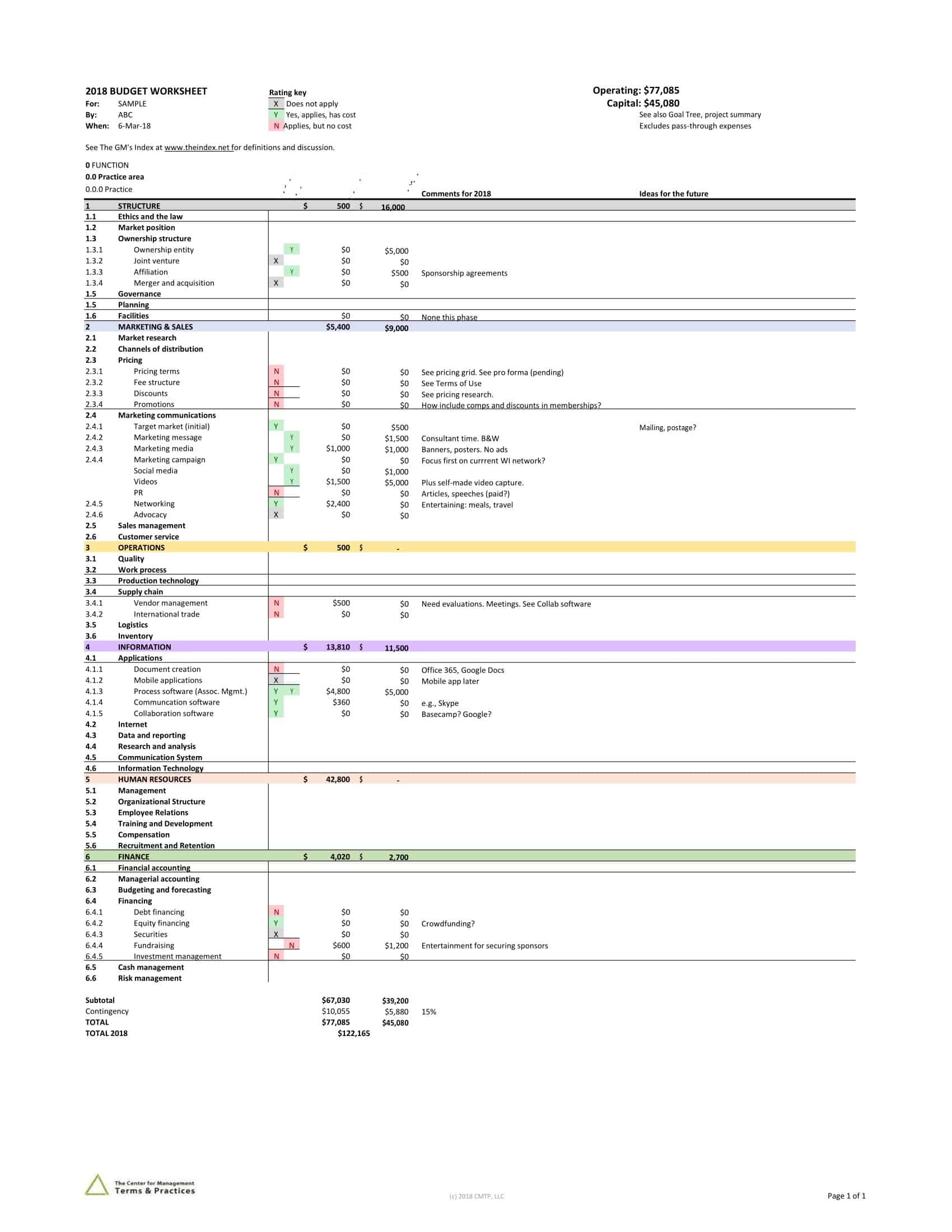

Zero-Based Budget Templates are powerful financial planning tools that enable individuals and organizations to take complete control of their finances by allocating every dollar of their income based on their needs and priorities. These templates provide a detailed framework for creating a zero-based budget, where income minus expenses equals zero, ensuring that every dollar is assigned a specific purpose.

Zero-based budget templates are available in various formats, including spreadsheet software, online budgeting tools, or printable templates. They are widely accessible and can be found through financial planning resources, budgeting apps, or personal finance websites. Utilizing these templates empowers individuals and organizations to achieve greater financial stability, reduce debt, increase savings, and work towards long-term financial success.

What is a zero-based budget plan?

A zero-based budget plan is a budgeting method that requires companies to justify and allocate funds for each expense from scratch, starting with a zero base. Unlike traditional budgeting approaches, which often involve incremental increases or decreases to an existing budget, zero-based budgeting requires businesses to justify all expenses every budget cycle.

This process involves analyzing each expense item and determining its relevance and priority in relation to the company’s overall strategic goals and objectives. By using a zero-based budget plan, businesses can identify areas where they may be overspending and redirect resources to areas where they can achieve a greater return on investment. This approach can help businesses to optimize their resource allocation, reduce waste, and improve overall financial performance.

How Zero-Based Budgeting (ZBB) Works

Zero-Based Budgeting (ZBB) is a budgeting process that requires businesses to justify all expenses from scratch, starting with a zero-base. Here’s how the ZBB process typically works:

Identify and prioritize business activities: Businesses first identify all activities that need to be performed to achieve their strategic goals and objectives. These activities are then prioritized based on their importance and potential impact on the business.

Assign costs to activities: Next, businesses assign a cost to each activity by estimating the resources required to perform them. This involves breaking down each activity into its component parts, estimating the required resources (such as personnel, equipment, and materials), and calculating the total cost.

Analyze and evaluate costs: Once costs have been assigned to each activity, businesses analyze and evaluate each cost to determine whether it is necessary and justifiable. This involves a rigorous examination of each cost item, including an assessment of its importance and potential impact on the business.

Optimize resource allocation: After evaluating all costs, businesses optimize their resource allocation by reallocating funds from lower-priority activities to higher-priority ones. This can help businesses to achieve their strategic goals more effectively and efficiently.

Monitor and review performance: Finally, businesses monitor and review their performance regularly to ensure that they are achieving their strategic goals and objectives. This involves ongoing performance analysis and evaluation to identify areas for improvement and to make adjustments to the budget as necessary.

Overall, zero-based budgeting can be a powerful tool for businesses to optimize their resource allocation, reduce waste, and improve financial performance. By carefully analyzing each expense item and justifying its inclusion in the budget, businesses can make more informed decisions and achieve better outcomes.

Advantages and Disadvantages of Zero-Based Budgeting

Zero-based budgeting (ZBB) is a budgeting approach that requires businesses to justify all expenses from scratch every budget cycle, rather than simply making incremental adjustments to an existing budget. While ZBB can provide many benefits, it also has some potential drawbacks that businesses should consider before implementing this approach. In this article, we’ll explore the advantages and disadvantages of ZBB in detail.

Advantages of Zero-Based Budgeting:

Encourages cost optimization: One of the biggest advantages of ZBB is that it encourages businesses to carefully scrutinize all costs and prioritize them based on their relevance and importance to the business. By requiring businesses to justify all expenses from scratch every budget cycle, ZBB helps identify areas of unnecessary spending and eliminates waste.

Enhances resource allocation: ZBB enables businesses to allocate resources based on their strategic priorities and goals. This approach allows businesses to identify activities that are critical to their success and prioritize their spending accordingly. It also helps businesses to reallocate resources from lower-priority activities to higher-priority ones.

Improves decision-making: By requiring businesses to justify all expenses from scratch, ZBB promotes a more rigorous approach to decision-making. This approach encourages businesses to evaluate all expenses in relation to their strategic goals and objectives, rather than simply making decisions based on historical data or assumptions.

Increases accountability: ZBB promotes accountability and responsibility among employees by requiring them to justify their expenses and activities. This approach encourages employees to be more mindful of their spending and to make more informed decisions about how they allocate their resources.

Enables greater flexibility: ZBB allows businesses to adjust their budgets more easily in response to changing circumstances. This approach enables businesses to respond quickly to market conditions, customer demands, and other external factors.

Disadvantages of Zero-Based Budgeting:

Time-consuming: One of the biggest drawbacks of ZBB is that it can be time-consuming to implement. This approach requires a significant amount of planning and analysis, and can be challenging for businesses with limited resources.

Resource-intensive: ZBB requires businesses to allocate significant resources to analyze all expenses from scratch every budget cycle. This approach can be costly, especially for businesses with limited budgets or those in industries with high operating costs.

Can be disruptive: ZBB can be disruptive to business operations, as it requires a significant amount of planning and analysis. This approach can be challenging for businesses with limited resources or those that are already operating under tight deadlines.

May lead to inaccurate projections: ZBB requires businesses to project expenses based on assumptions about future activities and costs. These projections may be inaccurate or incomplete, which can lead to budget shortfalls or unexpected expenses.

May lead to organizational resistance: ZBB may be met with resistance from employees, who may view it as a threat to their jobs or the status quo. This resistance can make it difficult to implement ZBB successfully, especially if employees are not fully on board with the approach.

Zero-Based Budgeting vs. Traditional Budgeting

Zero-based budgeting (ZBB) differs from traditional budgeting in several ways. Here are the key differences:

Approach: The main difference between ZBB and traditional budgeting is their approach. Traditional budgeting typically involves making incremental adjustments to the previous budget, based on historical data or assumptions. ZBB, on the other hand, requires businesses to justify all expenses from scratch every budget cycle.

Focus: Traditional budgeting typically focuses on controlling costs, while ZBB focuses on optimizing resource allocation. Traditional budgeting aims to minimize expenses and maximize profits, while ZBB aims to identify the most critical activities and allocate resources accordingly.

Inclusivity: Traditional budgeting is typically a top-down approach, with budget decisions made by senior management. ZBB, on the other hand, is a more inclusive approach that involves all levels of the organization in the budgeting process. This approach encourages greater participation and engagement among employees, which can lead to better decision-making and more informed budgeting.

Timeframe: Traditional budgeting typically has an annual budgeting cycle, while ZBB may have shorter budgeting cycles that can be more frequent. ZBB may also allow for more flexibility in adjusting budgets in response to changing circumstances.

Accountability: ZBB typically places greater accountability on employees and managers to justify their expenses and activities. This approach encourages greater responsibility and ownership among employees, which can lead to better decision-making and a more efficient use of resources.

Analysis: ZBB typically involves more thorough analysis and evaluation of expenses, as all expenses are evaluated from scratch every budget cycle. This approach can lead to a more accurate and complete understanding of the costs and benefits of each activity.

What is The 50/30/20 Budget Rule?

The 50/30/20 budget rule is a popular budgeting approach that suggests allocating your after-tax income into three broad categories:

50% for needs

This category includes expenses that are necessary for your day-to-day living, such as housing, utilities, groceries, transportation, and insurance. These are expenses that you cannot do without and are typically considered non-negotiable.

30% for wants

This category includes expenses that are not necessary for your day-to-day living, but that you enjoy and that make your life more comfortable or enjoyable. These might include things like dining out, travel, entertainment, or luxury items.

20% for savings

This category includes all of the money you set aside for your long-term financial goals. This might include contributions to your retirement account, emergency fund, or investments. This category is designed to help you build financial security and achieve your financial goals.

The 50/30/20 budget rule is a flexible guideline, so you can adjust the percentages to fit your personal financial situation. For example, if you have a high rent or mortgage payment, you might need to allocate more than 50% to your needs category. Similarly, if you are trying to pay off debt or save for a specific goal, you might need to allocate more than 20% to your savings category.

The 50/30/20 budget rule is a helpful starting point for people who are looking to get their finances in order, but it is not necessarily the best approach for everyone. It is important to understand your own financial situation and goals and to adjust your budgeting strategy accordingly.

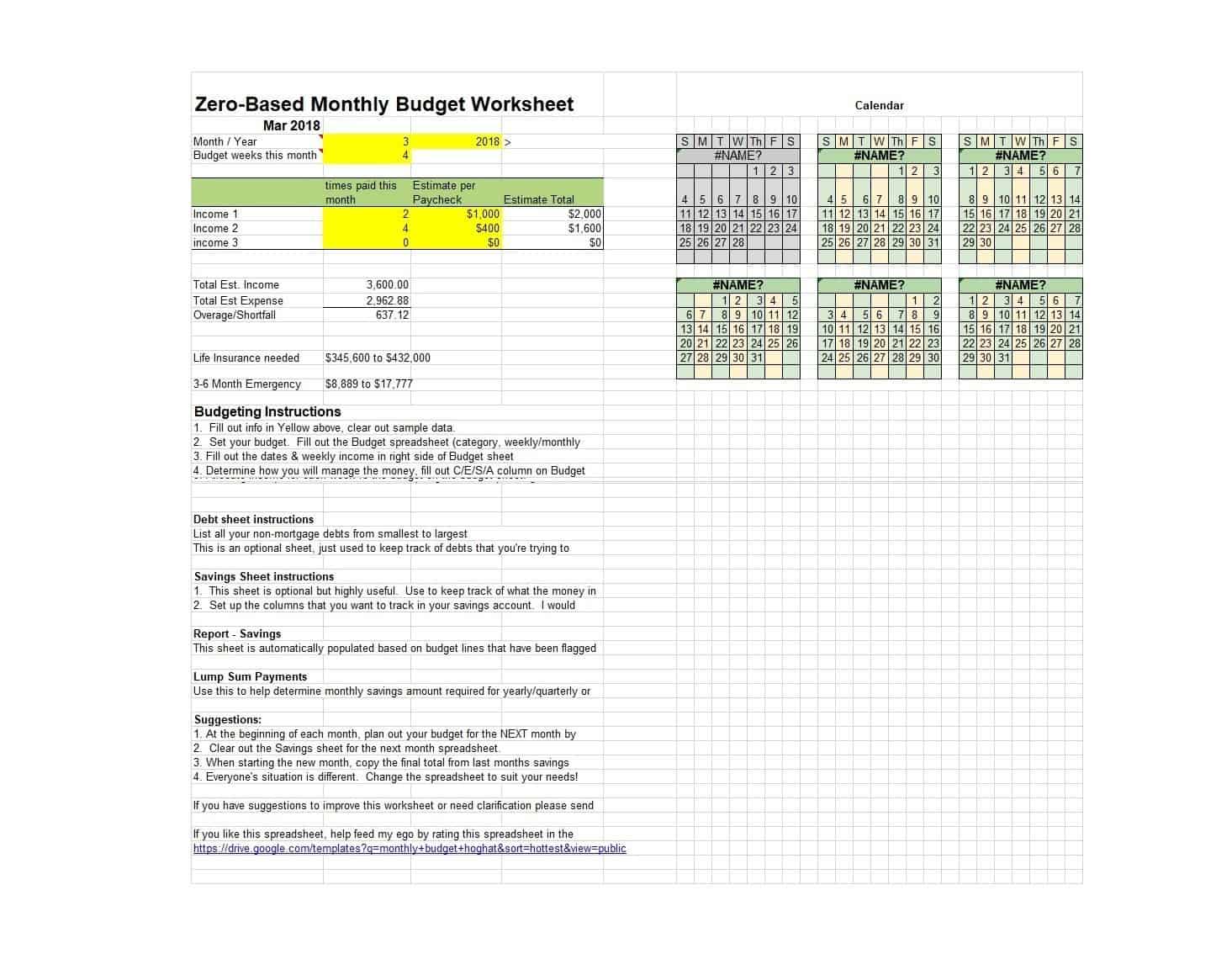

How to Make a Zero-Based Budget

Making a zero-based budget is a straightforward process that can help you take control of your finances and ensure that every dollar you spend has a purpose. Here is a step-by-step guide to making a zero-based budget:

Step 1: Determine Your Income

The first step in making a zero-based budget is to determine your income. This includes all of the money you earn, whether it is from your job, side hustles, or investments. Make sure to take into account any taxes, deductions, or other withholdings that may affect your take-home pay.

Step 2: List Your Expenses

The next step is to make a list of all your expenses. This includes everything from your regular bills, such as rent, utilities, and groceries, to your discretionary spending, such as dining out, entertainment, and travel. Be as detailed as possible in your list, so that you don’t miss any expenses.

Step 3: Categorize Your Expenses

Once you have a comprehensive list of your expenses, categorize them into different groups. This can include categories such as housing, transportation, food, entertainment, and savings. The goal is to create a clear and organized picture of your spending habits.

Step 4: Assign Priorities and Value

After categorizing your expenses, you need to assign priorities and value to each category. This means deciding which expenses are essential and which are discretionary. For example, rent or mortgage payments, utility bills, and groceries are essential expenses, while dining out and entertainment are discretionary expenses.

Step 5: Allocate Your Income

Now that you have a clear picture of your income and expenses, it’s time to start allocating your income. Start by allocating your income to the essential expenses, making sure that you have enough to cover your bills and other necessary expenses. Next, allocate any remaining income to your discretionary expenses and savings goals.

Step 6: Cut Expenses

If your expenses are higher than your income, you will need to cut back on your spending. This may mean reducing your discretionary spending or finding ways to save money on essential expenses. Look for areas where you can make cuts without sacrificing your needs or values.

Step 7: Review and Adjust Your Budget

Once you have completed your zero-based budget, it is essential to review and adjust it regularly. This will help you stay on track and ensure that you are meeting your financial goals. You may need to make adjustments to your budget as your income or expenses change, or if you encounter unexpected expenses.

Making a zero-based budget requires discipline and organization, but it is a powerful tool for taking control of your finances. By following these steps, you can create a budget that works for you and helps you achieve your financial goals.

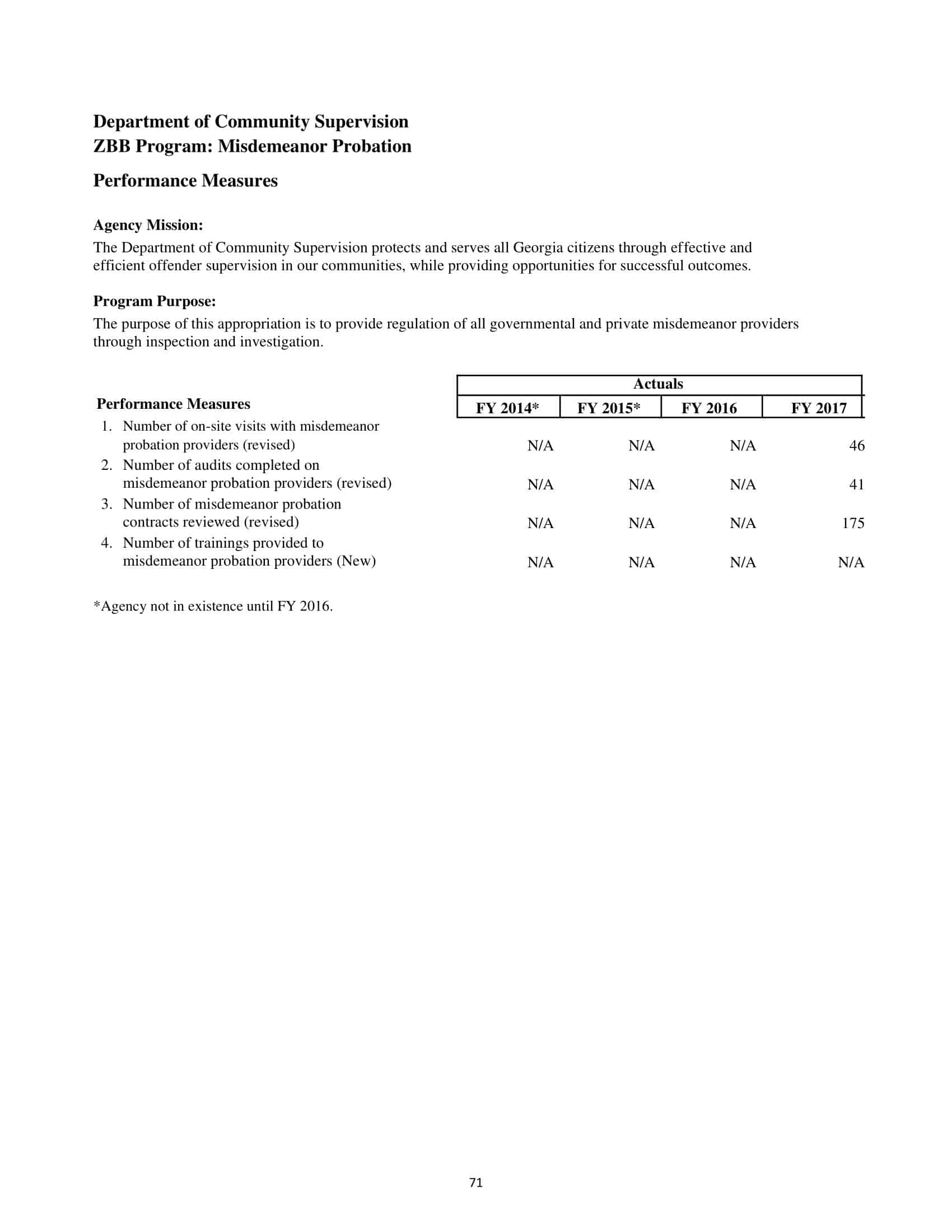

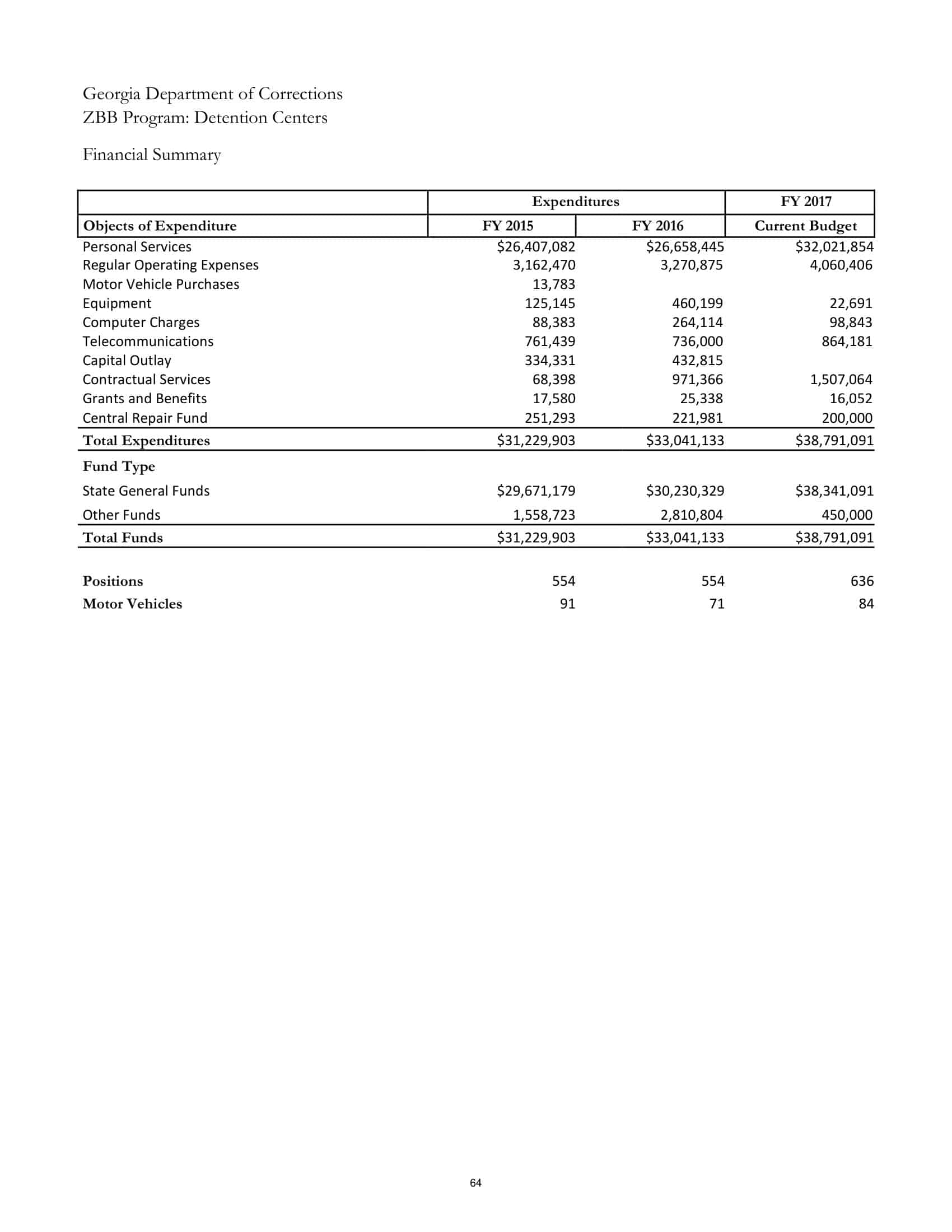

Example of Zero-Based Budgeting

Zero-based budgeting (ZBB) is a budgeting method in which all expenses must be justified for each new budgeting period, rather than simply carrying forward the expenses from the previous period. Here is an example of how zero-based budgeting can be applied in a hypothetical business:

Let’s say that the business wants to implement zero-based budgeting for the upcoming fiscal year. The business will start with a budget of zero and build up from there by justifying each expense.

Identify activities and projects: The business needs to identify all the activities and projects it plans to undertake during the upcoming year.

Set priorities: The business needs to determine which activities and projects are the highest priority and allocate the necessary resources to those activities.

Determine costs: The business needs to determine the costs associated with each activity or project, including salaries, materials, equipment, and other expenses.

Allocate resources: The business needs to allocate the necessary resources to each activity or project, based on their priority and cost.

Review and adjust: The business should review and adjust the budget regularly to ensure that it remains on track and that any changes or new activities are properly justified.

FAQs

Does zero-based budgeting work for every person or business?

No, zero-based budgeting may not work for every person or business, as it can be time-consuming and may not be suitable for organizations with complex operations. However, it can be a valuable tool for those who are looking to gain control of their finances or streamline their operations.

How frequently should I review and update my zero-based budget?

You should review and update your zero-based budget on a regular basis, such as monthly or quarterly. This will help you stay on track and make adjustments as necessary.

Is it necessary to use zero-based budget forms or software?

No, it is not necessary to use zero-based budget forms or software. You can create a zero-based budget using a spreadsheet or even pen and paper.

Can zero-based budgeting be used in personal finance?

Yes, zero-based budgeting can be a useful tool for personal finance. It can help individuals prioritize their spending, identify areas where they can save money, and achieve their financial goals.

Is zero-based budgeting only for cost-cutting?

No, zero-based budgeting is not only for cost-cutting. It can also be used to identify opportunities for investment and growth, and to ensure that resources are being allocated effectively.

What are the common challenges in implementing zero-based budgeting?

Some common challenges in implementing zero-based budgeting include resistance to change, lack of buy-in from stakeholders, and difficulty in setting priorities and values. It may also require more time and effort than traditional budgeting methods.

Is zero-based budgeting suitable for small businesses?

Yes, zero-based budgeting can be a valuable tool for small businesses, as it can help them identify and reduce unnecessary expenses and optimize their operations.

How do you determine the appropriate level of detail for a zero-based budget?

The level of detail for a zero-based budget will depend on the specific needs and goals of the organization. However, it is important to balance the level of detail with the time and effort required to create and maintain the budget.

Can zero-based budgeting be used in non-profit organizations?

Yes, zero-based budgeting can be useful for non-profit organizations, as it can help them identify areas where they can reduce costs and allocate resources more effectively.

Is zero-based budgeting more time-consuming than traditional budgeting?

Yes, zero-based budgeting can be more time-consuming than traditional budgeting, as it requires a more detailed analysis of expenses and operations. However, it can also lead to greater cost savings and efficiencies.

Can you use zero-based budgeting for multiple departments or business units?

Yes, zero-based budgeting can be applied to multiple departments or business units within an organization. However, it may require additional effort to coordinate and standardize the budgeting process across different units.

How do you prioritize expenses in a zero-based budget?

Prioritizing expenses in a zero-based budget involves identifying the most essential and valuable expenses and allocating resources accordingly. This may involve considering factors such as the organization’s goals, values, and core operations.

Can zero-based budgeting be used in combination with other budgeting methods?

Yes, zero-based budgeting can be used in combination with other budgeting methods, such as incremental budgeting or activity-based budgeting. This can help organizations achieve a balance between cost savings and stability.

What are some best practices for implementing zero-based budgeting?

Best practices for implementing zero-based budgeting include setting clear goals and priorities, involving stakeholders in the budgeting process, maintaining a consistent level of detail and analysis, and regularly reviewing and updating the budget. It is also important to have a strong communication and change management strategy to ensure buy-in from all stakeholders.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 2 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)