All businesses, big and small, need a budget template. After all, a plan on how much money you can spend on company overhead and capital expenses is essential to running a business. A realistic budget also helps you know where your hard-earned capital goes each month.

Unlike home budgets, though, companies need to allocate more, not less. This is because this amount includes the payroll for your employees and earnings for you and the other officers of your corporation or establishment. Making a budget is easy if you’re using a business expense spreadsheet template.

Table of Contents

What is a business budget?

A business budget is a financial plan that you use to manage your business. It’s a detailed list of all of your income and expenses for a specific period — typically one year — with each item listed separately. A budget helps you keep track of your business’s cash flow and allows you to see if you’re making or losing money.

A reasonable budget makes it easier for you to decide how much money to spend on each aspect of your business. This helps ensure that you pay attention to some areas while neglecting others entirely.

Business Budget Templates

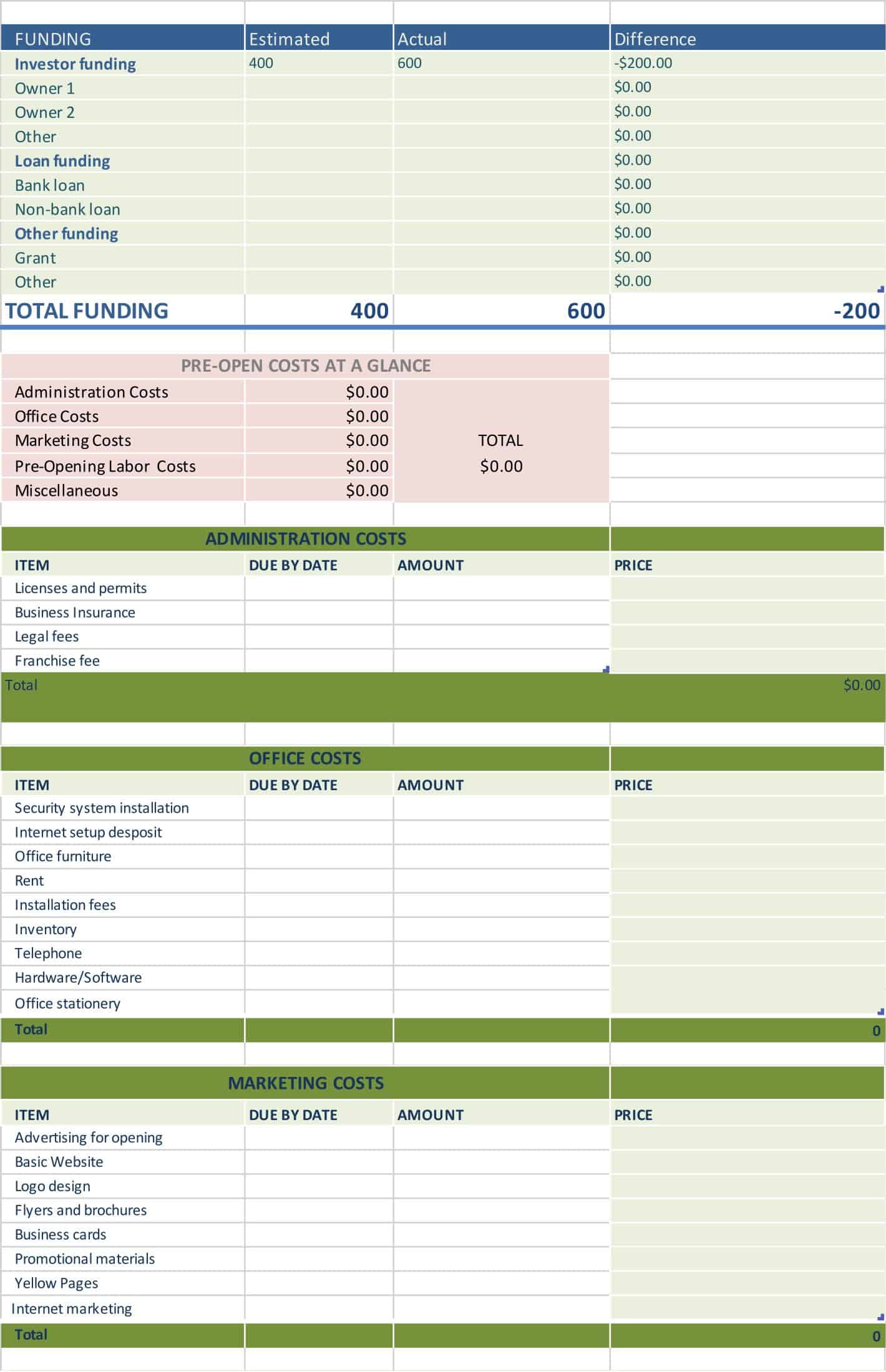

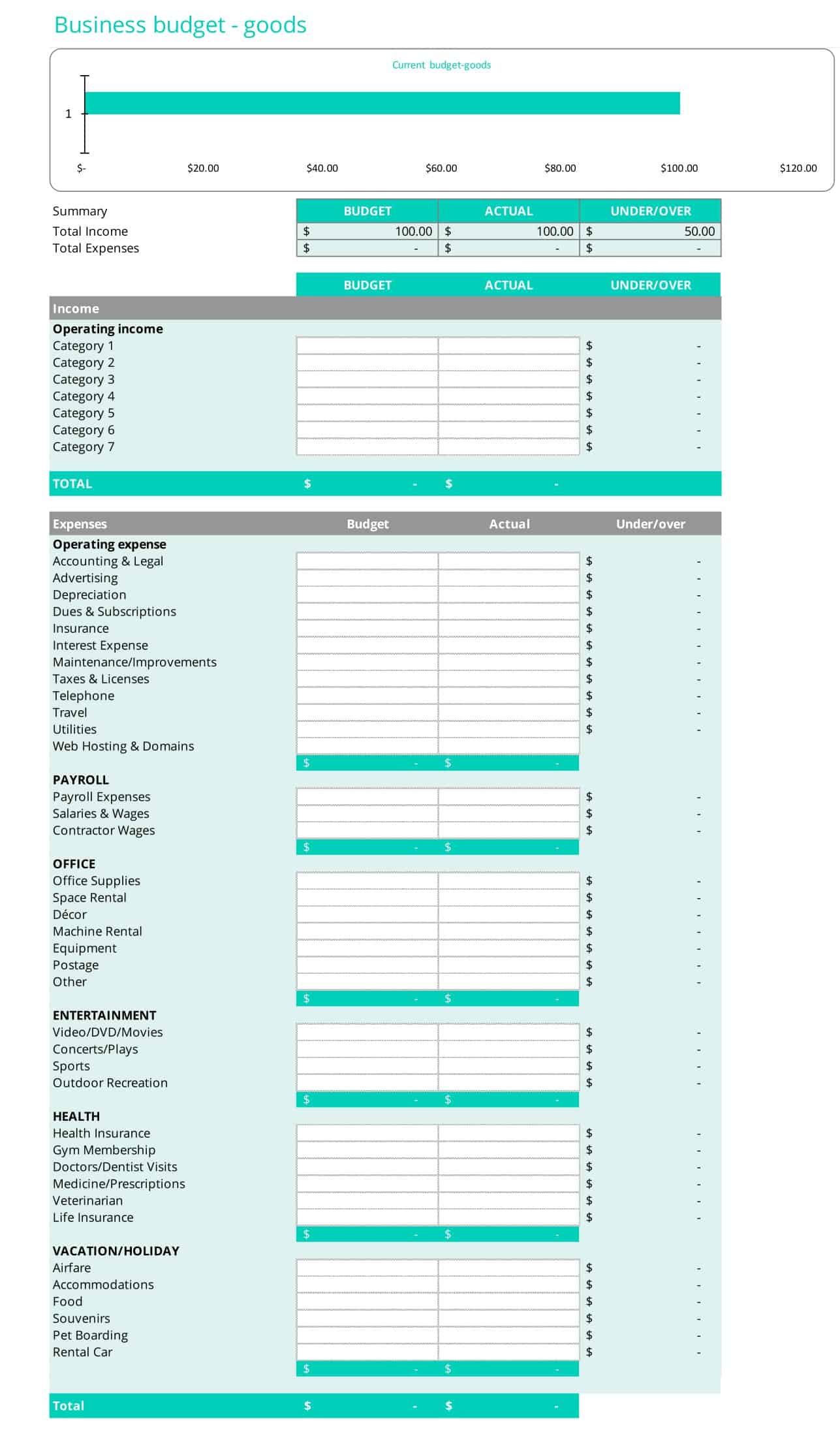

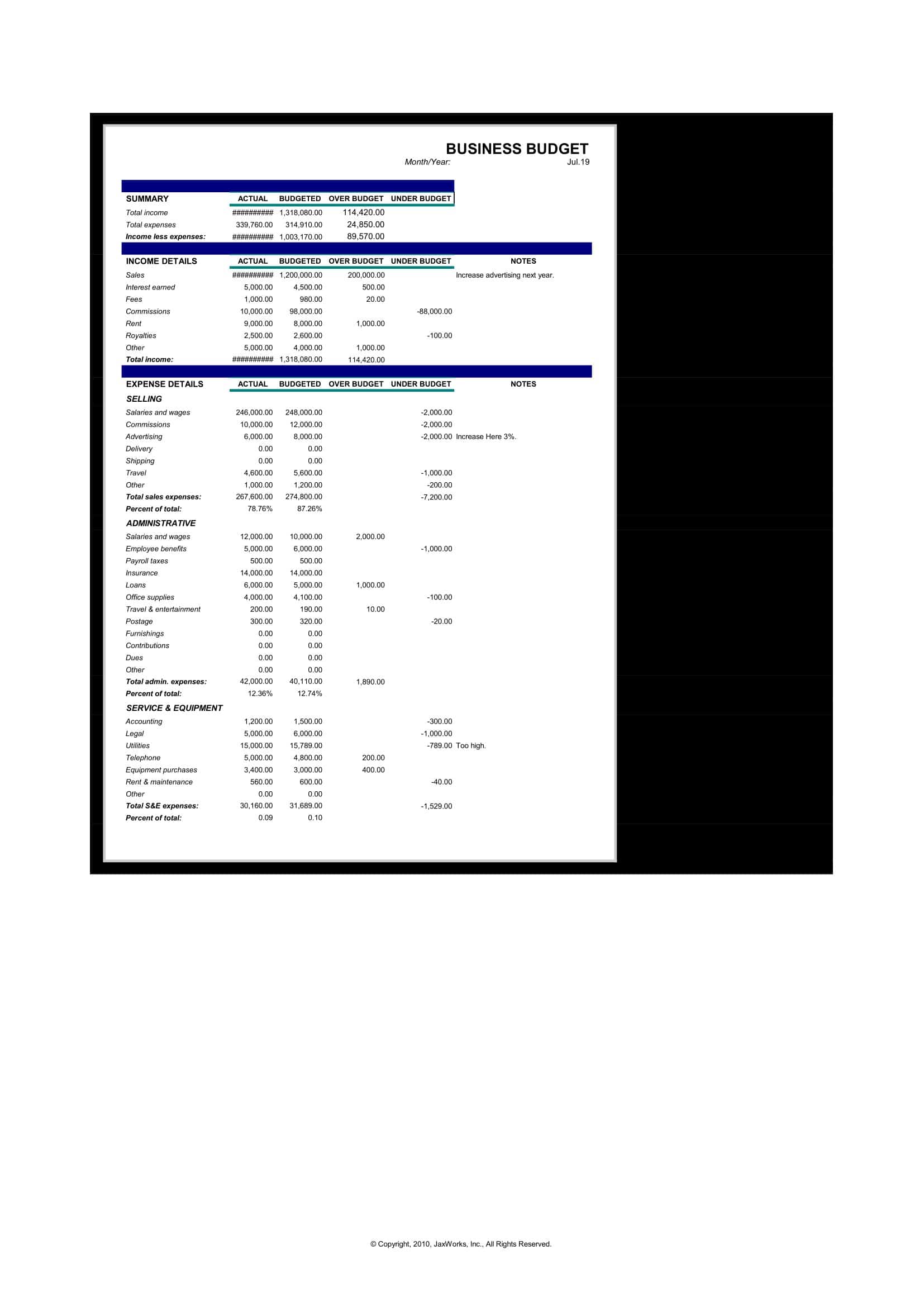

Business Budget Templates are pre-designed documents that assist individuals or businesses in creating a budget plan for their finances. These templates typically include categories for various expenses such as employee salaries, rent, utilities, marketing, and supplies.

They can be used for any type of business, from small startups to large corporations, and provide an efficient and organized way to keep track of income and expenses. Using a business budget template can help businesses make informed financial decisions and avoid overspending, leading to better financial health and stability.

Why Create a Budget?

A budget isn’t just a set of numbers; it’s a tool that helps you manage your finances. A well-crafted budget can help:

Track your earnings and expenses, so you know where money is coming from and going to

Make better decisions about spending because you have more information about how many resources are available for different needs.

Identify areas where costs are out of control so they can be addressed before they become serious problems.

What should be included in a business budget?

Budgeting is one of the most important aspects of running a business. It can be used to help you make decisions about how much money you have to spend on different areas of your business, as well as help you keep track of your finances.

In this part, we’ll look at what should be included in a budget, what isn’t included, and how to set one up.

The following list of items should be included in every business budget:

Expected revenues and sales

This is the most important part of your budget. You need to know what kind of revenue you expect to bring in each month, quarter, and year. You can use historical data to predict future revenues, but remember that these numbers will change over time as your business grows and evolves.

Fixed costs

These expenses don’t vary with the output level — they’re paid regardless of whether you have one customer or 100 customers. For example, rent or mortgage payments and utilities are fixed costs because they depend on how much business you do.

Variable costs

These expenses change depending on how much production occurs at a given time. For example, if you’re making widgets by hand, your labor costs will be variable because it depends on how many widgets you make in a day — one widget per hour means no labor cost at all!

Semi-variable costs

These are costs that increase or decrease based on how much work you do in a given time period. For example, office supplies are a semi-variable cost because if you produce more products, then more paper clips will be used up. If you produce fewer products, fewer paper clips will be used.

Profit margins

The profit margin is the percentage of each sale you keep after accounting for all expenses incurred during production or sales. Consider including this information in your business plan so that investors can see how much money they can expect from each sale once all expenses have been accounted for.

What are the steps in preparing a business budget?

The first step in preparing a business budget is determining how much money you will need. This can be done by looking at the previous year’s financial statements and projecting them out for the next year. You should also consider any seasonal factors that may affect your business, such as the months of peak sales or low-traffic times like winter months.

Once you know how much money your business needs, you can start to determine how much revenue you will bring in each month. You can do this by estimating what percentage of your total sales come from each product or service, then multiplying that percentage by each product’s sales price and adding up all of those individual figures to get an estimated total monthly revenue figure for your business.

Next, you must add up all of your monthly fixed costs, including rent payments and other ongoing expenses such as utilities and insurance premiums. Finally, add up all variable costs associated with each product or service your business offers (i.e., shipping costs), then subtract these variable costs from the monthly revenue figure to find out how much profit you’ll make for that month.

You need to know what percentage of sales will be profitable before you can set up the rest of your budget. The easiest way to do this is by using ratios — dividing expenses by revenue. For example, if you have $1 million in sales and $500,000 in expenses, your profit margin would be 50%. This means that if you want 20% profit on each sale (a healthy margin), then each sale needs to be 20 times greater than the cost of goods sold (COGS).

You should also create categories for each type of expense that occurs in your business and assign each category a percentage value based on its importance relative to other categories within your budget.

Types of business budget templates

A budget is a financial plan that allocates expected resources to specific activities. A budget can help you manage your finances, pay off debt and save for the future. The most common types of budgets include a 12-Month Business Budget, Department Business Budget, Professional Business Budget, and Small Business Budget.

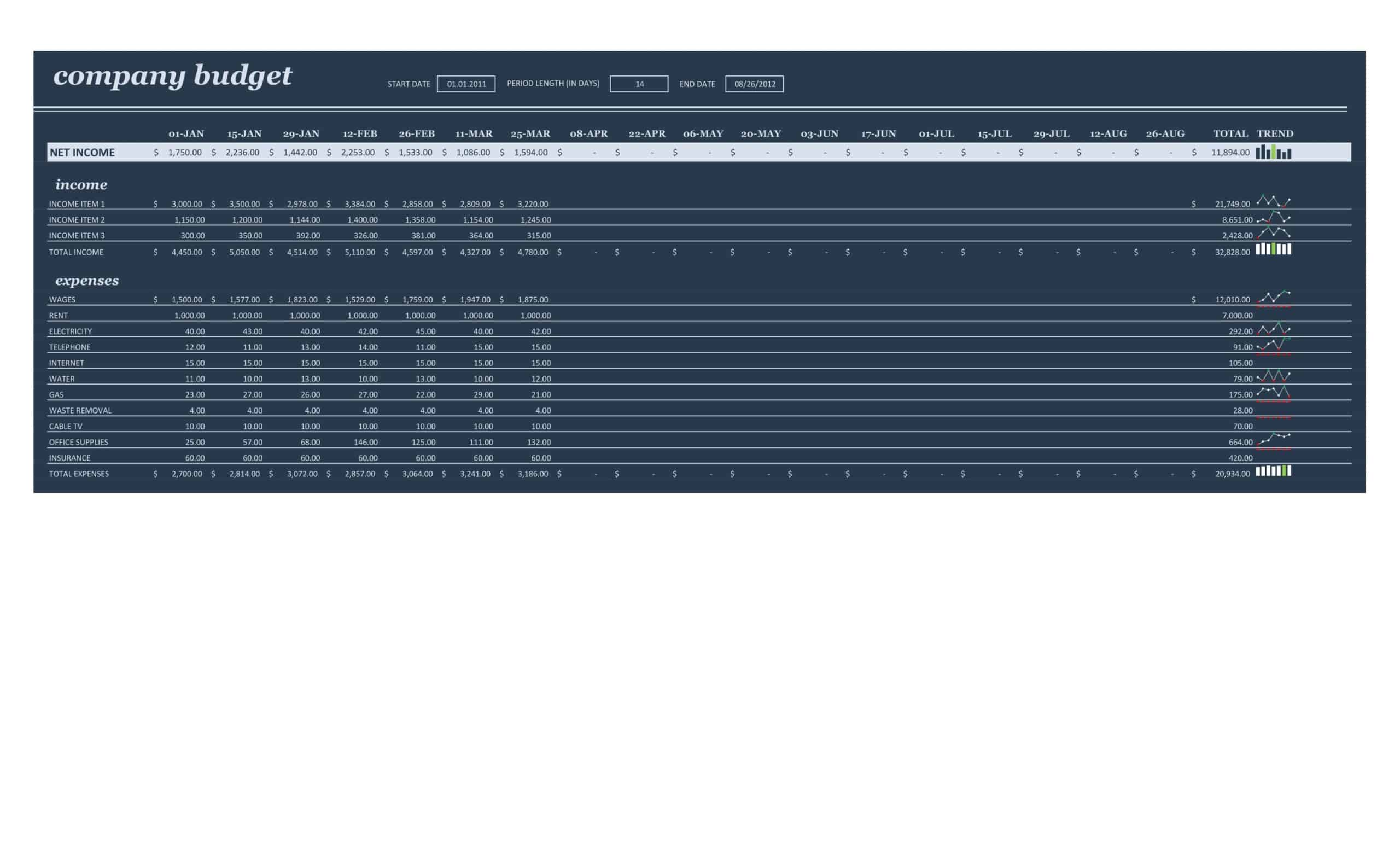

12-Month Business Budget

A 12-month business budget is ideal for companies that operate every year. It allows you to plan ahead of time and forecast revenues and expenses in the coming months, quarters, or years.

Department Business Budget

Suppose you have several departments in your organization. In that case, you might need a departmental budget template that lets you track each department’s finances separately from the rest of your company’s finances. This type of template helps you allocate resources where they are most needed and keeps everyone informed about how their part of the business is doing financially.

Professional Business Budget Template

Professional business budgets are used by companies needing more complex accounting tools than those offered by basic budget templates. This type of template usually includes more categories than those found in basic templates and various other features that help organize data better. However, professional budgets are more challenging to use than basic ones because they require more knowledge about accounting principles and practices.

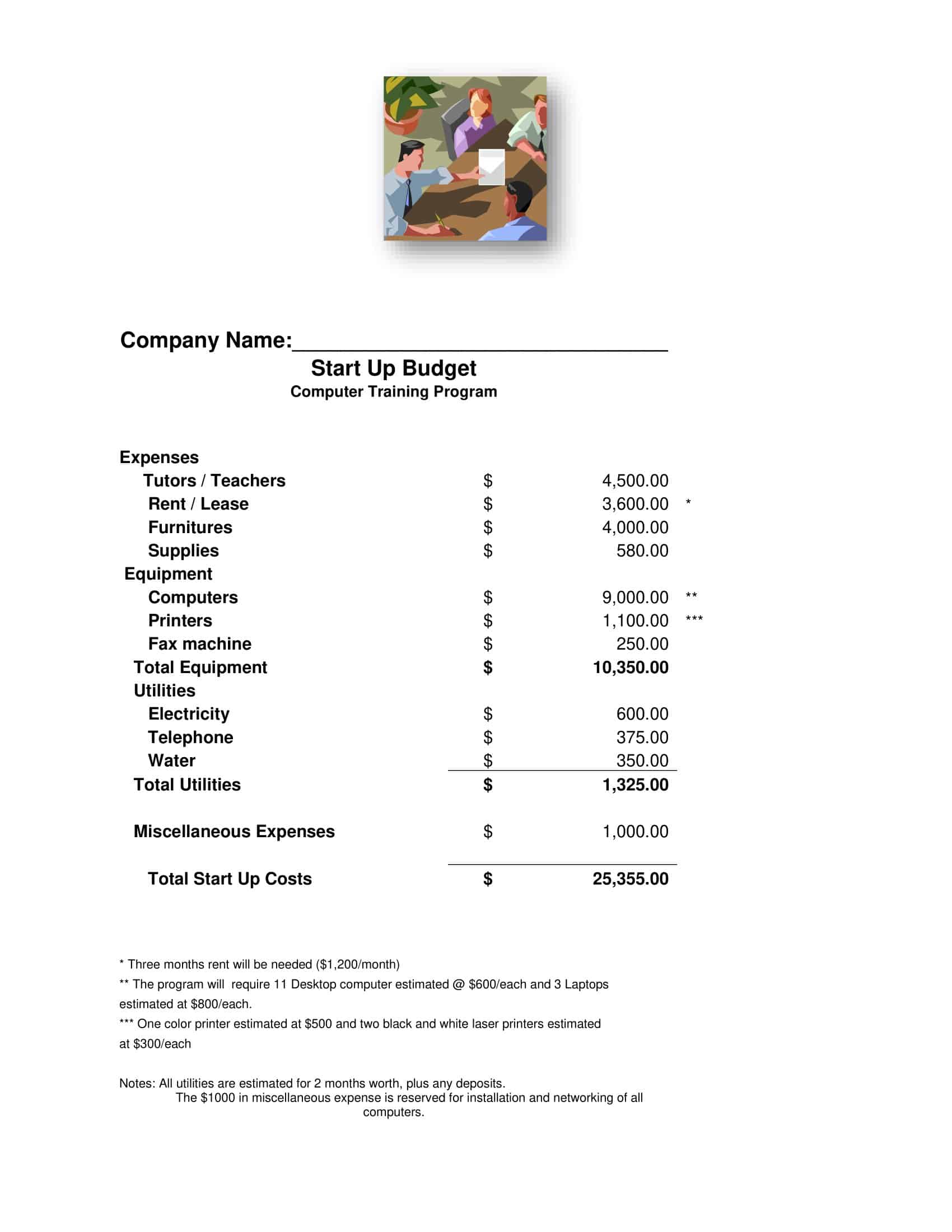

Small Business Budget

Small business budgets are useful for entrepreneurs who want to start their own businesses or expand their current ones. They provide clear-cut information on the company’s financial status and how it is performing in relation to its competitors in its industry. The template also indicates what areas need improvement so that you can adjust accordingly. It helps you set realistic goals for your company’s future development and manage cash flow efficiently so that there will be enough money available when needed most (e.g., when paying bills).

FAQs

How do I make a budget sheet for my business?

Make columns for income sources and expense categories. Add line items with monthly or yearly budget estimates. Include income like revenue, investments, and loans. Expenses can be things like payroll, rent, supplies, utilities, etc. Sum totals and ensure income exceeds expenses.

Is there a free budget template?

Yes, many free budget templates exist like vertex42, Smartsheet, and Excel budget templates. They contain formatted columns and common category headings to populate with your numbers. These can be customized as needed.

Does Excel have a budget template?

Yes, Excel has downloadable budget template files that include preset budget worksheets and financial tables. The files are customizable with personal income and spending details and contain formulas for calculations.

What is the budget rule for small business?

A key budgeting rule for small business is allocating revenue proportionately across necessary operating expenses, savings, debt payments, and owner’s salary. Aim for 50% to fixed costs, up to 30% to variable costs, 10% to savings, and 10% to owner’s pay.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)