Non-profit organizations play a vital role in promoting and supporting various causes and advocacies. They provide essential services and relief to those in need, and rely on the generosity of donors to continue their work.

To ensure that these donations are properly managed and accounted for, many non-profits use a donation or fundraiser tracker. This tool allows them to keep track of all contributions received, providing transparency and accountability for their donors.

Table of Contents

Donation Tracker Templates

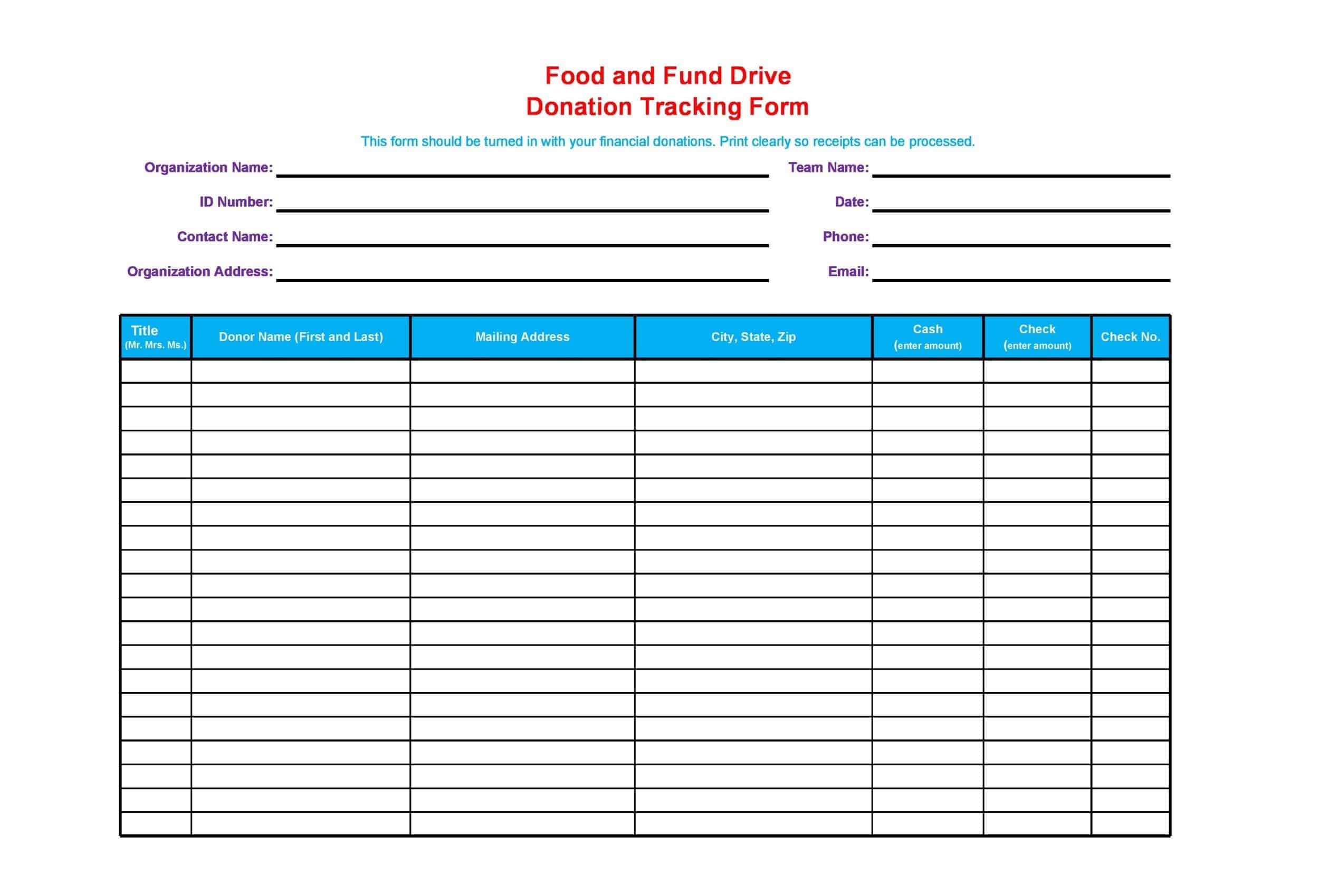

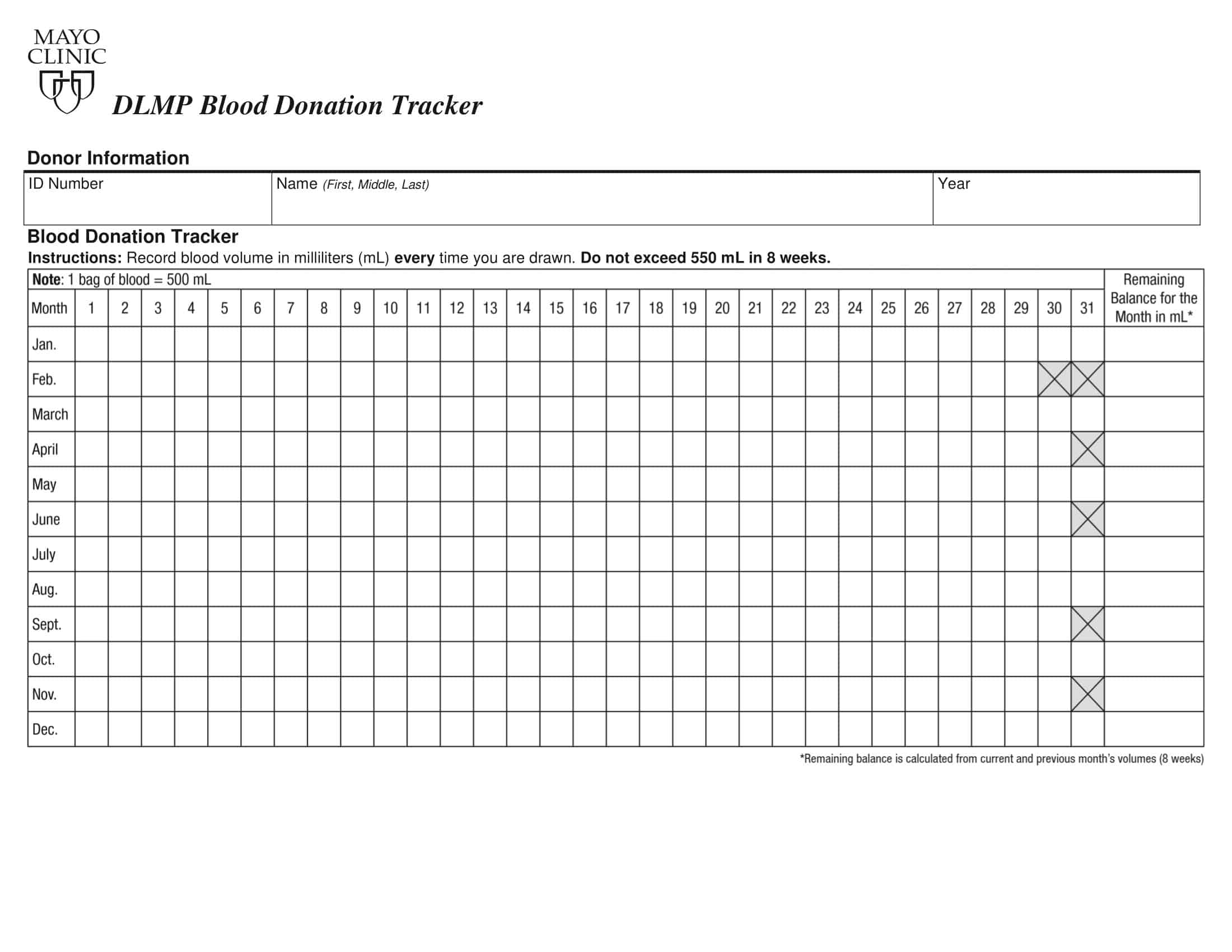

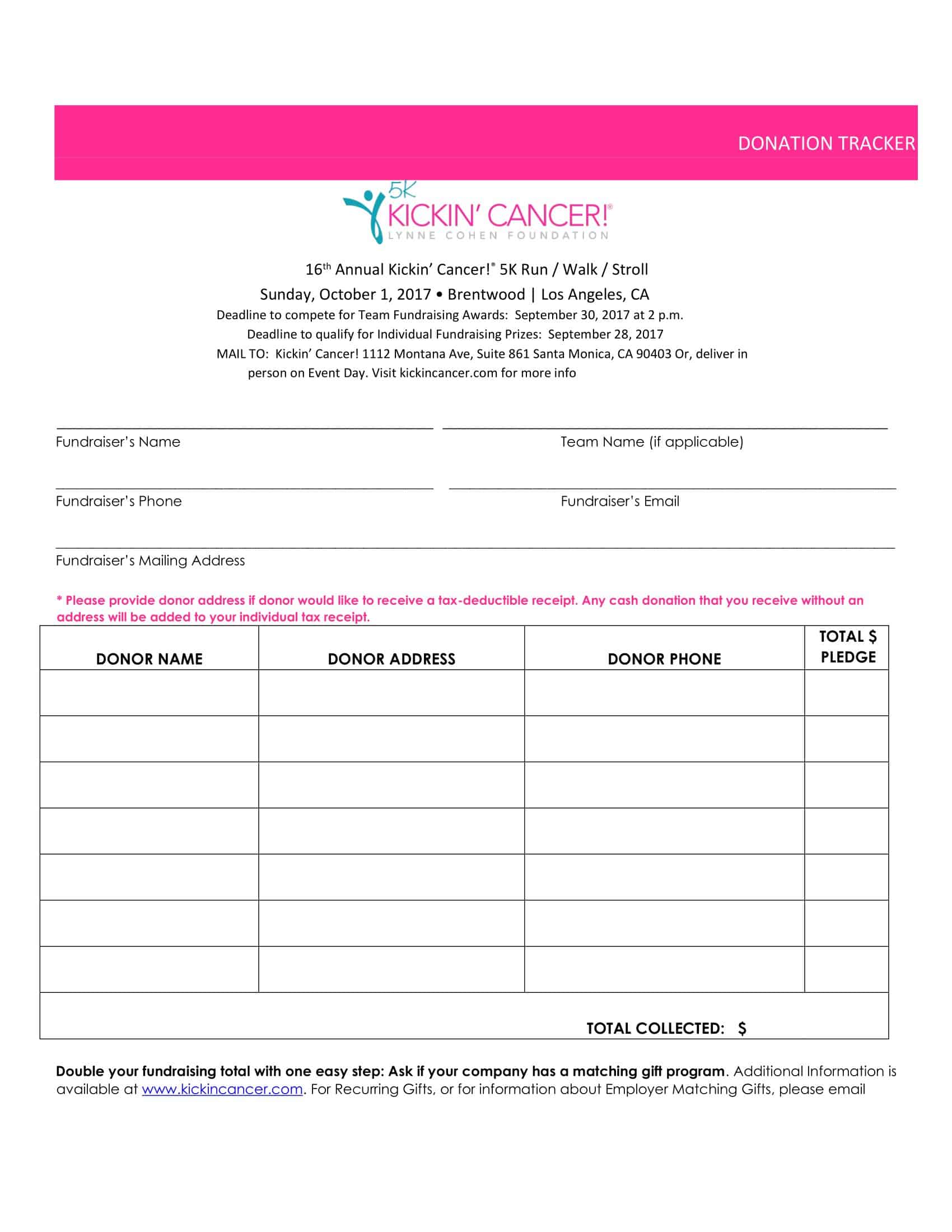

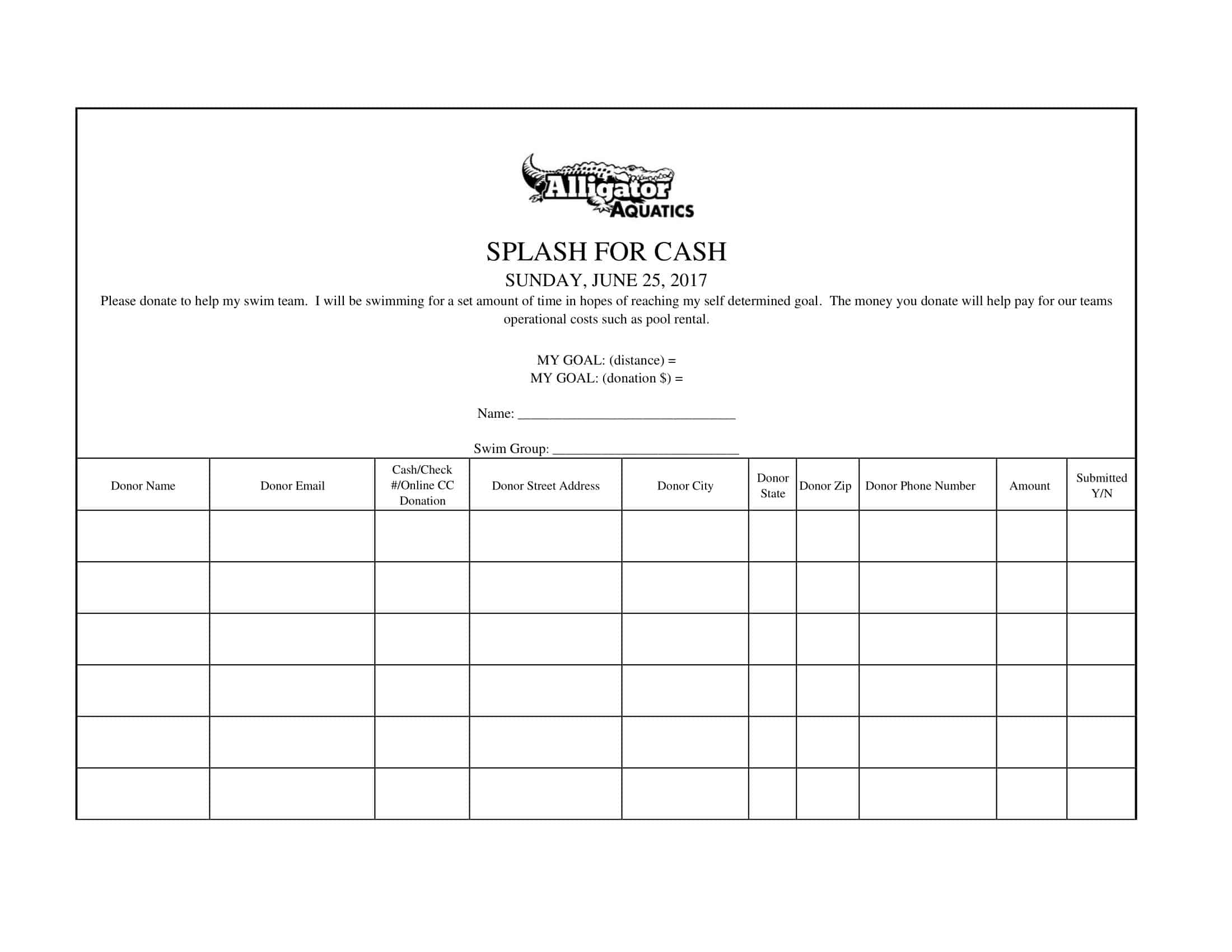

Donation Tracker Templates are pre-designed formats used by individuals, organizations, or nonprofits to track and record incoming donations, monitor fundraising progress, and maintain accurate records of contributions. These templates provide a structured framework for documenting essential information about each donation, such as the donor’s name, contact details, donation amount, date of donation, and any additional notes or specifications. Donation Tracker Templates ensure consistency, organization, and transparency in managing donations, enabling efficient tracking, reporting, and analysis of fundraising efforts.

Donation Tracker Templates assist in efficiently tracking and managing incoming donations, ensuring accuracy, transparency, and accountability in fundraising efforts. By using these templates, individuals and organizations can maintain organized records, monitor progress towards fundraising goals, and provide accurate reporting on funds raised.

Donation Tracker Templates facilitate effective donor management, enable targeted communication and stewardship, and support data-driven decision-making in fundraising strategies. These templates serve as valuable tools for nonprofits, charitable organizations, community initiatives, or individuals engaged in fundraising activities, enabling them to efficiently track, report, and analyze donation data for effective resource management and impactful giving.

What is a Donation Tracker ?

A donation tracker is a tool used by non-profit organizations to keep track of donations received from donors. This can include information such as the amount donated, the donor’s contact information, and the date the donation was received. By using a donation tracker, non-profits can have a clear and organized record of all donations, making it easier for them to manage their finances and ensure accountability to their donors.

Additionally, a donation tracker can be used to generate reports, helping organizations to better understand their funding sources and make data-driven decisions about their fundraising efforts.

Benefits of a donation tracker

There are several benefits to using a donation tracker for non-profit organizations:

Transparency and accountability: A donation tracker allows non-profits to keep track of all donations received, providing transparency and accountability to their donors.

Improved financial management: With a clear and organized record of all donations, non-profits can better manage their finances, ensuring that they are using funds in the most effective way.

Data-driven decision making: Donation trackers can generate reports that provide valuable insights into funding sources, helping organizations make data-driven decisions about their fundraising efforts.

Streamlined donation processing: A donation tracker can automate the process of collecting and managing donations, making it easier for organizations to handle large volumes of donations.

Improved donor engagement: By keeping track of donations, non-profits can better engage with donors and understand their giving habits. This can help them develop more effective fundraising strategies.

Data security: A donation tracker can also provide a secure way to store and manage sensitive donor information, protecting it from potential breaches.

How to track donations

Tracking donations can be a critical part of managing a nonprofit organization or charitable campaign. It allows you to keep track of who has donated, how much they have donated, and when they have made their donation. This information can be used to generate thank-you letters, issue receipts for tax purposes, and provide donors with regular updates on the impact of their donation.

Here is a comprehensive guide on how to track donations:

Step 1: Set up a donation tracking system

The first step in tracking donations is to set up a system for doing so. This can be done using a spreadsheet program such as Microsoft Excel or Google Sheets, or by using specialized donation tracking software.

When setting up your system, it’s important to consider what information you want to track. At a minimum, you’ll want to record the donor’s name, contact information, and donation amount. Additional information that may be useful to track includes the date of the donation, the donation method (e.g. cash, check, credit card), and any notes or comments about the donation.

Step 2: Collect donor information

Once you have your tracking system set up, you’ll need to start collecting information about your donors. This can be done through a variety of methods, such as:

Online donation forms: Many nonprofit organizations use online donation forms to collect donations through their website. These forms can be configured to automatically record donor information in your tracking system.

Manual entry: If you’re collecting donations in person or over the phone, you’ll need to manually enter donor information into your tracking system.

Importing data: If you’re using specialized donation tracking software, you may be able to import data from other sources, such as a CRM system or a fundraising database.

Step 3: Record donations

Once you have collected information about your donors, you can start recording their donations in your tracking system. This can be done manually by entering the donation amount and date, or automatically by linking your system to an online payment processor.

It’s important to make sure that all donations are recorded in a timely manner. This will help ensure that you can generate accurate financial reports and issue tax receipts to donors in a timely manner.

Step 4: Generate reports

One of the key benefits of tracking donations is the ability to generate reports that provide insight into your fundraising efforts. Some of the most common reports that organizations generate include:

Donor list: This report lists all of your donors, along with their contact information and donation history.

Donation summary: This report provides a summary of donations received, including the total amount raised, the number of donations, and the average donation amount.

Tax receipt: This report is used to issue tax receipts to donors who have made a charitable donation.

Step 5: Communicate with donors

Finally, it’s important to communicate with your donors on a regular basis to keep them informed about the impact of their donation and to thank them for their support. This can be done through a variety of channels, such as email, mail, or social media.

In addition to regular updates, it’s also important to send a thank-you note or receipt to donors after they have made a donation. This can be done through email or regular mail, and should include a personal message of appreciation along with a receipt for the donation.

In conclusion, tracking donations is a critical part of managing a nonprofit organization or charitable campaign. By setting up a system for tracking donations, collecting donor information, recording donations, generating reports, and communicating with donors, you can ensure that your fundraising efforts are effective and well-organized.

Benefits of making donations

Making donations can have a variety of benefits, both for the individual making the donation and for the recipient. Some benefits include:

- Helping to support a cause or organization that the individual believes in

- Feeling a sense of satisfaction and fulfillment from making a positive impact on the world

- Potentially reducing tax liability

- Creating connections and building community through shared values and goals

- Improving the well-being of individuals and communities in need

It’s also important to note that philanthropy can also be a powerful way to leverage resources to create systemic change and address social issues.

FAQs

How does a donation tracker work?

A donation tracker typically works by allowing users to input donation information such as the donor’s name, contact information, and the amount of the donation. This information is then stored in a database and can be used to generate reports and track the progress of a fundraising campaign. Some donation trackers may also integrate with payment processors to allow for online donations to be tracked in real-time.

Are there any free donation tracker software available?

There are a number of free donation tracker software available online, such as Google Sheets, Excel, or Airtable. Some may also have free versions of paid software with limited functionalities.

Can donation tracker software be integrated with other tools?

Yes, some donation tracker software can be integrated with other tools such as payment processors, accounting software, and CRM systems to streamline processes and improve efficiency.

How to select the right donation tracker software?

When selecting a donation tracker software, consider your needs and budget. You should also look at the features offered by different software and compare them to your requirements. It’s also important to consider the level of support provided, ease of use, and scalability of the software.

Can donation tracker software handle recurring donations?

Some donation tracker software can handle recurring donations, which are donations made on a regular schedule (e.g. monthly, quarterly, etc.). This feature can be useful for organizations that rely on regular donations from supporters.

Can I use a donation tracker for crowdfunding campaigns?

Yes, some donation trackers can be used for crowdfunding campaigns, which are a type of fundraising campaign where a large number of people make small donations to support a specific project or cause. These trackers can be used to track the progress of the campaign, manage donations, and communicate with donors.

Can I use a donation tracker to send thank-you emails to donors?

Some donation trackers have built-in functionality to send automated thank-you emails to donors. This can be a great way to show appreciation for donations and keep donors informed about the progress of the campaign or organization.

Is it possible to export data from a donation tracker?

Many donation trackers offer the ability to export data in a variety of formats, such as CSV or Excel, for use in other systems or for backup purposes. This feature can be useful for organizations that need to share donation data with other departments or stakeholders.

Can I customize the reports generated by a donation tracker?

Many donation trackers offer the ability to customize reports, such as selecting the data fields to include and the format of the report. This feature can be useful for organizations that need to track specific types of data or generate reports for specific stakeholders.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Financial Projections Templates [Excel, PDF] 3 Financial Projection](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Projection-1-150x150.jpg)