A prenuptial agreement, also known as a premarital agreement or “prenup,” is a legally binding contract entered into by two individuals before they get married. The agreement outlines how property and assets will be divided in the event of a divorce or death.

Prenups can also address issues related to spousal support and other financial matters. While historically prenups were primarily used by wealthy individuals, they are becoming increasingly common among couples of all income levels. Prenuptial agreements can provide peace of mind and can help prevent disputes in the event of a divorce.

Table of Contents

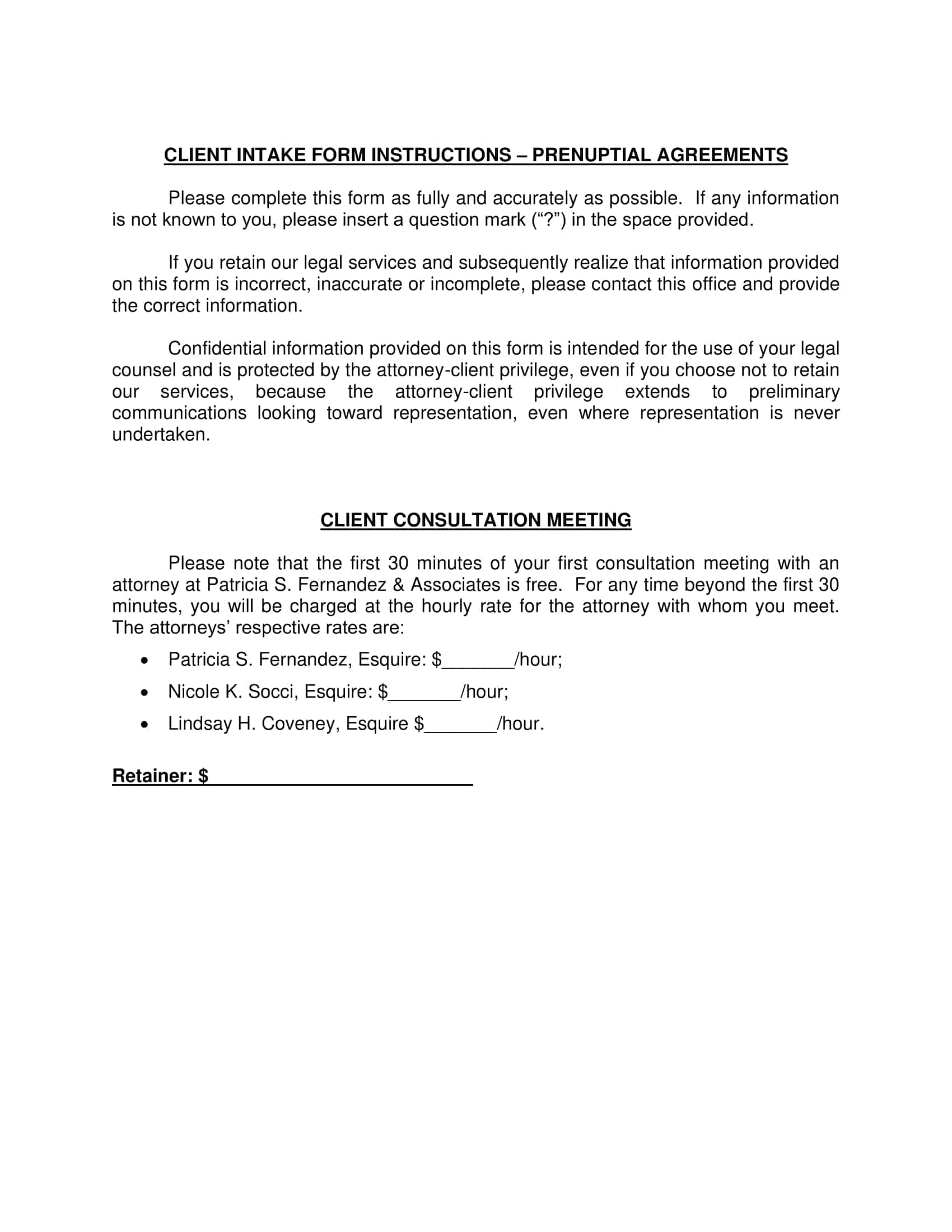

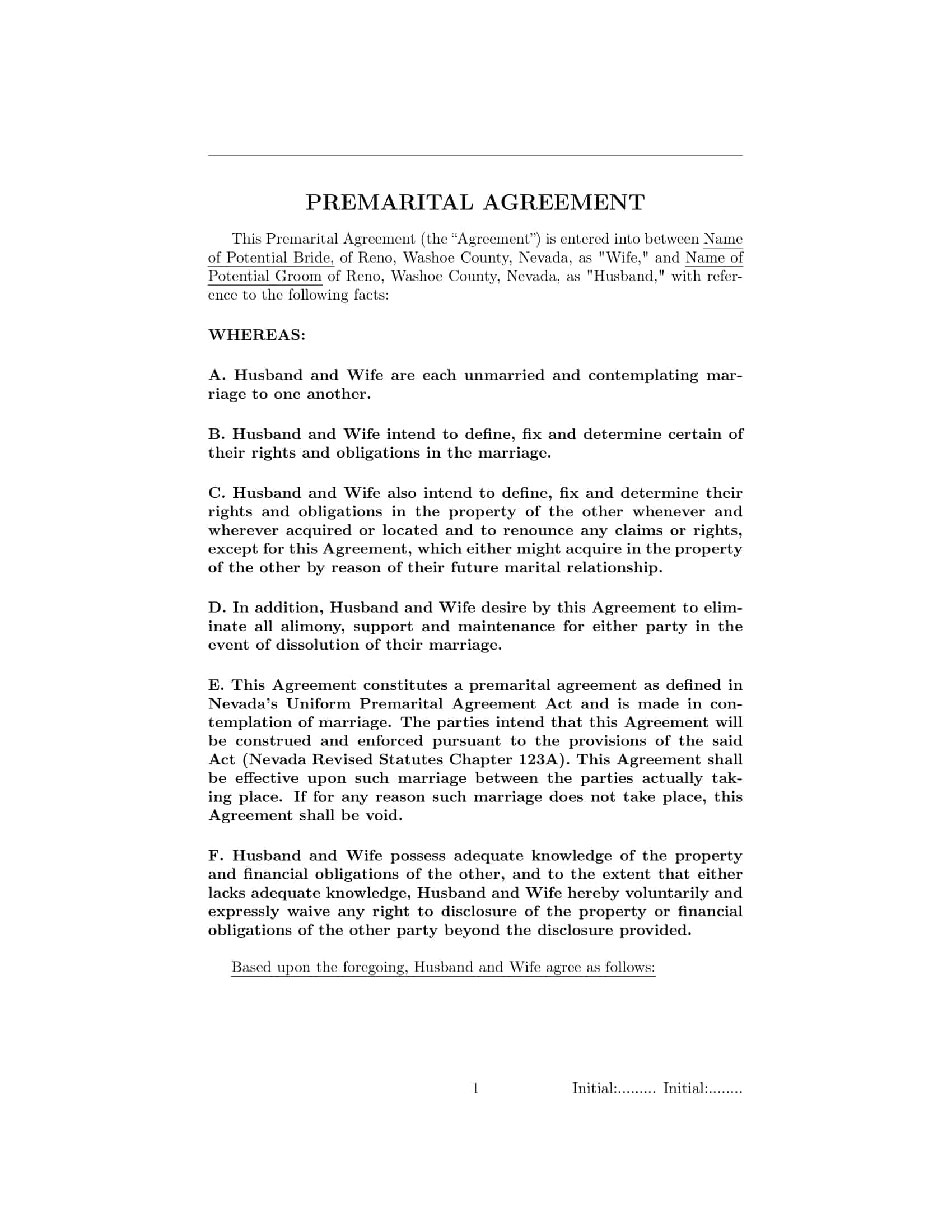

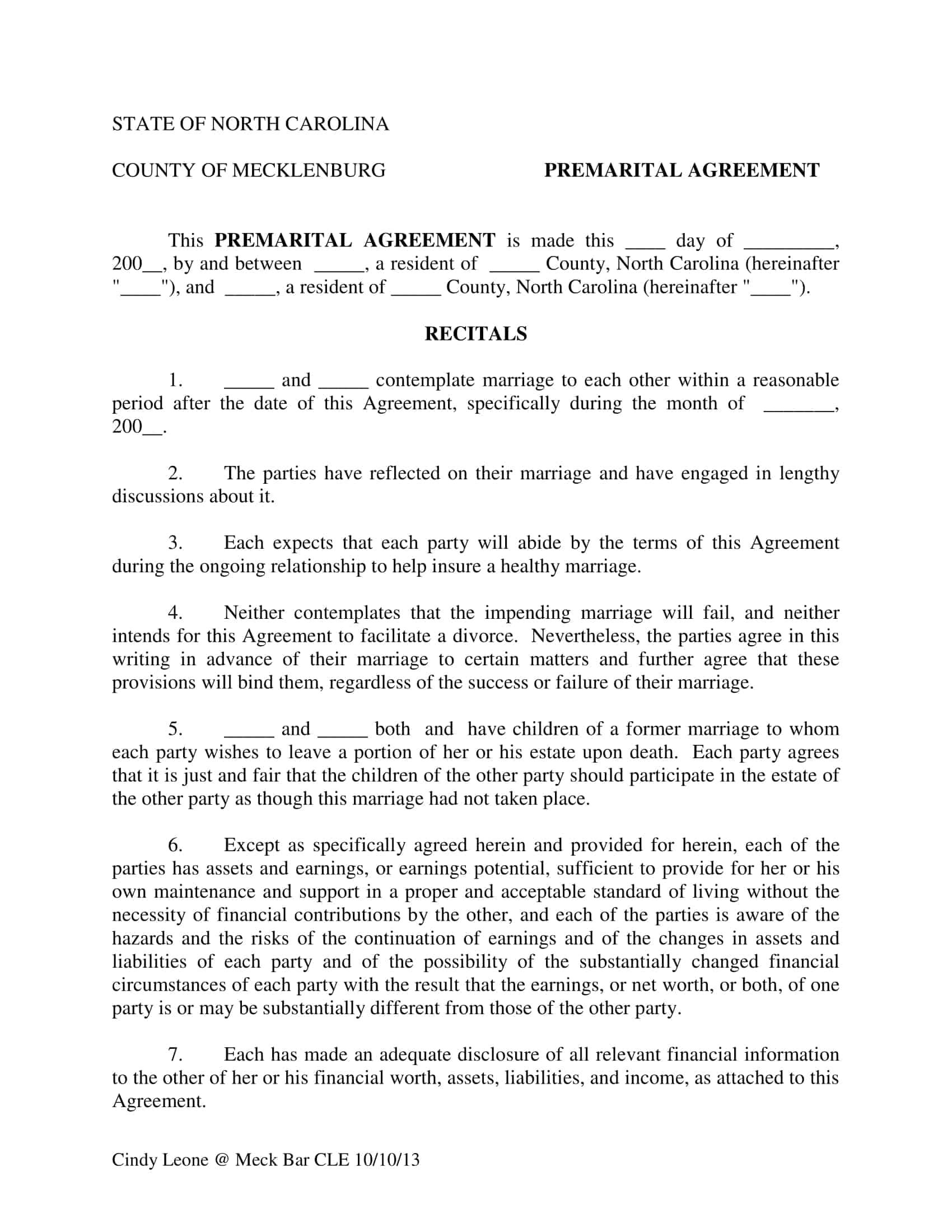

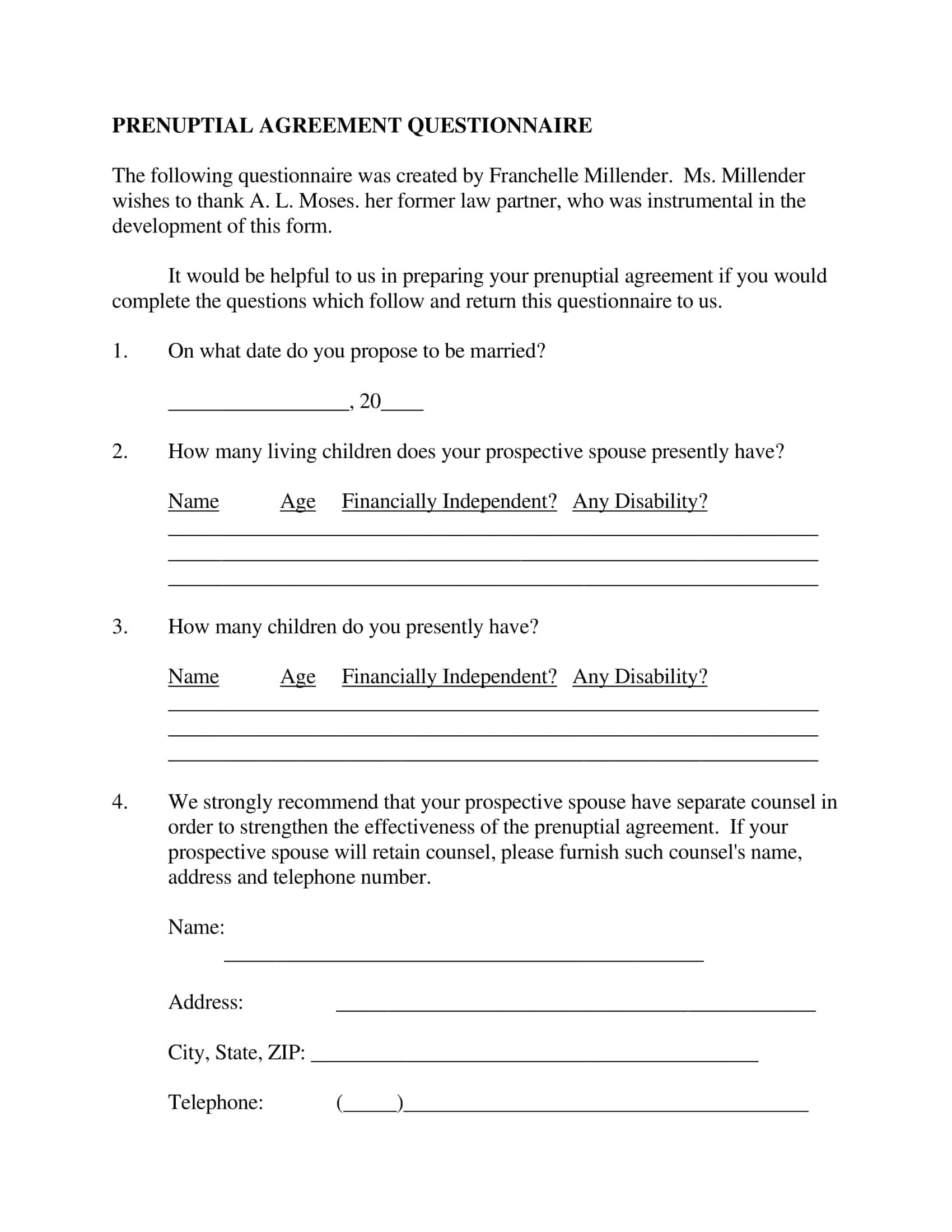

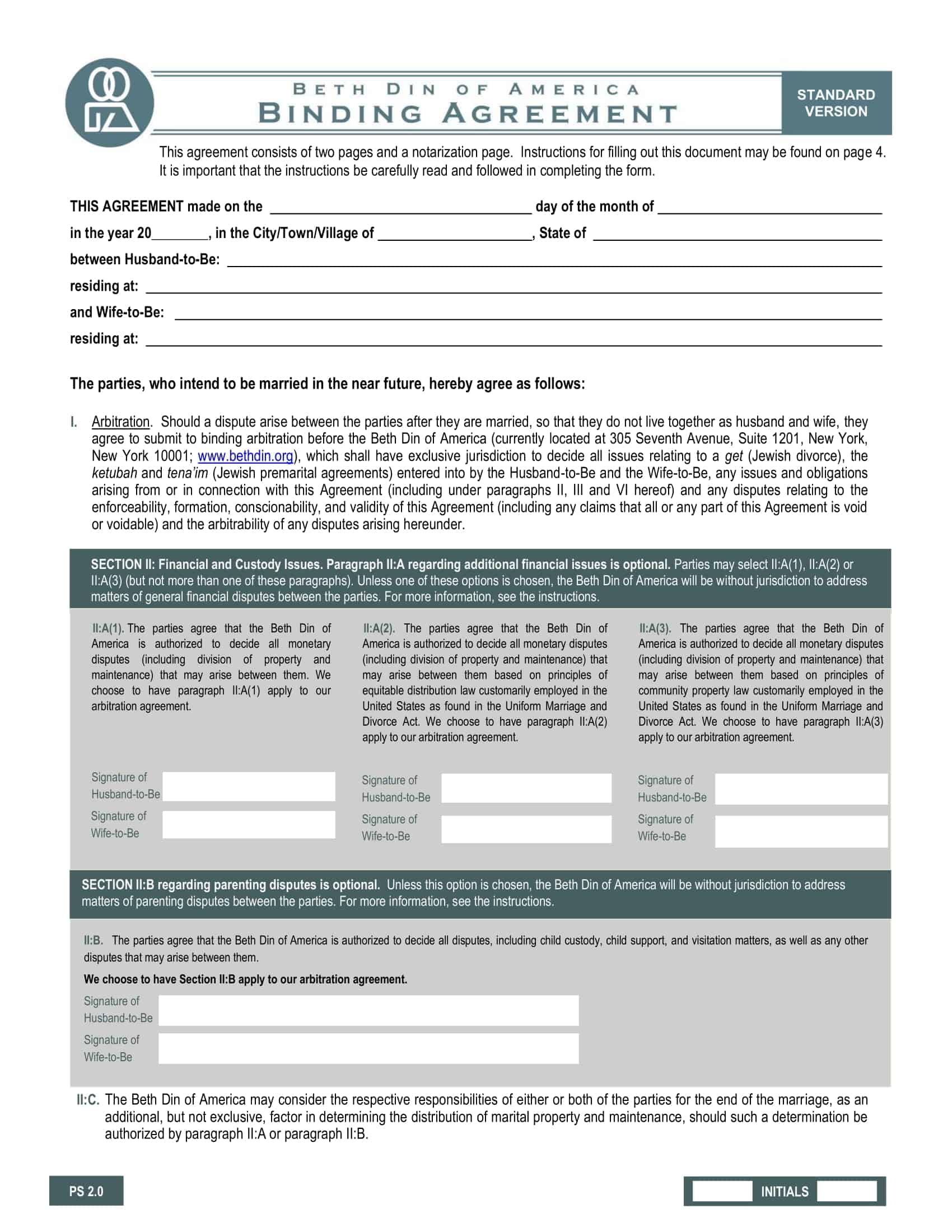

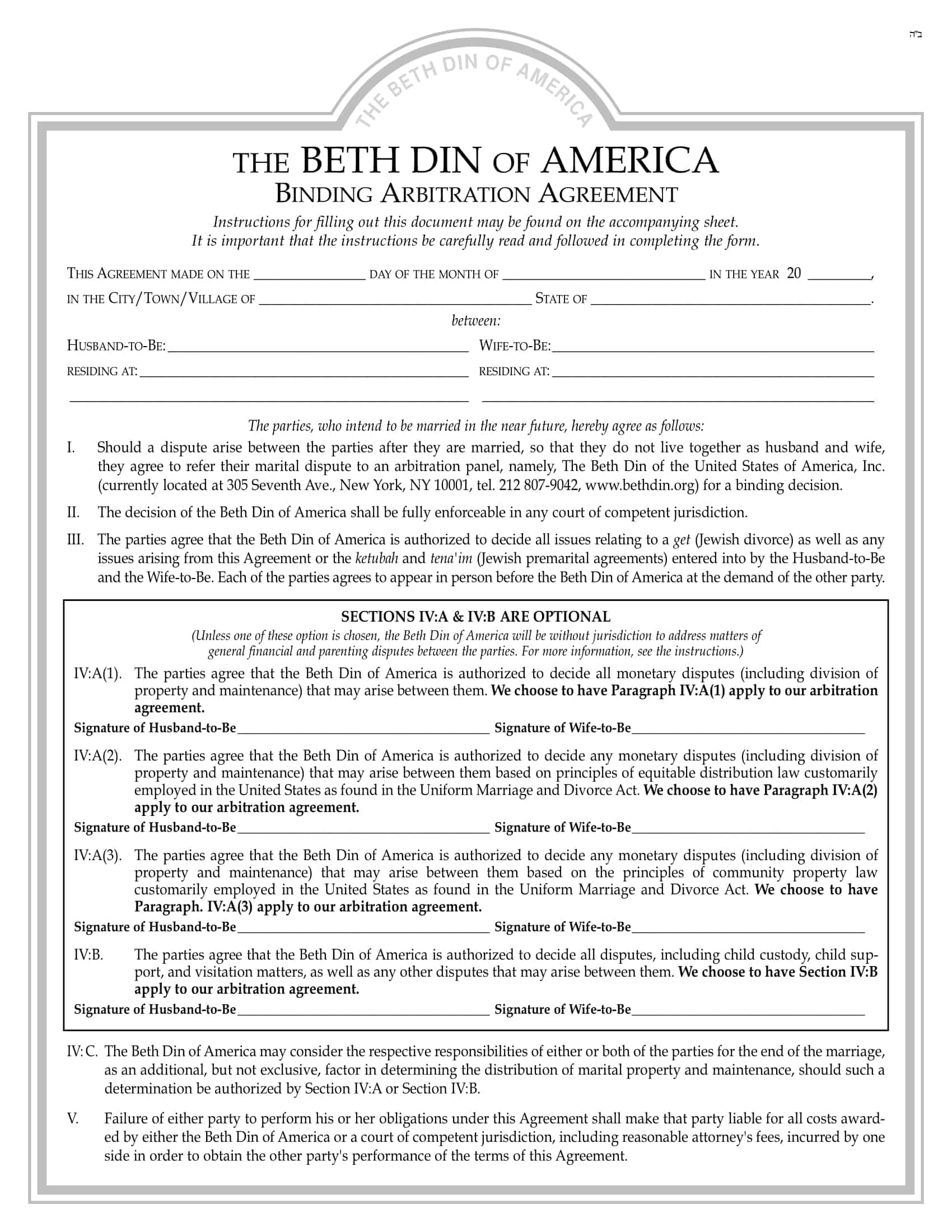

Prenuptial Agreement Templates

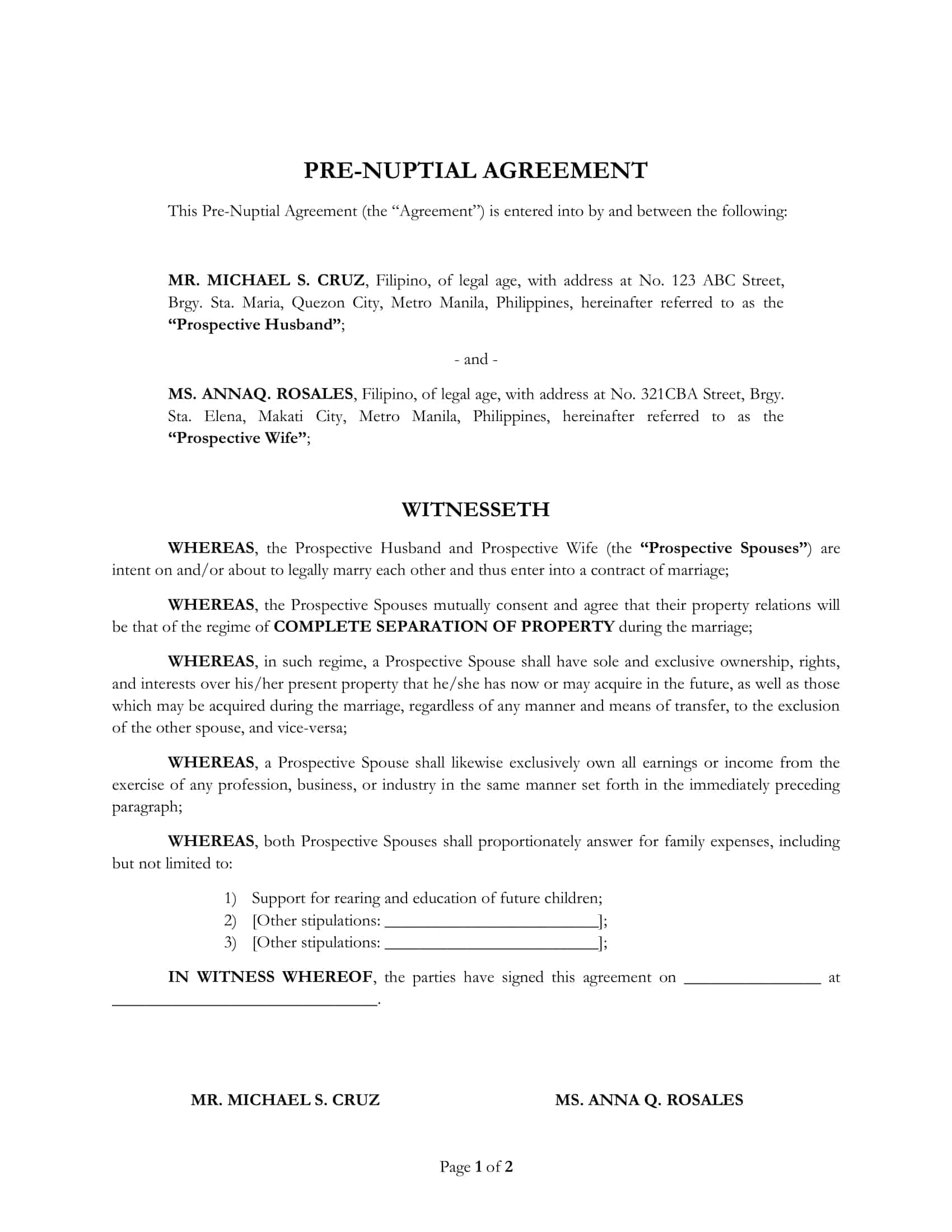

“Prenuptial Agreement Templates” are pre-designed legal documents that provide a framework for couples to establish financial and property arrangements before entering into marriage or a civil partnership. These templates serve as valuable tools for individuals seeking to protect their assets, define spousal rights, and clarify financial responsibilities in the event of divorce or separation.

A prenuptial agreement, also known as a prenup or premarital agreement, is a legally binding contract that outlines the division of assets, debts, and spousal support in the event of divorce or dissolution of the marriage. Prenuptial agreement templates offer a structured format that covers important considerations such as property ownership, financial obligations, inheritance rights, and other relevant provisions.

By utilizing prenuptial agreement templates, couples can openly and transparently discuss their financial expectations, rights, and obligations prior to marriage. These templates facilitate communication and provide a clear framework for resolving potential disputes, ensuring that both parties are protected and have a mutual understanding of their financial arrangements.

Why You Need a Prenuptial Agreement?

There are several reasons why a couple may choose to use a prenuptial agreement. Some of the most common reasons include:

Protection of assets: A prenup can protect one or both parties’ assets, such as a family business, real estate, or investments, from being divided in the event of a divorce.

Clarity on financial responsibilities: A prenup can clearly define each party’s financial responsibilities during the marriage and in the event of a divorce.

Peace of mind: A prenup can provide peace of mind for both parties by clearly outlining their rights and responsibilities before getting married.

Avoiding disputes: A prenup can help prevent disputes and legal battles in the event of a divorce by clearly outlining how property and assets will be divided.

Protecting future inheritance: A prenuptial agreement can protect any future inheritance that a party may receive from family members.

Simplifying the divorce process: A prenuptial agreement can simplify the divorce process by providing a clear roadmap for the division of assets, making the process less time-consuming and costly.

What Should Be Covered in a Prenuptial Agreement?

A prenuptial agreement should cover any financial or property-related matter that is important to one or both parties. Some of the most common topics that are covered in prenups include:

Division of assets: This includes the division of property, assets, and debts in the event of a divorce or death.

Spousal support: This outlines the amount of spousal support that will be paid in the event of a divorce and the duration of such payments.

Property ownership: This outlines the ownership rights and responsibilities of each party, particularly with regards to property acquired before or during the marriage.

Business ownership: For those who own a business, a prenuptial agreement can outline the ownership rights and responsibilities of each party with regards to the business.

Retirement benefits: This outlines how retirement benefits, such as pensions or 401(k)s, will be divided in the event of a divorce.

Children from previous marriage: A prenuptial agreement can provide for financial support and inheritance rights for children from a previous marriage.

Protection of future inheritance: A prenuptial agreement can protect any future inheritance that a party may receive from family members.

Agreements on spending and financial management: Some couple also include their agreements on how they will manage their finances, expenses and saving during their marriage.

It’s important to note that prenuptial agreements can be customized to meet the specific needs and concerns of each couple. It’s also essential to consult a lawyer before signing a prenuptial agreement to ensure that it is legally binding and enforceable.

Pros and Cons of Prenuptial Agreement

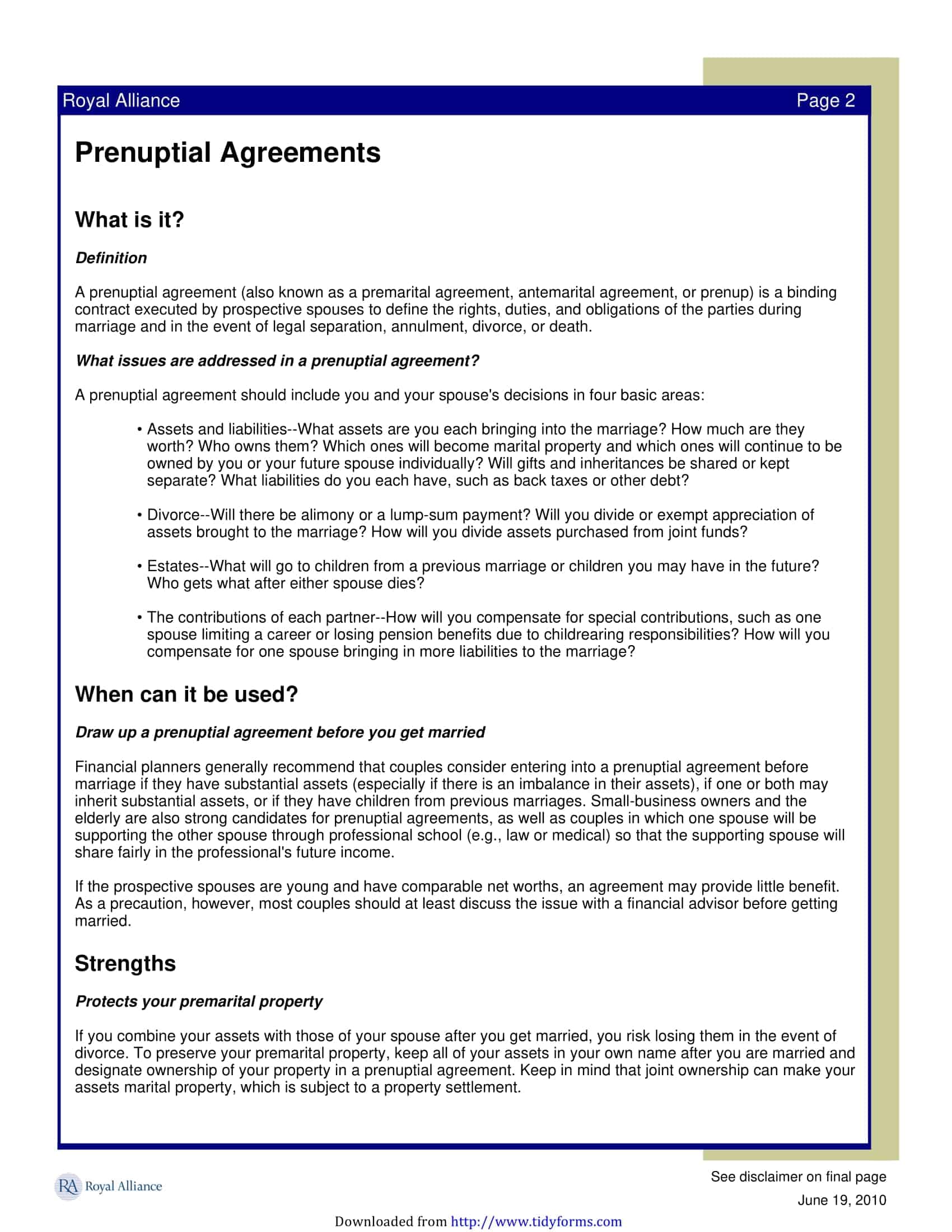

Pros of Prenuptial Agreement:

Protection of assets: Prenups can protect one or both parties’ assets, such as a family business, real estate, or investments, from being divided in the event of a divorce.

Clarity on financial responsibilities: Prenups can clearly define each party’s financial responsibilities during the marriage and in the event of a divorce.

Peace of mind: Prenups can provide peace of mind for both parties by clearly outlining their rights and responsibilities before getting married.

Avoiding disputes: Prenups can help prevent disputes and legal battles in the event of a divorce by clearly outlining how property and assets will be divided.

Simplifying the divorce process: Prenups can simplify the divorce process by providing a clear roadmap for the division of assets, making the process less time-consuming and costly.

Cons of Prenuptial Agreement:

Cost: Prenups can be expensive to draft and negotiate, especially if legal representation is required.

Complexity: Prenups can be complex and difficult to understand, especially for those without legal experience.

Lack of flexibility: Prenups can be inflexible and may not take into account unexpected changes in circumstances.

Lack of trust: Prenups can be seen as a lack of trust in the relationship, which can lead to emotional tension and strain.

Unenforceable: Prenups can be unenforceable if not prepared or executed properly.

Most Common Limitations of the Prenuptial Agreement

Prenuptial agreements, also known as premarital agreements or prenups, are legal contracts that couples enter into before getting married. These agreements outline how assets will be divided in the event of a divorce or death. However, prenuptial agreements do have some limitations.

Unfair terms

Prenuptial agreements can be challenged if they are found to be unjust or one-sided. A court may not enforce an agreement that is overly oppressive or that leaves one party without adequate support.

Changing circumstances

Prenuptial agreements are based on the financial circumstances of the parties at the time the agreement is signed. If circumstances change significantly, such as the birth of children or a significant change in income, a court may not enforce the agreement as written.

Fraud or duress

Prenuptial agreements may be invalidated if one party can prove that the agreement was signed under duress or that the other party engaged in fraud.

Child support

Prenuptial agreements cannot limit child support obligation.

Public policy

Prenuptial agreements may not be enforced if they contravene public policy.

Invalidated by court

A court can invalidate a prenuptial agreement if it does not comply with the requirements of the state law where the parties reside.

Despite these limitations, prenuptial agreements can be a useful tool for couples to plan for the future and protect their assets. It’s important to consult a lawyer before drafting a prenuptial agreement to ensure that it is legally enforceable.

How to Draft Your Own Prenuptial Agreement

Drafting a prenuptial agreement, also known as a premarital agreement or prenup, is a significant step for couples who are getting married. Prenuptial agreements are legal contracts that outline how assets will be divided in the event of a divorce or death. While it’s always best to consult with a lawyer when drafting a prenup, it is possible to draft your own prenuptial agreement if you and your partner are comfortable with the process.

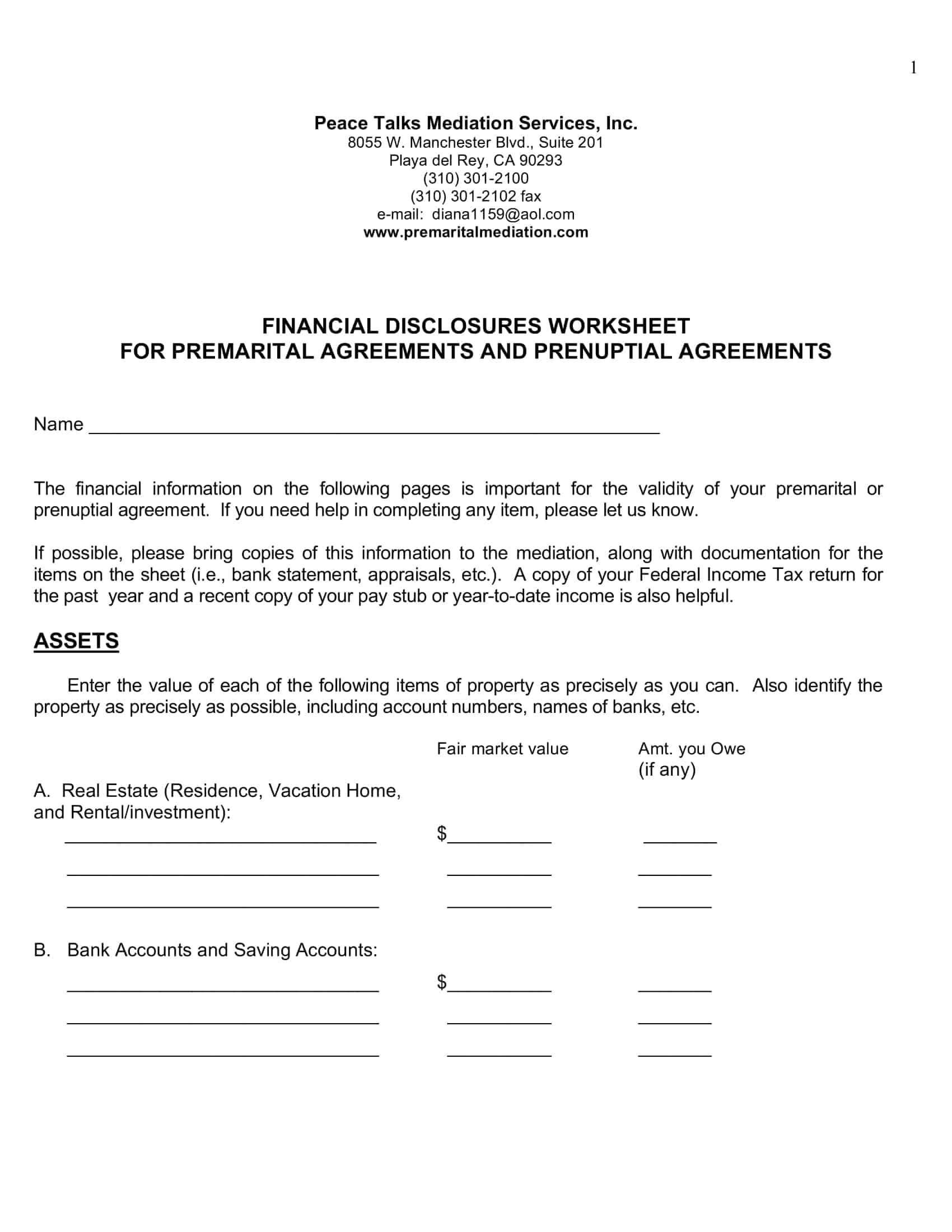

Step 1: Gather Information on Your Assets and Debts

The first step in drafting your own prenuptial agreement is to gather information on your assets and debts. This includes information on your income, savings, investments, real estate, and any other assets you own. It’s also important to list any debts you have, such as student loans, credit card debt, or mortgages.

Step 2: Decide on the Terms of the Agreement

Once you have a clear understanding of your assets and debts, you and your partner can start discussing the terms of the prenuptial agreement. Some common issues that are addressed in prenups include:

- Division of property in the event of a divorce

- Spousal support or alimony

- Handling of debts and liabilities

- Protection of pre-marital assets

- Protection of inherited or gifted assets

- It’s important to note that prenuptial agreements cannot limit child support obligations.

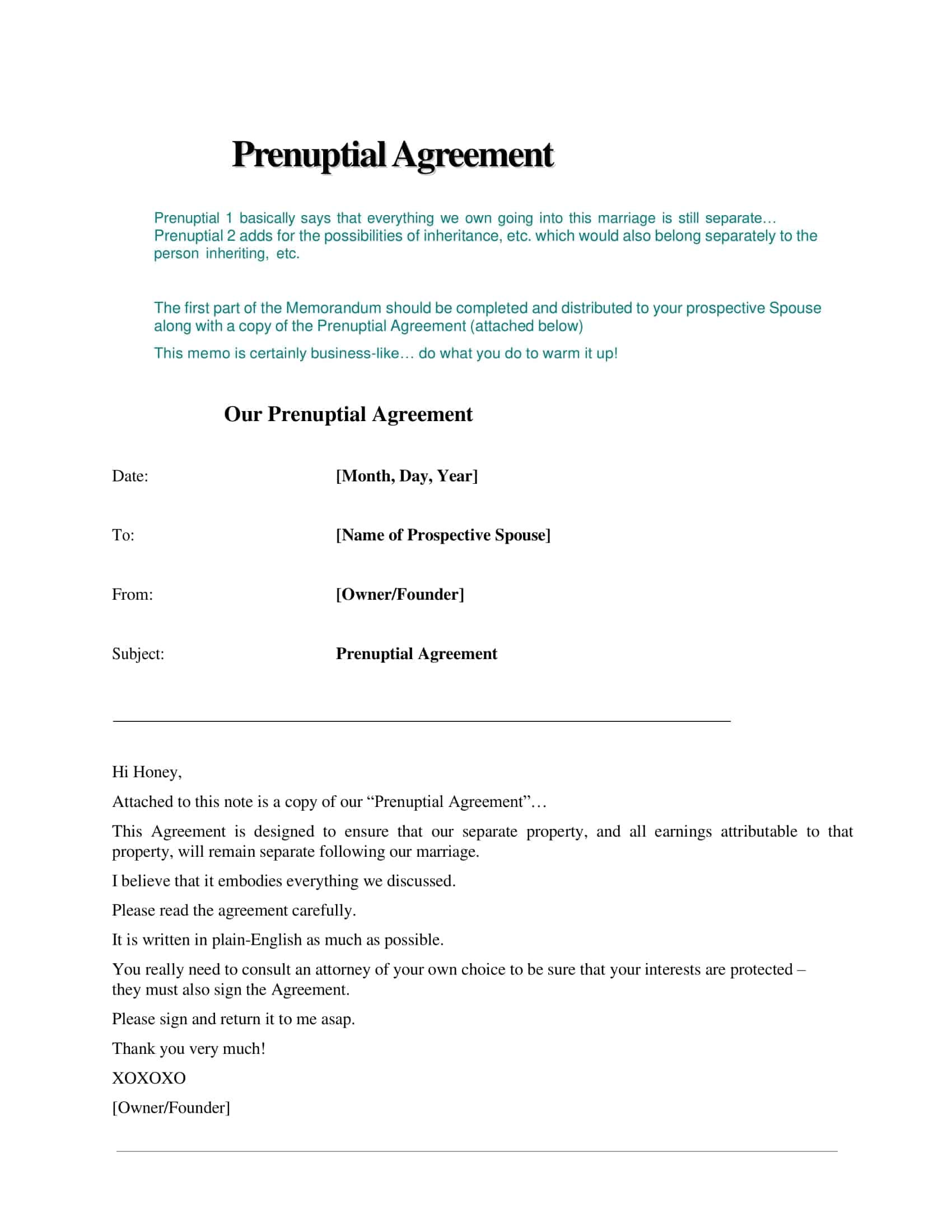

Step 3: Write the Agreement

Once you’ve decided on the terms of the agreement, it’s time to start writing the prenuptial agreement. It is important to use clear and concise language and to avoid legal jargon.

Here are some key elements that should be included in your prenuptial agreement:

Identification of the parties: The prenuptial agreement should clearly identify both parties, including their full names and addresses.

Statement of purpose: The prenuptial agreement should state the purpose of the agreement, which is typically to outline how assets and debts will be handled in the event of a divorce or death.

Division of property: The prenuptial agreement should clearly outline how property will be divided in the event of a divorce. This includes information on which assets will be considered separate property and which will be considered marital property.

Spousal support: The prenuptial agreement should address whether or not spousal support or alimony will be paid and, if so, how much and for how long.

Handling of debts and liabilities: The prenuptial agreement should outline how debts and liabilities will be handled in the event of a divorce.

Signatures: Both parties should sign the prenuptial agreement and have it notarized for authenticity.

Step 4: Review and Revise the Agreement

Once you’ve finished writing the prenuptial agreement, it’s important to review it carefully and make any necessary revisions. It is advisable to have each party review the agreement separately and then to have both parties sit down together to discuss any issues or concerns.

Step 5: Consult with a Lawyer

Even if you’ve drafted your own prenuptial agreement, it’s important to consult with a lawyer before signing it. A lawyer can review the agreement to ensure that it is legally enforceable and that it complies with state laws.

It is important to note that prenuptial agreements are legally binding contracts. Therefore, it’s essential to be honest and transparent about your assets and debts and to consider the needs of both parties when drafting the agreement. It’s also important to remember that prenuptial agreements can be challenged in court if they are found to be unjust or one-sided. This is why it’s essential to consult with a lawyer and to review the agreement carefully before signing it.

Step 6: Sign the Agreement

Once you’ve reviewed and revised the prenuptial agreement and consulted with a lawyer, it’s time to sign the agreement. Both parties should sign the agreement in the presence of a notary public. This ensures that the agreement is legally binding and that the signatures are authentic.

Step 7: Keep the Agreement Safe

After you’ve signed the prenuptial agreement, it’s important to keep the agreement in a safe place. This could be a safe deposit box, a lawyer’s office, or another secure location. It’s essential to have easy access to the agreement in case it’s needed in the future.

In conclusion, drafting your own prenuptial agreement can be a cost-effective and efficient way to plan for the future and protect your assets. However, it’s important to gather information on your assets and debts, decide on the terms of the agreement, write the agreement, review and revise the agreement, consult with a lawyer, sign the agreement, and keep the agreement safe. It’s always best to consult with a lawyer to ensure that the agreement is legally binding and enforceable.

FAQs

Why do people get prenuptial agreements?

Prenuptial agreements are often used by couples to protect their assets and plan for the future. They can also be used to define roles and expectations within the marriage and to provide financial security in the event of a divorce.

Are prenuptial agreements legally binding?

Yes, prenuptial agreements are legally binding contracts. The agreements are enforceable in court as long as they comply with state laws and are entered into voluntarily by both parties.

What can be included in a prenuptial agreement?

Prenuptial agreements can include a variety of terms, such as how assets and debts will be divided in the event of a divorce or death, spousal support or alimony, and handling of debts and liabilities. Child support cannot be limited by prenuptial agreements.

Can a prenuptial agreement be challenged in court?

Yes, prenuptial agreements can be challenged in court if they are found to be unjust or one-sided. A court may not enforce an agreement that is overly oppressive or that leaves one party without adequate support.

Is it necessary to have a lawyer when drafting a prenuptial agreement?

While it is possible to draft your own prenuptial agreement, it is recommended to have a lawyer review the agreement before signing it to ensure that it is legally enforceable and compliant with state laws.

Does a prenuptial agreement need to be notarized?

Yes, prenuptial agreements should be signed by both parties and notarized for authenticity. This ensures that the agreement is legally binding and that the signatures are authentic.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Payment Agreement Templates [PDF, Word] 3 Payment Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Payment-Agreement-1-150x150.jpg)