In this post, we’ll be diving into the world of real estate transactions, specifically focusing on an essential, yet often misunderstood legal document: the Quitclaim Deed. As a property owner or someone looking to acquire a property, you may encounter various types of deeds throughout your real estate journey.

The Quitclaim Deed, in particular, offers a unique way to transfer ownership interests without making any guarantees about the property’s title. So, join us as we explore the ins and outs of Quitclaim Deeds, their benefits and limitations, and how they differ from other types of deeds commonly used in real estate transactions. Let’s get started!

Table of Contents

What is a quitclaim deed?

A quitclaim deed is a legal document used in real estate transactions to transfer an individual’s interest in a property to another person without providing any warranties or guarantees about the property’s title. It is often used in situations where the grantor (the person transferring their interest) and the grantee (the person receiving the interest) have an existing relationship, such as family members, divorcing spouses, or business partners. The quitclaim deed is considered a relatively simple and quick method to transfer ownership interests, but it comes with certain limitations and risks.

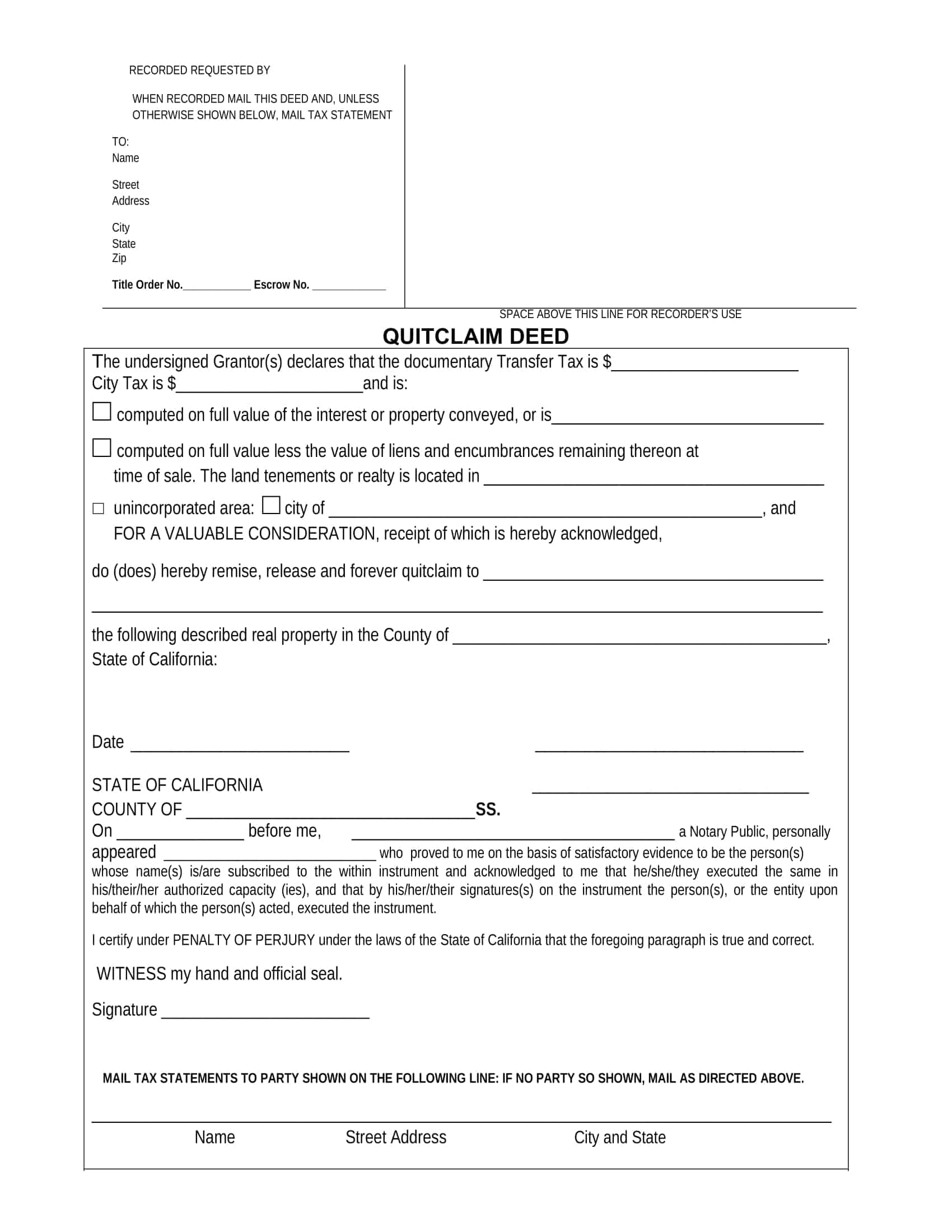

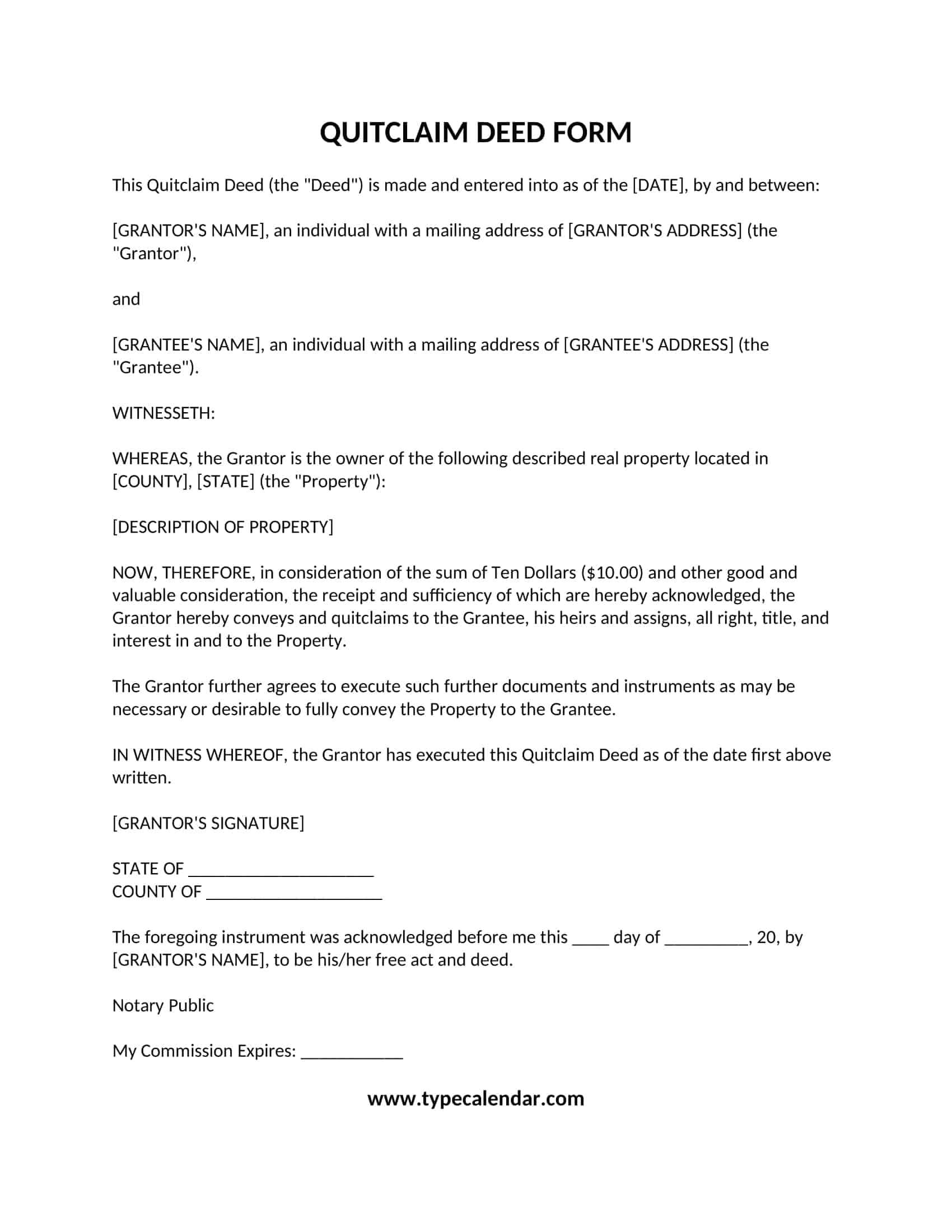

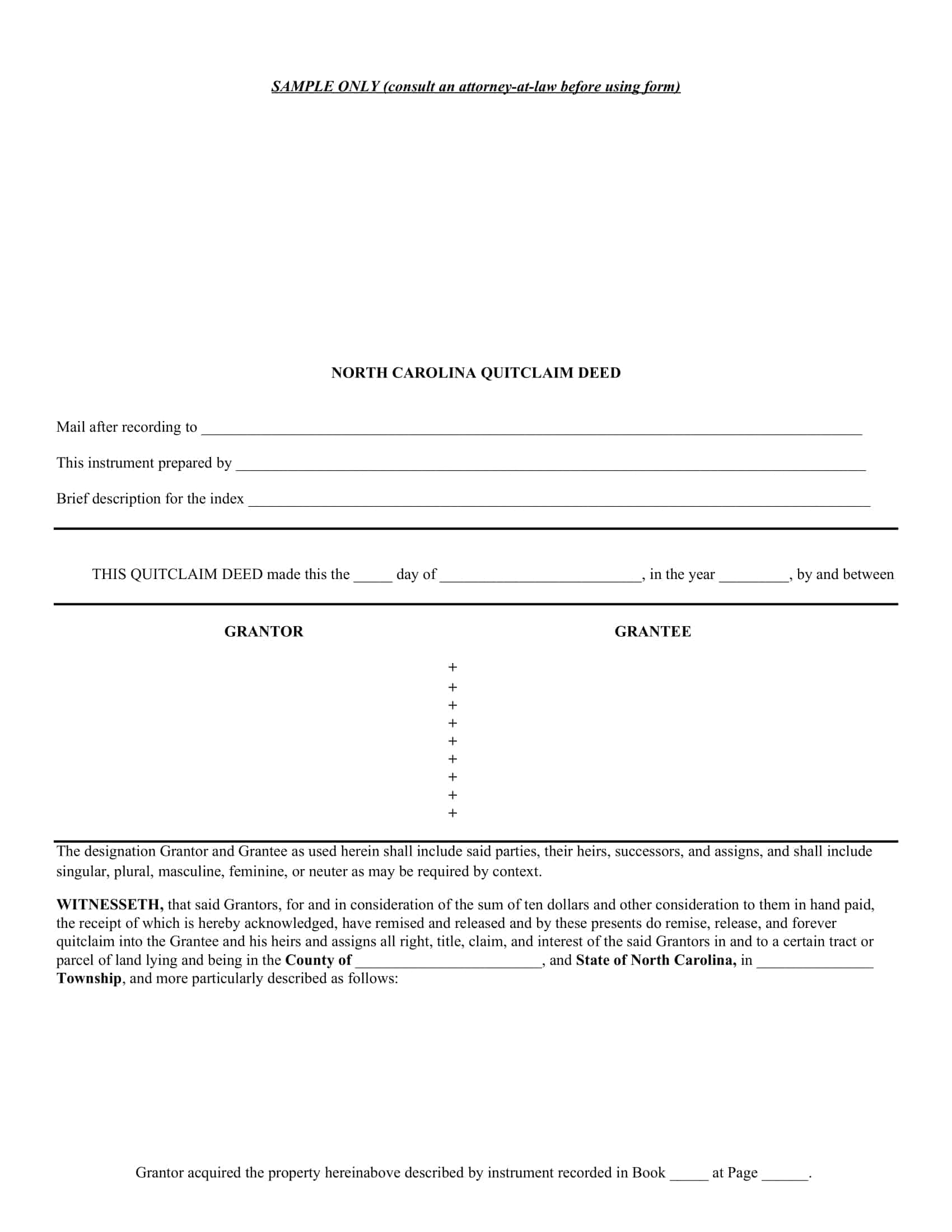

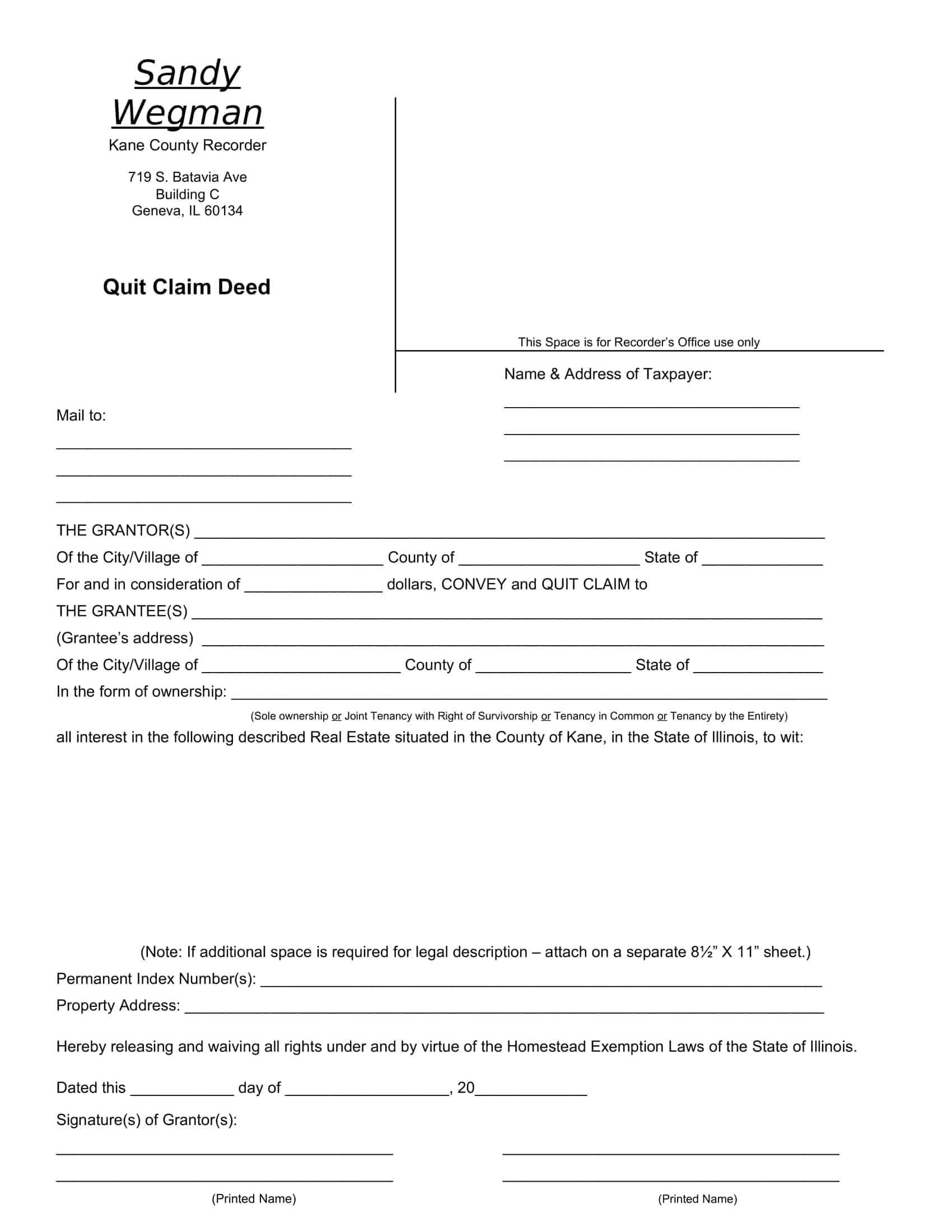

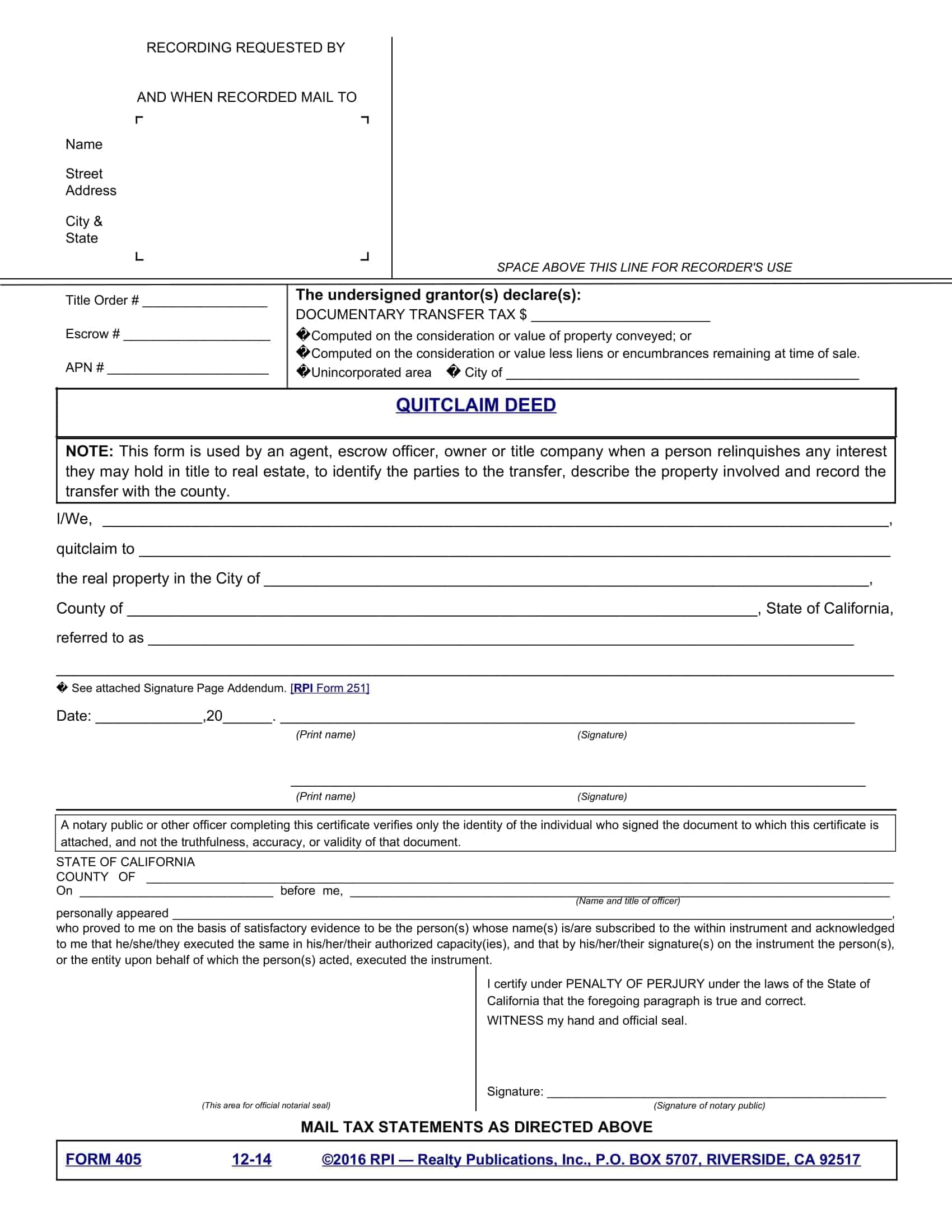

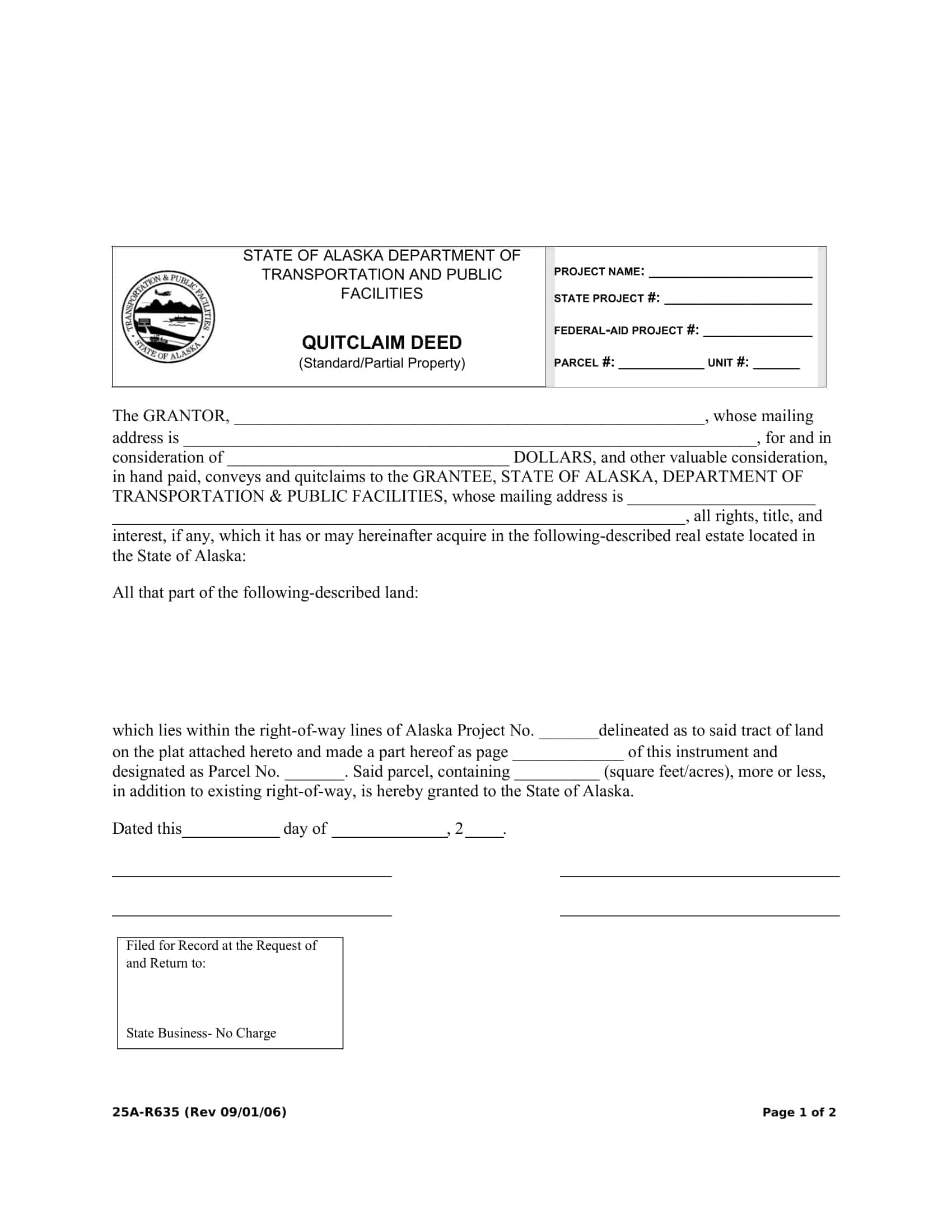

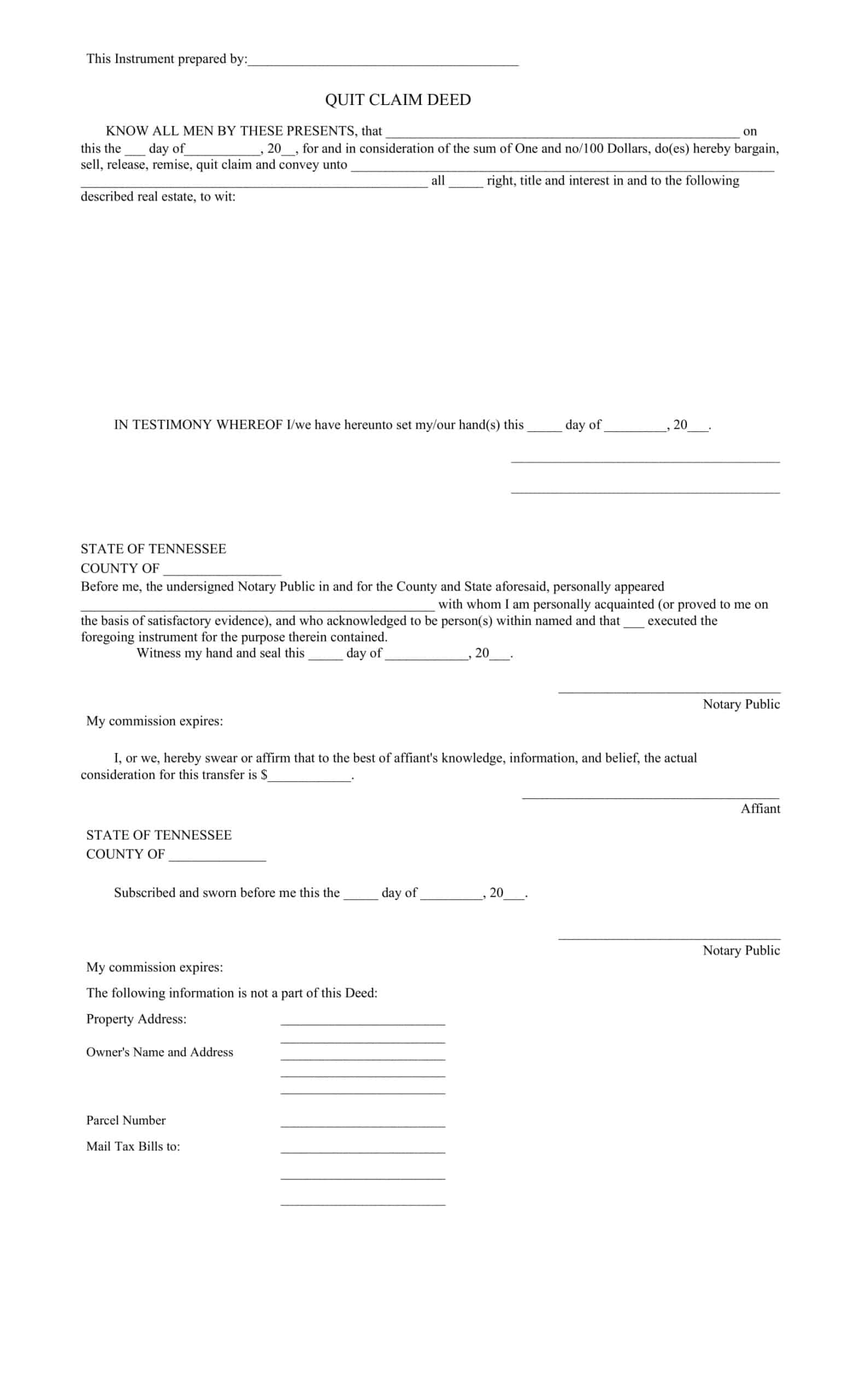

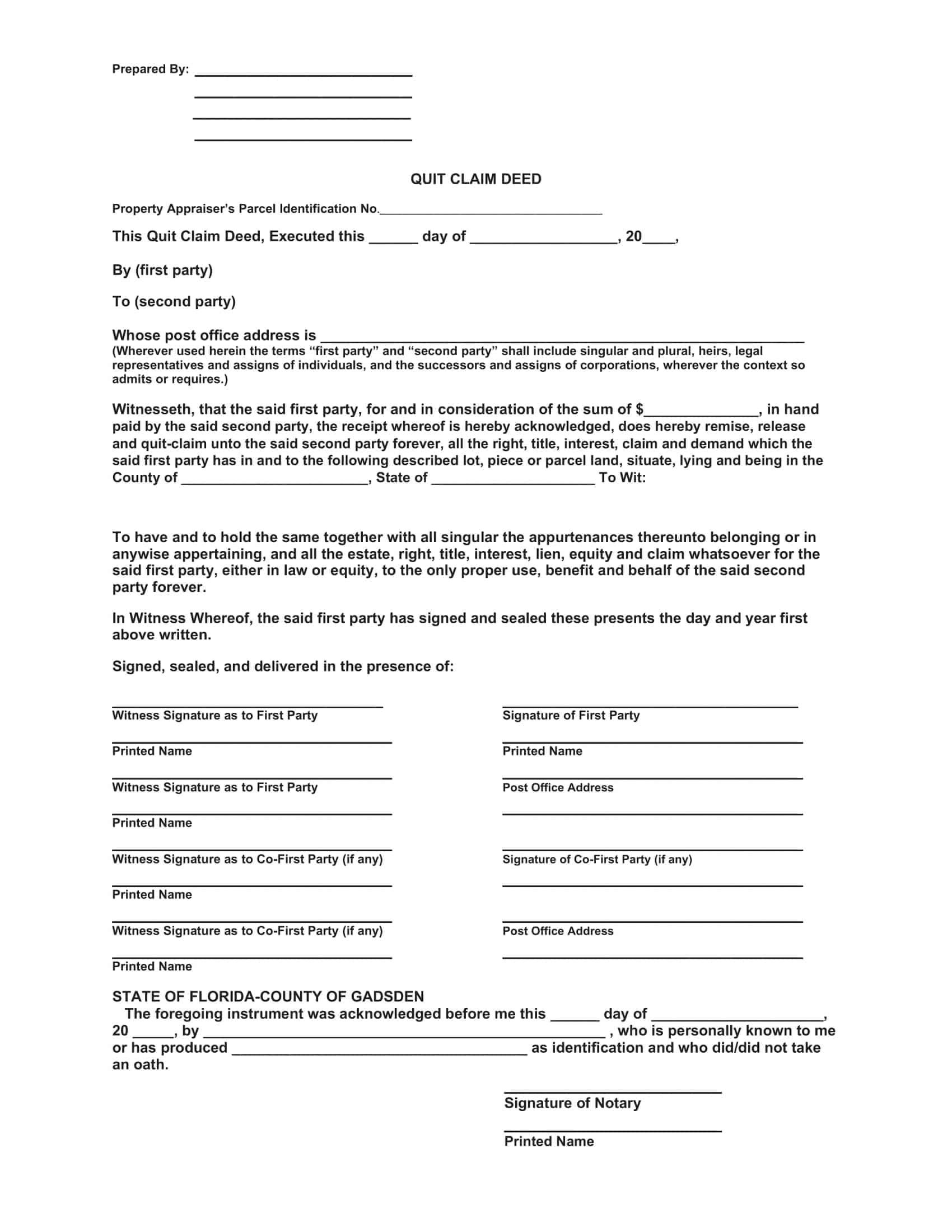

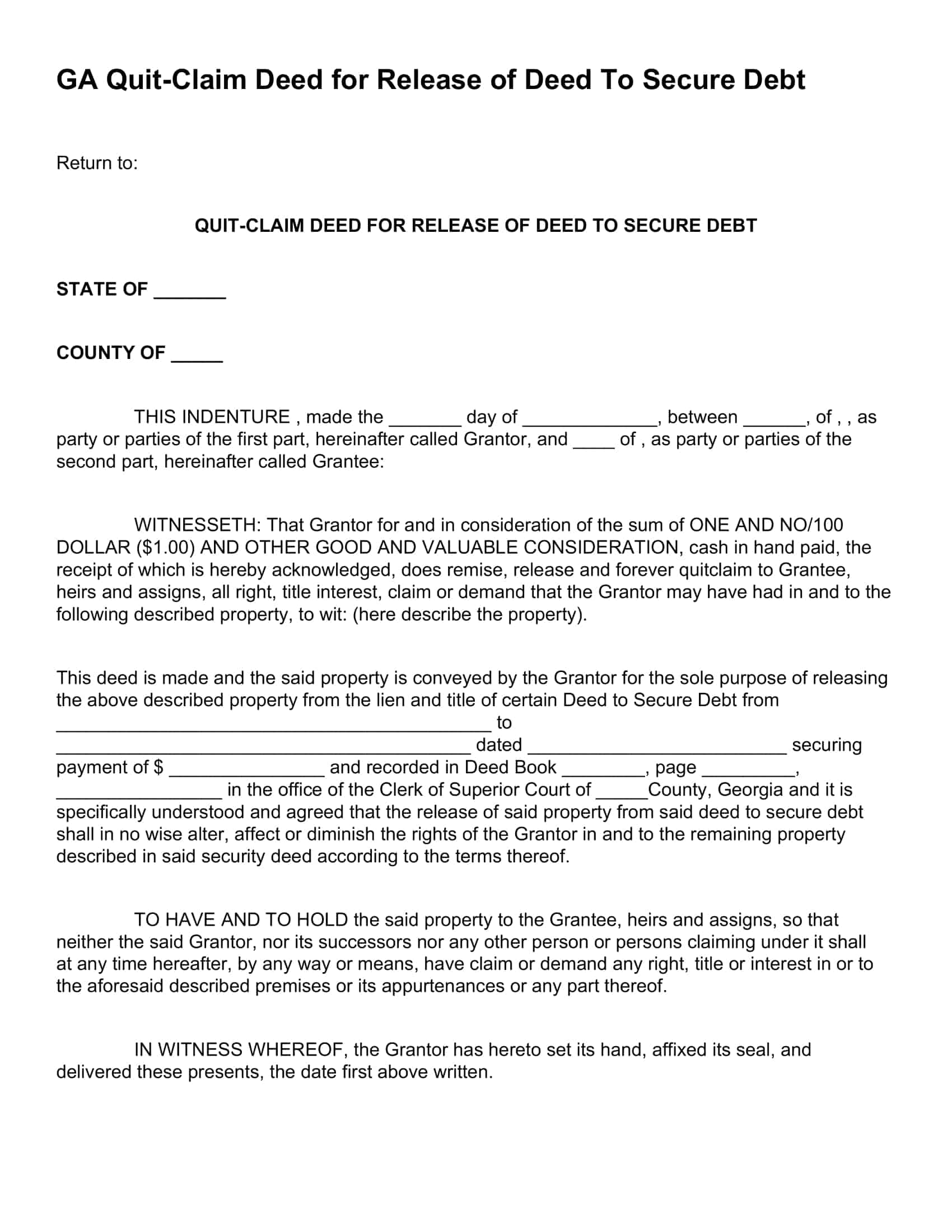

Quitclaim Deed Templates

Ensure a smooth transfer of property ownership with our comprehensive collection of Quitclaim Deed Templates. These free, printable templates provide a reliable and legally binding framework for transferring interest or title in real estate.

Whether you’re releasing your interest in a property or receiving ownership rights, our Quitclaim Deed Templates simplify the process and protect the interests of all parties involved. With customizable sections covering property details, grantor and grantee information, and specific terms of the transfer, our templates offer clarity and transparency. Avoid potential disputes and ensure a clear transfer of property with our user-friendly Quitclaim Deed Templates. Download now and confidently navigate the process of changing property ownership.

What is a quitclaim deed used for?

Quitclaim deeds are commonly utilized to expedite the process of transferring property title from one individual to another. While this document does not guarantee the conveyance of full ownership or title, it operates on the principle of good faith, assuming that the grantor is unaware of any additional parties or conflicts that could supersede the named grantee’s claim.

In some jurisdictions, it is implicitly understood that the grantor holds the authority to transfer the property’s ownership and title through a quitclaim deed. However, it is essential to note that quitclaim deeds solely address the transfer of the property’s title. Other parties with vested interests in the property may still hold responsibility and liability for the property, and potentially, maintain valid claims to it.

Types of Quitclaim Deed

There aren’t multiple types of quitclaim deeds, as the quitclaim deed itself is a specific type of deed used in real estate transactions. However, quitclaim deeds can be utilized in various scenarios and for different purposes. Some common uses of quitclaim deeds include:

Transferring property within the family: Quitclaim deeds are often used to transfer property between family members, such as from a parent to a child, between siblings, or from one spouse to another during marriage or divorce.

Adding or removing a spouse: If a property owner gets married or divorced, a quitclaim deed can be used to add or remove the spouse’s name to or from the property title, reflecting the change in ownership status.

Transferring property to a trust or an LLC: Property owners may use a quitclaim deed to transfer their property to a trust or a limited liability company (LLC) for estate planning or liability protection purposes.

Clearing title defects: Quitclaim deeds can help resolve title defects or “clouds on title,” such as correcting errors in the property description or addressing potential claims from previous owners.

Gifting property: A quitclaim deed can be used to gift property to another person, like a friend or a relative, without any financial consideration involved.

Although quitclaim deeds serve various purposes, it is important to remember that they do not offer any warranties or guarantees about the property’s title. Therefore, it is crucial to conduct thorough research and consult with a real estate attorney or professional before using a quitclaim deed in any transaction.

Warranty deed vs. Quitclaim deed

A warranty deed and a quitclaim deed are two distinct legal instruments used to transfer property ownership. Each serves a specific purpose and offers different levels of protection for the buyer. Here’s a comparison between warranty deeds and quitclaim deeds:

Warranty Deed:

Protection: A warranty deed provides the grantee (buyer) with the highest level of protection, as the grantor (seller) guarantees that they hold clear title to the property and have the legal right to transfer it. The grantor also warrants that there are no undisclosed liens, encumbrances, or other claims against the property.

Covenants: Warranty deeds typically include covenants or promises that the grantor will defend the title against any potential claims by third parties. This means the grantor is legally responsible for addressing any title issues that may arise after the transfer.

Usage: Warranty deeds are commonly used in traditional property sales, where the buyer and seller may not have an existing relationship and the buyer requires assurance regarding the property’s title.

Quitclaim Deed:

Protection: A quitclaim deed offers minimal protection to the grantee, as it merely transfers the grantor’s interest in the property, if any, without providing any warranties or guarantees regarding the title. This means the grantee assumes the risk of any title defects or claims that may exist.

No covenants: Quitclaim deeds do not contain any promises or covenants to defend the title against third-party claims. The grantee is responsible for addressing any title issues that may arise after the transfer.

Usage: Quitclaim deeds are often used in situations where the parties involved have a high level of trust and knowledge about the property, such as transfers between family members, friends, or business partners. They can also be used to clear up title defects or for transferring ownership interests in cases like divorce settlements.

In summary, the primary difference between warranty deeds and quitclaim deeds lies in the level of protection offered to the grantee. A warranty deed provides the grantee with guarantees and covenants regarding the property’s title, making it the preferred choice for most real estate transactions. In contrast, a quitclaim deed is a simpler and faster method of transferring property interests without any warranties, making it more suitable for specific situations where trust levels between parties are high and the parties involved have knowledge of the property’s history and potential title issues.

How to write a quitclaim deed

A quitclaim deed is a legal document used to transfer a person’s interest in a property to another individual without providing warranties or guarantees about the property’s title. Here’s a comprehensive guide on how to write a quitclaim deed:

Determine if a quitclaim deed is appropriate

Assess whether a quitclaim deed is the right instrument for your situation. Quitclaim deeds are best suited for transactions among family members, close friends, or business partners where trust levels are high, and the parties involved have knowledge of the property’s history and potential title issues.

Obtain a quitclaim deed form

Acquire a quitclaim deed form specific to your jurisdiction, as different states may have varying requirements and forms. You can obtain these forms online, at your local county recorder’s office, or from a real estate attorney.

Fill out the quitclaim deed form

The quitclaim deed form will require the following information:

- Grantor’s name and address (the person transferring their interest in the property)

- Grantee’s name and address (the person receiving the interest)

- Legal description of the property (found in the property’s current deed, tax records, or title report)

- The consideration or amount paid, if any (this could be nominal, such as $1, or simply state “for love and affection” in cases of gifting)

- The date of the transfer

Include additional provisions if necessary

Depending on your specific situation, you may need to include additional provisions in the quitclaim deed, such as easements, encumbrances, life estate, or mineral rights. Consult with a legal expert to ensure all necessary provisions are included.

Avoid creating warranties

When drafting the quitclaim deed, make sure the language used does not inadvertently create warranties or guarantees. To prevent confusion and potential legal issues, consult with a legal expert to review the document before finalizing it.

Sign the quitclaim deed

The grantor must sign the quitclaim deed in the presence of a notary public. Some states may also require witnesses to sign the deed. Check your local jurisdiction’s requirements.

Record the quitclaim deed

Once the quitclaim deed is signed and notarized, it needs to be recorded with the appropriate county recorder’s office or registrar of deeds. Recording the deed makes the transfer of interest public and provides notice to any potential future buyers or interested parties. There may be a fee associated with recording the deed, which varies by jurisdiction.

Notify relevant parties

After recording the quitclaim deed, inform all relevant parties, such as mortgage lenders, of the change in ownership. This step is crucial to ensure that all parties are aware of the updated property ownership status.

Retain a copy of the recorded quitclaim deed

Keep a copy of the recorded quitclaim deed for your records, as it serves as proof of the transfer of interest in the property.

Remember that quitclaim deeds do not offer any warranties or guarantees regarding the property’s title. If you are uncertain about any aspects of the property or its title, consult with a real estate attorney or professional before using a quitclaim deed.

There are additional elements you may want to consider including in your quitclaim deed to ensure a smooth and comprehensive transfer of property interests:

Easements:These can help clarify the boundaries between the subject property and adjacent properties, as well as grant rights of use or access to specific areas.

Encumbrances: Disclosing any known claims or liens against the property that the grantor is aware of can help the grantee understand potential obligations or limitations associated with the property.

Life estate: If the grantor wishes to retain a life estate interest in the property, this should be mentioned in the quitclaim deed. This arrangement allows the grantor to continue using the property until their death and is often employed for tax purposes.

Mineral rights: For undeveloped properties, specifying the transfer of mineral rights can be crucial, as these rights may be valuable assets beyond the property’s intrinsic value. The process of transferring mineral rights can be complex and may vary based on state laws, so seeking professional guidance may be necessary.

When drafting a quitclaim deed, it is important to ensure that the language used does not inadvertently create warranties or guarantees. To avoid confusion and potential legal issues, it is advisable to consult with a legal expert to review the document before submitting it to be signed and recorded.

Having a well-crafted and accurate quitclaim deed is essential to the success of the property interest transfer. Ensuring that the document contains all relevant information and avoids creating unintentional claims to the property or causing disputes is crucial. As with any legal document related to property and title transfers, taking the necessary precautions and seeking professional guidance can help ensure a smooth and effective process.

FAQs

How does a quitclaim deed work?

The person transferring their interest in the property (the grantor) signs the quitclaim deed, which is then filed with the local government office responsible for recording property transactions. The person receiving the interest in the property (the grantee) then becomes the legal owner of the property, subject to any existing liens or encumbrances on the title.

Does a quitclaim deed transfer ownership of a mortgage?

No, a quitclaim deed does not transfer ownership of a mortgage. If there is an outstanding mortgage on the property, the person taking over ownership will generally need to assume responsibility for making the mortgage payments, or refinance the mortgage in their own name.

Is a quitclaim deed reversible?

Generally, no. Once a quitclaim deed is filed, the transfer of ownership is considered final. However, if the transfer was made fraudulently or under duress, it may be possible to challenge the validity of the deed in court.

Do I need a lawyer to prepare a quitclaim deed?

While it is possible to prepare a quitclaim deed without a lawyer, it is generally recommended to seek legal advice before doing so, especially if you are unsure about the legal implications of the transfer. An attorney can help ensure that the deed is properly prepared and filed, and can advise on any potential issues with the transfer of ownership.

How long does it take to complete a quitclaim deed?

The time it takes to complete a quitclaim deed will vary depending on the specific circumstances, such as the complexity of the transfer and the availability of all parties involved. Generally, the process can take anywhere from a few days to several weeks.

How much does it cost to file a quitclaim deed?

The cost of filing a quitclaim deed will depend on the specific requirements of your local government office, such as filing fees or transfer taxes. These fees can range from a few hundred to a few thousand dollars.

Can a quitclaim deed be used to transfer ownership of personal property?

No, a quitclaim deed is used only to transfer ownership of real property, such as land and buildings. Ownership of personal property, such as furniture or vehicles, is generally transferred through a bill of sale or other legal document.

Can a quitclaim deed be used to clear up title issues?

A quitclaim deed can be used to transfer any interest in a property, but it does not necessarily clear up any title issues that may exist. It is important to thoroughly research the status of the property title before completing a quitclaim deed transfer.

Can a quitclaim deed be used to transfer ownership to a trust or LLC?

Yes, a quitclaim deed can be used to transfer ownership of property to a trust or LLC. However, it is important to consult with an attorney or tax professional to ensure that the transfer is done properly and in compliance with any relevant legal requirements.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Warranty Deed Form Templates [PDF, Word] 2 Warranty Deed Form](https://www.typecalendar.com/wp-content/uploads/2023/05/Warranty-Deed-Form-1-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 3 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)