Drafting a payment agreement is a crucial aspect of running a business. Having a clear and legally binding contract in place ensures that payment processes run smoothly and protects both parties involved. In this article, we will explore the different segments that should be included in a payment contract template and how to ensure that your payment plan is both effective and legally sound.

Table of Contents

What is a Payment Agreement?

A payment agreement, also known as a payment contract or installment agreement, is a legally binding document that outlines the terms and conditions of a payment plan between two parties. It typically includes details such as the amount to be paid, the payment schedule, the interest rate (if applicable), and any late fees or penalties. Payment agreements are commonly used in situations where a large sum of money is being borrowed or paid back over a period of time, such as in a loan or installment plan. The agreement serves as a written record of the terms of the payment plan and can be used as evidence in court if either party fails to fulfill their obligations under the agreement.

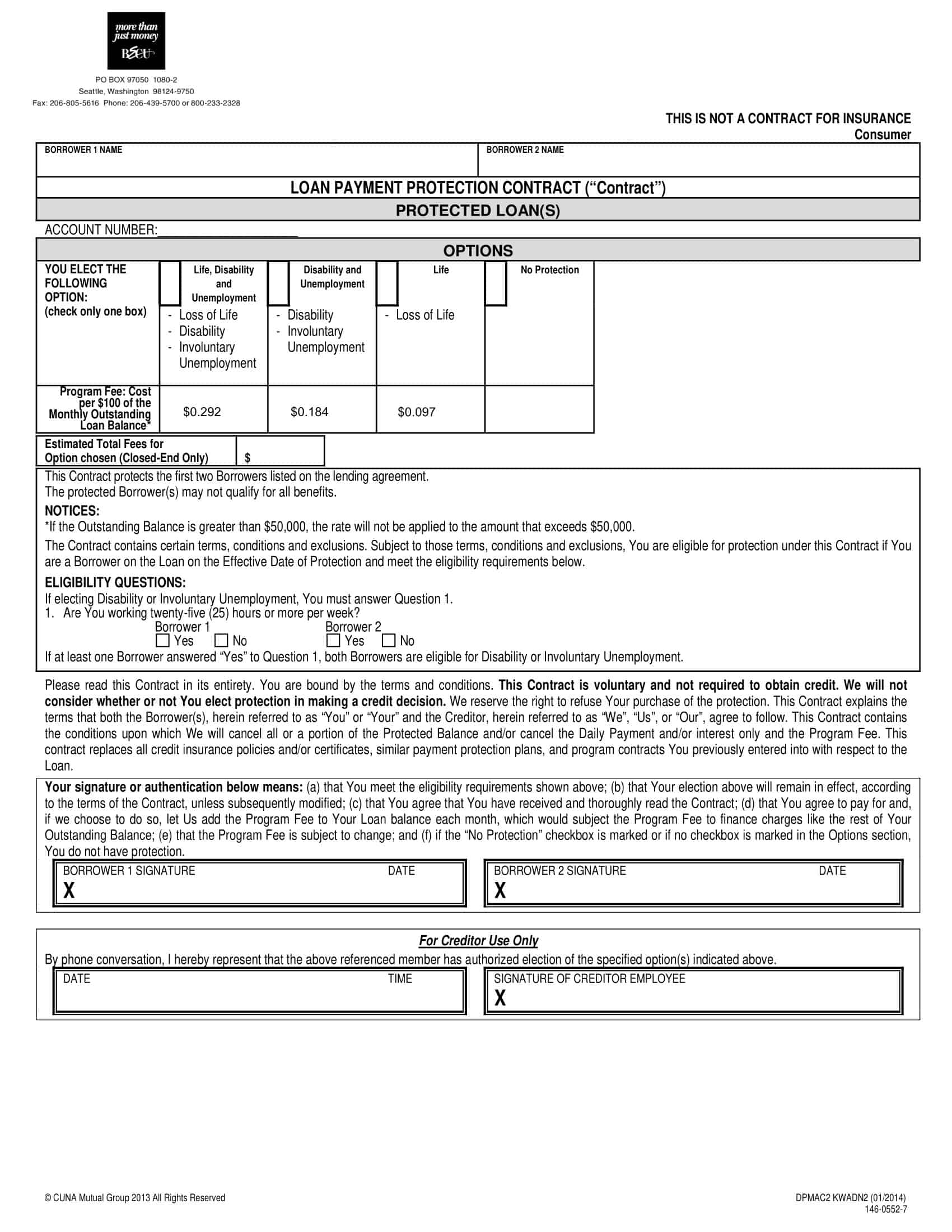

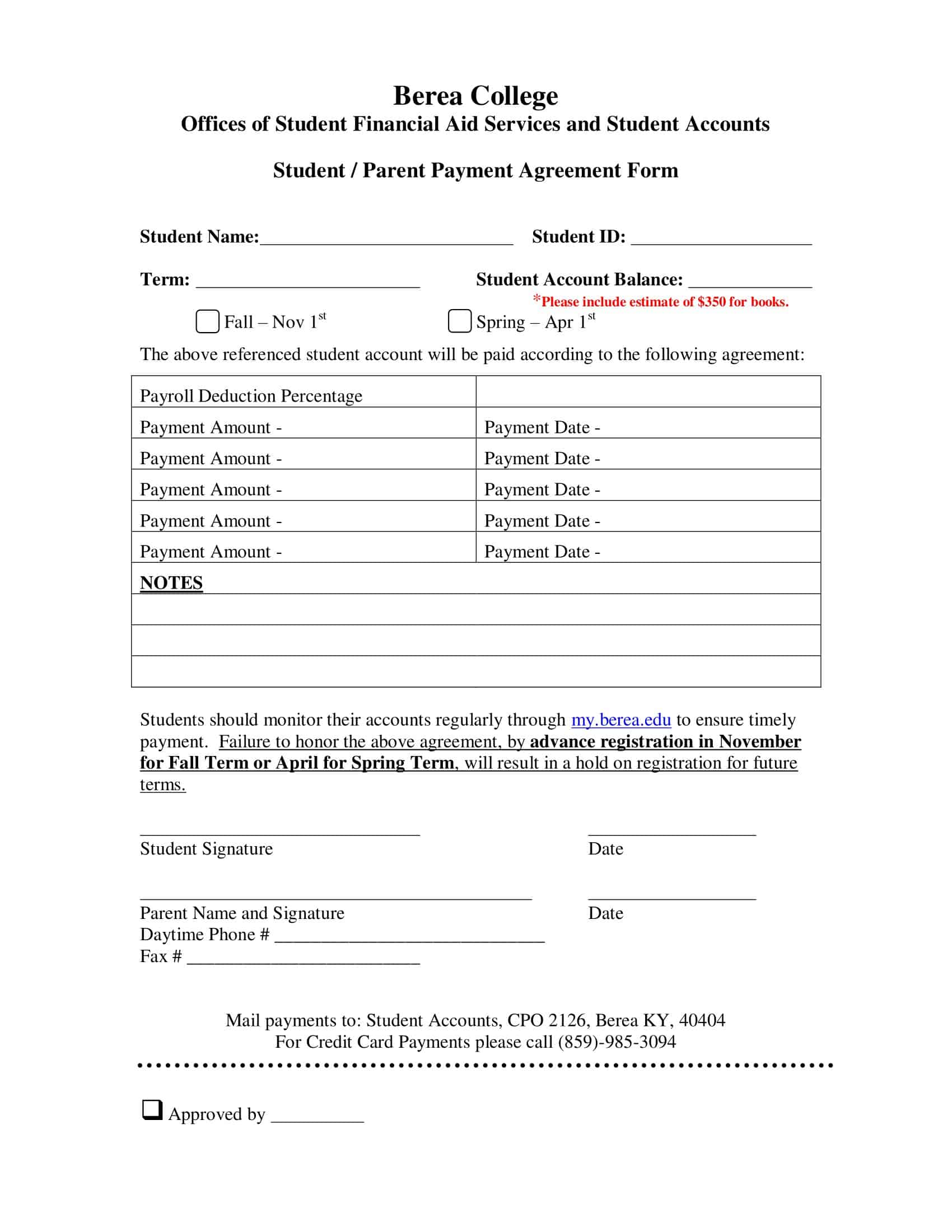

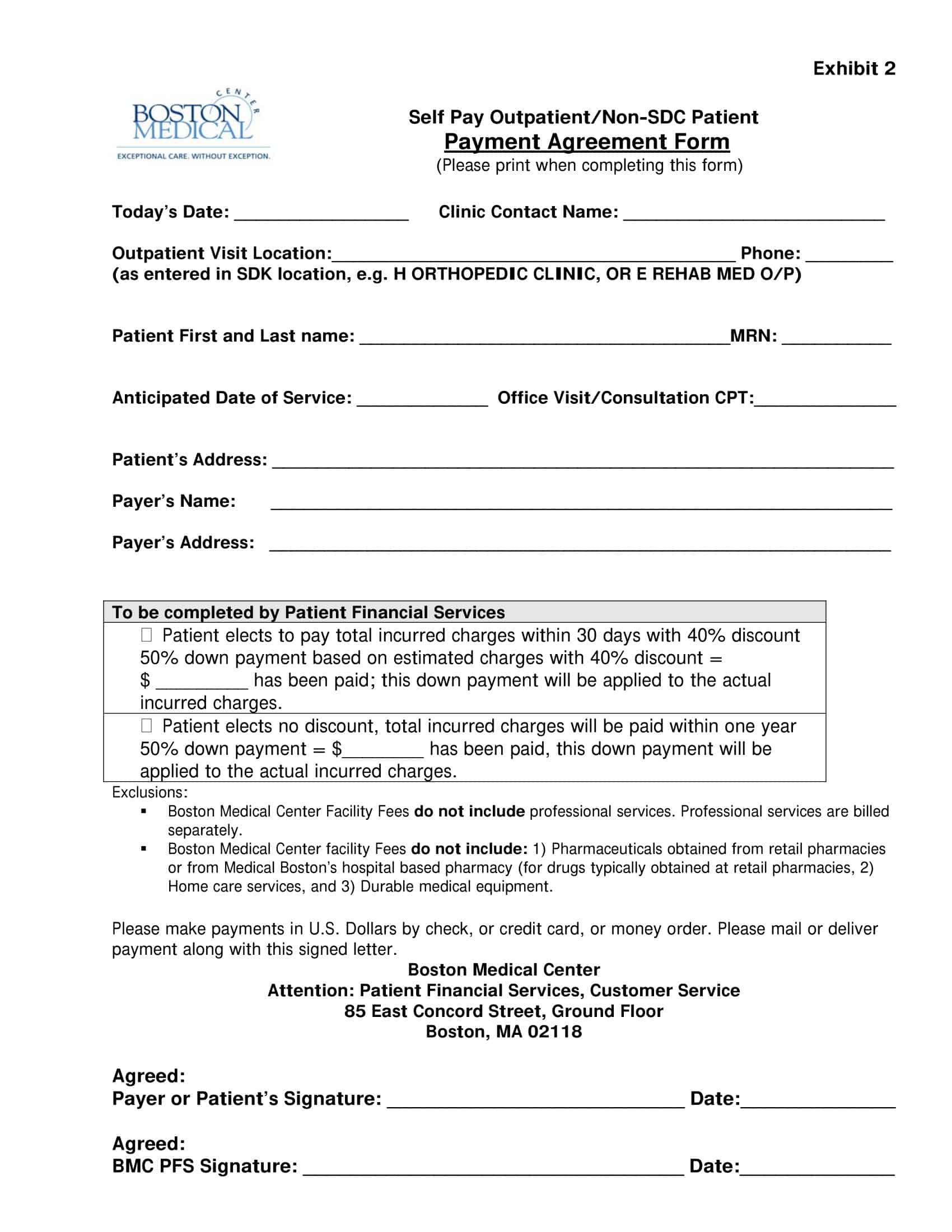

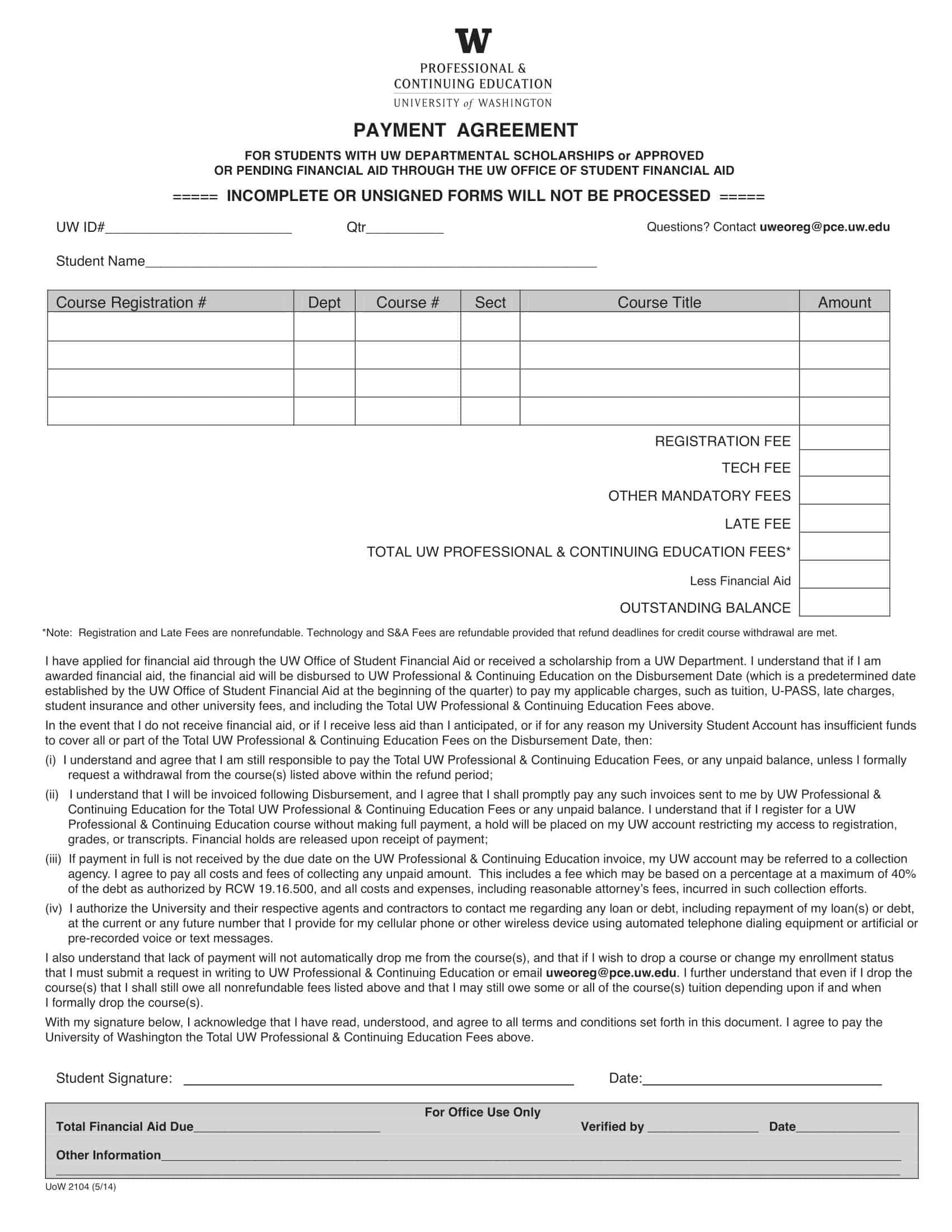

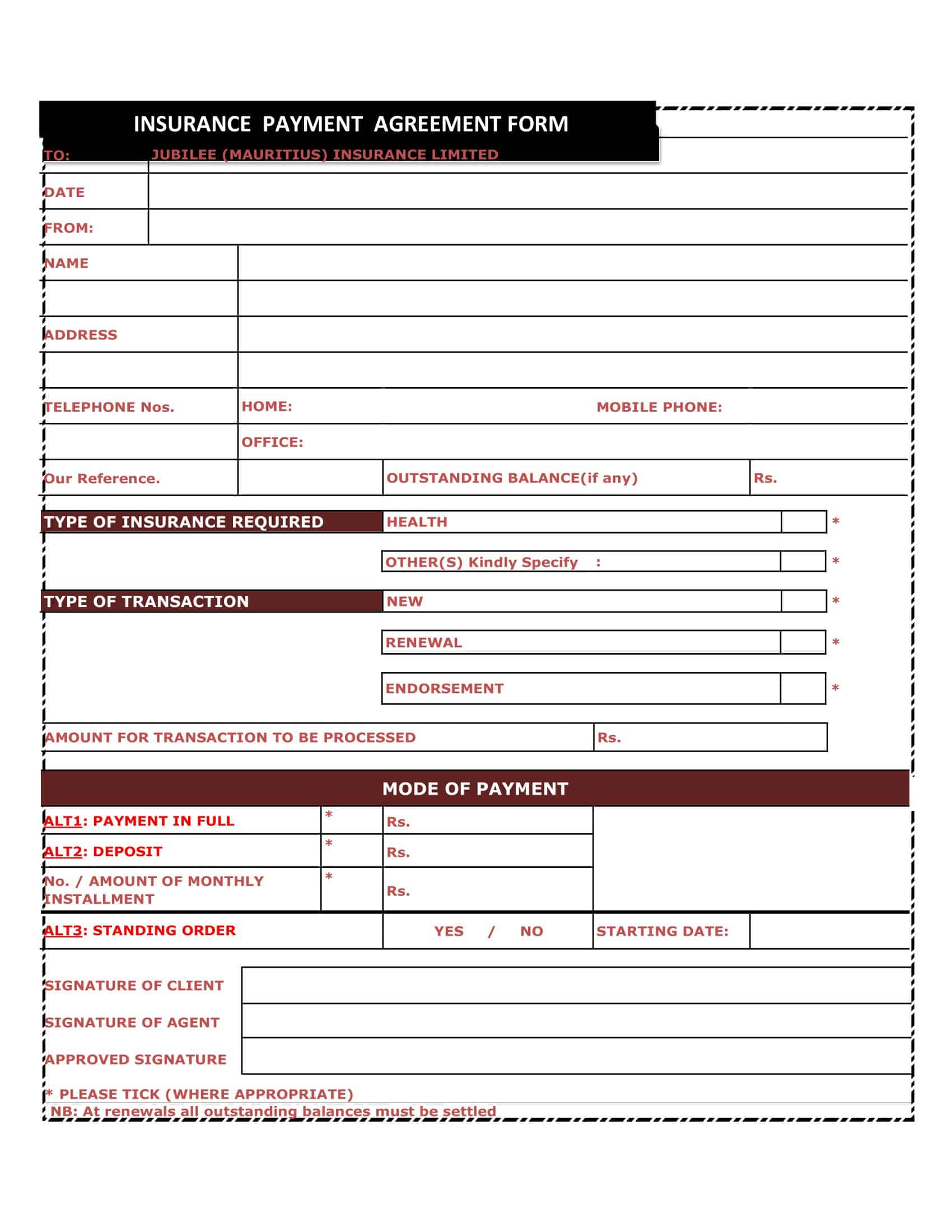

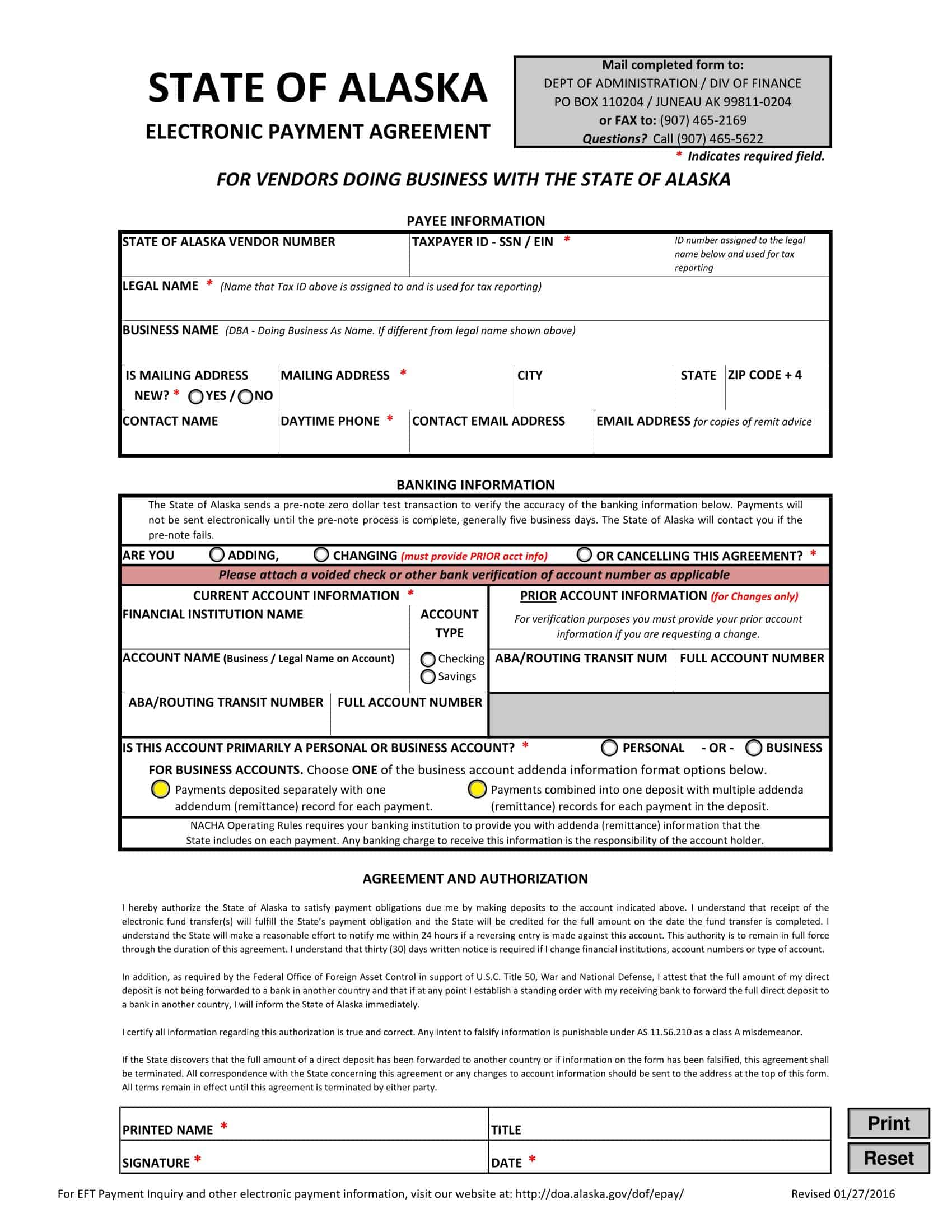

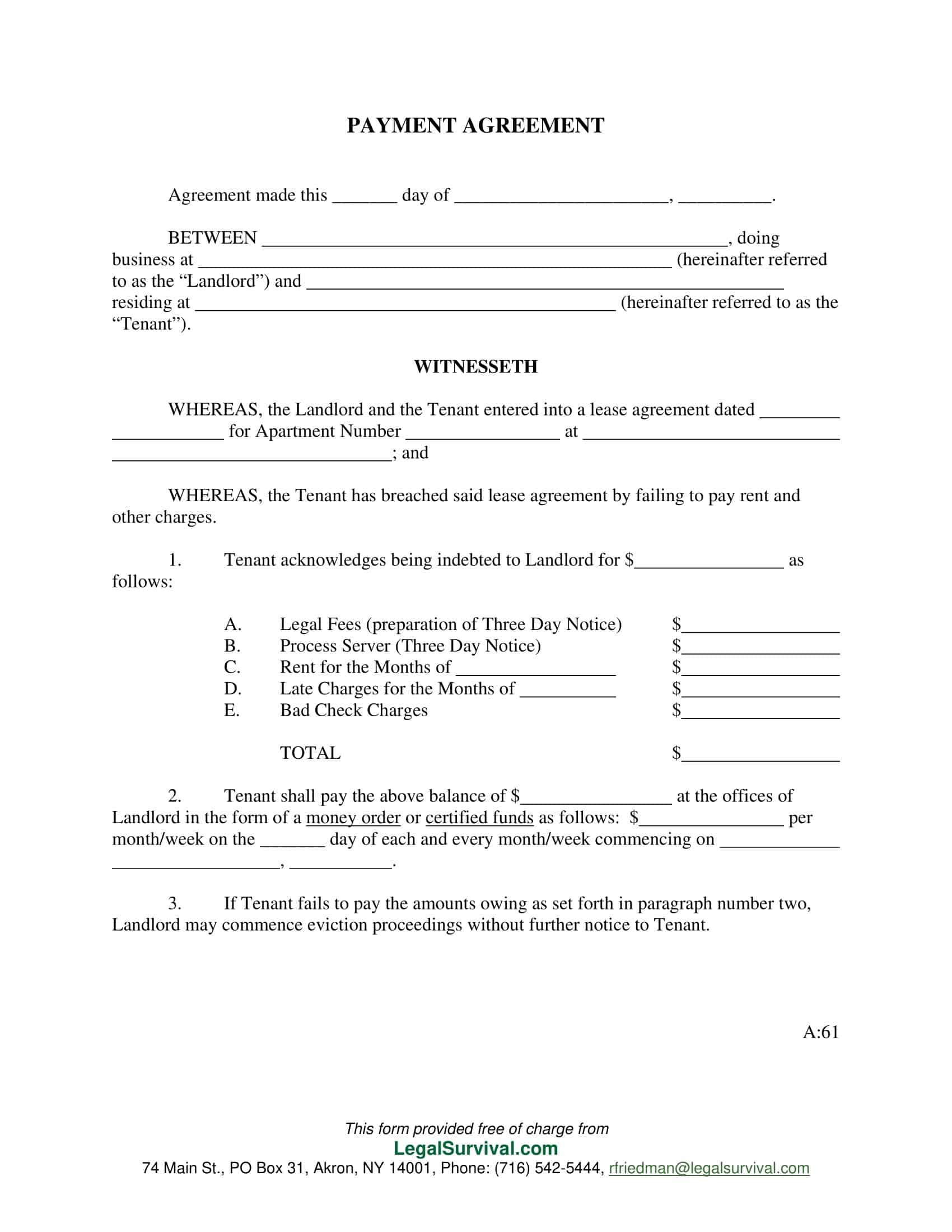

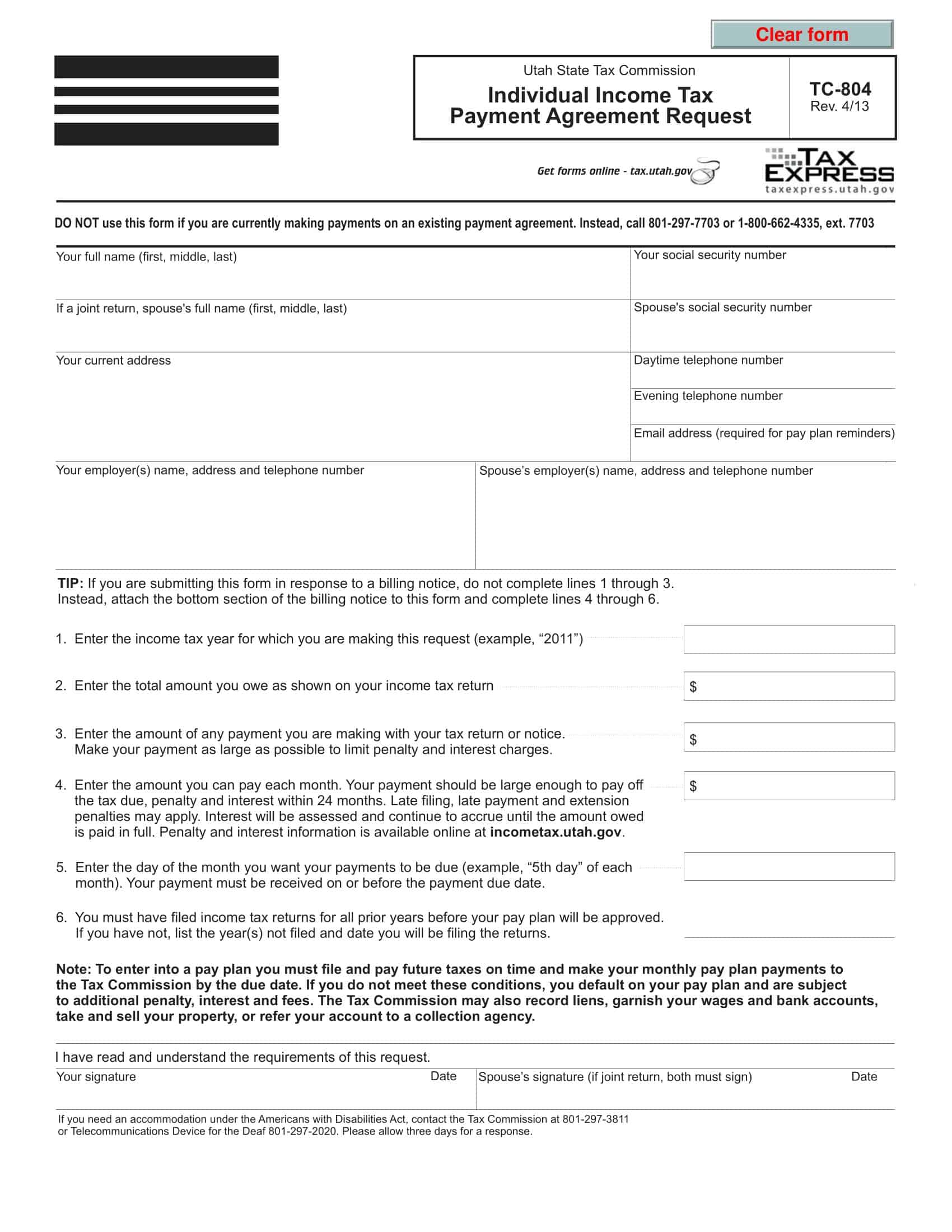

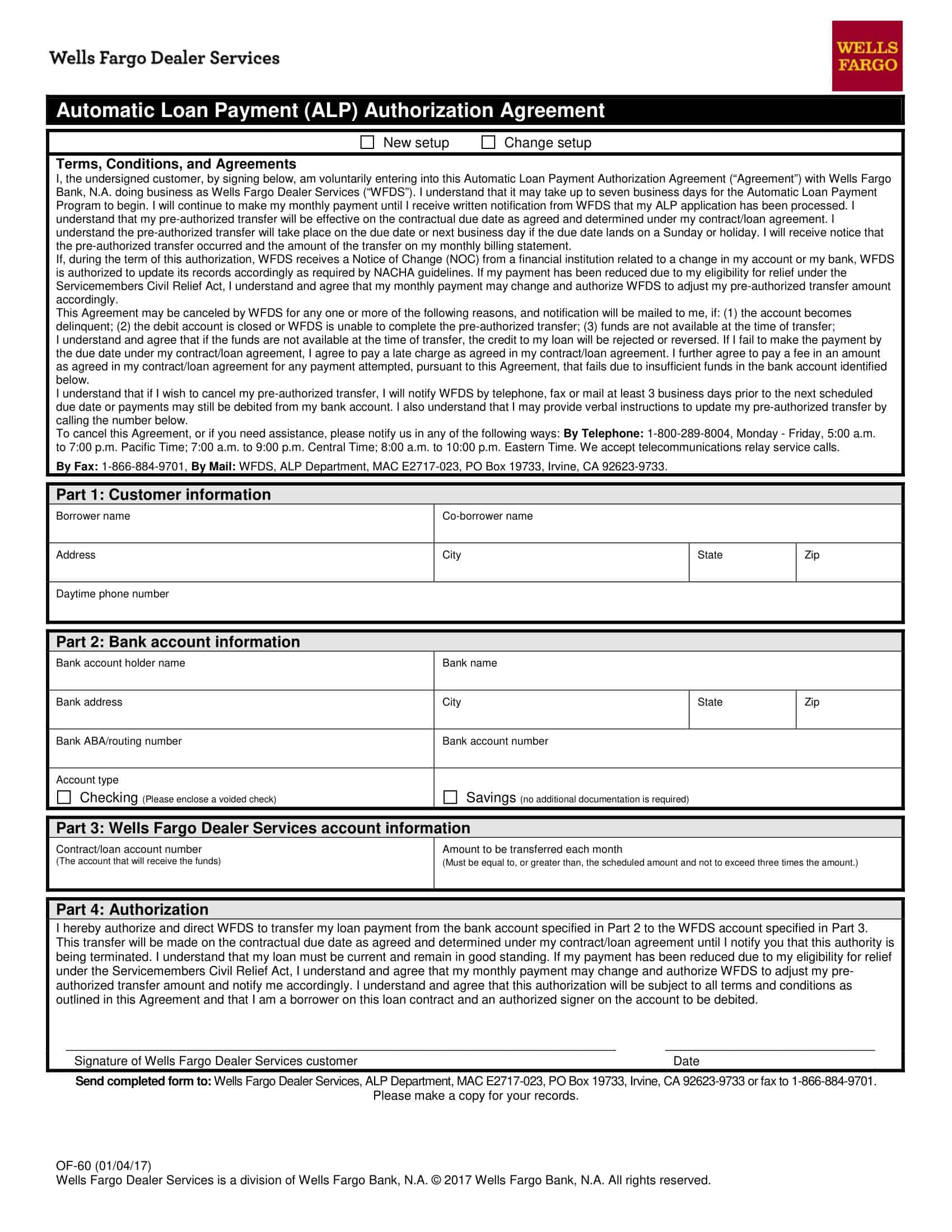

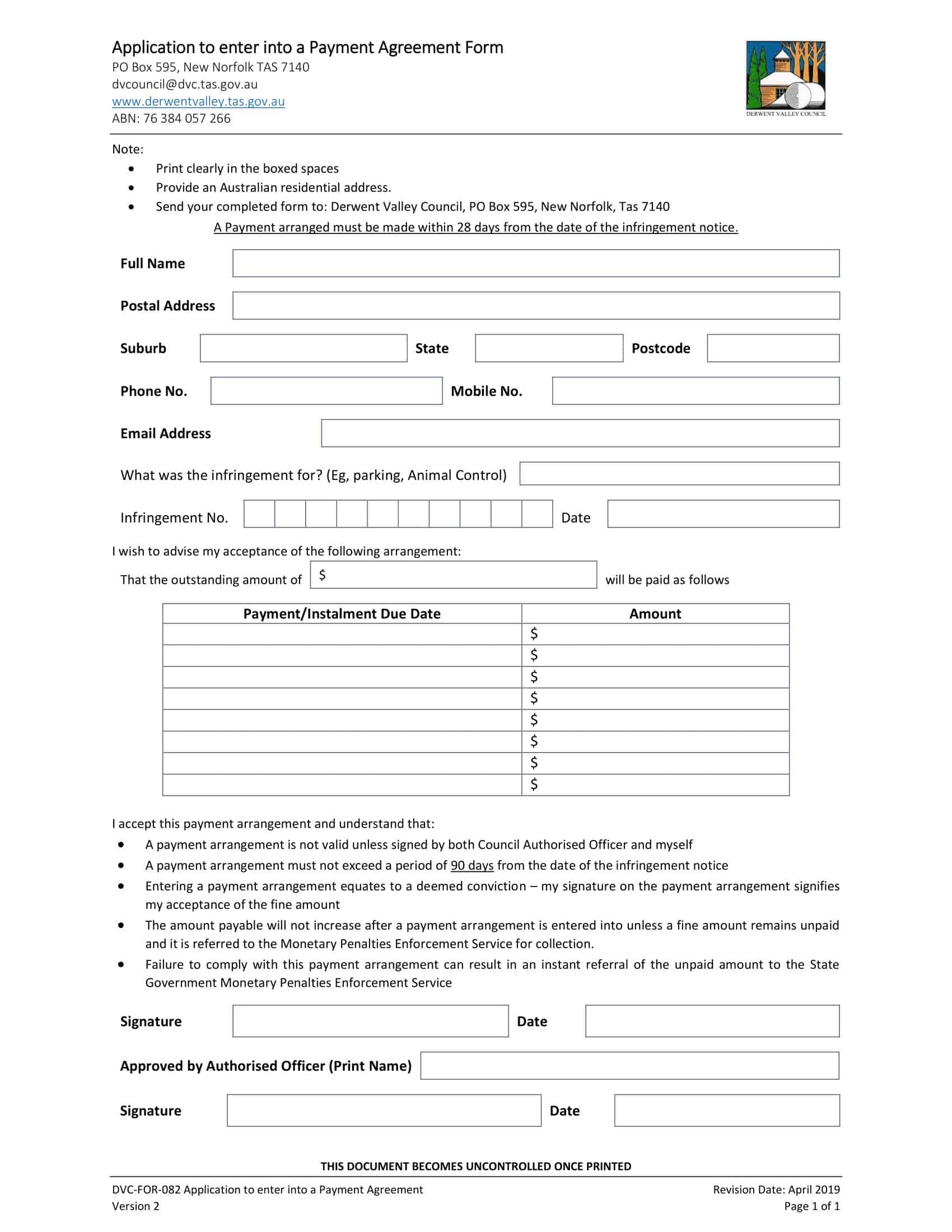

Payment Agreement Templates

“Payment Agreement Templates” are pre-designed documents that provide a structured framework for formalizing financial arrangements between parties involved in a transaction or business agreement. These templates serve as a valuable tool to outline the terms, conditions, and repayment schedules for loans, installment payments, or other financial obligations.

Payment agreements are essential to establish clear expectations and ensure that all parties are aware of their financial responsibilities. These agreements typically cover details such as the payment amount, due dates, interest rates (if applicable), late payment penalties, and any specific conditions or contingencies related to the transaction.

Payment agreement templates are often created or reviewed by legal professionals with expertise in contract law or finance. They ensure compliance with relevant regulations and provide a legally binding document that protects the rights and interests of both the payer and the payee.

How to Write a Payment Agreement

Writing a payment agreement can seem like a daunting task, but it is important to ensure that the document is clear and legally binding. Here are some key steps to follow when drafting a payment agreement:

Identify the parties involved: The first step in creating a payment agreement is to identify the parties involved. This includes the lender or creditor and the borrower or debtor. The names and contact information for each party should be included in the agreement.

Specify the amount and payment schedule: The agreement should clearly state the total amount to be paid, as well as the payment schedule. This should include the number of payments, the due date for each payment, and the amount of each payment. It is important to specify whether the payments will be made on a monthly, weekly, or other basis.

Include interest and late fee information: If interest is charged on the loan or if late fees will be applied, this should be clearly stated in the agreement. The interest rate and any late fee penalties should be specified in writing.

Define default and default remedy: The agreement should include a section outlining what constitutes default, such as missing a payment, and the remedies that will be taken if default occurs. These can include late fees, interest, legal action, and/or repossession.

Include any additional terms and conditions: Any additional terms and conditions, such as prepayment penalties or automatic debit agreements, should be included in the agreement. These should be clearly stated and easy for both parties to understand.

Make sure that the agreement is legally binding: A payment agreement is a legally binding document, so it is important to ensure that it is written in a way that adheres to the laws of your state or country. Have an attorney review the agreement before it is signed to ensure that it is legally sound.

Get the agreement signed and dated: Once the agreement has been written and reviewed, both parties should sign and date the document. It is important to keep a copy of the agreement for your records.

Review the agreement periodically: Payment agreements are not set in stone, and circumstances can change over time. It is important to review the agreement periodically to ensure that it is still accurate and that the terms are still being met.

How do you Make a Payment Plan Legally Binding?

A payment plan can be made legally binding by including certain elements in the document and ensuring that it is signed and dated by both parties. Here are some steps to follow to make a payment plan legally binding:

Include all relevant details: The payment plan should include all relevant details such as the names of the parties involved, the total amount to be paid, the payment schedule, any interest or late fees, and any additional terms or conditions.

Use clear and concise language: The language used in the payment plan should be clear and easy to understand to avoid ambiguity. The terms and conditions should be spelled out in plain language.

Get the agreement signed and dated: Both parties should sign and date the payment plan for it to be legally binding. It’s important to keep a copy of the agreement for your records.

Have an attorney review the agreement: Before it is signed, it is important to have an attorney review the agreement to ensure that it is legally sound and adheres to the laws of your state or country.

Make sure the agreement complies with all legal requirements: The agreement should comply with any applicable state or federal laws, such as usury laws, consumer protection laws, and other regulations.

Include a dispute resolution clause: it’s recommended to include a dispute resolution clause, which outlines how disputes will be handled in case of a disagreement.

Review the agreement periodically: As circumstances can change over time, it’s important to review the agreement periodically to ensure that it is still accurate and that the terms are still being met.

By following these steps, a payment plan can be made legally binding, protecting both parties and ensuring that the payment process runs smoothly. It is important to remember that laws vary by jurisdiction, so it’s always best to consult with an attorney to ensure that the agreement is legally sound and compliant.

The Importance of Having a Payment Plan Agreement in Place

Having a payment plan agreement in place is important because it lays out the terms and conditions of how and when a debt will be paid off. This can help prevent misunderstandings and disputes between the borrower and lender, and ensure that the debt is paid off in a timely and organized manner.

Additionally, a payment plan agreement can also establish a sense of accountability and commitment on the part of the borrower to pay off the debt. In the event of default, the lender can refer to the payment plan agreement to take legal actions.

FAQs

What should be included in a Payment Plan Agreement?

A Payment Plan Agreement should include the total amount of debt, the payment schedule, the due date for each payment, the interest rate, any fees or penalties for late or missed payments, and the consequences of default.

How do I create a Payment Plan Agreement?

You can create a Payment Plan Agreement by outlining the terms and conditions of the debt repayment plan and having both the borrower and lender sign the document. You can also use an online template or consult with a lawyer to draft the agreement.

Are Payment Plan Agreements legally binding?

Yes, Payment Plan Agreements are legally binding contracts. Both the borrower and lender are obligated to abide by the terms and conditions outlined in the agreement.

Can a Payment Plan Agreement be modified?

Yes, a Payment Plan Agreement can be modified if both the borrower and lender agree to the changes. It is important to have any modifications made in writing and signed by both parties to ensure that the terms of the agreement are legally binding.

What happens if a borrower defaults on a Payment Plan Agreement?

If a borrower defaults on a Payment Plan Agreement, the lender may take legal action to collect the debt. This could include wage garnishment, property liens, or other collection actions. It is important to note that the specific actions that can be taken will depend on the laws of the jurisdiction and the terms of the Payment Plan Agreement.

Are there different types of Payment Plan Agreements?

Yes, there are different types of Payment Plan Agreements depending on the type of debt and the lender. For example, there are payment plan agreements for medical debt, student loan debt, and credit card debt. Each type of agreement may have different terms and conditions.

Is it possible to negotiate the terms of a Payment Plan Agreement?

Yes, it is possible to negotiate the terms of a Payment Plan Agreement, such as the interest rate, payment schedule, and fees. However, it is important to be aware that some terms, such as the total amount of debt, may be non-negotiable. It is always best to consult with the lender to discuss the terms and options available.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Separation Agreement Templates [PDF, Word] 3 Separation Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Separation-Agreement-1-150x150.jpg)