An investment contract is a legally binding agreement between two parties where one party invests money in exchange for a financial return. This type of contract outlines the terms and conditions of the investment, including the amount invested, the expected return, and the duration of the investment.

Investment contracts can be used in a variety of financial instruments, including stocks, bonds, and real estate. The success of an investment contract depends on several factors, including the financial stability of the company or asset being invested in, market conditions, and the overall health of the economy. It is important for both parties to fully understand the terms and conditions of the investment contract before entering into the agreement.

Table of Contents

Why are Investment Contracts important?

Investment agreements are important because they provide a legal framework for investment transactions and help to ensure that the rights and obligations of both the investor and host country are clearly defined and protected. These agreements can provide stability and predictability for foreign investors, encourage investment flows, and help to promote economic growth and development. They can also help to mitigate potential disputes between investors and host countries and provide a mechanism for resolving disputes through binding arbitration.

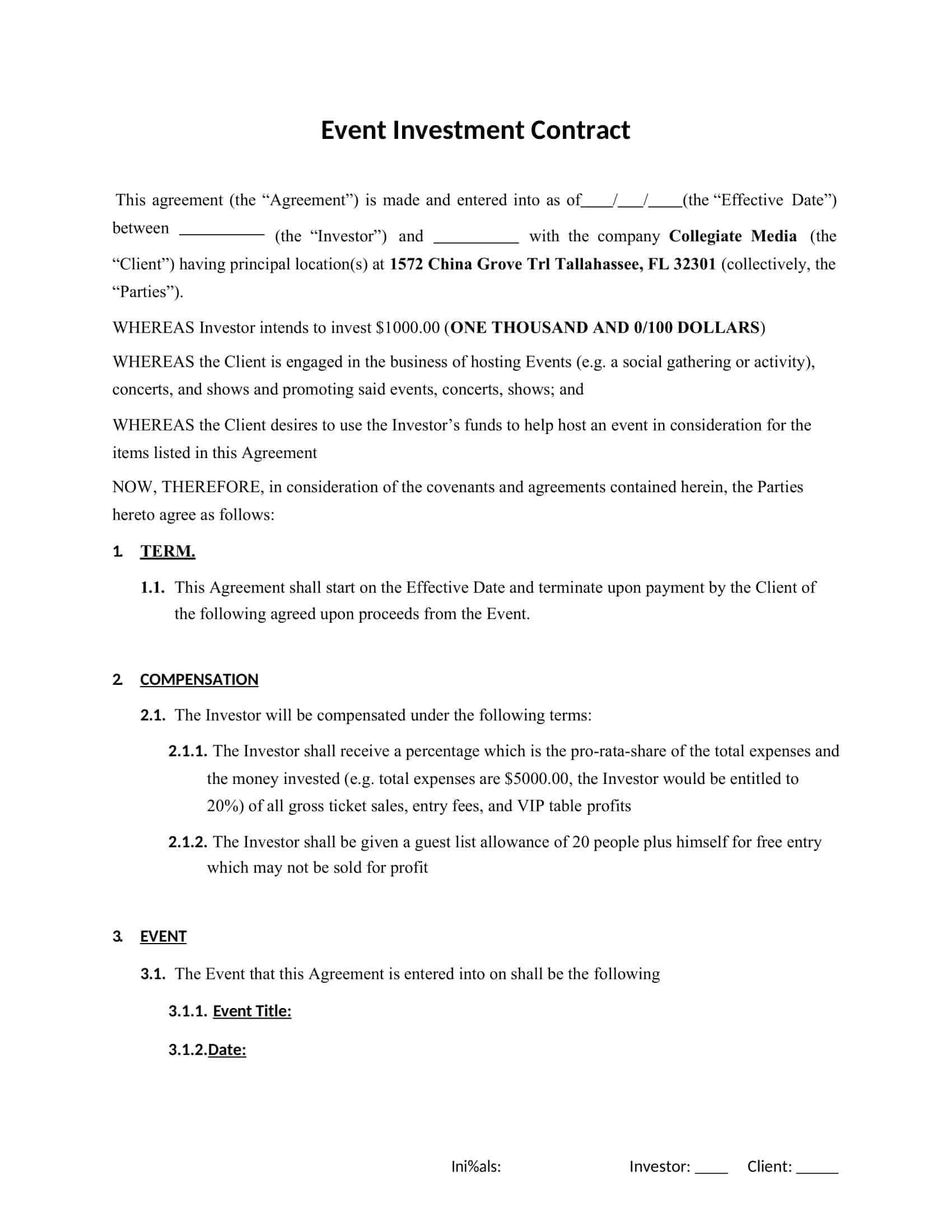

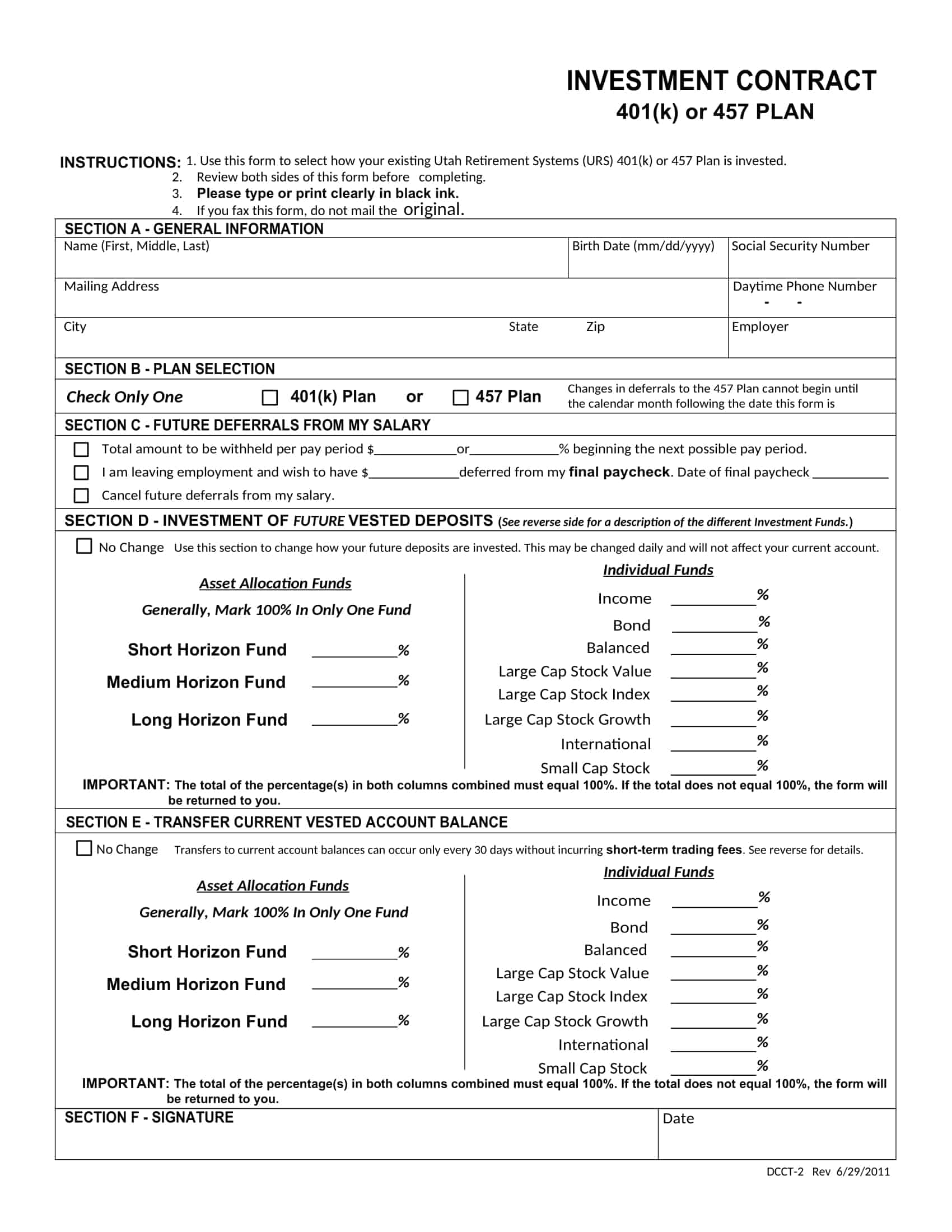

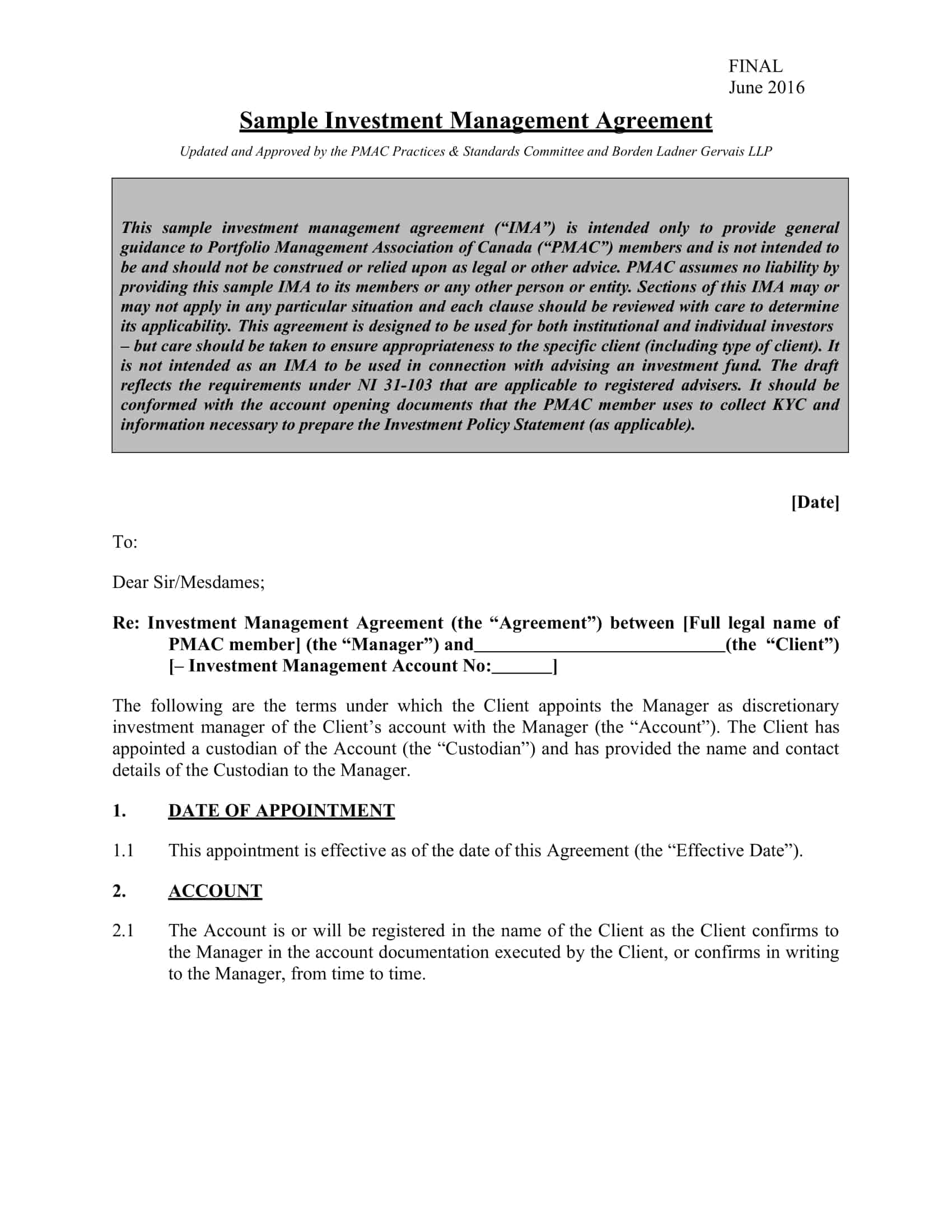

Investment Contract Templates

Secure your investment agreements with ease using our professionally designed templates. Whether you’re entering into a partnership, funding a startup, or engaging in any investment venture, our templates provide a solid foundation for creating comprehensive and legally binding contracts. Customize the templates to outline the terms, conditions, and responsibilities of each party involved, including investment amounts, profit sharing, and exit strategies.

Ensure clarity and protection for both investors and entrepreneurs by clearly defining rights, obligations, and dispute resolution procedures. With our Investment Contract Templates, you can streamline the contract creation process, minimize legal risks, and establish a solid framework for successful investment partnerships. Download now and safeguard your investment ventures with confidence.

What are the elements of an investment contract?

The elements of an investment contract can vary depending on the specific agreement, but common components include:

Definition of the investment: This includes a description of the type of investment and the assets being invested in.

Investment protection provisions: This outlines the guarantees provided to the investor, such as protection against expropriation, nationalization, or other forms of uncompensated taking of assets.

Transparency provisions: This outlines the requirements for the host country to provide information and access to the investor in order to carry out the investment.

Fair and equitable treatment: This provision outlines the requirement for the host country to treat the investor fairly and equitably, without discrimination.

Dispute resolution mechanism: This outlines the process for resolving disputes between the investor and host country, including the use of international arbitration.

Performance requirements: This outlines any conditions that must be met in order for the investment to proceed, such as regulatory approvals or local content requirements.

Exit provisions: This outlines the process by which the investor may exit the investment and repatriate their capital.

Duration of the agreement: This specifies the length of time the agreement will remain in effect.

These are some of the most common elements of an investment contract, but the specific provisions can vary depending on the nature of the investment, the legal framework of the host country, and the negotiated terms between the parties.

Types of Investment Contract

There are several types of investment contract, including:

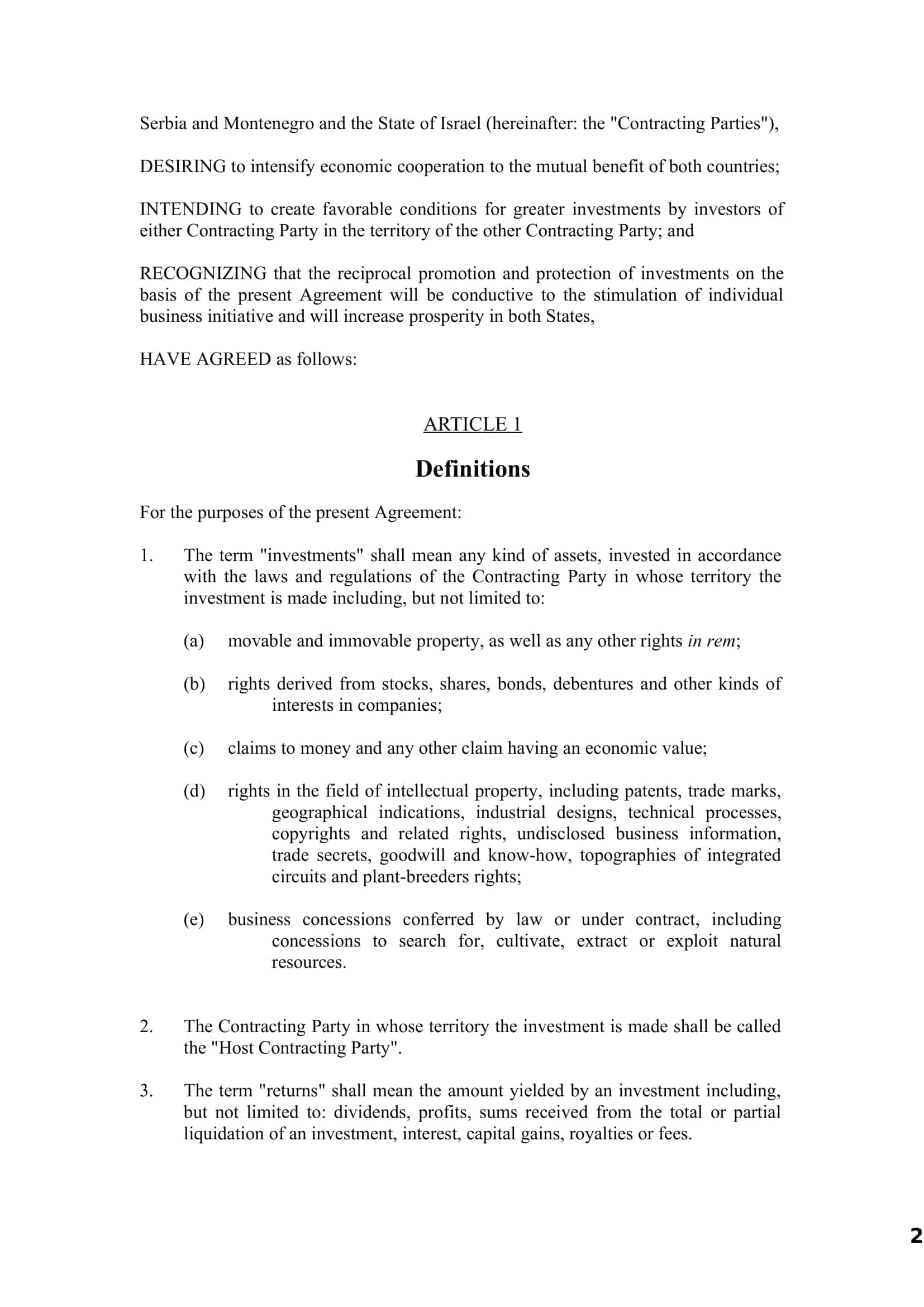

Bilateral Investment Treaties (BITs): These are agreements between two countries that provide a framework for investment protection and promote investment flows between the countries.

Free Trade Agreements (FTAs): These are agreements between two or more countries that promote trade and investment liberalization by reducing barriers to trade, such as tariffs and quotas.

Double Taxation Treaties (DTTs): These are agreements between two countries to prevent double taxation of investment income by setting out the tax obligations of the investor and host country.

Investment Promotion and Protection Agreements (IPPAs): These are agreements between a host country and an investor that provide investment guarantees and protections for the investor.

Energy Investment Agreements: These are agreements that provide a framework for investment in the energy sector, including the exploration and production of oil, gas, and renewable energy.

Concession Agreements: These are agreements between a government and a private investor that grant the investor the right to develop, operate, and manage a specific project, such as a port, airport, or infrastructure project.

Joint Venture Agreements: These are agreements between two or more parties to form a joint venture company to carry out a specific investment project.

Build, Operate, Transfer (BOT) Agreements: These agreements allow a private investor to finance, build, and operate a infrastructure project, such as a power plant or highway, for a specified period of time, after which the project is transferred back to the host country.

Public-Private Partnership (PPP) Agreements: These agreements involve the participation of both the public and private sectors in financing, building, and operating infrastructure projects, with the private sector providing expertise and financing and the public sector retaining ownership of the project.

Mining Concession Agreements: These agreements grant the right to a private investor to explore and extract minerals in a specified area for a specified period of time, subject to regulatory conditions and environmental standards.

Farm-Out Agreements: These agreements are used in the oil and gas industry and allow one party to transfer its rights and interests in an oil or gas field to another party in exchange for financing or technical expertise.

Development Agreements: These agreements are used in real estate development projects and provide the framework for the development and financing of a specific project, such as a shopping mall or residential complex.

Key terms of Investment Contract

The key terms of investment agreements can vary depending on the specific agreement, but common provisions include:

Definition of the investment: This includes a description of the type of investment and the assets being invested in.

Investment protection provisions: This outlines the guarantees provided to the investor, such as protection against expropriation, nationalization, or other forms of uncompensated taking of assets.

Transparency provisions: This outlines the requirements for the host country to provide information and access to the investor in order to carry out the investment.

Fair and equitable treatment: This provision outlines the requirement for the host country to treat the investor fairly and equitably, without discrimination.

Dispute resolution mechanism: This outlines the process for resolving disputes between the investor and host country, including the use of international arbitration.

Performance requirements: This outlines any conditions that must be met in order for the investment to proceed, such as regulatory approvals or local content requirements.

Exit provisions: This outlines the process by which the investor may exit the investment and repatriate their capital.

Duration of the agreement: This specifies the length of time the agreement will remain in effect.

Regulatory framework: This outlines the laws and regulations that will apply to the investment, including taxes, labor laws, and environmental regulations.

Termination provisions: This outlines the conditions under which the agreement may be terminated, such as a breach of contract or a change in law.

These are some of the most common terms of investment agreements, but the specific provisions can vary depending on the nature of the investment, the legal framework of the host country, and the negotiated terms between the parties.

Difference between investment contract and shareholders agreements

An investment agreement and a shareholders agreement are two different types of contracts that serve different purposes.

An investment agreement is a contract between an investor and a host country or company that outlines the terms and conditions of an investment. It sets out the rights and obligations of the parties and provides protection for the investor in the host country.

A shareholders agreement, on the other hand, is a contract between the shareholders of a company. It outlines the rights and obligations of the shareholders and sets out the rules for how the company will be managed and governed. This includes provisions such as the election of directors, decision-making processes, and restrictions on the transfer of shares.

In summary, an investment agreement is focused on the investment itself and provides protection and security for the investor, while a shareholders agreement is focused on the governance and management of the company and sets out the rules for how the company will be run.

How To Write an Investment Contract

Writing an investment agreement requires careful consideration of the terms and conditions of the investment, as well as an understanding of the legal framework of the host country. The following steps can be used as a guide to writing an investment agreement:

Step 1: Identify the Parties

The first step in writing an investment agreement is to identify the parties involved. This includes the investor, the host country or company, and any other relevant parties such as a government agency or regulatory authority. The agreement should clearly specify the names, addresses, and other relevant information of each party.

Step 2: Define the Investment

The next step is to define the investment. This includes a description of the type of investment and the assets being invested in. It is important to clearly define the investment in order to avoid ambiguity or misunderstandings.

Step 3: Outline Investment Protection Provisions

The investment agreement should outline the protection provisions provided to the investor. This may include guarantees against expropriation, nationalization, or other forms of uncompensated taking of assets. It is also important to consider the protections available under international investment law, such as the right to fair and equitable treatment and protection against discrimination.

Step 4: Provide for Transparency

Transparency provisions should be included in the agreement, outlining the requirements for the host country to provide information and access to the investor in order to carry out the investment. This may include provisions for access to government agencies or regulatory bodies, or the right to obtain information necessary to conduct due diligence.

Step 5: Include Fair and Equitable Treatment Provisions

The agreement should include a provision outlining the requirement for the host country to treat the investor fairly and equitably, without discrimination. This provision is important to ensure that the investment is protected against discriminatory or arbitrary actions by the host country.

Step 6: Specify Dispute Resolution Mechanism

The agreement should include a dispute resolution mechanism, outlining the process for resolving disputes between the investor and host country. This may include the use of international arbitration, as well as any other methods of resolving disputes that are acceptable to the parties.

Step 7: Outline Performance Requirements

The agreement should include performance requirements, outlining any conditions that must be met in order for the investment to proceed. This may include regulatory approvals, local content requirements, or other conditions specified by the host country.

Step 8: Specify Duration and Termination Provisions

The agreement should specify the duration of the agreement, as well as any termination provisions. This may include conditions for termination, such as a breach of contract, change in law, or other events that trigger termination of the agreement.

Step 9: Outline Regulatory Framework

The agreement should outline the regulatory framework that will apply to the investment, including taxes, labor laws, and environmental regulations. It is important to consider the legal framework of the host country and ensure that the provisions of the agreement are consistent with the local laws and regulations.

Step 10: Review and Revisions

Once the agreement has been drafted, it is important to review it carefully and make any necessary revisions. This may include obtaining legal advice from an attorney or other professional with expertise in investment agreements.

Step 11: Signatures and Finalization

Once the agreement has been reviewed and revised, it should be signed by all parties and finalized. This may include obtaining any necessary approvals or consents, and filing the agreement with the appropriate government agencies or regulatory bodies.

These are the basic steps for writing an investment agreement. It is important to consider the specific needs and circumstances of the investment, as well as the legal framework of the host country, when drafting the agreement.

FAQs

What is an investment contract?

An investment contract is a type of security or financial arrangement where individuals invest money with the expectation of earning profits primarily from the efforts of others, such as a promoter or third party. The precise definition can vary by jurisdiction and legal system.

How is an investment contract different from other types of contracts?

Unlike standard contracts, investment contracts involve an investment of money, with a common expectation of profits arising from the efforts of others. They are a form of securities and are subject to specific regulatory and legal requirements that other types of contracts may not be.

What are the characteristics of an investment contract?

Investment contracts typically have three characteristics: an investment of money, in a common enterprise, with an expectation of profits primarily from the efforts of others. These characteristics can be known as the “Howey Test” in the United States.

What laws govern investment contracts?

In the United States, investment contracts are governed by federal securities laws, primarily the Securities Act of 1933 and the Securities Exchange Act of 1934. State securities laws and regulations may also apply. The specific laws and regulations can vary significantly in other countries.

What is the Howey Test?

The Howey Test is a test created by the Supreme Court in the United States to determine whether certain transactions qualify as investment contracts. If so, then they are considered securities and subject to certain disclosure and registration requirements.

What should be included in an investment contract?

An investment contract should clearly outline the terms of the investment, the rights and obligations of each party, the structure of the investment, how profits and losses will be shared, and any other relevant terms. It’s also essential to include any legally required disclosures.

Why is it important to have a well-drafted investment contract?

A well-drafted investment contract helps to ensure that the rights and responsibilities of all parties are clearly defined, reducing the risk of disputes later on. It also helps to ensure compliance with applicable laws and regulations, which can help avoid legal problems.

Should I consult with a lawyer when drafting an investment contract?

Yes, it’s advisable to consult with a legal professional when drafting an investment contract due to the complex legal and regulatory requirements surrounding investment securities. A lawyer can help ensure that the contract complies with applicable laws and that the interests of all parties are adequately protected.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)