Professionals in various fields like engineering, medicine, architecture, and marketing excel in their areas of expertise, yet they may still struggle with financial issues. This is often due to the fact that their academic training focuses primarily on their respective disciplines, neglecting important financial management skills.

To overcome financial difficulties and ensure a stable financial future, it’s crucial to take a proactive approach and educate oneself in personal finance. By doing so, individuals can assess their financial standing, make well-informed decisions, and take control of their finances. Don’t wait for financial stability to come to you, take the reins and secure your financial future today.

Table of Contents

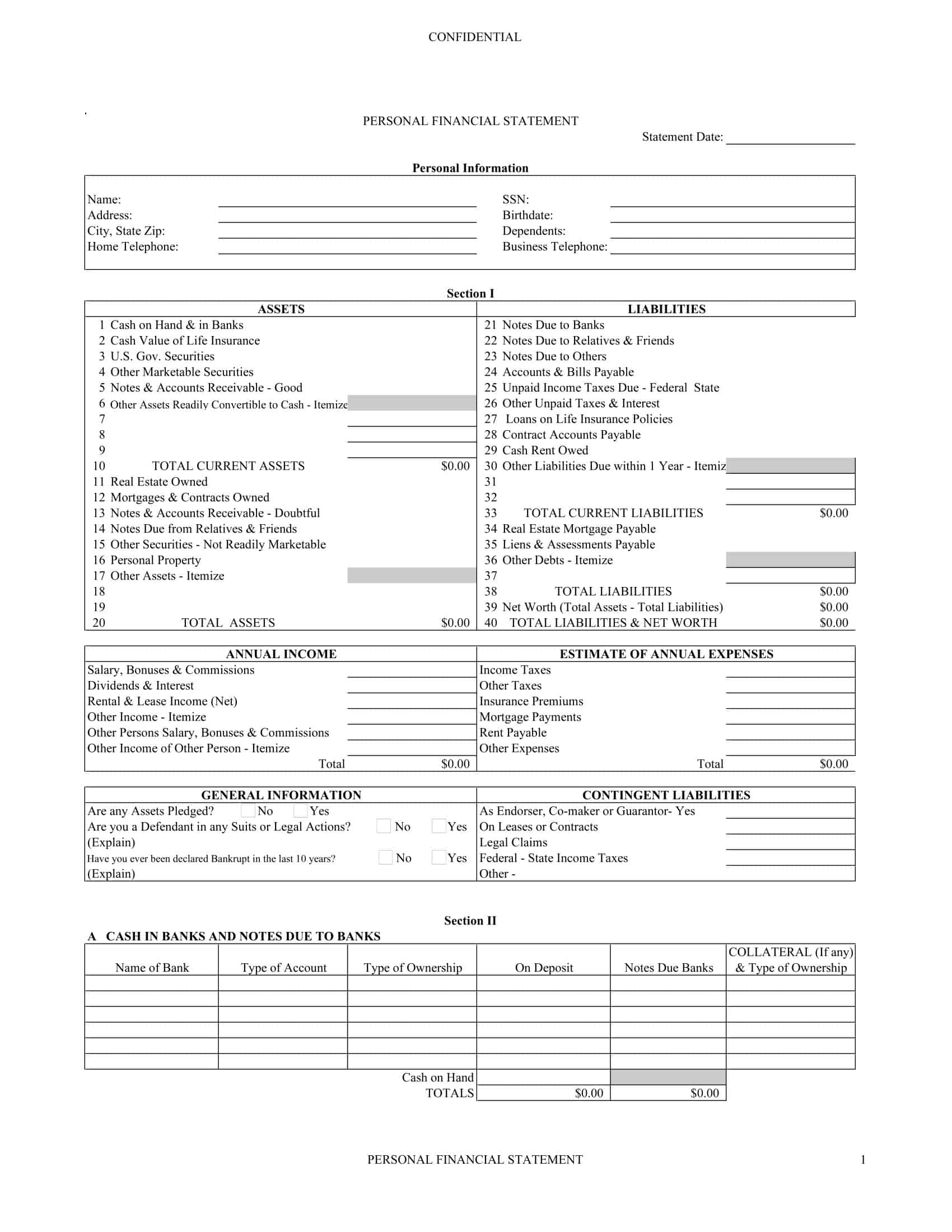

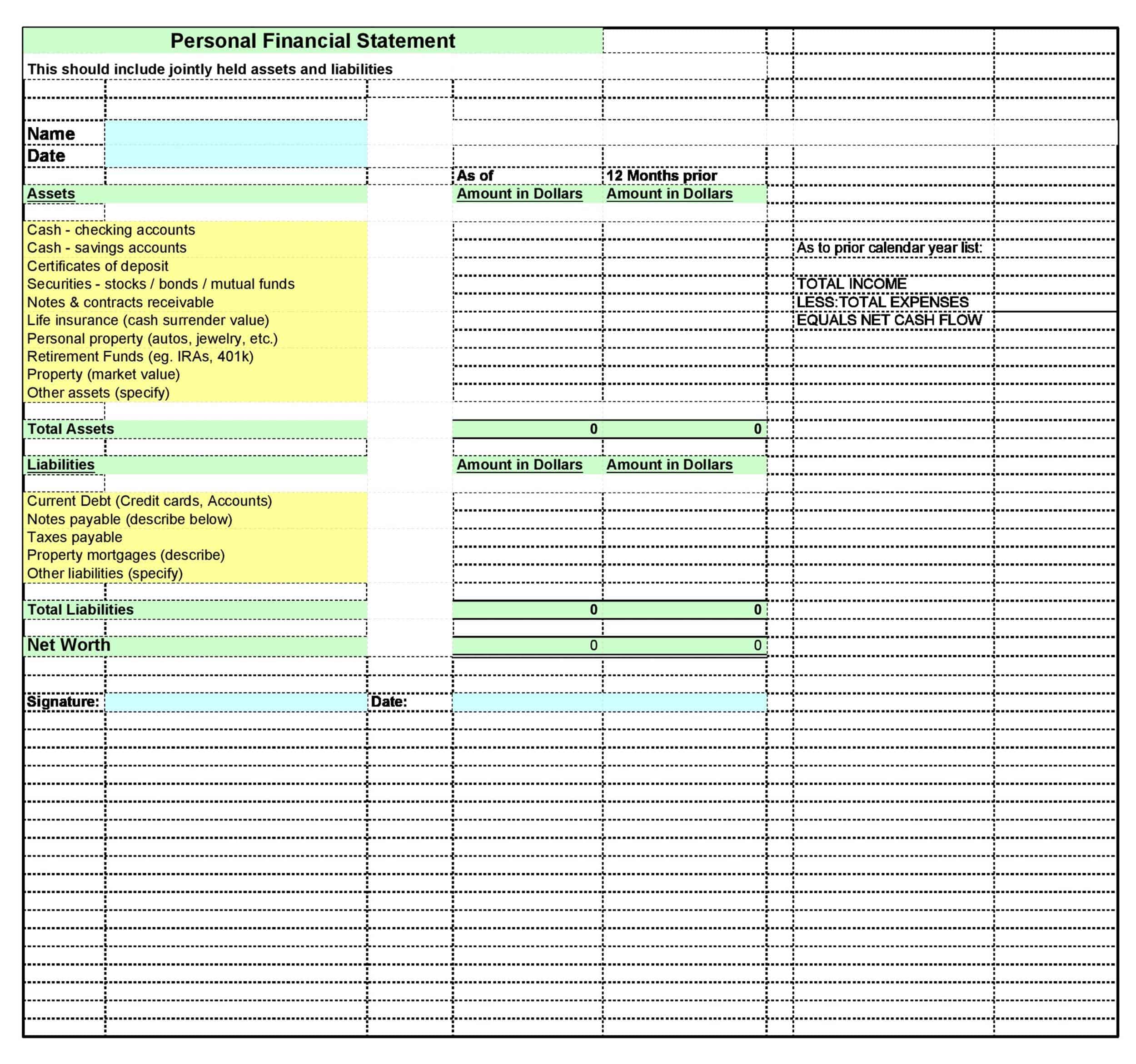

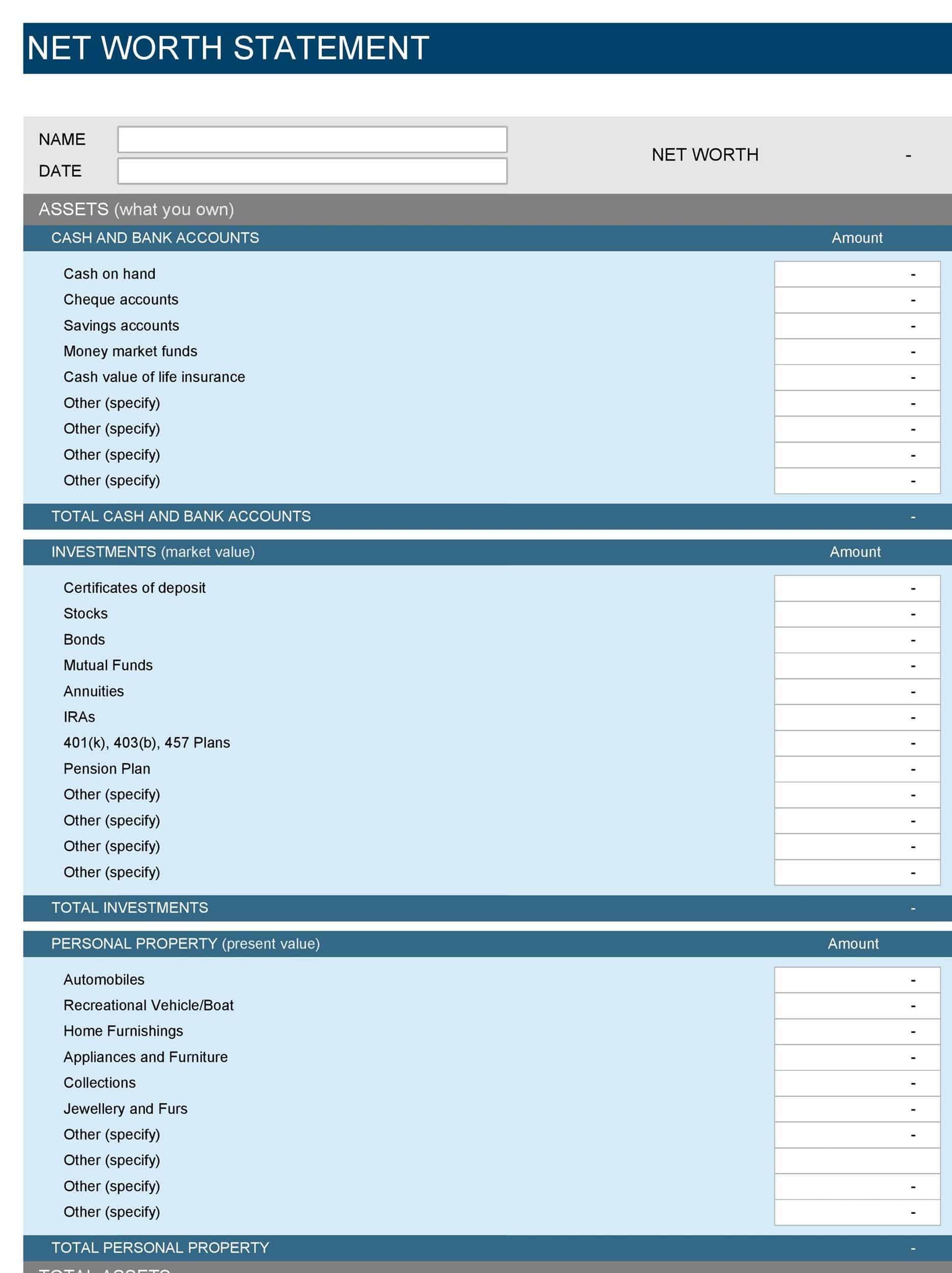

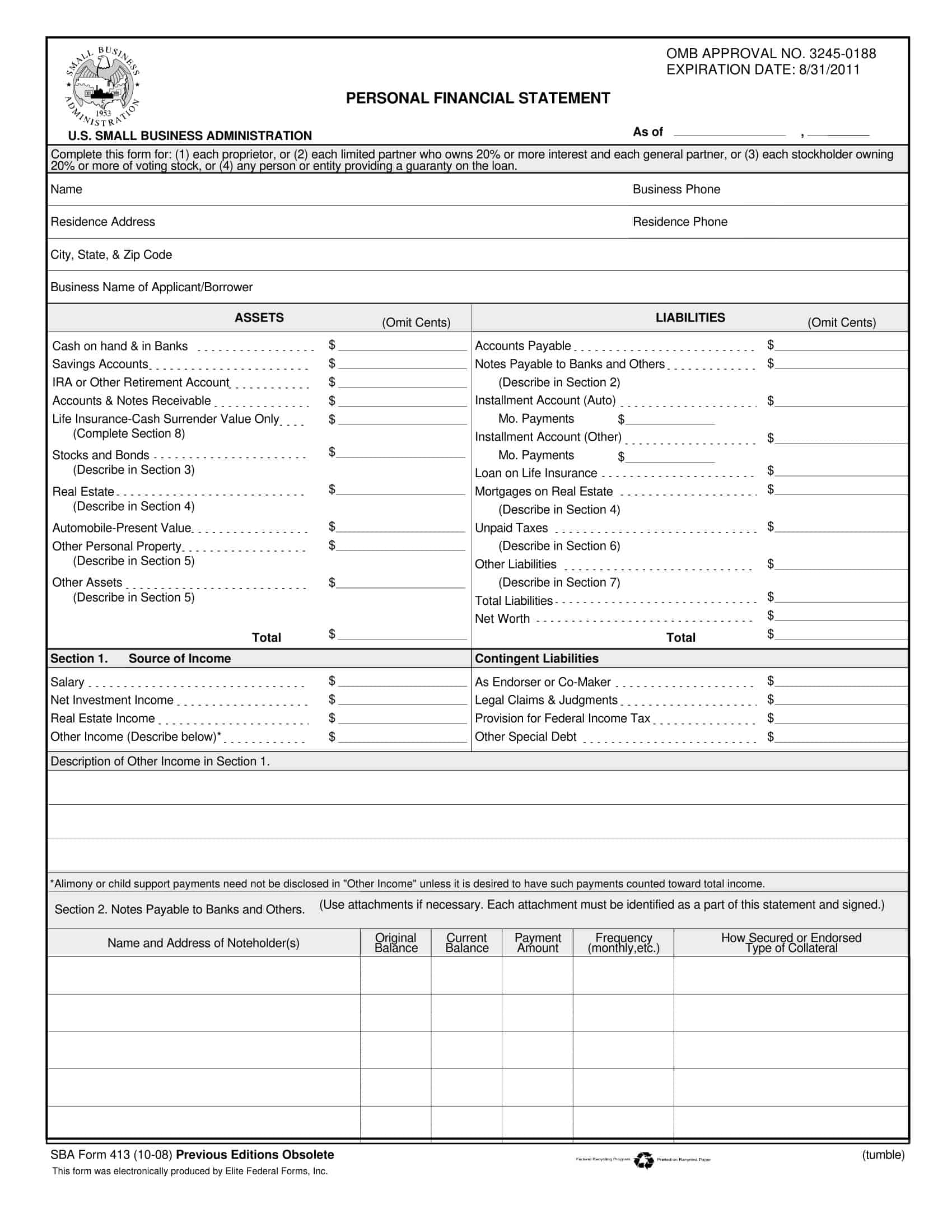

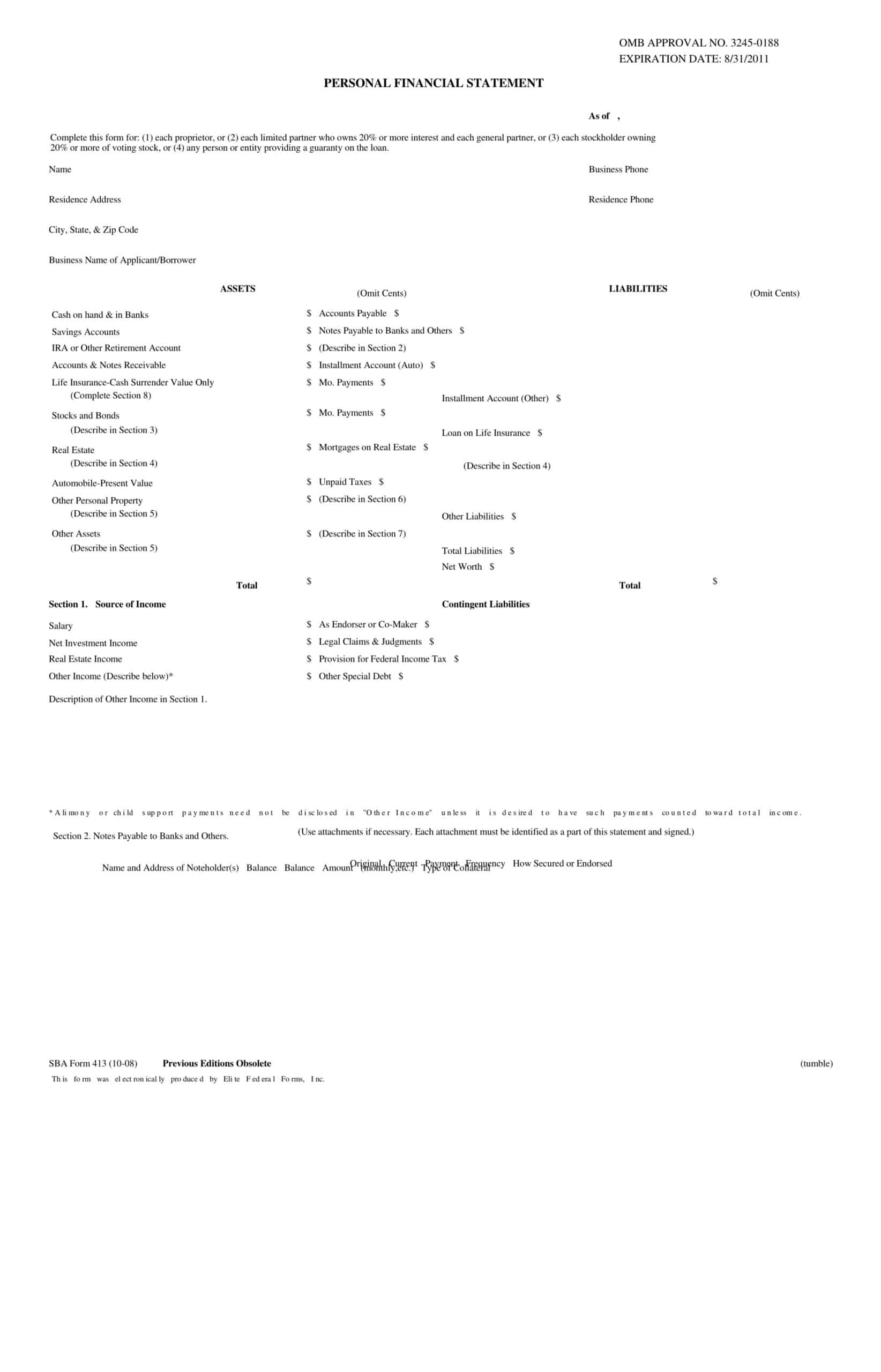

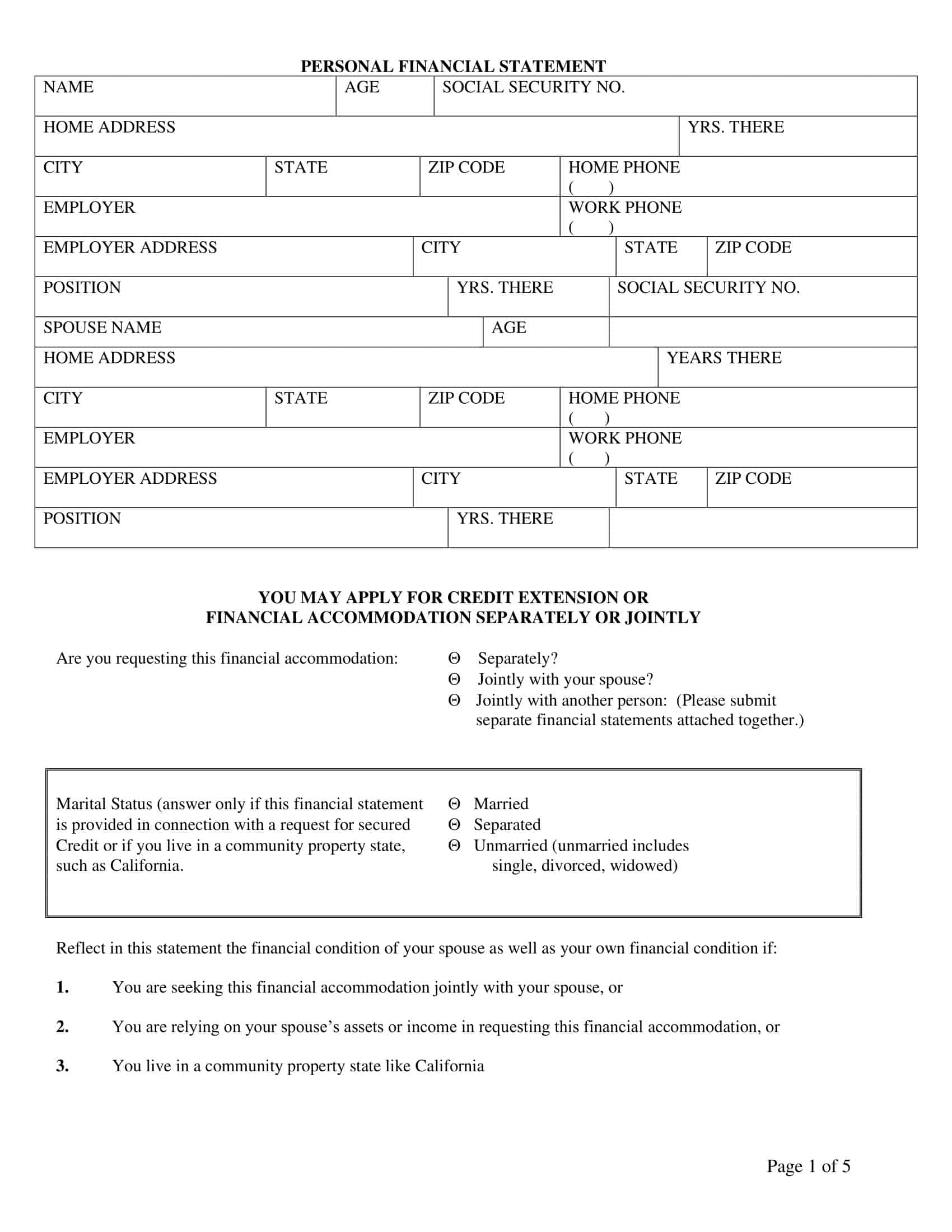

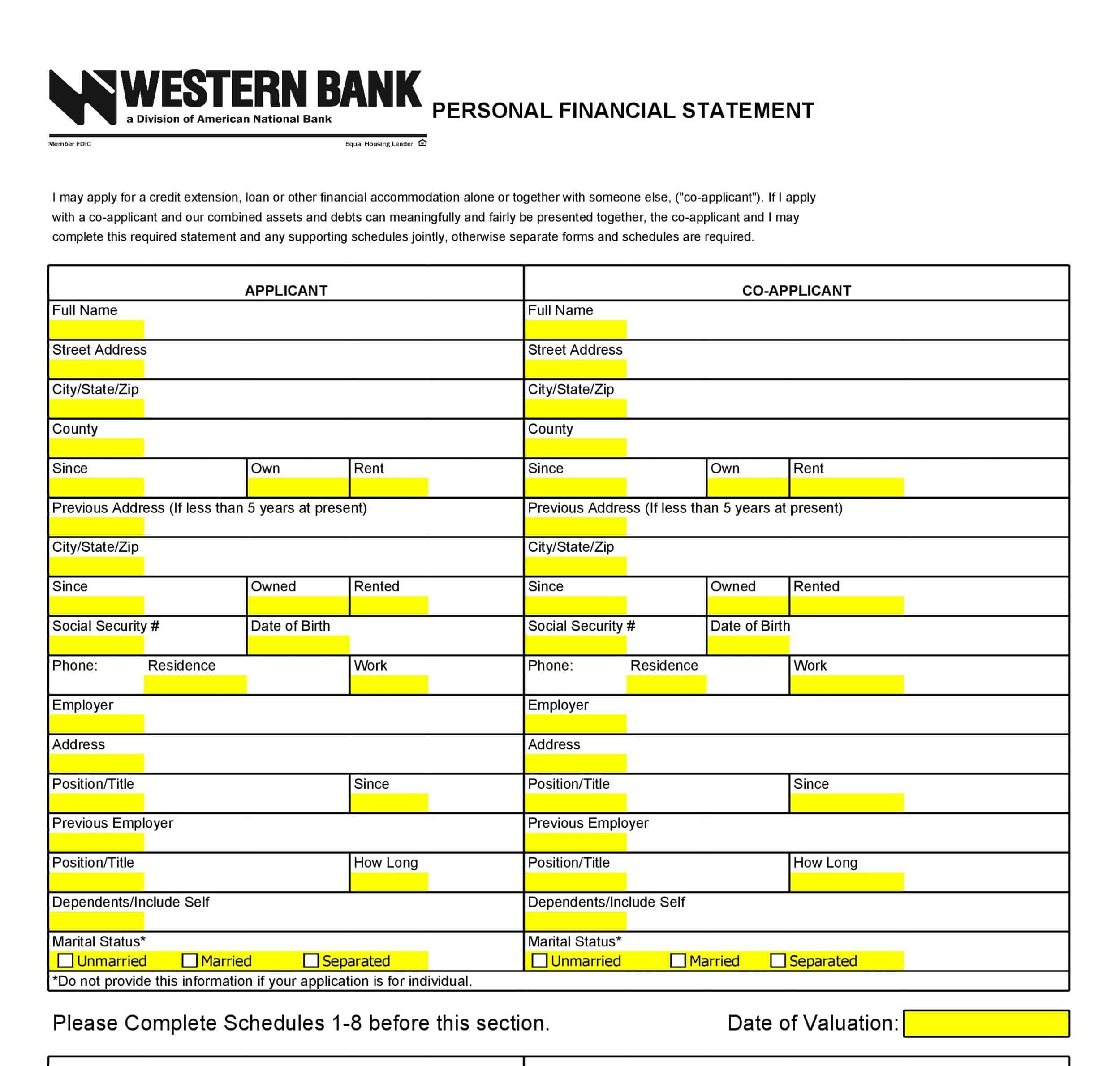

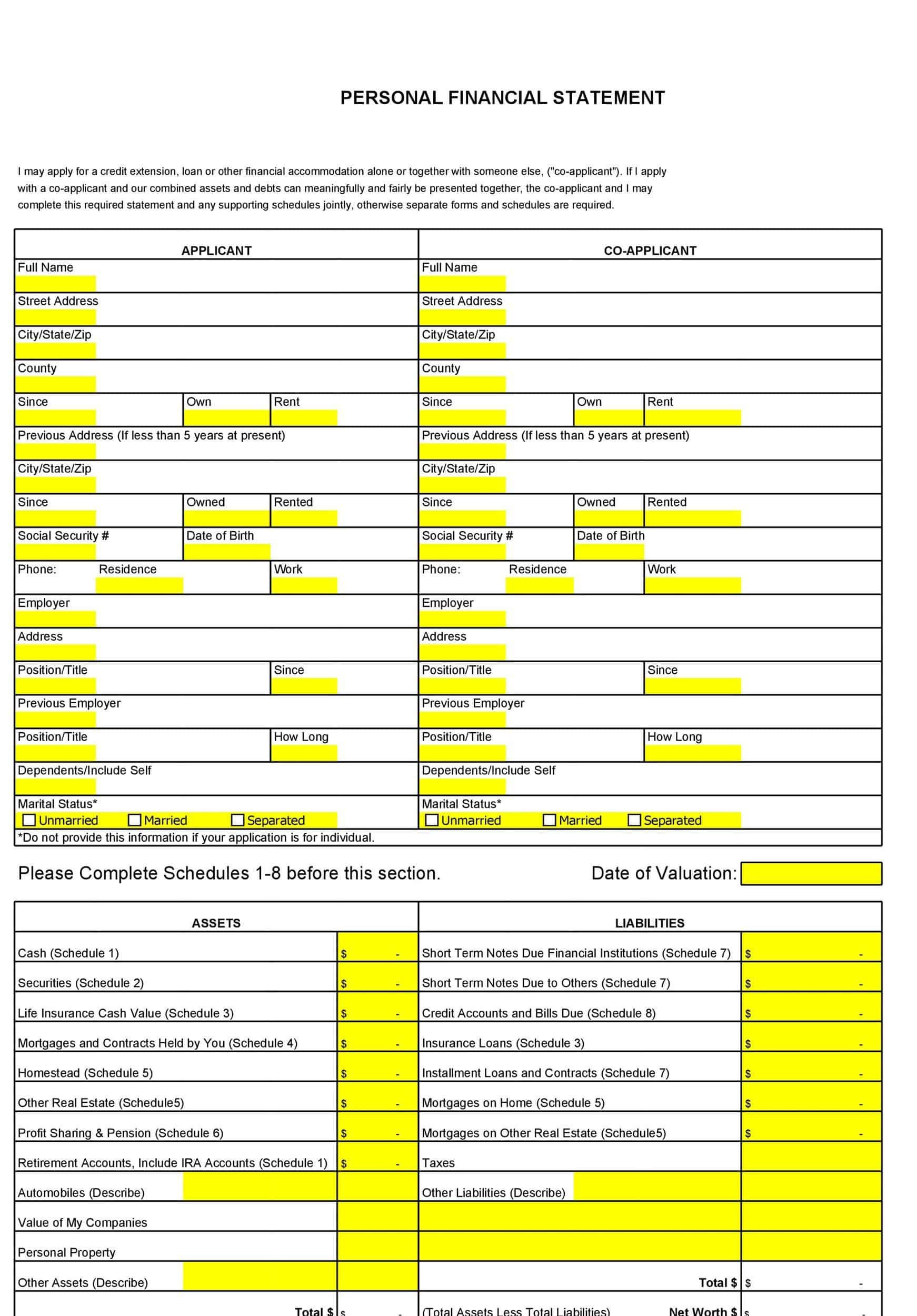

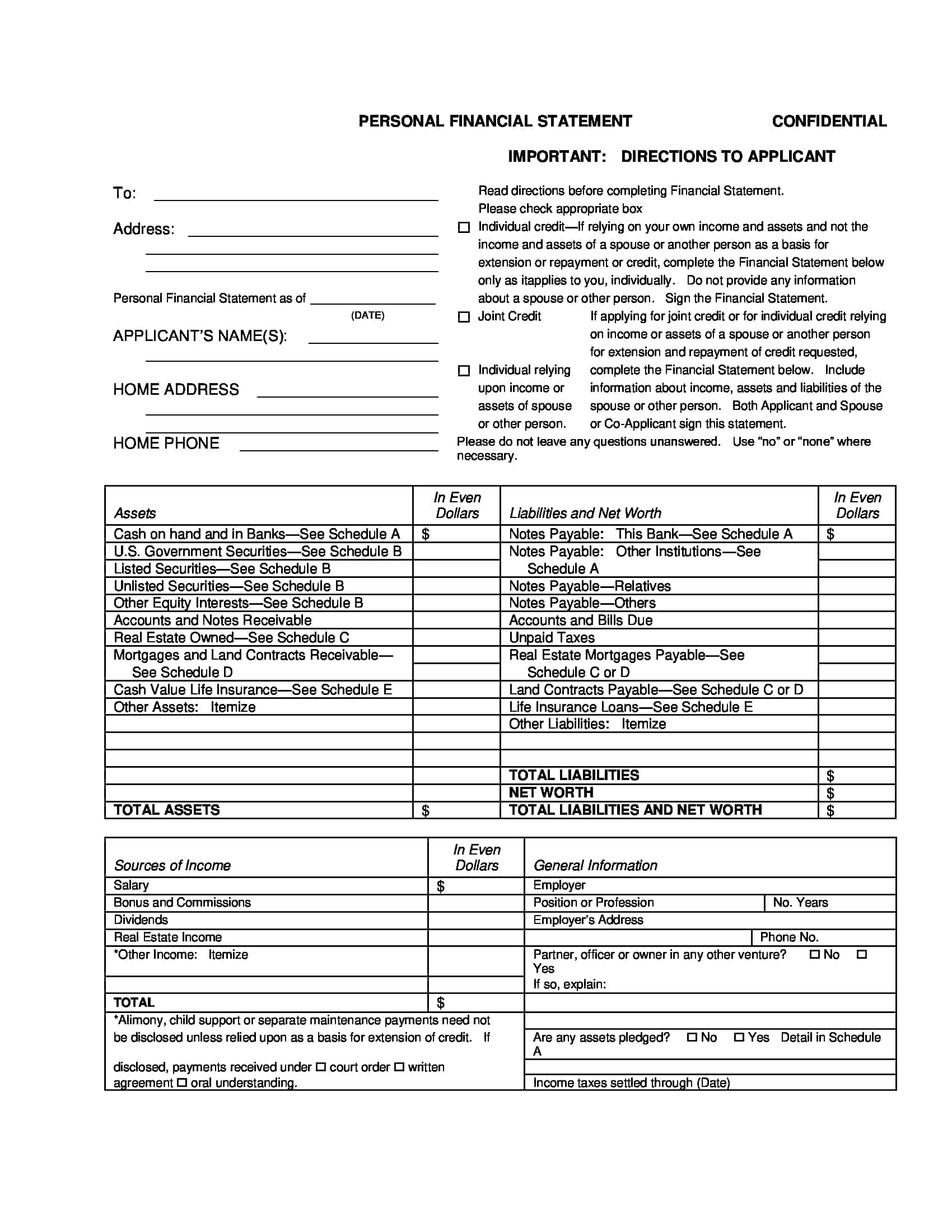

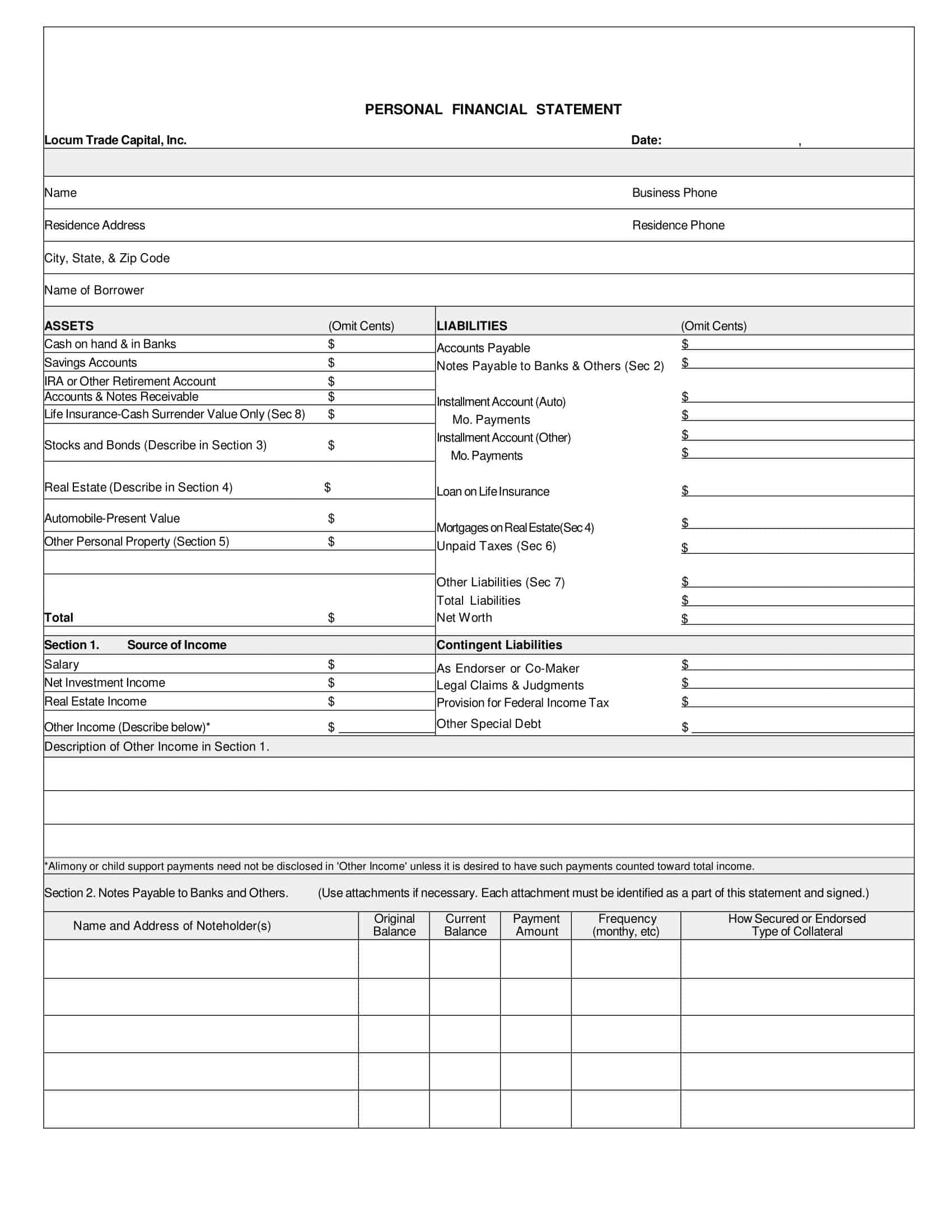

Personal Financial Statement Templates

Personal Financial Statement Templates are comprehensive documents used to assess an individual’s financial health and provide an overview of their personal financial situation. These templates offer a structured format for individuals to record and evaluate their assets, liabilities, income, and expenses, enabling them to gain a clear understanding of their overall financial standing. Personal Financial Statement Templates serve as valuable tools for financial planning, budgeting, and decision-making.

Personal Financial Statement Templates serve as essential tools for individuals to assess their current financial situation, track their progress over time, and make informed financial decisions. By utilizing these templates, individuals can gain a comprehensive understanding of their assets, liabilities, income, and expenses. This information allows for effective financial planning, budgeting, and goal setting. Personal Financial Statement Templates promote financial awareness, enable individuals to identify areas for improvement, and serve as a foundation for developing strategies to achieve financial stability and success. It is important for individuals to review and update their personal financial statements regularly to reflect any changes in their financial circumstances.

What Is a Personal Financial Statement?

A personal financial statement is a document that provides a snapshot of an individual’s financial status and details their assets, liabilities, and net worth. It typically includes information about income, expenses, debts, investments, and other financial assets and liabilities. The purpose of a personal financial statement is to provide a comprehensive view of an individual’s financial situation and to help them make informed decisions about their finances. This statement can also be used to support loan applications, provide proof of income, and track financial progress over time.

What purpose can you use for Personal Financial Statement?

A personal financial statement can serve several purposes, including:

Assessing financial status: A personal financial statement provides a clear overview of an individual’s financial situation and helps them identify areas where they can improve their finances.

Loan application: Personal financial statements can be used as part of a loan application process to demonstrate financial stability and ability to repay the loan.

Tracking financial progress: Regularly updating personal financial statements can help individuals track their financial progress over time and make changes to their spending habits if necessary.

Proof of income: A personal financial statement can be used as proof of income for rental applications, government benefits, or other purposes.

Estate planning: Personal financial statements can be useful for estate planning purposes, as they provide a complete picture of an individual’s assets and liabilities.

Budgeting: By understanding their financial status, individuals can create a realistic budget and work towards their financial goals.

Retirement planning: A personal financial statement can help individuals assess their retirement readiness and plan accordingly.

Investment decisions: By understanding their net worth and financial position, individuals can make informed investment decisions that align with their financial goals.

Negotiating a raise or promotion: A personal financial statement can be used to demonstrate financial need and justify a raise or promotion.

Determining insurance needs: By understanding their assets and liabilities, individuals can determine their insurance needs and choose the right coverage for their specific situation.

Tax planning: A personal financial statement can provide valuable information for tax planning purposes, such as determining the tax implications of different financial decisions.

Business planning: For small business owners, a personal financial statement can be used to evaluate the financial health of their business and make informed decisions about their operations.

How Does a Personal Financial Statement Work?

A personal financial statement works by helping individuals track and manage their financial situation. Here’s how it works:

Gathering Information: To create a personal financial statement, individuals must gather information about their assets, liabilities, income, expenses, savings, investments, and emergency fund.

Assessing Financial Situation: By including all relevant information, the personal financial statement provides a comprehensive view of an individual’s financial situation, allowing them to see their net worth and track their financial progress over time.

Setting Financial Goals: With a clear understanding of their financial situation, individuals can set realistic financial goals, such as reducing debt, increasing savings, and investing for the future.

Creating a Budget: A personal financial statement can help individuals create a budget by providing a comprehensive view of their income and expenses. This allows them to identify areas where they can cut expenses and redirect their resources towards their financial goals.

Monitoring Progress: Regularly updating the personal financial statement allows individuals to track their progress towards their financial goals and make necessary adjustments as circumstances change.

Components of a Personal Financial Statement Template

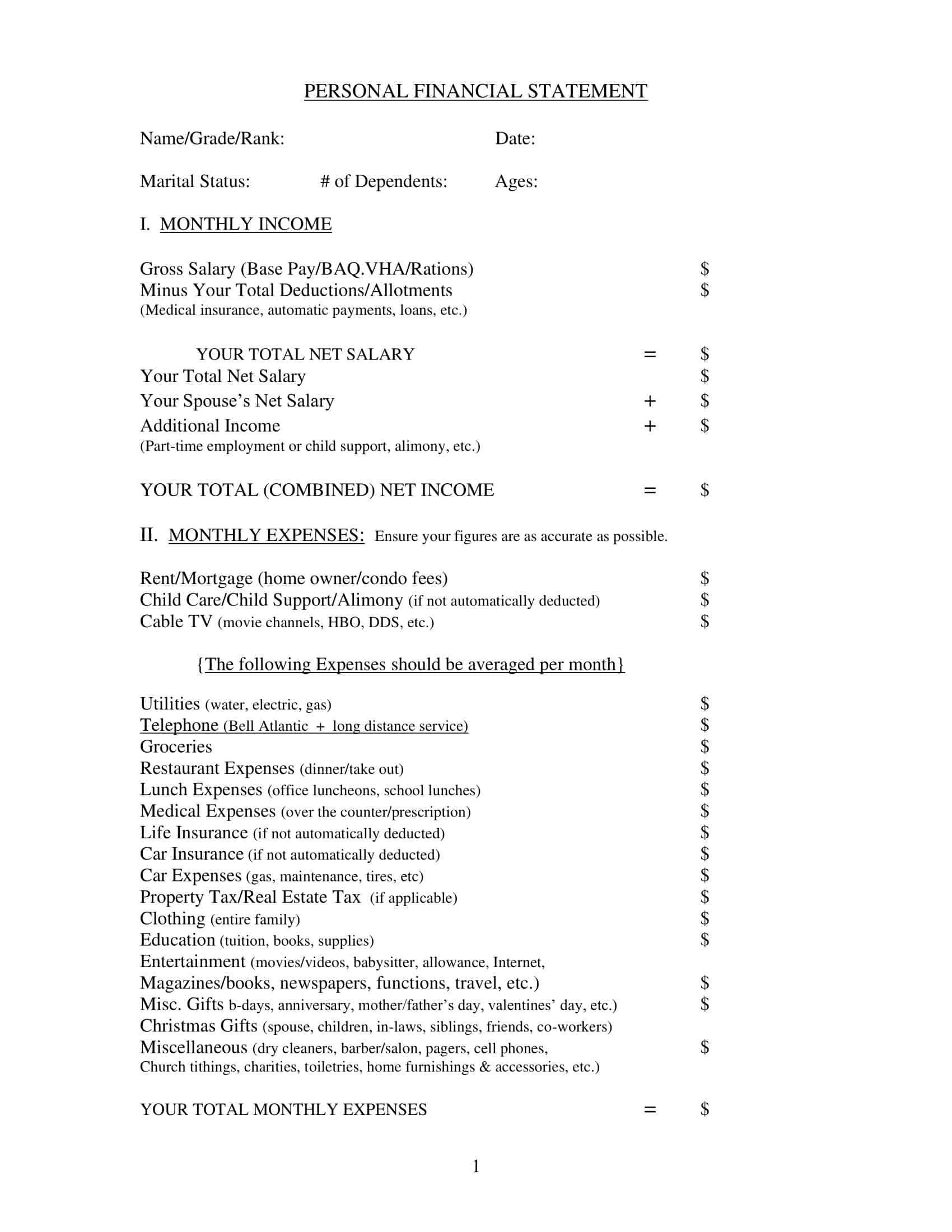

A personal financial statement typically includes the following elements:

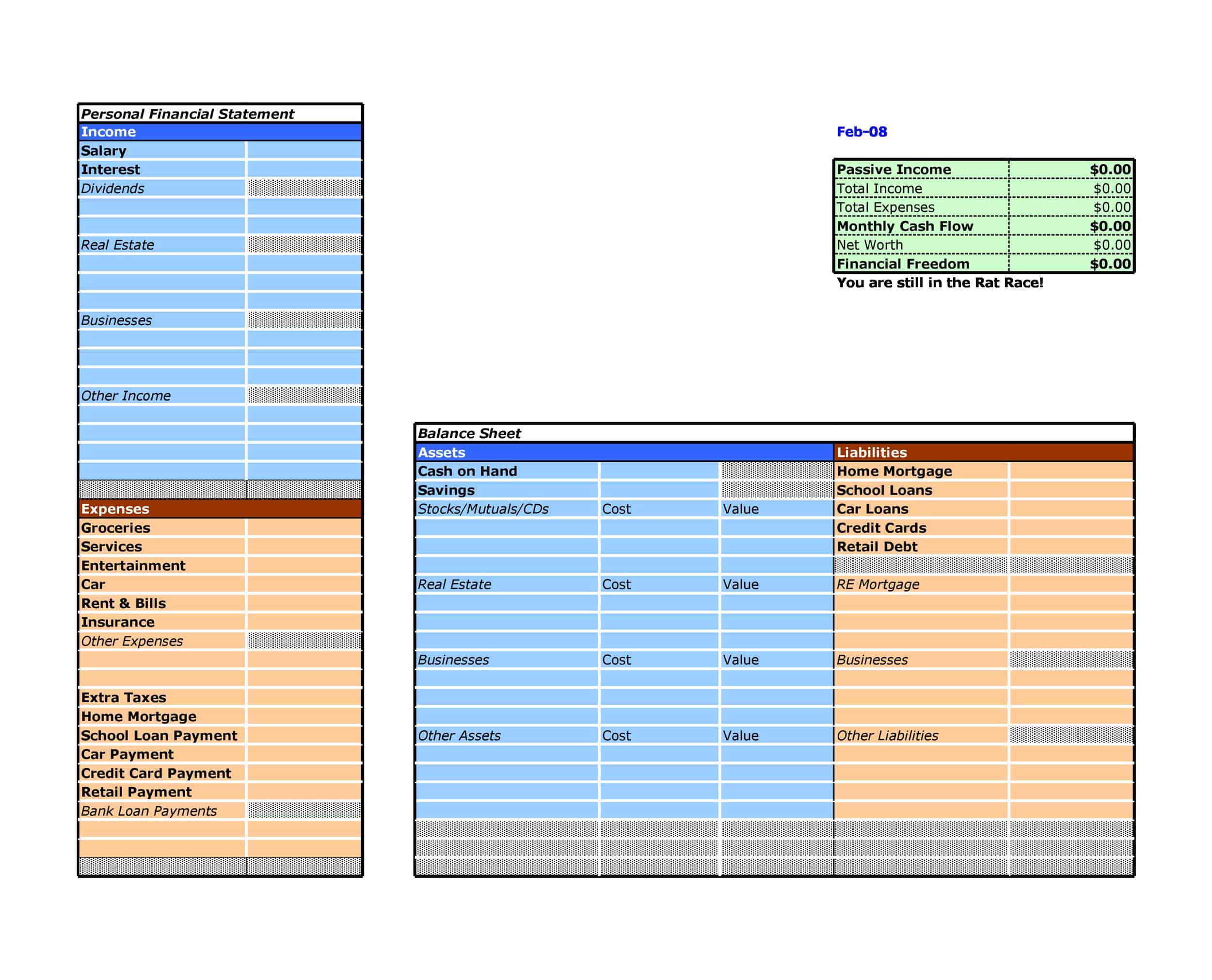

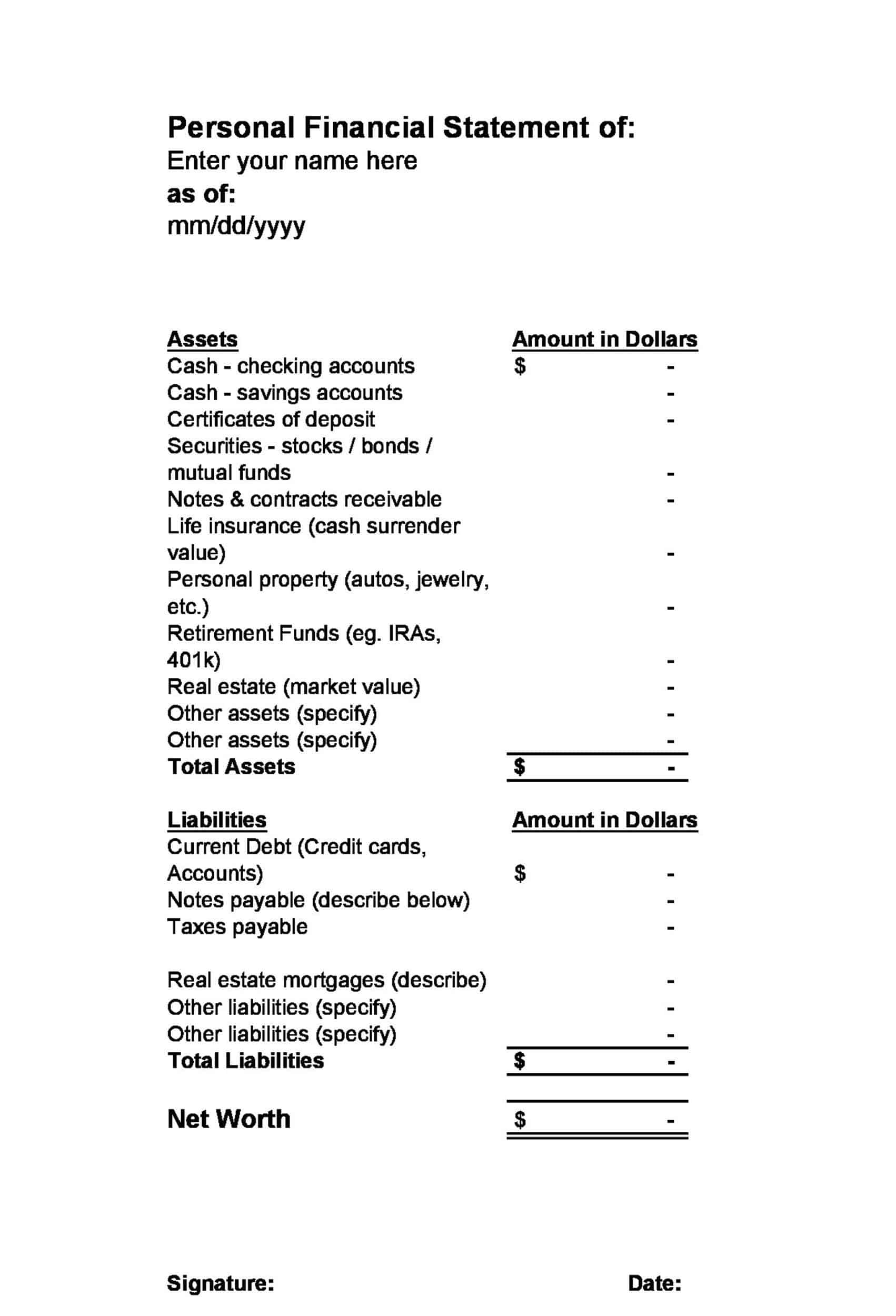

Assets: This section includes all the items an individual owns that have monetary value, such as cash, investments, real estate, and personal property.

Liabilities: This section includes all the debts an individual owes, such as mortgages, loans, credit card balances, and other forms of debt.

Net worth: This is calculated by subtracting liabilities from assets, and represents an individual’s financial position.

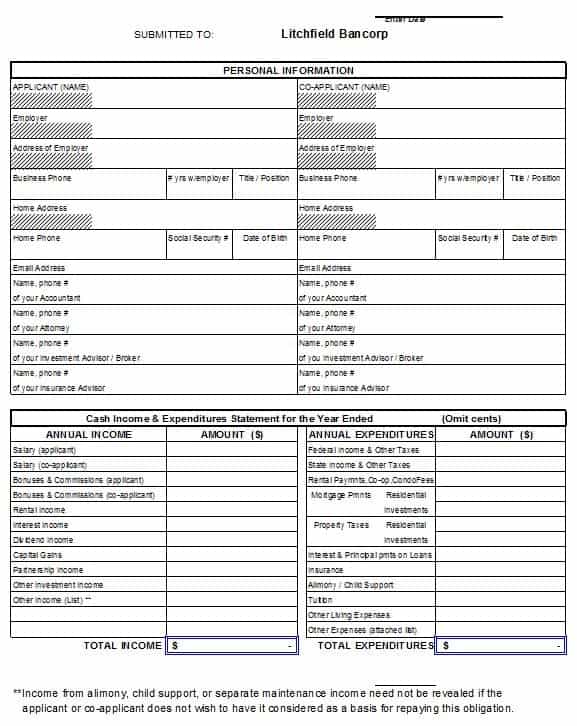

Income: This section includes all forms of income, such as salary, bonuses, dividends, and interest.

Expenses: This section includes all forms of regular and discretionary expenses, such as housing, food, transportation, entertainment, and taxes.

Savings and investments: This section includes information about an individual’s savings, investments, and retirement accounts.

Emergency fund: This section includes information about an individual’s emergency fund, including its size and purpose.

Personal information: This section includes personal information, such as name, address, date of birth, and employment information.

How to Create a Personal Financial Statement

Creating a personal financial statement is a straightforward process that can be completed in several steps:

Step 1: Gather Information

Start by gathering information about your assets, liabilities, income, expenses, savings, investments, and emergency fund. This information can be found on bank statements, investment accounts, tax returns, and other financial records.

Step 2: Organize Your Information

Next, organize your information into categories so that it’s easy to track and understand. You can use a spreadsheet or an online personal finance tool to help you with this.

Step 3: Assess Your Net Worth

To determine your net worth, subtract your liabilities from your assets. Your net worth is the total value of your assets minus your liabilities and provides a snapshot of your financial situation.

Step 4: List Your Assets

Start by listing your assets, including cash, checking and savings accounts, investment accounts, real estate, vehicles, and other valuable items.

Step 5: List Your Liabilities

Next, list your liabilities, including credit card debt, car loans, mortgages, student loans, and other outstanding debts.

Step 6: Review Your Income and Expenses

Review your income and expenses to determine your monthly cash flow. Be sure to include all sources of income, including salaries, investments, and any other sources of income. Also, list all your monthly expenses, including rent or mortgage payments, utilities, insurance, groceries, and other necessary expenses.

Step 7: Update Regularly

It’s important to update your personal financial statement regularly, at least once a month, to ensure it accurately reflects your current financial situation.

Step 8: Use Your Personal Financial Statement to Set Financial Goals

With a clear understanding of your financial situation, you can use your personal financial statement to set realistic financial goals, such as reducing debt, increasing savings, and investing for the future.

Step 9: Monitor Your Progress

Regularly monitoring your progress and updating your personal financial statement will allow you to track your progress towards your financial goals and make necessary adjustments as circumstances change.

By creating a personal financial statement, you’ll gain a comprehensive view of your financial situation and have a roadmap for managing your finances effectively.

FAQs

Who can use a Personal Financial Statement?

A Personal Financial Statement can be used by anyone who wants to keep track of their financial situation, including individuals, business owners, and families.

Can a Personal Financial Statement be used to apply for a loan?

Yes, a Personal Financial Statement can be used as a tool to apply for a loan. It provides a lender with information on an individual’s financial situation and creditworthiness.

How often should a Personal Financial Statement be updated?

A Personal Financial Statement should be updated regularly, at least once a year or more often if there have been significant changes in an individual’s financial situation.

Is a Personal Financial Statement the same as a credit report?

No, a Personal Financial Statement is not the same as a credit report. A credit report is a record of an individual’s borrowing and payment history, while a Personal Financial Statement provides a snapshot of an individual’s current financial situation.

Can a Personal Financial Statement be used to file taxes?

A Personal Financial Statement is not used to file taxes, but it can be a helpful tool in preparing tax returns by providing a comprehensive view of an individual’s financial situation.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)