An IOU, or “I owe you,” is a written or verbal agreement between two parties acknowledging a debt that one person owes to the other. IOUs are often used in personal transactions, but can also be utilized in business settings.

They serve as a record of the debt, allowing both parties to keep track of what is owed and to whom. In some cases, IOUs may also include information such as the amount owed, the date the debt is to be repaid, and the interest rate if applicable. Despite not being a legally binding document, IOUs can still play a critical role in ensuring that debts are repaid in a timely manner.

Table of Contents

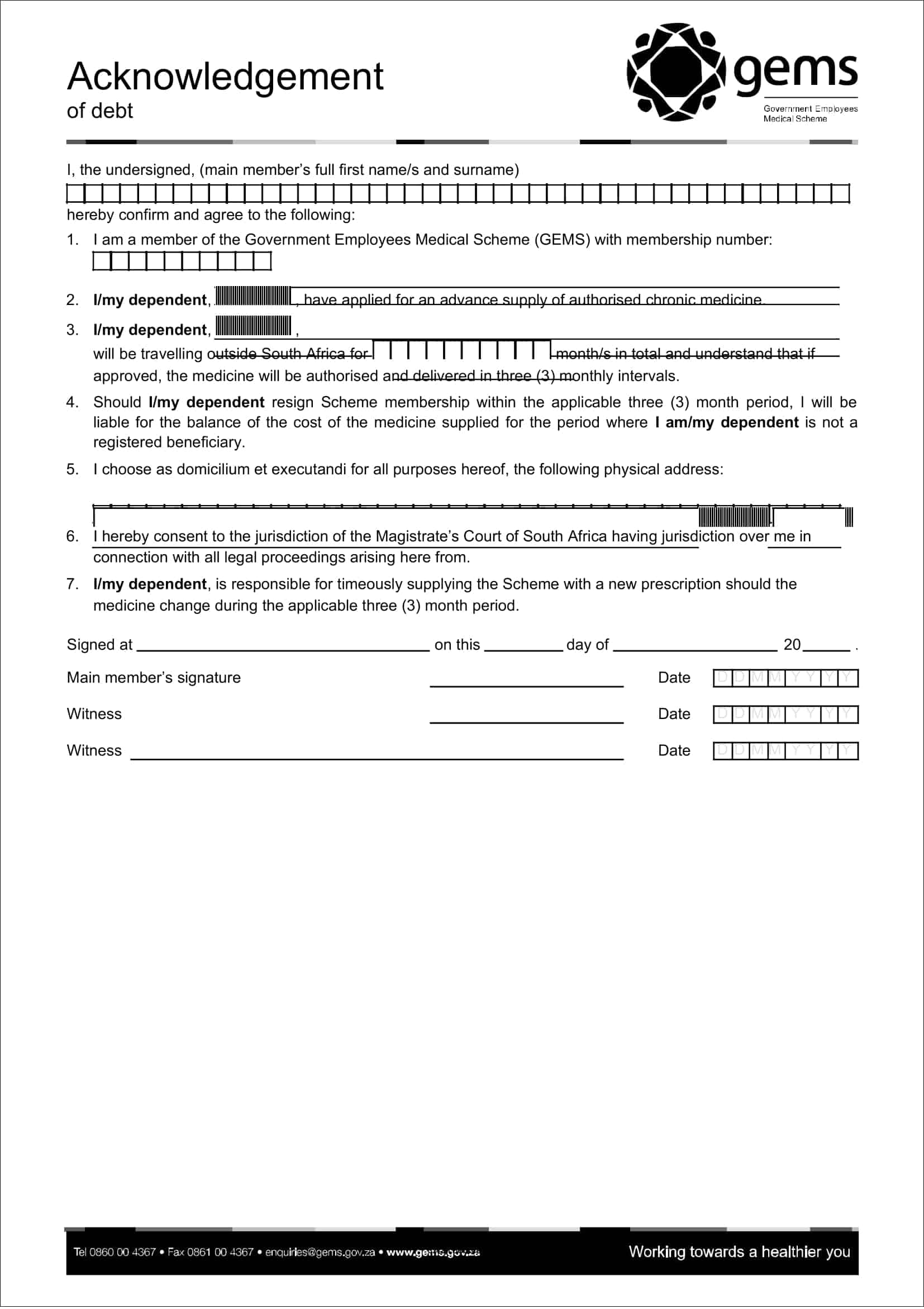

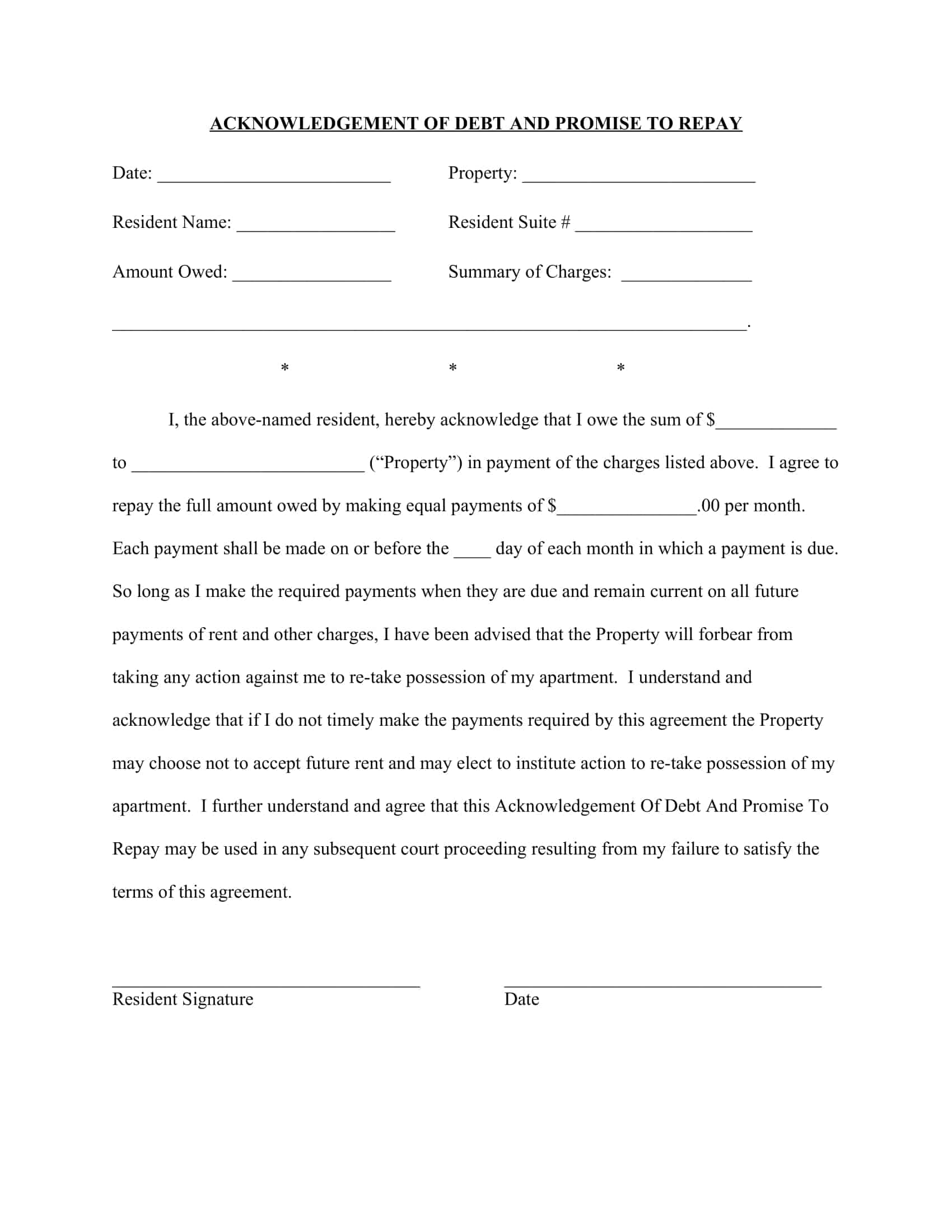

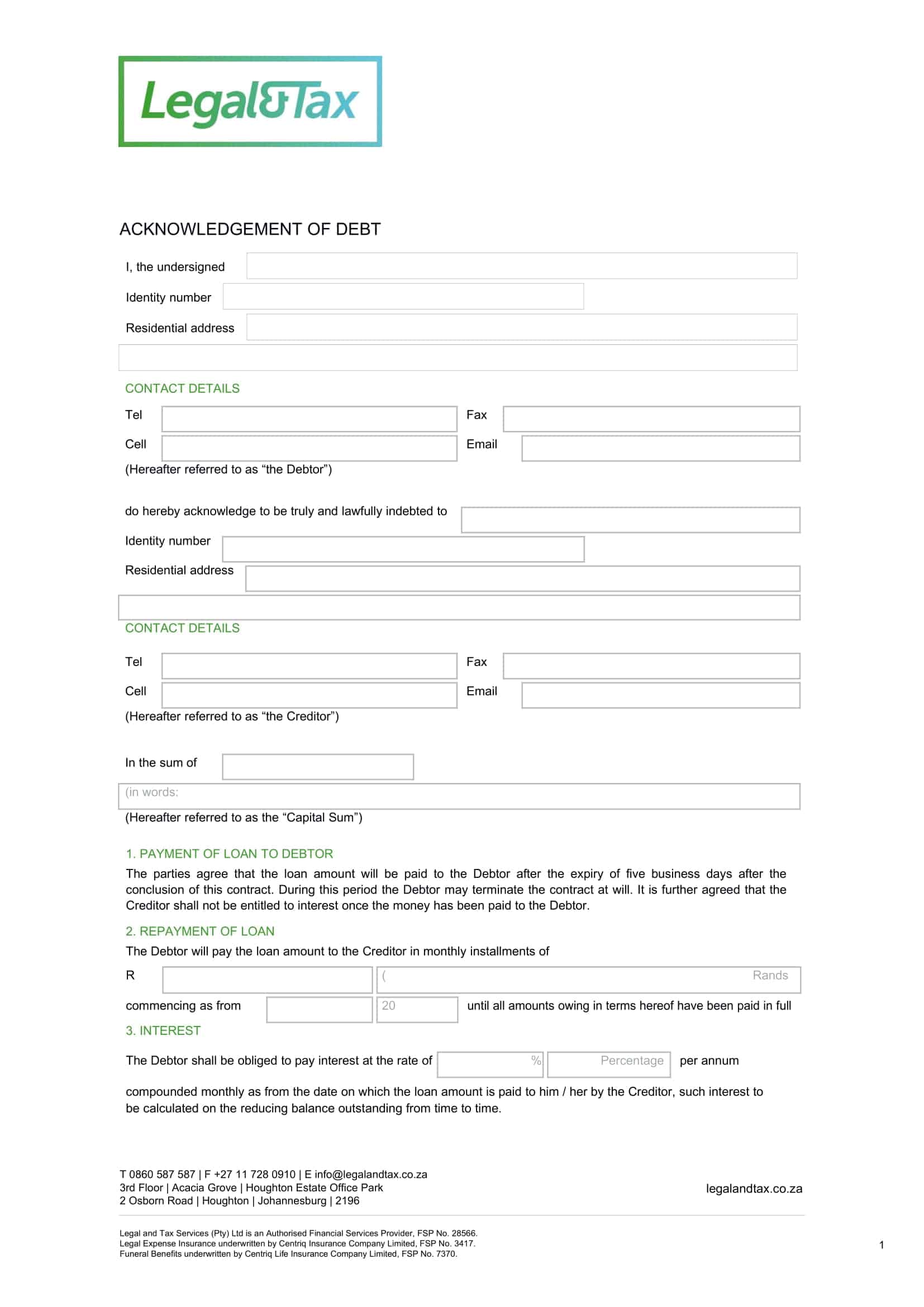

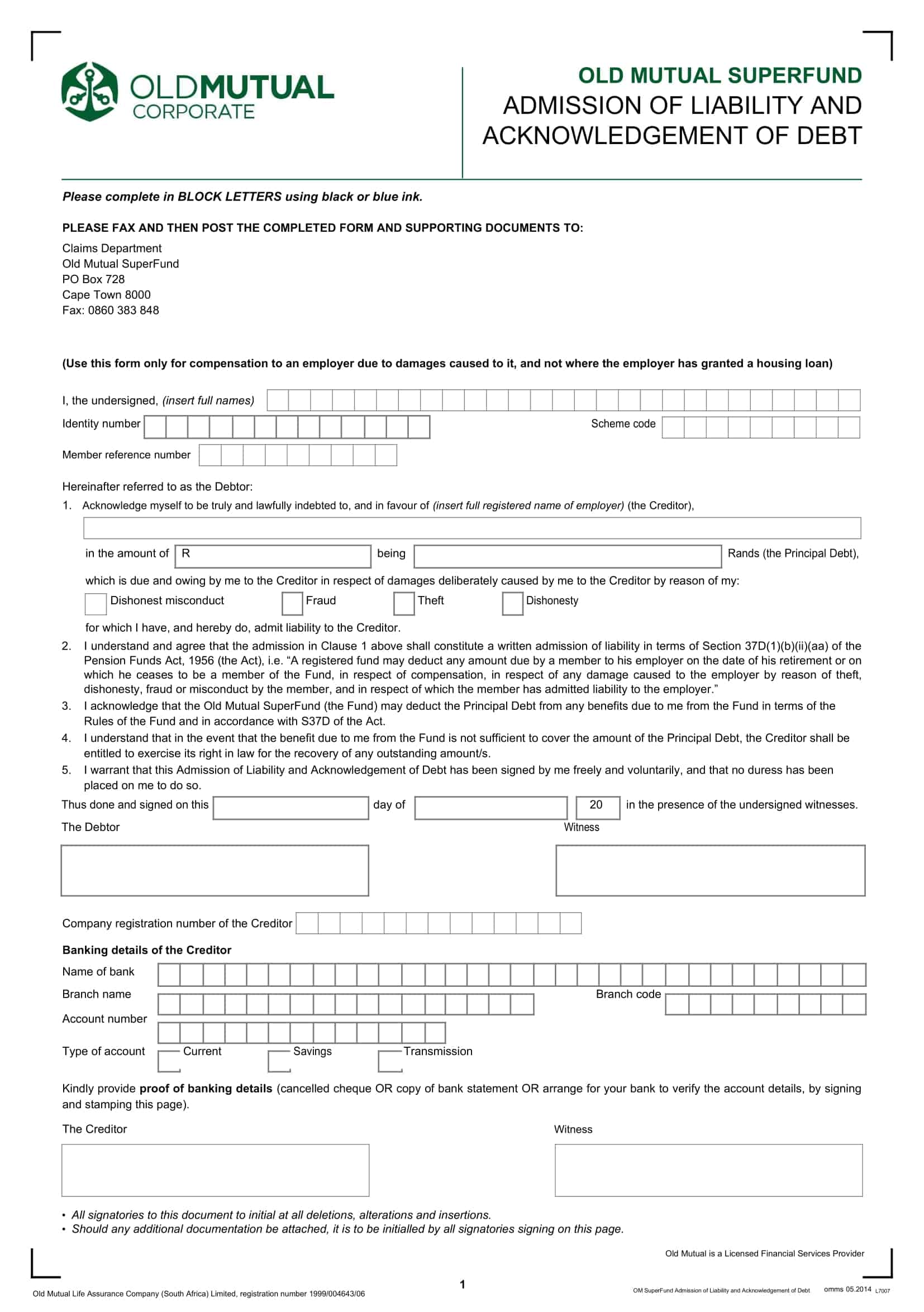

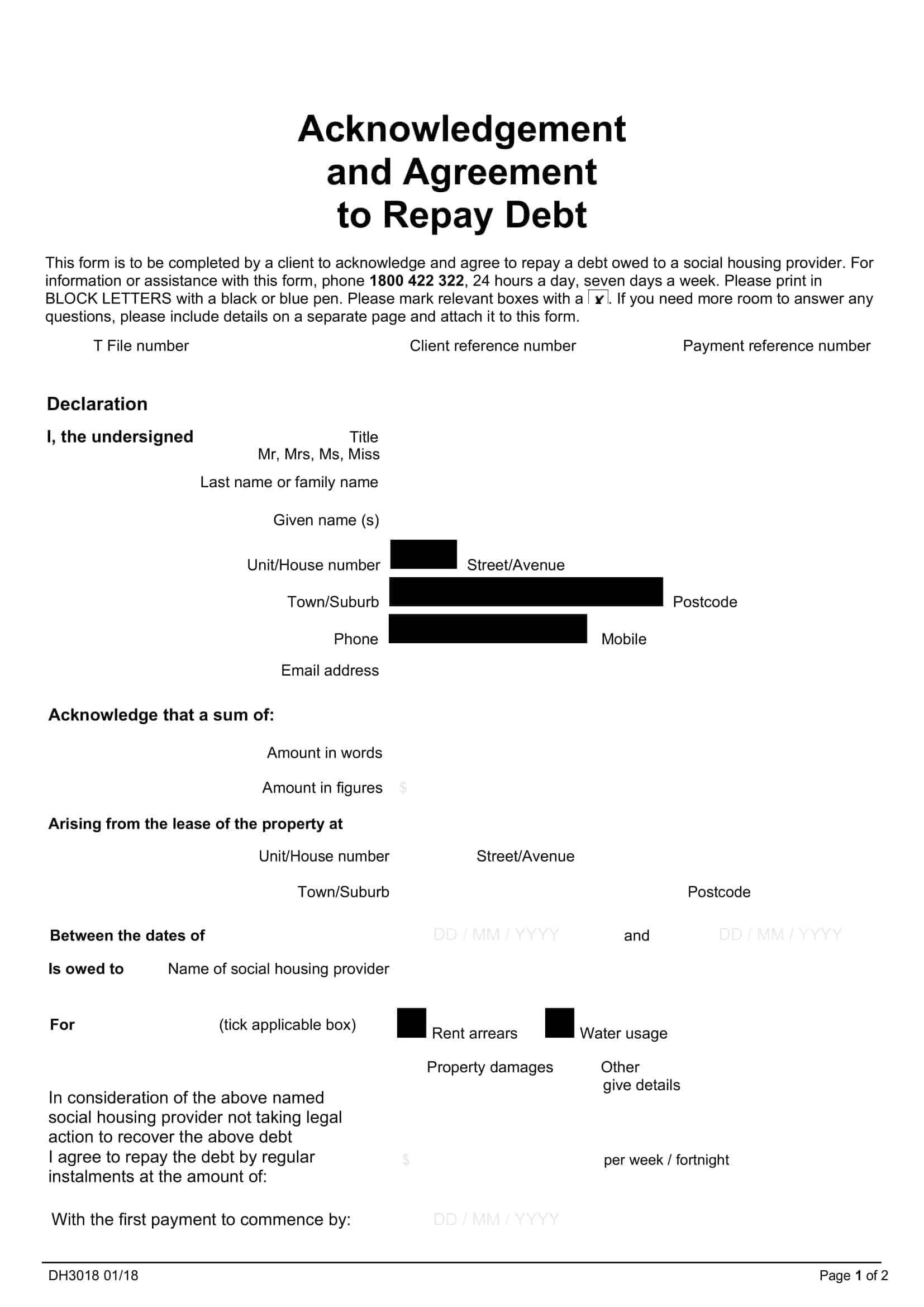

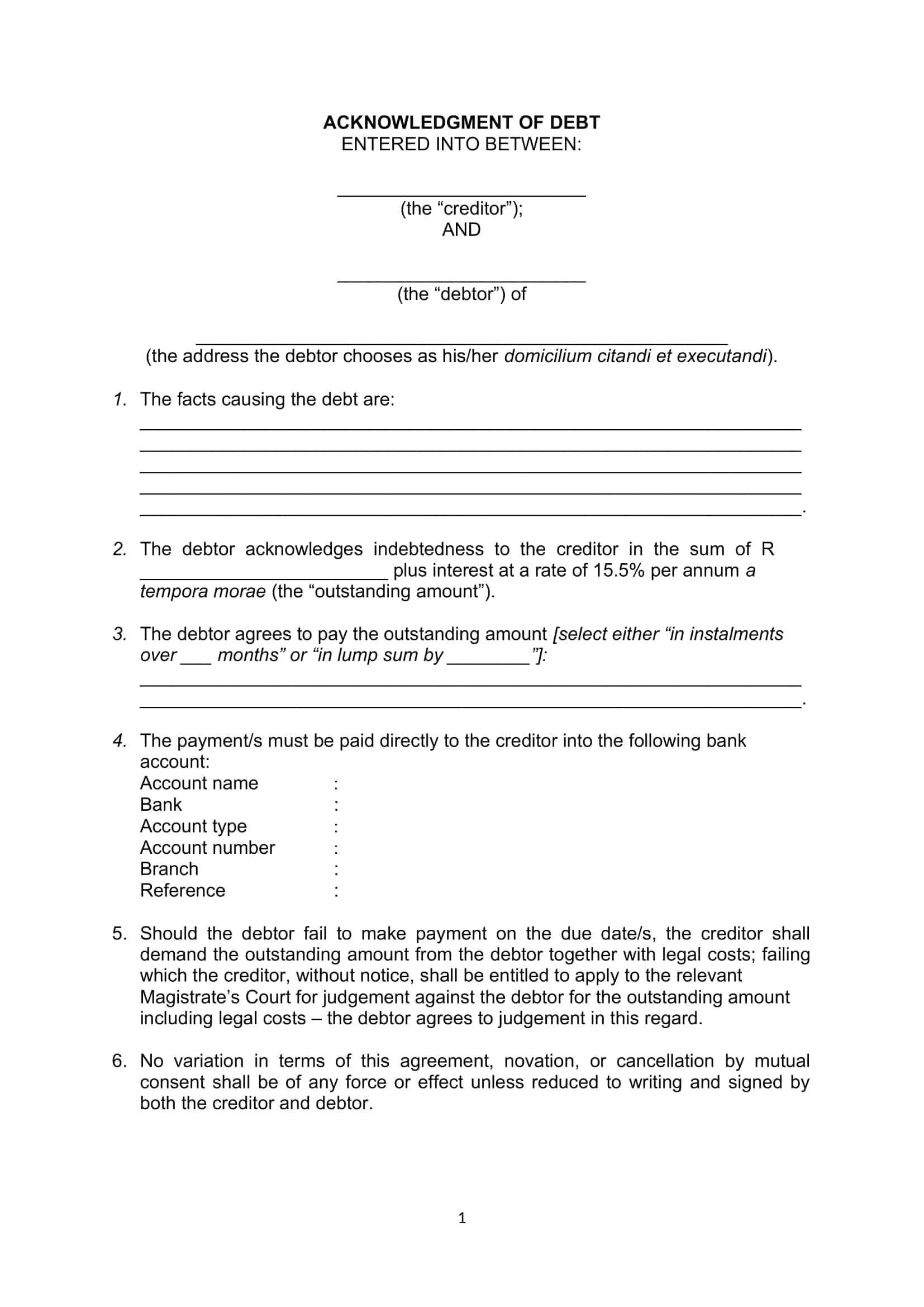

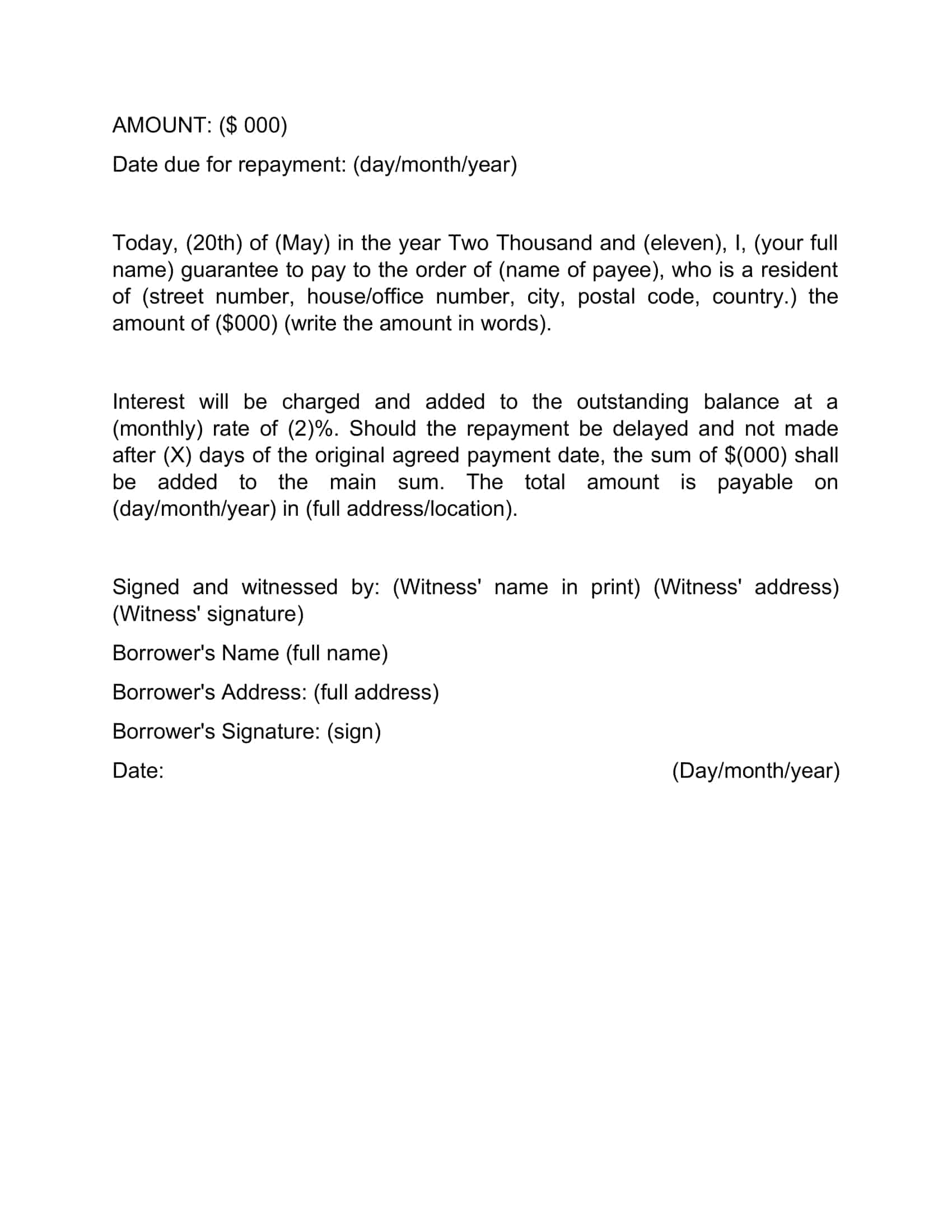

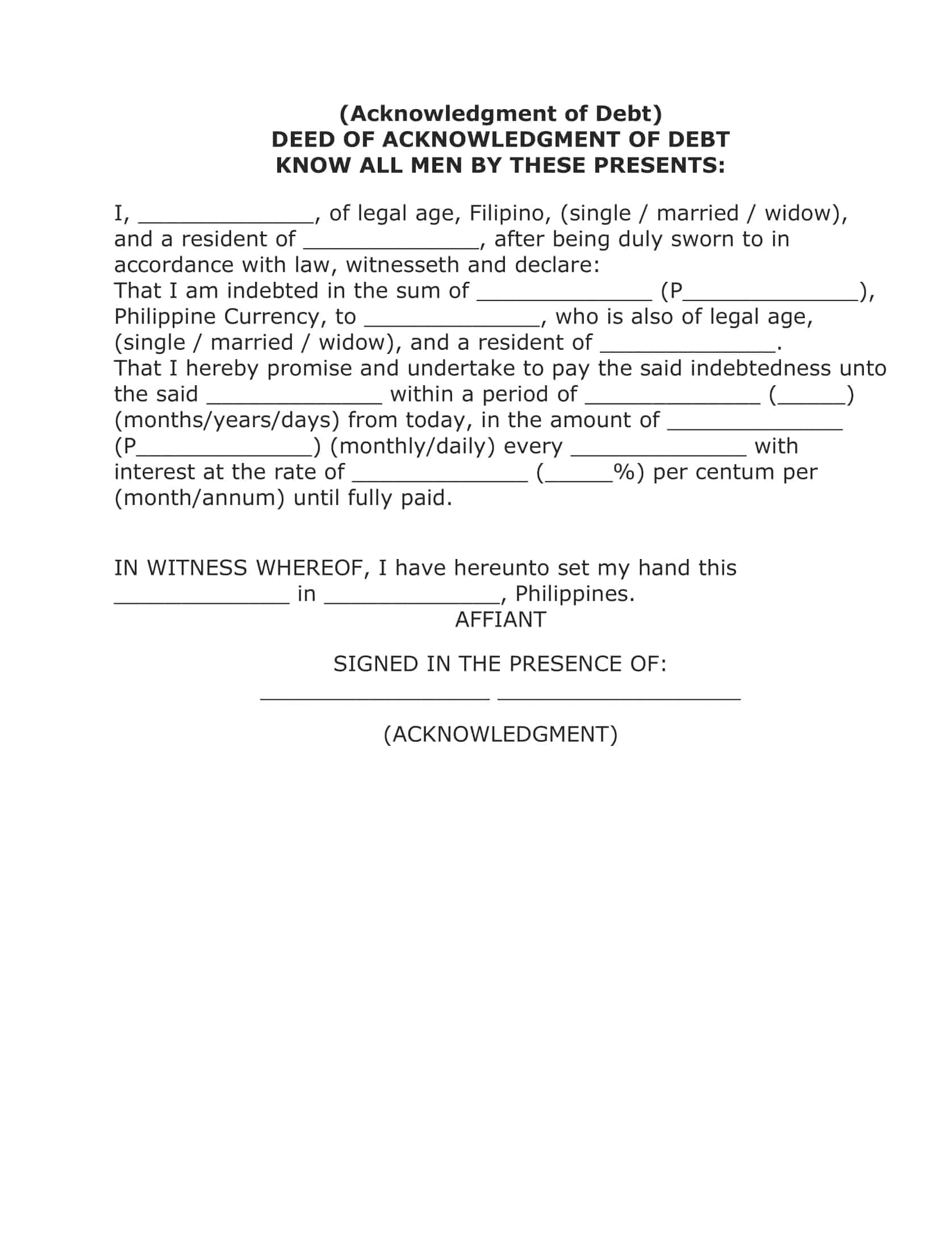

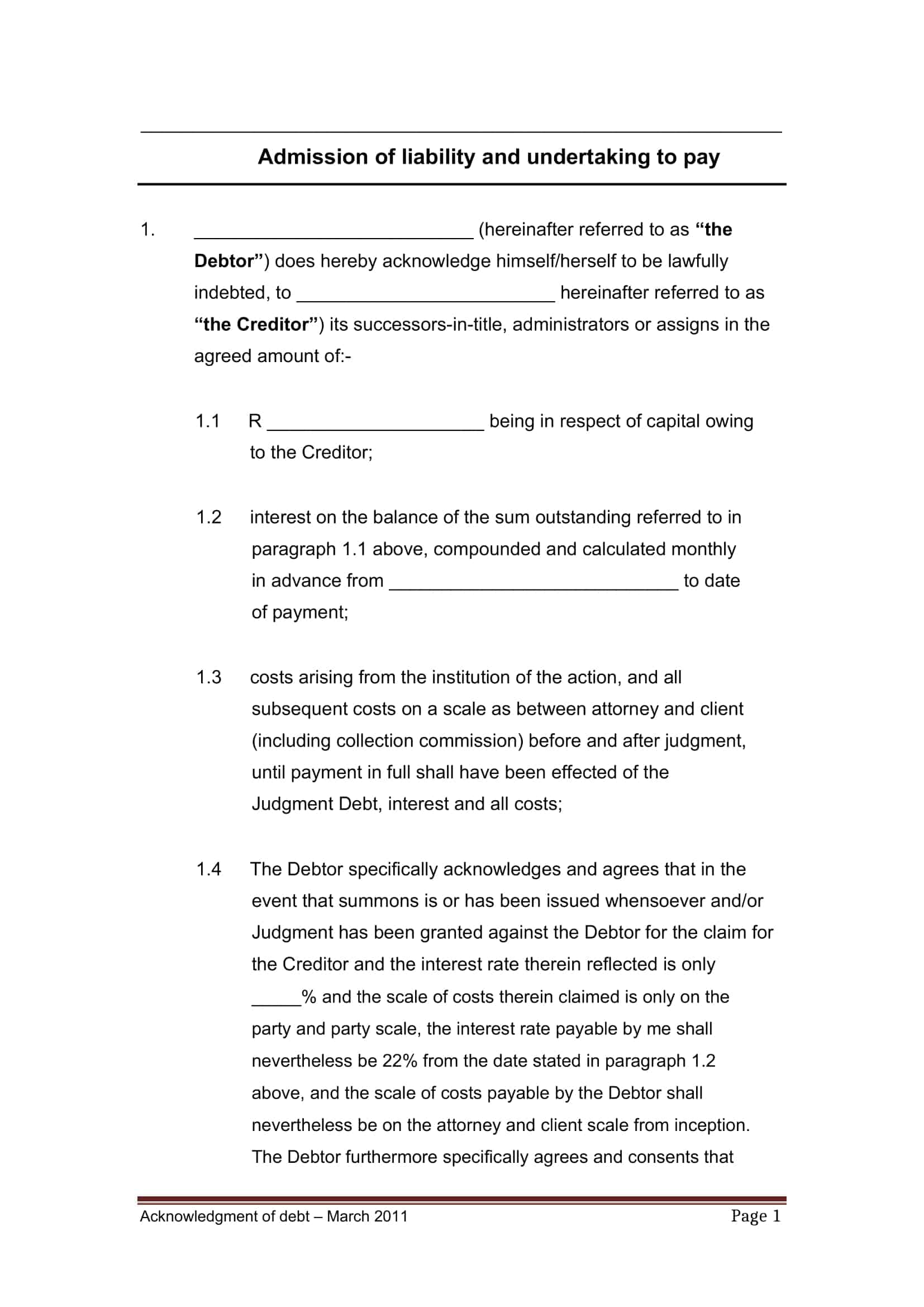

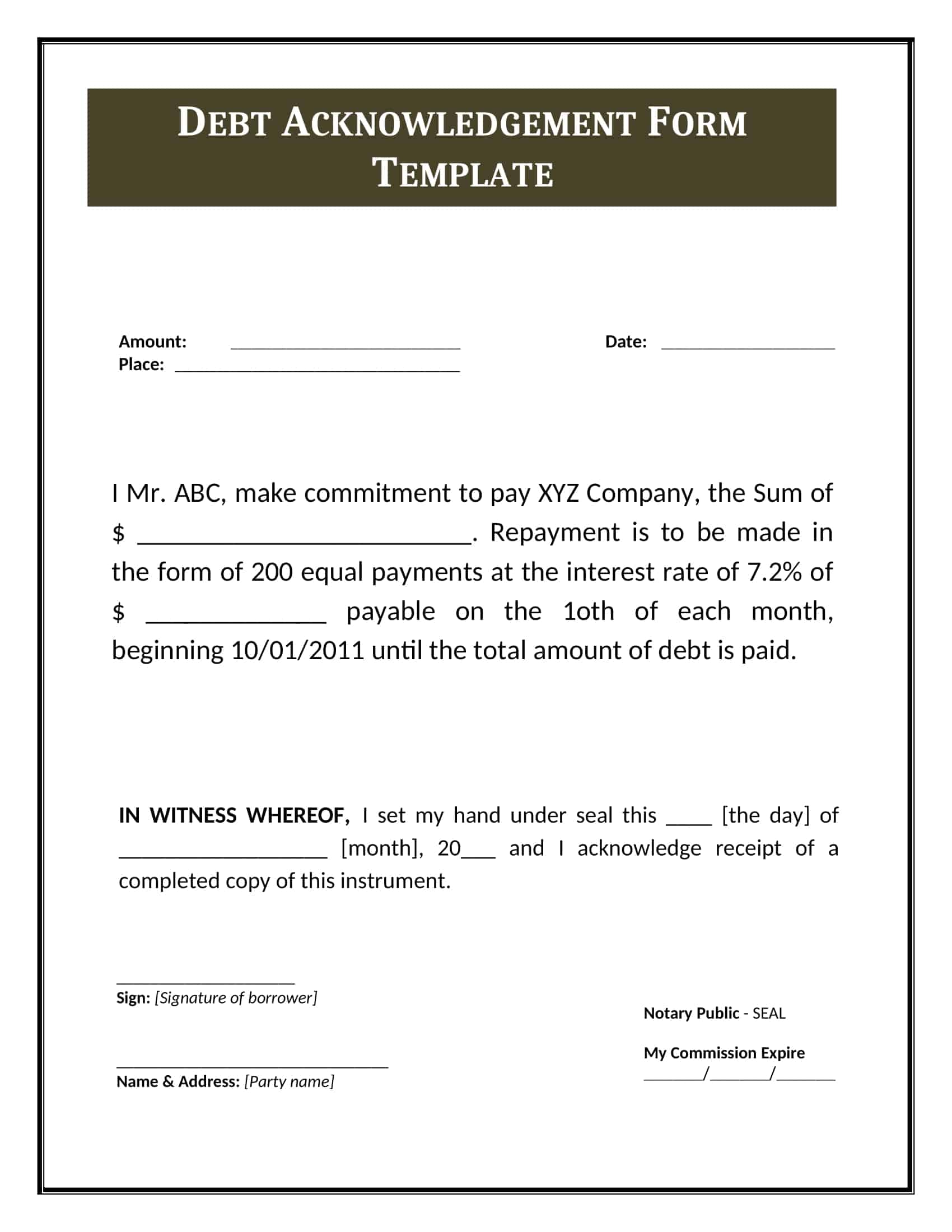

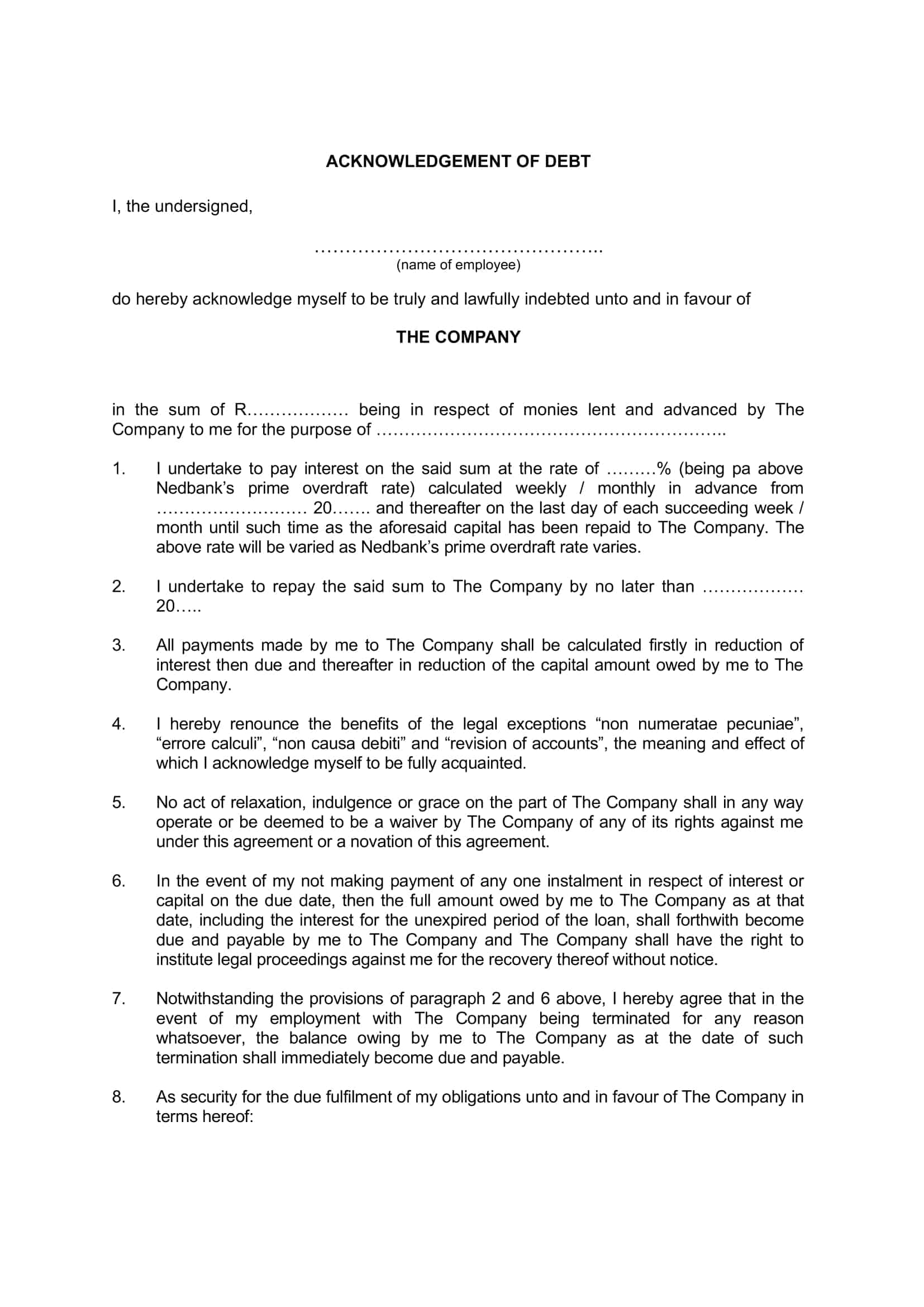

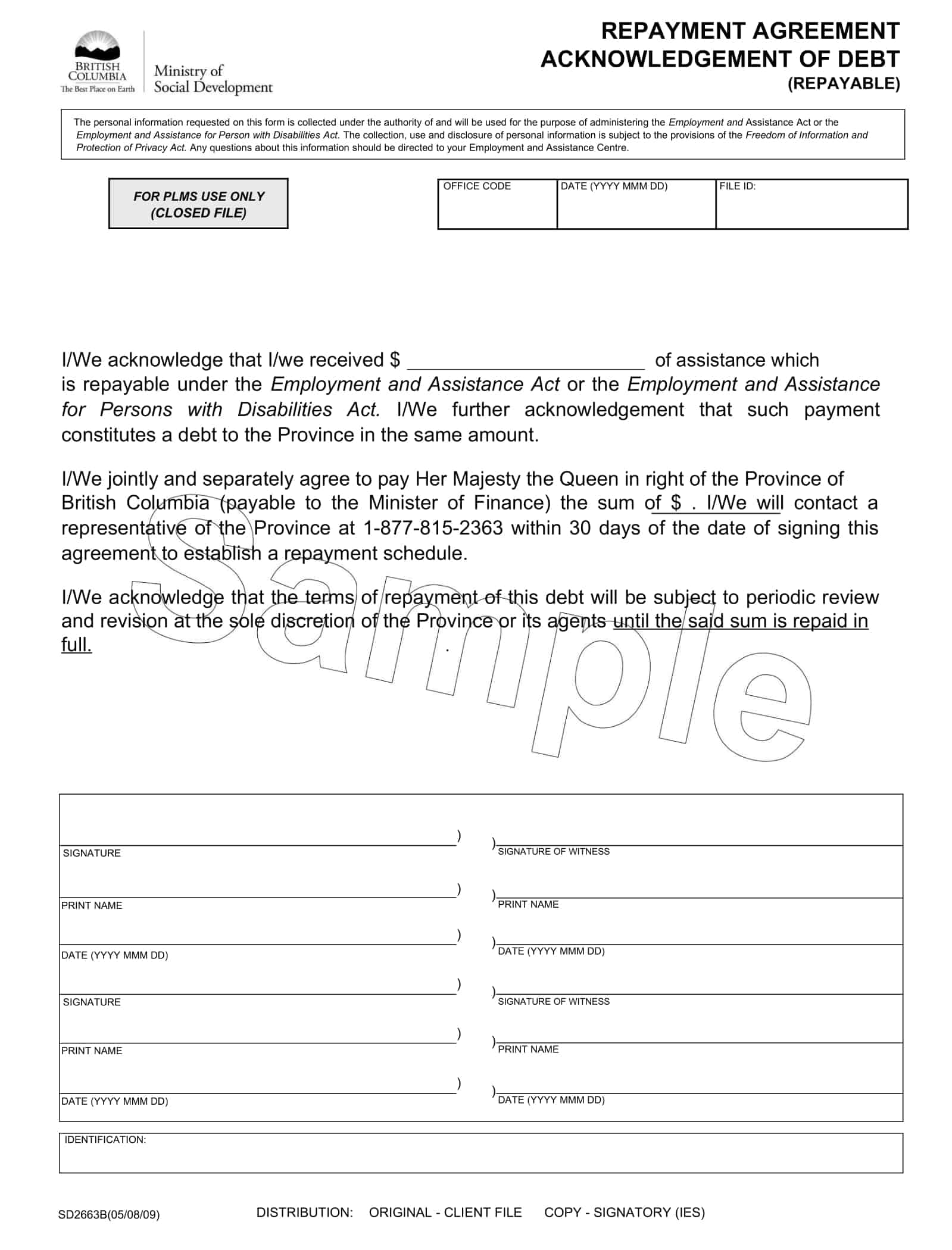

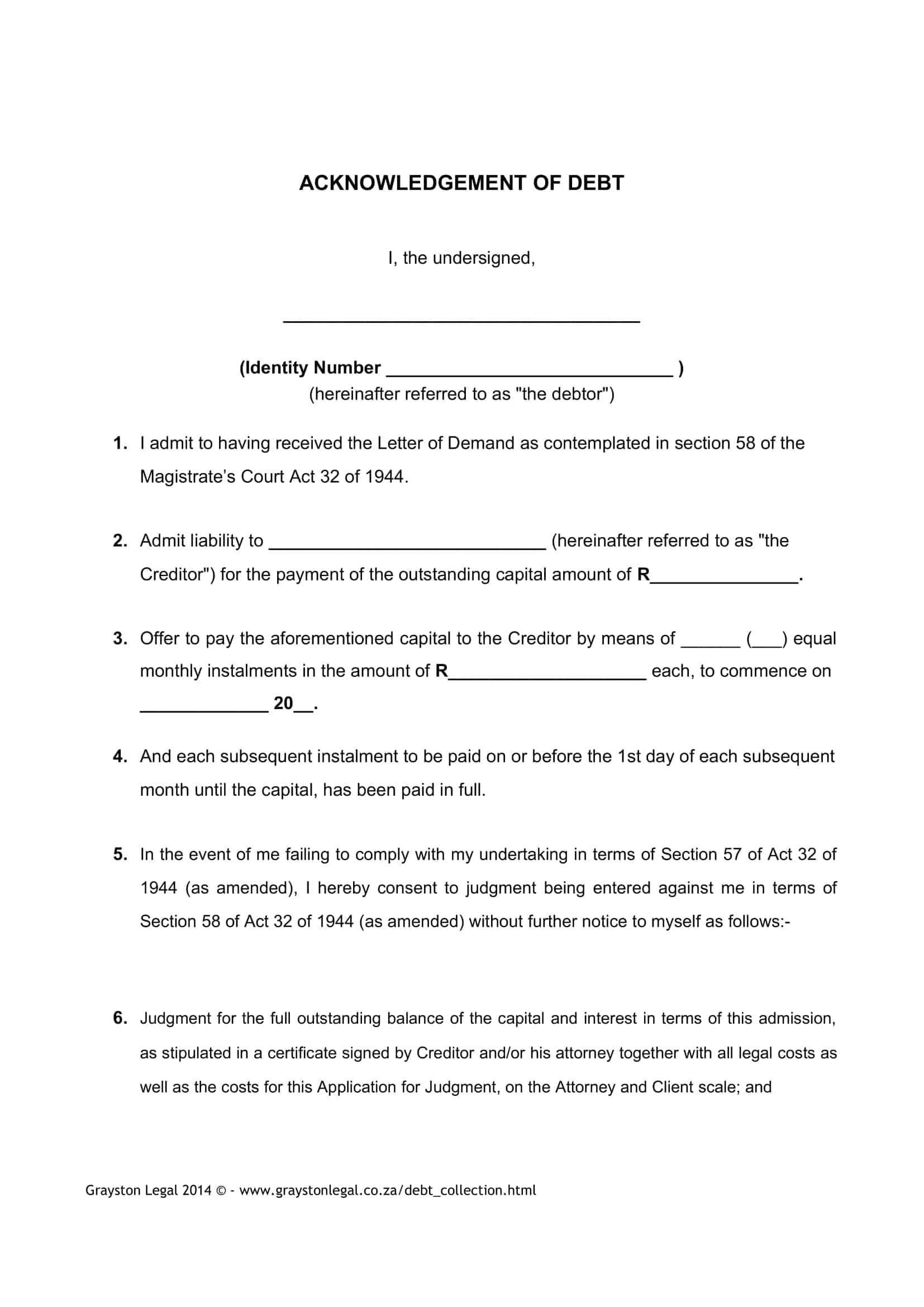

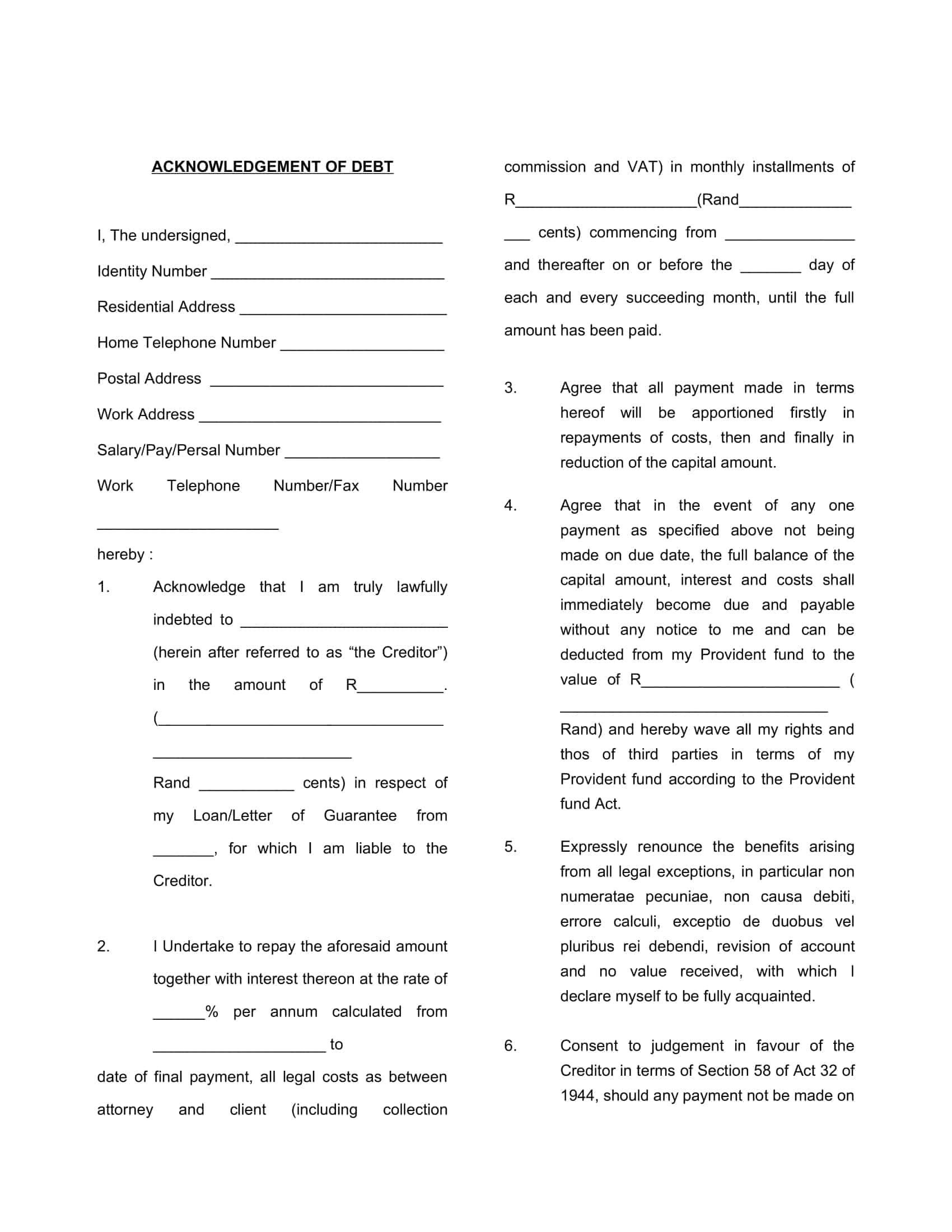

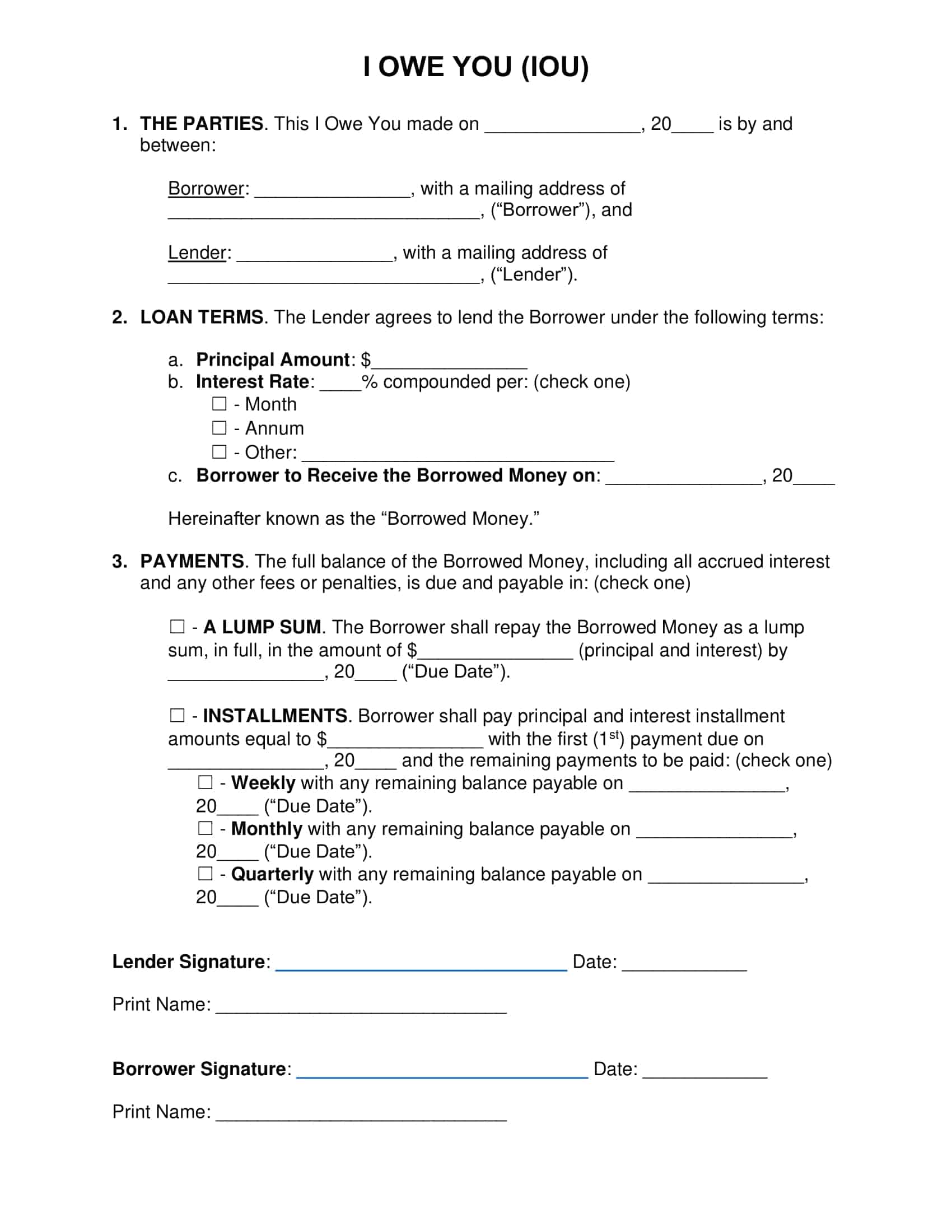

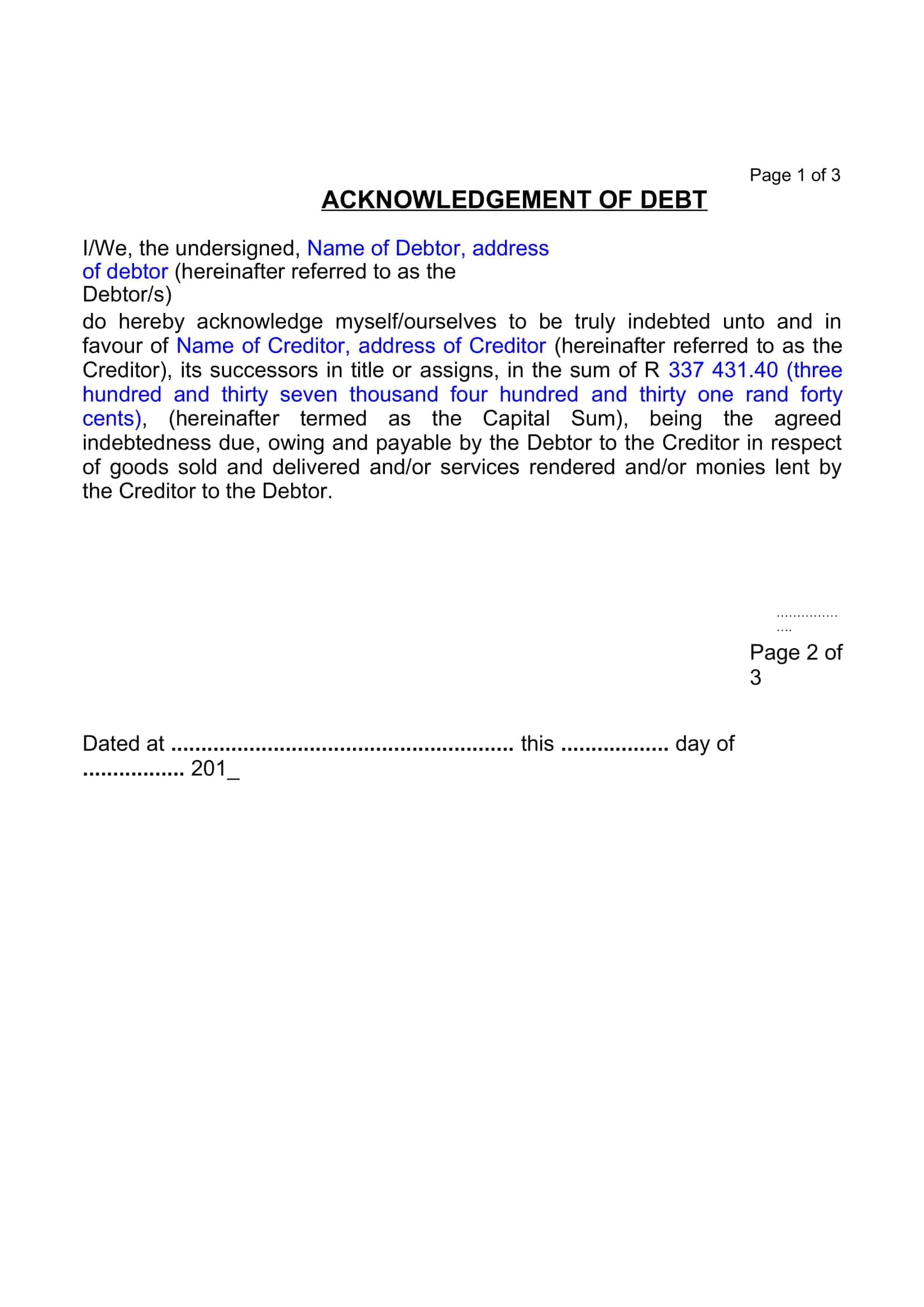

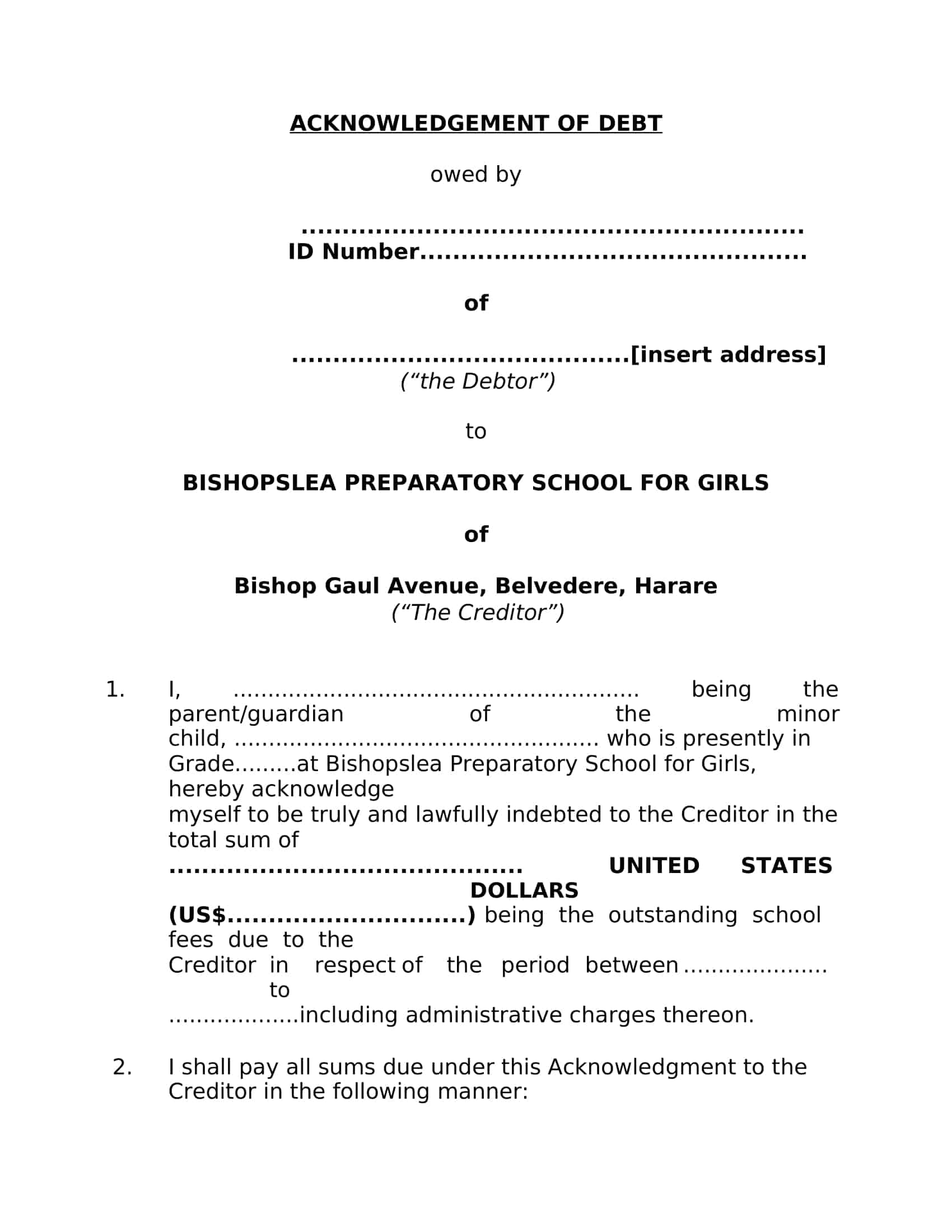

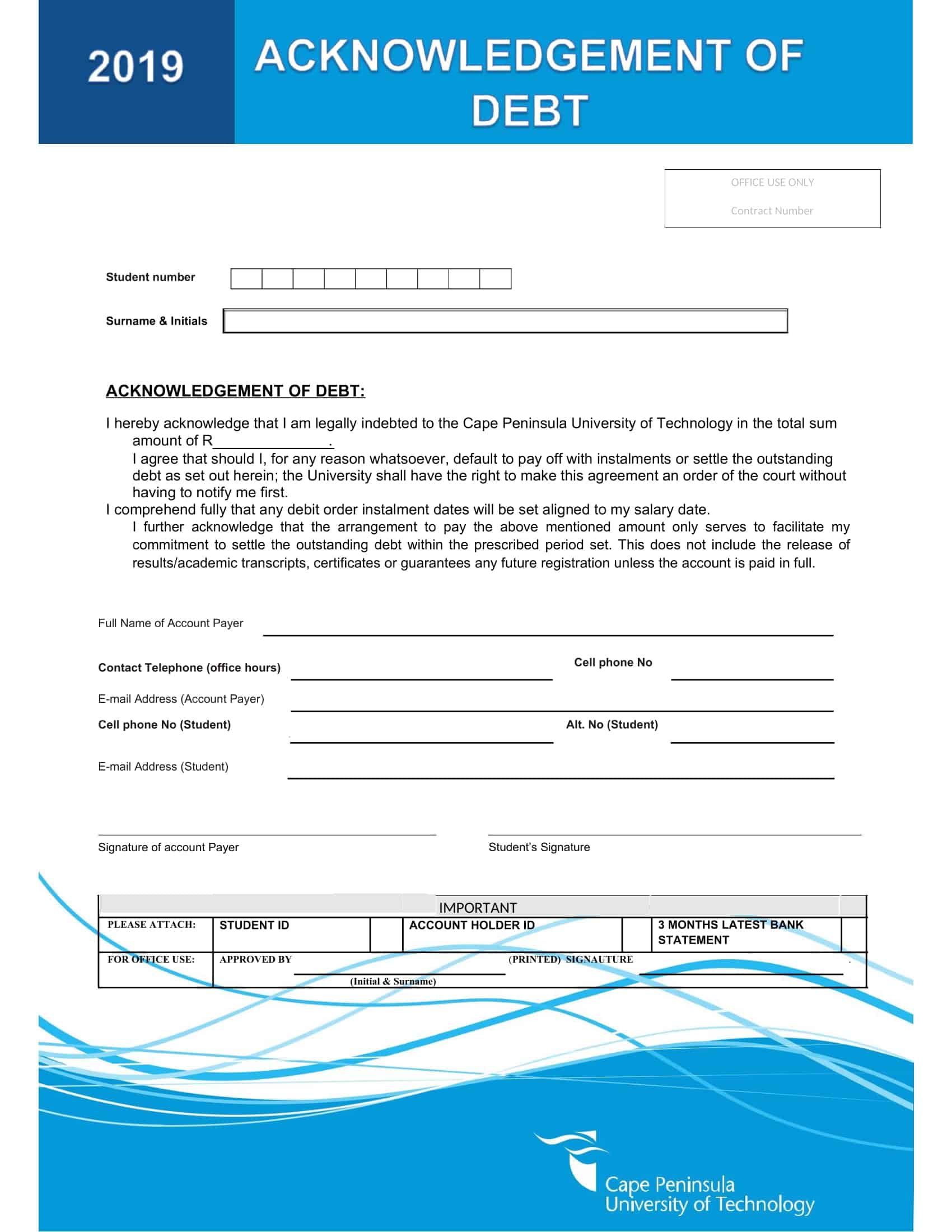

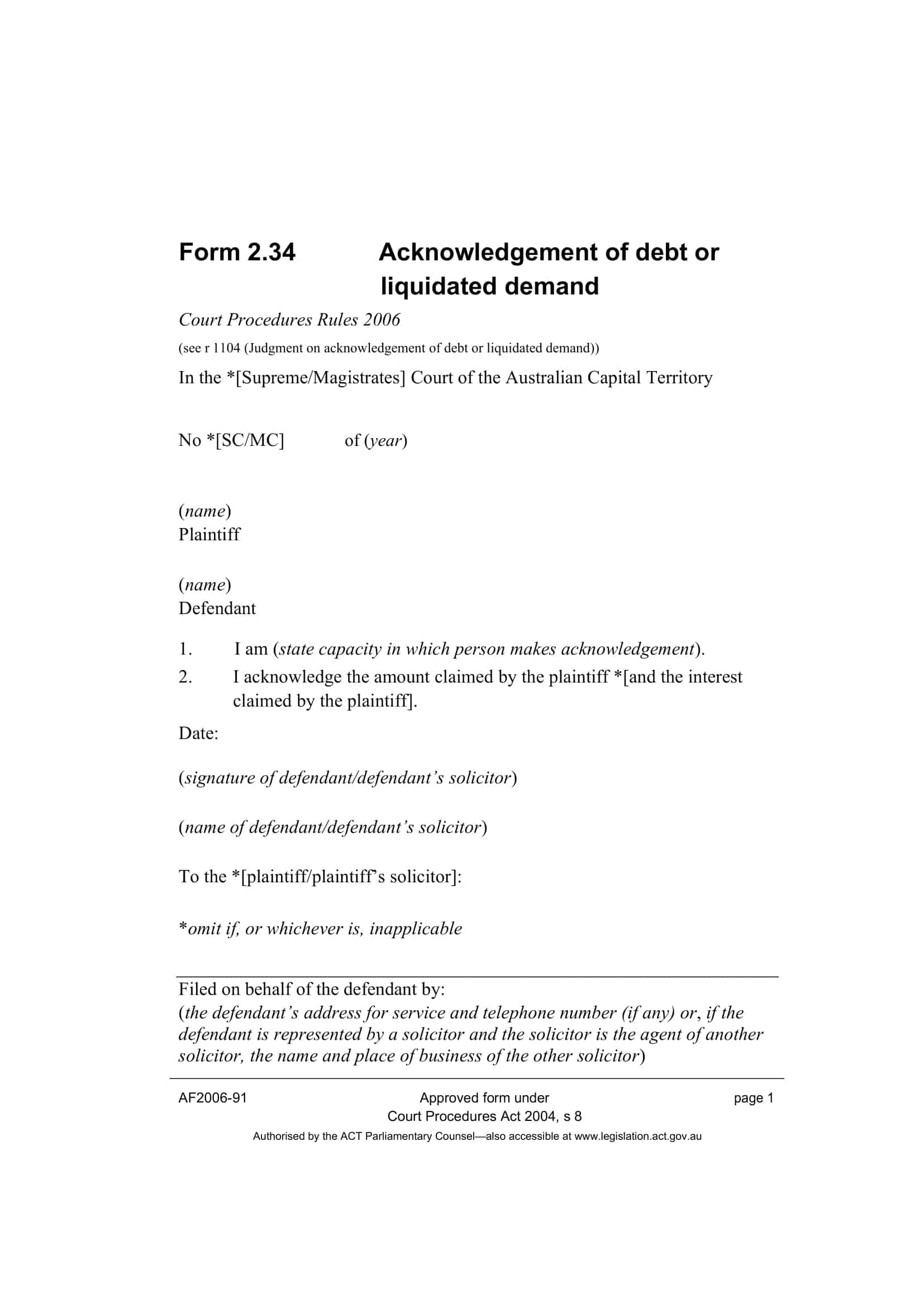

IOU Templates

Keep track of your personal loans and debts with our convenient and customizable IOU templates. Whether you’re lending money to a friend, family member, or colleague, or you’re the borrower in need of a formal agreement, our IOU templates provide a clear and legally binding record of the transaction. Easily specify the loan amount, repayment terms, interest (if applicable), and any additional terms and conditions.

Our templates help you establish trust, clarify expectations, and ensure a smooth repayment process. Print or digitally share the IOU document for easy reference and record-keeping. Simplify your lending and borrowing transactions with our IOU templates and maintain transparency in your financial dealings. Get started today and download our free and printable IOU templates.

When to use an IOU template?

An IOU template can be used in a variety of situations where one person owes another person money. Some common scenarios where an IOU template may be used include:

Personal loans: When lending or borrowing money among friends or family members, an IOU can help to clearly document the terms of the loan and ensure that the debt is repaid on time.

Small business transactions: If a small business owner owes a vendor or supplier money, an IOU can help to formalize the arrangement and ensure that the debt is paid off in a timely manner.

Advance payments: If an employee is advanced pay or receives a loan from their employer, an IOU can help to document the terms of the arrangement and ensure that the debt is repaid.

Event planning: When organizing an event, an IOU can be used to keep track of expenses and ensure that all participants pay their fair share.

Overall, an IOU template can be useful in any situation where one person owes another person money, and it can help to ensure that the terms of the agreement are clearly documented and understood by both parties.

Essential Elements of IOU template

An IOU should include the following key elements:

Date: The date on which the IOU is written or agreed upon.

Names of both parties: The full name of the person who owes the debt and the person to whom the debt is owed.

Amount owed: The exact amount of money that is owed, expressed in a clear and specific manner.

Repayment terms: The date on which the debt will be repaid, and any applicable interest rate or late payment fees.

Signature of both parties: The signature of both the person who owes the debt and the person to whom the debt is owed, indicating that they have agreed to the terms of the IOU.

Description of goods or services: If the debt is related to goods or services provided, a brief description of these goods or services should be included.

Payment method: The method by which the debt will be repaid, such as cash, check, bank transfer, or other methods.

Contact information: The contact information of both parties, including phone number and address, in case there is a need to contact either party in the future.

Having all of these elements in an IOU can help to ensure that the terms of the agreement are clear and can be easily enforced if necessary.

Do you need a formal IOU template?

Whether or not you need a formal IOU template depends on the specific circumstances of your situation. In general, a formal IOU template can be useful in situations where the debt is substantial or when the parties want to ensure that the terms of the agreement are clear and unambiguous. A formal IOU template can also help to establish a clear record of the debt and the terms of repayment, which can be useful in case of a dispute in the future.

However, for smaller debts or informal loans among friends or family members, a verbal agreement or a simple written note can be sufficient. In such cases, a formal IOU template may not be necessary.

Ultimately, the choice of whether to use a formal IOU template or not will depend on the specific circumstances of the debt and the preferences of the parties involved.

Legal implications of an IOU template

An IOU, or “I owe you,” is a simple agreement between two parties acknowledging a debt. While an IOU is not a legally binding document, it can still have significant legal implications.

In general, an IOU serves as evidence of a debt, and if a dispute arises, the IOU can be used to prove that a debt exists and the terms of repayment. This can be particularly important in situations where the debt is substantial or where there is a risk of the debt being disputed.

If an IOU is not honored, the party to whom the debt is owed may take legal action to collect the debt. This can include filing a lawsuit or using the IOU as evidence in court.

However, it is important to note that while an IOU can be used as evidence in court, it is not a legally binding document. To enforce a debt, a court may require a more formal agreement, such as a promissory note.

Overall, while an IOU template can be useful in documenting a debt and the terms of repayment, it is not a substitute for a legally binding agreement. If the debt is substantial or if there is a risk of the debt being disputed, it may be wise to consult a lawyer and have a formal agreement drawn up.

How to Write an I Owe You

An IOU, or “I owe you,” is a written or verbal agreement between two parties acknowledging a debt that one person owes to the other. To write an IOU, follow these steps:

Date the IOU: Write the date on which the IOU is being written or agreed upon.

Names of both parties: Write the full names of the person who owes the debt (the borrower) and the person to whom the debt is owed (the lender).

Amount owed: Write the exact amount of money that is owed, expressed in a clear and specific manner.

Repayment terms: Write the date on which the debt will be repaid, and any applicable interest rate or late payment fees.

Signature of both parties: Have both the borrower and the lender sign the IOU, indicating that they have agreed to the terms of the agreement.

Description of goods or services: If the debt is related to goods or services provided, write a brief description of these goods or services.

Payment method: Specify the method by which the debt will be repaid, such as cash, check, bank transfer, or other methods.

Contact information: Include the contact information of both parties, including phone number and address, in case there is a need to contact either party in the future.

By including these key elements in an IOU, you can help to ensure that the terms of the agreement are clear and unambiguous, and that the debt is repaid in a timely manner.

FAQs

Is an IOU legally binding?

An IOU is not a legally binding document, but it can serve as evidence of a debt in case of a dispute. If an IOU is not honored, the party to whom the debt is owed may take legal action to collect the debt.

What is the difference between an IOU and a promissory note?

An IOU is a simple agreement acknowledging a debt, while a promissory note is a more formal, legally binding agreement to repay a debt. A promissory note typically includes additional details, such as the interest rate, the payment schedule, and the consequences of default.

Can an IOU be cancelled?

Yes, an IOU can be cancelled if both parties agree to it. If the debt has already been repaid, the IOU can be marked as paid and both parties can sign and date the document to indicate that the debt has been satisfied.

What are the consequences of not honoring an IOU?

If an IOU is not honored, the party to whom the debt is owed may take legal action to collect the debt. This can include filing a lawsuit or using the IOU as evidence in court.

Do I need a lawyer to create an IOU?

No, you do not need a lawyer to create an IOU. An IOU can be a simple, informal agreement between two parties. However, if the debt is substantial or if there is a risk of the debt being disputed, it may be wise to consult a lawyer and have a formal agreement drawn up.

Can an IOU be used in court?

Yes, an IOU can be used as evidence in court in case of a dispute. However, it is important to note that an IOU is not a legally binding document, and a court may require a more formal agreement, such as a promissory note, in order to enforce a debt.

Is it necessary to have an IOU in writing?

No, an IOU can be either written or verbal. However, having a written IOU can provide evidence of the debt and the terms of repayment in case of a dispute.

Can an IOU be transferred to another person?

No, an IOU is a personal agreement between two parties and cannot be transferred to another person without the agreement of both parties. If the debt is to be transferred, a new IOU should be created with the new party.

What happens if the borrower dies before the debt is repaid?

If the borrower dies before the debt is repaid, the debt may become a part of the borrower’s estate and may be collectible from the borrower’s assets. The exact consequences will depend on the laws in the jurisdiction where the debt was incurred.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Financial Projections Templates [Excel, PDF] 3 Financial Projection](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Projection-1-150x150.jpg)