Seller financing refers to a situation where the seller of a property provides financing to the buyer in the form of a loan, rather than the buyer obtaining financing from a traditional lender. This type of financing can be an attractive option for buyers who may not qualify for traditional financing, or for sellers who want to sell their property quickly and are willing to carry the financing themselves.

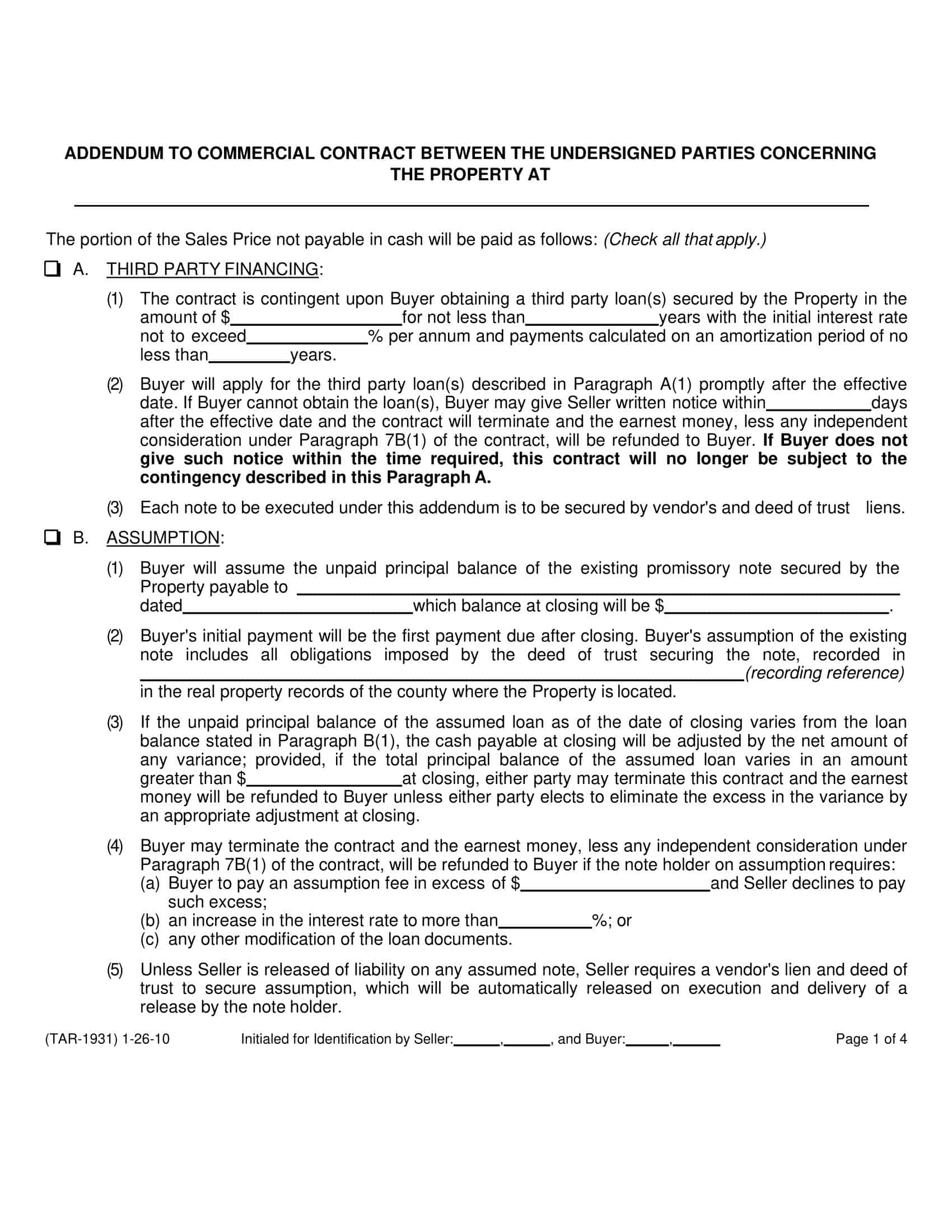

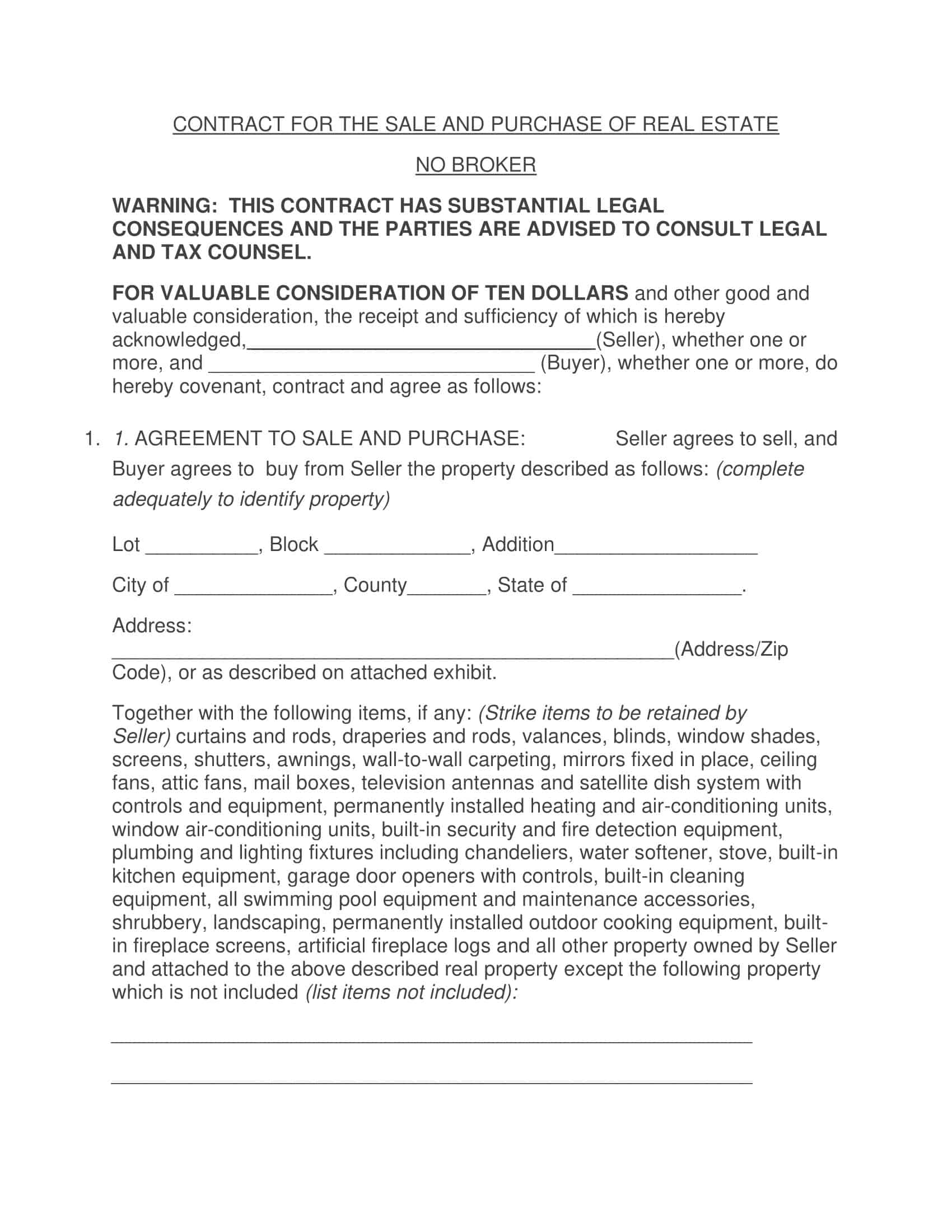

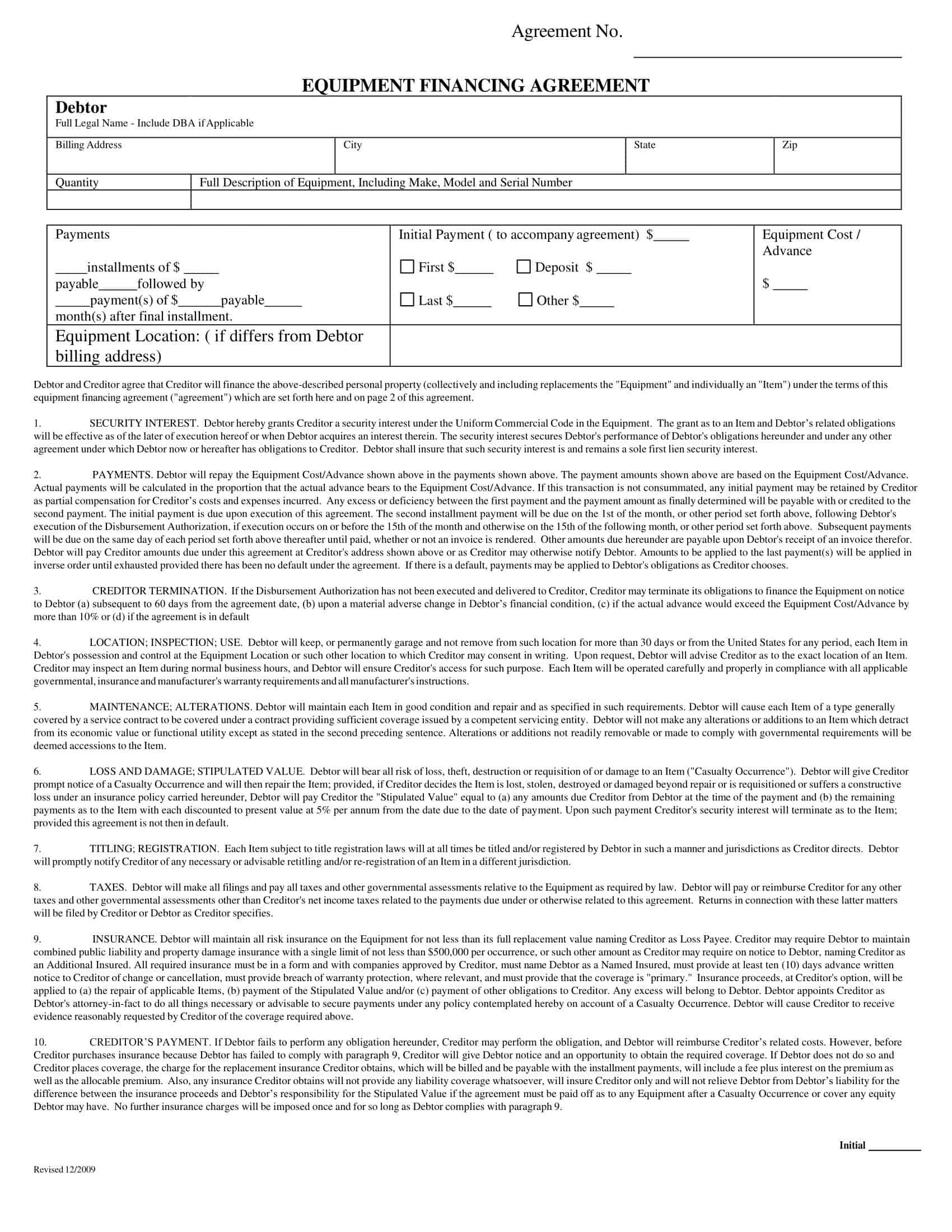

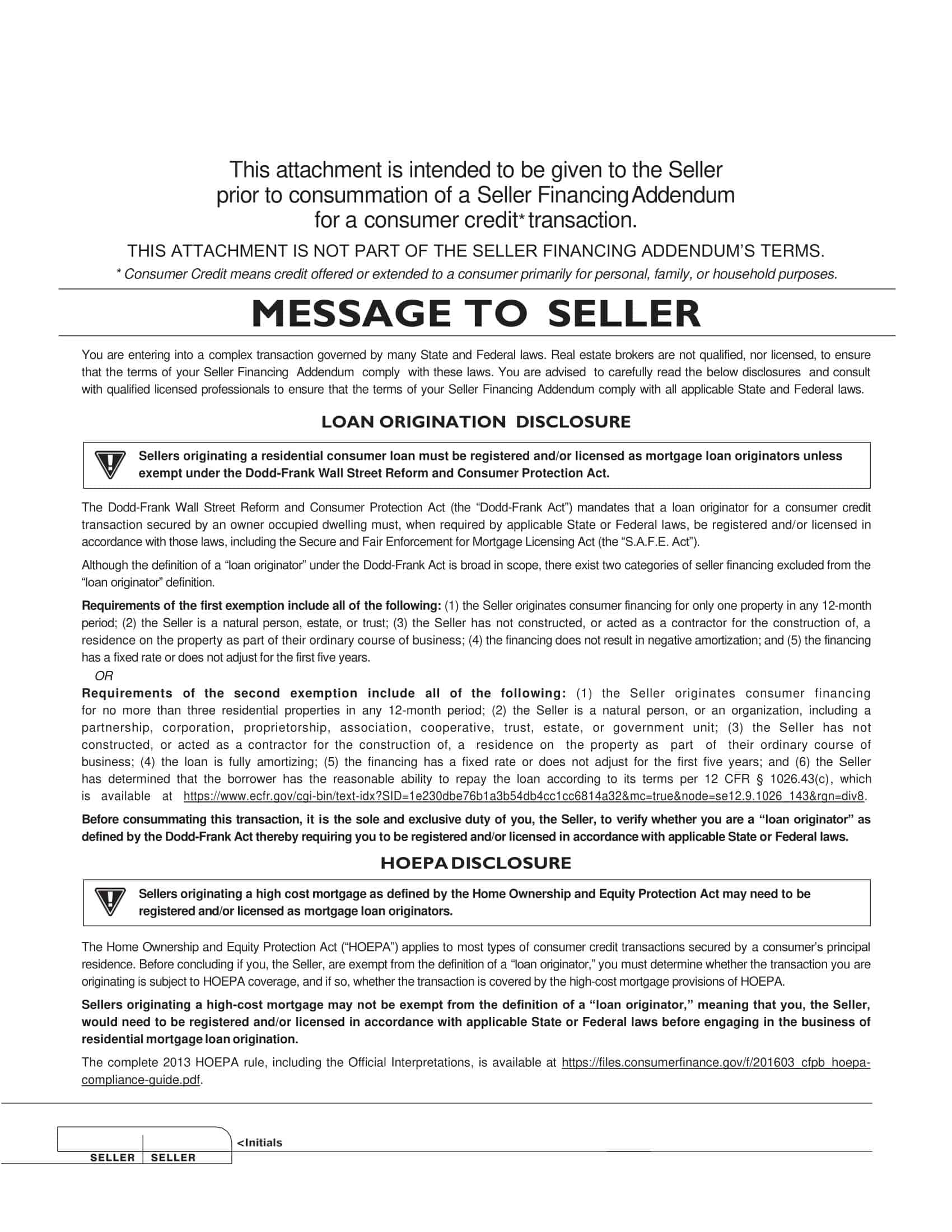

The Seller Financing Addendum is a legal document that outlines the terms and conditions of the financing agreement between the buyer and the seller. This document is typically attached to the purchase agreement and outlines the interest rate, repayment period, and any other important details related to the financing. This guide will provide an overview of the Seller Financing Addendum and the information it should include.

Table of Contents

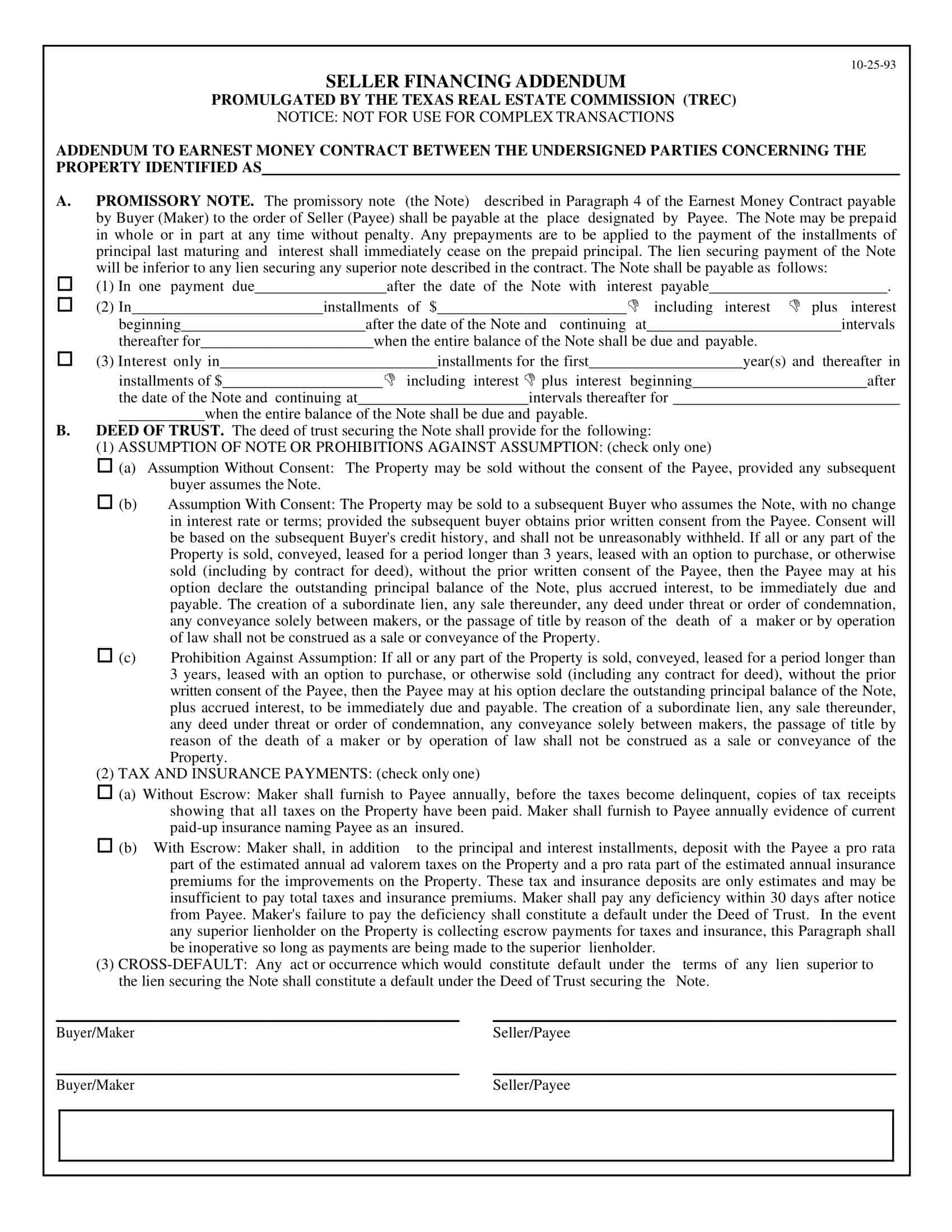

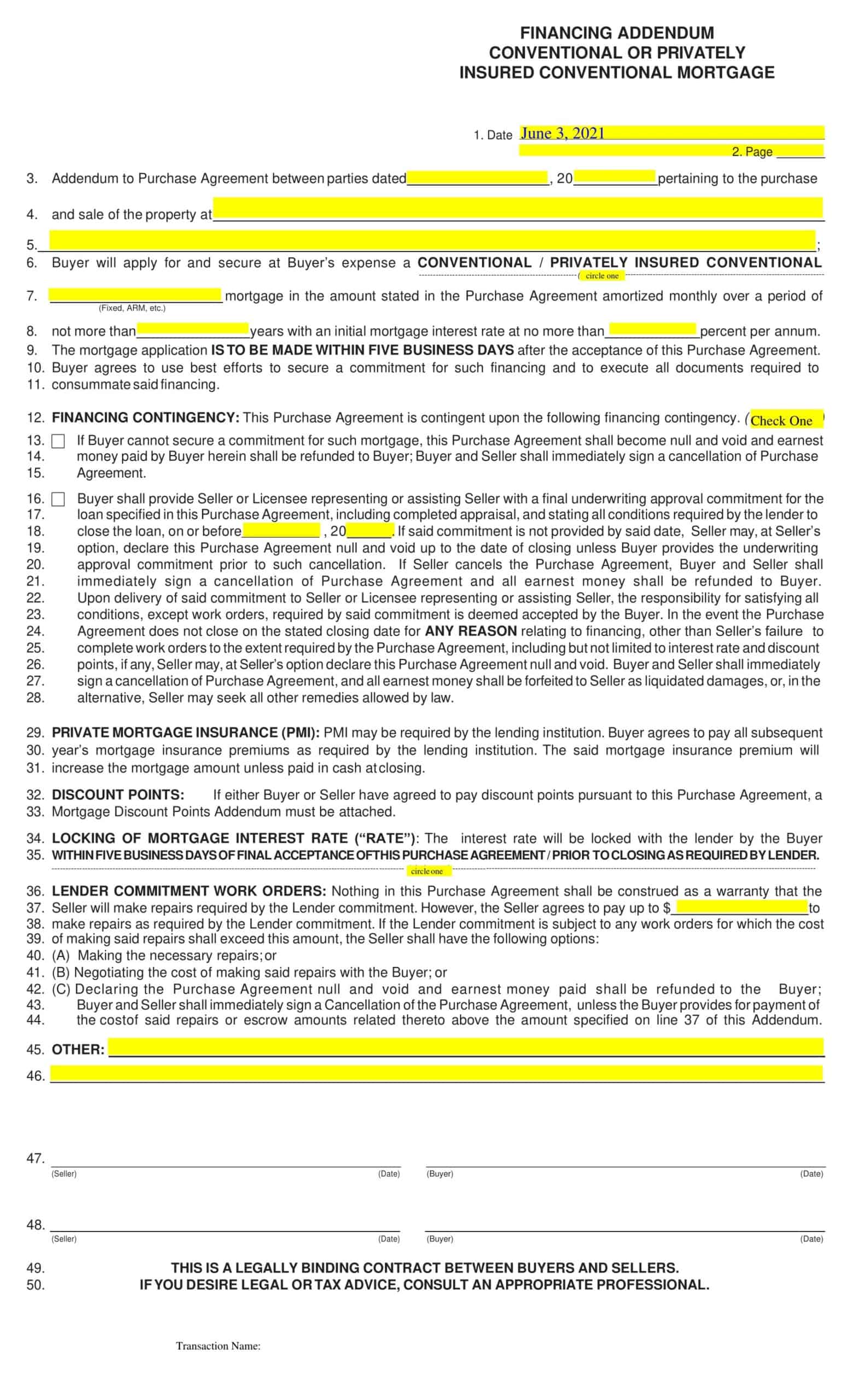

Seller Financing Addendum Templates

Facilitate flexible and secure real estate transactions with our comprehensive collection of Seller Financing Addendum Templates. These customizable and printable templates provide a formal and legally recognized framework to outline the terms and conditions of seller financing arrangements in real estate transactions.

Whether you’re a seller offering financing options or a buyer seeking alternative financing solutions, our templates offer sections to specify loan terms, interest rates, payment schedules, and any additional provisions. By utilizing our Seller Financing Addendum Templates, you can establish clear agreements, protect your interests, and ensure a smooth and transparent financing process. Simplify the complexities of seller financing and confidently navigate real estate transactions with our user-friendly templates. Download now and unlock the benefits of seller financing in your real estate endeavors.

Why is it required?

The Seller Financing Addendum is required to clearly define the terms and conditions of the financing agreement between the buyer and the seller. It is a legally binding document that protects the rights and interests of both parties and helps to prevent any misunderstandings or disputes that may arise in the future. The addendum outlines the specifics of the financing arrangement, including the interest rate, repayment period, and any other important details, such as late payment penalties or default provisions.

By having a clear and comprehensive financing agreement in place, both the buyer and the seller can feel confident in the transaction and know what to expect throughout the repayment period. In short, the Seller Financing Addendum is a critical component of any seller financing arrangement and helps to ensure a smooth and successful transaction for both parties.

How Does Seller Financing Work?

Seller financing is a type of financing arrangement where the seller provides financing to the buyer, instead of the buyer obtaining financing from a traditional lender, such as a bank. The following is a step-by-step explanation of how seller financing works:

The buyer and seller negotiate the terms of the financing arrangement: Thebuyer and seller will discuss and agree on the terms of the financing arrangement, including the amount of the loan, the interest rate, and the repayment period.

The buyer and seller sign a purchase agreement and a Seller Financing Addendum: Once the terms of the financing arrangement have been agreed upon, the buyer and seller will sign a purchase agreement that outlines the terms of the sale, as well as a Seller Financing Addendum that outlines the terms of the financing agreement.

The buyer makes a down payment: The buyer will typically make a down payment, which is a portion of the purchase price, to the seller at the time of closing.

The seller provides the financing: After the down payment has been made, the seller will provide the financing to the buyer in the form of a loan. The loan will be secured by the property itself, meaning that the seller has a lien on the property until the loan is repaid.

The buyer makes monthly payments to the seller: The buyer will make monthly payments to the seller, which will include both principal and interest. The amount of the payments and the repayment period will be specified in the Seller Financing Addendum.

The loan is repaid in full: Once the loan has been fully repaid, the lien on the property will be removed and the buyer will own the property outright.

Seller financing can be an attractive option for both buyers and sellers, as it allows the buyer to purchase a property without having to go through the traditional lending process and it allows the seller to sell their property quickly and potentially receive a higher sales price. However, it is important to understand the risks involved and to thoroughly review the terms of the financing agreement before entering into a seller financing arrangement.

Typical owner financing terms

The terms of owner financing, also known as seller financing, can vary depending on the buyer’s and seller’s individual needs and circumstances. However, the following are some typical terms that are often included in owner financing agreements:

Loan Amount: The amount of the loan, which is typically a portion of the purchase price of the property.

Interest Rate: The interest rate that will be charged on the loan, which is typically higher than the interest rate on a traditional loan from a bank.

Repayment Period: The length of time over which the loan will be repaid, which can range from a few years to several decades.

Monthly Payments: The amount of the monthly payments, which will typically include both principal and interest.

Down Payment: The amount of money that the buyer will pay upfront, which is typically a portion of the purchase price of the property.

Security Interest: The seller’s right to take possession of the property if the buyer defaults on the loan.

Prepayment Penalty: A fee that is charged if the buyer pays off the loan early.

Late Payment Penalty: A fee that is charged if the buyer misses a monthly payment.

Default Provisions: The conditions that must be met for the loan to be considered in default, as well as the consequences of default, such as the seller’s right to take possession of the property.

How to Manage Risk in Seller Financing

Managing risk is an important aspect of seller financing, as both the buyer and the seller are exposed to certain risks in this type of financing arrangement. The following are some steps that can be taken to help manage risk in seller financing:

Thoroughly review the terms of the financing agreement: Before entering into a seller financing arrangement, it is important to thoroughly review the terms of the financing agreement, including the interest rate, repayment period, and any other important details, such as late payment penalties or default provisions.

Obtain a credit report on the buyer: Before providing financing to the buyer, it is a good idea to obtain a credit report to assess the buyer’s creditworthiness and ability to repay the loan.

Consider using a promissory note: A promissory note is a written agreement between the buyer and the seller that outlines the terms of the loan, including the interest rate, repayment period, and any other important details. Using a promissory note can help to ensure that both parties have a clear understanding of the terms of the loan and can help to manage risk.

Consider using a mortgage: A mortgage is a type of security interest in real property that is given by the buyer to the seller to secure the loan. By using a mortgage, the seller can be sure that they will have a security interest in the property if the buyer defaults on the loan.

Consider obtaining insurance: Obtaining insurance, such as title insurance or a loan protection insurance policy, can help to manage risk in a seller financing arrangement. For example, title insurance can protect the seller against any title defects that may arise during the repayment period, and a loan protection insurance policy can provide coverage if the buyer defaults on the loan.

Regularly monitor the loan: It is important to regularly monitor the loan and keep track of payments, as well as any other important details, such as the interest rate, repayment period, and any other terms and conditions of the financing agreement.

How to structure an owner finance deal?

Structuring an owner finance deal can involve several steps, including the following:

Determine the terms of the loan: The first step in structuring an owner finance deal is to determine the terms of the loan, including the loan amount, interest rate, repayment period, monthly payments, down payment, security interest, and any other important terms and conditions.

Review the buyer’s credit: Before entering into an owner finance deal, it is important to review the buyer’s credit to assess their creditworthiness and ability to repay the loan. This can involve obtaining a credit report and reviewing the buyer’s financial history and current financial situation.

Prepare a promissory note: A promissory note is a written agreement between the buyer and the seller that outlines the terms of the loan. Preparing a promissory note can help to ensure that both parties have a clear understanding of the terms of the loan and can help to minimize misunderstandings or disputes.

Consider using a mortgage: A mortgage is a type of security interest in real property that is given by the buyer to the seller to secure the loan. By using a mortgage, the seller can be sure that they will have a security interest in the property if the buyer defaults on the loan.

Consider obtaining insurance: Obtaining insurance, such as title insurance or a loan protection insurance policy, can help to minimize the risks involved in an owner finance deal. For example, title insurance can protect the seller against any title defects that may arise during the repayment period, and a loan protection insurance policy can provide coverage if the buyer defaults on the loan.

Close the deal: Once the terms of the loan have been determined and the necessary documents have been prepared, the owner finance deal can be closed. This typically involves the transfer of ownership of the property, the signing of the promissory note, and the payment of any closing costs.

FAQs

What are the advantages of Seller Financing?

The advantages of Seller Financing include lower down payments, more flexible underwriting criteria, and the ability for the buyer to negotiate better terms with the seller. It can also help the seller sell the property faster, as it may make the property more appealing to potential buyers who may not qualify for traditional financing.

Is a Seller Financing Addendum legally binding?

Yes, a Seller Financing Addendum is a legally binding document and is enforceable in a court of law. It is important to have a clear understanding of the terms and conditions outlined in the addendum, and to have the document reviewed by a real estate attorney before signing.

Can a Seller Financing Addendum be changed after it has been signed?

Yes, a Seller Financing Addendum can be changed after it has been signed, but the changes must be agreed upon by both the buyer and the seller, and the changes must be documented in writing and signed by both parties.

Who is responsible for the payment of taxes and insurance on the property under a Seller Financing arrangement?

The terms of the Seller Financing Addendum should specify who is responsible for the payment of taxes and insurance on the property. In some cases, the buyer may be responsible for these payments, while in others the seller may require that they be included as part of the loan payments.

What happens if the buyer defaults on the loan in a Seller Financing arrangement?

If the buyer defaults on the loan, the terms of the Seller Financing Addendum should specify the steps that the seller can take, such as foreclosing on the property or requiring the transfer of the property back to the seller. The exact steps will depend on the specific terms outlined in the addendum.

Can a Seller Financing arrangement impact the buyer’s credit score?

Yes, a Seller Financing arrangement can impact the buyer’s credit score. If the buyer makes timely payments on the loan, it can improve their credit score. However, if the buyer defaults on the loan, it can have a negative impact on their credit score.

Is a down payment required in a Seller Financing arrangement?

A down payment may or may not be required in a Seller Financing arrangement. The terms of the financing, including the down payment, will be outlined in the Seller Financing Addendum.

What happens to the loan if the seller sells the property?

The terms of the loan and the Seller Financing Addendum should specify what will happen to the loan if the seller sells the property. In some cases, the loan may be transferred to the new owner, while in others the loan may need to be paid off in full at the time of the sale.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)