When it comes to purchasing a home, a mortgage is often the go-to option for those who cannot afford to pay the full cost upfront. Mortgages allow borrowers to pay off the cost of the property over a longer period of time, while still being able to use and benefit from the property.

However, the process of obtaining a mortgage is not as straightforward as simply applying for one. There are a number of steps that must be taken, including property inspections and credit checks, before a borrower can receive a pre-approval letter from a mortgage company.

Table of Contents

What is a pre-approval letter?

A pre-approval letter is a document issued by a mortgage lender to a prospective borrower, indicating that the lender has conducted a preliminary review of the borrower’s financial information and credit history, and is willing to provide them with a specific loan amount and interest rate, subject to certain conditions. The pre-approval letter is typically valid for a certain period of time, usually around 60-90 days, and may include an expiration date.

Obtaining a pre-approval letter can be beneficial for prospective homebuyers, as it gives them a better idea of how much they can afford to spend on a property, and allows them to demonstrate to sellers that they are serious and financially capable of making a purchase. However, it is important to note that a pre-approval letter is not a guarantee of a loan, and borrowers will still need to complete a full mortgage application process and meet all of the lender’s requirements before the loan is approved and funded.

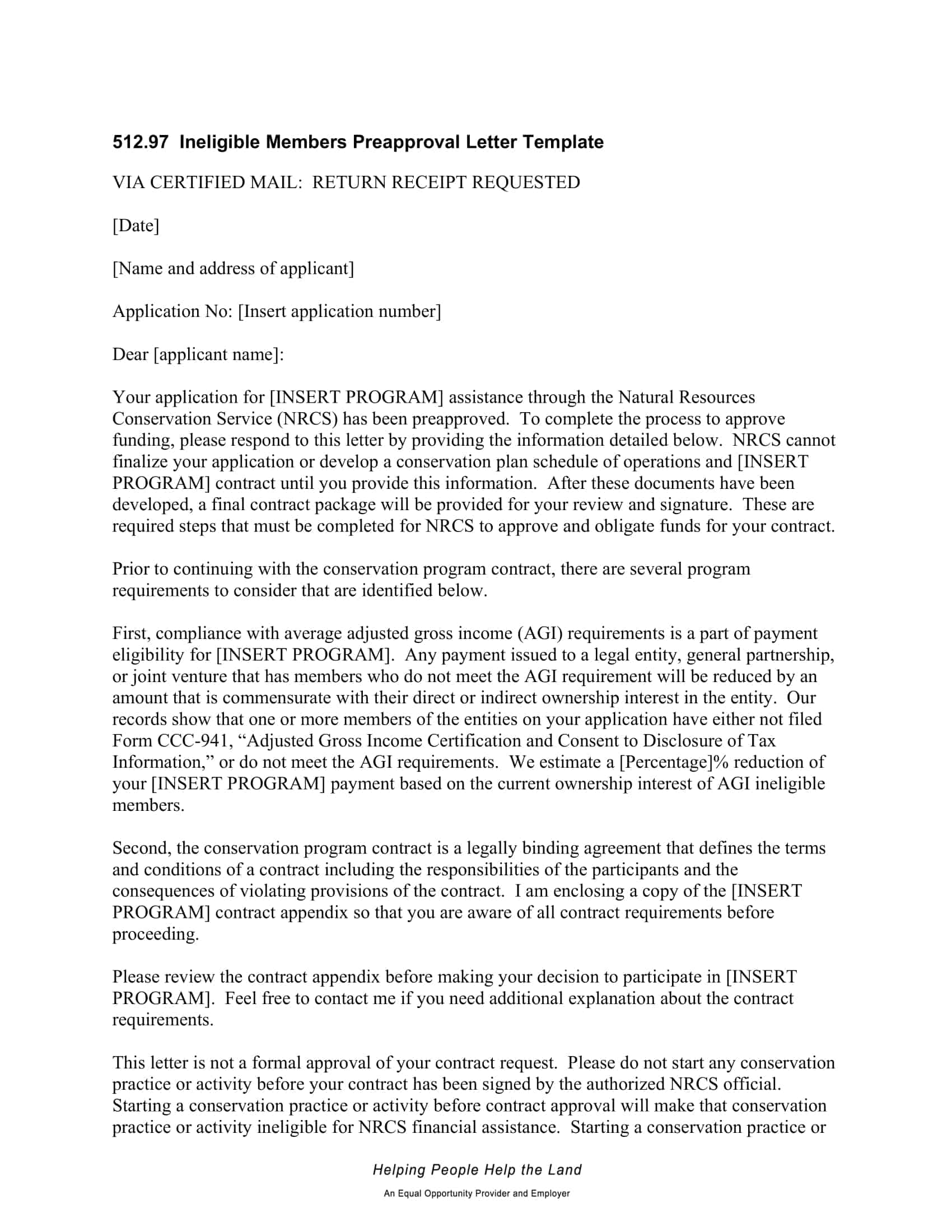

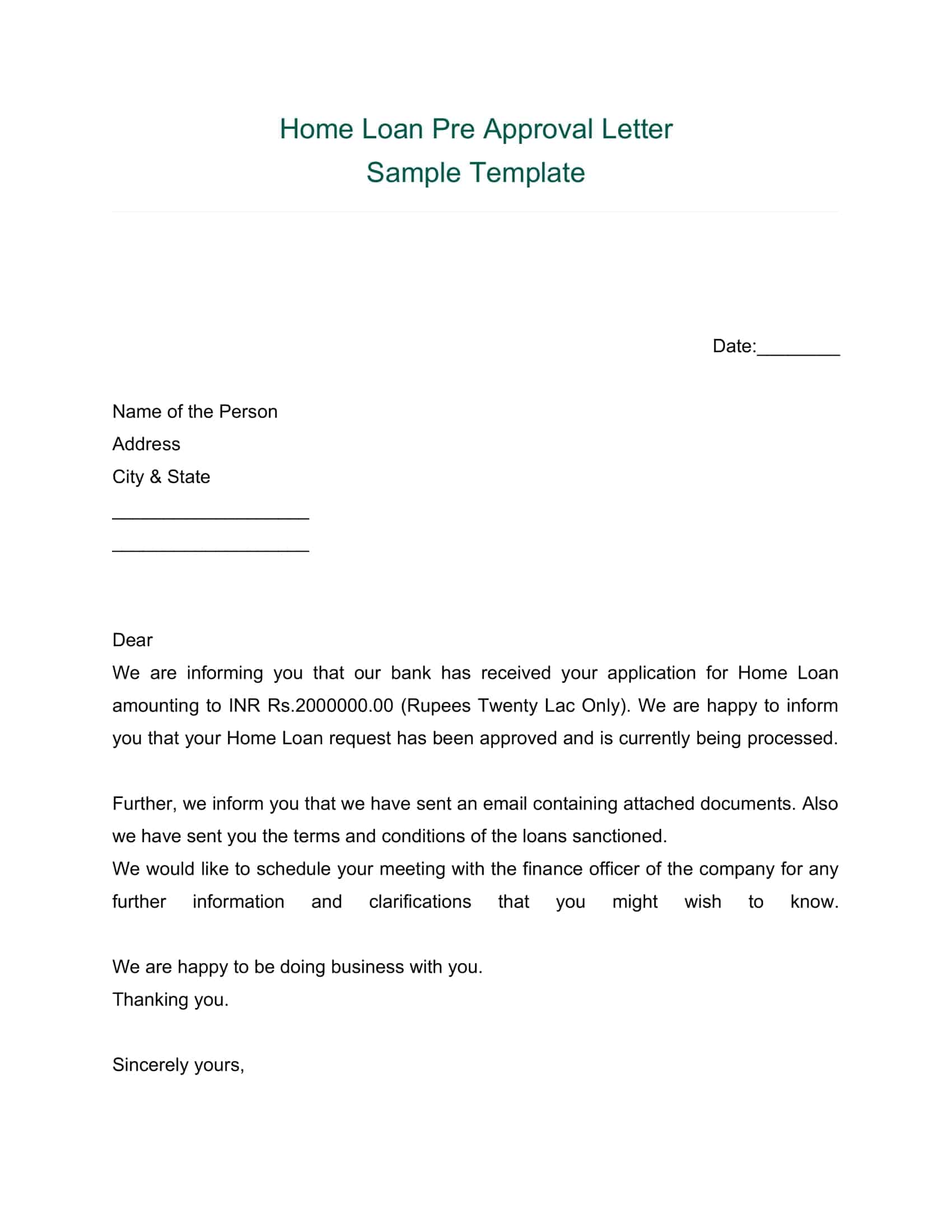

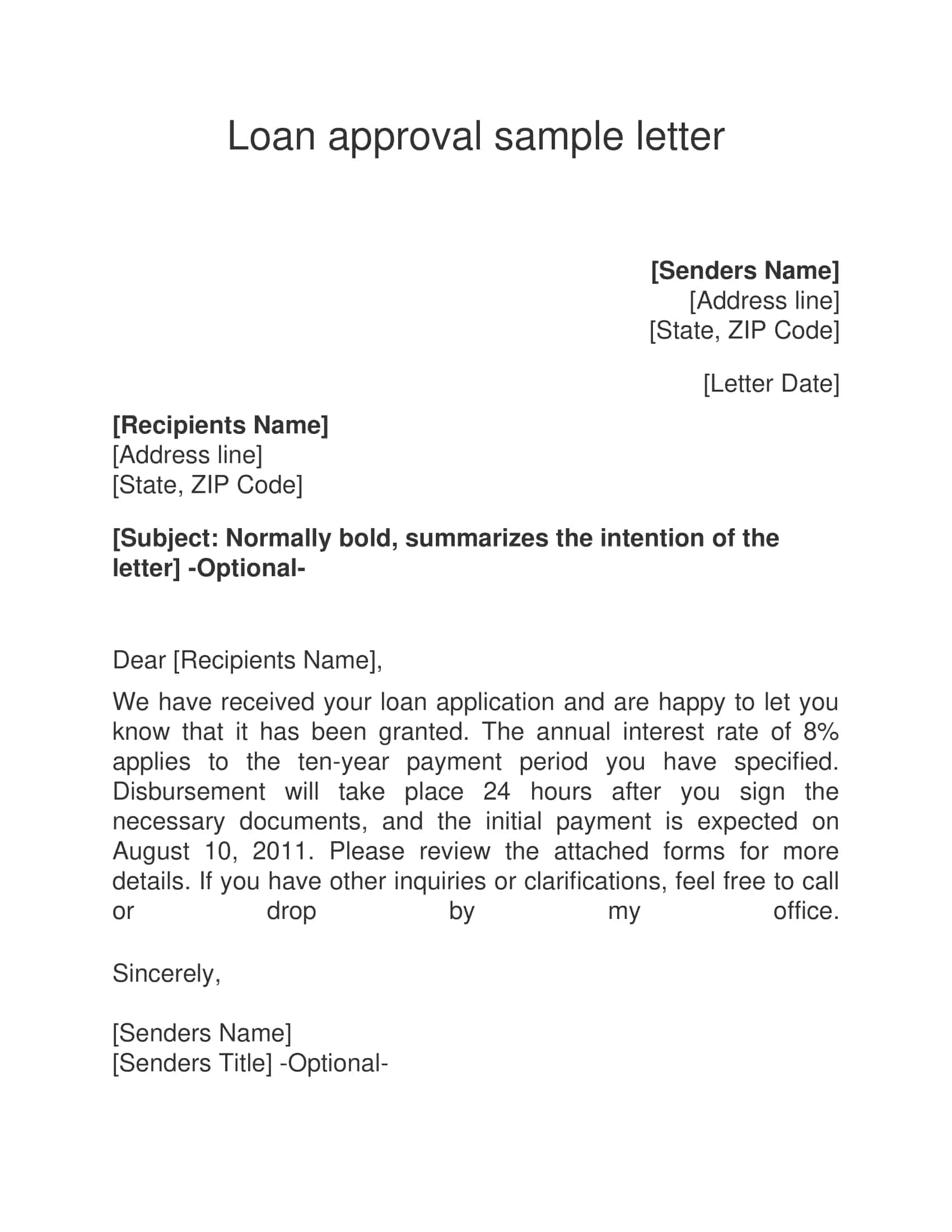

Mortgage & Loan Pre-Approval Letter Templates

“Mortgage & Loan Pre-Approval Letter Templates” are pre-designed documents that provide a structured format for lenders or financial institutions to issue pre-approval letters to borrowers seeking a mortgage or loan. These templates serve as valuable tools to streamline the pre-approval process, establish clear communication, and provide borrowers with a formal indication of their eligibility for financing.

A mortgage or loan pre-approval letter is a written document that confirms a borrower’s preliminary qualification for a specific loan amount based on their financial profile, creditworthiness, and other relevant factors. Mortgage & loan pre-approval letter templates offer a standardized layout that includes essential information such as the borrower’s name, loan amount, terms, and any conditions or contingencies.

By utilizing mortgage & loan pre-approval letter templates, lenders can efficiently generate pre-approval letters, ensuring consistency and accuracy in the information provided to borrowers. These templates guide lenders in summarizing the borrower’s financial qualifications and providing a clear indication of their readiness to proceed with the loan application process.

Advantages of a pre-approval letter

There are several advantages to obtaining a pre-approval letter when applying for a mortgage:

It helps you determine your budget

One of the primary benefits of a pre-approval letter is that it helps you determine how much you can afford to spend on a home. The letter will specify the loan amount you are pre-approved for, which gives you a clear idea of your budget and allows you to focus your search on properties that are within your price range.

It shows sellers you are serious

A pre-approval letter shows sellers that you are a serious and committed buyer, which can help you stand out in a competitive real estate market. It demonstrates that you have taken the necessary steps to secure financing, and gives the seller confidence that you are capable of following through with the purchase.

It gives you a negotiating advantage

Having a pre-approval letter can give you a negotiating advantage when making an offer on a property. If you are competing with other buyers, having a pre-approval letter can help you make a stronger offer and may increase the chances that your offer is accepted.

It streamlines the application process

A pre-approval letter can also help streamline the mortgage application process. Since you have already provided the lender with your financial information and undergone a credit check, the lender may be able to process your application more quickly and efficiently.

It provides peace of mind

Finally, a pre-approval letter can provide peace of mind for homebuyers. It gives you a better idea of how much you can afford to spend, and allows you to enter the home-buying process with more confidence and clarity about your financial situation.

It enables you to close the deal faster

Since obtaining a pre-approval letter involves completing some of the initial steps in the mortgage application process, it can help speed up the process of closing the deal on a property. Having a pre-approval letter in hand can help to reduce the time it takes to secure financing, and can help to ensure that the closing process goes smoothly.

It allows you to identify and address potential issues early

During the pre-approval process, the lender will review your credit report, income, employment history, and other financial information to determine whether you qualify for a loan. If there are any issues or concerns, such as a low credit score or a high debt-to-income ratio, the lender will inform you of these problems early on, giving you the opportunity to address them before you start shopping for a home.

It helps you avoid disappointment

One of the most frustrating things that can happen to a homebuyer is falling in love with a property, only to discover that they cannot afford it. Obtaining a pre-approval letter can help you avoid this disappointment by giving you a realistic idea of your budget and ensuring that you only look at properties that you can realistically afford.

It protects you against interest rate fluctuations

Finally, a pre-approval letter can protect you against interest rate fluctuations. Since the letter specifies the interest rate that you are pre-approved for, you can rest assured that your mortgage payments will not suddenly skyrocket due to interest rate hikes. This can help to make the home-buying process more predictable and less stressful.

How do you get a pre-approval letter?

To obtain a pre-approval letter, you will need to follow these steps:

Choose a lender: The first step is to choose a mortgage lender to work with. You can compare lenders by looking at interest rates, fees, and customer reviews.

Gather financial information: To apply for a pre-approval letter, you will need to provide the lender with information about your income, assets, and debts. You may be asked to provide recent pay stubs, tax returns, bank statements, and other financial documents.

Complete a mortgage application: Once you have gathered all of the necessary financial information, you will need to complete a mortgage application with the lender. This will include providing personal information, such as your name, address, and Social Security number.

Wait for the lender to review your application: After you submit your application, the lender will review your financial information and credit history to determine whether you qualify for a loan. This process typically takes a few days.

Receive your pre-approval letter: If you are approved for a loan, the lender will provide you with a pre-approval letter that specifies the loan amount you are pre-approved for and the interest rate you qualify for. This letter will typically be valid for 60-90 days, but this may vary depending on the lender.

It’s important to keep in mind that a pre-approval letter is not a guarantee of a loan, and you will still need to complete a full mortgage application process and meet all of the lender’s requirements before the loan is approved and funded.

Pre-qualification vs. Pre-approval

Pre-qualification and pre-approval are two terms that are often used interchangeably when it comes to the home-buying process, but they are actually two different things.

Pre-qualification is the initial step in the mortgage application process, and it is a way for lenders to determine whether a borrower may be eligible for a mortgage based on their self-reported financial information. This process typically involves filling out a brief application or submitting some basic financial information online, and the lender will provide an estimate of the loan amount and interest rate that the borrower may qualify for. Pre-qualification is usually quick and easy, and it doesn’t require a credit check or detailed financial documentation.

Pre-approval, on the other hand, is a more in-depth process that involves a full mortgage application, a credit check, and a more thorough review of the borrower’s financial information. The lender will review the borrower’s income, employment history, credit score, and other financial information to determine whether they are eligible for a mortgage and to determine the loan amount and interest rate that they qualify for. A pre-approval letter is a written statement from the lender that confirms the borrower’s eligibility for a loan, and it is usually valid for a specific period of time.

In short, pre-qualification is a quick and simple way to get an estimate of the loan amount and interest rate that you may qualify for, while pre-approval is a more thorough process that provides a written confirmation of your eligibility for a mortgage. Pre-approval is generally preferred by homebuyers and sellers, as it provides a more reliable indication of a borrower’s ability to obtain financing and complete a home purchase.

How long is a pre-approval letter valid?

The validity period of a pre-approval letter can vary depending on the lender and other factors, but it is typically valid for 60 to 90 days. During this time, the borrower can use the pre-approval letter to shop for homes and make offers on properties that are within the pre-approved loan amount.

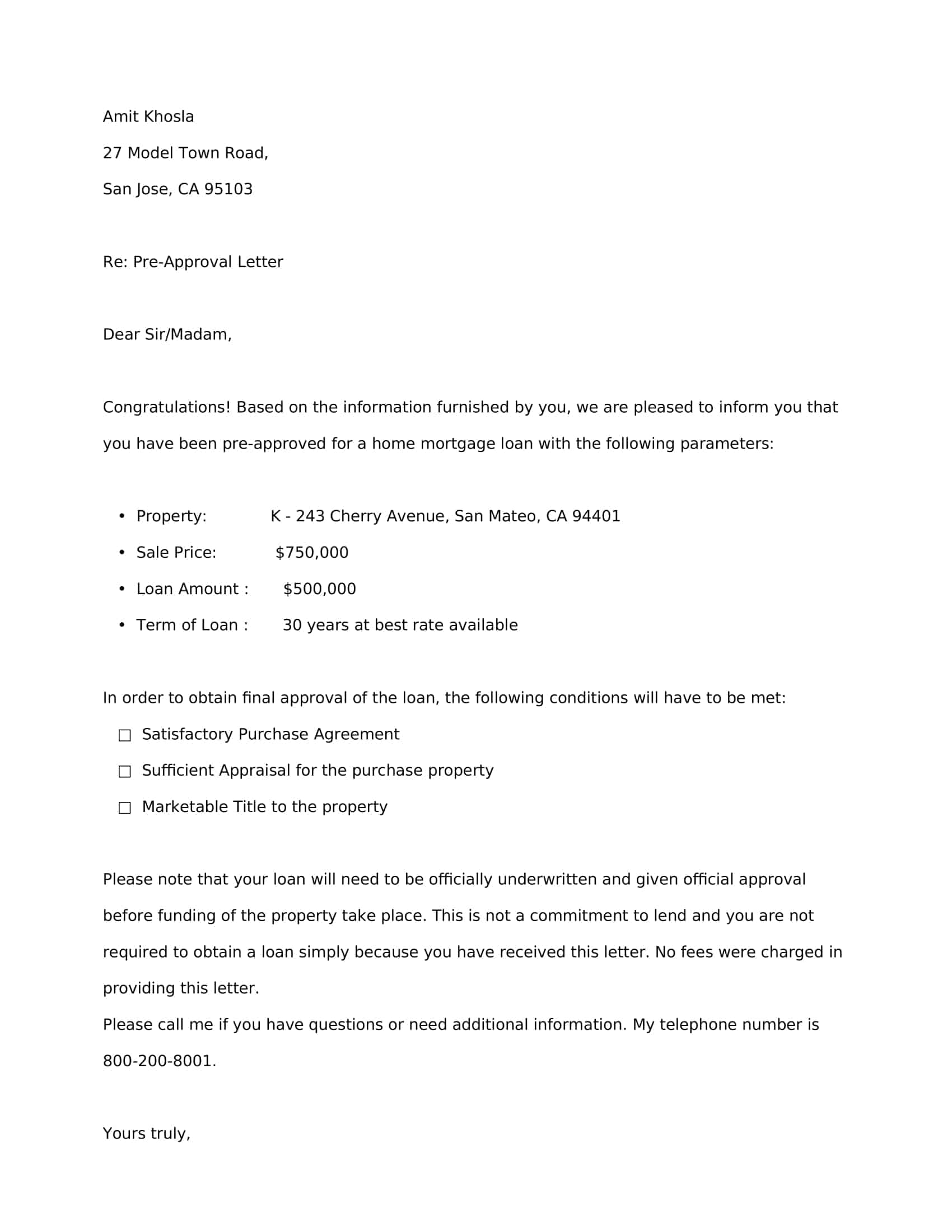

What should a pre-approval letter include?

A pre-approval letter is a document that a lender provides to a borrower that states the amount of money they are willing to lend the borrower for a mortgage. The letter should include the following information:

Borrower’s Name: The pre-approval letter should include the name of the borrower(s) who are seeking pre-approval.

Loan Amount: The letter should state the maximum amount the lender is willing to lend the borrower for a mortgage. This amount is typically based on the borrower’s credit score, income, and debt-to-income ratio.

Loan Term: The letter should state the length of the loan term, which is typically 15 or 30 years.

Interest Rate: The letter should state the interest rate that the borrower will be charged on the loan. This rate may be subject to change depending on the borrower’s credit score, down payment, and other factors.

Conditions: The letter may include conditions that the borrower must meet in order to obtain the loan. For example, the lender may require the borrower to provide additional documentation or to obtain an appraisal of the property.

Expiration Date: The letter should state the date on which the pre-approval letter expires. This is typically 60 to 90 days from the date of the letter.

Lender Information: The letter should include the name and contact information of the lender, as well as any relevant licensing information.

Is a pre-approval letter a guarantee that you will receive a mortgage, or are there still factors that could prevent you from being approved?

A pre-approval letter is not a guarantee of approval, but rather an indication that the lender is willing to lend you a certain amount of money based on the information provided. The lender has not yet underwritten the loan, which means that they have not fully reviewed and verified all of the borrower’s financial information.

During the pre-approval process, the lender typically reviews the borrower’s credit score, income, and debt-to-income ratio, among other factors, to determine their eligibility for a mortgage. If the borrower meets the lender’s minimum requirements, they may be issued a pre-approval letter.

However, a pre-approval letter is not a final approval, and the lender may still require additional documentation or information before the loan is fully approved. For example, the lender may need to verify the borrower’s employment, income, and assets, as well as obtain an appraisal of the property.

To sum up, a pre-approval letter is a good indication that you may be approved for a mortgage, but it is not a guarantee of final approval. It is important to continue working with your lender and providing any additional information or documentation they may need to fully underwrite your loan.

Conditions for loan denial after pre-approval

While a pre-approval letter can be a strong indication that a borrower is eligible for a mortgage, there are still certain conditions that could result in a loan denial after pre-approval. Here are some common reasons why a borrower may be denied for a mortgage after receiving a pre-approval letter:

Changes in the borrower’s financial situation: If the borrower’s financial situation changes significantly between the time they receive their pre-approval letter and the time they apply for a mortgage, they may no longer meet the lender’s eligibility criteria. For example, if the borrower loses their job, takes on additional debt, or has a significant decrease in their credit score, the lender may no longer be willing to approve the loan.

Issues with the property: Even if the borrower is pre-approved for a mortgage, the lender may still require an appraisal and inspection of the property before approving the loan. If there are issues with the property, such as structural problems or code violations, the lender may not be willing to approve the loan.

Lender-specific requirements: Each lender has its own set of eligibility criteria, and some lenders may have stricter requirements than others. For example, some lenders may require a higher credit score or a larger down payment than others. If the borrower doesn’t meet the lender’s specific requirements, they may be denied for the loan.

Employment or income verification issues: The lender may require verification of the borrower’s employment and income as part of the mortgage application process. If there are issues with the borrower’s employment or income verification, such as discrepancies in the employment history or insufficient income to support the loan, the lender may not be willing to approve the loan.

Title issues: If there are issues with the property’s title, such as liens or disputes over ownership, the lender may not be willing to approve the loan until the issues are resolved.

FAQs

Is a pre-approval letter binding?

No, a pre-approval letter is not binding and does not guarantee that you will be approved for a mortgage. The lender will need to underwrite the loan and verify your financial information before finalizing the mortgage.

Do I need to pay for a pre-approval letter?

Some lenders may charge a fee for pre-approvals, while others do not. It is important to check with the lender beforehand to understand any associated costs.

What should I do if my pre-approval letter is denied?

If your pre-approval letter is denied, you may want to work with your lender to understand why you were denied and what steps you can take to improve your chances of approval in the future. This may include improving your credit score or reducing your debt-to-income ratio.

How long does it take to get a pre-approval letter?

The time it takes to get a pre-approval letter may vary depending on the lender and your financial situation. Typically, it can take a few days to a week to receive a pre-approval letter.

Does a pre-approval letter affect my credit score?

The process of getting a pre-approval letter may involve a hard inquiry on your credit report, which can temporarily lower your credit score. However, the impact is usually small and should not have a significant impact on your credit score.

What factors are considered in a pre-approval letter?

Lenders typically consider several factors when issuing a pre-approval letter, including your credit score, income, employment history, debt-to-income ratio, and the amount of your down payment.

Can I get a pre-approval letter before finding a property?

Yes, you can get a pre-approval letter before finding a property. This can help you determine your budget and make your home search more focused.

Can I get a pre-approval letter from multiple lenders?

Yes, you can get a pre-approval letter from multiple lenders. However, each pre-approval may involve a hard inquiry on your credit report, which can temporarily lower your credit score.

What should I do if my financial situation changes after receiving a pre-approval letter?

If your financial situation changes after receiving a pre-approval letter, you should inform your lender and provide any updated financial information. This may affect the amount of money the lender is willing to lend you or your eligibility for a mortgage.

![Free Printable Friendly Letter Templates [PDF, Word, Excel] 1st, 2nd, 4th Grade 1 Friendly Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-1200x1200.jpg 1200w)

![43+ Printable Leave of Absence Letter (LOA) Templates [PDF, Word] / Free 2 Leave of Absence Letter](https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-1200x1200.jpg 1200w)

![Free Printable Congratulation Letter Templates [PDF, Word] Examples 3 Congratulation Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-1200x1200.jpg 1200w)