As a prospective homeowner or property investor, it’s crucial to understand the ins and outs of this legal document, as it sets the foundation for a smooth and successful transaction. So, buckle up, and join me on this journey to unravel the mysteries and intricacies of a Real Estate Purchase Agreement, ensuring you’re well-equipped to navigate your property-buying adventure like a pro!

Table of Contents

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a crucial document that outlines the terms and conditions of a property transaction between a buyer and a seller. It serves as a legally binding agreement that sets forth the details of the sale, such as the purchase price, the closing date, any contingencies, and any other obligations of both parties.

This document is an essential tool in protecting the interests of both the buyer and the seller. It helps to ensure that all the terms of the sale are clearly defined and that both parties understand their responsibilities. Additionally, the purchase agreement helps to prevent misunderstandings and potential disputes that may arise during the transaction.

The Real Estate Purchase Agreement is typically prepared by a real estate attorney who is knowledgeable in the laws and regulations surrounding property sales. It is then signed by both the buyer and the seller, turning it into a legally binding contract that can be enforced in a court of law if necessary.

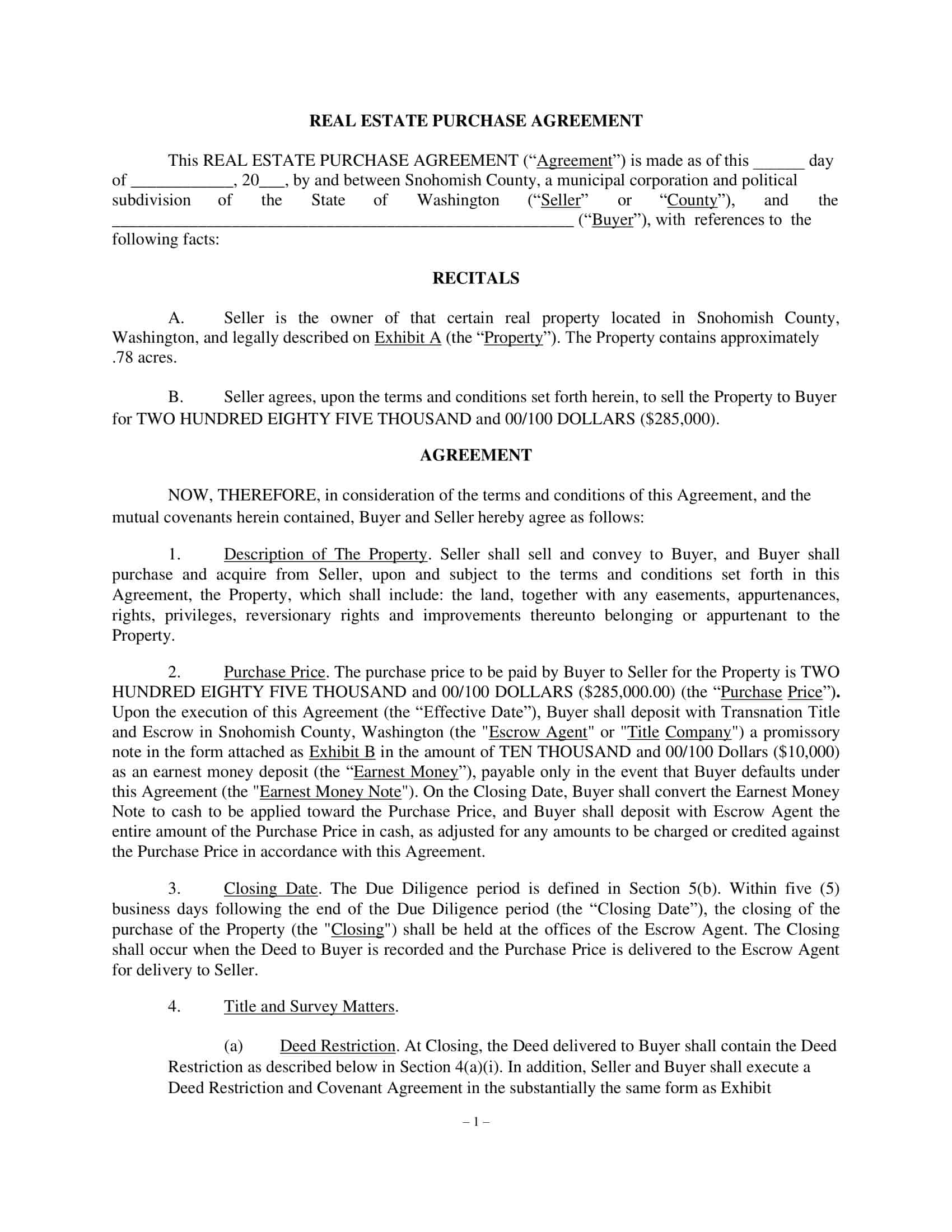

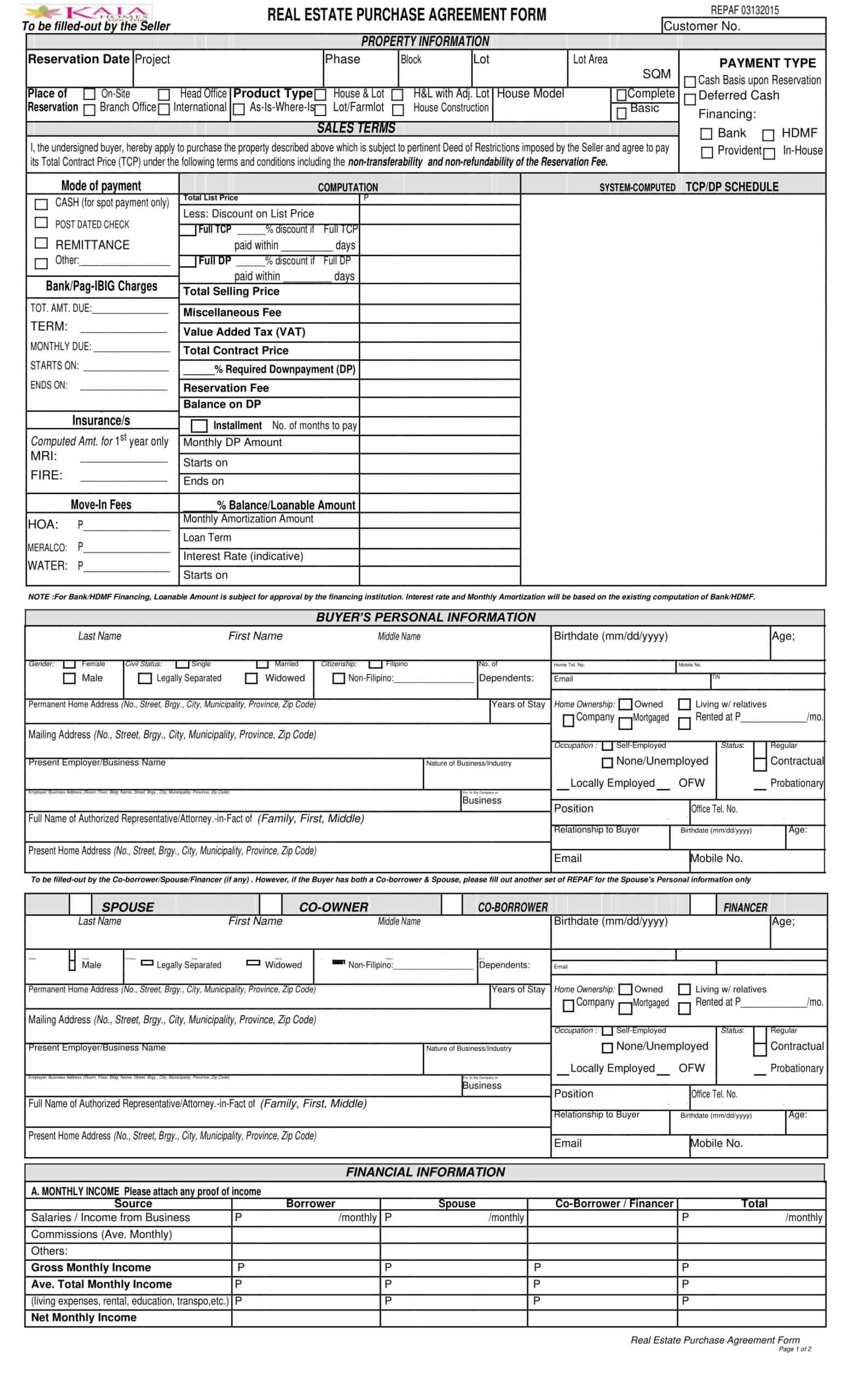

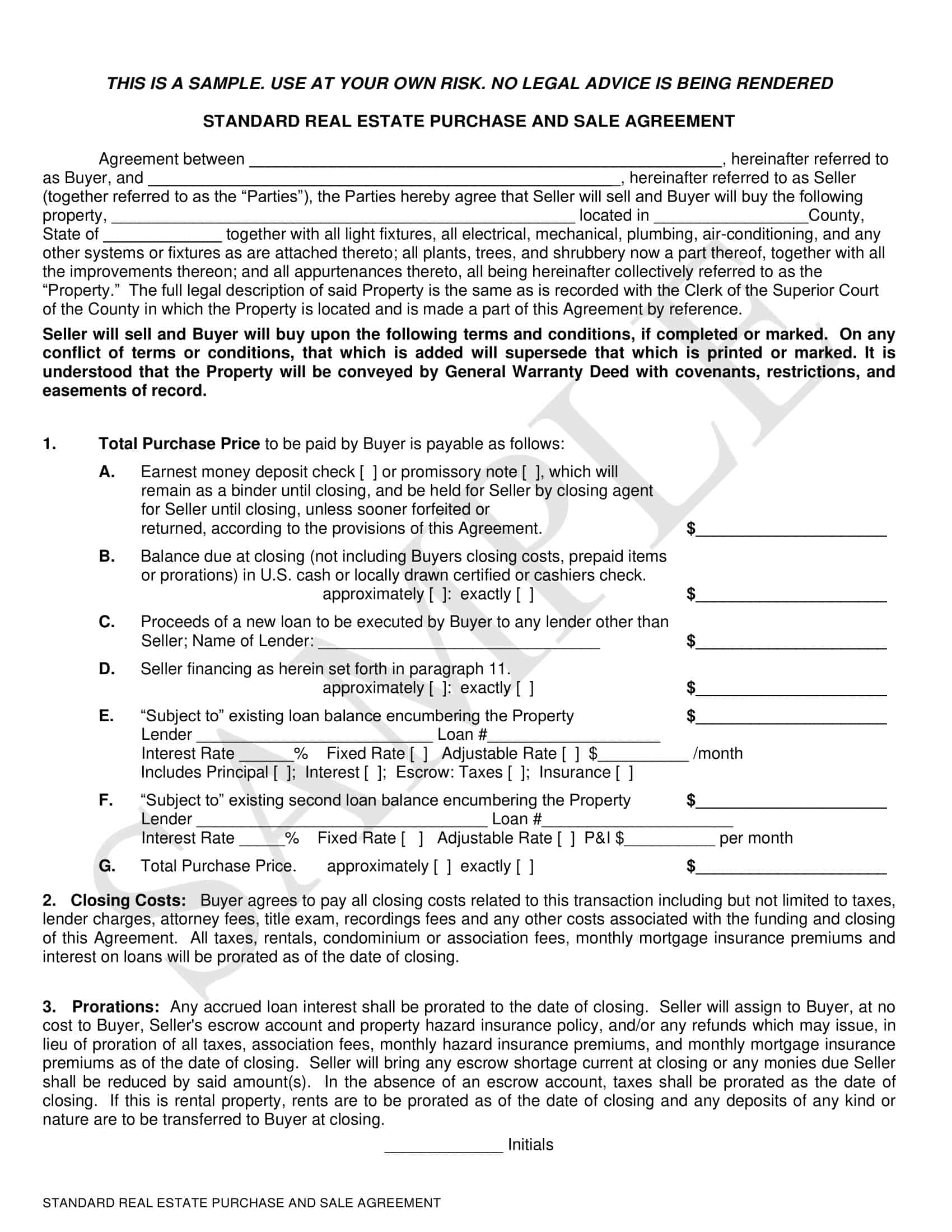

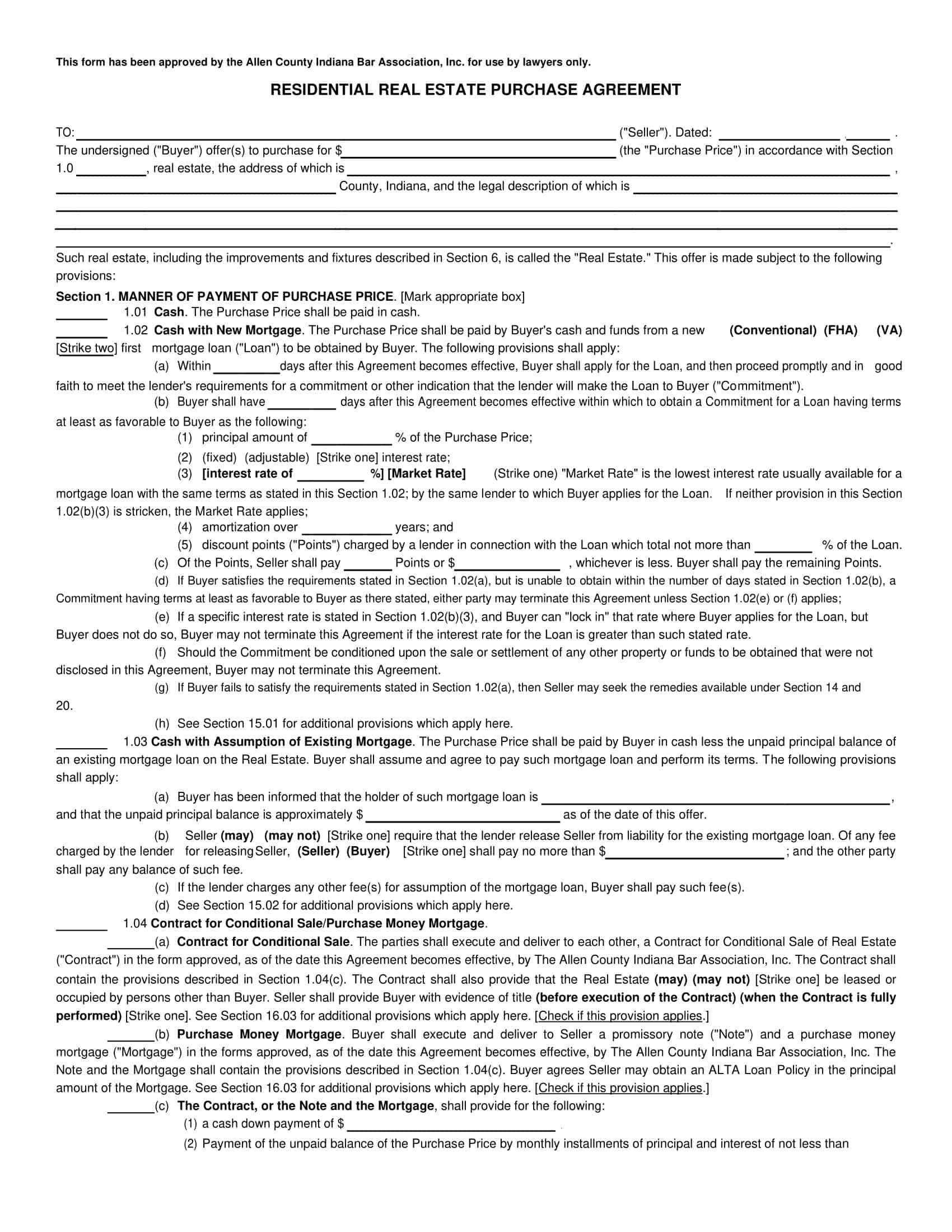

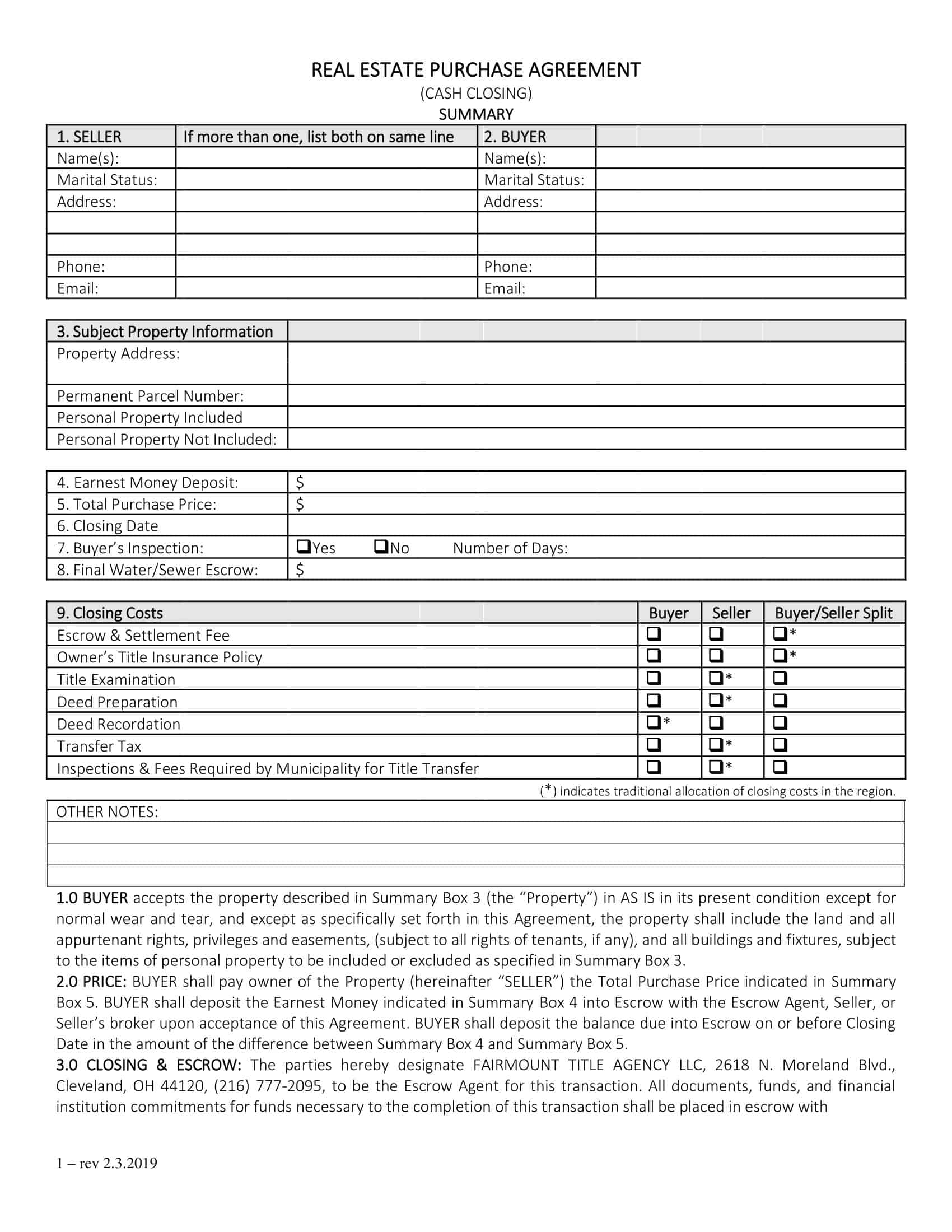

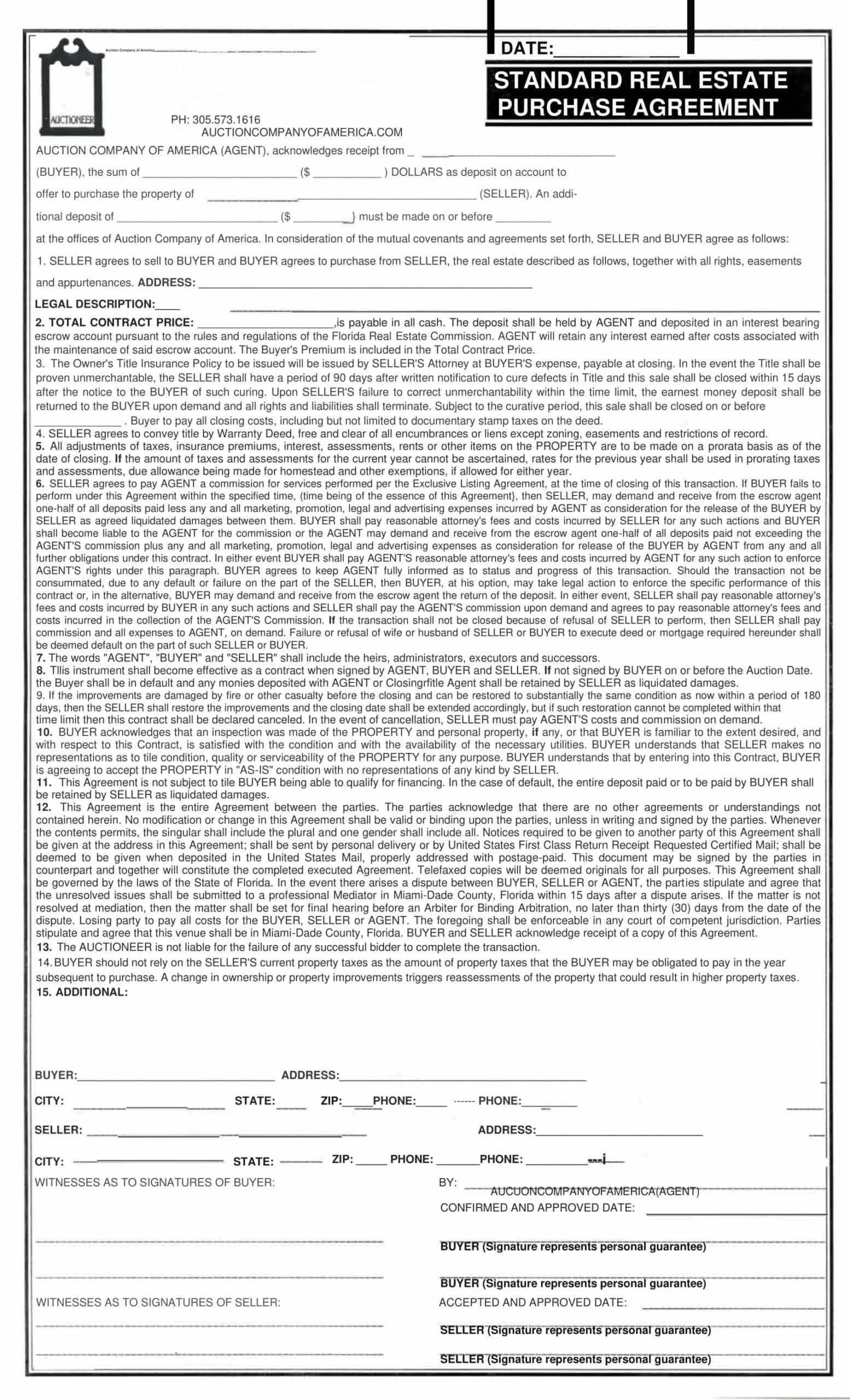

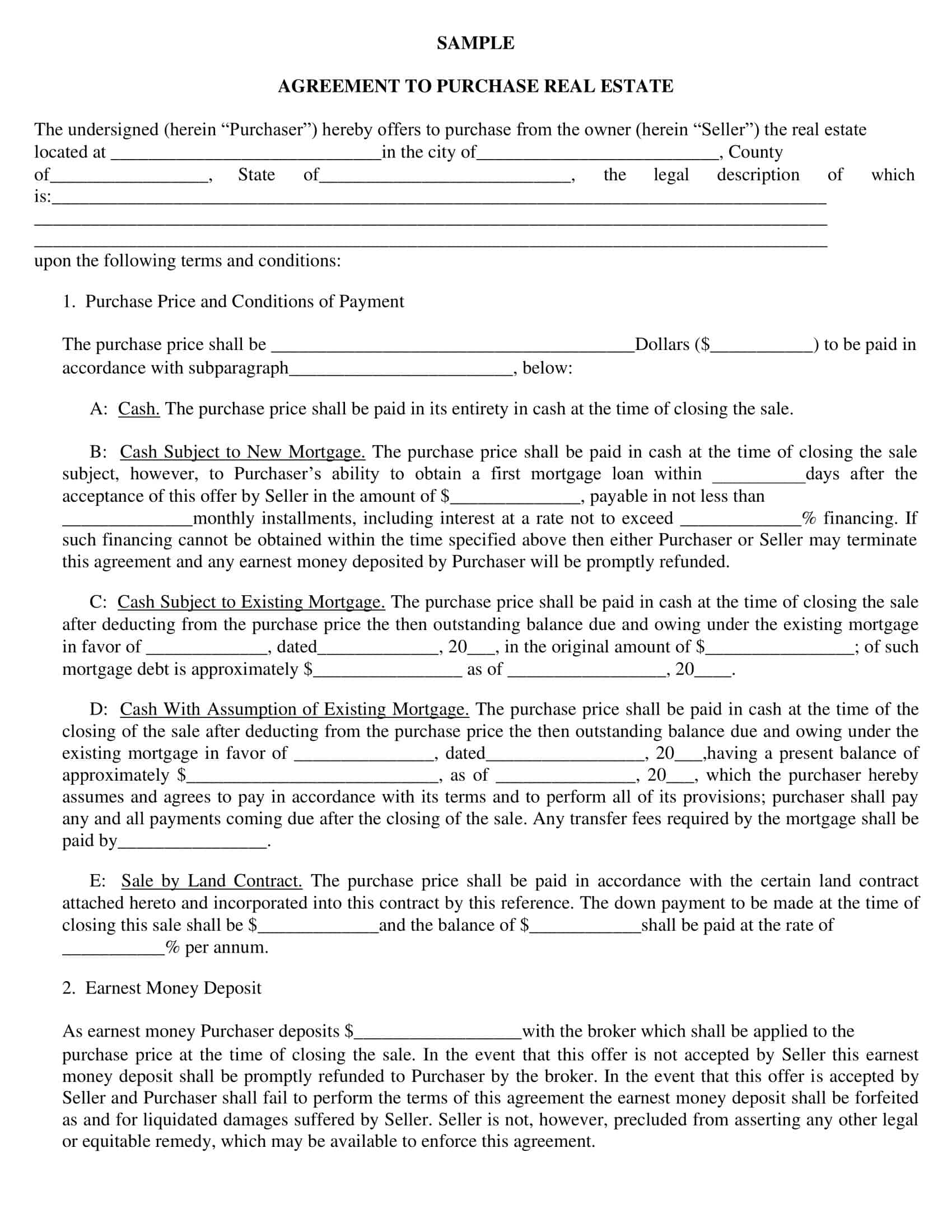

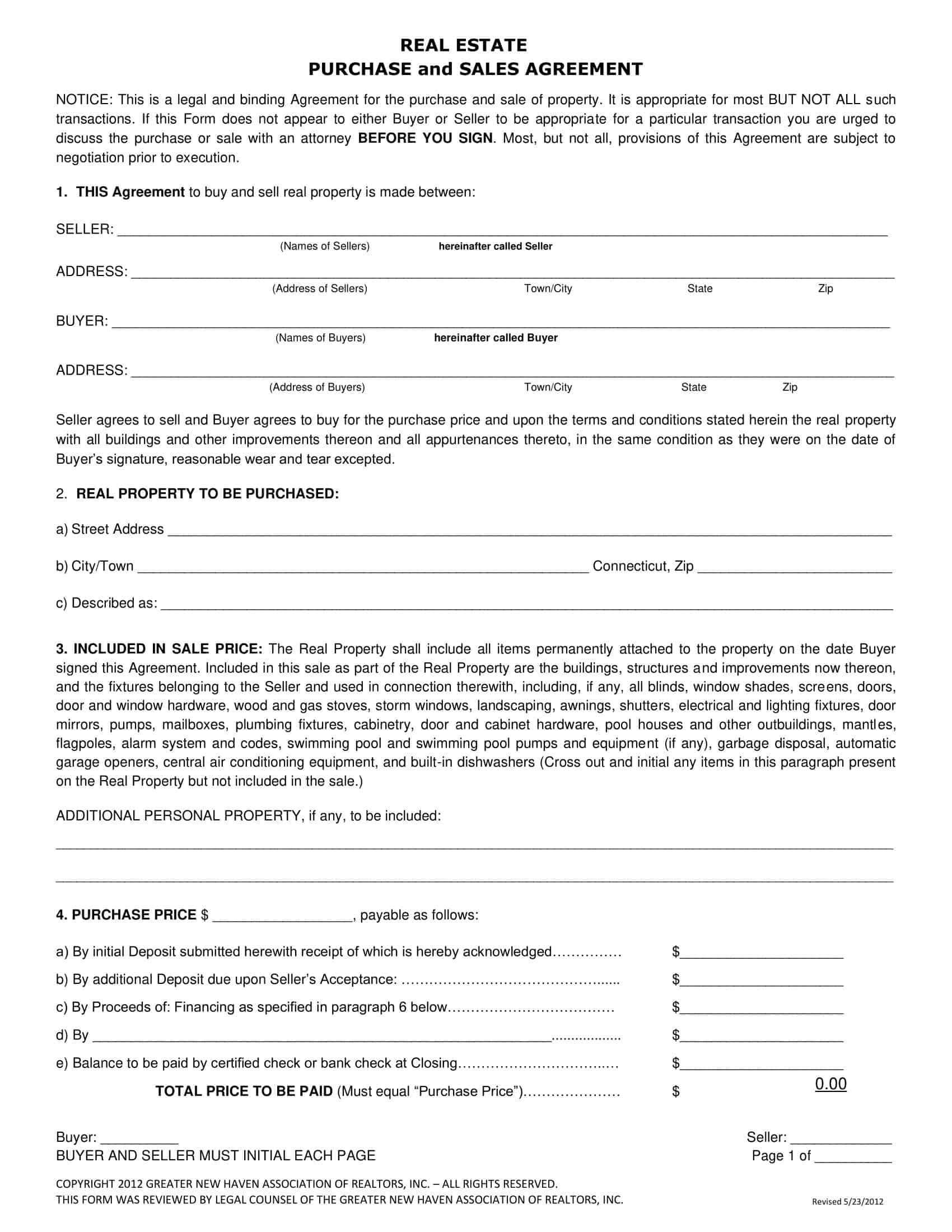

Real Estate Purchase Agreement Templates

Facilitate seamless real estate transactions with our extensive collection of Real Estate Purchase Agreement Templates. Whether you’re buying or selling a property, these free, printable templates provide a comprehensive framework to ensure a legally binding and transparent transaction. Our templates cover essential details such as property description, purchase price, payment terms, contingencies, and closing conditions.

With customizable sections, you can tailor the agreement to meet your specific needs. By using our Real Estate Purchase Agreement Templates, you can navigate the complexities of real estate transactions with confidence, protecting your interests and minimizing potential disputes. Simplify the process of buying or selling property and establish a solid foundation for a successful transaction. Download our templates now and streamline your real estate purchase process.

Essential Elements of a Real Estate Transaction Agreement

A real estate transaction agreement is a legally binding document that outlines the terms and conditions of a property sale. The content of the agreement varies depending on the buyer, seller, and the property, as well as the local and state laws governing the transaction. Some of the key components typically found in a real estate transaction agreement are:

Buyer and seller identification: This section contains the full names and contact information of the buyer and the seller involved in the transaction.

Property description: This part provides the property’s address, a detailed description, and any other relevant information.

Agreed-upon price: This section specifies the amount the buyer agrees to pay for the property, including down payments, seller concessions, and any additional costs involved in the transaction.

Payment method: This portion outlines how the buyer intends to finance the property, such as through a mortgage, assuming the seller’s existing mortgage, or paying in cash.

Seller’s disclosures: These are factual statements made by the seller regarding the property’s composition, structure, and condition, often disclosed through a warranty deed.

Inclusions and exclusions: This section lists any fixtures and appliances included in the sale. Clarifying which items stay with the property and which do not ensures a legally binding agreement.

Title insurance requirement: This part specifies whether the buyer or the seller is responsible for obtaining title insurance to protect against potential defects in the property’s title.

Property tax allocation: This section outlines the property taxes and designates which party is responsible for paying them.

Closing date: The closing date is a crucial part of the contract, as it indicates when the property sale will be finalized. However, this date may be subject to change.

Contingency clauses: These are provisions that allow either party to back out of the agreement under specific circumstances, such as inspection or financing issues. Some buyers may also include a contingency based on the sale of their current property.

Earnest money deposit: The agreement should indicate that the buyer has made an earnest money deposit as a show of good faith in the transaction.

In certain jurisdictions, additional disclosures, such as lead-based paint disclosures, may be required to ensure that the buyer is fully informed about the property. The seller is responsible for providing these disclosures or presenting them to the buyer before the transaction proceeds.

Once both parties have negotiated the terms and are satisfied with the real estate transaction agreement, they must sign the document to make it legally binding. Like any other legal contract, this agreement is enforceable for both parties.

The Significance of Contingencies in Real Estate Purchase Agreements

Contingencies play a crucial role in real estate purchase agreements, as they ensure that specific conditions are met before finalizing the transaction. By including contingencies, buyers can safeguard their interests when making a significant investment in a property.

Some of the most frequently encountered contingencies are:

Inspection contingency

This allows buyers to back out of the deal if the property inspection uncovers significant issues that the seller refuses to address.

Appraisal contingency

This ensures that buyers don’t overpay for a property by taking into account the property’s appraised value.

Financing contingency

This protects buyers in case they’re unable to secure a mortgage for the property, allowing them to recover their earnest money deposit.

Title contingency

A title report helps buyers verify that there are no hidden issues or liens on the property that they would unknowingly inherit upon purchase.

Home sale contingency

This provision stipulates that the purchase of the new property is contingent upon the successful sale of the buyer’s current home.

Buyers can decide which contingencies to include in their purchase agreement based on their individual needs and circumstances.

The number and type of contingencies may also depend on the state of the market. In a buyer’s market, sellers might be more willing to accept a greater number of contingencies. However, in a competitive seller’s market, buyers may need to limit their contingencies to improve their chances of securing a property.

In conclusion, contingencies are vital for protecting buyers’ interests in real estate transactions. By including appropriate contingencies in the purchase agreement, buyers can ensure that they’re making a well-informed decision and minimize potential risks associated with their investment.

Filling Out a Real Estate Purchase Agreement: A Comprehensive Guide

A real estate purchase agreement is a legally binding contract between the buyer and the seller, outlining the terms and conditions for the sale of a property. To ensure a smooth transaction, it’s essential to fill out the purchase agreement accurately. This comprehensive guide will walk you through the process step by step.

Gather necessary information

Before filling out the agreement, gather all relevant information, including the full names and contact information of the buyer and seller, the property’s address, the legal description, and the purchase price.

Identify the parties

Start by specifying the names and contact information of the buyer and seller. This information is crucial to establish a legally binding agreement between both parties.

Describe the property

Provide a detailed description of the property, including its address, legal description (found on the property deed or tax records), and any other relevant information, such as zoning or land use restrictions.

Set the purchase price

Clearly state the agreed-upon price for the property, as well as any deposits or down payments. Make sure to outline how the buyer will pay the deposit, whether it’s in the form of a check, wire transfer, or another method.

Specify financing details

Outline the financing method the buyer will use, such as a mortgage or cash payment. If the buyer is obtaining a mortgage, include information on the lender, loan amount, and loan approval deadline.

Include contingencies

List any contingencies the buyer wishes to include in the agreement, such as inspection, financing, or appraisal contingencies. These provisions protect the buyer’s interests by allowing them to back out of the deal if certain conditions are not met.

Detail inclusions and exclusions

Clarify which fixtures, appliances, and personal property items are included in the sale and which are not. This section helps avoid disputes over items that may or may not be part of the transaction.

Address property taxes and assessments

Specify how property taxes and any other assessments will be prorated between the buyer and the seller, typically as of the closing date.

Set the closing date

Indicate the target closing date when the ownership of the property will be transferred from the seller to the buyer. Keep in mind that this date may change due to unforeseen circumstances.

Outline closing costs and responsibilities

Define each party’s responsibility for closing costs, such as title insurance, escrow fees, and attorney fees. This section helps ensure both parties are aware of their financial obligations at closing.

Add required disclosures

Include any legally required disclosures, such as lead-based paint or environmental hazards, to ensure the buyer is fully informed about the property.

Signatures and dates

Once all terms have been reviewed and agreed upon, both the buyer and the seller must sign and date the agreement, making it legally binding.

How can I finance a real estate purchase?

Financing a real estate purchase can be achieved through various methods, depending on your financial situation, credit score, and the type of property you’re buying. Here are some common financing options to consider:

Conventional mortgage: A conventional mortgage is a loan offered by banks, credit unions, and other financial institutions. These loans typically require a down payment of at least 5-20% of the property’s value and a good credit score.

Government-backed loans: These loans are insured by the government and offer more relaxed lending standards than conventional mortgages. Some examples include:

a. Federal Housing Administration (FHA) loans: These loans require a lower down payment (as low as 3.5%) and have more lenient credit requirements, making them ideal for first-time homebuyers or those with less-than-perfect credit.

b. Veterans Affairs (VA) loans: VA loans are available to eligible veterans, active-duty service members, and their families. These loans offer competitive interest rates, no down payment requirements, and no private mortgage insurance (PMI).

c. United States Department of Agriculture (USDA) loans: USDA loans are designed for rural and suburban homebuyers who meet specific income requirements. These loans often require no down payment and have competitive interest rates.

Adjustable-rate mortgage (ARM): An ARM offers a lower initial interest rate than a fixed-rate mortgage, but the rate may adjust periodically based on market conditions. This option can be suitable for those who plan to sell or refinance their property before the rate adjusts.

Interest-only mortgage: With an interest-only mortgage, borrowers pay only the interest on the loan for a set period, after which the payments increase to cover both principal and interest. This option may be suitable for those who expect their income to increase in the future.

Seller financing: In some cases, the seller may agree to finance the property for the buyer, usually in the form of a short-term loan with a higher interest rate than a traditional mortgage. This option can be beneficial for buyers who cannot qualify for a traditional mortgage.

Private financing: Private lenders, such as individuals or investment groups, may offer loans for real estate purchases. These loans often have higher interest rates and shorter terms than traditional mortgages but can be a viable option for those who cannot obtain financing through conventional means.

Home equity loan or line of credit (HELOC): If you already own a property with significant equity, you can use a home equity loan or HELOC to finance the purchase of a new property. This option essentially uses your existing property as collateral for the new loan.

Real estate crowdfunding: Real estate crowdfunding platforms allow multiple investors to pool their funds together to finance a property purchase. This option is more commonly used for investment properties rather than primary residences.

Cash purchase: If you have sufficient funds, you can choose to buy the property outright with cash. This method eliminates the need for a mortgage and can make your offer more attractive to sellers.

Before choosing a financing option, it’s essential to assess your financial situation, credit history, and long-term goals. Additionally, consulting with a financial advisor or mortgage broker can help you determine the most suitable financing method for your specific needs.

What are other financial terms in a Real Estate Purchase Agreement?

In a real estate purchase agreement, several financial terms are used to outline the responsibilities and obligations of the buyer and the seller. Understanding these terms is crucial for a successful transaction. Some common financial terms include:

Purchase price: This is the agreed-upon amount that the buyer will pay for the property. It is one of the most important terms in the agreement and should be explicitly stated.

Earnest money deposit: This is an upfront payment made by the buyer to demonstrate their commitment to the transaction. The deposit is typically held in escrow until closing and applied towards the purchase price.

Down payment: The down payment is the portion of the purchase price that the buyer pays upfront, while the remaining amount is financed through a mortgage or other loan. A higher down payment typically results in lower monthly mortgage payments and potentially better loan terms.

Closing costs: These are the fees and expenses associated with finalizing the property transaction, such as title insurance, appraisal fees, attorney fees, recording fees, and transfer taxes. In the purchase agreement, it should be specified which party is responsible for paying each cost.

Escrow: Escrow refers to the process of holding funds, documents, or other assets by a neutral third party until the transaction is completed. This ensures that the funds are securely held and disbursed according to the terms of the agreement.

Financing contingency: This is a clause that allows the buyer to back out of the agreement if they are unable to secure financing for the property. It protects the buyer from losing their earnest money deposit if their loan application is denied.

Appraisal contingency: This contingency allows the buyer to renegotiate or terminate the agreement if the property’s appraised value comes in lower than the agreed-upon purchase price. It protects the buyer from overpaying for the property.

Prorations: Prorations refer to the allocation of expenses between the buyer and the seller based on the time each party owns the property during the month or year of the transaction. Common prorated expenses include property taxes, homeowner’s association fees, and utility bills.

Seller concessions: These are contributions made by the seller to help cover the buyer’s closing costs or other expenses. Seller concessions can make the property more attractive to buyers, but they may affect the seller’s net proceeds from the sale.

Contingency for the sale of another property: If the buyer needs to sell their current property to finance the new purchase, a contingency may be included in the agreement. This allows the buyer to back out of the transaction if they are unable to sell their existing property within a specified timeframe.

FAQs

Is a real estate purchase agreement legally binding?

Yes, a real estate purchase agreement is a legally binding contract once it is signed by both the buyer and the seller. Both parties must adhere to the terms and conditions outlined in the agreement or face potential legal consequences.

How long is a real estate purchase agreement valid?

The validity of a real estate purchase agreement depends on the terms specified in the contract. Most agreements have a specific closing date, by which the transaction must be completed. If the closing does not occur by the specified date, either party may have the right to terminate the agreement, unless an extension has been mutually agreed upon.

Can a real estate purchase agreement be terminated?

Yes, a real estate purchase agreement can be terminated under certain conditions, such as the failure to meet a contingency or a breach of the contract by one of the parties. The terms for termination should be clearly outlined in the agreement, along with any potential penalties or consequences.

What happens if either party breaches the real estate purchase agreement?

If either the buyer or the seller breaches the real estate purchase agreement, the non-breaching party may have legal remedies, such as seeking specific performance (requiring the breaching party to fulfill their obligations), pursuing monetary damages, or terminating the agreement and retaining any earnest money deposits.

Can a real estate purchase agreement be amended?

Yes, a real estate purchase agreement can be amended if both parties mutually agree to the changes. Any amendments should be made in writing, signed by both parties, and attached to the original agreement as an addendum.

What is earnest money, and is it refundable?

Earnest money is a deposit made by the buyer as a show of good faith and commitment to the transaction. It is typically held in escrow and applied towards the purchase price at closing. If the transaction is not completed due to a valid contingency or a breach by the seller, the earnest money may be refunded to the buyer. The specific terms regarding the refundability of earnest money should be outlined in the purchase agreement.

Do I need a real estate agent or attorney to prepare a real estate purchase agreement?

While it is not legally required to have a real estate agent or attorney prepare a real estate purchase agreement, it is highly recommended. An experienced professional can help ensure that the agreement is legally sound, complies with local and state regulations, and adequately protects your interests.

What happens after the real estate purchase agreement is signed?

After the real estate purchase agreement is signed, both parties work to fulfill their respective obligations, such as securing financing, conducting inspections, and addressing any contingencies. Once all conditions have been met and the closing date arrives, the transaction is finalized, and ownership of the property is transferred from the seller to the buyer.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Payment Agreement Templates [PDF, Word] 2 Payment Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Payment-Agreement-1-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 3 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)