According to salary.com, the average payroll cycle is two weeks. However, large companies employ vast numbers of workers according to labor demands. In such cases, some individuals get contracted to make payments on behalf of another business they work for to meet the deadlines made by employees differently.

Each employee might have joined the company on varying dates and, therefore, might fall into different payment schedules or could require lump-sum payments whenever they leave the company.

Payroll can be a tedious and challenging task for small businesses. It’s not easy to keep track of records such as which employee joined on what date, the amount due to them, how many workers were on duty at a specific date, etc.

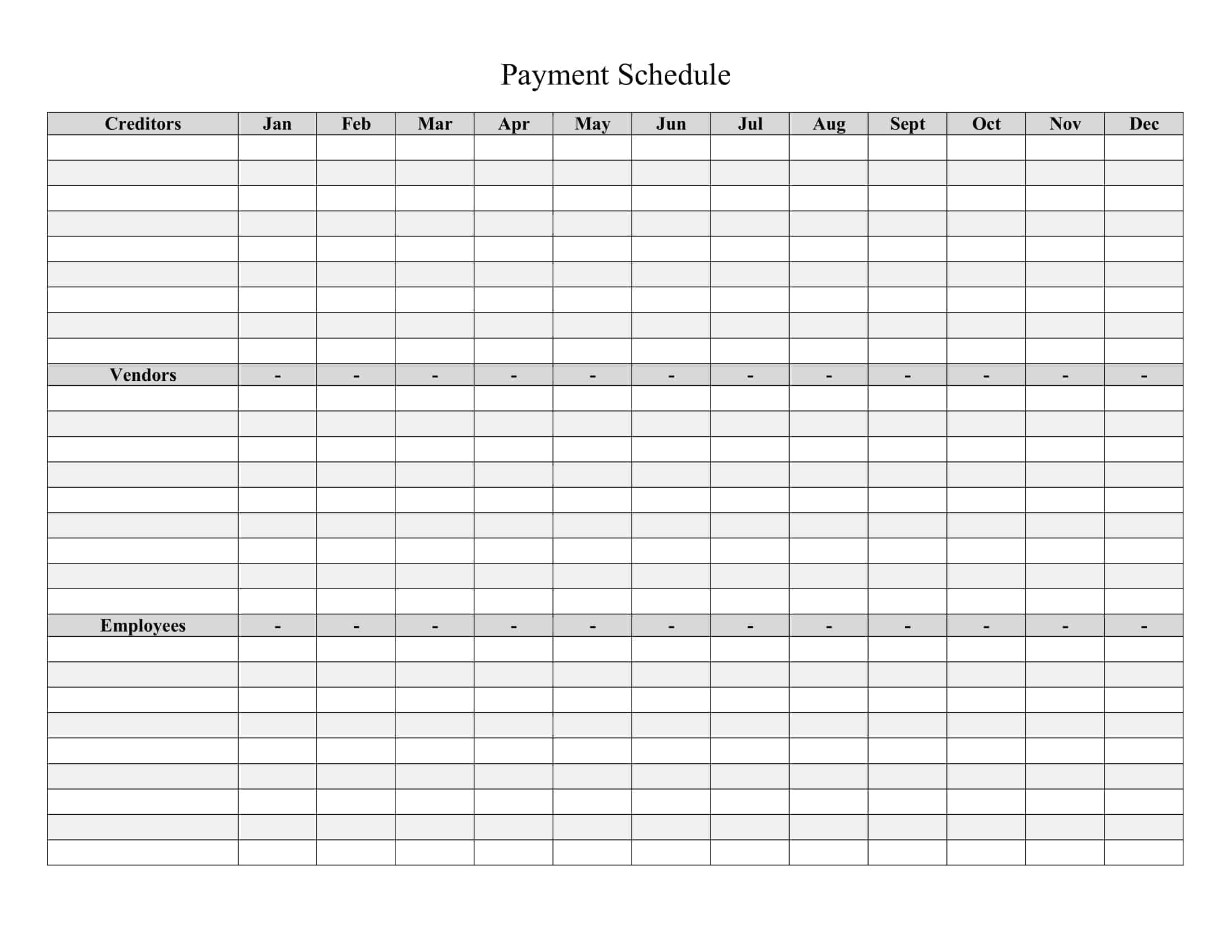

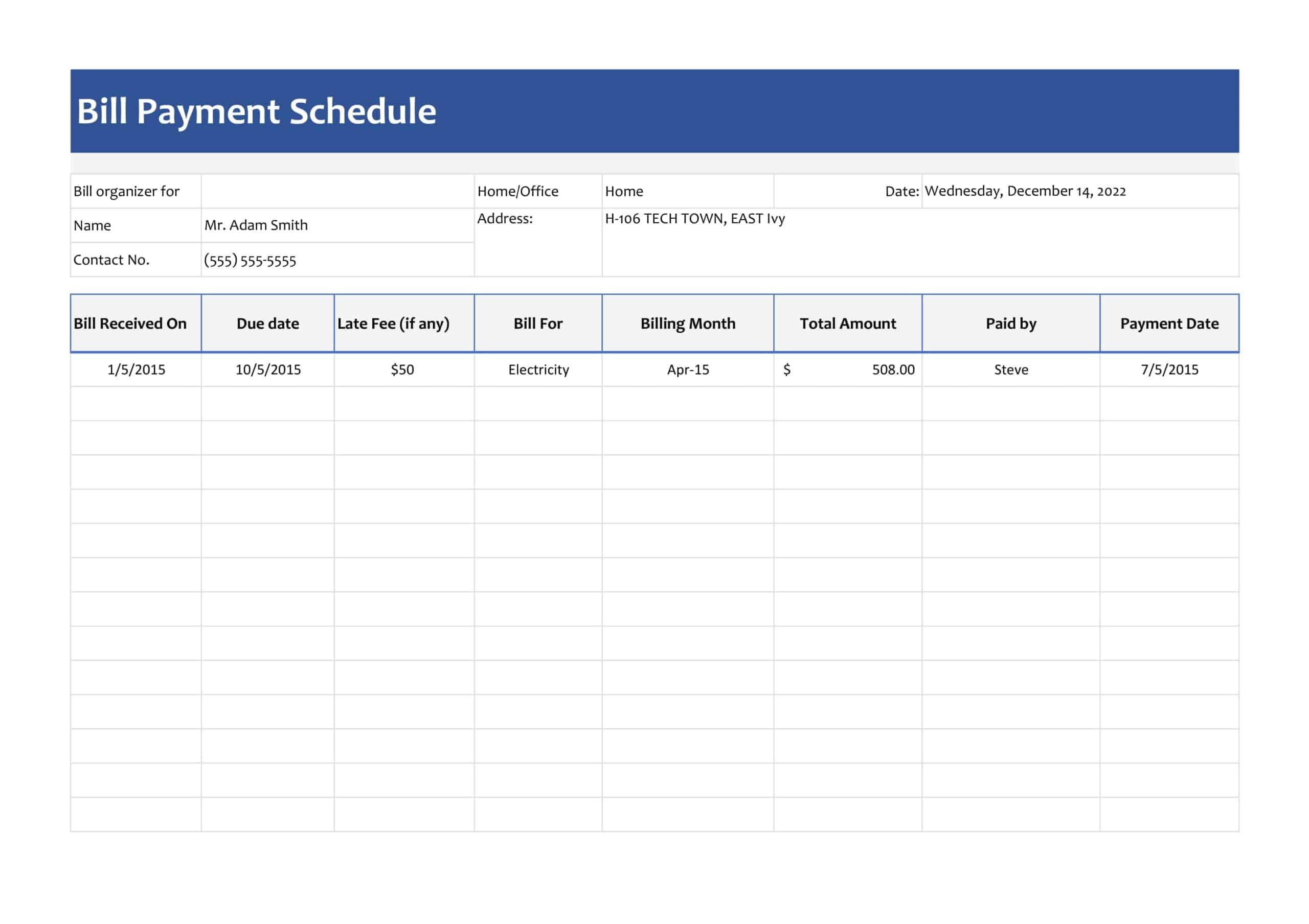

All this information can be conveniently prepared using a payment schedule template. A payment schedule can make it easier for you to manage the administration of any company with less staff and more shifts.

Table of Contents

Payment Schedule Templates

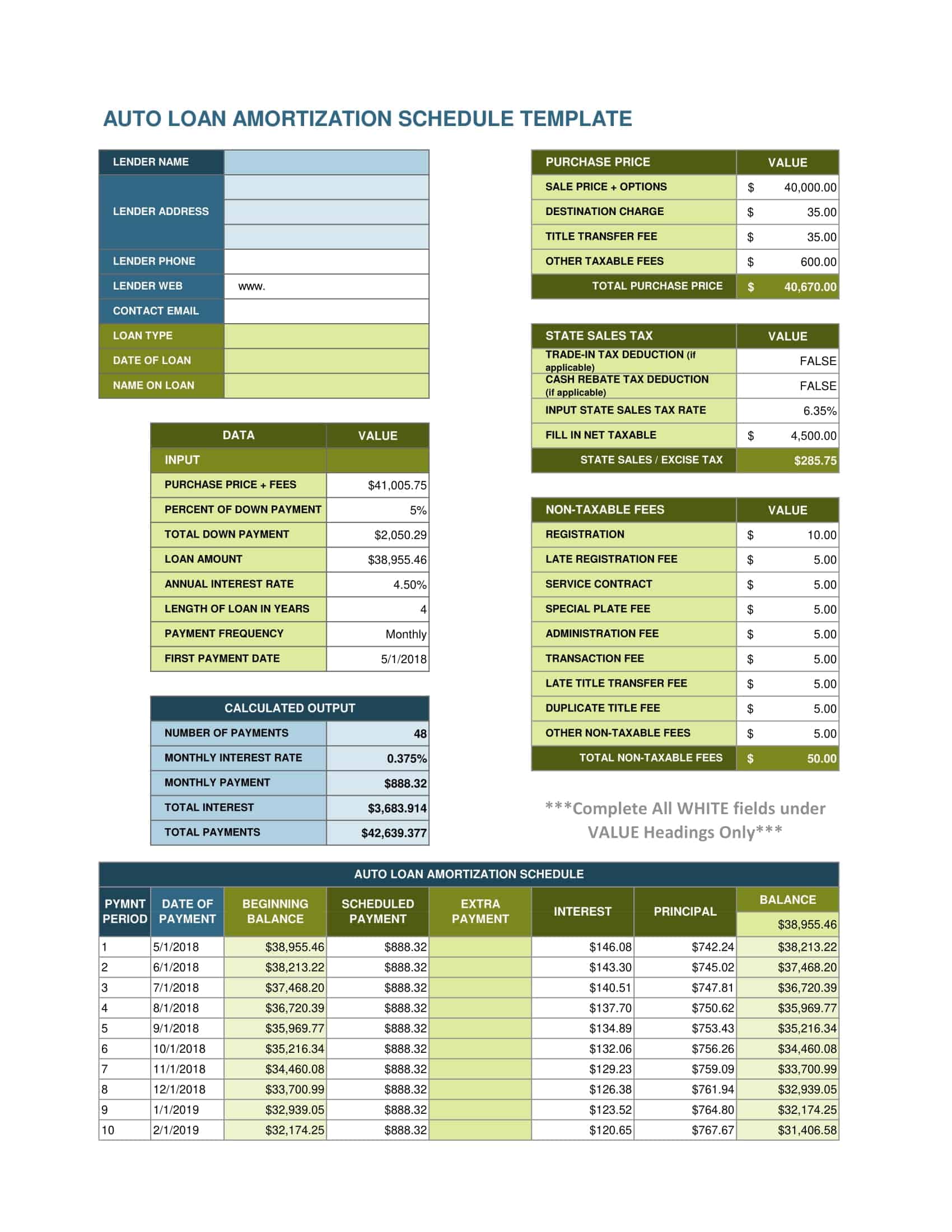

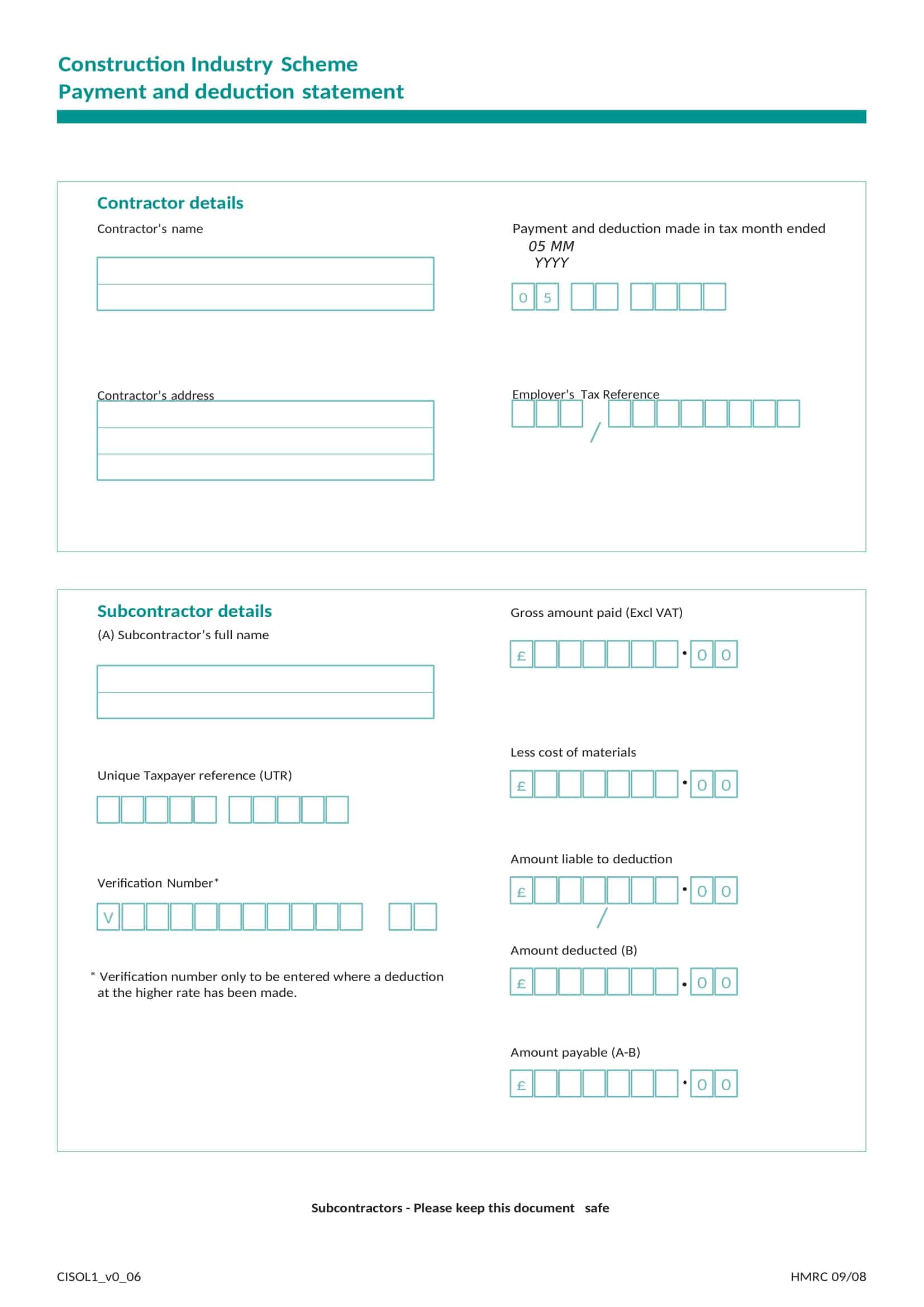

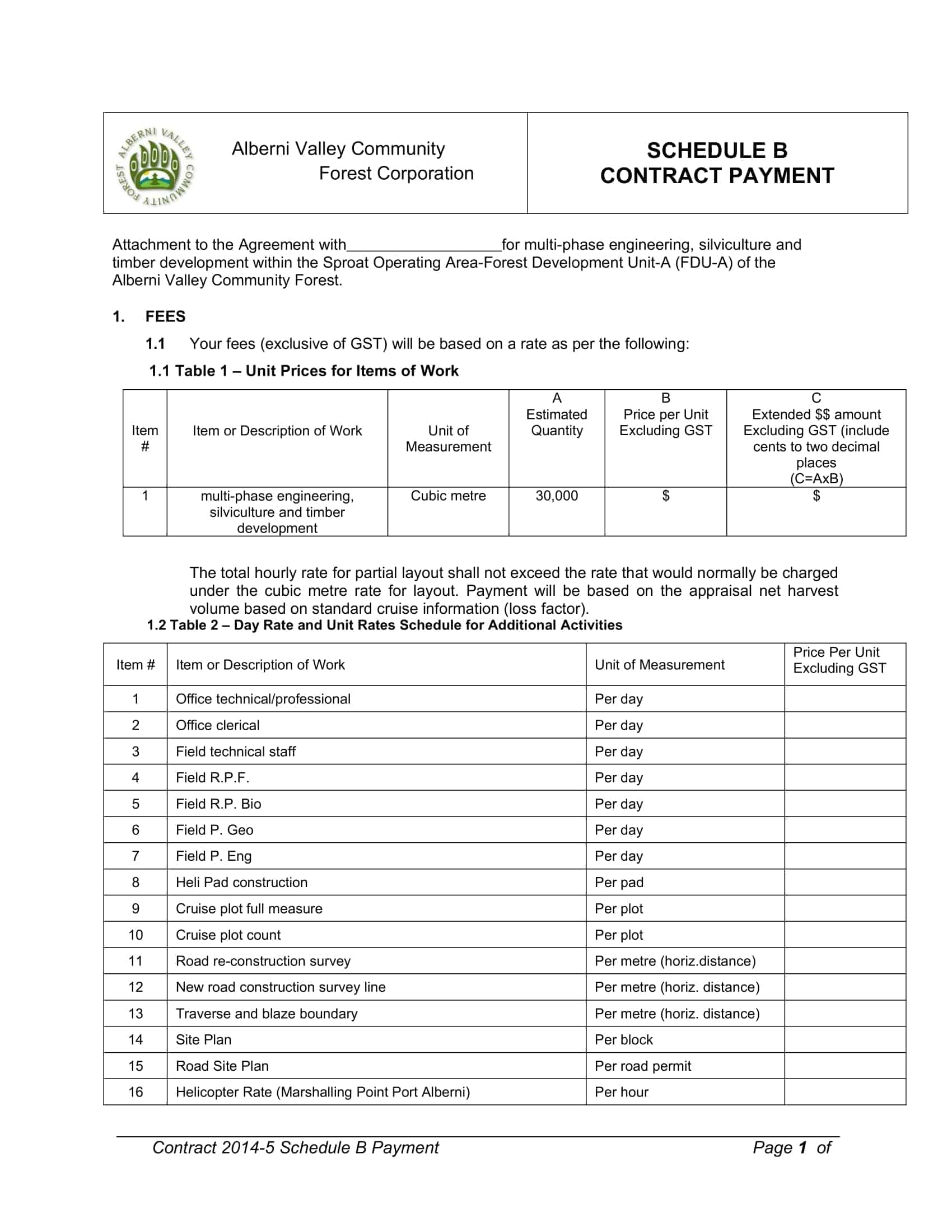

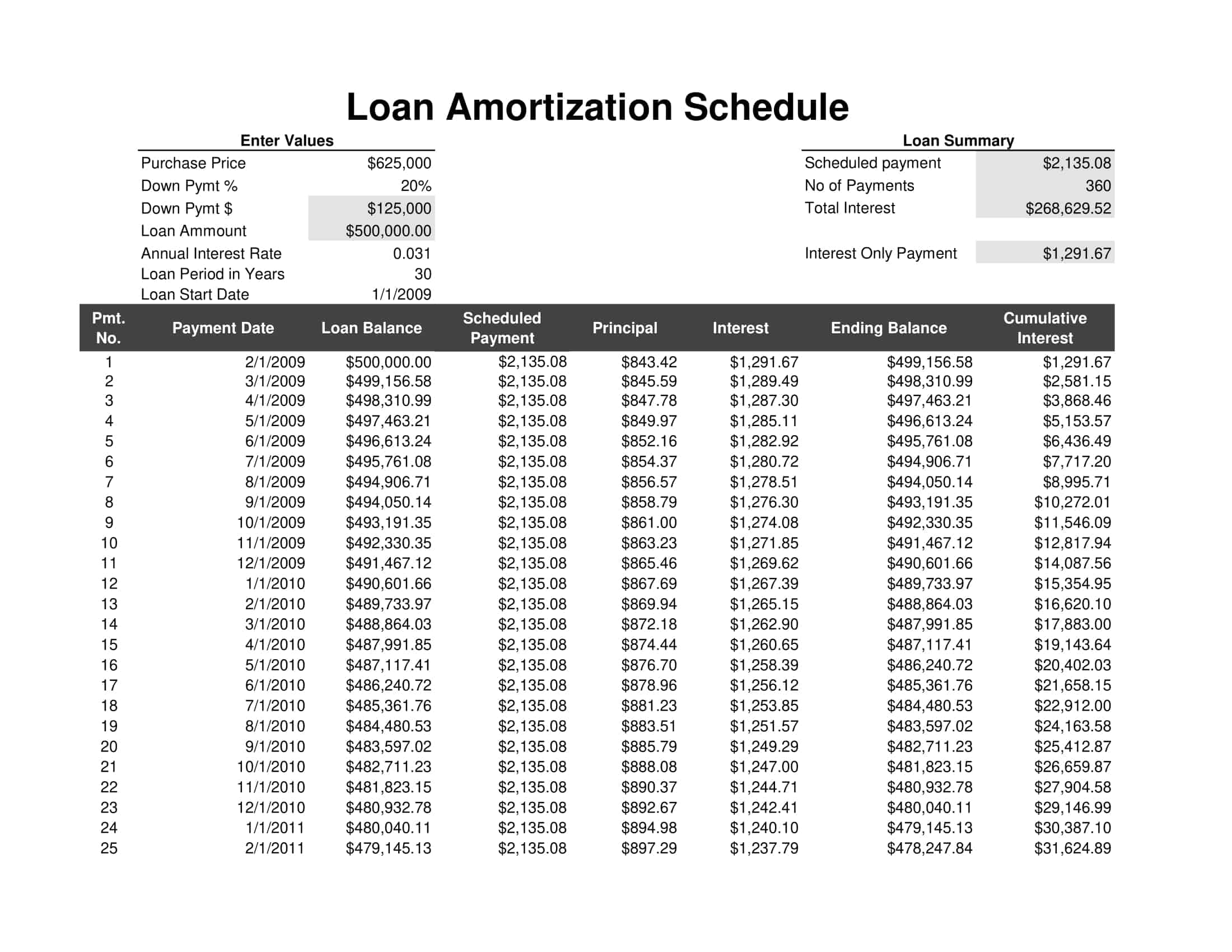

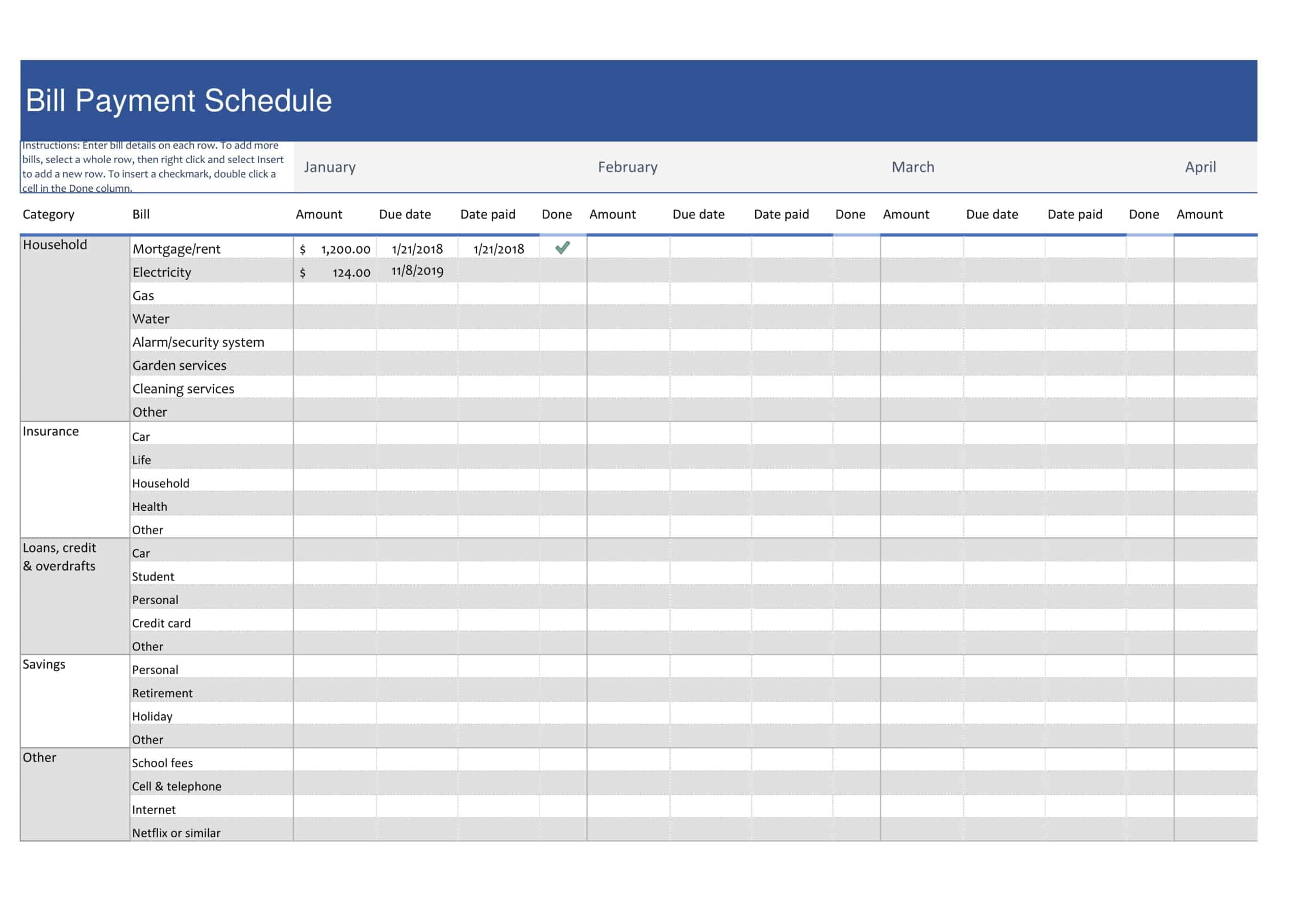

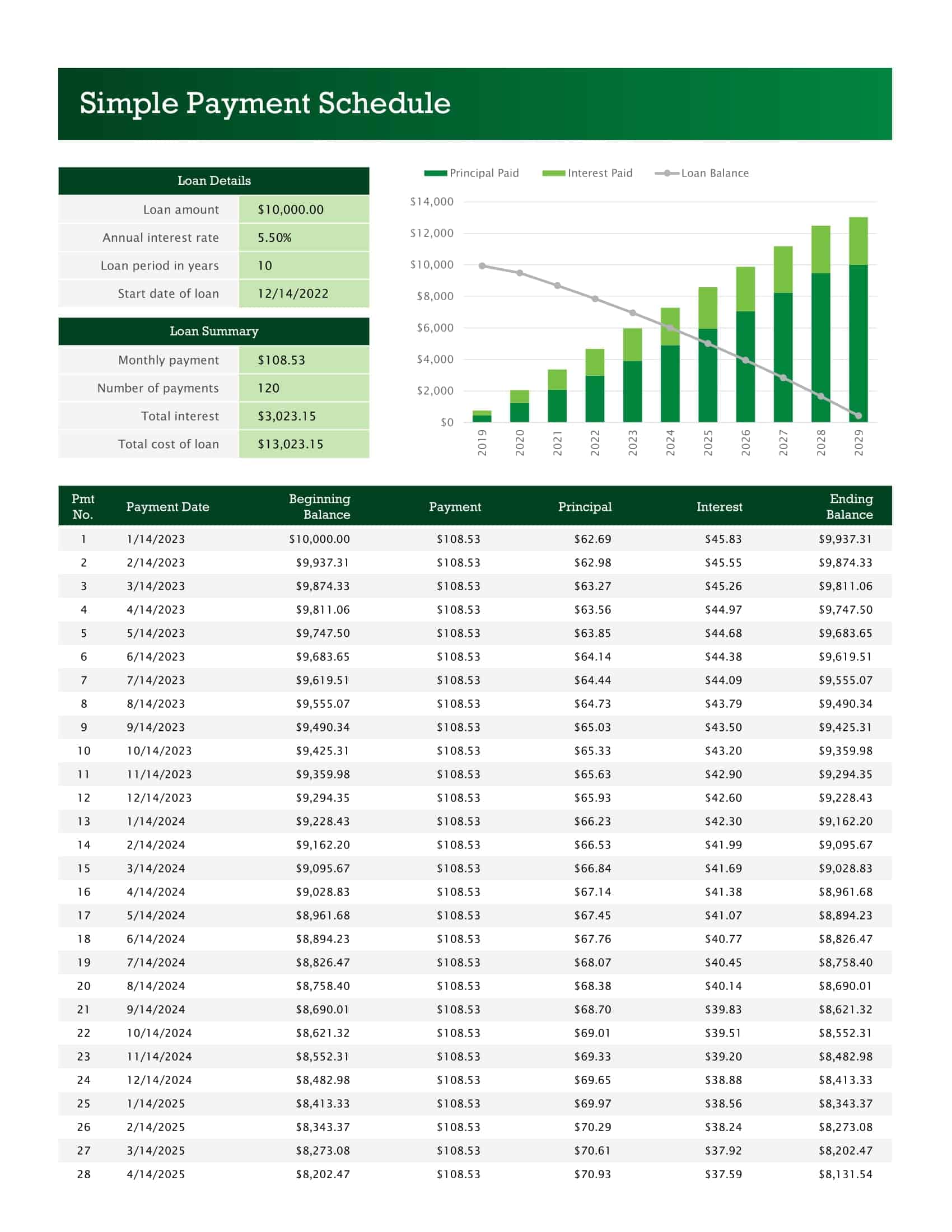

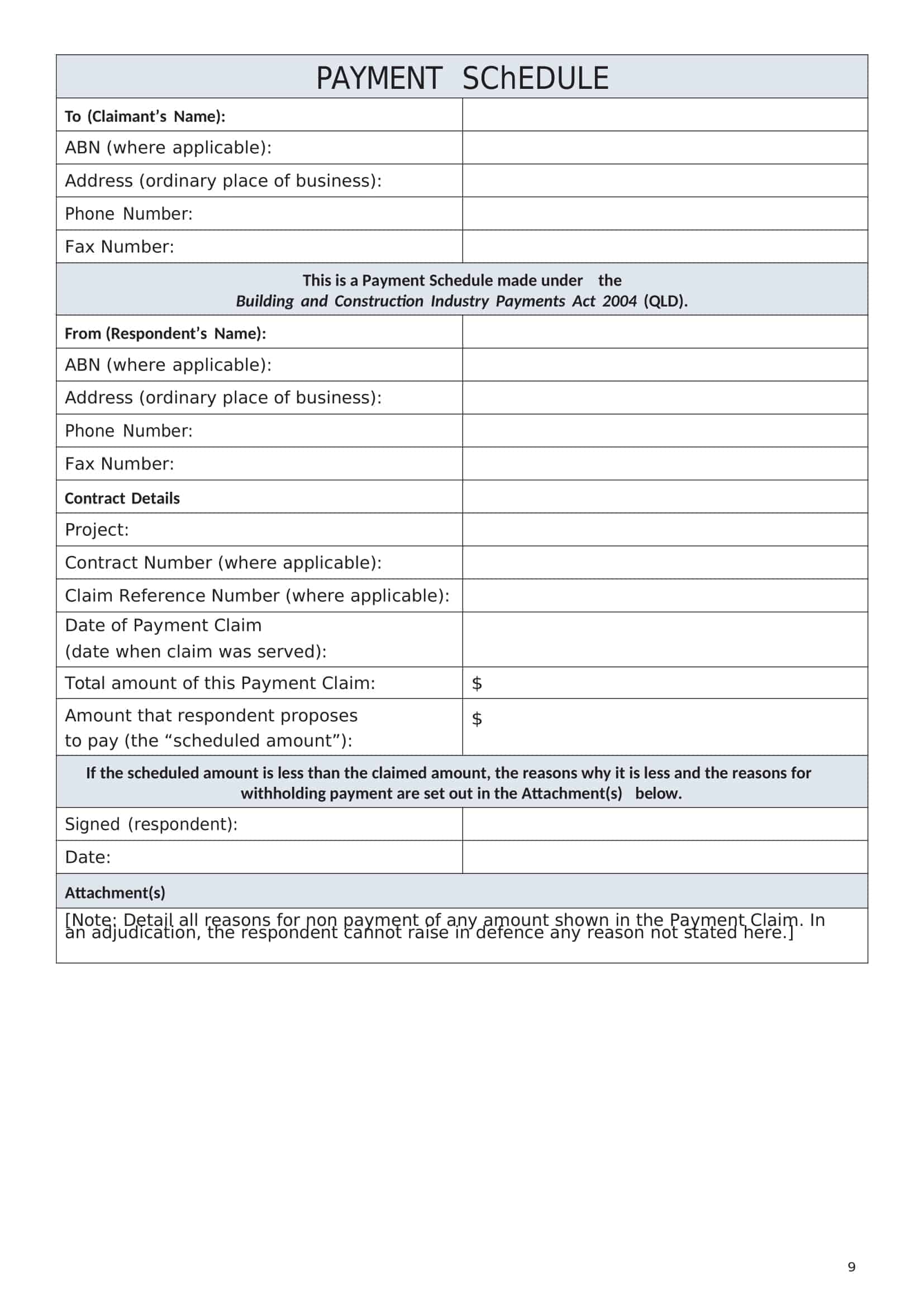

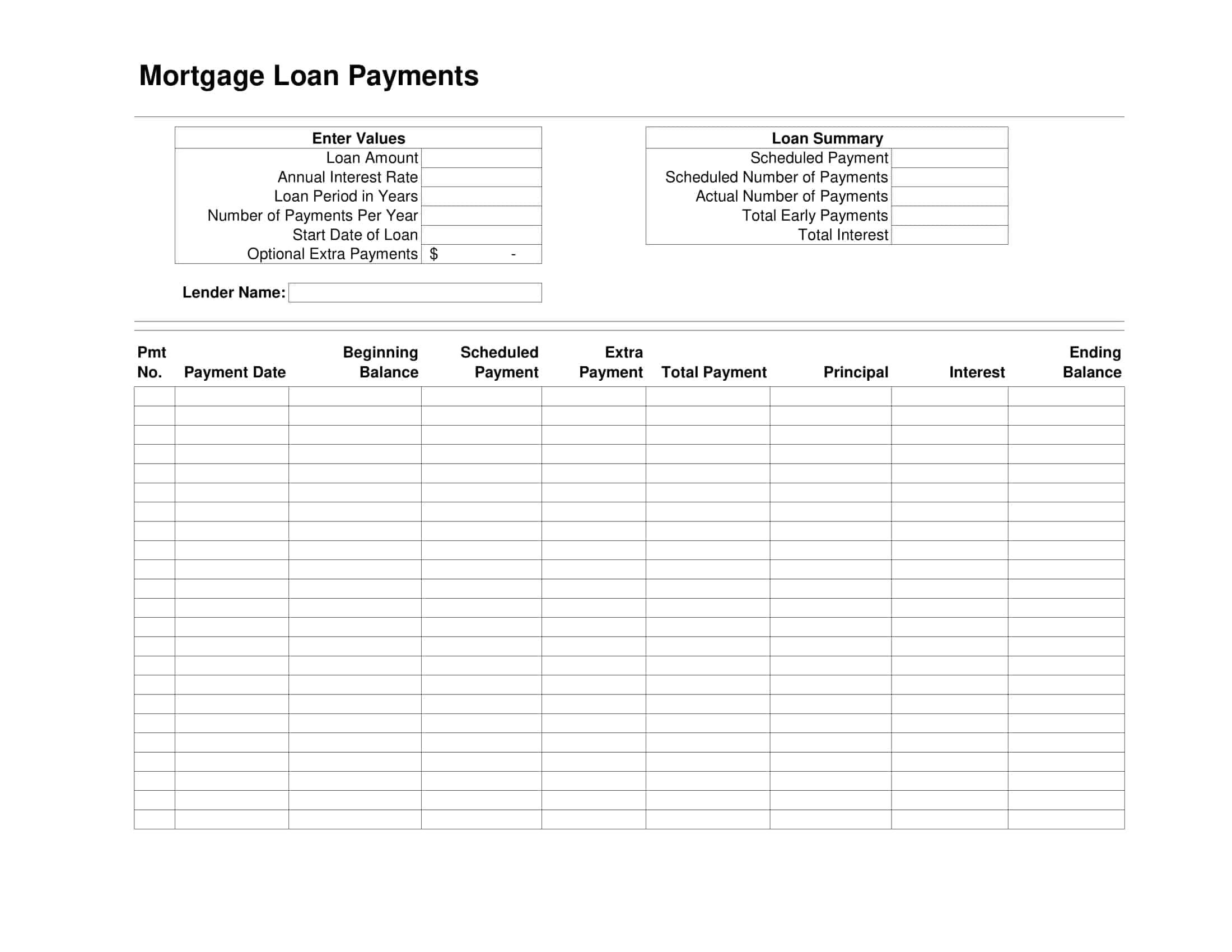

“Payment Schedule Templates” are pre-designed documents that provide a structured framework for outlining the timing and amounts of payments in various financial transactions or agreements. These templates serve as a valuable tool to organize and track the payment obligations between parties involved in loans, contracts, or installment plans.

Payment schedules are essential for establishing clear expectations and ensuring timely payments. These schedules typically include information such as payment due dates, the amount due for each installment, and any relevant terms or conditions related to the payment arrangement.

Payment schedule templates are often created by financial professionals or contract experts, ensuring accuracy and compliance with legal and financial regulations. They provide a convenient format for organizing payment information, enabling parties to track and manage their financial obligations effectively.

Why Is a Payment Schedule Template Important?

When you can fully use our payment schedule template, it will be easy to have a current record of payments. This is a famous Word document that contains all the relevant information on the date, payment amount, and details. You can easily retrieve information on who has made payment and when.

Entering everything is an effective way to get your payments up-to-date. It should not take more than a moment to find the required content, but it is worth noting that this approach contributes massively to transparent accounts for all parties involved.

How to Calculate a Payment Schedule?

Calculating a payment schedule for your company should be one of the first things on your to-do list. A well-thought-out and accurate payment schedule will ensure you get paid by your clients, but it can also provide you are paid on time.

The same type of payment schedule is used across all industries with the same terms and calculations that make it easy to understand no matter the industry.

To examine your expenses, you need to come up with a list of all the current payments your company is prioritizing. To do this, start by listing all things that should be paid monthly. This will include rent, payroll, insurance, and utilities that you may or may not have in a fixed budget.

- Make sure to include these companies and individuals in your invoicing system, and whether you’re on the receiving end or sending one out, be sure you know the payment schedule for each. This can ensure that everyone is paid on time and nobody’s getting stiffed.

- The next element is to classify your payment schedule by the period. There are several payment methods: daily, weekly, bi-weekly, monthly, annually, or whatever basis you prefer. Then it would help if you decided on the specific sum you should receive weekly or monthly.

Pros and Cons: Different Types of Payroll Schedules

- A weekly payment schedule is a regular, consistent pay plan that pays workers or contractors, usually every week. Weekly payment schedules are convenient for most workers since they can receive their payments regularly and on time. However, this is considered a hassle-free arrangement for both parties, some more than others seem to prefer it.

- On a bi-weekly payment schedule, workers can receive their total wages for each two-week pay period from their employers. This has a positive impact on the workers because they don’t have to deal with the headache of double calculations, and also, there are chances of error that arise when they need to be paid two times a month.

- Bi-monthly payments are becoming increasingly popular among freelancers who work on larger projects. Why? Because it’s one less thing to worry about. The uncertainty of whether or not your client will pay you because you’ve put so much time and effort into a project (on-time delivery and top quality) has always been the number one contributor to late payments. Paying freelancers bi-monthly helps to eliminate this issue.

- Monthly payments are the former payment schedules. It is done once every month. This is the most preferred by employers because it costs less processing costs. However, it is less preferred by employees who feel that the thirty-day waiting period is extended.

Conclusion

When it comes to paying your bills on time, a payment schedule template offers a simple way of keeping all your payments organized and reduces the chances of forgetting one or more. Having a working payment schedule template will save you time and reduce the possibility of failure to pay any accrued due amounts.

Contractors, Designers, Freelancers, and many others, can benefit from having a payment schedule template that can be loaded onto a computer to create an original template to use repeatedly.

FAQs

What is a Payment Schedule?

A Payment Schedule is a detailed outline that specifies when payments are to be made for a particular debt or service, along with the amount due on each payment date.

What is the purpose of a Payment Schedule?

The purpose is to provide a structured plan to ensure the debtor can manage repayments and the creditor receives payments in a timely manner.

How is a Payment Schedule created?

It can be created manually or using software, taking into account the total amount owed, the payment frequency, the interest rate if any, and the duration of the payment period.

What information is included in a Payment Schedule?

Information such as the total amount due, payment due dates, payment amounts, balance remaining, and any applicable interest or fees are included.

Can a Payment Schedule be altered?

Changes to a Payment Schedule typically require agreement from both parties. Conditions for changes should be stipulated in the original agreement.

What is the difference between a Payment Schedule and a Payment Plan?

A Payment Schedule is a part of a Payment Plan, detailing the dates and amounts of each payment. A Payment Plan is a broader agreement covering the terms and conditions of the repayment.

Is a Payment Schedule legally binding?

Yes, especially when it is part of a formal agreement or contract between the debtor and the creditor.

How does a Payment Schedule work with interest?

The schedule will allocate portions of each payment to interest and principal reduction, typically paying down interest first before reducing the principal.

What happens if a payment is missed on a Payment Schedule?

Missed payments may incur late fees, higher interest charges, and could affect credit scores. It’s crucial to understand the penalties as outlined in the agreement.

What types of loans or agreements use Payment Schedules?

Various types like personal loans, mortgages, auto loans, construction projects, and service contracts use Payment Schedules to manage repayments and ensure financial clarity.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)