A loan agreement is a legally binding document that outlines the terms and conditions under which a lender agrees to provide financing to a borrower. It details the amount of the loan, the interest rate, the repayment schedule, and any collateral that may be required.

A loan agreement serves as a protection for both the lender and the borrower by setting clear expectations and mitigating the risk of default. It is important to understand the terms of a loan agreement before signing, as it can have a significant impact on one’s financial future.

Table of Contents

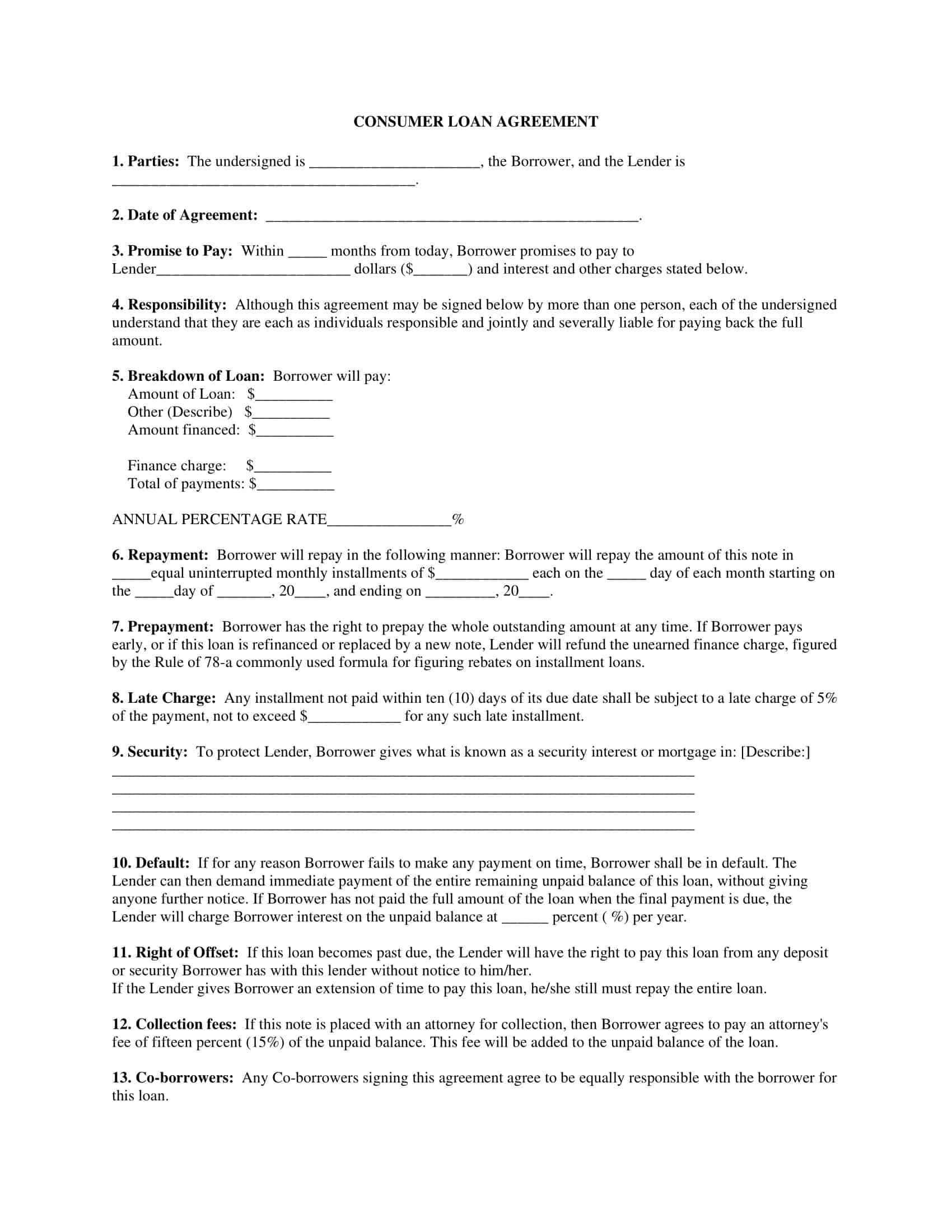

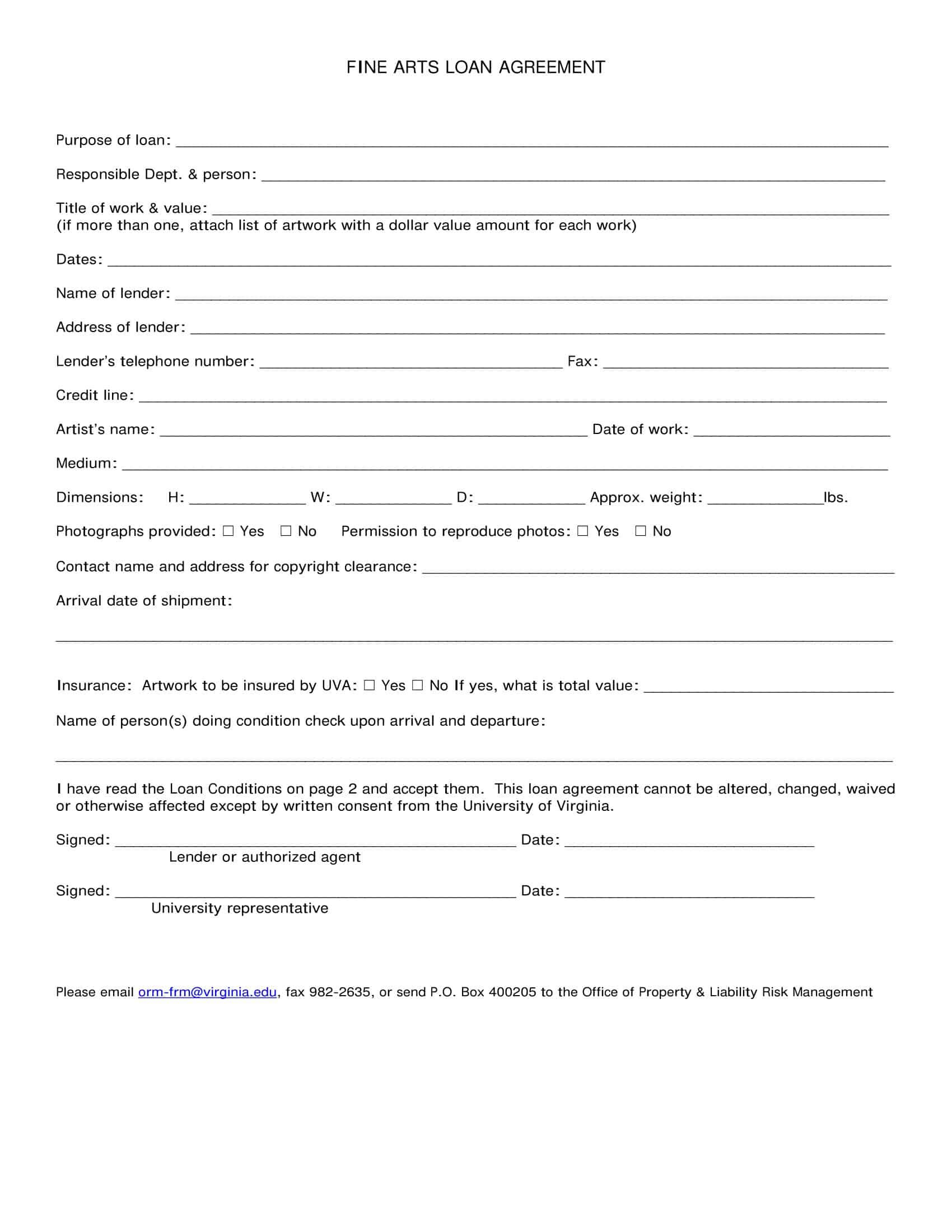

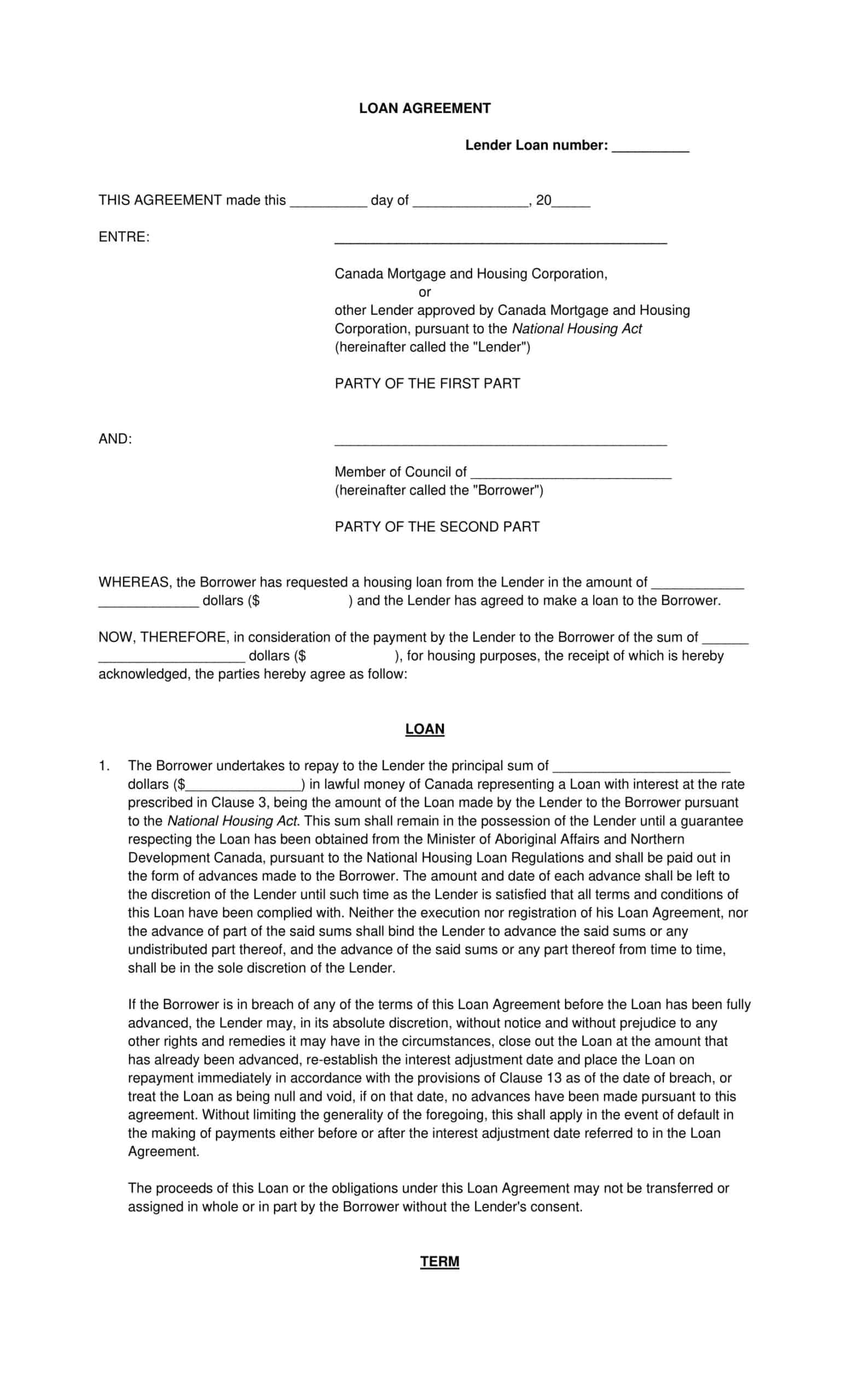

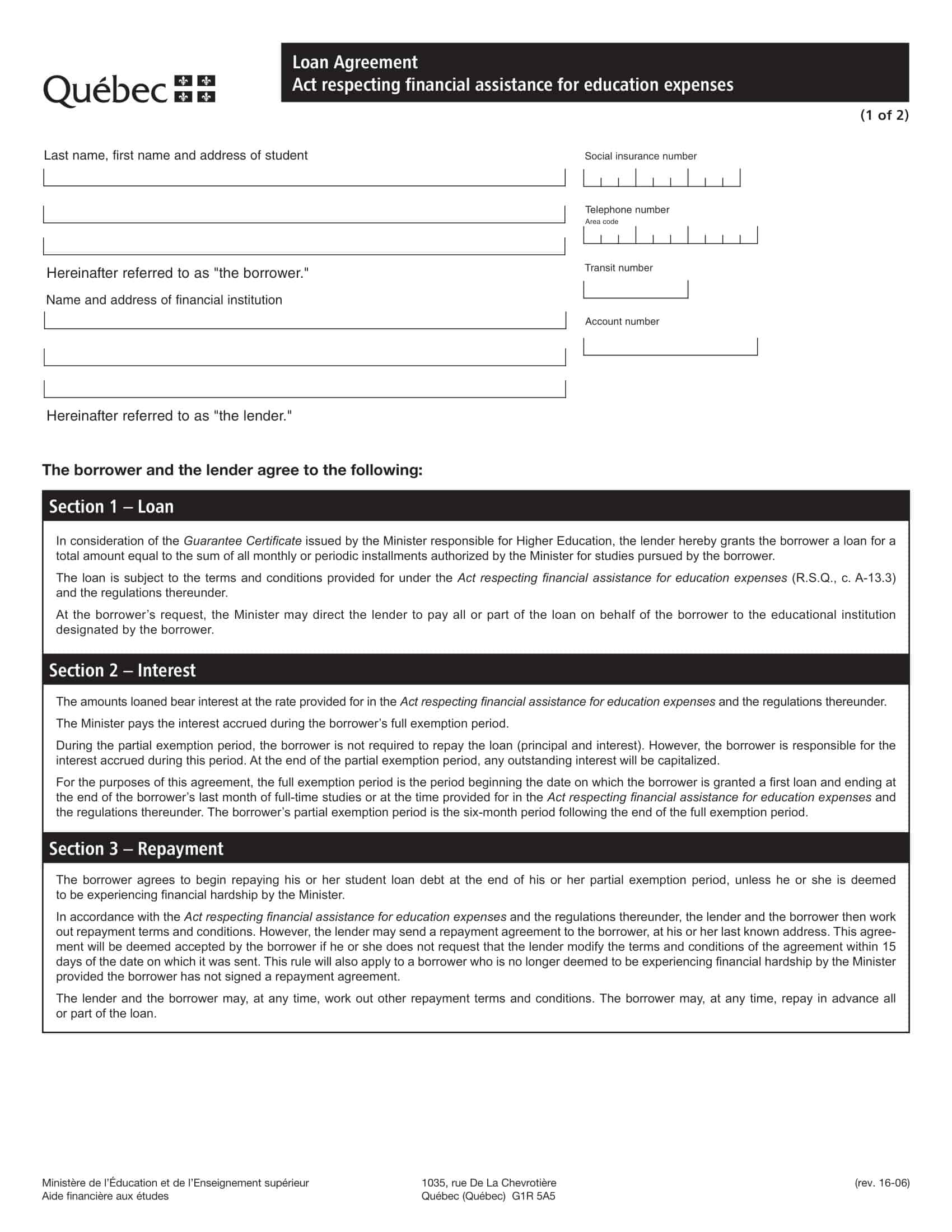

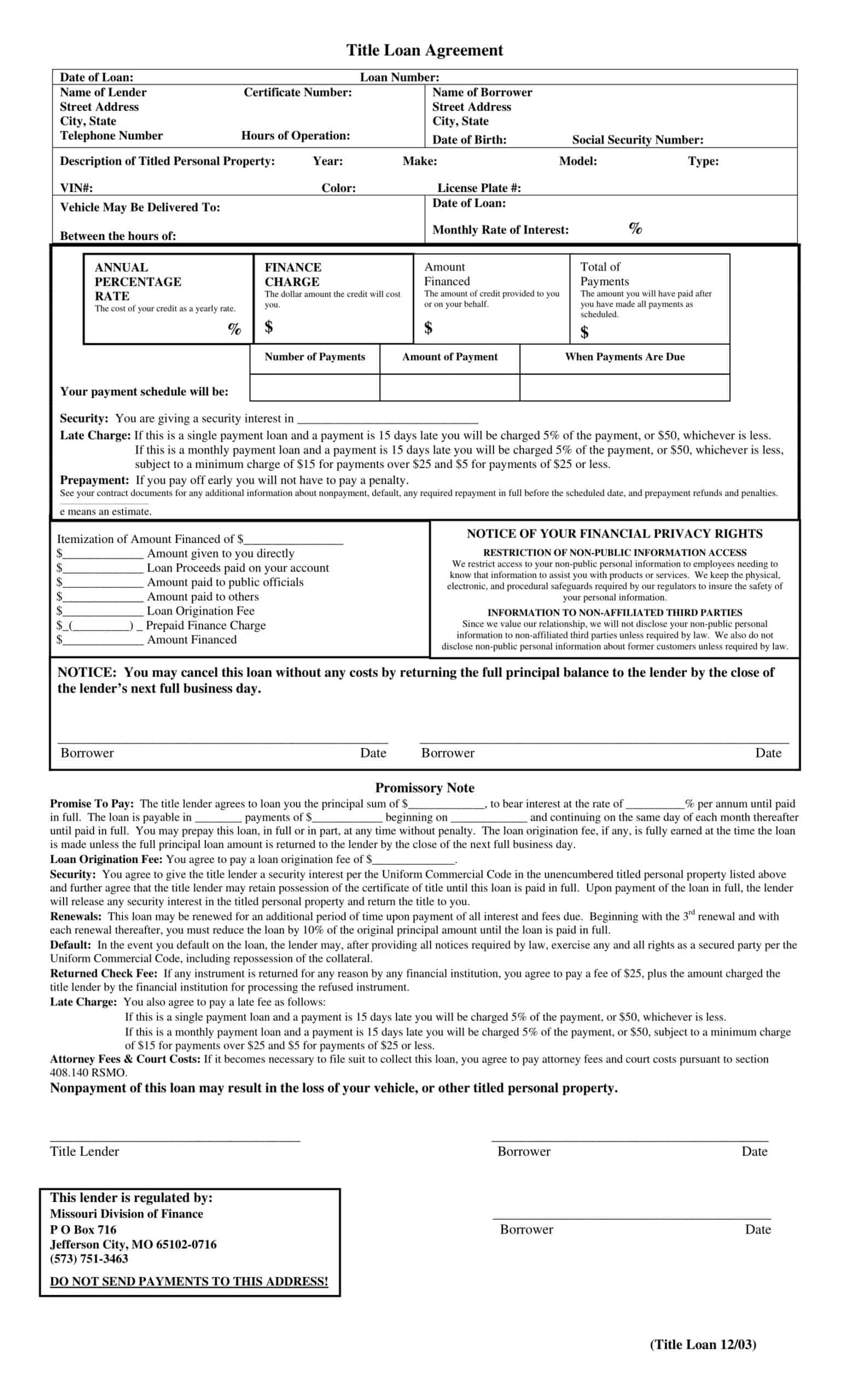

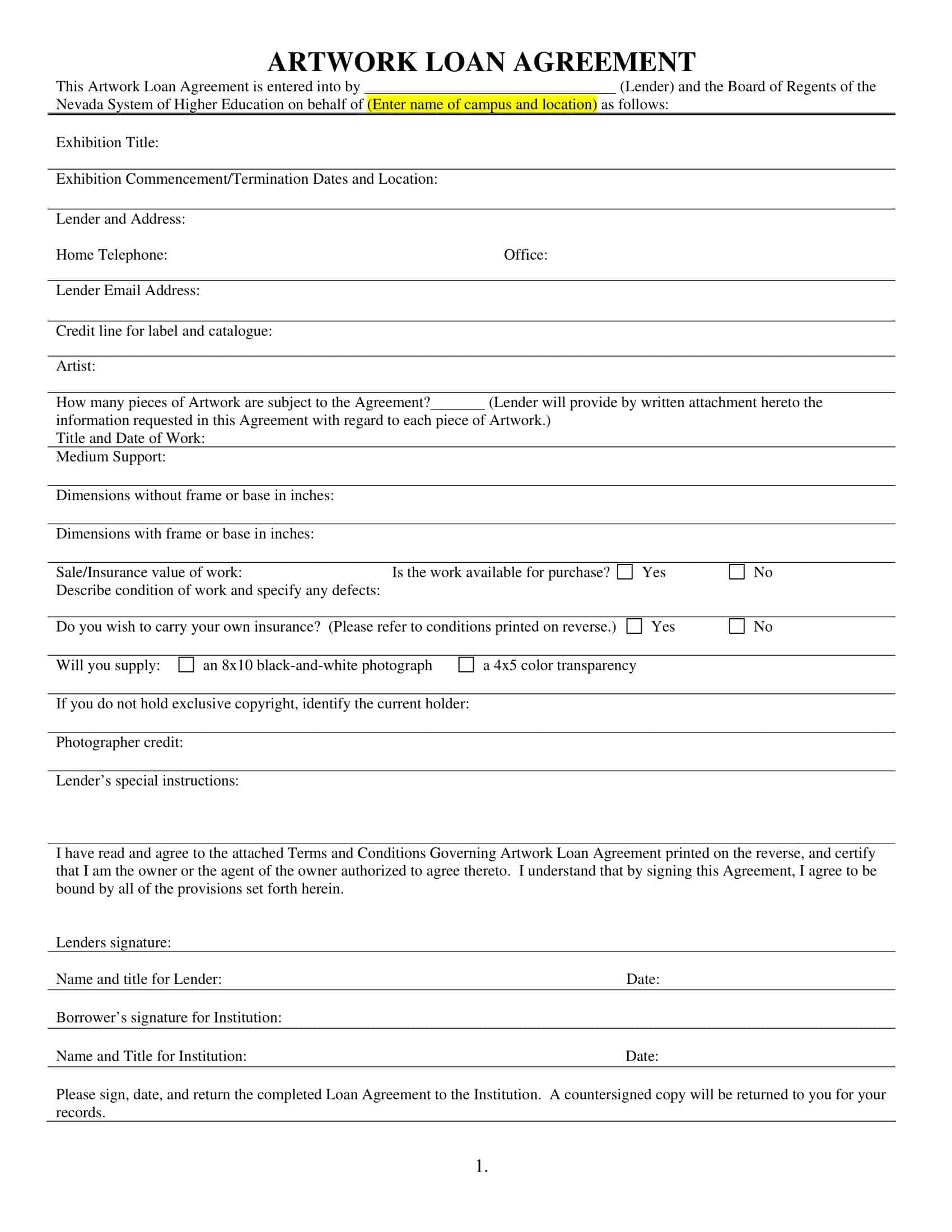

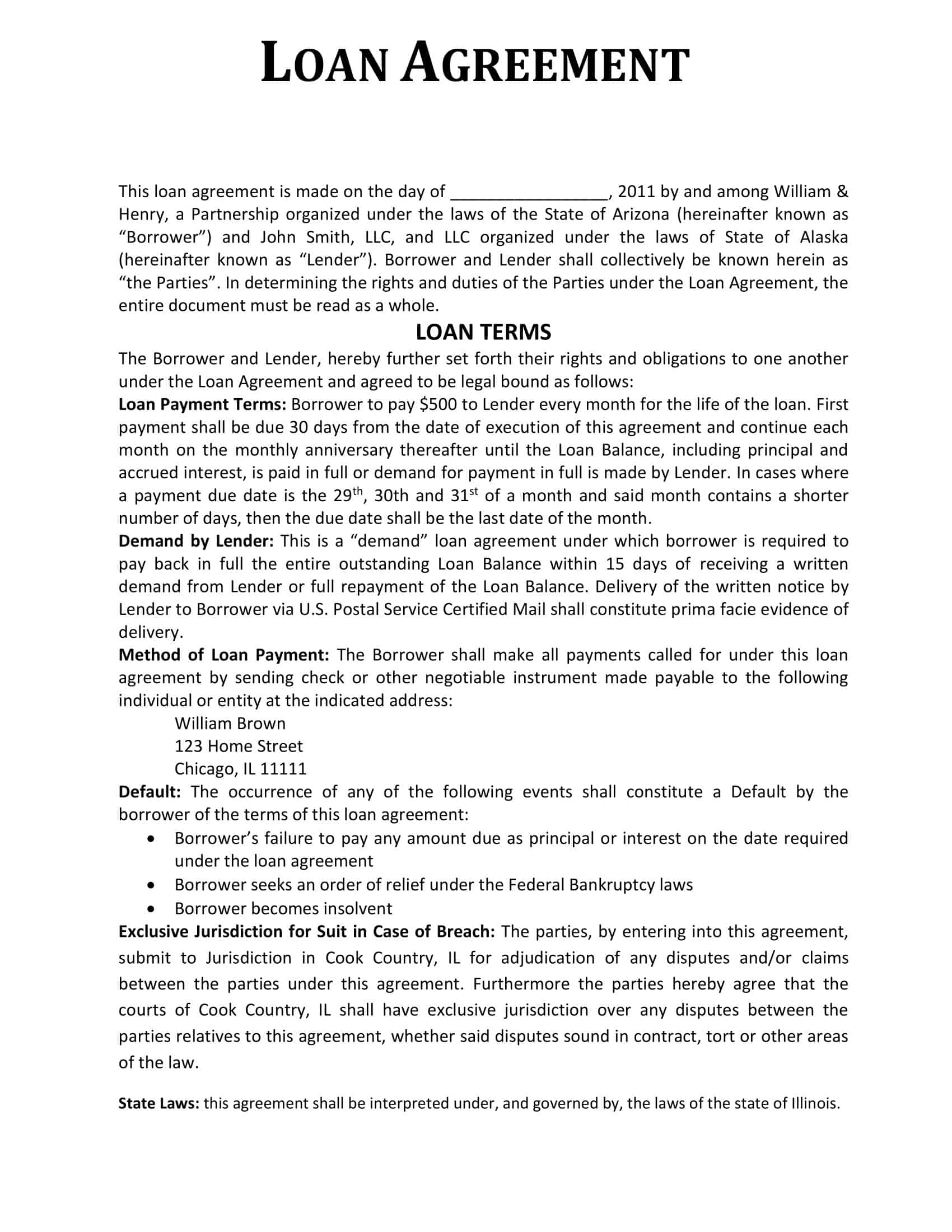

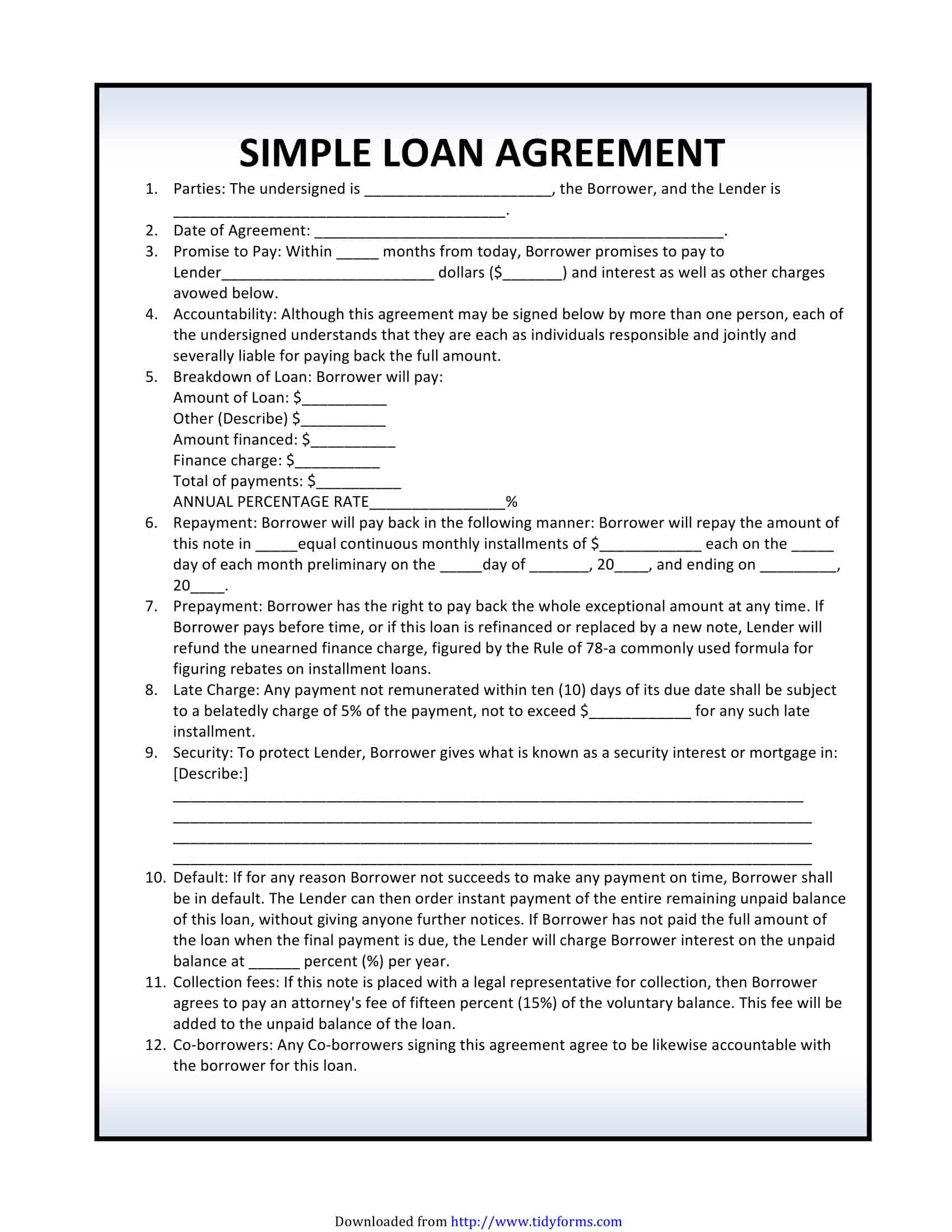

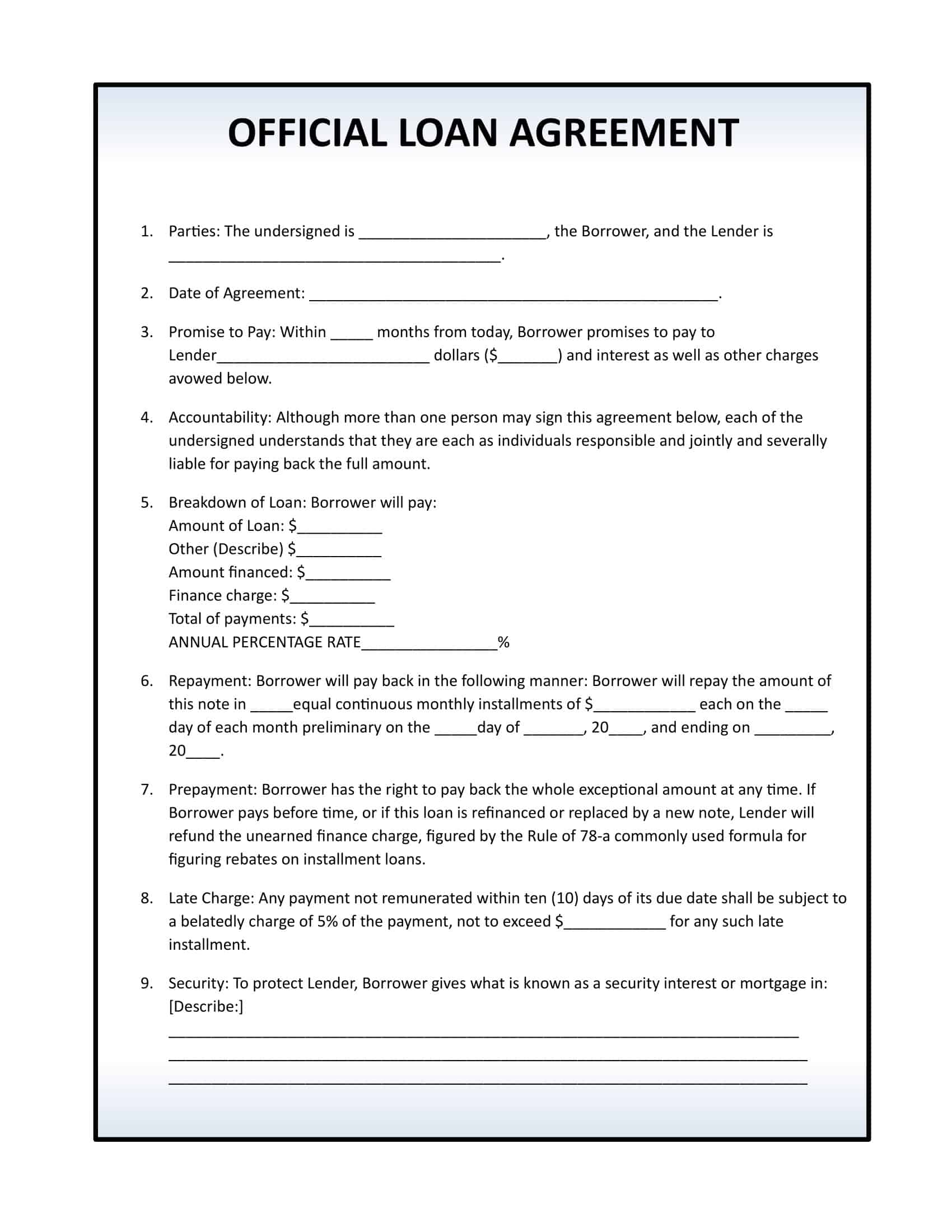

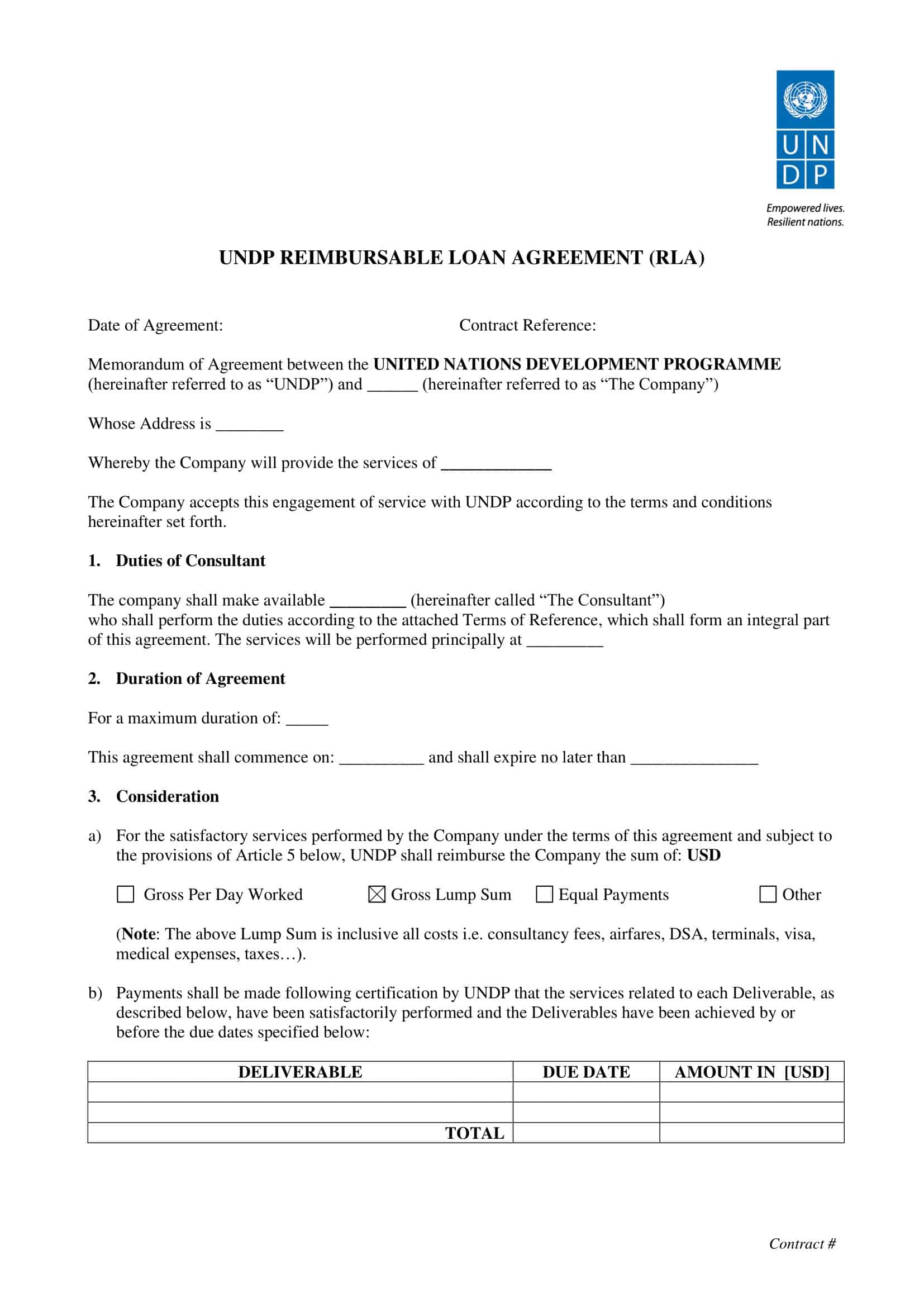

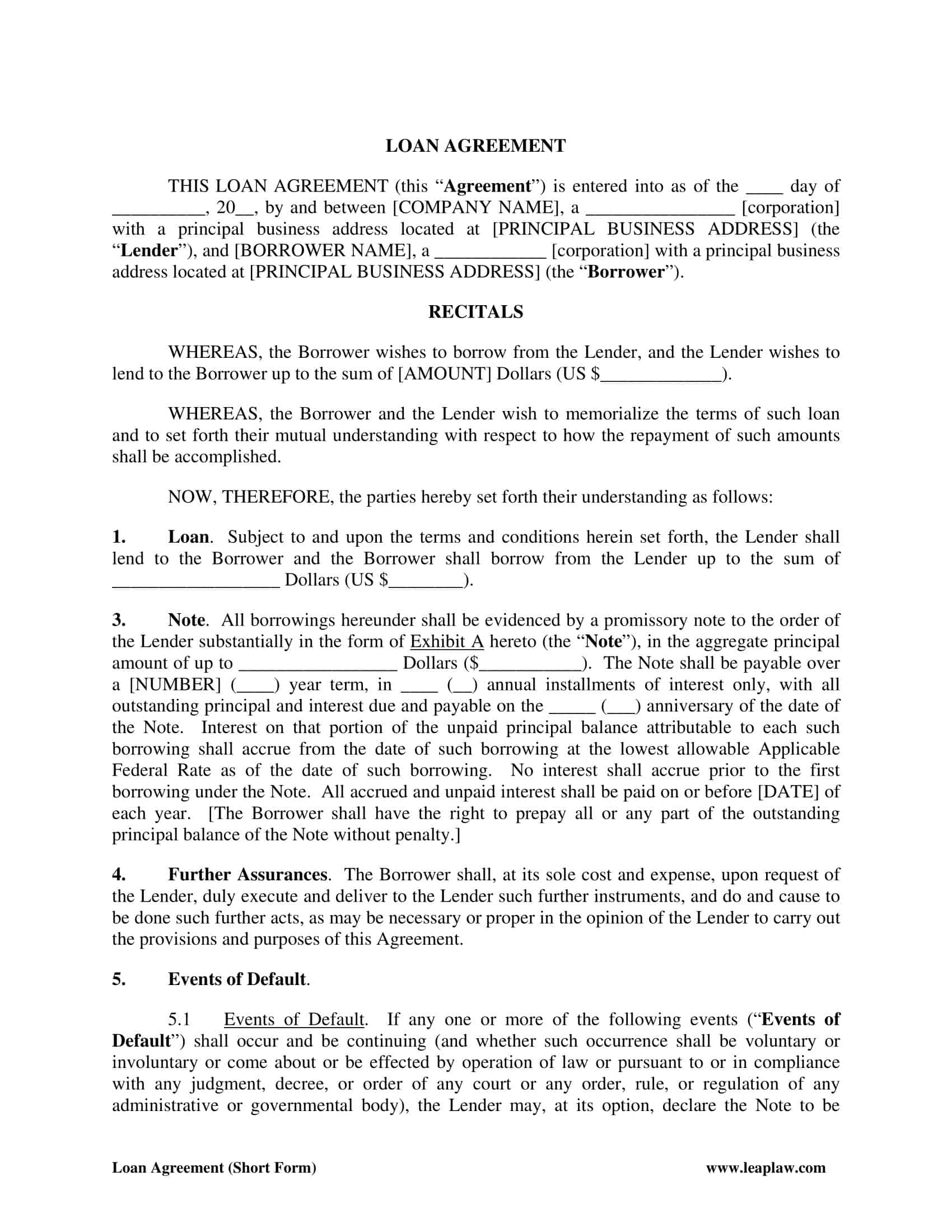

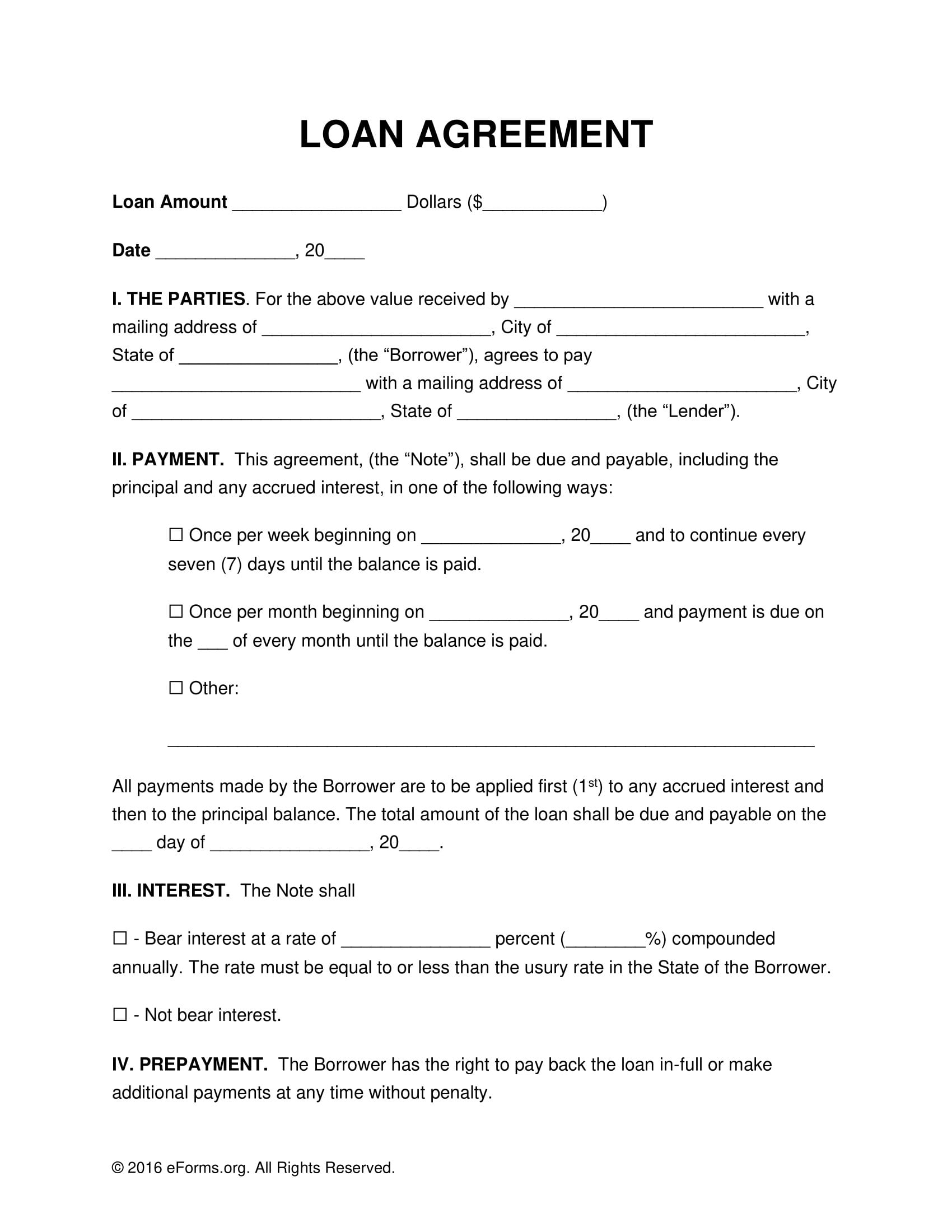

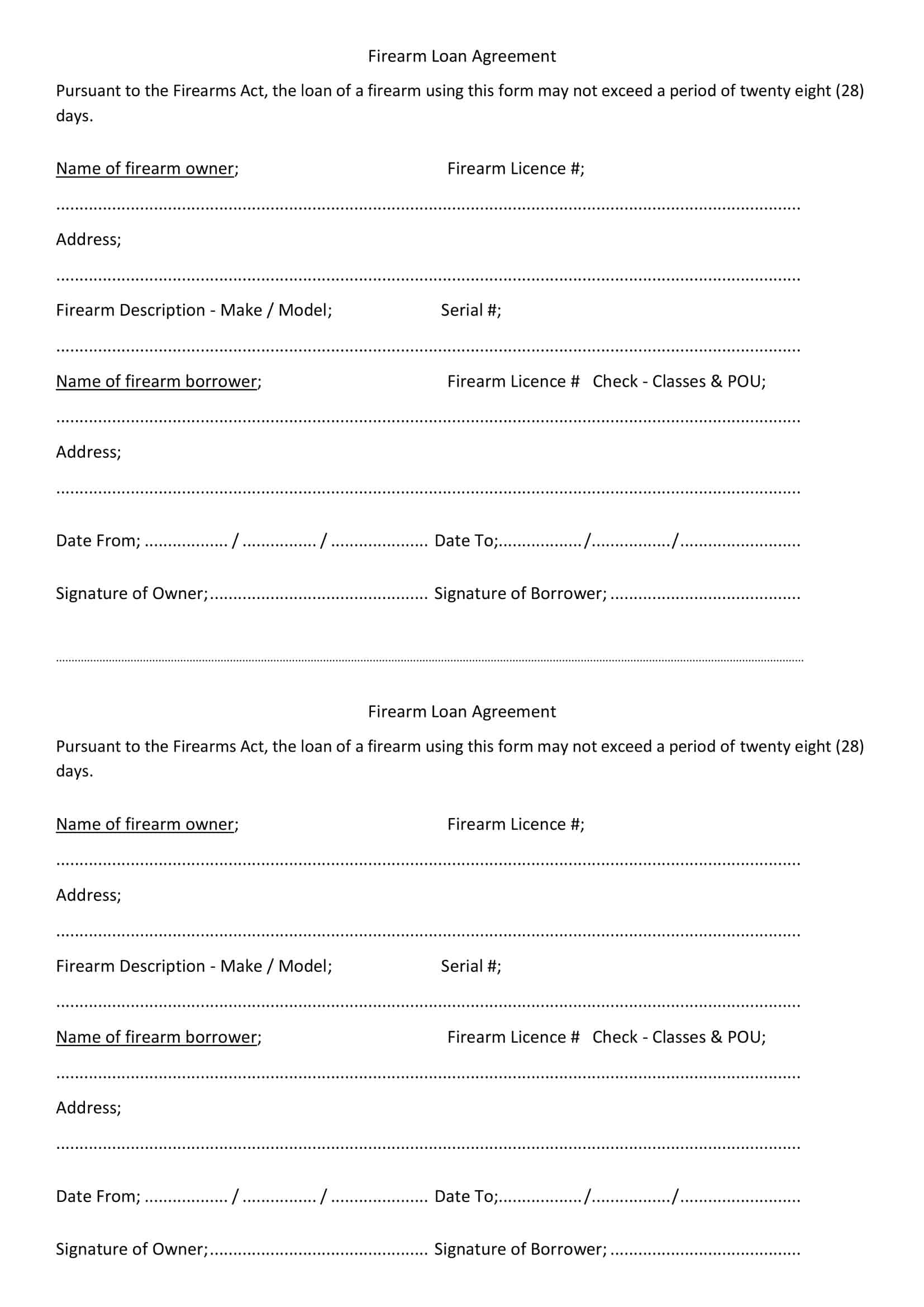

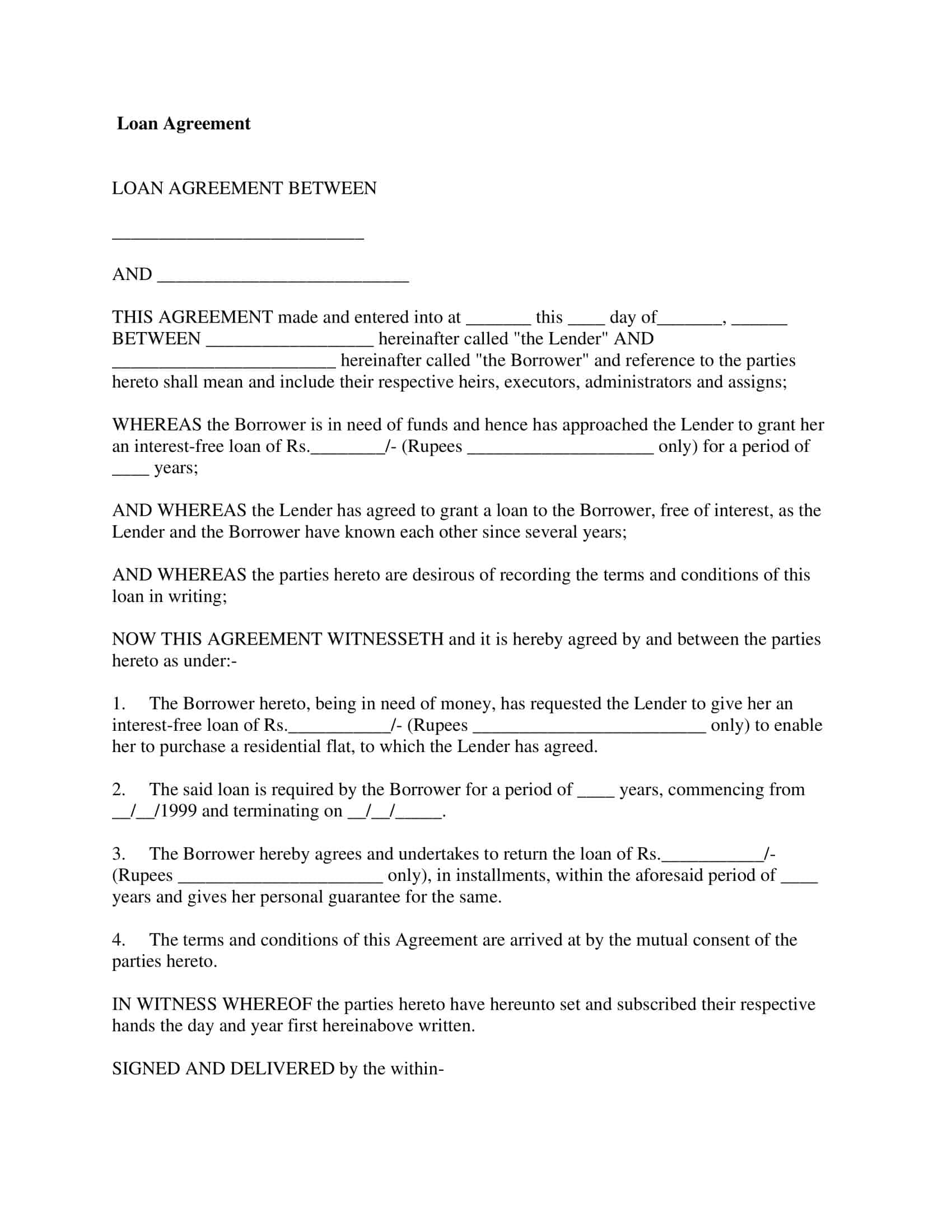

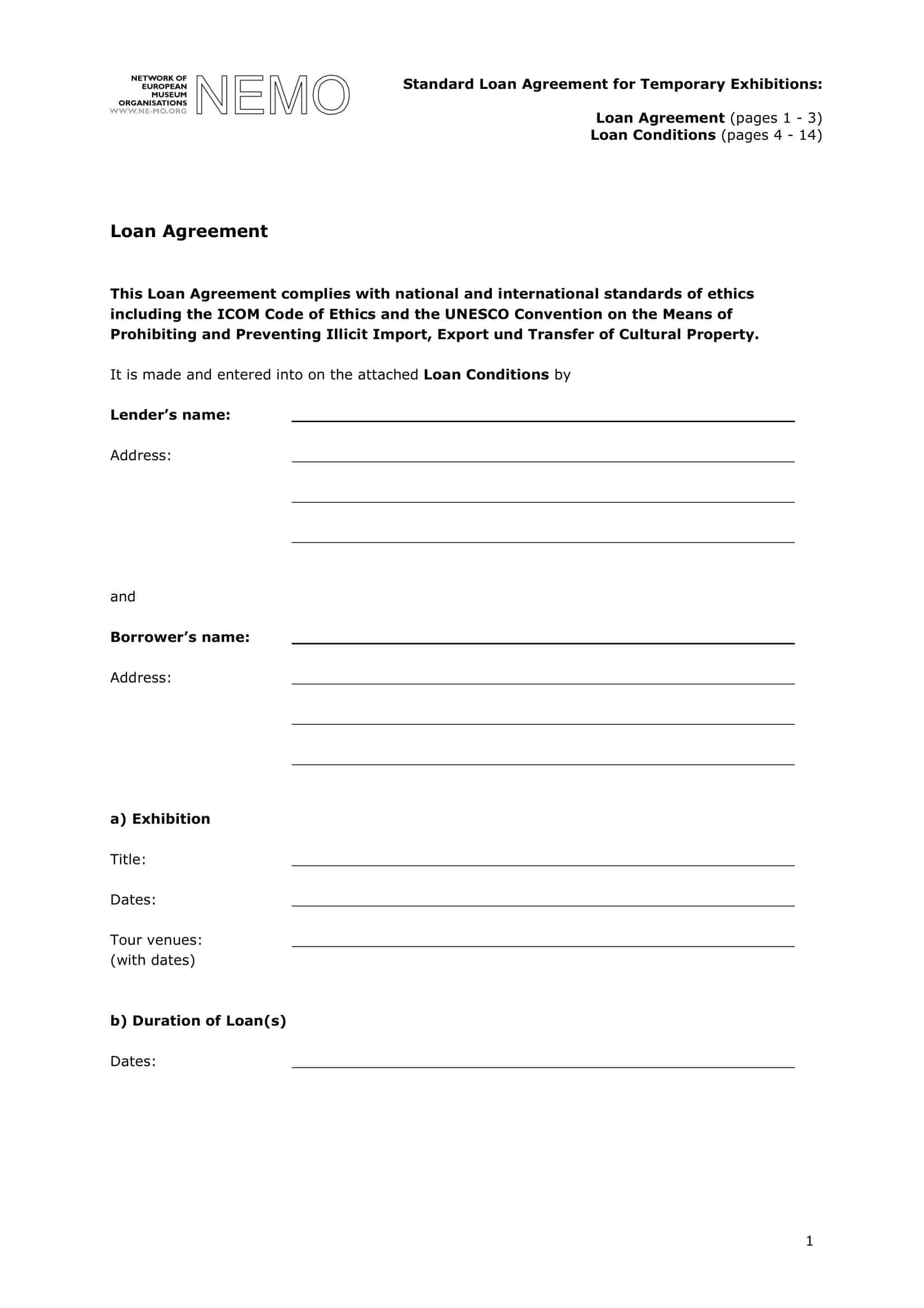

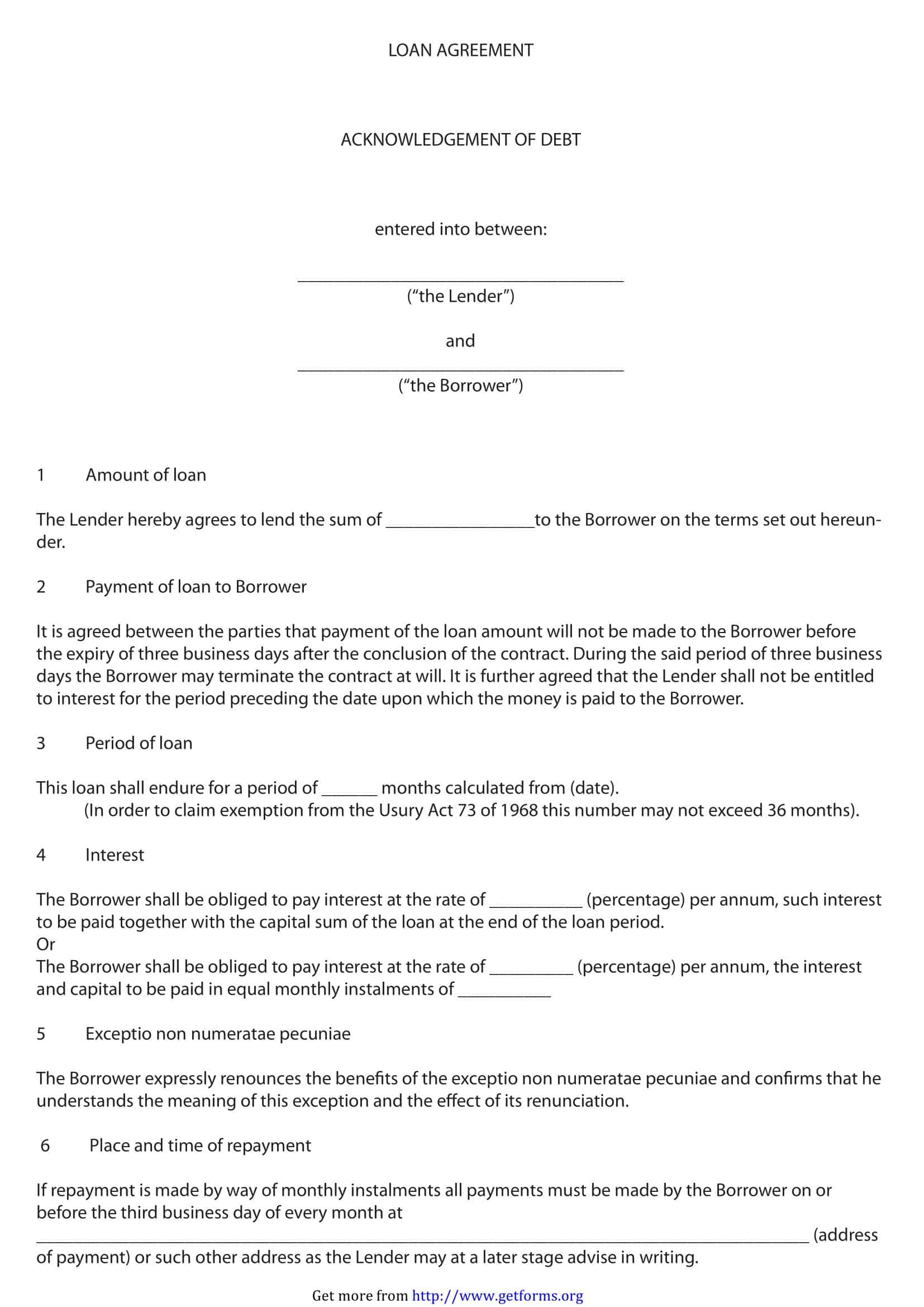

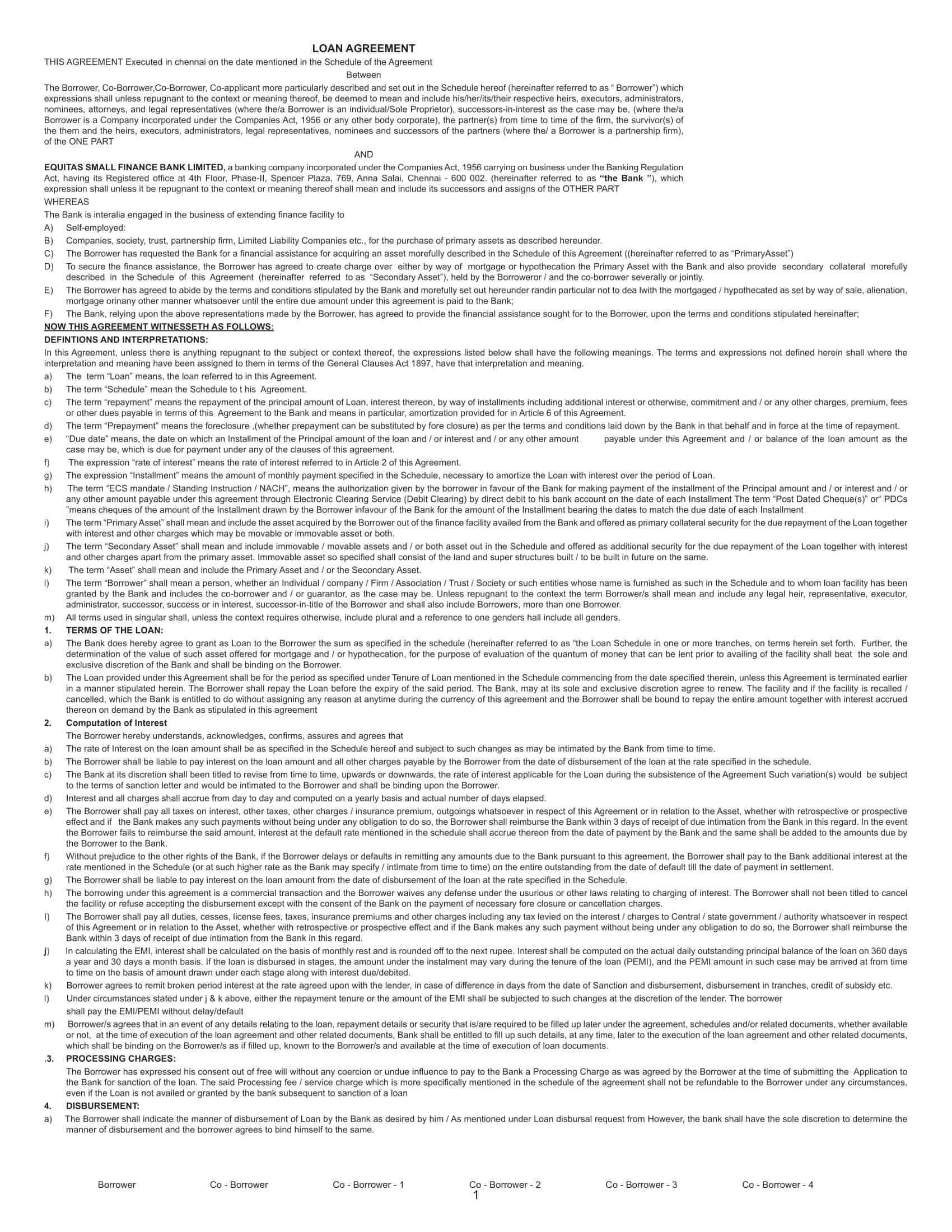

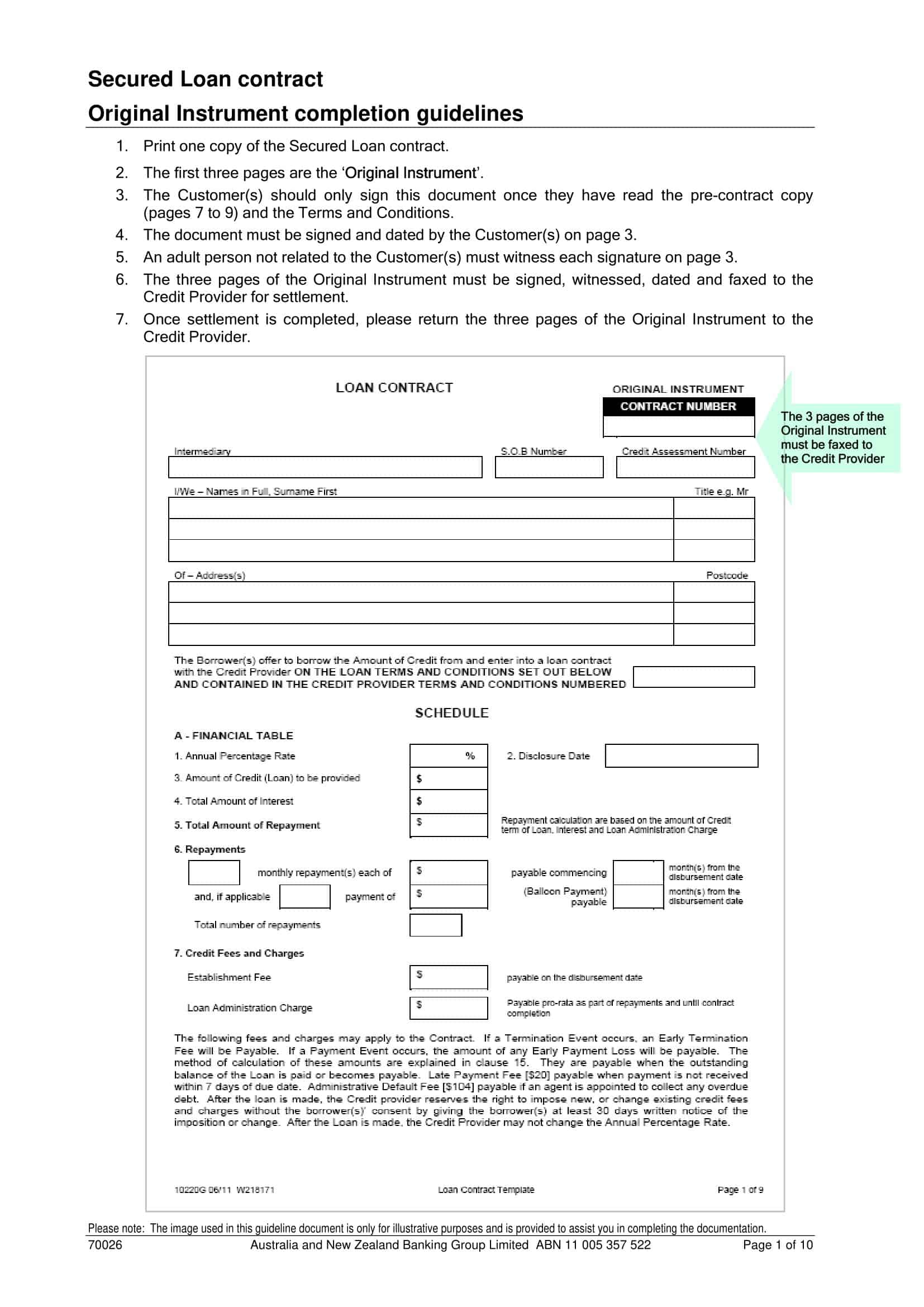

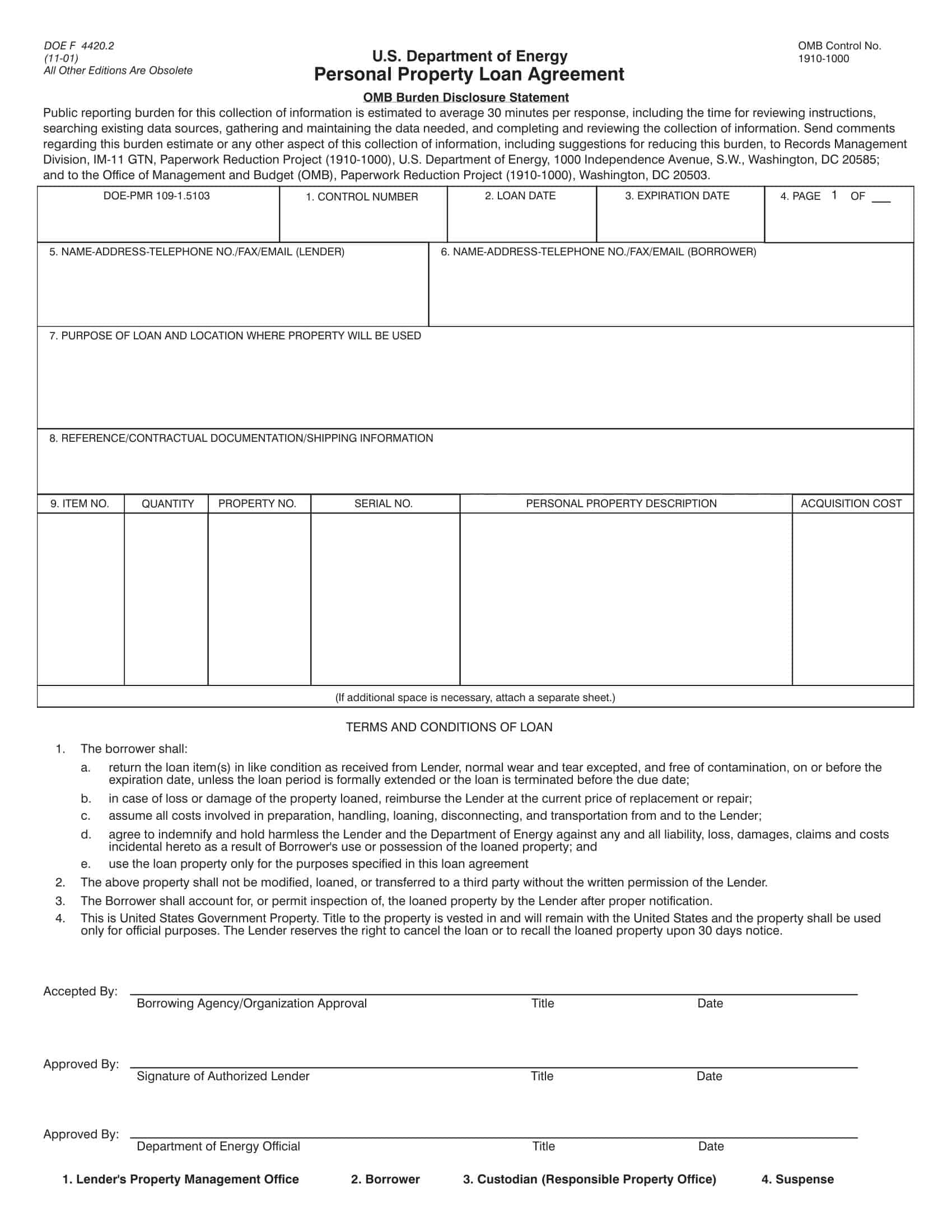

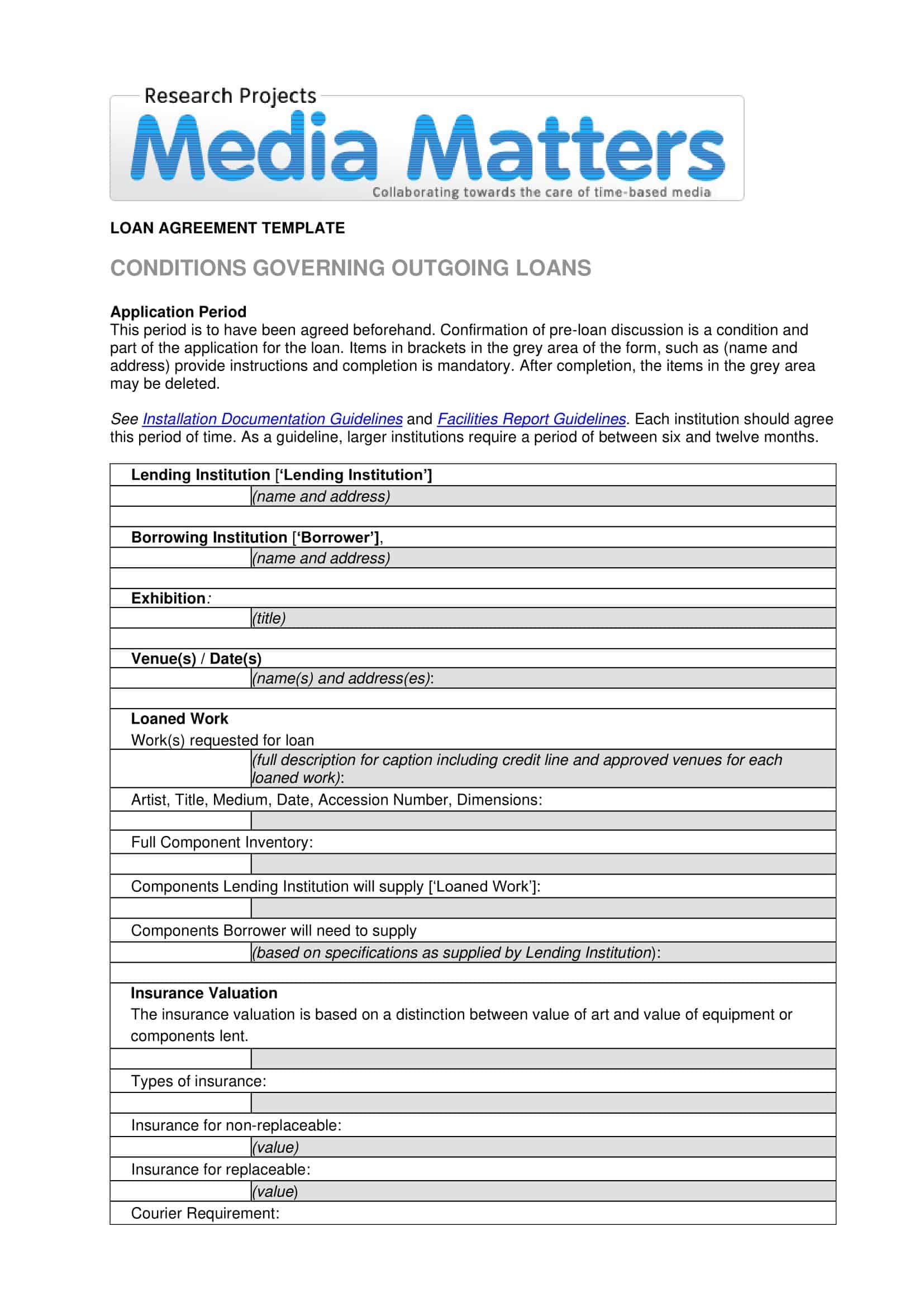

Loan Agreement Templates

When entering into a loan arrangement, it’s essential to have a clear and legally binding agreement that outlines the terms and conditions of the loan. Our Loan Agreement Templates provide a convenient and reliable solution for creating comprehensive loan agreements. Whether you’re lending or borrowing money, our templates offer a structured framework to specify loan amounts, interest rates, repayment terms, and any additional provisions or conditions.

With our printable and customizable templates, you can easily draft a professional and enforceable loan agreement that protects the interests of all parties involved. Don’t risk misunderstandings or disputes – use our Loan Agreement Templates to establish a solid foundation for your loan transactions and ensure a smooth lending or borrowing experience.

Why should I use a Loan Agreement?

There are several benefits to using a loan agreement when lending or borrowing money, including:

Clarity: A loan agreement sets out the terms and conditions of the loan in a clear and concise manner, reducing the risk of misunderstandings and disputes.

Protection: The loan agreement protects both the lender and the borrower by defining the rights and obligations of each party and providing a framework for resolving any disputes that may arise.

Record Keeping: The loan agreement serves as a permanent record of the loan and its terms, making it easier to track the status of the loan and ensure that all parties are meeting their obligations.

Legal enforceability: A loan agreement is a legally binding document, meaning that it can be enforced in a court of law if necessary. This provides both the lender and the borrower with peace of mind and a sense of security.

Professionalism: By using a loan agreement, both parties demonstrate a professional and organized approach to lending and borrowing money, which can strengthen their business or personal relationship.

Overall, a loan agreement is an essential tool for anyone who is lending or borrowing money. It helps to ensure a smooth and equitable transaction and protects both parties’ interests.

What to include in your loan agreement

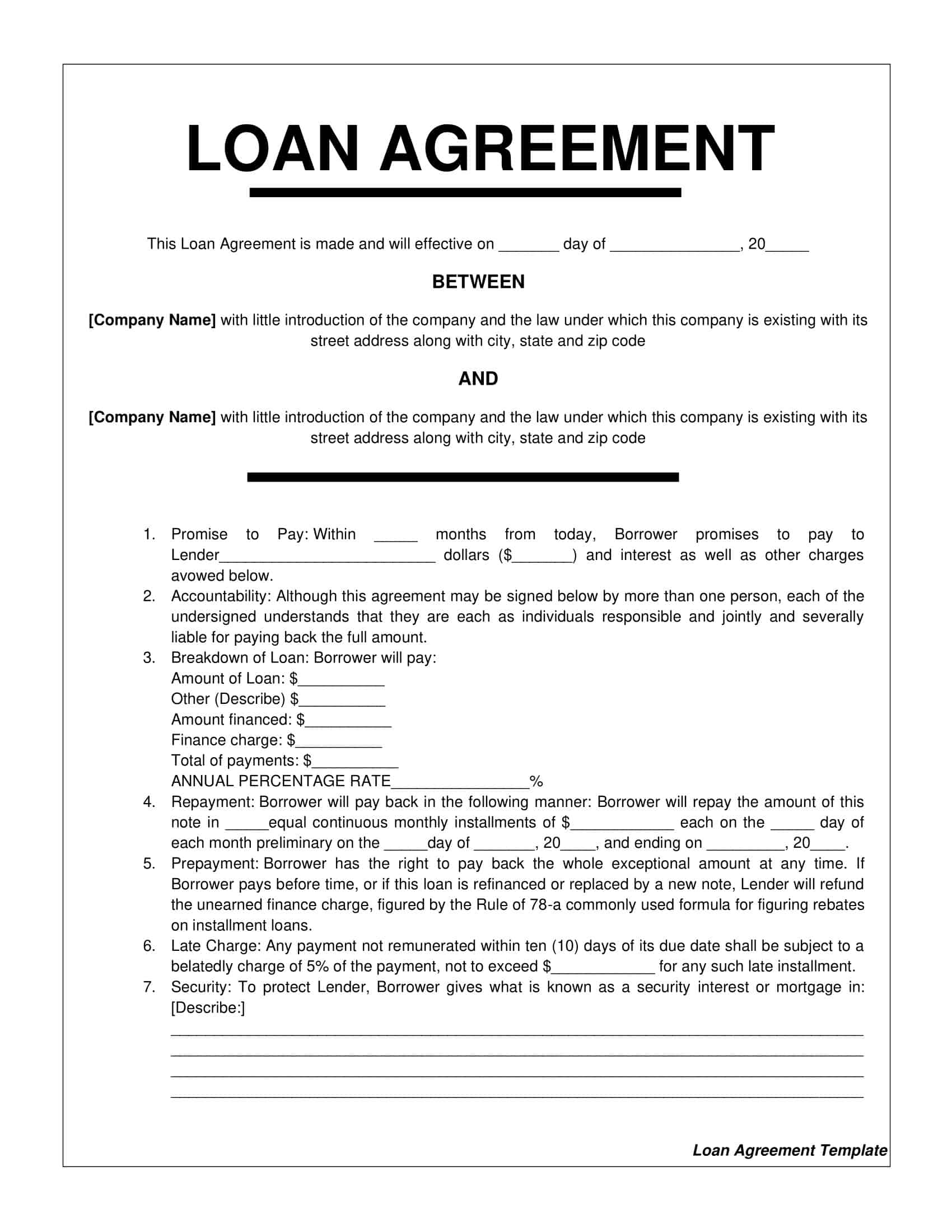

A loan agreement should include the following key elements:

Loan Amount: The amount of money being borrowed should be clearly stated in the agreement.

Interest rate: The interest rate charged on the loan should be clearly stated, along with the method used to calculate interest (e.g. simple or compound).

Repayment schedule: The agreement should specify the date or dates on which the borrower must make payments, as well as the amount and frequency of each payment.

Collateral: If the loan is secured by collateral, such as a car or a piece of property, the agreement should specify what the collateral is and how it will be used to secure the loan.

Default provisions: The agreement should specify the consequences of default, including late fees and the process for collecting the debt.

Termination provisions: The agreement should specify the conditions under which either party can terminate the loan agreement, such as if the borrower defaults or the lender is unable to make the loan.

Governing law: The agreement should specify which jurisdiction’s laws will govern the loan agreement, in case of any disputes.

Signatures: Both the borrower and the lender should sign the agreement, indicating their agreement to its terms and conditions.

Payment Method: The agreement should specify the method by which the borrower will make payments to the lender, such as electronic transfer or personal check.

Prepayment penalties: If the borrower pays off the loan early, the agreement should specify if there will be any penalties and the amount of such penalties.

Grace Period: The agreement should specify if there is a grace period for payments and the length of the grace period.

Renewal provisions: The agreement should specify if the loan can be renewed and the terms and conditions of renewal.

Insurance Requirements: If insurance is required to secure the loan, the agreement should specify the type of insurance required and who is responsible for obtaining and maintaining it.

Assignment and Transfer: The agreement should specify if either party can assign or transfer the loan to a third party and the conditions under which this can occur.

Dispute Resolution: The agreement should specify the process for resolving disputes, such as mediation or arbitration.

Key Legal Terms Found in Loan Agreements

Loan agreements can contain a variety of legal terms and concepts, which can be confusing to those who are not familiar with legal language. Some of the most important legal terms found in loan agreements include:

Principal: The principal amount of the loan is the amount of money that is borrowed, excluding any interest or other fees.

Interest: Interest is the fee charged by the lender for the use of the loaned funds.

Repayment Schedule: The repayment schedule is the plan for how the loan will be repaid, including the amount and timing of payments.

Collateral: Collateral is property or assets that are pledged as security for the loan. If the borrower fails to repay the loan, the lender may seize the collateral to recover its losses.

Default: Default occurs when the borrower fails to make payments or otherwise fails to comply with the terms of the loan agreement.

Acceleration: Acceleration is a clause in the loan agreement that allows the lender to demand immediate repayment of the loan in the event of default.

Security Interest: A security interest is a right granted to the lender to seize collateral in the event of default.

Guarantor: A guarantor is a third party who is responsible for repaying the loan if the borrower defaults.

Usury: Usury is the illegal act of charging excessive interest on a loan.

Prepayment Penalty: A prepayment penalty is a fee charged to the borrower if the loan is paid off before the end of the loan term.

Amortization: Amortization refers to the process of paying off a loan over time, typically through regular payments of both principal and interest.

Balloon Payment: A balloon payment is a large, lump sum payment that is due at the end of the loan term. This type of payment is often used in mortgage loans, where the borrower makes smaller payments over time and then repays the remaining balance in one lump sum at the end of the loan term.

Escrow: Escrow is a third-party holding account that is used to hold funds for the purpose of paying expenses or securing the loan.

Late Fees: Late fees are charges imposed on the borrower for failing to make payments on time.

Forbearance: Forbearance is a temporary suspension of loan payments, often granted to borrowers who are experiencing financial hardship.

Principal Reduction: Principal reduction is a reduction in the amount of the loan, typically granted to borrowers who are struggling to repay the loan.

Compound Interest: Compound interest is interest that is charged on both the principal amount of the loan and any accumulated interest.

Fixed Interest Rate: A fixed interest rate is an interest rate that remains constant over the life of the loan.

Adjustable Interest Rate: An adjustable interest rate is an interest rate that can change over time, typically in response to changes in market conditions.

Lien: A lien is a legal claim on property that is used to secure a loan. If the borrower fails to repay the loan, the lender can seize the property to recover its losses.

Co-borrower: A co-borrower is a second individual who is jointly responsible for repaying the loan.

Joint and Several Liability: Joint and several liability means that each borrower is individually responsible for repaying the loan, even if one borrower defaults.

Cross-collateralization: Cross-collateralization is a provision in the loan agreement that allows the lender to seize other assets if the borrower defaults on the loan.

Deed of Trust: A Deed of Trust is a legal document used in some states to secure a mortgage loan, where the property serves as collateral for the loan.

Foreclosure: Foreclosure is the process by which the lender seizes the property used as collateral in the event of default.

Power of Sale: Power of Sale is a provision in the loan agreement that allows the lender to sell the property used as collateral in the event of default.

Release of Lien: A release of lien is a document that releases the lien on the property once the loan has been repaid.

Renewal Option: A renewal option is a provision in the loan agreement that allows the borrower to renew the loan at the end of the loan term.

Subordination Agreement: A Subordination Agreement is a legal document that subordinates the interests of one creditor to another.

Waiver of Defenses: A waiver of defenses is a provision in the loan agreement that waives the borrower’s right to assert defenses against the lender in the event of default.

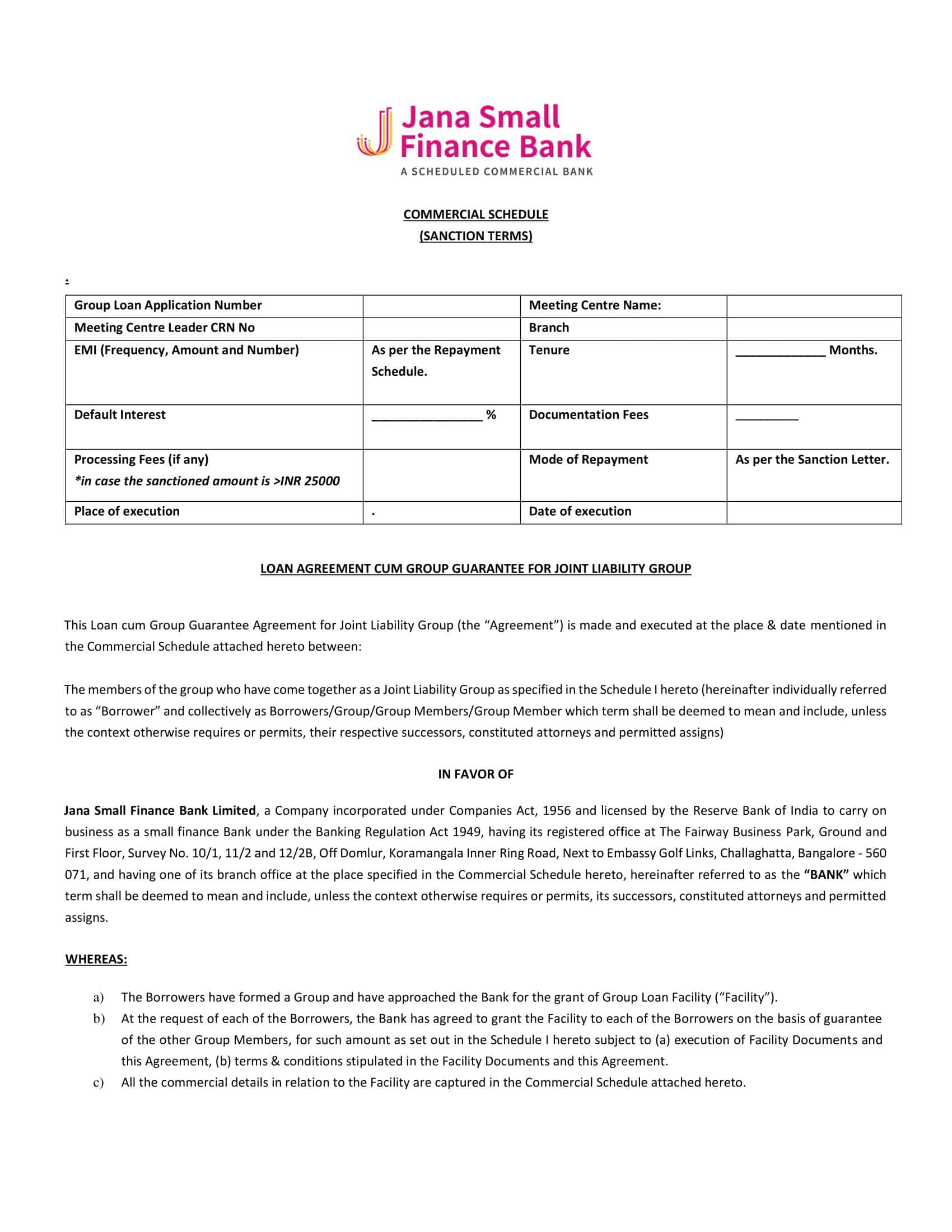

Commercial Loan Agreements

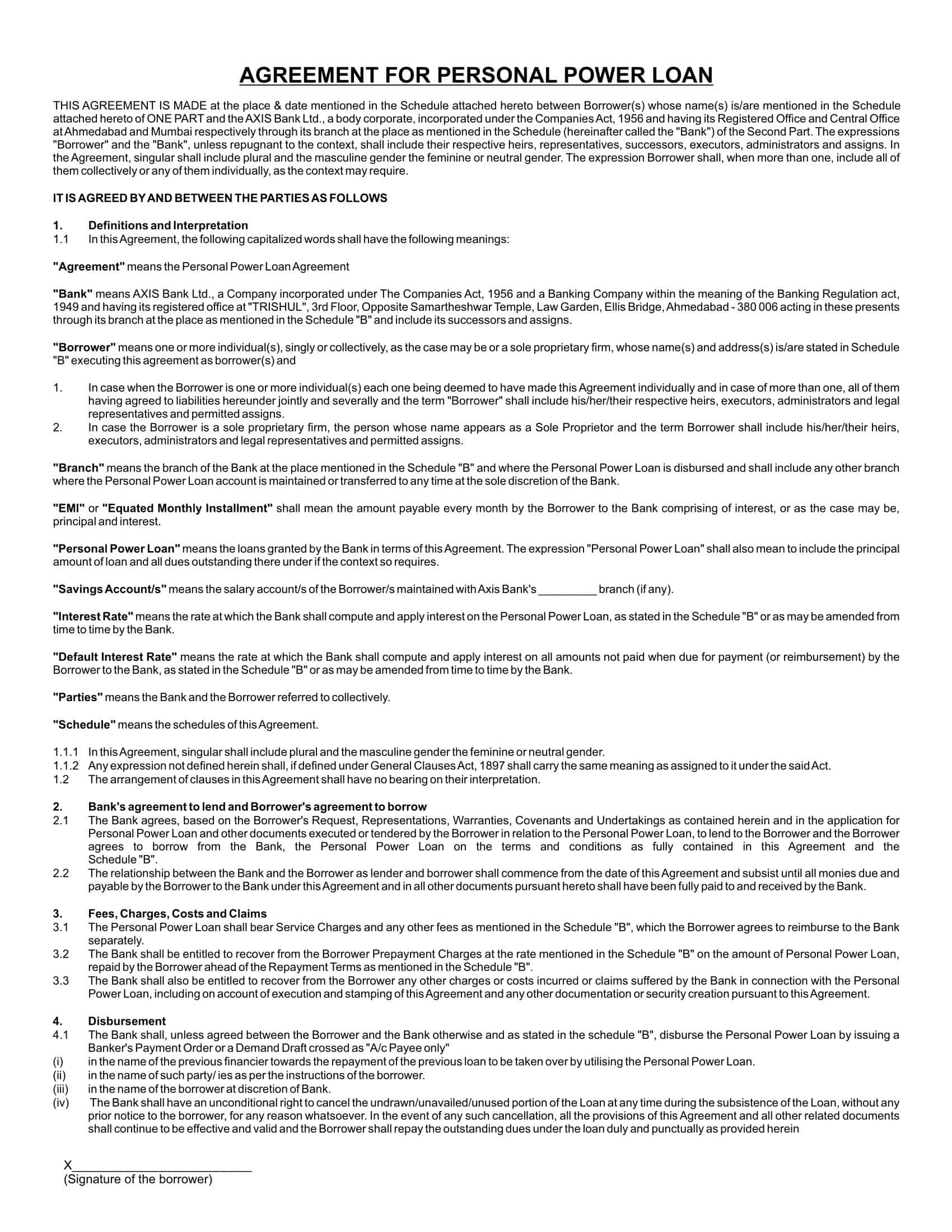

Commercial loan agreements are agreements between a lender and a borrower for the purpose of providing financing for a commercial purpose, such as the purchase of equipment or real estate. Commercial loan agreements are typically more complex than personal loan agreements, as they involve larger sums of money and may have more stringent repayment terms.

A commercial loan agreement should include all of the key elements listed in the previous answer, as well as additional provisions that are specific to commercial loans. Some of the additional elements to include in a commercial loan agreement are:

Purpose of Loan: The agreement should specify the purpose of the loan and how the funds will be used.

Business Information: The agreement should provide information about the borrower’s business, such as financial statements, tax returns, and business plan.

Repayment Sources: The agreement should specify the sources of repayment, such as cash flow from the business or other assets.

Covenants: Covenants are promises made by the borrower in the loan agreement. The agreement should specify any covenants, such as maintaining a minimum level of working capital or limiting new debt.

Security Interest: The agreement should specify the collateral that the lender will hold as security for the loan, and the conditions under which the lender can exercise its security interest.

Reporting Requirements: The agreement should specify the reporting requirements for the borrower, such as providing financial statements and tax returns.

By including these elements in a commercial loan agreement, the lender can ensure that the loan is structured in a way that meets the specific needs of the commercial loan and protects its interests.

Loan Agreements vs. Promissory Notes

A loan agreement and a promissory note are both legal documents used to document a loan, but they have some key differences.

A loan agreement is a comprehensive and detailed document that sets out the terms and conditions of a loan, including the amount of the loan, the interest rate, the repayment schedule, and any collateral that may be required. A loan agreement is typically used for larger and more complex loans, such as commercial loans or mortgage loans.

A promissory note, on the other hand, is a simpler and more straightforward document that sets out the basic terms of a loan, including the amount of the loan, the interest rate, and the repayment schedule. Promissory notes are typically used for smaller and less complex loans, such as personal loans or loans between friends or family members.

In summary, loan agreements are more comprehensive and detailed, while promissory notes are simpler and more straightforward. The type of document that you choose will depend on the size and complexity of the loan, as well as the specific needs of the borrower and the lender.

How to Draft a Loan Agreement

Drafting a loan agreement can be a complex process, but it is essential for ensuring that both the borrower and lender understand the terms and conditions of the loan. Here is a step-by-step guide to help you draft a loan agreement:

Step 1: Identify the Parties Involved

The first step in drafting a loan agreement is to identify the parties involved. This includes the borrower and the lender, as well as any co-borrowers or co-signers. You should also gather their contact information, including their names, addresses, and phone numbers.

Step 2: Determine the Purpose of the Loan

Next, you need to determine the purpose of the loan. This will help you determine the type of loan agreement you need to draft. For example, if the loan is for personal use, you may need to draft a personal loan agreement, while if it is for business purposes, you may need to draft a commercial loan agreement.

Step 3: Determine the Terms of the Loan

The next step is to determine the terms of the loan, including the loan amount, interest rate, repayment period, and any additional fees or charges. You should also determine whether the interest rate is fixed or adjustable, and whether the loan has a balloon payment.

Step 4: Determine the Security for the Loan

If the loan is secured, you will need to determine what type of security will be used. This can include a mortgage, a lien on a property, or a pledge of personal property.

Step 5: Determine the Repayment Schedule

Once you have determined the terms of the loan, you should determine the repayment schedule. This includes the amount and frequency of payments, as well as the due date for each payment.

Step 6: Determine the Default Provisions

Next, you should determine the default provisions, which outline what will happen in the event that the borrower defaults on the loan. This can include late fees, penalties, and the process for seizing the collateral in the event of default.

Step 7: Determine the Prepayment Provisions

You should also determine the prepayment provisions, which outline what will happen if the borrower decides to repay the loan early.

Step 8: Determine the Discharge Provisions

The discharge provisions outline what will happen when the loan is fully repaid and the security is released.

Step 9: Draft the Loan Agreement

With the terms of the loan determined, you can begin drafting the loan agreement. This should include the names and addresses of the parties involved, the purpose of the loan, the terms of the loan, the security for the loan, the repayment schedule, the default provisions, the prepayment provisions, and the discharge provisions.

Step 10: Review the Loan Agreement

Once the loan agreement is drafted, you should review it carefully to ensure that it accurately reflects the terms and conditions of the loan. You should also have the agreement reviewed by an attorney to ensure that it complies with local, state, and federal laws.

Step 11: Sign the Loan Agreement

Once the loan agreement has been reviewed and any necessary changes have been made, the parties should sign the agreement to make it legally binding.

Step 12: File the Loan Agreement

Finally, you should file the loan agreement with the appropriate government agency, such as the local county clerk’s office. This will ensure that the agreement is recorded and can be enforced in the event of a dispute.

By following these steps, you can draft a loan agreement that accurately reflects the terms and conditions of the loan, and that provides protection for both the borrower and the lender.

FAQs

Who is responsible for drafting a loan agreement?

Typically, the lender is responsible for drafting the loan agreement, but the borrower can also draft the agreement with the help of an attorney.

What happens if the borrower defaults on the loan?

If the borrower defaults on the loan, the lender may be able to seize the collateral, impose late fees and penalties, or take other legal action to recover the debt. The exact process will depend on the terms of the loan agreement and local, state, and federal laws.

Can I prepay a loan before the end of the repayment period?

Whether you can prepay a loan before the end of the repayment period will depend on the terms of the loan agreement. Some loans may have a prepayment penalty, while others may allow prepayment without penalty.

What happens if the lender defaults on the loan?

If the lender defaults on the loan, the borrower may have legal recourse, depending on the terms of the loan agreement and local, state, and federal laws. In some cases, the borrower may be able to sue the lender for breach of contract or seek other forms of relief.

What is the interest rate for a loan agreement?

The interest rate for a loan agreement will depend on the terms of the loan, the creditworthiness of the borrower, and the current market conditions. Some loan agreements may have a fixed interest rate, while others may have a variable interest rate that adjusts over time.

What is the repayment period for a loan agreement?

The repayment period for a loan agreement will depend on the terms of the loan, but typically ranges from one year to ten years or more. The length of the repayment period will affect the size of the monthly payment and the total interest paid over the life of the loan.

What is collateral for a loan agreement?

Collateral is a type of security that a borrower provides to a lender as a guarantee that the loan will be repaid. Common types of collateral include real estate, personal property, or a portion of the borrower’s salary. If the borrower defaults on the loan, the lender may be able to seize the collateral to repay the debt.

What are the late fees for a loan agreement?

The late fees for a loan agreement will depend on the terms of the loan, but may include a percentage of the unpaid balance, a flat fee, or a combination of both. The late fees are typically imposed when the borrower fails to make a payment by the due date.

What are the legal requirements for a loan agreement?

The legal requirements for a loan agreement will depend on local, state, and federal laws, but generally include disclosure of the terms and conditions of the loan, the security for the loan, the repayment schedule, and any default provisions. An attorney can help ensure that the loan agreement complies with all applicable laws and provides adequate protection for both the borrower and the lender.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Payment Agreement Templates [PDF, Word] 2 Payment Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Payment-Agreement-1-150x150.jpg)

![Free Printable Separation Agreement Templates [PDF, Word] 3 Separation Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Separation-Agreement-1-150x150.jpg)