Rent-to-own contracts are popular in the United States and other parts of the world. This is because they provide an opportunity for homeowners to buy a house even if they do not have good credit. And for renters, it gives them a chance to own a house through hard work and efforts instead of giving up on their dreams or taking a lender who makes the process arduous.

Table of Contents

Components of the Rent-to-Own Agreement

Rent-to-own contracts are becoming increasingly popular nowadays because of the versatility they provide. This is a traditional lease-to-own contract, so the buyer will be paying rent on the property before buying it. You can read the terms of rent-to-own agreements below and some case studies and ideas on how to increase your profit from it.

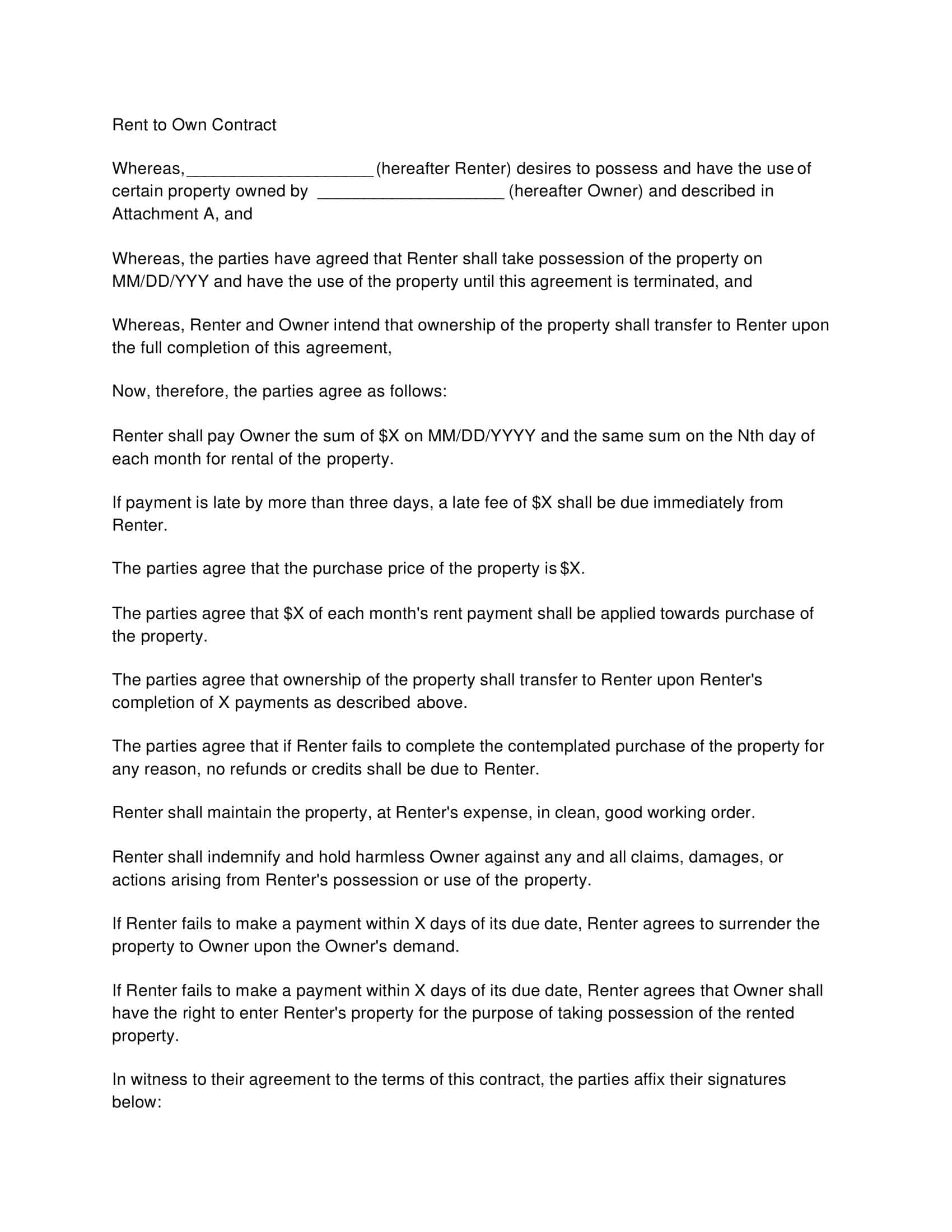

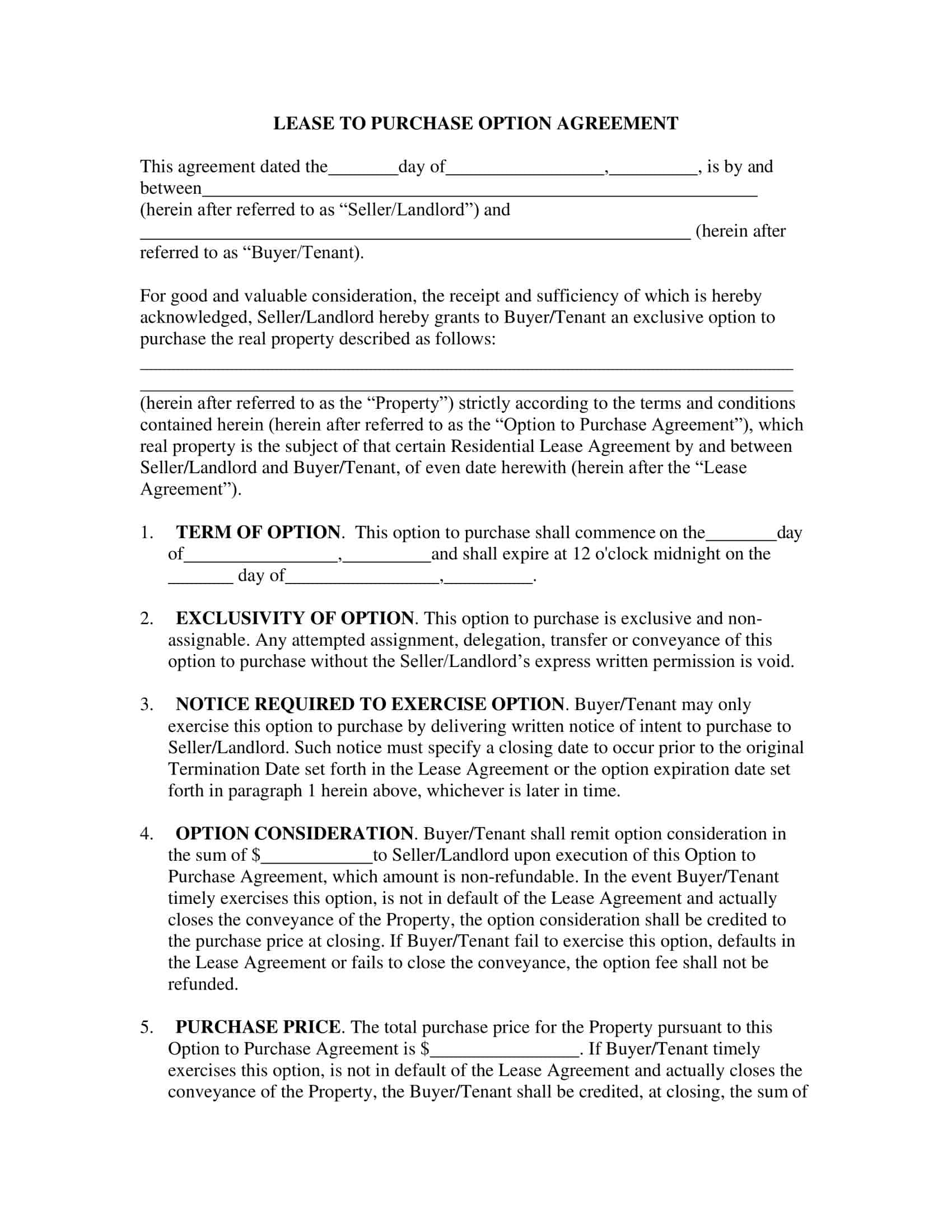

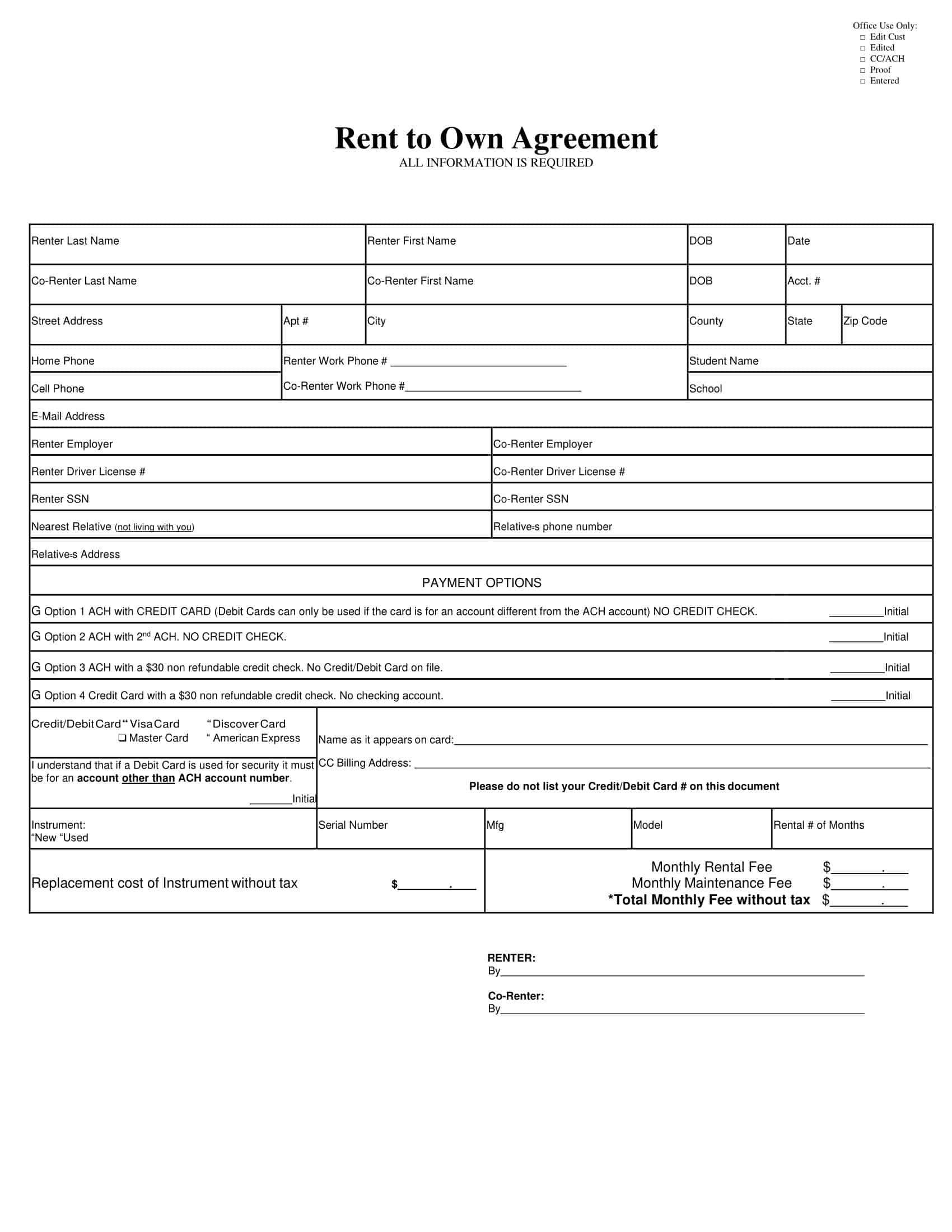

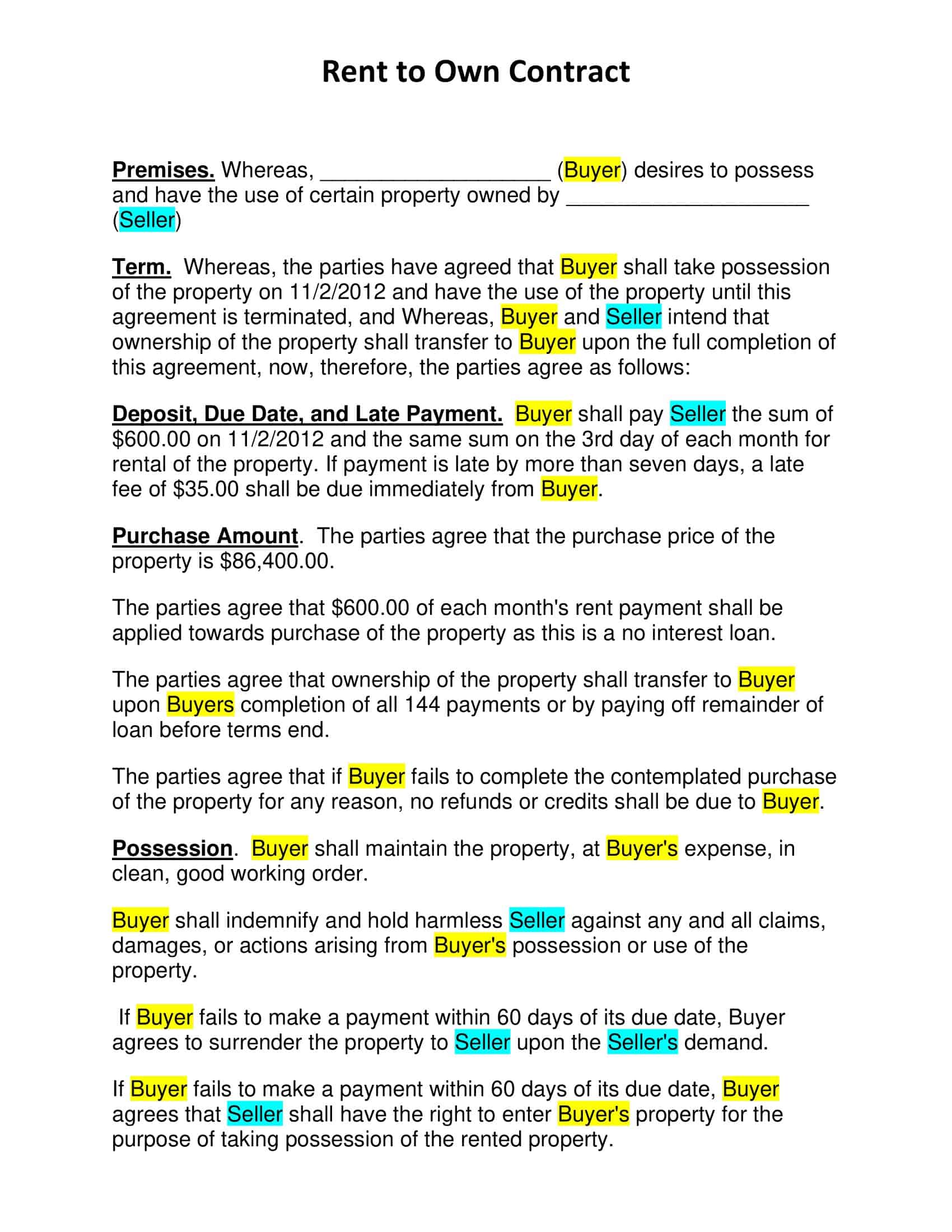

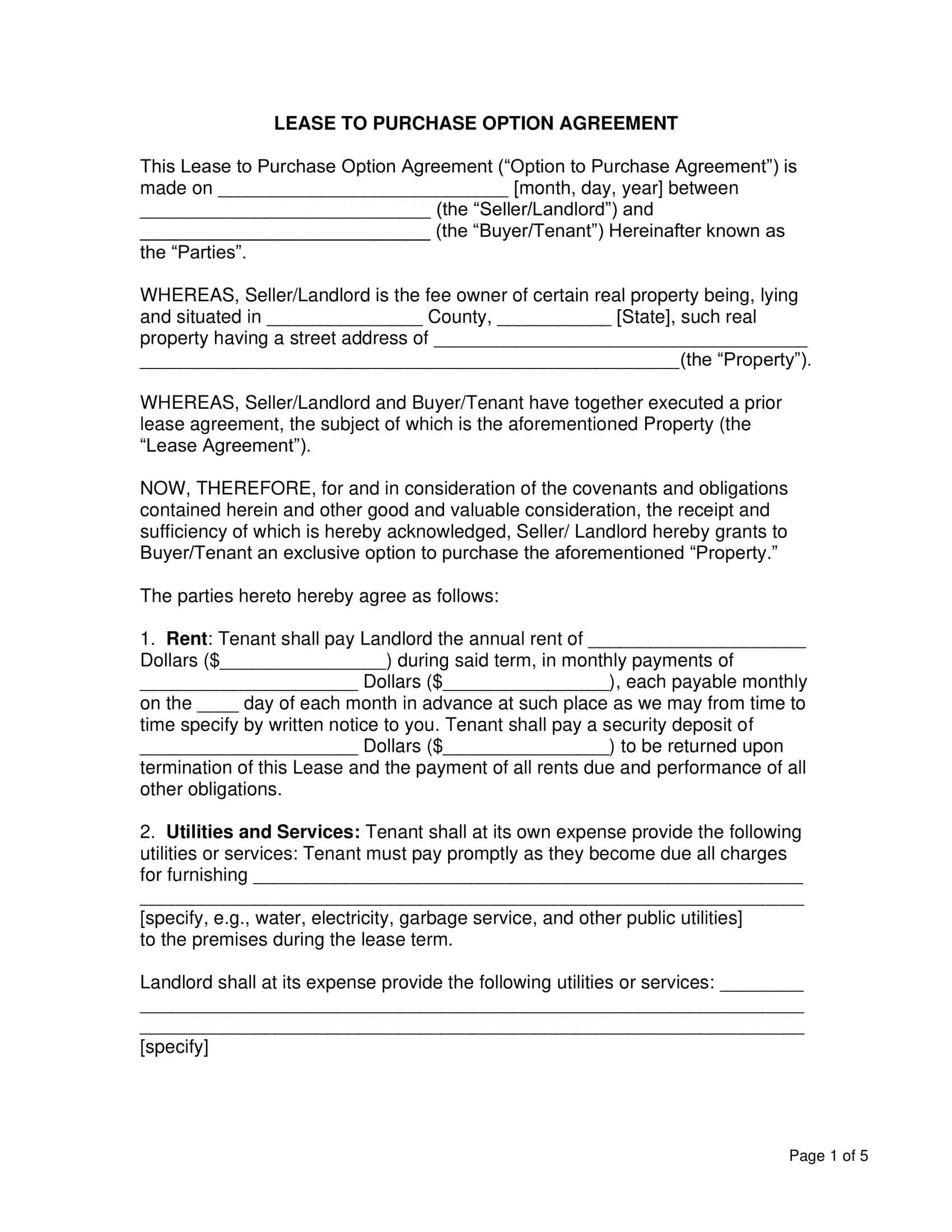

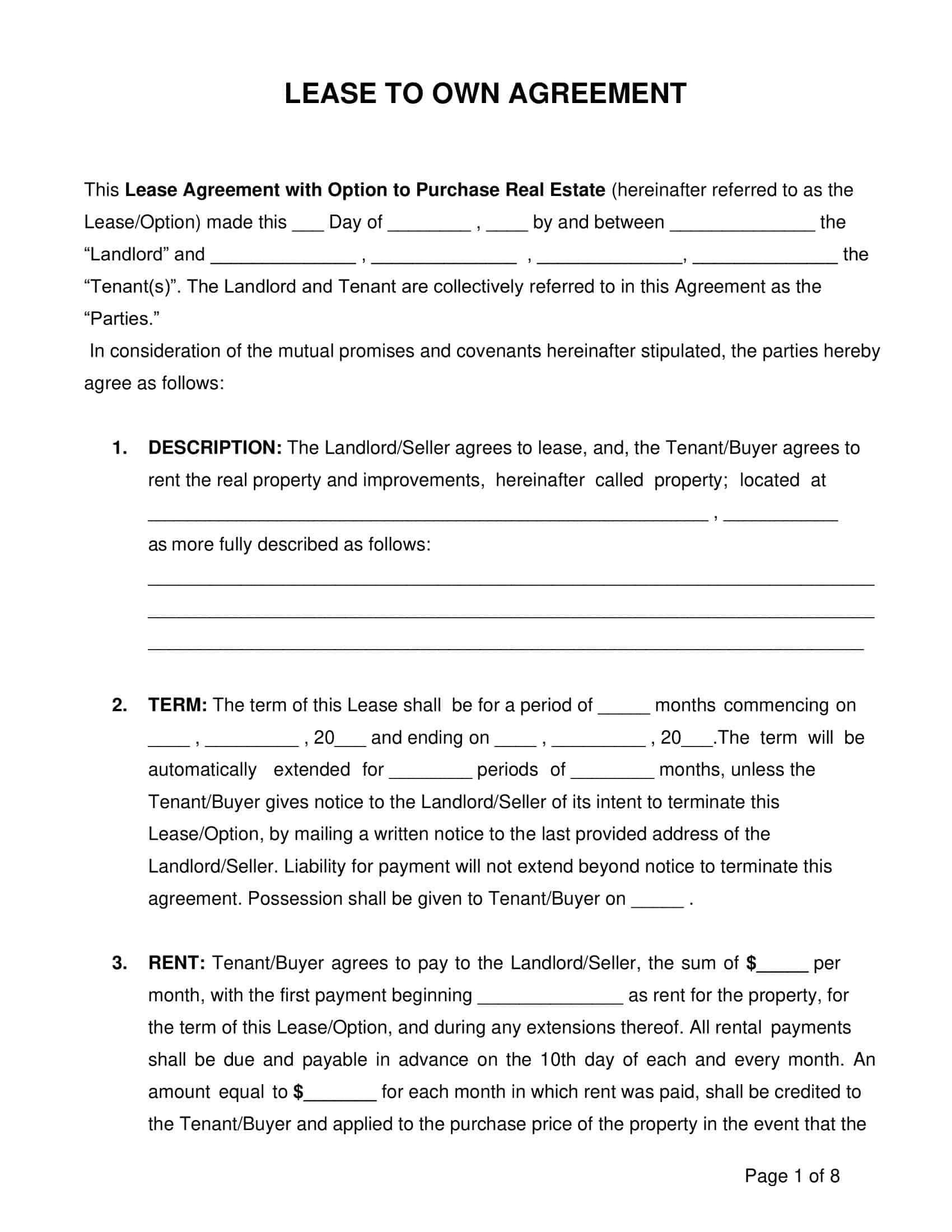

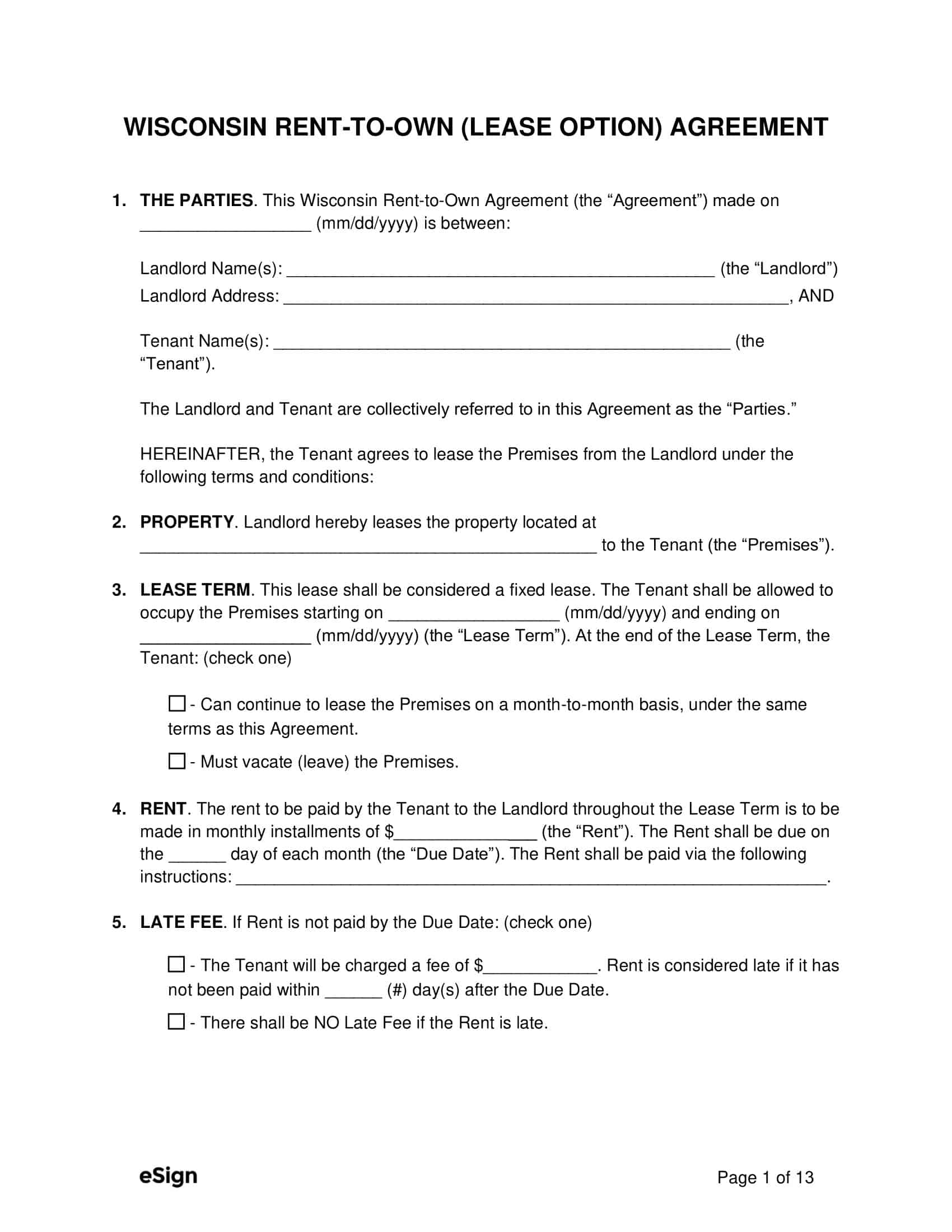

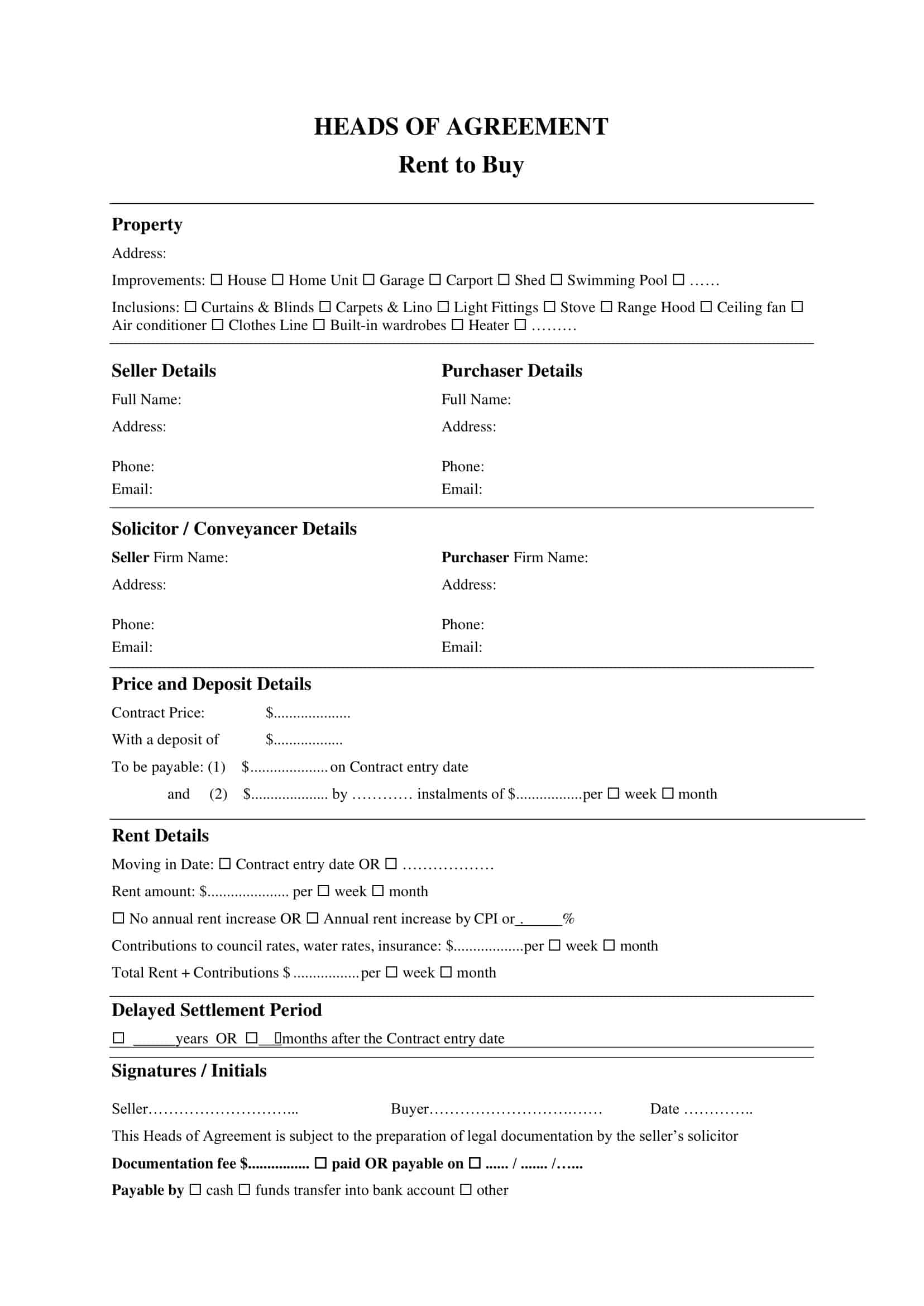

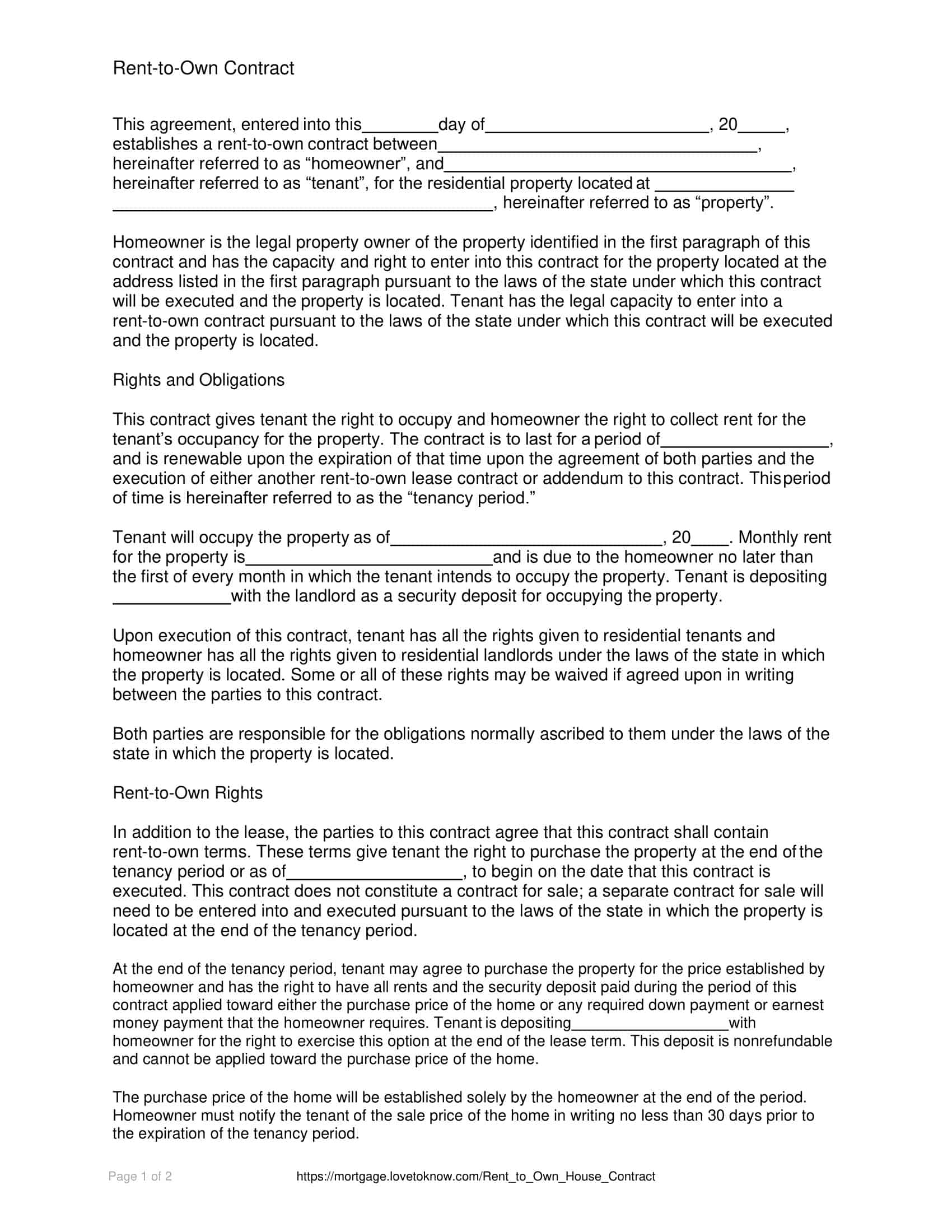

Rent To Own Contract Templates

Achieve your dream of homeownership with our comprehensive collection of Rent-to-Own Templates. Whether you’re a tenant looking to transition into homeownership or a property owner seeking a mutually beneficial agreement, our templates provide a structured framework for Rent-to-Own contracts.

These customizable and printable templates outline the terms and conditions of the agreement, including the rental period, purchase price, option consideration, and other relevant details. With our Rent-to-Own Templates, you can formalize your intentions, protect your interests, and pave the way for a successful rent-to-own arrangement. Take control of your path to homeownership or offer tenants a unique opportunity to build equity while renting. Download our templates now and embark on a journey towards owning your dream home.

The Rental Agreement

In a lease to own real estate property, the purchaser signs an agreement with a landlord to occupy the property for a certain amount of time. When the time period expires, and the parties meet the agreed requirements, the purchaser is given an option to purchase the property. However, it is essential to note that you are starting out as a tenant in a lease-to-own home contract and not as a purchaser. You do not have any option over the house title until you exercise your right and purchase it.

The Option to Purchase

In some rent-to-own agreements, the seller grants you an option to purchase the rented house within a given period of time in exchange for an upfront fee. This option to purchase is part and parcel of the rent-to-own agreement. You’re not required to exercise this option like you are in a take-over option where you agree to purchase the house at a specific price before the end of the term.

How Does the Rent-to-Own Process Work?

There are two options for you when buying a house, and the first is having a rent-to-own contract. This means that you will be renting the house, and once you have the required down payment, the property owner will transfer the title of the house to your name. The second option is buying outright without a rent-to-own contract, which involves making a large down payment plus home insurance fees.

Many people cannot manage to buy a house because of their poor credit history, lack of financial stability, and low income. Rent-to-own agreements offer an alternative to this. Here is some important information to explain how rent to own contract works:

Upfront Fees (non-refundable)

If you have your eye on a house but can’t make the down payment yet, an option fee could be useful for you. This allows you to pay a one-time upfront fee in return for the ability to purchase the house at a set date shortly. This is not as risky as it sounds because if you don’t purchase the house, the money is non-refundable.

In other words, this fee proves its worth because if you don’t purchase the home (also known as exercising your option), then you paid something for nothing. The option fee depends on how much time you get to check out mortgages and do everything else that comes along with purchasing a home.

Lease-Purchase vs. Lease Option

Lease purchase and lease option agreements have several striking differences. These agreements vary from state to state in certain areas. If you’re considering the purchase of a property using a lease option, it’s essential that you are aware of the differences between these two agreements.

Lease options and lease purchase agreements both offer the buyer a chance to purchase real estate without coming up with a down payment or secure financing. In deciding which is best for you, it’s important to outline your goals, realistic expectations, and established budget.

Purchase Price

You must understand how and when the purchase price of your home will be determined. Most landlords will have a method in place by which the home’s purchase price will be determined. There are various methods for determining the price at which you can buy the home, and your landlord should communicate it to you before signing the lease-to-own contract.

Apply rent to the principal

It is good to talk with your attorney before signing the lease. You will have a lease throughout the duration of the lease, which means you will pay rent throughout the duration of the lease. In my opinion, it is typically standard that part of each payment would get applied to the house’s purchase price.

Purchasing the property

One of the people’s biggest mistakes when purchasing real estate property is getting into a rent-to-own agreement. This loan option has several terms that really favor the seller, so there are rent-to-own home contract laws in place.

Despite these laws, many buyers don’t know their rights or risks, and they can get stuck with a house they cannot pay off because they committed to buying it at the end of the lease term. To prevent this from happening, it’s important to have an experienced real estate lawyer negotiate your lease so you’re protected if you can’t buy your house.

Length of Lease

Rent-to-own contracts are legally binding agreements that are used by consumers who wish to acquire a property while they are still renting it. The contract can be as long as five years, and during this time, the consumer will be paying 1/3 or even 1/2 of the total price of the house upfront. This is accomplished with interest-free credit and is a win-win solution for both parties – the seller gets regular payments while the tenant has time to save up for the full sum of money.

How can I get out of a rent-to-own contract?

A lease option agreement is a contract that you sign with a house owner. By signing the agreement, you acknowledge that you will be given an option to buy this house when the rental period expires.

If you find yourself stuck in a rent-to-own situation, talk to the landlord or property manager and explain your situation. Let him know this isn’t what you bargained for, nor do you want to buy the house on time. See if they would be willing to work within the contract terms and extend the lease portion of it.

Although the landlord has no obligation to do this, it can’t hurt to see their point of view. If you have already paid up-front fees and are struggling to make monthly payments, demand a full refund for those fees since you will not be gaining any equity in the home to justify them. If that doesn’t help, consult an attorney about getting out of the contract early.

FAQs

What is a Rent to Own Contract?

A Rent to Own Contract is an agreement where a tenant rents a property with an option to purchase it during or after the rental period at a predetermined price. This type of contract provides a way to buy a home without an immediate financial commitment.

How does a Rent to Own Contract work?

Typically, the tenant pays a higher rent than the market rate, with the excess amount going towards a down payment on the property should they decide to buy it at the end of the lease term.

What are the advantages of a Rent to Own Contract?

Rent to Own Contracts can be beneficial for individuals who need time to improve their credit score or save for a down payment while locking in a purchase price and living in the home they wish to buy.

Are Rent to Own Contracts risky?

They can be risky for both parties if not structured properly. Tenants may lose money if they don’t proceed with the purchase, and the seller may have a property tied up without a guaranteed sale.

How is the purchase price determined in a Rent to Own Contract?

The purchase price can be agreed upon when the contract is signed or determined based on the home’s future value when the option to buy is exercised.

Can I back out of a Rent to Own Contract?

The ability to back out depends on the terms of the contract. Typically, backing out could result in the loss of any extra money paid towards the down payment.

Who is responsible for maintenance and repairs in a Rent to Own Contract?

Responsibility for maintenance and repairs should be clearly defined in the contract. It can vary, with some contracts placing responsibility on the tenant, and others on the landlord.

Is a Rent to Own Contract a good idea?

It depends on individual circumstances. It could be beneficial for someone who needs time to improve their financial situation but wants to secure a home in the meantime.

Can a Rent to Own Contract be customized?

Yes, the terms of a Rent to Own Contract can be negotiated and customized to suit the needs and agreements of both the tenant/buyer and the landlord/seller.

What are the key components of a Rent to Own Contract?

Key components include:

- The purchase price of the property

- Rent amount and payment terms

- Duration of the rental term

- Portion of the rent to be credited towards the purchase price

- Maintenance and repair responsibilities

- Option fee (if any) and its terms

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Land Contract Templates [Word, PDF] Simple 3 Land Contract](https://www.typecalendar.com/wp-content/uploads/2023/05/Land-Contract-1-150x150.jpg)