Managing personal finances can be challenging, but developing a household budget is one of the most effective tools to tackle this task head-on. A well-structured budget acts as a guiding compass, illuminating your path towards financial security, personal goals, and peace of mind.

This article will delve into the various aspects of creating and maintaining a household budget, offering practical advice, proven strategies, and helpful resources. Whether you’re looking to cut unnecessary expenses, save for a dream vacation, plan for retirement, or simply gain better control over your money, understanding how to budget can dramatically transform your financial landscape. So, let’s embark on this journey of financial literacy and empowerment together.

Table of Contents

What is a household budget?

A household budget is a strategic financial plan that outlines the income and expenses of a home on a monthly or annual basis. It details where the household’s money is coming from and how it is being spent, covering various categories like housing, utilities, groceries, transportation, entertainment, and savings, among others.

A household budget serves as a critical tool for managing personal finances, helping individuals and families track their income and spending patterns, identify unnecessary expenditures, plan for future financial goals, and build a safety net for unexpected costs. It fosters financial discipline, awareness, and ultimately, financial well-being.

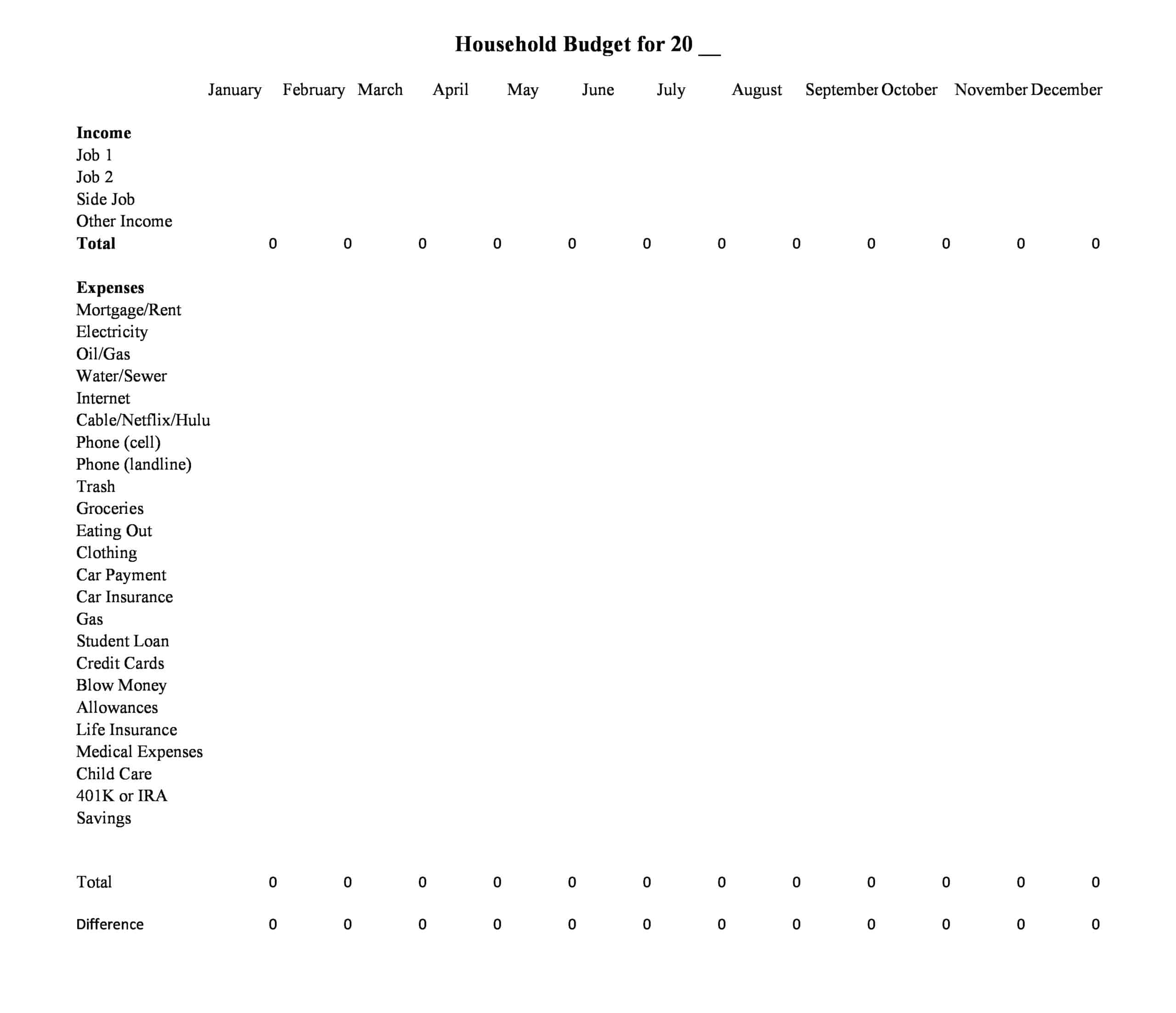

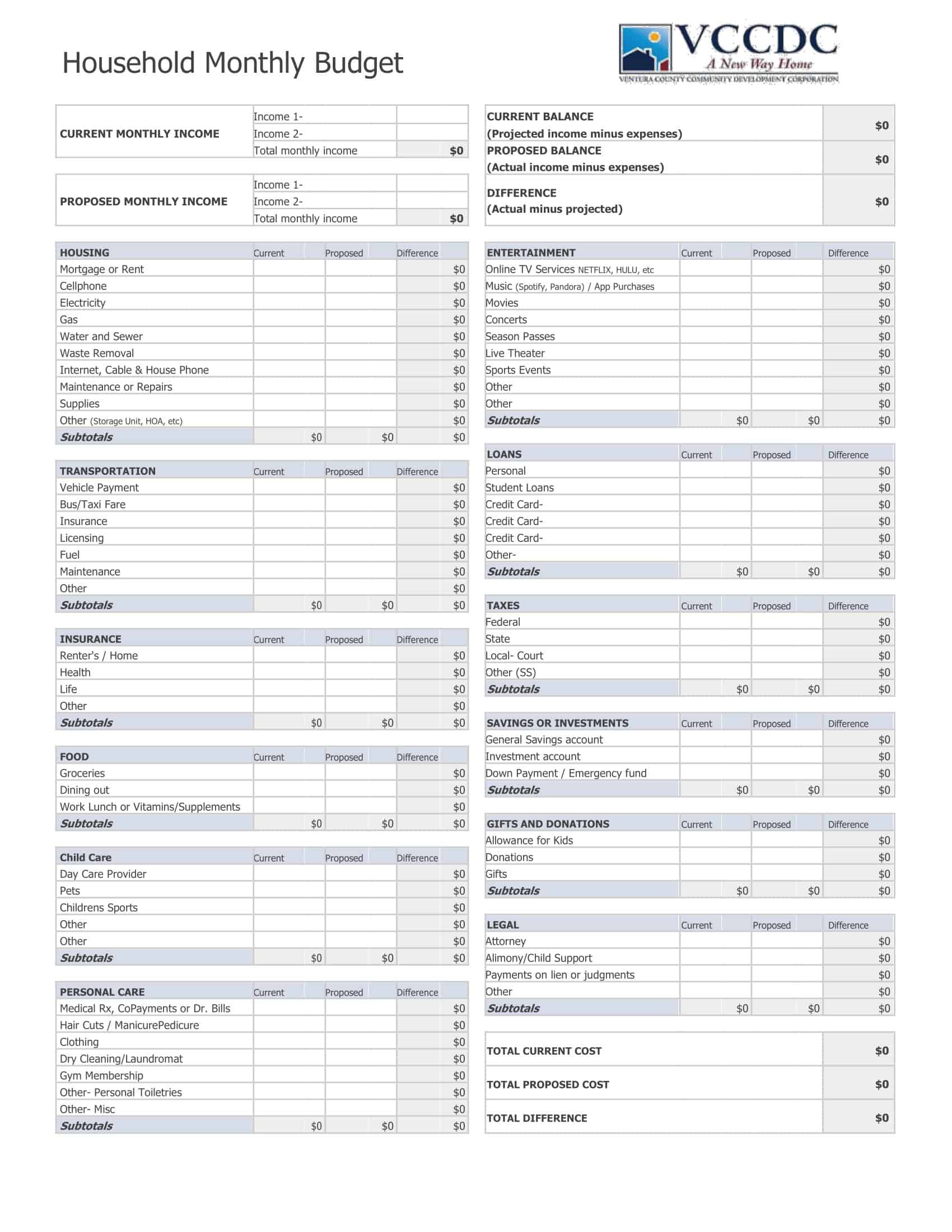

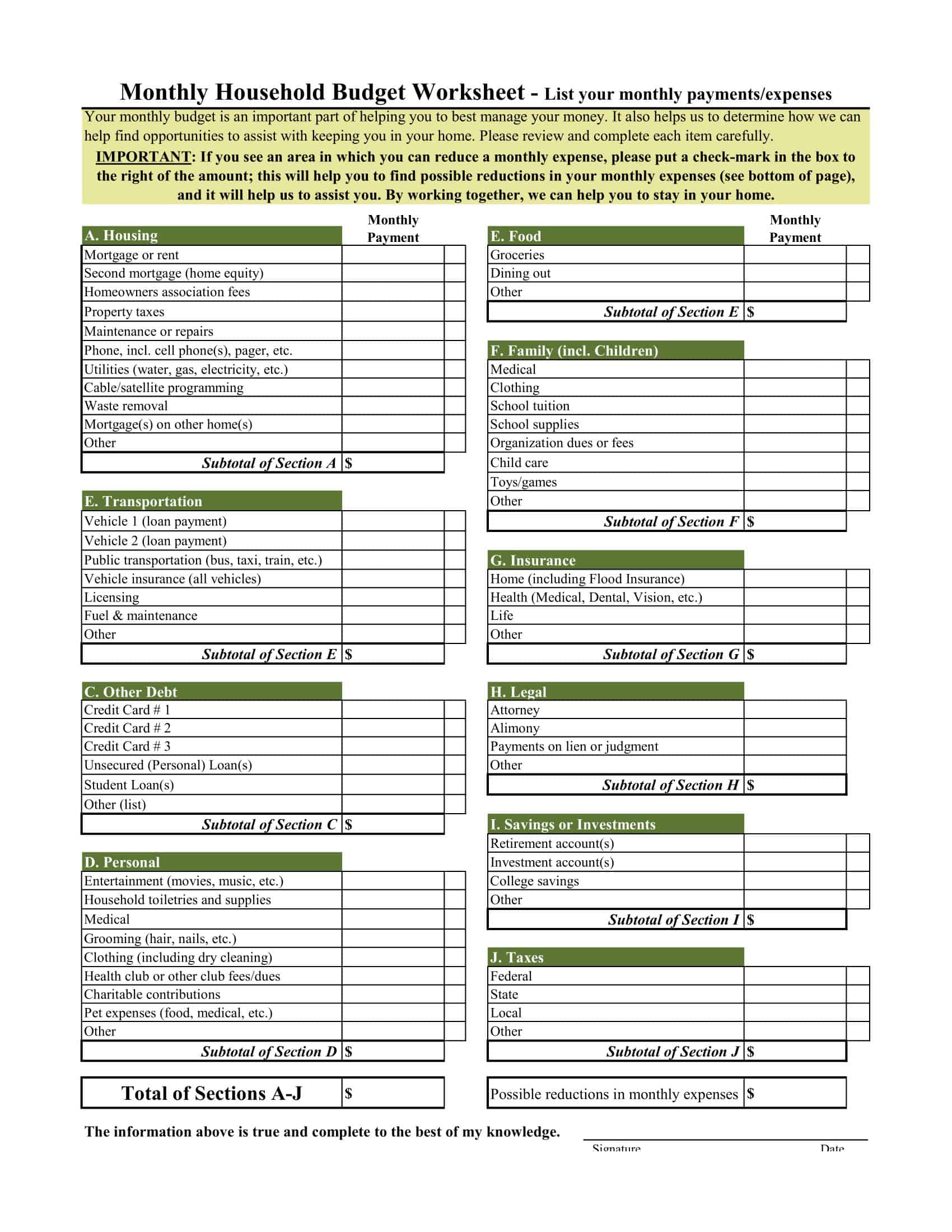

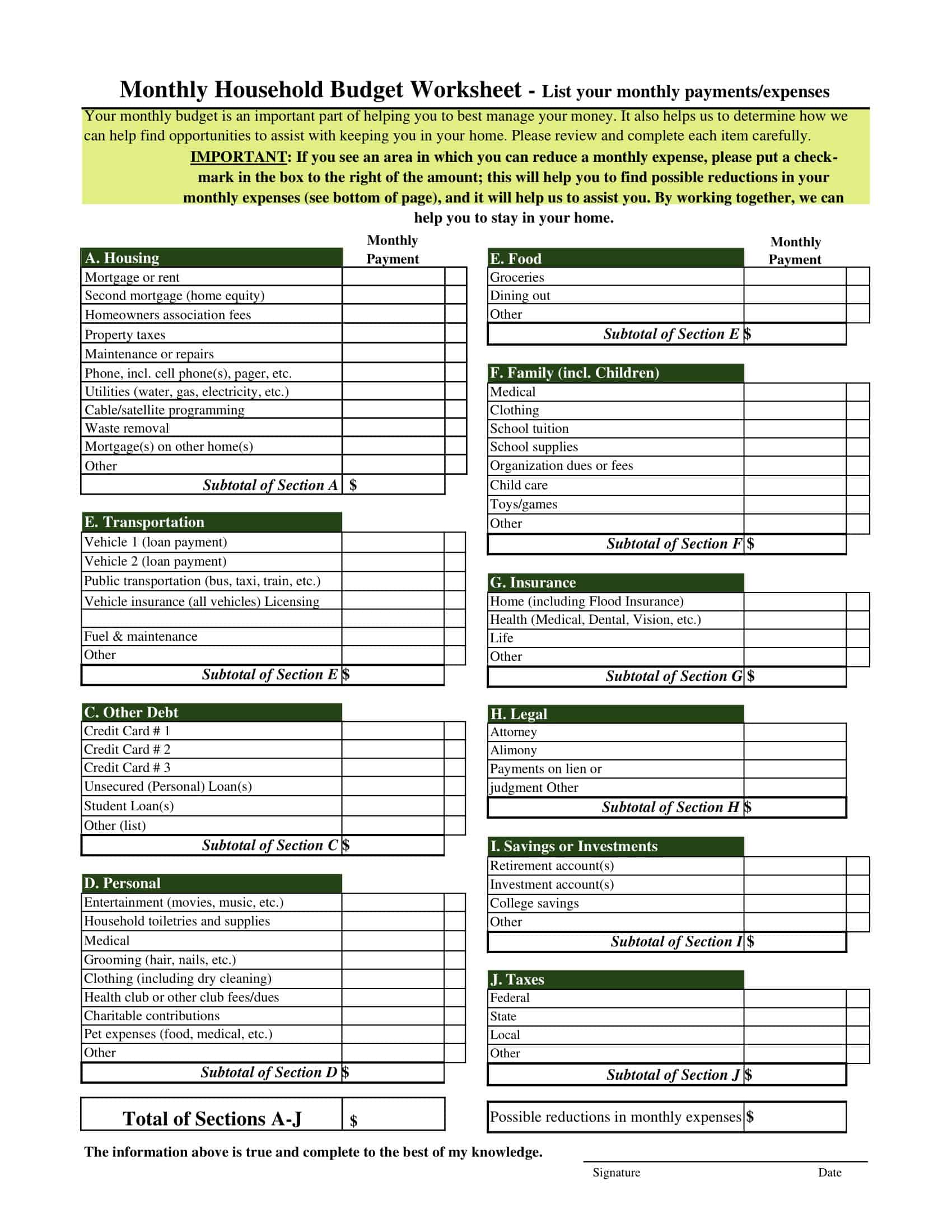

Household Budget Templates

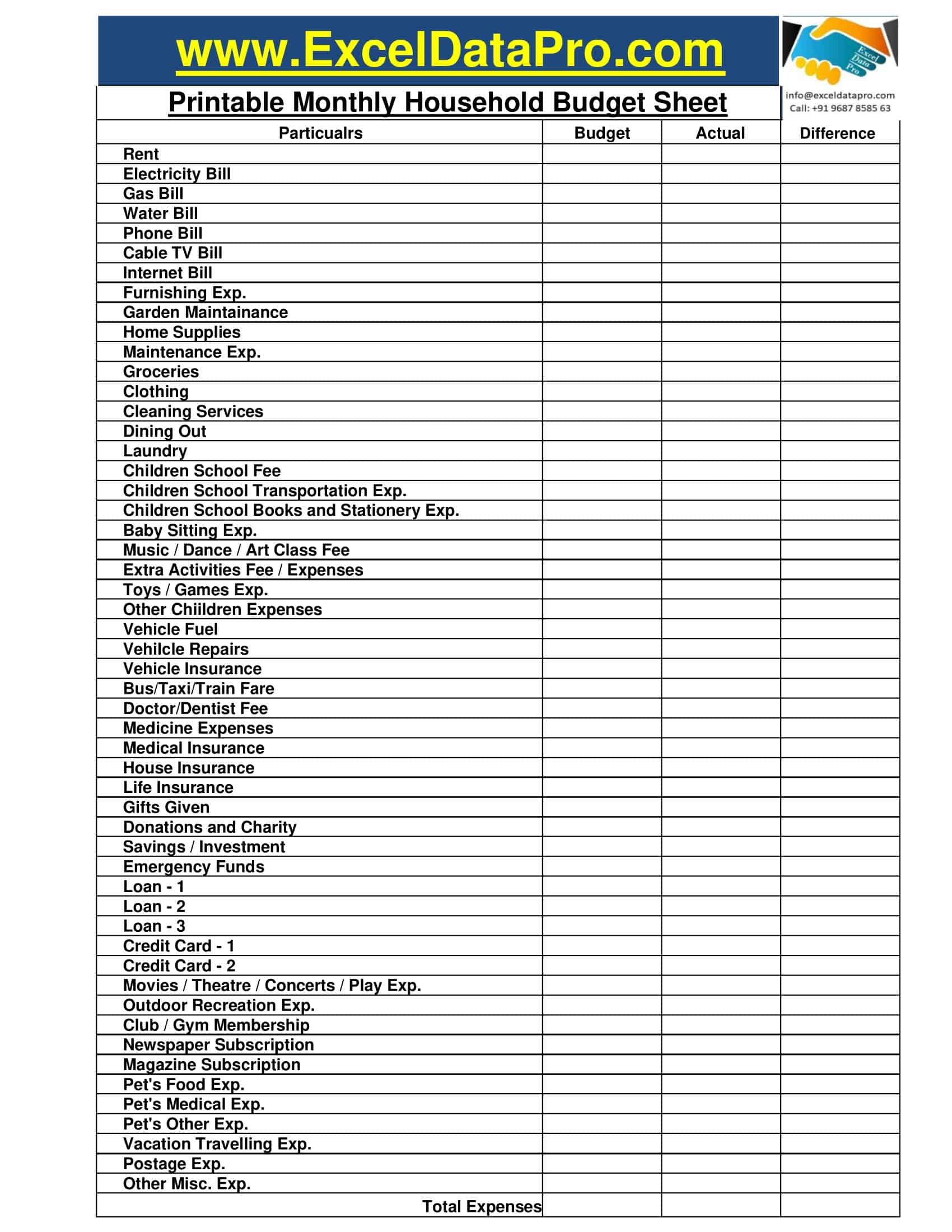

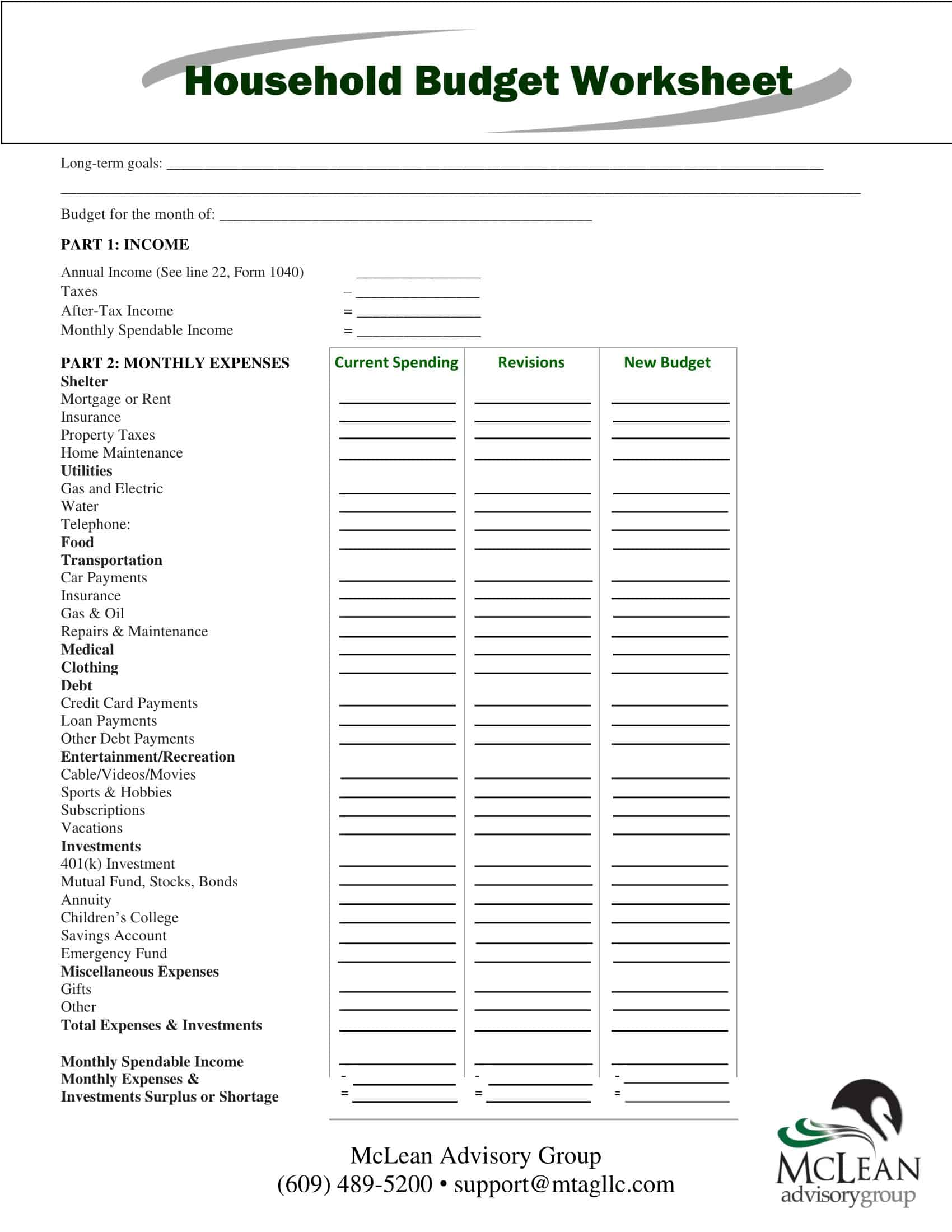

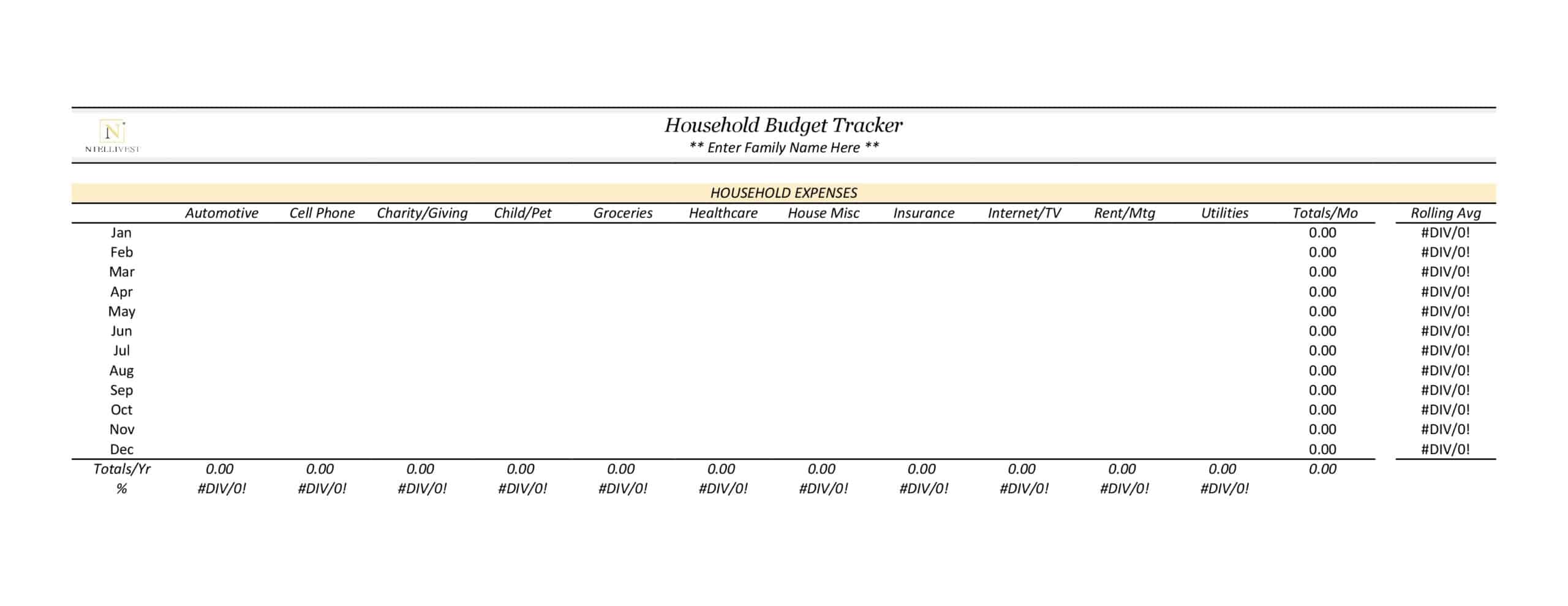

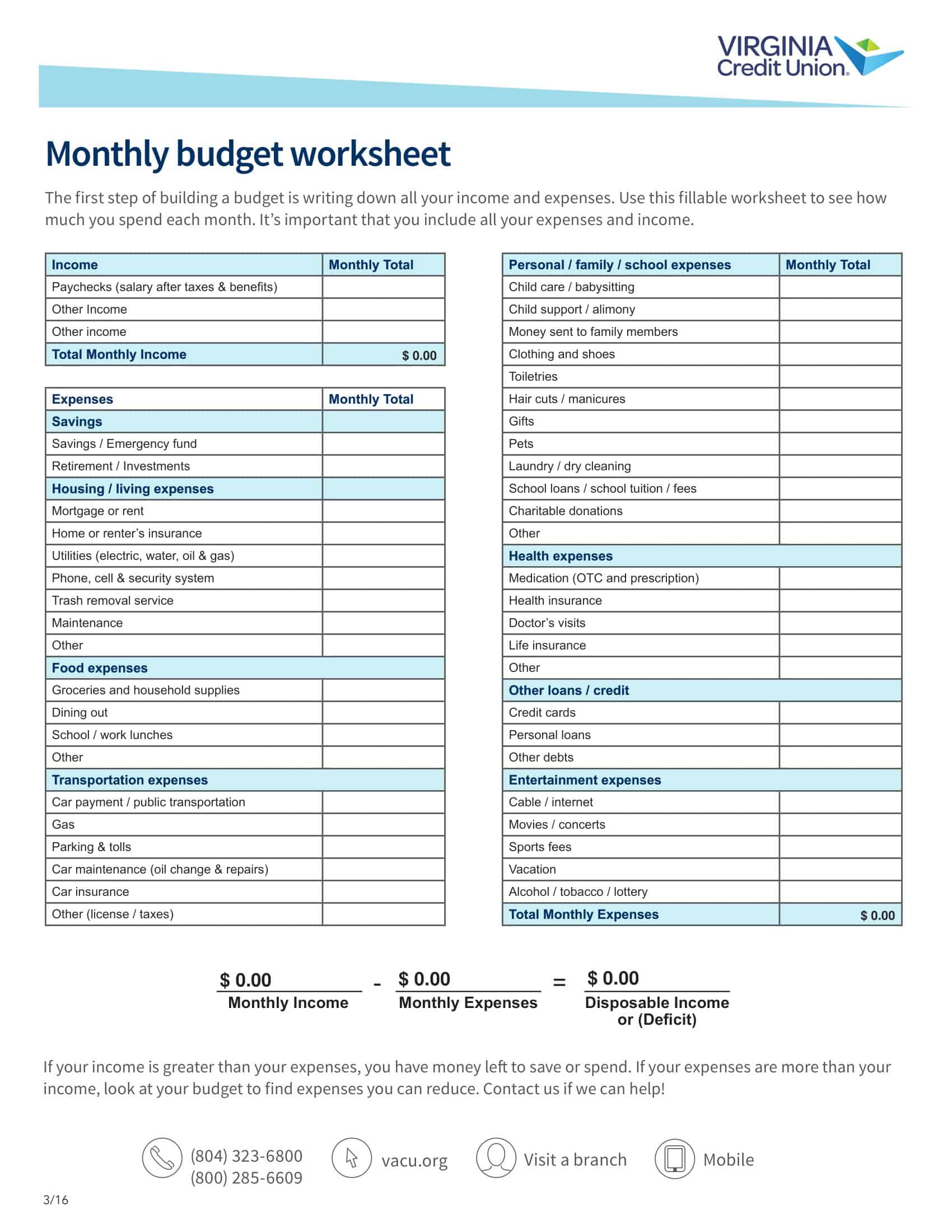

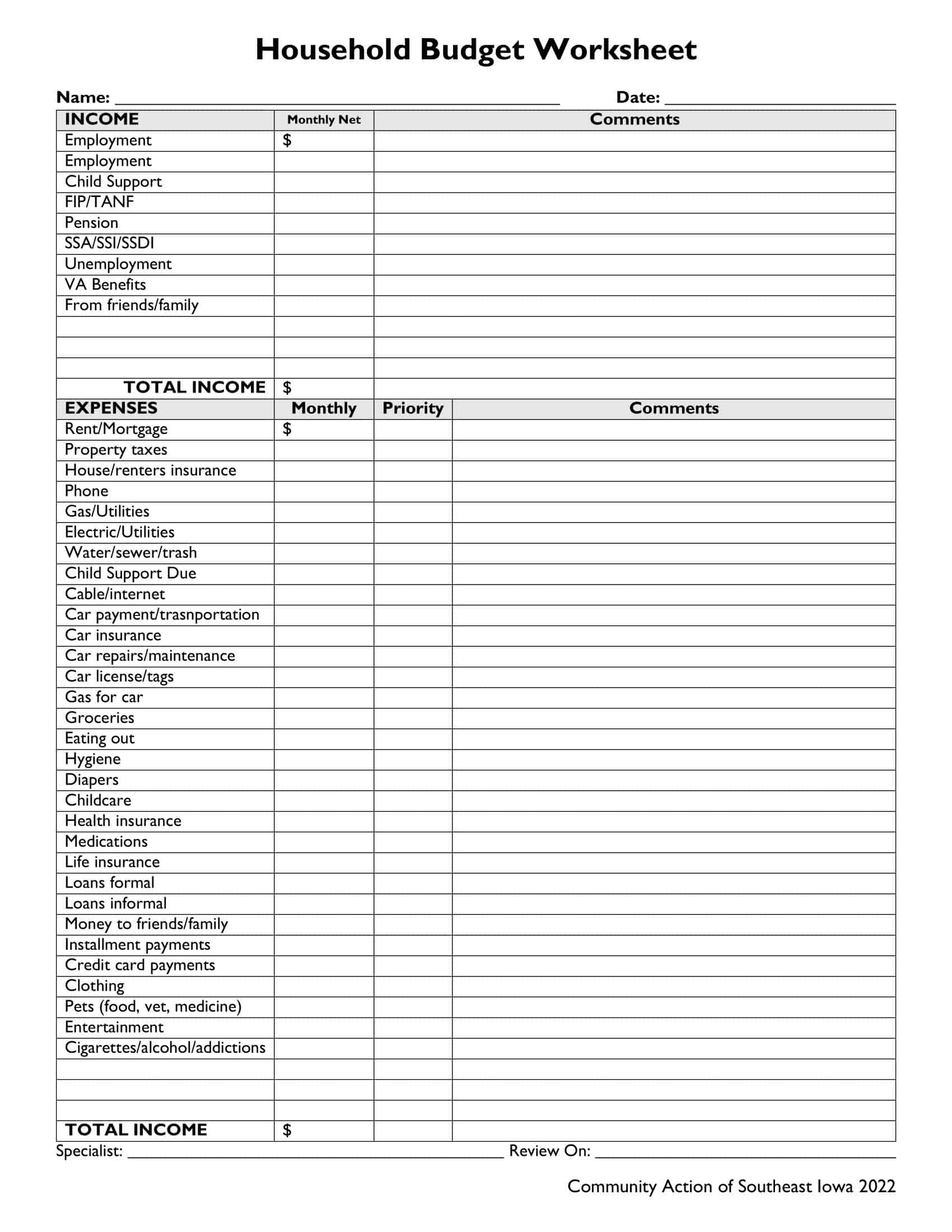

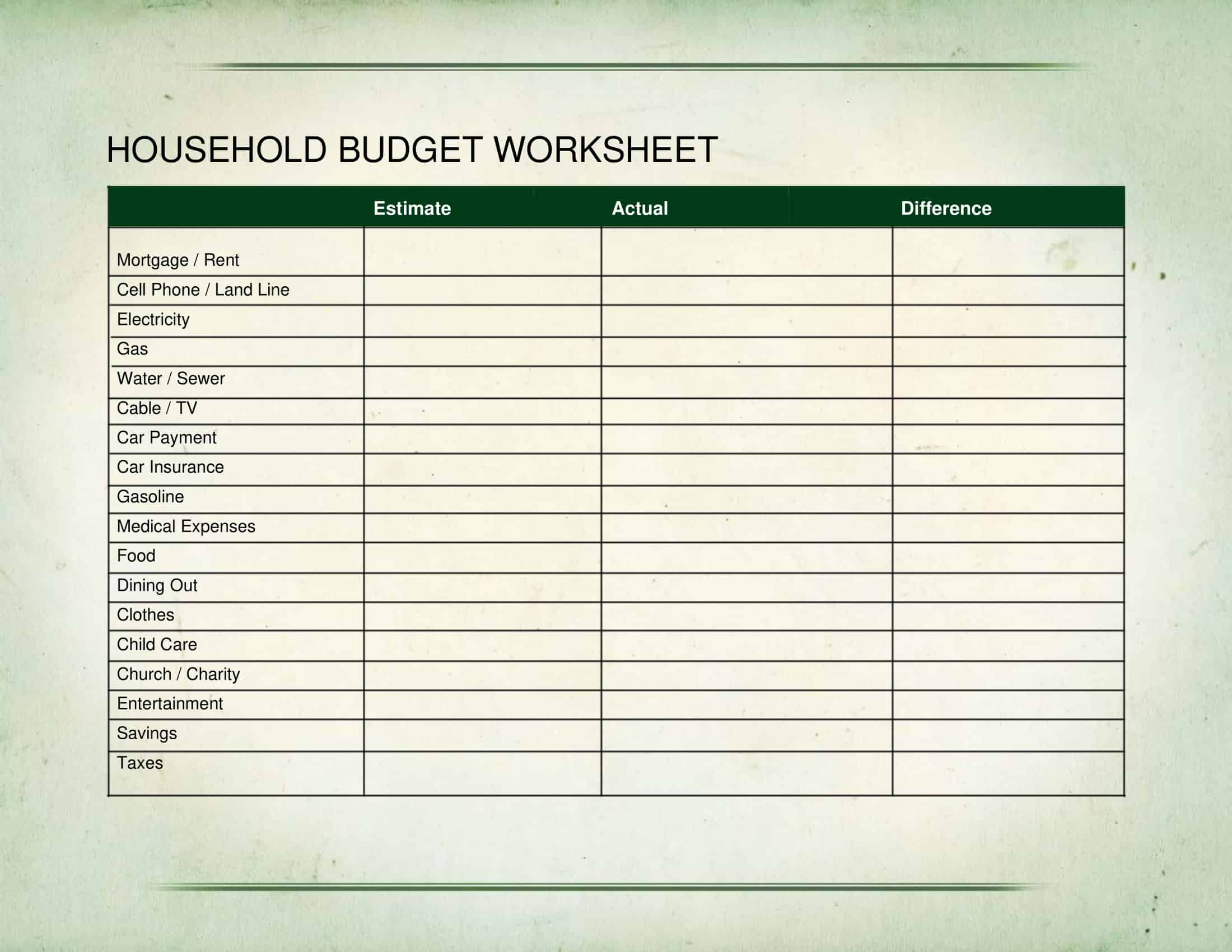

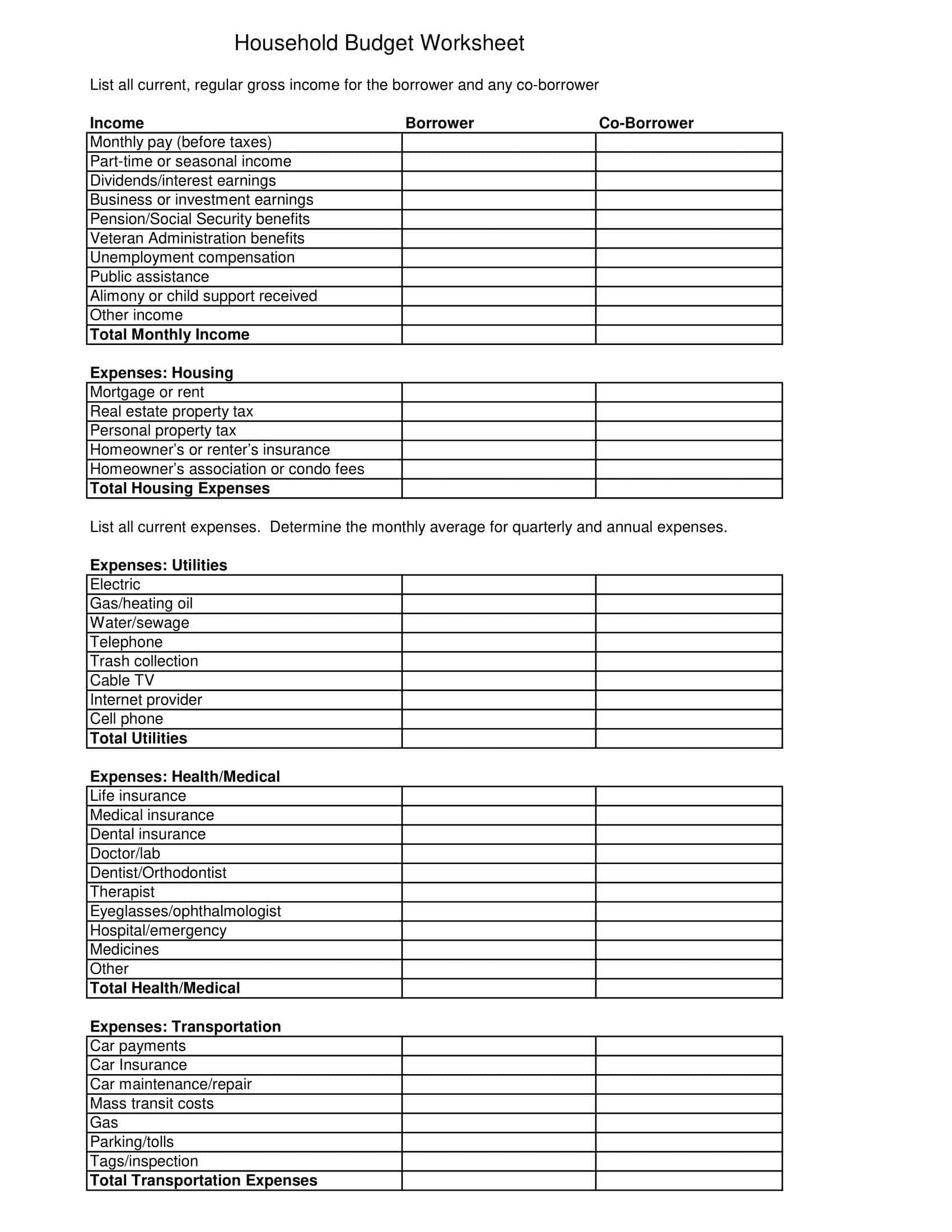

Household Budget Templates are organizational tools used by individuals or families to plan and track income and expenses. They provide a visual representation of financial health and can help identify areas for potential savings or investment.

Typically, these templates include sections for various types of income, such as salary, interest, dividends, and more. They also feature categories for expenses, which can range from fixed costs like mortgage or rent, utilities, and groceries to variable expenses like entertainment, eating out, and personal care items.

Some Household Budget Templates incorporate a savings section. This area might be further broken down into subcategories, such as emergency funds, retirement savings, or specific goals like vacation or education funds. This promotes a proactive approach to savings and financial health.

Benefits of Household Budgeting

Household budgeting offers numerous benefits, ranging from better financial management to long-term financial security. Here’s a detailed guide to the advantages of maintaining a household budget:

- Control Over Your Money: The most immediate benefit of household budgeting is gaining control over your money. By monitoring income and expenses, you can direct your funds effectively and avoid overspending. This also helps to prevent accumulating debt or missing bill payments.

- Clear Financial Picture: A budget allows you to visualize your financial health clearly. It gives you an understanding of your income, fixed costs, discretionary spending, and savings. This information enables you to make informed financial decisions and set realistic financial goals.

- Debt Management: If you’re in debt, a budget is an indispensable tool. It can help you devise a plan to pay off your debt faster by allocating a certain portion of your income towards repayments, while ensuring your regular expenses are covered.

- Savings and Investment: A budget encourages a habit of regular saving and investing. By designating a portion of your income towards savings or investments, you can work towards your long-term goals, be it buying a home, retirement, or creating an emergency fund.

- Financial Freedom and Independence: A household budget reduces financial stress and promotes financial freedom. With a budget, you’re less likely to find yourself in financial emergencies or living paycheck to paycheck. It gives you the independence to make choices and decisions that can enhance your lifestyle.

- Financial Goals Achievement: Whether you’re saving for a vacation, a new car, a house, or your child’s education, a budget is a roadmap that leads you towards your financial goals. It gives you a clear path and timeline for achieving these goals by setting aside money each month.

- Peace of Mind: Knowing exactly where your money is going provides peace of mind. It eliminates financial uncertainty and the fear of unexpected expenses, leaving you more secure and confident about your financial future.

- Spending Patterns Awareness: A budget exposes your spending habits, highlighting areas where you might be overspending. By identifying these, you can adjust your habits and cut back on unnecessary expenses, thereby increasing your savings.

- Improves Communication and Reduces Conflict: When managed collaboratively, a household budget can foster better communication about money matters in a family. It helps to prevent financial conflicts by setting clear expectations about spending and saving.

- Education and Financial Literacy: Lastly, the process of budgeting itself is educational. It improves your financial literacy, making you more competent and confident in managing money.

Key Components of a Household Budget

Creating a comprehensive household budget requires careful consideration of various components. Here’s a detailed guide on the essential elements of a household budget:

- Income: The first component to consider when creating a budget is your total household income. This includes all regular sources of income such as salaries, wages, bonuses, dividends, interest, rental income, and any other reliable source of funds. It’s important to have an accurate and complete picture of your total income to base your budget on.

- Fixed Expenses: These are expenses that remain relatively constant from month to month. They include costs such as rent or mortgage payments, car payments, insurance premiums, utility bills, and student loans. Identifying your fixed expenses is essential as these are often prioritized and paid first.

- Variable Expenses: These are costs that fluctuate from month to month, such as grocery bills, fuel, dining out, entertainment, and personal care. While they can change, it’s crucial to estimate an average cost for each category and include it in your budget.

- Periodic Expenses: These are costs that do not occur monthly but should still be budgeted for. Examples include annual insurance premiums, car maintenance, home repairs, and holiday spending. An efficient way to budget for these is to estimate the annual cost and then divide it by 12 to get a monthly amount.

- Emergency Fund: An emergency fund is a critical component of any budget. It is a pool of money set aside for unexpected expenses, like medical emergencies or sudden loss of income. It’s generally recommended to aim for three to six months’ worth of living expenses in your emergency fund.

- Savings: Whether you’re saving for a vacation, a down payment on a house, retirement, or just for a rainy day, your budget should include a category for savings. The amount you decide to save each month will depend on your income, expenses, and financial goals.

- Debt Repayment: If you have any debts such as credit card balances, loans, or mortgages, your budget should incorporate a plan for repaying these. Minimizing debt and managing repayments are crucial steps towards financial stability.

- Investments: If you have any investments or plan to start investing, these should also be included in your budget. Investment can be a powerful tool for growing your wealth over time.

- Financial Goals: Your budget should reflect your short-term and long-term financial goals. These could include saving for a new car, paying off a mortgage, planning for a child’s education, or preparing for retirement.

- Regular Review: Finally, a budget isn’t static. It should be reviewed and updated regularly to account for changes in income, expenses, or financial goals. Regular reviews ensure that your budget remains an accurate reflection of your financial situation.

House Budgeting Strategies and Tips

Developing effective budgeting strategies can significantly ease the process of managing your finances and reaching your financial goals. Here are some helpful tips and strategies for budgeting:

- 50/30/20 Rule: This rule is a simple way to budget which involves dividing your income into three categories: necessities, wants, and savings. Necessities should take up 50% of your income, wants should account for 30%, and the remaining 20% should go into savings or debt repayments.

- Zero-Based Budget: This is where you make your income minus your outgo equal to zero. This means that every dollar of income you have is assigned a specific purpose, whether it’s for expenses, savings, or debt repayment.

- Envelope System: This involves dividing your cash for the month into different envelopes labeled with different expense categories. Once the money in an envelope runs out, you stop spending in that category for the rest of the month.

- Automate Your Savings: Setting up automatic transfers to your savings account can be a powerful tool for reaching your savings goals. This makes saving less of a conscious effort and more of a built-in aspect of your budget.

- Use Budgeting Tools and Apps: There are numerous budgeting tools and apps available today that can simplify the budgeting process, from tracking your income and expenses to setting savings goals and reminders.

- Adjust As Needed: Your budget should not be set in stone. Adjust it as necessary to accommodate changes in your income, expenses, or financial goals.

- Plan for Irregular Expenses: Don’t forget about annual or semi-annual expenses like car maintenance, insurance premiums, or property taxes. Break these costs down into a monthly amount and include them in your budget.

- Prioritize Debt Repayment: High-interest debt can greatly hinder your financial progress. Prioritize paying off such debts to alleviate the financial burden and free up more money for your budget.

- Include Fun Money: Budgeting doesn’t mean depriving yourself of all enjoyment. Be sure to allocate a portion of your budget for fun activities and personal treats to keep your budget sustainable.

- Track Your Progress: Keep track of your progress towards your financial goals. This can provide motivation and show you where adjustments may be needed.

How to Create a Budget

Creating a household budget can be a straightforward process when broken down into manageable steps. Here is a detailed, step-by-step guide:

Step 1: Set Clear Financial Goals

Start by identifying what you’re hoping to achieve with your budget. Are you aiming to pay off debt? Saving for a home, retirement, or vacation? Your financial goals will shape how you allocate your funds, so it’s important to clarify these first.

Step 2: Determine Your Income

Calculate your total monthly income. This should include all sources: your salary, any bonuses, income from investments, and any other additional earnings you have. Be sure to use your net income (the amount you take home after taxes and other deductions) for your calculations.

Step 3: Identify Your Expenses

Start listing all your expenses. This includes fixed costs (like rent or mortgage payments, utilities, and car payments), variable costs (like groceries, gas, and entertainment), and irregular expenses (like annual insurance premiums or semi-annual property taxes).

Step 4: Categorize Your Expenses

Divide your expenses into categories. This can help you see where your money is going and identify areas for potential savings. Common categories include housing, transportation, food, personal care, health, entertainment, and savings.

Step 5: Compare Income and Expenses

Now that you have a clear picture of your income and expenses, compare the two. If you’re spending more than you’re earning, you’ll need to make some changes to avoid going into debt. If you’re earning more than you’re spending, you can decide how to allocate the excess towards your financial goals.

Step 6: Create a Plan

Create a plan for how you’ll allocate your funds across the different categories. This is where you may decide to follow a budgeting method like the 50/30/20 rule, the zero-based budget, or another approach that suits your needs.

Step 7: Build in Savings

Ensure your budget includes a category for savings. How much you save can depend on your income and financial goals, but a common suggestion is to aim to save at least 20% of your income.

Step 8: Plan for Unexpected Costs

Life is full of unexpected expenses, from car repairs to medical bills. To avoid these events derailing your budget, aim to build an emergency fund. A good rule of thumb is to save enough to cover 3-6 months of living expenses.

Step 9: Implement Your Budget

Once your budget is complete, it’s time to put it into action. Use your budget as a guide for making spending decisions. Remember, a budget isn’t meant to restrict you – it’s a tool to help you achieve your financial goals.

Step 10: Monitor and Adjust Your Budget

A budget should be a living document that changes with your circumstances. Regularly review your budget, at least once a month, to see if you’re staying on track or if any adjustments need to be made.

Conclusion

In conclusion, mastering the art of household budgeting is a transformative journey towards financial stability and independence. While the process may seem daunting at first, understanding its components, benefits, and the steps involved in creating a budget can make it an achievable task for everyone.

A budget serves as a financial roadmap, guiding us to make informed decisions, prioritize our spending, save effectively, and prepare for uncertainties. By embracing budgeting, we can move towards our financial goals more systematically and confidently, reducing financial stress and enhancing the overall quality of life. Remember, the goal of a budget isn’t to restrict your spending, but rather to empower you to spend in a way that supports your life goals and brings you peace of mind. So embark on this budgeting journey, and take control of your financial destiny.

FAQs

How do I start a household budget?

Starting a household budget involves several steps: setting financial goals, determining your income, identifying your expenses, comparing your income and expenses, creating a spending plan, building in savings, planning for unexpected costs, implementing your budget, and then reviewing and adjusting as necessary.

How much should I save in my budget?

The amount you should save depends on your income, expenses, and financial goals. A common suggestion is to save at least 20% of your income. However, this might vary depending on your personal circumstances.

How often should I review my budget?

It’s recommended to review your budget at least once a month. This allows you to check if you’re staying on track and make any necessary adjustments.

What if my expenses are more than my income?

If your expenses are more than your income, it’s important to make changes to avoid going into debt. This could involve reducing unnecessary expenses, finding ways to increase your income, or both.

What budgeting methods can I use?

There are several budgeting methods you can use, including the 50/30/20 rule, the zero-based budget, and the envelope system. The best method depends on your personal preferences and financial situation.

What tools can I use to help with budgeting?

There are numerous tools available to help with budgeting, from spreadsheets and templates to budgeting apps. These tools can simplify the budgeting process and help you stay on track.

How can a budget help me pay off debt?

A budget can help you pay off debt by allowing you to allocate a portion of your income towards debt repayments. This ensures that you’re consistently paying down your debt while also managing your other expenses.

Is budgeting only for people who are struggling financially?

No, budgeting is beneficial for everyone, regardless of their financial situation. Even if you’re not struggling financially, a budget can help you manage your money more effectively, save for future goals, and prepare for unexpected costs.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Financial Projections Templates [Excel, PDF] 3 Financial Projection](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Projection-1-150x150.jpg)