Proper money management is an essential life skill, often making the difference between financial security and monetary uncertainty. Our upcoming article features a comprehensive Money Management Worksheet, a tool specifically designed to aid in budgeting, saving, investing, and overall financial planning.

By utilizing this worksheet, you’ll gain a more detailed understanding of your income, expenses, and spending habits, paving the way towards greater financial wellness. In this article, we’ll walk you through how to effectively use this worksheet and implement its teachings into your daily life.

Table of Contents

What is a Money Management Worksheet ?

A Money Management Worksheet is a comprehensive tool intended to improve an individual’s or a household’s financial health by providing a structured way to track income and expenses, analyze spending habits, and plan for savings or investments. It allows the recording of all sources of income and a detailed account of monthly expenditures, categorized into fixed and variable costs.

This comparison between income and expenses facilitates an understanding of one’s spending habits, highlighting potential areas of overspending or opportunities for saving. Additionally, the worksheet aids in planning and allocating a portion of income towards savings, emergency funds, and retirement investments, ultimately leading to better financial management and stability.

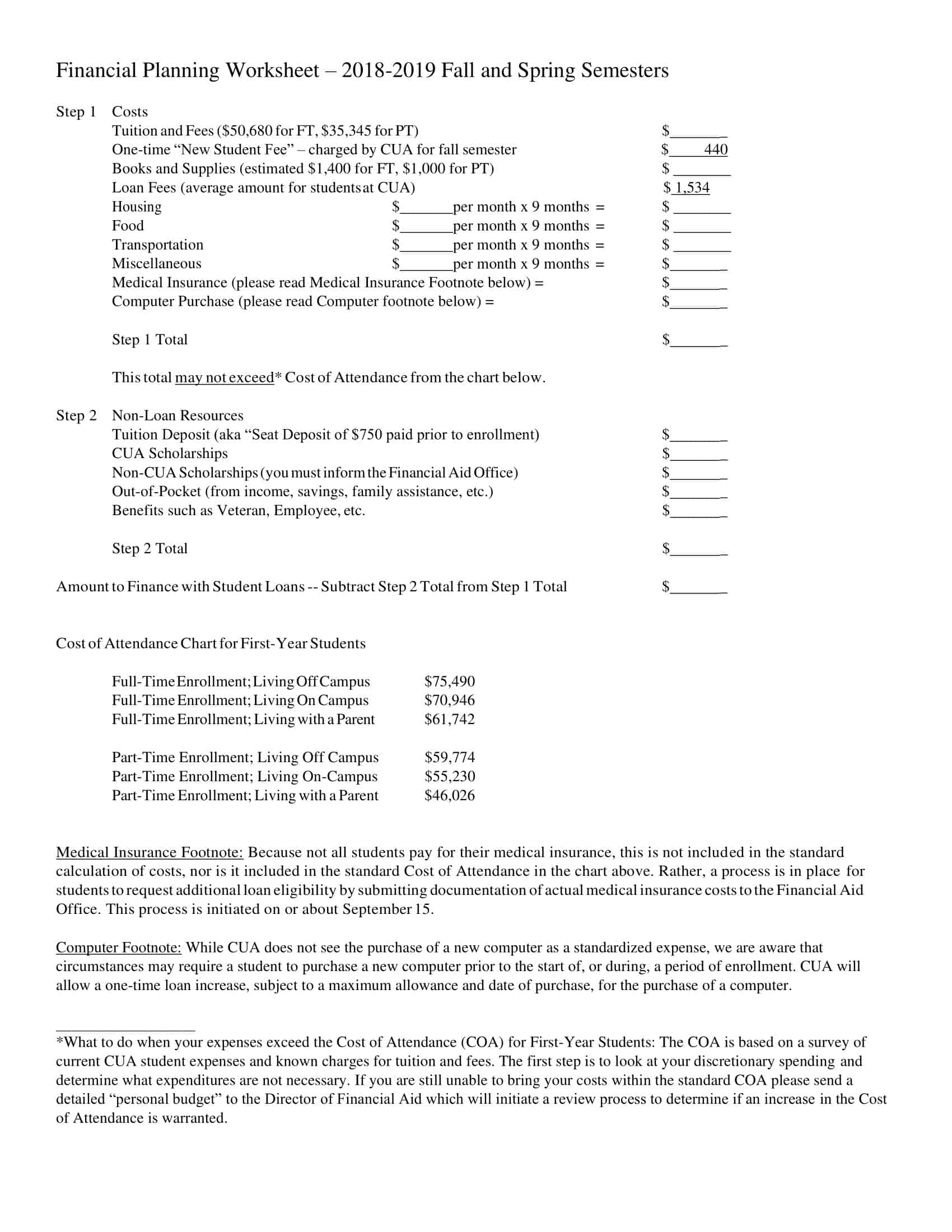

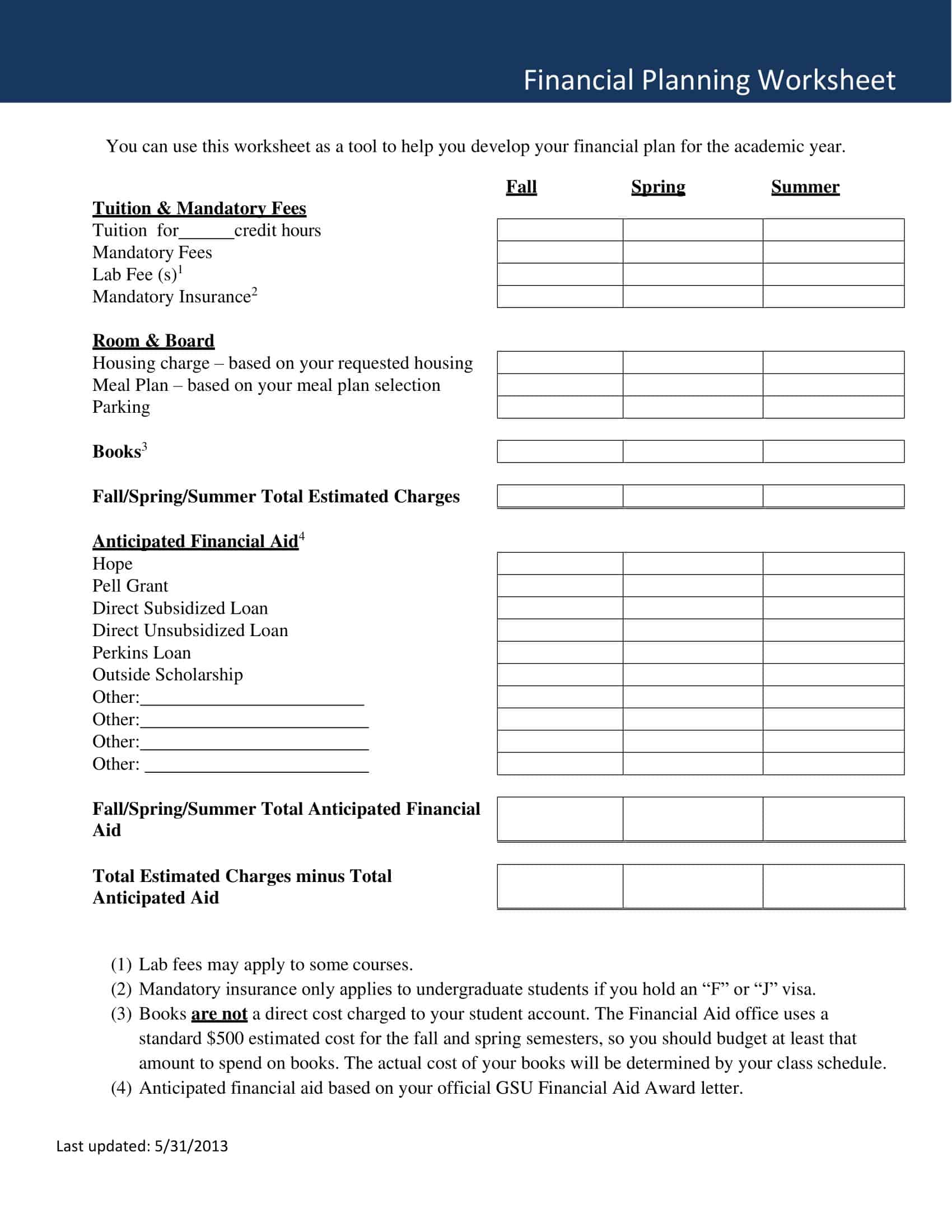

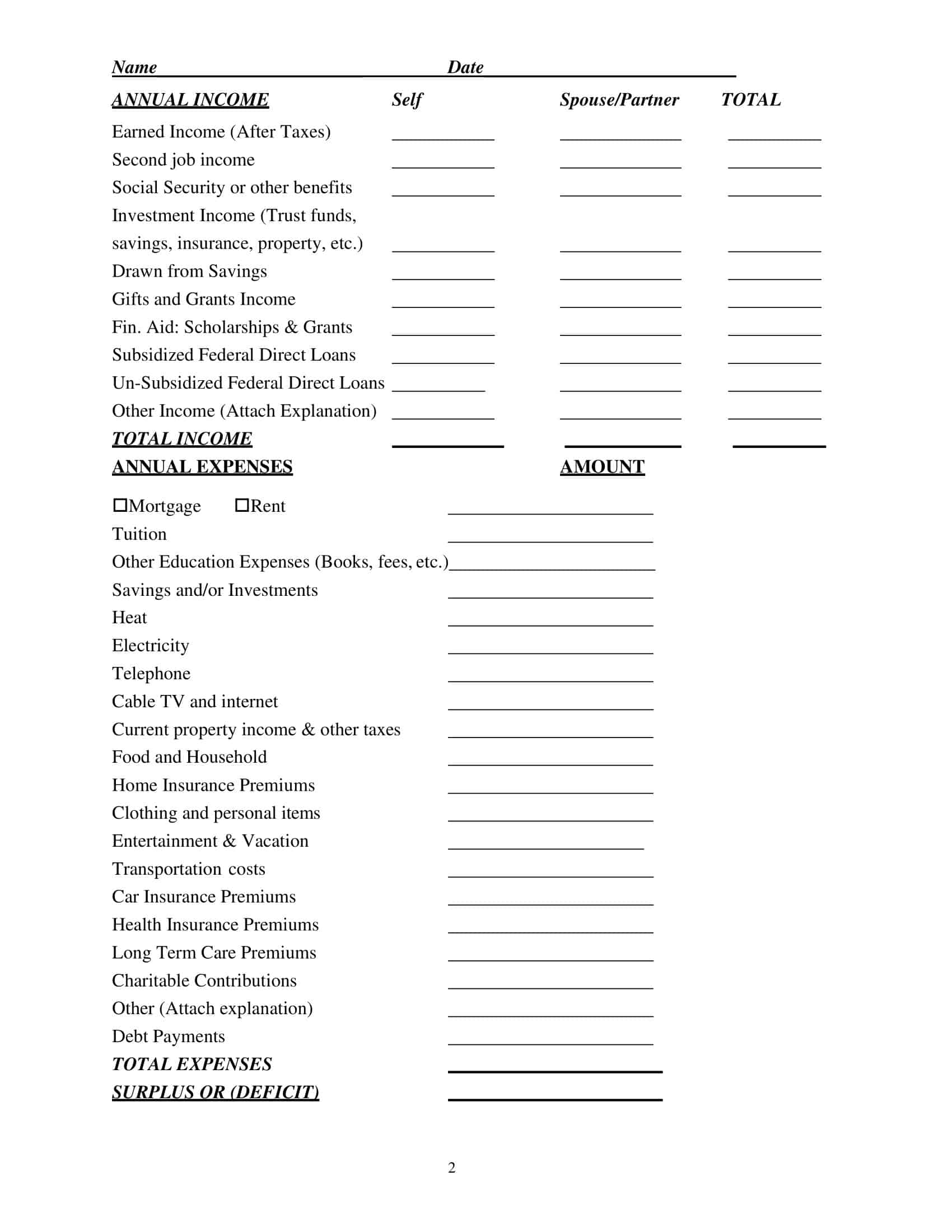

Money Management Worksheet Templates

Money Management Worksheet Templates are powerful financial tools that provide a structured approach to personal finance management. They are typically composed of numerous fields and sections, each representing a different aspect of one’s financial situation.

The heart of these templates is the income and expense section. Here, users document their sources of income – salaries, business profits, dividends, and more. The expense portion, on the other hand, may have entries for rent, utilities, groceries, entertainment, and other routine expenditures. The design here is to capture a complete picture of an individual’s or a family’s cash inflow and outflow.

Additionally, these templates often feature sections dedicated to savings and investments. They provide a way for individuals to set, track, and manage their financial goals, whether it’s for emergency funds, retirement savings, or investment capital. Users can specify the amount they wish to save or invest each month and monitor their progress over time.

Benefits of using a money management worksheet

The use of a Money Management Worksheet can yield a host of benefits, contributing to an individual’s financial understanding and stability. Here’s a comprehensive guide to the many advantages it offers:

Enhanced Financial Awareness

A money management worksheet helps bring all your financial information together in one place. It provides an overview of your income, expenses, debts, and savings, which is often the first step towards improving financial health. It allows for increased transparency and a better understanding of your monetary status.

Budgeting and Spending Control

By tracking your income and expenditures in detail, you can set a realistic budget and identify where your money is going each month. This awareness can help curtail unnecessary spending and facilitate wiser financial decisions, giving you more control over your money.

Promotes Saving

One of the key benefits of using a money management worksheet is the promotion of a regular saving habit. By identifying areas where you can cut back, you can increase the amount of money set aside for savings. It also enables the creation of an emergency fund, which is vital for financial security.

Debt Management

If you have loans or are in debt, a money management worksheet can help you strategize and plan for repayment. You can keep track of due dates, interest rates, and monthly payment amounts, which can help avoid late fees and reduce the overall debt burden.

Investment Planning

With a clear view of your financial status and better control over your spending and saving, you can make more informed decisions about investments. Whether it’s for retirement, buying a house, or other financial goals, the worksheet can help you calculate how much you can afford to invest.

Prepares for Unexpected Expenses

Life is full of surprises, and unfortunately, some of those surprises can be expensive. By having a clear budget and savings, you’re better equipped to handle unexpected expenses without falling into debt.

Financial Independence

Finally, effective use of a money management worksheet can lead to financial independence. It can help you build wealth over time, ensure you live within your means, and ultimately lead a more secure, stress-free financial life.

What are some essential details to include on your money management worksheets?

Creating a comprehensive Money Management Worksheet necessitates the inclusion of several key components. Each of these details plays a pivotal role in providing an accurate and meaningful snapshot of your financial situation.

Personal Information: Begin by noting down basic information such as your name, the current date, and the time period for which you’re planning (monthly, quarterly, annually).

Income: The first substantive section should detail your income. Include all sources of income such as salary, rental income, dividends, interest, and any other earnings. For irregular income, estimate an average and adjust it as you go along.

Fixed Expenses: These are costs that stay relatively constant from month to month, like rent or mortgage payments, utilities, insurance premiums, car payments, and subscriptions. Include all fixed obligations you have each month.

Variable Expenses: These are costs that fluctuate from month to month. They can include groceries, dining out, entertainment, travel, clothing, and any other discretionary spending.

Debts: List all of your debts such as student loans, credit cards, personal loans, car loans, and any other outstanding debt. Include the interest rate, minimum payment, and total amount owed for each.

Savings and Investments: Document all your savings and investments, including retirement accounts, emergency funds, mutual funds, stocks, bonds, or real estate investments. Include details about how much you contribute to each per month or per year.

Financial Goals: Outline both short-term and long-term financial goals. This could include saving for a vacation, paying off a specific debt, or planning for retirement. Attach a cost to each goal and a timeline for achieving it.

Spending Analysis: After you’ve documented your income and expenses, analyze where your money is going. Highlight areas where you may be overspending and identify potential savings.

Net Worth: Calculate your net worth by subtracting your total debts from your total assets. This gives you a comprehensive view of your financial health and can be a good motivator for improving your financial management.

Review and Adjust: Lastly, your worksheet should include a section for regular reviews. This enables you to adjust your budget as necessary and keeps your financial plan dynamic and responsive to changes in your financial situation.

Types of money management worksheets

Money management worksheets come in a variety of types to suit different financial goals, needs, and stages of life. Here are some commonly used types:

Budgeting Worksheets

These worksheets help you build and stick to a budget by tracking your income and expenses. They often categorize expenditures into fixed and variable costs, allowing you to see where your money is going and where you might be able to save.

Debt Payoff Worksheets

These are specifically designed to help manage and eliminate debt. They can help you keep track of what you owe, the interest rates, and your payment schedule. Some follow strategies like the “debt snowball” or “debt avalanche” methods for effective debt reduction.

Savings Goal Worksheets

These worksheets help you plan and track your progress towards specific financial goals, such as building an emergency fund, saving for a vacation, or making a down payment on a house.

Expense Tracker Worksheets

These worksheets focus on tracking your spending in detail. They can provide valuable insights into your spending habits and help identify areas for potential savings.

Net Worth Worksheets

These worksheets calculate your net worth by subtracting your liabilities (what you owe) from your assets (what you own). This can be a good tool for tracking your overall financial progress.

Retirement Planning Worksheets

These worksheets help you plan for retirement by estimating how much you’ll need to save and invest to achieve a comfortable retirement.

Investment Tracking Worksheets

These worksheets are used to track your investments, including stocks, bonds, mutual funds, and real estate. They can help you monitor performance and make informed decisions about your investment strategy.

Monthly Bill Organizer Worksheets

These worksheets are designed to help you organize and track your monthly bills, ensuring you never miss a payment.

Student Loan Worksheets

These are designed for managing student loans specifically. They can help you understand your loan repayment schedule, track your progress, and strategize for faster loan repayment.

Tips for Effective Money Management Worksheet Usage

Using a Money Management Worksheet effectively can greatly contribute to your financial health and stability. Here are some tips to ensure you’re making the most of this valuable tool:

Be Accurate and Honest: The first step towards effective money management is being completely accurate and honest about your income, expenses, debts, and savings. Only when you record truthful figures can you understand your real financial situation and make informed decisions.

Categorize Expenses: Categorize your expenses into “needs” and “wants”. Needs are necessary expenses for survival and functioning, like rent, groceries, and healthcare, while wants are more discretionary, like dining out, entertainment, or luxury items. Understanding this distinction can help prioritize spending and identify potential areas for savings.

Regular Updates: Update your worksheet regularly, ideally after every significant financial transaction. This will help you keep track of your spending in real-time, making it easier to stay within your budget.

Consistency is Key: The effectiveness of a money management worksheet lies in consistent usage. Make it a habit to review your worksheet regularly, such as at the end of each week or month.

Set Realistic Goals: It’s important to set achievable short-term and long-term financial goals. This can provide motivation to stick to your budget and make wise financial decisions. However, remember to keep these goals realistic to avoid unnecessary disappointment or stress.

Review and Adjust: A financial plan should never be static. Make sure to review your worksheet periodically and adjust your budget as necessary to accommodate changes in income, expenses, financial goals, or life circumstances.

Plan for Emergencies: Always allocate a part of your income towards an emergency fund. Life can be unpredictable, and having a financial cushion can protect you from unexpected expenses or a sudden loss of income.

Include All Household Members: If you share financial responsibilities with others in your household, make sure to include them in the process. This promotes transparency, shared responsibility, and teamwork towards achieving financial goals.

Use Technology: There are many apps and digital tools available today that can simplify the process of tracking your income and expenses. Utilize these resources to make managing your worksheet easier and more efficient.

Seek Professional Advice: If you’re having trouble managing your finances or don’t know where to start, consider seeking advice from a financial advisor. They can provide personalized guidance based on your unique financial situation and goals.

How to make Money Management Worksheet in Excel

Creating a Money Management Worksheet in Excel is a relatively straightforward process, and it provides a flexible, customizable tool for tracking your finances. Here are the steps you can follow:

- Step 1: Open Excel and start with a blank spreadsheet.

- Step 2: Name your worksheet. Click on “Sheet1” at the bottom and rename it to “Money Management” or another title of your choice.

- Step 3: Start by creating a section for your income. In cell A1, type “Income”. In cells A2, A3, A4, etc., list all your different income sources, like “Salary”, “Rental Income”, “Freelance Work”, etc.

- Step 4: In cell B1, type “Amount”. In column B next to each income source, record the respective amounts you earn from those sources each month.

- Step 5: In cell B1, under the list of income sources and amounts, type “Total Income”. In the cell to its right, use the SUM formula to add up all your income amounts. For example, if your income sources are listed from B2 to B4, you would type “=SUM(B2:B4)”.

- Step 6: Next, create a section for your expenses. Two to three rows below your income section, in cell A1, type “Expenses”. List all your expense categories down column A, such as “Rent”, “Groceries”, “Utilities”, “Entertainment”, etc.

- Step 7: In cell B1 next to “Expenses”, type “Amount”. List the respective amounts for each expense category in column B.

- Step 8: Similar to your income, calculate your “Total Expenses”. Below your expense list, type “Total Expenses” in column A and use the SUM formula to add up all your expenses.

- Step 9: To calculate your net income, a few rows below your total expenses, type “Net Income” in column A. In the corresponding cell in column B, subtract your total expenses from your total income. You can use a formula like “=B5-B10”, replacing B5 and B10 with the cells where you calculated total income and total expenses, respectively.

- Step 10: Format your worksheet as desired. You can use bold, underline, or different colors to highlight different sections or totals. You can also use the “Format as Currency” option to format your income and expense amounts as currency.

- Step 11: Save your worksheet and update it regularly with new income and expense information. Remember to update the total income, total expenses, and net income whenever you add new data.

Conclusion

Mastering financial wellness is a journey that demands organization, understanding, and consistent tracking of your income and expenses. A Money Management Worksheet serves as a powerful ally on this journey, providing a clear and comprehensive view of your financial landscape. It empowers you to plan wisely, spend mindfully, and save effectively, while also preparing for unexpected financial exigencies.

Not only does it enable better debt management and investment planning, but it also fosters long-term habits that pave the way towards financial independence. As you continue your financial journey, remember that the path to prosperity begins with a well-managed worksheet and informed money management choices.

FAQs

How do you create a money management sheet?

To make a money management sheet, use a spreadsheet and create columns to log monthly income amounts, fixed costs by category like housing or insurance, variable spending on needs and wants, amounts going into savings, and how much remains for discretionary spending based on priorities.

What is the 60 20 20 budget template?

The 60 20 20 budget philosophy recommends: 60% of net monthly income covers living essentials like food, rent, transport

20% goes toward medium-term financial goals like paying off debts 20% goes into long-term savings for retirement or big purchases

How to make a budget worksheet?

To create a helpful budget worksheet: Design a grid table itemizing income sources, fixed costs per category, variable spending holding allocations, savings contribution amounts or percentages, remaining discretionary funds. Tally up total amounts per column showing inflows/outflows for balancing.

Does Excel have financial templates?

Yes, Microsoft Excel provides several free and premium ready-made personal finance spreadsheet templates to track budgets, savings, expenses, investments, debt and more. Easy customization adding personal details through guided steps. Insightful planning and money management reports generated on auto-pilot saving hours every month.

What is the 50 30 20 rule?

The 50 30 20 budgeting guideline recommends: 50% of take-home income covers living essentials 30% toward personal lifestyle expenses and extras

20% of earnings saved for short and long term goals

This allowance ratio balances current spending with wealth building principles.

What is the money management formula?

A basic money management formula is: Income – Expenses = Disposable Income Take total salary/wages minus cost of living like rent, insurance premiums, loan payments to get remaining disposable income amount. This illustrates how much is available to allocate towards goals like paying off debts or building savings.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)