Owning a home is a dream for many, and paying off a mortgage is a significant milestone in achieving that dream. The satisfaction of a mortgage is the document that signifies the end of a borrower’s financial obligation to a lender and confirms that the property is now fully owned by the borrower. It is a moment of great joy and relief for homeowners, marking the achievement of a significant financial goal and providing a sense of security and stability.

Table of Contents

What Is Satisfaction of Mortgage?

A satisfaction of mortgage is a legal document that is issued by a lender to a borrower upon the full repayment of a mortgage loan. This document confirms that the mortgage has been paid in full and that the lender no longer has a lien on the property.

The satisfaction of mortgage is recorded with the relevant government agency, such as a county recorder’s office, to remove the mortgage from the property’s title and legally transfer the ownership of the property to the borrower. It is important to note that in some states, the satisfaction of mortgage is known as a “release of mortgage” or a “deed of reconveyance.”

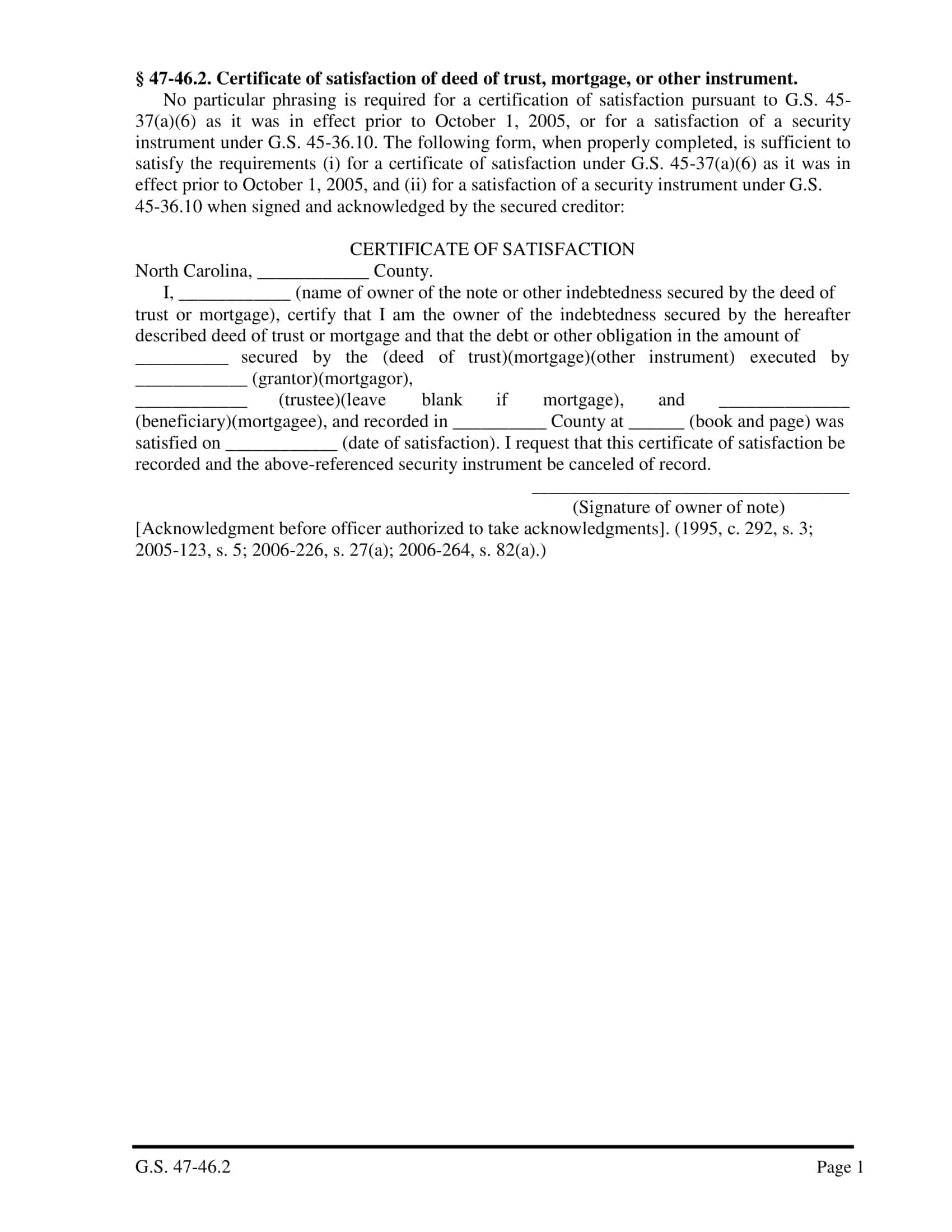

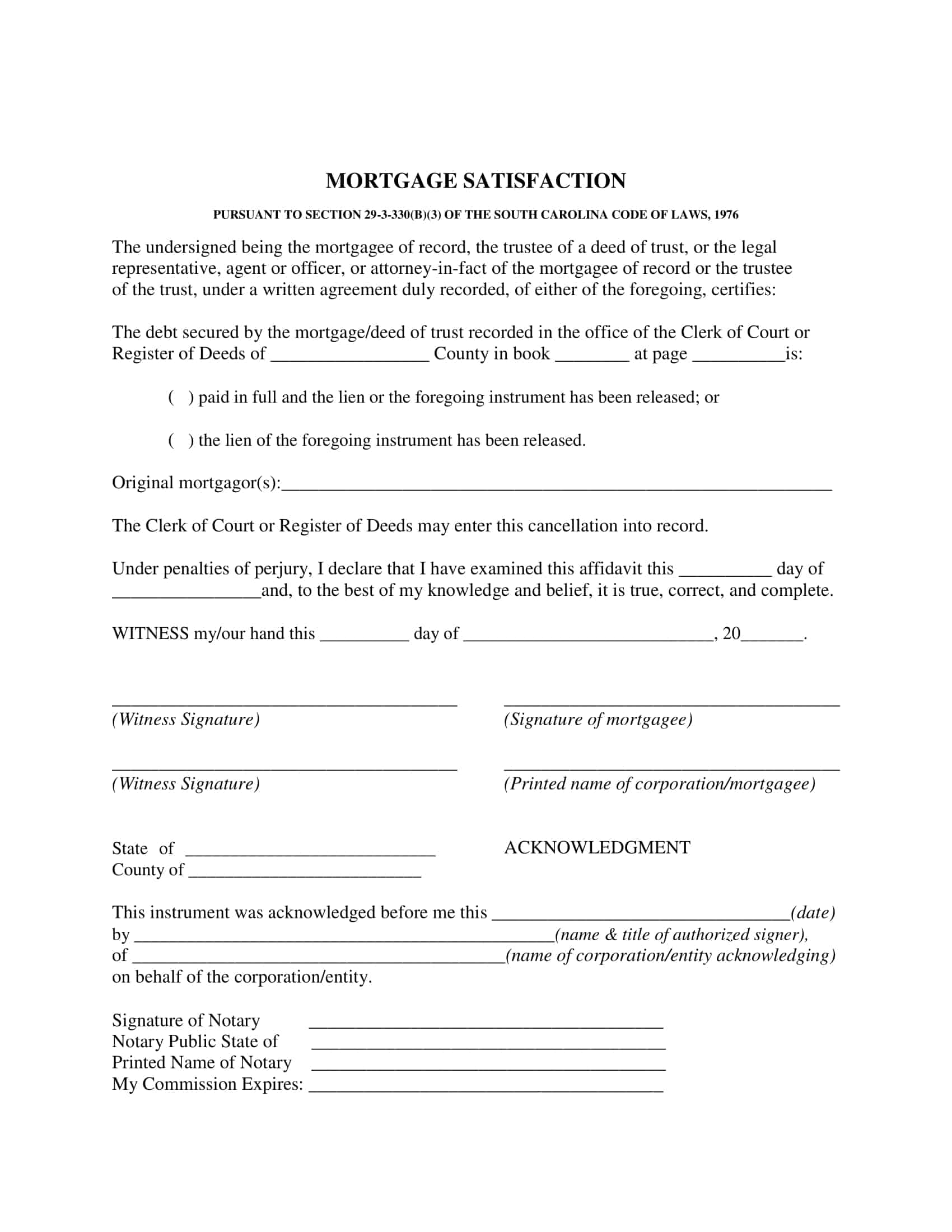

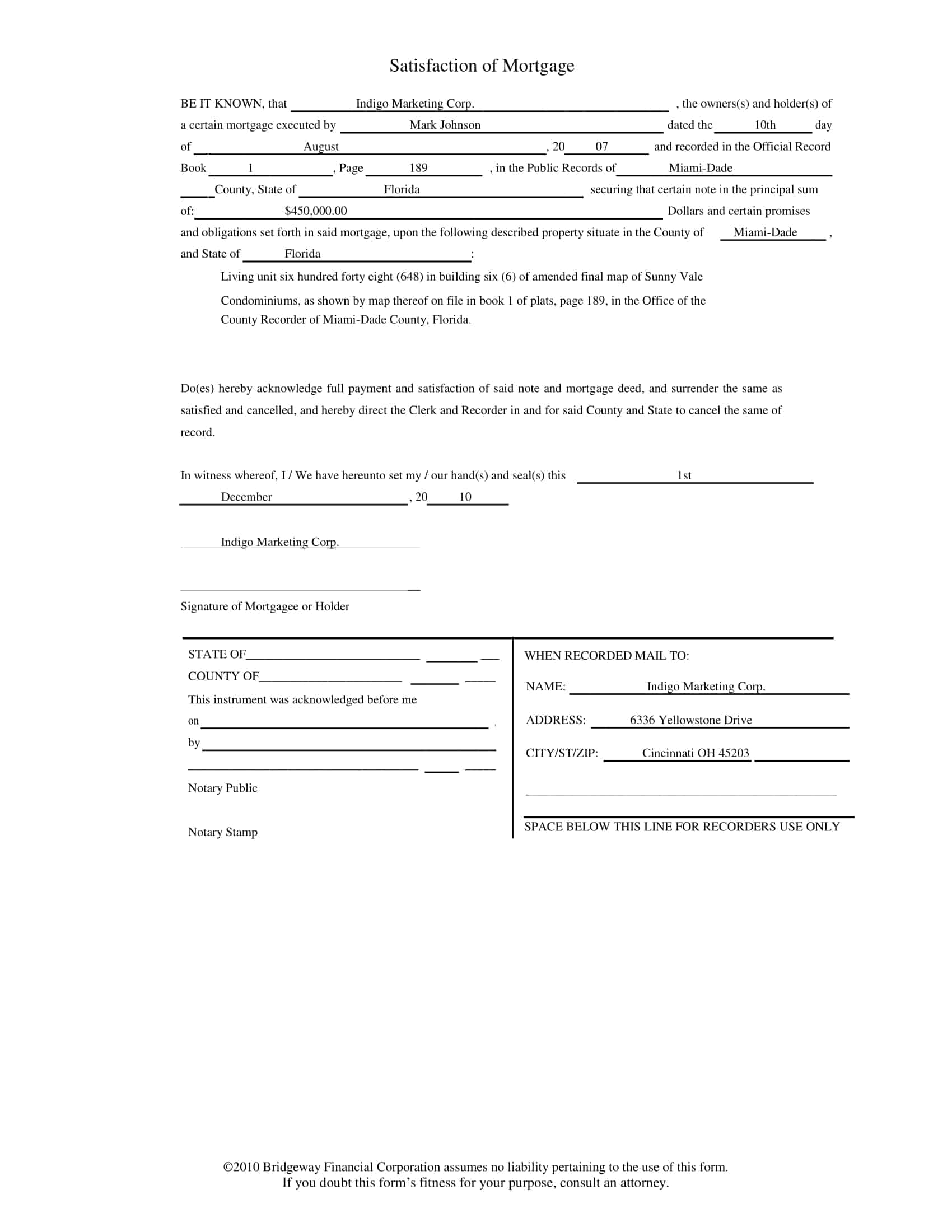

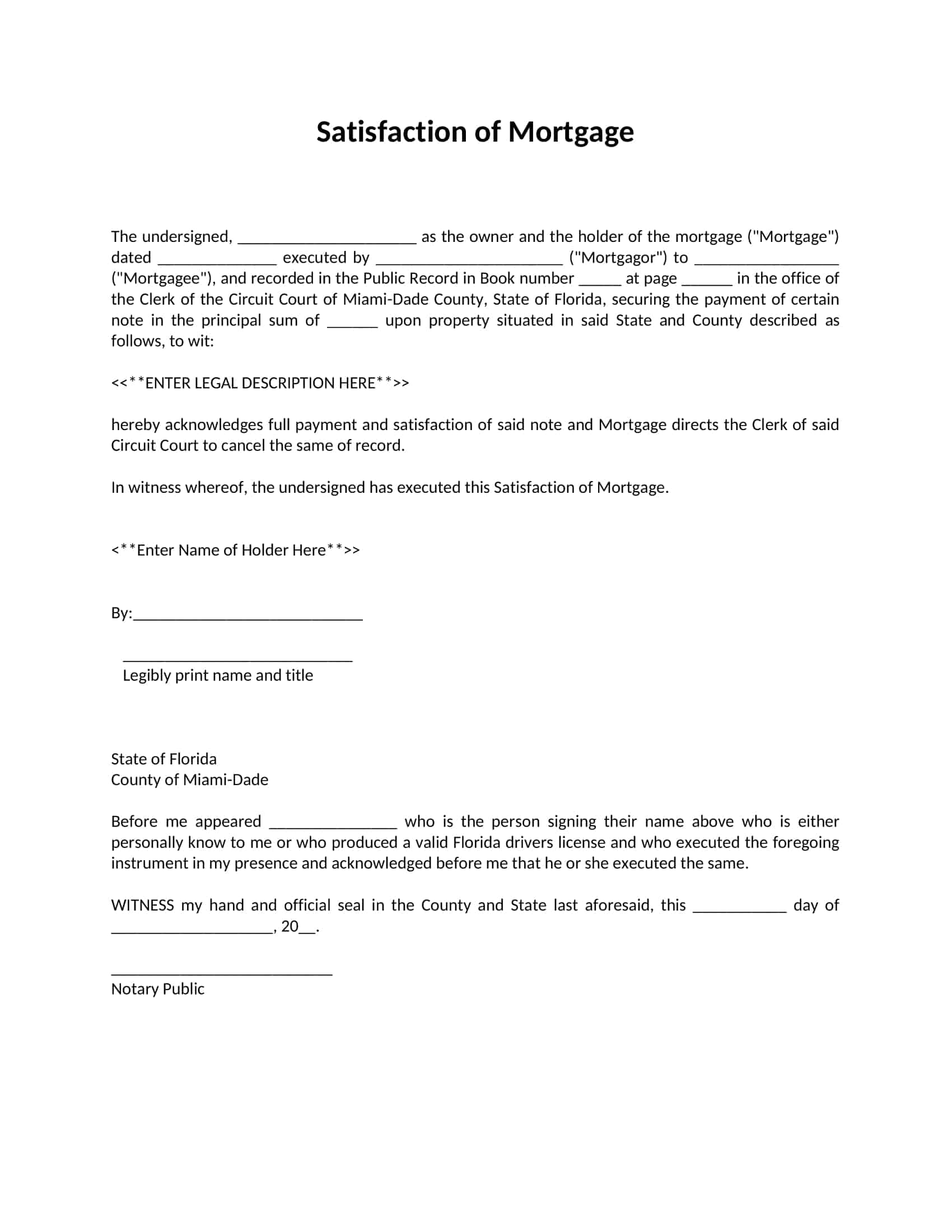

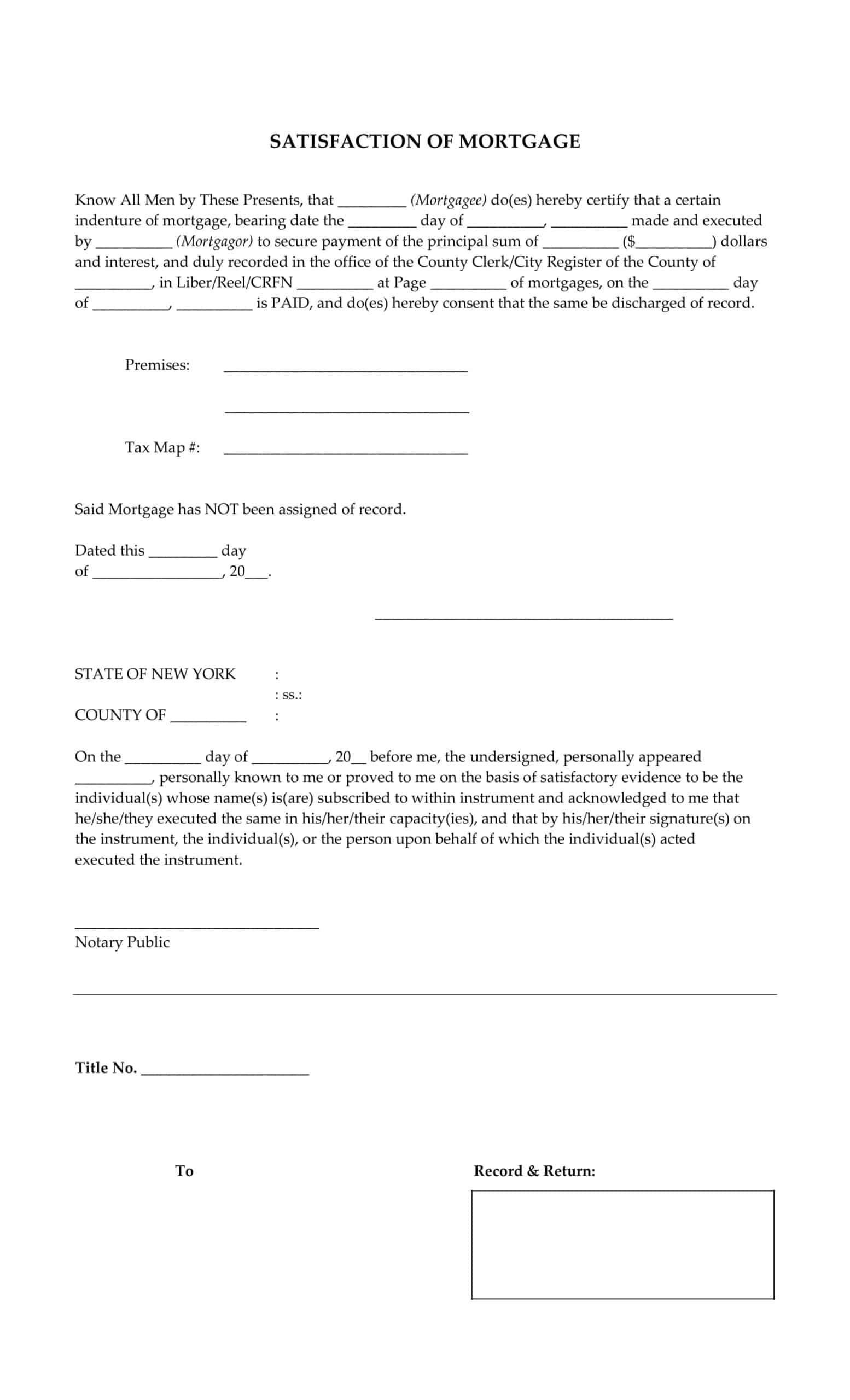

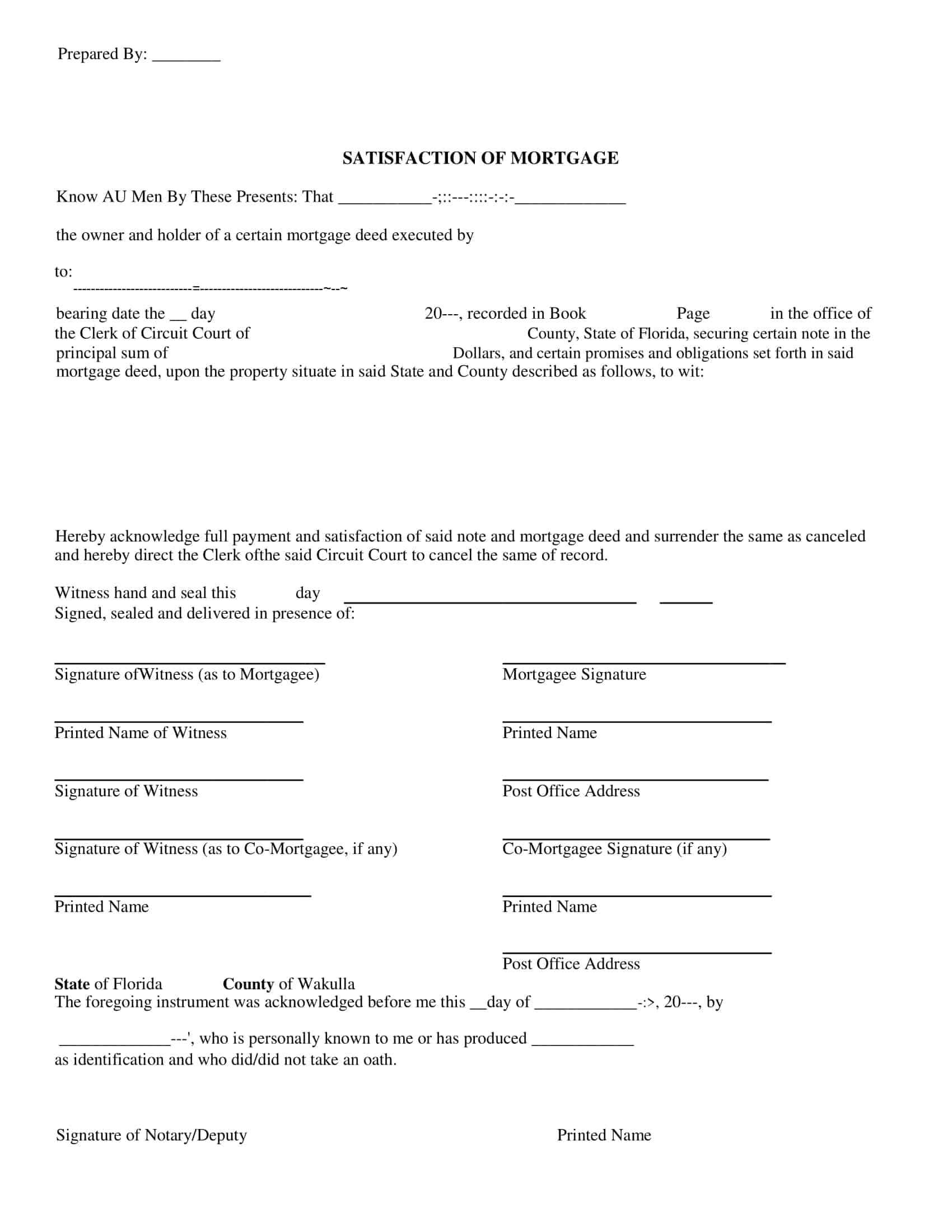

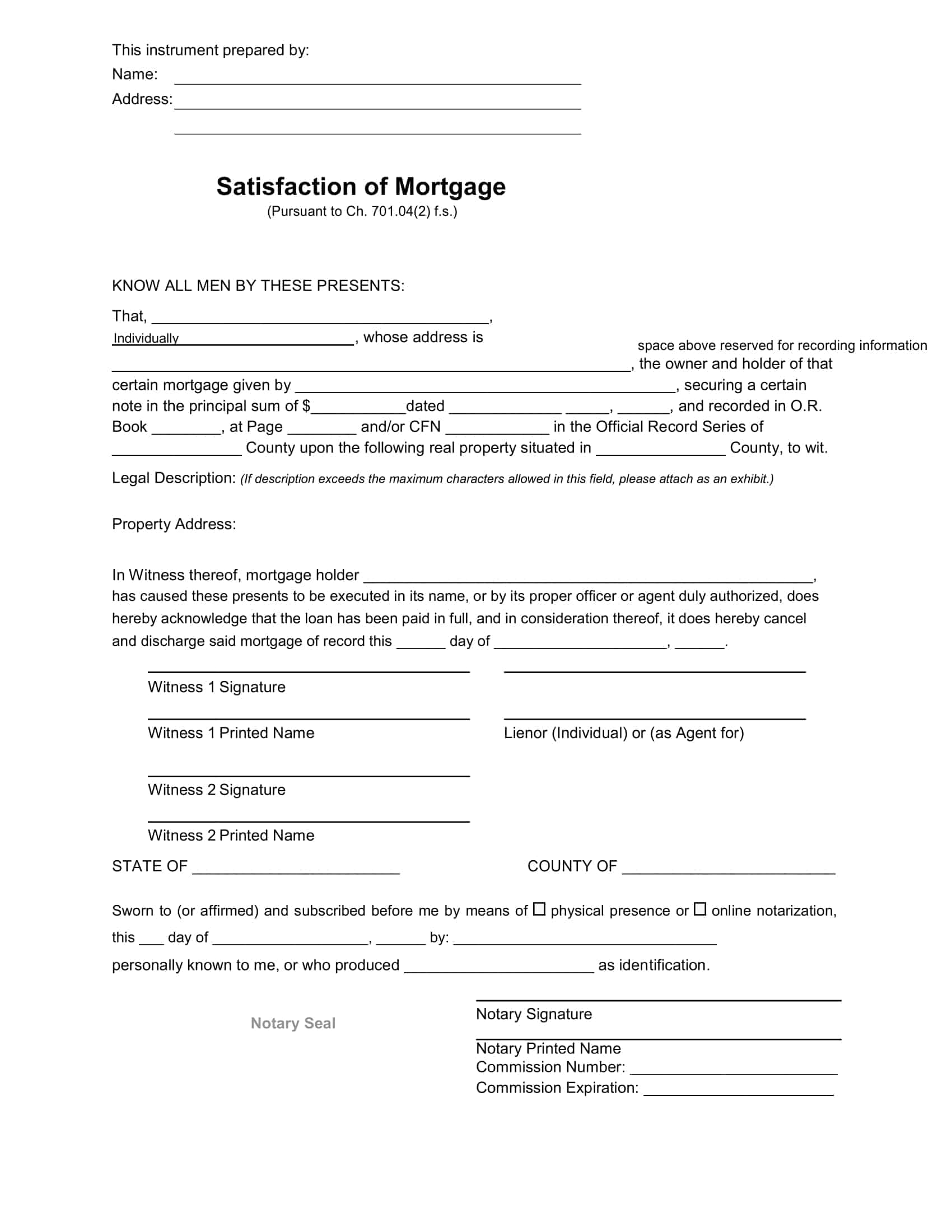

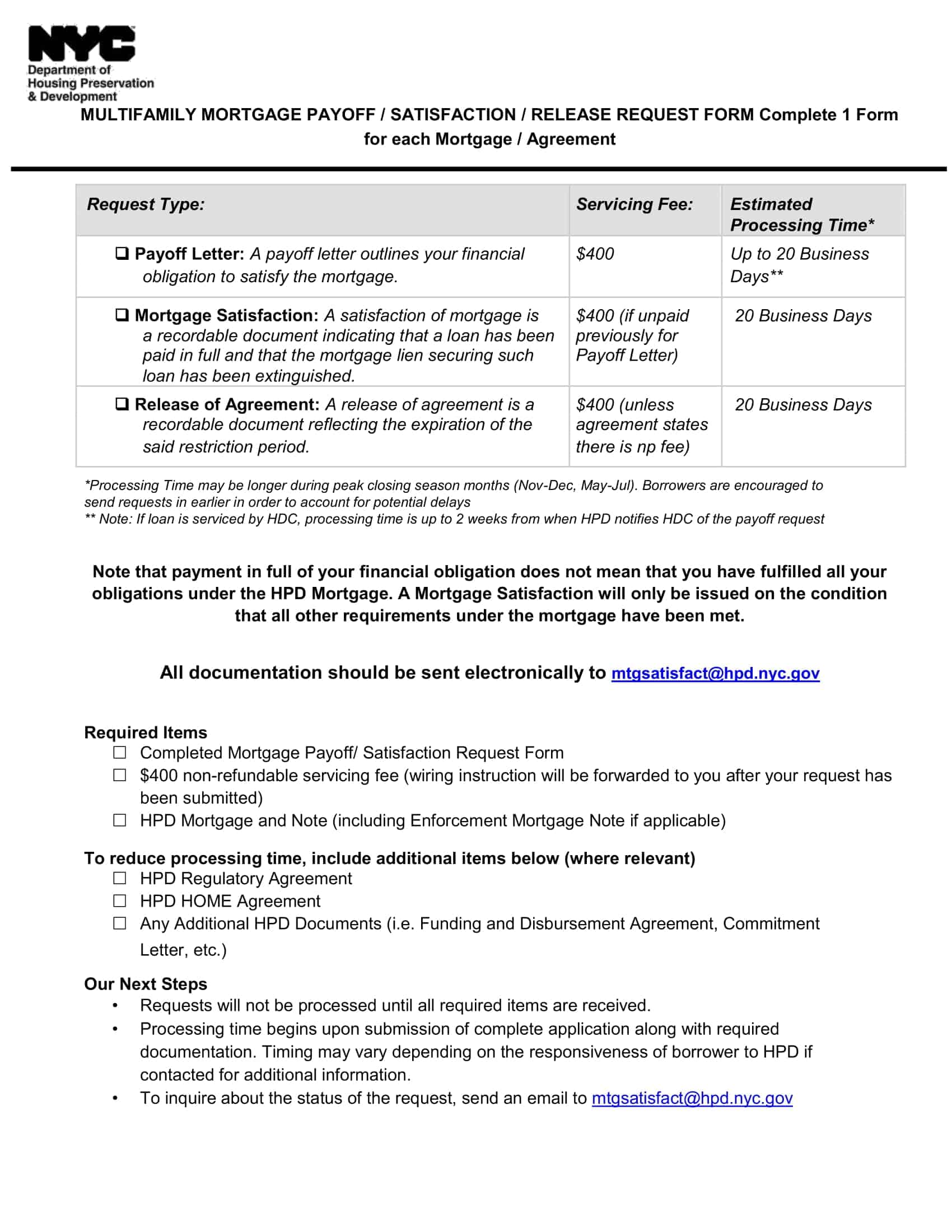

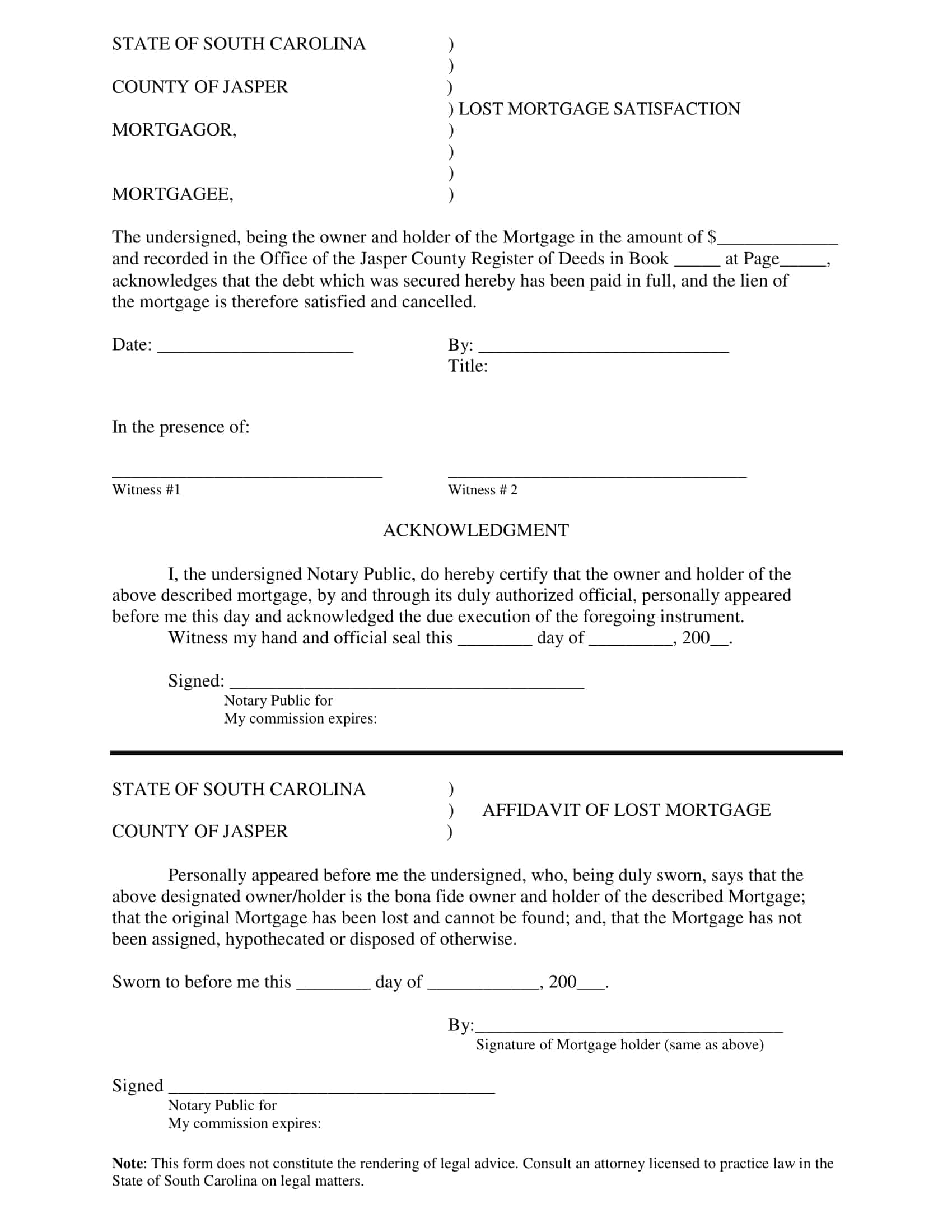

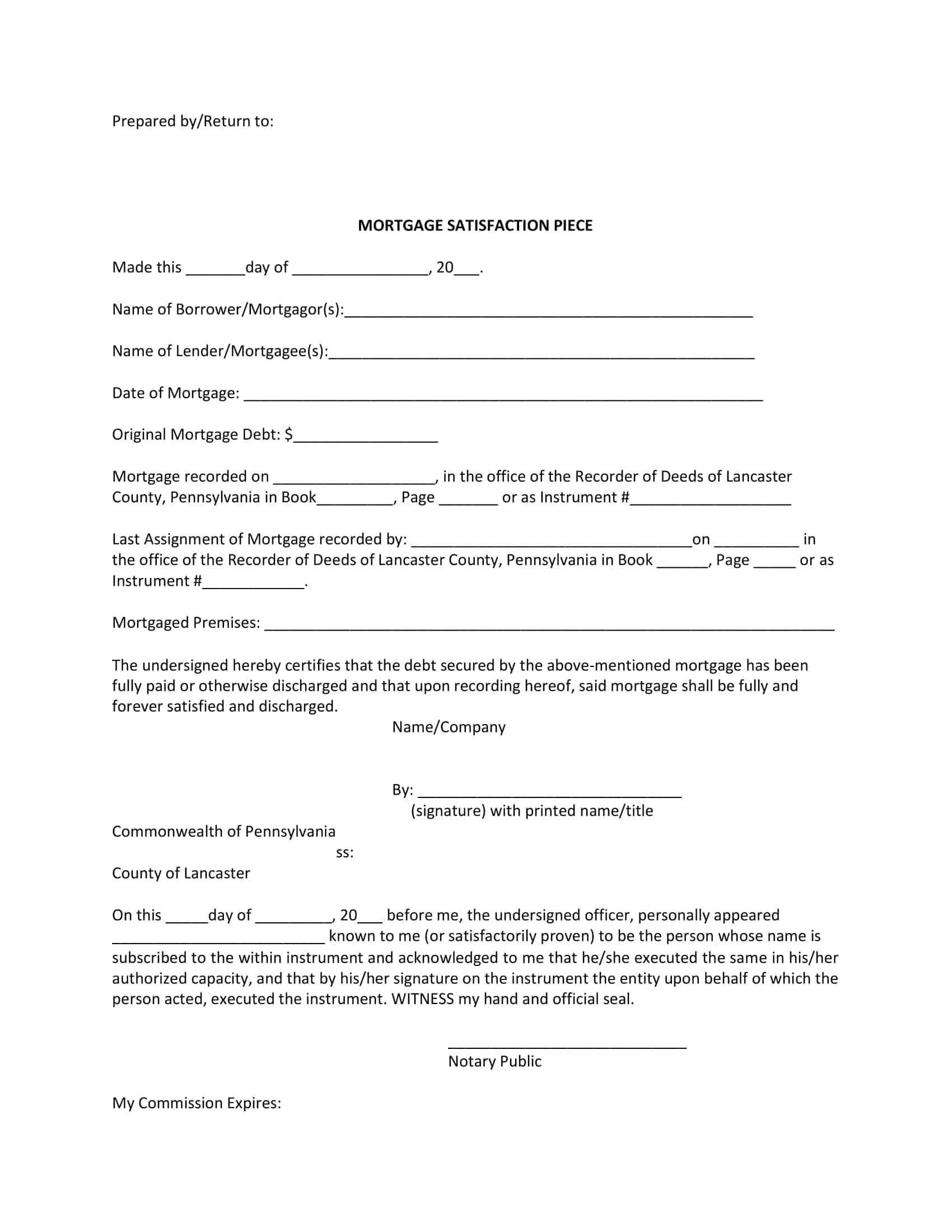

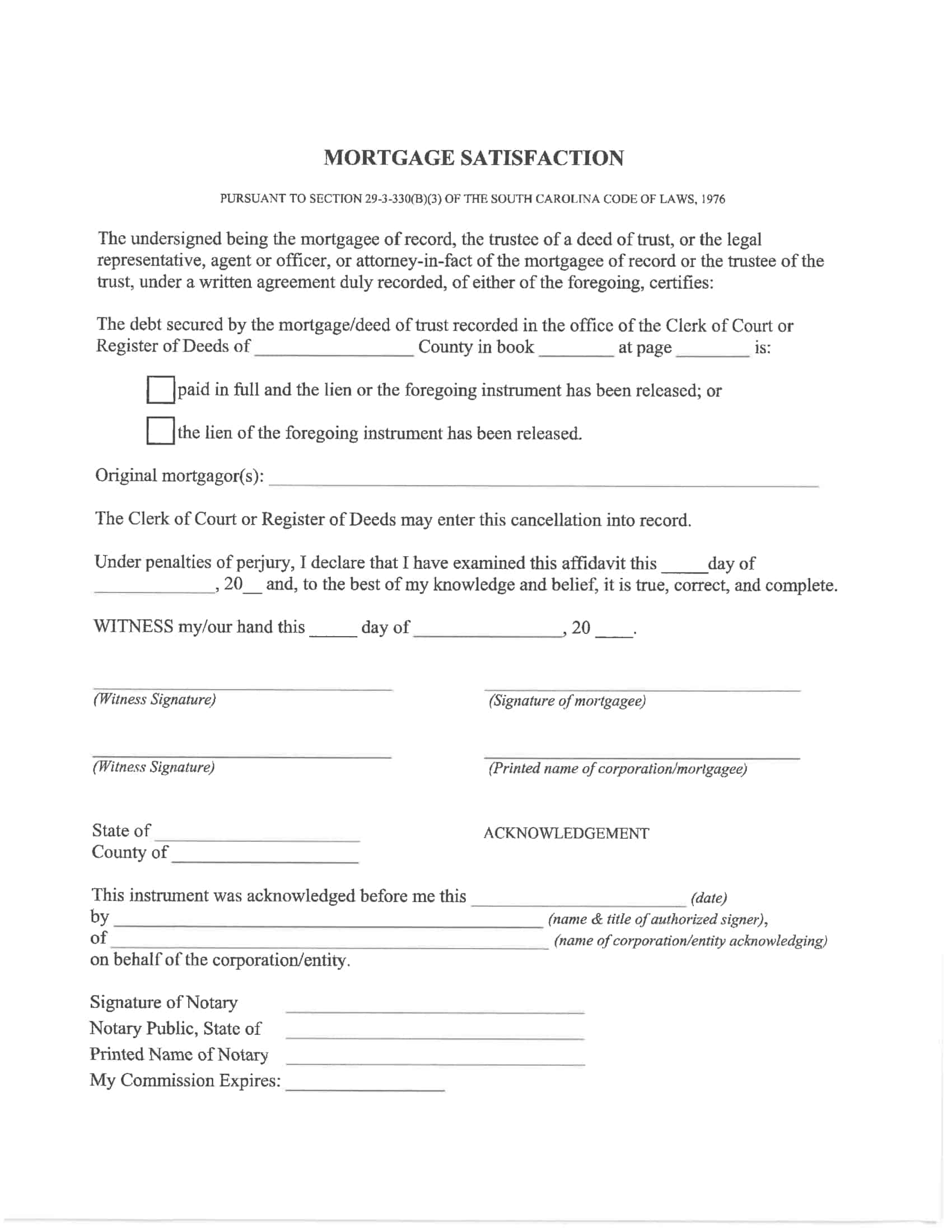

Satisfaction of Mortgage Templates

Celebrate the achievement of paying off your mortgage with our comprehensive collection of Satisfaction of Mortgage Templates. These customizable and printable templates provide a formal and legally recognized document to confirm the satisfaction and release of your mortgage lien. By utilizing our templates, you can easily document the final payment and discharge of your mortgage, ensuring that your property is free and clear of any encumbrances.

With sections for property details, loan information, and acknowledgement of payment, our Satisfaction of Mortgage Templates offer a streamlined and professional approach to closing this significant financial chapter. Celebrate your accomplishment and establish a clear record of mortgage satisfaction with our user-friendly templates. Download now and mark the end of your mortgage journey with confidence and satisfaction.

What is mortgage release satisfaction and discharge?

Mortgage release, satisfaction, and discharge all refer to the process of legally removing a mortgage from a property’s title after the loan has been paid in full.

A mortgage release is the process of releasing the property from the lien of the mortgage, making the property free and clear of the mortgage.

Satisfaction of mortgage is the legal document that states that the mortgage has been paid in full and that the lender no longer has a lien on the property. It is issued by the lender and recorded with the relevant government agency to remove the mortgage from the property’s title.

A mortgage discharge, on the other hand, is the process of terminating the mortgage contract between the lender and the borrower, releasing the borrower from any further obligations under the mortgage. It is usually issued by the lender and recorded with the relevant government agency.

In summary, a mortgage release and satisfaction are the process of removing the mortgage lien and the document that confirms it has been paid in full, while a discharge is the process of ending the contract between lender and borrower.

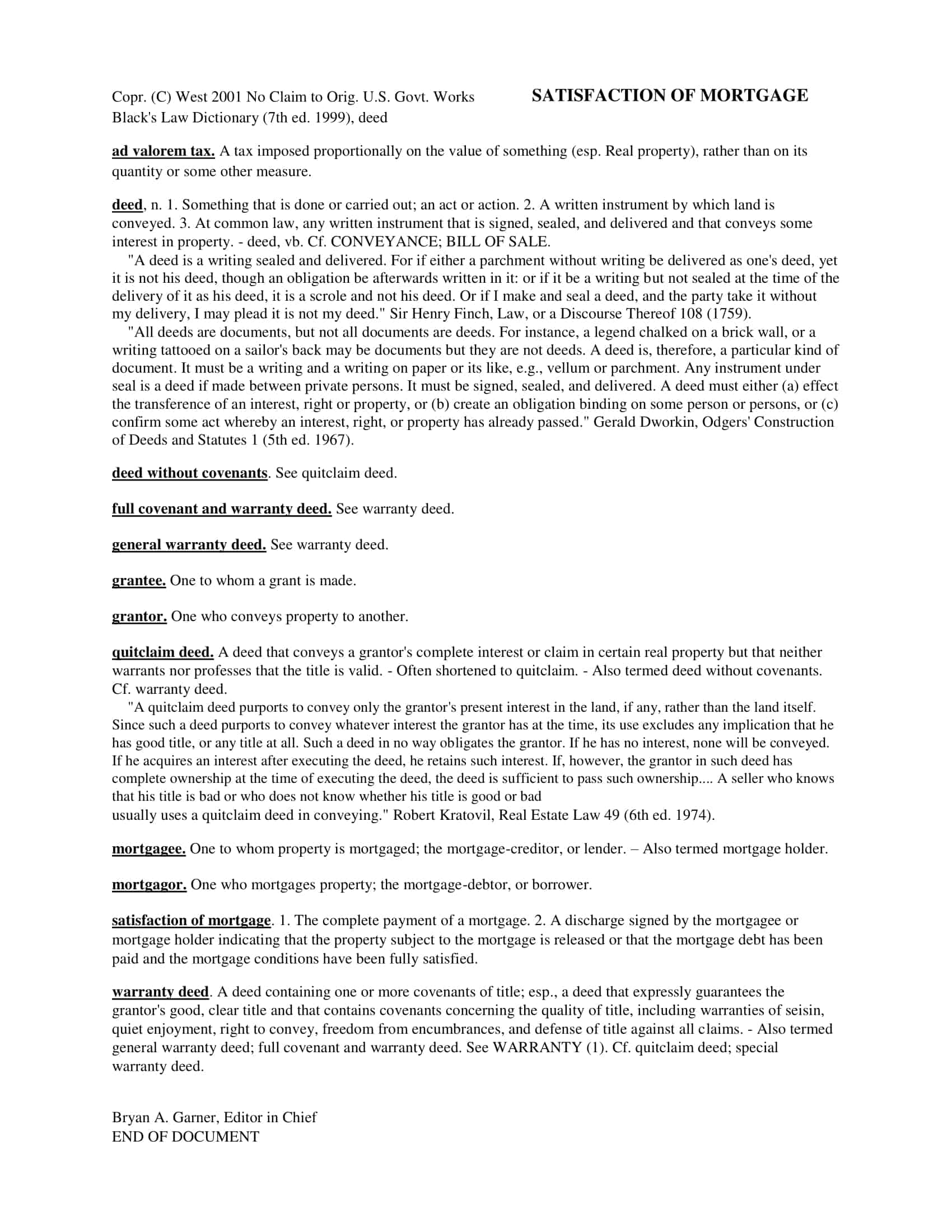

Is a satisfaction of mortgage the same as a deed?

A satisfaction of mortgage and a deed are two different legal documents, although they are related.

A satisfaction of mortgage is a legal document that is issued by a lender to a borrower upon the full repayment of a mortgage loan. It confirms that the mortgage has been paid in full and that the lender no longer has a lien on the property. The satisfaction of mortgage is recorded with the relevant government agency, such as a county recorder’s office, to remove the mortgage from the property’s title.

A deed, on the other hand, is a legal document that transfers ownership of a property from one party to another. There are different types of deeds, but the most common is the warranty deed, which is used to transfer ownership from a seller to a buyer. The warranty deed includes a guarantee from the seller that they have clear title to the property and that they will defend against any claims to the property.

So while a satisfaction of mortgage is a document that confirms the mortgage has been paid in full, a deed is a document that transfers the ownership of the property. They are related in the sense that the satisfaction of mortgage is recorded with the relevant government agency after the mortgage is paid in full and the property is transferred to the borrower.

How to Get a Satisfaction of Mortgage

There are several steps to obtain a satisfaction of mortgage:

Verify that your mortgage loan is paid in full: Before requesting a satisfaction of mortgage, make sure that you have made all of your mortgage payments and that the balance on your loan is zero.

Contact your lender: Contact your lender and request a satisfaction of mortgage. Most lenders will require a written request, and some may require a fee to process the request.

Provide required documentation: Your lender may require you to provide certain documentation, such as proof of insurance or a property tax receipt, before they will issue a satisfaction of mortgage.

Wait for the lender to process the request: Once your lender has received your request and all required documentation, they will process the request and issue the satisfaction of mortgage.

Record the satisfaction of mortgage: Once you receive the satisfaction of mortgage from your lender, you will need to record it with the relevant government agency, such as the county recorder’s office. This will remove the mortgage from the property’s title and legally transfer the ownership of the property to you.

It’s important to note that the process and requirements for obtaining a satisfaction of mortgage may vary depending on the state and lender, so it’s always a good idea to check with your lender and the relevant government agency for specific instructions.

Key Takeaways

- A satisfaction of mortgage is a legal document that confirms that a mortgage loan has been fully repaid and that the lender no longer has a lien on the property.

- Obtaining a satisfaction of mortgage is an important step in transferring ownership of a property from a borrower to a lender.

- The process of obtaining a satisfaction of mortgage typically includes verifying that the loan is paid in full, requesting the document from the lender, providing required documentation, waiting for the lender to process the request, and recording the document with the relevant government agency.

- The process and requirements for obtaining a satisfaction of mortgage may vary depending on the state and lender, so it’s always a good idea to check with your lender and the relevant government agency for specific instructions.

- Once the satisfaction of mortgage is recorded, the property is legally transferred to the borrower and the mortgage is removed from the property’s title.

- Obtaining a satisfaction of mortgage is a moment of great joy and relief for homeowners, marking the achievement of a significant financial goal and providing a sense of security and stability.

FAQs

Why is a satisfaction of mortgage important?

Obtaining a satisfaction of mortgage is an important step in transferring ownership of a property from a borrower to a lender. It also removes the mortgage from the property’s title and legally transfers the ownership of the property to the borrower.

How do I obtain a satisfaction of mortgage?

The process of obtaining a satisfaction of mortgage typically includes verifying that the loan is paid in full, requesting the document from the lender, providing required documentation, waiting for the lender to process the request, and recording the document with the relevant government agency.

Do the requirements for obtaining a satisfaction of mortgage vary by state?

Yes, the process and requirements for obtaining a satisfaction of mortgage may vary depending on the state and lender, so it’s always a good idea to check with your lender and the relevant government agency for specific instructions.

What happens after the satisfaction of mortgage is recorded?

Once the satisfaction of mortgage is recorded, the property is legally transferred to the borrower and the mortgage is removed from the property’s title.

What is the difference between a mortgage release and a satisfaction of mortgage?

A mortgage release is the process of releasing the property from the lien of the mortgage, making the property free and clear of the mortgage. A satisfaction of mortgage is the legal document that states that the mortgage has been paid in full and that the lender no longer has a lien on the property.

Will I receive a satisfaction of mortgage automatically once my mortgage is paid off?

Not necessarily, you will need to request the document from the lender and follow the process for obtaining a satisfaction of mortgage as outlined by your lender and the relevant government agency.

Is a satisfaction of mortgage required to sell or refinance a property?

No, a satisfaction of mortgage is not required to sell or refinance a property, but it is a necessary step in transferring ownership of a property.

Can a satisfaction of mortgage be issued if the mortgage is in default?

No, a satisfaction of mortgage can only be issued if the mortgage loan is paid in full. If a mortgage is in default, the lender may initiate foreclosure proceedings.

Do I need to hire a lawyer to obtain a satisfaction of mortgage?

It depends on the laws and requirements of your state, and the process of obtaining a satisfaction of mortgage. In most cases, you will not need to hire a lawyer, but it is always a good idea to consult with one if you have any questions or concerns.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 2 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)