Regardless of the type of business, a check template is often required. Not just for writing checks but also for recording and keeping track of payments and payments received. These check templates are designed to assure that all your financial transactions are always in order.

Some businesses might opt to use Microsoft Word or Excel, but doing so is less professional than having a check template. Why? Because using these software applications can leave room for errors and inconsistencies. Having a custom check template will give you peace of mind knowing that everything is in order in your business’s bank account.

Table of Contents

Check Templates, Example, Layout

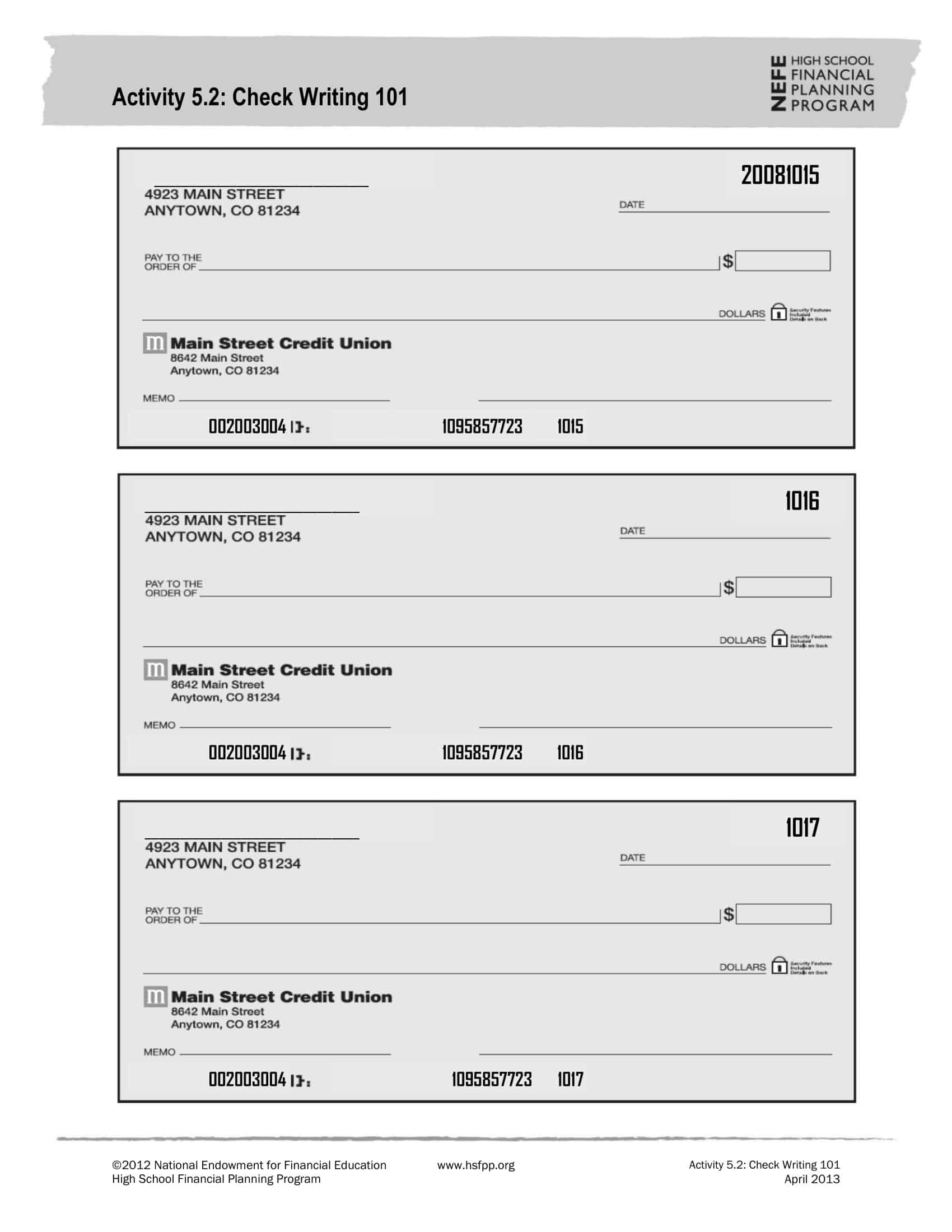

Checks are a common payment method for both personal and business transactions. Using check templates allows for quick, consistent check drafting and printing. The templates make check management easy.

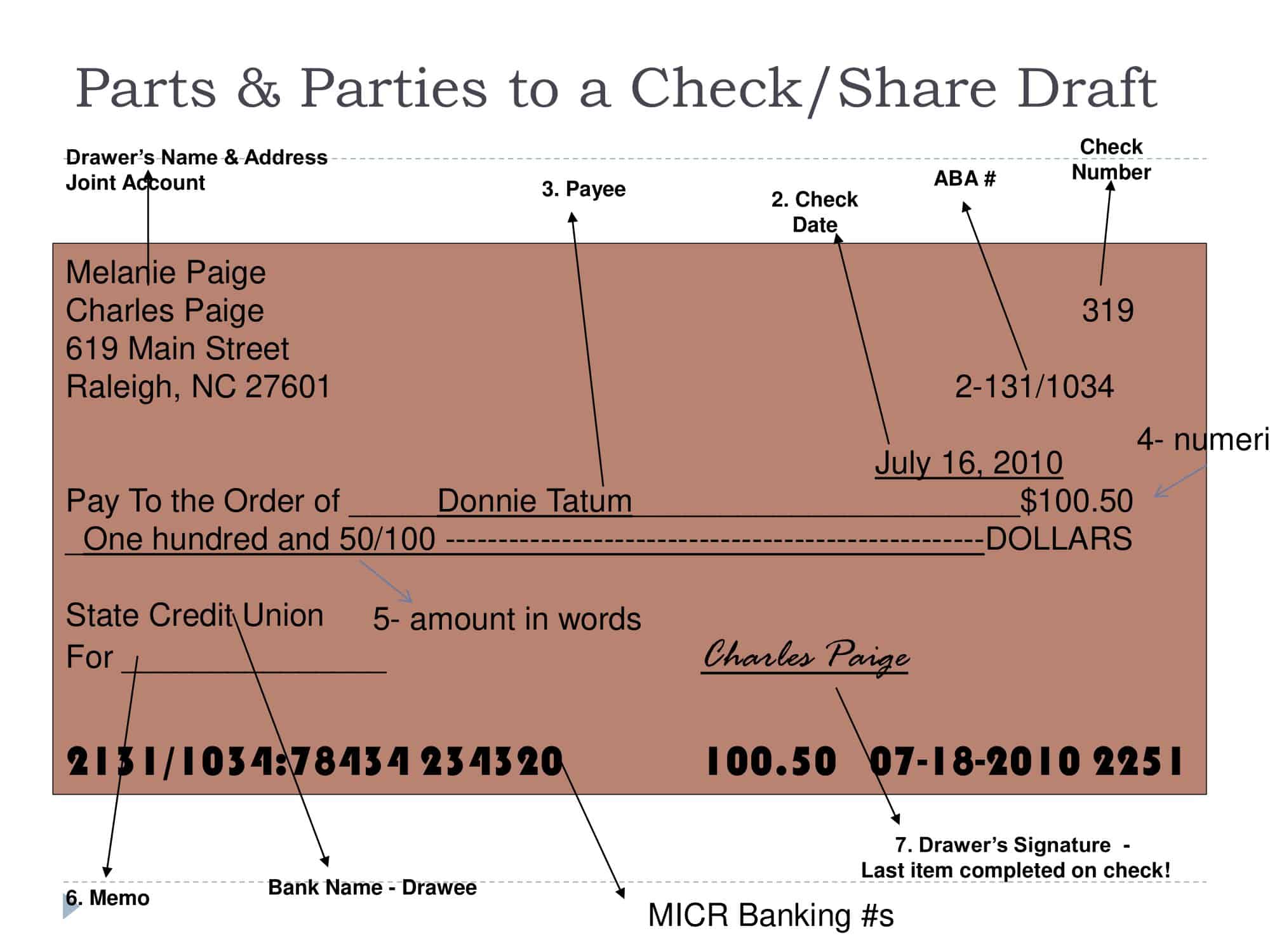

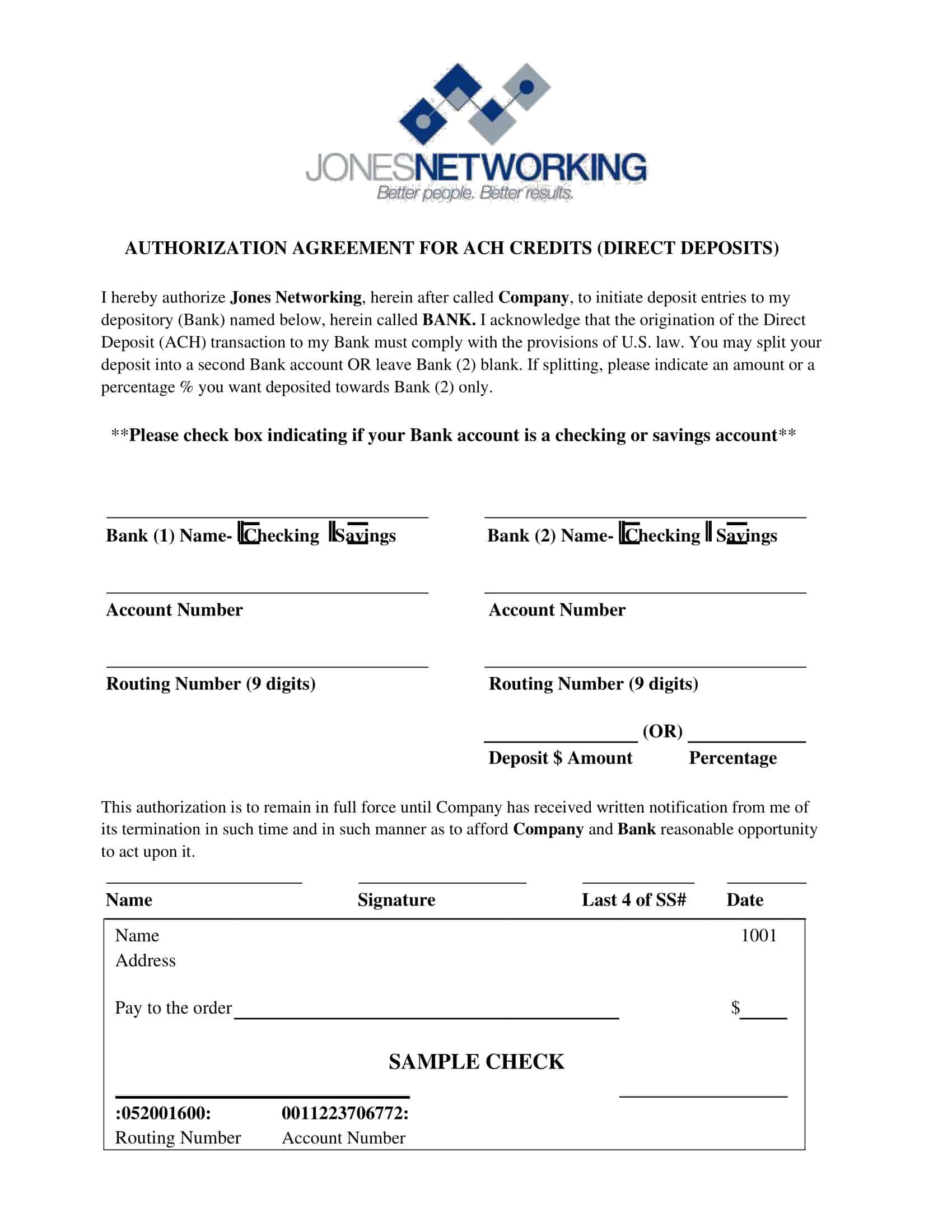

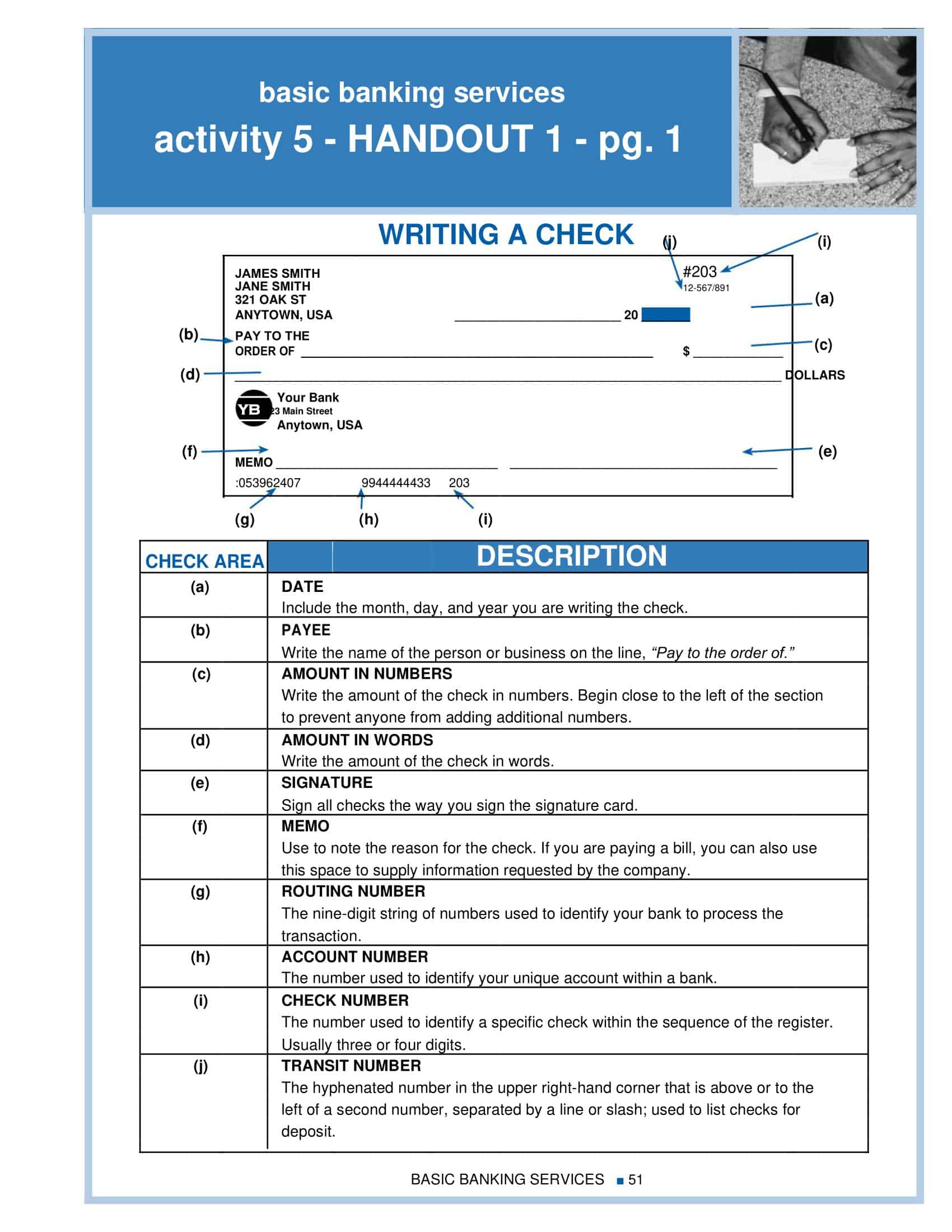

Check templates provide pre-formatted check designs. They include standard check elements like date, payee, amount, account numbers, bank routing numbers, and signature lines. Templates align these elements precisely for proper clearance. Some check templates are intended for personal checking while others are for business checks.

With check templates, users can skip manually formatting checks each time. Templates populate checks with static information so only the variable payment details need to be entered. They allow users to print checks on demand as needed.

Templates help maintain consistency across checks for easier recordkeeping. Organizations can brand templates with company names, logos, and contact information. Overall, check templates offer convenience while keeping check processing orderly and professional. They save time over creating checks from scratch. Check templates provide efficient and standardized check writing and printing.

Why do you need a check template?

In today’s business world, there are so many different types of checks that one can use. The standard check is still the most popular, but there are also some other types that you should consider.

A check template is a great way to make sure that your checks are always accurate and consistent. It should include all of the information that goes on a standard check, but it also allows you to customize it to fit your specific needs.

You can use the check template as a starting point when you create new checks or change the format of existing ones. This will save you time and make your company look more professional.

If you need to use a check template, you may find yourself constantly making mistakes when filling out those little boxes. Sometimes, it can be not easy to see what box goes where or how many digits are needed in each field, especially if you’re using a physical imprinting printer.

Types of checks

Checks are a common method of making payments. Checks can be made out to a person or business and written in any amount. The check must be signed by the person who wrote it, and the signature must match the signature on file with the bank.

There are many different types of checks that you might encounter during your banking experience. Here is a list of some of them:

Payroll check

A payroll check template is a simple way to write out your paychecks to employees. This type of check has a line for their social security number, an area for their name and address, and blank spaces where you can write the amount paid to each employee.

Business check

Business checks allow you to show off your company logo or slogan on them. They also have lines for routing numbers, account numbers, and amounts written in them so that they can be used at any time by anyone without worrying about issues with writing checks on blank paper or using preprinted checks that do not fit your needs perfectly.

Bank deposit check

Bank deposit checks have all the information needed for filling out payment forms at your local bank or credit union. With these types of blank checks, you can write down all of your banking information so that you don’t need to worry about forgetting anything important when making deposits or withdrawals from your account(s).

The Dollar Check

This is the most common type of check, and it is used for all types of payments. This kind of check has two blank lines for writing in the dollar amount. It also includes three lines for writing in the payee’s name and address. There is also an area where you can write in your own signature and a line for depositing the check in your bank account. The bottom part of this check contains information about the bank on which it was printed and its routing and account numbers.

The Donation Check

This type of blank check is used when donating money to charity organizations or other non-profit organizations such as schools or hospitals. These organizations will accept donations from individuals who want to help them with their cause but cannot afford to donate large amounts of money at once (or perhaps they need more time to make a large donation). The donor writes down how much he/she wishes to donate in this check and gives it back to the organization so that they can deposit it into their account immediately after receiving it.

In addition to the various types of checks, businesses can also benefit from using receipt templates to keep track of payments received. For example, the Zintego Receipt Template provides a professional and organized way to record and manage incoming payments, helping businesses maintain accurate financial records.

Tips for using blank check templates

Blank check templates are a simple way to create checks. If you want to write a check but don’t have any preprinted checks, you can use the blank check template and then print it out on your home computer or at your local copy shop. Depending on the type of check you want to create and your printer, you can use Microsoft Word or another word processor to create your own blank check template.

The following are tips for using blank check templates:

- Use a font that is easy to read. You should not use small fonts or fancy fonts that are difficult to read, as this can cause problems when the bank processes your check.

- Use good quality paper. Check stock should be made of heavy paper that’s strong enough to withstand repeated folding and writing. It’s also important that the paper’s surface doesn’t show through when you write on it. A high-quality check stock will have a watermark or security thread embedded in the paper to prevent fraudulent alterations.

- Use a simple font like Arial or Times New Roman for your textboxes and headings. This will make reading easier for other people, especially if they need to learn what information goes in each box or heading.

- Make sure that each box has enough room on it so that any information you need to fill in will fit without being cut off by the edge of the page or causing other boxes to run into each other. If insufficient space is available, adjust the box size so that everything fits in without overlapping with another box. Also, consider making some boxes larger than others so that they.

- Read the fine print. If any important information needs to be clarified, ask someone at your bank or software company to explain it to you before filling in any blanks or signing off on any purchases.

- Make sure all of the fields are filled out correctly and that there aren’t any typos. This includes both numbers and letters. If there are questions about how much money should be entered into certain fields (for example, “Date” or “Payee”), ask someone at your bank or software company before entering anything into those fields when making payments with a checkbook or other payment method.

- Use them to make sure you have enough money to pay your bills. Blank check templates allow you to track how much money is spent on each bill every month. This can help you avoid overspending and make all payments on time.

- Use them to create a budget. Blank check templates make it easy to create a realistic budget that includes all of your monthly expenses. You can use these check registers to see exactly where your money goes each month so that you know what adjustments need to be made to stick with your budget goals and save more money each month (or week).

- Use them as reminders of upcoming payments. Blank checks can serve as reminders that certain bills are due soon and need payment before they’re late, which will save you from paying fees or penalties on late payments (which will cost more than the original amount owed).

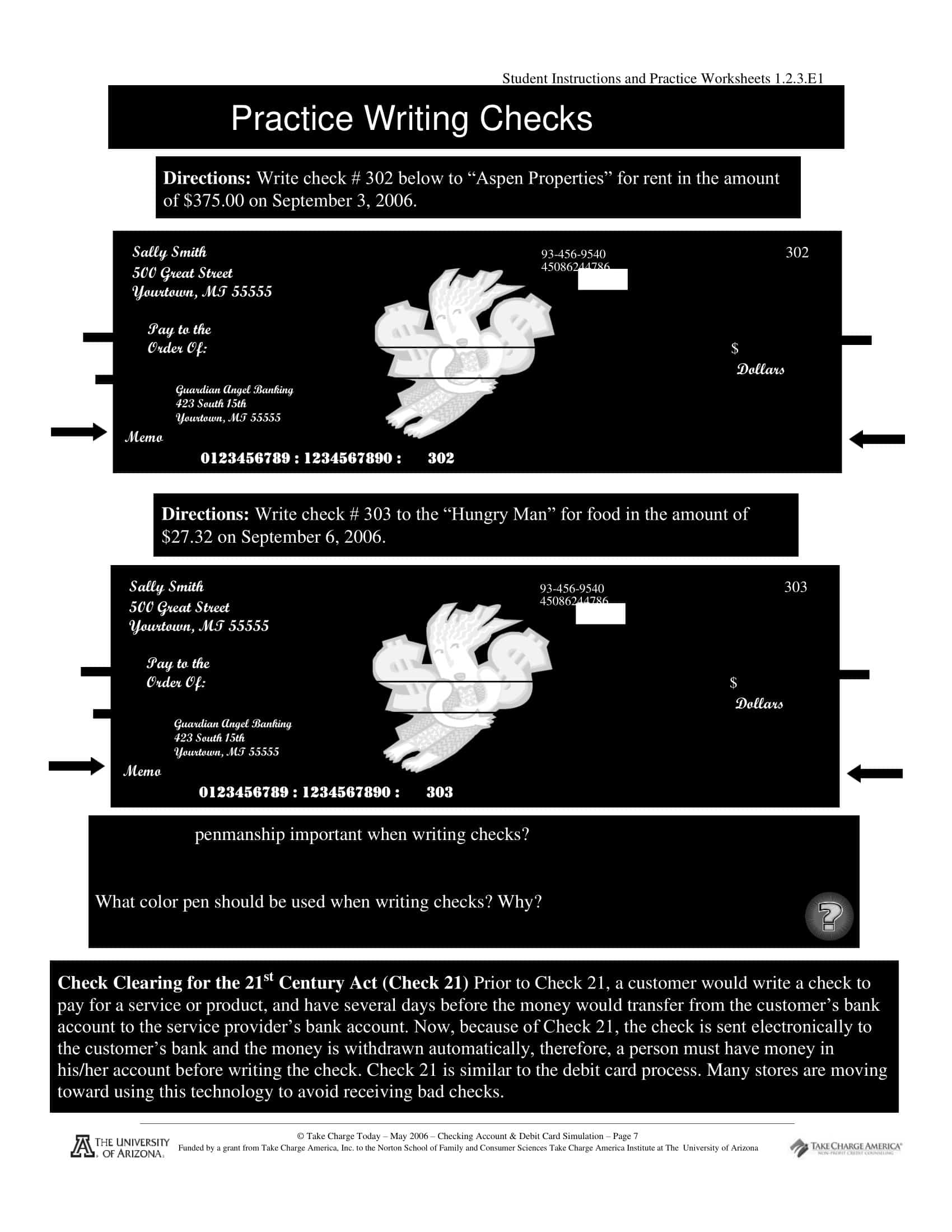

How to Write A Check: Step by Step

Writing a check is easy. You can do it in just a few seconds. Here’s what you need to know:

Write the check

Write the amount of your check in the upper left-hand corner. Use a decimal point if there is a fractional amount, such as $1.25 or $1.99. Write the date in the upper right-hand corner of the check. If you’re using an electronic check scanner, this information isn’t required, but it’s important to include it on paper checks so the bank can process them correctly.

If you’re writing your check to pay a credit card bill or another account, write out the account holder’s name and address exactly as it appears on their statement. If you’re writing your check to pay an individual (such as a friend), write out their first and last name exactly as it appears on their photo ID (such as their driver’s license).

Sign your name

Sign your name in blue ink in the lower left-hand corner of your check (or at least 1/4 inch from that corner). If you’re writing multiple checks at once, make sure each one has a different amount written on it so that they can be deposited separately if necessary (for example, if one is lost). Write an “X” next to each amount to ensure this happens.

FAQs

What information needs to be included on a check?

A check should include the date, payee name, amount in numerical and written form, memo line for what the check is for, account number, routing number, and signature.

What size paper should I use for printing checks?

Standard check paper size is 6″ x 2 3/4″. You can buy pre-perforated check paper at office supply stores. Regular printer paper can also be used but may not work with some printers or bank processing equipment.

How do I customize a check template?

Most check templates are editable so you can add your company name, logo, address, etc. Look for a template with form fields you can update with your information. You may need to adjust font size or positioning to fit your custom details.

What types of checks are there?

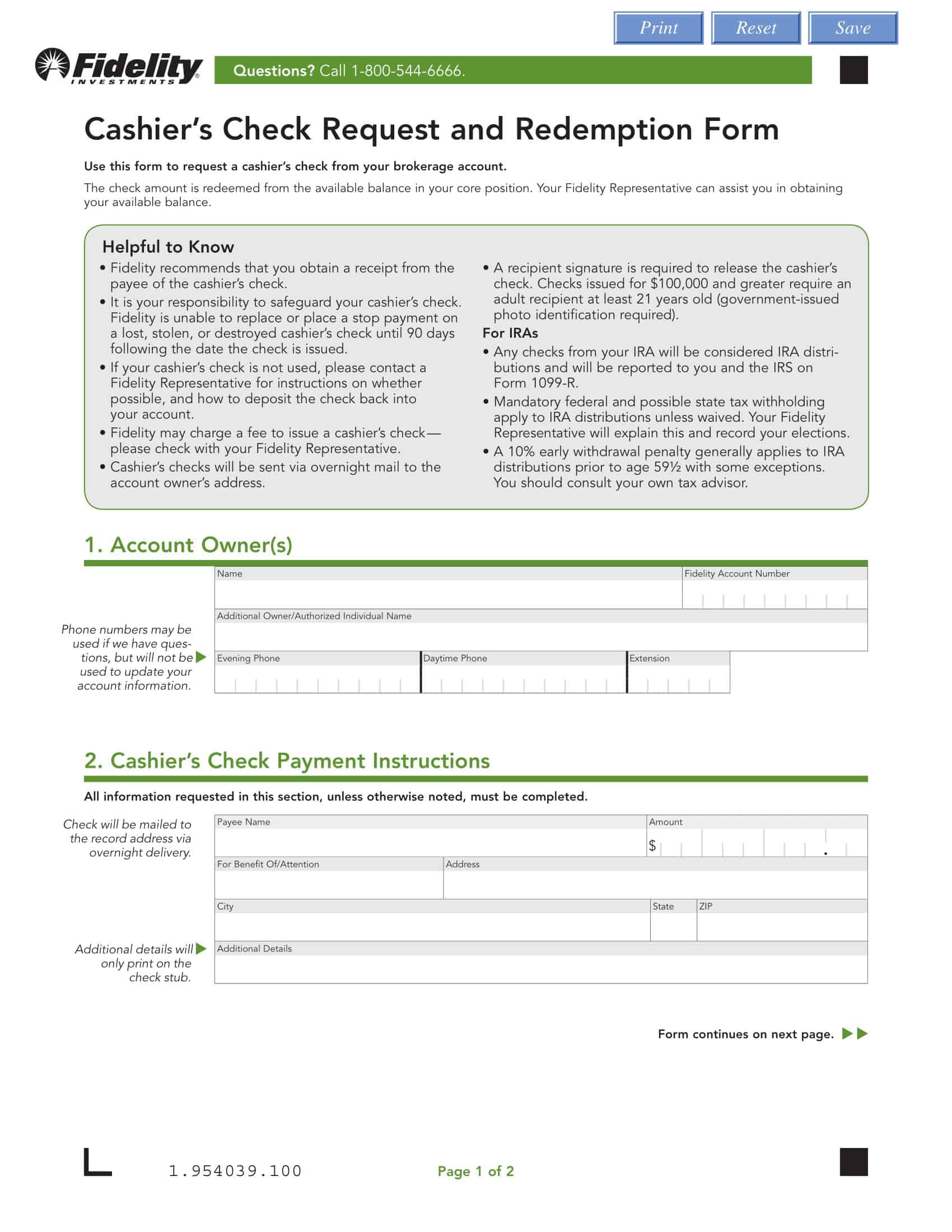

Common checks include personal checks, business checks, cashier’s checks, teller’s checks, certified checks, and traveler’s checks. Checks come in different sizes and paper types like voucher checks, manual checks, and continuous feed checks.

Can I print checks on plain paper?

You can print on plain paper but it’s not recommended for legal/business purposes. Checks printed on non-standard paper may not go through bank clearing processes smoothly. Use official check paper for proper alignment, security features, and ruggedness.

How do I void a check?

To void a check, write “VOID” in large letters across the check. You can also cut out the signature portion or shred the check if you do not need it for record keeping. Destroying the check prevents unauthorized use.

What safety features should be on checks?

Standard security features include watermarks, microprinting, security threads, checksum digits, heat sensitive ink, and background void pantographs that say “VOID” if copied.

How long do I need to keep check copies?

Keep check copies for tax documentation and tracking payments. Personal checks should be kept for 7 years. Business checks used for tax records should be kept for 8 years.

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 1 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 2 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)

![Free Printable Financial Projections Templates [Excel, PDF] 3 Financial Projection](https://www.typecalendar.com/wp-content/uploads/2023/05/Financial-Projection-1-150x150.jpg)