Contractor invoices serve as crucial elements within the economic ecosystem of the business world, silently facilitating the exchange of services, payments, and legal compliances. This article takes you through the intricate mechanisms that build this financial instrument, diving deep into its essential components, potential challenges, and best practices. As we proceed, we unravel the complexity of contractor invoices, enabling freelancers and companies alike to operate with increased financial clarity and confidence.

Table of Contents

What is a contractor invoice?

A contractor invoice is a formal request for payment sent by a contractor to a client after the completion of services or work as agreed upon in the contract. This document typically includes details such as the contractor’s contact information, the description of the work performed or services provided, the date of service, the agreed rate or price, and the total amount due. The invoice serves a dual purpose: it prompts the client to pay for the contractor’s services, and it provides a record of the transaction for both parties, which can be useful for accounting and tax purposes.

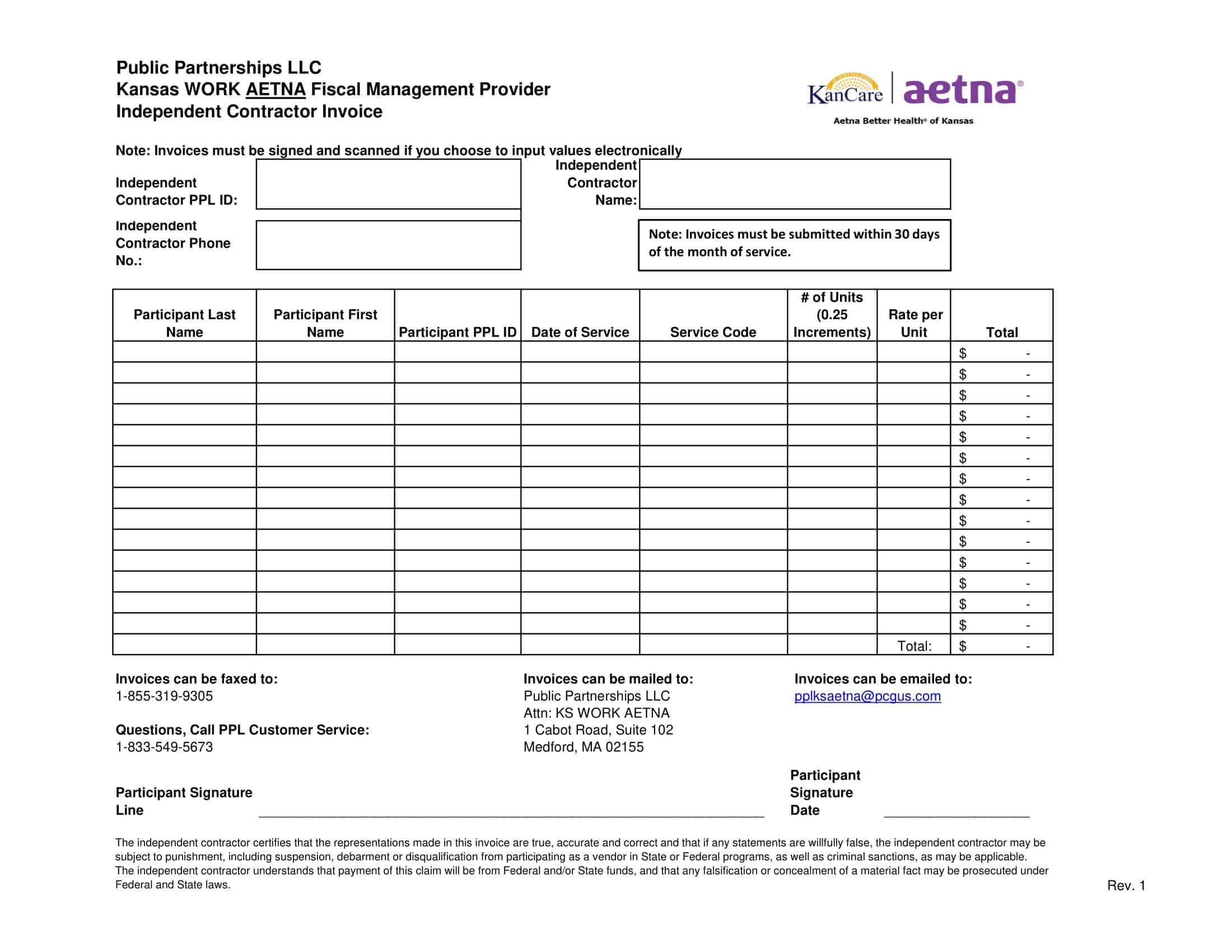

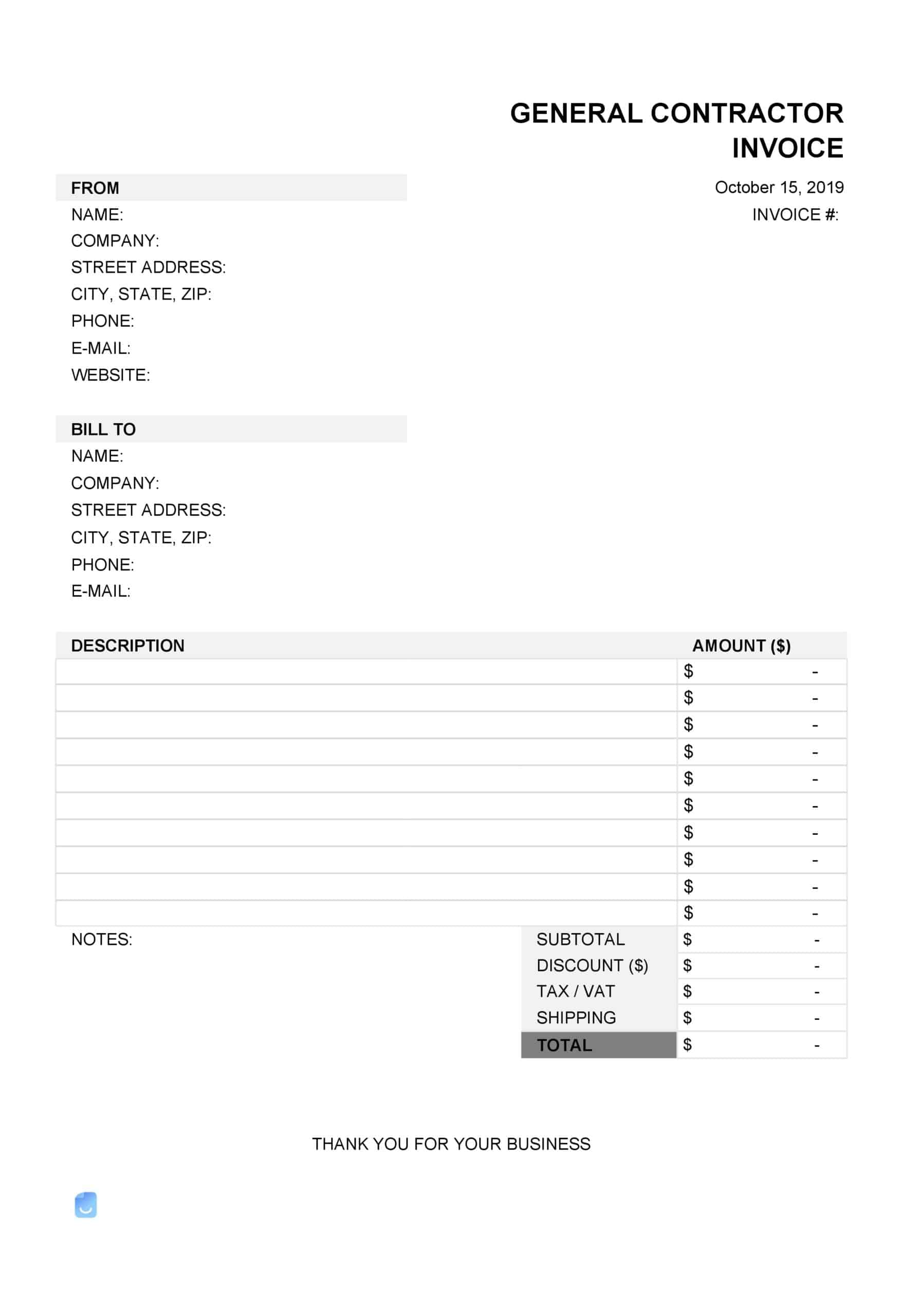

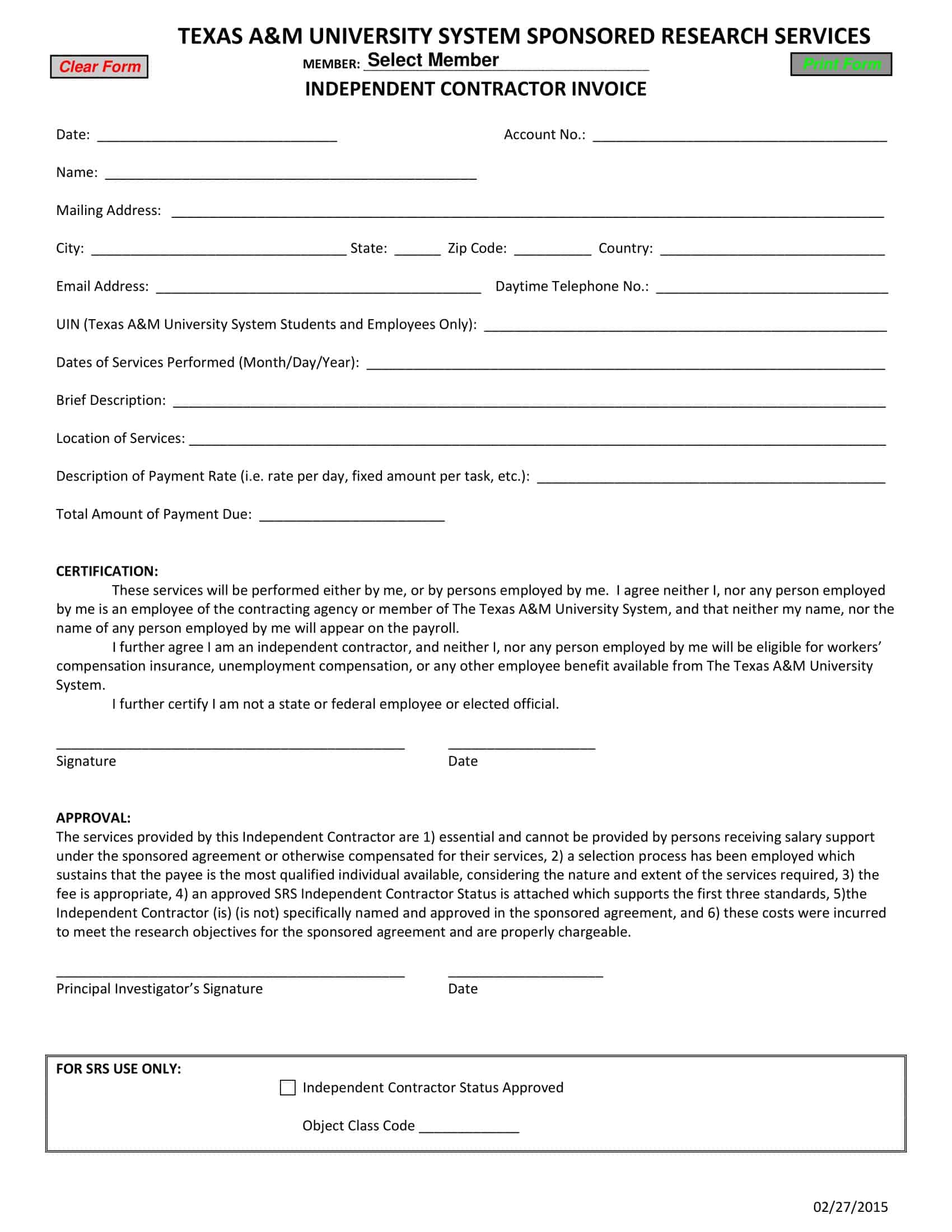

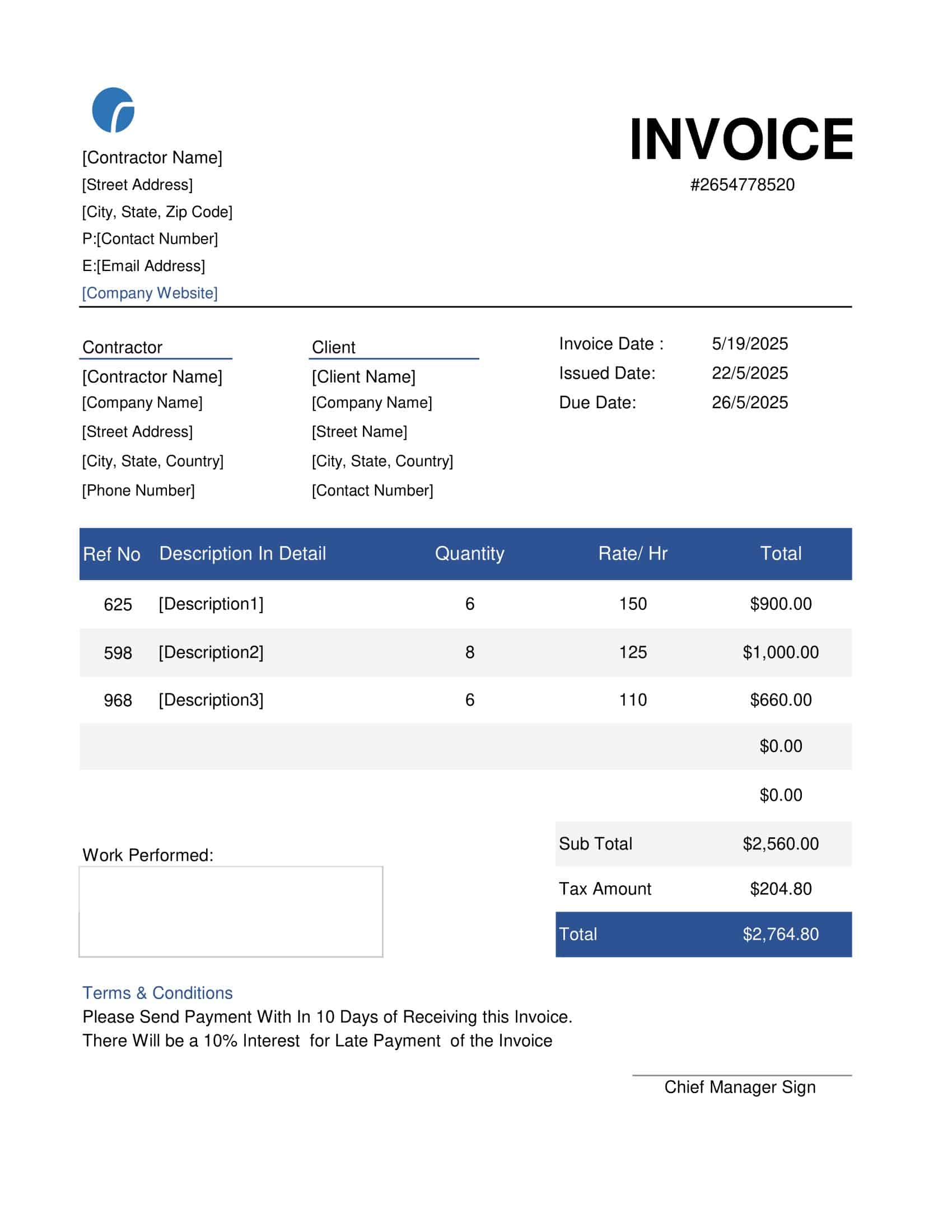

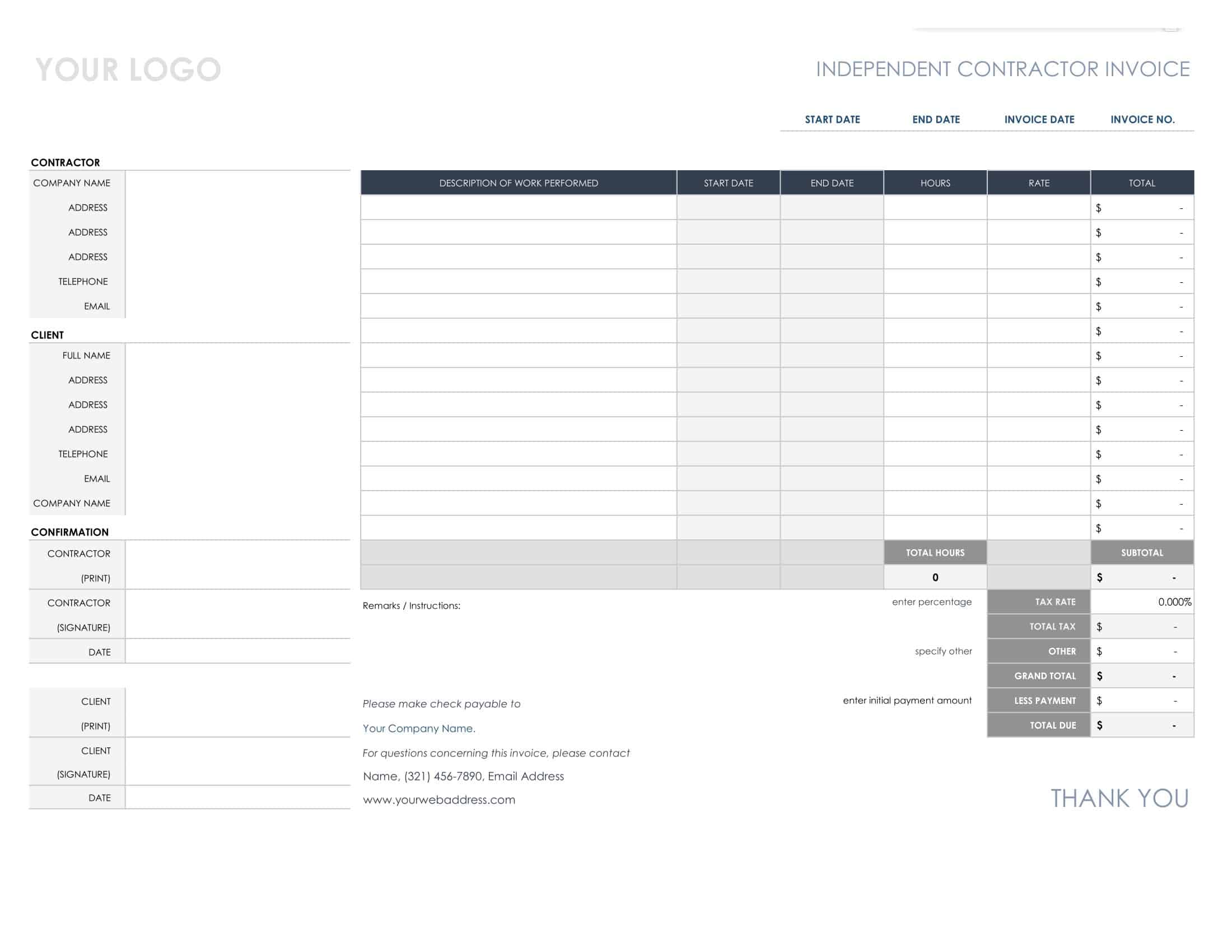

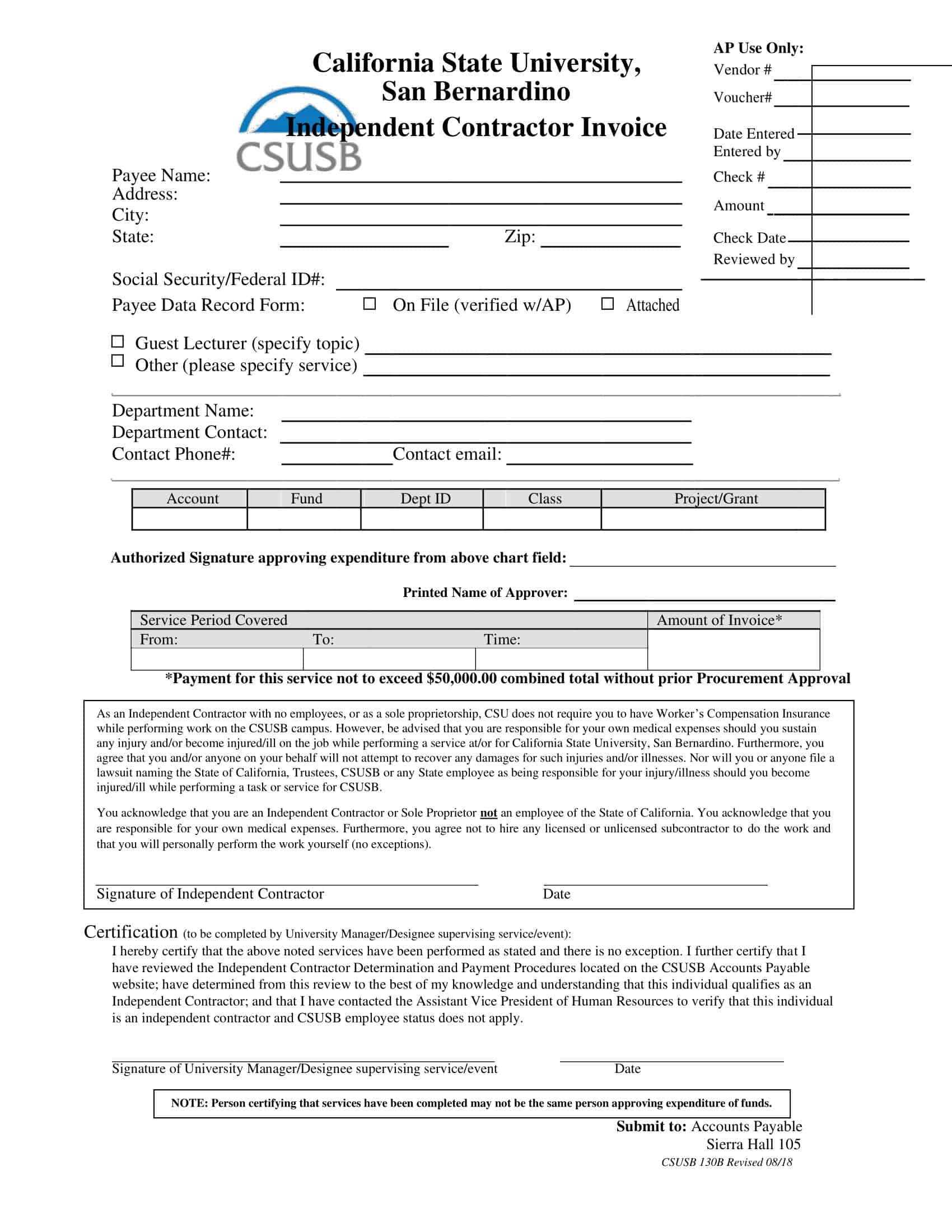

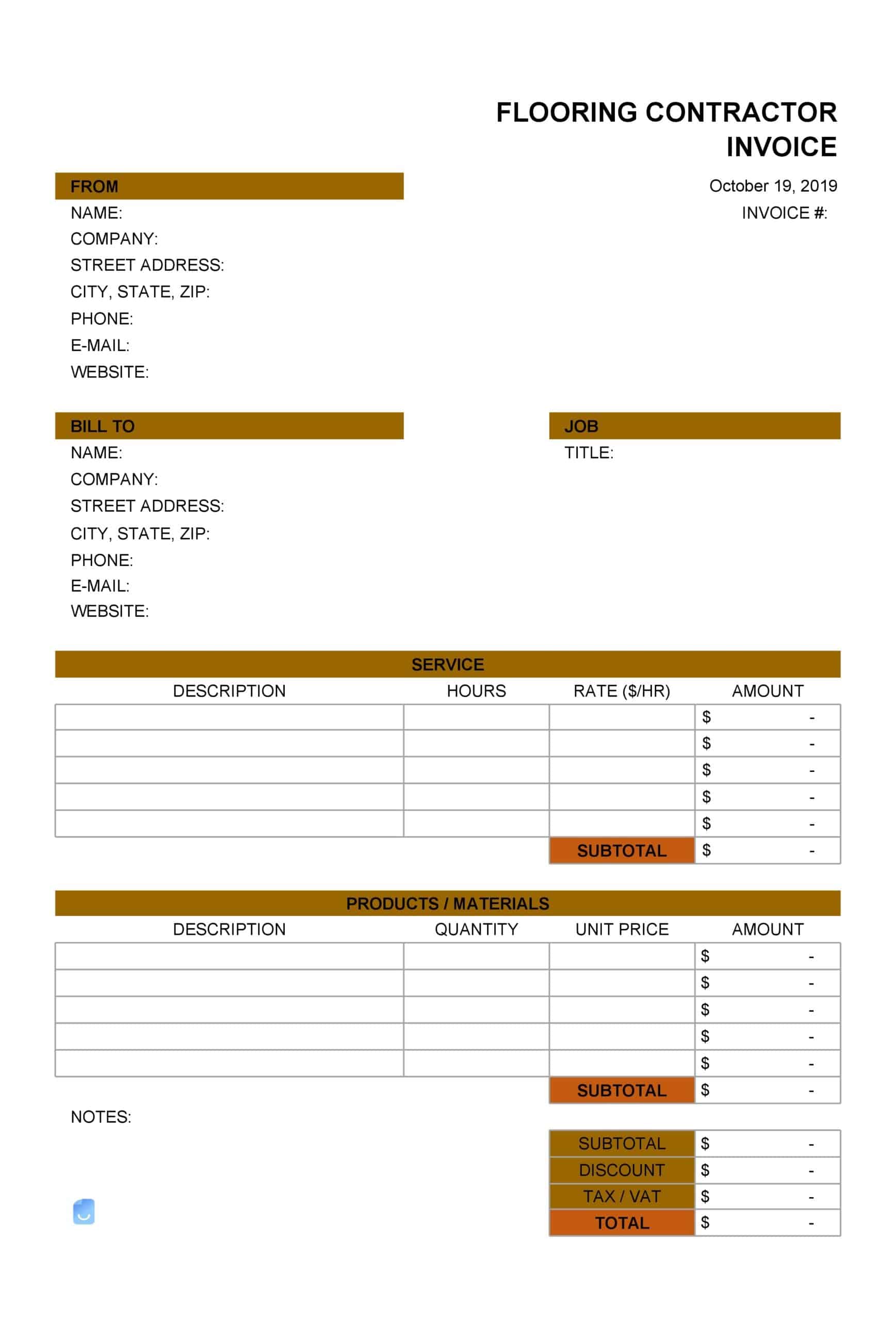

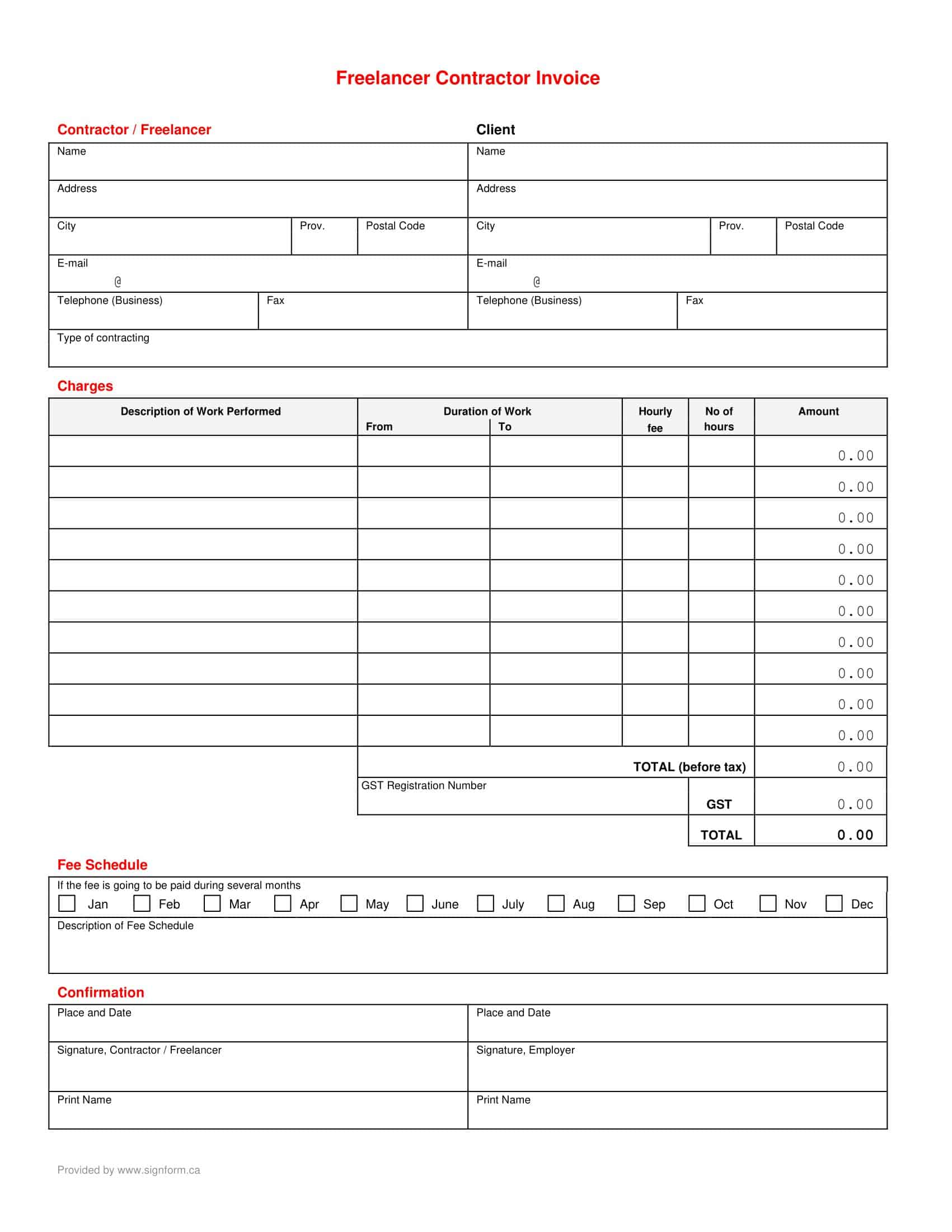

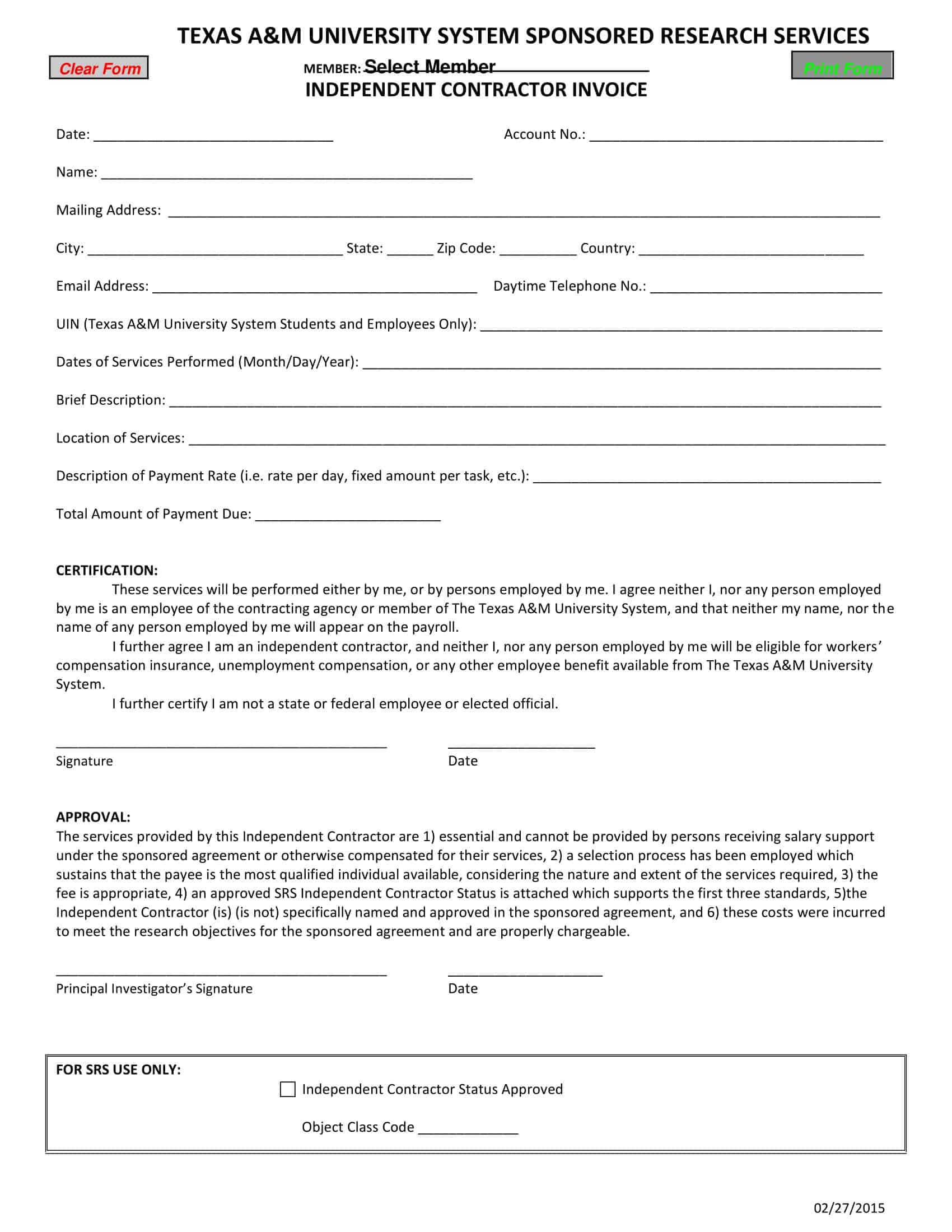

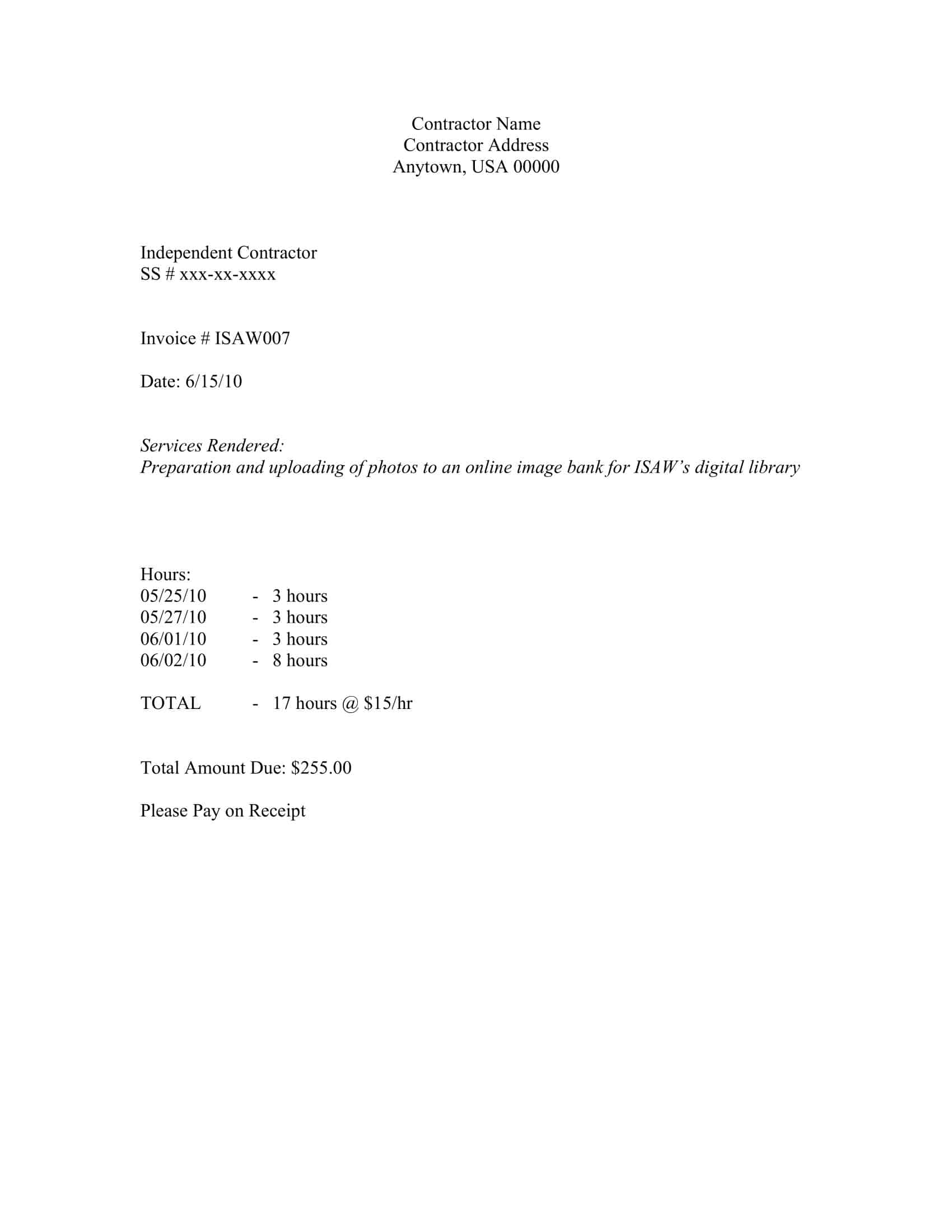

Contractor Invoice Templates

Contractors bill clients for completed project work via invoices. Professional contractor invoices clearly detail provided services and fees charged. Contractor invoice templates simplify generating polished invoices.

The templates include dedicated sections for listing work performed, line-item charges, taxes, total amounts due, and payment terms. They incorporate fields for contractor information, client details, and project data. Calculations are automated for fast invoicing.

Contractor invoice templates enable creating succinct, branded invoices without starting from scratch. Contractors just customize the template with the client, project, completed work, timeline, and owed amounts. Approved templates create consistent records and prevent missing details. Clients better understand charges with clear, detailed invoices. Contractor invoice templates save time, boost professionalism, and facilitate on-time payment for excellent work delivered.

Purpose of Contractor Invoices

Contractor invoices serve several key purposes. First, they act as a formal request for payment, prompting the client to settle the due amount for the services rendered or work completed. Second, they provide a detailed breakdown of the work done, including the tasks performed, hours worked or materials used, and the corresponding rates or costs.

This ensures transparency and aids in resolving any disputes about the scope or cost of the work. Third, contractor invoices serve as a crucial record for financial management. They help contractors track income, manage cash flow, and maintain accurate financial records. Lastly, these documents are important for tax purposes. They substantiate income and expenses, allowing for proper tax filing and potentially serving as proof in the event of an audit.

Things to Include in a Contractor Invoice

Creating a comprehensive and effective contractor invoice involves including several key elements:

- Header: The invoice should clearly state that it is an “Invoice” at the top. This helps in immediate recognition and categorization.

- Contractor Information: The invoice should include the contractor’s full name or business name, address, phone number, and email address. If the contractor has a business logo, it should also be included for branding purposes.

- Client Information: Similar to contractor information, the client’s name or company name, address, and contact details should be included.

- Invoice Number: Every invoice should have a unique invoice number for tracking and reference purposes. This is critical for managing and organizing your financial records.

- Invoice Date: The date when the invoice is created should be clearly stated. This helps to establish when the payment process begins.

- Payment Terms: It’s important to clearly define the terms of payment, including the due date (usually 30 days from the invoice date but can be agreed upon), acceptable forms of payment (bank transfer, check, credit card, etc.), and any late payment fees or interest.

- Service Details: This section should include a detailed description of the services provided or work done. This can be itemized line by line, with each task, the number of hours worked (if applicable), and the rate per hour or per task.

- Costs: Each line item should have an associated cost, based on the rate and quantity or hours. Material costs and other expenses can also be listed separately.

- Total Amount Due: This is the total of all the costs detailed in the invoice. If a deposit or advance payment has been made, it should be deducted from this total.

- Tax Information: If the contractor is required to charge sales tax, VAT, or any other tax, it should be calculated and listed separately.

- Notes or Additional Information: This optional section can be used to provide additional information or instructions to the client. For example, you might include your bank details for a wire transfer or a note thanking the client for their business.

- Legal Requirements: Depending on local laws and the nature of your work, you might need to include other legal details. For example, contractors in some jurisdictions need to include their tax ID or business registration number.

When should you send an invoice to a customer as a contractor?

The timing of sending a contractor invoice depends largely on the terms agreed upon between the contractor and the client at the outset of their professional relationship. These terms can be outlined in a formal contract or in written communication. However, here are some common scenarios that can help determine the ideal timing:

- Upon Completion: If the project is relatively short, perhaps a few days to a week, it’s typical for the invoice to be sent upon completion of the work. This means once the final deliverable has been submitted and approved by the client, an invoice can be issued.

- Periodic/Milestone Basis: For longer-term projects, it’s common to invoice on a periodic basis (e.g., weekly, bi-weekly, monthly) or at specific project milestones. This could be when a certain phase of the work is complete, or when a deliverable has been accepted by the client. Invoicing at milestones helps maintain a steady cash flow and divides payment across the project’s timeline.

- In Advance: In some cases, contractors may invoice in advance, particularly if significant upfront costs are involved. The invoice may be for the full amount, or for a percentage of the total cost. This is agreed upon before the work begins.

- Progress Invoicing: This method involves invoicing for the part of the project that’s been completed during a specific period. This is common in industries like construction, where large projects span across several months.

- Upon Delivery: In certain industries, it’s standard practice to send an invoice upon delivery of goods or services. This is common in sectors such as retail, hospitality, and others.

Once the invoice is issued, it’s important to have clear payment terms (e.g., net 30, which means payment is due 30 days from the invoice date) specified on the invoice. These terms should also have been part of the initial agreement.

Common Invoicing mistakes to avoid

Invoicing is a critical part of managing your freelance or contracting business. However, it can also be a source of potential errors if not done properly. Here are some common invoicing mistakes to avoid as a contractor:

- Lack of Clarity: Ensure that your invoice is clear and easy to understand. Include comprehensive details of the services provided or work done, itemize costs, and don’t use vague descriptions that could confuse the client.

- Inaccurate Information: Always double-check the information on your invoice. Incorrect client details, wrong invoice numbers, misstated dates, or incorrect amounts can lead to delays in payment.

- Not Including Payment Terms: Not setting or communicating clear payment terms is a common mistake. Specify when payment is due (for example, “Payment due within 30 days of invoice date”) and how payment should be made.

- Omitting Important Tax Information: Depending on your jurisdiction, you may need to include specific tax information on your invoice, such as your tax identification number, or the amount of tax included in your charges. Omitting these details can lead to legal complications.

- Ignoring Local Laws and Regulations: In certain jurisdictions, there might be specific legal requirements for what an invoice must contain. Ensure you are aware of these to maintain compliance.

- Failing to Follow Up: If a client doesn’t pay an invoice by the due date, it’s important to follow up. Failure to do so can lead to unpaid invoices and cash flow problems.

- Not Keeping Records: Invoices are important financial documents. Not keeping copies, whether physical or digital, can create challenges when it comes to financial management, taxes, or resolving disputes.

- Not Personalizing Your Invoice: While the invoice is a formal document, personalizing it (for example, adding a “thank you” note or your business logo) can help build stronger relationships with clients and enhance your brand.

- Inconsistent Invoicing: Inconsistent invoicing, such as sending invoices at irregular intervals or using different invoice formats, can lead to confusion and make you look unprofessional. Stick to a regular invoicing schedule and use a consistent format.

- Not Using Invoicing Software: Manual invoicing can be time-consuming and prone to errors. Using invoicing software can automate much of the process, reduce errors, and save you time.

How to write a contractor invoice

Creating a contractor invoice is an essential step to getting paid for your work. Here’s a step-by-step guide to help you create an effective contractor invoice:

Step 1: Choose Your Format

Decide whether you’ll use an invoice template, a word processor, a spreadsheet, or invoicing software. The format you choose should be professional, clear, and easy to use.

Step 2: Add Your Information

Include your name or your business name, address, and contact details (phone number and email address) at the top of the invoice. If you have a business logo, include it for a professional touch.

Step 3: Add Client Information

Directly below or opposite your details, add the client’s name or business name, their address, and contact details. Make sure you spell the client’s name correctly and use the proper address.

Step 4: Include Invoice Information

Write the word “Invoice” clearly, followed by a unique invoice number. This number will help you track and manage your invoices. Also include the invoice date, which is usually the day you’re sending the invoice.

Step 5: Detail Your Services

List all the services you provided or work you’ve done. For each service, include a brief description, the date of service, the rate (per hour or per project), and the total amount for that service. Be specific and detailed in your descriptions to avoid confusion.

Step 6: Add Up the Total

Calculate the total amount due from all services and list it as the ‘Total’ at the bottom of the service details section. If you need to charge tax, add it to the total here.

Step 7: Define Payment Terms Specify the due date for the payment and the accepted forms of payment (e.g., check, bank transfer, credit card). Most contractors use “net 30” terms, meaning payment is due within 30 days of the invoice date.

Step 8: Include Tax Information

If you’re required to charge sales tax, VAT, or other taxes, calculate these and list them separately on the invoice. Include your tax identification number if applicable.

Step 9: Add a Personal Touch

Consider adding a personal note or a ‘Thank You’ to the client. This personal touch can help strengthen your business relationship.

Step 10: Review Your Invoice

Before sending, review your invoice for any errors or omissions. Ensure all information is correct and clearly presented.

Step 11: Send Your Invoice

You can send your invoice via email, mail, or invoicing software, depending on the preference of the client. Always follow up to confirm the invoice was received.

Step 12: Keep a Record

Save a copy of every invoice you send for your records. These documents are important for tracking payments, accounting purposes, and tax preparation.

FAQs

Can I create my own contractor invoice?

Yes, you can create your own contractor invoice. There are various tools available online, such as invoice templates and invoicing software, that can help you design and generate professional-looking invoices. You can customize these templates to include the necessary information specific to your business.

Are there any specific payment terms I should include in a contractor invoice?

While payment terms can vary, it’s essential to include clear and concise information about when and how payment should be made. Common payment terms include the due date, accepted payment methods (e.g., bank transfer, credit card), and any late payment penalties or interest charges for overdue invoices. It’s also a good practice to specify whether partial payments or deposits are required.

Should I include my business’s terms and conditions on the contractor invoice?

Including your business’s terms and conditions on the contractor invoice can be beneficial. It helps ensure that both parties are aware of the agreed-upon terms, such as payment terms, project scope, liability limitations, and dispute resolution procedures. By including these terms and conditions, you can mitigate potential misunderstandings and protect your rights as a contractor.

Can I invoice multiple clients for different projects on a single contractor invoice?

It is generally recommended to issue separate invoices for each client and project. Combining multiple clients or projects on a single invoice can cause confusion and make it harder to track payments and reconcile accounts.

How should I calculate the total amount on a contractor invoice?

To calculate the total amount on a contractor invoice, multiply the quantity or hours of work performed by the rate or price per unit for each service or item. Then, sum up the subtotals of all the services or items and add any applicable taxes or fees. The resulting sum is the total amount due.

Can I include discounts or deductions on a contractor invoice?

Yes, you can include discounts or deductions on a contractor invoice if agreed upon with the client. Clearly state the discount or deduction amount and provide a brief explanation if necessary. Ensure that the final total reflects the adjusted amount after the discount or deduction.

How long should I keep copies of contractor invoices?

It is advisable to keep copies of contractor invoices for a recommended period of at least six years for financial and tax purposes. However, specific record retention requirements may vary depending on your jurisdiction and industry. Consult with an accountant or tax professional to ensure compliance with applicable regulations.

Can I invoice for reimbursable expenses?

Yes, you can invoice for reimbursable expenses incurred during the course of providing services. Ensure that you clearly separate and itemize reimbursable expenses on the invoice, including detailed descriptions and corresponding amounts. Attach any necessary supporting documentation, such as receipts or invoices for the expenses.

What happens if there are errors or discrepancies on a contractor invoice?

If you discover errors or discrepancies on a contractor invoice after sending it to the client, promptly notify the client and provide a corrected version. It is crucial to maintain accuracy and transparency in invoicing to avoid confusion and potential disputes. Keeping open lines of communication with the client will help resolve any issues efficiently.

Is it necessary to include a payment deadline on a contractor invoice?

Yes, including a payment deadline or due date on a contractor invoice is highly recommended. Clearly state the date by which payment should be received to avoid any payment delays or misunderstandings. This provides a clear expectation for the client and helps you manage your cash flow effectively.

Can I invoice for advance payments or deposits?

Yes, you can invoice for advance payments or deposits if it is part of your agreement with the client. Clearly state the amount of the advance payment or deposit on the invoice and provide instructions on how the remaining balance will be handled. This helps protect your interests and ensures that you receive payment before commencing work.

Can I send electronic invoices instead of paper invoices?

Yes, electronic invoices, such as PDF documents or digital invoices sent via email, are widely accepted and convenient for both contractors and clients. Electronic invoices save time, reduce paper usage, and facilitate faster communication and payment processing. However, ensure that electronic invoices comply with any legal or regulatory requirements in your jurisdiction.

What should I do if a client disputes an invoice?

If a client disputes an invoice, it is best to address the issue promptly and professionally. Openly communicate with the client to understand their concerns and try to find a resolution. Provide any necessary documentation or evidence to support the accuracy and validity of the invoice. If the dispute persists, you may need to negotiate or seek mediation to reach a mutually agreeable solution.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)