Navigating the bustling corridors of global commerce necessitates a precise understanding of many complex documents, one of which is the Commercial Invoice. The Commercial Invoice often resides in the shadows of more widely known financial papers, yet its importance cannot be overstated.

Our journey explores the core of international trade through the lens of this crucial document, underscoring its pivotal role, key elements, and the diverse contexts in which it operates. From the offices of multinational corporations to the loading docks of local shipping companies, the Commercial Invoice acts as a silent protagonist in the grand narrative of international commerce. Let’s pull back the curtain on this understated actor and illuminate its critical place within the business world.

Table of Contents

What is a Commercial Invoice?

A Commercial Invoice is a legal document between the supplier and the buyer that details the goods or services sold, their quantities, and prices. It’s used in international trade to declare items crossing borders, assisting customs authorities in assessing taxes and duties.

The document generally includes information such as the names and addresses of the seller and buyer, date of sale, terms of sale, description of items, and total value of shipment. Essential for the transparency and smoothness of global commerce, a Commercial Invoice serves a dual purpose as both a record of the transaction and a crucial tool for customs control.

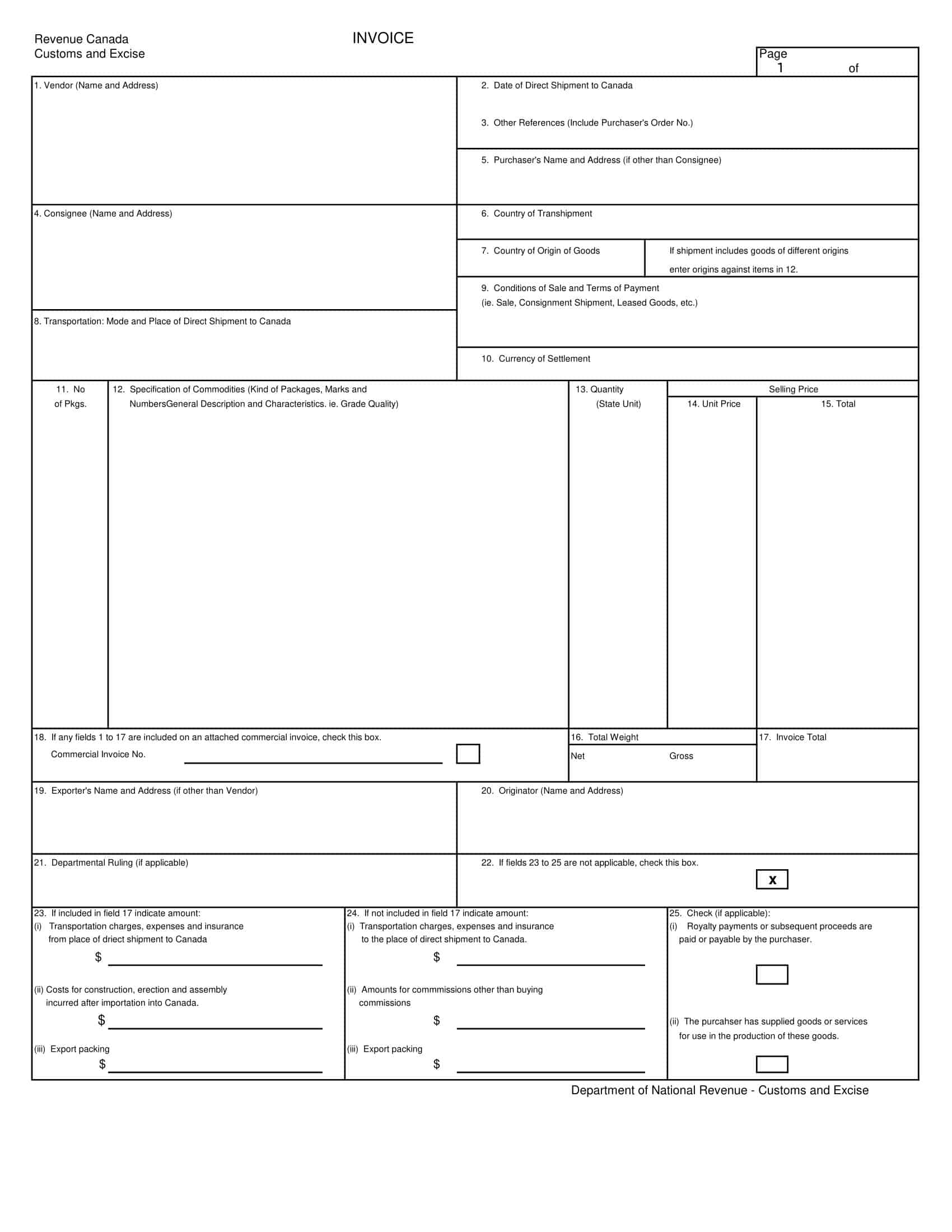

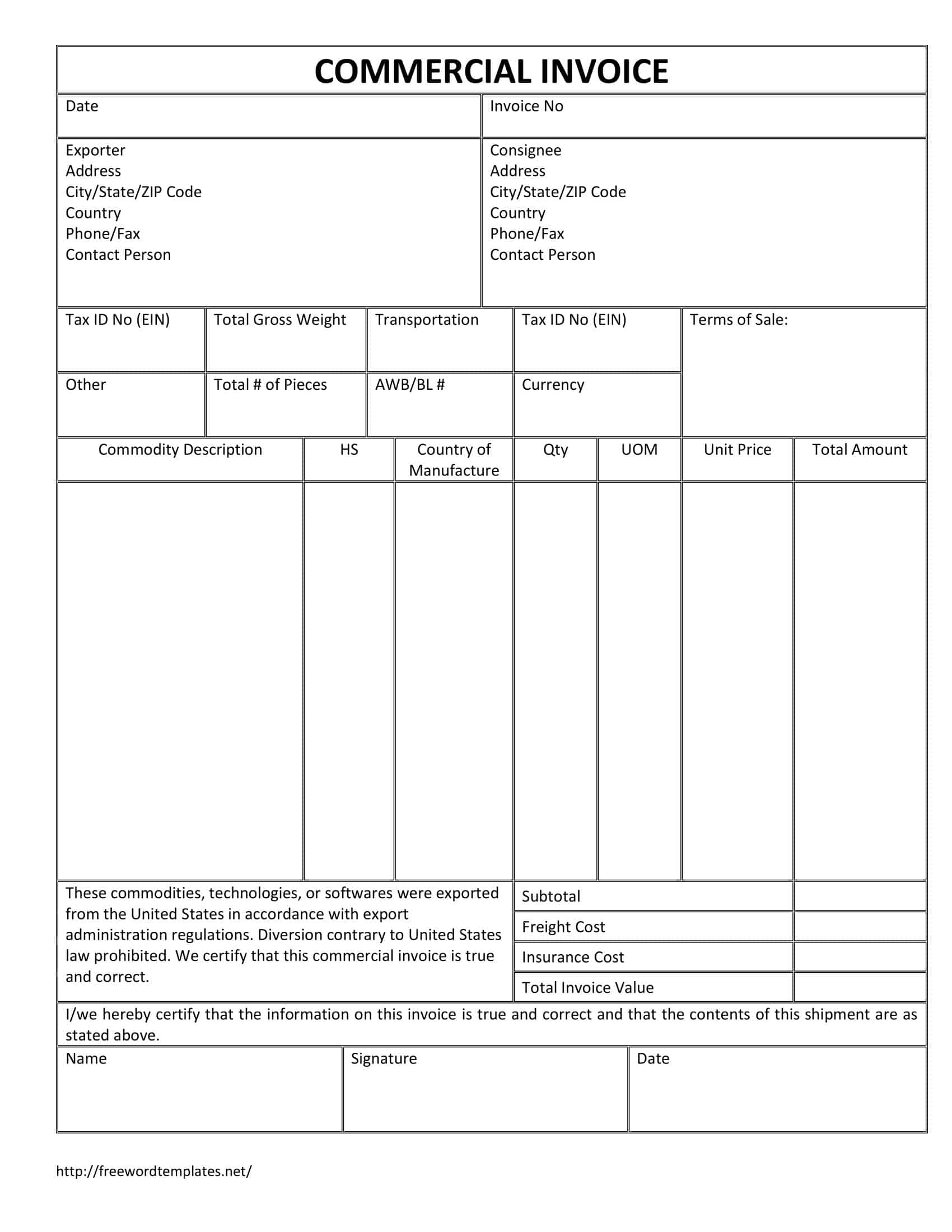

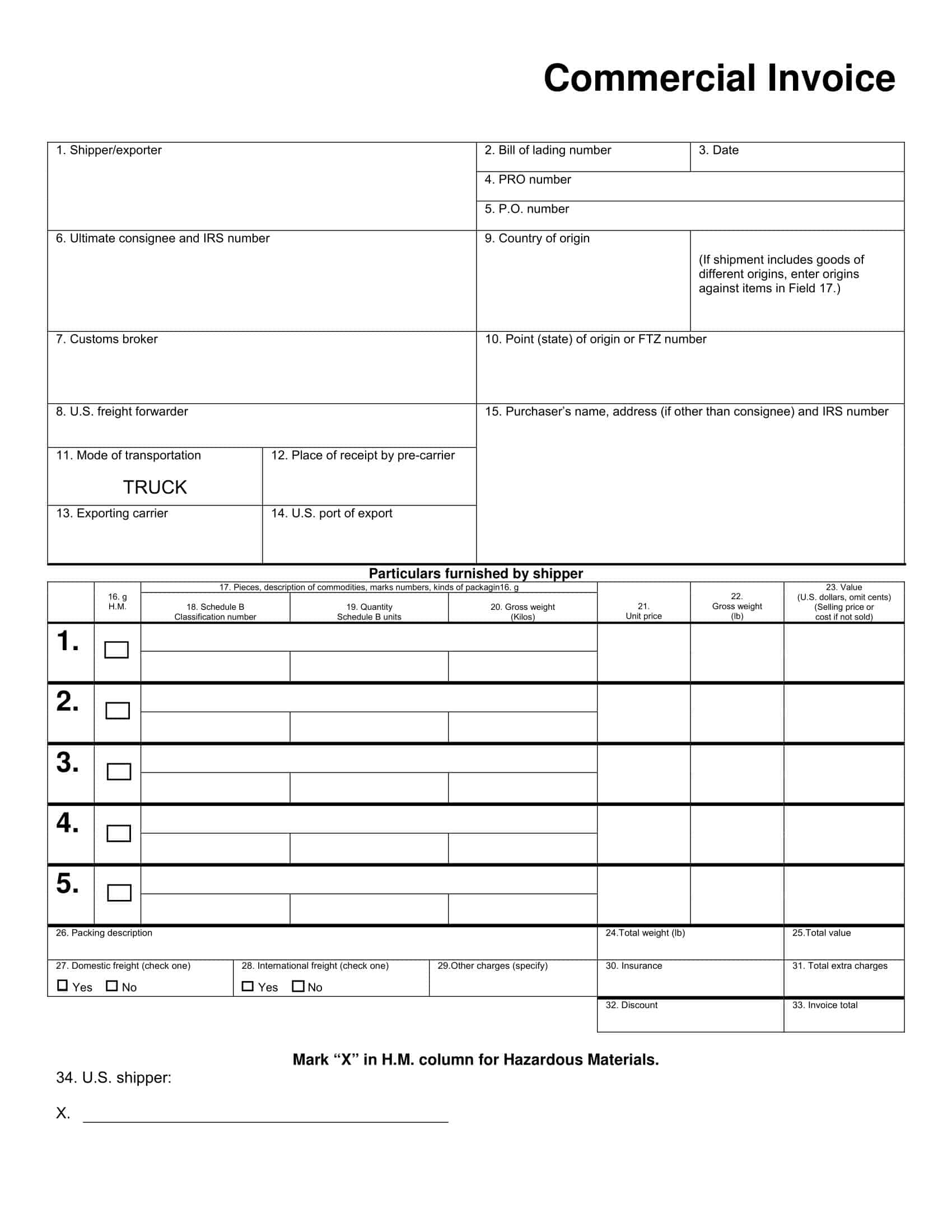

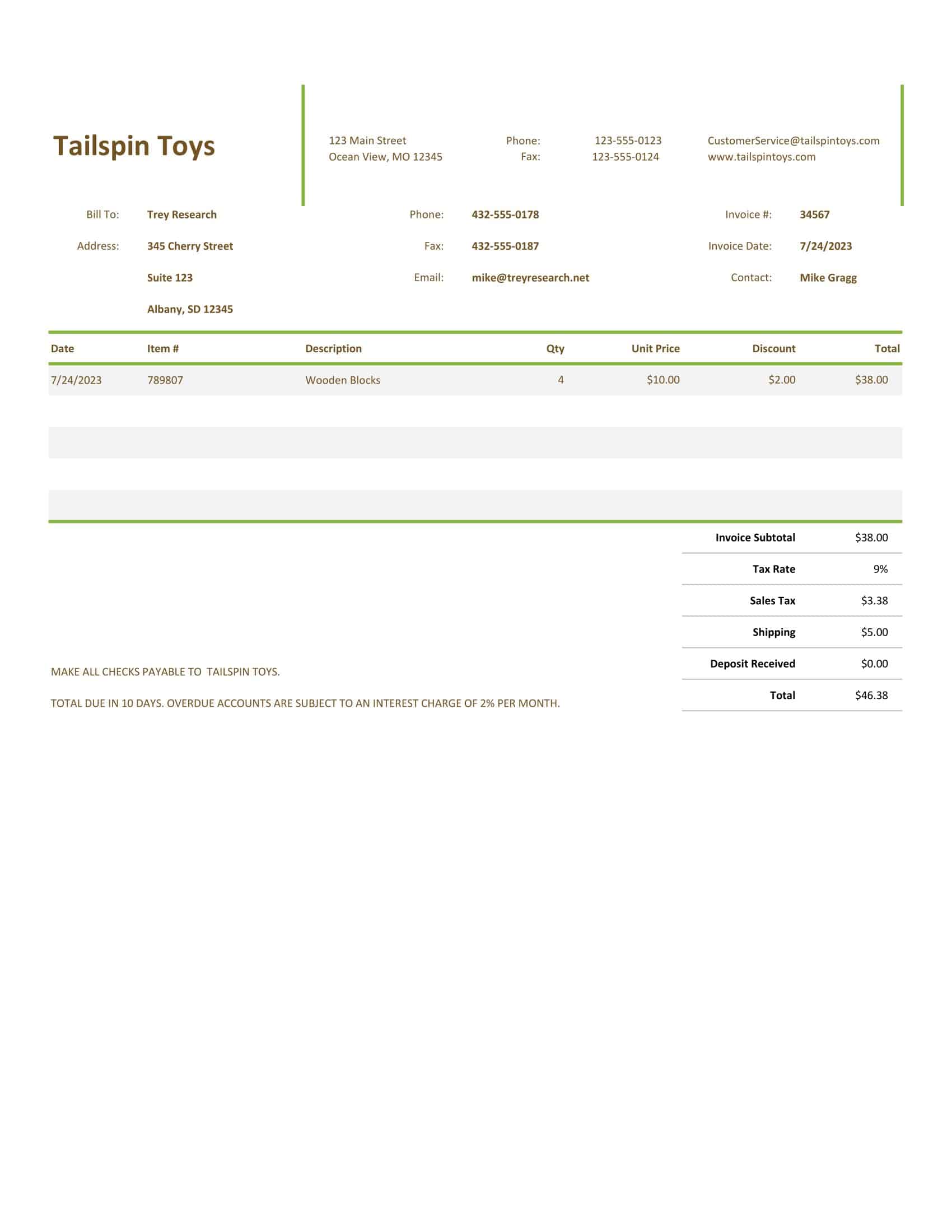

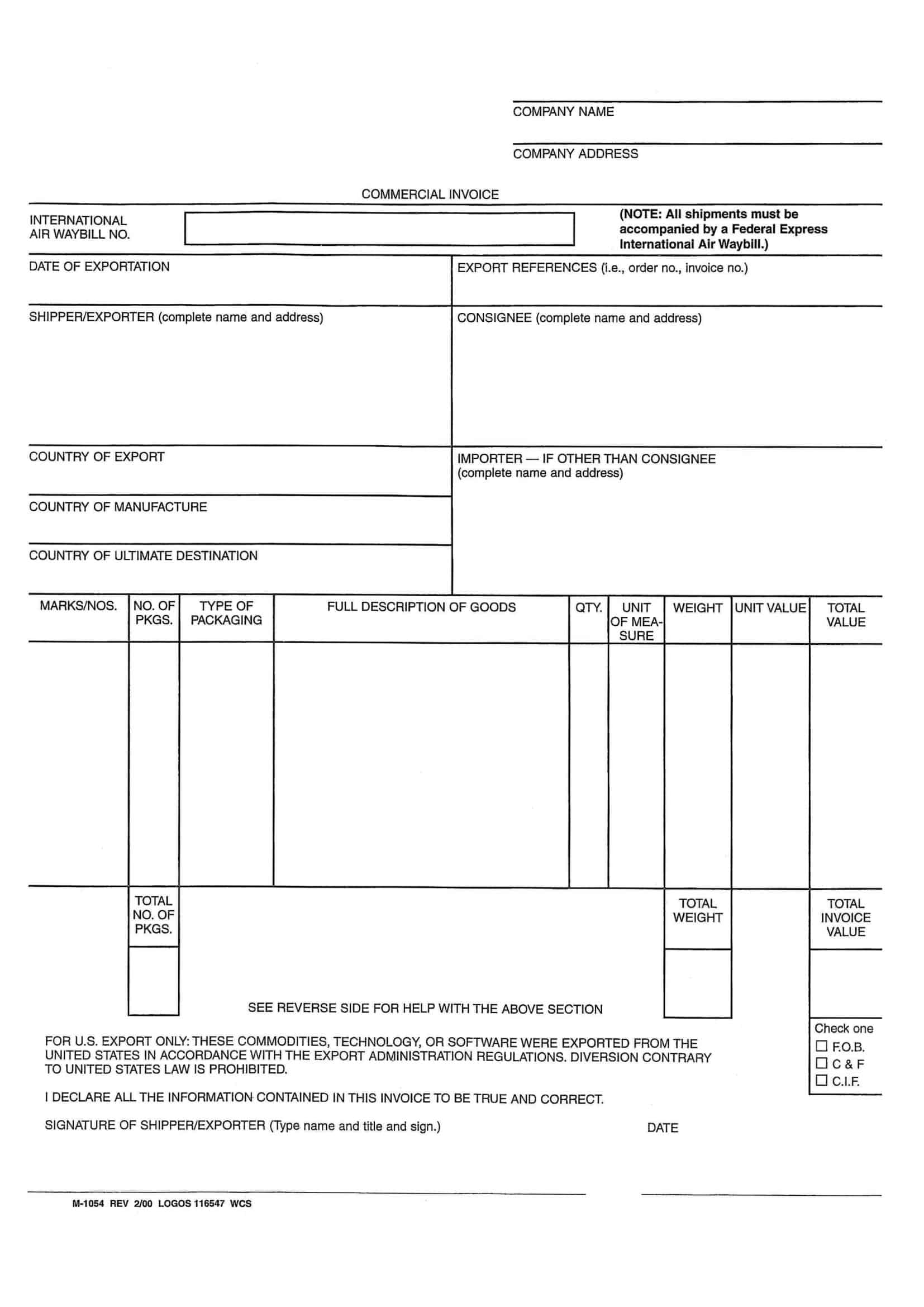

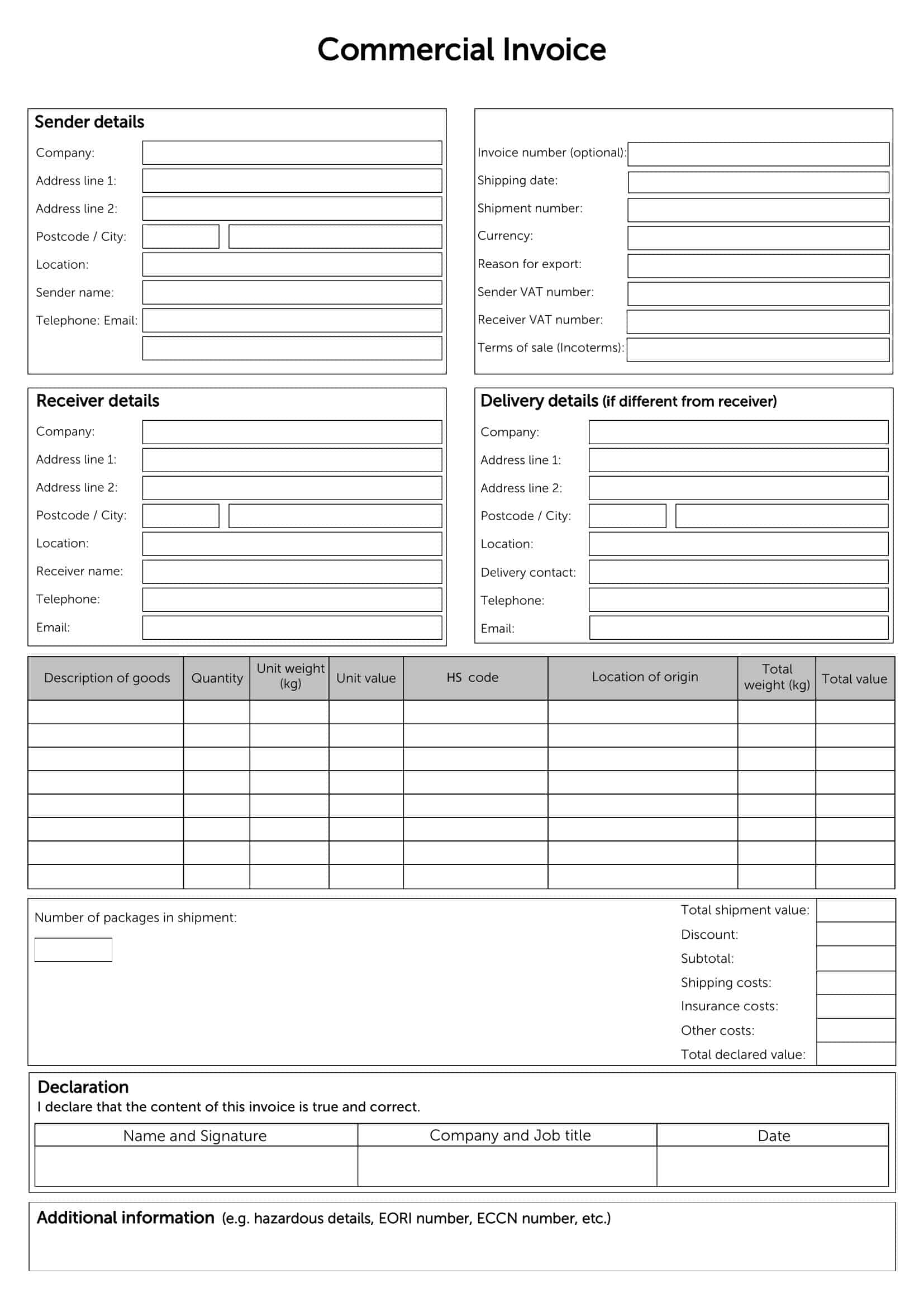

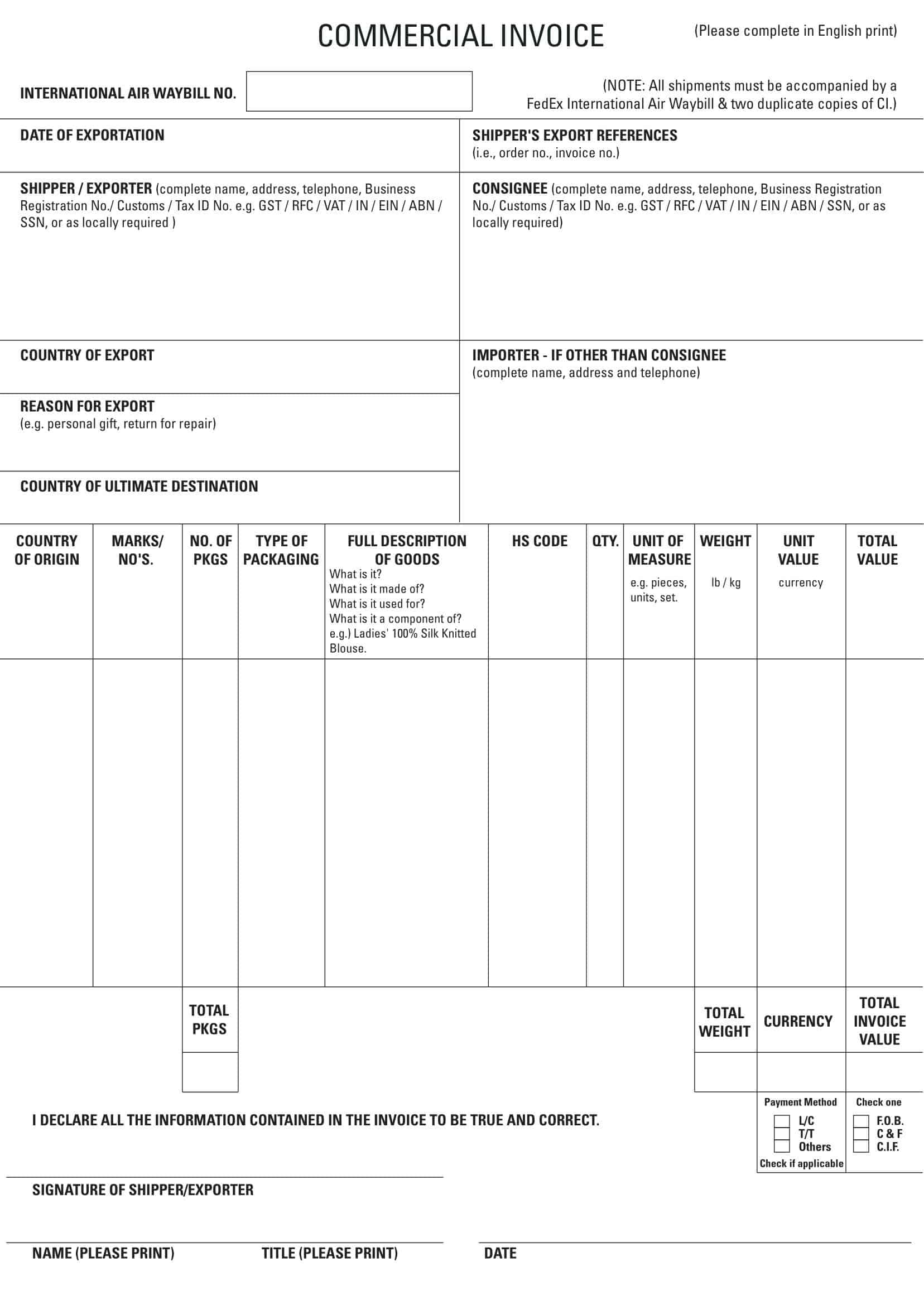

Commercial Invoice Templates

Commercial invoice templates serve a significant role in international trade, providing a framework for businesses to generate a detailed record of goods sold or services provided. These templates typically consist of multiple sections designed to hold crucial information about transactions.

In the header section, business details such as company name, address, and contact information are inserted. This part also includes details of the buyer or recipient. Such data help in identifying the parties involved in the transaction, crucial for shipping and delivery.

The body section of these templates is for itemizing the goods or services involved in the transaction. It lists product descriptions, quantities, unit prices, and total costs. Some templates may also include sections for additional fees, such as shipping costs, taxes, or discounts.

When are Commercial Invoices Used?

Commercial Invoices are used at several stages and in multiple scenarios within the sphere of international trade. Here’s a comprehensive look at when and where these documents come into play:

1. Export Documentation: The journey of a Commercial Invoice begins at the point of export. When goods are exported from one country to another, a Commercial Invoice is used as a detailed record of the transaction and the goods involved. It outlines all necessary information regarding the goods and terms of the sale, making it an integral part of export documentation.

2. Customs Clearance: Perhaps the most critical use of the Commercial Invoice is during customs clearance. Customs authorities at the point of import use the Commercial Invoice to ascertain the nature, origin, and value of the goods being imported. This information is used to assess the duties and taxes that should be applied to the goods, and to ensure the goods comply with local import laws.

3. Import Documentation: Just as in export, the Commercial Invoice is crucial when goods are imported. The importer, in addition to customs authorities, uses the Commercial Invoice to verify that the goods received are as agreed in terms of type, quantity, and price.

4. Trade Financing: Commercial Invoices are commonly used in trade finance scenarios. For example, in transactions involving Letters of Credit or Documentary Collections, banks require a Commercial Invoice to ensure the goods have been shipped and match the contractual obligations before they release funds to the seller.

5. Freight Forwarders and Shipping Agents: Freight forwarders and shipping agents often require a Commercial Invoice to arrange the transportation of goods. The information within the invoice, such as descriptions of the goods, their value, and terms of sale, aids in ensuring that goods are correctly handled, packaged, and shipped.

6. Insurance Claims: In case of damage, loss, or theft of goods during transportation, insurance companies may require a Commercial Invoice to process and validate a claim. The invoice serves as proof of the value of the goods insured, and therefore the potential loss to the business.

7. Record Keeping and Audits: Businesses use Commercial Invoices for their internal record-keeping processes. They are used to maintain accurate sales records, manage inventory, and prepare financial statements. In the event of an audit, a Commercial Invoice provides a paper trail to validate reported income and taxes.

8. Dispute Resolution: In the event of a disagreement or dispute between a buyer and a seller, the Commercial Invoice can serve as a legally binding document that outlines the terms of the transaction. Legal authorities can refer to the Commercial Invoice to make decisions regarding disputes.

Importance of a Commercial Invoice

The Commercial Invoice is a linchpin of international trade, embodying importance that is multifaceted and stretches across various aspects of business transactions.

The starting point of its importance lies in its role as a contractual agreement. Serving as a record of sale between the supplier and the buyer, it sets out what goods or services are being provided, how many, and at what cost. In a sense, it stands as an assurance to the buyer that the goods or services agreed upon will be delivered and acts as a record for the supplier of what has been sold.

From the contractual sphere, we move onto the realm of logistics. The Commercial Invoice is the primary document used by customs authorities worldwide to assess and apply any necessary duties and taxes on goods crossing borders. The invoice details the nature, value, origin and destination of the goods, assisting customs officials in determining whether the goods may legally enter the country, what controls or restrictions may apply, and what duties or taxes should be levied.

In financial terms, the Commercial Invoice plays a critical role as it’s often used by banks and financial institutions as a requirement in trade financing mechanisms such as Letters of Credit or Documentary Collections. Banks require this document to ensure the goods have been shipped and match the contract before they release funds to the seller.

Furthermore, this document is indispensable for bookkeeping and audit processes. It enables businesses to track sales, manage inventory, and measure performance. Accountants use these invoices to help calculate net sales and cost of goods sold, which are essential elements of financial reporting.

Lastly, it’s critical from a legal perspective. In cases of disputes, legal authorities may refer to the Commercial Invoice to resolve issues regarding the nature of goods sold, their quantity, or agreed prices. It also aids in determining liability and responsibility throughout various stages of the delivery process.

What Does a Commercial Invoice include?

A Commercial Invoice is a detailed document that lays the groundwork for transparent and legitimate international transactions. It comprises multiple elements that provide essential information about the goods or services being sold, the involved parties, and the terms of the trade. Here’s a detailed look into the components that typically make up a Commercial Invoice:

1. Seller and Buyer Details: At its core, a Commercial Invoice is a legal document between a seller and a buyer. Thus, it starts with the identification of both parties. This includes the complete names and addresses of the supplier (exporter) and the buyer (importer). The contact details of both parties may also be included for communication purposes.

2. Invoice Number and Date: The Commercial Invoice must include a unique invoice number for reference and tracking purposes. This is particularly important for record-keeping, accounting, and auditing. The date when the invoice was issued also needs to be clearly stated.

3. Description of Goods or Services: This includes a detailed and precise description of the goods being shipped or services provided. Information typically includes the type of product, quantity, weight, and any other specification necessary for the identification of the goods. This is crucial for customs purposes as it helps determine if the goods are admissible and the applicable customs duties.

4. Harmonized System (HS) Code: The Harmonized System is an international nomenclature developed by the World Customs Organization for the classification of products. It allows participating countries to classify traded goods on a common basis for customs purposes. Each product will have a specific HS code, which needs to be included in the Commercial Invoice.

5. Terms of Trade (Incoterms): Incoterms or International Commercial Terms are a set of pre-defined commercial terms published by the International Chamber of Commerce. They clearly define the tasks, costs, and risks associated with the transportation and delivery of goods in international trade. The agreed Incoterm (e.g., EXW, FOB, CIF, etc.) should be specified on the Commercial Invoice.

6. Price and Currency: The unit price of each type of goods or service, along with the total cost, should be stated. The currency in which the transaction is made should also be specified. This information is vital for customs authorities to ascertain the value of the goods for the levying of duties and taxes.

7. Country of Origin: This refers to the country where the goods were produced or manufactured. The country of origin can influence the amount of duty payable and may affect whether the goods can be lawfully imported at all, depending on any trade embargoes, sanctions, or protections in place.

8. Terms of Payment: Details about the payment agreement between the seller and the buyer should be included, such as whether the amount will be paid upon receipt, within a certain number of days, or if a Letter of Credit is being used.

9. Shipping Method and Packaging Details: The method of shipment (air, sea, rail, or road) and information about packaging (number of packages, type of packaging, etc.) are typically included in a Commercial Invoice.

10. Declaration: Finally, the Commercial Invoice generally ends with a declaration by the exporter confirming that the details provided are true and correct. This is usually accompanied by the signature of the authorized individual or company representative.

Difference between commercial invoice and standart invoice

Commercial Invoices and Standard Invoices are both critical components of the broader business landscape, but they serve distinct roles and are used in different contexts. Let’s delve into the key differences that separate these two types of invoices:

1. Use and Purpose:

- Commercial Invoice: This is primarily used in the context of international trade. It provides detailed information about the goods being shipped across borders and is crucial for customs declarations. The Commercial Invoice assists customs authorities in determining the value of goods for the application of duties and taxes. It is also used in trade financing scenarios, such as in transactions involving Letters of Credit or Documentary Collections.

- Standard Invoice: This is a basic billing document used in transactions, primarily domestic, to request payment for goods or services rendered. It details the items sold, their quantities, and prices. It is an integral part of bookkeeping and accounting processes, helping businesses keep track of sales, revenues, and receivables.

2. Content:

- Commercial Invoice: It includes comprehensive information needed for the shipment of goods internationally. This includes the details of the buyer and seller, detailed description of goods, prices, currency, Incoterms (terms of trade), payment terms, country of origin, Harmonized System (HS) codes, and a declaration by the exporter. This document often requires the signature of the exporter, confirming that the details provided are accurate.

- Standard Invoice: It generally contains basic transaction information such as the names of the buyer and seller, description of goods or services sold, the quantity, unit price, total amount due, payment terms, and the date of the transaction. While it includes information about the items sold and their prices, it lacks the detailed shipping and customs-related information found in a Commercial Invoice.

3. Legal Importance:

- Commercial Invoice: In the realm of international trade, a Commercial Invoice has significant legal importance. It can be used as a contract between buyer and seller and as a document of title in certain cases. It’s an essential document for customs authorities and is often needed in dispute resolutions related to international transactions.

- Standard Invoice: While a Standard Invoice is legally binding and can be used as evidence of a transaction in case of a dispute, its primary function is to serve as a bill for goods or services. It is primarily used for accounting and tax purposes within a country, and unlike the Commercial Invoice, it is not intended to be used for customs declarations.

4. Role in Taxation:

- Commercial Invoice: It serves as the basis for customs duties and taxes in the importing country. The declared value of goods on the Commercial Invoice directly affects the amount of duty or tax that will be applied.

- Standard Invoice: This type of invoice is used to calculate sales tax or VAT within a country. The tax rate applied depends on the local tax laws and the nature of the goods or services sold.

A Comprehensive Guide to Commercial Invoice Terminology

Filling out a Commercial Invoice requires a solid understanding of a few key terms commonly used in international trade. These terms provide a standard for trade agreements and play a critical role in shaping the content of the Commercial Invoice. Here are the most important terms you’ll need to know:

1. Seller/Exporter: The party selling the goods or services. They are responsible for preparing the Commercial Invoice. In the context of international trade, the seller is often referred to as the exporter.

2. Buyer/Importer: The party purchasing the goods or services. In international trade, the buyer is typically referred to as the importer.

3. Harmonized System (HS) Code: The Harmonized System is an international standardized system of names and numbers to classify traded products. It is used by customs authorities around the world to identify products for the application of duties and taxes. An HS code is a six-digit number that describes the exact product being shipped.

4. Incoterms (International Commercial Terms): These are a set of international standards for the uniform interpretation of common contractual sales practices. They are published by the International Chamber of Commerce and define the responsibilities of sellers and buyers for the delivery of goods under sales contracts for domestic and international trade. Examples include FOB (Free On Board), CIF (Cost, Insurance, and Freight), and EXW (Ex Works).

5. Country of Origin: This term refers to the country in which the goods were produced or made. It is important as it can influence the amount of duty payable and may affect whether the goods can be lawfully imported, based on trade agreements or restrictions.

6. Bill of Lading (B/L or BOL): This is a document issued by a carrier (or their agent) to acknowledge receipt of cargo for shipment. In the case of ocean freight, the Bill of Lading serves as a contract of carriage and a receipt for goods. It also represents ownership of the cargo and can therefore be bought, sold, or traded while the goods are in transit.

7. Letter of Credit (L/C): This is a letter from a bank guaranteeing that a buyer’s payment to a seller will be received on time and for the correct amount. If the buyer is unable to make payment, the bank will be required to cover the full or remaining amount.

8. Duty and VAT: Duty is a tax imposed by the customs authorities of a country on goods entering the country. The duty owed depends on the product’s classification, value, and country of origin. VAT, or Value-Added Tax, is a tax on the consumption of goods and services and is collected incrementally.

9. Currency Code: This is a three-letter code that represents a particular currency used in the transaction. For example, the United States dollar is represented as USD, and the Euro as EUR. These codes are standardized by the International Organization for Standardization (ISO).

10. Terms of Payment: This refers to the conditions under which a seller will complete a sale. These terms specify how the payment will be made, when it will be made, and may include any discounts or penalties for late payment.

11. Invoice Date: The date when the Commercial Invoice was issued. This is significant for record-keeping, payment terms, and finance tracking.

12. Invoice Number: A unique identifier for each Commercial Invoice. It’s used for tracking, referencing, and organizing transactions, and it’s vital for efficient record-keeping and financial management.

13. Unit of Measure (UOM): This term refers to the standard quantity in which the product is sold or purchased. Common units of measure include pieces (pcs), kilograms (kg), tons, liters (L), etc.

14. Quantity: The number of units of the product being sold, usually in the unit of measure defined for that particular product.

15. Total Invoice Value: The aggregate value of all the goods or services in the invoice, generally excluding any taxes or additional fees.

16. Freight Charges: These are costs associated with the physical transportation of goods from the seller to the buyer. They are usually determined based on the weight or volume of the goods, the type of goods, the distance they need to be transported, and the method of transportation used.

17. Insurance Charges: If the terms of the sale require one party to procure insurance for the goods during transit, the cost of that insurance is listed as a separate line item.

18. Packing List: This is a detailed document that lists all the items in the shipment, their unit of measure, and their location within the package(s). While it is often a separate document, it aligns closely with the Commercial Invoice, and understanding its contents is critical for accurate invoicing.

19. Freight Forwarder: A freight forwarder is a company that organizes shipments for individuals or corporations to get goods from the producer or manufacturer to a market, customer, or final point of distribution. In many Commercial Invoices, the freight forwarder is indicated as part of the shipping instructions.

20. Declaration: The section of the Commercial Invoice where the seller or shipper certifies that the information in the invoice is truthful and accurate. This is usually accompanied by the signature of the authorized individual or company representative.

How to create a commercial invoice?

Creating a commercial invoice involves several steps, each detailing a specific aspect of the transaction. Here’s a step-by-step guide to help you:

Step 1: Include Seller and Buyer Information: Begin by listing the full contact details of the seller (or exporter) and buyer (or importer). This includes the company name, address, country, contact person, phone number, and email address. This section identifies the parties involved in the transaction.

Step 2: Assign an Invoice Number and Date: Each commercial invoice should have a unique invoice number and the date it was created. This helps keep track of the transactions for both seller and buyer, making future references easier and more organized.

Step 3: Detail the Shipment Terms: Include the shipping terms using Incoterms (International Commercial Terms). These define the responsibilities of the buyer and seller in the shipment process, such as who pays for freight, insurance, and customs duties. The place or port of shipment should also be indicated.

Step 4: Describe the Goods or Services: List the products or services being sold. Each item should have a clear description, quantity, unit price, and total price. Depending on the nature of the goods, more specific details may be required, such as weight, dimensions, or material composition.

Step 5: Include HS Codes: Each product should have an accompanying Harmonized System (HS) code. These are internationally standardized codes that classify traded products and are used by customs authorities to determine the import duties payable.

Step 6: Indicate the Country of Origin: For each product, mention the country where the goods were manufactured or produced. The country of origin can influence the amount of duty payable and may affect whether the goods can be legally imported.

Step 7: Calculate the Total Value: Calculate the total value of all goods or services provided. This includes the subtotal for the items, any additional costs such as freight or insurance (if these are included as per the agreed Incoterms), and the grand total in the specified currency.

Step 8: Specify the Currency: Ensure you specify the currency of the transaction, such as USD for United States dollars or EUR for Euros. This avoids any confusion or misinterpretations during payment processing.

Step 9: Include Payment Terms: Clearly state the terms of payment on the invoice. This could range from immediate payment upon receipt of the invoice to payment within a certain number of days (e.g., Net 30 indicates payment is due within 30 days of the invoice date).

Step 10: Declaration by the Exporter: This is a statement usually found at the end of the invoice. The exporter declares that all the details on the invoice are correct to the best of their knowledge. This statement often needs to be signed and dated by the authorized representative of the exporter.

How to Fill Up Commercial Invoices

Creating and filling up a Commercial Invoice can be an intimidating task, particularly for those new to international trade. However, understanding the process can significantly simplify the task. Here’s a comprehensive guide:

Step 1: Include Seller and Buyer Information:

Start by clearly identifying both parties involved in the transaction. For the seller (exporter), this will include your business name, full address (including city, country, and postal code), and contact information. Similarly, provide detailed contact information for the buyer (importer). The information must be accurate and complete to prevent any issues during shipping or customs clearance.

Example:

- Seller: ABC Exports, 123 Trade Street, New York, NY, USA, 10001, Phone: +1-123-456-7890

- Buyer: XYZ Imports, 456 Commerce Avenue, London, UK, WC2N 5DU, Phone: +44-987-654-3210

Step 2: Assign an Invoice Number and Date:

Every commercial invoice needs a unique invoice number. This can be any sequence of numbers (and often letters) that you choose, but each invoice should have a different number for tracking and record-keeping purposes. The invoice date refers to the date when the invoice is issued, which is usually the shipping date.

Example:

- Invoice Number: ABC-2023-001

- Invoice Date: July 12, 2023

Step 3: Detail the Shipment Terms:

In this step, specify the shipping terms using Incoterms (International Commercial Terms), which describe who is responsible for the shipping, insurance, and tariffs on the items being shipped. Common Incoterms include EXW (Ex Works), FOB (Free on Board), CIF (Cost, Insurance, and Freight), and others. Along with Incoterms, it’s important to mention the agreed place or port of delivery.

Example:

- Shipping Terms: FOB, Port of New York

Step 4: Describe the Goods or Services:

Detail the products or services being sold. Include a complete description of each product, its quantity, unit price, and total price. The description should be detailed enough for customs officials to understand what the product is. Remember to specify the unit of measure (pieces, kilograms, etc.) and ensure the total price for each item is correctly calculated.

Example:

- Product: Men’s Cotton T-Shirts, Size M, Blue

- Quantity: 1000 pieces

- Unit Price: $10

- Total Price: $10,000

Step 5: Include HS Codes:

The Harmonized System (HS) code for each product should be included. These are international codes used to classify products for customs purposes and determine the amount of duty payable. The HS code should accurately represent the product being shipped to avoid any issues at customs.

Example:

- HS Code: 6109.10 (T-Shirts, singlets, and other vests, of cotton, knitted or crocheted)

Step 6: Indicate the Country of Origin:

The country of origin is the country where the goods were produced or manufactured. This can impact the amount of duty or tax applied upon import, due to various trade agreements or restrictions between countries.

Example:

- Country of Origin: United States

Step 7: Calculate the Total Value:

Add up the total value of all the goods provided, then add any additional costs such as freight or insurance, if these are included as per the agreed Incoterms. The grand total should be indicated in the currency agreed upon for the transaction.

Example:

- Subtotal: $10,000

- Freight Charges: $1,000

- Total Invoice Value: $11,000 (USD)

Step 8: Specify the Currency:

Clearly state the currency used in the transaction, such as USD for United States dollars or EUR for Euros. This ensures there is no confusion about the amount to be paid.

Example:

- Currency: USD (United States Dollars)

Step 9: Include Payment Terms:

Detail the agreed payment terms on the invoice. This could be immediate payment upon receipt, due on a specific date, or within a certain number of days from the invoice date.

Example:

- Payment Terms: Net 30 (Payment due within 30 days from the invoice date)

Step 10: Declaration by the Exporter:

Finally, include a signed statement declaring that the details provided in the invoice are correct. This should be signed by an authorized individual within your company.

Example:

- Declaration: I declare that the information provided in this invoice is true and accurate to the best of my knowledge.

- Signature: [Signature]

- Name: John Doe, Position: Export Manager, Date: July 12, 2023

FAQs

Who prepares the commercial invoice?

The exporter or seller typically prepares the commercial invoice. It is their responsibility to ensure that all the required information is accurately included. The invoice may be prepared manually or using electronic invoicing systems, depending on the preferences and capabilities of the parties involved.

Are there any specific requirements for a commercial invoice?

The specific requirements for a commercial invoice may vary depending on the country of import and any applicable trade agreements. It is important to research and comply with the regulations of the importing country. Generally, the invoice should provide clear and accurate information about the goods, their value, and the terms of the transaction.

Can a commercial invoice be issued in any currency?

Yes, a commercial invoice can be issued in any currency agreed upon by the buyer and the seller. However, it is common for invoices to be issued in the currency of the seller’s country or the currency widely accepted in international trade, such as the US dollar (USD) or the euro (EUR).

Is a commercial invoice the same as a proforma invoice?

No, a commercial invoice and a proforma invoice are not the same. A proforma invoice is a preliminary document issued by the seller before the actual shipment of goods. It provides a cost estimate and describes the goods and terms of the transaction. In contrast, a commercial invoice is issued after the goods have been shipped and provides the final details of the transaction.

Can a commercial invoice be used for domestic transactions?

While a commercial invoice is primarily used in international trade, it can also be used for domestic transactions, especially in cases where a detailed description of goods and terms of sale is required. However, domestic transactions often have different invoicing requirements and may utilize other types of invoices or documents specific to the country’s regulations.

Is a commercial invoice the same as a shipping invoice?

The terms “commercial invoice” and “shipping invoice” are sometimes used interchangeably, but they can have slightly different meanings depending on the context. Generally, a commercial invoice refers to the document that provides a detailed description of the goods and terms of the transaction. A shipping invoice, on the other hand, specifically focuses on the charges and fees associated with shipping the goods, including transportation costs, insurance, and other related expenses. In some cases, a shipping invoice may be included as part of the commercial invoice or issued separately.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)