When you receive a loan, the agreement you come to with the lender is often called a promissory note. If you have ever received a loan, you have signed a promissory note at some point. A promissory note is an instrument that protects the contractual relationship between the lender and borrower and the monetary transaction.

The promissory note is essential in a lending relationship and something that seems rather complicated at times but is not too difficult to comprehend if broken down.

Table of Contents

What Is a Promissory Note?

The term promissory note applies to a specific type of loan security used in the United States, Canada, and Australia. A promissory note is a written promise to pay another party a specified sum of money at an agreed future date. Often referred to as notes payable, they are commonly used throughout legal systems as they are simple to understand, clear, and unambiguous. Promissory notes are cheaper than registered bonds or debentures but may be more costly if complex cash flow arrangements are needed.

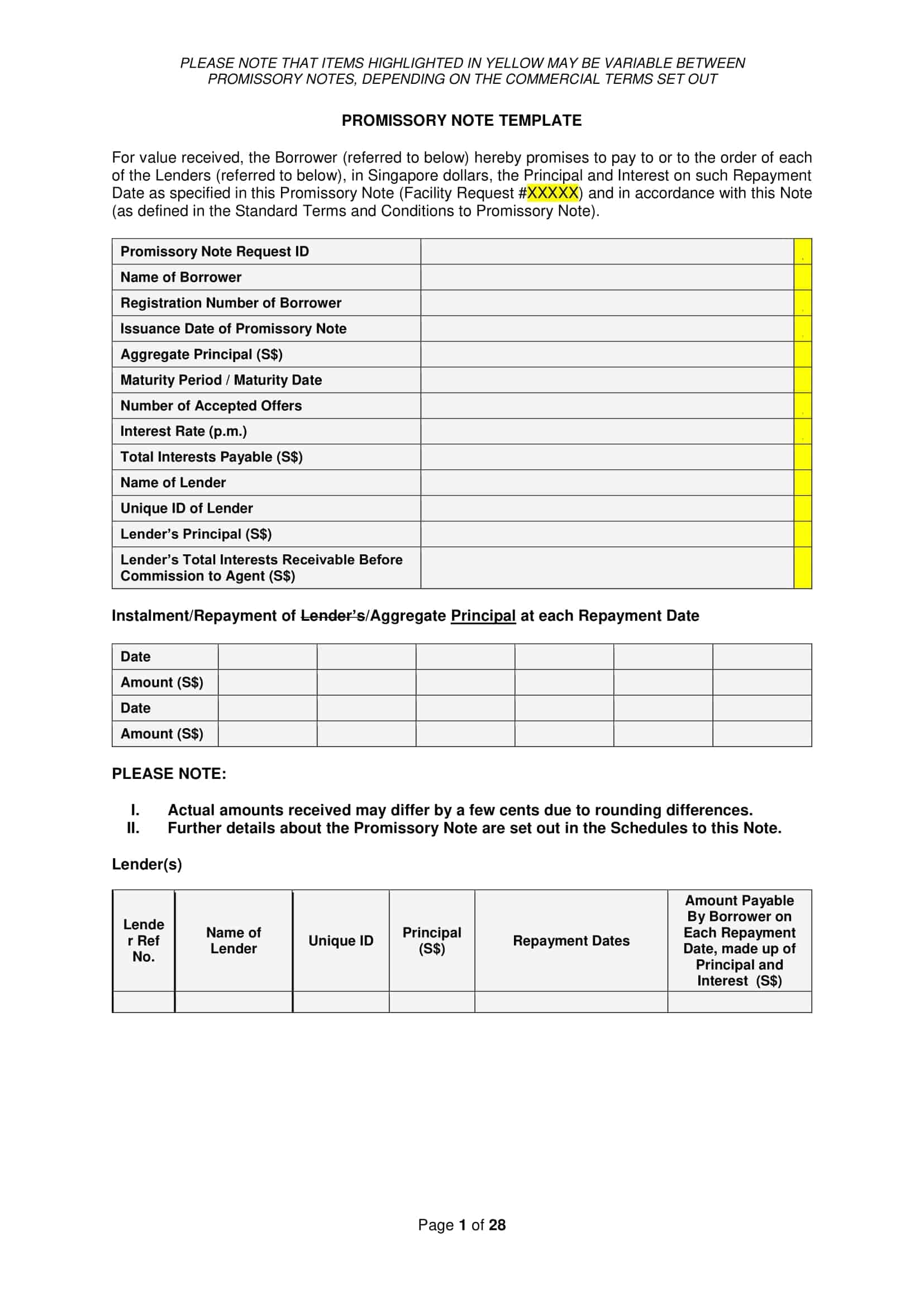

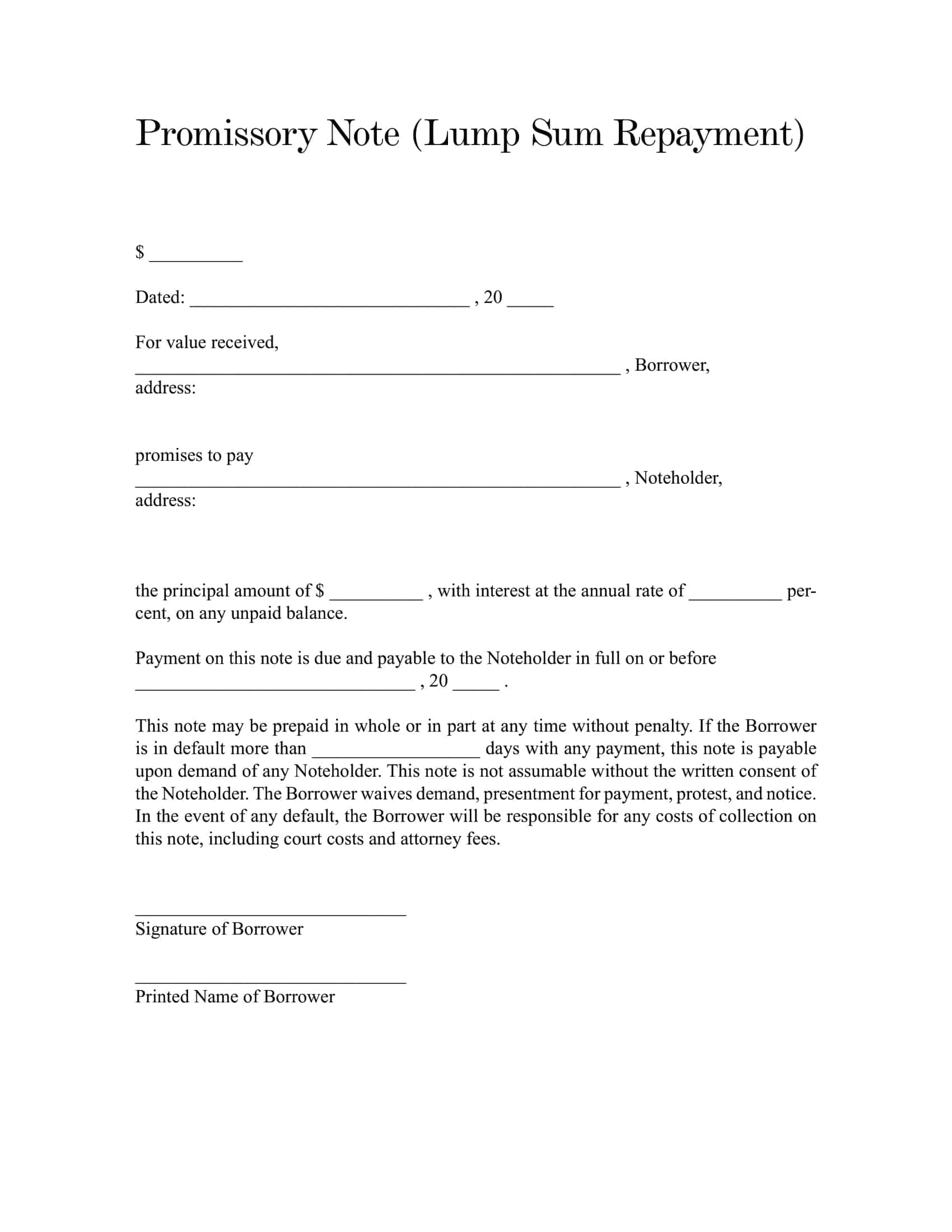

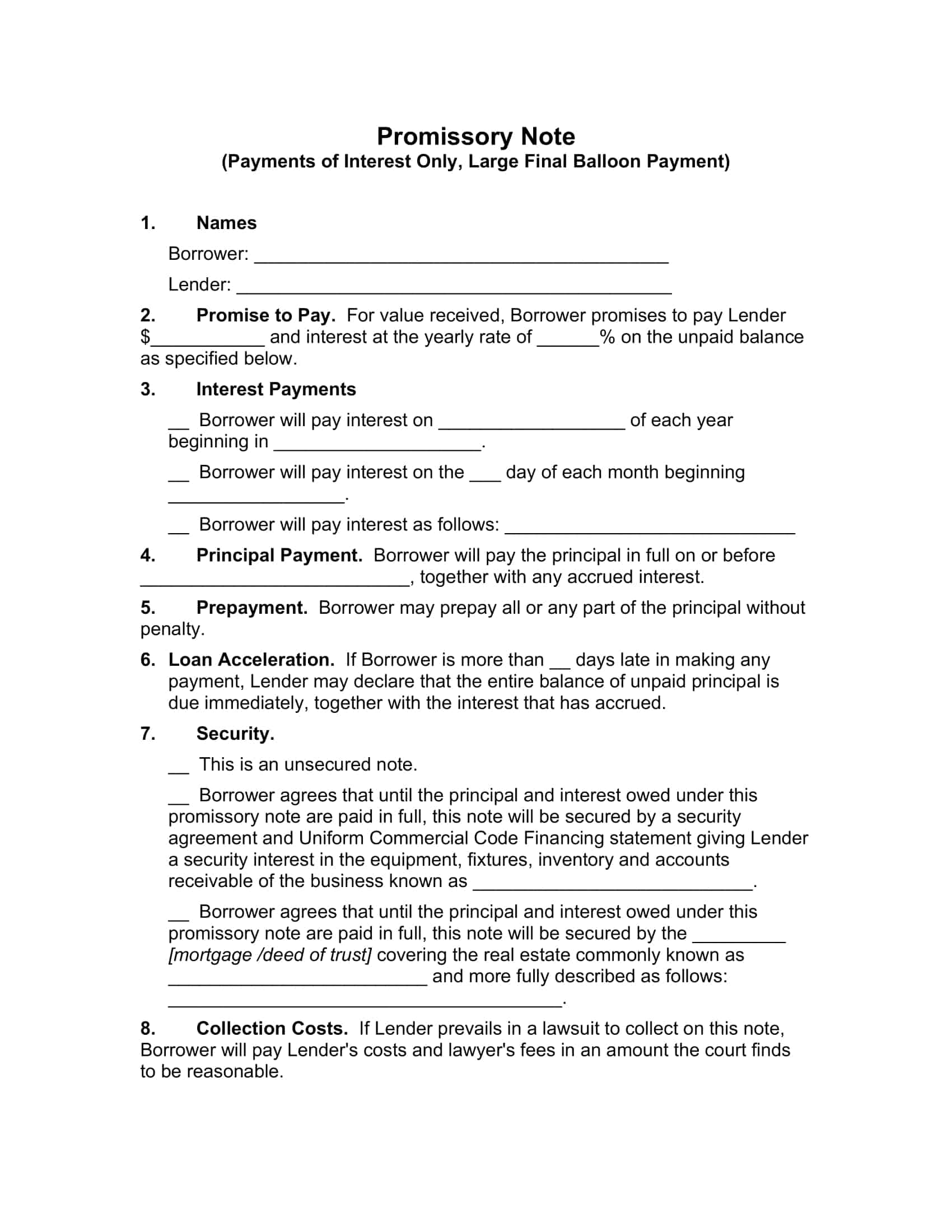

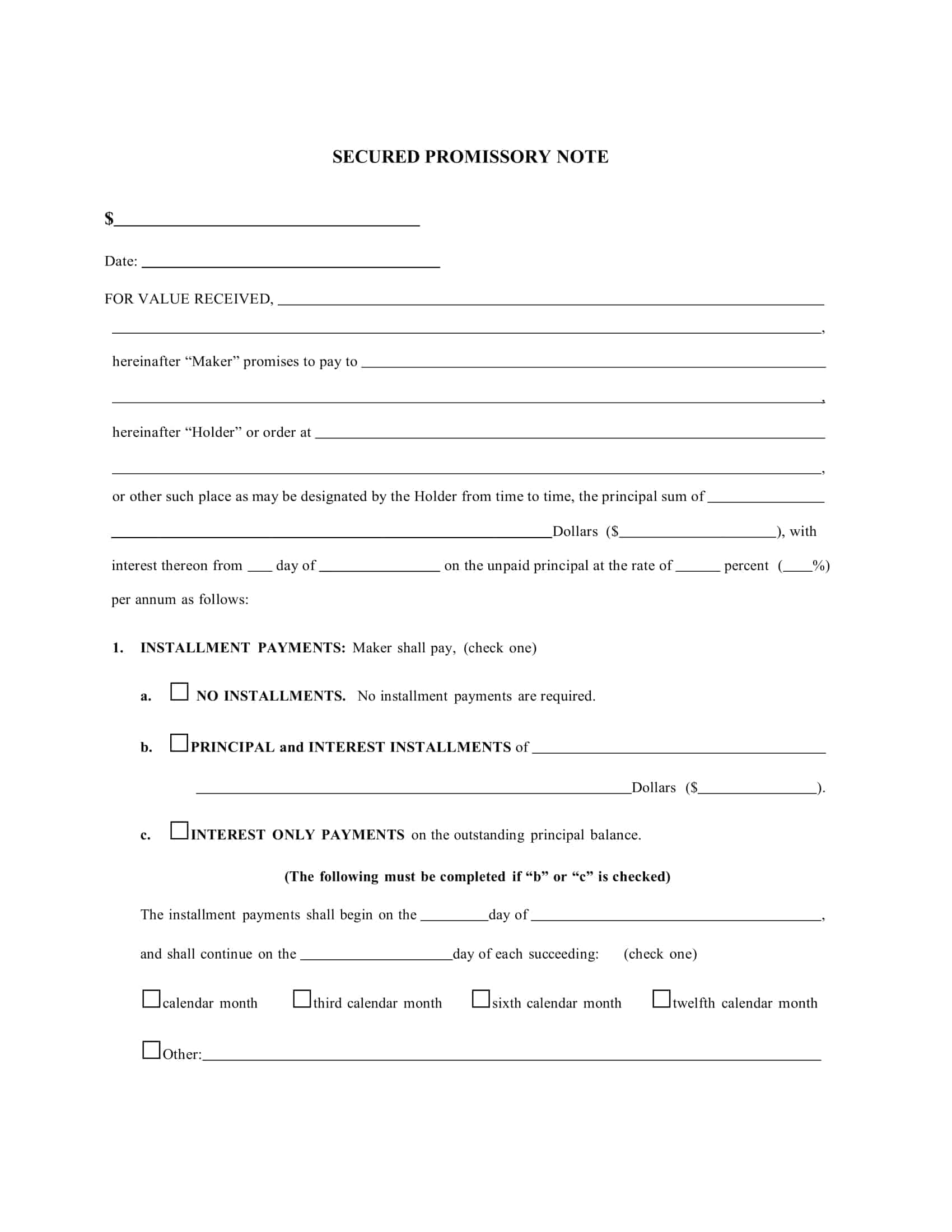

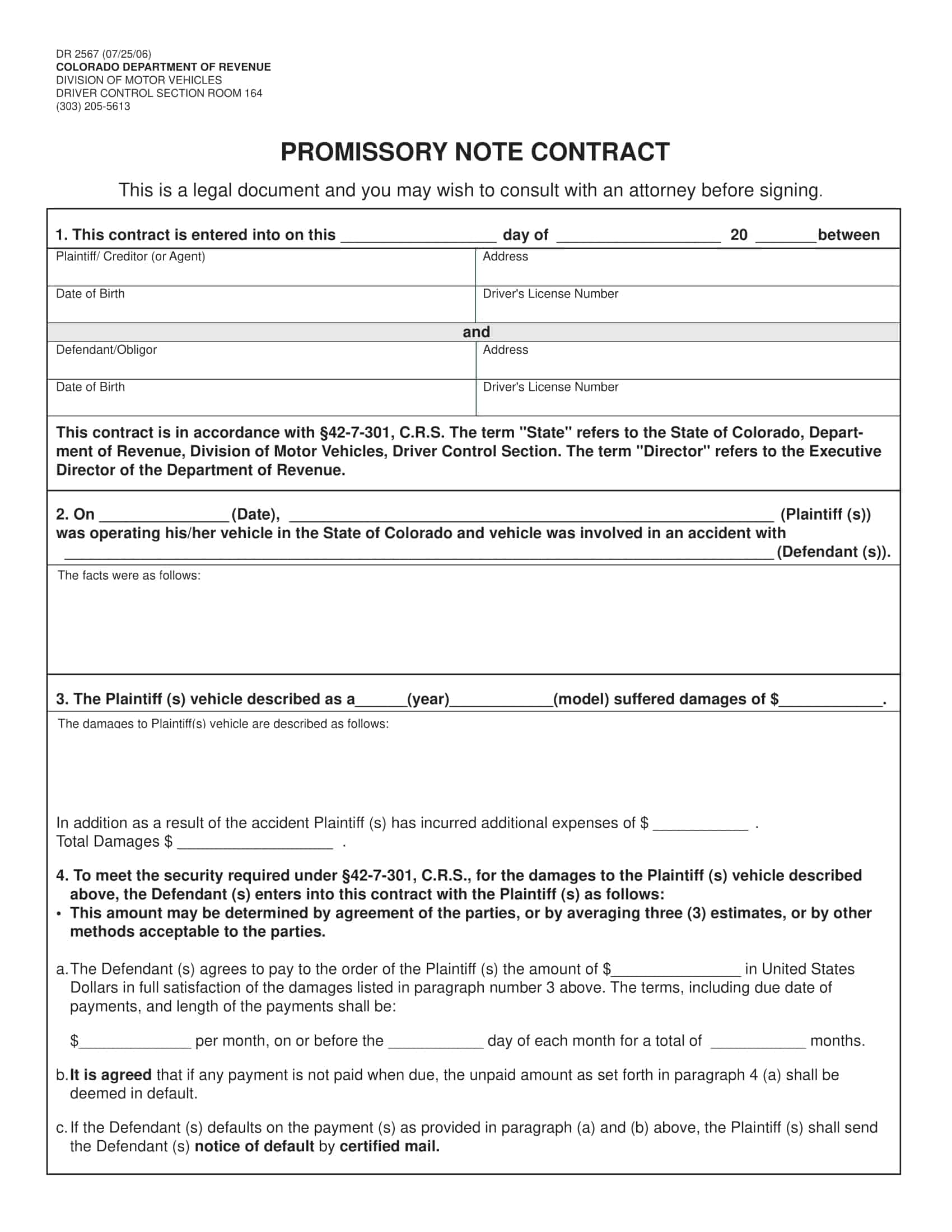

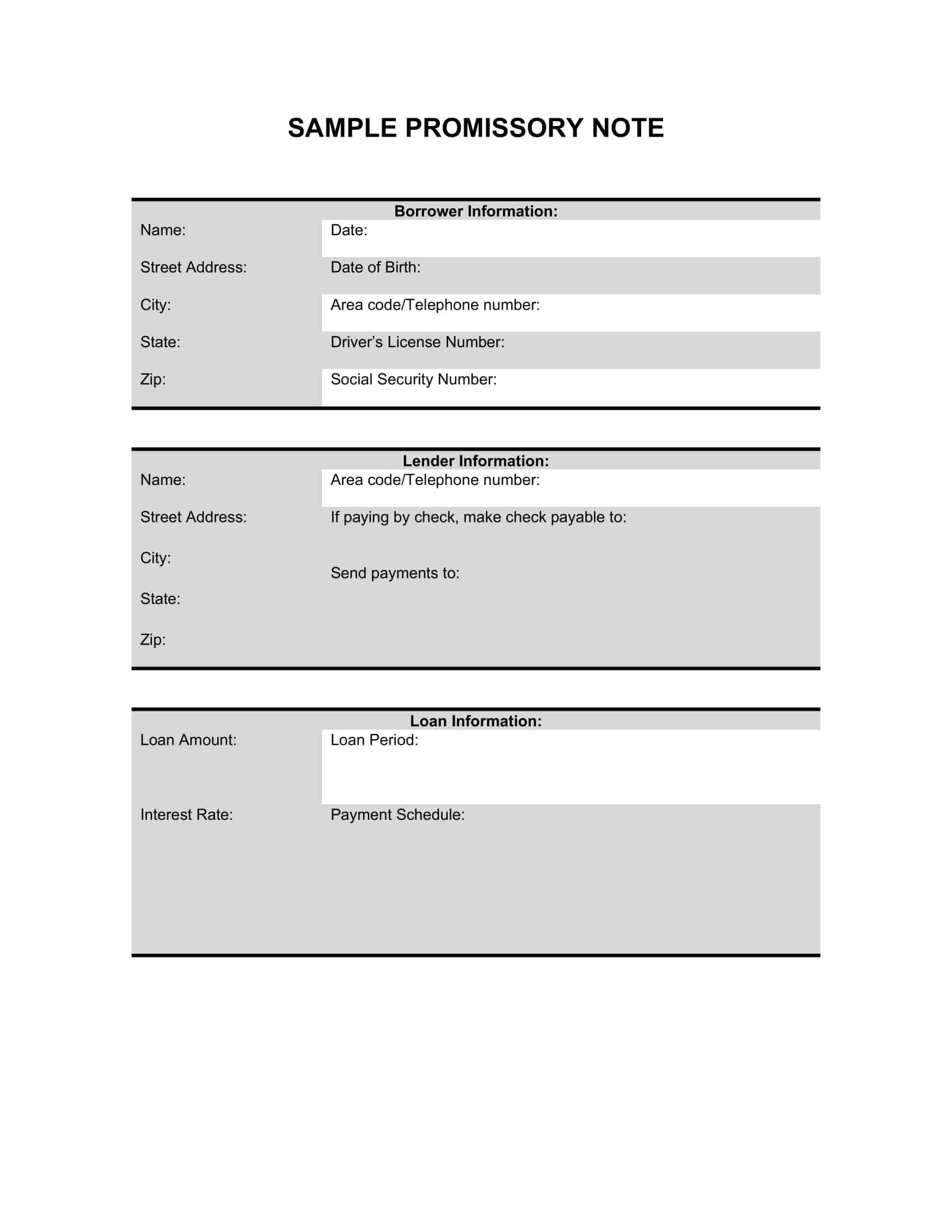

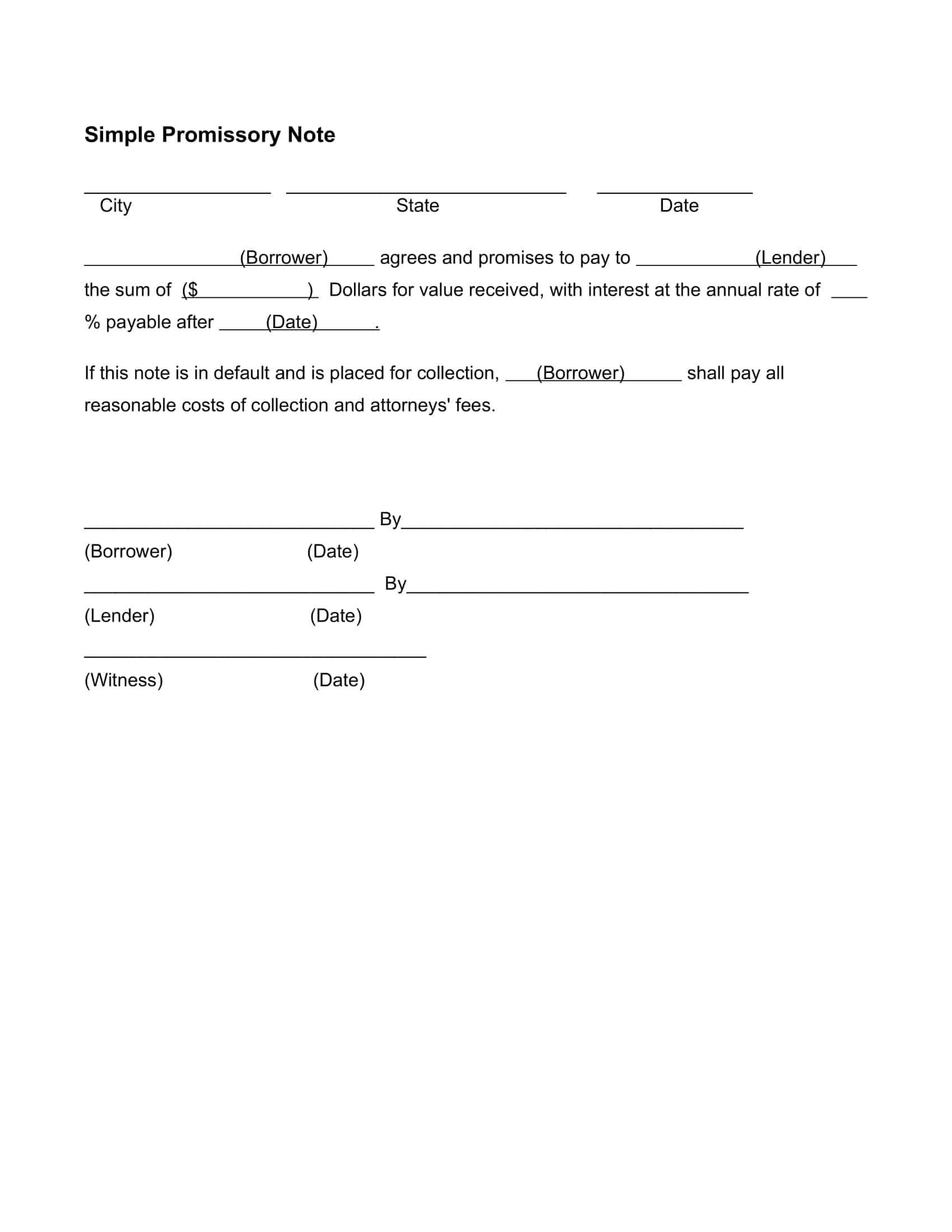

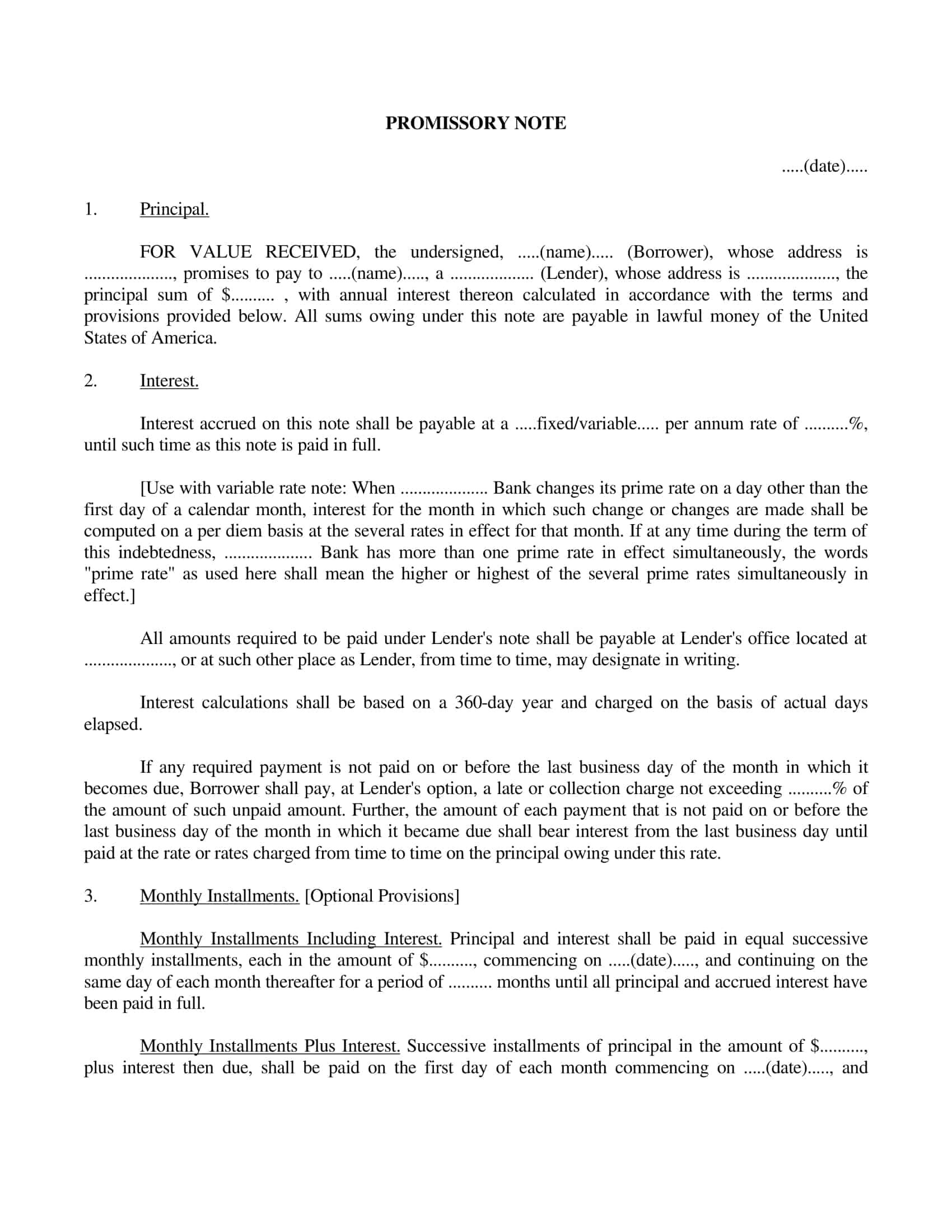

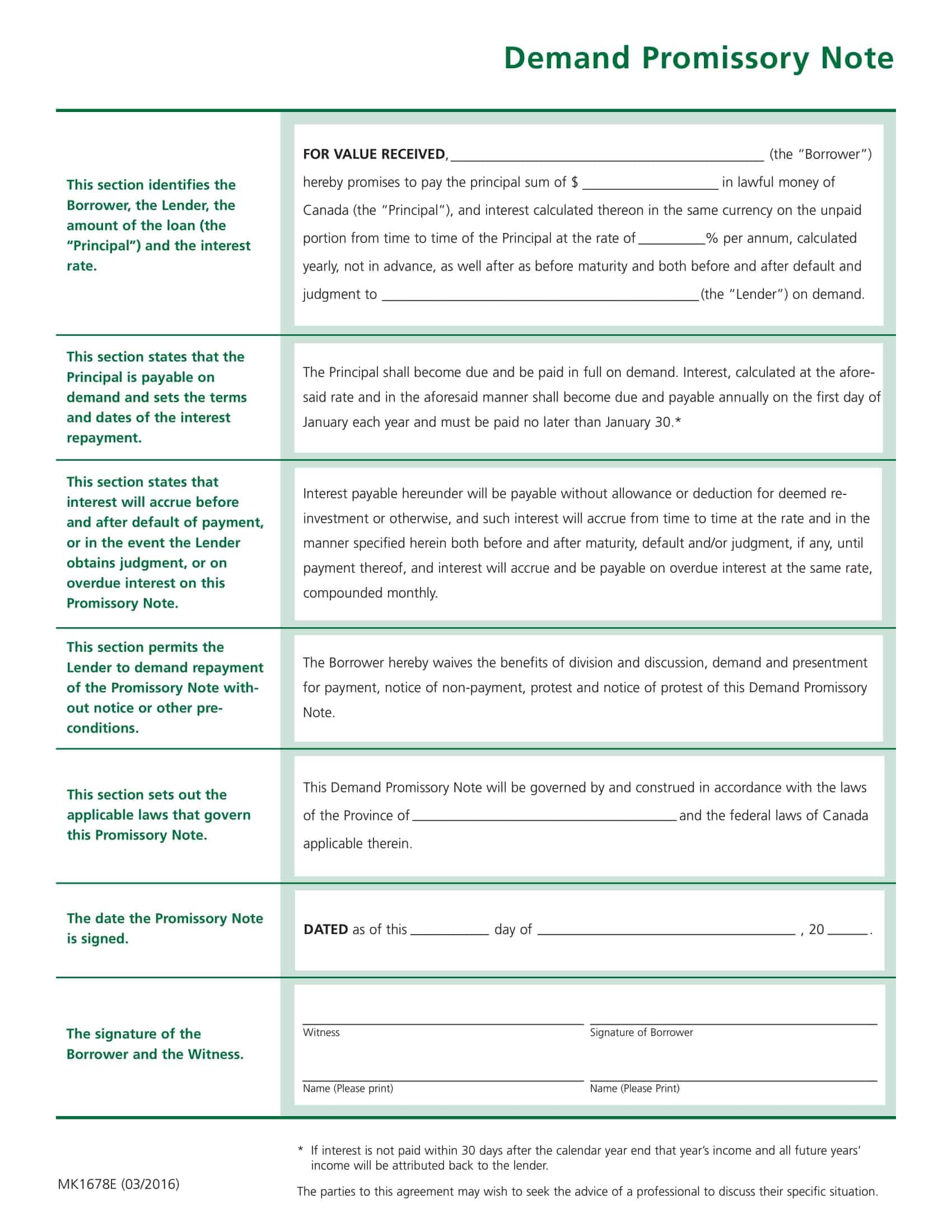

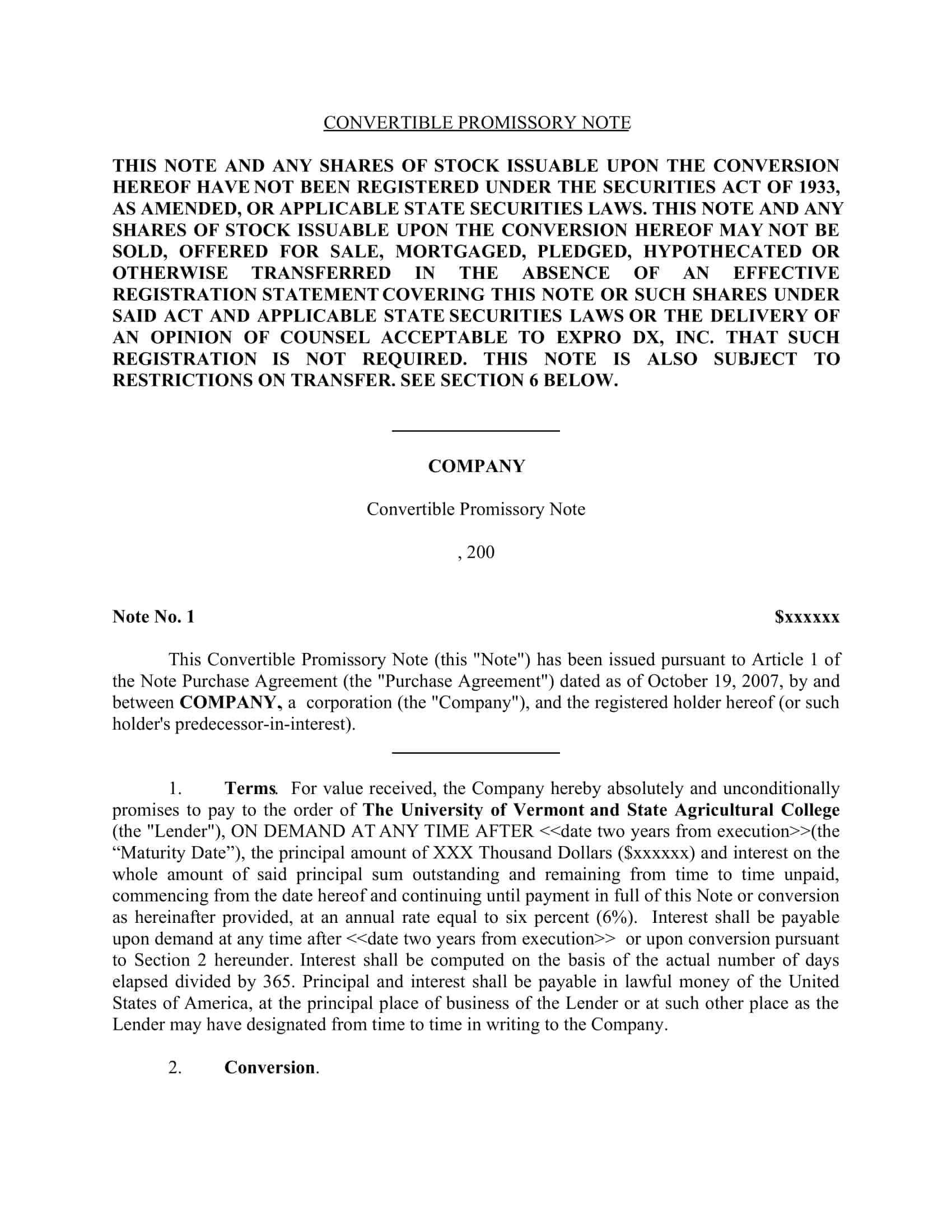

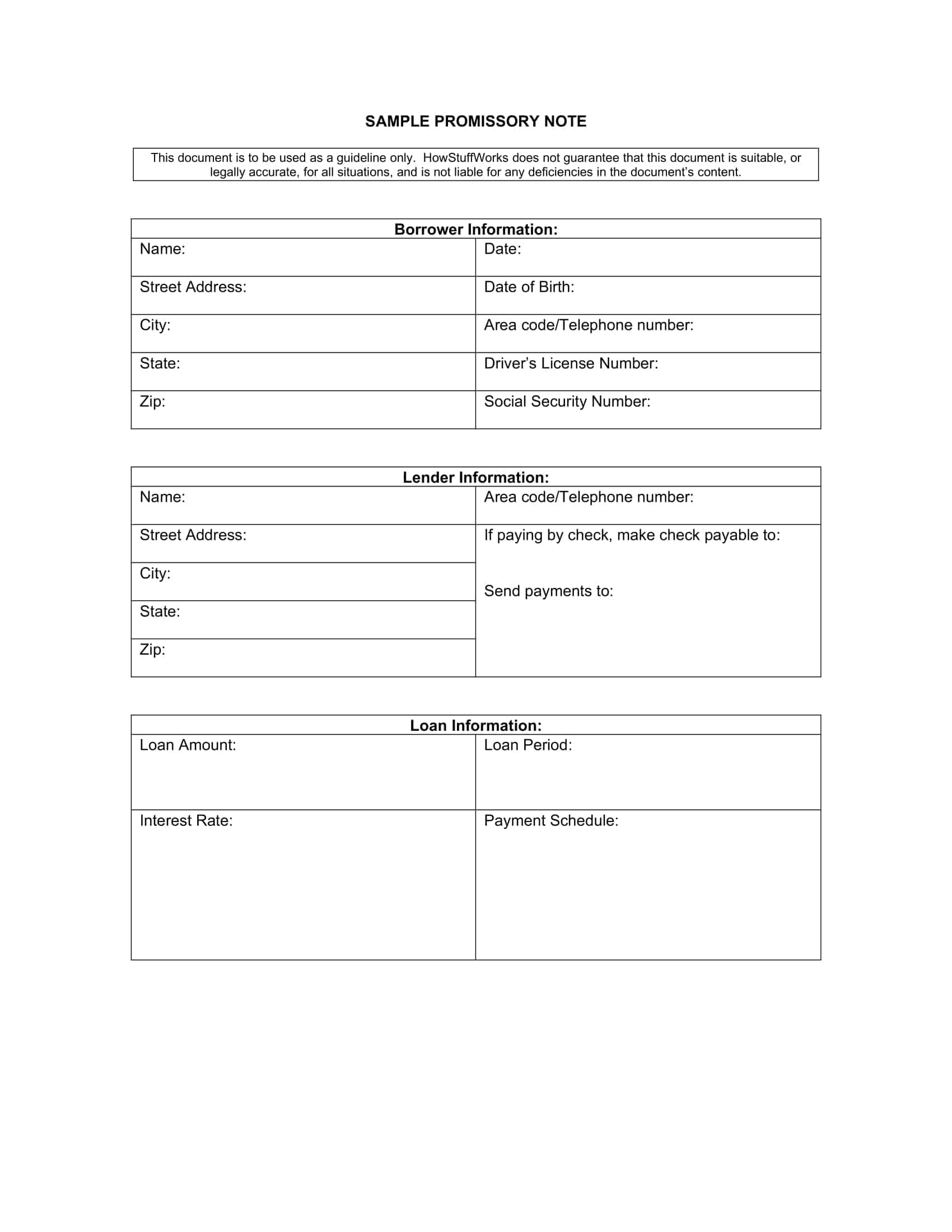

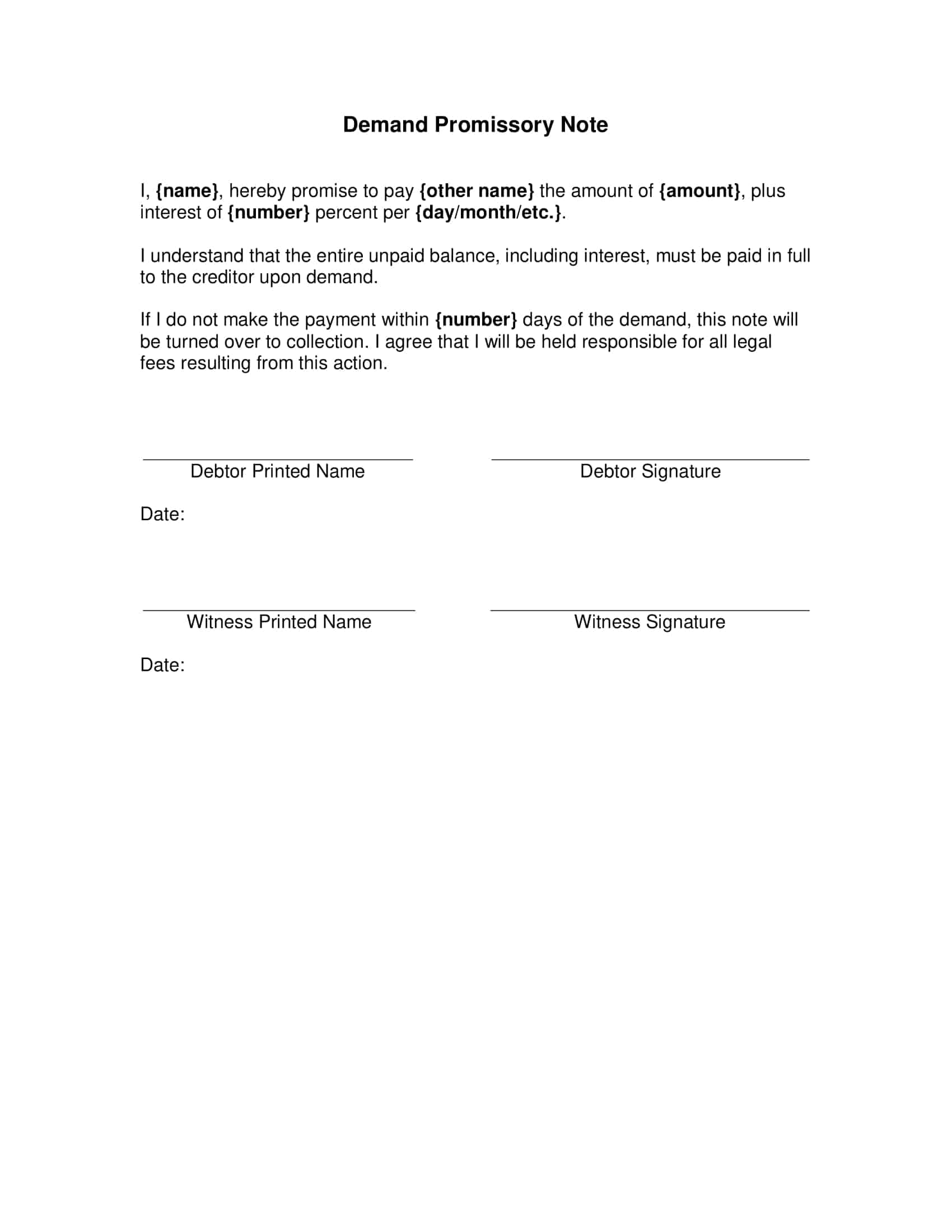

Promissory Note Templates

Promissory notes are important legal documents that set out a written promise to pay back a loan. Promissory note templates provide a useful starting point for creating a customized promissory note. The templates contain standard promissory note sections and language that can be edited to fit the specific loan details.

Promissory note templates typically contain sections for the loan amount, interest rate, payment due dates, and signatures of the lender and borrower. The templates have blank spaces that can be filled in with the specific information for the loan transaction. Some promissory note templates are state-specific and contain applicable state law provisions. Others are more generic and can be used in any state.

Using a promissory note template can save time and ensure the note contains the necessary legal clauses. The templates provide the basic promissory note format and sections so the user can focus on customizing the details for the specific loan. Promissory note templates provide convenience and efficiency for creating legally sound loan agreements between lenders and borrowers. They are a useful resource for anyone needing to create a promissory note.

What Are the Essential Elements?

Promissory note templates can be downloaded from the Internet and used as-is or customized to suit your needs. However, before you download a template, it is important that you understand what constitutes an acceptable promissory note.

The essential elements of a promissory note include:

- The name and address of the lender (i.e., the person who will receive payment)

- The date on which the note was made, signed and delivered;

- A brief description of the loan;

- A statement that the borrower agrees to pay back the loan amount within a specified time period;

- The amount being borrowed (the principal), including any interest that may accrue on the principal; and

- A promise by the borrower to repay this amount in full as well as any interest owing under certain conditions outlined in the contract.

Types of Promissory Notes

There are two different types of promissory notes:

Secured Promissory Notes

A secured promissory note is a type of loan that is repaid with interest. It is similar to a mortgage in that the borrower’s collateral secures the loan. The lender may take possession of the collateral if the borrower defaults on the loan. Secured promissory notes are generally easier to obtain than unsecured loans as they require less financial information from you as a borrower.

Unsecured Promissory Notes

An unsecured promissory note is not backed by any collateral and does not require any security for its repayment. Unsecured promissory notes are also known as “signature loans” because they do not require collateral or security for repayment.

How to Make a Promissory Note Template?

Terms and Conditions of the Promissory Note

The terms and conditions can vary widely depending on what you require from your lender. Make sure you know exactly what kind of loan you need before drafting your terms; otherwise, you may end up with something that’s not as good as you expected!

Choose the Type of Promissory Note

There are two types of promissory notes: secured and unsecured. A secured promissory note requires collateral for it to be legally binding. An unsecured one does not require any physical assets as collateral but uses other types of security, such as personal guarantees from third parties like friends, family members, or associates who have faith in your business venture.

In case your business has a good credit rating, and you have no problems repaying debts on time, lenders will likely approve an unsecured promissory note for your business needs even if there is no collateral involved since they.

Ensure About an Enforceable Promissory Note

You need to make sure that your promissory note is enforceable by law. This means it must contain all necessary elements and information to be considered valid and enforceable. It should also be signed by both parties involved in the transaction so that there will be no dispute when it comes time for payment or repaying the loaned amount.

Can anyone make a promissory note?

A promissory note template can be found online and used to record loans. However, it is important to understand that having a lawyer create a promissory note template is unnecessary for you. It is possible to create your own free of charge by editing an existing template or using one of the many templates available on the web.

However, if you want to ensure that your promissory note has been written legally and accurately, you should hire a lawyer who knows how to draft these documents properly. A lawyer will also be able to draft any other documents required by your state’s law when recording loans, like security agreements and mortgages, which may be needed in addition to your promissory note for your mortgage loan agreement to be legally binding on all parties involved.

FAQs

Can I write my own promissory note?

Yes, you can draft your own basic promissory note without a lawyer. Ensure it includes key details like loan amount, interest, repayment terms, dates, and signatures. Review requirements for your state. A DIY note may not cover complex situations. Consider having an attorney review it.

How do I write a simple promissory note?

Start with a promissory note template and fill in your specific loan details. Include the principal amount, interest rate, borrower/lender names, issuance date, maturity date, repayment schedule, and signatures. Keep descriptions simple and clear. Omit unnecessary legalese. Ensure it meets your state’s regulations.

Is a notarized promissory note legal?

A promissory note does not require notarization to be legal and binding in most states. However, notarizing it can provide additional legal benefits. The notary verifies the identity of those signing and their willingness to enter the contract. This prevents signers from claiming fraud.

Do you have to pay taxes on a promissory note?

If interest is charged on a promissory note, the interest received by the lender is generally considered taxable income. IRS Form 1099-INT is used to report interest earnings over $600. The borrower can potentially deduct the interest paid on an income-producing promissory note. Consult a tax professional.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)