Successfully securing your financial interests is vital in today’s rapidly evolving business landscape. Central to this is understanding how to pursue outstanding payments tactfully and professionally without damaging your client relationships.

Our article examines the intricacies of crafting a compelling Demand for Payment Letter, providing practical examples, offering strategies to encourage prompt payment, and exploring options should you encounter resistance. This vital communication tool helps companies and individuals alike transform a potentially uncomfortable conversation into a structured, systematic, and empathetic process.

Table of Contents

What is a Demand Letter for a Payment?

A Demand Letter for Payment is a formal written document that requests the recipient to settle an outstanding debt within a specified period. It typically outlines the amount owed, the deadline for payment, any potential consequences of non-payment, and the steps the debtor must take to resolve the debt.

This letter serves as a crucial step in the debt recovery process, demonstrating a serious intent to recover the debt and often precipitating a negotiation between the involved parties. Despite its stern nature, it allows the debtor an opportunity to rectify their situation before more severe legal actions are undertaken.

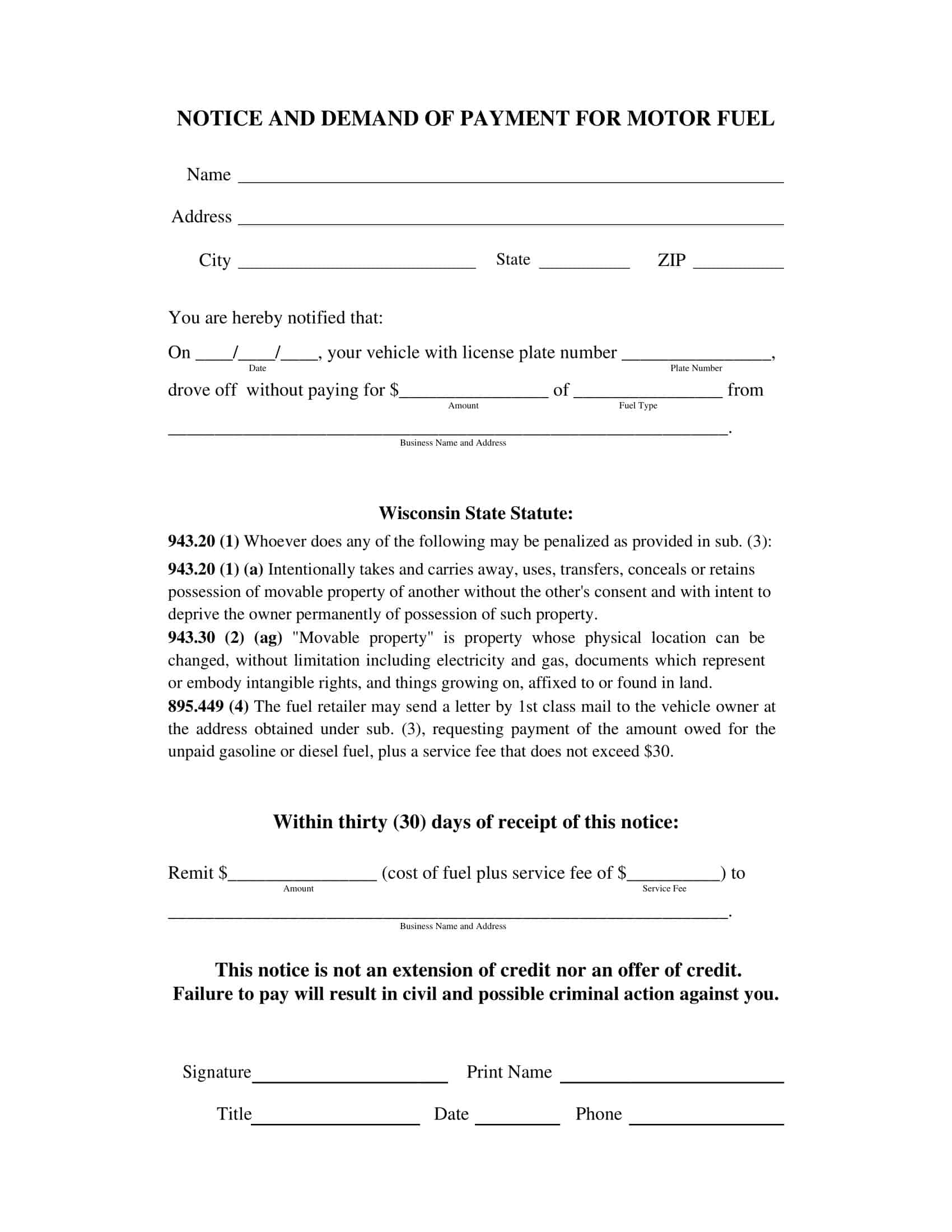

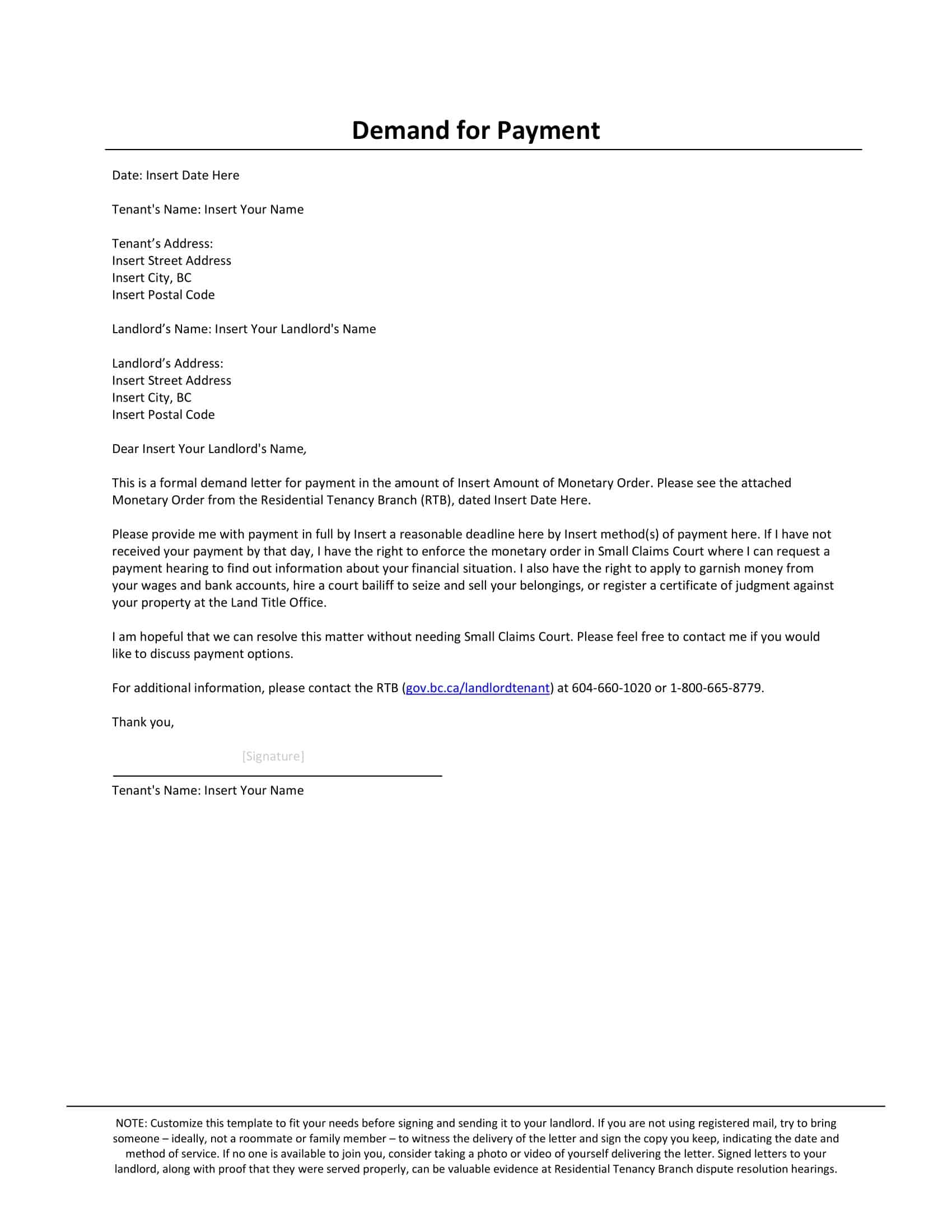

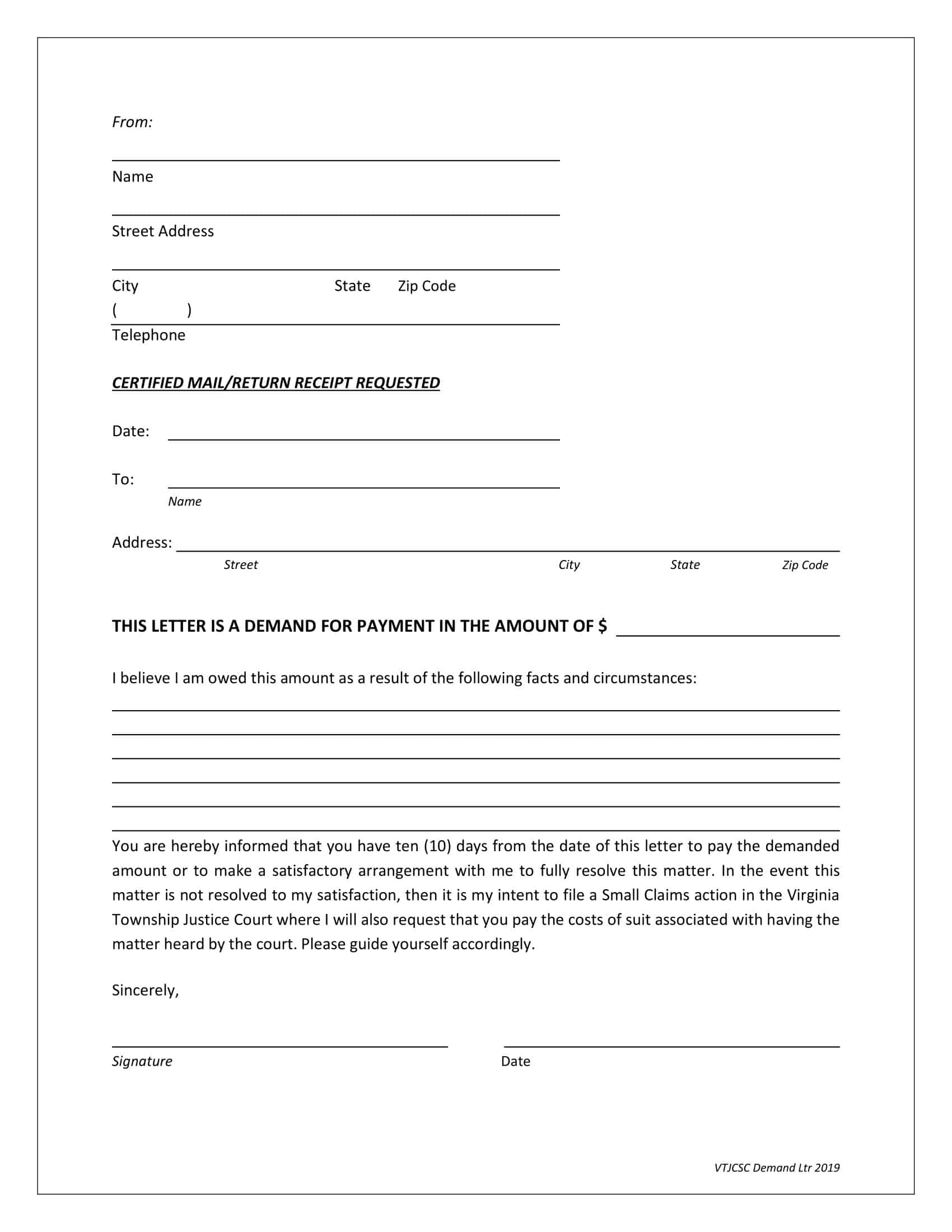

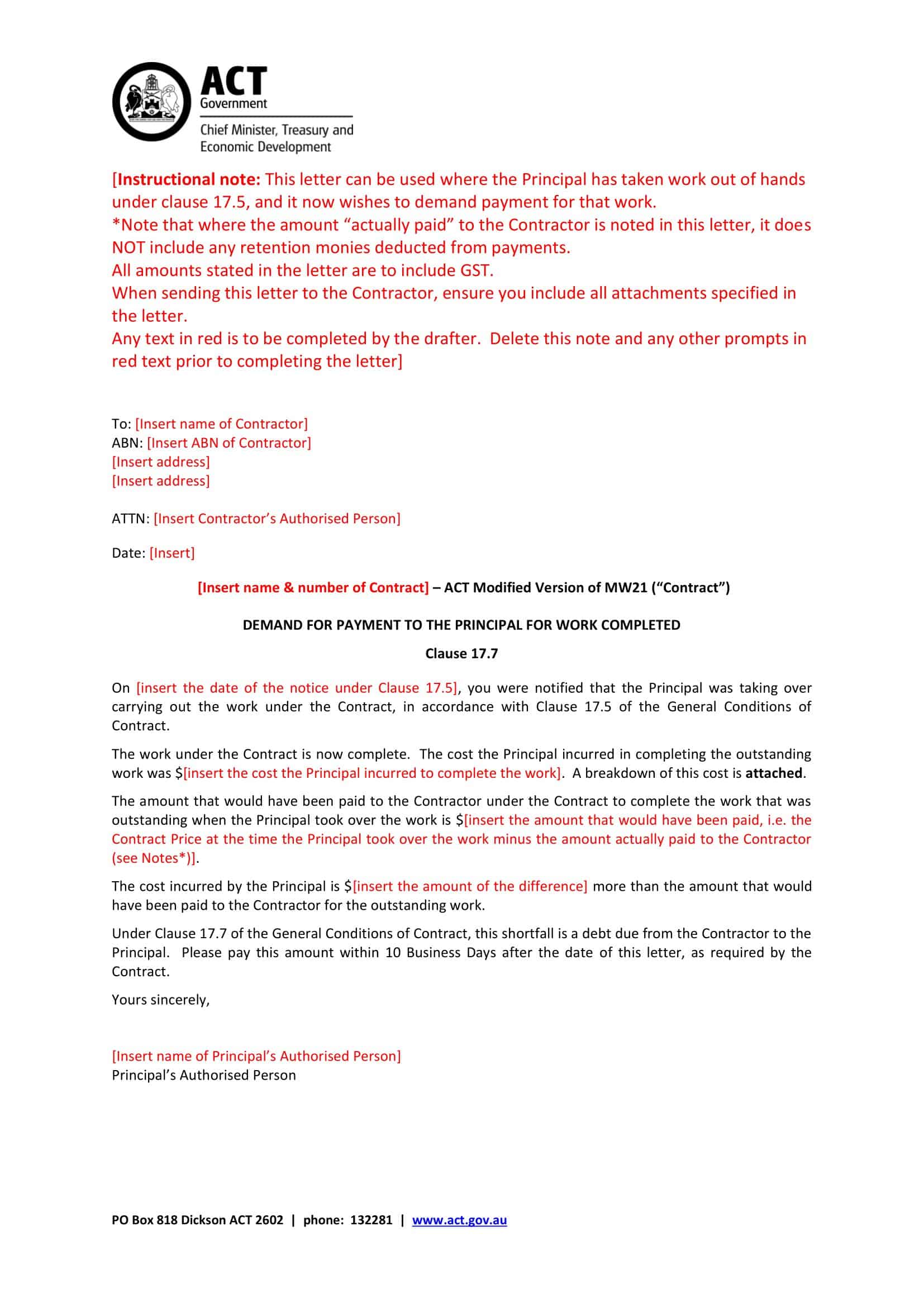

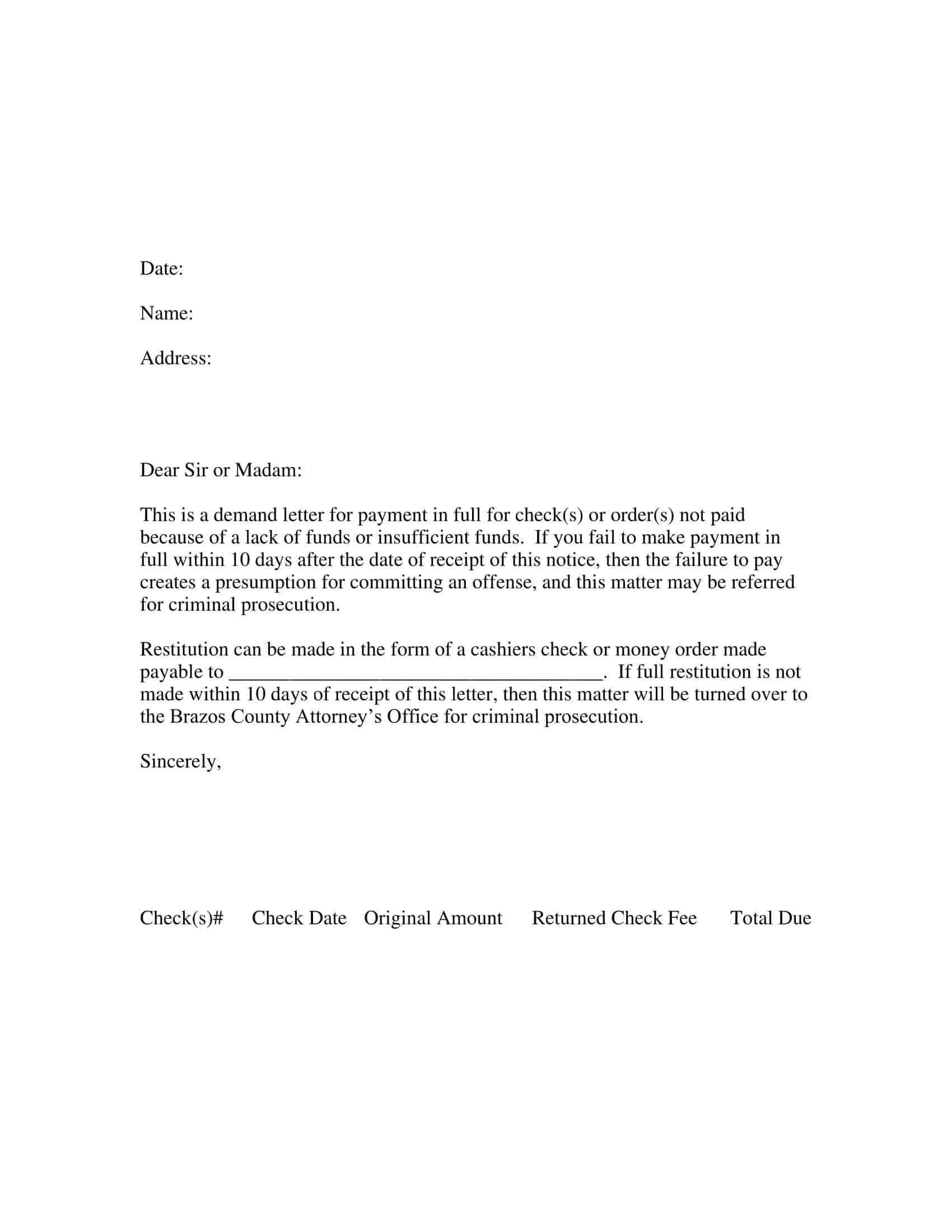

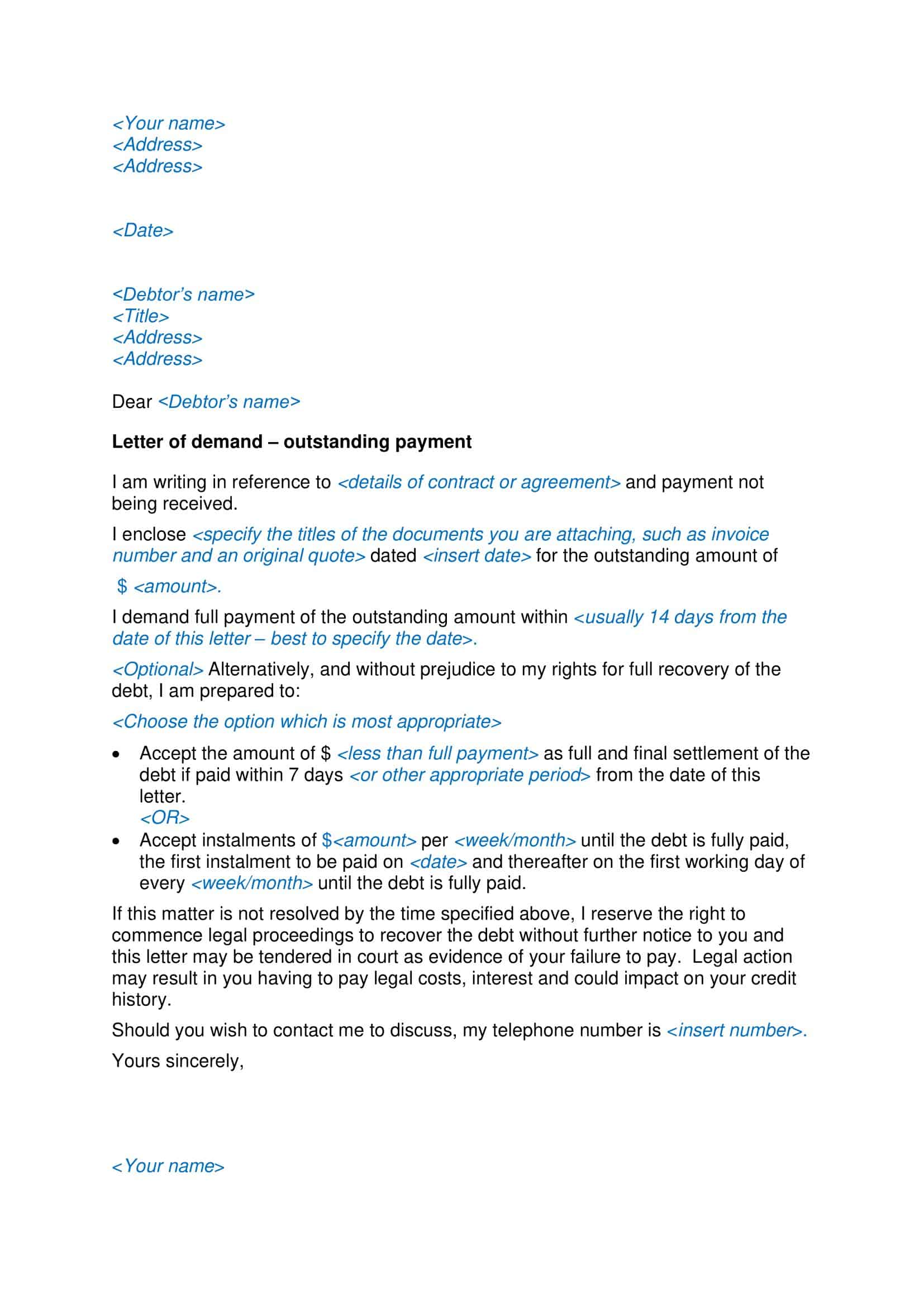

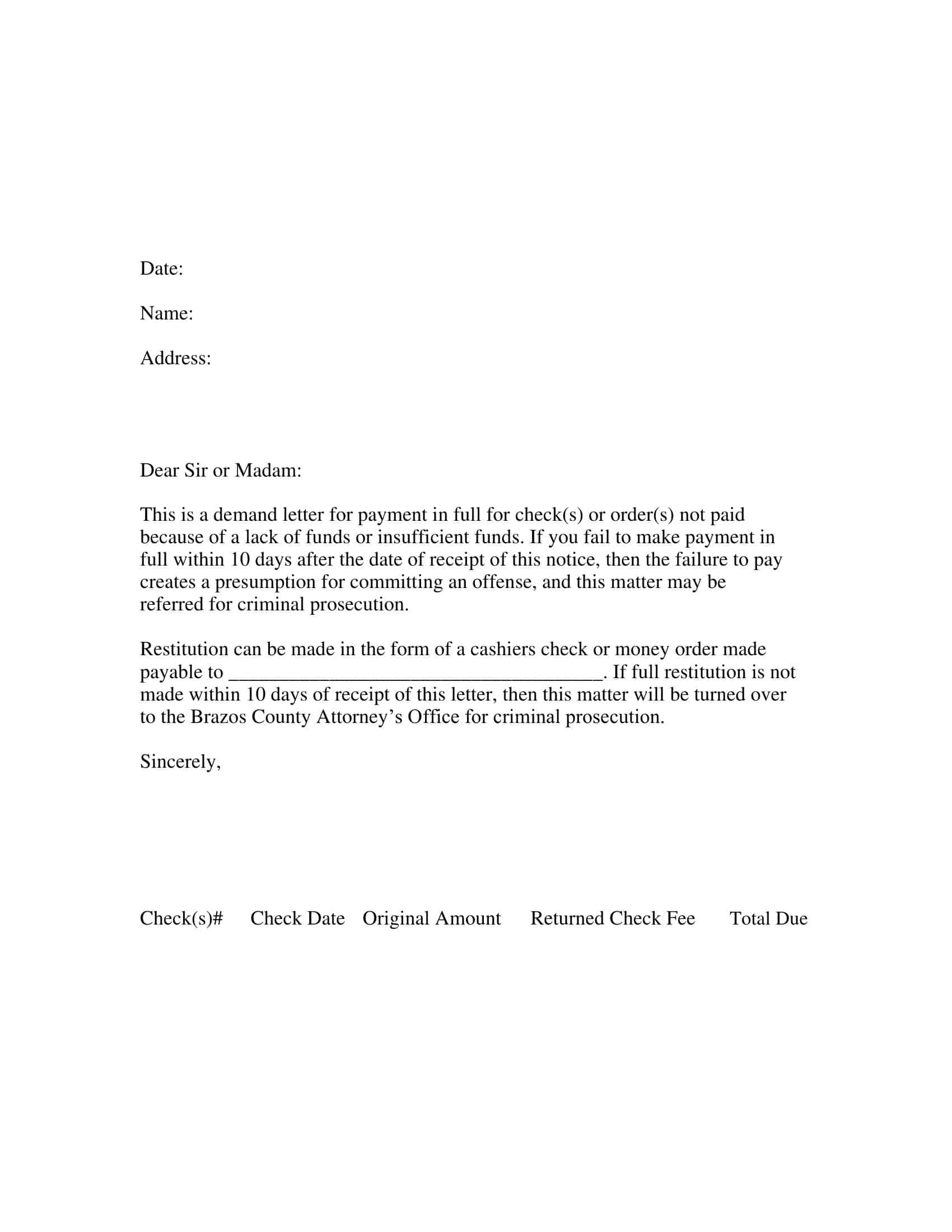

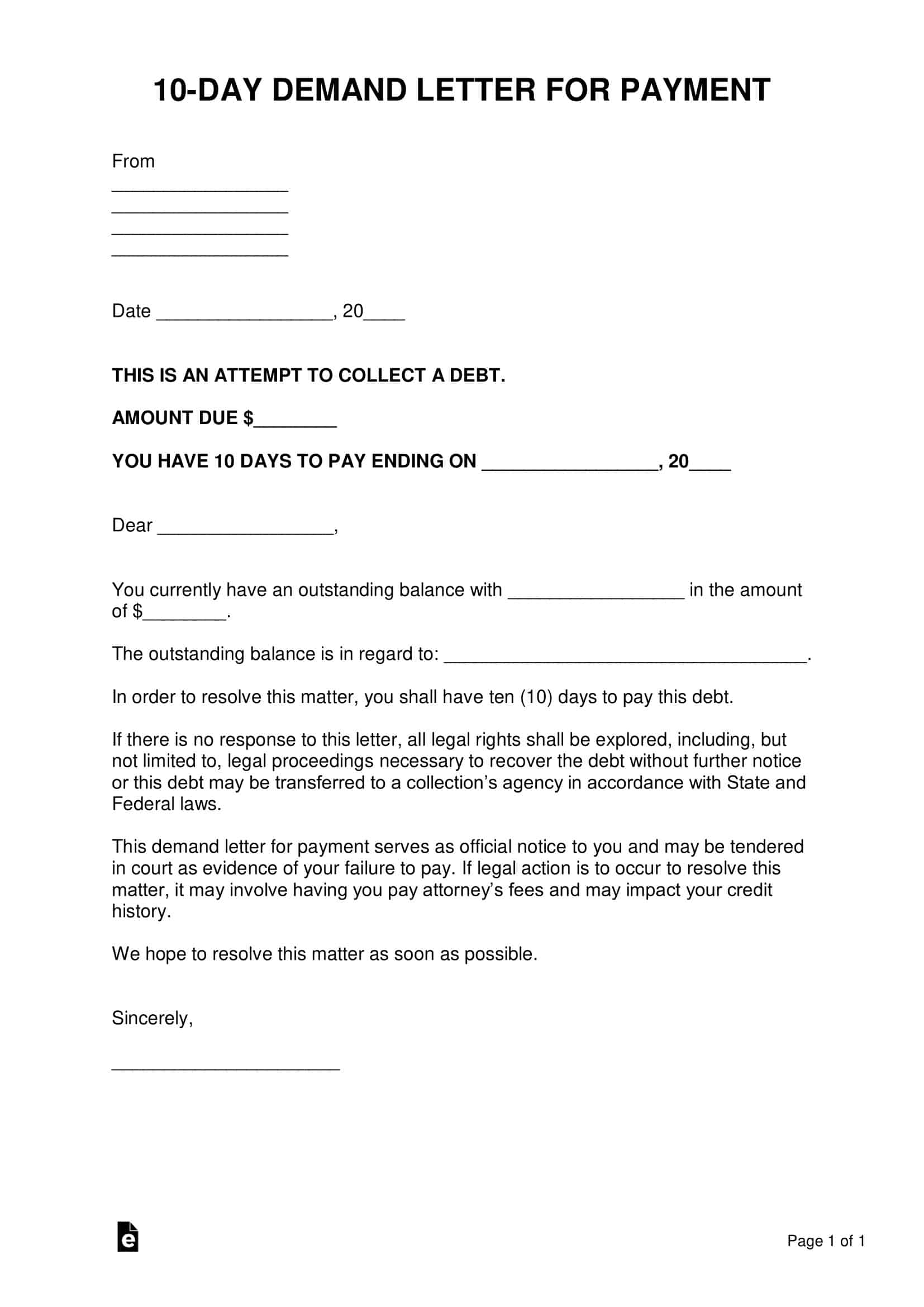

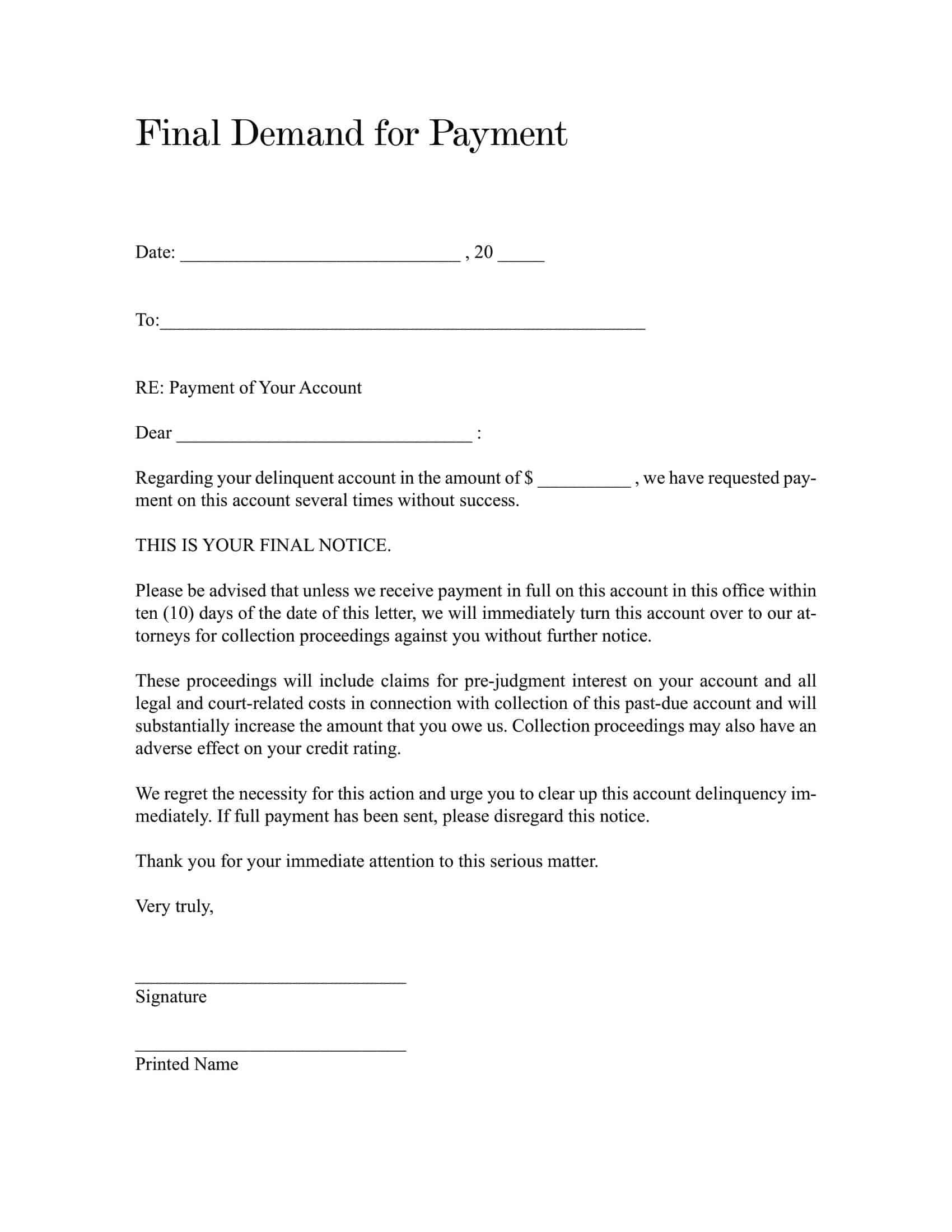

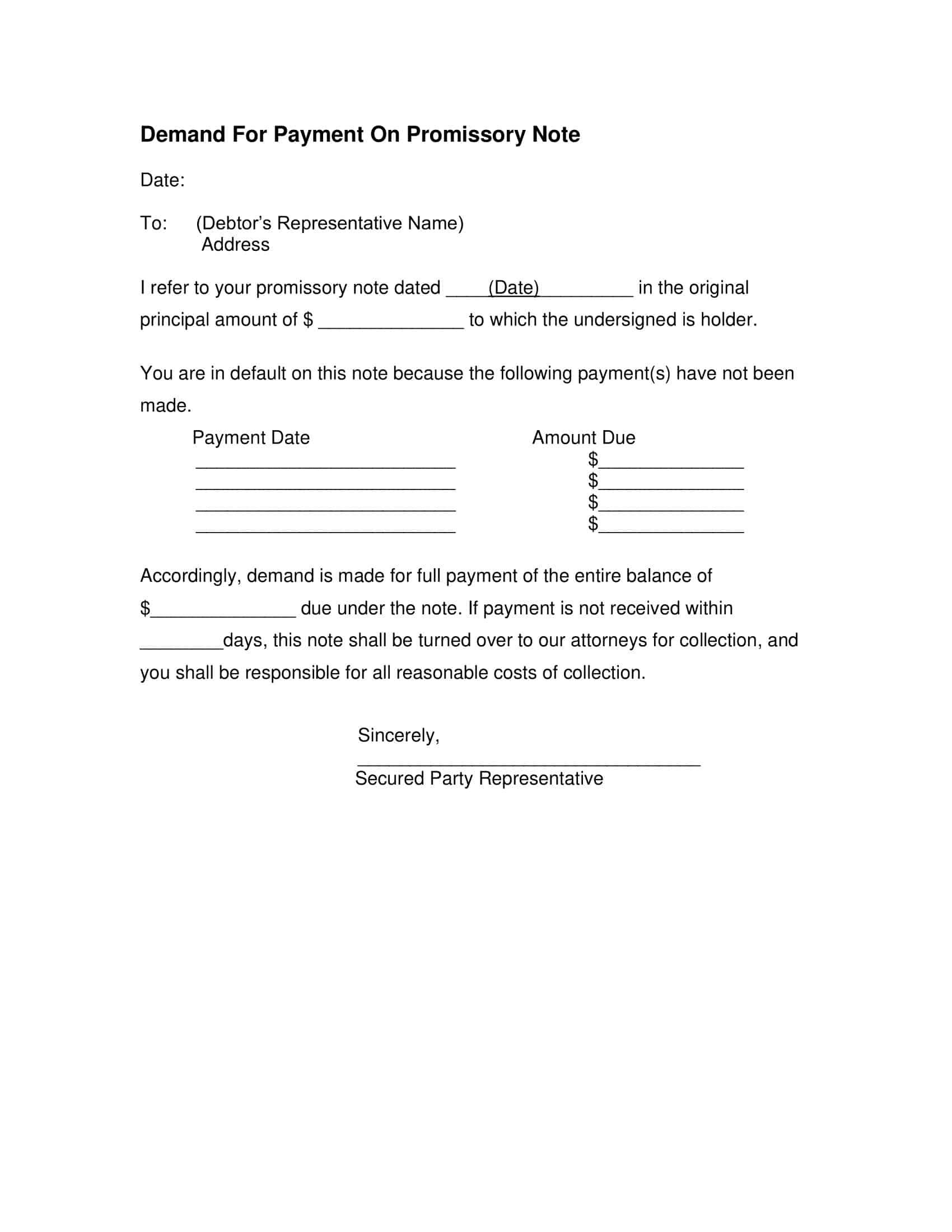

Demand Letter for a Payment Templates

Businesses provide goods or services with the expectation of payment per terms. Demand letters request overdue payments from clients. Demand letter for payment templates help create these important documents.

The letter templates start with a statement of the amount owed and formally request payment. They include space to specify the original billing date, invoices, and terms granted. Templates adopt a firm yet professional tone regarding expectation of payment receipt by a stated deadline.

Demand letter for payment templates enable easy crafting of customized letters. Businesses simply describe the circumstances and overdue amount. Templates provide proper language to convey the demand while maintaining client relationships. If payments remain delinquent, the templates provide documentation showing collection efforts for potential legal action. With strong payment processes key for cash flow, demand letter for payment templates help businesses recover revenue from past-due accounts.

Why is a Demand Letter for Payment Important?

A Demand Letter for Payment is an important instrument in debt recovery and serves several crucial functions that can contribute to the smooth resolution of outstanding financial issues.

- Initiating the Communication: A demand letter is the first formal communication to the debtor about their outstanding debt. It gives an opportunity for the debtor to understand the seriousness of the issue, the total outstanding amount, and the deadline for settling the debt. Without this initial communication, the debtor may remain uninformed about the status of their account, the amount they owe, and the urgency of payment.

- Providing Legal Proof: Demand letters serve as a legally recognized document of communication between the creditor and the debtor. It can be used as evidence in a court of law if the case escalates to litigation, showing the court that the creditor made reasonable efforts to collect the debt before taking legal action. It helps demonstrate due diligence and the willingness of the creditor to resolve the issue outside of court.

- Preventing Legal Action: Demand letters can often prevent the escalation of the matter to legal proceedings. Most people are willing to negotiate and settle their debts once they understand the potential legal implications of non-payment. It gives the debtor an opportunity to avoid additional costs, such as court fees and lawyer charges, associated with a lawsuit.

- Creating Room for Negotiation: Demand letters often open a pathway for negotiation between the debtor and the creditor. It might lead to the formulation of a payment plan or even a reduction in the total debt amount, thereby offering an opportunity for the debtor to repay the debt under mutually agreed terms.

- Asserting Legal Rights: A well-crafted demand letter not only requests payment but also outlines the potential consequences of non-payment, effectively serving as a warning. It asserts the legal rights of the creditor, acting as a deterrent against the debtor’s neglect or refusal to pay the debt.

- Building a Comprehensive Payment History: Over time, demand letters form part of a comprehensive payment history, offering a transparent and chronological record of the debtor’s payment behavior. This is particularly useful when dealing with habitual late payers or when a business has to make decisions about extending credit to a customer in the future.

- Maintaining Professionalism: A demand letter helps to maintain a level of professionalism in the debt recovery process. It ensures that the creditor communicates their requirements formally and respectfully, thereby preserving their image and reputation.

Therefore, a Demand Letter for Payment plays a critical role in debt recovery, acting as a starting point for communication, providing legal evidence, opening up avenues for negotiation, asserting legal rights, and maintaining a professional approach. Despite its stern tone, it is a tool for resolution and ideally leads to the settlement of outstanding debts without having to resort to legal action.

When do you need a demand for payment letter?

A Demand for Payment Letter is a valuable tool for debt recovery and is generally necessary in several scenarios. Each situation may require a nuanced approach and careful crafting of the letter. Here are a few circumstances where you might need to write a demand for payment letter:

Late Payments

This is perhaps the most common reason for sending a demand for payment letter. If a client or customer has not paid an invoice by the due date, and reminders have gone unanswered, a demand for payment letter can be the next step. It’s an official document that states the amount owed and provides a deadline for the payment to be made.

Incomplete Payments

If a debtor has partially paid their debts, but some portion remains unpaid even after the due date, a demand letter can be used to request the remaining amount. The letter should clearly state the initial amount, the amount paid, and the remaining balance that needs to be paid.

Breach of Contract

In the event of a contractual agreement being violated — for instance, if goods or services have been provided but the payment agreed upon in the contract has not been received — a demand letter serves as the initial step in addressing the breach.

Failed Payment Arrangements

If a debtor has entered into a payment plan to settle a debt but fails to comply with the terms of this plan, a demand for payment letter can be used to address the issue. The letter can outline the original agreement, highlight the debtor’s failure to adhere to the agreed-upon plan, and request immediate payment of the outstanding amount.

Security Deposit Returns

In the context of a landlord-tenant relationship, a tenant might need to send a demand letter to their landlord if their security deposit is not returned within the time frame specified by law or the rental agreement.

Insurance Companies

After an accident or incident, an individual may need to send a demand letter to their insurance company to request payment for a claim. The letter typically outlines the incident, the coverage outlined in the insurance policy, the amount claimed, and a request for timely payment.

Debt Sale or Transfer

If a debt has been sold or transferred to a third party (such as a collection agency), a demand for payment letter is usually sent to inform the debtor about this change and to request payment.

Legal Action

If all previous attempts to recover a debt have failed, a demand letter can serve as a final notice before legal action is taken. This can often prompt a debtor to settle their debts to avoid court proceedings.

Important Key Terms to Include in A Demand Letter

When drafting a Demand for Payment Letter, it is crucial to include certain key terms and information that enhance its effectiveness and clarity. Here are some of the important elements to include:

- Date: The date on which the letter is written should be clearly indicated. This will help to establish a timeline of communication for potential future references.

- Parties Involved: The names of both the creditor (the person or entity to whom the money is owed) and the debtor (the person or entity who owes the money) should be accurately listed. For businesses, the legal company names should be used.

- Account or Invoice Number: If applicable, it’s essential to include an account number, invoice number, or any other identification number associated with the debt. This facilitates easy reference and avoids any potential confusion.

- Amount Due: Clearly state the total amount of money owed. If applicable, include a detailed breakdown of this amount, such as the principal amount, interest accrued, late fees, or any other charges.

- Original Agreement: Provide a brief description of the original agreement that led to the debt. This could be a contract, a purchase order, a lease, or any other type of agreement. Reference the date of the agreement and summarize its key terms.

- Due Date: State the original due date of the payment. This helps to highlight the delay in payment and adds urgency to the request.

- Demand for Payment: Here is where you formally demand payment of the outstanding debt. Be clear about your expectations and specify a reasonable deadline for payment.

- Consequences of Non-payment: Outline potential consequences if the payment is not made within the stipulated time. This may include late fees, interest accumulation, legal action, or reporting to credit bureaus.

- Method of Payment: Explain how the debtor can make the payment. Provide relevant information such as bank account details, the address for mailing checks, or instructions for online payment, if applicable.

- Contact Information: Include your contact information (or that of your representative), such as phone number, email, and postal address, for the debtor to respond or ask any questions.

- Legal Notice: Depending on the severity of the debt, you may want to include a note indicating that this letter serves as a formal legal notice of the debt owed.

- Signature: End the letter with your signature (or that of your representative). This makes the letter official and provides validation to the demand.

How to Write a Demand Letter for Payment

Writing a Demand Letter for Payment requires careful planning, a clear structure, and a professional tone. Here’s a step-by-step guide to help you write an effective demand letter:

Step 1: Understand Your Rights and Obligations

Before drafting your letter, it’s crucial to understand your rights and obligations. Review the original agreement or contract and make sure you’re clear on the terms. This will help you to state your case accurately and confidently in the letter.

Step 2: Collect All Necessary Information

Collect all the necessary information to support your claim. This includes the original contract or agreement, invoices, payment records, previous correspondence regarding the debt, and any other relevant documents. Having this information at hand will allow you to reference specific details accurately.

Step 3: Open with Formal Salutations

Start your letter with a professional greeting. Address the recipient formally using their full name or the legal name of the company. Avoid using first names unless your relationship warrants it.

Step 4: Identify the Parties Involved

Clearly state your name (or the name of your company) and the debtor’s name (or the name of their company). Be clear about who owes the debt and to whom it is owed.

Step 5: State the Purpose of the Letter

Early in the letter, make the purpose of the letter clear. State that the purpose of the letter is to demand payment for an outstanding debt. This will immediately convey the seriousness of the situation to the recipient.

Step 6: Detail the Debt

Provide a detailed account of the debt. Include the original amount, the invoice or account number, the date the debt was incurred, any payments that have been made, and the outstanding balance. It’s essential to be precise and clear in this section.

Step 7: Specify the Due Date

State the original due date of the payment and highlight the fact that the payment is overdue. This underscores the urgency of the situation.

Step 8: Demand Payment

Now is the time to formally demand payment. Clearly state the total amount due, including any interest or late fees if applicable, and specify a deadline for the payment.

Step 9: Explain the Consequences of Non-Payment

Outline the potential consequences if the debt is not paid by the deadline. This could include legal action, additional late fees, or reporting the debt to a credit bureau.

Step 10: Specify the Payment Method

Provide information on how the debtor can make the payment. This could include bank account details for a direct deposit, an address for mailing a check, or instructions for online payment.

Step 11: Include Your Contact Information

Provide your contact information so the debtor can reach you if they have any questions or wish to discuss the matter further. Include your phone number, email address, and mailing address.

Step 12: Close the Letter Professionally

Close the letter with a professional sign-off, such as ‘Sincerely’ or ‘Best Regards’, followed by your name and title. If appropriate, include your company’s name and logo.

Step 13: Review and Proofread the Letter

Review the letter to ensure that it’s clear, accurate, and free of any errors. Check the tone of the letter to make sure it’s professional and respectful.

Step 14: Send the Letter

Send the letter in a way that provides a record of its receipt, such as registered mail, email with a read receipt, or a courier service.

Step 15: Keep a Record

Finally, keep a copy of the letter and any delivery receipts for your records. This may be needed later if legal action becomes necessary.

Next Steps After Sending a Demand Letter for Payment

- Wait for the Response: After sending your Demand for Payment Letter, allow the debtor reasonable time to respond, typically 14 to 30 days. This gives them time to seek advice, organize their finances, or arrange for the payment.

- Document All Communications: Maintain a record of all communications concerning the debt, including the Demand Letter, delivery receipts, emails, phone calls, and any responses. This documentation could serve as vital evidence if you have to take the issue to court.

- Send a Follow-Up Letter: If you do not receive a response within the specified timeframe, consider sending a follow-up letter. This can serve as a reminder and add urgency to your demand.

- Consider a Payment Plan: If the debtor responds but is unable to pay the full amount at once, you might consider agreeing on a payment plan that allows them to pay the debt in installments.

- Seek Legal Advice: If the debtor does not respond or refuses to pay, consult with a legal professional. They can guide you on the next steps, which might include mediation, hiring a collection agency, or filing a lawsuit.

- Initiate Legal Action: If all else fails, you may need to resort to legal action to recover your money. The exact process will depend on the laws in your jurisdiction and the amount of the debt. Keep in mind that legal proceedings can be time-consuming and costly, so they should be considered as a last resort.

What to Do When You Receive a Demand Letter for Payment

- Don’t Ignore the Letter: It’s essential not to ignore a Demand Letter for Payment. The situation won’t disappear on its own, and delays could lead to additional costs or legal proceedings.

- Review the Claim: Carefully read the letter and review the claim. Make sure you understand why you’re being asked to pay, the amount of the debt, and the due date for the payment.

- Verify the Debt: If you’re uncertain about the debt, request documentation or evidence from the creditor. This could include a copy of the original contract or agreement, an itemized account of the debt, or proof of previous communications regarding the debt.

- Seek Legal Advice: If the amount is substantial or if you dispute the debt, it might be wise to consult with a legal professional. They can advise you on how to respond and may be able to negotiate with the creditor on your behalf.

- Contact the Creditor: If you acknowledge the debt but are unable to pay the full amount, contact the creditor. Many are willing to negotiate a payment plan or even a reduction of the debt. Ensure to get any agreement in writing.

- Pay the Debt: If you agree with the claim and are able to pay, it’s usually best to pay the debt as soon as possible to avoid any additional charges or damage to your credit rating.

- Respond in Writing: Regardless of whether you dispute the debt or agree to pay, it’s generally a good idea to respond to the letter in writing. This ensures that your position is clear and provides a record of your response.

Sample Demand Letter for Payment Template

[Your Name]

[Your Address]

[City, State, Zip Code]

[Email Address]

[Phone Number]

[Date]

[Debtor’s Name]

[Debtor’s Address]

[City, State, Zip Code]

Dear [Debtor’s Name],

Re: Outstanding Payment for [Account/Invoice Number]

I write this letter in reference to the above-mentioned account. According to our records, you currently have an outstanding debt of $[Amount] for [goods/services] provided on [Date goods/services were provided].

As outlined in our initial agreement dated [Date of Agreement], the payment was due by [Original Due Date]. Despite our previous reminders sent on [Dates of reminders], we have not received the full payment or response from your end regarding this issue.

Therefore, we demand the full payment of $[Amount] by [Specific Date – typically two weeks from the date of the letter]. You may make the payment via [Specify Payment Method – bank transfer, online, check etc.], using the attached payment slip.

Please be aware that if we do not receive payment by the above deadline, we may [describe what action you will take – commence legal proceedings, engage a debt collection agency, report the debt to credit reporting agencies etc.].

We hope it does not come to this, and anticipate that you will resolve this matter promptly. If you wish to discuss this matter or need further clarification, please feel free to contact us at [Your Contact Information].

This letter is intended to serve as a formal demand for payment and does not constitute a waiver of any rights, remedies, claims, or defenses available to us, all of which are expressly reserved.

Thank you for your immediate attention to this matter.

Sincerely,

[Your Name]

[Your Title, if applicable]

Enclosure: Payment Slip

FAQs

Q: Is there a specific format for a Demand for Payment letter?

A: While there is no strict format, a Demand for Payment letter should be clear, concise, and professional. It is advisable to use a formal tone and maintain a business-like structure. You can find templates or examples online that can help guide you in drafting the letter.

Q: Can a Demand for Payment letter be sent via email?

A: Yes, a Demand for Payment letter can be sent via email. However, it is recommended to follow up with a physical copy sent through registered mail or certified mail with return receipt requested. This ensures that you have proof of delivery and receipt of the letter.

Q: Is it necessary to consult a lawyer before sending a Demand for Payment letter?

A: It is not always necessary to consult a lawyer before sending a Demand for Payment letter. However, if the debt is substantial, complex, or involves legal implications, seeking legal advice can be beneficial. A lawyer can guide you on the appropriate course of action and help you understand your rights and obligations.

Q: What should I do if the debtor does not respond to the Demand for Payment letter?

A: If the debtor does not respond to the Demand for Payment letter or fails to make payment by the specified deadline, you may need to consider taking further action. This can involve engaging a debt collection agency, pursuing legal action, or exploring alternative dispute resolution methods, depending on the circumstances and applicable laws in your jurisdiction. Consulting with a lawyer or a debt collection professional can provide you with guidance on the next steps to take.

Q: Can a Demand for Payment letter negatively impact the relationship between the creditor and debtor?

A: Sending a Demand for Payment letter can strain the relationship between a creditor and debtor, especially if it is the first communication of that nature. However, it is important to remember that the letter is a business communication aimed at resolving a financial matter. Clear communication and a willingness to find a mutually acceptable solution can help mitigate any negative impact on the relationship.

Q: Are there any legal requirements for sending a Demand for Payment letter?

A: The legal requirements for sending a Demand for Payment letter can vary depending on the jurisdiction. Generally, it is advisable to ensure that the letter complies with any relevant consumer protection laws and debt collection regulations. It is important to avoid any false statements, harassment, or unfair practices when communicating with debtors. Consulting a lawyer or familiarizing yourself with the applicable laws in your jurisdiction can help ensure compliance.

![Free Printable Friendly Letter Templates [PDF, Word, Excel] 1st, 2nd, 4th Grade 1 Friendly Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-1200x1200.jpg 1200w)

![43+ Printable Leave of Absence Letter (LOA) Templates [PDF, Word] / Free 2 Leave of Absence Letter](https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-1200x1200.jpg 1200w)

![Free Printable Congratulation Letter Templates [PDF, Word] Examples 3 Congratulation Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-1200x1200.jpg 1200w)