Mastering the art of financial documentation can greatly impact a service-based business‘ operational success. Among these documents, the service invoice stands out as a crucial component. This piece aims to unpack the role of the service invoice, diving into its creation process, the significance it holds for small and large corporations alike, and the potential it has to streamline business operations. As we navigate through the world of service invoices, we’ll gain insights that can shape the way we handle transactions and manage cash flow in our businesses.

Table of Contents

What’s a Service Invoice?

A service invoice is a detailed billing document issued by service providers to their clients. It outlines the specific services performed, the hours worked or the quantity provided, and the agreed-upon rates. This document plays a vital role in ensuring transparency and accuracy during financial transactions.

Besides detailing the nature and cost of services, it also includes pertinent information such as the invoice date, the due date for payment, and the contact information for both parties involved. Therefore, a service invoice not only acts as a formal request for payment but also serves as a valuable record for bookkeeping, tax purposes, and potential dispute resolution.

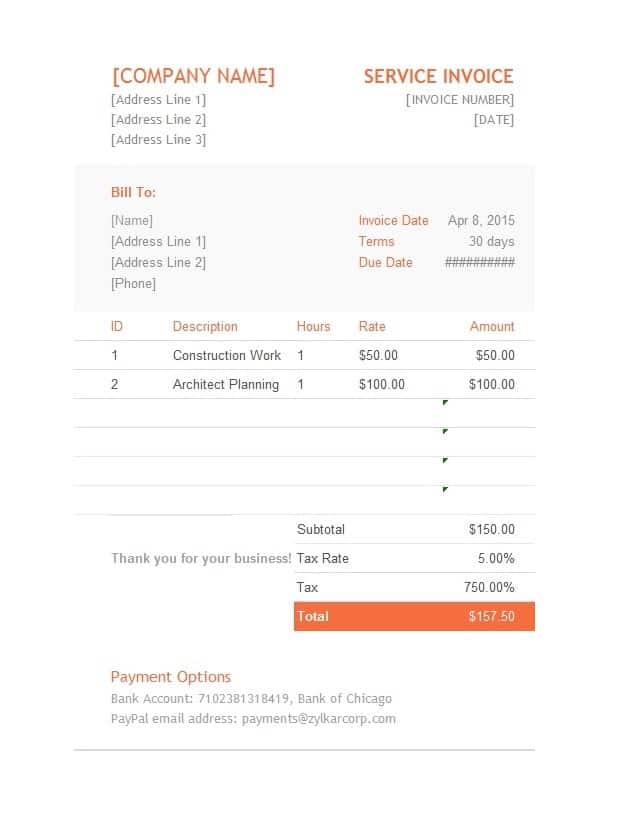

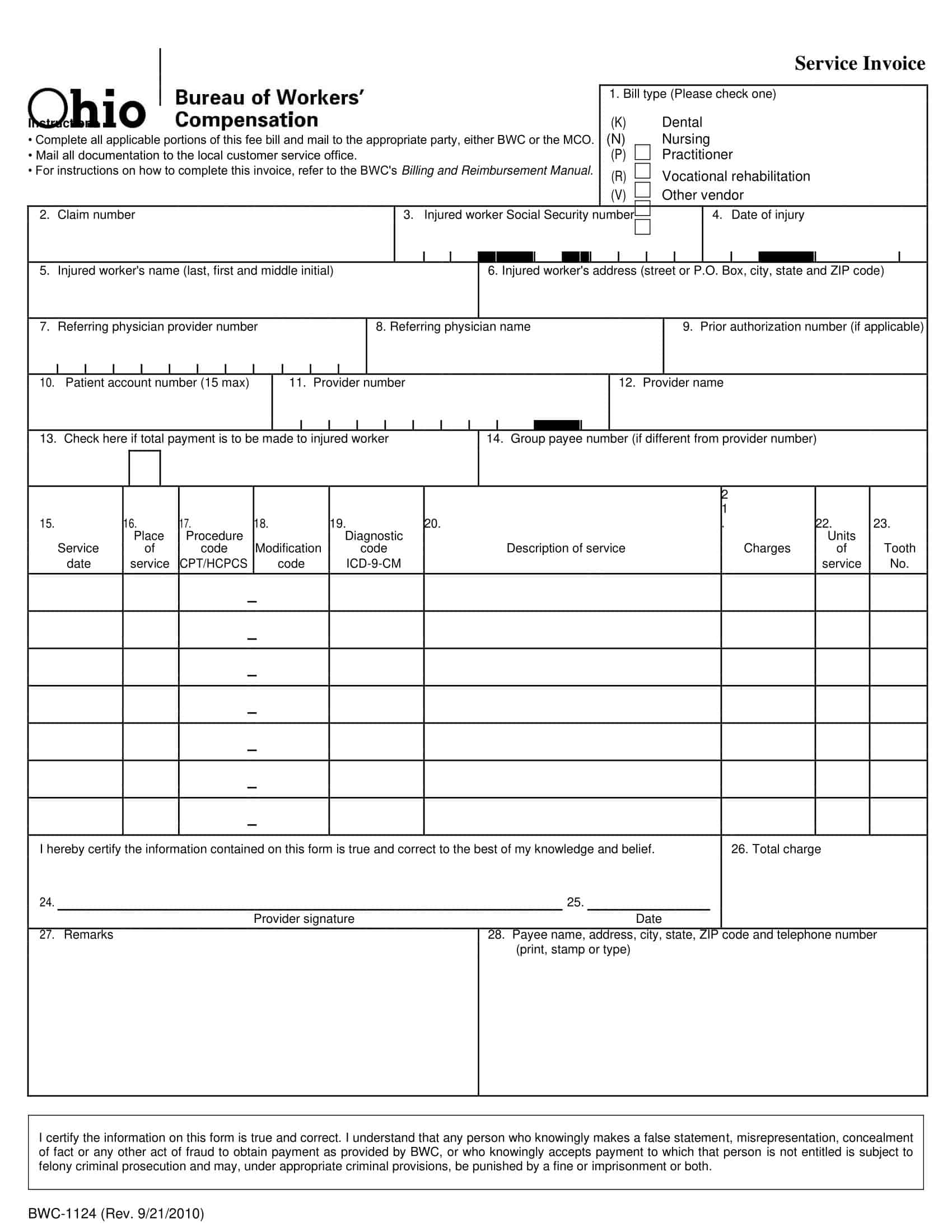

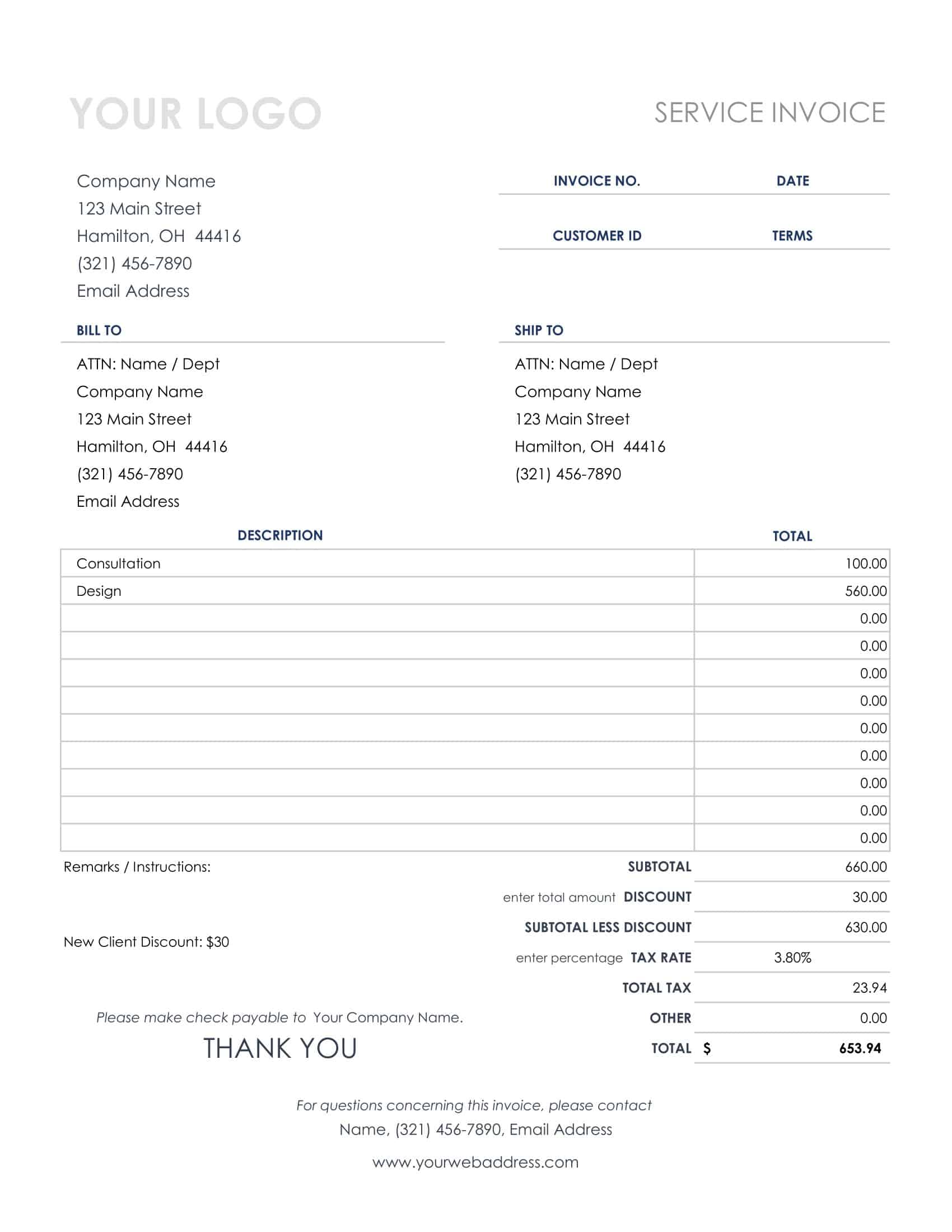

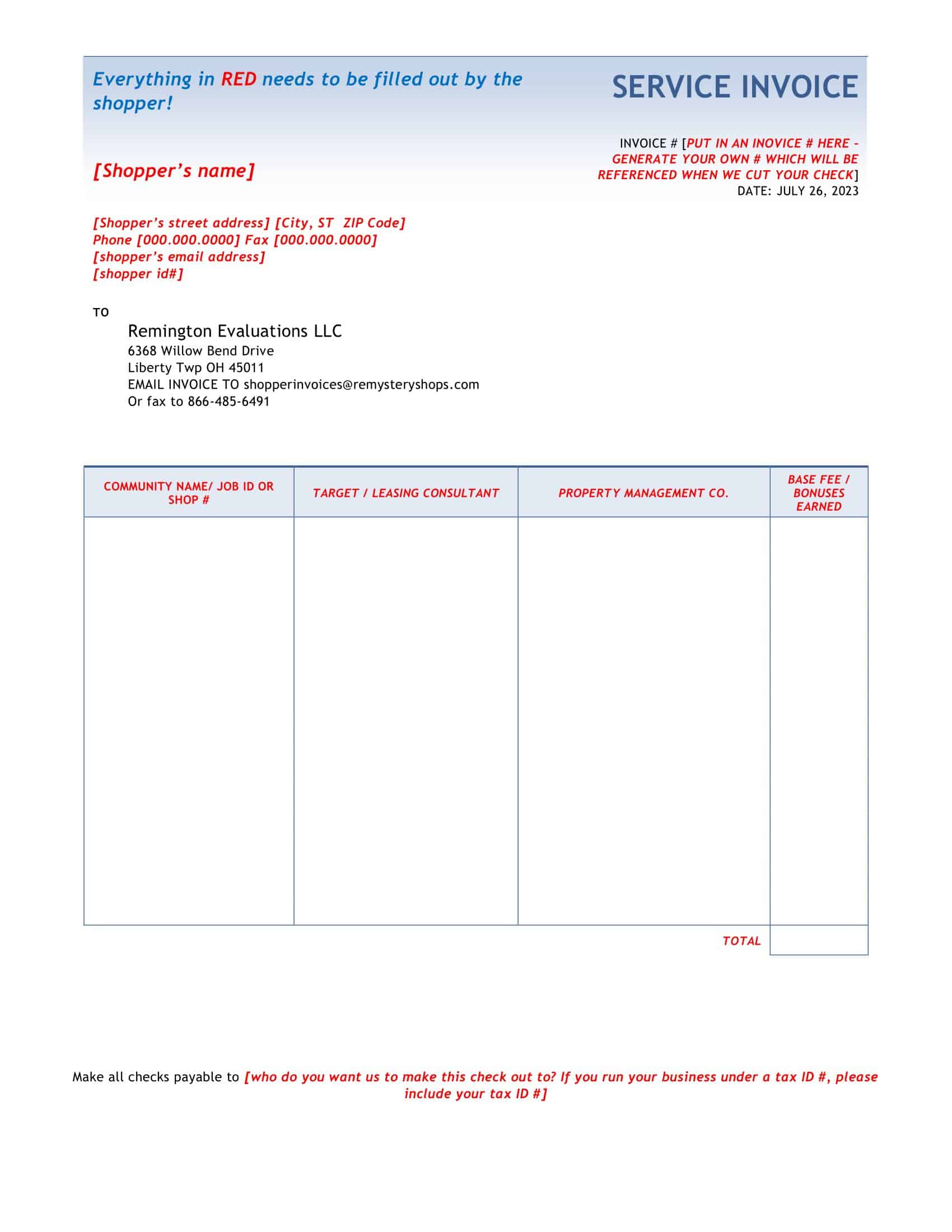

Service Invoice Templates

Service businesses need to bill clients for completed work. Service invoices formally request payment for provided services. Service invoice templates offer convenient tools to quickly create professional invoices.

The templates contain standard invoice sections for listing performed services, associated fees, taxes, and totals due. They include fields for client and business details like contacts, addresses, and payment terms. Automated calculations are featured for totals, balances due, and other figures.

Service invoice templates allow service providers to efficiently generate consistent, branded invoices. The template format prompts capturing all relevant details. Providers simply customize each invoice with the client, services, dates, and amounts. Templates can be saved for recurring client billing needs. With service invoice templates, important payment records can be produced fast without reinventing from scratch. They facilitate service businesses getting paid efficiently while conveying professionalism.

Service-Based Businesses

A service-based business is a company that primarily earns revenue by providing intangible products or services rather than tangible goods. These services can range from consulting, legal services, and healthcare, to house cleaning, catering, and personal training, among many others.

Unlike product-based businesses that rely on the selling of physical items, service-based businesses hinge upon the knowledge, skills, and expertise of its workforce to meet the needs of its clients. The success of such businesses largely depends on the quality of service delivered and the relationship established with the clients.

What Should I Include in my Service Invoice?

Creating an effective service invoice requires you to include certain essential elements that ensure transparency, facilitate timely payment, and serve as a legal document in case of any disputes. Here’s a detailed guide on what you should include in your service invoice:

Business Information

At the top of the invoice, include your business name, address, contact number, and email address. This provides the client with your contact details and also helps in presenting a professional image.

Client Information

Similar to your business details, include your client’s name, address, and contact information. This ensures that the invoice is directed towards the right person or department in an organization.

Invoice Number

Each invoice should have a unique number for tracking and reference purposes. This can be particularly important when dealing with questions or disputes about payment.

Date of Issue and Payment Due Date

Include the date when the invoice is issued and the date by which the payment is due. This helps both parties track payment deadlines and manage cash flow effectively.

List of Services Rendered

Include a detailed breakdown of the services you provided. Each service should have a brief description, the number of hours worked or quantity provided, and the rate for each service.

Total Amount Due

After listing all the services and their costs, calculate the total amount due. If any taxes, discounts, or additional fees apply, these should also be itemized and included in the total calculation.

Payment Terms

Clearly state your payment terms. This could include the methods of payment you accept (e.g., bank transfer, check, online payment, etc.), any penalties for late payment, and the currency in which you wish to be paid if dealing with international clients.

Notes or Special Instructions

This section can be used to provide additional information or special instructions. For instance, you might thank your clients for their business, remind them of an upcoming appointment, or provide details about an ongoing promotion.

Terms and Conditions

You should include any legal terms and conditions related to your service or industry. This could include details about your refund or cancellation policy, warranty information, or other regulatory disclosures.

Digital Signature

A digital signature or a printed name at the end of the invoice adds a personal touch and increases the legitimacy of the document.

Types of Service Invoices

Invoicing is a crucial part of the financial process in all service-based businesses. However, not all service invoices are the same. They can vary based on the nature of the transaction, the client’s requirements, or the type of service rendered. Here are some common types of service invoices you may encounter:

Standard Invoice: A standard invoice is the most common type of invoice, applicable to most service situations. It typically includes basic information such as business and client details, unique invoice number, date, itemized list of services, total amount due, and payment terms.

Pro Forma Invoice: A pro forma invoice is sent to customers before a service is delivered. It serves as a commitment on part of the seller to deliver services as described for the stated price. It’s useful in cases where the client requires an upfront summary of the costs.

Recurring Invoice: This type of invoice is used for ongoing services provided at regular intervals (like weekly, monthly). For instance, if you offer monthly website maintenance services, you might use a recurring invoice with the same details each billing period.

Time-Based Invoice: A time-based invoice is used when you bill clients by the hour. This is common in legal services, consulting, or any other profession where work is done on a time basis. In this case, the invoice should clearly indicate the number of hours worked and the rate per hour.

Credit Invoice: Also known as a credit memo, a credit invoice is used to correct a mistake on an already issued invoice or to give a credit for the returned services. It typically shows a negative amount, indicating a reduction in the amount that is owed by the client.

Debit Invoice: A debit invoice is the opposite of a credit invoice. It’s used when there’s a need to increase the amount that a customer owes. It could be due to an undercharge on the original invoice or additional services being provided that were not included in the original invoice.

Mixed Invoice: A mixed invoice combines the features of credit and debit invoices. It lists both charges and credits, showing the net amount that the client owes.

Commercial Invoice: Used primarily in customs declaration for international transactions, a commercial invoice contains details about the services along with their respective values, the parties involved, and the country of origin. This helps in determining the value of the service for levying customs duties.

How to Make a Service Invoice

Creating a service invoice may seem daunting, but with a step-by-step guide, it becomes a straightforward process. Here are the steps you can follow to make a comprehensive and professional service invoice:

Step 1: Choose a Format

Decide if you will use an invoice template, a pre-formatted invoice from a software program, or if you will create your own. There are many online tools and software available that can help create professional-looking invoices.

Step 2: Add Your Business Information

At the top of your invoice, include your business name, address, phone number, and email address. If you have a business logo, add it for a more professional appearance.

Step 3: Include Client Information

Under your business information, add the client’s name, address, and contact details. This ensures the invoice goes to the correct person or department.

Step 4: Generate an Invoice Number

Every invoice should have a unique invoice number. This can be a simple sequential number, or it can be a combination of letters and numbers that reference specific projects or clients. Keep track of these invoice numbers for easy reference in the future.

Step 5: List the Services Provided

Create an itemized list of services you provided. For each service, write a brief description, the quantity or hours, and the rate. Be specific and detailed to avoid any confusion or dispute.

Step 6: Calculate and State the Total Amount

Add up the costs of the individual services and write the total amount due. If there are any taxes or discounts, add or subtract them as appropriate and indicate the final total clearly.

Step 7: Specify Payment Terms

Include your payment terms at the bottom of the invoice. This should include the accepted forms of payment, the due date for payment, and any penalties for late payment.

Step 8: Add any Additional Information

Use a notes section to add any additional details or specific instructions for your client. You can also use this section to thank your client for their business or to provide details about an ongoing promotion.

Step 9: Add Terms and Conditions

If there are any legal terms and conditions related to your service, include them on the invoice. This could include details about your refund or cancellation policy, or warranty information.

Step 10: Sign the Invoice

Sign your invoice to add a personal touch and increase its legitimacy. This could be a digital signature or a printed name at the end of the invoice.

Step 11: Review and Send

Before sending, review the invoice for any mistakes or omissions. Once you’re sure everything is accurate, send the invoice to your client by email, mail, or whichever method is agreed upon.

Tips for Timely Payment: Sending Service Invoices for Smooth Transactions

Ensuring timely payment of your service invoices is key to maintaining smooth transactions and a healthy cash flow for your business. Follow these tips to increase your chances of receiving prompt payments:

1. Set Clear Payment Terms: Before initiating a project, establish and agree upon the payment terms with your client. This includes the method of payment, the currency (especially for international clients), and the due date. Make sure these terms are included on every invoice.

2. Use Professional Invoice Software: Using a professional invoicing software or service not only makes the invoice creation process easier, but can also provide useful features like payment reminders, automatic follow-ups, and even the ability to accept payments directly through the invoice.

3. Be Prompt with Invoicing: Send your invoice as soon as the service is delivered. The sooner the client receives the invoice, the sooner you’re likely to get paid. Also, timely invoicing shows your business is organized and professional.

4. Itemize Services: Clearly itemize each service performed, the rate, and the quantity on the invoice. This transparency will help the client understand exactly what they’re paying for, which can speed up the approval process.

5. Follow Up: If a due date is approaching and you haven’t received payment, don’t hesitate to send a friendly reminder. It’s possible the invoice got overlooked or misplaced. Many invoicing software programs can automate this process.

6. Offer Multiple Payment Options: The more ways clients can pay, the easier it is for them to do so. Consider offering various payment methods such as bank transfers, credit/debit cards, or digital payment platforms.

7. Apply Late Payment Fees: While it may seem harsh, charging a late fee can incentivize clients to pay on time. Ensure this is communicated upfront and included in your agreed payment terms.

8. Offer Early Payment Incentives: Alternatively, offering a small discount for early payment can be a positive way to encourage timely payment.

9. Keep Records: Maintain accurate and thorough records of all your invoices, payments, and follow-up communications. This can be crucial in case of payment disputes.

10. Maintain Good Relationships: Building a good relationship with your clients can make them more inclined to pay on time. Be professional, courteous, and responsive in all your interactions.

By adopting these practices, you can reduce the likelihood of late payments, improve your cash flow, and maintain positive relationships with your clients. Keep in mind that the approach might need to be adjusted based on the client and the nature of the service provided.

Conclusion

In conclusion, service invoices play a crucial role in the operations of any service-based business. These documents not only stand as a formal record of the transactions and services provided but also act as a tool for promoting clarity, transparency, and professionalism in the financial dealings of a business. With a well-structured service invoice, businesses can facilitate smoother transactions, ensure timely payments, and manage their cash flows more effectively.

Furthermore, understanding the different types of invoices and their appropriate usage can further enhance the invoicing process. While the creation and management of service invoices require attention to detail and consistency, the benefits reaped in terms of business efficiency, customer relationships, and financial health are invaluable. With the aid of modern invoicing tools and best practices, managing service invoices can become an efficient and streamlined aspect of running a successful service-based business.

FAQs

What payment terms should I include on my service invoice?

Payment terms should clearly specify the due date for payment, the accepted payment methods, any late payment penalties or discounts, and any additional instructions for payment. Common payment terms include “net 30” (payment due within 30 days) or “due upon receipt” (payment due immediately).

Can I send service invoices electronically?

Yes, sending service invoices electronically is a convenient and efficient method. You can email the invoice as a PDF attachment or use online invoicing platforms that allow you to create, send, and track invoices digitally.

Can I include additional charges or expenses on a service invoice?

Yes, you can include additional charges or expenses on a service invoice, as long as they are agreed upon with the client beforehand. Make sure to clearly outline the details of these additional charges, such as item descriptions, quantities, rates, and any applicable taxes.

Should I include my business’s tax identification number on the service invoice?

It is generally recommended to include your business’s tax identification number (such as a VAT number or GST number) on the service invoice. This helps the client accurately report and track the transaction for tax purposes.

How should I handle invoice disputes or discrepancies?

If there is a dispute or discrepancy regarding the service invoice, it is important to address it promptly and professionally. Communicate with the client to understand their concerns and try to reach a resolution through negotiation or compromise. Providing supporting documentation or evidence for the services rendered can be helpful in resolving any disputes.

Is it necessary to provide a detailed description of the services on the invoice?

Yes, providing a detailed description of the services on the invoice is essential. It helps the client understand what they are being billed for and reduces the chances of confusion or disputes. Include specifics such as dates, hours, or tasks performed, along with any relevant itemized costs.

Can I request a deposit or advance payment on the service invoice?

Yes, you can request a deposit or advance payment on the service invoice, especially for larger projects or long-term services. Clearly specify the amount of the deposit, the deadline for payment, and how it will be applied to the final invoice. This helps protect your business’s interests and ensures commitment from the client.

How long should I keep copies of service invoices for record-keeping purposes?

It is recommended to keep copies of service invoices for record-keeping purposes for a specific period, typically at least five to seven years. This timeframe allows you to comply with tax regulations and provides a reference for any future audits or inquiries.

Is it necessary to send a thank-you note or acknowledgment after receiving payment for a service invoice?

While it is not necessary, sending a thank-you note or acknowledgment after receiving payment for a service invoice can be a professional gesture. It shows appreciation to the client for their prompt payment and helps maintain a positive business relationship.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 2 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)