As you embark on crafting your personalized real estate collaboration document, you may have perused various samples of property partnership agreements to discern the essential components.

Multiple types of property partnership contracts may demand your attention, and it is crucial to tailor the appropriate real estate collaboration framework to your specific circumstances. You may require a leasehold property alliance contract or a joint proprietorship arrangement in the real estate format to accommodate the diverse property agreements you participate in.

Table of Contents

Real Estate Partnership Agreement Templates

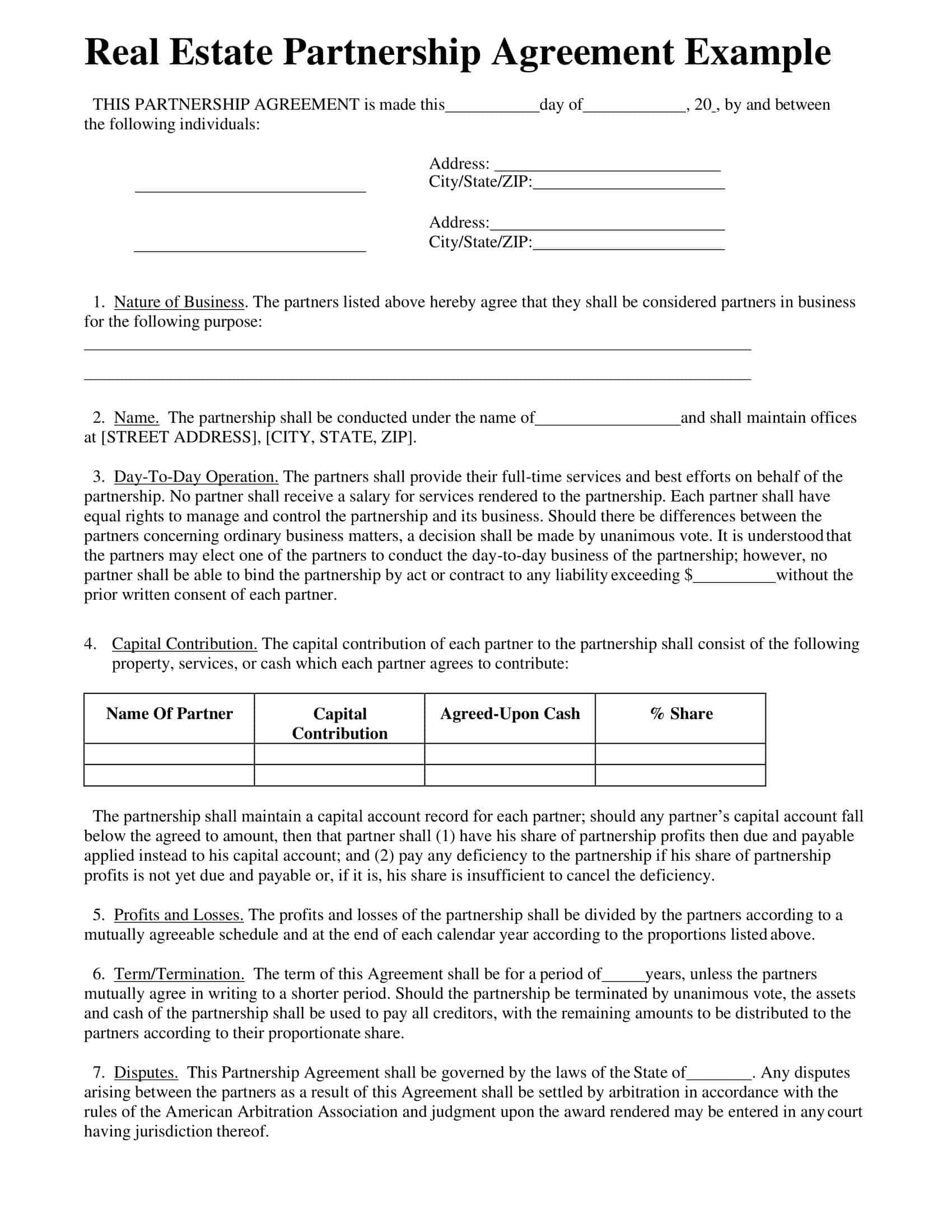

Embark on successful real estate ventures with our comprehensive collection of Real Estate Partnership Agreement Templates. These free, printable templates provide a solid foundation for establishing clear and mutually beneficial agreements between partners entering into a real estate venture.

Whether you’re pooling resources for property investments, joint development projects, or rental properties, our templates offer customizable sections to address profit sharing, responsibilities, decision-making processes, and more. With our Real Estate Partnership Agreement Templates, you can ensure that all parties are aligned and protected, reducing the potential for disputes and misunderstandings. Streamline the process of forming a real estate partnership and set the groundwork for a prosperous collaboration. Download our templates now and embark on your real estate journey with confidence.

What is a Real Estate Partnership Agreement?

A Real Estate Partnership Agreement is a legally binding document that outlines the terms, conditions, roles, responsibilities, and expectations of all parties involved in a real estate partnership. It is an essential tool for individuals or entities who choose to combine their resources, expertise, and efforts to invest in, develop, manage, or sell real estate properties jointly.

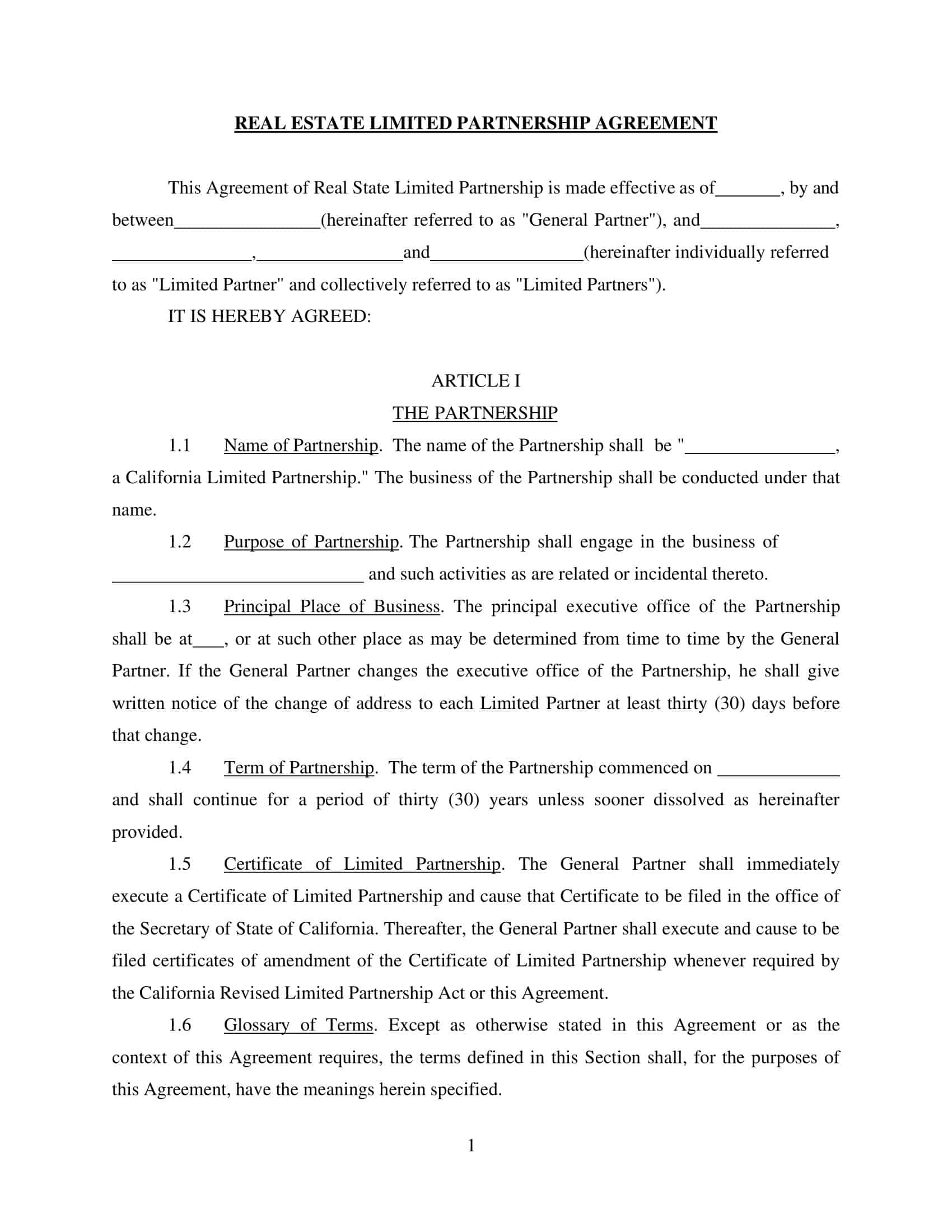

There are three primary variations of Real Estate Partnership Agreements:

- General Partnership Agreements

- Limited Partnership Agreements

- Limited Liability Partnership Agreements

While not legally mandated, these documents prove to be invaluable in establishing a solid foundation for real estate partnerships or investments involving multiple parties. Differences in business objectives and property management philosophies can often lead to conflicts, even among family members or close acquaintances. A well-crafted legal document that outlines the relationship’s specifics and each party’s expectations can significantly reduce the likelihood of disputes and promote a harmonious partnership among all involved parties.

When to Use a Real Estate Partnership Agreement?

A Real Estate Partnership Agreement should be used in the following situations:

Joint investment: When two or more parties decide to pool their resources and expertise to invest in real estate together, an agreement helps clarify the terms and conditions of their partnership.

Development projects: If partners collaborate to develop a property, such as constructing a building or renovating an existing structure, a partnership agreement is essential to define roles, responsibilities, and financial arrangements.

Property management: If the partnership plans to manage a real estate property, such as a rental building or commercial space, an agreement can help establish the partners’ responsibilities, profit sharing, and decision-making authority.

Succession planning: A partnership agreement can outline the process for adding or removing partners, transferring ownership, or dissolving the partnership in the event of a partner’s death, retirement, or voluntary departure.

Dispute resolution: The agreement can establish a mechanism for resolving any disputes that may arise among the partners, such as mediation or arbitration, thereby reducing the likelihood of litigation and promoting a harmonious working relationship.

In summary, a Real Estate Partnership Agreement should be used whenever two or more parties collaborate in real estate ventures to ensure a clear understanding of each party’s roles, responsibilities, and expectations, thereby minimizing the risk of conflicts and misunderstandings.

What to Include in a Real Estate Partnership Agreement?

A comprehensive Real Estate Partnership Agreement should include the following elements to ensure clarity and proper understanding of each party’s roles, responsibilities, and expectations:

Partnership structure: Specify the type of partnership being formed, such as a general partnership, limited partnership, or limited liability partnership, to determine each partner’s liability and involvement in the partnership’s management.

Partner information: Include the names, contact information, and ownership percentages of all partners, establishing each partner’s stake in the partnership.

Capital contributions: Detail the initial capital contributions made by each partner, whether in the form of cash, property, or services, and provide guidelines for additional contributions that may be required in the future.

Allocation of profits and losses: Describe the method for distributing profits and losses among partners, which may be based on ownership percentages or a different agreed-upon formula.

Roles and responsibilities: Define the roles, responsibilities, and decision-making authority of each partner in the partnership, including property management, financial management, and other essential tasks.

Decision-making process: Outline the decision-making process for the partnership, including voting rights, meeting requirements, and procedures for making major decisions, such as property acquisitions, sales, or development projects.

Dispute resolution: Establish a mechanism for resolving disputes among partners, such as mediation or arbitration, to minimize the likelihood of litigation and maintain a harmonious working relationship.

Buy-sell provisions: Include provisions for the sale, transfer, or buyout of a partner’s interest in the partnership, addressing scenarios like a partner’s death, disability, retirement, or voluntary departure.

Admission and withdrawal of partners: Specify the process for adding new partners or removing existing ones, as well as any restrictions or conditions that may apply to these actions.

Dissolution and termination: Detail the conditions and procedures for dissolving the partnership, including the distribution of assets and liabilities, as well as the process for winding up the partnership’s affairs.

Confidentiality and non-compete clauses: Incorporate clauses that protect the partnership’s confidential information and restrict partners from engaging in competing businesses during the partnership and for a specified period after its termination.

Governing law: Indicate the jurisdiction whose laws will govern the agreement and any disputes arising from it.

Amendments: Establish the process for amending the partnership agreement, typically requiring the consent of a majority or all partners.

Signatures: Obtain the signatures of all partners, along with the date of signing, to make the agreement legally binding.

How to Safeguard Your Interests in a Real Estate Partnership?

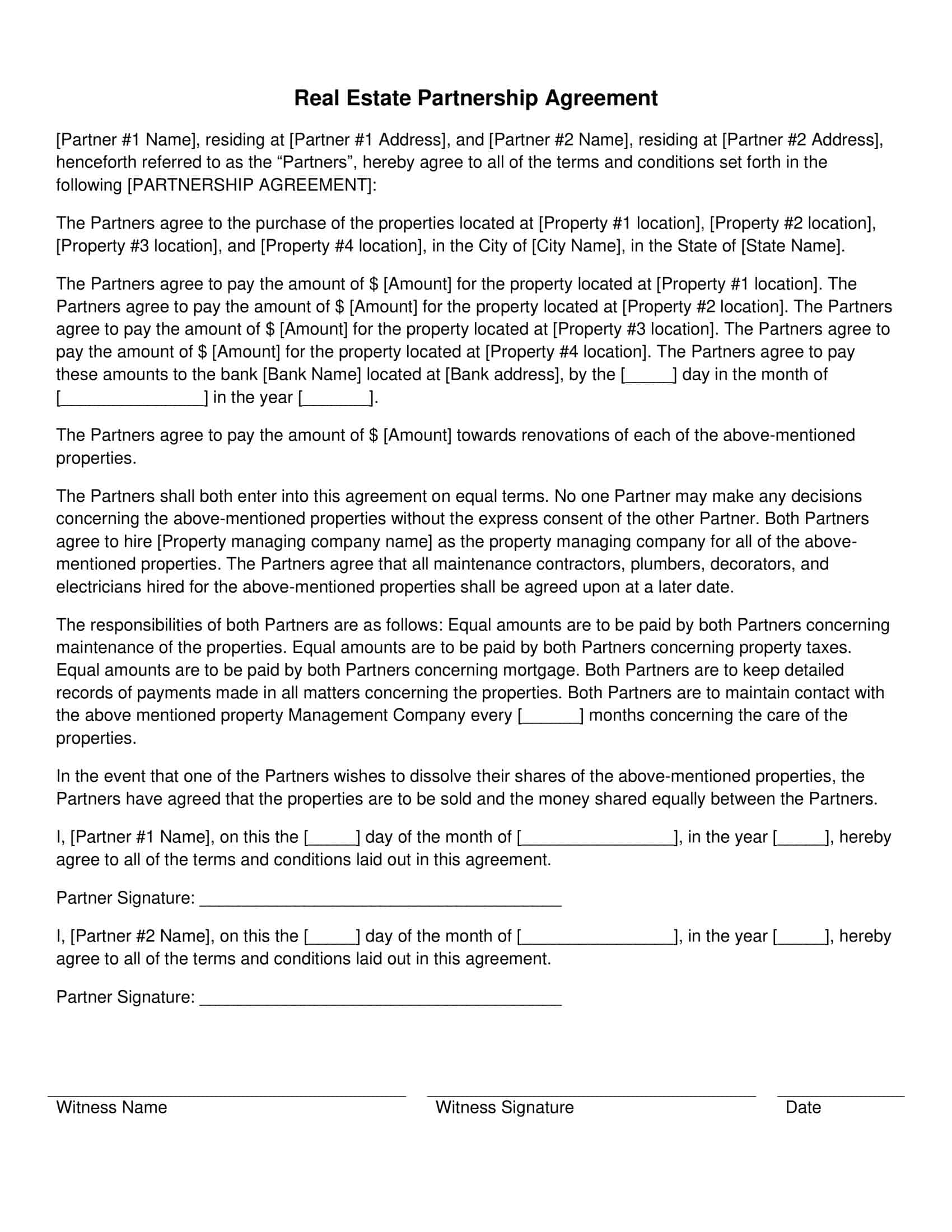

There are two primary methods to ensure the security of your real estate partnership:

- Meticulously crafted legal agreements

- Signatures on the corresponding legal documents

The most basic form of protection in a real estate partnership comes from having all parties sign the real estate partnership agreement. This signature signifies that the contract is legally binding and that all partners commit to adhering to the agreement’s stipulations. Without signatures, the agreement holds no legal weight, and unsigned partners are not obliged to follow its terms.

Another essential aspect of safeguarding your interests is ensuring that the agreement itself contains all the necessary legal provisions. Incorporate bylaws, legal restrictions, and other relevant laws to guarantee that all partners adhere to the stipulated regulations. Including these legal provisions in your real estate partnership agreement helps preserve the partnership from potential complications that could result in its dissolution while preventing disputes among the involved parties.

A legal document is only binding when signed by all participating parties. Therefore, it is crucial to ensure that every partner involved in the real estate partnership signs the agreement. This fundamental step is vital to protect the interests of all parties and validate the document as legally enforceable, maintaining a secure and well-regulated real estate partnership.

Active vs. Passive Real Estate Partnership Agreements

Active and passive real estate partnership agreements refer to the differing roles and responsibilities of partners within a real estate partnership. These agreements determine the level of involvement and decision-making authority of each partner concerning the partnership’s property investments, management, and overall operation.

Active Real Estate Partnership Agreement:

In an active real estate partnership agreement, partners actively participate in the day-to-day operations, management, and decision-making processes of the partnership. This type of partnership often involves partners who have relevant experience, skills, or expertise in real estate, such as property developers, investors, or managers.

Key aspects of an active partnership include:

- Direct involvement: Active partners are directly involved in the partnership’s operations, including property acquisition, management, and development.

- Decision-making authority: Active partners share the decision-making authority, collaborating on strategic decisions, financial management, and other critical aspects of the partnership.

- Liability: Depending on the partnership structure, active partners may bear a greater degree of personal liability for the partnership’s debts and obligations.

- Profit-sharing: Active partners typically share in the profits and losses of the partnership based on their ownership percentages or a predetermined profit-sharing arrangement.

Passive Real Estate Partnership Agreement:

In a passive real estate partnership agreement, partners primarily contribute capital to the partnership without actively participating in the daily operations or decision-making processes. Passive partners are often investors seeking exposure to real estate as an asset class while relying on the expertise and management skills of active partners to oversee the partnership’s operations.

Key aspects of a passive partnership include:

- Limited involvement: Passive partners have minimal involvement in the partnership’s operations, primarily serving as financial contributors.

- Limited decision-making authority: Passive partners usually have limited authority in making decisions, entrusting active partners to manage the partnership’s affairs.

- Limited liability: In a limited partnership or limited liability partnership structure, passive partners typically enjoy limited liability, protecting their personal assets from the partnership’s debts and obligations.

- Profit-sharing: Passive partners share in the profits and losses of the partnership based on their capital contributions or a predetermined profit-sharing arrangement.

Shortly, active and passive real estate partnership agreements define the roles and responsibilities of partners in a real estate venture. Active partners take on a more hands-on role in managing and making decisions, while passive partners primarily serve as financial contributors with limited involvement in daily operations. A comprehensive partnership agreement should clearly outline the roles, responsibilities, and expectations of both active and passive partners to ensure a smooth and successful collaboration.

How To Write Real Estate Partnership Agreement

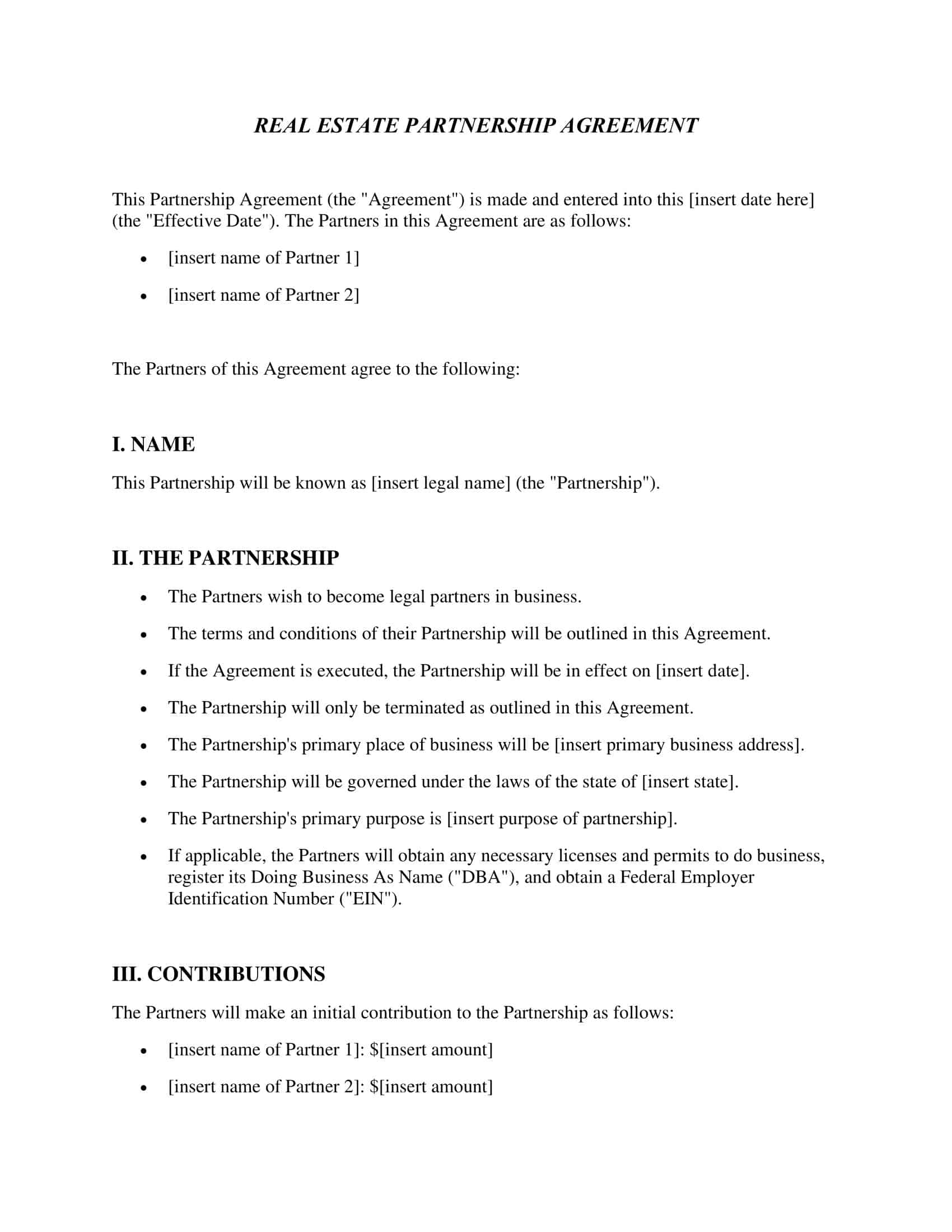

Writing a comprehensive Real Estate Partnership Agreement involves several key steps to ensure clarity and a proper understanding of each party’s roles, responsibilities, and expectations. Here’s a step-by-step guide to help you create an effective agreement:

Step 1: Determine the partnership structure

Decide whether your real estate partnership will be a general partnership, limited partnership, or limited liability partnership. This decision will impact each partner’s liability and involvement in the partnership’s management.

For example, a general partnership implies equal responsibility and authority for all partners, whereas a limited partnership includes active and passive partners with varying levels of involvement and liability.

Step 2: Identify the partners and their ownership percentages

List the names, contact information, and ownership percentages of all partners. This information establishes each partner’s stake in the partnership and will be crucial when distributing profits and losses.

For example:

Partner A: 60% ownership

Partner B: 40% ownership

Step 3: Specify capital contributions

Detail the initial capital contributions made by each partner, whether in cash, property, or services. Include guidelines for any additional contributions that may be required in the future. For example:

Partner A contributes $60,000 in cash

Partner B contributes a property valued at $40,000

Step 4: Outline the allocation of profits and losses

Describe the method for distributing profits and losses among partners, which may be based on ownership percentages or a different agreed-upon formula. For example:

Profits and losses will be distributed according to each partner’s ownership percentage.

Step 5: Define roles and responsibilities

Clearly outline each partner’s roles, responsibilities, and decision-making authority within the partnership, covering aspects like property management, financial management, and other essential tasks. For example:

Partner A will manage property acquisitions and development projects

Partner B will oversee property maintenance and tenant relations

Step 6: Establish the decision-making process

Detail the decision-making process for the partnership, including voting rights, meeting requirements, and procedures for making major decisions such as property acquisitions, sales, or development projects. For example:

Major decisions require approval from partners holding at least 75% of the ownership.

Step 7: Include dispute resolution mechanisms

Incorporate a process for resolving disputes among partners, such as mediation or arbitration, to minimize the likelihood of litigation and maintain a harmonious working relationship. For example:

In case of disputes, partners agree to engage in mediation before pursuing legal action.

Step 8: Address buy-sell provisions and partner changes

Specify the process for selling, transferring, or buying out a partner’s interest in the partnership, as well as the procedure for adding or removing partners. Include provisions for scenarios like a partner’s death, disability, retirement, or voluntary departure. For example:

In the event of Partner A’s death, Partner B will have the option to purchase Partner A’s interest at fair market value.

Step 9: Detail dissolution and termination procedures

Outline the conditions and procedures for dissolving the partnership, including the distribution of assets and liabilities, and the process for winding up the partnership’s affairs. For example:

The partnership may be dissolved upon mutual agreement, bankruptcy, or the death of a partner.

Step 10: Specify governing law and amendments

Indicate the jurisdiction whose laws will govern the agreement and any disputes arising from it. Also, establish the process for amending the partnership agreement, typically requiring the consent of a majority or all partners. For example:

This agreement shall be governed by the laws of the State of X.

Step 11: Obtain signatures

Have all partners sign and date the agreement to make it legally binding. Each partner should receive a copy of the signed agreement for their records.

FAQs

Below are some frequently asked questions (FAQs) and answers about Real Estate Partnership Agreements:

How are profits and losses distributed in a Real Estate Partnership Agreement?

Profits and losses in a Real Estate Partnership Agreement are typically distributed based on each partner’s ownership percentage or a predetermined profit-sharing arrangement. This distribution method should be clearly outlined in the agreement to avoid misunderstandings and disputes.

Can I modify or terminate a Real Estate Partnership Agreement?

Yes, a Real Estate Partnership Agreement can be modified or terminated under certain conditions specified within the agreement. Typically, modifications require the consent of a majority or all partners, and termination may occur upon mutual agreement, bankruptcy, or the death of a partner, among other stipulated circumstances.

What happens if there is a dispute between partners in a Real Estate Partnership?

If a dispute arises between partners in a Real Estate Partnership, they should first refer to the dispute resolution mechanism outlined in the partnership agreement. This may involve mediation, arbitration, or another agreed-upon method for resolving conflicts, reducing the likelihood of litigation and promoting a harmonious working relationship.

What are the tax implications of a Real Estate Partnership Agreement?

In a real estate partnership, the partnership itself is generally not taxed. Instead, profits and losses are passed through to the individual partners, who report them on their personal tax returns. Each partner’s share of the profits and losses is determined by the terms outlined in the Real Estate Partnership Agreement.

How does liability work in a Real Estate Partnership Agreement?

Liability in a Real Estate Partnership Agreement depends on the partnership structure. In a general partnership, all partners share unlimited personal liability for the partnership’s debts and obligations. In a limited partnership, general partners have unlimited liability, while limited (passive) partners have limited liability based on their capital contributions. In a limited liability partnership, all partners have limited liability, protecting their personal assets from the partnership’s debts and obligations.

Can a Real Estate Partnership Agreement be verbal, or does it need to be written?

While verbal agreements may be legally binding, it is highly recommended to have a written Real Estate Partnership Agreement. A written agreement clearly outlines the terms and conditions of the partnership, reducing the likelihood of misunderstandings and disputes. Additionally, written agreements are more easily enforceable in court if legal action becomes necessary.

Can a partner exit a Real Estate Partnership Agreement?

Yes, a partner can exit a Real Estate Partnership Agreement based on the terms and conditions specified in the agreement. The agreement should address buy-sell provisions, including the process for selling, transferring, or buying out a partner’s interest. It should also outline the procedure for adding or removing partners and address scenarios such as death, disability, retirement, or voluntary departure.

How do I ensure that my Real Estate Partnership Agreement is legally binding?

To ensure that your Real Estate Partnership Agreement is legally binding, make sure it includes all essential elements, such as the partnership structure, capital contributions, profit-sharing arrangements, roles and responsibilities, decision-making processes, and dispute resolution mechanisms. Additionally, all partners should sign and date the agreement, indicating their consent to be bound by its terms.

Can a Real Estate Partnership Agreement be used for both residential and commercial properties?

Yes, a Real Estate Partnership Agreement can be used for both residential and commercial properties. The agreement should clearly specify the types of properties the partnership will invest in, develop, manage, or sell. It should also outline each partner’s roles and responsibilities related to the various types of properties involved in the partnership.

![Free Printable Partnership Agreement Templates [PDF, Word] 1 Partnership Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Partnership-Agreement-150x150.jpg)

![Free Printable Limited Partnership Agreement Templates [PDF, Word] LPA 2 Limited Partnership Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Limited-Partnership-Agreement-2-150x150.jpg)

![Free Printable Roommate Agreement Templates [Word, PDF] 3 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)