Even a credit card balance that was closed years ago or a minor phone‑bill delinquency showing on your credit report—can operate as a hidden brake on your ability to obtain new credit for years. The fact that debts that have been paid or are approaching the statute of limitations are still visible unnecessarily suppresses the credit score; moreover, automatic notifications from the collection agency that inherits the debt prolong the problem.

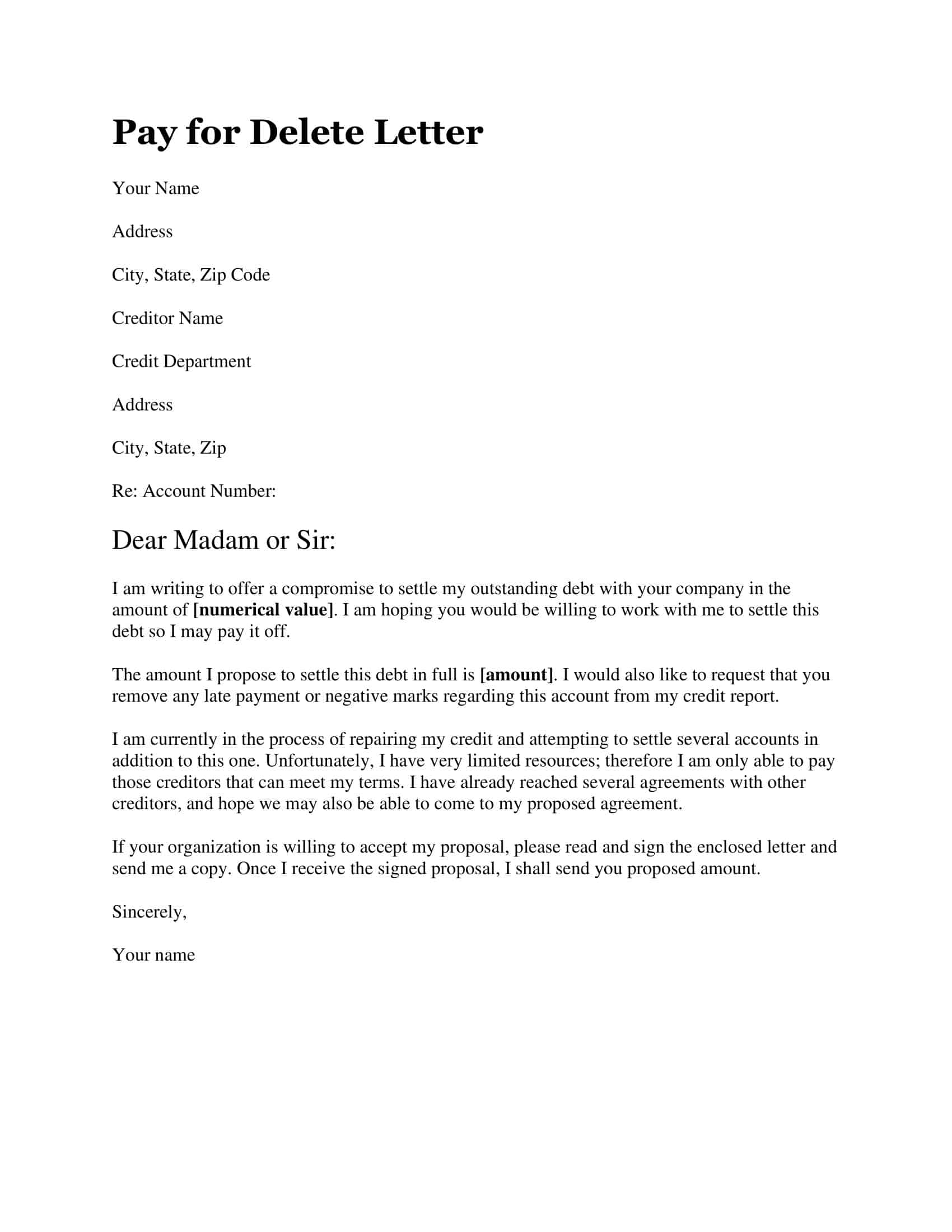

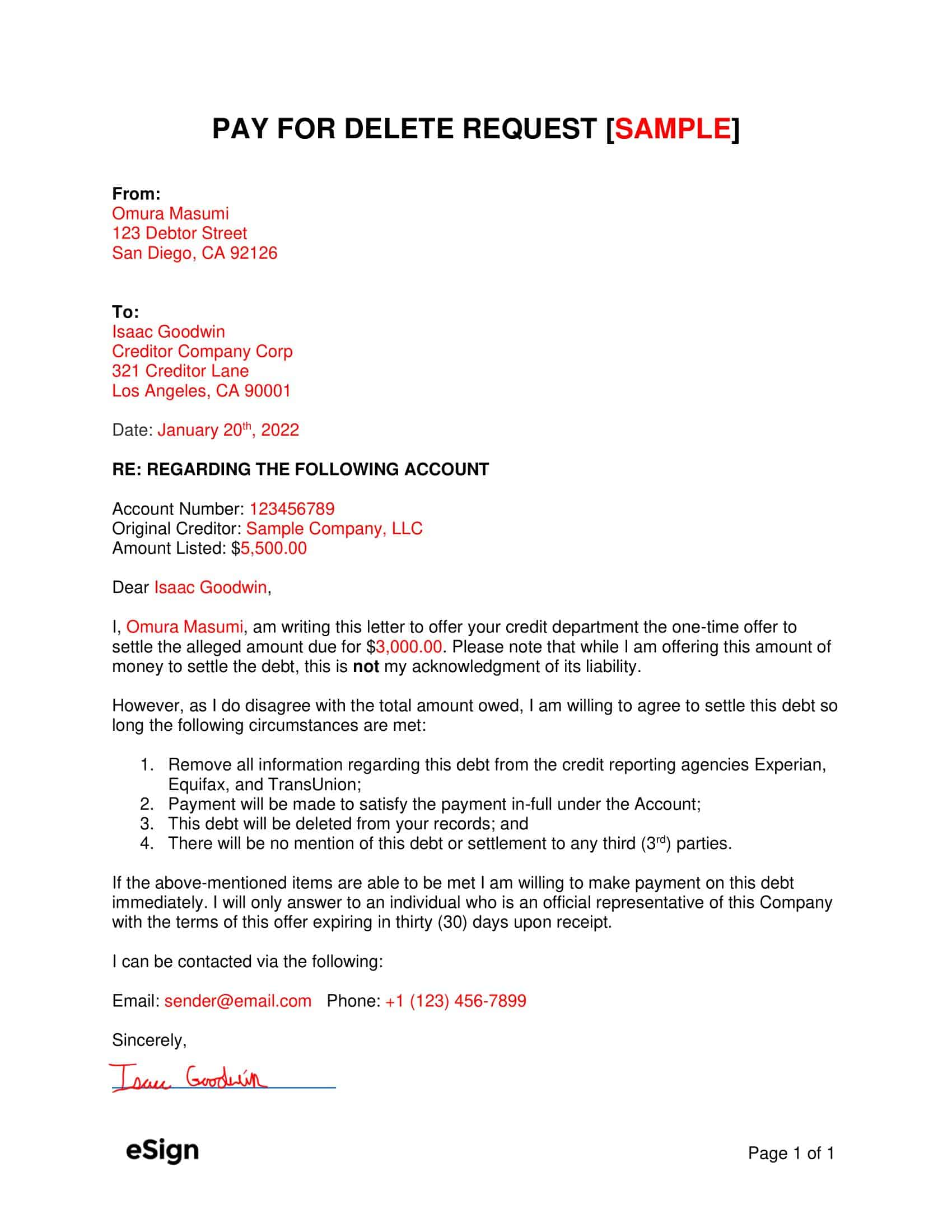

The Pay for Delete Letter comes into play at this point: it declares that you are ready to pay the full amount of the debt (or the agreed upon portion), while clearly and officially stating your request for deletion in return.When written correctly, this single letter both provides the creditor with an amount to collect immediately and knocks down the first domino in clearing your credit score.

Table of Contents

TypeCalendar’s Collection — 41 Ready-Made Templates

It is difficult to establish a universal standard text because state laws and collection agency procedures in the US are not uniform.Based on this reality, TypeCalendar created 15 different Pay for Delete Letter templates. The collection includes a polite but precise draft for the credit card “charge off” scenario, the version with the interest deduction option for non-federal student loans, and the “goodwill + delete” hash for low-consistent subscription debts.

There is also a special model that includes additional lines for “co‑signers” for situations where spouses who jointly assume the debt take separate responsibilities.The language of each template is crafted to comply with the Fair Debt Collection Practices Act (FDCPA), thus creating room for negotiation without implying that you accept the debt.

Key Components of the Pay for Delete Letter

The header section includes your name, address, and the account number that appears on the report; the date line is especially important because it proves that you made the bid without resetting the statute of limitations. The first paragraph defines the debt, the second paragraph presents the net offer with the sentence “full payment of $___ upon written confirmation of deletion from all three credit bureaus”.

The third paragraph specifies a 14-day response time, thus minimizing the agency’s stalling tactics.The last paragraph emphasizes that “your written acceptance must be on company letterhead and bear an authorized signature”, and that verbal agreement made over the phone is invalid. TypeCalendar templates pre-configure these sections, leaving only the amount, date and account information blank, thus minimizing the risk of incorrect expressions.

Negotiation Tips to Secure Deletion

- Full Payment Offer More Effective – Even if partial payment is accepted, most agencies quickly approve report deletion once the full balance is cleared.

- Use Legal Language – The sentence “This is not an acknowledgment of debt” indicates that you are negotiating without resetting the statute of limitations.

- Patience May Be Required – If the first letter is rejected, send an updated offer to the same agency after 60 days; the portfolio value of receivables decreases over time.

Download and Start with a Clean Slate Today

If you need a ready-made, legally balanced letter to ease the burdens on your credit report, download TypeCalendar’s Pay for Delete Letter template archive now. Choose the template that works for you, add the amount and account information, then send your offer via certified mail or trusted email. Once you receive written approval and complete the payment, your report is cleared and you turn a clean page on your financial future all with just a few paragraphs and a well crafted letter.

![Free Printable Friendly Letter Templates [PDF, Word, Excel] 1st, 2nd, 4th Grade 1 Friendly Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Friendly-Letter-1200x1200.jpg 1200w)

![43+ Printable Leave of Absence Letter (LOA) Templates [PDF, Word] / Free 2 Leave of Absence Letter](https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/01/Leave-of-Absence-Letter-1200x1200.jpg 1200w)

![Free Printable Congratulation Letter Templates [PDF, Word] Examples 3 Congratulation Letter](https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Congratulation-Letter-1200x1200.jpg 1200w)