Petty cash refers to a small amount of money set aside by a business or organization for minor expenses that require immediate payment. A petty cash log is a record of all transactions made with the petty cash, documenting the amount of money received and the purpose for which it was spent.

Keeping track of petty cash transactions is essential for ensuring the proper management of financial resources, maintaining accountability and preventing fraud or mismanagement. This article provides an overview of what a petty cash log is, its benefits and how to create an effective and efficient one for your organization.

Table of Contents

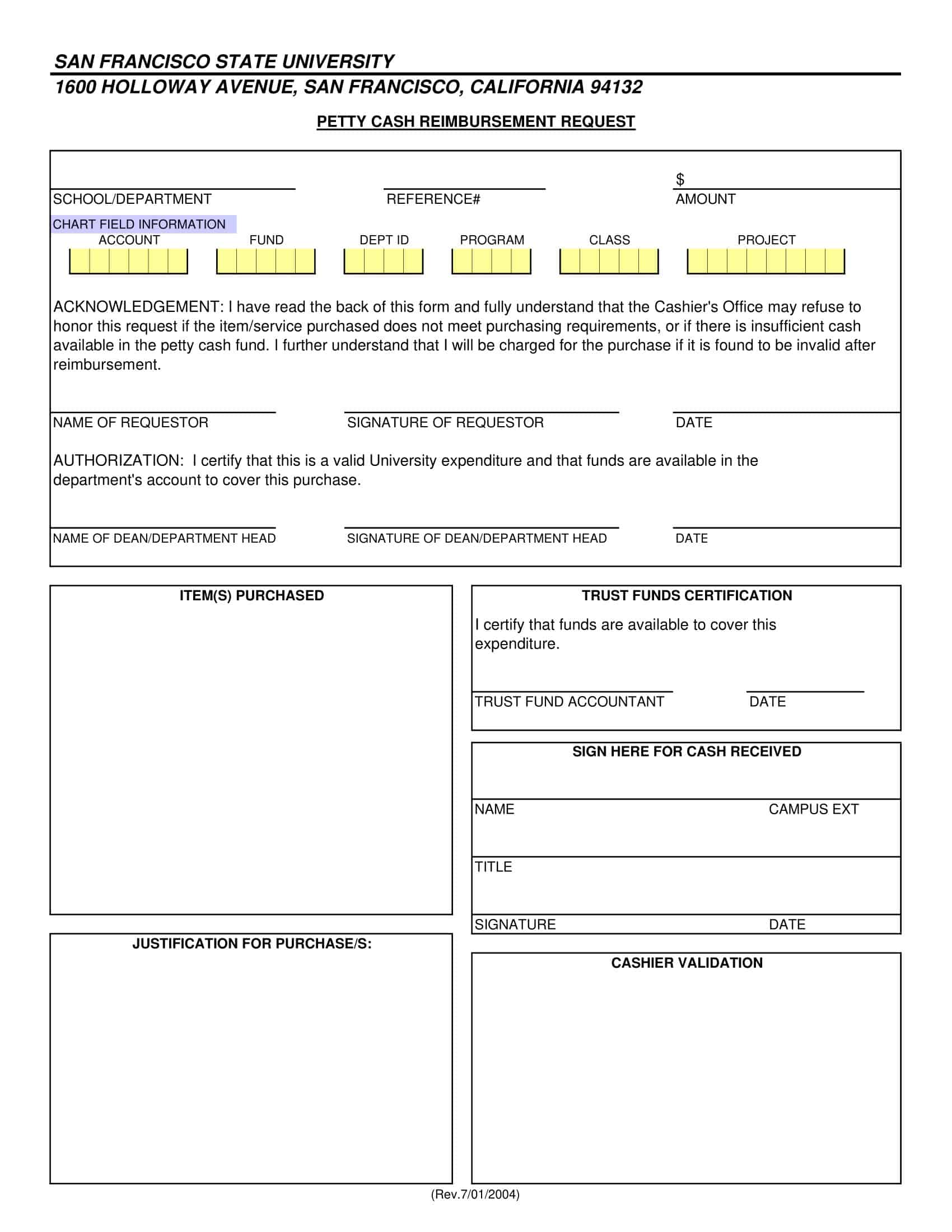

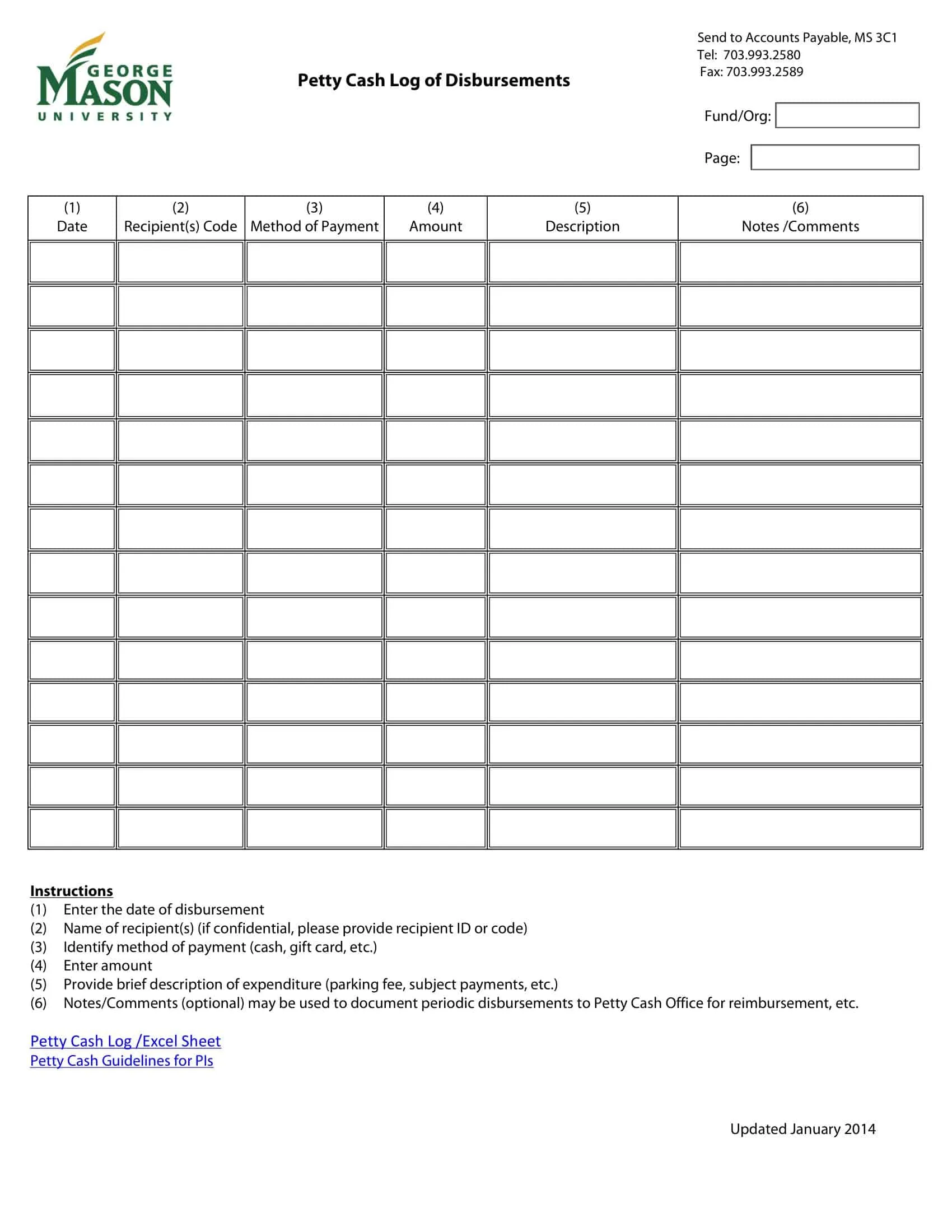

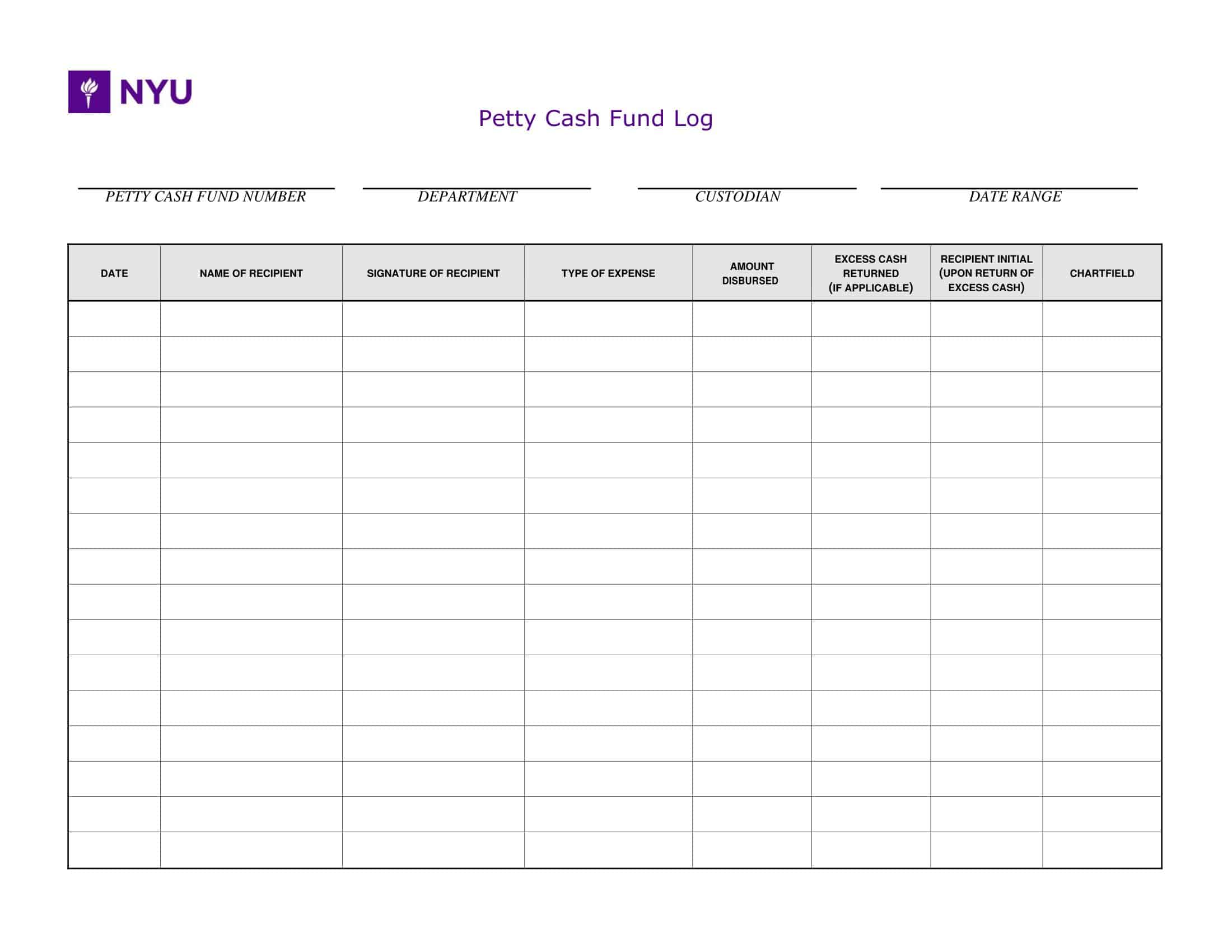

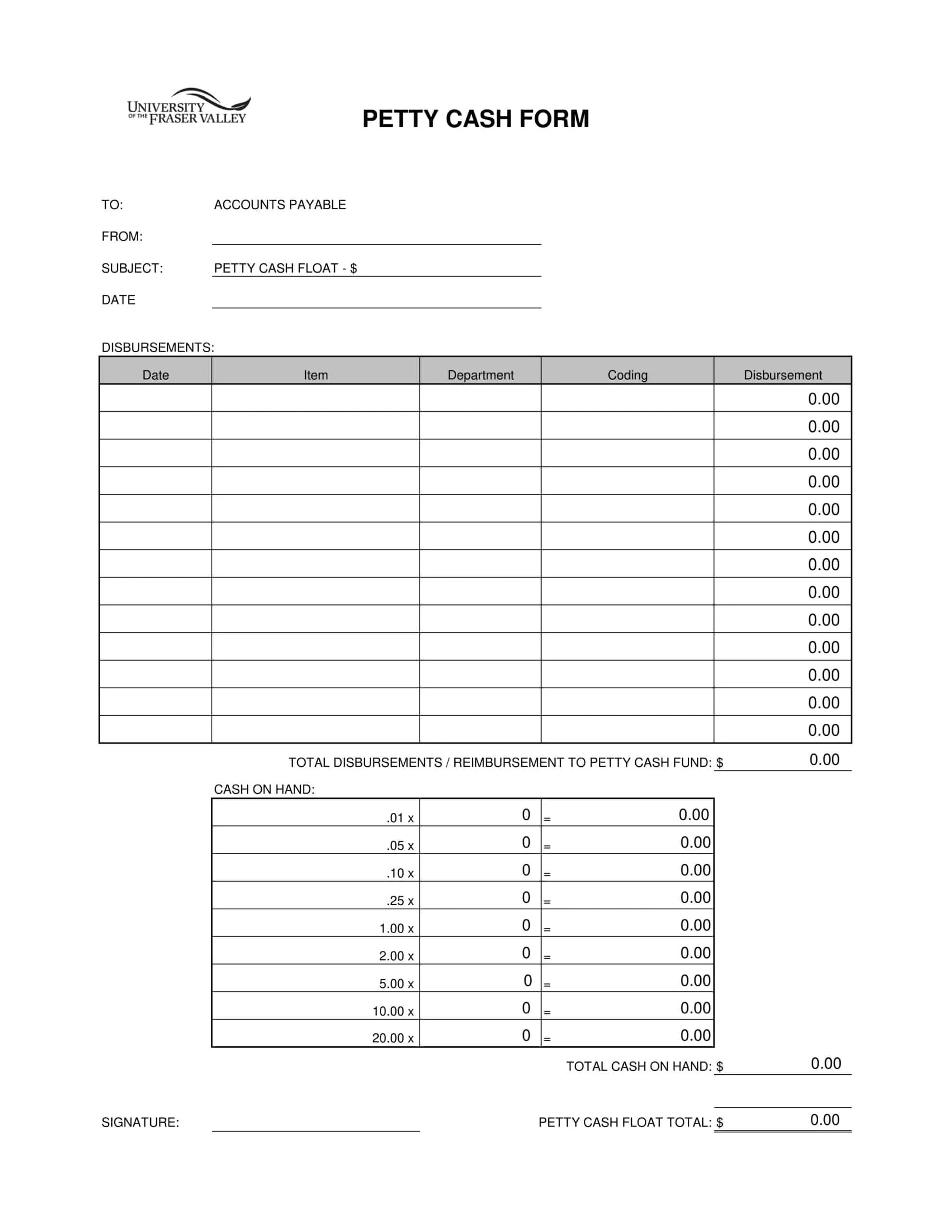

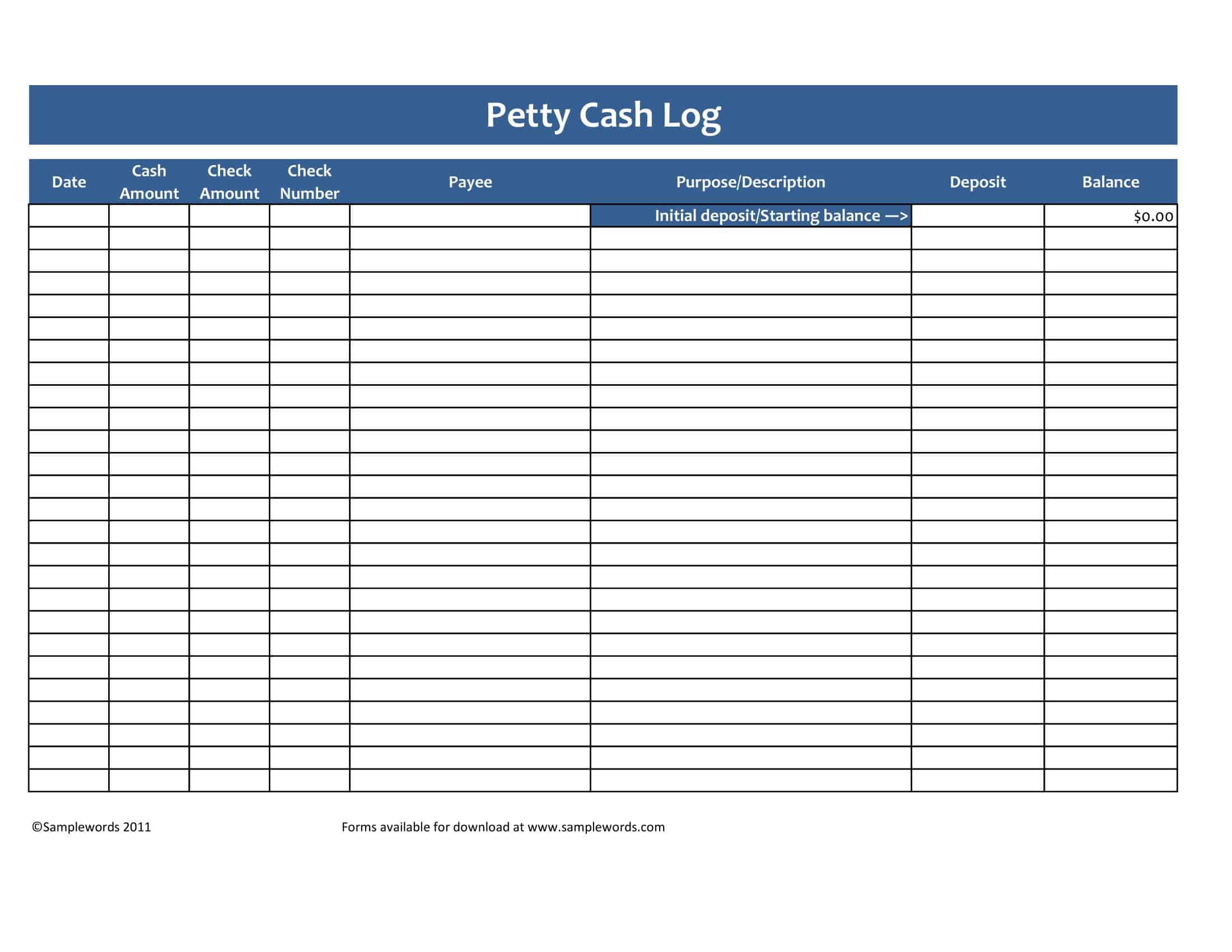

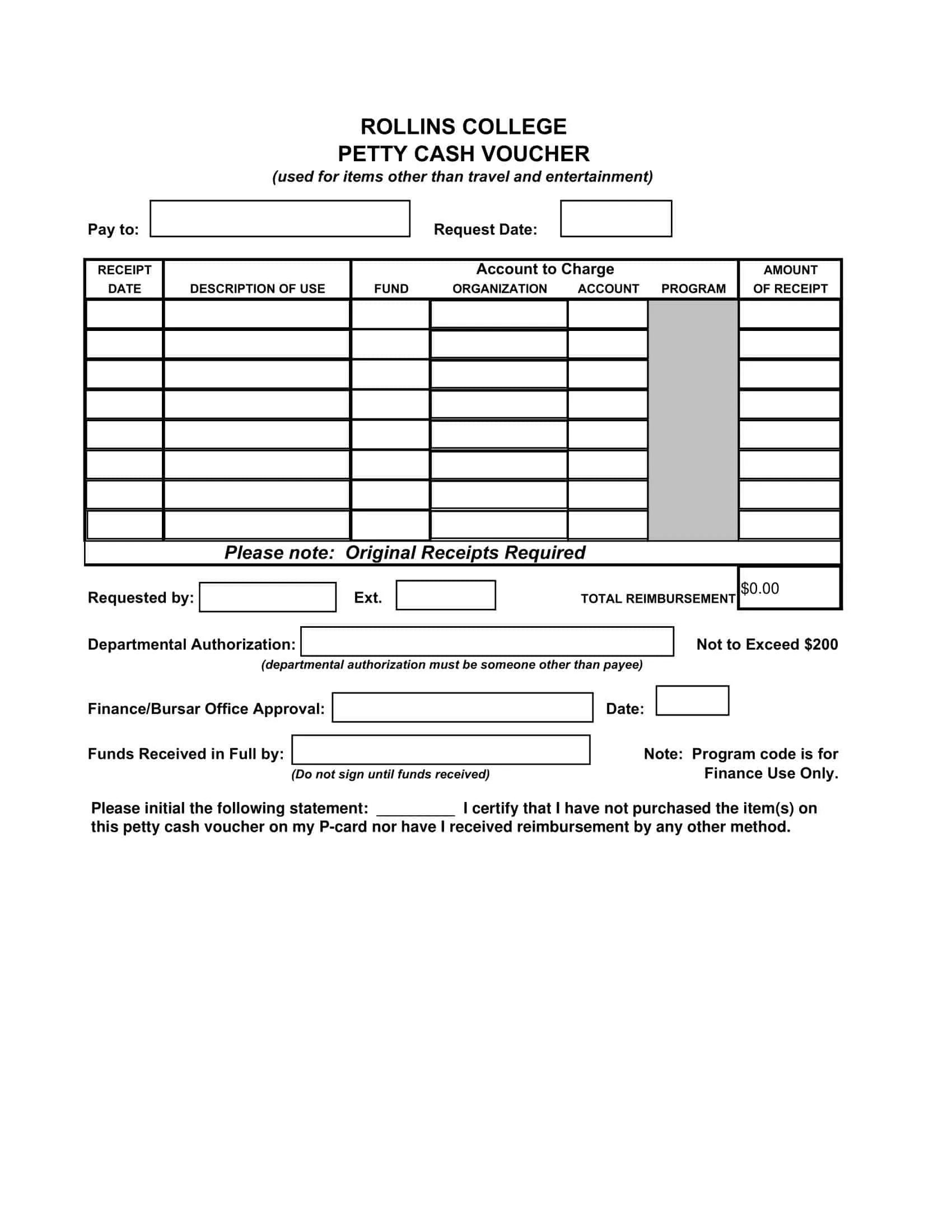

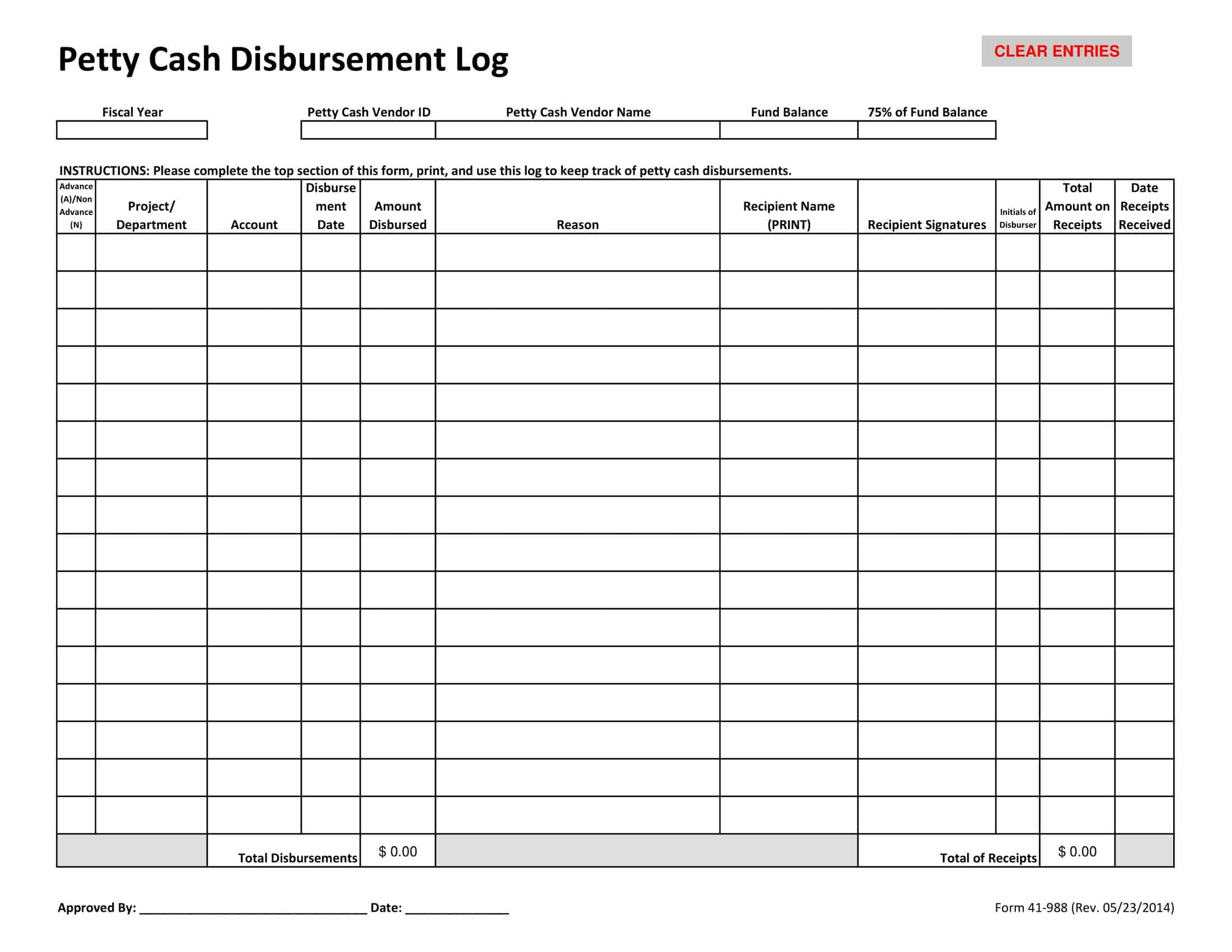

Petty Cash Templates

Petty Cash Log Templates are practical tools used to track and manage small cash transactions within an organization or business. These templates provide a structured format for recording petty cash expenses, ensuring transparency, accuracy, and accountability in the management of small cash funds. Petty Cash Log Templates assist in tracking cash inflows and outflows, maintaining proper documentation, and facilitating the reconciliation of petty cash balances.

Petty Cash Log Templates are valuable tools for businesses and organizations that handle small cash transactions on a regular basis. They promote financial control, minimize the risk of errors or discrepancies, and facilitate proper documentation for auditing or reporting purposes. By utilizing these templates, businesses can maintain a clear and organized record of petty cash expenses, ensure compliance with financial regulations, and promote transparency in financial management. Regularly updating and reviewing the Petty Cash Log allows for effective tracking of cash flows, identification of any misuse or irregularities, and timely replenishment of the petty cash fund.

What Is Petty Cash Used For?

Petty cash is a small amount of cash that is set aside by an organization for use in making small, routine purchases that are not significant enough to require a check or other formal payment method. Some common uses of petty cash include:

Office Supplies: Petty cash can be used to purchase office supplies, such as paper, pens, and printing ink.

Refreshments: Petty cash can be used to purchase refreshments, such as coffee, tea, and snacks, for employees and visitors.

Postage and Delivery: Petty cash can be used to purchase postage stamps and pay for delivery services, such as courier or messenger services.

Small Equipment and Repairs: Petty cash can be used to purchase small equipment and supplies, such as batteries, light bulbs, and other items needed for maintenance and repair.

Travel Expenses: Petty cash can be used to pay for small travel expenses, such as taxi fares, tolls, and parking fees.

Employee Reimbursements: Petty cash can be used to reimburse employees for out-of-pocket expenses incurred while on business trips or conducting company business.

Miscellaneous Expenses: Petty cash can be used to cover miscellaneous expenses, such as tips, gifts, and donations.

Importance of Having a Petty Cash Log

Having a petty cash log is important for several reasons:

Record Keeping: A petty cash log helps to keep track of all transactions made using the petty cash fund. This provides a clear and organized record of the petty cash expenditures, making it easier to reconcile the balance and verify that the funds are being used for their intended purpose.

Accountability: A petty cash log helps to promote accountability for the use of the petty cash funds. It provides a record of who was responsible for each transaction, making it easier to identify any potential discrepancies or unauthorized expenditures.

Budgeting and Cost Control: By keeping a record of all petty cash expenditures, a petty cash log can help organizations to better manage their budgets and control costs. This information can be used to identify areas where the organization can make savings or improve efficiency.

Auditing: A petty cash log is an important tool for auditors. It provides them with the information they need to verify that the petty cash funds are being used appropriately and in accordance with the organization’s policies and procedures.

Tax Purposes: A petty cash log can also be useful for tax purposes. By keeping a record of all petty cash expenditures, organizations can easily identify and categorize business-related expenses for tax reporting purposes. This can help to reduce the risk of errors and ensure that the organization complies with tax laws and regulations.

Improved Transparency: A petty cash log promotes transparency in the use of petty cash funds. This can help to build trust with stakeholders, such as employees, customers, and shareholders, by demonstrating that the organization is using its funds responsibly and with integrity.

Streamlined Processes: Having a petty cash log in place can help to streamline processes and improve the overall efficiency of the organization. By keeping a clear and organized record of all petty cash transactions, it is easier to manage the petty cash fund and ensure that it is being used effectively.

Avoiding Over or Underfunding: By keeping a record of petty cash expenditures, organizations can avoid over or underfunding their petty cash account. This helps to ensure that the petty cash fund remains balanced and available for use when needed.

Types of Petty Cash Logs

There are several different types of petty cash logs that organizations can use, depending on their specific needs and requirements. Some common types include:

Manual Logs

A manual log is a simple paper-based record of petty cash transactions. This type of log is suitable for small organizations with a limited number of transactions.

Spreadsheet Logs

A spreadsheet log is an electronic record of petty cash transactions that can be created using programs such as Microsoft Excel or Google Sheets. This type of log is suitable for organizations with a larger number of transactions and provides greater flexibility for analysis and reporting.

Electronic Logs

An electronic log is a digital record of petty cash transactions that is maintained using software specifically designed for this purpose. This type of log is suitable for larger organizations with complex financial management systems and provides a range of features, such as real-time reporting, automatic reconciliation, and user-defined security permissions.

Hybrid Logs

A hybrid log is a combination of manual and electronic methods, and is suitable for organizations that prefer to maintain a paper-based record of transactions but also need the ability to generate reports and perform other analysis tasks.

Custom Logs

A custom log is a tailored solution that is designed to meet the specific needs and requirements of an organization. This type of log may include features such as multiple levels of authorization, custom reporting, and integration with other financial management systems.

Each type of petty cash log has its own advantages and disadvantages, and organizations should choose the one that best meets their specific needs and requirements.

Petty Cash Tips & Tricks

Here are some tips and tricks for handling petty cash effectively:

Establish clear policies and procedures

Clearly define the purpose and procedures for using petty cash, including who is authorized to access the fund and how expenses are to be recorded and reported.

Set aside a reasonable amount

Determine the appropriate amount of petty cash to set aside based on the frequency and size of the expenses that will be incurred. Be mindful of the need to keep the fund balanced, so that there is enough cash on hand to cover expenses as they arise.

Keep detailed records

Keep accurate and detailed records of all petty cash transactions, including the date, amount, purpose, and receipts. This will help to ensure that expenses are accounted for and that the fund remains balanced.

Reconcile the fund regularly

Regularly reconcile the petty cash fund to ensure that the cash balance is accurate and that all expenses have been recorded and accounted for.

Limit access to authorized personnel

Limit access to the petty cash fund to authorized personnel to reduce the risk of theft, fraud, or mismanagement.

Use pre-numbered receipts

Use pre-numbered receipts for all petty cash transactions to provide a clear and auditable trail of all expenditures.

Conduct regular audits

Conduct regular audits of the petty cash fund to ensure that it is being used appropriately and to identify any issues or discrepancies.

Separate petty cash from other funds

Keep petty cash separate from other funds to avoid confusion and ensure that it is only used for its intended purpose.

How to Keep Track of Petty Cash

Keeping track of petty cash can be a challenge, but it is important to ensure that your finances are organized and accounted for. Here are some steps you can follow to keep track of your petty cash:

Establish a petty cash fund: Determine the amount of money you want to allocate for petty cash expenses and keep it in a secure location.

Set up a system for tracking expenses: This can be done through a physical ledger or a digital system, such as a spreadsheet or accounting software. Make sure to record every transaction, including the date, description of the expense, and amount.

Assign a responsible person: Choose someone who will be responsible for handling the petty cash fund and recording transactions. This person should also be responsible for reconciling the petty cash account on a regular basis.

Implement a reimbursement process: Establish a process for employees to request reimbursement for petty cash expenses they incur on behalf of the business. The reimbursement should be recorded in the same way as other petty cash transactions.

Reconcile the petty cash account regularly: This means checking that the total of the petty cash transactions match the actual amount of cash on hand. Any discrepancies should be investigated and resolved promptly.

Keep receipts and documentation: Retain receipts and other documentation related to petty cash transactions for auditing purposes.

By following these steps, you can ensure that your petty cash is well-organized and accounted for, and that you have a clear and accurate record of all petty cash expenses.

FAQs

What information should be included in a petty cash log?

A petty cash log should include the date, description of the expense, amount, and running total of petty cash available. Additionally, it may be helpful to include the name of the person who made the expenditure and the purpose of the expense.

How often should a petty cash log be updated?

A petty cash log should be updated after every transaction. It’s important to keep the log up-to-date in order to have an accurate record of all petty cash expenditures.

Who should be responsible for maintaining the petty cash log?

The person responsible for maintaining the petty cash log will vary depending on the size and structure of the organization. It may be a designated staff member, an accounting team, or an external bookkeeper. The important thing is to have one person or team who is responsible for maintaining the log and reconciling the petty cash account on a regular basis.

How can I prevent petty cash fraud or theft?

To prevent petty cash fraud or theft, it’s important to have clear policies and procedures in place for handling petty cash transactions. The person responsible for maintaining the petty cash log should be someone who is trustworthy and knowledgeable about financial procedures. Regular reconciliation of the petty cash account can also help to prevent fraud or theft.

What is the difference between petty cash and a cash advance?

Petty cash refers to a small amount of cash kept on hand for making small, routine purchases that cannot be charged to a company credit card. A cash advance, on the other hand, is a loan given to an employee to cover expenses while on a business trip or for other work-related purposes. Unlike petty cash, cash advances are typically reimbursed by the company after the employee submits receipts and a report of the expenses incurred.

Can petty cash be used for personal expenses?

No, petty cash should only be used for business-related expenses. Personal expenses should not be charged to the petty cash account.

How do I replenish the petty cash fund?

The petty cash fund should be replenished when the amount on hand falls below a certain threshold or as needed. The person responsible for maintaining the petty cash log should request additional funds from the organization’s finance department as needed.

How can I ensure that petty cash expenditures are properly documented and supported?

To ensure that petty cash expenditures are properly documented and supported, it’s important to have a clear process for requesting and obtaining receipts for all petty cash transactions. Additionally, the person responsible for maintaining the petty cash log should verify that all receipts match the recorded expenditures before reconciling the petty cash account.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)