Hey there, financial trailblazers! Today, we’re diving headfirst into the exhilarating world of Personal Balance Sheets. Now, before you let the jargon scare you off, let me assure you – it’s not as intimidating as it sounds. Picture this, your personal balance sheet is basically a snapshot of your financial health at a given moment in time, laying bare your assets (think savings, investments, and properties), your liabilities (like loans, credit card debts), and your net worth (assets minus liabilities).

Think of it as your own financial GPS, helping you know exactly where you are and guiding you to where you want to be. So, buckle up and let’s journey into understanding how this powerful tool can get you one step closer to achieving your financial dreams.

Table of Contents

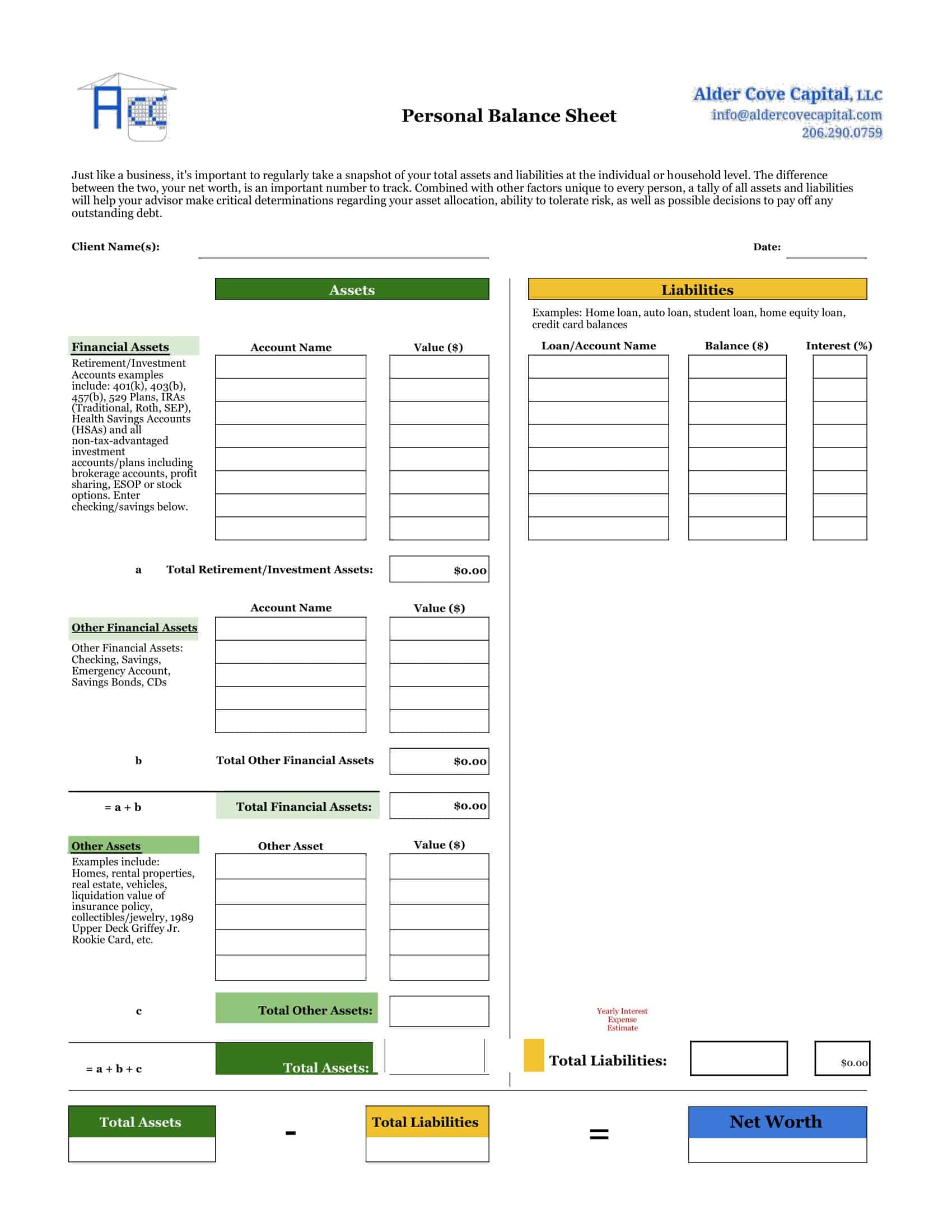

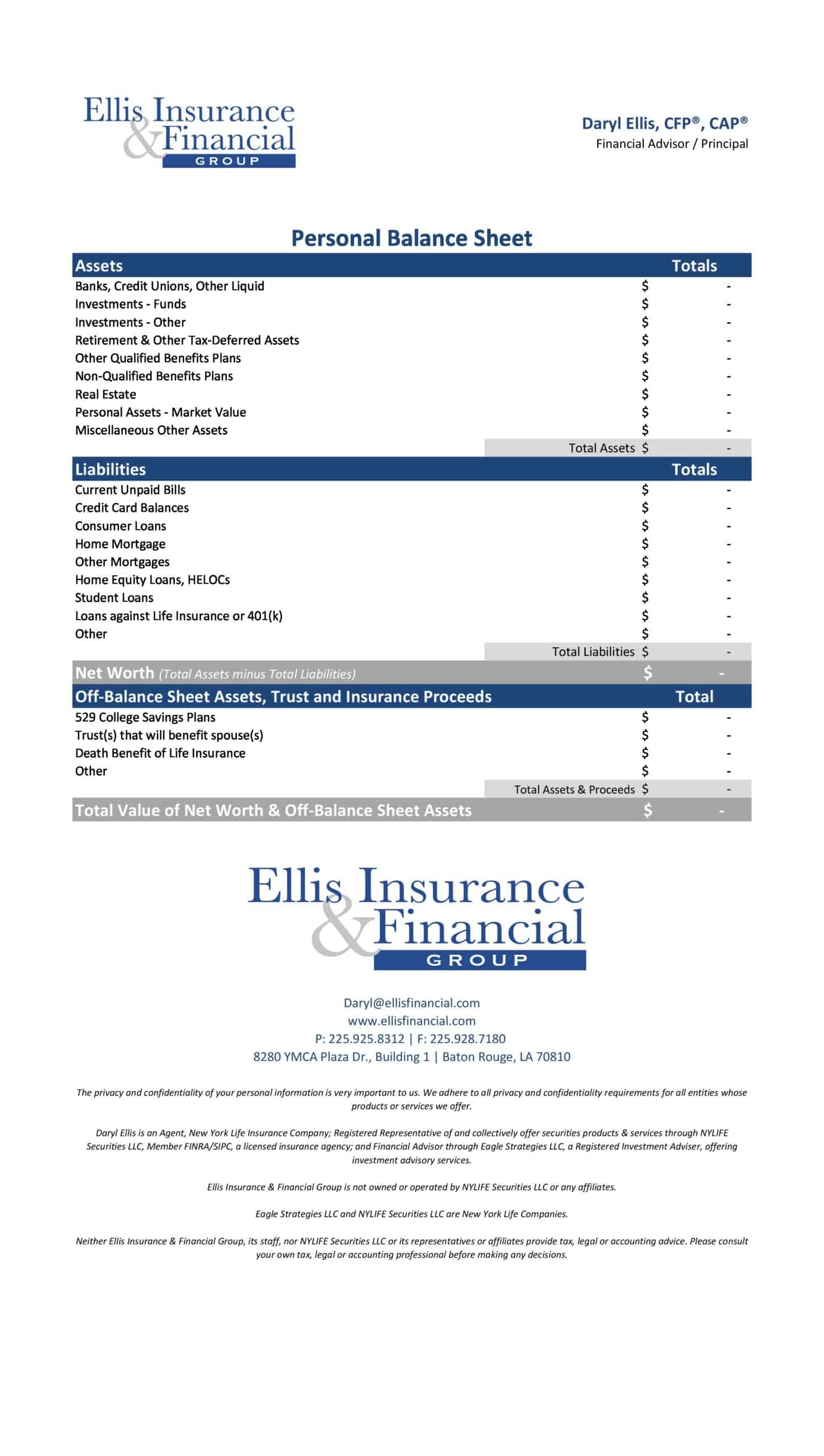

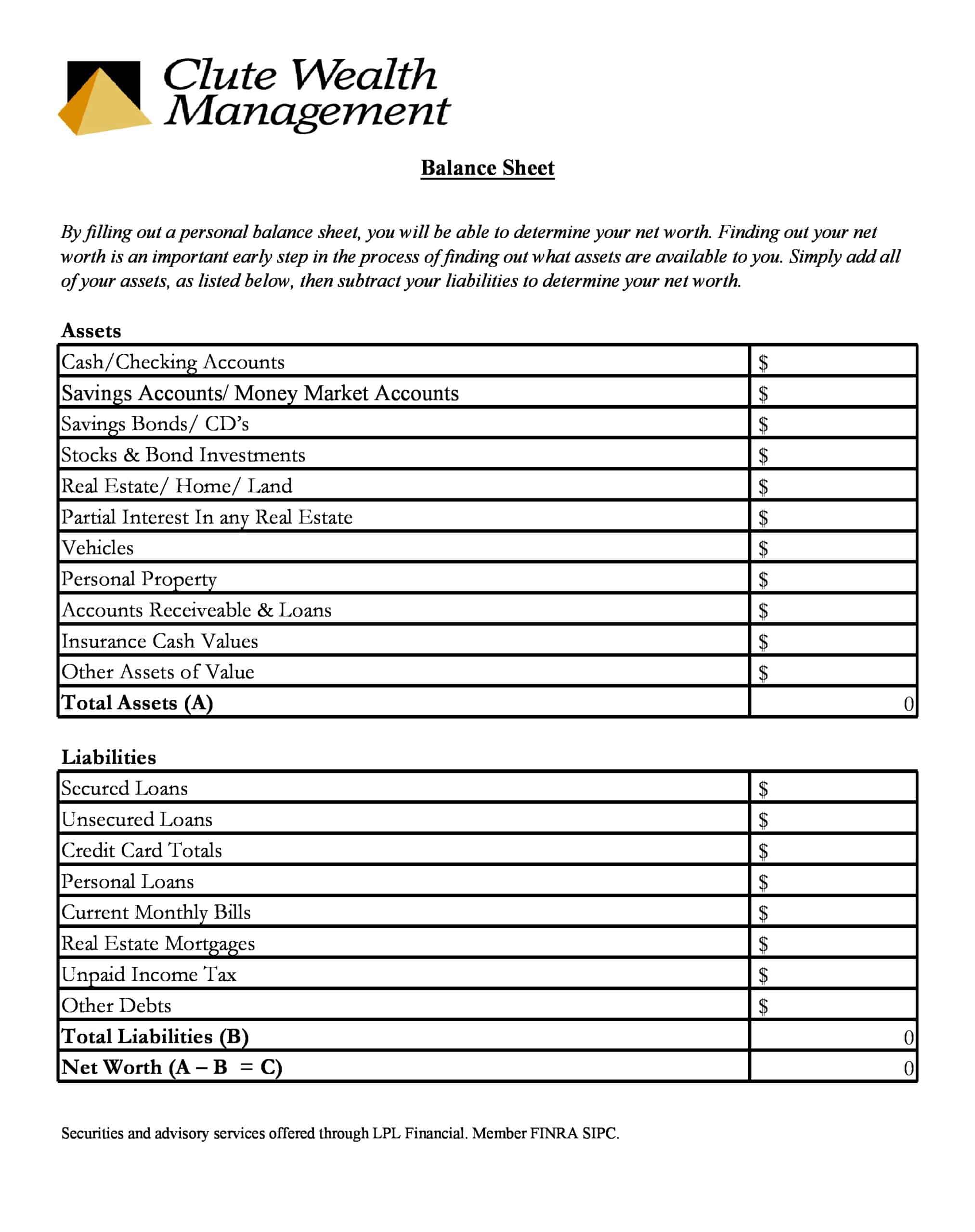

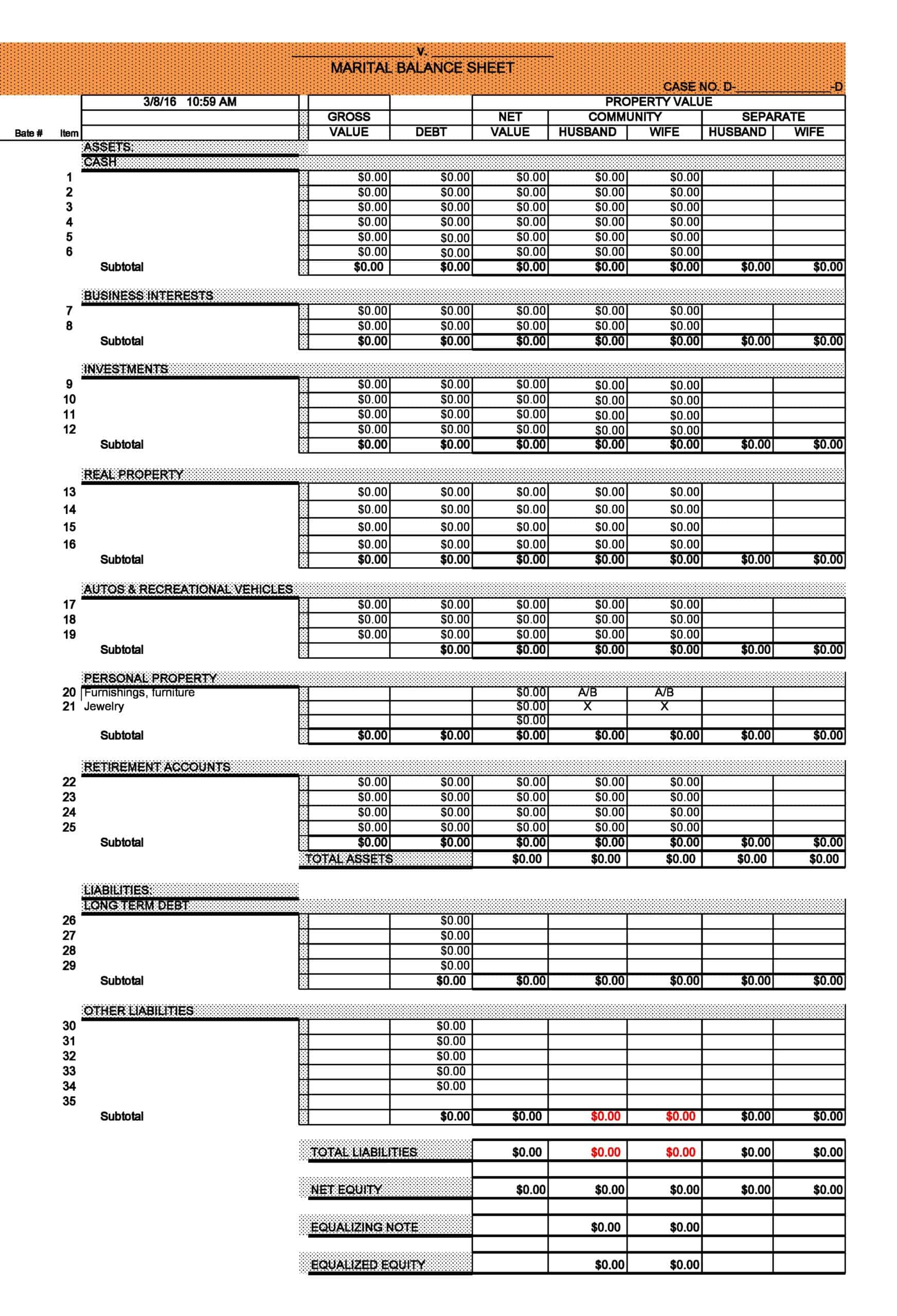

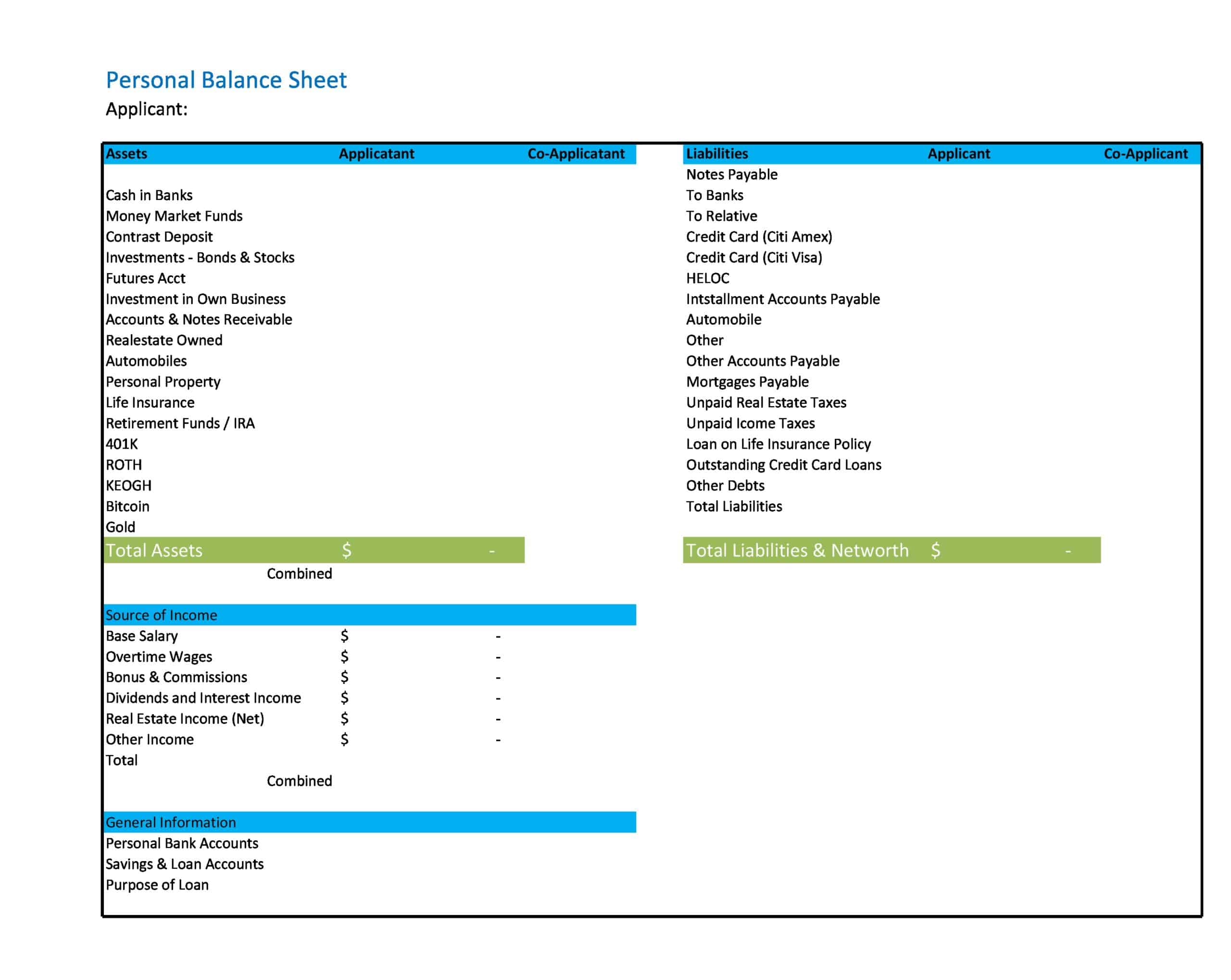

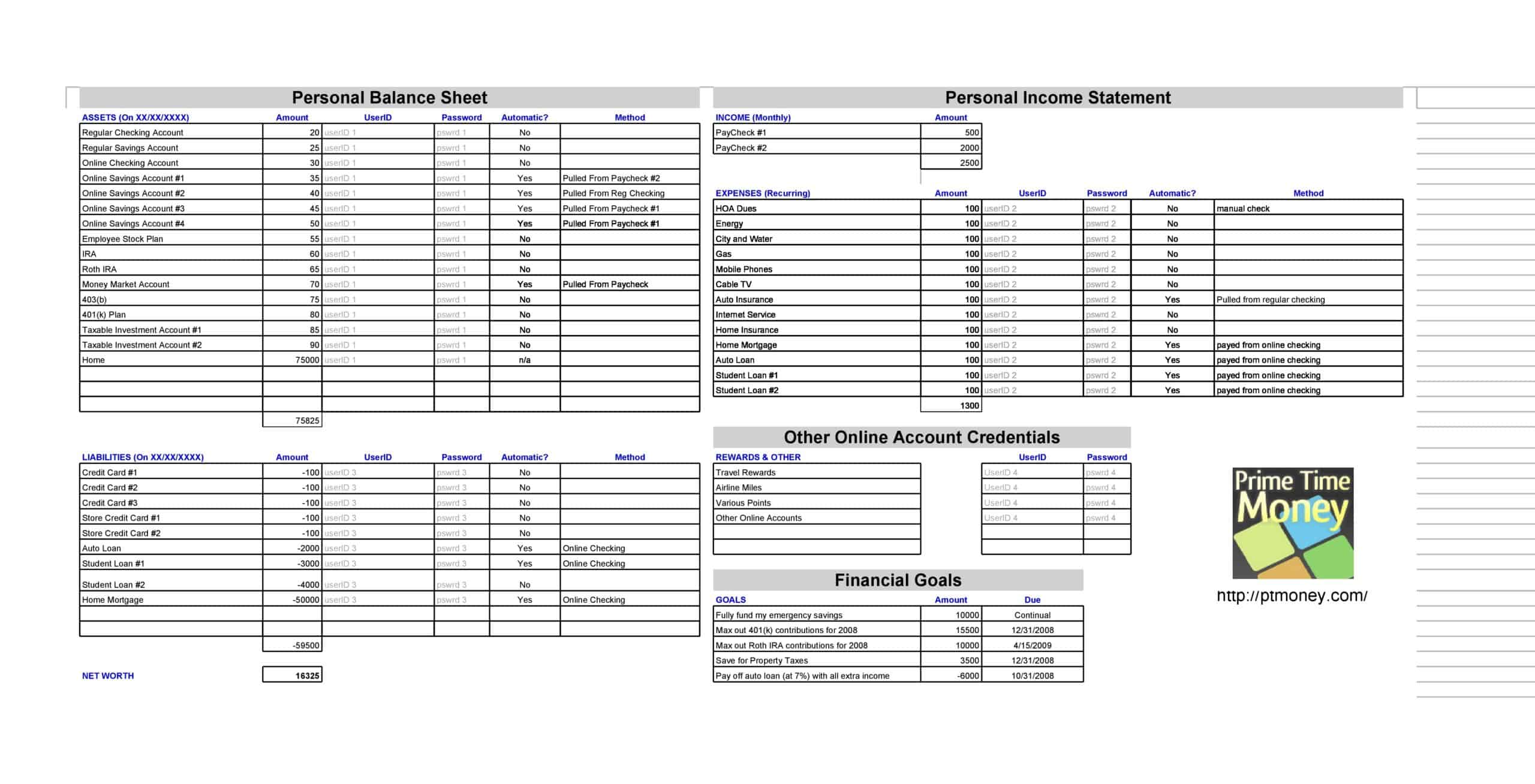

Personal Balance Sheet Templates

What is a personal balance sheet?

A personal balance sheet is essentially a financial statement that provides a snapshot of an individual’s financial position at a specific point in time. Similar to a balance sheet in business, it details what you own (assets), what you owe (liabilities), and your net worth (assets minus liabilities).

Assets could include everything from your cash in checking and savings accounts, to your investment portfolio, retirement accounts, real estate properties, personal items of significant value like a car, jewelry, or other collectibles.

Liabilities are all the debts and obligations you owe, such as your mortgage, car loan, student loans, credit card debts, or any other personal loans.

Your net worth, then, is calculated by subtracting your total liabilities from your total assets. It’s a crucial figure that can help gauge your financial health and progress towards your long-term financial goals. Whether you’re planning for retirement, a big purchase, or simply looking to improve your financial health, regularly updating and reviewing your personal balance sheet can prove to be a very beneficial exercise.

Importance of Having a Personal Balance Sheet

In the financial realm, the key to comprehending your own financial health and planning for the future is information – transparent, timely, and accurate. The task, while straightforward, is often misunderstood: each individual should have a clear and comprehensive understanding of their personal financial position. And it is precisely here that a personal balance sheet comes into play.

A personal balance sheet, akin to a balance sheet for businesses, provides a snapshot of your financial position at a particular point in time. It sums up what you own (your assets) and what you owe (your liabilities), the difference being your net worth. The importance of maintaining a personal balance sheet can be expounded as follows:

Understanding Your Net Worth

The fundamental role of a balance sheet is to calculate your net worth. Your net worth is the value that remains when you subtract your total liabilities from your total assets. This net worth figure is essential, as it gives you a solid baseline to evaluate your current financial health and helps you chart your financial progress over time.

Planning for the Future

A well-maintained balance sheet can serve as a roadmap for financial planning. It can help you identify where you are excessively invested, where you are under-invested, and where you can afford to take on more or need to shed off liabilities. This can significantly aid in retirement planning, saving for a significant purchase, or creating an emergency fund.

Risk Management

Your balance sheet allows you to identify areas of potential financial risk. For instance, high levels of debt relative to assets can signal a precarious financial position, potentially forcing you to sell off assets to cover liabilities in case of a sudden financial setback. Understanding these risks helps in making prudent financial decisions.

Achieving Financial Goals

By identifying your financial strengths and weaknesses, a balance sheet can provide a clear path to reaching your financial goals. If your net worth is lower than your targets, for instance, your balance sheet could indicate whether you need to save more, reduce your debts, or both.

Better Debt Management

A balance sheet can reveal the overall debt situation, making it easier to form strategies for paying off debts. You might have multiple credit cards, loans, or other forms of debt. Consolidating these into a single view can help you determine which debts to prioritize, based on factors such as interest rates and outstanding balances.

To sum up, maintaining a personal balance sheet is not just an exercise for businesses or wealthy individuals. It is a powerful tool that empowers individuals to manage their finances effectively, plan for the future, and ensure that they are on track to achieve their financial goals. Regardless of where you stand financially today, crafting and maintaining a personal balance sheet will undoubtedly provide you with the knowledge and power to take control of your financial destiny.

How Personal Balance Sheets Work

A personal balance sheet works by providing a clear and concise overview of your financial situation at a particular moment in time. It gives you a comprehensive look at what you own (assets), what you owe (liabilities), and what you’re worth after all debts are paid off (net worth).

Here’s a simple step-by-step guide on how a personal balance sheet works:

List Your Assets

Begin by cataloging all of your assets. This should include cash, savings and checking accounts, real estate, investments (stocks, bonds, mutual funds), retirement accounts (like 401(k) or IRAs), and personal property with value, such as vehicles, jewelry, or artwork.

List Your Liabilities

Next, list all of your liabilities. This should include any form of debt you owe such as a mortgage, car loans, student loans, credit card balances, or any other personal loans.

Calculate Your Net Worth

Once you have all your assets and liabilities listed, you subtract your total liabilities from your total assets to calculate your net worth. This is the value that you’d theoretically have if you sold off all of your assets and paid off all your debts.

Net Worth = Total Assets – Total Liabilities

A positive net worth means your assets outweigh your debts, which is generally a sign of good financial health. Conversely, a negative net worth might indicate that you’re in a difficult financial situation and need to work on reducing debts or increasing assets.

Review and Update Regularly

Your personal balance sheet is a dynamic tool that should be updated regularly, especially when there’s a significant change in your financial situation. Regular reviews will help you track your financial progress, identify areas for improvement, and make informed decisions about future financial planning.

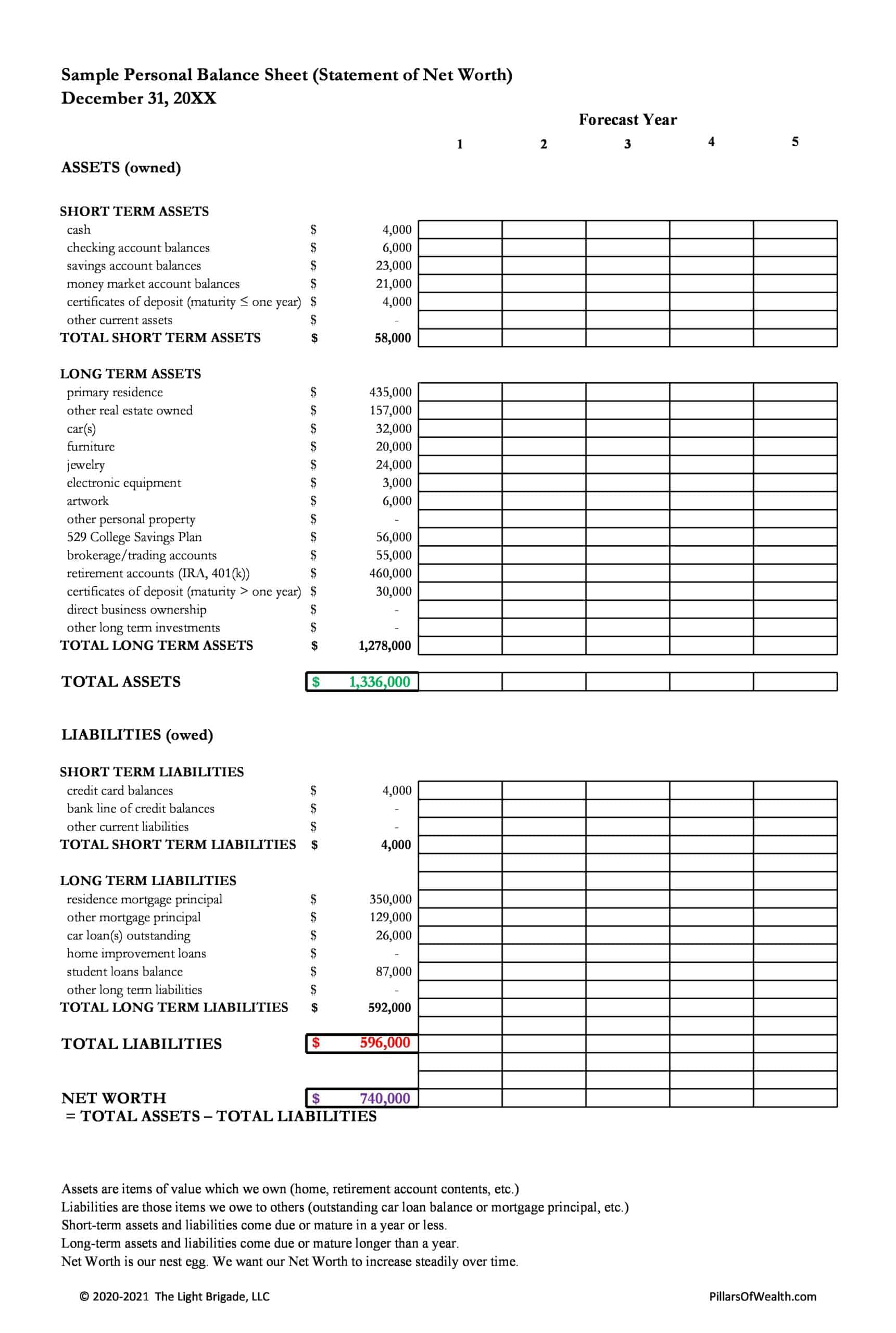

Components of a Personal Balance Sheet

Assets

These represent everything you own that has significant value. Assets are typically categorized as either liquid assets (easy to convert into cash) or non-liquid assets (not easily converted into cash).

Liquid Assets: This includes cash on hand, checking accounts, savings accounts, and any investments that can be easily sold, like stocks or bonds. For example, if you have $5,000 in your savings account, $1,500 in your checking account, $15,000 worth of stocks, and $2,000 in cash at home, your total liquid assets would amount to $23,500.

Non-Liquid Assets: This includes assets that can’t be easily converted to cash, such as real estate, vehicles, jewelry, or other personal property. Suppose you own a home valued at $250,000, a car worth $20,000, and jewelry worth $10,000. Your total non-liquid assets would then be $280,000.

Liabilities

Liabilities are the debts and financial obligations you owe. Like assets, liabilities can also be broken down into two categories: short-term liabilities (due within a year) and long-term liabilities (due over a longer period).

Short-Term Liabilities: These are obligations due within the next year. This can include credit card balances, utility bills, monthly subscriptions, personal taxes due, etc. If your credit card balance is $2,000 and you owe $500 in other bills, your total short-term liabilities would be $2,500.

Long-Term Liabilities: These are obligations that are due over a longer period. Examples of long-term liabilities include mortgage debt, car loans, student loans, etc. If you owe $200,000 on your mortgage, and have a car loan for $15,000, your total long-term liabilities would be $215,000.

Net Worth

This is the final part of your personal balance sheet and is calculated by subtracting your total liabilities from your total assets. It represents your financial worth at a particular point in time. If your assets exceed your liabilities, you have a positive net worth. But if your liabilities exceed your assets, you have a negative net worth.

For example, if your total assets (liquid + non-liquid) are $303,500 ($23,500 + $280,000) and your total liabilities (short-term + long-term) are $217,500 ($2,500 + $215,000), then your net worth would be $86,000 ($303,500 – $217,500).

How To Create A Personal Finance Balance Sheet

Creating a personal finance balance sheet is a crucial step towards understanding your financial position. This process can help you figure out where your money is coming from, what it’s being spent on, and how much wealth you are accumulating. Let’s go through it step-by-step:

Step 1: List All of Your Assets

Assets are things you own that have financial value. This includes:

Cash and cash equivalents: This refers to the money in your bank accounts (checking, savings), cash on hand, and other liquid assets that can be quickly converted into cash, like money market funds.

Investments: List your retirement accounts like 401(k) or IRA, stocks, bonds, mutual funds, and other investment assets. For each, write down the current market value.

Real estate: If you own property, list the current market value of each property.

Personal possessions: These could be valuable items such as cars, jewelry, furniture, or electronics. Only include items that can be realistically sold for a significant value.

Business ownership: If you own a percentage of a business, include its value as an asset.

Step 2: List All of Your Liabilities

Liabilities are the debts you owe. This includes:

Credit Card Debt: List each credit card account and its current balance.

Loans: Include your mortgage, car loans, student loans, personal loans, or any other type of loan you might have. Write down the outstanding balance for each.

Other Liabilities: This could be unpaid taxes, unpaid bills, or any other money you owe.

Step 3: Calculate Your Net Worth

Now that you have your assets and liabilities listed, you can calculate your net worth. This is done by subtracting your total liabilities from your total assets. The formula is:

- Net Worth = Total Assets – Total Liabilities

Step 4: Analyze Your Balance Sheet

Now that you have your balance sheet prepared, it’s time to analyze it.

If your net worth is positive, this means that you own more than you owe. This is a good position to be in, and the goal should be to continue growing your net worth over time.

If your net worth is negative, this means you owe more than you own. This is a sign that you need to work on either reducing your liabilities, increasing your assets, or both.

Step 5: Update Regularly

Your personal finance balance sheet is not a static document. Your assets, liabilities, and net worth will change over time as you earn income, spend money, pay off debt, and acquire new assets or liabilities. Therefore, it’s important to update your balance sheet regularly. A good practice is to update it at least once a year, but doing it quarterly or even monthly would provide a more accurate and timely picture of your financial situation.

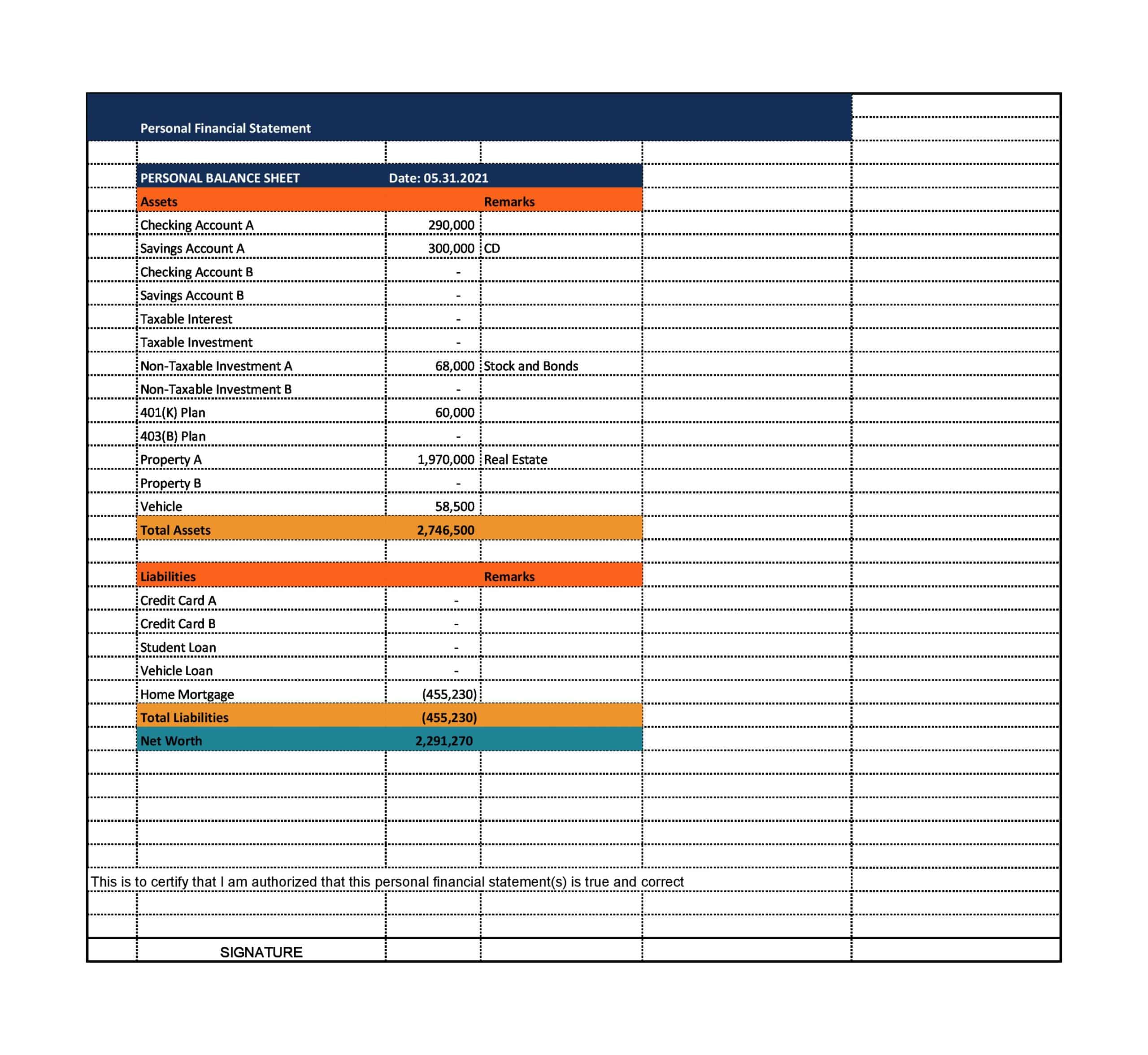

Example of a Personal Balance Sheet

| Assets | Liabilities | ||

| Current Assets | Current Liabilities | ||

| Cash | $5,000 | Credit Card Debt | $2,500 |

| Checking Account | $10,000 | Car Loan | $8,000 |

| Savings Account | $15,000 | ||

| Investments | Long-term Liabilities | ||

| Stocks | $20,000 | Mortgage | $150,000 |

| Bonds | $10,000 | Student Loan | $20,000 |

| Retirement Account (e.g., 401k) | $50,000 | ||

| Personal Property | |||

| Home | $200,000 | ||

| Car | $25,000 | ||

| Other personal items (e.g., jewelry, electronics) | $5,000 | ||

| Total Assets | $340,000 | Total Liabilities | $180,500 |

| Net Worth (Total Assets – Total Liabilities) | $159,500 | ||

FAQs

What does a negative net worth mean on a personal balance sheet?

A negative net worth indicates that your liabilities (debts) exceed your assets (what you own). This could be a signal to reassess your financial strategies and find ways to reduce debt or increase assets.

How often should I update my personal balance sheet?

It’s a good practice to update your personal balance sheet at least once a year, but you may want to do it more frequently, such as quarterly or even monthly, depending on your financial situation and goals.

Can a personal balance sheet help with financial planning?

Absolutely. A personal balance sheet provides a snapshot of your current financial position and can be used as a tool for planning and tracking progress towards financial goals. It can help identify areas where you might need to reduce debt or save more, and track changes in your net worth over time.

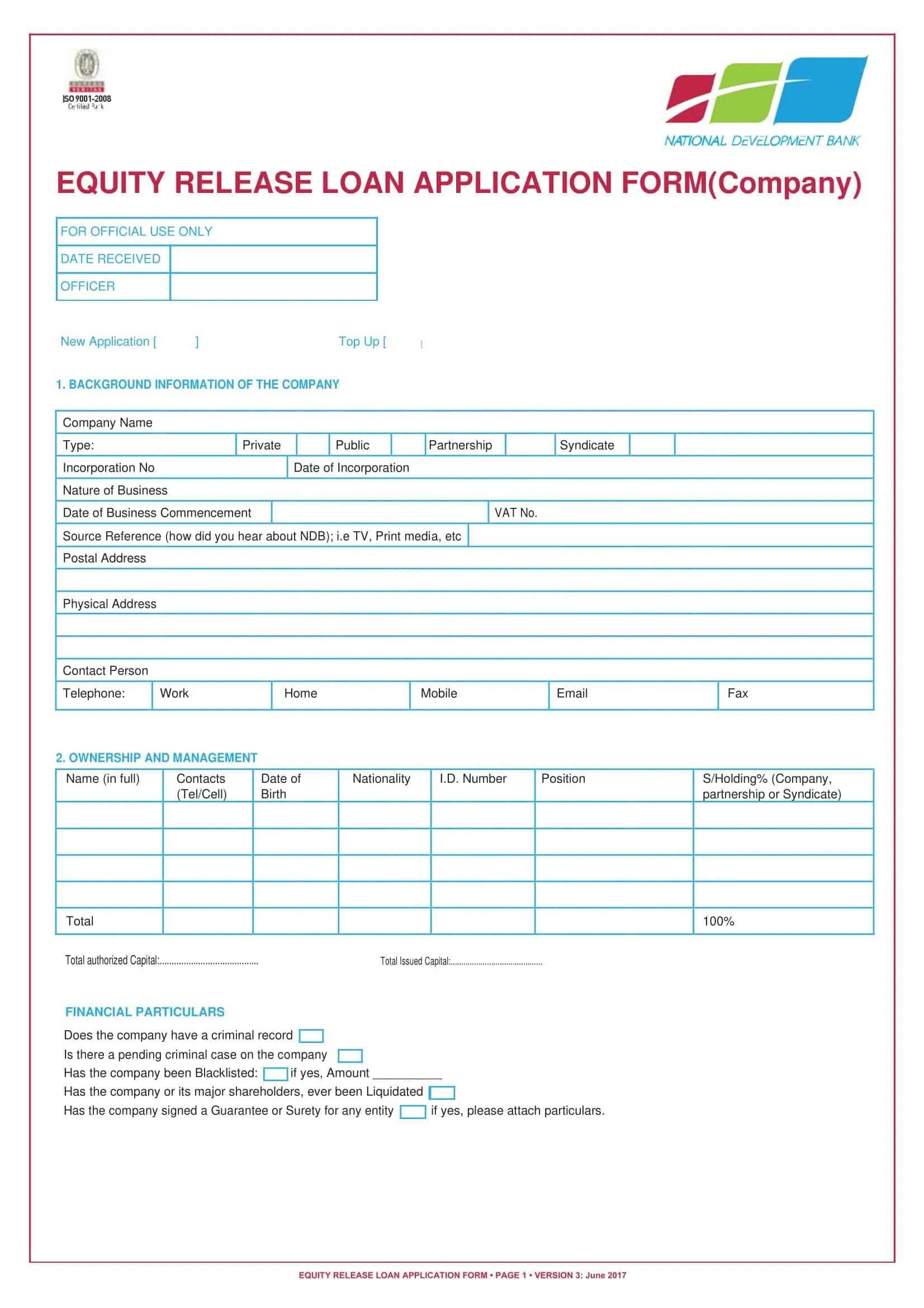

Can a personal balance sheet help me get a loan?

While a personal balance sheet itself might not secure a loan, it can provide a clear picture of your financial situation which could be beneficial when applying for a loan. Lenders often appreciate applicants who have a good understanding of their finances.

What is the difference between tangible and intangible assets?

Tangible assets are physical items of value, such as your home, car, or cash. Intangible assets, on the other hand, are non-physical items of value, such as investments, patents, or intellectual property.

How can a personal balance sheet help me plan for retirement?

A personal balance sheet gives you a clear picture of your current financial situation and can be a useful tool when planning for retirement. It helps you see if you’re on track to meet your retirement goals and what changes might need to be made to your savings or investment strategies.

How do I calculate equity in a personal balance sheet?

Equity is the value of an asset after subtracting any associated liabilities. For example, if you own a house worth $200,000 and you owe $150,000 on the mortgage, your equity in the house is $50,000. In a broader sense, your total equity (or net worth) is calculated by subtracting your total liabilities from your total assets.

What is a contingent liability and should it be included in a personal balance sheet?

A contingent liability is a potential debt that could occur in the future, depending on the outcome of a certain event. It might include potential lawsuits, guarantees, or warranties. In a personal balance sheet, contingent liabilities are usually noted separately since they are not definite.

How does depreciation affect a personal balance sheet?

Depreciation is the loss in value of an asset over time due to wear and tear, age, or obsolescence. It’s most commonly applied to tangible assets like vehicles or electronics. If you track the value of these assets on your personal balance sheet, you’ll need to adjust their value downward over time to account for depreciation.

What are some common mistakes when creating a personal balance sheet?

Common mistakes include forgetting to include some assets or liabilities, overvaluing assets, not updating the balance sheet regularly, and not factoring in depreciation for tangible assets.

Can a personal balance sheet help me improve my credit score?

A personal balance sheet can’t directly improve your credit score, but it can help you better manage your finances. By keeping track of your debts and payments, you can develop a plan to pay off debts on time, which can improve your credit score.

What is the difference between a personal balance sheet and a budget?

A personal balance sheet provides a snapshot of your financial situation at a specific point in time, showing your assets, liabilities, and net worth. A budget, on the other hand, is a plan for how to spend your income over a certain period, tracking incoming money and outgoing expenses. Both are important tools for personal finance management.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)