When it comes to managing personal finances, securing a loan can be an essential step in achieving various life goals, be it purchasing a car, funding a small business, or paying for an emergency expense. However, without a properly structured agreement, this simple process can quickly become a complex ordeal.

This article is here to guide you through the essentials of personal loan templates and agreements, ensuring you have all the knowledge you need to confidently understand the ins and outs of such contracts. We’ll explore the critical elements that these documents should contain and how to use them effectively, helping you safeguard your financial future.

Table of Contents

What is a personal loan?

A personal loan is a type of installment loan provided by financial institutions such as banks, credit unions, and online lenders. The loaned amount is generally unsecured, meaning it does not require collateral like a car or a house. It is “personal” because it can be used for a wide range of personal reasons, unlike other types of loans which are intended for specific purposes, like mortgages for home purchases or auto loans for buying cars.

A personal loan is repaid in regular installments over a set period, typically between one to seven years. The terms of repayment, including the interest rate and the duration of the loan, are defined at the outset in a loan agreement. The borrower (the person taking out the loan) agrees to repay the loan amount (also known as the principal) plus interest, which is the cost of borrowing the money.

Interest rates on personal loans can be either fixed or variable. Fixed rates remain the same throughout the life of the loan, making your payments predictable. Variable rates, on the other hand, can fluctuate according to market conditions, which means the amount you owe each month can change over time.

The amount you can borrow and the interest rate you are offered will depend on various factors, including your credit history, income, employment status, and debt-to-income ratio. Individuals with higher credit scores are usually offered lower interest rates because they are considered less risky to lend to.

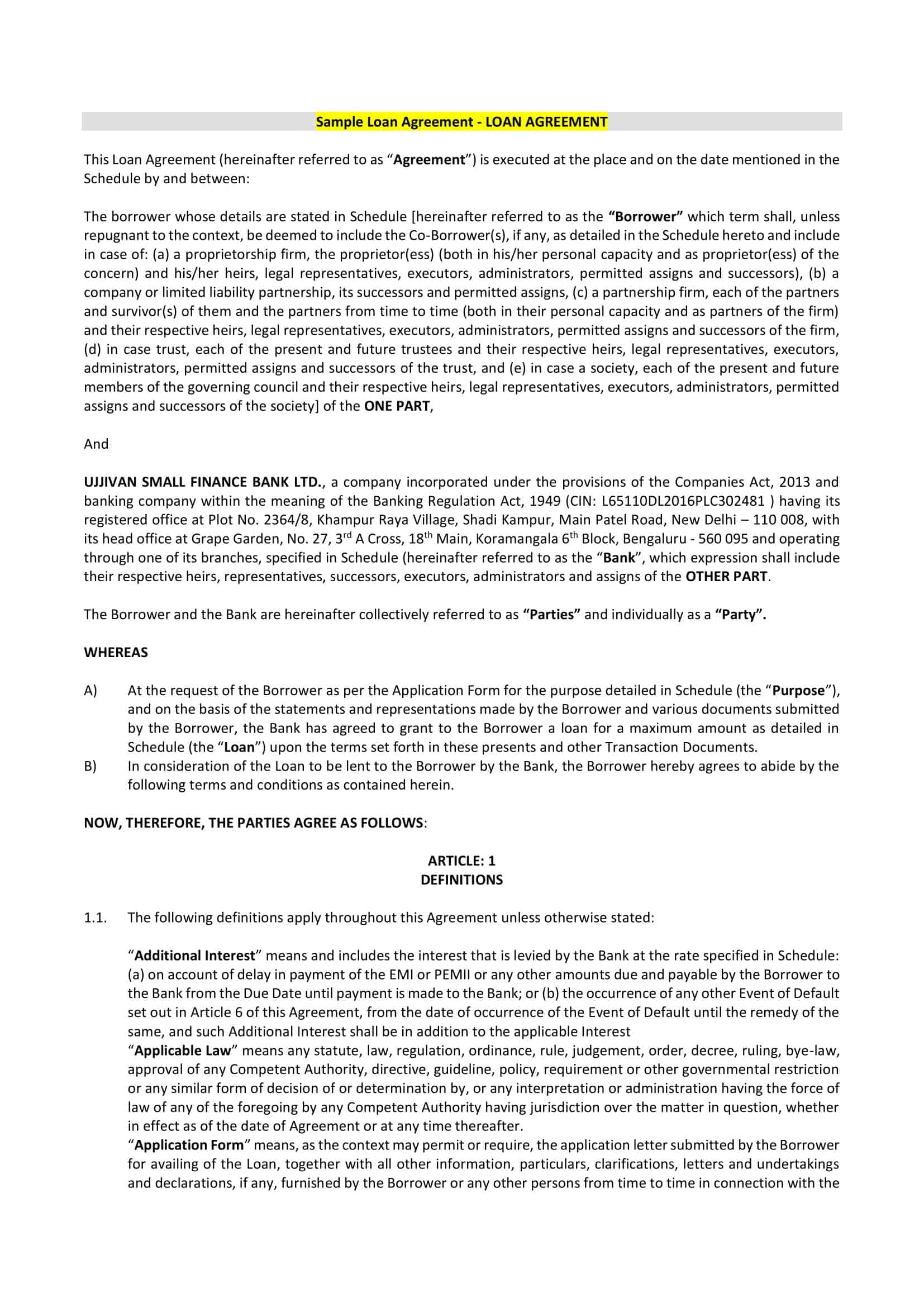

Personal Loan Templates

Personal loans allow people to borrow money for any purpose, whether it’s debt consolidation, home improvements, medical expenses, or other major costs. When applying for a personal loan, it’s important to have the right documents in order. Personal loan templates can make the application process smoother.

Personal loan templates provide a framework that borrowers can use to prepare the necessary paperwork. They include sample forms and agreements that are typically required by lenders. For example, loan application templates allow borrowers to provide details on their income, expenses, assets, debts, and other financial information. Loan agreement templates outline the terms and conditions of the loan in a standard format. Promissory note templates can be used to formalize the borrower’s pledge to repay the loan.

Having personal loan templates makes it easier for borrowers to gather and organize everything needed for a complete application package. The templates serve as checklists to ensure no critical documents are overlooked. They help borrowers submit applications that are clear, accurate and compliant with the lender’s requirements. Overall, personal loan templates help streamline the application process so borrowers can get access to financing faster. They are a valuable resource for anyone considering applying for a personal loan.

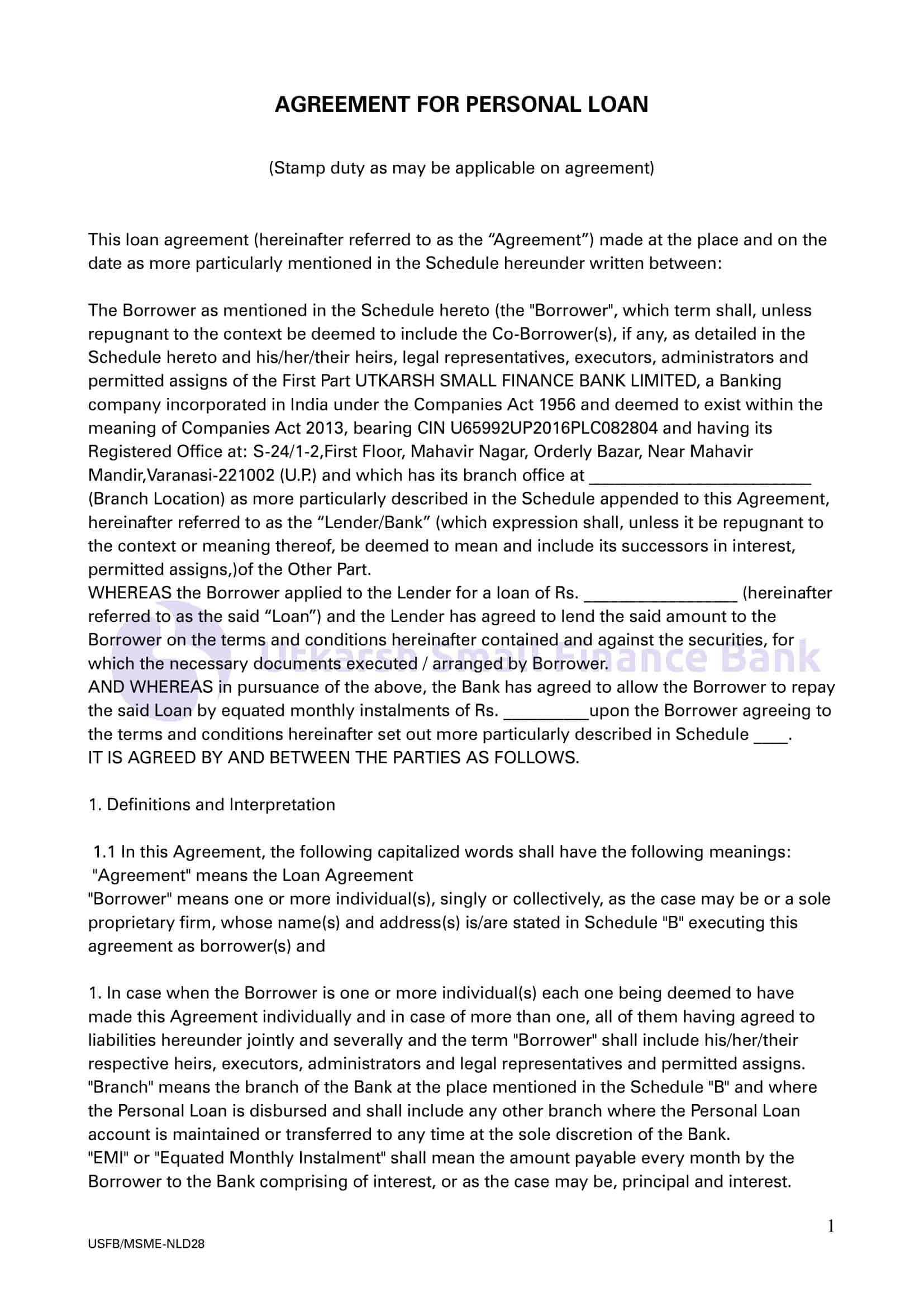

What is a personal loan agreement?

A personal loan agreement is a legally binding contract between a lender and a borrower that outlines the terms and conditions of the personal loan. This document specifies essential details such as the amount of money borrowed (the principal), the interest rate applied, the repayment schedule, any applicable fees, and the term of the loan. It also includes provisions for what happens in case of default, i.e., if the borrower fails to repay the loan as agreed.

This agreement serves to protect both parties, ensuring the borrower understands their obligations and the lender has recourse if the borrower fails to meet those obligations. By signing this agreement, the borrower commits to repay the loan under the specified conditions.

What Are the 3 Main Components of a Personal Loan?

When it comes to understanding personal loans, there are three critical components that shape the nature of these financial agreements. They are the Principal, the Interest Rate, and the Loan Term. Each of these components impacts the total cost of the loan and the repayment strategy. Let’s discuss each of these in detail:

- Principal: The principal refers to the actual amount of money that you borrow from a lender. This is the base amount that you agree to repay, not including any interest or additional fees. When setting the principal amount, lenders consider factors such as your income, credit history, and debt-to-income ratio to determine how much money they’re willing to lend. Over time, as you make payments on your loan, the principal amount decreases. In the early stages of loan repayment, a smaller portion of your payment goes towards reducing the principal, with the larger portion going towards paying off the accrued interest. As time progresses, however, more of your payment goes towards the principal balance, helping you to pay down the actual amount borrowed.

- Interest Rate: The interest rate is the cost of borrowing money and is expressed as a percentage of the principal loan amount. This is essentially the lender’s charge for allowing you to use their money. Interest can be either fixed or variable. A fixed interest rate stays the same throughout the entire loan term, providing predictability in your monthly payments. A variable interest rate, on the other hand, can fluctuate based on market conditions, making your payments less predictable. The interest rate offered to you is primarily determined by your credit score, the lender’s assessment of your ability to repay, and the overall market interest rates at the time of the loan.

- Loan Term: The loan term refers to the agreed-upon period over which you will repay the loan. This is usually stated in months or years. Shorter loan terms typically result in higher monthly payments but less interest paid over the life of the loan because you’re paying off the principal faster. On the other hand, longer loan terms will have lower monthly payments, but you’ll end up paying more in total interest over the life of the loan. The right loan term for you will depend on what you can afford to pay each month and how quickly you want to be out of debt.

What should be in a personal loan contract?

A personal loan contract, often referred to as a personal loan agreement, should contain all the necessary terms and conditions that clearly define the responsibilities of both parties – the lender and the borrower. Here’s a detailed guide to what should be included in a personal loan contract:

- Names and Contact Information: The agreement should include the full names and contact information of both the borrower and the lender. This typically includes addresses, phone numbers, and email addresses.

- Loan Amount (Principal): This section should clearly state the exact amount of money being lent. This is known as the principal amount.

- Interest Rate: The agreement should specify the annual percentage rate (APR), which is the yearly cost of the loan, including interest and any fees. It should also state whether the interest rate is fixed (remains the same for the duration of the loan) or variable (may change over time).

- Repayment Schedule: The contract must lay out the repayment schedule, specifying whether payments are to be made weekly, biweekly, or monthly. It should also include the amount of each payment and the number of payments required to fully repay the loan.

- Loan Term: This is the period over which the loan is to be repaid and should be clearly stated. It could be expressed in months or years.

- Fees and Penalties: The agreement should outline any fees associated with the loan, such as origination fees or late payment penalties. It should also state any consequences for failing to make payments on time or defaulting on the loan.

- Prepayment: If the borrower decides to pay off the loan before the end of the term, some lenders charge a prepayment penalty. This should be stated clearly in the agreement if applicable.

- Default Terms: The contract should specify what constitutes a default on the loan, what happens in the event of a default, and the rights of each party in such a circumstance.

- Dispute Resolution: The agreement should also have a clause outlining how disputes relating to the loan will be resolved. This might involve arbitration or court proceedings.

- Signatures: Finally, both the borrower and the lender must sign and date the agreement. In some cases, the contract may also need to be notarized.

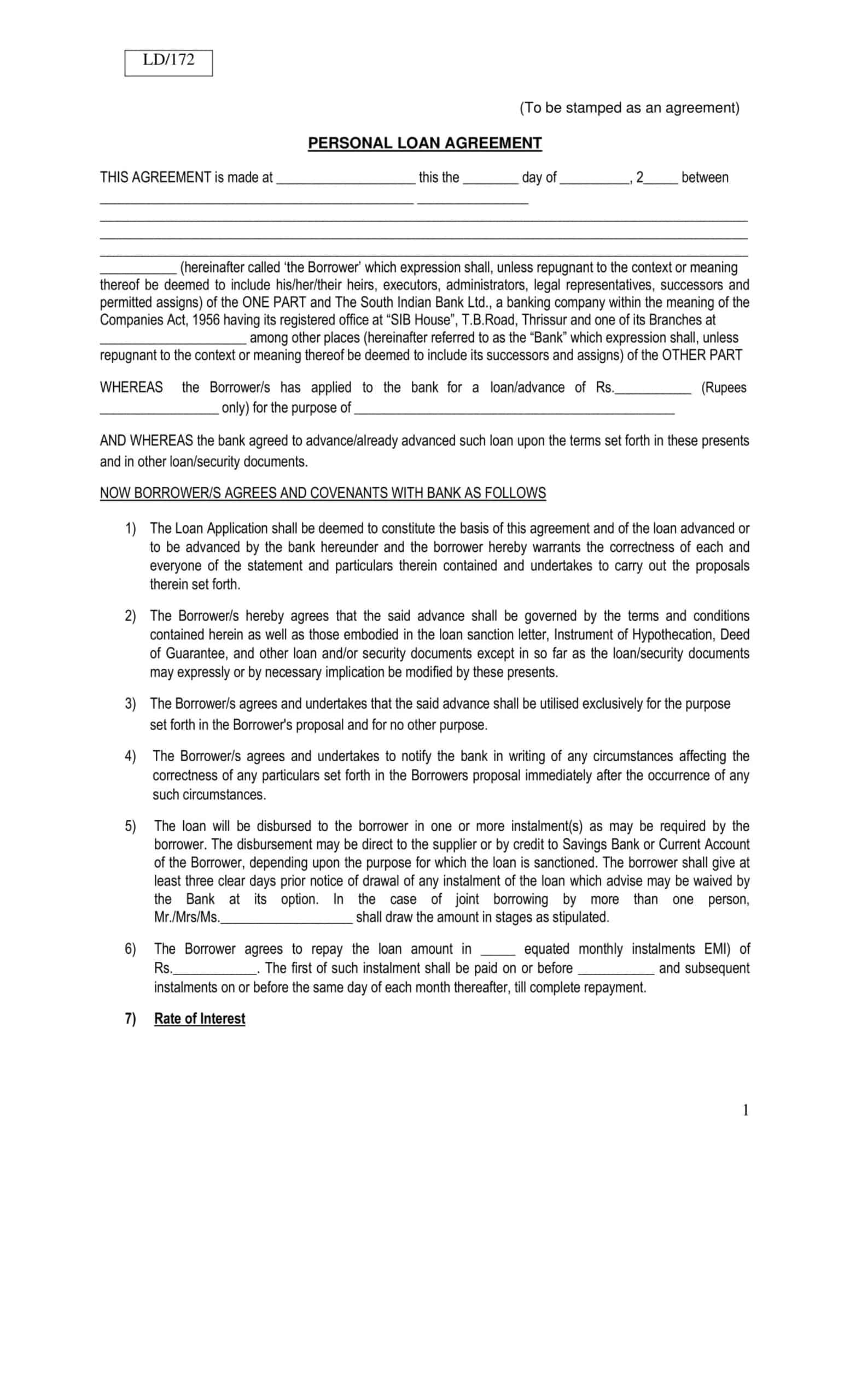

How do you write a personal loan agreement?

Writing a personal loan agreement is a careful process that requires attention to detail and a clear understanding of the terms being agreed upon. Here’s a step-by-step guide to writing one:

Step 1: Title and Introduction: Start by creating a title for the document, such as “Personal Loan Agreement.” Below that, include an introductory statement specifying the parties involved (the lender and borrower), the date, and the purpose of the loan.

Step 2: Define the Parties: Clearly identify both parties involved. Include their legal names, addresses, and contact information. Typically, you’ll refer to them as the “Lender” and the “Borrower” throughout the agreement.

Step 3: Loan Amount and Use: Specify the amount of money being lent (the principal) and the purpose of the loan. Make it clear that the borrower is obligated to use the loan only for the stated purpose.

Step 4: Interest Rate: State the interest rate for the loan, specifying whether it’s fixed or variable. If it’s variable, define how and when it can change.

Step 5: Repayment Terms: Detail the repayment schedule, including the start date, the frequency of payments (weekly, biweekly, monthly), the amount of each payment, and the date by which the loan should be fully repaid.

Step 6: Fees and Penalties: List any fees or charges associated with the loan. Detail the penalties for late payments, missed payments, or defaulting on the loan.

Step 7: Default Terms: Clearly define what constitutes a default, what happens in such a case, and the rights of each party.

Step 8: Prepayment Clause: Indicate whether there’s an option for prepayment (paying off the loan before the agreed end date), and if so, whether there will be any prepayment penalties.

Step 9: Dispute Resolution: Include a clause specifying the method for resolving any disputes related to the loan agreement, such as mediation or arbitration.

Step 10: Governing Law: State the legal jurisdiction that governs the agreement. This is typically where the lender is located or where the agreement is signed.

Step 11: Signatures: At the end of the agreement, include spaces for the date and the signatures of both parties. This signifies that both parties agree to the terms and makes the contract legally binding.

Where to Get a Personal Loan

Choosing where to get a personal loan involves comparing various lenders to find the one that best fits your needs. Interest rates, loan amounts, terms, fees, and the lender’s customer service should all factor into your decision. Here’s a detailed guide to ten companies that offer personal loans as of my last knowledge update in September 2021:

- SoFi: SoFi, or Social Finance, offers unsecured personal loans that range from $5,000 to $100,000. They have competitive interest rates and offer both fixed and variable rates. They don’t charge origination fees or prepayment penalties.

- LightStream: A division of Truist Bank, LightStream offers personal loans from $5,000 to $100,000. They offer competitive rates and have a “Rate Beat” program where they promise to beat any rate a competitor offers by 0.10 percentage points. They also don’t charge any fees.

- Marcus by Goldman Sachs: Marcus offers unsecured personal loans from $3,500 to $40,000. They have no fees and offer flexible loan terms to suit your repayment preferences.

- Discover: Discover offers personal loans ranging from $2,500 to $35,000. They offer fixed rates and do not charge origination fees.

- Payoff: Payoff specializes in loans to help consumers pay off high-interest credit card debt. Their loans range from $5,000 to $35,000. They offer fixed rates and flexible repayment terms.

- Upstart: Upstart uses artificial intelligence to assess loan applications, taking into account more than just your credit score. Their loans range from $1,000 to $50,000. They do charge origination fees.

- LendingClub: LendingClub is a peer-to-peer lending platform where investors fund your loan. They offer personal loans up to $40,000. They do charge an origination fee.

- Prosper: Prosper is another peer-to-peer lender offering loans from $2,000 to $40,000. They offer fixed rates but do charge origination fees.

- Best Egg: Best Egg offers personal loans from $2,000 to $35,000 for a variety of purposes. They offer competitive rates but do charge origination fees.

- Avant: Avant caters to borrowers with less-than-perfect credit, offering loans ranging from $2,000 to $35,000. They do charge an administration fee.

Conclusion

In conclusion, a personal loan agreement is a critical instrument that safeguards the interests of both the lender and borrower. It outlines the terms and conditions of the loan, providing a clear framework for the loan amount, interest rate, repayment schedule, and any associated penalties or fees.

While personal loans can be an excellent resource in financial crunch times, it’s crucial for borrowers to read and fully understand the loan agreement before signing. This ensures they are aware of their obligations and can confidently repay the loan within the specified term. Proper diligence and attention to the details of a personal loan agreement can contribute to responsible financial management and a smooth borrowing experience.

FAQs

Can I use a personal loan template for creating an agreement?

Yes, you can use a personal loan template as a starting point for creating your own agreement. A template provides a framework that you can customize according to your specific needs. However, it is essential to review and modify the template to ensure it complies with your local laws and regulations and accurately reflects the terms of your loan.

Do I need a lawyer to create a personal loan agreement?

While it is not always necessary to involve a lawyer, it can be beneficial, especially for complex loan agreements or if you have any specific legal concerns. A lawyer can review the agreement, offer guidance, and ensure that it complies with all applicable laws. If you’re unsure about any aspect of the agreement or want to safeguard your interests, consulting with a lawyer is recommended.

Can a personal loan agreement be modified after it is signed?

Generally, both parties must agree to any modifications or amendments to a personal loan agreement. It is important to document any changes in writing and have both parties sign the updated agreement. This helps avoid misunderstandings and provides a clear record of the revised terms.

What should I do if I can’t repay my personal loan as per the agreement?

If you find yourself unable to repay your personal loan according to the agreed-upon terms, it is crucial to communicate with your lender promptly. Inform them about your situation and try to negotiate an alternative repayment plan. In some cases, lenders may be willing to offer temporary relief, such as a grace period or revised payment schedule. Ignoring the issue or defaulting on the loan without communication can lead to further complications and potentially damage your credit rating.

Is a personal loan agreement enforceable in court?

Yes, a properly drafted and executed personal loan agreement is generally enforceable in court. However, the enforceability may vary depending on local laws and regulations. It’s important to ensure that the agreement complies with all legal requirements and that both parties have willingly entered into the contract for it to be enforceable.

Can I use a personal loan agreement for lending money to friends or family?

Yes, a personal loan agreement can be used for lending money to friends or family members. In fact, it is highly recommended to use a written agreement in such situations to avoid misunderstandings and maintain healthy relationships. It provides clarity on the terms of the loan and helps manage expectations for both parties involved.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)