A financial plan is a crucial tool for anyone looking to manage their financial resources effectively. Whether for personal or business purposes, a financial plan template allows you to easily create a plan that outlines your financial goals and how to achieve them.

By setting a budget and tracking your expenses, you can ensure that you are staying on track to meet your financial objectives. With a financial plan, you can make informed decisions about your spending and investments, and ensure that you are making the most of your financial resources.

Table of Contents

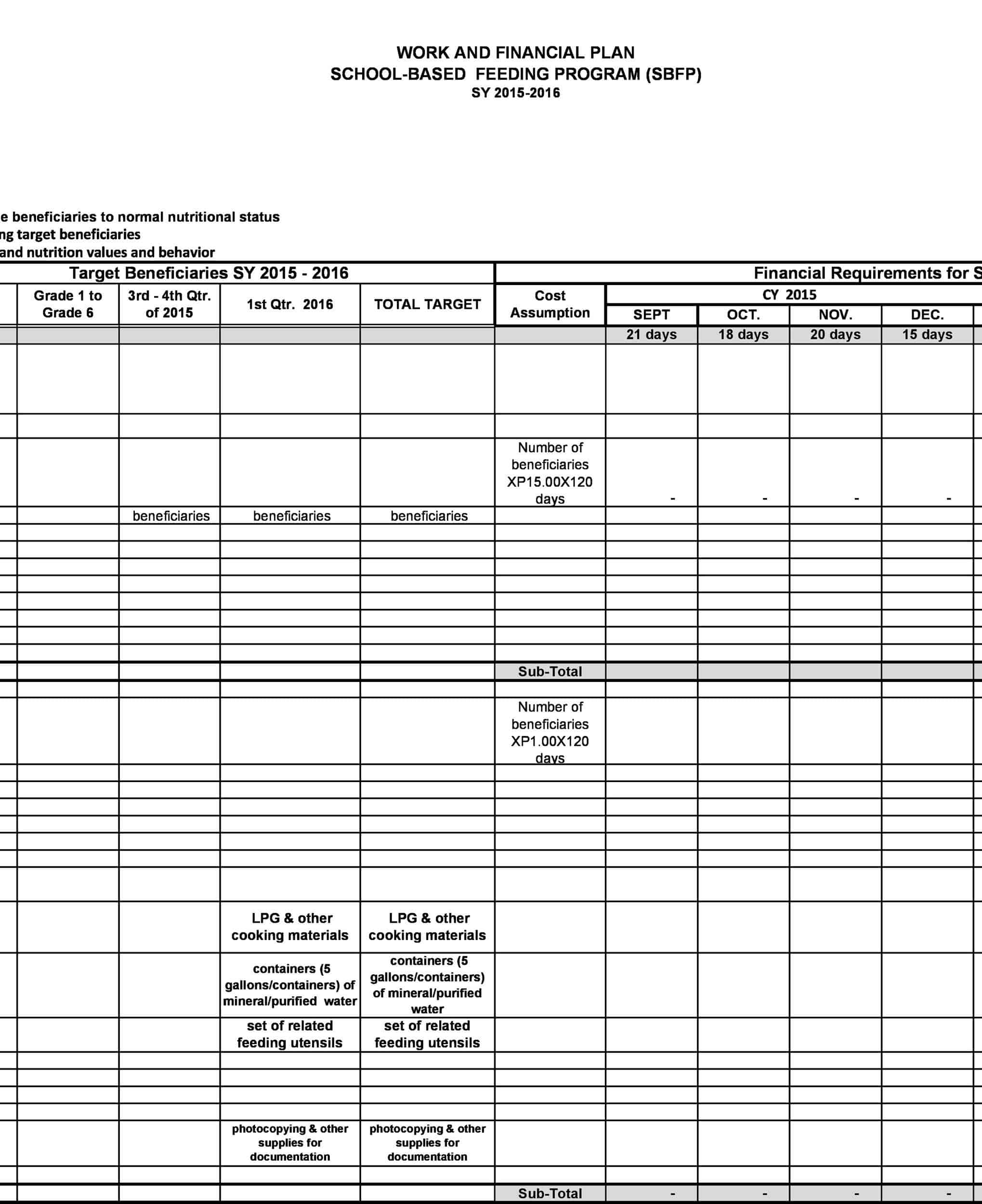

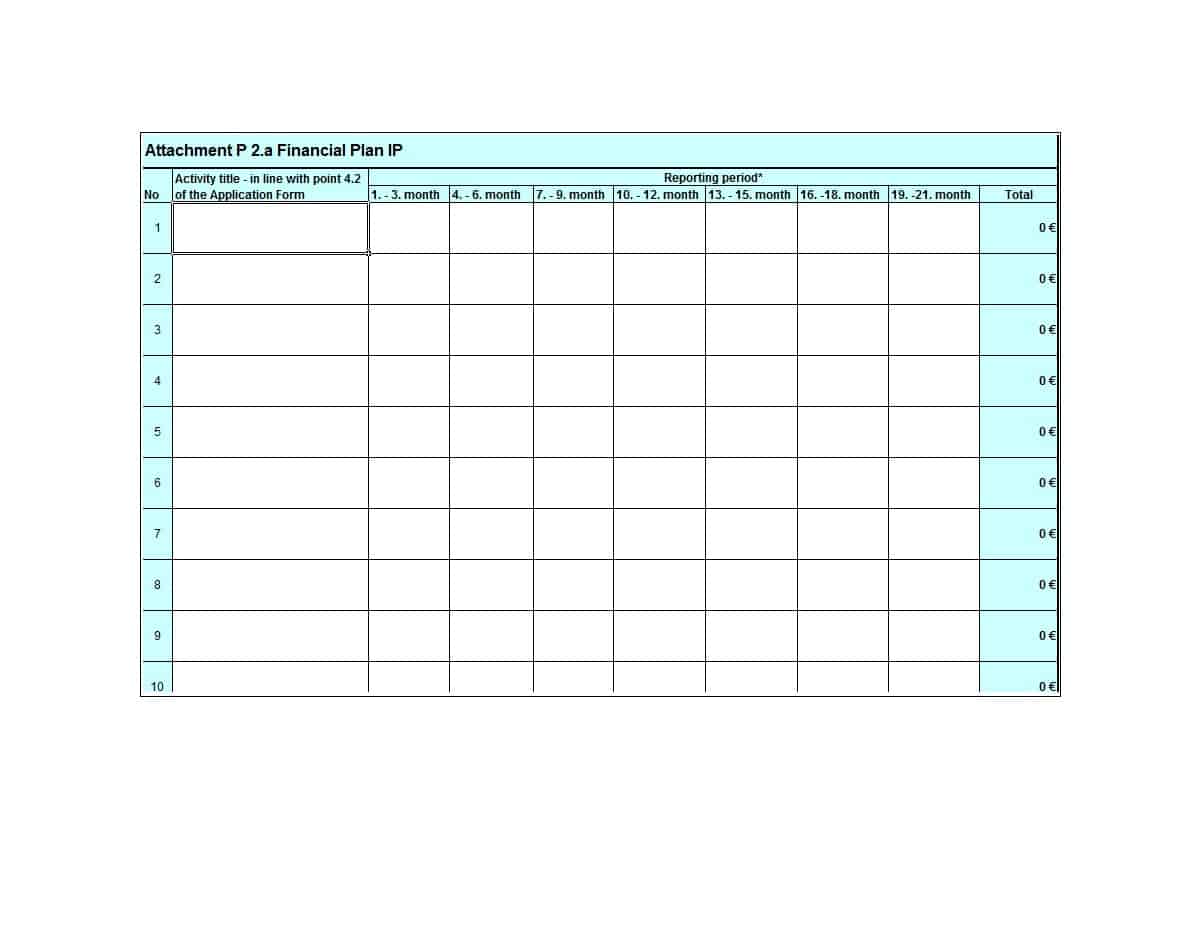

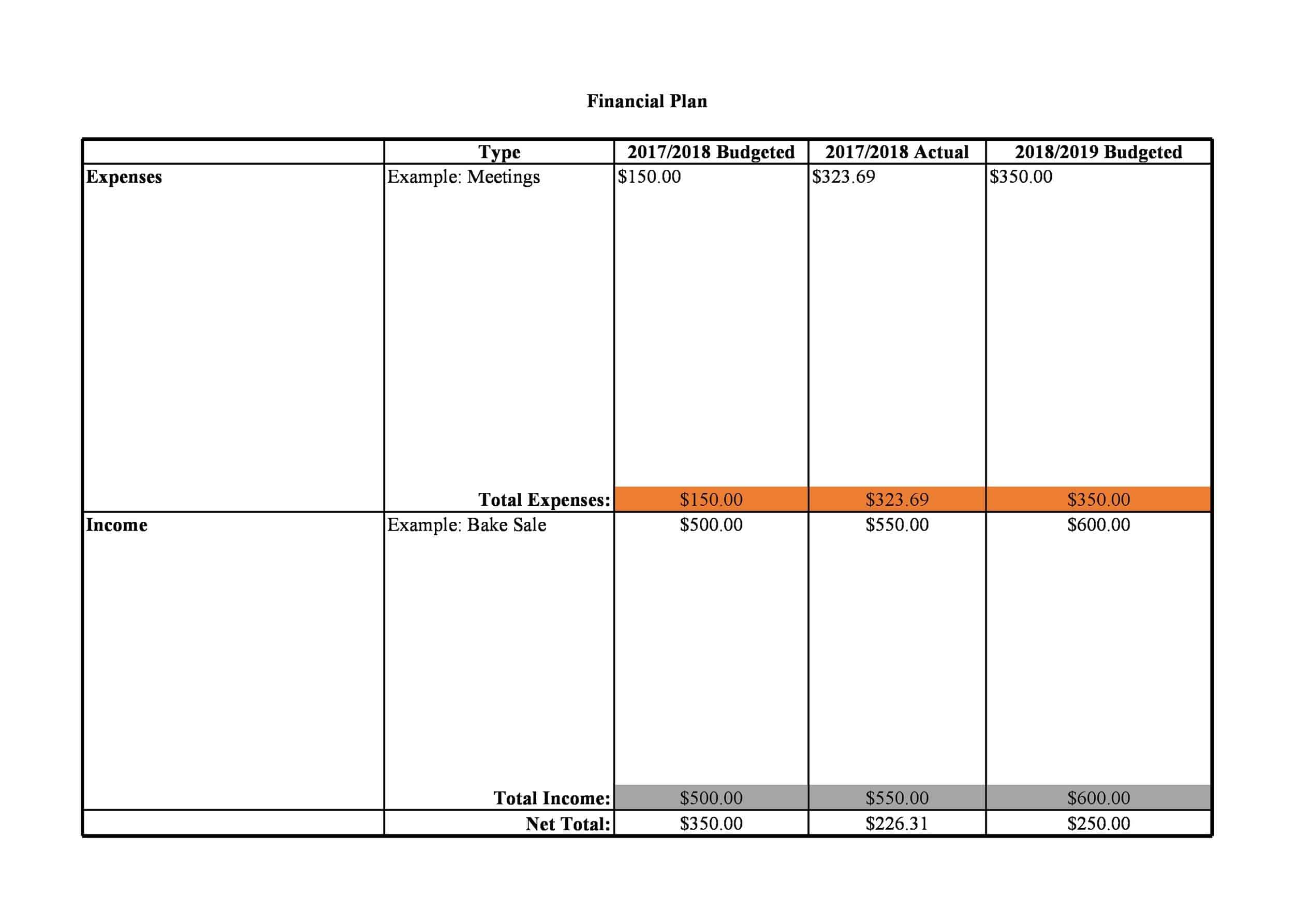

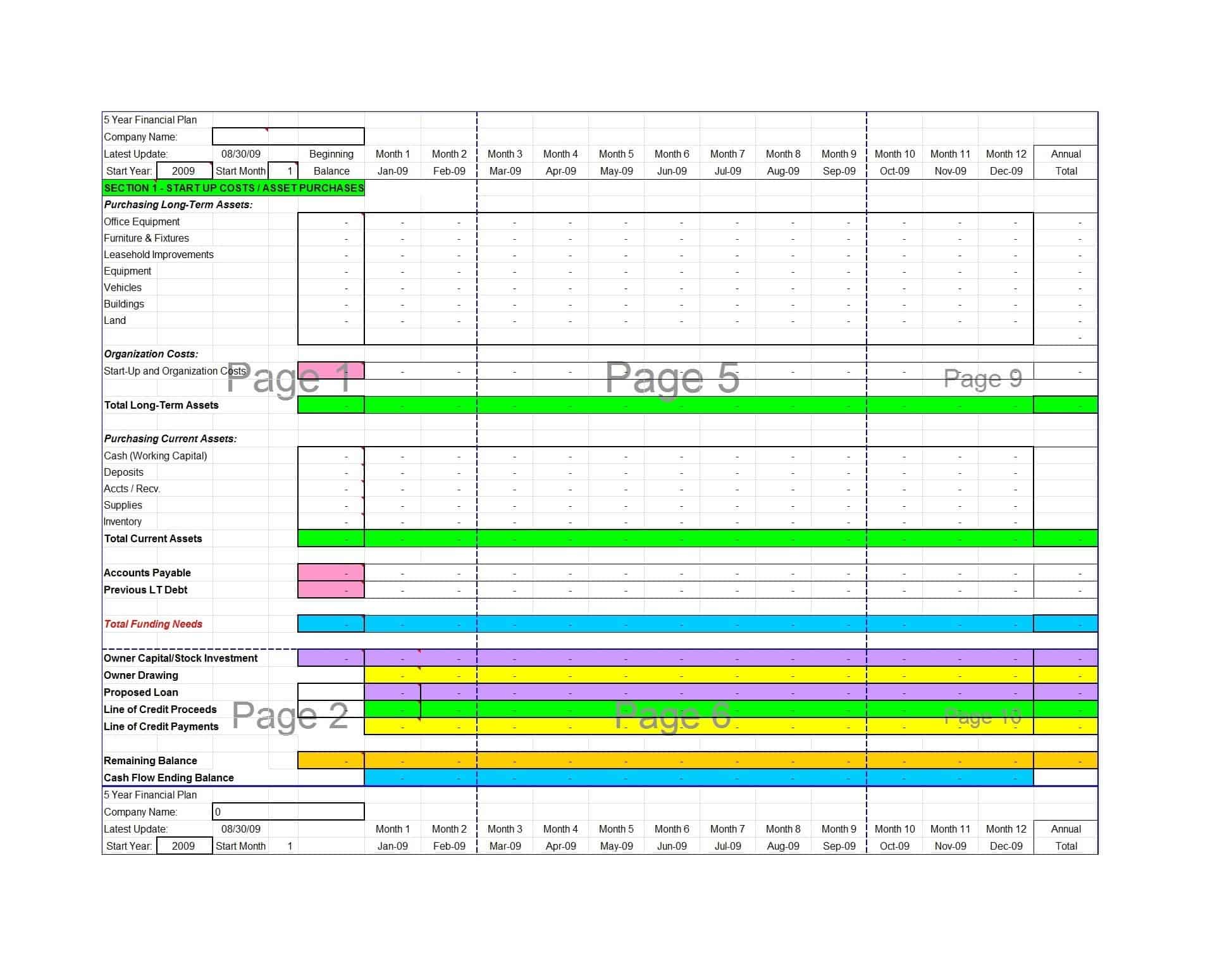

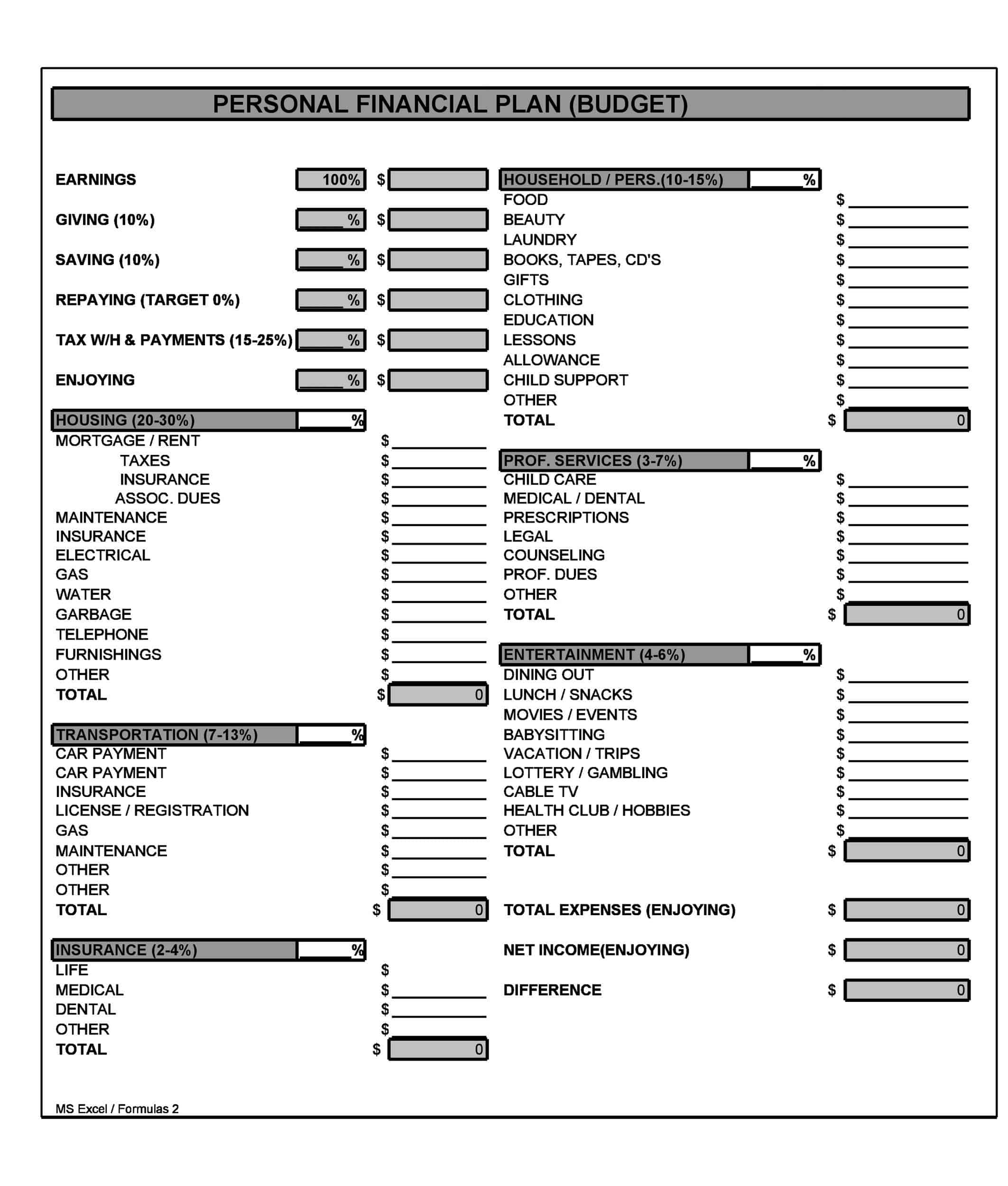

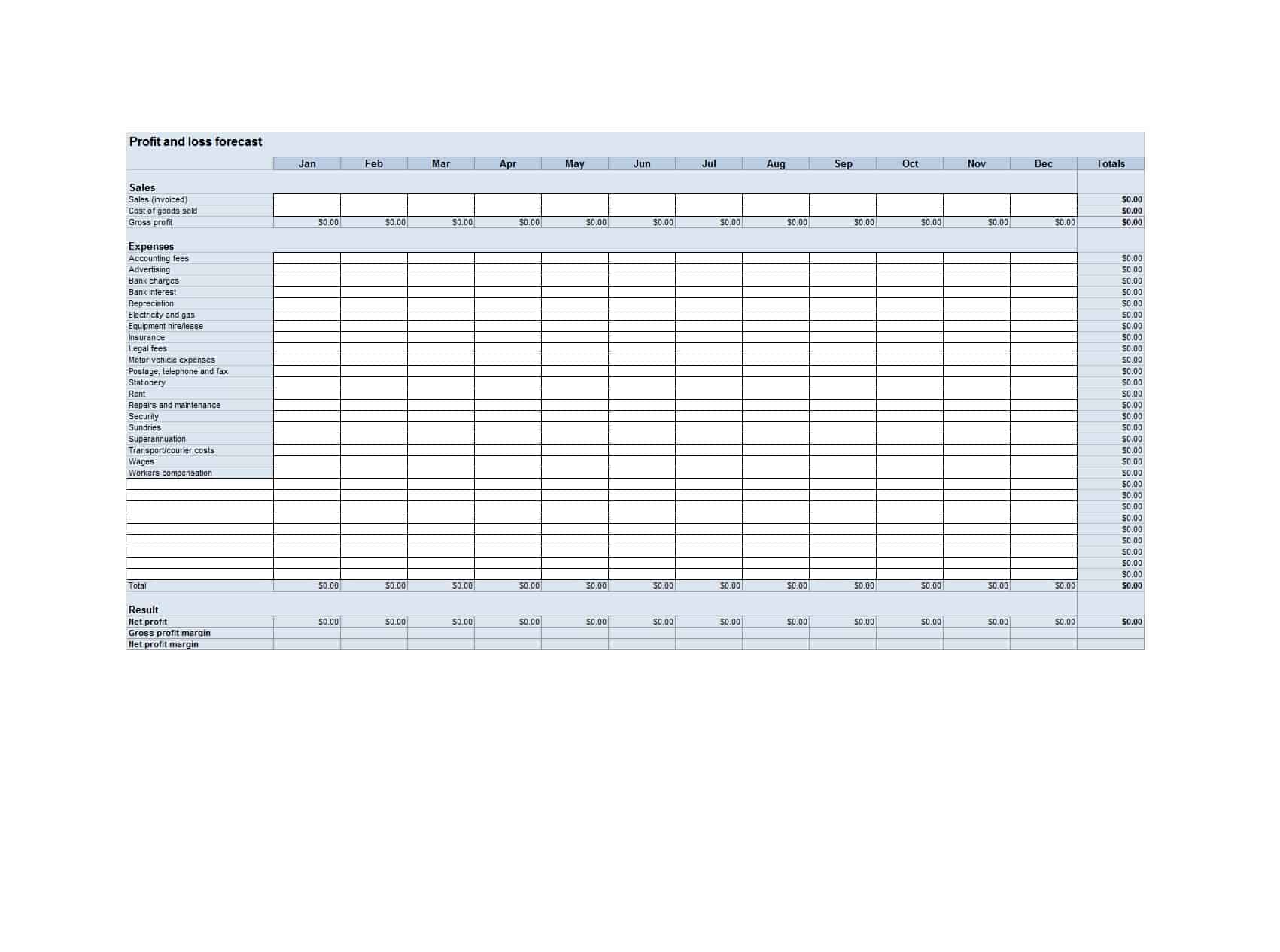

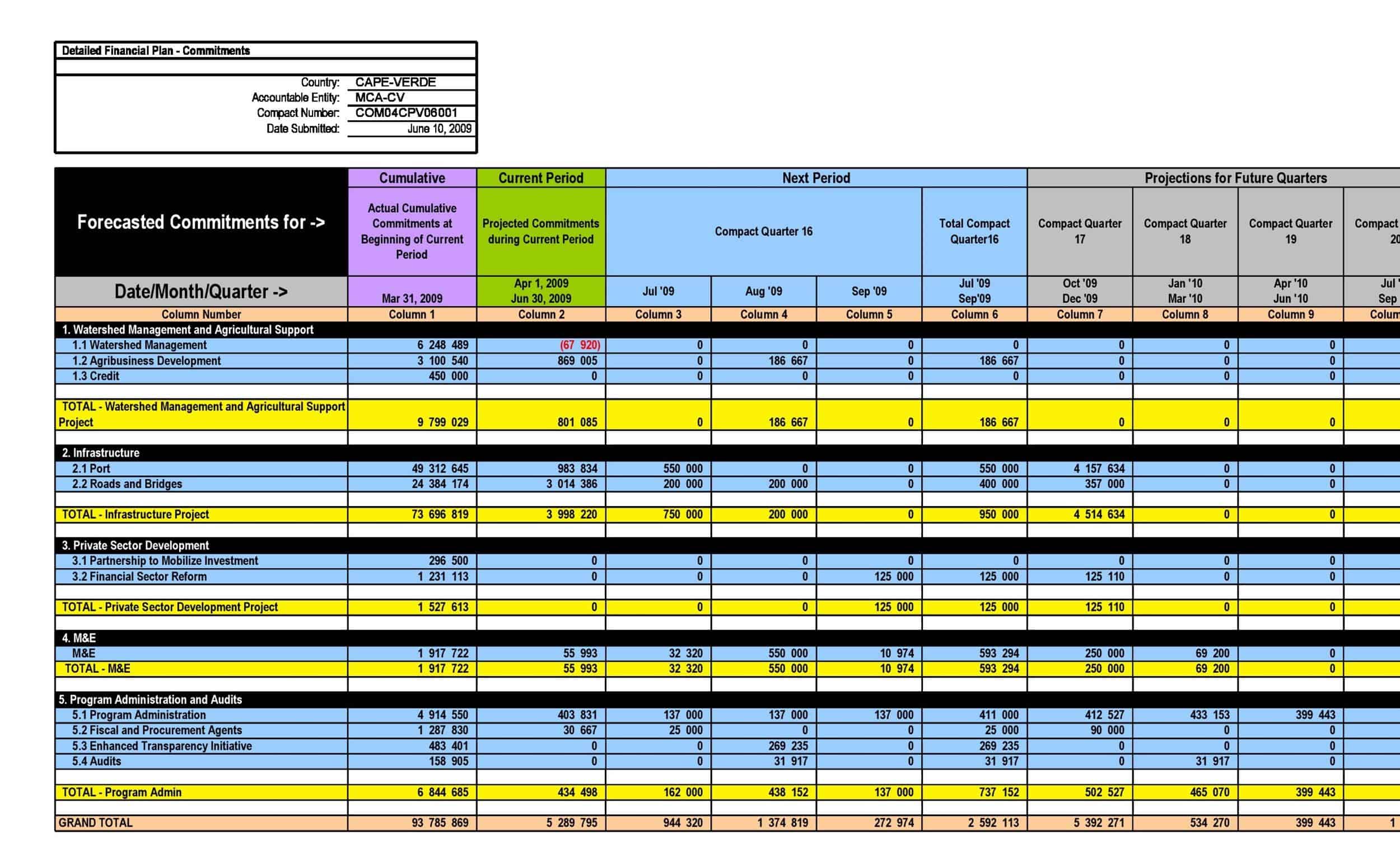

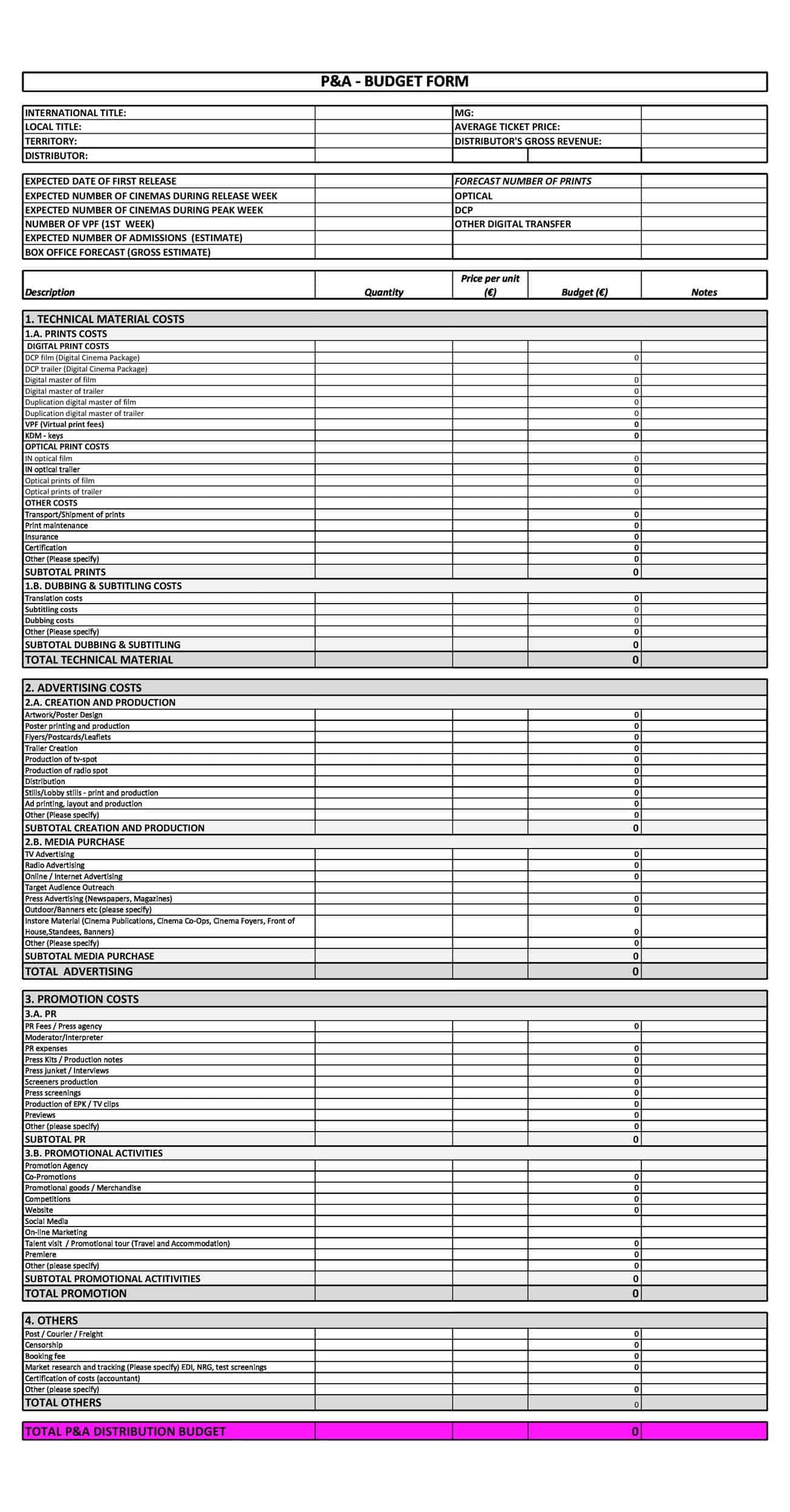

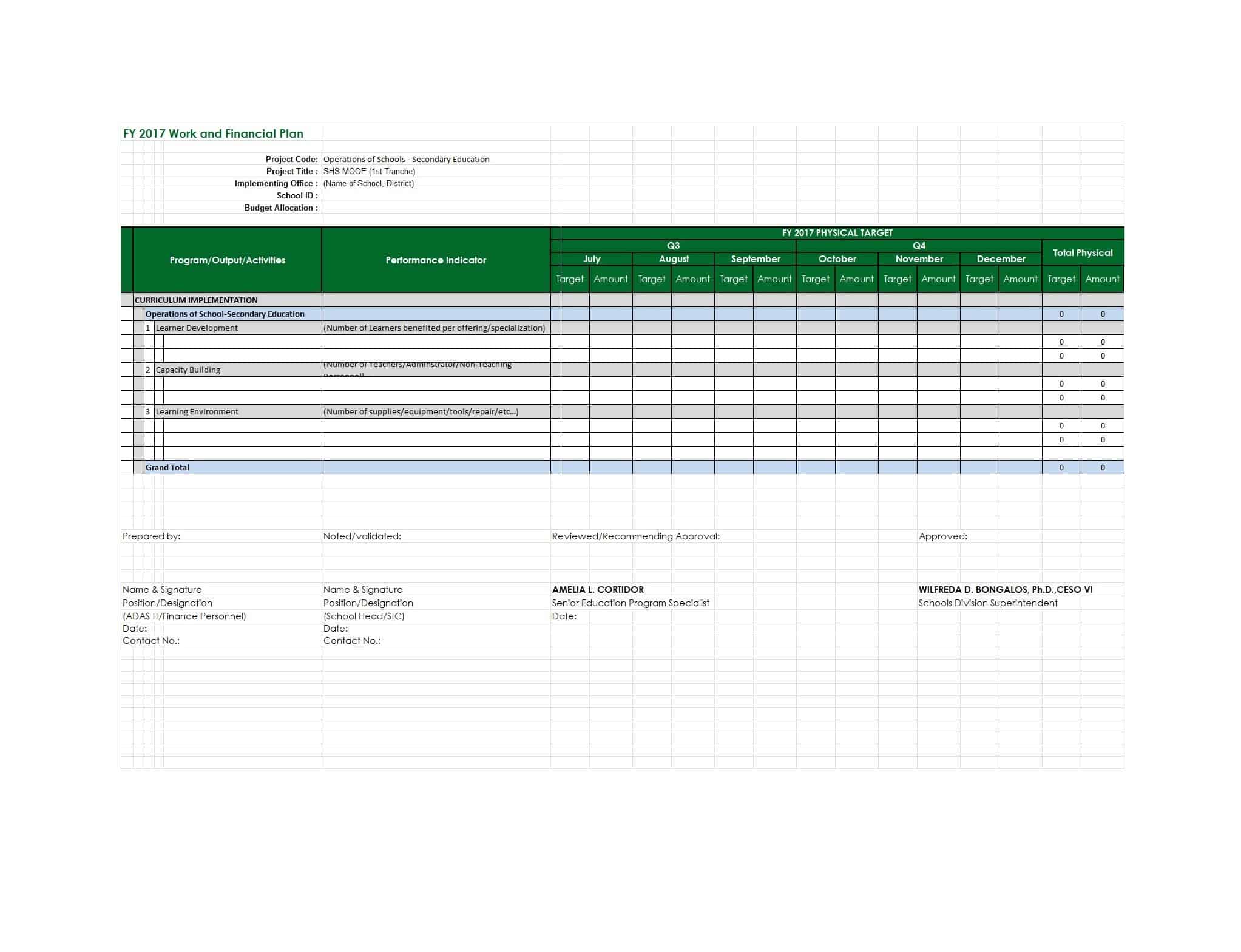

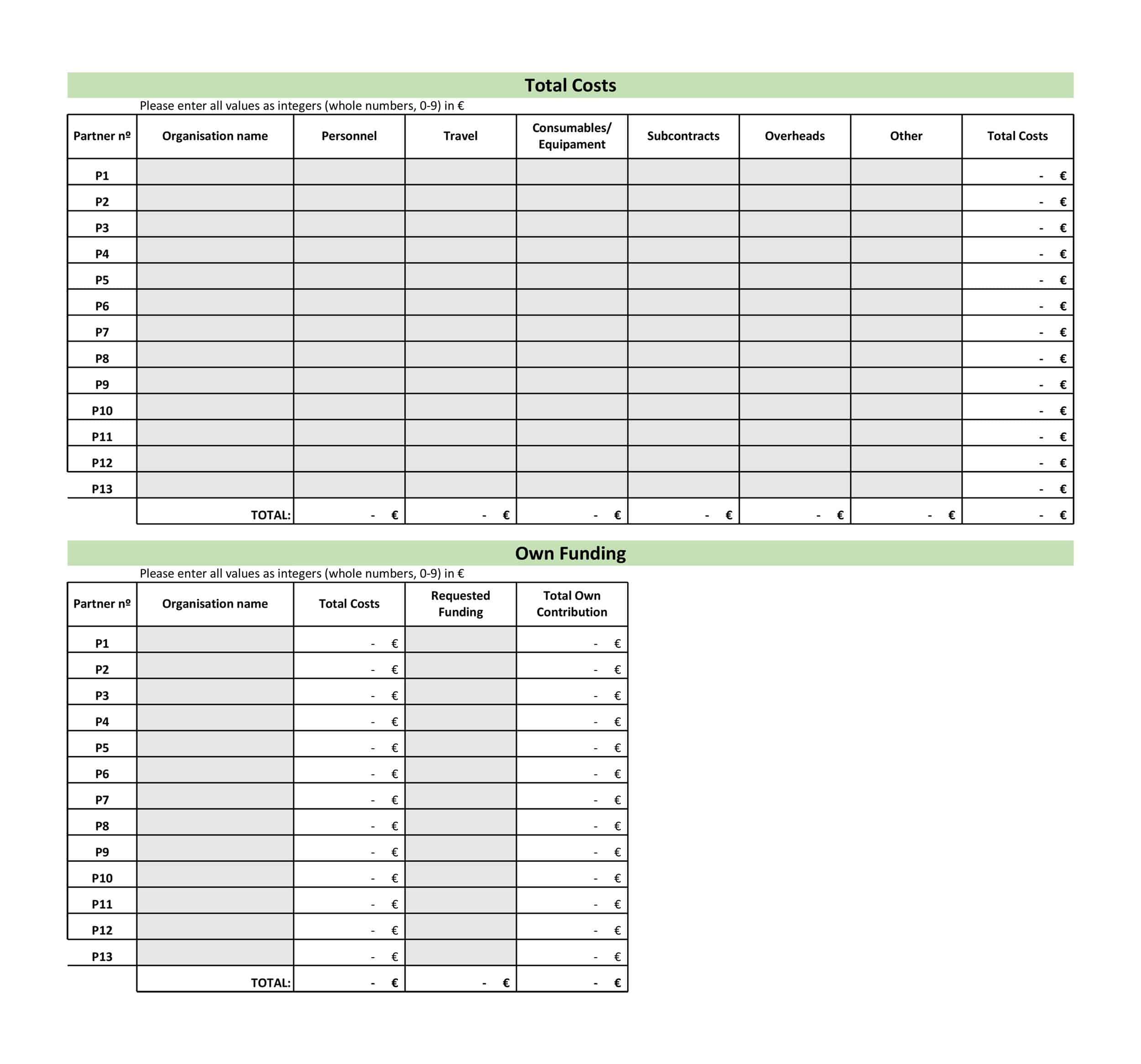

Financial Plan Templates

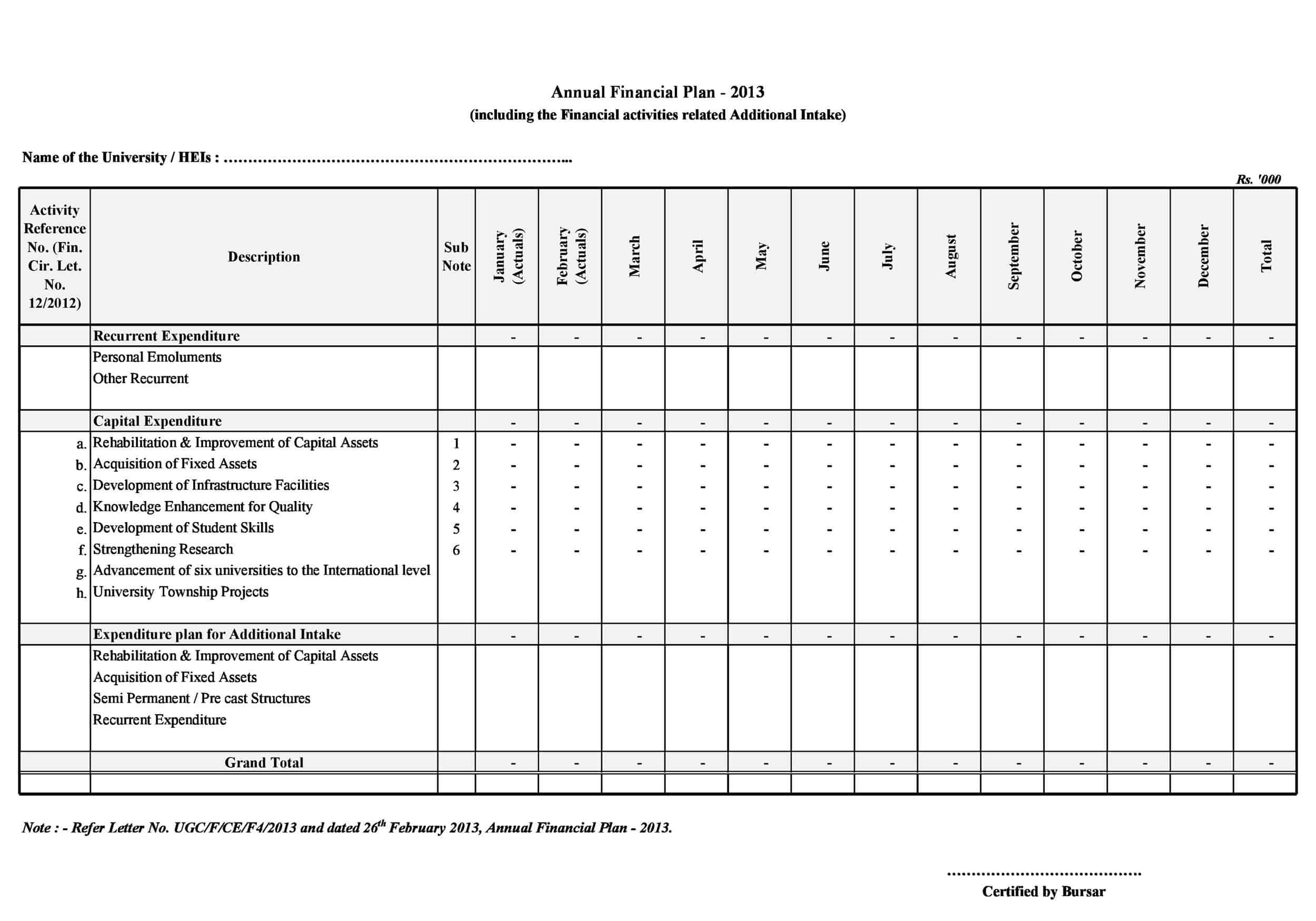

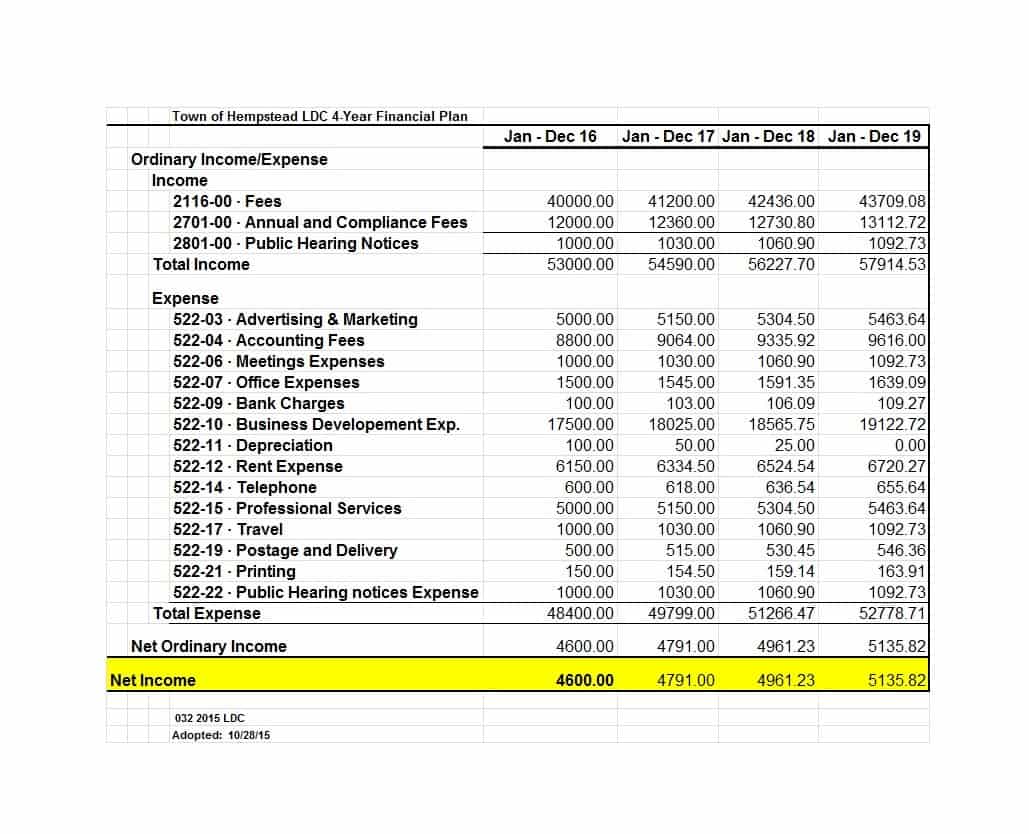

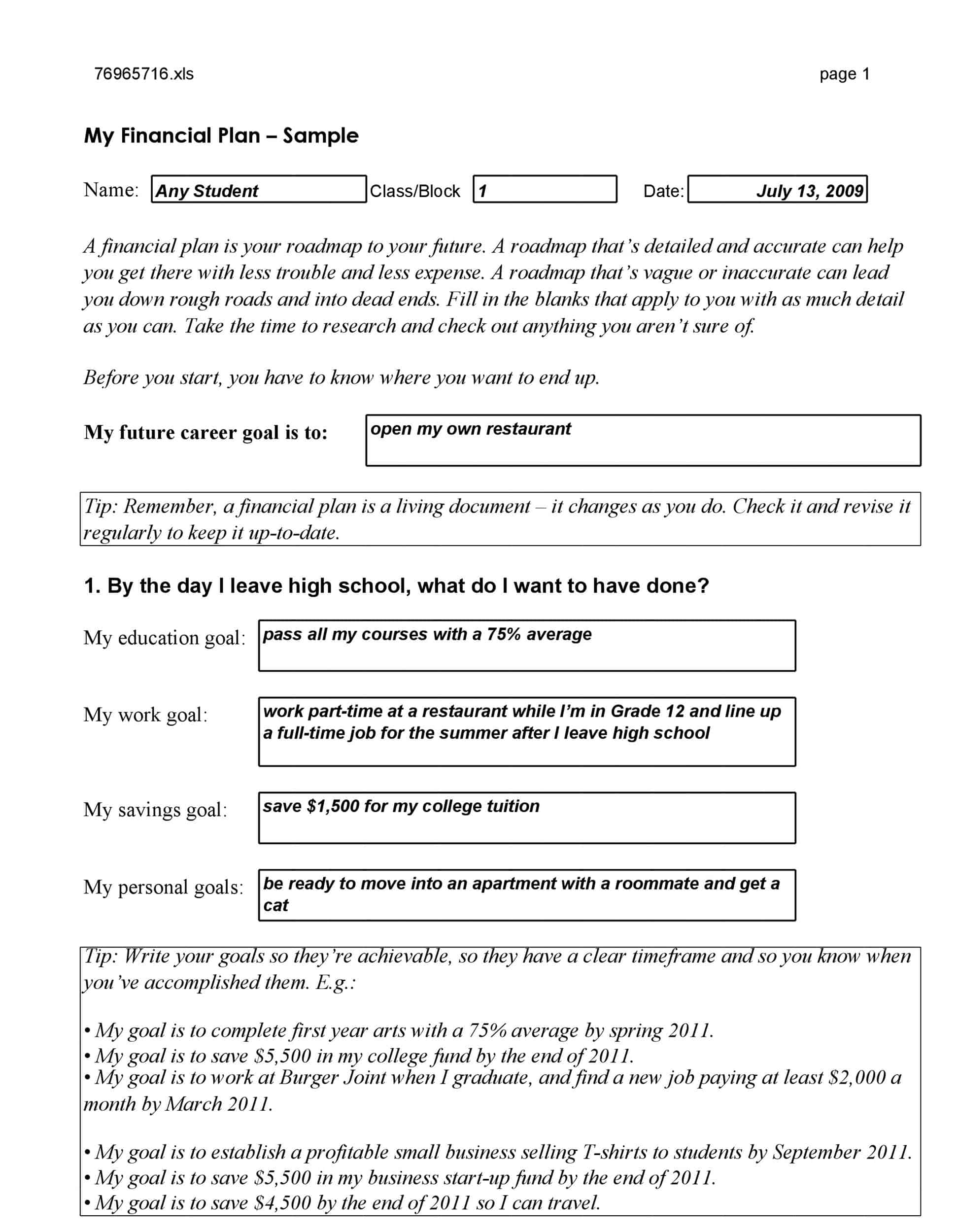

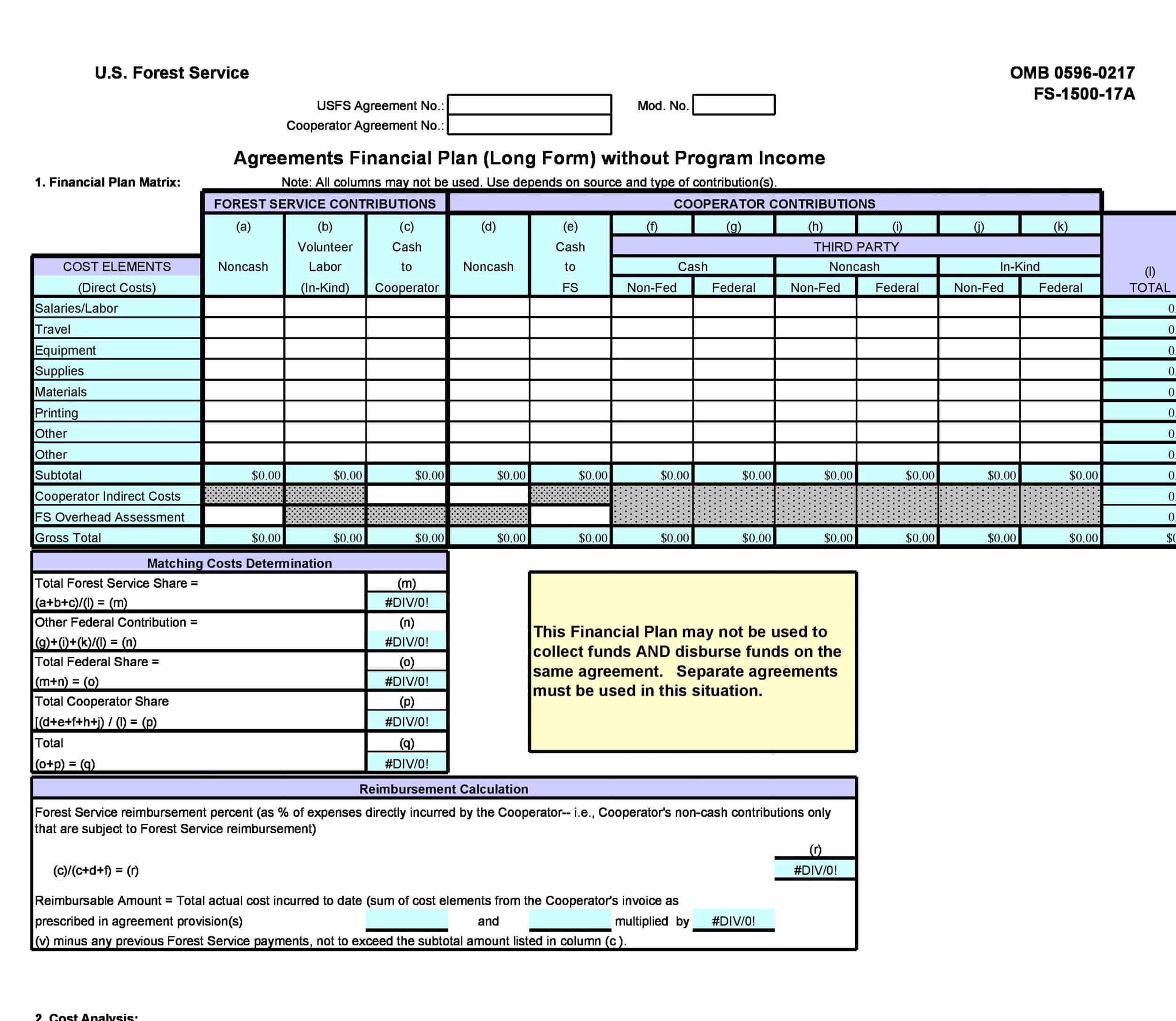

A Financial Plan Template is a comprehensive document that outlines an individual’s or organization’s financial goals, strategies, and projections. It serves as a roadmap for managing and achieving financial objectives, whether they are related to personal finances, business finances, investments, or retirement planning. Financial Plan Templates provide a structured framework for analyzing current financial situations, setting financial goals, and creating actionable plans to attain those goals.

Financial Plan Templates provide individuals and organizations with a structured approach to managing their finances and achieving their financial goals. By using these templates, individuals can gain clarity about their financial situation, set meaningful objectives, and develop actionable strategies to reach those objectives. Financial Plan Templates promote financial discipline, informed decision-making, and proactive financial management. They are valuable tools for individuals, families, businesses, and financial professionals seeking to create a comprehensive and organized approach to managing their financial well-being.

What Is a Financial Plan?

A financial plan is a detailed plan that outlines how you will manage your financial resources in order to achieve your financial goals. It typically includes an assessment of your current financial situation, as well as a plan for the future.

A financial plan may include budgeting, saving and investing, and risk management strategies. It can be created for personal or business purposes, and may be created by an individual or a team of financial professionals. The goal of a financial plan is to provide a roadmap for managing your financial resources in a way that allows you to achieve your financial goals and objectives.

Components of a Perfect Financial Plan

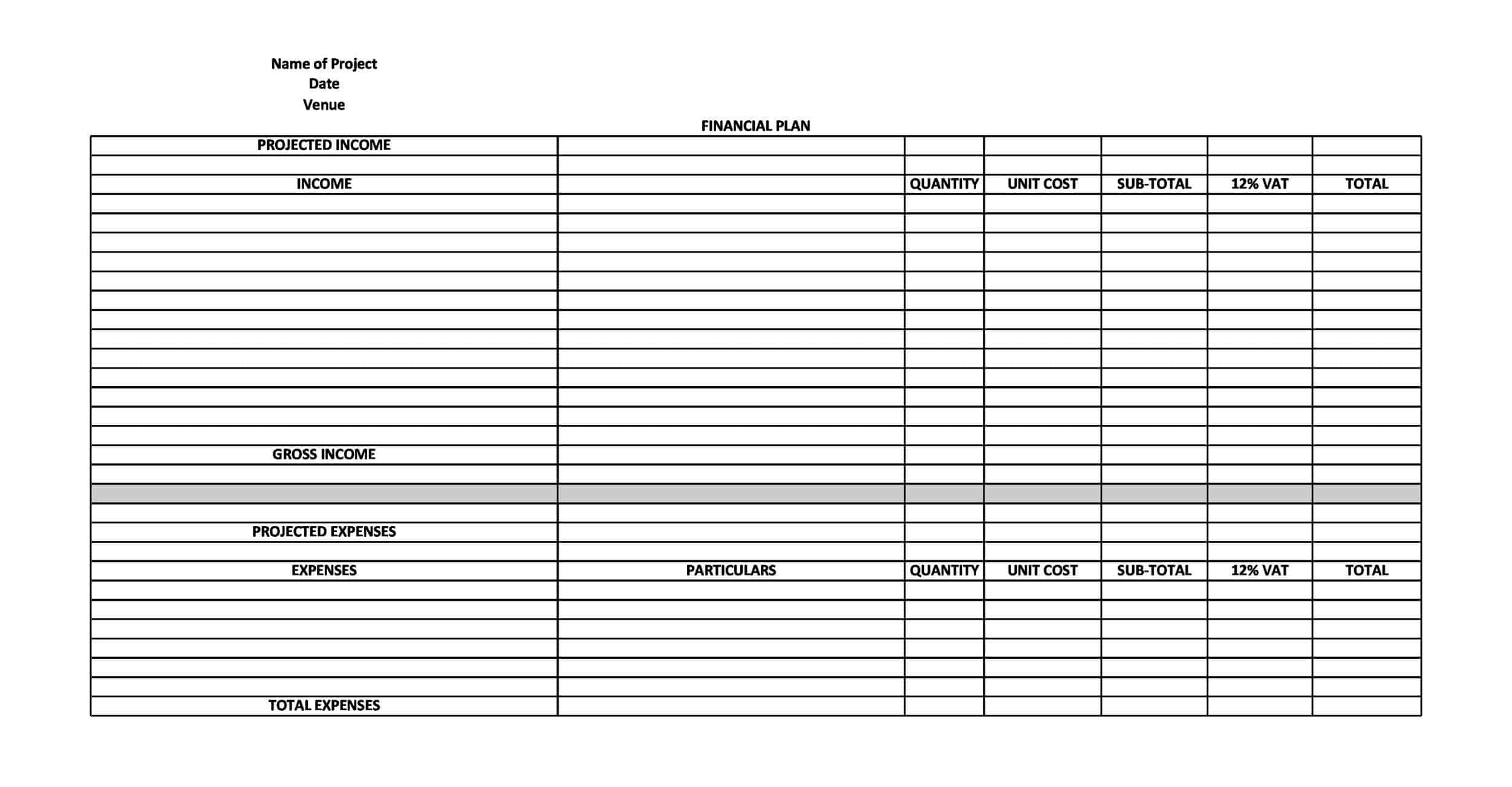

A financial plan template can include the following elements:

Personal and financial information: This section includes your personal details and information about your current financial situation, such as your income, expenses, and debts.

Goals and objectives: This section outlines your financial goals and objectives, such as saving for retirement, paying off debt, or buying a house.

Financial projections: This section includes estimates of your future financial situation, including your projected income, expenses, and net worth.

Strategies and action plan: This section outlines the steps you will take to achieve your financial goals, including any changes you will make to your spending and saving habits.

Risk management: This section addresses potential risks to your financial plan and outlines strategies for managing them.

Review and update: This section includes a plan for reviewing and updating your financial plan on a regular basis to ensure that it remains relevant and effective.

Savings plan: This section outlines how much you will save each month and where you will save it, such as in a retirement account, emergency fund, or investment account.

Investment plan: This section outlines your investment strategy, including the types of investments you will make and the level of risk you are comfortable with.

Debt management plan: This section outlines how you will pay off your debts, including credit card debts, student loans, and mortgages.

Insurance plan: This section discusses the types of insurance you need to protect yourself and your family, such as life insurance, health insurance, and disability insurance.

Estate planning: This section outlines your plans for your assets after you pass away, including a will, trust, or power of attorney.

Tax planning: This section discusses strategies for minimizing your tax liability, such as contributing to tax-advantaged accounts or claiming tax credits and deductions.

Tips For Creating A Personal Or Business Financial Plan

Creating a financial plan can seem intimidating, but it is an important step towards achieving your financial goals and improving your financial wellbeing. A financial plan template can help you organize your thoughts and create a roadmap for reaching your financial objectives. By following these tips, you can create a comprehensive financial plan that will serve as a valuable guide for managing your finances and making informed financial decisions.

And here are some tips for creating your financial plan template:

- Start by gathering all of your financial documents and information, including your income statements, bills, debts, and investment accounts.

- Identify your financial goals and priorities, such as paying off debt, saving for retirement, or buying a house.

- Create a budget to track your income and expenses and identify areas where you can cut costs or increase savings.

- Develop a plan for managing your debts, including a strategy for paying off high-interest debts first.

- Consider your risk tolerance and create an investment plan that aligns with your goals and risk profile.

- Review your insurance coverage and consider purchasing additional policies to protect yourself and your family.

- Create a plan for saving and investing for the long term, including contributions to retirement accounts and other investment accounts.

- Review and update your financial plan regularly to ensure that it remains relevant and effective.

- Seek professional advice if necessary. If you have complex financial needs or are unsure about how to create a financial plan, consider seeking the guidance of a financial planner or advisor.

- Use online resources and tools to help you create and manage your financial plan. There are many online resources and tools available that can help you track your budget, create a debt repayment plan, and develop an investment strategy.

- Make a plan for achieving your financial goals. Once you have identified your financial goals, create a detailed action plan for achieving them. This can include steps such as increasing your income, cutting expenses, or saving a certain amount each month.

- Monitor your progress and adjust your plan as needed. It is important to regularly review your financial plan to ensure that you are on track to achieve your goals. If you encounter any setbacks or changes in your circumstances, be prepared to adjust your plan accordingly.

By following these tips and using a financial plan template, you can create a comprehensive plan that will help you manage your finances and achieve your financial goals.

Conclusion

A financial plan is a valuable tool for managing your finances and achieving your long-term financial goals. It can help you to create a budget, develop a plan for paying off debt, and save and invest for the future. By regularly reviewing and updating your financial plan, you can ensure that it remains relevant and effective in helping you to achieve your financial objectives.

Whether you create a financial plan on your own or seek the guidance of a financial planner, it is an important step towards improving your financial wellbeing and building financial security for yourself and your family.

Financial Planning FAQs

Here are a few frequently asked questions about financial planning, along with their answers:

Why is it important to have a financial plan?

A financial plan is important because it helps you to make informed financial decisions and stay on track to achieve your financial goals. It can also help you to identify potential risks to your financial wellbeing and develop strategies for managing them.

Who needs a financial plan?

Everyone can benefit from having a financial plan, regardless of their income level or financial situation. A financial plan can help you to manage your money effectively, reduce financial stress, and achieve your financial goals.

How do I create a financial plan?

To create a financial plan, start by gathering all of your financial information and documents. Identify your financial goals and priorities, and create a budget to track your income and expenses. Develop a plan for managing your debts and saving for the long term. Consider seeking the guidance of a financial planner or advisor if you have complex financial needs or are unsure about how to create a financial plan.

How often should I review my financial plan?

It is a good idea to review your financial plan regularly, at least once a year. This will help you to ensure that your plan is still relevant and effective, and to make any necessary adjustments based on changes in your circumstances or financial goals.

Can I create a financial plan on my own?

Yes, you can create a financial plan on your own by following the steps outlined above and using online resources and tools. However, if you have complex financial needs or are unsure about how to create a financial plan, you may want to consider seeking the guidance of a financial planner or advisor.

Is a financial plan the same as a budget?

A financial plan is a more comprehensive document than a budget. A budget is a tool for tracking your income and expenses, while a financial plan includes your budget as well as your long-term financial goals and the steps you will take to achieve them.

Can a financial plan help me to save money?

A financial plan can help you to save money by identifying areas where you can cut costs and by creating a plan for saving and investing for the long term. By following a budget and making a plan for saving and investing, you can increase your overall financial wellbeing and build wealth over time.

Can a financial planner help me to create a financial plan?

A financial planner can help you to create a financial plan by analyzing your financial situation and providing guidance on how to achieve your financial goals. They can help you to develop a budget, create a debt repayment plan, and design an investment strategy that aligns with your risk tolerance and financial goals.

![%100 Free Hoodie Templates [Printable] +PDF 1 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Parenting Plan Templates [PDF, Excel] 2 Parenting Plan](https://www.typecalendar.com/wp-content/uploads/2023/05/Parenting-Plan-1-150x150.jpg)

![Free Printable Food Diary Templates [Word, Excel, PDF] 3 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)