The construction industry is rife with risks, and to mitigate these, various legal provisions like the Mechanics Lien come into play. This legal tool, often formalized through a Mechanics Lien Form, safeguards the financial interests of contractors, subcontractors, and suppliers when they are not paid for their services or supplies.

Acting as a security interest in the title to property, it ensures those who have contributed labor or materials to a project are adequately compensated. Through this article, we’ll delve deeper into the complexities and nuances of Mechanics Liens, their forms, their application, and their pivotal role within the realm of construction law.

Table of Contents

What is a Mechanics Lien?

A Mechanics Lien is a legal claim against a property that has been remodeled or improved. This legal tool is used primarily in the construction industry by contractors, subcontractors, and suppliers as a form of protection against non-payment. The lien essentially grants the claimant a security interest in the property until they have been paid for their services or materials.

If the property owner fails to pay, the claimant can enforce the lien by initiating a lawsuit, which could ultimately lead to a court-ordered sale of the property to cover the unpaid debt. It’s essential to note that laws governing Mechanics Liens can vary widely from one jurisdiction to another, affecting who can file a lien, the type of properties liens can be filed against, and the process of filing and enforcing a lien.

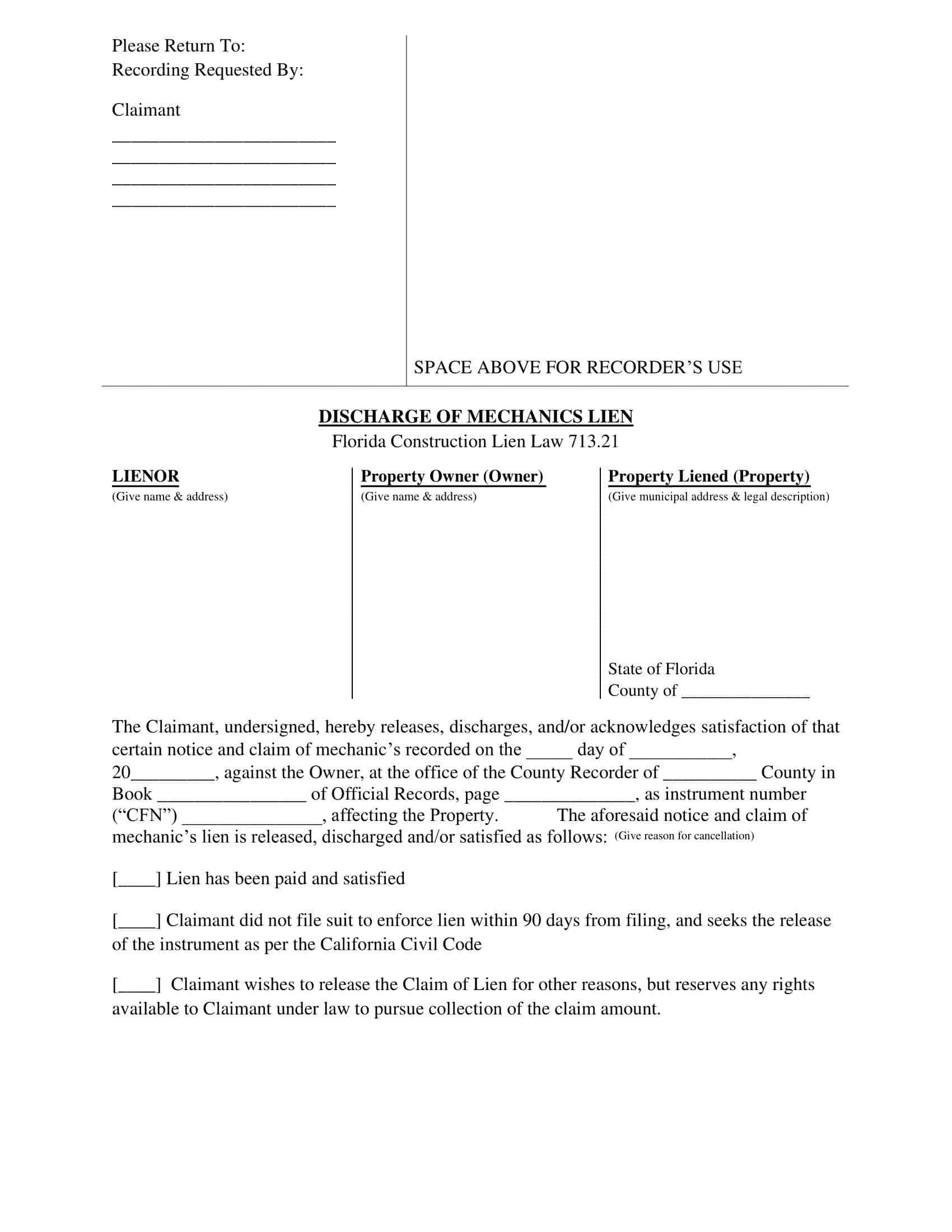

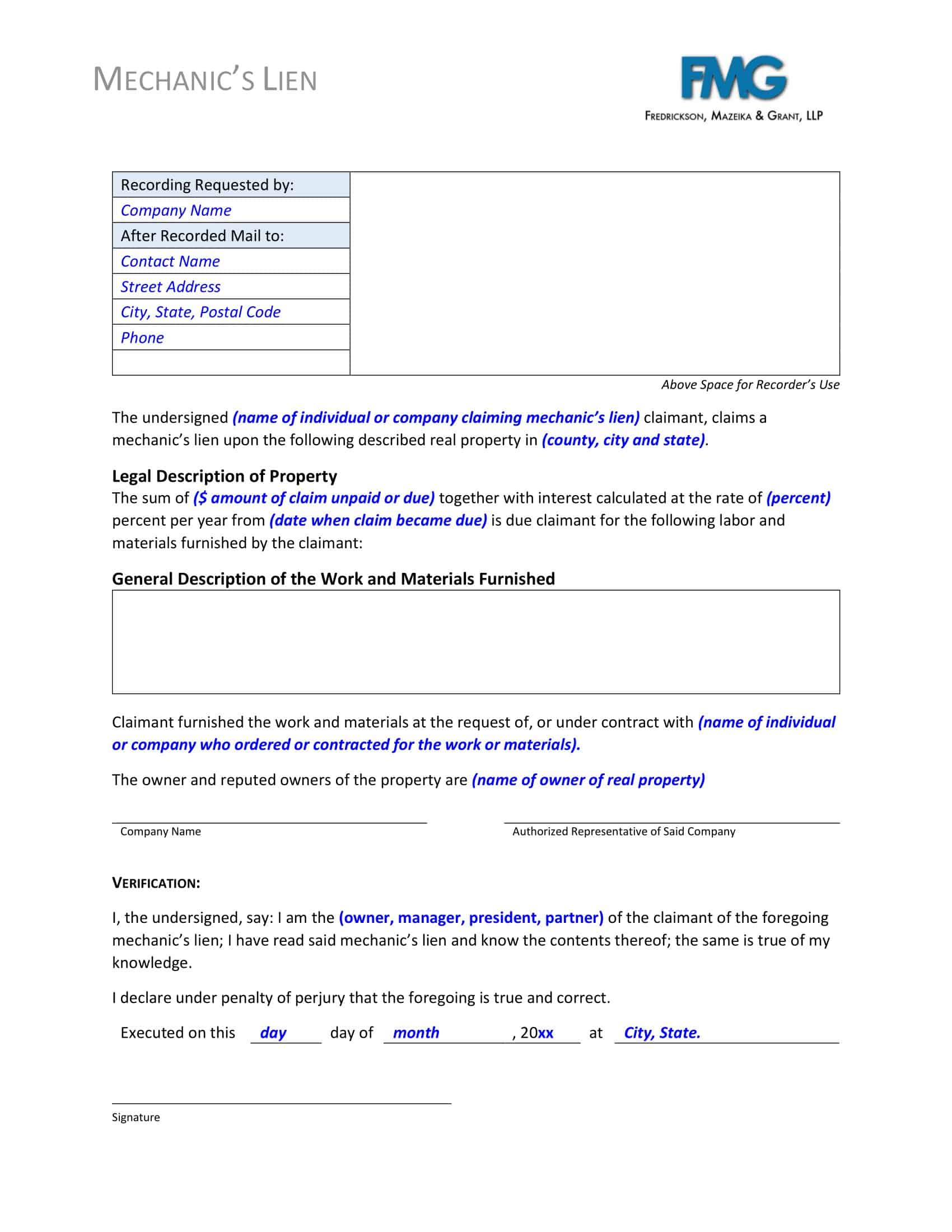

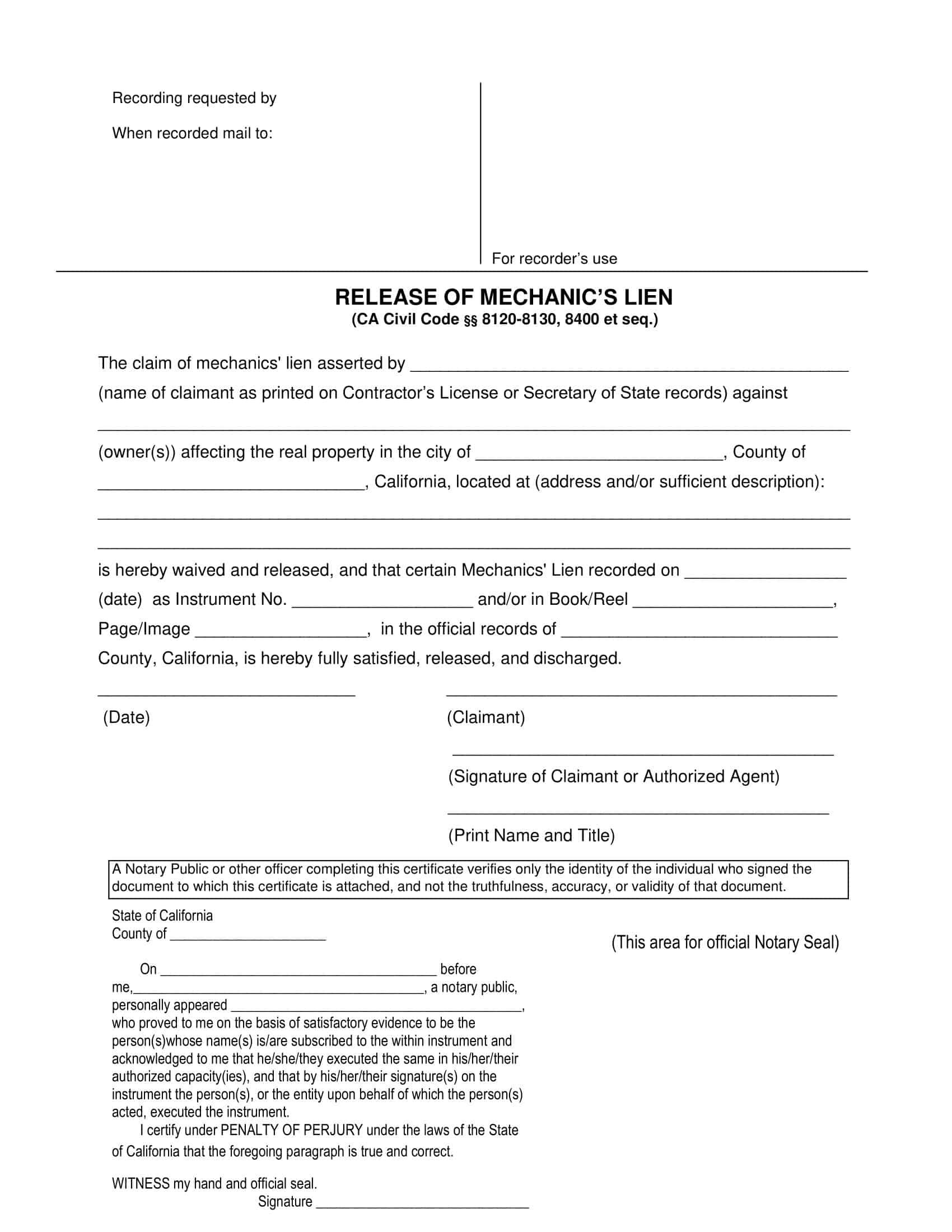

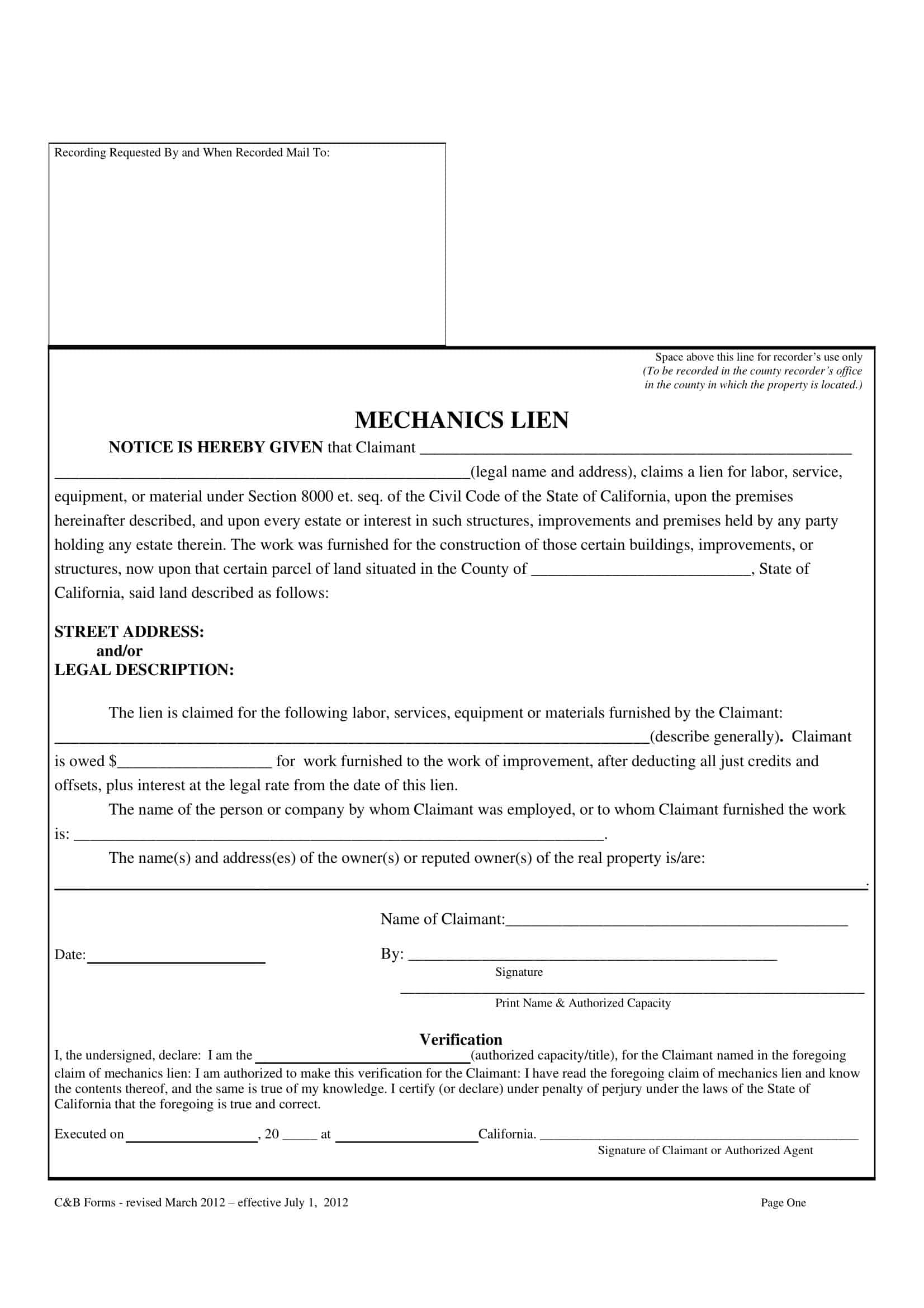

Mechanics Lien Form Templates

Mechanics lien form templates are valuable tools used in the construction industry to legally protect contractors, subcontractors, suppliers, and other parties involved in a construction project. These templates provide a standardized format and structure for documenting and asserting a mechanics lien, which is a legal claim against a property that ensures payment for services or materials provided.

A mechanics lien form template typically includes essential information such as the name and contact details of the claimant, the property owner, and the general contractor. It also outlines the project details, including the location and description of the property, the scope of work performed, and the dates when the services or materials were provided.

What is a Mechanics Lien Form?

A Mechanics Lien Form is the document used to officially file a Mechanics Lien. This form typically includes information such as the amount due to the claimant, the labor or materials supplied, the property where these were provided, the owner of the property, and the party who contracted for the labor or materials. Upon completion, this form is usually filed with the county recorder or a similar local government office in the county where the property is located.

The completed and filed form gives public notice of the claimant’s interest in the property, protecting their right to payment. As with the liens themselves, the requirements for Mechanics Lien Forms and their filing process can vary by jurisdiction. Therefore, it’s crucial for the claimant to familiarize themselves with their local laws to ensure proper compliance.

When Do I Need a Mechanic’s Lien Form?

A Mechanic’s Lien Form becomes necessary when a contractor, subcontractor, supplier, or laborer has not received payment for work completed or materials supplied on a construction or improvement project. It acts as a legal assurance, ensuring that these parties can claim the unpaid amount against the property on which the project was completed.

Here are several specific situations when you might need a Mechanic’s Lien Form:

Non-payment for Services or Materials

This is the most common situation necessitating a Mechanic’s Lien Form. If a property owner, or a general contractor in the case of a subcontractor or supplier, fails to pay for services rendered or materials provided, the aggrieved party can file a Mechanic’s Lien to secure their right to compensation.

Incomplete or Abandoned Projects

If a project is prematurely terminated or abandoned and you’ve performed work or supplied materials that haven’t been paid for, a Mechanic’s Lien can help you recover the debt.

Disputes over Work Quality or Scope

Sometimes, disagreements arise over the quality or scope of the work completed. If these disagreements lead to withheld payment, a Mechanic’s Lien provides leverage for negotiation and, if necessary, legal action.

Note: Remember, a Mechanic’s Lien is not an initial step but often a last resort when all other attempts to recover the owed amount have failed. It’s important to maintain clear and open communication with the debtor and attempt to resolve the issue through mediation or negotiation if possible.

Before proceeding with a Mechanic’s Lien, it’s essential to be aware of the local lien laws, as these can significantly differ from one jurisdiction to another. The timelines for filing a lien, the required notices, and the specifics that need to be included in the Mechanic’s Lien Form can all vary. Additionally, some jurisdictions may require that a preliminary notice be served before a lien can be filed. Non-compliance with these regulations can render the lien invalid, so professional legal advice is recommended to navigate this complex process.

Who has the authority to file a mechanic’s lien?

In general, any party who contributes labor, services, or materials to a construction or improvement project and has not been fully paid can file a Mechanic’s Lien. However, the specific eligibility requirements can vary significantly based on local laws and regulations. Here are the most common parties who can file a Mechanic’s Lien:

Contractors: This includes both general contractors, who have a direct contractual relationship with the property owner, and subcontractors, who are hired by the general contractor. If either has not been paid for the work performed, they can file a lien.

Sub-subcontractors: These are entities or individuals hired by a subcontractor. If a sub-subcontractor has not received payment for their work, they may have the right to file a Mechanic’s Lien. The rules regarding sub-subcontractors can be complex and vary by jurisdiction.

Suppliers: Suppliers who provide materials for a project and have not received payment can file a Mechanic’s Lien. This can apply whether the materials were supplied directly to the property owner, the general contractor, or a subcontractor.

Laborers: Workers who have provided labor for a project and have not been fully paid for their work may file a lien.

Design Professionals: In some jurisdictions, architects, engineers, and other design professionals can file a Mechanic’s Lien if they’ve provided services that benefit the property and have not been paid.

Equipment Rental Companies: If equipment was rented for use on a project and the rental company has not received payment, they may be eligible to file a lien.

How to File a Mechanics Lien in California

Step 1: Preliminary Notice

In California, you are required to serve a Preliminary Notice to the property owner, general contractor, and lender within 20 days of first supplying labor or materials to the project. This notice informs these parties that you are a potential lien claimant and establishes your right to file a lien if you are not paid. If the Preliminary Notice is served more than 20 days after first supplying labor or materials, the lien rights only cover the work done or materials supplied within the 20 days preceding the notice and thereafter.

Step 2: Prepare the Mechanics Lien Form

If you have not been paid 30 days after sending the Preliminary Notice, you can start preparing your Mechanics Lien Form. The form should include your information, the property owner’s information, a description of the labor or services you provided, a description of the property, the amount you are owed, and your signature. California law also requires that a Mechanics Lien include a specific statutory warning and that the claimant must sign the lien under penalty of perjury.

Step 3: Record the Lien

You must record the lien with the County Recorder’s Office in the county where the property is located. The lien must be recorded within 90 days after completion of the work or cessation of the work. “Completion” can be defined in several ways, including when the owner starts using the improvement, or 60 days after the general contractor files a Notice of Completion or Cessation with the County Recorder’s Office.

Step 4: Serve the Mechanics Lien

After recording the lien, you must serve the Mechanics Lien on the property owner or reputed owner. This can be done by registered mail, certified mail, or personal delivery. You must then file a Proof of Service Affidavit with the County Recorder within 30 days after you record the lien.

Step 5: Enforce the Lien

If you still haven’t been paid, you’ll need to enforce the lien by filing a lawsuit against the property owner. This must be done within 90 days after recording the lien. If you don’t file a lawsuit within this timeframe, the lien becomes null and void.

Step 6: Release the Lien

If you are paid, or if you do not file a lawsuit to enforce the lien within 90 days, you should release the lien. This is done by recording a Release of Lien Form in the same County Recorder’s Office where you recorded the lien.

What Are the Potential Consequences of Failing to Establish a Mechanic’s Lien?

Failure to establish a Mechanic’s Lien can have significant consequences for contractors, subcontractors, and suppliers in the construction industry. It’s crucial to understand these potential pitfalls to ensure you take the appropriate steps to protect your rights to payment. Here are some potential consequences:

1. Difficulty Recovering Unpaid Amounts:

The most immediate and obvious consequence of failing to establish a Mechanic’s Lien is the difficulty in recovering unpaid amounts. Without the lien as security, you are left with fewer options to recover the money owed to you. In most cases, you’ll have to resort to a standard breach of contract claim, which can be time-consuming and costly.

2. Legal Costs:

If you’re forced to go through a lawsuit for a breach of contract, you may incur substantial legal costs. Even if you win the case, the cost of legal proceedings can significantly reduce your net recovery. A Mechanic’s Lien can expedite the process, potentially leading to a quicker resolution and lower legal fees.

3. Prolonged Resolution:

Without a lien, resolving payment disputes can become a drawn-out process. The legal system can be slow, and without the urgency a lien can create, the debtor has less incentive to settle the matter quickly.

4. Risk of Non-Payment:

If the property owner goes bankrupt or faces serious financial difficulties, you might not get paid at all. A Mechanic’s Lien provides some protection against this, as it attaches to the property itself, increasing the chances of recovering the unpaid amount, even in cases of bankruptcy.

5. Lost Priority:

Mechanic’s Liens generally follow a “first in time, first in right” rule. If you fail to file a lien, others may file liens and have their debts satisfied before yours. If the value of the property is not sufficient to cover all debts, you might receive less than you are owed, or nothing at all.

6. Damage to Business Relationships:

While filing a lien can strain business relationships, not getting paid can also be damaging. If the debtor knows you are unlikely to assert your lien rights, they might be less likely to prioritize payment to you, which can strain or even destroy business relationships.

7. Lost Opportunity for Negotiation:

Mechanic’s Liens can be a powerful tool in negotiations. If you fail to file a lien, you may lose a significant bargaining chip that could help you negotiate payment or reach a compromise.

Failing to establish a Mechanic’s Lien when necessary can lead to considerable risks and challenges. It’s crucial to understand the lien laws in your jurisdiction and follow the proper steps to assert your lien rights when necessary. Consulting with a legal professional can provide valuable guidance and ensure you’re taking the appropriate steps to protect your interests.

Mechanic’s Lien Sample

CLAIM OF MECHANIC’S LIEN

This document serves to assert a Mechanic’s Lien under California Civil Code § 8400 et seq.

1. Claimant Information

Claimant’s Name: [Your Full Legal Name] Claimant’s Address: [Your Legal Address] Claimant’s Role to the Project: [Your Role, i.e., Contractor, Subcontractor, Supplier]

2. Property Owner Information

Property Owner’s Name: [Owner’s Full Legal Name] Property Owner’s Address: [Owner’s Legal Address]

3. Job Site / Property Information

Job Site or Property Address: [Full Address of the Property]

4. General Contractor Information

General Contractor’s Name: [Full Legal Name] General Contractor’s Address: [Legal Address]

5. Description of Labor/Services/Materials Provided

[Provide a thorough and detailed description of the labor, services, or materials you provided.]

6. Invoice and Payment Information

Total Contract Price: $[Total amount of the contract] Total Amount Paid: $[Total amount you have been paid] Total Amount Due: $[Total amount you are still owed]

7. Additional Information

Date Work Commenced: [Date when you started providing labor or materials] Date Work Completed: [Date when you last provided labor or materials]

8. Certification

I certify under penalty of perjury under the laws of the State of California that the foregoing is true and correct.

Date: _________ [Date]

________________ [Your Name]

________________ [Your Signature]

NOTARY ACKNOWLEDGMENT

State of ___________) County of _________ )

On _____________ before me, ______________ (insert name and title of the officer), personally appeared _____________, who proved to me on the basis of satisfactory evidence to be the person(s) whose name(s) is/are subscribed to the within instrument and acknowledged to me that he/she/they executed the same in his/her/their authorized capacity(ies), and that by his/her/their signature(s) on the instrument the person(s), or the entity upon behalf of which the person(s) acted, executed the instrument.

________________ [Signature of Notary Public]

Mechanic’s Lien Laws: By State

| State | Statutes |

| Alabama | Title 35, Ch. 11, Art. 5, Div. 8 |

| Alaska | Title 34, Ch. 35, Art. 2 |

| Arizona | Title 33, Ch. 7, Art. 6 |

| Arkansas | Title 18, Subtitle 4, Ch. 44, Subch. 1 |

| California | Div. 4, Part 6, Title 2, Ch. 4 |

| Colorado | Title 38, Art. 22 |

| Connecticut | Title 49, Ch. 847 |

| Delaware | Title 25, Ch. 27 |

| Florida | Title XL, Ch. 713 |

| Georgia | Title 44, Ch. 14, Art. 8, Part 3 |

| Hawaii | Title 28, Ch. 507, Part 2 |

| Idaho | Title 45, Ch. 5 |

| Illinois | Ch. 770, ILCS 60 |

| Indiana | Title 32, Art. 28, Ch. 3 |

| Iowa | Title XIV, Ch. 572 |

| Kansas | Ch. 60, Art. 11 |

| Kentucky | Chapter 376 |

| Louisiana | Title 9, Title XXI, Ch. 2, Part 1 |

| Maine | Title 10, Ch. 603 |

| Maryland | Real Property, Title 9, Subtitle 1 |

| Massachusetts | Part III, Title IV, Ch. 254 |

| Michigan | Ch. 570, Part 1 |

| Minnesota | Ch. 514 |

| Mississippi | Title 85, Ch. 7, Art. 21 |

| Missouri | Title XXVII, Ch. 429 |

| Montana | Title 71, Ch. 3, Part 5 |

| Nebraska | Ch. 52 (§§ 101-159) |

| Nevada | Title 9, Ch. 108 |

| New Hampshire | Title 41, Ch. 447 |

| New Jersey | Title 2A, Ch. 2A:44A |

| New Mexico | Ch. 48, Art. 2 |

| New York | Ch. Lien, Art. 2 |

| North Carolina | Ch. 44A, Art. 2, Part 1 |

| North Dakota | Title 35, Ch. 35-27 |

| Ohio | Title 13, Ch. 1311 |

| Oklahoma | Title 42 |

| Oregon | Title 9, Ch. 87 |

| Pennsylvania | Title 49, Ch. 6 |

| Rhode Island | Title 34, Ch. 28 |

| South Carolina | Title 29, Ch. 5 |

| South Dakota | Title 44, Ch. 9 |

| Tennessee | Title 66, Ch. 11 |

| Texas | Title 5, Subtitle B, Ch. 53 |

| Utah | Title 38, Ch. 1a |

| Vermont | Title 9, Part 3, Ch. 51, Subch. 1 |

| Virginia | Title 43, Ch. 1 |

| Washington | Title 60, Ch. 60.04 |

| West Virginia | Ch. 38, Art. 2 |

| Wisconsin | Ch. 779, Subch. 1 |

| Wyoming | Title 29, Chs. 1, 2 & 10 |

Notice of Intent to Lien: By State

| State | Required Notice | Statute |

| Arkansas | 10 days | § 18-44-114 |

| Colorado | 10 days | § 38-22-109 |

| Connecticut | 90 days | § 49-35 |

| Illinois | 90 days | 770 ILCS 60/24 |

| Maryland | 120 days | § 9-104 |

| Missouri | 10 days | § 429.100 |

| North Dakota | 10 days | § 35-27-02 |

| Pennsylvania | 30 days | § 1501 |

| Wisconsin | 30 days | § 779.06(2) |

| Wyoming | 20 days | § 29-2-107(a) |

FAQs

How does a mechanics lien work?

By filing a mechanics lien, the claimant establishes a legal interest in the property, making it difficult for the property owner to sell or refinance the property until the debt is satisfied. If the debt remains unpaid, the lienholder may eventually be able to foreclose on the property to recover their payment.

Where can I find a mechanics lien form?

Mechanics lien forms can usually be obtained from your local county or state government offices, such as the county clerk’s office or the secretary of state’s website. You can also find templates or downloadable forms online from legal document providers.

Can I file a mechanics lien if I have a verbal agreement?

While it is generally easier to file a mechanics lien if there is a written contract, some jurisdictions may allow the filing of a mechanics lien based on a verbal agreement. However, it can be more challenging to prove the existence and terms of the agreement without written documentation.

Can a mechanics lien be removed?

Yes, a mechanics lien can be removed if the underlying debt is paid or resolved. Once the payment dispute is settled, the lienholder can release the lien by filing a release or satisfaction of lien form with the appropriate government office.

What happens if a mechanics lien is contested?

If a mechanics lien is contested, it may lead to a legal dispute or a lien foreclosure action. The parties involved may need to resolve the matter through negotiation, mediation, or litigation, depending on the circumstances and applicable laws.

Can a mechanics lien be filed on a residential property?

Yes, mechanics liens can be filed on both residential and commercial properties, depending on the type of construction or improvement work performed and the applicable laws in your jurisdiction.

Can a subcontractor file a mechanics lien if the general contractor has been paid?

Yes, subcontractors can file a mechanics lien even if the general contractor has been paid. Mechanics liens provide protection to all parties involved in the construction project, ensuring they have a means to seek payment for their work or supplies.

Can a mechanics lien be filed on a public project?

In some jurisdictions, mechanics liens cannot be filed on public projects since public properties are typically immune from liens. Instead, subcontractors and suppliers may need to pursue other remedies, such as making a claim against a payment bond.

What is a preliminary notice, and is it required before filing a mechanics lien?

A preliminary notice, also known as a notice to owner or notice of furnishing, is a document sent by a subcontractor or supplier to the property owner, general contractor, or both. It serves as a formal notification that the subcontractor or supplier is working on the project and may file a mechanics lien if they are not paid. Preliminary notice requirements vary by jurisdiction, and failure to provide it may limit or affect your ability to file a mechanics lien.

Can I file a mechanics lien if I didn’t have a written contract?

In many jurisdictions, a written contract is not required to file a mechanics lien. However, it may be more challenging to prove the existence and terms of the agreement without a written contract. It is advisable to consult the laws of your specific jurisdiction to determine the requirements.

How long does a mechanics lien last?

The duration of a mechanics lien varies by jurisdiction. Generally, mechanics liens have a limited lifespan, often ranging from several months to a few years. If the debt remains unpaid within the specified timeframe, the lienholder may need to take further legal action to enforce the lien or extend its duration.

Can a mechanics lien be filed after the property has been sold?

In most cases, mechanics liens attach to the property and remain valid even if the property is sold. If the lien was filed before the property’s transfer, it will typically remain enforceable against the new owner. However, laws regarding lien priority and enforceability after a property sale can vary, so it’s crucial to consult local regulations and seek legal advice.

Can a property owner remove a mechanics lien without paying?

In general, a property owner cannot remove a mechanics lien without addressing the underlying debt. The lienholder has a legal right to seek payment for their work or supplies, and the lien can only be released or removed once the debt is resolved.

Can I file a mechanics lien for unpaid professional services?

Mechanics liens primarily apply to construction-related services and materials. However, some jurisdictions may allow certain professional services, such as architectural or engineering work directly related to construction, to be eligible for mechanics lien filing. It’s important to consult the laws in your jurisdiction to determine the specific requirements.

Does a mechanics lien need to be notarized?

The notarization requirement for mechanics liens varies by jurisdiction. In some states or countries, notarization of the mechanics lien is required, while in others, it may not be necessary. It’s important to consult the specific laws and regulations of your jurisdiction to determine whether notarization is required for mechanics liens.

Notarization typically involves the presence of a notary public who verifies the identity of the person signing the lien and witnesses the signing. The notary public then affixes their official seal or stamp to the document, indicating that it has been notarized.

If notarization is required, it is important to follow the proper procedures and have the mechanics lien form notarized before filing it with the appropriate government office. Failure to comply with notarization requirements, where applicable, could result in the rejection or invalidation of the mechanics lien.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)