Providing professional cleaning services requires properly documenting your work to get paid. A well-designed cleaning invoice clearly communicates the services rendered, fees charged, and policies to customers. Having a polished invoice template ready to customize for each job or client instills confidence in your business and makes billing seamless.

The invoice should include all relevant details like date, location, specific tasks, total hours, products used, and amount due. With clear invoicing, cleaning companies can showcase their reliability while keeping their own accounts in order. This article explores the elements of a comprehensive cleaning invoice and provides a downloadable sample template. Follow these tips to create professional invoices that give your clients transparency and help your home or office cleaning business get paid efficiently.

Table of Contents

What Is A Cleaning Invoice?

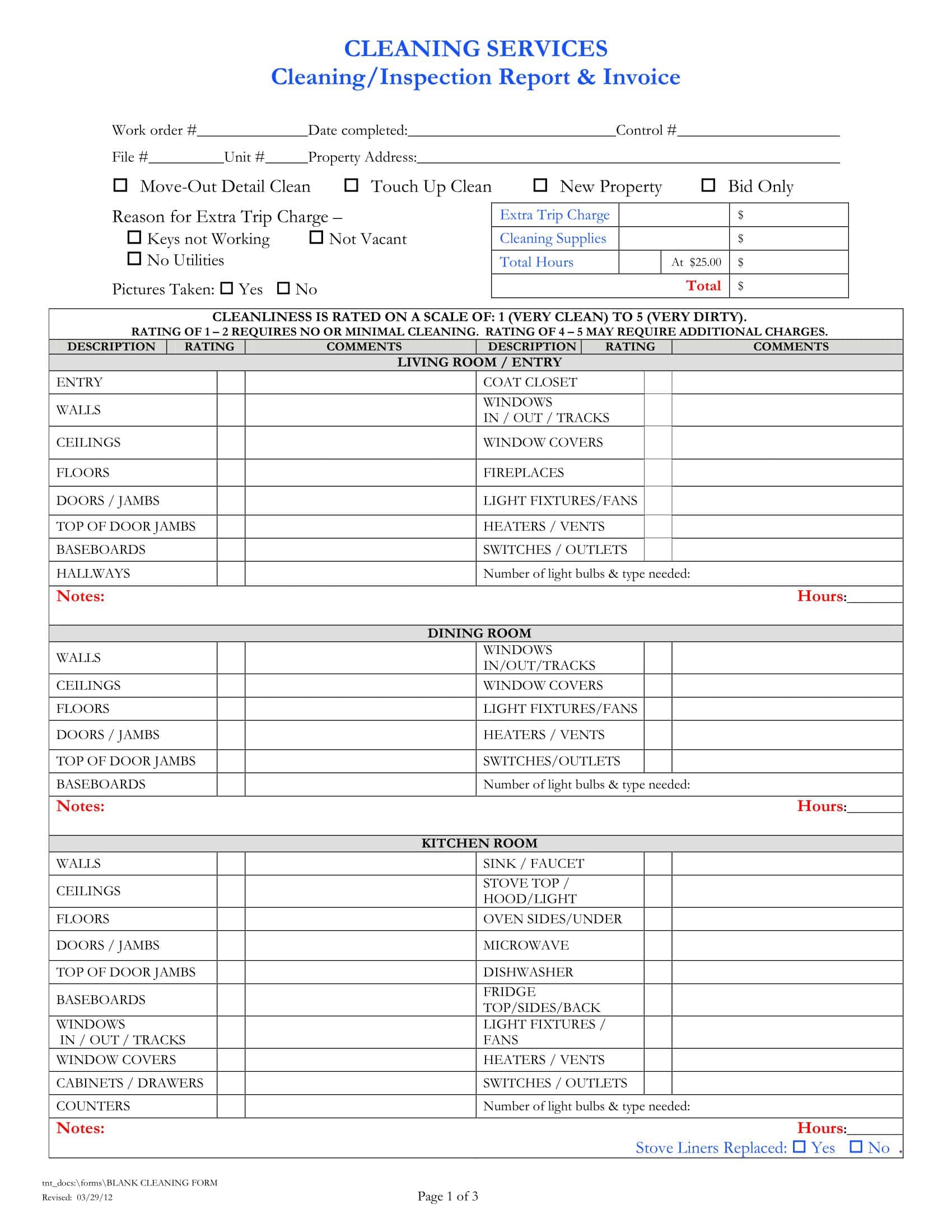

A cleaning invoice is a bill sent by a professional cleaning service to their client listing the cleaning tasks completed and total amount owed. A standard cleaning invoice includes details like the date, location, specific services rendered such as dusting, vacuuming, scrubbing, waste disposal, etc. along with the total hours worked.

Any cleaning products used will also be itemized. Additional fees for travel time or deodorizing treatments may be listed separately. The total amount due, accepted payment methods and due date will be clearly stated. A cleaning invoice allows the cleaner to clearly communicate the work performed and total charges while also creating a record for their own accounting purposes.

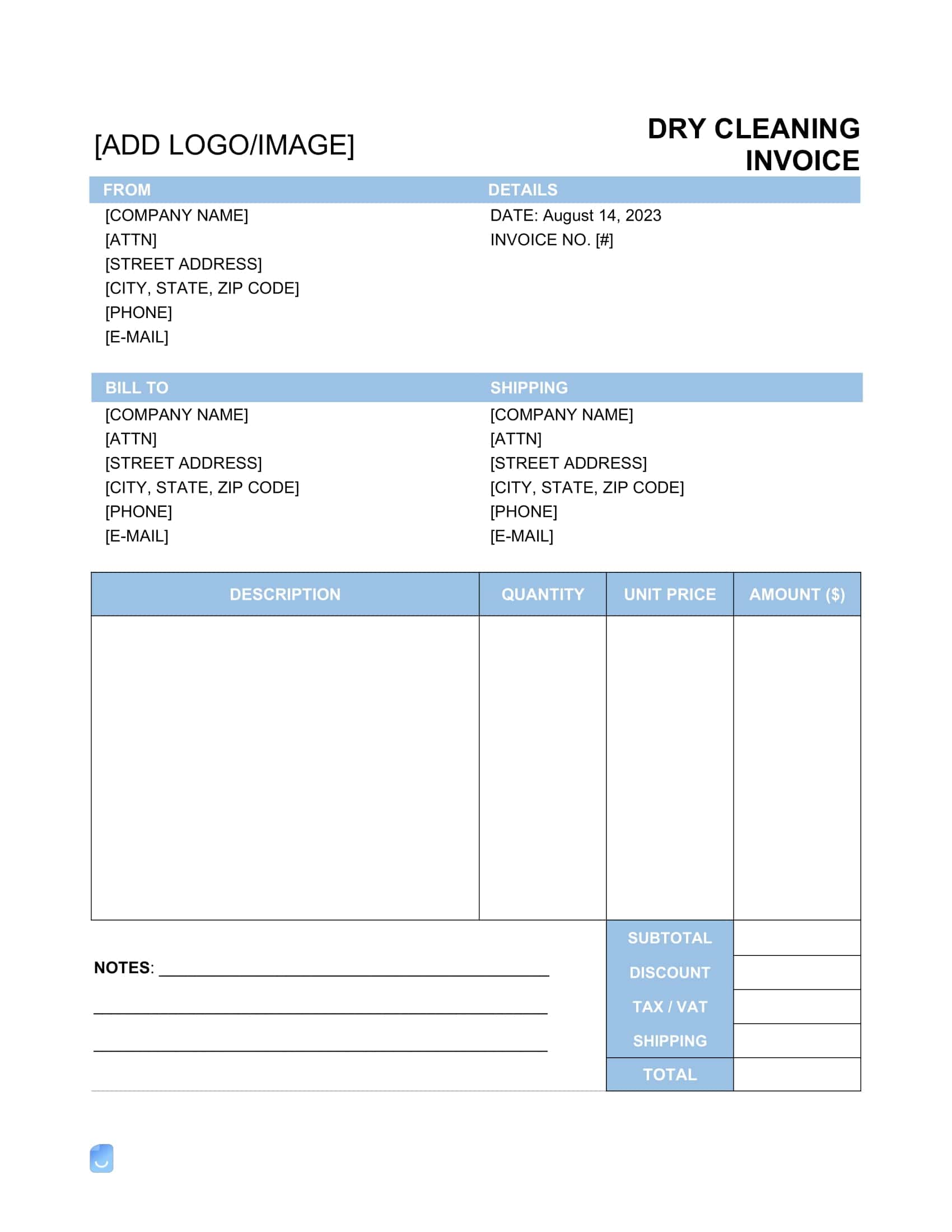

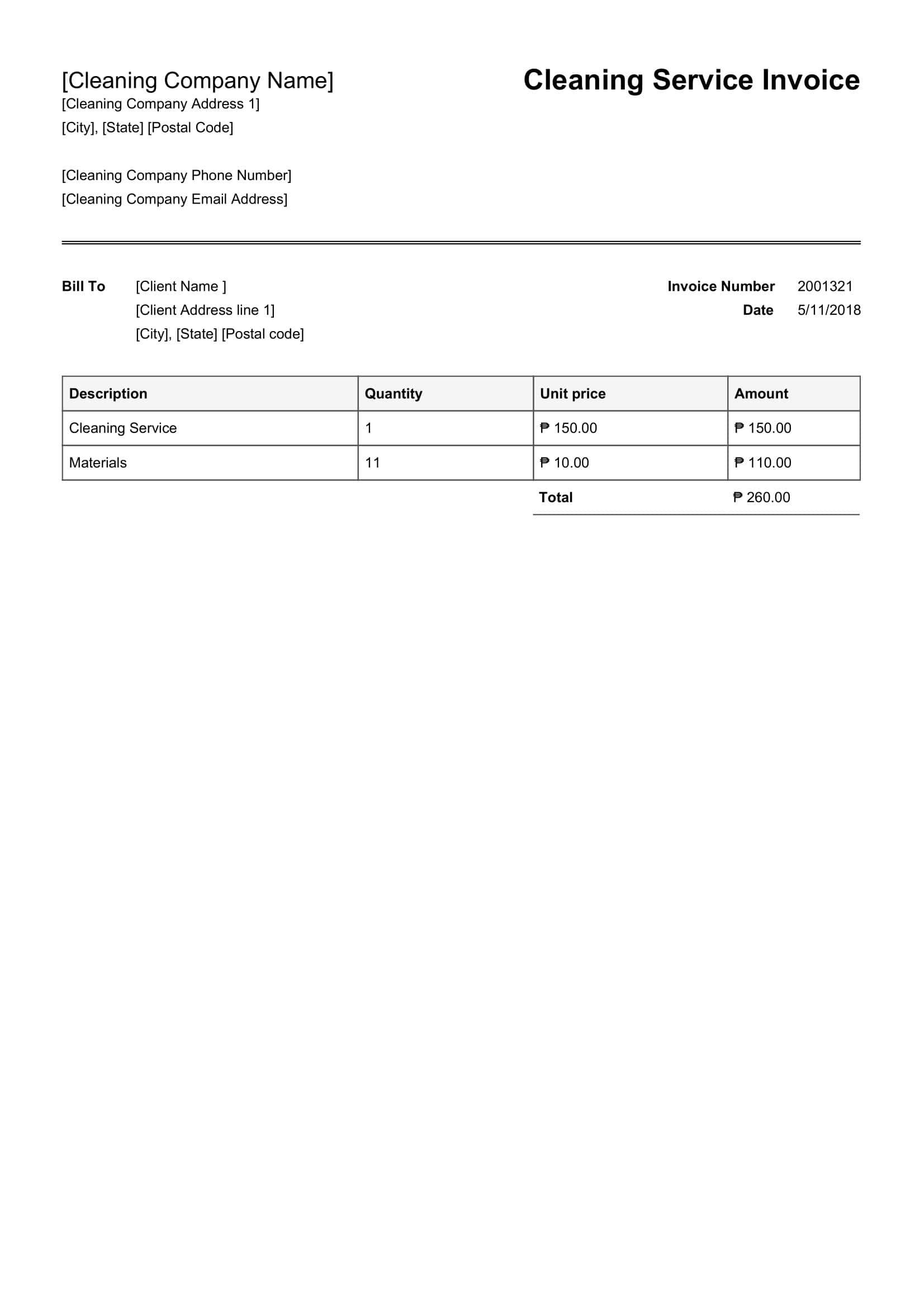

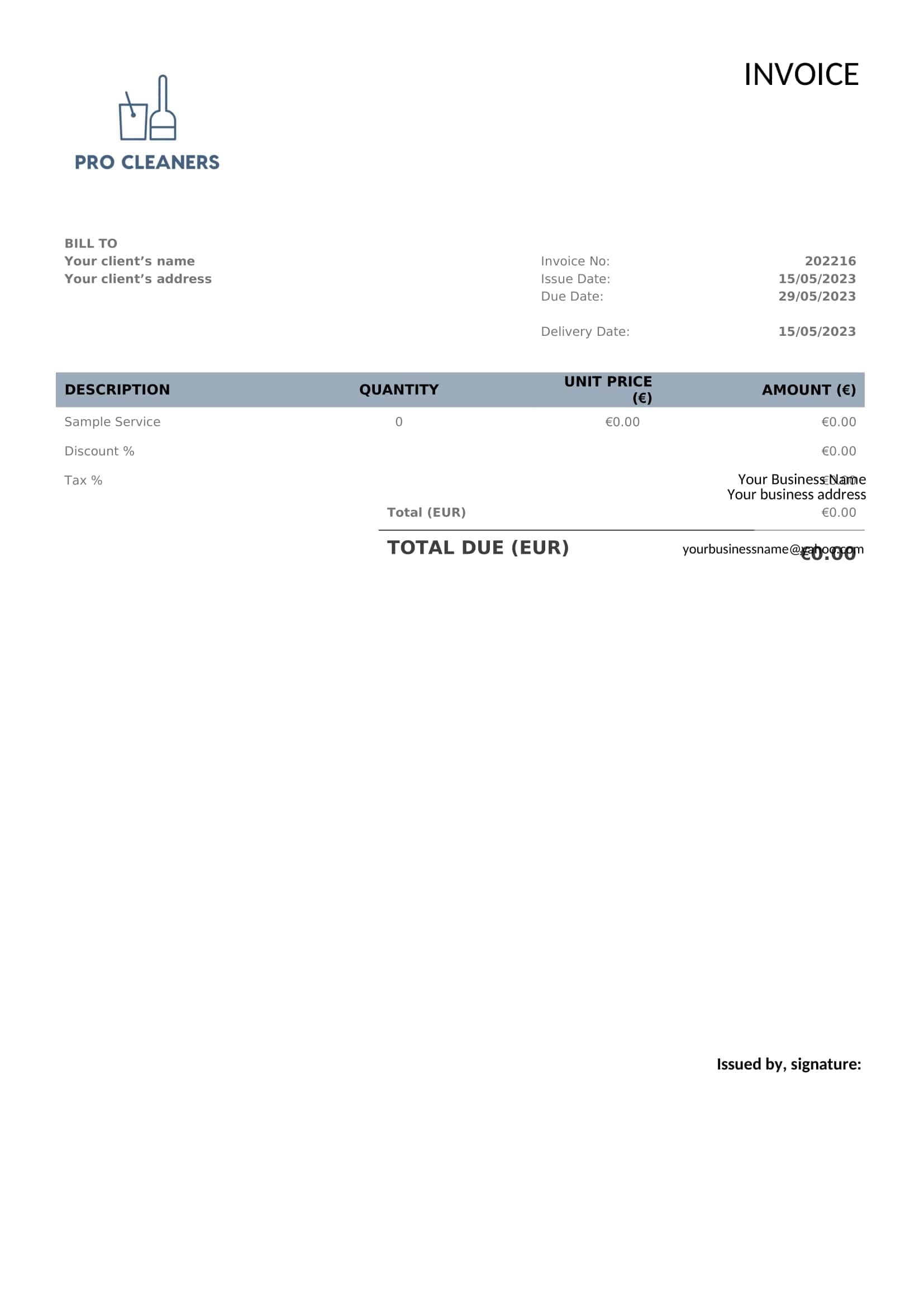

Cleaning Invoice Templates

Cleaning Invoice Templates allow residential and commercial cleaning companies to efficiently bill clients for services rendered. Having standardized Cleaning Invoice Templates optimizes the process of accurately invoicing each customer on a recurring basis. The templates save cleaning businesses time while maintaining consistency.

The Cleaning Invoice Templates consolidate all key details like business identity, client info, dates, locations, services provided, rates, and payment terms in an organized format for straightforward billing. Some templates allow clients to customize their own invoice preferences. Calculations are handled automatically based on cleaning frequency and rates for each client.

For cleaning companies, Cleaning Invoice Templates enable professionalism and consistency in customer transactions. The templates minimize time spent on administrative tasks so focus stays on service quality. Routinely billing clients using uniform Cleaning Invoice Templates simplifies accounts receivable monitoring and collections as well. Cleaning Invoice Templates provide an invaluable tool for smooth back-office operations.

What is a Cleaning Invoice Used for?

Here’s a breakdown of its uses:

- Payment Request: At its core, an invoice serves as a formal request for payment. Once the cleaning services have been provided, the cleaning business or individual issues an invoice to notify the client of the amount due.

- Record-Keeping: For the cleaning service provider, invoices help in maintaining financial records. These records are critical for accounting, tax reporting, and tracking income and expenses.

- Documentation for Services Rendered: An invoice provides a detailed account of what services were performed, when, and at what cost. This clarity can reduce potential disputes or misunderstandings between the provider and the client.

- Legal Protection: In the event of non-payment or disputes over services provided, a detailed invoice can serve as a legal document. Having a paper trail can be invaluable in such scenarios.

- Professionalism: Issuing formal invoices reflects professionalism on the part of the cleaning service provider. It demonstrates that the provider is running a serious, organized business.

- Client’s Financial Records: Just as the service provider needs records, the client may also need the invoice for their own accounting and record-keeping. They might need it to track their expenses, report for tax purposes, or verify costs for reimbursement (in the case of businesses).

- Track Payment Due Dates: Including due dates on invoices allows service providers to track when payments are expected. This helps in cash flow management and also in following up on late payments.

- Marketing & Branding: Invoices can also serve as a subtle marketing tool. By including branding elements like a company logo, contact information, and even special offers or promotions, businesses can maintain mindshare with their clients.

- Promotion of Payment Methods: By listing preferred or accepted payment methods on the invoice, businesses can guide clients towards certain payment channels, whether it’s online payment, checks, or other methods.

- Feedback & Communication: Some businesses use the invoice as an opportunity to solicit feedback or provide additional communication to the client, like thank you notes, reminders about upcoming specials, or referral incentives.

What Should Be Included On A Cleaning Invoice?

A well-detailed cleaning invoice ensures clarity for both the service provider and the client, reducing potential disputes or misunderstandings.

Here’s what should be included on a cleaning invoice:

- Header:

- Company/Individual Name: Your business or personal name.

- Logo: If you have one.

- Address: Your business or home address.

- Contact Information: Phone number, email, website, etc.

- Invoice Number: A unique number to track the invoice.

- Date: The date the invoice is issued.

- Due Date: The date by which the payment should be made.

- Client Information:

- Client’s Name: The name of the person or business you provided services for.

- Client’s Address: Their physical address.

- Contact Information: Their phone number and email address.

- Details of Services Provided:

- Description of Service: A clear, detailed description of each service provided, e.g., “Carpet Cleaning”, “Window Washing”, “General House Cleaning”, etc.

- Date of Service: When the service was performed.

- Hours Worked: If you’re charging hourly, specify the hours spent.

- Rate: How much you charge per hour or service.

- Total: For each line item (Hours Worked x Rate or flat rate for the service).

- Materials & Supplies (if applicable):

- List any materials or supplies used which are chargeable. This can include detergents, specialized cleaning solutions, and other consumables. Include the cost for each item.

- Additional Charges:

- This could be for extra services, rush jobs, or any other additional fees.

- Subtotal:

- Total cost before any taxes, discounts, or additional fees are applied.

- Taxes:

- If applicable, specify the tax rate and the corresponding amount.

- Discounts/Credits:

- If you’re offering a discount or if there were previous credits, mention them here with the corresponding amount.

- Total Amount Due:

- The final amount the client owes, after considering taxes, discounts, and credits.

- Payment Details:

- Payment Methods Accepted: E.g., bank transfer, credit card, check, etc.

- Payment Terms: E.g., “Net 30” (meaning the payment is due within 30 days from the invoice date).

- Banking Details: If clients will be paying through bank transfer.

- Notes/Additional Information:

- Any additional details or context that might be important. For instance, if there’s a satisfaction guarantee, or if there are penalties for late payment.

- Terms & Conditions:

- Any legal terms that the client should be aware of, such as late payment fees, guarantees, and refund policies.

- Footer:

- You can include a thank you note for the client’s business, or any other relevant comments.

How Do I Make An Invoice For Cleaning?

Creating a cleaning invoice can be broken down into several steps to ensure you provide a thorough and professional document. Here’s a step-by-step guide:

Step 1: Choose a Format

Begin by determining how you’ll create your invoice. You can choose from various options such as using accounting software, office suites like Microsoft Word or Excel, online invoice generators, or purchasing pre-made invoice books. For this example, we’ll use Microsoft Word. Start by opening Word and selecting a blank document. Alternatively, you can search for “invoice templates” within Word to get a head start.

Step 2: Header and Branding

Place your company name at the top of the document, followed by your company logo if you have one. Branding your invoice not only looks professional but also ensures immediate recognition from your clients. Example:

[Your Company Logo]

SPARKLING CLEAN SERVICES

Step 3: Contact Information

List your address, phone number, email address, and any other relevant contact details. If you’re registered, include your business registration number or tax identification. On the opposite side, list your client’s name and contact details.

Example:

123 Clean Street, Cleanville, CL 12345

Phone: (123) 456-7890

Email: sparklingclean@email.com

Bill To:

Mr. John Doe

456 Dusty Road, Cleanville, CL 54321

Step 4: Invoice Details

In this section, detail the invoice number, invoice date, and due date. Using a unique invoice number for every bill helps with tracking and organization.

Example:

Invoice Number: 00123

Invoice Date: August 15, 2023

Due Date: September 1, 2023

Step 5: Service Breakdown

List the cleaning services you provided in a table format. The table should have columns for the description of service, date of service, rate, hours worked, and total cost.

Example:

| Description | Date | Rate | Hours | Total |

|———————–|————|——|——-|——-|

| Window Cleaning | 08/13/2023 | $25 | 2 | $50 |

| Carpet Cleaning | 08/13/2023 | $100 | 1 | $100 |

Step 6: Additional Charges

Below your service table, add any additional charges, like cleaning supplies or any special equipment rentals.

Example:

Specialized Cleaning Solution: $10

High-powered Vacuum Rental: $20

Step 7: Calculate the Total

Sum up the charges from the services and additional charges, apply any tax if required, and then give the final total amount due.

Example:

Subtotal: $180

Tax (8%): $14.40

Total Amount Due: $194.40

Step 8: Payment Information

Detail how the client can pay the invoice. This includes accepted payment methods and possibly bank details for electronic transfers.

Example:

Accepted Payment Methods: Check, Bank Transfer, Credit Card

For bank transfers:

Bank: Clean Bank

Account Number: 123456789

Sort Code: 12-34-56

Step 9: Terms and Notes

State any terms and conditions related to the payment, like late fees. You can also add a section for notes or a brief thank you to the client.

Example:

Payment terms: Net 15 days. Late payments may incur a 5% fee.

Note: Thank you for choosing Sparkling Clean Services! We appreciate your business.

Step 10: Review and Send

Before sending the invoice, review it for any errors or omissions. Ensure all the details are correct and that the presentation is professional. Once reviewed, save the document as a PDF and send it to your client via email, mail, or any other preferred method.

Get Invoicing Quickly with Customizable Word and Excel Cleaning Templates

For cleaning companies without a dedicated invoicing system, Microsoft Word and Excel provide straightforward options for creating professional invoices. These commonly used programs allow businesses to make customized invoices and track billing quickly and easily.

We offer downloadable cleaning invoice templates for both Word and Excel formats. The Excel template does the math for you with pre-set formulas to automatically calculate totals and subtotals. The Word document provides flexible formatting to list out detailed cleaning tasks and fees.

Personalize these templates by adding your own cleaning business branding, contact information, bank details, terms and conditions. You can customize the look while maintaining a clear, organized invoice.

While Word and Excel work great for producing the occasional invoice, high-volume cleaners may benefit more from specialized invoicing software. But for independent cleaners and small operations, these templates are an excellent free resource to start digitizing your invoicing quickly.

Popular Invoicing Software Options with Cleaning Invoice Templates

- FreshBooks: Known for its ease of use, FreshBooks provides customizable invoice templates tailored for various businesses, including cleaning services.

- QuickBooks: Apart from robust accounting features, QuickBooks offers invoicing features that can be customized for cleaning services.

- Wave: A free option suitable for small businesses, Wave provides customizable invoice templates.

- Zoho Invoice: Part of the larger Zoho suite, it offers easy customization for cleaning service invoices.

- Square Invoices: Especially if you’re using Square for point-of-sale or other services, their invoicing solution is streamlined and easy to use.

FAQs

How often should I issue a cleaning invoice?

The frequency of invoicing depends on the agreement between the service provider and the client. For one-time services, you would typically issue an invoice right after the job is completed. For recurring services, you might invoice weekly, bi-weekly, or monthly, depending on the arrangement.

What should I do if a client doesn’t pay the invoice on time?

If a client misses a payment deadline, start by sending a gentle reminder. If there’s no response or payment, consider sending a more formal follow-up or contacting them directly. It’s essential to maintain professionalism throughout the process. If non-payment persists, you might need to consider legal actions or hiring a collection agency.

Is it necessary to include tax in a cleaning invoice?

This largely depends on local regulations. In many regions, services, including cleaning services, are subject to sales tax or VAT. It’s crucial to research local tax regulations or consult with an accountant to ensure you’re invoicing correctly.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)