In the fast-paced trucking industry, creating clear, detailed invoices is essential yet often overlooked. Invoicing not only ensures truckers get paid for loads hauled, but also reinforces professionalism and provides documentation to customers. However, for independent truck drivers and small carriers juggling routes and regulations, invoicing can become an afterthought. Without a streamlined, consistent process, payments can be delayed and record keeping can suffer.

This article explores best practices in trucking invoicing, from accurately tracking mileage and accessorial charges to integrating helpful invoice templates. With advice tailored for owner-operators and small fleets, we aim to demystify the invoicing process. Truckers will gain skills to quickly generate polished, comprehensive invoices that showcase their services while protecting their bottom line. Detailed invoicing establishes credibility, provides proof of delivery, and ensures timely compensation for services – critical factors in a competitive industry. The template samples and how-to guidance contained here offer a blueprint to elevate any trucking business’ invoicing practices.

Table of Contents

What Is a Trucking Invoice?

A trucking invoice is a bill sent by a trucking company or independent owner-operator to a customer, typically a manufacturer, distributor, or broker, detailing charges for transporting freight. It documents the shipment specifics including total mileage, pickup and delivery locations, freight classification, weight and quantity, accessorial fees, fuel surcharges, and payment terms.

The invoice acts as a request for payment for services rendered in safely transporting the cargo within the agreed timeframe. It also serves as a record of the transaction, and proof of delivery upon full payment by the customer. Having clear, accurate trucking invoices are vital for owner-operators and trucking companies to receive fair compensation, maintain cash flow, prevent disputes, and sustain positive customer relationships in the logistics industry.

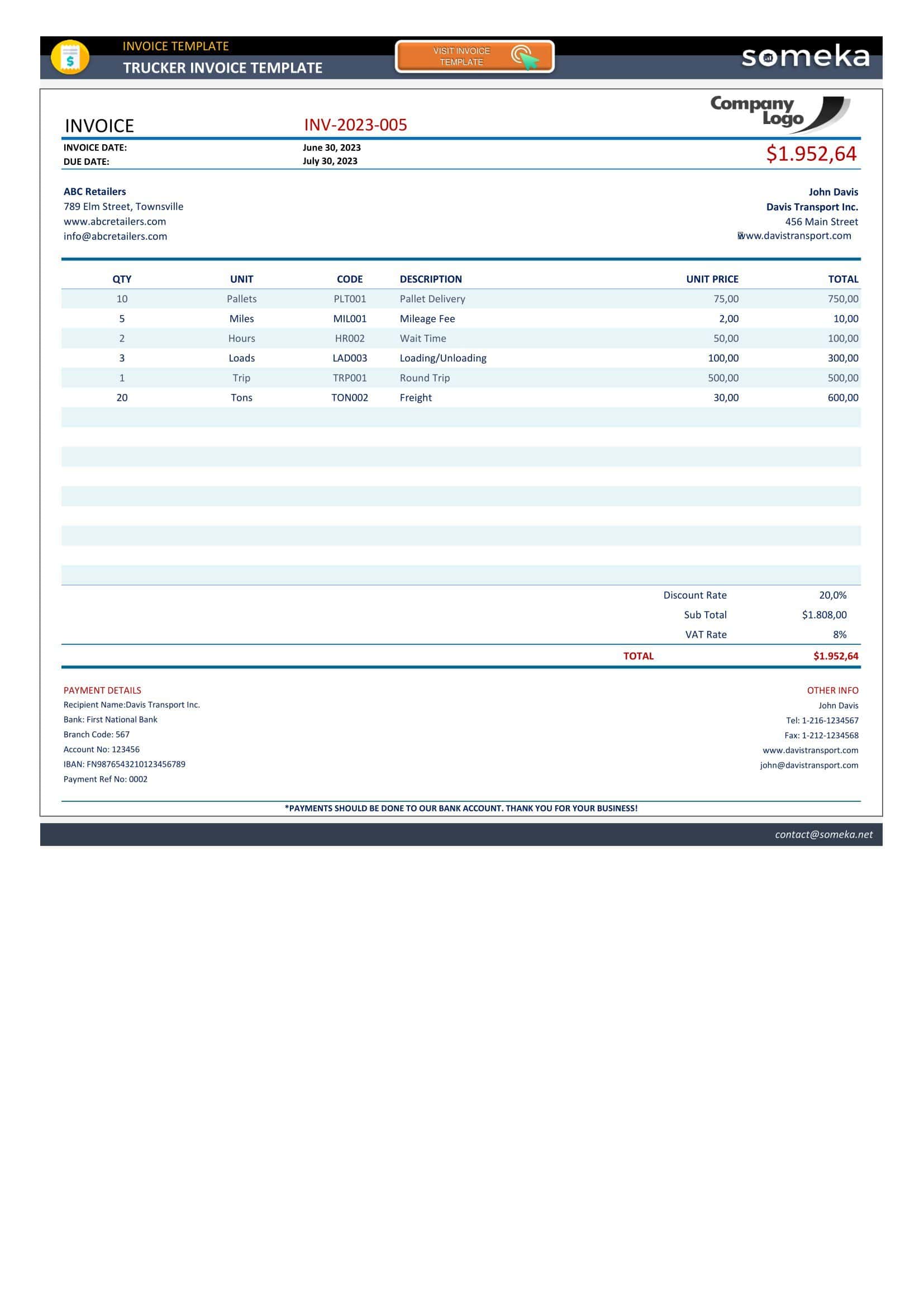

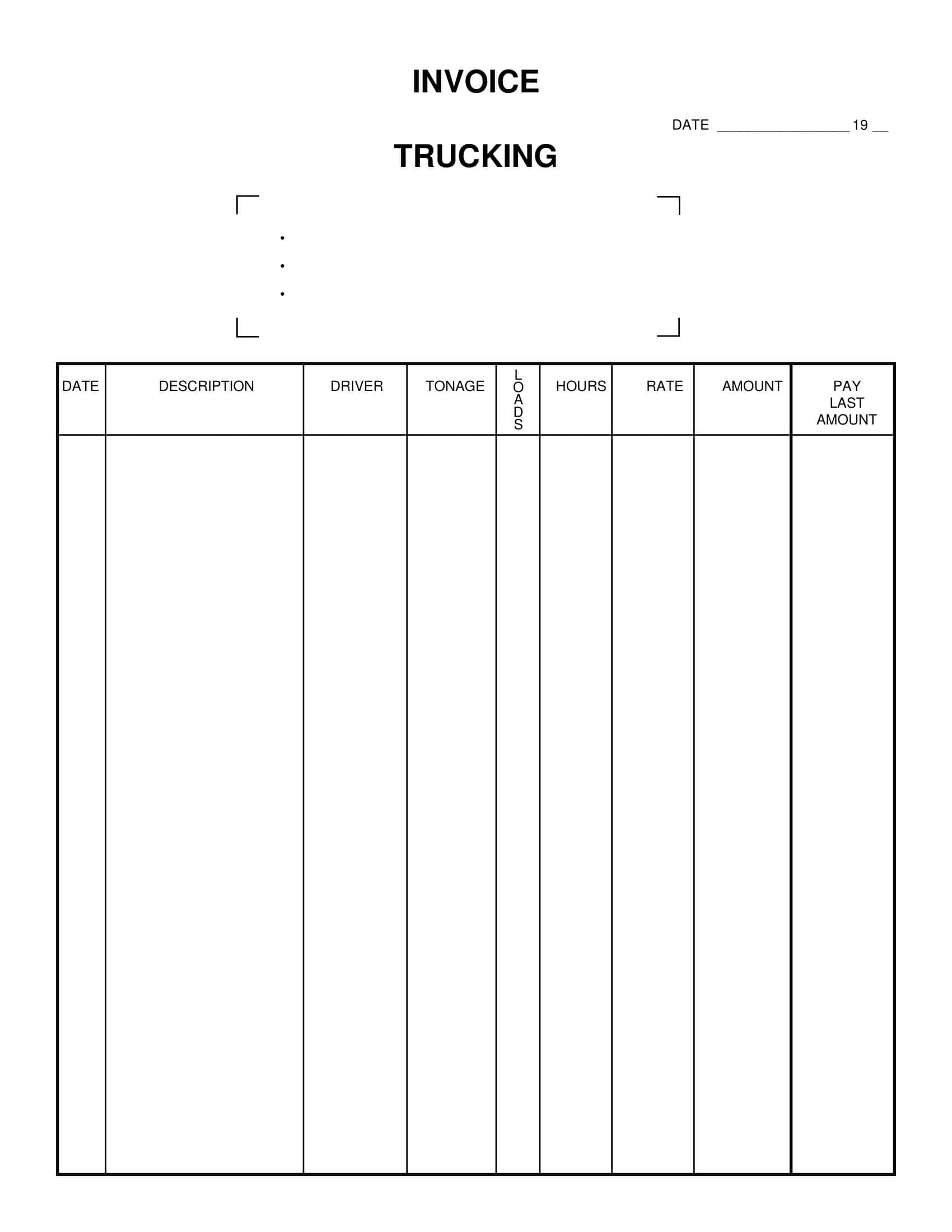

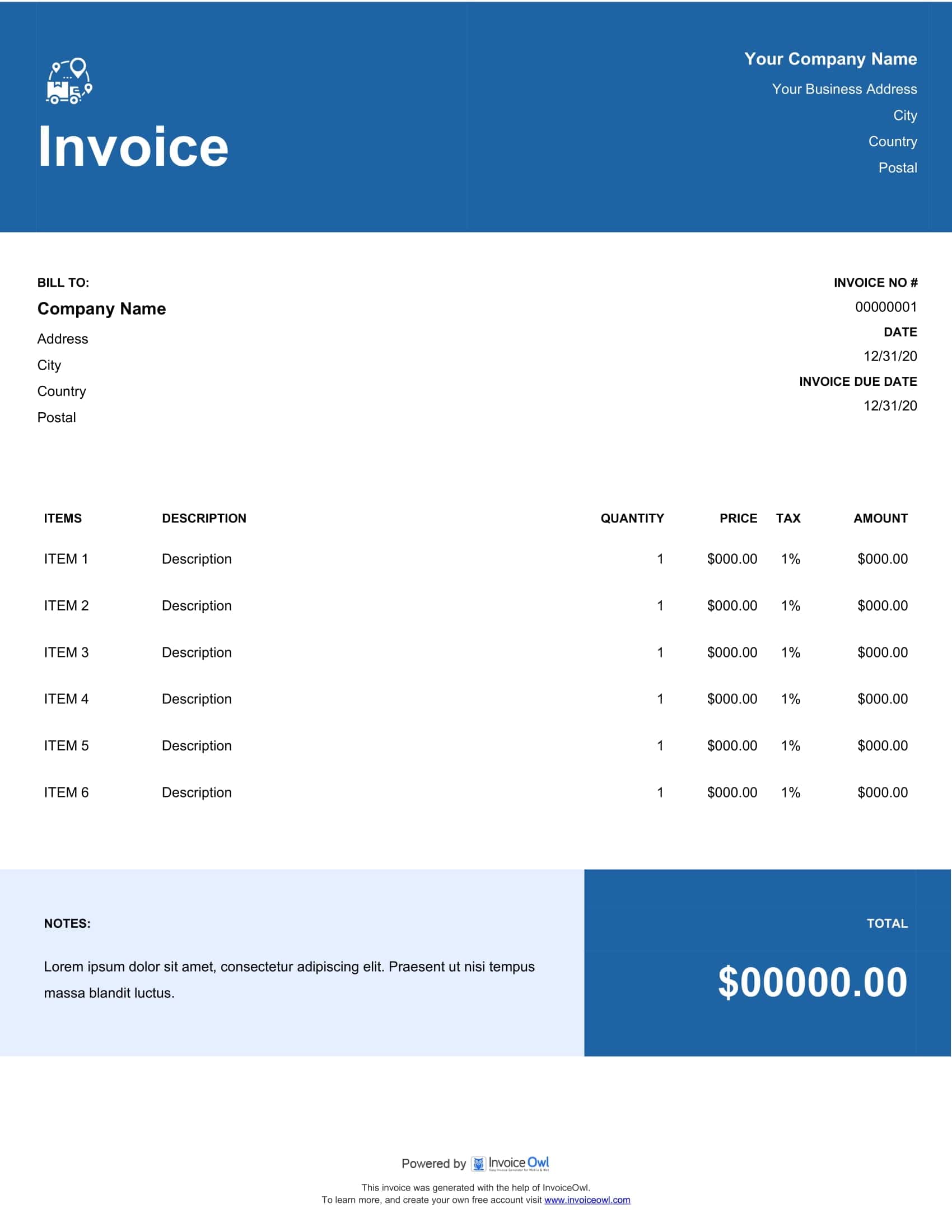

Trucking Invoice Templates

Trucking Invoice Templates allow trucking companies and owner-operators to efficiently bill clients for hauling services and keep accurate accounts receivable records. Having standardized Trucking Invoice Templates optimizes and simplifies invoice creation for each shipment moved. The templates save truckers time while looking professional.

The Trucking Invoice Templates consolidate all essential billing information like company details, client contacts, origin/destination, freight classifications, weight, rates, charges, and payment terms in a clear standardized format. Load numbers, dates, tracking details, and other data can be included for reference. Calculations are automated to prevent errors. Custom company branding promotes credibility.

For trucking businesses, Trucking Invoice Templates enable fast, consistent invoicing that enforces payment policies and keeps cash flowing. The templates minimize the effort required to properly bill each customer. Having invoices uniform in appearance and content also makes billing easier for clients to understand and process promptly. Trucking Invoice Templates are an invaluable tool for smooth business-to-business transactions.

What Is a Trucking Invoice Used for?

A trucking invoice is a specialized type of billing document used within the trucking industry. Unlike standard invoices that businesses might use for generic services or product sales, a trucking invoice caters specifically to the nuances of transporting goods. Here’s a detailed exploration of its uses:

- Documentation of Services Rendered: At its core, a trucking invoice serves as a record of transportation services rendered. This includes details such as the origin and destination of the shipment, type of goods transported, weight or volume of the goods, and the distance covered.

- Payment Clarification: The invoice itemizes costs associated with the shipment, providing clarity on what the client is paying for. Charges might include base transportation fees, fuel surcharges, additional services like loading or unloading, and any other applicable fees or tolls.

- Facilitation of Timely Payments: For independent truckers or trucking companies, invoicing is a tool that prompts clients to make payments. Clearly stated payment terms, such as net 30 or net 60, and penalties for late payments, encourage clients to pay on time.

- Financial Record Keeping: Invoices play an essential role in maintaining financial records for a trucking business. They help in tracking revenue, identifying outstanding payments, and analyzing business growth. Proper invoicing can also simplify tax filing by offering clear financial documentation.

- Legal Protection: In cases of disputes regarding payment or services rendered, a well-detailed invoice can serve as a legal document that shows what was agreed upon and what services were provided.

- Building Professionalism: Sending structured and detailed invoices reflects professionalism, which can help build trust with clients. It assures clients that they are dealing with a reputable and organized service provider.

- Operational Analysis: By maintaining and reviewing trucking invoices, companies can gather insights into their operations. Patterns may emerge, such as which routes are most profitable, which clients consistently have extra requirements, or seasonal fluctuations in business.

- Track of Receivables: With the help of trucking invoices, companies can keep track of their account receivables, allowing them to manage their cash flow better. Recognizing which clients are habitual late-payers or understanding the overall outstanding dues can guide a company’s financial strategies.

- Proof of Transaction: For clients, the invoice serves as proof of the transaction. It can be used to validate expenses, claim deductions, or confirm the receipt of goods in the condition as stipulated.

- Customization for Client Needs: Trucking invoices can be adapted to suit specific client needs. Some clients might require additional details, like references to purchase orders, specific item codes, or detailed breakdowns of services. A customized invoice can accommodate these preferences, ensuring smoother business transactions.

Importance of a Trucking Invoice

The trucking invoice, while a piece of documentation, plays a pivotal role in the business logistics and financial dynamics of the trucking industry. Its importance is multifaceted, touching various aspects of the business. Here’s a detailed guide to understanding its significance:

Revenue Generation:

At its most basic, the trucking invoice is the tool through which trucking companies or independent truckers bill their clients, ensuring that they are compensated for their services. Without clear, comprehensive invoicing, revenues can be delayed or even lost.

Professionalism and Credibility:

A well-structured invoice is a reflection of a company’s or individual’s professionalism. It gives clients confidence in the service provider’s commitment to proper business practices, enhancing the trucker’s reputation in a competitive market.

Financial Management:

Invoices play a critical role in cash flow management. By tracking issued invoices and their respective payment statuses, companies can manage their accounts receivable efficiently. This ensures steady cash flow, enabling the business to meet its operational costs promptly.

Legal Documentation:

A trucking invoice serves as a legally binding document that outlines the agreed-upon services and costs. In the event of disagreements or disputes, it provides evidence that can be referred to in legal settings or negotiations.

Taxation and Compliance:

For tax purposes, maintaining a detailed record of all invoices is essential. They serve as proof of revenue and are critical when computing taxes, claiming deductions, or during audits. Proper invoicing ensures that businesses remain compliant with tax regulations.

Operational Insights:

Regularly reviewing trucking invoices can provide a wealth of insights. Companies can gauge which routes are most profitable, which clients yield the most business, or even seasonal trends in transportation demands. These insights can guide operational strategies and business growth.

Client Relationship Management:

Invoices often include detailed descriptions of services, which ensure transparency with clients. By clearly detailing what clients are being charged for, trust is fostered, and misunderstandings are minimized. Moreover, if clients have specific invoicing requirements or need breakdowns for their records, catering to these needs can enhance client relationships.

Tracking and Verification:

Given the nature of trucking – with goods moving across vast distances – an invoice can also serve as a verification tool. It can be used to verify the delivery of goods, the condition they were received in, or any additional services rendered during transit.

Forecasting and Budgeting:

A systematic collection and analysis of trucking invoices can aid in forecasting future revenue streams. It can also help businesses budget for future expenses, making for more informed financial decisions.

Streamlined Communication:

A detailed invoice can reduce the need for back-and-forth communication between truckers and clients. By providing all necessary information upfront, companies can save time and reduce potential friction points.

Customization and Flexibility:

The ability to customize trucking invoices allows businesses to cater to a diverse clientele with varied requirements. This flexibility can be a competitive advantage, making it easier for clients to integrate their processes with the trucking service provider.

Types of Invoice for Trucking Companies

Invoicing is an integral part of the trucking industry, ensuring accurate billing and documentation of transportation services. Depending on the nature of the service, client requirements, or the terms of service, trucking companies can employ various types of invoices. Here’s a detailed look at the different types:

Proforma Invoice:

- Description: This is a preliminary invoice, often sent before the transportation service is completed or before the shipment is delivered. It gives the client an idea of the expected costs.

- Usage: It’s frequently used in international shipping to provide customs officers with a detailed outline of the goods being imported or exported, allowing them to determine the correct duties or tariffs.

Commercial Invoice:

- Description: Used primarily in international shipping, this invoice is more detailed than the proforma and represents a formal request for payment.

- Usage: It serves dual purposes – as a bill for the goods and as a critical document for customs clearance, detailing the value of goods, country of origin, and other essential data.

Rate Confirmation Invoice:

- Description: This invoice confirms the agreed-upon rates between the shipper (or broker) and the trucking company or independent trucker before the shipment.

- Usage: It’s crucial for establishing clear terms, avoiding future disputes, and ensuring transparency.

Spot Freight Invoice:

- Description: In the trucking industry, spot freight refers to shipments made in the open market, as opposed to those under a contract. The invoice for such services is often immediate and based on current market rates.

- Usage: For one-off, non-contractual shipments where pricing might vary based on market conditions.

Recurring Invoice:

- Description: For clients who use the trucking company’s services regularly, a recurring invoice is issued at agreed intervals, such as monthly or quarterly.

- Usage: Suitable for long-term contracts or agreements where the same services are rendered repeatedly over time.

Progress Invoice:

- Description: This is issued at various stages of a lengthy transportation project, allowing the trucking company to get paid in increments.

- Usage: Typically used for large projects, where payment in stages helps manage cash flow and financial stability.

Time-Based Invoice:

- Description: Instead of charging based on distance or load, this invoice charges based on the time taken to complete the transportation service.

- Usage: Suitable for tasks that might have unpredictable durations, like transporting delicate items requiring extra care.

Lumper Invoice:

- Description: A lumper service involves third-party loading or unloading of cargo. An invoice for these services, either integrated into the main trucking invoice or separate, is the lumper invoice.

- Usage: Common in scenarios where external labor is used for loading or unloading, ensuring these services are billed for.

Freight Bill Invoice:

- Description: This is a detailed bill provided by carriers to shippers, containing specifics like shipment origin, destination, weight, and the amount due.

- Usage: It’s the standard invoice type for many trucking operations, detailing the core transportation services.

Past Due Invoice:

- Description: If a client hasn’t settled their bill by the due date, a past due invoice, often with added late fees or interest, is sent as a reminder.

- Usage: Effective for managing late payments and highlighting the importance of timely settlements.

How to Create a Trucking Invoice

For truckers transporting freight loads near and far, accurate invoicing is critical for getting paid quickly. However, invoicing can get pushed aside amidst the demands of hauling loads on tight deadlines across state lines. Developing efficient invoicing habits not only gets truckers compensated sooner, it portrays professionalism and keeps clients satisfied. This part will provide owner-operators and small fleets a step-by-step guide on how to generate complete, polished trucking invoices. We will outline what information to include, best practices for organizing details, and tips for streamlining the process using templates and tools. You’ll learn how to capture all hauling particulars from mileage to wait times while showcasing your services. With these invoicing techniques, payments will be processed swiftly so you can get back on the road. A rock-solid invoicing approach provides the foundation for success in the trucking business.

Step 1: Gather Necessary Information

Before you begin creating the invoice, ensure that you have all the essential information on hand. This includes your company’s details such as name, address, and contact number, the client’s details, the date of shipment, the cargo details, and any pre-agreed rates or charges. Having this information readily available will make the process more streamlined and prevent backtracking. If you’re using an invoicing software, some of this information may be pre-filled or saved from previous invoices.

Step 2: Choose an Invoicing Platform

There are multiple platforms available for generating invoices, from traditional software like Microsoft Word or Excel to specialized invoicing software tailored for the trucking industry. Selecting the right platform depends on your needs, budget, and volume of invoices. Some trucking-specific software solutions might even have features that allow tracking, automatic rate calculation, and integration with other logistics tools.

Step 3: Design the Invoice Layout

Begin with a clear title at the top, usually the word “Invoice”. Ensure that the layout is clean and organized. Typically, your company’s information goes on the top left, while the client’s details are on the right. Below this, include sections for the shipment details, such as the date, origin, and destination. Some businesses also include a unique invoice number for tracking purposes. Ensure that there’s a clear section for itemizing the services provided and the associated costs.

Step 4: Fill in Shipment Details

Detail every important aspect of the shipment. This includes the date of shipment, the cargo’s description, its weight, origin, destination, and the type of trucking service provided (e.g., full truckload, less than truckload). This provides clarity to your client about what they’re being charged for and can also serve as proof of service.

Step 5: Itemize Costs

List down all the services provided along with their associated costs. This can include mileage or per-hour charges, toll fees, fuel surcharges, and any other additional services or fees. Ensure that all charges are clearly defined and in line with your pre-agreed terms. Total up all the itemized costs at the bottom, making it clear what the final charge is.

Step 6: Include Payment Terms

Clearly state your payment terms. This could be “Due upon receipt”, “Net 30 days”, or any other terms you’ve agreed upon with your client. This section should also include acceptable payment methods, such as checks, bank transfers, or credit card payments, and provide details for each (e.g., bank account number, mailing address for checks).

Step 7: Add Notes or Special Instructions

Sometimes, there might be specific details or instructions related to the shipment or payment terms that need to be communicated. Use this section to provide any additional information, clarifications, or even just a thank-you note to build rapport with your clients.

Step 8: Proofread and Send

Before sending out the invoice, take a moment to review it for any errors or omissions. A simple oversight can lead to disputes or delayed payments. Once you’re satisfied that everything is in order, send the invoice to the client using their preferred method, whether it’s email, mail, or any other method.

Step 9: Track and Follow-up

Keep a copy of all sent invoices and track their status. If a payment hasn’t been received by the due date, send a polite reminder to the client. Keeping an organized system will ensure you maintain positive cash flow and professional relationships with your clients.

When To Send a Trucking Invoice?

The ideal time to send a trucking invoice is within 24 hours of completing delivery while the details are still fresh. However, at the very latest, invoices should be sent within 3-5 days of finishing the haul. Quick invoicing speeds up payment processing so truckers get compensated faster. For spot market loads, it’s prudent to submit the invoice same-day since those customers typically want billing as soon as the haul is done. Truckload or LTL shipments with regular customers may allow a few more days for invoicing but still should be sent promptly. This prevents details from being forgotten and prevents payment delays. With trucking invoicing software, e-invoicing, and invoice templates, generating and sending polished invoices quickly is simple. The faster accurate invoices are in customers’ hands, the faster truckers will have checks in theirs.

Mistakes to Avoid in Trucking Invoice

Trucking companies, like other businesses, rely on accurate invoicing to ensure timely payments and maintain good relationships with their clients. Mistakes in invoicing can lead to delayed payments, disputes, and strained business relationships. Here are some common mistakes to avoid in trucking invoicing and the challenges that trucking companies often face:

- Incorrect Billing Details:

- Ensure that all client details, including company name, address, and contact information, are correct.

- Always double-check the shipment’s details, like the origin and destination.

- Omission of Important Details:

- Always include load number, purchase order number, and any other reference numbers provided by the customer.

- Make sure to detail the services provided, such as type of freight, weight, number of packages, and the route taken.

- Mismatched Rates:

- It’s crucial to match the rates in the invoice with the agreed-upon rates in the contract or rate sheet. Inconsistencies can lead to disputes and delayed payments.

- Not Including Accessorial Charges:

- Charges such as fuel surcharges, detention time, and lumper fees should be itemized separately on the invoice.

- Always have a pre-agreed basis or documented proof when including these charges.

- Lack of Backup Documentation:

- Always attach essential documents like the Bill of Lading (BOL), proof of delivery, weight tickets, etc.

- These documents provide proof of service and can prevent disputes.

- Inconsistent Invoicing Schedules:

- Inconsistent billing can cause confusion. Have a fixed schedule, whether it’s weekly, bi-weekly, or monthly.

- Errors in Calculations:

- Whether it’s manual or automated invoicing, always double-check the calculations to ensure there are no overcharges or undercharges.

- Using an Outdated System:

- Relying on paper-based or outdated systems can lead to errors, lost invoices, and inefficiencies.

- Consider using modern invoicing software tailored for the trucking industry.

- Failing to Communicate with Clients:

- Always communicate any changes, discrepancies, or additional charges in real-time. This can prevent disputes at the invoicing stage.

- Not Keeping Copies:

- Always keep copies of sent invoices and backup documentation. This is essential for reference, audits, or in case of disputes.

- Delayed Invoicing:

- Waiting too long to send an invoice can result in delayed payments. Prompt invoicing often leads to faster payment.

- Ignoring Invoice Disputes:

- Always address any invoice disputes promptly. Open communication can help resolve issues amicably and ensure future business.

- Not Having Clear Payment Terms:

- Clearly state the payment terms on the invoice, including due dates, late fees, and accepted payment methods.

- Not Following Up on Past Due Invoices:

- Regularly review your accounts receivable and follow up on past-due invoices. Establish a consistent reminder system for overdue payments.

- Neglecting Invoice Reconciliation:

- Periodically reconcile your invoices with your accounting system to ensure that all payments are accurately recorded.

Challenges:

- Complex Rate Structures: Trucking companies often deal with varied and complex rate structures, making accurate billing a challenge.

- Changing Fuel Prices: Fluctuating fuel prices mean that fuel surcharges can change frequently, which must be reflected accurately in invoices.

- Multiple Stakeholders: Dealing with brokers, shippers, and consignees can complicate the invoicing process.

- Varied Payment Terms: Different clients might have different payment terms, which need to be managed and tracked effectively.

- Regulatory Changes: The trucking industry is subject to various regulations. Keeping up with these and ensuring that invoicing complies can be challenging.

To minimize these mistakes and challenges, trucking companies should invest in training staff, implementing robust invoicing software, and maintaining open communication channels with their clients.

FAQs

What is an accessorial charge on a trucking invoice?

Accessorial charges are additional fees that might be applied for services beyond basic shipping. Examples include fuel surcharges, detention time, lumper fees, or fees for handling hazardous materials.

How do I handle disputes on a trucking invoice?

It’s essential to address disputes promptly. Begin by reviewing the invoice with the client, referencing any agreements or contracts. If needed, provide backup documentation like the BOL or proof of delivery. Open communication is key to resolving disputes amicably.

Why is my trucking invoice higher than the quoted rate?

Several factors can contribute to this discrepancy, such as additional services rendered, unexpected fees, changes in fuel prices affecting surcharges, or errors in the initial quote or final invoice. It’s essential to itemize every charge on the invoice for clarity.

How do I ensure timely payment of my trucking invoices?

Clearly state your payment terms, send invoices promptly, and establish a consistent follow-up system for overdue payments. Some companies offer discounts for early payments as an incentive.

What is a Bill of Lading (BOL), and how does it relate to a trucking invoice?

A BOL is a legal document between the shipper and the carrier detailing the type, quantity, and destination of the goods being carried. It serves as proof of shipment and can be used to resolve disputes related to an invoice.

What invoicing software is recommended for trucking businesses?

There are many invoicing software solutions tailored for the trucking industry, such as TruckingOffice, AscendTMS, and QuickBooks for Trucking. The best option depends on the company’s specific needs and size.

What happens if a client refuses to pay a trucking invoice?

If a client refuses to pay, first address any disputes and try to find an amicable resolution. If disputes continue, you might need to consider legal action, collection agencies, or factoring the invoice to a third-party company.

![Free Printable Food Diary Templates [Word, Excel, PDF] 1 Food Diary](https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-150x150.jpg 150w, https://www.typecalendar.com/wp-content/uploads/2023/05/Food-Diary-1-1200x1200.jpg 1200w)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)