Facing financial hardship? You may be able to get some relief through a forbearance agreement. This legal contract between a lender and borrower allows for a temporary pause or reduction in payments. While not ideal for the long-term, forbearance can provide breathing room when money is tight. In this article, we’ll explain what forbearance entails, who qualifies, and how to request it.

We’ll also look at a sample forbearance agreement so you know what to expect if you pursue this option with your lender. Though not right for everyone, understanding forbearance could help you make an informed decision during difficult financial times.

Table of Contents

What Is a Forbearance Agreement?

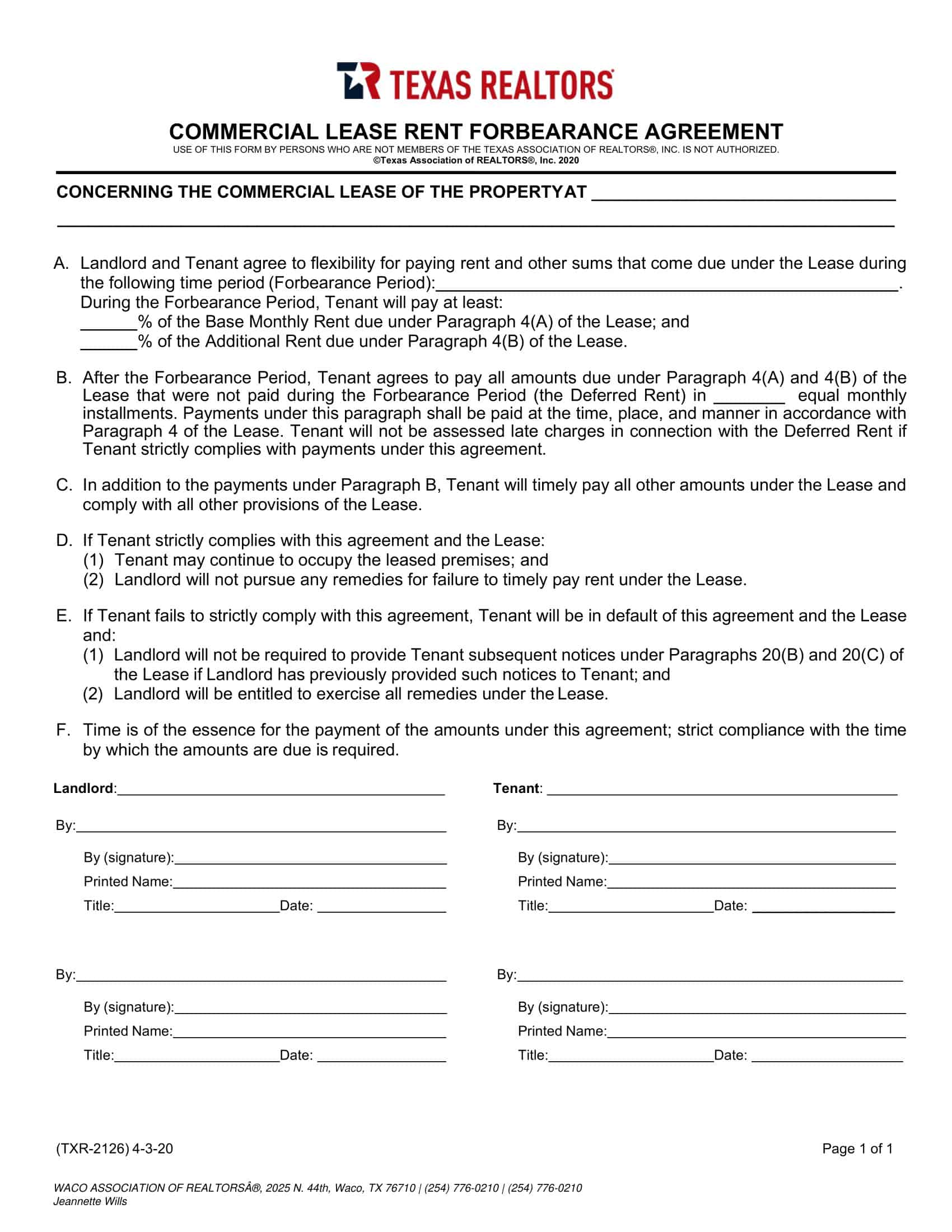

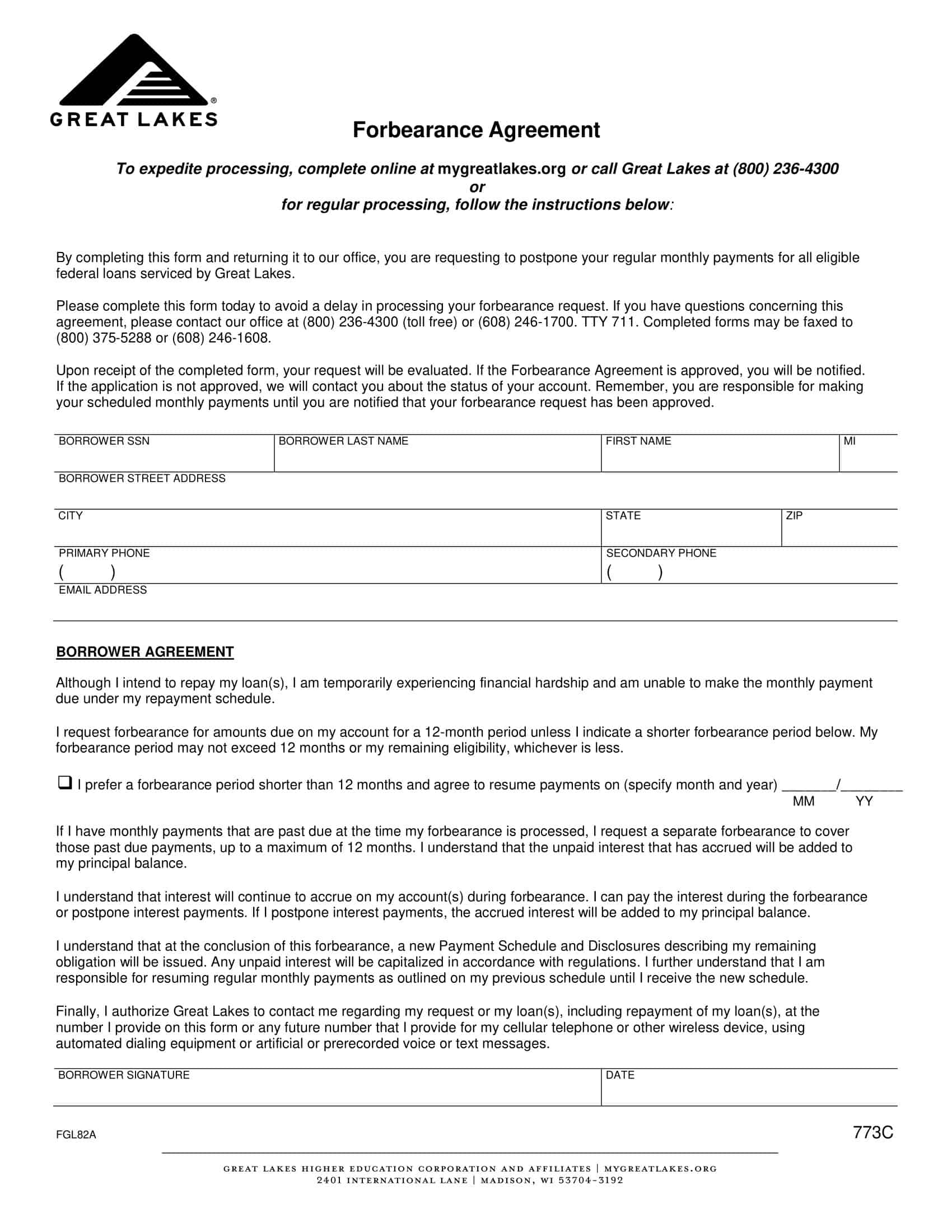

![Free Printable Forbearance Agreement Templates [PDF, Word] Example 1 Forbearance Agreement](https://www.typecalendar.com/wp-content/uploads/2023/08/Forbearance-Agreement.jpg 1920w, https://www.typecalendar.com/wp-content/uploads/2023/08/Forbearance-Agreement-300x169.jpg 300w, https://www.typecalendar.com/wp-content/uploads/2023/08/Forbearance-Agreement-1024x576.jpg 1024w, https://www.typecalendar.com/wp-content/uploads/2023/08/Forbearance-Agreement-768x432.jpg 768w, https://www.typecalendar.com/wp-content/uploads/2023/08/Forbearance-Agreement-1536x864.jpg 1536w, https://www.typecalendar.com/wp-content/uploads/2023/08/Forbearance-Agreement-1200x675.jpg 1200w)

A forbearance agreement is a formal arrangement between a borrower and a lender wherein the lender agrees to temporarily suspend or reduce the borrower’s regular payments, providing short-term relief from financial obligations.

This agreement doesn’t erase the debt; rather, it modifies the payment terms for a specified period, allowing the borrower some time to improve their financial situation or resolve temporary setbacks. After the forbearance period, the borrower will typically resume regular payments, and may also need to pay additional amounts to catch up on the deferred amounts.

Forbearance Agreement Templates

A Forbearance Agreement PDF is an important legal document that can provide temporary financial relief for a borrower unable to make loan payments. Having a standardized Forbearance Agreement PDF available allows lenders to efficiently grant payment pauses under certain conditions as spelled out in the agreement. The PDF document formalizes a binding contract between lender and borrower to suspend payments for a set time period.

The Forbearance Agreement PDF specifies key details like the duration of forbearance, exact date when regular payments will resume, affirmation that late fees will not accrue during the forbearance period, and any special terms or circumstances influencing the agreement. Borrowers are wise to thoroughly review the details and obligations outlined before signing. For lenders, keeping the Forbearance Agreement PDF details clear and consistent simplifies the process of legal notification when granting forbearance across their client base.

A properly executed Forbearance Agreement PDF benefits both lender and borrower by preventing delinquency and maintaining positive lending relationships during temporary borrower hardships. Having quick access to a standardized Forbearance Agreement PDF allows lenders to swiftly generate agreements that protect all parties involved and encourage successful fulfillment of loan obligations. The Forbearance Agreement PDF serves an important role in promoting cooperative borrower-lender relationships.

When to use a Forbearance Agreement?

Using a forbearance agreement can be a strategic tool for borrowers facing temporary financial setbacks. However, it’s crucial to understand when and how to use it appropriately. Here’s a detailed guide:

Identify the Need:

- Temporary Financial Hardship: Forbearance agreements are best suited for borrowers who have a short-term financial crisis, such as job loss, medical emergencies, or natural disasters.

- Transition Periods: You’re in between jobs, or there’s a delay in a known income source.

Understand the Consequences:

- Interest Accrual: Even if payments are reduced or suspended, interest typically continues to accrue, which can increase the total debt amount.

- Credit Impact: Some lenders may report forbearance to credit bureaus, potentially affecting your credit score. However, during specific crises, like pandemics, there may be provisions to avoid negative credit reporting.

Explore Alternatives First:

Before requesting a forbearance:

- Refinancing: Consider refinancing the loan at a lower interest rate or longer term to reduce monthly payments.

- Loan Modification: This permanently changes the loan terms to make them more manageable.

- Hardship Programs: Some lenders offer hardship programs or deferments which might be more suitable.

Communicate with Your Lender:

- Early and Open Communication: As soon as you foresee financial difficulty, reach out to your lender. They might offer solutions you’re unaware of.

- Documentation: Be ready to provide proof of your hardship, such as medical bills, unemployment notices, or proof of reduced income.

Negotiate the Terms:

- Duration: Define the length of the forbearance. It can range from a few months to a year or more, depending on the circumstances.

- Payment After Forbearance: Will you be required to make a lump sum payment of the deferred amount, or will the payments be spread out over time?

- Terms Review: Always read the fine print. Understand if there are any fees, how interest is being treated, and any other conditions.

Formalize the Agreement:

- Written Agreement: Always get the forbearance agreement in writing. It should clearly lay out the terms and conditions.

- Legal Advice: It might be beneficial to consult with a financial advisor or attorney to ensure the agreement is in your best interest.

Plan for the End of Forbearance:

- Savings Plan: If possible, set aside funds to cover the deferred amounts, so you’re prepared once the forbearance period ends.

- Stay in Touch with Lender: If your financial situation hasn’t improved towards the end of the forbearance period, contact your lender to discuss potential next steps.

Resume Payments Promptly:

- Avoid Additional Fees: Missing a payment post-forbearance might result in late fees or other penalties.

- Rebuild Trust: Resuming regular payments can help restore your financial credibility.

Monitor Your Credit Report:

- Accuracy: Ensure the forbearance is reported correctly to credit bureaus.

- Disputes: If there are discrepancies, contact the credit bureau and your lender to resolve them.

Learn and Adapt:

- Financial Counseling: Consider counseling to better manage finances and avoid future hardships.

- Emergency Fund: Aim to build an emergency fund to cushion against future financial setbacks.

Benefits of Forbearance Agreement

A forbearance agreement, while not always the first or best solution for everyone, offers several benefits for borrowers facing temporary financial challenges. Here are the primary advantages:

Temporary Relief: The main benefit is that it provides borrowers with temporary relief from their monthly payments, allowing them time to address and navigate short-term financial hardships.

Avoid Default: By securing a forbearance agreement, borrowers can avoid defaulting on their loans, which can have severe legal and financial repercussions.

Prevent Foreclosure: For homeowners, forbearance can help avoid the foreclosure process, allowing them to keep their home while they work through financial difficulties.

Flexibility in Repayment: Lenders might offer a variety of options for making up the missed payments after the forbearance period, such as spreading them out over time or adding them to the end of the loan term.

Protect Credit Score: If the lender agrees not to report the reduced or paused payments to credit bureaus, the borrower’s credit score may not be negatively impacted as it would with missed payments or defaults.

Maintain Good Relationship with Lender: By proactively communicating and negotiating with the lender, borrowers can maintain a positive relationship, which can be beneficial for any future negotiations or loan needs.

Mental and Emotional Relief: Knowing there’s a grace period where payments are paused or reduced can reduce the psychological stress and burden associated with potential default or eviction.

Time to Strategize: With the immediate pressure of payments paused, borrowers have time to seek financial counseling, find alternative sources of income, or make other necessary adjustments to their financial situation.

Avoid Additional Late Fees: Most forbearance agreements will suspend late fees during the forbearance period, saving the borrower from accumulating more debt.

Potential for Loan Modifications: In some cases, once the forbearance period ends, lenders might be more amenable to discussing a permanent loan modification if the borrower’s circumstances haven’t significantly improved.

However, while these benefits can provide temporary relief and flexibility, it’s essential for borrowers to understand the potential long-term implications of a forbearance agreement, such as increased interest over the life of the loan and larger future payments. It’s advisable to seek financial advice or counseling when considering a forbearance agreement to ensure it’s the best solution for one’s specific situation.

Forbearance Agreement vs. Loan Modification

Both mortgage forbearance agreements and loan modifications are tools that borrowers can use to manage financial hardships. However, each offers different relief and works in distinct ways. Here’s a detailed guide to help you understand the differences between the two:

- Duration:

- Forbearance: Temporary relief, typically lasting a few months to a year.

- Loan Modification: Permanent change to the loan’s original terms.

- Nature of Relief:

- Forbearance: Pauses or reduces monthly payments for a set period.

- Loan Modification: Alters the mortgage terms to make payments more manageable (e.g., reduced interest rate, extended loan term).

- Repayment:

- Forbearance: Deferred payments are required to be repaid in the future, either in a lump sum, increased monthly payments, or by extending the loan term.

- Loan Modification: There’s no separate “catch-up” on payments; instead, the original loan terms are adjusted to fit the borrower’s capacity.

- Interest Accrual:

- Forbearance: Interest typically continues to accrue during the forbearance period.

- Loan Modification: Interest terms may be modified, potentially reducing the rate or changing it from variable to fixed.

- Credit Impact:

- Forbearance: Lenders might not report forbearance as a missed payment, but it depends on the agreement and lender practices.

- Loan Modification: Impact varies. Reduced payment amounts might not negatively affect credit, but prior late payments (pre-modification) could.

- Eligibility Criteria:

- Forbearance: Typically requires demonstration of a temporary hardship.

- Loan Modification: Requires proof of more sustained or long-term financial hardship, and the lender assesses the borrower’s long-term financial situation.

- Long-term Impact:

- Forbearance: Payments are delayed, not forgiven, which can result in a financial burden once the forbearance period ends.

- Loan Modification: Payments are adjusted to become more manageable, resulting in a modified loan structure for the remainder of the term.

Requirements for Mortgage Forbearance

The specific requirements for mortgage forbearance can vary depending on the lender, the type of loan, federal and state regulations, and other factors. However, some general requirements and considerations for mortgage forbearance include:

Proof of Financial Hardship: This is the most crucial requirement. Borrowers need to demonstrate genuine financial hardship that prevents them from making their regular mortgage payments. Examples of hardships include:

- Job loss or significant income reduction

- Medical emergencies or severe illness

- Natural disasters affecting the property or borrower’s place of employment

- Death in the family

- Divorce or legal separation

Communication with Lender: Borrowers must proactively communicate with their lender or loan servicer. It’s essential to inform them as soon as you anticipate difficulty in making payments. Don’t wait until you’ve missed payments.

Documentation: Lenders will typically require documentation that supports the claim of financial hardship. This can include:

- Recent pay stubs or proof of income

- Job termination letters or unemployment documentation

- Medical bills or proof of medical condition

- Any other relevant documents that can substantiate your hardship claim

Loan Type Specific Requirements: Different types of loans may have specific requirements or procedures for forbearance:

Federal Loans: Loans backed by federal entities such as Fannie Mae, Freddie Mac, FHA, VA, or USDA often have specific guidelines for forbearance, especially during federally mandated relief periods like during the COVID-19 pandemic.

Private Loans: For loans not backed by a government entity, the terms and requirements for forbearance depend on the individual lender’s policies.

Review the Terms: Ensure you understand the terms of the forbearance agreement. Know how long the forbearance period will last, how much you’ll need to pay (if anything) during the forbearance, and how you’ll be required to make up the deferred payments after the forbearance period ends.

Credit Considerations: Check with your lender about how they will report the forbearance to credit bureaus. In some situations, like during the COVID-19 relief initiatives, forbearance was not supposed to negatively impact borrowers’ credit scores.

Beware of Fees: Some lenders might still accrue interest or fees during the forbearance period. Make sure you understand any additional costs associated with entering into a forbearance agreement.

Conclusion: Understand that forbearance is not the same as a loan modification. At the end of forbearance, you’ll typically need to repay the amount that was paused or reduced, whereas a loan modification involves permanently changing the loan’s terms.

How forbearance agreement works?

A forbearance agreement is primarily designed to provide relief to borrowers undergoing short-term financial hardships, such as job loss, medical emergencies, or other unforeseen challenges that affect their ability to make regular payments.

During the forbearance period, the borrower might be required to make reduced payments or, in some cases, no payments at all. However, it’s important to note that interest usually continues to accrue on the principal balance, even if payments are paused. This means the total amount owed might increase during forbearance.

Once the forbearance period concludes, borrowers generally have to resume their regular payments and make arrangements to repay the amount that was deferred. This could be done in several ways, such as paying a lump sum, increasing monthly payments for a while, or extending the duration of the loan. It’s essential for borrowers to clarify these terms with their lender before entering into a forbearance agreement to avoid surprises down the road.

What a forbearance agreement looks like

While the specific content may vary depending on the lender, the jurisdiction, and the individual circumstances, a typical forbearance agreement might include the following sections:

- Parties Involved: This section lists the names and contact information of the borrower and the lender.

- Recitals/Preamble: This section provides background information on why the forbearance agreement is being executed, typically referring to the borrower’s financial hardship.

- Definitions: Any special terms or jargon used throughout the agreement might be defined in this section.

- Acknowledgment of Debt: This part acknowledges the existing debt, the current outstanding amount, and that the borrower is currently in default or anticipating a default.

- Terms of Forbearance:

- Duration: Specifies the length of the forbearance period.

- Payment Terms: Describes any reduced payments required during the forbearance period or if payments are fully paused.

- Interest Accrual: Details whether interest will continue to accrue during the forbearance period.

- Post-Forbearance Terms: Outlines how the borrower will repay the deferred amounts once the forbearance period ends, whether it’s through a lump sum, higher monthly payments, or an extended loan term.

- Conditions for Default: Specifies conditions under which the forbearance can be terminated, such as if the borrower misses a reduced payment or if the borrower fails to resume regular payments after the forbearance period.

- Waivers: This section may state that the borrower waives any defenses or counterclaims against collection of the debt.

- Representations and Warranties: Statements that confirm the validity, accuracy, and truthfulness of the information provided by both parties.

- Miscellaneous Provisions: This can include:

- Governing Law: States which jurisdiction’s laws will govern the agreement.

- Entire Agreement: Affirms that the agreement contains the full understanding between parties and supersedes all prior understandings or agreements.

- Amendments: Specifies that changes to the agreement must be in writing and signed by both parties.

- Signatures: Both the lender and borrower (and possibly witnesses or a notary public) will sign and date the agreement.

FAQs

Does a forbearance agreement affect my credit score?

Typically, a forbearance in itself doesn’t negatively affect your credit score. However, late or missed payments before entering into a forbearance might be reported and could impact your score. It’s crucial to check with your lender about how they report to credit bureaus.

Will interest continue to accrue during forbearance?

In most cases, yes, interest continues to accrue on your loan during the forbearance period, which can increase the total amount you owe.

Do I have to pay back the skipped payments in a lump sum once forbearance ends?

The terms vary by agreement. Some may require a lump sum, while others may spread the deferred amount over subsequent payments or add the payments to the end of the loan term. It’s essential to understand the repayment terms before entering into forbearance.

How long can I be in forbearance?

The length of forbearance depends on the lender and the borrower’s situation, but it generally ranges from a few months to a year.

Can I request forbearance more than once?

It’s possible, but it depends on the lender’s policies and the specific reasons for the request. Each time, you’d need to demonstrate financial hardship and negotiate the terms with the lender.

Is there a fee to enter into a forbearance agreement?

Some lenders might charge a fee, while others might not. Always ask about potential fees before entering into an agreement.

What happens if I can’t resume payments after forbearance ends?

If you’re unable to make payments once forbearance concludes, you should contact your lender immediately to discuss potential options. These could include loan modification, refinancing, or, in worst-case scenarios, foreclosure.

Can forbearance be applied to any loan type?

Most commonly, forbearance is associated with mortgages, especially those backed by federal entities. However, forbearance can also apply to other types of loans, like student loans, depending on the lender’s policies.

![Free Printable Roommate Agreement Templates [Word, PDF] 2 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![%100 Free Hoodie Templates [Printable] +PDF 3 Hoodie Template](https://www.typecalendar.com/wp-content/uploads/2023/05/Hoodie-Template-1-150x150.jpg)

![Free Printable Payment Agreement Templates [PDF, Word] 4 Payment Agreement](https://www.typecalendar.com/wp-content/uploads/2023/05/Payment-Agreement-1-150x150.jpg)