In the complex world of international trade and ecommerce, documentation plays a crucial role, with one of the most important documents being the proforma invoice. This article delves into the realm of proforma invoices — an integral preliminary billing document that marks the first step in any transaction process.

Far from being a simple piece of paper, a proforma invoice serves as a commitment between the buyer and seller, outlining the goods or services to be provided, their quantities, and prices. It offers a glimpse into the transaction before it happens, helping to establish expectations and build trust. Whether you’re a business owner looking to expand globally, or a curious individual seeking to understand more about commercial trade mechanics, understanding proforma invoices is vital.

Table of Contents

What Is a ProForma Invoice?

A pro forma invoice is a preliminary bill of sale sent to buyers ahead of a shipment or delivery of goods or services. It is often used to declare the value of the trade to customs authorities. It is not a true invoice because it is issued before the seller completes the work or ships the goods, and therefore, it doesn’t serve as a demand for payment.

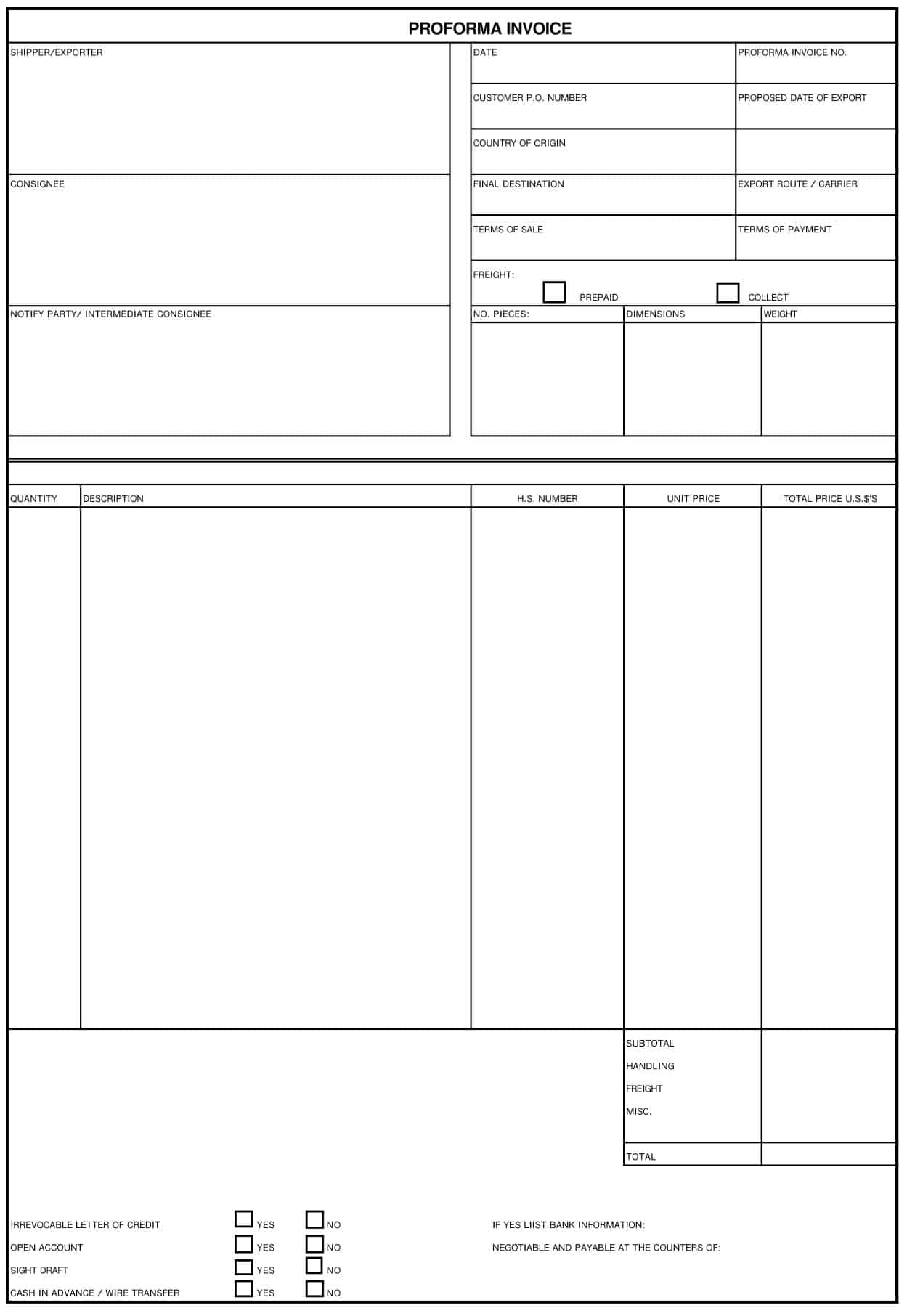

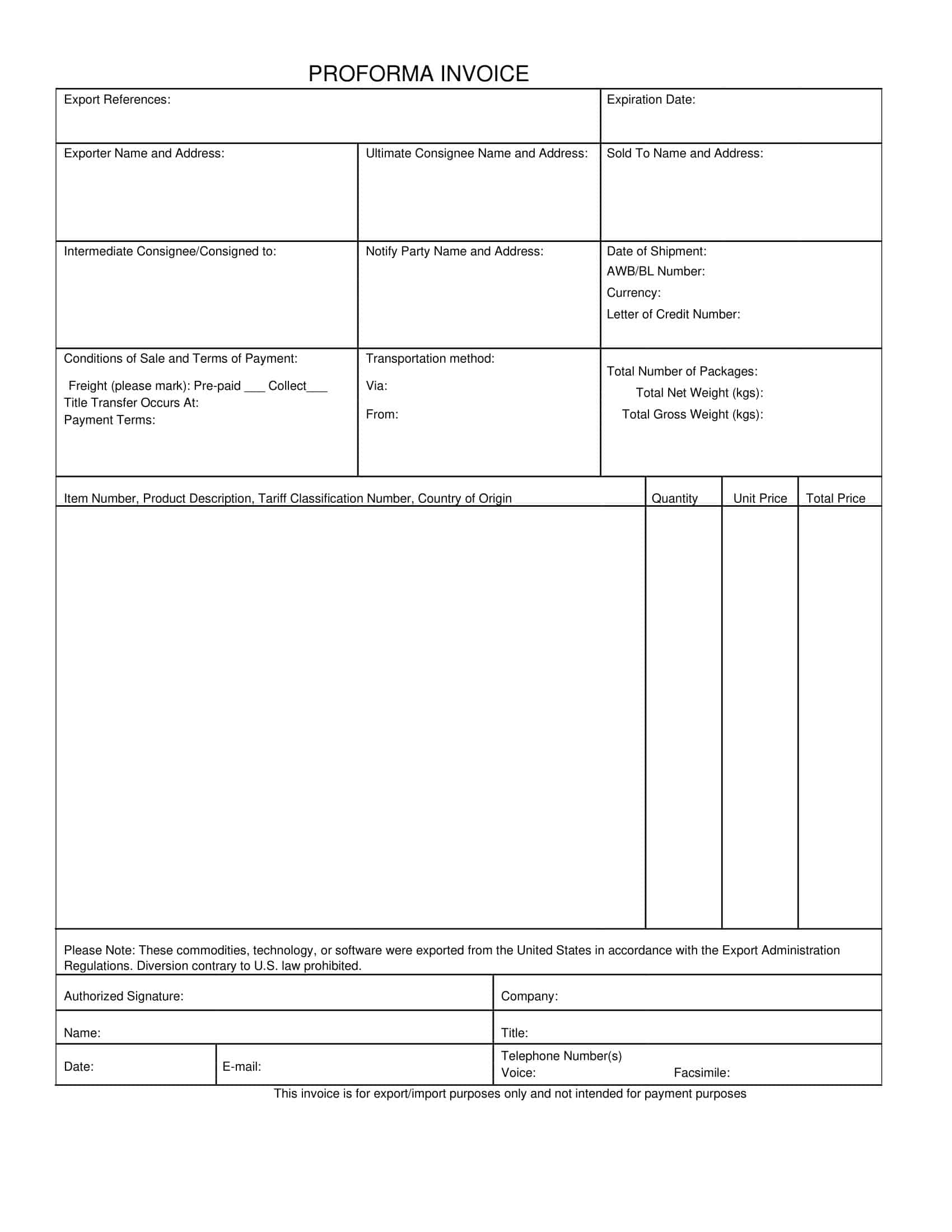

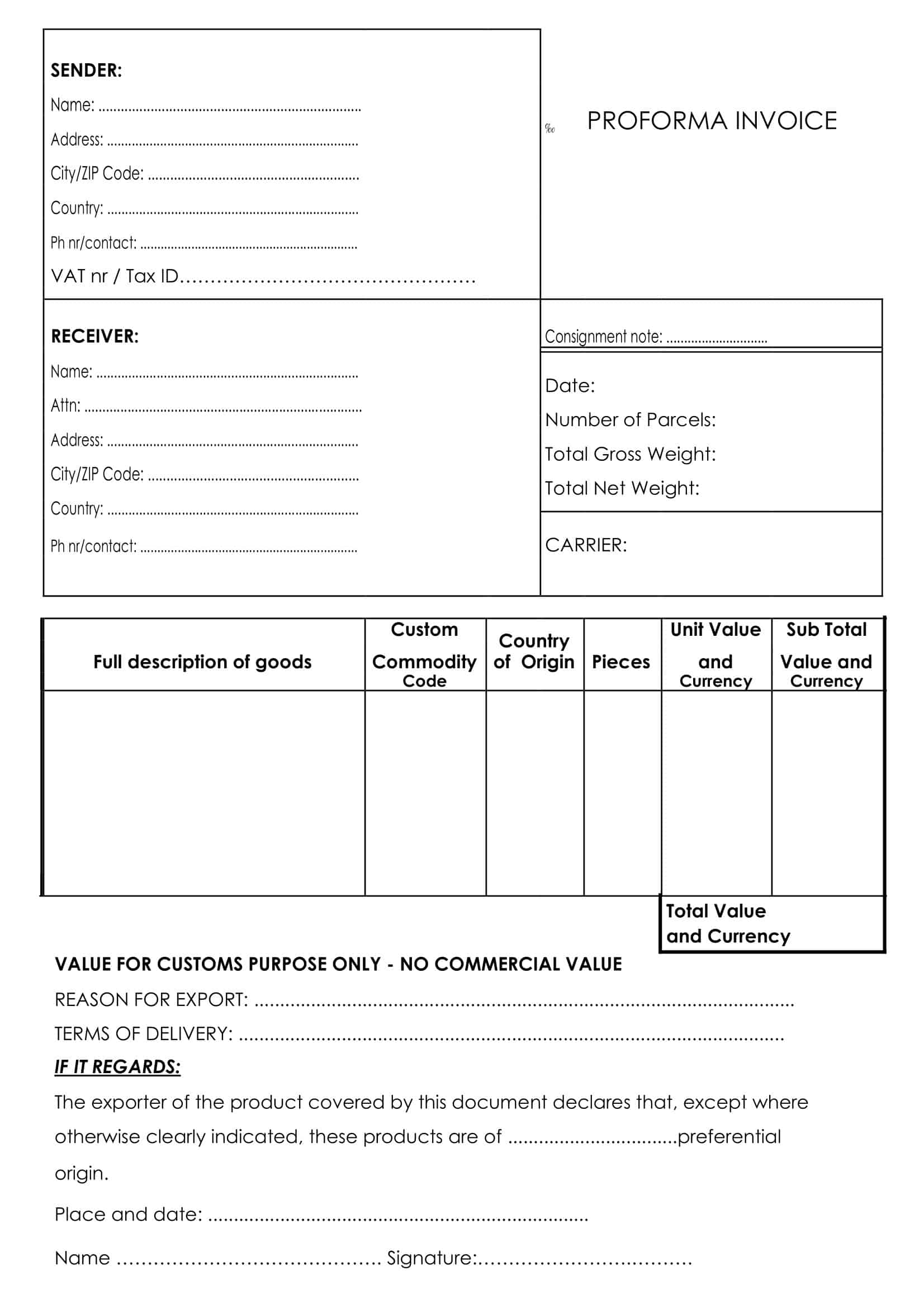

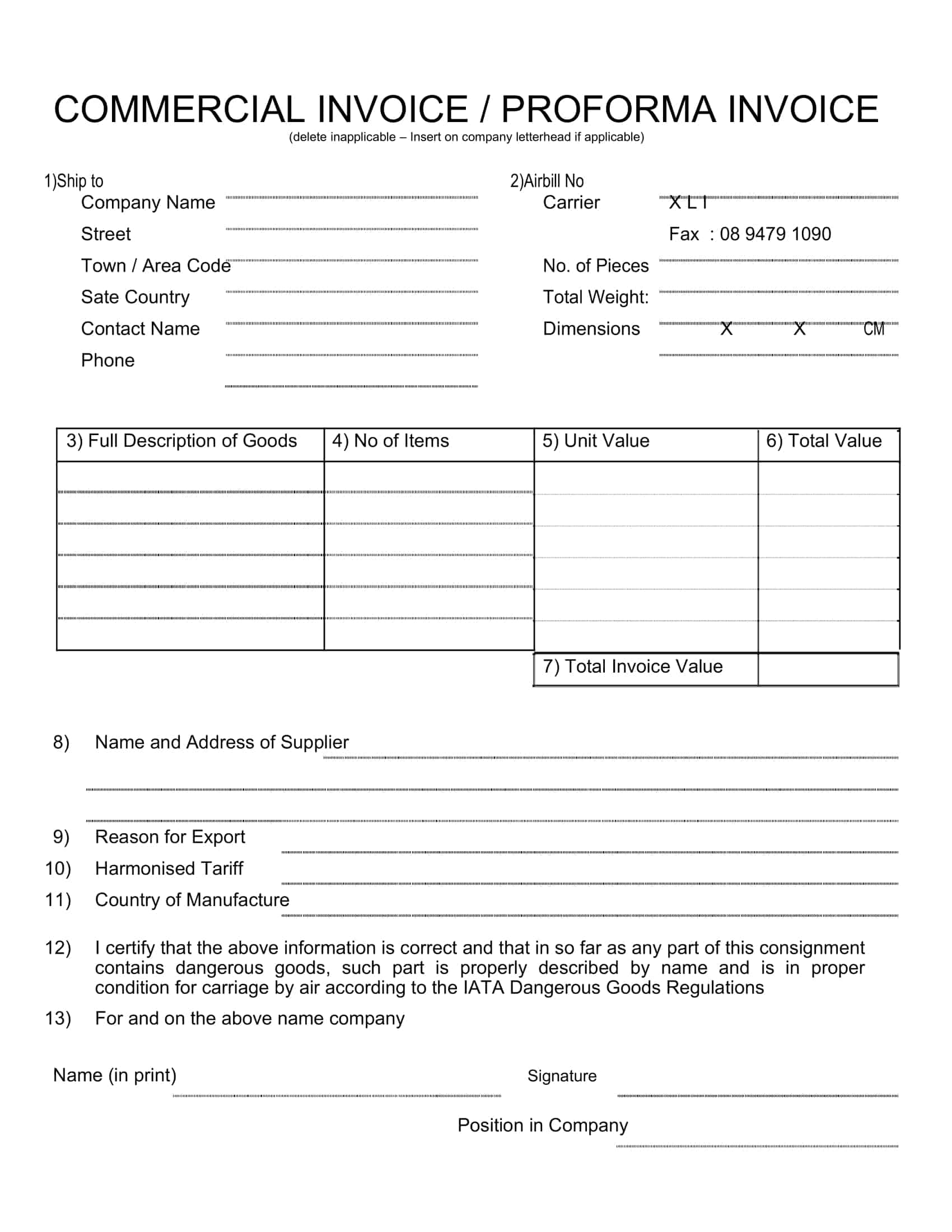

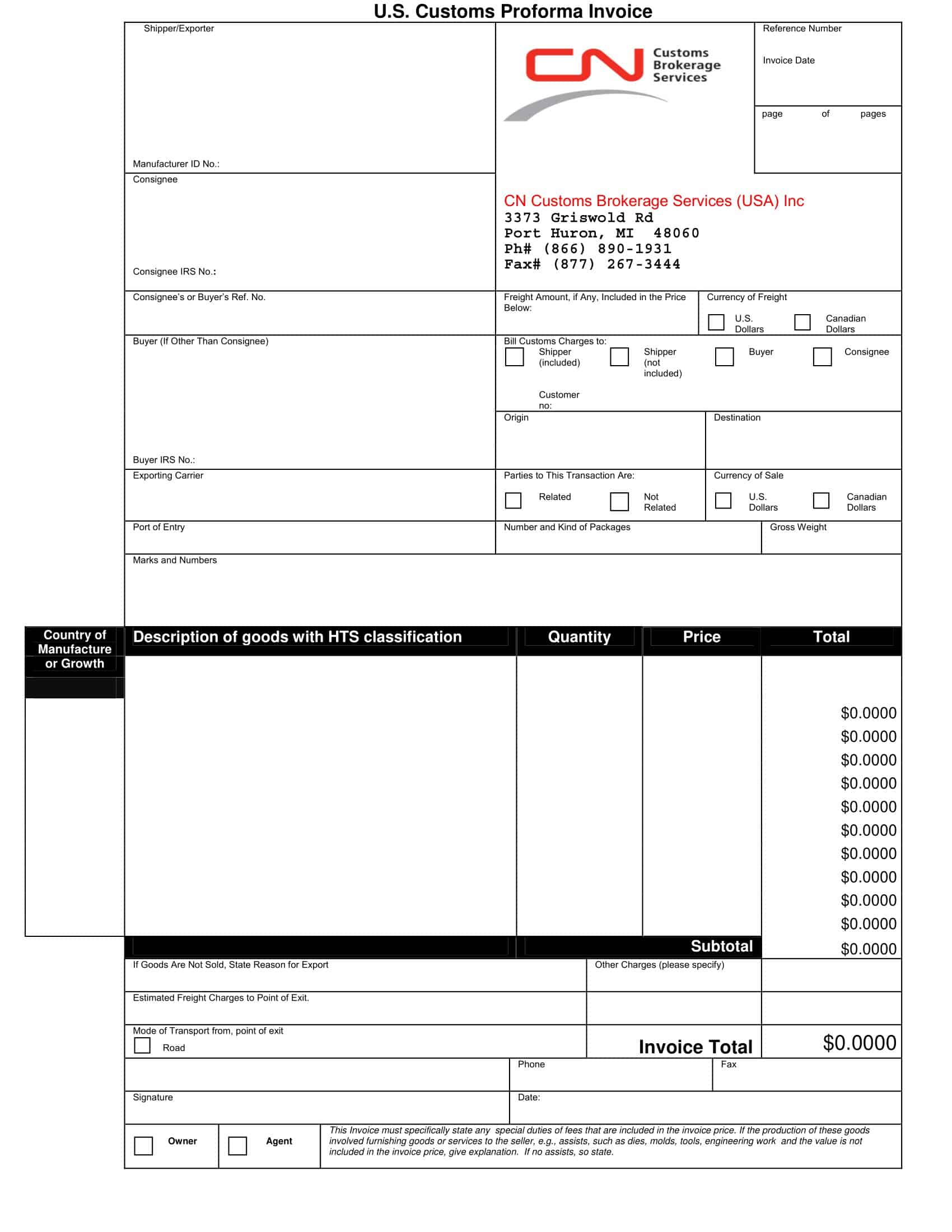

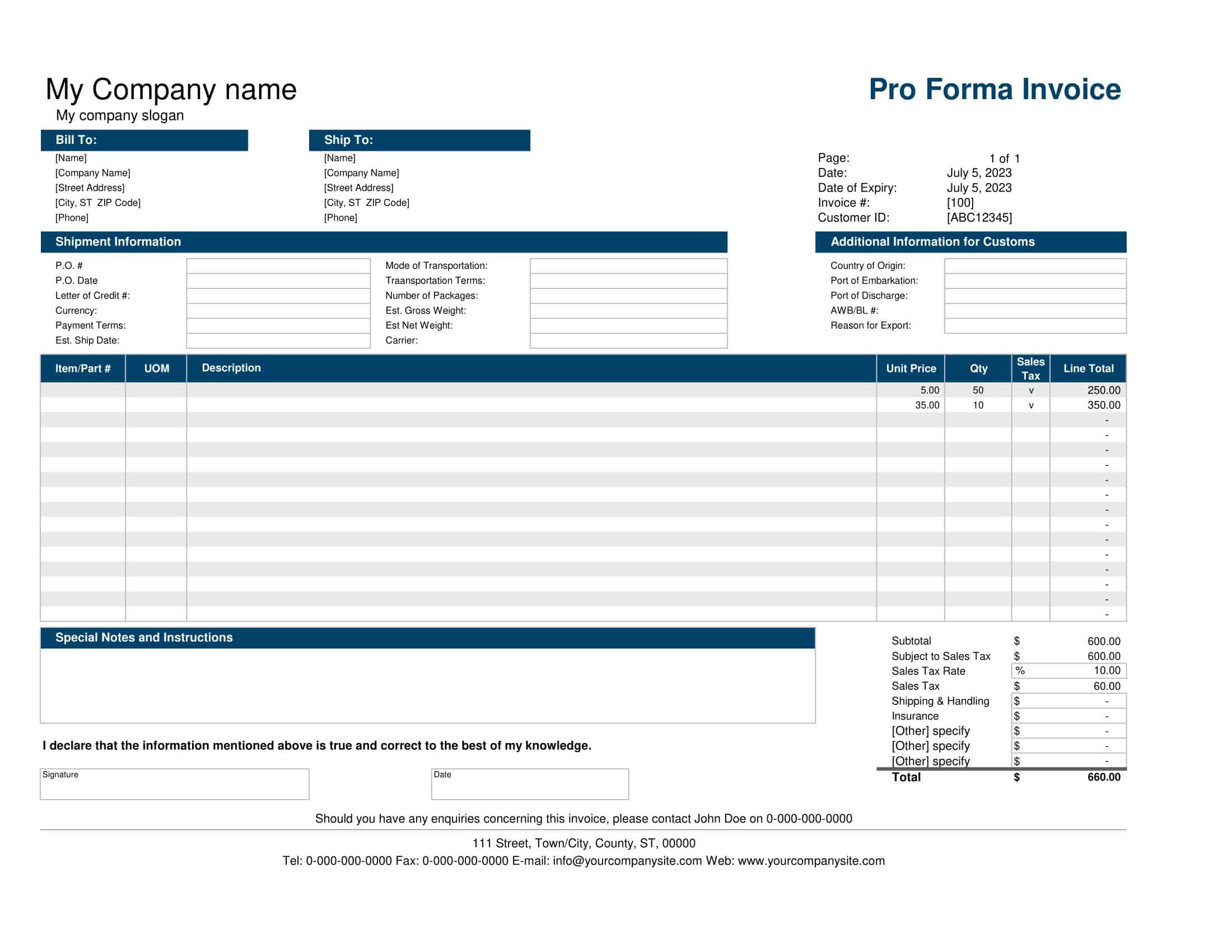

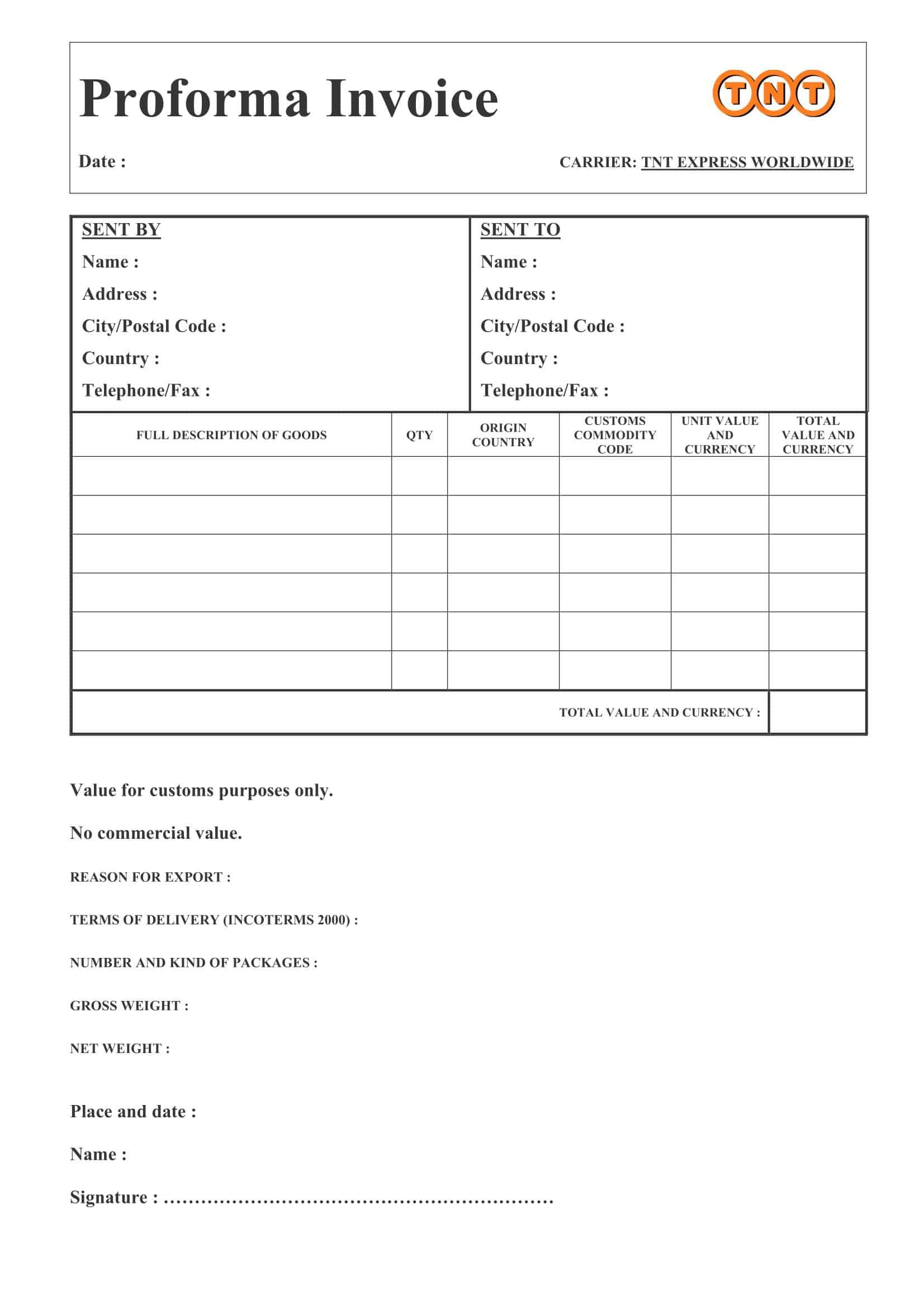

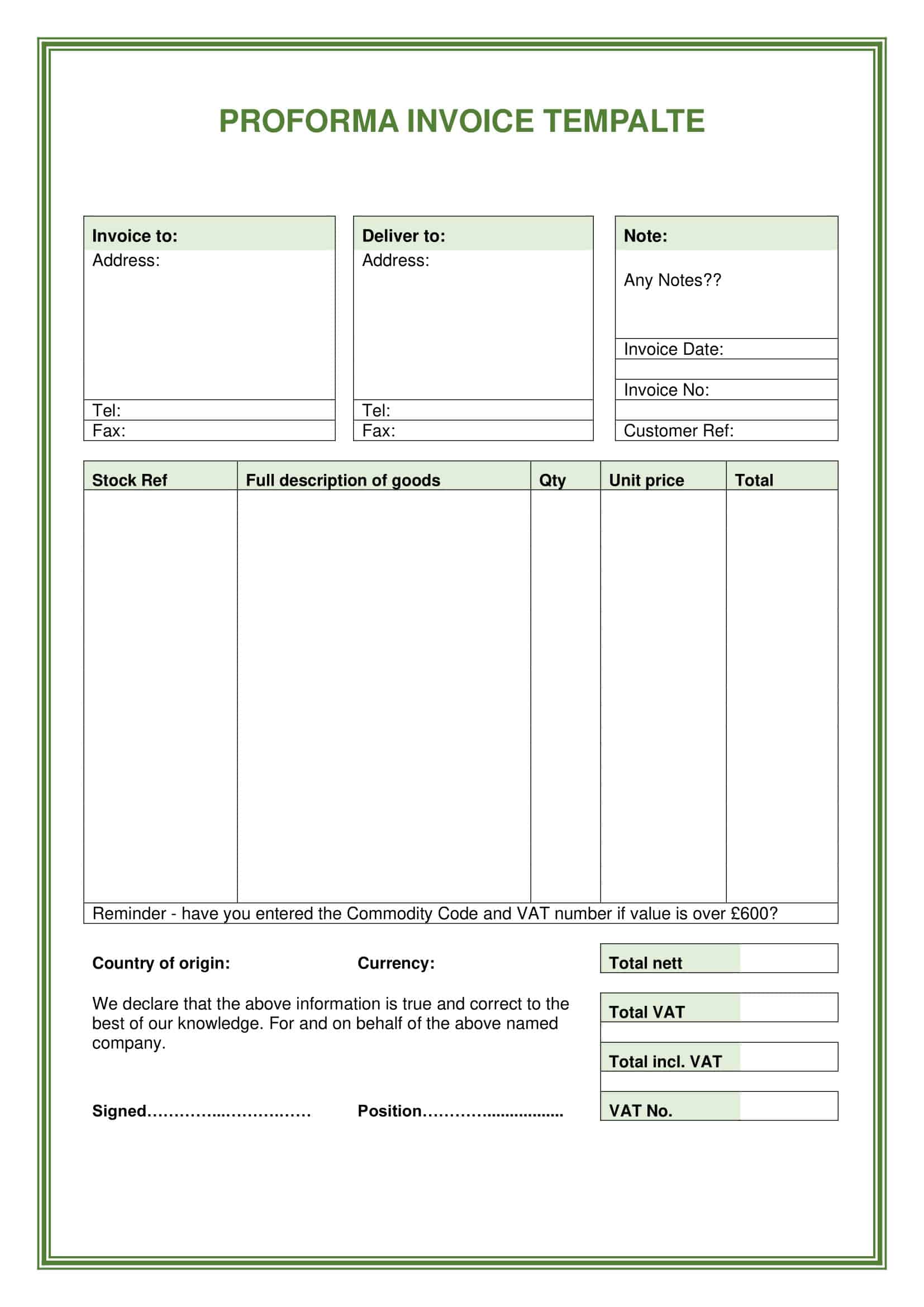

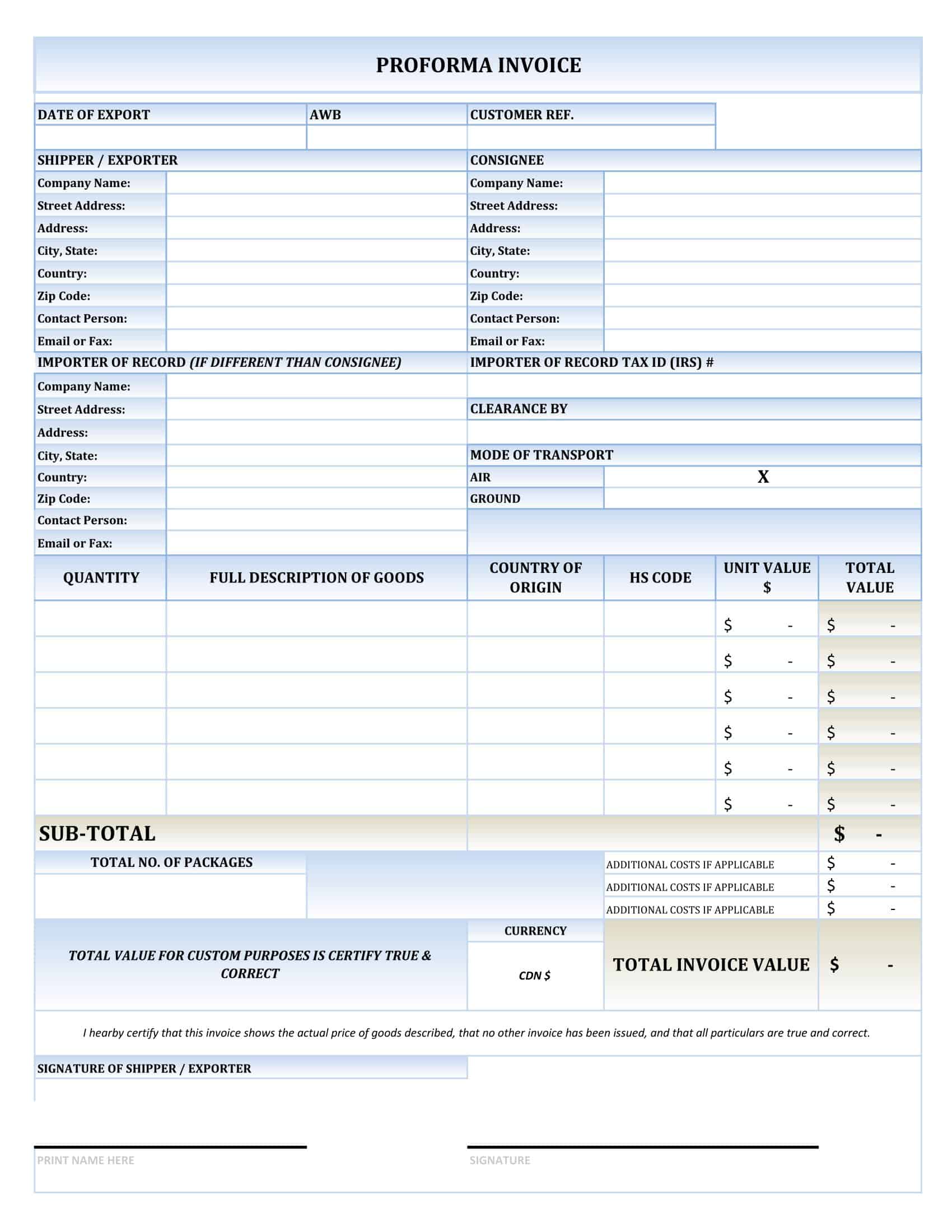

Proforma Invoice Templates

Proforma Invoice Templates are predefined layouts used to create proforma invoices, which are preliminary bills of sale sent to buyers before a shipment or delivery of goods. Often utilized in international trade and other high-value transactions, these templates contain information about the products being sold, their quantities, and prices, as well as shipping details.

Distinct features of these templates are the key fields such as sender’s and recipient’s details, invoice number, date, product or service description, quantity, price per unit, and total cost. Some templates might also include information about taxes, shipping costs, and other additional charges. A statement that the document is a proforma invoice is also typically included.

The primary role of Proforma Invoice Templates is to provide a consistent format for companies to communicate details of the goods or services being sold before finalizing the transaction. This clarity helps both the seller and buyer agree on terms, prevents misunderstandings, and sets clear expectations.

Purpose of a ProForma Invoice

A pro forma invoice serves several significant functions within the sales, delivery, and accounting process. Its primary purpose is to provide a buyer with detailed information about a purchase, allowing them to make informed decisions. It also outlines the expectations between the two parties before finalizing the transaction. Here are some of the key purposes of a pro forma invoice:

Defining the Terms of Sale

A pro forma invoice allows the seller to provide a detailed proposal to the buyer, outlining the types and quantities of products or services, their respective prices, delivery charges, taxes, and any other related costs. This allows both parties to agree on the terms of sale before finalizing the transaction.

Customs Documentation

In international trade, a pro forma invoice can be used to declare the value of goods for customs. It helps customs officials understand the nature of the shipment, which is necessary for determining duties and taxes. Although it’s not a legal document, it provides a detailed prediction of the transaction that’s about to take place.

Securing Business Financing

In some cases, businesses may use pro forma invoices to secure trade financing from their bank or other lending institution. Lenders might require a pro forma invoice to ascertain the validity of the proposed trade and the ability of the business to repay the loan.

Financial Planning and Forecasting

Pro forma invoices can be beneficial for both buyers and sellers in terms of budgeting and financial planning. For buyers, it helps to know the total cost of a purchase beforehand. For sellers, it allows them to predict their income and manage inventory.

Building Trust

A pro forma invoice helps to build trust between the buyer and seller as it outlines the obligations of both parties. It reduces the chances of misunderstandings by providing clarity on the transaction details.

Preparation for Real Invoice

It can also serve as a draft for the commercial invoice. Once the goods or services are delivered, the seller can easily convert the pro forma invoice into a final, legally-binding invoice, with minimal changes required if any.

What to include on a proforma invoice

Creating a pro forma invoice requires meticulous attention to detail to ensure that all necessary information is accurately captured. While the specific requirements may vary depending on the nature of your business and the complexity of the transaction, here are the key elements that are generally included in a pro forma invoice:

Header: The term “Proforma Invoice” should be clearly mentioned at the top of the document to differentiate it from other types of invoices.

Seller’s Information: Include the full legal name, address, contact details, and possibly the business identification number of the seller. If the seller is registered for VAT or GST, their registration number should be included as well.

Buyer’s Information: Similar to the seller’s details, the invoice should have the full legal name, address, and contact information of the buyer.

Invoice Date: The date when the pro forma invoice is issued.

Pro Forma Invoice Number: A unique identifier or number for tracking and reference purposes. This is especially important for maintaining accurate records.

Product or Service Information: Detailed description of the goods or services being sold, including product codes or service identifiers if applicable.

Quantity: The number of goods or the hours/days of service to be provided.

Price: The agreed price per unit of each product or service. The currency should also be mentioned if dealing with international trade.

Subtotal: This is the total cost before taxes, discounts, and additional fees are added.

Discounts: If any discounts are being provided, they should be clearly mentioned and subtracted from the subtotal.

Taxes and Additional Charges: Details of any taxes (like VAT or GST) and additional charges like shipping or delivery fees. Each should be listed separately and added to the subtotal.

Total Amount: The final total cost that the buyer is expected to pay. This is calculated after adding any taxes and additional fees to the subtotal and subtracting any discounts.

Payment Terms: Specific details about the payment terms such as the method of payment, currency, and any payment deadlines.

Shipping Details: If goods are being shipped, include details like the method of shipment, expected delivery date, and delivery address.

Disclaimer: Since a pro forma invoice is not a legally binding document, it’s a good idea to include a disclaimer noting that prices and other details are subject to change.

Signature and Date: The seller’s signature, along with the date, adds a layer of authenticity to the document.

While this seems like a lot, most of these details are standard and will be similar across most invoices you create. The important thing is to ensure that the document is clear, accurate, and provides all the necessary information that your customer might need.

When should you send a proforma invoice?

A pro forma invoice can be sent under a variety of circumstances where a preliminary bill of sale or a detailed quote is required. Here are some common scenarios when you might send a pro forma invoice:

International Trade

In international transactions, a pro forma invoice is typically sent to the buyer to provide an estimate of the goods or services to be delivered. It is used to declare the trade’s value to customs authorities, facilitating the customs clearance process.

Pre-delivery Estimate

Pro forma invoices are sent before delivering goods or services as an advanced statement of cost. This allows the buyer to understand what they will owe once the transaction is complete. It is especially helpful in situations where goods are made to order or services are customized to the client’s needs.

Request for Advance Payment

If a seller requires an advance payment or deposit before providing goods or services, they may issue a pro forma invoice to detail the costs and terms of the transaction.

Establishing Terms for Letter of Credit

In international trade, a letter of credit is often used to guarantee payment to the seller. A pro forma invoice can be used to agree upon the terms before the letter of credit is issued.

Securing Business Financing or Insurance

Businesses may provide a pro forma invoice to a financial institution or insurance company to secure trade financing or shipment insurance.

Record Keeping

A pro forma invoice helps maintain clear and transparent records of all estimates provided, which can be useful for future reference, auditing, or financial planning.

How is a proforma invoice different from a standart invoice?

While both pro forma invoices and official (or commercial) invoices share the fundamental role of documenting the details of a transaction, they serve different purposes and hold different legal statuses. Below are the key distinctions between a pro forma invoice and an official invoice:

Proforma Invoice

- Timing: Issued before the delivery of goods or services.

- Purpose: Serves to provide a detailed quote or estimate for the transaction. It outlines the anticipated goods or services, prices, and additional costs (like taxes or shipping fees).

- Legal Status: Not legally binding. It doesn’t constitute a record of sale or an official demand for payment. The prices and other details can still be negotiated.

- Accounting: Doesn’t play a direct role in financial accounting or inventory management as it does not confirm a completed sale.

- Customs: Frequently used in international trade to declare the value of goods to customs authorities prior to shipment.

- Changes: The terms outlined can be altered or updated based on negotiations or changes in the agreement.

Standard Invoice

- Timing: Issued after the delivery of goods or provision of services.

- Purpose: Serves as a demand for payment, documenting the details of the transaction, including the final agreed-upon costs.

- Legal Status: Legally binding. It is a documented record of the sale of goods or services, establishing a debtor-creditor relationship between the buyer and seller.

- Accounting: Integral to financial accounting. It reflects revenue and is used to calculate profit and loss, tax obligations, and during audits. It also typically triggers updates in inventory management systems.

- Customs: In international trade, a commercial invoice is used after the goods have been shipped, serving as a declaration for customs and indicating the final details of the transaction.

- Changes: The details of a standard invoice are not subject to change once issued; it reflects the final terms of the transaction.

How to create a proforma invoice

Creating a pro forma invoice is quite straightforward. Here’s a step-by-step guide:

Step 1: Choose a Platform

There are many software platforms that allow you to create pro forma invoices. Some of the popular ones include Quickbooks, Zoho, Freshbooks, and Xero. Additionally, Microsoft Excel and Google Sheets also have invoice templates that you can customize for your needs.

Step 2: Clearly Label the Document

At the top of your document, clearly label it as a “Pro Forma Invoice”. This differentiates it from other types of invoices and indicates that it’s not a legal demand for payment.

Step 3: Include Your Company Details

Include your company’s name, address, contact information, and logo if you have one. If you’re registered for VAT or GST, include your registration number as well.

Step 4: Include the Recipient’s Details

Next, include the details of the recipient (i.e., your customer). This should include their name, address, and contact information.

Step 5: Add an Invoice Number and Date

To keep track of your invoices, include a unique invoice number and the date of issuance.

Step 6: List the Products or Services

Provide a detailed description of each product or service you’re providing. Include any necessary details like the quantity, unit price, and total cost for each line item.

Step 7: Calculate the Total

Calculate the subtotal, then add any taxes, shipping fees, or other charges, and subtract any discounts to calculate the total amount due.

Step 8: Specify Payment Terms

Include information on how and when you expect to be paid. This can include your accepted payment methods, currency, and payment deadline.

Step 9: Include a Disclaimer

As a pro forma invoice is not a legally binding document, it can be helpful to include a disclaimer stating that the prices and other details are subject to change.

Step 10: Finalize and Send

Review the invoice to ensure all details are correct, then send it to your customer. You can typically send invoices via email, though some businesses may prefer to print and mail them.

Each software platform has a slightly different process, but they all will include these basic steps. Many software platforms also offer additional features such as the ability to track whether your customer has viewed the invoice, automated reminders for late payments, and integration with other accounting software.

FAQs

Is a pro forma invoice a legal document?

No, a pro forma invoice is not a legally binding document. It’s more of an agreement or proposal than a formal invoice. The final, official invoice is issued after goods are delivered or services are provided.

Can I change a pro forma invoice?

Yes, the details of a pro forma invoice can be changed as it’s not a legally binding document. It’s essentially a draft that outlines the seller’s intent, but the details can still be negotiated.

Does a pro forma invoice need to be paid?

A pro forma invoice is more of an estimate or quote, and it does not demand payment. The actual invoice that requires payment is sent after the goods have been delivered or the services have been rendered.

Is a pro forma invoice the same as a quote?

While they are similar, a quote generally provides cost estimates for a potential sale and does not typically include detailed shipment information. A pro forma invoice, on the other hand, often includes more detailed transaction information, making it useful for international trades.

Can a pro forma invoice be cancelled?

Yes, since a pro forma invoice is not a legal document, it can be cancelled or modified at any time before the transaction is finalized.

How long is a pro forma invoice valid for?

The validity of a pro forma invoice depends on the terms set by the seller. There isn’t a universally set time limit; it depends on the nature of the goods, market conditions, and the agreement between buyer and seller.

Do I charge VAT on a pro forma invoice?

Yes, if you’re registered for VAT and the goods or services you’re selling are liable for VAT, you should include VAT in your pro forma invoice.

Is a pro forma invoice an official receipt?

No, a pro forma invoice is not an official receipt. An official receipt is issued after payment has been received, while a pro forma invoice is issued before the completion of the transaction.

How does a pro forma invoice look like?

A pro forma invoice looks similar to a regular invoice, but it will be clearly marked as a “Pro Forma Invoice”. It includes details of the transaction like the seller’s and buyer’s information, a description of goods or services, prices, quantities, taxes, and total amount due.

Can a pro forma invoice be used for export?

Yes, in international trade, pro forma invoices are often used to declare the value of goods for customs purposes before shipping.

Does a pro forma invoice affect accounting books?

No, a pro forma invoice does not affect accounting books since it’s not considered a completed sale. It is a preliminary document outlining a planned transaction, so it does not impact revenue or inventory in the accounting books.

![Free Printable Roommate Agreement Templates [Word, PDF] 1 Roommate Agreement](https://www.typecalendar.com/wp-content/uploads/2023/06/Roommate-Agreement-150x150.jpg)

![Free Printable Credit Card Authorization Form Templates [PDF, Word, Excel] 2 Credit Card Authorization Form](https://www.typecalendar.com/wp-content/uploads/2023/06/Credit-Card-Authorization-Form-150x150.jpg)

![Free Printable Stock Ledger Templates [Excel,PDF, Word] 3 Stock Ledger](https://www.typecalendar.com/wp-content/uploads/2023/08/Stock-Ledger-150x150.jpg)